Abstract

The purpose of this article is to explore whether and based on what criteria local governments employ reduced tax rates on means of transportation to encourage hybrid and electric vehicles. The study also aims to determine if there has been a more rapid increase in the number of means of transportation powered entirely or partially by electricity in local government units that have implemented more substantial incentives. The study encompasses the ten largest cities in Poland and the years 2018–2020. To achieve the above research objectives, an analysis of the texts of the resolutions of the city councils was carried out in terms of the tax rates in effect during the selected period. On the basis of the relevant amounts provided in the resolutions, the amount of concessions resulting from the application of lower tax rates was calculated, and the criteria for the use of these concessions related to the level of emissivity were presented. To assess the potential correlation between the scale of tax preferences and the dynamics of growth in the number of hybrid and electric vehicles, a statistical tool in the form of Spearman’s rank correlation coefficient was used for a thorough data analysis. The results suggest that municipalities use their authority to introduce differentiated tax rates on means of transportation. However, those utilizing hybrid and electric vehicles are more likely to employ these powers on an equal basis, with owners of vehicles adhering to lower emission standards covered by EURO standards. In addition, there was no positive correlation between the amount of tax credits and the rate of growth in the number of reduced-emission vehicles. This work can foster a green mindset and societal nature-based new thinking.

1. Introduction

In the era of implementation of the concept of sustainable development, many actors at various levels of government are making efforts to encourage solutions that foster greater care for the environment. One way to accomplish this is through the development of means of transportation powered by hybrid and electric engines. The increase in the number of this type of vehicles is important not only from the point of view of improving air quality but should also be treated as contributing to increasing economy competitiveness and innovativeness and reducing the social costs generated by transport [1,2,3]. Local government units act significantly, as highlighted in many works, e.g., [4,5,6]. Similarly, Adamashvili and colleagues [7] argue that a collaborative approach involving government, business representatives, and research units leads to success in the industry. Similarly, Galati et al. [8], in their work regarding electric vehicles (EVs) adoption, assert that systems’ actors should cooperate in order to overcome difficulties. Galati and colleagues’ [9] extended research about the feasibility of EVs uptake and authors affirm the significance of government-sponsored incentives for EV purchases in order to lower their financial costs. Indeed, using their powers, local governments functioning at the lowest level can stimulate various pro-ecological behaviors, although in individual countries their possibilities are different due to different legal systems [10]. In some countries, local officials are responsible, among other things, for setting rates and collecting selected taxes. This is significant as, for example, the European Commission deems these economic instruments particularly promising for the implementation of environmental protection legal acts [11].

According to one of the OECD reports, in nearly one-third of the member countries of this organization, local authorities can influence the improvement of the environment through the competence to tax the owners of motor vehicles [12].

The issue of incentivization in expanding the number of vehicles that exude less harmful emission of gasoline is discussed worldwide and, respectfully, mostly in developed countries, as the evidence shows [13] This particular topic is, however, not extended to economies such as the Polish economy and, as such, can represent the case of the emerging ones [14]. From this perspective, as the topic of taxation incentivization is still underrepresented in the Polish literature, and the existing research mostly focuses on the implementation before analysis, contributing to this topic is the authors’ main goal. Polish local government has the right to introduce different rates of tax on means of transport. This issue is regulated by a separate legal act which specifies the types of vehicles subject to such taxation. It lists trucks, trucks and ballast tractors weighing more than 3.5 tons, trailers and semi-trailers weighing more than 7 tons, and buses. According to the relevant regulations, commune councils may, by way of a resolution, not only specify different tax rates depending on the adopted criteria (type of drive, age), but also grant additional exemptions other than those contained in the Act [15]. Thus, questions arise as to whether local governments use this right and to what extent it results in an increasing number of hybrid and electric vehicles. In the following section, an attempt will be made to address this issue based on a case study of the ten largest cities. According to national regulations, these centers are communes with Powiat rights, and the entities managing them act as local governments. The analyses were conducted on data obtained between 2018 and 2020, aiming to examine:

- -

- Whether local governments have implemented reduced tax rates on means of transport to owners of hybrid and electric vehicles and what criteria in the field of exhaust emission standards were used for this purpose.

- -

- The existence of correlation between the amount of reliefs in the tax discussed and the trucks growth rate, as well as the growth rate of tractors and buses with the lowest emissions.

The research problems formulated above are, in fact, questions to which answers should significantly expand the existing knowledge about the possibility of local governments influencing the development of environmentally friendly means of transport through economic instruments such as taxes. This is an issue that, as the literature review below shows, has not been adequately researched thus far. In this context, the research results obtained and the conclusions formulated based on them are particularly significant.

