The Impact of Enterprise Digital Transformation on Low-Carbon Supply Chains: Empirical Evidence from China

Abstract

1. Introduction

2. Theoretical Model and Hypotheses

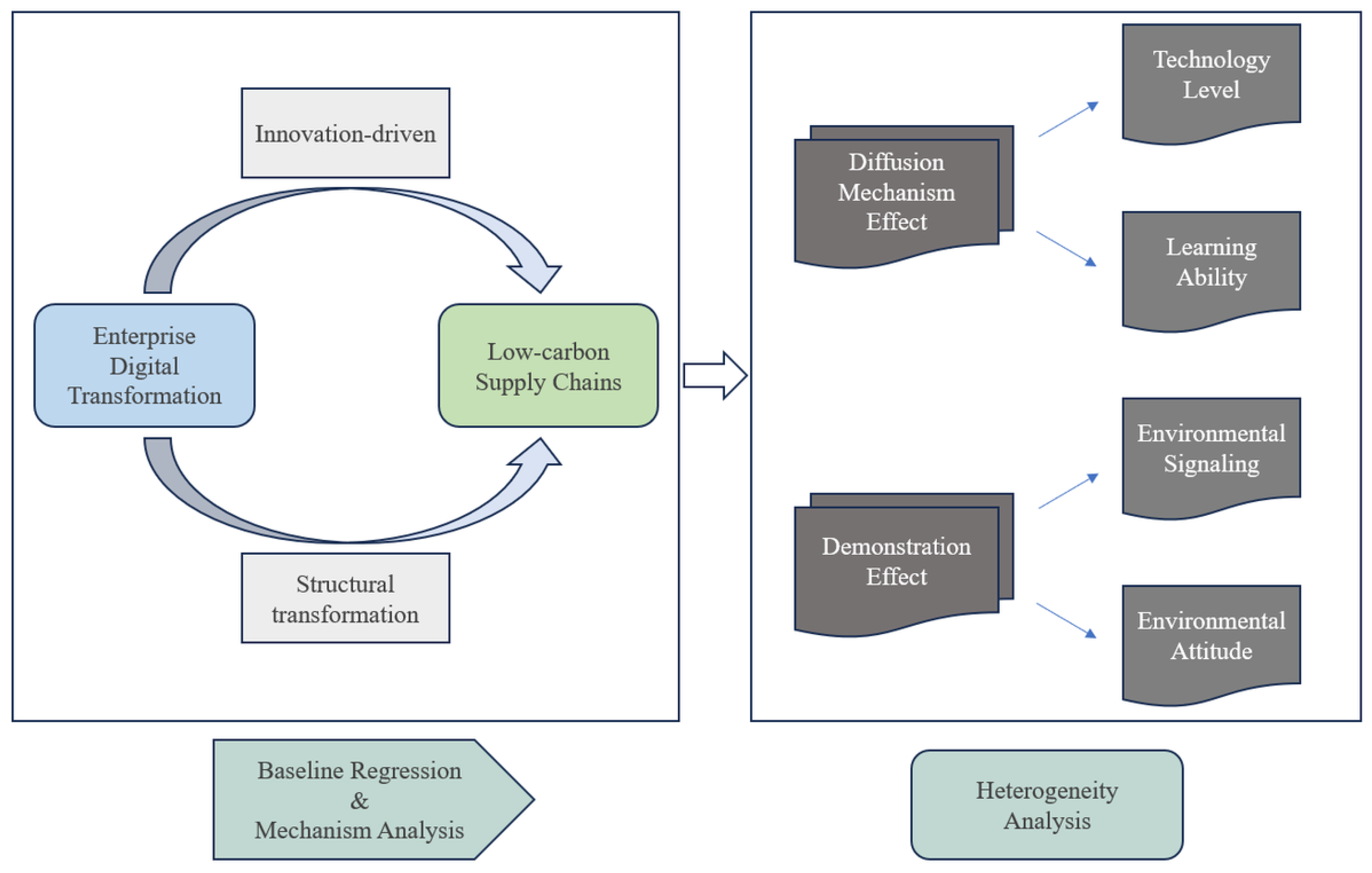

2.1. Theoretical Model

2.1.1. Assumptions and Basic Settings

2.1.2. Game-Theoretic Analysis

2.1.3. Theoretical Model Results

2.2. Innovation-Driven and Structural Transformation

2.3. The Diffusion Mechanism and Demonstration Effects

3. Data and Model Settings

3.1. Data

3.2. Model Setting

3.2.1. Regression Mode

3.2.2. A Further Test Model

3.3. Variable Determination and Interpretation

3.3.1. Carbon Emission Intensity

3.3.2. Enterprise Digital Transformation

3.3.3. Control Variables

- The control variables that influence the digital transformation of downstream enterprises include the following: (1) Firm Size : the logarithm of a firm’s annual total assets, indicating its resource allocation and management capability. (2) Return on Equity : the ratio of net profit to average shareholder equity, reflecting profitability and investment potential. (3) Leverage : the ratio of total liabilities to year-end total assets, indicating financial stability and debt capacity. (4) Cash Holdings : the proportion of cash flow relative to assets, reflecting liquidity and financial health. (5) Ownership Nature : assigned a value of 1 for state-owned enterprises and 0 otherwise, capturing the influences of policy and management. (6) Return on Assets : the proportion of profit to average assets, indicating asset utilization efficiency. (7) Market-to-Book Ratio : the ratio of book value to total market value, indicating the market assessment of future development potential. (8) CEO–Chair Duality : assigned a value of 1 if the chairman and CEO are the same person, and 0 otherwise, affecting decision-making efficiency. (9) Tobin’s Q : the proportion of market value to the replacement cost of company assets, reflecting long-term planning and technology investment decisions.

