Renewable Energy Credits Transforming Market Dynamics

Abstract

:1. Introduction and Context

2. Literature Review

2.1. Economic Implications of Climate Change and Policy Instruments

2.2. Socio-Economic Impacts of Climate Change Mitigation

2.3. Integration of Findings with Literature

3. Methodology

3.1. Statistical Framework

3.2. Data Collection

3.3. Model Calibration

3.4. Policy Impact Assessment

3.5. Statistical Testing

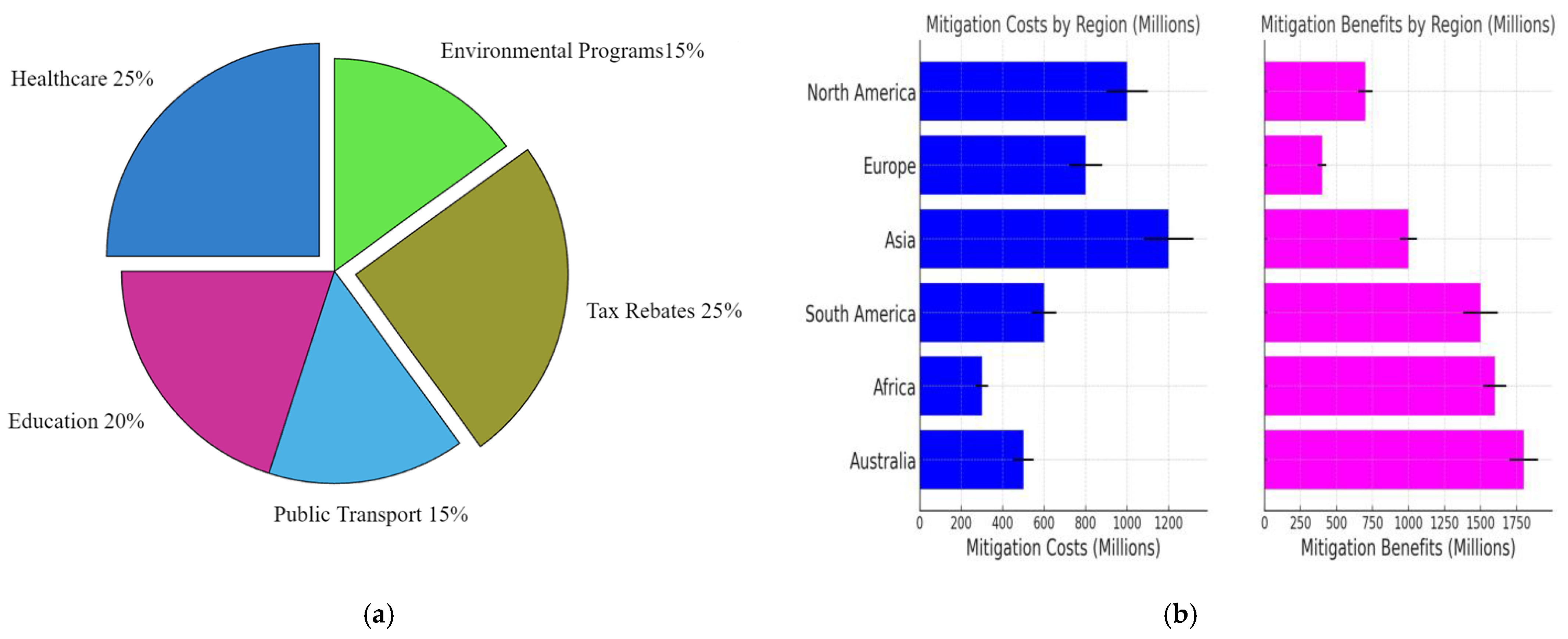

3.5.1. Chi-Square Test for Distribution of Funds

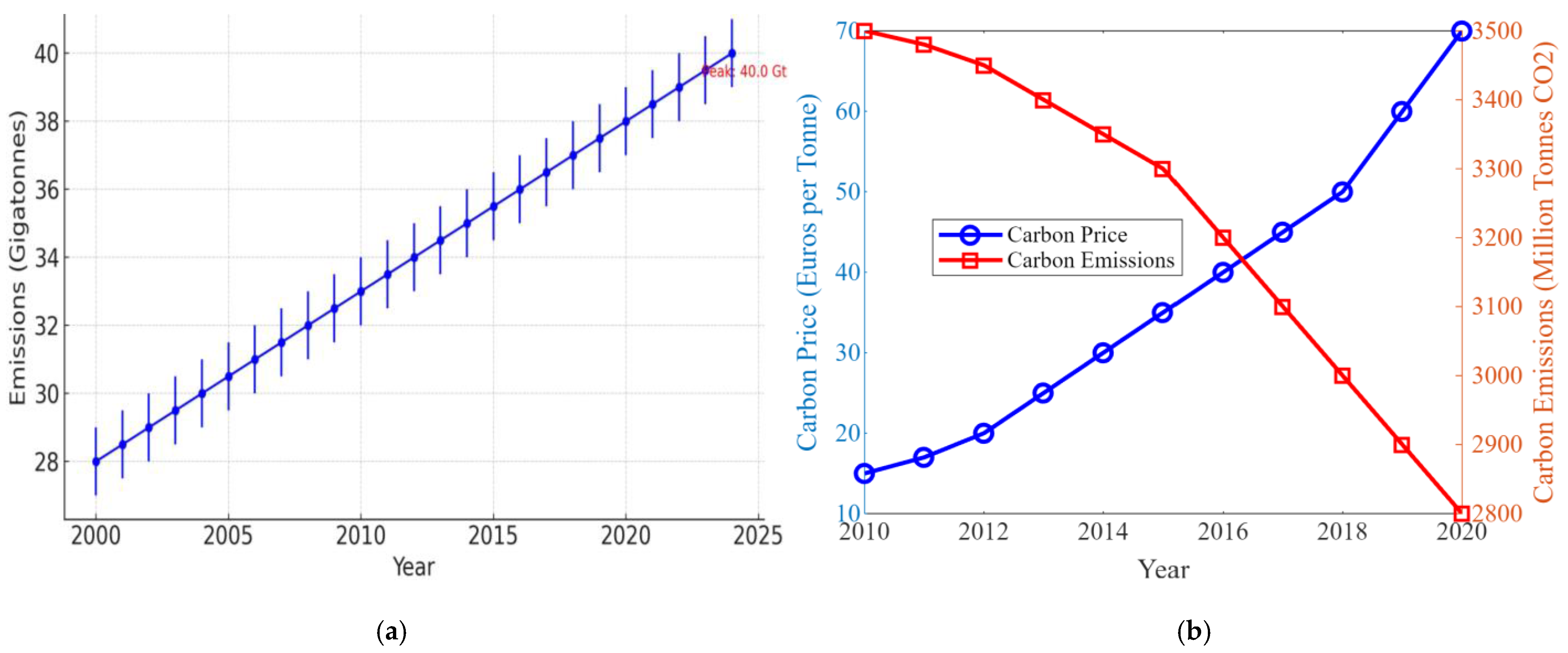

