Financial Inclusion and Poverty Alleviation: A Critical Analysis in Nigeria

Abstract

1. Introduction

2. Literature Review and Hypotheses Development

2.1. Theoretical Frameworks on Financial Inclusion (FI) and Poverty

2.2. Financial Inclusion and Poverty

2.3. The Case of Nigeria

3. Methodology and Methods

3.1. Data and Model Specification

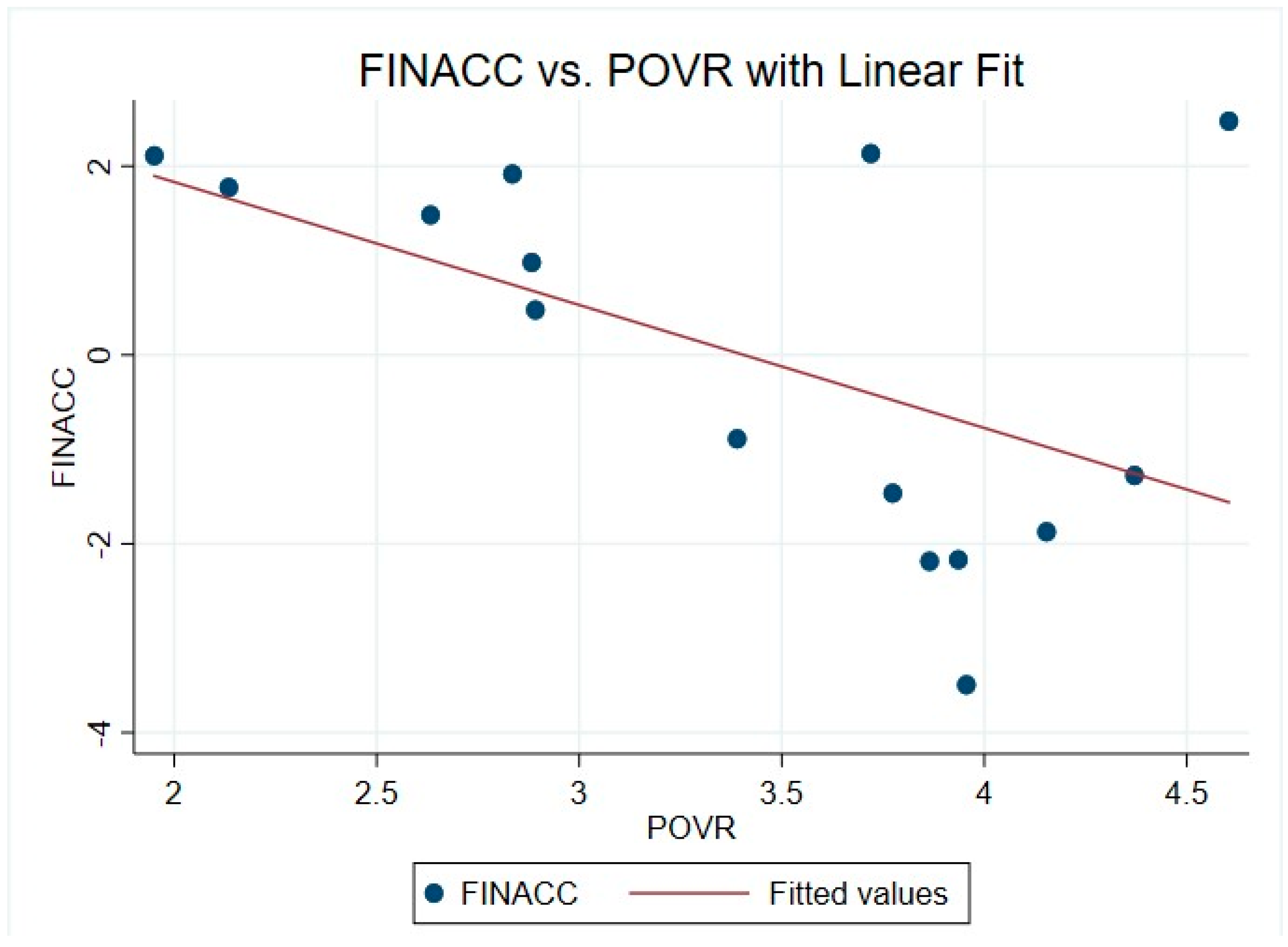

3.1.1. Financial Access (FINACC) and Poverty

3.1.2. Financial Usage and Quality on Poverty Alleviation

3.1.3. Financial Inclusion Index on Poverty Alleviation

3.2. Strategy of Data Analysis

Binary Regression Analysis for Models 1 and 2

4. Results

4.1. Descriptive Statistics

4.1.1. Descriptive Statistics for Financial Access Variables

4.1.2. Descriptive Statistics for Model 1

4.2. Principal Component Analysis (PCA)

4.2.1. Reliability and Validity

4.2.2. Access to Financial Services and Poverty Alleviation

4.3. Test of Hypotheses

4.3.1. Financial Usage and Poverty Alleviation

4.3.2. Quality of Financial Services and Poverty Alleviation

4.3.3. Financial Inclusion and Poverty Alleviation

5. Discussion

5.1. Implications for Theory

5.2. Implications for Practice

5.3. Limitations and Implications for Future Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Summary of Variables for Access Indicators and Control Regressors