- The control variables that influence the carbon emission intensity of upstream suppliers include the following: (1) Board Size : the number of board members, expressed as a natural logarithm, affecting decision-making efficiency and governance quality. (2) Independent Director Ratio : the ratio of independent directors to total directors, reflecting board independence and governance transparency. (3) Top Shareholder’s Ownership Ratio : the ratio of shares held by the largest shareholder to the total shares outstanding, indicating the ownership structure and its influence on strategic decisions. (4) Top Ten Shareholders’ Ownership Ratio : the ratio of shares held by the top ten shareholders to the total shares outstanding, reflecting a broader ownership structure and governance model, influencing long-term environmental policy execution.

3.3.4. Moderating Variables

- Mechanism variables: (1) Innovation-driven. In this paper, we use the level of green innovation technology of enterprises to measure innovation-driven effects . Based on patent classification numbers and using the WIPO green patent list, we filter out enterprises’ green patents and calculate the number of green utility model patent applications. The logarithm of the number of green utility model patent applications, after adding 1, is used to measure the green innovation technology level of enterprises. (2) Structural transformation. The structural transformation of enterprises is measured by their total factor productivity. Structural transformation typically refers to the shift of resources from low-efficiency sectors or activities to more efficient areas, and the improvement in can reflect the productivity gains brought about by this shift. Therefore, we employ the Olley–Pakes () method to measure enterprises’ total factor productivity (Equations (16) and (17)). In Equation (16), Y represents the sales revenue; L denotes the labor input, measured by the number of employees; K stands for capital input, which is measured by the book value of fixed assets; and M is the intermediate input, calculated as the sales revenue minus depreciation, labor compensation, net production taxes, and operating surplus. indicates the ages of the enterprises. , , and denote time, region, and industry fixed effects, respectively, while is the residual term. Both and are used to explore how enterprise digital transformation can effectively promote the low-carbon effect of supply chains through “innovation-driven” and “structural transformation” mechanisms.