3.5.2. Linear Regression for Carbon Pricing and CO2 Emissions

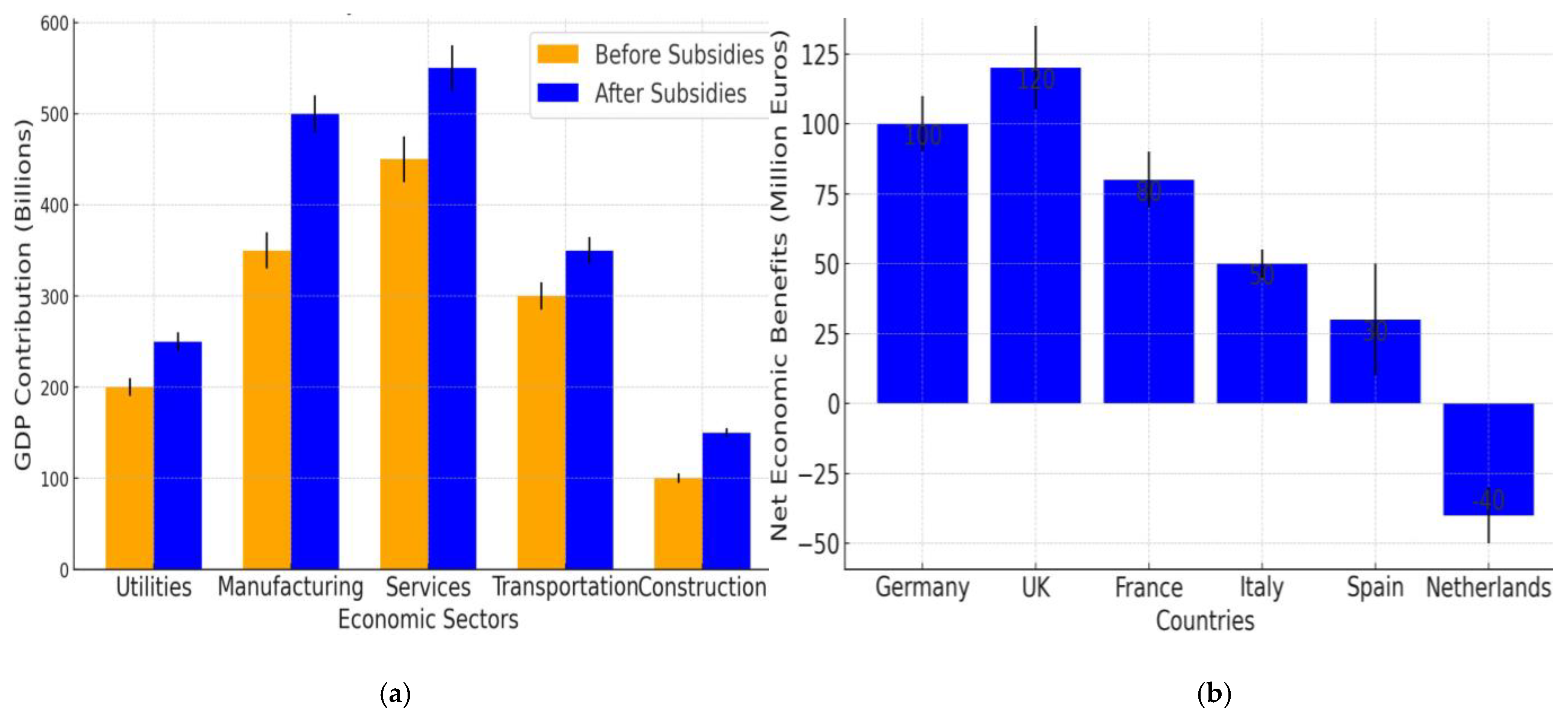

3.5.3. Multiple Regression for GDP Growth and Employment

3.5.4. Time Series Regression for Energy Prices and Innovation

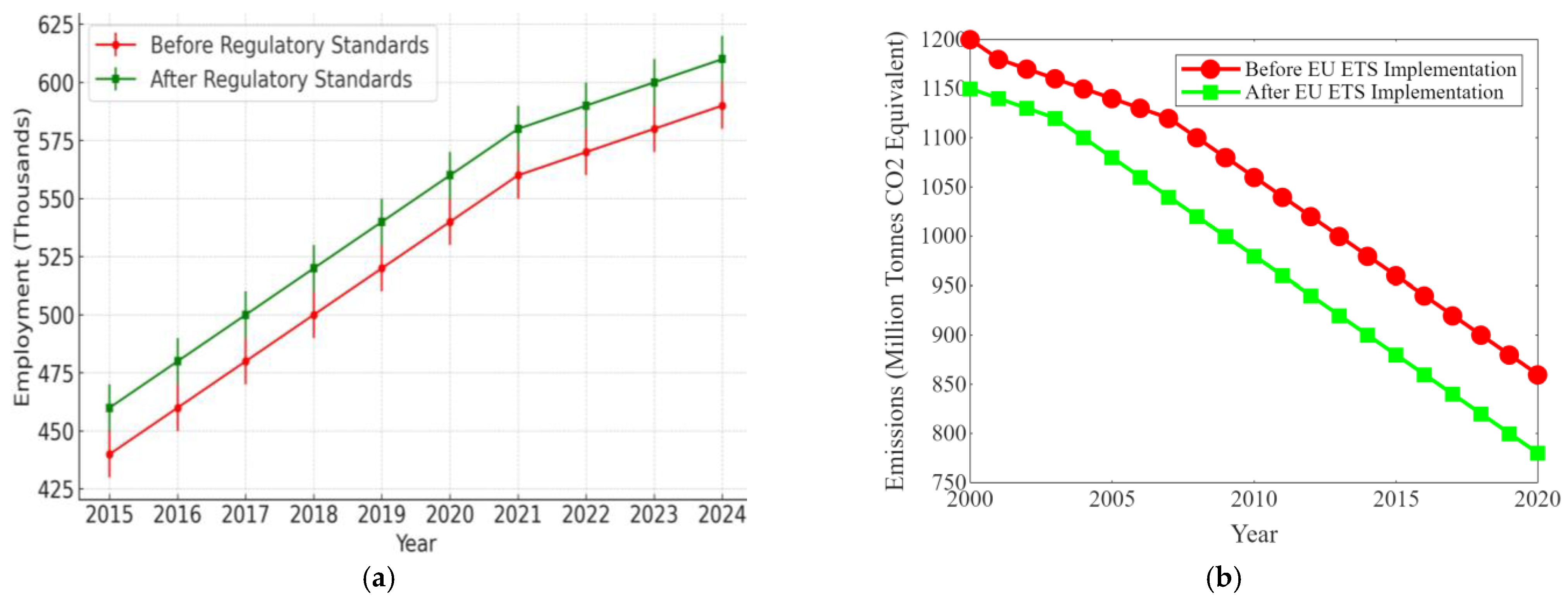

3.5.5. t-Tests for Comparative Analysis

4. Results

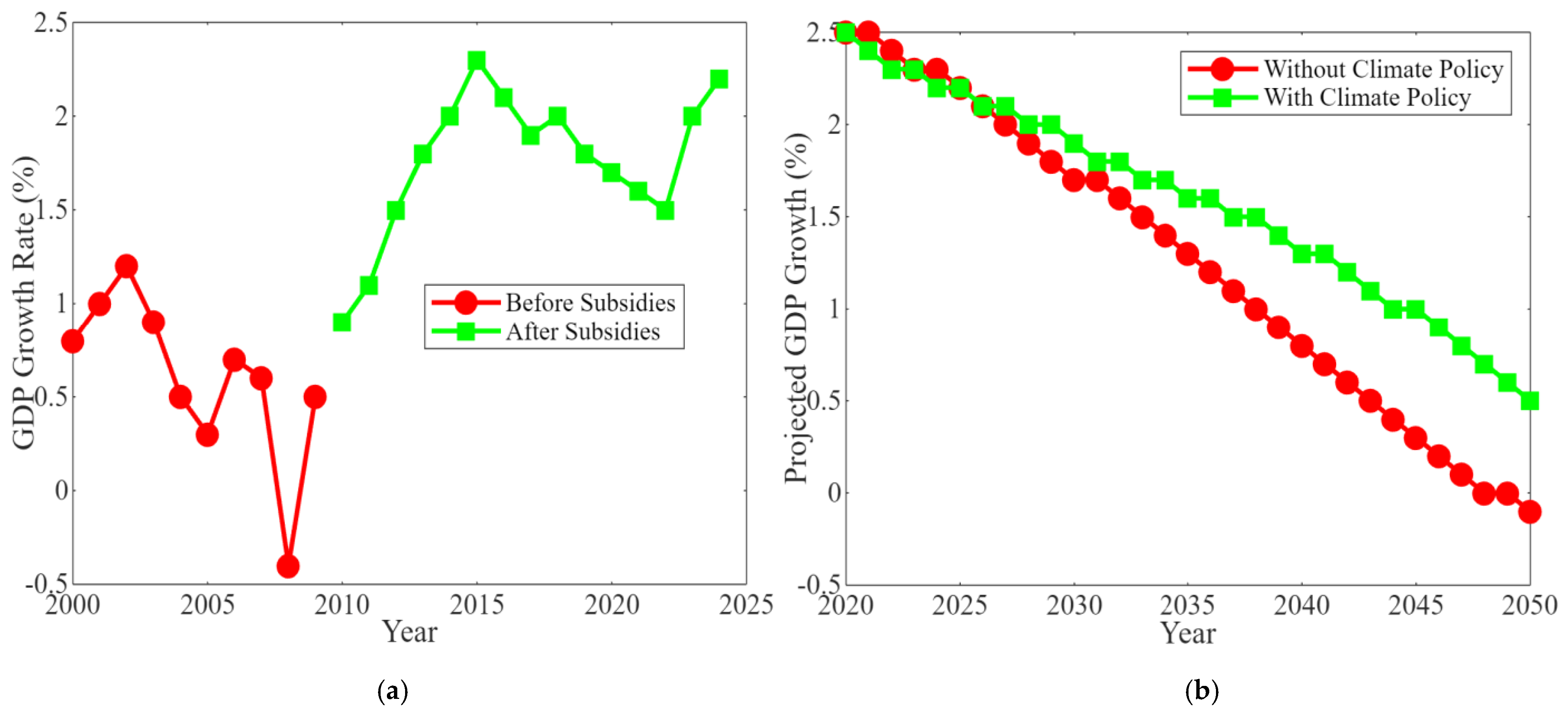

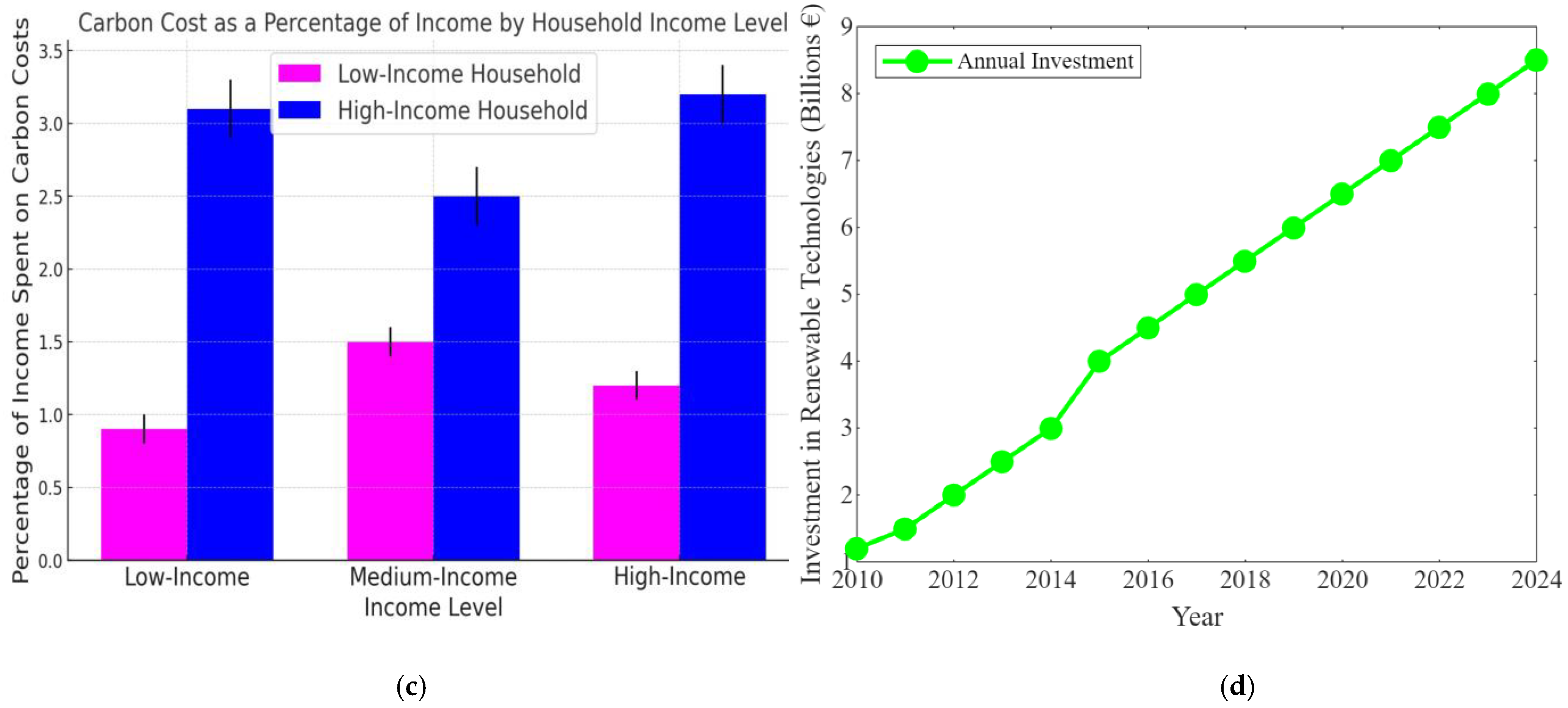

4.1. Statistical Outcomes of Mitigation Policies

4.2. Comparative Effectiveness of Policies

4.3. Sensitivity Analysis

4.4. Model Validation

5. Discussion

5.1. Interpretation of Statistical Findings

5.2. Comparison with the Existing Literature

5.3. Policy Implications

6. Conclusions

- Economic Efficiency and Policy Impact: The study demonstrates that carbon pricing, renewable energy subsidies, and emission trading schemes each contribute to reducing emissions, with carbon pricing being the most cost-effective option, while renewable energy subsidies drive economic growth through innovation and job creation.

- Social Equity and Distributional Effects: The analysis highlights that climate policies can unevenly impact different income groups and regions, with low-income households disproportionately affected by carbon pricing. Policy mechanisms like revenue recycling and targeted financial assistance are crucial for mitigating these effects.

- Dynamic Policy Optimisation: By employing advanced mathematical models like general equilibrium models (GEMs) and Laplace transforms, the study provides a framework for optimising climate policies over time, ensuring that environmental and economic goals are achieved.

Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Verlinghieri, E.; Haines-Doran, T.; Marsden, G.; Schwanen, T. The role of funding in the ‘performative decarbonisation’ of transport in England. Political Geogr. 2024, 109, 103053. [Google Scholar] [CrossRef]

- Agrawal, D.; Awani, K.; Nabavi, S.A.; Balan, V.; Jin, M.; Aminabhavi, T.M.; Dubey, K.K.; Kumar, V. Carbon emissions and decarbonisation: The role and relevance of fermentation industry in chemical sector. Chem. Eng. J. 2023, 475, 146308. [Google Scholar] [CrossRef]

- Wu, X.; Liu, Z.; Yin, L.; Zheng, W.; Song, L.; Tian, J.; Yang, B.; Liu, S. A Haze Prediction Model in Chengdu Based on LSTM. Atmosphere 2021, 12, 1479. [Google Scholar] [CrossRef]

- Rayner, T. Taking the slow route to decarbonisation? Developing climate governance for international transport. Earth Syst. Gov. 2021, 8, 100100. [Google Scholar] [CrossRef]

- Jackson, B.; Decker Sparks, J.L. Ending slavery by decarbonisation? Exploring the nexus of modern slavery, deforestation, and climate change action via REDD+. Energy Res. Soc. Sci. 2020, 69, 101610. [Google Scholar] [CrossRef]

- Zhang, S.; Zhang, C.; Su, Z.; Zhu, M.; Ren, H. New structural economic growth model and labor income share. J. Bus. Res. 2023, 160, 113644. [Google Scholar] [CrossRef]

- Steen, M.; Bjerkan, K.Y.; Hansen, L.; Seter, H. Implementing decarbonisation measures in Norwegian ports. Transp. Res. Interdiscip. Perspect. 2024, 23, 100993. [Google Scholar] [CrossRef]

- Zhang, S.; Li, X.; Zhang, C.; Luo, J.; Cheng, C.; Ge, W. Measurement of factor mismatch in industrial enterprises with labor skills heterogeneity. J. Bus. Res. 2023, 158, 113643. [Google Scholar] [CrossRef]

- Yu, G.; Ye, X.; Ye, Y.; Huang, H.; Xia, X. Optimal decarbonisation pathway for mining truck fleets. J. Autom. Intell. 2024, 3, 129–143. [Google Scholar] [CrossRef]

- Ma, Q.; Zhang, Y.; Hu, F.; Zhou, H. Can the energy conservation and emission reduction demonstration city policy enhance urban domestic waste control? Evidence from 283 cities in China. Cities 2024, 154, 105323. [Google Scholar] [CrossRef]

- Mc Guire, J.; Rogan, F.; Balyk, O.; Mac Uidhir, T.; Gaur, A.; Daly, H. Developing decarbonisation pathways in changing TIMES for Irish homes. Energy Strategy Rev. 2023, 47, 101086. [Google Scholar] [CrossRef]

- Shang, K.; Chen, Z.; Liu, Z.; Song, L.; Zheng, W.; Yang, B.; Liu, S.; Yin, L. Haze Prediction Model Using Deep Recurrent Neural Network. Atmosphere 2021, 12, 1625. [Google Scholar] [CrossRef]

- Oladapo, B.I.; Olawumi, M.A.; Olugbade, T.O.; Tin, T.T. Advancing sustainable materials in a circular economy for decarbonisation. J. Environ. Manag. 2024, 360, 121116. [Google Scholar] [CrossRef] [PubMed]

- Duan, W.; Li, C. Be alert to dangers: Collapse and avoidance strategies of platform ecosystems. J. Bus. Res. 2023, 162, 113869. [Google Scholar] [CrossRef]

- Alotaiq, A. Strategies to Achieving Deep Decarbonisation in Power Generation: A Review. J. Econ. Technol. 2024, in press. [Google Scholar] [CrossRef]

- Qiu, L.; Xia, W.; Wei, S.; Hu, H.; Yang, L.; Chen, Y.; Zhou, H.; Hu, F. Collaborative management of environmental pollution and carbon emissions drives local green growth: An analysis based on spatial effects. Environ. Res. 2024, 259, 119546. [Google Scholar] [CrossRef]

- Chivhenge, E.; Mabaso, A.; Museva, T.; Zingi, G.K.; Manatsa, P. Zimbabwe’s roadmap for decarbonisation and resilience: An evaluation of policy (in)consistency. Glob. Environ. Change 2023, 82, 102708. [Google Scholar] [CrossRef]

- McDiarmid, H.; Bonner Septien, A.; Parker, P. Achieving rapid decarbonisation of Canada’s residential sector requires a strategic approach. Energy Build. 2024, 308, 113999. [Google Scholar] [CrossRef]

- Msimango, N.; Orffer, C.; Inglesi-Lotz, R. South Africa’s energy policy: Prioritising competition and climate change for decarbonisation. Energy Policy 2023, 183, 113815. [Google Scholar] [CrossRef]

- Wang, Y.; Quan, S.; Tang, X.; Hosono, T.; Hao, Y.; Tian, J.; Pang, Z. Organic and Inorganic Carbon Sinks Reduce Long-Term Deep Carbon Emissions in the Continental Collision Margin of the Southern Tibetan Plateau: Implications for Cenozoic Climate Cooling. J. Geophys. Res. Solid Earth 2024, 129, e2024JB028802. [Google Scholar] [CrossRef]

- Shirov, A.A.; Kolpakov, A.Y.; Gambhir, A.; Koasidis, K.; Köberle, A.C.; McWilliams, B.; Nikas, A. Stakeholder-driven scenario analysis of ambitious decarbonisation of the Russian economy. Renew. Sustain. Energy Transit. 2023, 4, 100055. [Google Scholar] [CrossRef]

- Hu, F.; Zhang, S.; Gao, J.; Tang, Z.; Chen, X.; Qiu, L.; Hu, H.; Jiang, L.; Wei, S.; Guo, B.; et al. Digitalisation empowerment for green economic growth: The impact of green complexity. Environ. Eng. Manag. J. 2024, 23, 519–536. [Google Scholar] [CrossRef]

- Zhao, S.; Zhang, L.; An, H.; Peng, L.; Zhou, H.; Hu, F. Has China’s low-carbon strategy pushed forward the digital transformation of manufacturing enterprises? Evidence from the low-carbon city pilot policy. Environ. Impact Assess. Rev. 2023, 102, 107184. [Google Scholar] [CrossRef]

- Marin, P.; Denise, A.; Mathilde, L.; Guillaume, H. From limit values to carbon budgets: Assessing comprehensive building stock decarbonisation strategies. Build. Environ. 2024, 256, 111505. [Google Scholar] [CrossRef]