In order to achieve the main objectives of the study, the comparative method of Polish cities was applied, examining the relationship between the tax mechanism encouraging the purchase of hybrid and electric vehicles and actual purchase decisions. This relationship is illustrated by data on the number of these vehicles registered in each region. Applying the comparative factor method should yield information of a general nature, i.e., to what extent have existing tax incentives influenced purchase decisions? On the other hand, however, the application of this method has some limitations, in addition to the fact that there is a discussion in the literature about the limitations of using comparative studies [16,17]. In the context of the comparative method used in this study, it should be noted that only quantitative data were compared, i.e., the growth in the number of registered vehicles, and preferential rates were indicated in the tax context. Hence, the comparison only looked at the basic factor of the tax rate. It should be noted that in recent years, many factors have influenced the interest in purchasing hybrid and electric cars, as evidenced by studies in this area [18,19]. Thus, given the issue of attempting to assess the impact of tax incentives alone against a more aggregated spectrum of factors, this has the effect of limiting the study to a single-factor analysis. Indeed, in addition to the tax incentive, regional and local authorities offer diverse incentives, including free battery charging at stations, preferential parking, and urban traffic preferences.

This study appears decisive within the international and EU strategies and polices focused on green and sustainable paths and on reducing GHG emissions (e.g., the Sustainable Development Goals, Green Deal, EU Biodiversity strategy and others). It can also enrich our understanding of the role of transportation in Poland to promote hybrid and electric vehicles, with implications potentially extending to broader contexts. The lack of adequate tools is a major bottleneck to deploy innovation in a sector, as transportation and innovation are key to meeting the Green Deal challenges in the European Union and worldwide. In particular, addressing the last mile of the climate challenge is crucial for the most relevant sectors. This is necessary to provide solutions toward achieving the decarbonization goals outlined in the European Green Deal, as well as to develop adaptation options for dealing with the impacts of climate change.

The structure of this work is composed of the following sections. The next section is keen to analyze the literature on tax instruments and pro-environmental behavior. Section 3 describes the methods used. The results and discussion are presented in Section 4. In the Section 5, the conclusions close the paper by outlining the future directions and research challenges to be faced.

2. Literature Review

The use of tax instruments to achieve environmental and nature protection objectives is present in the literature; however, the general approach to the problem still prevails here. In works such as that of Bouwma et al. [20], Postul & Radecka-Moroz [21] and Bräuer et al. [22] the authors point out that a properly structured tax system can stimulate certain pro-environmental behavior through various preferences, and, on the other hand, discourage activities that damage the environment. Also, Tawari et al. [23], in the results of their conducted research, clearly indicate the need to implement appropriate economic policy (including tax) to reduce the so-called ecological footprint and dissemination of green technologies. Similarly, Abban et al. [24], who focus more on the issue of reducing carbon dioxide emissions, note the need for active actions in this direction by various regulatory agencies. Some emphasize the specificity of this type of incentive, highlighting their flexibility and adaptability, which allows them to occupy a unique position among tools designed to serve ecological purposes. Others, such as Binning & Young [25], compare such protection benefits with results of natural resources exploitation, recognizing their advantage. The use of taxes imposed by local government authorities for the purposes of environmental protection are discussed much less often in scientific works. Here, the subject of particular interest for scientists seems to be the property tax, which is perceived as particularly promising [26,27], but whose potential is not effective in the promotion of pro-ecological behavior [28,29,30]. A few authors, such as Dziuba and Życzkowska [31] or Kołoszko-Chomentowska [32], recognize the possible usage of pro-ecological forest tax, concluding, however, that it is often the case that these possibilities are not widely recognized and, consequently, are only occasionally utilized by local governments.

In light of the growing worries about climate change worldwide, the introduction of electric vehicles (EVs) has emerged as a crucial step toward today’s updated transportation system [33]. The topic of pro-ecological taxation of vehicle owners is present in both scientific research and publications based on these studies, primarily in the context of road taxes and taxes included in fuel prices, or the issue of taxes imposed on car manufacturers, which indirectly burden final buyers [34,35,36,37,38,39,40]. Wappelhorst et al. [41] write about taxes on motor vehicles in the context of reducing carbon dioxide emissions, reviewing the solutions used in this area in several European countries. These authors highlight, for example, the decision by Norway to abandon this levy in favor of a new solution in the form of special fees for vehicle insurance. However, their primary focus is on emphasizing the differences in tax systems. Another study on conditions in Australia concludes that higher taxation on the use of vehicles with increased emission has a negative impact on household income; hence, the use of incentives or concessions is justified [42]. Among a very limited group of studies on the transportation tax and its potential role in reducing emissions is Delucchi and Murphy’s recent report, which was prepared for the European clean transport group known as Transport and Environment [43] based on analyses carried out on the American market. The report’s authors consider this issue both in the context of tax levies imposed on car manufacturers, as well as taxing vehicle ownership, and not their use, which, in their opinion, will result, among other effects, in the purchase of cars with excessive emissions [44]. In their second paper, the authors quite surprisingly conclude that the widespread use of vehicles powered by petroleum fuels in the USA is attributed to the fact that their owners and users can benefit from numerous tax benefits [45]. In publications referring to the conditions existing in Poland, the topic of the role of the tax on means of transport as a source of income for local governments prevails [46,47,48], this tax impact on the business entities competitiveness as less frequently studied [49,50].