| Access Indicators | Definition | Source of Data | |

| POVR | Poverty rate | Log poverty headcount ratio, defined as the percentage of the population living on less than USD 1.9 per day at 2011 international prices; was used to calculate poverty rates in the study. | |

| FINACC | Number of automated teller machines (ATMs) per 100,000 adults | This metric represents the number of ATMs per 100,000 adult individuals in Nigeria | IMF Financial Access Surveys |

| ATMs per 1000 km2 (Atm km2) | This variable identifies the number of ATMs in Nigeria per 1000 square kilometres. | IMF Financial Access Surveys | |

| Number of commercial bank branches per 100,000 adults | This metric represents the number of commercial banks and their respective branches per 100,000 adult individuals in Nigeria. | IMF Financial Access Surveys | |

| Commercial bank branches per 1000 km2 (Branch km2) | This variable identifies the number of commercial bank branches in Nigeria per 1000 square kilometres. | IMF Financial Access Surveys | |

| Depositors with commercial banks (per 1000 adults) | This variable represents the number of depositors with commercial banks per 100,000 adult individuals in Nigeria. | IMF Financial Access Surveys | |

| Control Regressors | |||

| CRS | Credit to private sector (% of GDP) | Domestic credit to private sector pertains to the monetary funds extended to the private sector by financial institutions, which may include loans, non-equity securities purchases, trade credits, and other accounts receivable that create an obligation for reimbursement (World Bank, 2022) [84]. CRS is expected to have a negative coefficient. | World Development Indicators |

| INFL | Inflation rate (Consumer price index) | The term “inflation” refers to the alteration in wholesale prices on a yearly basis. According to [85], the poor are more sensitive to the negative consequences of regular, large price swings since they keep more cash in smaller investments and have less access to inflation hedging tools. Thus, the model’s INFL coefficient will be positive. | World Development Indicators |

| GCF | Gross Capital Formation (% of GDP) | Expenditures on the creation of new fixed assets and the net change in inventory are the two components that make up an economy’s gross capital formation [84]. This variable is expected to have a negative coefficient. | World Development Indicators |

| Note: Data for FINACC and other variables were from IMF Access survey (Macrodata). | |||

Appendix B. Usage, Quality and Overall Inclusion Index Indicators of FI and Control Variables

| Indicators | Variables Description | Coding | Source |

| POOR | This is the income quintile of the household. This variable is made up of five quintiles (poor, second, middle, fourth richest). It is further divided into two groups. “Poor” includes poor and second, while “non-poor” include middle, fourth and richest. This is based on WDI 40% and 60% income grouping. | The outcome variable is a binary variable denoted as “poor”, where a value of 1 was assigned to individuals “within economy income quintile” who fell within the lowest 40% of the distribution, and 0 was assigned otherwise [22,39]. | Global Findex Survey (2021) |

| Financial Usage (FINUSE) | |||

| ACCT | Number of adults who report having an account at a financial institution | ACCT is coded 1 if the adult has an account at a financial institution and 0 otherwise | Global Findex Survey (2021) |

| MOACC | Percentage of adults who report having a mobile account | MOACC is coded 1 if the adult reported having a bank account and 0 otherwise | Global Findex Survey (2021) |

| SAVED | Percentage of adults who saved in the past year. | SAVED is coded 1 if the saved in the past year and 0 otherwise | Global Findex Survey (2021) |

| BORROWED | Percentage of adults who borrowed in the past year. | BORROWED is coded 1 if the saved in the past year and 0 otherwise | Global Findex Survey (2021) |

| Product Quality (FINQUA) | |||

| EMERGENCY | Adults whose main source of emergency funds in 30 days was their saving | EMERGENCY is coded 1 if the adult reported using saving as emergency fund and 0 otherwise. | Global Findex Survey (2021) |

| DIGITAL | Adults who made or received a digital payment. | It will be coded 1 if the adult made or received a digital payment and 0 otherwise. | Global Findex Survey (2021) |