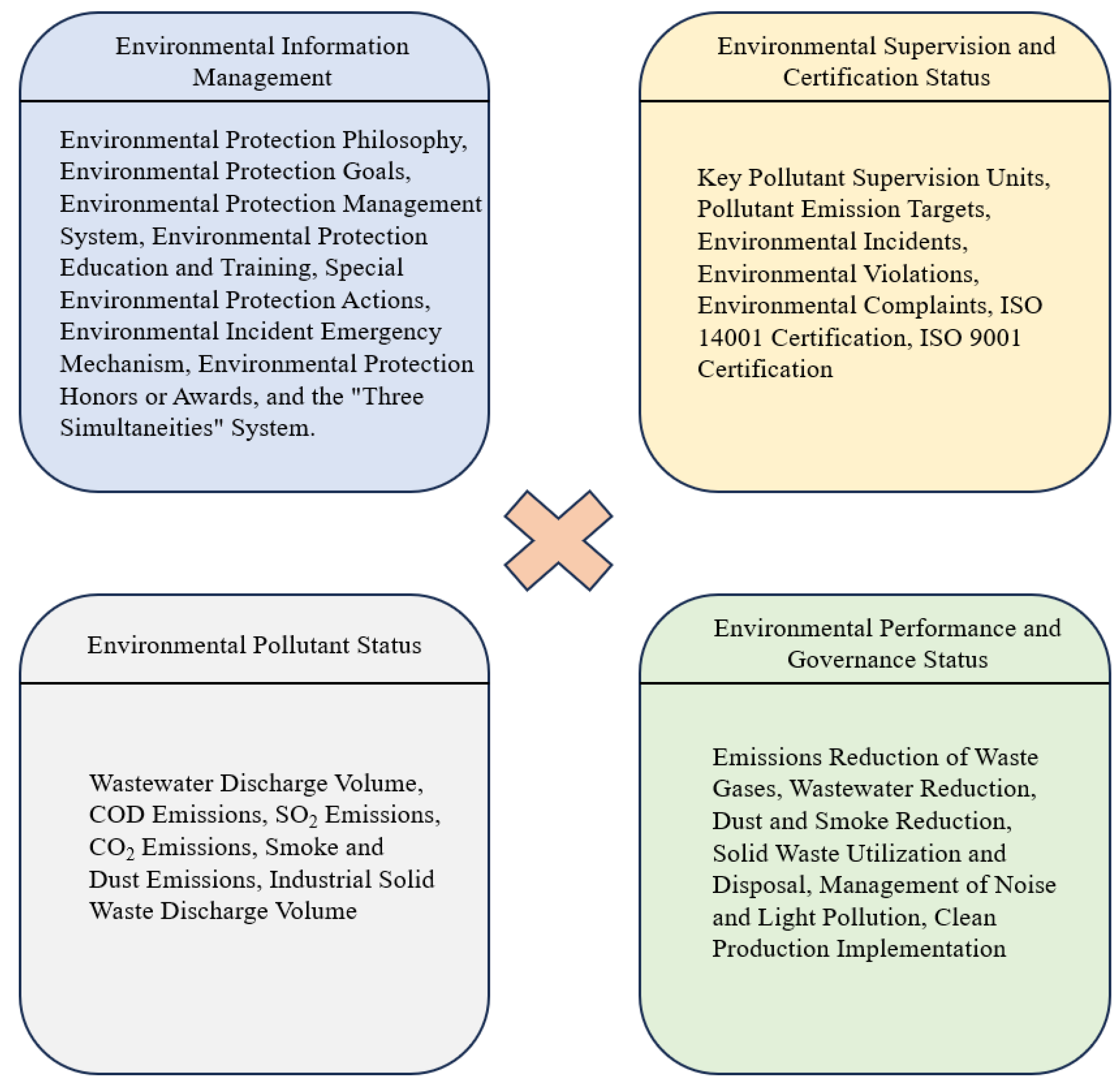

- We have also identified a number of heterogeneity variables. (1) Green technology level : assessed based on the aggregate number of green patent filings, with enterprises in the top 5% assigned a value of 1, and 0 otherwise. (2) Non-green technology level : assessed based on the aggregate number of non-green patent filings, with firms in the top 5% assigned a value of 1, and 0 otherwise. (3) Degree of Enterprise rejuvenation : determined by taking the reciprocal of the time span between the current year and the year the company was listed. (4) Technological level : a binary variable representing the enterprises’ classification in the high-tech sector, where enterprises in the high-tech industry are coded as 1 and all others as 0. (5) Enterprise information disclosure level : quantified by whether the enterprise disclosed environmental information in its annual or social responsibility report, with a value of 1 if disclosed, and 0 otherwise. (6) CEO green background : based on the CEO’s education and experience, with a value of 1 if the CEO has green education or project experience, and 0 otherwise. (7) Enterprise environmental score : measured by scoring enterprises in terms of four environmental aspects and using the logarithm of the total score (Figure 3). (8) CEO green environmental awareness : calculated using the logarithm of the word frequency related to green awareness in the CEO’s annual reports [58]. Among these, , , , and are used to examine the impact of diffusion mechanism effects, while , , , and are used to examine the impact of demonstration effects.

3.4. Descriptive Statistical Analysis

4. Results

4.1. Baseline Regression

4.2. Robustness Test

4.2.1. Substitute the Dependent and Independent Variables

- Substituting the dependent variable: Given the extended time span of the annual dataset and significant fluctuations in corporate revenue, we remeasure using the ratio of the logarithm of the number of employees to the logarithm of corporate carbon emissions. The test results, presented in Columns (1) and (2), show significantly negative coefficients at the 1% level, indicating that enterprise digital transformation enhances the low-carbon effect of supply chains.

- Substituting the independent variable: We select 99 relevant word frequencies across four dimensions and use the logarithm of their occurrences to remeasure the level of enterprise digital transformation. The test results, presented in Columns (3) and (4), reveal significantly negative coefficients at the 1% level, consistent with our findings.

4.2.2. Exclusivity Test

- The low-carbon effect from suppliers may be due to their own digital transformation. To address this, the carbon emission intensity of suppliers is regressed against their , and the resulting residuals are used to replace the in the baseline regression. The residuals are then regressed against the of downstream enterprises. The results, presented in column (1), indicate that the coefficient of is −0.0054, which is significant at the 10% level.

- The low-carbon effect observed from suppliers might be due to inherently low carbon emissions. To account for this, this analysis focuses on suppliers with a above the median in the dataset. The results, presented in column (2), indicate that the coefficient of is −0.0032, which is significant at the 10% level.

- The baseline regression includes only firm and year fixed effects. Given the variability of fixed effects, the results might still vary. Therefore, we further incorporate industry fixed effects for a high-dimensional fixed effects analysis. The regression results are shown in column (3), where the coefficient of is −0.0033, which is significant at the 1% level.

- Excluding policy factors. We incorporate the smart city pilot policy variable in the regression. The results, presented in column (4), indicate that the coefficient of is −0.0034, which is significant at the 5% level, while has a coefficient of −0.0048 and is not significant.

4.3. Endogeneity Test

- Instrumental variable method: We use the product of the number of fixed telephones per 10,000 people in each prefecture-level city in 1984 and the lagged national number of internet users as an instrumental variable of enterprise digital transformation to address endogeneity [59]. The increase in fixed telephones’ density in prefecture-level cities indicates a more advanced communication infrastructure, while the lagged national number of internet users reflects the internet’s penetration. Using the interaction terms of these two factors as the instrumental variable enhances the analysis of enterprise digital transformation’s impact. Column (1) shows the results of the instrumental variable regression, where the coefficient of is −0.0125 and statistically significant at the 10% level, thereby supporting the baseline regression findings.

