Impact of Enterprise Supply Chain Digitalization on Cost of Debt: A Four-Flows Perspective Analysis Using Explainable Machine Learning Methodology

Abstract

:1. Introduction

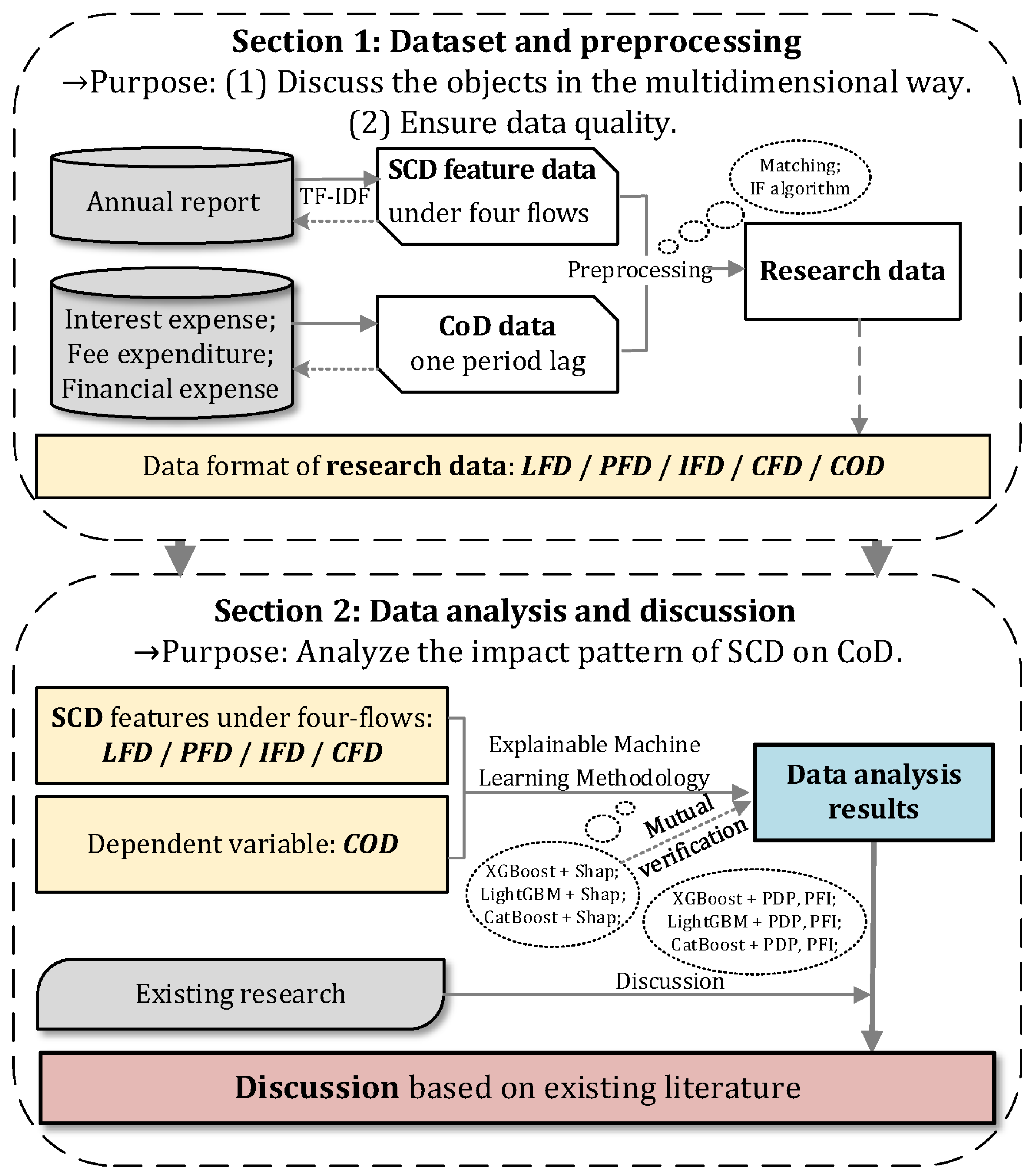

- How can enterprises comprehensively and conveniently understand their SCD? This research focuses on the topic of “How to develop SCD”, which requires the investigation and deconstruction of SCD. Existing research indicates that the investigation of SCD is predominantly conducted using questionnaire methods. While this approach enables a more comprehensive analysis of SCD, it also comes with certain drawbacks, including high investigation costs, challenges in obtaining the required data, and difficulties in reproducing the experiment [38]. In this regard, drawing on previous research related to supply chain management [39,40,41] and considering the insights from the “2022 China Supply Chain Digitalization Upgrade Industry Research Report” [42], it has been suggested that the investigation and analysis of enterprise supply chains should encompass four aspects: logistics flow, product flow, information flow, and capital flow (referred to as a perspective named “four flows”). Furthermore, we also use text mining algorithms to quantify these four features [41]. The unique advantage of this perspective lies in its applicability to horizontal studies, as opposed to traditional vertical research that primarily focuses on suppliers and customers. Moreover, this perspective facilitates the decomposition of SCD into four distinct features, making it more convenient for researchers to perform quantitative analysis and aiding managers in making well-informed decisions.

- How can an enterprise strategically develop its SCD to effectively reduce CoD? Based on the decomposition of SCD into four features from the four flows perspective, the analysis will focus on identifying which specific features deserve more attention for reduce CoD. In other words, the objective is to help enterprises identify a viable strategy for developing SCD to reduce CoD. To achieve this, the research employs the explainable machine learning methodology to investigate the influence of SCD and its features on the reduction in CoD. This involves the use of advanced and reliable machine learning models, accompanied by explanations for the results using specific explanatory methods [35,36,37]. Additionally, alternative explanatory methods are employed for sensitivity analysis to further ensure the robustness of the results. Ultimately, the findings from this analysis will provide valuable insights for enterprises aiming to optimize their SCD strategies to reduce CoD, thereby ensuring both financial health and sustainable development.