| WAGE | Number of adults who received wage payments into an account | It will be coded 1 if adult received wage payments into an account and 0 otherwise. | Global Findex Survey (2021) |

| Control Variables | |||

| EDU | Educational level of the respondent | EDU is coded as: No education (0), primary (1) Secondary (2), and tertiary (3). | Global Findex Survey (2021) |

| EMP | Employment status of the respondent | EMP is coded 1 if the adult is in the workforce and 0 otherwise | Global Findex Survey (2021) |

| RURAL | Where the respondent lives | RURA is coded 1 if the adult lives in rural area and 0 otherwise | Global Findex Survey (2021) |

| AGE | Age of individual respondent | This is a continuous variable | Global Findex Survey (2021) |

| GEN | Gender of the respondent | GEN is coded 1 if the adult is in the male and 0 female | Global Findex Survey (2021) |

| Note: Data for FINUSE, FINQUA and FI were from the 2021 Global findex (microdata). | |||

References

- Osuji, C.C.; Erhijakpor, A.; Mgbeze, J.C. Electronic Banking Platforms and Financial Inclusiveness Index in Nigeria. Int. J. Manag. Commer. Innov. 2022, 10, 463–470. [Google Scholar]

- Baidoo, S.T.; Yusif, H.; Ayesu, E.K. Improving loan repayment in Ghana: Does financial literacy matter? Cogent Econ. Financ. 2020, 8, 1787693. [Google Scholar] [CrossRef]

- Bateman, M.; Duvendack, M.; Loubere, N. Is fintech the new panacea for poverty alleviation and local development? Contesting Suri and Jack’s M-Pesa findings published in Science. Rev. Afr. Polit. Econ. 2019, 46, 480–495. [Google Scholar] [CrossRef]

- Koomson, I.; Villano, R.A.; Hadley, D. Effect of financial inclusion on poverty and vulnerability to poverty: Evidence using a multidimensional measure of financial inclusion. Soc. Indic. Res. 2020, 149, 613–639. [Google Scholar] [CrossRef]

- Ene, E.E. The impact of electronic banking on FI in Nigeria. Am. J. Bus. Manag. 2019, 9, 201–230. [Google Scholar]

- Demirgüç-Kunt, A.; Klapper, L.; Singer, D. The Global Findex Database 2017: Measuring Financial Inclusion and the FinTech Revolution; The World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Dogan, E.; Madaleno, M.; Taskin, D. Financial inclusion and poverty: Evidence from Turkish household survey data. Appl. Econ. 2022, 54, 2135–2147. [Google Scholar] [CrossRef]

- Jia, S.; Qiu, Y.; Yang, C. Sustainable development goals, financial inclusion, and grain security efficiency. Agronomy 2021, 11, 2542. [Google Scholar] [CrossRef]

- Vo, D.H.; Nguyen, N.T.; Thi-Hong, V.L. Financial Inclusion and stability in the Asian region using bank-level data. Borsa Istanbul Rev. 2020, 21, 36–43. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A.; Klapper, L.; Singer, D.; Ansar, S. The Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19; The World Bank: Washington, DC, USA, 2022. [Google Scholar] [CrossRef]

- Mehrotra, A.N.; Yetman, J. Financial inclusion-issues for central banks. BIS Q. Rev. March 2015, 83–96. Available online: https://ssrn.com/abstract=2580310 (accessed on 23 July 2024).

- Chakravarty, S.R.; Pal, R. Financial inclusion in India: An axiomatic approach. J. Policy Model. 2013, 35, 813–837. [Google Scholar] [CrossRef]

- Sharma, D. Nexus between financial inclusion and economic growth: Evidence from the emerging Indian economy. J. Financ. Econ. Policy 2016, 8, 13–36. [Google Scholar] [CrossRef]

- World Bank. Nigeria Poverty Assessment 2022: A Better Future for All Nigerians; The World Bank: Washington, DC, USA, 2022; Available online: https://openknowledge.worldbank.org/handle/10986/37295 (accessed on 24 June 2023).

- Ansar, S.; Klapper, L.; Singer, D. The importance of financial education for the effective use of formal financial services. J. Fin. Lit. Wellbeing 2023, 1, 28–46. [Google Scholar] [CrossRef]

- Ozili, P.K. Financial inclusion in Nigeria: An overview. Int. J. Bank. Financ. 2022, 17, 1–24. [Google Scholar] [CrossRef]

- Enhancing Financial Innovation & Access (EFInA). EFInA Access to Financial Services in Nigeria. 2021. Available online: https://efina.org.ng/ (accessed on 23 July 2024).

