The Impacts of Carbon Policy and “Dual Carbon” Targets on the Industrial Resilience of Ferrous Metal Melting and Rolling Manufacturing in China

Abstract

1. Introduction

2. Methodology

2.1. Comprehensive Indicator System for Supply Chain Resilience in Ferrous Smelting and Rolling Manufacturing

2.2. Evaluation Methodology—Entropy Weight Method

2.3. Research Design

2.3.1. Modelling

2.3.2. Variable Setting

3. Results

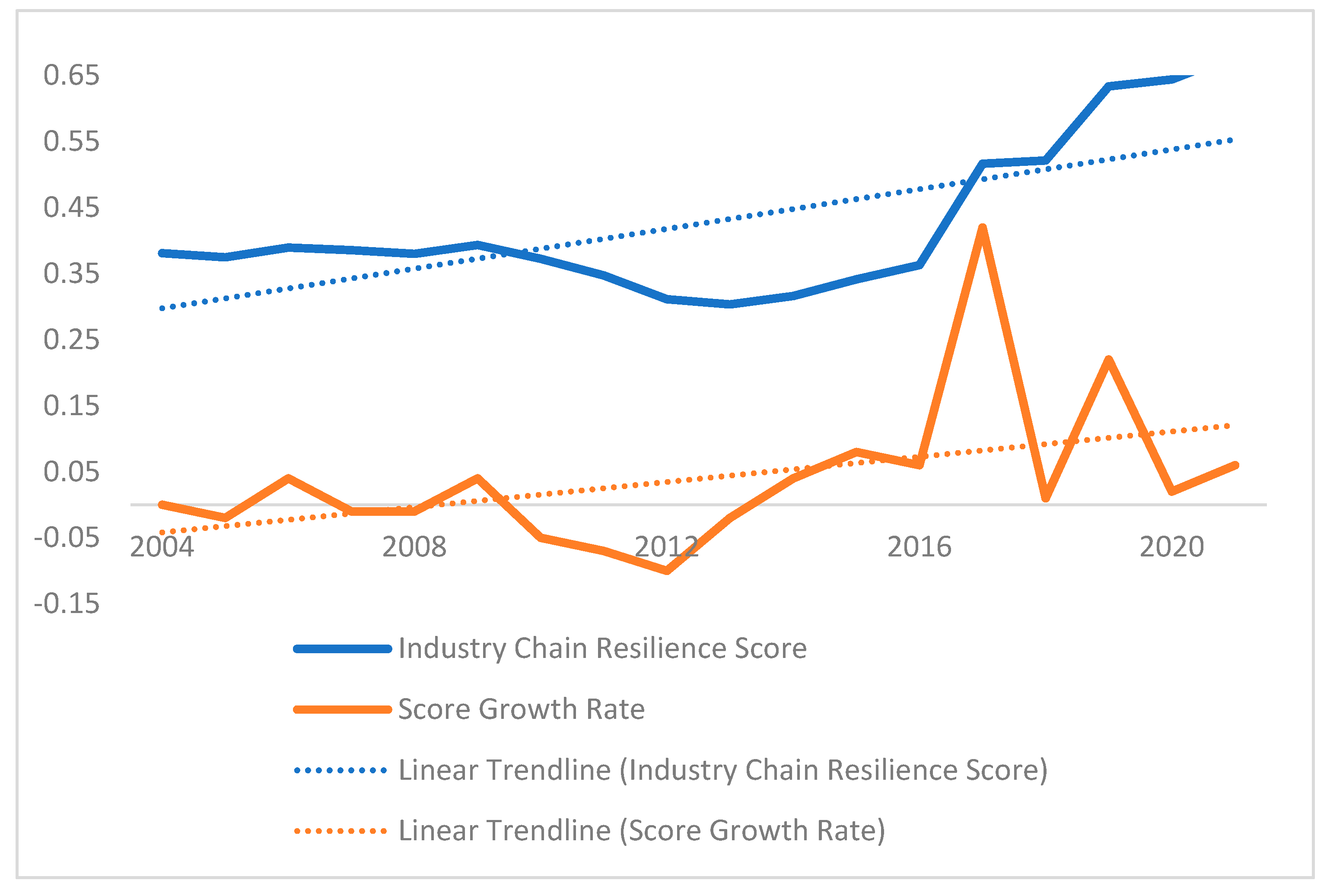

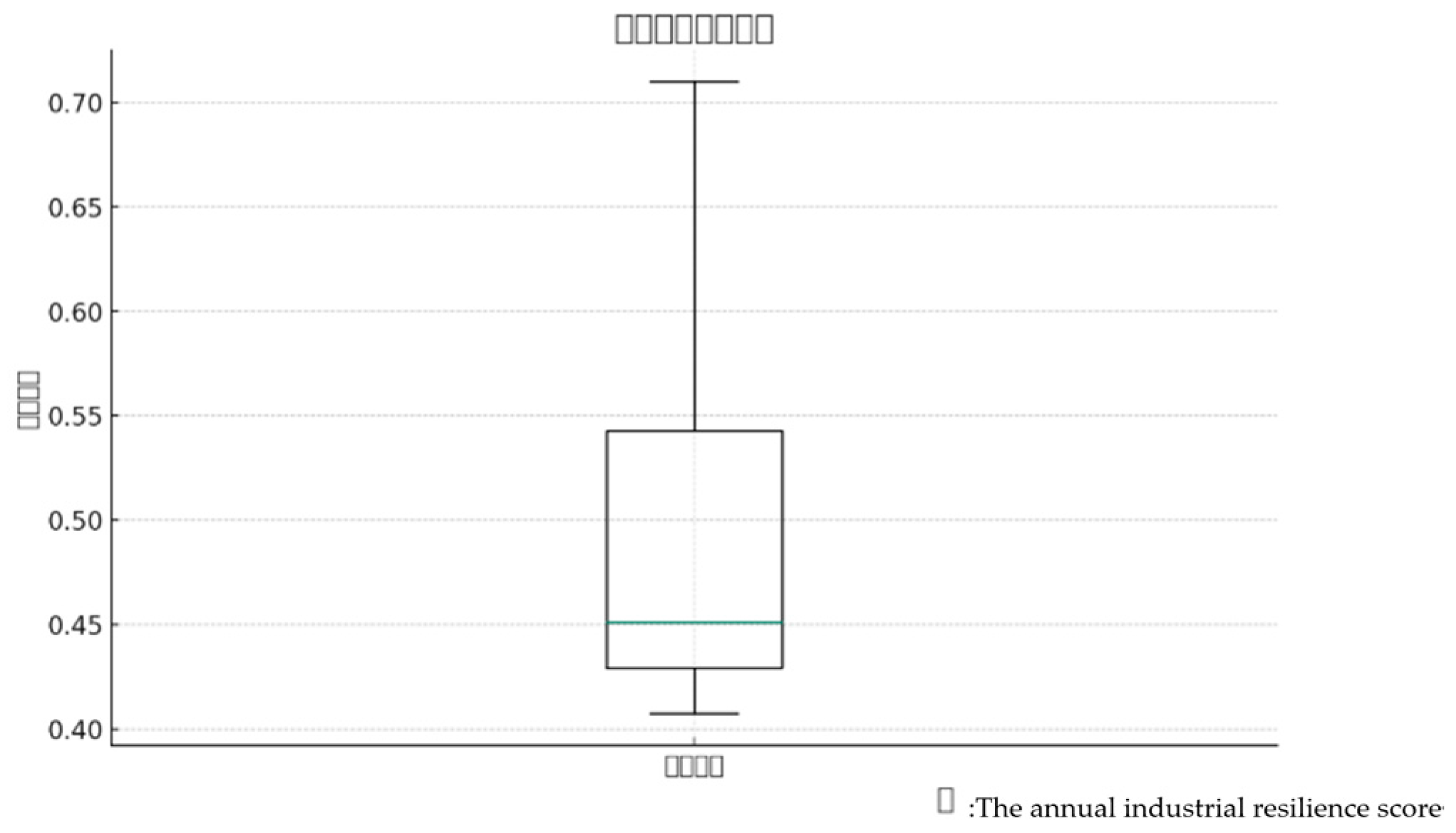

3.1. Comprehensive Score of Industrial Toughness of Ferrous Metal Smelting and Rolling Industry

3.2. Benchmark Regression Results

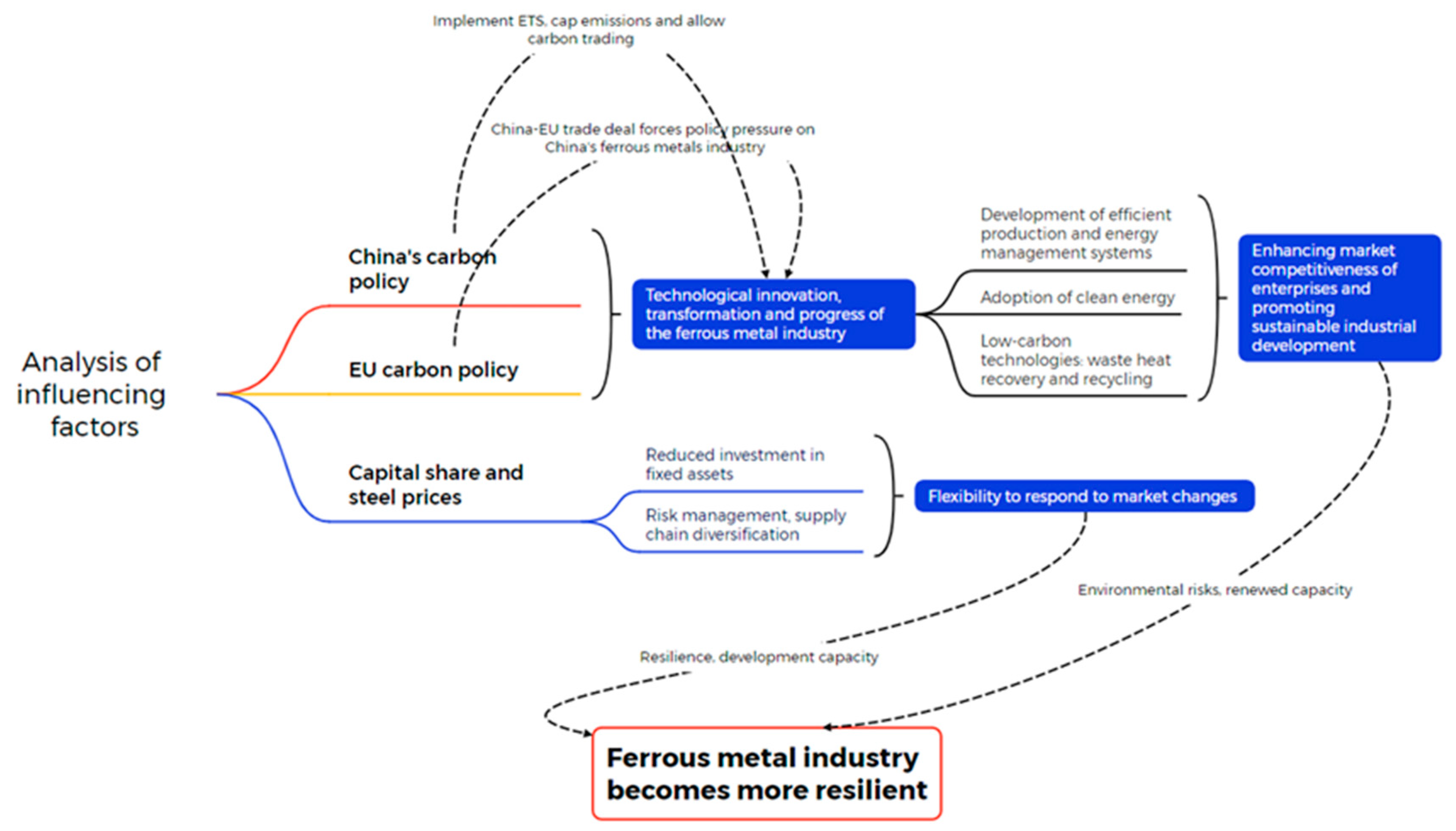

- China’s carbon policy exerts a notably positive impact on the comprehensive assessment, with a coefficient of 0.1145 and a p-value of <0.001, This demonstrates that since the launch of China’s carbon policy pilot in 2014, the policy’s implementation has significantly improved the overall performance of the industry. Beginning in 2018, the Chinese government has fully promoted the carbon emissions trading system (ETS), which mandates emission caps and allows for nationwide carbon credit trading. This measure has directly contributed to technological innovation and the optimization of energy use in companies. The policy