Does Independent Directors’ Interlocking Network Position Affect Green Innovation?

Abstract

:1. Introduction

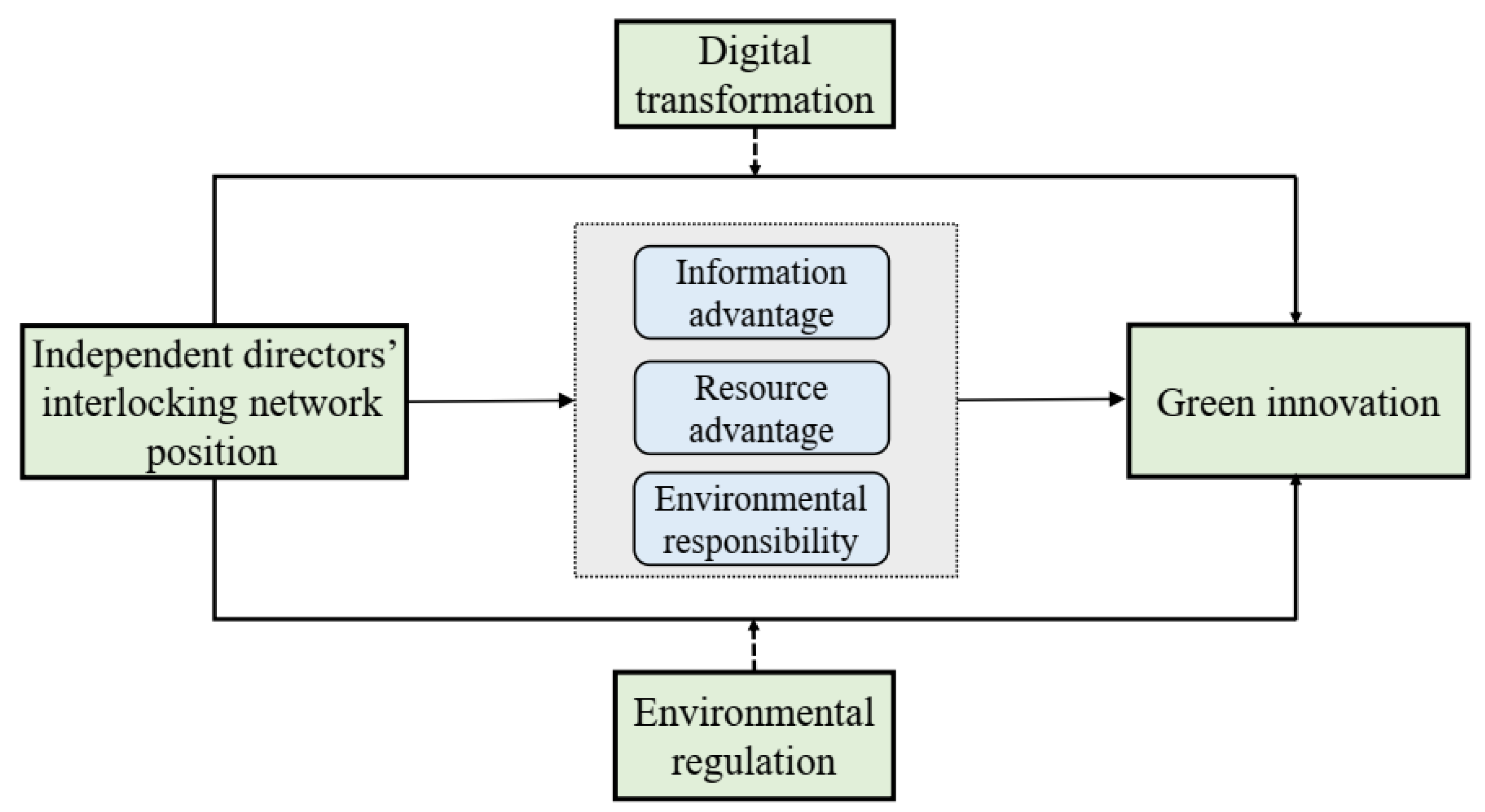

- Enhanced understanding of green innovation factors.Compared to the aforementioned studies that focused on the impact of green innovation based on the resource-based view, institutional theory, and innovation diffusion theory, and that examined factors such as stakeholder attention, government subsidies, and level of digitalization, this paper applies social network theory to explore in depth the impact of IDINP on corporate green innovation, extending the theoretical application of social networks in corporate governance and sustainable development.Additionally, this study diverges from the practice of using developed countries as samples by focusing on a developing country, China. Given its distinctive relational culture and its position as the leading emitter of carbon dioxide globally, China epitomizes a vital context for the exploration of green innovation, particularly through the IDINP framework.