Based on the above review of these works, it is clear that there is a research gap when it comes to analyzing the impact of tax solutions used by local governments on the increase in the number of hybrid and electric vehicles. In this light, the results of the study discussed below may constitute a significant contribution to the current knowledge about the possibilities of influencing the lowest level of local governments on the development of electro mobility. Additionally, the issue of imposing tax on owners of means of transport and the effectiveness of this taxation should be considered particularly prospective due to the fact mentioned in the introduction that this levy falls within the competence of municipal local government units not only in Poland but also in many other countries. Therefore, the answers to the above research questions have, to some extent, a universal dimension, i.e., they go beyond the institutional and legal framework of a single country, and at the same time they can be considered important from the point of view of the more broadly understood effective management of sustainable development at the local level.

3. Materials and Methods

To achieve our research goal, we used the method of analyzing selected documents constituting acts of local law. Additionally, a statistical tool in the form of Spearman’s rank correlation coefficient was employed. Spearman statistics are used in quantitative research in which the analyzed samples are characterized by relatively small numbers, which is also the case in the study discussed in this paper. This tool is used to detect correlations between variables and related trends. Examples of applications of the mentioned methodology are works by Aras et al. [50] or Esra Atukalp [51]. It is a non-parametric measure used, among others, as a descriptive statistic that paints a picture of the dependency strength when analyzing two variables. The output here is pairs of n observations of two variables, X and Y. All observations of each variable are assigned separately and ranked from lowest to the highest [52].

The research objective was achieved through the method of analyzing selected documents constituting local acts, coupled with the statistical tool of Spearman’s rank correlation coefficient. Spearman’s statistics are occasionally employed in quantitative research, particularly when dealing with relatively small sample sizes. Spearman’s statistics are sometimes used in quantitative research, especially when the studied samples are characterized by relatively small numbers [51,52].

The analysis covers the legislative activity of city councils of the largest Polish cities, which function as medium-level local governments at the district level. Data from the Central Statistical Office (GUS) were used, according to which at the beginning of 2017 approximately 16.3% of the total population of Poland (6255 thousand people) lived in these centers [53].

Texts of resolutions of municipal councils on tax rates on means of transport in 2018–2020 were analyzed. According to the amounts shown in the documents, the tax credit for owners of hybrid and electric vehicles in each city in the following years was calculated according to the Formula (1):

where U—discount (in %), XN—the annual amount of the lower tax rate, and XP—the annual amount of the basic tax rate. The indicator reflecting the level of the relief over the whole period considered is presented as the average of the calculated values of the Formula (1).

Since the resolutions contained different provisions specifying how to determine tax rates, the following rules were adopted for the aforementioned calculations:

When the text of the resolution included different rates depending on the year of production of vehicles, the amount for the oldest vehicles was included in the calculations for two separate rates for hybrid and electric vehicles, the average of the two was calculated, where the resolution did not provide separately for hybrid and electric vehicles, the rate assigned to vehicles with the most restrictive emission standard (euros) was included in the calculation.

Details of the number of vehicles were obtained from a database called the Local Data Bank of the Central Statistical Office [54]. The dynamics of change were formulated by means of the following calculation Formula (2):

where Sw—growth rate, X1—value of the variable (vehicles quantity) calculated at the end of period, and X0—variable value (vehicles quantity) at the beginning of the tested period.

The Spearman rank correlation coefficient was employed to determine the statistical dependency between the amount of tax discount for owners of electric and hybrid vehicles and the increase dynamics in the number of these vehicles in individual cities. It is a non-parametric measure used, among others, as a descriptive statistic that paints a picture of the dependency strength when analyzing two variables [52]. The output here is pairs of n observations of two variables, X and Y. All observations of each variable are assigned separate ranks from the lowest to the highest, and then the statistics are used. (3):

where rs—Spearman correlation rank coefficient, di—the variance between the ranks for each pair of X and Y, and n—the number of pairs of variables X i Y.

The variables in the study were the average level of tax discount on means of transport for hybrid and electric vehicles owners (X) and the growth rate, referring to the number of hybrid and electric vehicles (Y). The pairs of X and Y variables were the calculated indices for each of the ten cities. The so-called right-sided test (positive correlation) was used, rejecting the hypothesis stating that the calculated value of rs is higher than or equal to the critical value.

Table 1 and Table 2 present, respectively, data on vehicle tax rates, on the basis of which the average relief was calculated, and data on the number of hybrid and electric vehicles used in the growth rate calculation.

Table 1.

The rates of tax on means of transport for owners of hybrid and electric vehicles in 2018–2020.

Table 2.

Number of hybrid and electric vehicles in 2018–2020.

4. Results and Discussion

In the years 2018–2020, among the ten largest Polish cities, tax discounts for owners of hybrid and electric vehicles were applicable in nine of these centers. (No such solution was decided upon in the city of Bydgoszcz).

There were variations in the scale of the advantages, as well as the criterion of the type of propulsion used. Although in certain cities (Warsaw, Poznań) a separate, lower tax rate was adopted for hybrid and electric vehicles, in other cities, owners of this type of trucks, tractors and buses paid lower rates on a par with owners of vehicles meeting selected EURO emission standards. In the majority of cases, the EURO 5 or 6 emission standard (Kraków, Wrocław, Katowice, Lublin) was used as a criterion, although, for example, in such centers as Łódź or Gdańsk, officials decided to set this limit at a fairly low level (EURO 2).