- Awaworyi Churchill, S.; Nuhu, A.S.; Smyth, R. Financial inclusion and poverty: Micro-level evidence from Nigeria. In Moving from the Millennium to the Sustainable Development Goals; Awaworyi Churchill, S., Ed.; Palgrave MacMillan: Singapore, 2020; pp. 11–36. [Google Scholar]

- Ndem, B.E.; Walter, M.H.; Henry, J.T.; Lebo, M.P. Financial Inclusion and Poverty Alleviation in Akwa Ibom State, Nigeria: The Case Study of Small and Medium Enterprises. Int. J. Econ. Financ. Issues 2022, 12, 129–134. [Google Scholar] [CrossRef]

- Ozili, P.K. Financial inclusion research around the world: A review. In Forum for Social Economics; Routledge: Oxfordshire, UK, 2021; Volume 50, pp. 457–479. [Google Scholar]

- Bello, S.; Oyedokun, E.G.; Adeolu-Akande, M. Financial Inclusion and Gender-Induced Poverty in Nigeria. Int. J. Res. Bus. Soc. Sci. 2022, 10, 266–274. [Google Scholar] [CrossRef]

- Lain, J.; Vishwanath, T. Tackling Poverty in Multiple Dimensions: A Proving Ground in Nigeria. World Bank Blogs. 2021. Available online: https://blogs.worldbank.org/en/opendata/tackling-poverty-multiple-dimensions-proving-ground-nigeria (accessed on 23 July 2024).

- Barbier, E.B.; Burgess, J.C. Sustainability and development after COVID-19. World Dev. 2020, 135, 105082. [Google Scholar] [CrossRef]

- National Bureau of Statistics. Nigeria Multidimensional Poverty Index. 2022. Available online: https://www.nigerianstat.gov.ng/pdfuploads/NIGERIA%20MULTIDIMENSIONAL%20POVERTY%20INDEX%20SURVEY%20RESULTS%202022.pdf (accessed on 15 June 2023).

- Omar, M.A.; Inaba, K. Does financial inclusion reduce poverty and income inequality in developing countries? A panel data analysis. J. Econ. Struct. 2020, 9, 37. [Google Scholar] [CrossRef]

- Sarma, M. Measuring FI using multidimensional data. World Econ. 2016, 17, 15–40. [Google Scholar]

- Pesqué-Cela, V.; Tian, L.; Luo, D.; Tobin, D.; Kling, G. Defining and measuring financial inclusion: A systematic review and confirmatory factor analysis. J. Int. Dev. 2021, 33, 316–341. [Google Scholar] [CrossRef]

- Abimbola, A.; Olokoyo, F.; Babalola, O. Financial inclusion as a catalyst for poverty reduction in Nigeria. Int. J. Sci. Res. Manag. 2018, 6, 481–490. [Google Scholar]

- Aribaba, F.O.; Adedokun, O.J.; Oladele, R.; Babatunde, A.D.; Ahmodu, O.; Olasehinde, S.A. Financial inclusion scheme and poverty alleviation in Nigeria (2004–2019). Acta Univ. Danubius. Acon. 2020, 16, 220–233. [Google Scholar]

- Adeleke, O.K.; Olomola, P. An Empirical Investigation of Financial Inclusion, Poverty and Inequality in Nigeria. Redeemer’s Univ. J. Manag. Soc. Sci. 2022, 5, 1–18. [Google Scholar]

- Ogbeide, S.O.; Igbinigie, O.O. Financial inclusion and poverty alleviation in Nigeria. Acc. Tax. Rev. 2019, 3, 42–54. [Google Scholar]

- Sakanko, M.A.; David, J.; Onimisi, A.M. Advancing inclusive growth in Nigeria: The role of financial inclusion in poverty, inequality, household expenditure, and unemployment. Indones. J. Islamic Econ. Res. 2020, 2, 70–84. [Google Scholar] [CrossRef]

- Ajide, F. Financial inclusion and rural poverty reduction: Evidence from Nigeria. Int. J. Manag. Sci. Hum. 2015, 3, 1–15. [Google Scholar]

- Umaru, H.; Imo, C.C. The effects of financial inclusion on poverty reduction: The moderating effects of microfinance. Int. J. Multidiscip. Res. Dev. 2018, 5, 188–198. [Google Scholar]

- International Monetary Fund (IMF). IMF Data to Macroeconomic and Financial Data. 2023. Available online: https://data.imf.org/?sk=388dfa60-1d26-4ade-b505-a05a558d9a42 (accessed on 10 June 2023).