- Capturing moderating variables and an innovative methodological approach. Previous research has focused on the impact of digital transformation and environmental regulation on corporate green innovation [19,25], yet these have not been incorporated as situational variables in a model that also considers IDINP and its effect on green innovation. By comprehensively applying social network theory, neoclassical economics, and the Porter hypothesis, our study reveals, for the first time, the substantial moderating effects of digital transformation and environmental regulation within this framework. This study provides a solid theoretical foundation for governments to formulate green policies and for companies to effectively implement green innovation initiatives.Additionally, this study enhances the precision in quantifying the interplay between IDINP and a company’s digital transformation by integrating social network analysis with text analysis. This multifaceted approach surpasses the confines of prior research that relied on a solitary indicator, thereby providing a more holistic understanding of interlocking network positions and digital transformation dynamics.

- Clarification of boundary conditions and mechanisms. This research not only clarifies the contextual constraints that shape the impact of IDINP on corporate green innovation but also, for the first time, reveals how these network positions promote green innovation through novel mechanisms (environmental responsibility).

2. Theoretical Analysis and Hypotheses

2.1. IDINP and Green Innovation

2.2. Moderating Role of Digital Transformation

2.3. Moderating Role of Environmental Regulation

3. Data and Methodology

3.1. Data and Sample Selection

3.2. Variable Measurement

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Moderating Variable

Digital Transformation

Environmental Regulation

3.2.4. Control Variable

3.3. Empirical Framework

4. Empirical Analysis

4.1. Descriptive Statistics

4.2. Basic Regression Results

4.3. Moderating Effect Test Results

4.4. Robustness Tests

- (1)

- To mitigate the potential for reverse causality, a one-period lag was applied to both the independent variables and control variables. The regression outcomes for this lagged period are presented in Column (1) of Table 5. The findings reveal that the IDINP, after accounting for a one-period lag, exhibited a significant positive association at the 1% significance level, consistent with the results observed in the baseline model.

- (2)

- The Heckman two-step method was employed to mitigate against potential sample self-selection issues. In Heckman’s first-stage regression model, the explanatory variable was set as a dummy variable Centrality_D (assigned a value of 1 if the IDINP exceeds the sample median, and 0 otherwise). Additionally, the IDINP for other companies within the same industry was incorporated as an exogenous instrumental variable. Following the computation of the Ni-Mills Ratio (IMR), it was then incorporated into the second-stage model for estimation. The regression results are presented in Column (2) of Table 5 using the Heckman two-step method. The findings indicate that IMR was not statistically significant, while IDINP was significantly positive at the 1% significance level, suggesting the absence of a self-selection problem.

- (3)

- To further mitigate against endogeneity concerns, instrumental variables were used for testing, and weak instrumental variable tests were performed. Given the challenges in identifying suitable instrumental variables in social network analysis, this study adopted an approach inspired by Hu et al. [9]. This approach introduces IDINP as an independent variable into the regression model to predict residuals, which are subsequently employed as instrumental variables. The rationale behind this choice was that these residuals are independent of the other control variables, while exhibiting a strong correlation with IDINP. The results are shown in column (3) of Table 5. The results show that the positive relationship between the IDINP and the level of green innovation in listed companies remained robust.

- (4)

- Substituting the dependent variable, we employed the ratio of green patents filed by companies to the total patents filed in a given year (IPC) as a proxy variable. Column (4) of Table 5 displays the regression results with the dependent variable replacement. The findings reveal a significantly positive correlation between IDINP and green innovation within the company at a 1% significance level, aligning with the central hypothesis of this paper.