- Heckman two-stage approach: Given that information disclosure by listed companies regarding their suppliers and customers is voluntary, there may be sample selection bias. To address this, we employ the Heckman two-step method to correct for sample self-selection bias [60]. In the first stage, the dependent variable is whether the sample undergoes enterprise digital transformation , with the exogenous variable of the executives’ digital background included in the Probit regression. In the second stage, is added as an additional control variable to correct for potential sample self-selection bias in the regression. In the first stage of this approach, the coefficient of is 0.3632, which is significantly positive at the 1% level, indicating that listed companies with executives who have a digital background are more likely to undergo digital transformation. In the second stage, after correcting for sample self-selection bias, the coefficient of Digital is −0.0034, which still significantly negative at the 5% level, consistent with the baseline regression results.

4.4. Mechanism Test

4.5. Heterogeneity Test

4.5.1. The Heterogeneity of the Diffusion Mechanism Effect

4.5.2. The Heterogeneity of the Demonstration Effect

5. Conclusions

5.1. Conclusions

5.2. Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Pettit, T.J.; Croxton, K.L.; Fiksel, J. The evolution of resilience in supply chain management: A retrospective on ensuring supply chain resilience. J. Bus. Logist. 2019, 40, 56–65. [Google Scholar] [CrossRef]

- Negri, M.; Cagno, E.; Colicchia, C.; Sarkis, J. Integrating sustainability and resilience in the supply chain: A systematic literature review and a research agenda. Bus. Strategy Environ. 2021, 30, 2858–2886. [Google Scholar] [CrossRef]

- Sobb, T.; Turnbull, B.; Moustafa, N. Supply chain 4.0: A survey of cyber security challenges, solutions and future directions. Electronics 2020, 9, 1864. [Google Scholar] [CrossRef]

- Zhao, N.; Hong, J.; Lau, K.H. Impact of supply chain digitalization on supply chain resilience and performance: A multi-mediation model. Int. J. Prod. Econ. 2023, 259, 108817. [Google Scholar] [CrossRef]

- Chowdhury, M.M.H.; Quaddus, M. Supply chain readiness, response and recovery for resilience. Supply Chain. Manag. Int. 2016, 21, 709–731. [Google Scholar] [CrossRef]

- Kang, K.; Zhao, Y.; Zhang, J.; Qiang, C. Evolutionary game theoretic analysis on low-carbon strategy for supply chain enterprises. J. Clean. Prod. 2019, 230, 981–994. [Google Scholar] [CrossRef]

- Du, S.; Hu, L.; Wang, L. Low-carbon supply policies and supply chain performance with carbon concerned demand. Ann. Oper. 2017, 255, 569–590. [Google Scholar] [CrossRef]

- Sarkis, J.; Zhu, Q.; Lai, K.-H. An organizational theoretic review of green supply chain management literature. Int. J. Prod. Econ. 2011, 130, 1–15. [Google Scholar] [CrossRef]

- Abbasi, S.; Choukolaei, H.A. A systematic review of green supply chain network design literature focusing on carbon policy. Decis. Anal. J. 2023, 6, 100189. [Google Scholar] [CrossRef]

- Abdallah, A.B.; Al-Ghwayeen, W.S. Green supply chain management and business performance: The mediating roles of environmental and operational performances. Bus. Process Manag. J. 2020, 26, 489–512. [Google Scholar] [CrossRef]

- Westerman, G.; Bonnet, D.; McAfee, A. Leading Digital: Turning Technology into Business Transformation; Harvard Business Press: Boston, MA, USA, 2014. [Google Scholar]

- Kane, G. Strategy, Not Technology, Drives Digital Transformation; MIT Sloan Management Review and Deloitte University Press: Westlake, TX, USA, 2015. [Google Scholar]

- Ross, J.; Beath, C.; Sebastian, I.M. How to Develop a Great Digital Strategy; MIT Sloan Management Review: Cambridge, MA, USA, 2016. [Google Scholar]

- ElMassah, S.; Mohieldin, M. Digital transformation and localizing the sustainable development goals (sdgs). Ecol. Econ. 2020, 169, 106490. [Google Scholar] [CrossRef]

- Li, Y.; Yang, X.; Ran, Q.; Wu, H.; Irfan, M.; Ahmad, M. Energy structure, digital economy, and carbon emissions: Evidence from china. Environ. Sci. Pollut. Res. 2021, 28, 64606–664629. [Google Scholar] [CrossRef] [PubMed]

- Li, Z.; Wang, J. The dynamic impact of digital economy on carbon emission reduction: Evidence city-level empirical data in china. J. Clean. Prod. 2022, 351, 131570. [Google Scholar] [CrossRef]

- Ren, X.; Shao, Q.; Zhong, R. Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from china based on a vector error correction model. J. Clean. Prod. 2020, 277, 122844. [Google Scholar] [CrossRef]