- Sarma, M. Index of Financial Inclusion. In Indian Council for Research on International Economic Relations; Working Paper; Indian Council for Research on International Economic Relations (ICRIER): New Delhi, India, 2008. [Google Scholar]

- Sharma, U.; Changkakati, B. Dimensions of global financial inclusion and their impact on the achievement of the United Nations Development Goals. Borsa Istanbul Rev. 2022, 22, 1238–1250. [Google Scholar] [CrossRef]

- World Bank. The Global Findex Data Base 2017; The World Bank: Washington, DC, USA, 2018; Available online: https://globalfindex.worldbank.org/ (accessed on 25 July 2023).

- Klapper, L.; Singer, D. The Role of Demand-Side Data. Measuring Financial Inclusion from the Perspective of Users of Financial Services; Bank of Morocco—CEMLA—IFC Satellite Seminar at the ISI World Statistic: Marrakech, Morocco, 2017. [Google Scholar]

- Eze, E.; Alugbuo, J.C. Financial inclusion and poverty reduction in Nigeria: A survey-based analysis. GSC Adv. Res. Rev. 2021, 7, 075–084. [Google Scholar]

- Fadun, O. Risk management in the financial services sector: The derivatives option. Int. J. Hum. 2014, 14, 18–27. [Google Scholar]

- Terzi, N. Financial inclusion in Turkey. Acad. J Interdiscip. Stud. 2015, 4, 269–276. [Google Scholar] [CrossRef][Green Version]

- Salman, A.Y.; Ayo-Oyebiyi, G.T.; Emenike, O.A. Influence of financial inclusion on small and medium scale enterprises growth and development in Nigeria. Int. J. Manag. Soc. Sci. 2015, 3, 390–401. [Google Scholar]

- Aghion, P.; Bolton, P. Theory of Trickle-Down Growth and Development. Rev. Econ. Stud. 1997, 64, 151–172. [Google Scholar] [CrossRef]

- Sethi, D.; Acharya, D. Financial inclusion and economic growth linkage: Some cross-country evidence. J. Financ. Econ. Policy 2018, 10, 369–385. [Google Scholar] [CrossRef]

- Arackal, F. Relevance and Application of Trickle-Down Theory of Development in the Context of India. Ph.D. Thesis, Amity University, Gurgaon, India, 2016. [Google Scholar]

- Boskov, T. Level of Deepening Financial Infrastructure, Fintech Companies and Financial Inclusion: Theory and Evidence. Int. J. Inf. Bus. Manag. 2018, 10, 23–31. [Google Scholar]

- Ulwodi, D.W.; Muriu, P.W. Barriers of Financial Inclusion in Sub-Saharan Africa. J. Econ. Sustain. Dev. 2017, 8, 66–81. [Google Scholar]

- Buckland, J. Financial inclusion and building financial resilience. In Building Financial Resilience: Do Credit and Finance Schemes Serve or Impoverish Vulnerable People? Palgrave Macmillan: Cham, Switzerland, 2018. [Google Scholar] [CrossRef]

- Bagehot, W. Lombard Street: A Description of the Money Market; HS King: London, UK, 1873. [Google Scholar]

- Schumpeter, J.A. The theory of economic development. In An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Harvard University Press: Cambridge, UK, 1934. [Google Scholar]

- Park, C.Y.; Mercado, R. Financial inclusion, poverty, and income inequality. Singap. Econ. Rev. 2018, 63, 185–206. [Google Scholar] [CrossRef]

- Tsouli, D. Financial inclusion, poverty, and income inequality: Evidence from European Countries. Ekon.—Vilniaus Univ. 2022, 101, 37–61. [Google Scholar] [CrossRef]

- Tran, H.T.; Le, H.T. The Impact of Financial Inclusion on Poverty Reduction. Asian J. Law Econ. 2021, 12, 95–119. [Google Scholar] [CrossRef]

- Ouechtati, I. The contribution of financial inclusion in reducing poverty and income inequality in developing countries. Asian Econ. Financ. Rev. 2020, 10, 1051–1061. [Google Scholar] [CrossRef]

- Xu, F.; Zhang, X.; Zhou, D. Does digital financial inclusion reduce the risk of returning to poverty? Evidence from China. Int. J. Financ. Econ. 2023, 29, 2927–2949. [Google Scholar] [CrossRef]

- Hathroubi, S. Inclusive finance, growth and socio-economic development in Saudi Arabia: A threshold co-integration approach. J. Econ. Dev. 2019, 44, 77–111. [Google Scholar] [CrossRef]

- Ratnawati, K. The Impact of Financial Inclusion on Economic Growth, Poverty, Income Inequality, and Financial Stability in Asia. J. Asian Financ. Econ. Bus. 2020, 7, 73–85. [Google Scholar] [CrossRef]