2. Related Literature

2.1. The Existing Literature on the Focus of CoD

2.2. The Current Research Status of SCD

2.3. Can SCD Affect CoD?

2.4. Summary: How to Explore the Impact of SCD on CoD

3. Research Preparation

3.1. Research Framework

3.2. Variable Description

3.2.1. The Features of Supply Chain Digitalization

- LFD refers to utilizing technologies like IoT, smart logistics, and digitalization warehousing to optimize logistics resource allocation, offer personalized services, enable visual management, and reduce risks. This improves logistics efficiency, quality, and reliability in the supply chain.

- PFD refers to utilizing technologies such as automatic production, cloud manufacturing and 3D printing for smart product design, automated production, and quality control. It enables differentiated production and enhances product traceability and quality for the entities in the supply chain.

- IFD refers to utilizing digitalization tools like information centers, cloud services, and platforms for efficient information collection, processing, and sharing. This reduces redundancy, enhances accuracy, and improves communication within the supply chain.

- CFD refers to utilizing digitalization financial methods like mobile payments and digitalization currencies and online transaction for convenient, real-time fund management. This boosts fund utilization and profitability and improves the credit rating of the enterprise in the supply chain.

3.2.2. Cost of Debt

4. Dataset, Analysis, and Discussion

4.1. Dataset

4.1.1. Data Acquisition

4.1.2. Data Preprocessing and Descriptive Statistics

4.2. Data Analysis

4.2.1. Model Setting

4.2.2. Explainable Analysis

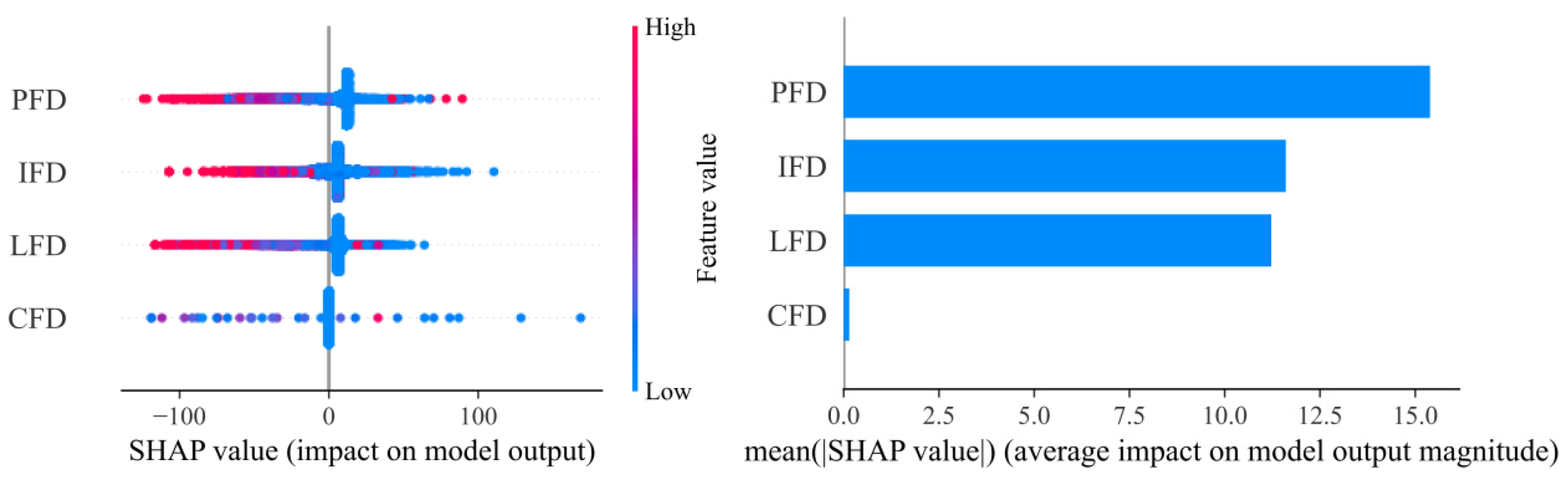

- From a global perspective, the overall development of SCD has a reducing effect on CoD. It is evident from the visualization that the majority of the red data points are clustered on the left side of the abscissa, whereas the blue data points are concentrated on the right side. This observation suggests that, at a global level, SCD is more likely to have a reducing effect on CoD.

- PFD is the most important feature affecting CoD from the four flows perspective, with an average |SHAP| value of 17.0149. Moreover, it has a negative impact on CoD, as indicated by the majority of red data points located in the negative value range of the abscissa axis.

- LFD is the second most influential feature, with an average |SHAP| value of 10.7676. Furthermore, it also has a negative impact on CoD, with the majority of red data points situated in the negative value range of the abscissa axis.

- IFD ranks third among the features, with an average |SHAP| value of 8.7471. Similar to PFD and LFD, IFD has a negative impact on CoD, as indicated by the distribution of data points.

- CFD has the smallest average |SHAP| value of 0.1265, significantly lower than the other features. This suggests that CFD has a very limited influence power on CoD. The distribution of data points for CFD appears relatively sparse and scattered, creating a few challenges for discerning its specific impact on CoD.