- (5)

- Substituting the independent variable, we employed degree centrality (), betweenness centrality (), and closeness centrality () as alternative variables for IDINP. Columns (5)–(7) of Table 5 display the regression results with each independent variable replacement, respectively. The outcomes demonstrated a strong and significantly positive correlation between the degree centrality, betweenness centrality, and closeness centrality of the independent directors’ interlocking network and the level of green innovation among listed companies, all at a 1% significance level. This consistency underscores the robustness of the central findings of this paper.

5. Further Analysis

5.1. Mechanism Test

5.2. Heterogeneity Analysis

6. Discussion and Conclusions

6.1. Discussion

6.2. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Albort-Morant, G.; Leal-Rodríguez, A.L.; De Marchi, V. Absorptive capacity and relationship learning mechanisms as complementary drivers of green innovation performance. J. Knowl. Manag. 2018, 22, 432–452. [Google Scholar] [CrossRef]

- Li, C.J.; Razzaq, A.; Irfan, M.; Luqman, A. Green innovation, environmental governance and green investment in China: Exploring the intrinsic mechanisms under the framework of COP26. Technol. Forecast. Soc. 2023, 194, 122708. [Google Scholar] [CrossRef]

- Ge, W.; Xu, Y.; Razzaq, A.; Liu, G.; Su, X.; Yang, X.; Ran, Q. What drives the green transformation of enterprises? A case of carbon emissions trading pilot policy in China. Environ. Sci. Pollut. Res. 2023, 30, 56743–56758. [Google Scholar] [CrossRef] [PubMed]

- Liu, Q.; Yang, X.; Shen, Z.; Štreimikiene, D. Digital economy and substantial green innovation: Empirical evidence from Chinese listed companies. Technol. Anal. Strateg. 2022, 1–15. [Google Scholar] [CrossRef]

- Roh, T.; Lee, K.; Yang, J.Y. How do intellectual property rights and government support drive a firm’s green innovation? The mediating role of open innovation. J. Clean. Prod. 2021, 317, 128422. [Google Scholar] [CrossRef]

- Zhang, L.; Zhang, Y.; Li, N.; Zhang, Q. Do the academician independent directors promote green innovation in enterprises? Environ. Sci. Pollut. Res. 2023, 30, 84061–84082. [Google Scholar] [CrossRef] [PubMed]

- Guo, C.; Lv, P. Network position of independent director in cross-border mergers and acquisitions. Int. J. Emerg. Mark. 2018, 13, 118–135. [Google Scholar] [CrossRef]

- Chen, S.; Nie, Y. Director network, governance of independent directors and efficiency of enterprise capital allocation. Entrep. Res. J. 2020, 13, 163–184. [Google Scholar] [CrossRef]

- Hu, H.; Guo, S.; Dou, B.; Wang, A. Chain director network and Chinese listed company violations. Econ. Manag. Stud. 2022, 43, 62–88. (In Chinese) [Google Scholar] [CrossRef]

- Beasley, M.S. An empirical analysis of the relation between the board of director composition and financial statement fraud. Account. Rev. 1996, 71, 443–465. Available online: https://www.jstor.org/stable/248566 (accessed on 6 June 2023).

- Liang, S.; Chen, D.; Fu, B.; Fang, K. Independent directors’ board networks and accounting conservatism. Chin. J. Account. Stud. 2017, 5, 173–195. [Google Scholar] [CrossRef]

- Gong, X.; Wang, Z.; Xiong, X. Independent director network and stock price synchronicity. Syst. Eng. Theory Pract. 2022, 42, 2049–2070. (In Chinese) [Google Scholar] [CrossRef]

- Xing, J.; Zhang, Y.; Xiong, X. Social capital, independent director connectedness, and stock price crash risk. Int. Rev. Econ. Financ. 2023, 83, 786–804. [Google Scholar] [CrossRef]

- Quan, X.; Ke, Y.; Qian, Y.; Zhang, Y. CEO foreign experience and green innovation: Evidence from China. J. Bus. Ethics 2021, 182, 535–557. [Google Scholar] [CrossRef]

- He, F.; Yan, Y.; Hao, J.; Wu, J.G. Retail investor attention and corporate green innovation: Evidence from China. Energy Econ. 2022, 115, 106308. [Google Scholar] [CrossRef]

- Hu, G.; Wang, X.; Wang, Y. Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 2021, 98, 105134. [Google Scholar] [CrossRef]