not only aligns with both domestic and international carbon reduction goals but also compels ferrous metal smelting and rolling companies to adopt more efficient production technologies and energy management systems. By integrating domestic air quality management with carbon trading, the policy helps firms meet increasingly stringent environmental regulations and avoid potential carbon tax liabilities. This technological innovation directly enhances the competitiveness of firms in the marketplace, allowing them to respond more effectively to external economic and policy pressures, thereby increasing the resilience of the industry as a whole. This suggests that China’s carbon policy has been successful in integrating environmental protection objectives with industrial development and promoting sustainable industrial development.

- The EU carbon policy also exerts a notably positive impact on the comprehensive assessment on the composite evaluation, with a coefficient of 0.0571 and a p-value of 0.003. This highlights the significant positive impact of the EU’s Emissions Trading System (ETS) on the ferrous metal smelting and rolling industry since its implementation in 2005. The EU’s ETS, the world’s first and most developed carbon market, compels companies to reduce emissions by setting a cap on carbon emissions and allowing the trading of carbon credits. It also incentivizes the adoption of cleaner energy and green technologies. This policy framework places particular emphasis on technological innovation and productivity improvements, such as waste heat recovery and recycling technologies, which have significantly enhanced the environmental resilience of industries [17]. Given the close trade links between China’s ferrous metal smelting and rolling industry and the EU, the EU’s carbon policy not only affects the export market environment for Chinese enterprises but also encourages them to enhance their adaptability to environmental changes. This, in turn, promotes the low-carbon transformation and sustainable development of the industry chain. Thus, the EU’s carbon policy not only boosts the industry’s international competitiveness but also makes a significant contribution to global environmental protection.

- Capital share and steel price, as control variables, do not have significant effects on the overall evaluation, with p-values of 0.356 and 0.516, respectively. In the capital-intensive ferrous metal smelting and rolling industry, excessive investment in fixed assets may reduce a company’s ability to respond quickly to market changes. A high proportion of fixed assets can make it difficult for enterprises to remain flexible when adapting to carbon policies and shifts in market demand. Moreover, although the cost of raw materials is a significant factor, the resilience of the industry is more profoundly influenced by internal management, technological innovation, and strategies for adapting to policies. This indicates that the ferrous metal smelting and rolling industry has effectively mitigated the impact of price fluctuations through various mechanisms, such as risk management strategies and the diversification of the supply chain.

3.3. DID Model Validity Test

- The positive impacts of China’s carbon policy and the EU’s carbon policy on the comprehensive evaluation remain significant, with coefficients and p-values consistent with previous analyses. This is further evidence that the conclusion that these variables have significant positive impacts on the comprehensive evaluation is robust.

- The effects of the control variables “capital share” and “steel price” on the overall evaluation remain insignificant, in line with the outcomes from the prior analysis.

- The explanatory power of the model (adjusted R-squared of 0.865) and the overall significance of the model (p-value of the F-statistic) remain unchanged, indicating that the model fits the data well.