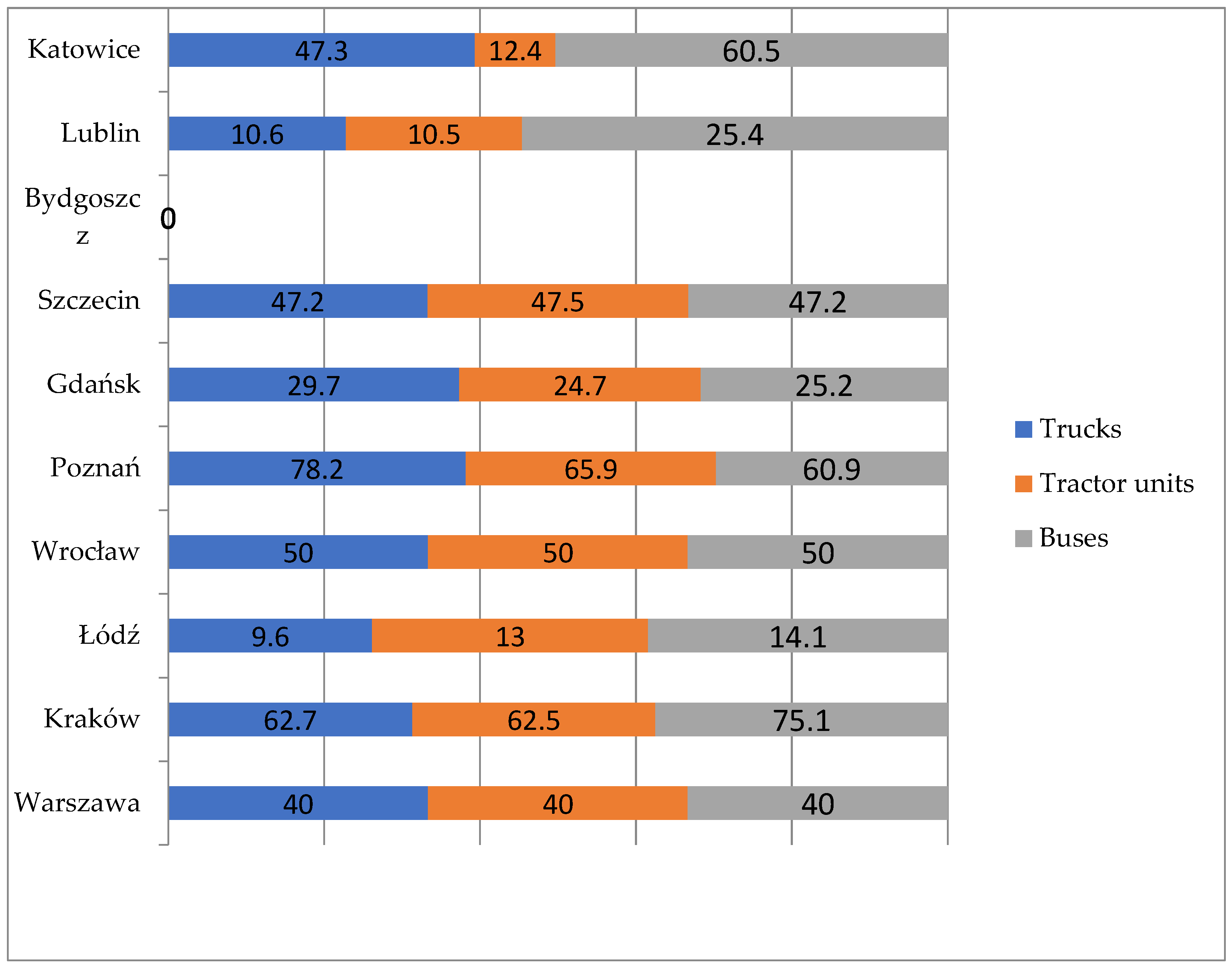

When it comes to the scale of reduction of tax rates only in the group of electric vehicles, the Krakow city local government went farthest, where a full tax exemption was in force throughout the period under review [55]. On the other hand, in 2017, the councilors of the city of Szczecin introduced the same—and at the same time very low, compared to other cities—amount of tax levy of PLN 48 applicable in each of the years in question [56], and in Katowice, the councilors decided not to collect the benefit for the possession of electric buses [57]. The average level of relief in individual cities by vehicle type is presented in Figure 1.

Figure 1.

Average level of tax relief on means of transport for electric and hybrid vehicles owners in 2018–2020 (%). Source: Own calculation.