- Huang, Y.; Xue, L.; Khan, Z. What abates carbon emissions in china: Examining the impact of renewable energy and green investment. Sustain. Dev. 2021, 29, 823–834. [Google Scholar] [CrossRef]

- Zhang, W.; You, J.; Lin, W. Internet plus and china industrial system’s low-carbon development. Renew. Sustain. Energy Rev. 2021, 151, 111499. [Google Scholar] [CrossRef]

- Ahmad, T.; Zhang, D.; Huang, C.; Zhang, H.; Dai, N.; Song, Y.; Chen, H. Artificial intelligence in sustainable energy industry: Status quo, challenges and opportunities. J. Clean. Prod. 2021, 289, 125834. [Google Scholar] [CrossRef]

- Williams, E. Environmental effects of information and communications technologies. Nature 2011, 479, 354–358. [Google Scholar] [CrossRef] [PubMed]

- Belkhir, L.; Elmeligi, A. Assessing ict global emissions footprint: Trends to 2040 & recommendations. J. Clean. Prod. 2018, 177, 448–463. [Google Scholar]

- Hittinger, E.; Jaramillo, P. Internet of things: Energy boon or bane? Science 2019, 364, 326–328. [Google Scholar] [CrossRef]

- Hig, D.A.; Gholami, R.; Shirazi, F. Ict and environmental sustainability: A global perspective. Telemat. Informatics 2017, 34, 85–95. [Google Scholar]

- Cheng, Y.; Zhang, Y.; Wang, J.; Jiang, J. The impact of the urban digital economy on china’s carbon intensity: Spatial spillover and mediating effect. Resour. Conserv. Recycl. 2023, 189, 106762. [Google Scholar] [CrossRef]

- Chen, X.; Despeisse, M.; Johansson, B. Environmental sustainability of digitalization in manufacturing: A review. Sustainability 2020, 12, 10298. [Google Scholar] [CrossRef]

- Gao, D.; Yan, Z.; Zhou, X.; Mo, X. Smarter and prosperous: Digital transformation and enterprise performance. Systems 2023, 11, 329. [Google Scholar] [CrossRef]

- Rogers, D.L. The Digital Transformation Playbook: Rethink Your Business for the Digital Age; Columbia University Press: New York, NY, USA, 2016. [Google Scholar]

- Du, X.; Jiang, K. Promoting enterprise productivity: The role of digital transformation. Borsa Istanb. Rev. 2022, 22, 1165–1181. [Google Scholar] [CrossRef]

- Zhuo, C.; Chen, J. Can digital transformation overcome the enterprise innovation dilemma: Effect, mechanism and effective boundary. Technol. Forecast. Soc. Change 2023, 190, 122378. [Google Scholar] [CrossRef]

- Han, D.; Ding, Y.; Shi, Z.; He, Y. The impact of digital economy on total factor carbon productivity: The threshold effect of technology accumulation. Environ. Sci. Pollut. Res. 2022, 29, 55691–55706. [Google Scholar] [CrossRef]

- Hao, Y.; Guo, Y.; Wu, H. The role of information and communication technology on green total factor energy efficiency: Does environmental regulation work? Bus. Strategy Environ. 2022, 31, 403–424. [Google Scholar] [CrossRef]

- Faruquee, M.; Paulraj, A.; Irawan, C.A. Strategic supplier relationships and supply chain resilience: Is digital transformation that precludes trust beneficial? Int. J. Oper. Prod. 2021, 41, 1192–1219. [Google Scholar] [CrossRef]

- Stroumpoulis, A.; Kopanaki, E. Theoretical perspectives on sustainable supply chain management and digital transformation: A literature review and a conceptual framework. Sustainability 2022, 14, 4862. [Google Scholar] [CrossRef]

- Coase, R.H. The Nature of the Firm; Springer: Berlin/Heidelberg, Germany, 1995. [Google Scholar]

- Williamson, O.E. Transaction-cost economics: The governance of contractual relations. J. Law Econ. 1979, 22, 233–261. [Google Scholar] [CrossRef]

- Wang, G.; Gunasekaran, A.; Ngai, E.W.; Papadopoulos, T. Big data analytics in logistics and supply chain management: Certain investigations for research and applications. Int. J. Prod. Econ. 2016, 176, 98–110. [Google Scholar] [CrossRef]

- Hofmann, E.; Rüsch, M. Industry 4.0 and the current status as well as future prospects on logistics. Comput. Ind. 2017, 89, 23–34. [Google Scholar] [CrossRef]

- Yang, G.; Wang, F.; Deng, F.; Xiang, X. Impact of digital transformation on enterprise carbon intensity: The moderating role of digital information resources. Int. J. Environ. Res. Public Health 2023, 20, 2178. [Google Scholar] [CrossRef]

- Zhang, C.; Fang, J.; Ge, S.; Sun, G. Research on the impact of enterprise digital transformation on carbon emissions in the manufacturing industry. Int. Rev. Econ. Financ. 2024, 92, 211–227. [Google Scholar] [CrossRef]