- The positive impact of China’s carbon policy on the overall evaluation remains significant, with a slight increase in the coefficient to 0.1166 and a p-value of <0.001, indicating a relatively stable result.

- The positive impact of the EU carbon tax policy also remains significant, with a slight increase in the coefficient to 0.0608 and a p-value of 0.002, further validating its positive effect on the overall evaluation.

- The coefficient for steel prices is similar to that in the previous model, but still insignificant (p-value = 0.400), suggesting that its effect on the composite evaluation is not significant.

| Name | Y2 |

|---|---|

| ccp | −0.0085 |

| (0.0351) | |

| ecp | 0.0599 * |

| (0.0292) | |

| cr | 0.4361 |

| (0.2440) | |

| fmp | 0.00008 |

| (0.0005) | |

| pi | |

| CCP_Lag | 0.0448 |

| (0.0391) | |

| ECP_Lag | 0.0376 |

| (0.0306) | |

| timetrend | 0.0145 ** |

| (0.0060) | |

| R-squared | 0.9685 |

| Adj. R-squared | 0.9439 |

4. Conclusions and Recommendations

4.1. Conclusions

4.2. Recommendations

5. Discussion

5.1. Overall Assessment

5.2. Research Limitations

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zhou, L.L.; Gu, A.L.; Teng, F.; He, J.K. Influences of Border Carbon Adjustments on China’s Foreign Trade. Chin. J. Popul. Resour. Environ. 2012, 10, 94–100. [Google Scholar] [CrossRef]

- Tommaso, M.R.D.; Prodi, E.; Pollio, C.; Barbieri, E. Conceptualizing and measuring “industry resilience”: Composite indicators for postshock industrial policy decision-making. Socio-Econ. Plan. Sci. 2023, 85, 101448. [Google Scholar] [CrossRef]

- Cao, Q.R.; Zhou, S.Y.; Sajid, M.J.; Cao, M. The impact of China’s carbon-reduction policies on provincial industrial competitiveness. Energy Effic. 2022, 15, 34. [Google Scholar] [CrossRef]

- Chou, K.T.; Liou, H.M. Carbon Tax in Taiwan: Path Dependence and the High-Carbon Regime. Energies 2023, 16, 513. [Google Scholar] [CrossRef]

- Steenkamp, L.A. A classification framework for carbon tax revenue use. Clim. Policy 2021, 21, 897–911. [Google Scholar] [CrossRef]

- Mechouar, Y.; Hovelaque, V.; Gaigné, C. Effect of raw material substitution on the facility location decision under a carbon tax policy. EURO J. Transp. Logist. 2022, 11, 100061. [Google Scholar] [CrossRef]

- Morgenstern, R.D.; Ho, M.; Shih, J.S.; Zhang, X.H. The near-term impacts of carbon mitigation policies on manufacturing industries. Energy Policy 2004, 32, 1825–1841. [Google Scholar] [CrossRef]

- Shi, K.H.; Du, D.N.; Zhang, X.X. Performance Prediction of the Ferrous Metal Smelting and Rolling Processing Industry in Supply-Side Structural Reform in China. J. Math. 2021, 2021, 2383473. [Google Scholar] [CrossRef]

- Qiu, L.L.; Zhao, H.F.; Li, L. Analysis on Investment Value of Listed Companies in the Industries of Ferrous and Non-ferrous Metal Smelting and Rolling and Metal Products. In Proceedings of the International Symposium on Open Economy and Financial Engineering, US Global Finance Assoc, Hangzhou, China, 24–26 April 2023; pp. 537–567. [Google Scholar]

- Shen, J.; Zhao, C.H. Carbon Trading or Carbon Tax? A Computable General Equilibrium-Based Study of Carbon Emission Reduction Policy in China. Front. Energy Res. 2022, 10, 906847. [Google Scholar] [CrossRef]

- Martin, R. Regional economic resilience, hysteresis and recessionary shocks. J. Econ. Geogr. 2012, 12, 1–32. [Google Scholar] [CrossRef]