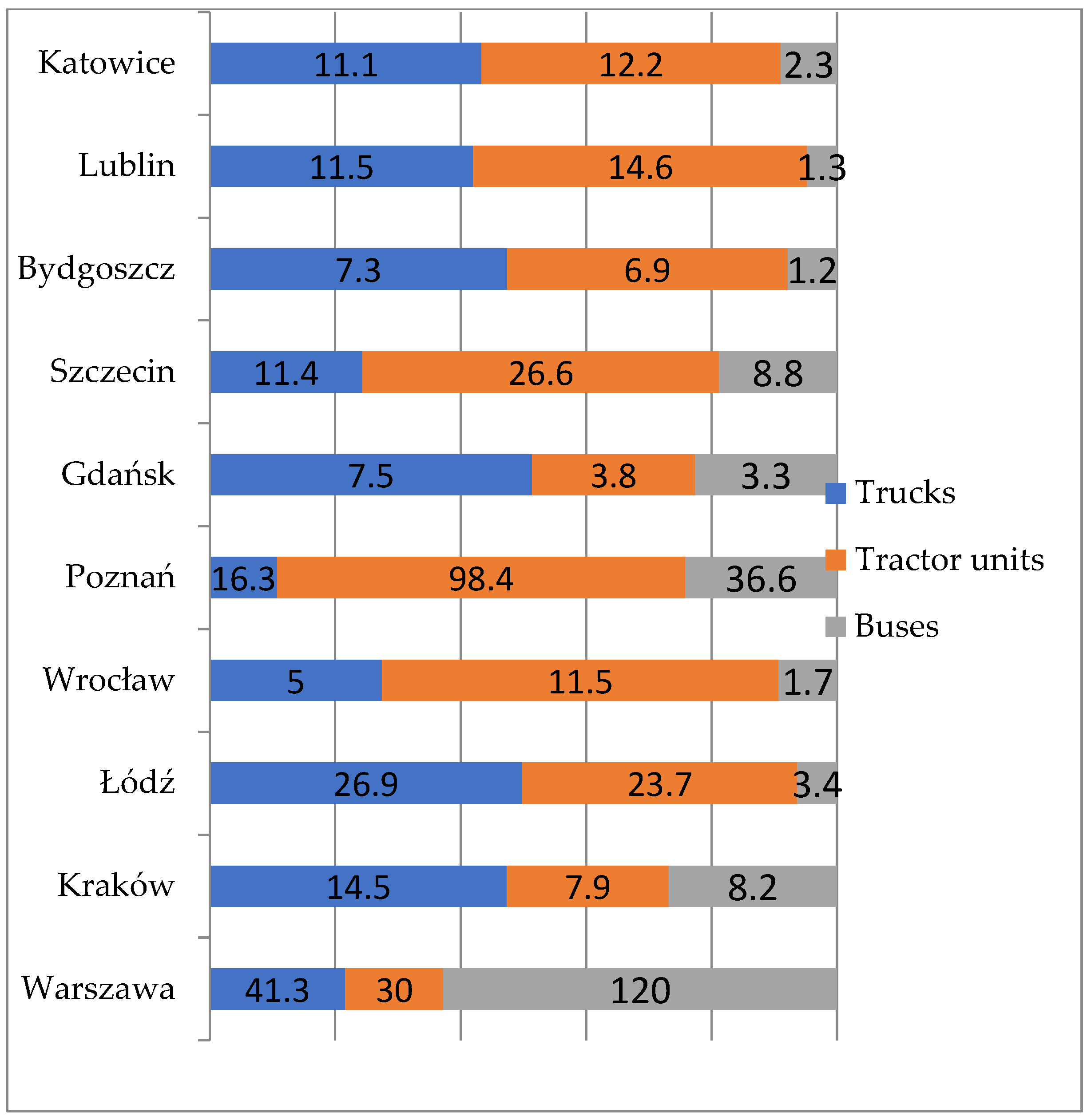

Central Statistical Office data from 2018–2020 indicate that in each of the surveyed cities, an increase in the number of hybrid and electric vehicles was observed with the possibility of lower taxation policies results (Figure 2). The highest dynamics were observed in the change in the number of buses in Warsaw and tractor units in Poznań (120% and 98.4%, respectively). In some cases (which is especially true for buses), however, these changes were relatively small, at the level of 1–3%.

Figure 2.

Growth rate of the number of hybrid and electric vehicles in 2018–2020 (%). Source: Own calculation.

In order to statistically verify the dependency between the amount of discounts and the dynamics of changes, Spearman’s correlation coefficient (rs) was used. For each of the three groups of vehicles, the same null hypothesis was made about the lack of a positive correlation (ps) between the two features, which was contrasted with the alternative hypothesis about the occurrence of such a correlation. Information on the test and its results is presented in Table 3. The presented data indicate that for the sample n = 10 and the significance ratio α = 0.005, the critical value is equal to 0.794. As the result is, in each case, lower than the critical value, it gives the basis for accepting the null hypothesis each time and rejecting the alternative. Based on the test, the conclusion should be drawn that, in the analyzed urban centers, the utilization of higher tax transportation discounts did not result in higher growth in the number of hybrid and electric vehicles in the group of trucks, tractors, and buses.

Table 3.

Statistical test of the relationship between the level of discount for owners of electric and hybrid vehicles and their growth dynamics in 2018–2020.

5. Conclusions and Implications

Local governments in Poland have the ability to vary the rates of tax on means of transport in such a way as to favor hybrid and electric vehicles. Among the ten largest Polish cities surveyed between 2018 and 2020, local authorities did not exercise this right in just one case. In the remaining cities, discounts were applied; however, different criteria were adopted by individual city offices in terms of emissivity, ranging from the EURO 2 standard to fully electric motors.