- Greaker, M.; Rosendahl, K.E. Environmental policy with upstream pollution abatement technology firms. J. Environ. Econ. Manag. 2008, 56, 246–259. [Google Scholar] [CrossRef]

- Zhang, L.; Xue, L.; Zhou, Y. How do low-carbon policies promote green diffusion among alliance-based firms in china? An evolutionary-game model of complex networks. J. Clean. Prod. 2019, 210, 518–529. [Google Scholar] [CrossRef]

- Melander, L. Customer and supplier collaboration in green product innovation: External and internal capabilities. Bus. Strategy Environ. 2018, 27, 677–693. [Google Scholar] [CrossRef]

- Grant, D.B.; Wong, C.Y.; Trautrims, A. Sustainable Logistics and Supply Cchain Management: Principles and Practices for Sustainable Operations and Management; Kogan Page Publishers: New York, NY, USA, 2017. [Google Scholar]

- Ramanathan, U.; Bentley, Y.; Pang, G. The role of collaboration in the uk green supply chains: An exploratory study of the perspectives of suppliers, logistics and retailers. J. Clean. Prod. 2014, 70, 231–241. [Google Scholar] [CrossRef]

- Tsai, S.-B.; Wei, Y.-M.; Chen, K.-Y.; Xu, L.; Du, P.; Lee, H.-C. Evaluating green suppliers from a green environmental perspective. Environ. Plan. Plan. Des. 2016, 43, 941–959. [Google Scholar] [CrossRef]

- Stucki, T.; Woerter, M. Intra-firm diffusion of green energy technologies and the choice of policy instruments. J. Clean. Prod. 2016, 131, 545–560. [Google Scholar] [CrossRef]

- Yang, X.; Zhang, J.; Ren, S.; Ran, Q. Can the new energy demonstration city policy reduce environmental pollution? evidence from a quasi-natural experiment in china. J. Clean. Prod. 2021, 287, 125015. [Google Scholar] [CrossRef]

- Wang, L.; Zheng, J. Research on low-carbon diffusion considering the game among enterprises in the complex network context. J. Clean. Prod. 2019, 210, 1–11. [Google Scholar] [CrossRef]

- Shi, Y.; Wei, Z.; Shahbaz, M.; Zeng, Y. Exploring the dynamics of low-carbon technology diffusion among enterprises: An evolutionary game model on a two-level heterogeneous social network. Energy Econ. 2021, 101, 105399. [Google Scholar] [CrossRef]

- Jiang, X.; Zhang, X.; Xia, Y. Peer effect on low-carbon practices of firms along the value chain: Evidence from china. Energy Econ. 2023, 127, 107102. [Google Scholar] [CrossRef]

- Ju, Y.; Hou, H.; Cheng, Y.; Feng, Y. Assessing the impact of government-led green supply chain demonstration on firms’ financial distress: The role of environmental information disclosure quality and supply chain concentration. J. Clean. Prod. 2024, 440, 140786. [Google Scholar] [CrossRef]

- Isaksson, O.H.; Simeth, M.; Seifert, R.W. Knowledge spillovers in the supply chain: Evidence from the high tech sectors. Res. Policy 2016, 45, 699–706. [Google Scholar] [CrossRef]

- Chu, Y.; Tian, X.; Wang, W. Corporate innovation along the supply chain. Manag. Sci. 2019, 65, 2445–2466. [Google Scholar] [CrossRef]

- Gao, J.; Xu, N.; Zhou, J. Does digital transformation contribute to corporate carbon emissions reduction? empirical evidence from china. Sustainability 2023, 15, 13414. [Google Scholar] [CrossRef]

- Long, Y.; Liu, L.; Yang, B. The effects of enterprise digital transformation on low-carbon urban development: Empirical evidence from china. Technol. Forecast. Soc. Chang. 2024, 201, 123259. [Google Scholar] [CrossRef]

- Zhong, W.; Ma, Z.; Tong, T.W.; Zhang, Y.; Xie, L. Customer concentration, executive attention, and firm search behavior. Acad. Manag. 2021, 64, 1625–1647. [Google Scholar] [CrossRef]

- Duriau, V.J.; Reger, R.K.; Pfarrer, M.D. A content analysis of the content analysis literature in organization studies: Research themes, data sources, and methodological refinements. Organ. Res. 2007, 10, 5–34. [Google Scholar] [CrossRef]

- Nunn, N.; Qian, N. Us food aid and civil conflict. Am. Rev. 2014, 104, 1630–1666. [Google Scholar] [CrossRef]

- Bendig, D.; Hoke, J. Correcting Selection Bias in Innovation and Entrepreneurship Research: A Practical Guide to Applying the Heckman Two-Stage Estimation. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4105207 (accessed on 28 August 2024).