- Neaime, S.; Gaysett, I. Financial inclusion and stability in MENA: Evidence from poverty and inequality. Financ. Res. Lett. 2018, 24, 230–237. [Google Scholar] [CrossRef]

- Erlando, A.; Riyanto, F.D.; Masakazu, S. Financial inclusion, economic growth, and poverty alleviation: Evidence from eastern Indonesia. Heliyon 2020, 6, 1–13. [Google Scholar] [CrossRef]

- Saha, S.K.; Qin, J. Financial inclusion and poverty alleviation: An empirical examination. Econ. Change Restruct. 2023, 56, 409–440. [Google Scholar] [CrossRef]

- Mahalika, R.; Matsebula, V.; Yu, D. Investigating the relationship between financial inclusion and poverty in South Africa. Dev. S. Afr. 2023, 40, 109–132. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A.; Klapper, L.F. Measuring Financial Inclusion: The Global Findex Database; World Bank Policy Research Working Paper; The World Bank: Washington, DC, USA, 2012; Volume 6025, pp. 1–58. [Google Scholar]

- Nguyen, T.T. Measuring financial inclusion: A composite FI index for the developing countries. J. Econ. Dev. 2021, 23, 77–99. [Google Scholar] [CrossRef]

- Aslan, G.; Deléchat, C.; Newiak, M.M.; Yang, M.F. Inequality in Financial Inclusion and Income Inequality; IMF Working Paper; International Monetary Fund: Washington, DC, USA, 2017. [Google Scholar]

- D’atta, S.K.; Singh, K. Variation and determinants of financial inclusion and their association with human development: A cross-country analysis. IIMB Manag. Rev. 2019, 31, 336–349. [Google Scholar] [CrossRef]

- Gharbi, I.; Kammoun, A. Developing a multidimensional financial inclusion index: A comparison based on income groups. J. Risk Financ. Manag. 2023, 16, 296. [Google Scholar] [CrossRef]

- Le, T.; Chuc, A.; Taghizadeh-Hesary, F. Financial inclusion and its impact on financial efficiency and sustainability: Empirical evidence from Asia. Borsa Istanb. Rev. 2019, 19, 310–322. [Google Scholar] [CrossRef]

- Das, P. Econometrics in Theory and Practice Analysis of Cross Section, Time Series and Panel Data with Stata 15.1, 1st ed.; Springer: Singapore, 2019. [Google Scholar]

- Stock, J.H.; Watson, M.W. Introduction to Econometrics; Pearson: New York, NY, USA, 2015. [Google Scholar]

- Wooldridge, J.M. Introductory Econometrics: A Modern Approach; Cengage Learning: Andover, UK, 2013. [Google Scholar]

- Gunduz, N.; Fokoue, E. On the predictive properties of binary link functions. Commun. Fac. Sci. Univ. Ank. Ser. A1Math. Stat. 2017, 66, 1–18. [Google Scholar]

- De Faria, R.Q.; dos Santos, A.R.; Amorim, D. Probit or logit? Which is the better model to predict the longevity of seeds? Seed Sci. Res. 2020, 30, 49–58. [Google Scholar] [CrossRef]

- Ozili, P.K. COVID-19 in Africa: Socio-economic impact, policy response and opportunities. Int. J. Soc. Soc. Policy 2020, 42, 177–200. [Google Scholar] [CrossRef]

- Kama, U.; Adigun, M. Financial Inclusion in Nigeria: Issues and Challenges; National Financial Inclusion Strategy Occasional Papers: Abuja, Nigeria, 2013; Volume 45, pp. 1–15. [Google Scholar]

- Asteriou, D.; Hall, S.G. Applied Econometrics, 2nd ed.; Palgrave Macmillan: New York, NY, USA, 2011. [Google Scholar]

- Agwu, M.E. Can technology bridge the gap between rural development and financial inclusions? Technol. Anal. Strateg. Manag. 2021, 33, 123–133. [Google Scholar] [CrossRef]

- Ozili, K.P. Financial inclusion: A strong critique. In New Challenges for Future Sustainability and Wellbeing; Munich Personal Re Pec Archive Paper 01813; Emerald Publishing Limited: Bingley, UK, 2020; pp. 1–17. [Google Scholar]

- Triki, T.; Faye, I. Financial Inclusion in Africa; African Development Bank: Abidjan, Côte d’Ivoire, 2013. [Google Scholar]

- Efobi, U.; Beecroft, I.; Osabuohien, E. Access to and use of bank services in Nigeria: Micro-econometric evidence. Rev. Dev. Financ. 2014, 4, 104–114. [Google Scholar] [CrossRef]