Based on the statistical results, higher tax preferences introduction in a given area did not lead to faster growth in the number of trucks, tractors and buses that were partially or fully electrically powered. The weakest correlation was found for the first of the mentioned types of vehicles, and the strongest for buses, but in none of these cases does the obtained result justify the claim of statistically proven dependency between the concession amount and the vehicles’ growth rate dynamics.

As evident from the data presented in Figure 1 and Figure 2, the highest level of tax preferences was implemented in cities such as Krakow and Poznan, where the rates exceeded 50% for the three classes of vehicles in question. A preferential rate of 50% for each of the three groups of vehicles was introduced in Wrocław; thus, the best tax conditions for the purchase of new vehicles were introduced in these three cities. Szczecin can also be classified among the leaders in the implemented tax rates (47%), only followed by Warsaw with equal 40% relief. Considering the results of purchase growth in these particular cities, Warsaw and Poznań recorded vehicle purchase growth that differed from the other cities. According to the results of the statistical analysis, it was found that there is no dependence between the applied mechanism of preferential tax rates for the purchase of hybrid and electric vehicles. This may imply that there is no need to adhere to the position of having to reduce tax revenues for the mayors. Therefore, providing continued promotion of the purchase of hybrid and electric vehicles is important for the authorities, it is necessary to verify the strategy here to something other than solely based on tax preferences. As shown earlier, the conducted analysis has several limitations, including relying solely on the tax result in the purchase preference study.

It seems that when it comes to non-tax factors determining consumers’ purchasing decisions, there is, as in the case of tax factors, variation in local policies. City mayors have their own ideas in this regard, constituting purchase incentives; however, it is difficult to give an answer as to whether these incentives are the result of credible marketing analyses being carried out. Certainly, the favoritism of electric and hybrid vehicles is not facilitated by the major problems associated with using these vehicles during periods of increased cold weather. Cases of complete paralysis of public transportation could be found in Northern Europe, or in Poland. These challenges are ones that local and national authorities need to address in a comprehensive and planned manner.

The results of the research discussed in this paper have both practical and future implications. In practical terms, their use may have a significant impact on the policy of city governments towards owners of hybrid and electric vehicles, which should translate into improved air quality. This policy should be more comprehensive and long-term. Based on the sample examined, it was proven that tax solutions alone aimed at relieving financial burdens may not produce the desired effect in the form of popularizing pro-ecological means of transport and that they should be combined with other incentive instruments, which is consistent with the position of authors such as Lam and Mercure [39] or Jenn et al. [40].This, in turn, highlights an important research implication, emphasizing the need to continue research on the determinants of the development of green transport. This could include factors such as parking spaces subsidized by local governments and the number of charging stations, among others [55,56,57] and appropriately targeted marketing activities of local authorities [58].

This work can foster a green mindset and societal nature-based new thinking by responding to the EU green initiatives and council recommendation on learning for the green transition and sustainable development, which encourage the education and training sector to take action towards a greener world. This change can be achieved through research and development initiatives, partnerships with industry and government, and community engagement. Finally, this study can help to create a culture of sustainability and a prepositive green-friendly awareness.

6. Limitations

The limitations can be traced in difficult-to-obtain key data on the electricity distribution network for vehicle users, as, for example, Poland lacks reliable information on this subject so far. The available data in this case are quite fragmentary and it is difficult to build uniform, reliable knowledge on the real availability of this power source based on them.

Author Contributions

Conceptualization: J.W.; methodology: J.W.; formal analysis: J.W.; investigation: J.W.; resources: J.W., T.K. and M.F.; data curation: J.W.; writing—original draft preparation: J.W., M.F., T.K. and Z.O.; Writing—review and editing: J.W., M.F. and T.K.; supervision M.F. and T.K.; project administration: M.F. and T.K.; funding acquisition: M.F. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The authors declare that the investigations were carried out following the rules of the Declaration of Helsinki of 1975 (https://www.wma.net/what-we-do/medical-ethics/declaration-of-helsinki/, accessed on 26 December 2021), revised in 2013.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data are contained within an article.

Conflicts of Interest

The authors declare no conflicts of interest.

References and Notes

- Motowidłak, U. Conditions for the Sustainable Development of Electromobility in the European Union Road Transport. Transp. Geogr. Pap. PGS 2021, 25, 7–25. [Google Scholar]

- Liguo, X.; Ahmad, M.; Khan, S.; UlHaq, Z.; Khattak, S.I. Evaluating the role of innovation in hybrid electric vehicle-related technologies to promote environmental sustainability in knowledge-based economies. Technol. Soc. 2023, 74, 102283. [Google Scholar] [CrossRef]

- Veza, I.; ZackyAsy’ari, M.; Idris, M.; Epin, V.; Rizwanul Fattah, I.M.; Spraggon, M. Electric vehicle (EV) and driving towards sustainability: Comparison between EV, HEV, PHEV, and ICE vehicles to achieve net zero emissions by 2050 from EV. Alex. Eng. J. 2023, 82, 459–467. [Google Scholar] [CrossRef]

- Harris, J. Basic Principles of Sustainable Development. Tufts University, Medford. 2000. Available online: https://sites.tufts.edu/gdae/files/2019/10/00-04Harris-BasicPrinciplesSD.pdf (accessed on 4 May 2022).