- Tang, K.; Qiu, Y.; Zhou, D. Does command-and-control regulation promote green innovation performance? Evidence from China’s industrial enterprises. Sci. Total Environ. 2020, 712, 136362. [Google Scholar] [CrossRef]

- Zhang, J.; Kang, L.; Li, H.; Ballesteros-Pérez, P.; Skitmore, M.; Zuo, J. The impact of environmental regulations on urban Green innovation efficiency: The case of Xi’an. Sustain. Cities Soc. 2020, 57, 102123. [Google Scholar] [CrossRef]

- Li, J.; Du, Y. Spatial effect of environmental regulation on green innovation efficiency: Evidence from prefectural-level cities in China. J. Clean. Prod. 2021, 286, 125032. [Google Scholar] [CrossRef]

- Bai, Y.; Song, S.; Jiao, J.; Yang, R. The impacts of government R&D subsidies on green innovation: Evidence from Chinese energy-intensive firms. J. Clean. Prod. 2019, 233, 819–829. [Google Scholar] [CrossRef]

- Xia, L.; Gao, S.; Wei, J.; Ding, Q. Government subsidy and corporate green innovation-Does board governance play a role? Energy Policy 2022, 161, 112720. [Google Scholar] [CrossRef]

- Roh, T.; Yu, B. Paving a Way Toward Green World: Two-Track Institutional Approaches and Corporate Green Innovation. IEEE Trans. Eng. Manag. 2023, 1–14. [Google Scholar] [CrossRef]

- Dou, Q.; Gao, X. The double-edged role of the digital economy in firm green innovation: Micro-evidence from Chinese manufacturing industry. Environ. Sci. Pollut. Res. 2022, 29, 67856–67874. [Google Scholar] [CrossRef] [PubMed]

- Ning, J.; Jiang, X.; Luo, J. Relationship between enterprise digitalization and green innovation: A mediated moderation model. J. Innov. Knowl. 2023, 8, 100326. [Google Scholar] [CrossRef]

- Chen, X.; Zhou, P.; Hu, D. Influences of the ongoing digital transformation of the Chinese Economy on innovation of sustainable green technologies. Sci. Total Environ. 2023, 875, 162708. [Google Scholar] [CrossRef]

- Fan, F.; Lian, H.; Liu, X.; Wang, X. Can environmental regulation promote urban green innovation Efficiency? An empirical study based on Chinese cities. J. Clean. Prod. 2021, 287, 125060. [Google Scholar] [CrossRef]

- Sun, S.; Guo, L. Digital transformation, green innovation and the Solow productivity paradox. PLoS ONE 2022, 17, e0270928. [Google Scholar] [CrossRef] [PubMed]

- Du, J.; Shen, Z.; Song, M.; Zhang, L. Nexus between digital transformation and energy technology innovation: An empirical test of A-share listed enterprises. Energy Econ. 2023, 120, 106572. [Google Scholar] [CrossRef]

- Xu, J.; Yu, Y.; Zhang, M.; Zhang, J.Z. Impacts of digital transformation on eco-innovation and sustainable performance: Evidence from Chinese manufacturing companies. J. Clean. Prod. 2023, 393, 136278. [Google Scholar] [CrossRef]

- Qiu, Q.; Yu, J. Impact of independent director network on corporate green innovation: Evidence from Chinese listed companies. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 3271–3293. [Google Scholar] [CrossRef]

- Williams, N.; Vorley, T. Institutional asymmetry: How formal and informal institutions affect entrepreneurship in Bulgaria. Int. Small Bus. J. 2015, 33, 840–861. [Google Scholar] [CrossRef]

- Fliaster, A.; Kolloch, M. Implementation of green innovations–The impact of stakeholders and their network relations. R&D Manag. 2017, 47, 689–700. [Google Scholar] [CrossRef]

- Duan, Y.; Liu, H.; Yang, M.; Chin, T.; Peng, L.; Russo, G.; Dezi, L. The moderating effect of corporate environmental responsibility on relational capital and green innovation: Evidence from a knowledge-driven context. J. Intellect. Cap. 2022, 24, 1002–1024. [Google Scholar] [CrossRef]

- Tsai, W.; Ghoshal, S. Social capital and value creation: The role of intrafirm networks. Acad. Manag. J. 1998, 41, 464–476. [Google Scholar] [CrossRef]