- Hartley, J.L.; Sawaya, W.J. Tortoise, not the hare: Digital transformation of supply chain business processes. Bus. Horizons 2019, 62, 707–715. [Google Scholar] [CrossRef]

- Jabbour, C.J.C.; Neto, A.S.; Gobbo, J.A., Jr.; de Souza Ribeiro, M.; Jabbour, S. Eco-innovations in more sustainable supply chains for a low-carbon economy: A multiple case study of human critical success factors in brazilian leading companies. Int. J. Prod. 2015, 164, 245–257. [Google Scholar] [CrossRef]

- Herrendorf, B.; Rogerson, R.; Valentinyi, A. Growth and structural transformation. Handb. Econ. Growth 2014, 2, 855–941. [Google Scholar]

- Xing, X.; Ye, A. Consumption upgrading and industrial structural change: A general equilibrium analysis and empirical test with low-carbon green transition constraints. Sustainability 2022, 14, 13645. [Google Scholar] [CrossRef]

| Symbol | Definition |

|---|---|

| q | Downstream enterprise output |

| Output and density functions of downstream enterprises | |

| c | Unit product cost of downstream enterprises |

| C | Total carbon emissions from downstream enterprises |

| p | Market price of the product |

| Carbon emissions incurred by the enterprises per unit of production | |

| Carbon emission cap for downstream enterprises | |

| Unit quota operating cost | |

| Carbon emission rights trading price | |

| External transaction costs of enterprise digital transformation | |

| Enterprise digital transformation | |

| Profit function |

| S.D. | ||||||

|---|---|---|---|---|---|---|

| 2570 | 1.7850 | 0.1287 | 1.5170 | 1.7782 | 2.6815 | |

| 2570 | 1.3904 | 1.3294 | 0 | 1.0986 | 6.1633 | |

| 2570 | 23.0290 | 1.8126 | 19.2775 | 22.6793 | 28.6365 | |

| 2570 | 0.0707 | 0.1391 | −1.7236 | 0.0757 | 1.3193 | |

| 2570 | 0.4945 | 0.1998 | 0.0327 | 0.5082 | 0.9763 | |

| 2570 | 0.0460 | 0.0704 | −0.4630 | 0.0434 | 0.4876 | |

| 2570 | 0.5054 | 0.5001 | 0 | 1 | 1 | |

| 2570 | 0.0365 | 0.0569 | −0.3628 | 0.0337 | 0.6553 | |

| 2570 | 0.7024 | 0.2815 | 0 | 0.7280 | 1.5592 | |

| 2570 | 0.2089 | 0.4067 | 0 | 0 | 1 | |

| 2570 | 1.7494 | 1.3717 | 0 | 1.3494 | 24.4953 | |

| 2570 | 2.1660 | 0.2061 | 1.3863 | 2.1972 | 2.8904 | |

| 2570 | 37.6797 | 6.2398 | 22.2200 | 36.3600 | 80 | |

| 2570 | 36.0505 | 15.8931 | 4.1456 | 32.9757 | 88.5493 | |

| 2570 | 55.6383 | 16.0169 | 12.2560 | 55.7993 | 95.5023 | |

| 1976 | 0.0540 | 0.1265 | 0 | 0 | 0.8889 | |

| 1091 | −0.4270 | 1.0220 | −5.7298 | −0.1402 | 0.7297 | |

| 1994 | 0.0501 | 0.2183 | 0 | 0 | 1 | |

| 1994 | 0.0502 | 0.2183 | 0 | 0 | 1 | |

| 2508 | 0.0616 | 0.0308 | 0.0277 | 0.0526 | 0.5 | |

| 2508 | 0.0617 | 0.0308 | 0 | 0 | 1 | |

| 2566 | 0.2510 | 0.4336 | 0 | 0 | 1 | |

| 1746 | 0.1191 | 0.3240 | 0 | 0 | 1 | |

| 2547 | 2.5769 | 0.9051 | 0 | 2.8332 | 3.8918 | |

| 1433 | 1.3783 | 0.8889 | 0 | 1.3863 | 3.8712 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| CEE | CEE | CEE | |

| −0.0048 * | −0.0045 * | −0.0051 * | |

| (0.0028) | (0.0027) | (0.0028) | |

| 1.8335 *** | 2.0362 *** | 2.0520 *** | |

| (0.0118) | (0.1862) | (0.1908) | |

| No | Yes | Yes | |

| No | No | Yes | |

| Yes | Yes | Yes | |

| Yes | Yes | Yes | |

| 2570 | 2570 | 2570 | |

| R- | 0.0634 | 0.0623 | 0.0690 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| CEE | CEE | CEE | CEE | |

| −0.0074 *** | −0.0072 *** | −0.0037 *** | −0.0034 *** | |

| (0.0032) | (0.0033) | (0.0033) | (0.0013) | |

| 1.8484 *** | 2.0486 *** | 0.6965 *** | 0.7924 *** | |

| (0.0137) | (0.1982) | (0.0060) | (0.0928) | |

| No | Yes | No | Yes | |

| Yes | Yes | Yes | Yes | |

| Yes | Yes | Yes | Yes | |

| Yes | Yes | Yes | Yes | |

| 2545 | 2545 | 2545 | 2545 | |

| R- | 0.0634 | 0.0623 | 0.0690 | 0.1214 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| CEE | CEE | CEE | CEE | |