- Lenort, R.; Wicher, P. Concept of a system for resilience measurement in industrial supply chain. In Proceedings of the 22nd International Conference on Metallurgy and Materials (METAL), Brno, Czech Republic, 15–17 May 2013; pp. 1982–1988. [Google Scholar]

- Wu, A.B.; Sun, Y.; Zhang, H.L.; Sun, L.H.; Wang, X.P.; Li, B.Y. Research on Resilience Evaluation of Coal Industrial Chain and Supply Chain Based on Interval Type-2F-PT-TOPSIS. Processes 2023, 11, 566. [Google Scholar] [CrossRef]

- Gölgeci, I.; Kuivalainen, O. Does social capital matter for supply chain resilience? The role of absorptive capacity and marketing-supply chain management alignment. Ind. Mark. Manag. 2020, 84, 63–74. [Google Scholar] [CrossRef]

- Negri, M.; Cagno, E.; Colicchia, C.; Sarkis, J. Integrating sustainability and resilience in the supply chain: A systematic literature review and a research agenda. Bus. Strategy Environ. 2021, 30, 2858–2886. [Google Scholar] [CrossRef]

- Qi, S.Z.; Zhou, C.B.; Li, K.; Tang, S.Y. The impact of a carbon trading pilot policy on the low-carbon international competitiveness of industry in China: An empirical analysis based on a DDD model. J. Clean. Prod. 2021, 281, 125361. [Google Scholar] [CrossRef]

- Chai, S.L.; Sun, R.X.; Zhang, K.; Ding, Y.T.; Wei, W. Is Emissions Trading Scheme (ETS) an Effective Market-Incentivized Environmental Regulation Policy? Evidence from China’s Eight ETS Pilots. Int. J. Environ. Res. Public Health 2022, 19, 3177. [Google Scholar] [CrossRef]

- Qian, Z.; Yunjia, W.; Lu, L. Carbon Tax or Low-Carbon Subsidy? Carbon Reduction Policy Options under CCUS Investment. Sustainability 2023, 15, 5301. [Google Scholar] [CrossRef]

- Shinagawa, S.; Tsuzuki, E. Policy Lag and Sustained Growth. Ital. Econ. J. 2019, 5, 403–431. [Google Scholar] [CrossRef]

- Zhang, H.X.; Li, S.B. Research on the Factors Influencing CO2 Emission Reduction in High-Energy-Consumption Industries under Carbon Peak. Sustainability 2023, 15, 13437. [Google Scholar] [CrossRef]

- Du, M.; Chai, S.L.; Li, S.; Sun, Z.J. How Environmental Regulation Affects Green Investment of Heavily Polluting Enterprises: Evidence from Steel and Chemical Industries in China. Sustainability 2022, 14, 11971. [Google Scholar] [CrossRef]

- Ruan, T.S.; Gu, Y.; Li, X.H.; Qu, R. Research on the Practical Path of Resource-Based Enterprises to Improve Environmental Efficiency in Digital Transformation. Sustainability 2022, 14, 13974. [Google Scholar] [CrossRef]

- Dimitriou, D.; Sartzetaki, M. Criticality of a regional airport development to mitigate COVID-19 economic effects. Case Stud. Transp. Policy 2022, 10, 581–590. [Google Scholar] [CrossRef] [PubMed]

- Cherepovitsyn, A.; Stroykov, G.; Nevolin, A. Efficiency of Low-Carbon Technologies Implementation at Non-Ferrous Metallurgy Enterprises under the Conditions of Carbon-Regulation Development in Russia. Sustainability 2023, 15, 16640. [Google Scholar] [CrossRef]

- Kondo, R.; Kinoshita, Y.; Yamada, T. Green Procurement Decisions with Carbon Leakage by Global Suppliers and Order Quantities under Different Carbon Tax. Sustainability 2019, 11, 3710. [Google Scholar] [CrossRef]