- Arribas, I.; Hernández, P.; Vila, J.E. Guanxi, performance and innovation in entrepreneurial service projects. Manag. Decis. 2013, 51, 173–183. [Google Scholar] [CrossRef]

- Ingley, C.B. Company growth and board attitudes to corporate social responsibility. Int. J. Bus. Gov. Ethics 2008, 4, 17–39. [Google Scholar] [CrossRef]

- Wang, Y.; Wilson, C.; Li, Y. Gender attitudes and the effect of board gender diversity on corporate environmental responsibility. Emerg. Mark. Rev. 2021, 47, 100744. [Google Scholar] [CrossRef]

- Granovetter, M. Economic action and social structure: The problem of embeddedness. Am. J. Sociol. 1985, 91, 481–510. [Google Scholar] [CrossRef]

- Beji, R.; Yousfi, O.; Loukil, N.; Omri, A. Board diversity and corporate social responsibility: Empirical evidence from France. J. Bus. Ethics 2021, 173, 133–155. [Google Scholar] [CrossRef]

- Brodeur, J.; Pellerin, R.; Deschamps, I. Collaborative approach to digital transformation (CADT) model for manufacturing SMEs. J. Manuf. Technol. Manag. 2022, 33, 61–83. [Google Scholar] [CrossRef]

- Boulhaga, M.; Bouri, A.; Elamer, A.A.; Ibrahim, B.A. Environmental, social and governance ratings and firm performance: The moderating role of internal control quality. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 134–145. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Peterson, S.R.; Portney, P.R.; Stavins, R.N. Environmental regulation and the competitiveness of US manufacturing: What does the evidence tell us? J. Econ. Lit. 1995, 33, 132–163. [Google Scholar]

- Chen, Z.; Zhang, X.; Chen, F. Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. 2021, 168, 120744. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Li, Z.; Huang, Z.; Su, Y. New media environment, environmental regulation and corporate green technology innovation: Evidence from China. Energ. Econ. 2023, 119, 106545. [Google Scholar] [CrossRef]

- Dou, Y.; Guan, S. The regionally heterogeneous impact of China’s environmental regulation on the transformation and upgrading of its industrial structure. Sustainability 2023, 15, 16939. [Google Scholar] [CrossRef]

- Freeman, L.C. Centrality in social networks conceptual clarification. Soc. Netw. 1978, 1, 215–239. [Google Scholar] [CrossRef]

- Qu, L.; Li, Y.; Xie, Z. Research on the impact of executive chain network on the effectiveness of shareholder incentives: Internal mechanism and empirical test. J. Zhejiang Gongshang Univ. 2019, 36, 205–206. (In Chinese) [Google Scholar] [CrossRef]

- Huang, Y.; Bai, F.; Shang, M.; Liang, B. Catalyst or stumbling block: Do green finance policies affect digital transformation of heavily polluting enterprises? Environ. Sci. Pollut. Res. 2023, 30, 89036–89048. [Google Scholar] [CrossRef] [PubMed]

| Type | Name | Symbol | Definitions |

|---|---|---|---|

| Dependent Variable | Green Innovation | GI | The natural logarithm of the total number of green patent applications filed by the company that year plus 1 |

| Independent Variable | Interlocking Network Position of Independent Directors | Centrality | The product of degree centrality, closeness centrality, and betweenness centrality |

| Moderating Variable | Digital Transformation | DT | Frequency of words related to digital transformation in annual reports |

| Environmental Regulation | ER | The intensity of environmental regulations in the province to which the company belongs | |

| Control Variable | Company Size | Size | The natural logarithm of the company’s total assets |

| Nature of Property Rights | Soe | Dummy variable, the state-owned value is 1, otherwise it is 0 | |

| listing Age | Age | Company listing age | |

| Leverage ratio | Lev | Total liabilities at the end of the year divided by total assets at the end of the year | |

| Inventory Ratio | Inv | Ending inventory divided by ending total assets | |

| Capital Intensity | Cap | Ratio of net fixed assets at the end of the year divided by total assets at the end of the year | |

| The Shareholding Ratio of the Top Shareholder | Top | The ratio of the number of shares held by the largest shareholder to the total share capital | |