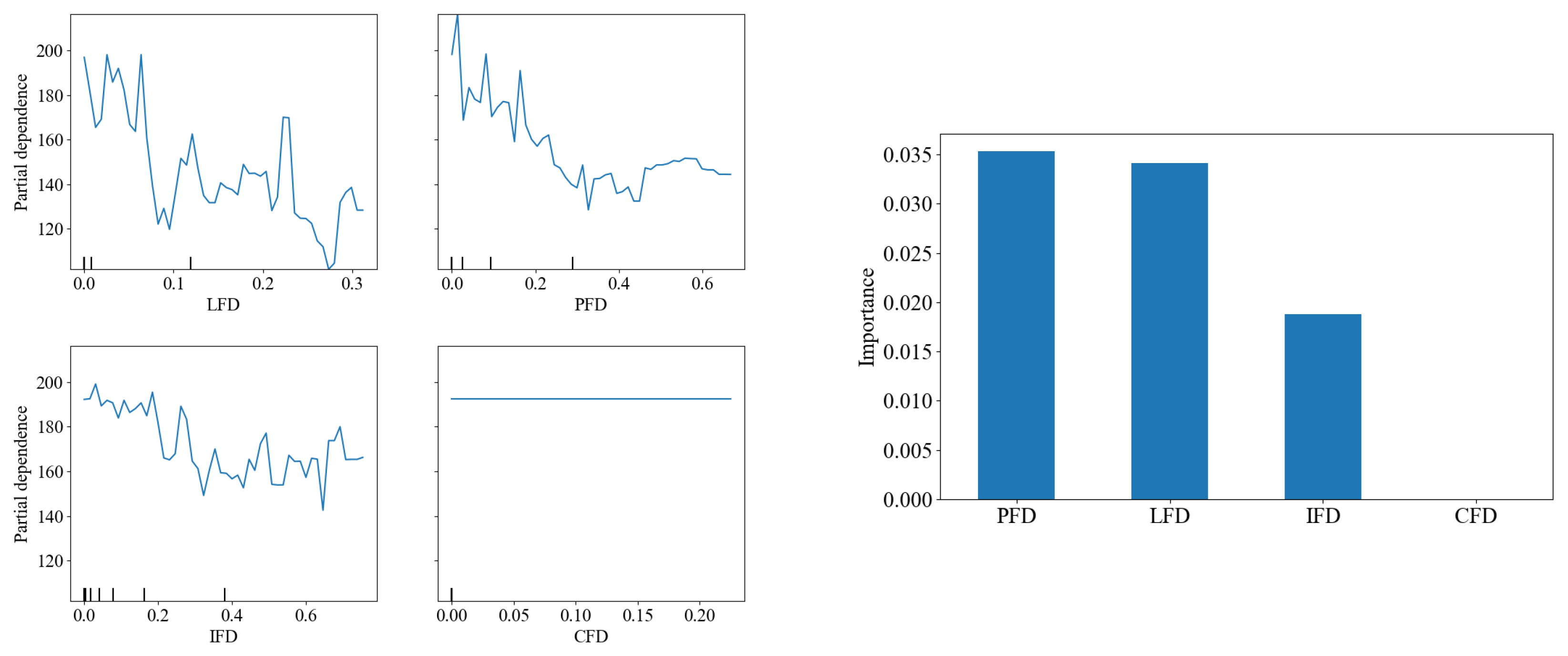

4.2.3. Sensitive Analysis of Data

4.2.4. Discussion for Data Analysis Results

5. Conclusions

5.1. Key Finding and Implications

- SCD exerts an overall reducing effect on CoD, primarily due to improvements in supply chain efficiency, cost reduction, and enhanced collaboration. These factors collectively mitigate debt financing risks for enterprises, improve their creditworthiness, and ultimately lower debt financing costs, while also contributing to the long-term sustainability of both financial and operational practices.

- The effects of different SCD features are not exactly the same. Among the four aspects of SCD, LFD, PFD, and IFD show negative impacts on CoD, indicating that focusing on the digitalization of these areas can effectively reduce debt costs, alleviate financing constraints, and promote the overall sustainable development of the company. However, CFD fails to exhibit a clear impact on debt costs, suggesting that within the process of SCD, it may not directly influence the company’s financial performance as significantly as the other aspects. This may be due to the fact that its introduction creates a more complex and uncertain financing environment, and the potential financial risks associated with further CFD development could lead companies to adopt a more cautious approach.

- The various aspects of SCD contribute to varying degrees. LFD, PFD, and IFD contribute effectively to reducing CoD, while CFD shows a limited and uncertain impact. Among these, LFD exerts the greatest influence among all SCD features, while CFD consistently ranks as the least significant. The importance of PFD and IFD follows that of LFD, though their ranks vary depending on the model. This suggests that business managers and other stakeholders should allocate attention proportionately to the different aspects of SCD. Prioritizing areas that can effectively reduce debt costs, improve financing efficiency, and promote the sustainable development of enterprises is essential. This finding reaffirms the significance of the supply chain horizontal deconstruction approach based on the four flows perspective and suggests that future supply chain researchers consider adopting this deconstruction method for other supply chain studies.

- Enterprises should acknowledge the complexity and interconnectedness inherent in digital supply chains when formulating their SCD optimization strategies. The four flow framework offers a holistic approach to analyzing SCD, enabling enterprises to understand the digitalization of their supply chains from a horizontal perspective. By adopting this framework, businesses can prioritize their digital investments and allocate resources efficiently across areas such as PFD, LFD, and IFD, with particular emphasis on PFD. This strategy has the potential to reduce debt costs and support enterprises in promoting sustainable development at lower costs.

- When considering the CFD feature, enterprises need to adopt a cautious approach due to its uncertain impact on CoD. To avoid potential financial risks associated with investment in this area, companies must undertake thorough and comprehensive evaluations before taking any actions related to CFD. This ensures that investments in this domain do not inadvertently increase debt costs but rather contribute to maintaining financial health and optimizing the path of supply chain digitalization through prudent and rational assessment.