- Huang, Y.; Zhang, Y. Financial inclusion and urban-rural income inequality: Long-run and short-run relationships. Emerg. Mark. Financ. Trade 2020, 56, 457–471. [Google Scholar] [CrossRef]

- Ji, X.; Wang, K.; Xu, H.; Li, M. Has digital financial inclusion narrowed the urban-rural income gap: The role of entrepreneurship in China. Sustainability 2021, 13, 8292. [Google Scholar] [CrossRef]

- Davis, E.P.; Sanchez-Martinez, M. Economic Theories of Poverty; Joseph Rowntree Foundation: London, UK, 2015. [Google Scholar]

- World Bank. World Development Indicators (WDI). 2022. Available online: https://databank.worldbank.org/source/world-development-indicators/preview/on (accessed on 2 July 2023).

- Inoue, T. Financial inclusion and poverty reduction in India. J. Financ. Econ. Policy 2019, 11, 21–33. [Google Scholar] [CrossRef]

| Variable | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|

| GDP per capita | 479.096 | 92.551 | 281.3254 | 590.630 |

| Number of insurance corporations | 62.333 | 20.158 | 48 | 103 |

| Number of bank branches per 1000 km2 | 5.396 | 0.936 | 3.3258 | 6.401 |

| Number of bank branches per 100,000 adults | 5.1606 | 0.8964 | 3.7811 | 6.564 |

| Number of ATMs per 1000 km2 | 12.8433 | 7.451 | 0.584121 | 21.365 |

| ATMs (per 100,000 adults) | 12.171 | 5.391 | 0.6801 | 17.195 |

| Depositors with commercial banks | 754.203 | 350.066 | 296.167 | 1458.407 |

| Regressors | ||||

| Domestic credit to private sector | 12.4838 | 3.101 | 8.1204 | 19.626 |

| Gross Capital Formation (GCF) (% of GDP) | 20.936 | 5.782 | 14.904 | 33.835 |

| Inflation, consumer prices (annual) | 12.157 | 3.456 | 5.388 | 17.864 |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| ACCOUNT | . | . | . | . | . |