| Size of the board | Board | Total number of board members | |

| Proportion of Independent Directors | Indep | Proportion of independent directors on the board of directors | |

| The Frequency of Board Meetings | Meeting | Number of board meetings held per year | |

| Duality | Dual | The dummy variable equals 1 if the Chairman and CEO are the same person, 0 otherwise | |

| BigFour | Bigfour | Dummy variable, takes the value 1 if audited by the Big Four, otherwise 0 | |

| Turnover Rate of Outstanding Shares | Turnover | Annual stock trading volume divided by stock outstanding capital | |

| Heavy Polluting Enterprises | Pollution | Dummy variable, if the enterprise belongs to a heavily polluting industry, the value is 1, otherwise, it is 0 | |

| Marketization Degree | Market | Dummy variable, the marketization index of the current year where the company is located is higher than the national median of that year, and the value is 1, otherwise, it is 0 | |

| Year & Industry Dummies | Year | Year | Year dummy variables are assigned a value of 1 for the relevant year and 0 for all other years. |

| Industry | Industry | Industry dummy variables are assigned as binary indicators based on the standard industry classification (CSRC’s Industry Classification of Listed Companies, revised edition 2012), with a value of 1 for companies in a specific industry and 0 for all others. |

| Variable | N | Mean | Std. Dev. | Median | Min | Max | VIF |

|---|---|---|---|---|---|---|---|

| GI | 20209 | 0.441 | 0.852 | 0.000 | 0.000 | 3.850 | - |

| Centrality | 20209 | 0.009 | 0.013 | 0.004 | 0.000 | 0.064 | 1.05 |

| DT | 20209 | 8.621 | 21.140 | 1.000 | 0.000 | 132.000 | 1.45 |

| ER | 20209 | 21.090 | 15.320 | 15.870 | 3.072 | 77.650 | 1.39 |

| Size | 20209 | 21.980 | 1.302 | 21.820 | 19.300 | 25.920 | 1.39 |

| Soe | 20209 | 0.394 | 0.489 | 0.000 | 0.000 | 1.000 | 1.24 |

| Age | 20209 | 10.000 | 6.775 | 9.000 | 0.000 | 25.000 | 1.22 |

| Lev | 20209 | 1.413 | 1.138 | 1.088 | 0.000 | 8.491 | 1.03 |

| Inv | 20209 | 0.881 | 2.968 | 0.110 | 0.000 | 23.050 | 1.36 |

| Cap | 20209 | 0.222 | 0.167 | 0.187 | 0.002 | 0.713 | 1.41 |

| Top | 20209 | 34.490 | 14.900 | 32.200 | 8.500 | 74.450 | 1.10 |

| Board | 20209 | 8.654 | 1.732 | 9.000 | 5.000 | 15.000 | 1.44 |

| Indep | 20209 | 0.375 | 0.054 | 0.353 | 0.333 | 0.571 | 1.50 |

| Meeting | 20209 | 15.220 | 6.017 | 14.000 | 5.000 | 35.000 | 1.10 |

| Dual | 20209 | 0.256 | 0.477 | 0.000 | 0.000 | 1.000 | 1.10 |

| Bigfour | 20209 | 0.055 | 0.229 | 0.000 | 0.000 | 1.000 | 1.13 |

| Pollution | 20209 | 0.268 | 0.443 | 0.000 | 0.000 | 1.000 | 1.43 |

| Market | 20209 | 0.830 | 0.375 | 1.000 | 0.000 | 1.000 | 1.28 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Centrality | 3.4748 *** (7.3174) | 2.9594 *** (6.3051) | 2.9697 *** (6.4909) | 3.3958 *** (7.7074) |

| Size | - | 0.0109 ** (2.0731) | 0.0096 * (1.8989) | 0.0171 *** (3.5038) |

| Soe | - | 0.0127 (0.9561) | 0.0071 (0.5533) | 0.0089 (0.7235) |

| Age | - | −0.0138 *** (−15.2978) | −0.0157 *** (−17.9613) | −0.0074 *** (−8.4101) |