- The data-driven paradigm and explainable machine learning methodology provide clearer insights for enterprise managers. As enterprises drive SCD, managers should continuously perform cross-verification across multiple models to improve the accuracy and robustness of their analyses, thereby gaining a better understanding of how SCD impacts CoD. This approach enables managers to identify and prioritize the SCD features that most effectively reduce debt costs, ultimately supporting both financial and operational sustainability.

5.2. Contribution

- The findings from this study offer valuable insights into the relationship between SCD and CoD, potentially deepening academic understanding of this topic. Unlike previous studies that primarily adopt a vertical perspective focused on suppliers and customers, this research follows Chen et al. [41] in decomposing SCD into four features—logistics flow, product flow, information flow, and capital flow—under the four flows framework, providing a horizontal view of the supply chain. This horizontal perspective allows for a more comprehensive analysis of a company’s supply chain structure, helping enterprises to identify which aspects of SCD have the greatest impact on reducing CoD and supporting enterprises in advancing the sustainable development goals.

- Practically, our research provides valuable insights for professionals in the fields of supply chain management, digital transformation, corporate finance, and business sustainability. For instance, in the pursuit of corporate sustainability with a focus on lowering financing costs, managers should prioritize the significant roles of PFD, LFD, and IFD in turn, while carefully analyzing CFD. Moreover, our study demonstrates that even with limited data resources, it is possible to uncover the logical relationships between variables. This holds significant relevance for decision-makers who need to make timely decisions with minimal cognitive resources.

- From a methodological perspective, we depart from the traditional hypothesis-based inference commonly used in statistical studies by adopting a data-driven paradigm based on limited text and financial data. This idea uncovers hidden patterns and relationships within the data, offering a more objective view of the functional links between SCD and CoD. It provides a clearer understanding of how specific features of SCD impact CoD from a horizontal perspective. Specifically, this study employs an explainable machine learning methodology to analyze the data, enabling the relationships between variables to be understood with only limited data, thereby conserving decision-makers’ cognitive resources. Furthermore, multiple machine learning models and a multi-explanatory approach were used for cross-verification, replacing the traditional single-method analysis. Incorporating multiple models enhances the robustness and accuracy of the results, leading to a more reliable understanding of the impact patterns of SCD on CoD. Finally, building on the data-driven research framework of Zhou and Li [73], we refine it to improve its application. By integrating insights from the existing literature with empirical findings, this study deepens the exploration of how SCD influences CoD, advancing theoretical discussions at the intersection of supply chain management, corporate finance, and sustainable economic development.

5.3. Innovations

- Although our analysis of SCD from the four flows perspective builds upon existing research like Chen et al. [41], prior studies primarily conducted empirical research on SCD from an integrated perspective. In contrast, our study simultaneously analyzes the four distinct SCD features. This approach involved examining the impact of each SCD feature on CoD before extending the analysis to the overall SCD framework. This step-by-step progression in research methodology provides a novel perspective for future scholars.

- By relying solely on text data from annual reports and a limited amount of financial data, our study identifies the relationship between SCD, its features, and CoD. This enables corporate decision-makers to conserve cognitive resources, showcasing an innovative dimension in our approach.

- Unlike traditional data-driven explainable machine learning methodologies [33,34,35,36,37,38], our research goes beyond merely focusing on feature importance and influence direction. We also integrate existing theories and the literature to explore how and why SCD and its features affect CoD, further enriching the understanding of this relationship.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Brundtland, G.H. World commission on environment and development. Environ. Policy Law 1985, 14, 26–30. [Google Scholar]

- Bansal, P.; DesJardine, M.R. Business sustainability: It is about time. Strat. Organ. 2014, 12, 70–78. [Google Scholar] [CrossRef]

- Ye, Z.; Shahab, Y.; Riaz, Y.; Ntim, C.G. Strategic deviation and the cost of debt financing. Econ. Model. 2023, 125, 106371. [Google Scholar] [CrossRef]

- Borisova, G.; Fotak, V.; Holland, K.; Megginson, W.L. Government ownership and the cost of debt: Evidence from government investments in publicly traded firms. J. Financ. Econ. 2015, 118, 168–191. [Google Scholar] [CrossRef]

- Jung, J.; Herbohn, K.; Clarkson, P. Carbon risk, carbon risk awareness and the cost of debt financing. J. Bus. Ethics 2018, 150, 1151–1171. [Google Scholar] [CrossRef]

- KPMG. Corporate Sustainability: A Progress Report; KPMG: Seoul, Republic of Korea, 2011. [Google Scholar]

- Wang, S.; Li, J. How carbon emission trading mechanism and supply chain digitization affect manufacturing enterprises’ competitiveness? Evidence from China. J. Clean. Produc. 2024, 452, 142164. [Google Scholar] [CrossRef]

- Belhadi, A.; Mani, V.; Kamble, S.S.; Khan, S.A.R.; Verma, S. Artificial intelligence-driven innovation for enhancing supply chain resilience and performance under the effect of supply chain dynamism: An empirical investigation. Ann. Oper. Res. 2021, 333, 627–652. [Google Scholar] [CrossRef]

- Holmström, J.; Partanen, J. Digital manufacturing-driven transformations of service supply chains for complex products. Supply Chain Manag. Int. J. 2014, 19, 421–430. [Google Scholar] [CrossRef]

- Yang, M.; Fu, M.; Zhang, Z. The adoption of digital technologies in supply chains: Drivers, process and impact. Technol. Forecast. Soc. Chang. 2021, 169, 120795. [Google Scholar] [CrossRef]