- OECD. Sustainable Development Strategies: A Resource Book. United Nations Development Programme, Paris-New York. 2022. Available online: https://www.sd-network.eu/pdf/resources/Dalal-Clayton,%20Bass%20(2002)%20-%20Sustainable%20Development%20Strategies%20-%20A%20Resource%20Book.pdf (accessed on 4 May 2022).

- Kates, R.W.; Parris, T.M.; Leiserovitz, A.A. Whatissustainable development? Goals, Indicators, Values, and Practice. Environ. Sci. Policy Sustain. Dev. 2005, 47, 8–21. [Google Scholar]

- Adamashvili, N.; Fiore, M.; Contò, F.; La Sala, P. Ecosystem for Successful Agriculture. Collaborative Approach as a Driver for Agricultural Development. Eur. Countrys. 2020, 12, 242–256. [Google Scholar] [CrossRef]

- Galati, A.; Giacomarra, M.; Concialdi, P.; Crescimanno, M. Exploring the feasibility of introducing electric freight vehicles in the short food supply chain: A multi-stakeholder approach. Case Stud. Transp. Policy 2021, 9, 950–957. [Google Scholar] [CrossRef]

- Galati, A.; Adamashvili, N.; Crescimanno, M. A feasibility analysis on adopting electric vehicles in the short food supply chain based on GHG emissions and economic costs estimations. Sustain. Prod. Consum. 2022, 36, 49–61. [Google Scholar] [CrossRef]

- Mazur, E. Environmental Enforcement in Decentralized Governance Systems: Toward a Nationwide Level Playing Field; OECD Environment Working Papers 34; OECD Publishing: Paris, France, 2011. [Google Scholar]

- European Commission. Possible Reforms of Real Estate Taxation: Criteria for Successful Policies; Occasional Papers 119; European Commission: Brussels, Belgium, 2012. [Google Scholar]

- OECD. Consumption Tax Trends 2020: VAT/GST and Excise Rates, Trends and Policy Issues; OECD: Paris, France, 2020. [Google Scholar] [CrossRef]

- Karpiesiuk, Ł.; Kozerski, R. Raport: Niskoemisyjna Mobilność; PZPM: Warszawa, Poland, 2021. [Google Scholar]

- Murawski, J.; Szczepański, E. Perspektywy dla Rozwoju Elektromobilności w Polsce. Logistyka 2014, 4, 2249–2258. [Google Scholar]

- Act of 12 January 1991 on Local Taxes and Fees (Journal of Laws 2019 item 1170).

- Goggin, M.L. The “too few cases/too many variables” problem in implementation research. West. Political Q. 1986, 39, 328–347. [Google Scholar]

- Kimbell, L. Rethinking design thinking: Part II. Des. Cult. 2012, 4, 129–148. [Google Scholar] [CrossRef]

- Manohar, S.; Tolani, K.; Mittal, A. Redefining mobility for society 5.0: Electric vehicles for sustainable transportation. In Innovations and Sustainability in Society 5.0; Nova Science Publishers, Inc.: Hauppauge, NY, USA, 2023; pp. 243–261. [Google Scholar]

- Held, T.; Gerrits, L. On the road to electrification—A qualitative comparative analysis of urban e-mobility policies in 15 European cities. Transp. Policy 2019, 81, 12–23. [Google Scholar] [CrossRef]

- Bouwma, I.M.; Gerritsen, A.L.; Kamphorst, D.A.; Kistenkas, F.H. Policy Instruments and Modes of Governance in Environment al Policies of the European Union; Statutory Research Tasks Unit for Nature & the Environment (WOT Natuur& Milieu): Wageningen, The Netherlands, 2015. [Google Scholar]

- Postula, M.; Radecka-Moroz, K. Fiscal policy instruments in environmental protection. Environ. Impact Assess. Rev. 2020, 84, 106435. [Google Scholar] [CrossRef]

- Bräuer, I.; Müssner, R.; Marsden, K.; Oosterhuis, F.; Rayment, M.; Miller, C.; Dodoková, A. The Use of Market Incentives to Preserve Biodiversity. Final Report. Available online: https://www.ecologic.eu (accessed on 11 February 2022).

- Tiwari, S.; Sharif, A.; Nuta, F.; Nuta, A.; Cutcu, I.; Eren, M. Sustainable pathways for attaining net-zero emissions in European emerging countries—The nexus between renewable energy sources and ecological footprint. Environ. Sci. Pollut. Res. 2023, 30, 105999–106014. [Google Scholar] [CrossRef]

- Abban, O.J.; Xing, Y.H.; Nuţă, A.C.; Nuţă, F.M.; Borah, P.S.; Ofori, C.; Jing, Y.J. Policies for carbon-zero targets: Examining the spillover effects of renewable energy and patent applications on environmental quality in Europe. Energy Econ. 2023, 126, 106954. [Google Scholar] [CrossRef]

- Binning, C.; Young, M. Talking to the Taxman about Nature Conservation: Proposals for the Introduction of Tax Incentives for the Protection of High Conservation Value Native Vegetation; Csiro Wildlife &Ecology: Canberra, Australia, 1999. [Google Scholar]