| Lev | - | 0.0030 (0.5679) | 0.0028 (0.5566) | 0.0008 (0.1697) |

| Inv | - | 0.0155 *** (8.0348) | 0.0141 *** (7.5544) | 0.0204 *** (10.8357) |

| Cap | - | 0.0080 (0.2130) | 0.0557 (1.5347) | −0.1263 *** (−3.3243) |

| Top | - | −0.0007 * (−1.8133) | −0.0001 (−0.2452) | 0.0006 * (1.7046) |

| Board | - | 0.0314 *** (7.8625) | 0.0401 *** (10.3444) | 0.0409 *** (10.9128) |

| Indep | - | 0.3127 ** (2.3627) | 0.2488 * (1.9463) | 0.2448 ** (1.9870) |

| Meeting | - | −0.0024 ** (−2.3496) | −0.0018 * (−1.8190) | −0.0017 * (−1.7910) |

| Dual | - | 0.0339 ** (2.4372) | 0.0149 (1.1085) | 0.0087 (0.6686) |

| Bigfour | - | 0.4142 *** (15.4074) | 0.3991 *** (15.3669) | 0.4252 *** (16.9051) |

| Pollution | - | −0.2051 *** (−14.9844) | −0.1918 *** (−14.5025) | −0.3993 *** (−27.3749) |

| Market | - | 0.1227 *** (7.6876) | 0.0980 *** (6.3474) | 0.1248 *** (8.3317) |

| Year | - | - | Control | Control |

| Industry | - | - | - | Control |

| Constant | 0.4096 *** (55.5259) | 0.7464 *** (4.7161) | 0.4682 *** (3.0255) | 0.0573 (0.3669) |

| R | 0.0026 | 0.0522 | 0.1166 | 0.1848 |

| Observations | 20209 | 20209 | 20209 | 20209 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Centrality | 2.4947 *** (5.2162) | 3.3824 *** (7.6777) | 6.5038 *** (5.4458) |

| DT | 0.0026 *** (7.2657) | - | - |

| Centrality × DT | 0.1064 *** (4.4645) | - | - |

| ER | - | −0.0008 (−0.6615) | 0.0014 (0.9685) |

| ER | - | 0.0000 (0.5953) | −0.0000 (−0.8427) |

| Centrality × ER | - | - | −0.2482 *** (−2.6922) |

| Centrality × ER | - | - | 0.0031 ** (2.3139) |

| Size | 0.0189 *** (3.8695) | 0.0188 *** (3.8297) | 0.0187 *** (3.8125) |

| Soe | 0.0075 (0.6127) | 0.0085 (0.6917) | 0.0085 (0.6882) |

| Age | −0.0071 *** (−8.0547) | −0.0076 *** (−8.5616) | −0.0076 *** (−8.6240) |

| Lev | 0.0009 (0.1903) | 0.0008 (0.1694) | 0.0009 (0.1766) |

| Inv | 0.0244 *** (11.4932) | 0.0248 *** (11.6576) | 0.0248 *** (11.6537) |

| Cap | −0.0558 (−1.4554) | −0.1219 *** (−3.2011) | −0.1239 *** (−3.2534) |

| Top | 0.0008 ** (2.1459) | 0.0006 (1.5761) | 0.0006 (1.5835) |

| Board | 0.0387 *** (10.3534) | 0.0403 *** (10.7537) | 0.0402 *** (10.7330) |

| Indep | 0.1873 (1.5253) | 0.2306 * (1.8719) | 0.2260 * (1.8342) |

| Meeting | −0.0017 * (−1.7622) | −0.0017 * (−1.8172) | −0.0017 * (−1.7995) |

| Dual | 0.0035 (0.2707) | 0.0084 (0.6491) | 0.0089 (0.6834) |

| Bigfour | 0.4237 *** (16.9050) | 0.4249 *** (16.8892) | 0.4251 *** (16.8967) |

| Pollution | −0.3890 *** (−26.7316) | −0.3986 *** (−27.3301) | −0.3984 *** (−27.3157) |

| Market | 0.1220 *** (8.1754) | 0.1235 *** (7.5345) | 0.1243 *** (7.5818) |

| Year | Control | Control | Control |

| Industry | Control | Control | Control |

| Constant | 0.0248 (0.1589) | 0.0322 (0.2039) | 0.0064 (0.0406) |

| R | 0.1914 | 0.1856 | 0.1859 |

| Observations | 20209 | 20209 | 20209 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| Centrality | 3.2256 *** (6.7857) | 3.3884 *** (4.2123) | 3.4216 *** (7.7083) | 0.2644 *** (2.8847) | - | - | - |