- Büyüközkan, G.; Göçer, F. Digital Supply Chain: Literature review and a proposed framework for future research. Comput. Ind. 2018, 97, 157–177. [Google Scholar] [CrossRef]

- Seyedghorban, Z.; Tahernejad, H.; Meriton, R.; Graham, G. Supply chain digitalization: Past, present and future. Prod. Plan. Control 2020, 31, 96–114. [Google Scholar] [CrossRef]

- Farajpour, F.; Hassanzadeh, A.; Elahi, S.; Ghazanfari, M. Digital supply chain blueprint via a systematic literature review. Technol. Forecast. Soc. Chang. 2022, 184, 121976. [Google Scholar] [CrossRef]

- Frank, A.G.; Dalenogare, L.S.; Ayala, N.F. Industry 4.0 technologies: Implementation patterns in manufacturing companies. Int. J. Prod. Econ. 2019, 210, 15–26. [Google Scholar] [CrossRef]

- Holmström, J.; Holweg, M.; Lawson, B.; Pil, F.K.; Wagner, S.M. The digitalization of operations and supply chain management: Theoretical and methodological implications. J. Oper. Manag. 2019, 65, 728–734. [Google Scholar] [CrossRef]

- Sawik, T. Stochastic optimization of supply chain resilience under ripple effect: A COVID-19 pandemic related study. Omega 2022, 109, 102596. [Google Scholar] [CrossRef]

- Ardolino, M.; Bacchetti, A.; Ivanov, D. Analysis of the COVID-19 pandemic’s impacts on manufacturing: A systematic literature review and future research agenda. Oper. Manag. Res. 2022, 15, 551–566. [Google Scholar] [CrossRef]

- Zhao, N.; Hong, J.; Lau, K.H. Impact of supply chain digitalization on supply chain resilience and performance: A multi-mediation model. Int. J. Prod. Econ. 2023, 259, 108817. [Google Scholar] [CrossRef]

- Thomas, D.J.; Griffin, P.M. Coordinated supply chain management. Eur. J. Oper. Res. 1996, 94, 1–15. [Google Scholar] [CrossRef]

- Le, M.T.; Nhieu, N.L. A novel multi-criteria assessment approach for post-COVID-19 production strategies in Vietnam manufacturing industry: OPA–fuzzy EDAS model. Sustainability 2022, 14, 4732. [Google Scholar] [CrossRef]

- Shen, L.; Sun, C.; Ali, M. Role of servitization, digitalization, and innovation performance in manufacturing enterprises. Sustainability 2021, 13, 9878. [Google Scholar] [CrossRef]

- Apergis, N.; Poufinas, T.; Antonopoulos, A. ESG scores and cost of debt. Energy Econ. 2022, 112, 106186. [Google Scholar] [CrossRef]

- Ding, X.; Appolloni, A.; Shahzad, M. Environmental administrative penalty, corporate environmental disclosures and the cost of debt. J. Clean. Prod. 2022, 332, 129919. [Google Scholar] [CrossRef]

- Sun, C.; Zhang, Z.; Vochozka, M.; Vozňáková, I. Enterprise digital transformation and debt financing cost in China’s A-share listed companies. Oeconomia Copernic. 2022, 13, 783–829. [Google Scholar] [CrossRef]

- Yang, X.; Gan, H.; Luo, S.; Lv, J. A Study on the Impact of Enterprise Digital Evolution on Outward Foreign Investments. Sustainability 2024, 16, 4021. [Google Scholar] [CrossRef]

- Nasiri, M.; Ukko, J.; Saunila, M.; Rantala, T. Managing the digital supply chain: The role of smart technologies. Technovation 2020, 96, 102121. [Google Scholar] [CrossRef]

- Lin, Q.; Qiao, B. The relationship between trade credit and bank loans under economic fluctuations-based on the perspective of the supply chain. Appl. Econ. 2021, 53, 688–702. [Google Scholar] [CrossRef]

- Sweller, J. Cognitive Load During Problem Solving: Effects on Learning. Cogn. Sci. 1988, 12, 257–285. [Google Scholar] [CrossRef]

- Mayer-Schönberger, V.; Cukier, K. Big Data: A Revolution that Will Transform How We Live, Work, and Think; Houghton Mifflin Harcourt: Boston, MA, USA, 2013. [Google Scholar]

- Li, H.; Liu, Z. Multivariate time series clustering based on complex network. Pattern Recognit. 2021, 115, 107919. [Google Scholar] [CrossRef]

- Chen, L.; Pelger, M.; Zhu, J. Deep learning in asset pricing. Manag. Sci. 2024, 70, 714–750. [Google Scholar] [CrossRef]

- McCollin, C. Applied stochastic models in business and industry. Appl. Stoch. Models Bus. Ind. 2011, 27, 476–480. [Google Scholar] [CrossRef]

- Tiffin, M.A.J. Machine Learning and Causality: The Impact of Financial Crises on Growth; International Monetary Fund: Washington, DC, USA, 2019. [Google Scholar]

- Tidhar, R.; Eisenhardt, K.M. Get rich or die trying… finding revenue model fit using machine learning and multiple cases. Strateg. Manag. J. 2020, 41, 1245–1273. [Google Scholar] [CrossRef]

- Ha, T. An explainable artificial-intelligence-based approach to investigating factors that influence the citation of papers. Technol. Forecast. Soc. Chang. 2022, 184, 121974. [Google Scholar] [CrossRef]

- Weng, F.; Zhu, J.; Yang, C.; Gao, W.; Zhang, H. Analysis of financial pressure impacts on the health care industry with an explainable machine learning method: China versus the USA. Expert Syst. Appl. 2022, 210, 118482. [Google Scholar] [CrossRef]