| No | 1000 | 0.385 | 0.487 | 0 | 1 |

| Yes | 1000 | 0.615 | 0.487 | 0 | 1 |

| account mob | . | . | . | . | . |

| No | 1000 | 0.848 | 0.359 | 0 | 1 |

| Yes | 1000 | 0.152 | 0.359 | 0 | 1 |

| Saved last year | . | . | . | . | . |

| No | 1000 | 0.363 | 0.481 | 0 | 1 |

| Yes | 1000 | 0.637 | 0.481 | 0 | 1 |

| Borrowed last year | . | . | . | . | . |

| No | 1000 | 0.437 | 0.496 | 0 | 1 |

| Yes | 1000 | 0.563 | 0.496 | 0 | 1 |

| DIGITAL | . | . | . | . | . |

| No | 1000 | 0.486 | 0.5 | 0 | 1 |

| Yes | 1000 | 0.514 | 0.5 | 0 | 1 |

| Emergency saving | . | . | . | . | . |

| no | 978 | 0.797 | 0.403 | 0 | 1 |

| yes | 978 | 0.203 | 0.403 | 0 | 1 |

| wage payment | . | . | . | . | . |

| no | 256 | 0.441 | 0.498 | 0 | 1 |

| yes | 256 | 0.559 | 0.498 | 0 | 1 |

| poverty | . | . | . | . | . |

| non-poor | 1000 | 0.692 | 0.462 | 0 | 1 |

| poor | 1000 | 0.308 | 0.462 | 0 | 1 |

| Age | 999 | 31.542 | 11.813 | 15 | 94 |

| EDU | . | . | . | . | . |

| primary | 999 | 0.213 | 0.41 | 0 | 1 |

| secondary | 999 | 0.747 | 0.435 | 0 | 1 |

| tertiary | 999 | 0.04 | 0.196 | 0 | 1 |

| EMP | . | . | . | . | . |

| unemployed | 1000 | 0.206 | 0.405 | 0 | 1 |

| employed | 1000 | 0.794 | 0.405 | 0 | 1 |

| GEN | . | . | . | . | . |

| male | 1000 | 0.563 | 0.496 | 0 | 1 |

| female | 1000 | 0.437 | 0.496 | 0 | 1 |

| rural | . | . | . | . | . |

| Urban area | 1000 | 0.66 | 0.474 | 0 | 1 |

| Rural area | 1000 | 0.34 | 0.474 | 0 | 1 |

| Dimensions | Components | Eigenvalue | Proportion | Cumulative |

|---|---|---|---|---|

| FINACC | 1 | 3.935 | 0.656 | 0.656 |

| 2 | 1.472 | 0.245 | 0.901 | |

| 3 | 0.464 | 0.077 | 0.979 | |

| 4 | 0.124 | 0.021 | 0.999 | |

| 5 | 0.003 | 0.001 | 1.000 | |

| 6 | 0.001 | 0.000 | 1.000 | |

| FINUSE | 1 | 1.579 | 0.395 | 0.395 |

| 2 | 0.944 | 0.236 | 0.631 | |

| 3 | 0.803 | 0.201 | 0.832 | |

| 4 | 0.674 | 0.168 | 1.000 | |

| FINQUA | 1 | 1.749 | 0.583 | 0.583 |

| 2 | 0.888 | 0.296 | 0.879 | |

| 3 | 0.363 | 0.121 | 1.000 | |

| FI (FINUSE & FINQUA) | 1 | 1.433 | 0.716 | 0.716 |

| 2 | 0.567 | 0.284 | 1.000 |

| Variable | Comp1 | Comp2 |

|---|---|---|

| FINACC | ||

| Number of insurance corporations | −0.376 | −0.346 |

| Number of bank branches per 1000 km2 | −0.114 | 0.771 |

| Number of bank branches per 100,000 adults | −0.418 | 0.457 |

| Number of ATMs per 1000 km2 | 0.494 | 0.117 |

| ATMs (per 100,000 adults) | 0.469 | 0.246 |

| Depositors with commercial banks | 0.454 | −0.053 |

| FINUSE | ||

| ACC | 0.587 | −0.210 |

| MOACC | 0.528 | −0.422 |

| SAVED | 0.511 | 0.096 |

| BORROWED | 0.339 | 0.877 |

| FINQUA | ||

| DIGITAL | 0.629 | −0.410 |

| EMERGENCY | 0.390 | 0.902 |

| WAGE | 0.672 | −0.139 |

| FINC | ||

| FINUSE | 0.707 | 0.707 |

| FINQUA | 0.707 | −0.707 |

| BTS | KMO Measure | |||

|---|---|---|---|---|

| Dimensions | Chi-Square | Degrees of Freedom | p-Value | KMO Measure |

| Access index | 155.917 | 15 | 0.0000 | 0.533 |

| Usage index | 214.355 | 6 | 0.0000 | 0.620 |

| Quality index | 142.699 | 3 | 0.0000 | 0.526 |

| Inclusion index | 51.684 | 1 | 0.0000 | 0.500 |

| Model 1 | Model 2 | |

|---|---|---|

| Variables | Marginal Effects (1) | Marginal Effects (2) |

| FINUSE | −0.0510 ** (0.019) | |

| FINQUA | −0.00862 (0.756) | |

| FI | −0.0308743 (0.254) | |

| AGE | −0.0062187 ** (0.026) | −0.00642 ** (0.019) |

| EDU (base-Primary) | ||

| Secondary | −0.3418343 ** (0.013) | −0.3621 *** (0.010) |

| Tertiary | −0.3225606 * (0.073) | −0.3527 *** (0.047) |

| EMP (base-not employed) | ||

| Employed | −0.1742933 (0.126) | −0.1773415 (0.121) |

| GEN (base-male) | ||

| Female | 0.1333 ** (0.023) | 0.1362 ** (0.022) |

| RURAL (base urban) | ||

| Rural | 0.0367835 (0.520) | 0.054464 (0.356) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Omenihu, C.M.; Brahma, S.; Katsikas, E.; Vrontis, D.; Siachou, E.; Krasonikolakis, I. Financial Inclusion and Poverty Alleviation: A Critical Analysis in Nigeria. Sustainability 2024, 16, 8528. https://doi.org/10.3390/su16198528

Omenihu CM, Brahma S, Katsikas E, Vrontis D, Siachou E, Krasonikolakis I. Financial Inclusion and Poverty Alleviation: A Critical Analysis in Nigeria. Sustainability. 2024; 16(19):8528. https://doi.org/10.3390/su16198528

Chicago/Turabian StyleOmenihu, Chinonyerem Matilda, Sanjukta Brahma, Epameinondas Katsikas, Demetris Vrontis, Evangelia Siachou, and Ioannis Krasonikolakis. 2024. "Financial Inclusion and Poverty Alleviation: A Critical Analysis in Nigeria" Sustainability 16, no. 19: 8528. https://doi.org/10.3390/su16198528

APA StyleOmenihu, C. M., Brahma, S., Katsikas, E., Vrontis, D., Siachou, E., & Krasonikolakis, I. (2024). Financial Inclusion and Poverty Alleviation: A Critical Analysis in Nigeria. Sustainability, 16(19), 8528. https://doi.org/10.3390/su16198528