| Degree | - | - | - | - | 0.0022 *** (6.0018) | - | - |

| Closeness | - | - | - | - | - | 0.7893 *** (6.1095) | - |

| Betweenness | - | - | - | - | - | - | 31.3968 *** (7.0358) |

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Control |

| Constant | 0.1054 (0.5835) | −0.7729 (−1.1258) | 0.0416 (0.2640) | 0.0955 *** (2.9317) | 0.0197 (0.1255) | −0.0201 (−0.1286) | −0.0090 (−0.0576) |

| IMR | - | 0.3926 (1.2755) | - | - | - | - | - |

| Wald chi2(41) | - | - | 4557.09 | - | - | - | - |

| Prob > chi2 | - | - | 0.0000 | - | - | - | - |

| R | 0.1929 | 0.1856 | 0.1865 | 0.0948 | 0.1846 | 0.1847 | 0.1852 |

| Observations | 15682 | 20209 | 19878 | 20209 | 20209 | 20209 | 20209 |

| Variable | Information Advantage | Resource Advantage | Environmental Responsibility | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Centrality | - | 3.2965 *** (7.3463) | - | 2.3911 *** (5.2711) | - | 3.2023 *** (7.1275) |

| SYN | 0.3197 *** (9.8156) | 0.3127 *** (9.6075) | - | - | - | - |

| SUB | - | - | 0.0864 *** (25.7847) | 0.0850 *** (25.3034) | - | - |

| CER | - | - | - | - | 0.0125 *** (10.3642) | 0.0122 *** (10.1045) |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −0.1748 (−1.0860) | −0.1590 (−0.9889) | −1.1696 *** (−6.9694) | −1.1438 *** (−6.8176) | 0.0084 (0.0512) | 0.0060 (0.0370) |

| R | 0.1885 | 0.1907 | 0.2061 | 0.2072 | 0.1864 | 0.1886 |

| Observations | 19513 | 19513 | 19149 | 19149 | 18965 | 18965 |

| Sobel test | 0.0518 *** (2.676) | 1.2370 *** (10.61) | 0.1016 *** (3.783) | |||

| Indirect effect | 0.0518 *** (2.6758) | 1.230 *** (10.6080) | 0.1016 *** (3.7829) | |||

| Direct effect | 2.9101 *** (6.0690) | 1.5523 *** (3.2467) | 2.4258 *** (5.0308) | |||

| Total effect | 2.9619 *** (6.1756) | 2.7893 *** (5.7034) | 2.5274 *** (5.2431) | |||

| Proportion of total effect that is mediated | 0.0174 | 0.4434 | 0.0402 | |||

| Variable | Non-Heavy Pollution | Heavy Pollution | Non-Diligent | Diligent |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Centrality | 4.6878 *** (8.6155) | −0.5703 (−0.8431) | 4.7592 ** (2.2620) | 3.2374 *** (7.4711) |

| Controls | Yes | Yes | Yes | Yes |

| Constant | −0.0286 (−0.1485) | 0.1548 (0.6810) | −1.2937 * (−1.6598) | 0.0940 (0.5900) |

| R | 0.1794 | 0.2013 | 0.2005 | 0.1853 |

| Observations | 14791 | 5418 | 632 | 19577 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, Y.; Li, Z.; Guo, J. Does Independent Directors’ Interlocking Network Position Affect Green Innovation? Sustainability 2024, 16, 1089. https://doi.org/10.3390/su16031089

Hu Y, Li Z, Guo J. Does Independent Directors’ Interlocking Network Position Affect Green Innovation? Sustainability. 2024; 16(3):1089. https://doi.org/10.3390/su16031089

Chicago/Turabian StyleHu, Yun, Zhuohang Li, and Jiajia Guo. 2024. "Does Independent Directors’ Interlocking Network Position Affect Green Innovation?" Sustainability 16, no. 3: 1089. https://doi.org/10.3390/su16031089

APA StyleHu, Y., Li, Z., & Guo, J. (2024). Does Independent Directors’ Interlocking Network Position Affect Green Innovation? Sustainability, 16(3), 1089. https://doi.org/10.3390/su16031089