- Dzyabura, D.; El Kihal, S.; Hauser, J.R.; Ibragimov, M. Leveraging the power of images in managing product return rates. Mark. Sci. 2023, 42, 1125–1142. [Google Scholar] [CrossRef]

- Li, H.; Tang, H.; Zhou, W.; Wan, X. Impact of enterprise digitalization on green innovation performance under the perspective of production and operation. Front. Public Health 2022, 10, 971971. [Google Scholar] [CrossRef]

- Scuotto, V.; Caputo, F.; Villasalero, M.; Del Giudice, M. A multiple buyer–supplier relationship in the context of SMEs’ digital supply chain management. Prod. Plan. Control 2017, 28, 1378–1388. [Google Scholar] [CrossRef]

- Du, M.; Chen, Q.; Xiao, J.; Yang, H.; Ma, X. Supply chain finance innovation using blockchain. IEEE Trans. Eng. Manag. 2020, 67, 1045–1058. [Google Scholar] [CrossRef]

- Chen, J.; Wu, W.; Zhuang, Y. Impact of Digital Supply Chain on Sustainable Trade Credit Provision: Evidence from Chinese Listed Companies. Sustainability 2023, 15, 11861. [Google Scholar] [CrossRef]

- Yu, K.; Wei, Q. 2022 China Supply Chain Digital Upgrade Industry Research Report. iResearch 2022. Available online: https://report.iresearch.cn/report/202205/3998.shtml (accessed on 11 December 2023).

- Lugo, S. Insider ownership and the cost of debt capital: Evidence from bank loans. Int. Rev. Financ. Anal. 2019, 63, 357–368. [Google Scholar] [CrossRef]

- Liu, C.; Xu, L.; Yang, H.; Zhang, W. Prosocial CEOs and the cost of debt: Evidence from syndicated loan contracts. J. Corp. Financ. 2023, 78, 102316. [Google Scholar] [CrossRef]

- Houston, J.F.; Jiang, L.; Lin, C.; Ma, Y. Political connections and the cost of bank loans. J. Account. Res. 2014, 52, 193–243. [Google Scholar] [CrossRef]

- Gong, G.; Huang, X.; Wu, S.; Tian, H.; Li, W. Punishment by securities regulators, corporate social responsibility and the cost of debt. J. Bus. Ethics 2021, 171, 337–356. [Google Scholar] [CrossRef]

- Gao, H.; Wang, J.; Wang, Y.; Wu, C.; Dong, X. Media coverage and the cost of debt. J. Financ. Quant. Anal. 2020, 55, 429–471. [Google Scholar] [CrossRef]

- Almaghrabi, K.S. COVID-19 and the cost of bond debt: The role of corporate diversification. Finance Res. Lett. 2022, 46, 102454. [Google Scholar] [CrossRef]

- Lan, Y.; Wang, J.; Wu, S.; Yang, J. Research on corporate finance: History, challenge and prospect in China. Nankai Bus. Rev. Int. 2019, 10, 487–500. [Google Scholar] [CrossRef]

- Wu, K.; Fu, Y.; Kong, D. Does the digital transformation of enterprises affect stock price crash risk? Financ. Res. Lett. 2022, 48, 102888. [Google Scholar] [CrossRef]

- Yonghong, L.; Jie, S.; Ge, Z.; Ru, Z. The impact of enterprise digital transformation on financial performance—Evidence from Mainland China manufacturing firms. Manag. Decis. Econ. 2023, 44, 2110–2124. [Google Scholar] [CrossRef]

- Zouari, D.; Ruel, S.; Viale, L. Does digitalising the supply chain contribute to its resilience? Int. J. Phys. Distrib. Logist. Manag. 2021, 51, 149–180. [Google Scholar] [CrossRef]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2019, 57, 2117–2135. [Google Scholar] [CrossRef]

- Garay-Rondero, C.L.; Martinez-Flores, J.L.; Smith, N.R.; Morales, S.O.C.; Aldrette-Malacara, A. Digital supply chain model in Industry 4.0. J. Manuf. Technol. Manag. 2020, 31, 887–933. [Google Scholar] [CrossRef]

- Khan, S.A.; Kusi-Sarpong, S.; Gupta, H.; Arhin, F.K.; Lawal, J.N.; Hassan, S.M. Critical factors of digital supply chains for organizational performance improvement. IEEE Trans. Eng. Manag. 2021, 71, 13727–13741. [Google Scholar] [CrossRef]

- Roztocki, N.; Weistroffer, H.R. Investments in enterprise integration technology: An event study. Inf. Syst. Front. 2015, 17, 659–672. [Google Scholar] [CrossRef]

- Li, J.; Chen, L.; Chen, Y.; He, J. Digital economy, technological innovation, and green economic efficiency—Empirical evidence from 277 cities in China. Manag. Decis. Econ. 2022, 43, 616–629. [Google Scholar] [CrossRef]

- Liao, G.; Ma, M.; Yu, X. Transporting transparency: Director foreign experience and corporate information environment. J. Int. Bus. Stud. 2022, 53, 1343–1369. [Google Scholar] [CrossRef]

- Pekar, V.; Candi, M.; Beltagui, A.; Stylos, N.; Liu, W. Explainable Text-Based Features in Predictive Models of Crowdfunding Campaigns. Ann. Oper. Res. 2024, 1–31. [Google Scholar] [CrossRef]

- Liu, F.T.; Ting, K.M.; Zhou, Z.H. Isolation-based anomaly detection. ACM Trans. Knowl. Discov. Data 2012, 6, 1–39. [Google Scholar] [CrossRef]