- Dincer, I. Renewable energy and sustainable development: A crucial review. Renew. Sustain. Energy Rev. 2000, 4, 157–175. [Google Scholar] [CrossRef]

- Aldy, J.E.; Pizer, W.A. The competitiveness impacts of climate change mitigation policies. J. Assoc. Environ. Resour. Econ. 2015, 2, 565–595. [Google Scholar] [CrossRef]

- Arrow, K.J.; Debreu, G. Existence of an equilibrium for a competitive economy. Econom. J. Econom. Soc. 1954, 22, 265–290. [Google Scholar] [CrossRef]

- Duan, W.; Madasi, J.D.; Khurshid, A.; Ma, D. Industrial structure conditions economic resilience. Technol. Forecast. Soc. Change 2022, 183, 121944. [Google Scholar] [CrossRef]

- Böhringer, C.; Rutherford, T.F.; Wiegard, W. Computable general equilibrium analysis: Opening a black box. Z. Wirtsch. Sozialwissenschaften 2012, 132, 221–251. [Google Scholar]

- Bowen, A.; Kuralbayeva, K.; Tipoe, E.L. The Impact of Green Growth Policies on Labor Markets and Wage Inequality; World Bank Policy Research Working Paper, 6935; World Bank: Washington, DC, USA, 2014. [Google Scholar]

- Burtraw, D.; Sweeney, R.; Walls, M. The Long-Term Impacts of Carbon Pricing on Equity and Emissions; Resources for the Future Discussion Paper; Resources for the Future: Washington, DC, USA, 2019. [Google Scholar]

- Li, L.; Han, Y.; Li, Q.; Chen, W. Multi-Dimensional Economy-Durability Optimization Method for Integrated Energy and Transportation System of Net-Zero Energy Buildings. IEEE Trans. Sustain. Energy 2024, 15, 146–159. [Google Scholar] [CrossRef]

- Carley, S.; Konisky, D.M. The justice and equity implications of the clean energy transition. Nat. Energy 2020, 5, 569–577. [Google Scholar] [CrossRef]

- Dasgupta, P. Discounting climate change. J. Risk Uncertain. 2008, 37, 141–169. [Google Scholar] [CrossRef]

- Ellerman, A.D.; Convery, F.J.; De Perthuis, C. Pricing Carbon: The European Union Emissions Trading Scheme; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Fawcett, A.A.; Iyer, G.C.; Clarke, L.E.; Edmonds, J.A. The role of border carbon adjustments in a U.S. carbon tax. Clim. Change Econ. 2014, 5, 1450017. [Google Scholar]

- Gillingham, K.; Newell, R.G.; Palmer, K. Energy efficiency economics and policy. Annu. Rev. Resour. Econ. 2013, 5, 597–620. [Google Scholar]

- Gray, W.B.; Shadbegian, R.J. Environmental regulation, investment timing, and technology choice. J. Ind. Econ. 2003, 51, 317–340. [Google Scholar]

- Xu, A.; Song, M.; Wu, Y.; Luo, Y.; Zhu, Y.; Qiu, K. Effects of new urbanisation on China’s carbon emissions: A quasi-natural experiment based on the improved PSM-DID model. Technol. Forecast. Soc. Change 2024, 200, 123164. [Google Scholar] [CrossRef]

- Jacobsson, S.; Lauber, V. The politics and policy of energy system transformation—Explaining the German diffusion of renewable energy technology. Energy Policy 2006, 34, 256–276. [Google Scholar] [CrossRef]

- Johnstone, N.; Hascic, I.; Popp, D. Renewable energy policies and technological innovation: Evidence based on patent counts. Environ. Resour. Econ. 2010, 45, 133–155. [Google Scholar] [CrossRef]

- Kopp, R.E.; Shwom, R.L.; Wagner, G.; Yuan, J. Tipping elements and climate-economic shocks: Pathways toward integrated assessment. Earth’s Future 2019, 7, 91–98. [Google Scholar] [CrossRef]

- Wang, Z.; Teng, Y.; Wu, S.; Chen, H. Does Green Finance Expand China’s Green Development Space? Evidence from the Ecological Environment Improvement Perspective. Systems 2023, 11, 369. [Google Scholar] [CrossRef]

- Lund, H. Renewable Energy Systems: A Smart Energy Systems Approach to the Choice and Modeling of 100% Renewable Solutions; Academic Press: Cambridge, MA, USA, 2009. [Google Scholar]

- Markandya, A.; González-Eguino, M.; Escapa, M. Environmental taxes and economic welfare: The case of Spain. Ecol. Econ. 2012, 77, 188–200. [Google Scholar]

- Metcalf, G.E.; Stock, J.H. The Macroeconomic Impact of Europe’s Carbon Taxes; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Zheng, C.; Chen, H. Revisiting the linkage between financial inclusion and energy productivity: Technology implications for climate change. Sustain. Energy Technol. Assess. 2023, 57, 103275. [Google Scholar] [CrossRef]

- Newell, R.G.; Pizer, W.A.; Raimi, D. Carbon markets 15 years after Kyoto: Lessons learned, new challenges. J. Econ. Perspect. 2014, 27, 123–146. [Google Scholar] [CrossRef]

- Nordhaus, W.D. Optimal Greenhouse-Gas Reductions and Tax Policy in the DICE Model; Cowles Foundation for Research in Economics at Yale University: New Haven, CT, USA, 1993. [Google Scholar]

- Nordhaus, W.D. The Climate Casino: Risk, Uncertainty, and Economics for a Warming World; Yale University Press: London, UK, 2013. [Google Scholar]

- Li, T.; Yu, L.; Ma, Y.; Duan, T.; Huang, W.; Zhou, Y.; Jin, D.; Li, Y.; Jiang, T. Carbon emissions of 5G mobile networks in China. Nat. Sustain. 2023, 6, 1620–1631. [Google Scholar] [CrossRef]