- Gianoli, A.; Bravo, F. Carbon Tax, Carbon Leakage and the Theory of Induced Innovation in the Decarbonisation of Industrial Processes: The Case of the Port of Rotterdam. Sustainability 2020, 12, 7667. [Google Scholar] [CrossRef]

- Liu, W.J.; Li, Y.Y.; Liu, T.T.; Liu, M.; Wei, H. How to Promote Low-Carbon Economic Development? A Comprehensive Assessment of Carbon Tax Policy in China. Int. J. Environ. Res. Public Health 2021, 18, 10699. [Google Scholar] [CrossRef]

- Liang, X.; Xu, Z.; Wang, Z.; Wei, Z. Low-carbon economic growth in Chinese cities: A case study in Shenzhen city. Environ. Sci. Pollut. Res. Int. 2023, 30, 25740–25754. [Google Scholar] [CrossRef]

| First-Level Indicators | Second-Level Indicators | Specific Indicators | Indicator Attribute | |||

|---|---|---|---|---|---|---|

| Resilience | A1 | Gearing ratio | B1 | Gearing ratio | C1 | Negative |

| Product inventory turnover days | B2 | Inventory turnover (%) | C2 | Positive | ||

| Accounts receivable turnover days | B3 | Accounts receivable turnover (%) | C3 | Positive | ||

| Supply chain security index | B4 | Import dependency | C4 | Negative | ||

| Export dependence | C5 | Negative | ||||

| Supply concentration | C6 | Negative | ||||

| Composite index of scale of supply and competitive influence | C7 | Positive | ||||

| Capacity development | A2 | Main operating costs | B5 | Main business costs of industrial enterprises above designated size (CNY billion) | C8 | Negative |

| Investment income | B6 | Total profit of ferrous metal smelting and rolling processing industry (CNY billion) | C9 | Positive | ||

| Net assets | B7 | Total assets of industrial enterprises above designated size (CNY billion) | C10 | Positive | ||

| Dominant comparative advantage | B8 | Dominant competitive advantage in upstream, midstream and downstream trade | C11 | Positive | ||

| Trade competitive advantage | B9 | Trade competitive advantage in upstream, midstream and downstream trade | C12 | Positive | ||

| Environmental risk | A3 | Wastewater discharge | B10 | Total industrial wastewater discharge (tonnes) | C13 | Negative |

| Exhaust emissions | B11 | Total industrial emissions (billion cubic metres) | C14 | Negative | ||

| Solid waste | B12 | Total solid waste generation (tonnes) | C15 | Negative | ||

| Renewal of capacity | A4 | Full-time equivalent | B13 | Full-time equivalent of national research and development (R&D) personnel (tens of thousands CNY/year) | C16 | Positive |

| Applied Research | B14 | National financial expenditure on science and technology (CNY billion) | C17 | Positive | ||

| R&D provision | B15 | Internal expenditure on national research and experimental development (R&D) funding (CNY billion) | C18 | Positive | ||

| Term (in a Mathematical Formula) | Information Entropy Value e | Information Utility Value d | Weighting (%) |

|---|---|---|---|

| Inventory turnover (%) | 0.897 | 0.103 | 4.107 |

| Accounts receivable turnover ratio (%) | 0.929 | 0.071 | 2.812 |

| Composite index of scale of supply and competitive influence | 0.54 | 0.46 | 18.365 |

| Total profit of ferrous metal smelting and rolling processing industry (CNY billion) | 0.93 | 0.07 | 2.812 |

| Total assets of industrial enterprises above designated size (CNY billion) | 0.937 | 0.063 | 2.505 |

| Competitive advantage in upstream trade | 0.924 | 0.076 | 3.048 |

| Competitive advantage in midstream trade | 0.927 | 0.073 | 2.904 |

| Competitive advantage in downstream trade | 0.95 | 0.05 | 2.013 |

| Upstream dominant comparative advantage | 0.878 | 0.122 | 4.851 |

| Midstream dominant comparative advantage | 0.88 | 0.12 | 4.778 |

| Downstream explicit comparative advantage | 0.861 | 0.139 | 5.544 |

| Full-time equivalent of national research and development (R&D) personnel (tens of thousands CNY/year) | 0.914 | 0.086 | 3.433 |