- Rico-Juan, J.R.; de La Paz, P.T. Machine learning with explainability or spatial hedonics tools? An analysis of the asking prices in the housing market in Alicante, Spain. Expert Syst. Appl. 2021, 171, 114590. [Google Scholar] [CrossRef]

- Jabeur, S.B.; Khalfaoui, R.; Arfi, W.B. The effect of green energy, global environmental indexes, and stock markets in predicting oil price crashes: Evidence from explainable machine learning. J. Environ. Manag. 2021, 298, 113511. [Google Scholar]

- Baptista, M.L.; Goebel, K.; Henriques, E.M. Relation between prognostics predictor evaluation metrics and local interpretability SHAP values. Artif. Intell. 2022, 306, 103667. [Google Scholar]

- Ivanov, D. Predicting the impacts of epidemic outbreaks on global supply chains: A simulation-based analysis on the coronavirus outbreak (COVID-19/SARS-CoV-2) case. Transp. Res. Part E: Logist. Transp. Rev. 2020, 136, 101922. [Google Scholar]

- Kohtamäki, M.; Parida, V.; Patel, P.C.; Gebauer, H. The relationship between digitalization and servitization: The role of servitization in capturing the financial potential of digitalization. Technol. Forecast. Soc. Chang. 2020, 151, 119804. [Google Scholar] [CrossRef]

- Fritzsch, S.; Scharner, P.; Weiß, G. Estimating the relation between digitalization and the market value of insurers. J. Risk Insur. 2021, 88, 529–567. [Google Scholar] [CrossRef]

- Wei, Z.; Sun, L. How to leverage manufacturing digitalization for green process innovation: An information processing perspective. Ind. Manag. Data Syst. 2021, 121, 1026–1044. [Google Scholar] [CrossRef]

- Garechana, G.; Río-Belver, R.; Bildosola, I.; Salvador, M.R. Effects of innovation management system standardization on firms: Evidence from text mining annual reports. Scientometrics 2017, 111, 1987–1999. [Google Scholar] [CrossRef]

- Wang, Y.; Liang, S.; Kong, D.; Wang, Q. High-speed rail, small city, and cost of debt: Firm-level evidence. Pac.-Basin Financ. J. 2019, 57, 101194. [Google Scholar] [CrossRef]

- Pittman, J.A.; Fortin, S. Auditor choice and the cost of debt capital for newly public firms. J. Account. Econ. 2004, 37, 113–136. [Google Scholar] [CrossRef]

- Fonseka, M.; Rajapakse, T.; Richardson, G. The effect of environmental information disclosure and energy product type on the cost of debt: Evidence from energy firms in China. Pac.-Basin Financ. J. 2019, 54, 159–182. [Google Scholar] [CrossRef]

- Lu, Q.; Song, L.; Yu, K. The Effects of Operational and Digitalization Capabilities on SMEs’ Supply Chain Financing under Supply Risk. Int. J. Logist. Res. Appl. 2023, 26, 1642–1662. [Google Scholar] [CrossRef]

- Zhou, W.; Li, H. A Study on the Multidimensional Driving Mechanism of Cross-Regional Scientific Collaboration Network in China. Technol. Anal. Strateg. Manag. 2023, 1–15. [Google Scholar] [CrossRef]

- Lai, K.H.; Wong, C.W.; Cheng, T.E. Bundling digitized logistics activities and its performance implications. Ind. Mark. Manag. 2010, 39, 273–286. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A.; Sokolov, B. The impact of digital technology and Industry 4.0 on the ripple effect and supply chain risk analytics. Int. J. Prod. Res. 2019, 57, 829–846. [Google Scholar] [CrossRef]

- Nishihara, M.; Sarkar, S.; Zhang, C. Agency cost of debt overhang with optimal investment timing and size. J. Bus. Financ. Account. 2019, 46, 784–809. [Google Scholar] [CrossRef]

- Zhou, C.; Su, F.; Pei, T.; Zhang, A.; Du, Y.; Luo, B.; Xiao, H. COVID-19: Challenges to GIS with big data. Geogr. Sustain. 2020, 1, 77–87. [Google Scholar] [CrossRef]

- Loebbecke, C.; Picot, A. Reflections on societal and business model transformation arising from digitization and big data analytics: A research agenda. J. Strateg. Inf. Syst. 2015, 24, 149–157. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. Manag. Digit. Transform. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Tan, K.J.K.; Zhou, Q.; Pan, Z.; Faff, R. Business shocks and corporate leverage. J. Bank. Financ. 2021, 131, 106208. [Google Scholar] [CrossRef]

- Giannopoulos, G.A. The application of information and communication technologies in transport. Eur. J. Oper. Res. 2004, 152, 302–320. [Google Scholar] [CrossRef]

- Chen, S.; Du, J.; He, W.; Siponen, M. Supply chain finance platform evaluation based on acceptability analysis. Int. J. Prod. Econ. 2022, 243, 108350. [Google Scholar] [CrossRef]

- Yunzhang, H.; Lee, C.K.; Shuzhu, Z. Trinomial tree based option pricing model in supply chain financing. Ann. Oper. Res. 2023, 331, 141–157. [Google Scholar] [CrossRef]

- Dai, Y.; Zhang, L. Regional digital finance and corporate financial risk: Based on Chinese listed companies. Emerg. Mark. Financ. Trade 2023, 59, 296–311. [Google Scholar]