- OECD. Investing in Climate, Investing in Growth; OECD Publishing: Paris, France, 2017. [Google Scholar]

- Parry, I.; Veung, C.; Heine, D. How much carbon pricing is in countries’ own interests? The critical role of co-benefits. Clim. Change Econ. 2014, 5, 1450003. [Google Scholar]

- Li, T.; Li, Y. Artificial intelligence for reducing the carbon emissions of 5G networks in China. Nat. Sustain. 2023, 6, 1522–1523. [Google Scholar] [CrossRef]

- Reedman, L.; Graham, P.; Coombes, P. Using Fourier series for long-term energy demand forecasting: A case study of New Zealand. Energy Policy 2016, 38, 3156–3165. [Google Scholar]

- Shang, M.; Luo, J. The Tapio Decoupling Principle and Key Strategies for Changing Factors of Chinese Urban Carbon Footprint Based on Cloud Computing. Int. J. Environ. Res. Public Health 2021, 18, 2101. [Google Scholar] [CrossRef]

- Stern, N. The Stern Review on the Economics of Climate Change; Cambridge University Press: Cambridge, UK, 2006. [Google Scholar]

- Tol, R.S.J. The economic effects of climate change. J. Econ. Perspect. 2009, 23, 29–51. [Google Scholar] [CrossRef]

- Vona, F.; Marin, G.; Consoli, D.; Popp, D. Environmental regulation and green skills: An empirical exploration. J. Assoc. Environ. Resour. Econ. 2018, 5, 713–753. [Google Scholar] [CrossRef]

- Feng, Y.; Chen, J.; Luo, J. Life cycle cost analysis of power generation from underground coal gasification with carbon capture and storage (CCS) to measure the economic feasibility. Resour. Policy 2024, 92, 104996. [Google Scholar] [CrossRef]

- Tryndina, N.; An, J.; Varyash, I.; Litvishko, O.; Khomyakova, L.; Barykin, S.; Kalinina, O. Renewable energy incentives on the road to sustainable development during climate change: A review. Front. Environ. Sci. 2022, 10, 1016803. [Google Scholar] [CrossRef]

- Bölük, G.; Kaplan, R. Effectiveness of renewable energy incentives on sustainability: Evidence from dynamic panel data analysis for the EU countries and Turkey. Environ. Sci. Pollut. Res. 2022, 29, 26613–26630. [Google Scholar] [CrossRef] [PubMed]

- Hu, F.; Qiu, L.; Xiang, Y.; Wei, S.; Sun, H.; Hu, H.; Weng, X.; Mao, L.; Zeng, M. Spatial network and driving factors of low-carbon patent applications in China from a public health perspective. Front. Public Health 2023, 11, 1121860. [Google Scholar] [CrossRef] [PubMed]

- Fu, X.; Pace, P.; Aloi, G.; Guerrieri, A.; Li, W.; Fortino, G. Tolerance Analysis of Cyber-Manufacturing Systems to Cascading Failures. ACM Trans. Internet Technol. 2023, 23, 1–23. [Google Scholar] [CrossRef]

- Velasquez, C.E.; Chaves, G.M.; Motta, D.M.; e Estanislau, F.B.G. Carbon dioxide life cycle assessment for Brazilian passenger cars fleet towards 2050. Renew. Sustain. Energy Rev. 2024, 189, 113952. [Google Scholar] [CrossRef]

- Wen, D.; Aziz, M. Perspective of staged hydrogen economy in Japan: A case study based on the data-driven method. Renew. Sustain. Energy Rev. 2024, 189, 113907. [Google Scholar] [CrossRef]

- Van Uffelen, N.; Taebi, B.; Pesch, U. Revisiting the energy justice framework: Doing justice to normative uncertainties. Renew. Sustain. Energy Rev. 2024, 189, 113974. [Google Scholar] [CrossRef]

- Zhang, X.; Li, Y.; Xiong, Z.; Liu, Y.; Wang, S.; Hou, D. A Resource-Based Dynamic Pricing and Forced Forwarding Incentive Algorithm in Socially Aware Networking. Electronics 2024, 13, 3044. [Google Scholar] [CrossRef]

- Gayoso Heredia, M.; Sánchez-Guevara Sánchez, C.; Neila González, F.J. Integrating lived experience: Qualitative methods for addressing energy poverty. Renew. Sustain. Energy Rev. 2024, 189, 113917. [Google Scholar] [CrossRef]

- Yap, K.Y.; Chin, H.H.; Klemeš, J.J. Solar Energy-Powered Battery Electric Vehicle charging stations: Current development and future prospect review. Renew. Sustain. Energy Rev. 2022, 169, 112862. [Google Scholar] [CrossRef]

- Zhu, C. Research on Emotion Recognition-Based Smart Assistant System: Emotional Intelligence and Personalised Services. J. Syst. Manag. Sci. 2023, 13, 227–242. [Google Scholar] [CrossRef]

- Dias, R.A.; Rios de Paula, M.; Silva Rocha Rizol, P.M.; Matelli, J.A.; Rodrigues de Mattos, C.; Perrella Balestieri, J.A. Energy education: Reflections over the last fifteen years. Renew. Sustain. Energy Rev. 2021, 141, 110845. [Google Scholar] [CrossRef]

- Zhu, C. An Adaptive Agent Decision Model Based on Deep Reinforcement Learning and Autonomous Learning. J. Logist. Inform. Serv. Sci. 2023, 10, 107–118. [Google Scholar] [CrossRef]

- Piselli, C.; Fronzetti Colladon, A.; Segneri, L.; Pisello, A.L. Evaluating and improving social awareness of energy communities through semantic network analysis of online news. Renew. Sustain. Energy Rev. 2022, 167, 112792. [Google Scholar] [CrossRef]