| National financial expenditure on science and technology (CNY billion) | 0.896 | 0.104 | 4.133 |

| Internal expenditure on national research and experimental development (R&D) funding (CNY billion) | 0.881 | 0.119 | 4.756 |

| Gearing ratio | 0.886 | 0.114 | 4.561 |

| Upstream import dependence | 0.952 | 0.048 | 1.899 |

| Midstream import dependence | 0.964 | 0.036 | 1.455 |

| Downstream import dependence | 0.942 | 0.058 | 2.313 |

| Upstream export dependence | 0.964 | 0.036 | 1.428 |

| Midstream export dependence | 0.96 | 0.04 | 1.583 |

| Downstream export dependence | 0.956 | 0.044 | 1.752 |

| Upstream supply concentration | 0.897 | 0.103 | 4.095 |

| Midstream supply concentration | 0.911 | 0.089 | 3.548 |

| Downstream supply concentration | 0.925 | 0.075 | 3 |

| Main business costs of industrial enterprises above designated size (CNY billion) | 0.945 | 0.055 | 2.193 |

| Total industrial wastewater discharge (tonnes) | 0.98 | 0.02 | 0.796 |

| Total industrial emissions (billion cubic metres) | 0.96 | 0.04 | 1.589 |

| Total solid waste generation (tonnes) | 0.907 | 0.093 | 3.727 |

| Notation | Variant | Definition | Observed Value | Average Value | (Statistics) Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|---|---|

| SCIRit | Industry chain resilience | Ferrous metal smelting and rolling industry toughness level for industry in year i | 504 | 0.4801 | 0.09831 | 0.40731 | 0.70981 |

| CCPit | Chinese policy dummy variables | Dummy variables before and after carbon policy implementation in China | 504 | 0.3888 | 0.50168 | 0 | 1 |

| ECPit | European policy dummy variables | Dummy variables before and after the implementation of the European carbon policy | 504 | 0.1667 | 0.3835 | 0 | 1 |

| CRit | Capital ratio | State capital to paid-in capital ratio | 504 | 0.2589 | 0.0719 | 0.1658 | 0.4023 |

| FMPit | Ferrous metal prices | Ferrous metal prices | 504 | 109.7385 | 18.9301 | 66.8324 | 143.0963 |

| Name | Y1 |

|---|---|

| ccp | 0.1150 *** |

| (−0.0225) | |

| ecp | 0.1136 *** |

| (0.0307) | |

| cr | −0.1234 |

| (0.1289) | |

| fmp | −0.0003 |

| (0.0004) | |

| pi | 0 |

| R-squared | 0.9086 |

| Adj. R-squared | 0.8805 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wan, R.; Xia, B. The Impacts of Carbon Policy and “Dual Carbon” Targets on the Industrial Resilience of Ferrous Metal Melting and Rolling Manufacturing in China. Sustainability 2024, 16, 8385. https://doi.org/10.3390/su16198385

Wan R, Xia B. The Impacts of Carbon Policy and “Dual Carbon” Targets on the Industrial Resilience of Ferrous Metal Melting and Rolling Manufacturing in China. Sustainability. 2024; 16(19):8385. https://doi.org/10.3390/su16198385

Chicago/Turabian StyleWan, Rui, and Bing Xia. 2024. "The Impacts of Carbon Policy and “Dual Carbon” Targets on the Industrial Resilience of Ferrous Metal Melting and Rolling Manufacturing in China" Sustainability 16, no. 19: 8385. https://doi.org/10.3390/su16198385

APA StyleWan, R., & Xia, B. (2024). The Impacts of Carbon Policy and “Dual Carbon” Targets on the Industrial Resilience of Ferrous Metal Melting and Rolling Manufacturing in China. Sustainability, 16(19), 8385. https://doi.org/10.3390/su16198385