- Ren, X.; Zeng, G.; Zhao, Y. Digital finance and corporate ESG performance: Empirical evidence from listed companies in China. Pac. Basin Financ. J. 2023, 79, 102019. [Google Scholar] [CrossRef]

| Category | Authors & Studies | Key Findings |

|---|---|---|

| Internal Factors | Borisova [4] | Government ownership negatively impacts CoD (credit spreads). |

| Lugo [43] | U-shaped relationship between insider ownership control and CoD. | |

| Sun et al. [24] | Digital transformation significantly reduces CoD for Chinese enterprises. | |

| Ye et al. [3] | Strategic deviation from industry norms increases debt financing costs. | |

| Liu et al. [44] | CEOs identified through charitable donations are negatively correlated with CoD. | |

| Apergis [22] | Positive ESG performance can reduce CoD by improving corporate reputation and reducing financial risks. | |

| External Factors | Ding et al. [23] | Environmental administrative penalties increase CoD |

| Houston et al. [45] | Strong government ties reduce bank loan costs for corporations. | |

| Gong et al. [46] | Regulatory penalties increase CoD due to higher default and information risks. | |

| Gao et al. [47] | Increased media coverage inversely affects CoD by reducing bond yield spreads and enhancing investor awareness. | |

| Almaghrabi [48] | COVID-19 has created industry-specific impacts on CoD, with greater uncertainty in financial markets leading to increased CoD. | |

| Lan [49], Wu [50] | The rapid advancement of digital technologies challenges traditional financial practices, influencing CoD through process automation and transparency. | |

| Future Directions | The impact of SCD on CoD has yet to be fully explored, even though SCD has become a major focus in academic research. | |

| Category | Authors & Studies | Key Findings |

|---|---|---|

| Empirical Research on SCD | Nasiri et al. [26] | Positive role of SCD in enhancing a company’s competitive advantage. |

| Zouari et al. [52] | SCD promotes supply chain resilience. | |

| Zhao et al. [18] | Developed a framework: “supply chain digitalization → supply chain resilience → supply chain performance”, showing how SCD improves resilience and performance. | |

| Shen et al. [21] | SCD helps companies promote the development of green supply chains and achieve efficient energy management. | |

| Chen et al. [41] | SCD positively influences sustainable trade credit provision for Chinese listed firms, with logistics, product, and information flows showing significant impacts. | |

| Conceptual models on SCD | Saberi et al. [53] | Proposed a conceptual framework distinguishing between inter-organizational and intra-organizational supply chain transformations under SCD. |

| Du et al. [40] | Presented a multi-dimensional framework focusing on managing digitalized flows (information, logistics, and capital flow) within SCD to improve practical applications. | |

| Garay-Rondero et al. [54] | Developed a conceptual model of SCD for Industry 4.0, integrating artificial intelligence, cloud computing, machine learning, and digital platforms into supply chain management. | |

| Khan et al. [55] | Identified key factors promoting organizational performance via SCD, including supplier configuration, supply chain responsiveness, and information sharing, creating a comprehensive SCD framework for enhancing logistics, production, and information management. | |

| Future Directions | 1. Solely focusing on theoretical models lacks practical application. 2. Current studies often address single aspects of SCD, limiting comprehensive understanding. 3. Increasing empirical research is necessary. | |

| LFD | PFD | IFD | CFD | COD | |

|---|---|---|---|---|---|

| mean | 0.0621 | 0.1287 | 0.1317 | 0.0002 | 191.6762 |

| std | 0.2406 | 0.4096 | 0.3096 | 0.0067 | 152.0809 |

| min | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| 50% | 0.0000 | 0.0000 | 0.0162 | 0.0000 | 169.7250 |

| 75% | 0.0200 | 0.0625 | 0.1060 | 0.0000 | 294.0340 |

| max | 4.1329 | 5.5103 | 3.4030 | 0.5250 | 662.4810 |

| Feature | XGBoost | LightGBM | CatBoost | |||

|---|---|---|---|---|---|---|

| Mean |SHAP| Value | Order | Mean |SHAP| Value | Order | Mean |SHAP| Value | Order | |

| LFD | 10.7676 | 2 | 10.8443 | 2 | 11.2132 | 3 |

| PFD | 17.0149 | 1 | 16.7914 | 1 | 15.3879 | 1 |

| IFD | 8.7471 | 3 | 8.9285 | 3 | 11.6024 | 2 |

| CFD | 0.1265 | 4 | 0.0897 | 4 | 0.1408 | 4 |

| Feature | XGBoost | LightGBM | CatBoost | |||

|---|---|---|---|---|---|---|

| Importance of PDPs | Order | Importance of PDPs | Order | Importance of PDPs | Order | |

| LFD | 0.0332 | 1 | 0.0341 | 2 | 0.0347 | 2 |

| PFD | 0.0331 | 2 | 0.0353 | 1 | 0.0359 | 1 |

| IFD | 0.0170 | 3 | 0.0188 | 3 | 0.0218 | 3 |

| CFD | 0.0017 | 4 | 0.0000 | 4 | 0.0006 | 4 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tang, H.; Zhu, J.; Li, N.; Wu, W. Impact of Enterprise Supply Chain Digitalization on Cost of Debt: A Four-Flows Perspective Analysis Using Explainable Machine Learning Methodology. Sustainability 2024, 16, 8702. https://doi.org/10.3390/su16198702

Tang H, Zhu J, Li N, Wu W. Impact of Enterprise Supply Chain Digitalization on Cost of Debt: A Four-Flows Perspective Analysis Using Explainable Machine Learning Methodology. Sustainability. 2024; 16(19):8702. https://doi.org/10.3390/su16198702

Chicago/Turabian StyleTang, Hongqin, Jianping Zhu, Nan Li, and Weipeng Wu. 2024. "Impact of Enterprise Supply Chain Digitalization on Cost of Debt: A Four-Flows Perspective Analysis Using Explainable Machine Learning Methodology" Sustainability 16, no. 19: 8702. https://doi.org/10.3390/su16198702