- Dong, J.; Hu, J.; Zhao, Y.; Peng, Y. Opinion formation analysis for Expressed and Private Opinions (EPOs) models: Reasoning private opinions from behaviors in group decision-making systems. Expert Syst. Appl. 2024, 236, 121292. [Google Scholar] [CrossRef]

- Feenstra, M.; Özerol, G. Energy justice as a search light for gender-energy nexus: Towards a conceptual framework. Renew. Sustain. Energy Rev. 2021, 138, 110668. [Google Scholar] [CrossRef]

- Li, G.; Luo, J.; Liu, S. Performance Evaluation of Economic Relocation Effect for Environmental Non-Governmental Organizations: Evidence from China. Economics 2024, 18, 20220080. [Google Scholar] [CrossRef]

- Rämä, M.; Pursiheimo, E.; Sundell, D.; Abdurafikov, R. Dynamically distributed district heating for an existing system. Renew. Sustain. Energy Rev. 2024, 189, 113947. [Google Scholar] [CrossRef]

- Zhang, Z.; Paschalis, A.; Mijic, A.; Meili, N.; Manoli, G.; van Reeuwijk, M.; Fatichi, S. A mechanistic assessment of urban heat island intensities and drivers across climates. Urban Clim. 2022, 44, 101215. [Google Scholar] [CrossRef]

- Gürsan, C.; de Gooyert, V.; de Bruijne, M.; Raaijmakers, J. District heating with complexity: Anticipating unintended consequences in the transition towards a climate-neutral city in the Netherlands. Energy Res. Soc. Sci. 2024, 110, 103450. [Google Scholar] [CrossRef]

| Policy Type | Estimated Reduction in Emissions (%) | Cost per Ton of CO2 Reduced (USD) | Error Margin (%) |

|---|---|---|---|

| Carbon Pricing | 25 ± 5% | $50 ± $10 | ±5% |

| Renewable Subsidies | 15 ± 3% | $75 ± $15 | ±10% |

| Emission Trading Schemes | 30 ± 2% | $45 ± $9 | ±3% |

| Regulatory Standards | 20 ± 4% | $60 ± $12 | ±7% |

| Policy Type | Impact on GDP (%) | Employment Change (%) | Sector Affected |

|---|---|---|---|

| Carbon Pricing | −0.5 ± 0.1 | −2 ± 0.5 | Energy |

| Renewable Subsidies | 1.2 ± 0.2 | 5 ± 1 | Renewable Energy |

| Emission Trading Schemes | 0.8 ± 0.15 | 3 ± 0.7 | Industrial Manufacturing |

| Regulatory Standards | −0.3 ± 0.1 | −1 ± 0.3 | Automotive |

| Policy Type | Low Income Group Impact (%) | Middle Income Group Impact (%) | High Income Group Impact (%) | Equity Enhancement |

|---|---|---|---|---|

| Carbon Pricing | −3 ± 0.5 | −1 ± 0.3 | 0.5 ± 0.2 | No |

| Renewable Subsidies | 2 ± 0.3 | 3 ± 0.4 | 1 ± 0.2 | Yes |

| Emission Trading Schemes | 1 ± 0.2 | 1.5 ± 0.3 | 2 ± 0.3 | Yes |

| Regulatory Standards | −2 ± 0.4 | −1 ± 0.3 | 0 ± 0.1 | No |

| Year | GDP Growth Rate (%) | Total Emissions (Million Tons CO2) | Policy Impact Score |

|---|---|---|---|

| 2020 | 1.2 ± 0.1 | 5000 ± 100 | 75 ± 5 |

| 2021 | 1.1 ± 0.1 | 4850 ± 100 | 78 ± 5 |

| 2022 | 1.3 ± 0.1 | 4700 ± 100 | 80 ± 5 |

| 2023 | 1.5 ± 0.1 | 4600 ± 100 | 82 ± 5 |

| 2024 | 1.7 ± 0.1 | 4500 ± 100 | 85 ± 5 |

| 2025 | 2.0 ± 0.1 | 4300 ± 100 | 88 ± 5 |

| 2026 | 2.2 ± 0.1 | 4200 ± 100 | 90 ± 5 |

| 2027 | 2.4 ± 0.1 | 4100 ± 100 | 92 ± 5 |

| 2028 | 2.6 ± 0.1 | 4000 ± 100 | 94 ± 5 |

| 2029 | 2.8 ± 0.1 | 3850 ± 100 | 95 ± 5 |

| 2030 | 3.0 ± 0.1 | 3700 ± 100 | 97 ± 5 |

| Chi-Square Test | Linear Regression (Carbon Pricing vs. CO2) | t-Test (Low- vs. High-Income Carbon Costs) | |

|---|---|---|---|

| Chi-Square Statistic | 0.6284202469088749 | ||

| p-value | 0.8898964878933171 | 1.2004217548761408 × 10−30 | 4.580080108440359 × 10−6 |

| Slope | −0.5 | ||

| Intercept | 50.0 | ||

| R-squared | 1.0 | ||

| t-statistic | 10.856818299903626 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oladapo, B.I.; Olawumi, M.A.; Omigbodun, F.T. Renewable Energy Credits Transforming Market Dynamics. Sustainability 2024, 16, 8602. https://doi.org/10.3390/su16198602

Oladapo BI, Olawumi MA, Omigbodun FT. Renewable Energy Credits Transforming Market Dynamics. Sustainability. 2024; 16(19):8602. https://doi.org/10.3390/su16198602

Chicago/Turabian StyleOladapo, Bankole I., Mattew A. Olawumi, and Francis T. Omigbodun. 2024. "Renewable Energy Credits Transforming Market Dynamics" Sustainability 16, no. 19: 8602. https://doi.org/10.3390/su16198602