| −0.0054 *** | −0.0032 *** | −0.0033 *** | −0.0034 *** | |

| (0.0028) | (0.0019) | (0.0012) | (0.0028) | |

| −0.0048 | ||||

| (0.0058) | ||||

| 0.2165 *** | 0.7111 *** | 0.7967 *** | 0.7940 *** | |

| (0.0920) | (0.1028) | (0.0866) | (0.0939) | |

| Yes | Yes | Yes | Yes | |

| Yes | Yes | Yes | Yes | |

| Yes | Yes | Yes | Yes | |

| No | No | Yes | No | |

| 2545 | 1273 | 2566 | 2542 | |

| R- | 0.0630 | 0.1854 | 0.8729 | 0.1212 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| CEE | digi_dum | CEE | |

| −0.0125 * | −0.0034 *** | ||

| (0.0068) | (0.0013) | ||

| 0.3632 *** | 2.0520 *** | ||

| (0.0538) | |||

| 0.7567 *** | −4.8270 *** | 0.7411 *** | |

| (0.1299) | (0.6128) | (0.1200) | |

| Yes | Yes | Yes | |

| Yes | Yes | Yes | |

| Yes | Yes | Yes | |

| 2406 | 2401 | 2401 | |

| R- | 0.0196 | 0.0959 | 0.8684 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| CEE | CEE | CEE | CEE | |

| −0.0001 | −0.0001 | −0.0037 *** | −0.0034 *** | |

| (0.0001) | (0.0001) | (0.0033) | (0.0013) | |

| −0.0047 | −0.0042 | |||

| (0.0043) | (0.0042) | |||

| 0.0009 *** | 0.0007 ** | |||

| (0.0003) | (0.0003) | |||

| −0.0037 | −0.0145 | |||

| (0.0048) | (0.0095) | |||

| 0.0010 ** | 0.0012 *** | |||

| (0.0004) | (0.0005) | |||

| 0.5472 *** | 2.0486 *** | 0.6965 *** | 0.7924 *** | |

| (0.0032) | (0.1982) | (0.0060) | (0.0938) | |

| No | Yes | No | Yes | |

| Yes | Yes | Yes | Yes | |

| Yes | Yes | Yes | Yes | |

| 1994 | 1994 | 1091 | 1091 | |

| R- | 0.0858 | 0.0955 | 0.0851 | 0.1226 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| CEE | CEE | CEE | CEE | |

| 0.0001 | 0.0001 | 0.0056 ** | 0.0023 *** | |

| (0.0001) | (0.0001) | (0.0025) | (0.0009) | |

| −0.0002 ** | ||||

| (0.0001) | ||||

| −0.0001 | ||||

| (0.0001) | ||||

| −0.0002 * | ||||

| (0.0001) | ||||

| −0.0035 ** | ||||

| (0.0018) | ||||

| 0.5558 *** | 2.0486 *** | 0.6965 *** | 0.7924 *** | |

| (0.0741) | (0.0732) | (0.0503) | (0.0538) | |

| Yes | Yes | Yes | Yes | |

| Yes | Yes | Yes | Yes | |

| Yes | Yes | Yes | Yes | |

| 1994 | 1994 | 2508 | 2508 | |

| R- | 0.0924 | 0.0955 | 0.0947 | 0.0962 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| CEE | CEE | CEE | CEE | |

| 0.0107 *** | 0.0024 ** | 0.0210 *** | 0.01873 *** | |

| (0.0029) | (0.0010) | (0.0076) | (0.0061) | |

| −0.0098 ** | ||||

| (0.0039) | ||||

| −0.0053 * | ||||

| (0.0029) | ||||

| −0.0051 * | ||||

| (0.0024) | ||||

| −0.0059 ** | ||||

| (0.0033) | ||||

| 1.2825 *** | 0.4333 *** | 1.2410 *** | 1.6876 *** | |

| (0.2051) | (0.0774) | (0.2039) | (0.2491) | |

| Yes | Yes | Yes | Yes | |

| Yes | Yes | Yes | Yes | |

| Yes | Yes | Yes | Yes | |

| 2565 | 1746 | 2546 | 1433 | |

| R- | 0.1134 | 0.0756 | 0.1153 | 0.1433 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lou, Z.; Gao, N.; Lu, M. The Impact of Enterprise Digital Transformation on Low-Carbon Supply Chains: Empirical Evidence from China. Sustainability 2024, 16, 8242. https://doi.org/10.3390/su16188242

Lou Z, Gao N, Lu M. The Impact of Enterprise Digital Transformation on Low-Carbon Supply Chains: Empirical Evidence from China. Sustainability. 2024; 16(18):8242. https://doi.org/10.3390/su16188242

Chicago/Turabian StyleLou, Zhilong, Nan Gao, and Min Lu. 2024. "The Impact of Enterprise Digital Transformation on Low-Carbon Supply Chains: Empirical Evidence from China" Sustainability 16, no. 18: 8242. https://doi.org/10.3390/su16188242

APA StyleLou, Z., Gao, N., & Lu, M. (2024). The Impact of Enterprise Digital Transformation on Low-Carbon Supply Chains: Empirical Evidence from China. Sustainability, 16(18), 8242. https://doi.org/10.3390/su16188242