- Podstawka, M.; Rudowicz, E. Utilization for examplelocaltaxes in creating the fiscal policy of communes. Zesz. Nauk. Polityki Eur. Finans. Mark. 2010, 4, 79–87. [Google Scholar]

- Kettunen, M.; Illes, A. (Eds.) Opportunities for Innovative Biodiversity Financing: Ecological Fiscal Transfers (EFT), Tax Reliefs, Marketed Products, and Fees and Charges. A Compilation of Cases Studies Developed in the Context of a Project for the European Commission (DG ENV). 2017. Available online: https://ec.europa.eu/environment/nature/natura2000/financing/docs/Kettunen_2017_financing_biodiversity_case_studies.pdf (accessed on 14 February 2022).

- Dziuba, J. Environmental aspects in the system of local taxes and tax policy of cities with the powiat status in Poland. Res. Wrocław Univ. Econ. 2015, 397, 78–88. [Google Scholar] [CrossRef][Green Version]

- Śmiechowicz, J. Zwolnieniaiulgi w podatkuodnieruchomościjako instrument wspieranialokalnejprzedsiębiorczości. Kryt. Prawa 2013, 5, 457–479. [Google Scholar]

- Adamczyk, A.; Dawidowicz, D. Polityka w zakresiepodatkuodnieruchomościnaprzykładziemiastwojewódzkich. Ekon. Probl. Usług 2018, 4, 21–32. [Google Scholar] [CrossRef][Green Version]

- Dziuba, J.; Życzkowska, E. The importance of municipal tax policy in shaping forest tax revenues in Poland. Econ. Law 2021, 20, 91–105. [Google Scholar] [CrossRef]

- Kołoszko-Chomentowska, Z. Financial economy of communes with a large forest area—Example of rural communes of the Podlaskie voivodeship. Econ. Environ. 2022, 1, 53–64. [Google Scholar] [CrossRef]

- Galati, A.; Migliore, G.; Thrassou, A.; Schifani, G.; Rizzo, G.; Adamashvili, N.; Crescimanno, M. Consumers’ Willingness to Pay for Agri-Food Products Delivered with Electric Vehicles in the Short Supply Chains. FIIB Bus. Rev. 2022, 12, 193–207. [Google Scholar] [CrossRef]

- Mabit, S.L. Vehicle type choice under the influence of a tax reform and rising fuel prices. Transp. Res. Part A Policy Pract. 2014, 64, 32–42. [Google Scholar] [CrossRef]

- Giblin, S.; McNabola, A. Modelling the impacts of a carbon emission-differentiated vehicle tax system on CO2 emissions intensity from new vehicle purchases in Ireland. Energy Policy 2009, 37, 1404–1411. [Google Scholar] [CrossRef]

- Ciccone, A. Environmental effects of a vehicle tax reform: Empirical evidence from Norway. Transp. Policy 2018, 69, 141–157. [Google Scholar] [CrossRef]

- Sánchez-Braza, A.; Cansino, J.M.; Lerma, E. Main drivers for local tax incentives to promote electric vehicles: The Spanish case. Transp. Policy 2014, 36, 1–9. [Google Scholar] [CrossRef]

- Yan, S.; Eskeland, G. Greening the Vehicle Fleet: Evidence from Norway’s CO2 Differentiated Registration Tax. Discussion Paper 14/16. 2016. Available online: https://openaccess.nhh.no/nhh-xmlui/bitstream/handle/11250/2404232/1416.pdf?sequence=1&isAllowed=y (accessed on 26 May 2022).

- Lam, A.; Mercure, J.-F. Which policy mixes are best for decarbonizing passenger cars? Simulating interactions among taxes, subsidies and regulations for the United Kingdom, the United States, Japan, China, and India. Energy Res. Soc. Sci. 2021, 75, 101951. [Google Scholar] [CrossRef]

- Jenn, A.; Springel, K.; Gopal, A. Effectiveness of electric vehicle incentives in the United States. Energy Policy 2018, 119, 349–356. [Google Scholar] [CrossRef]

- Wappelhorst, S.; Mock, P.; Yang, Z. Using Vehicle Taxation Policy to Lower Transport Emissions. An Overview for Passenger Cars in Europe; International Council on Clean Transportation: Berlin, Germany, 2018. [Google Scholar]

- Vidyattama, Y.; Tanton, R.; Nakanishi, H. Investigating Australian households’ vehicle ownership and its relationship with emission tax policy options. Transp. Policy 2021, 114, 196–205. [Google Scholar] [CrossRef]

- Delucchi, M.; Murphy, J. How large are tax subsidies to motor-vehicle users in the US? Transp. Policy 2008, 15, 196–208. [Google Scholar] [CrossRef][Green Version]

- Poliscanova, J. How Vehicle Taxes Can Accelerate Electric Car Sales. 2019. Available online: https://www.transportenvironment.org/wp-content/uploads/2021/07/2019_02_How_vehicle_taxes_can_accelerate_electric_car_final.pdf (accessed on 18 May 2022).

- Felis, P.; Rosłaniec, H. The application of tax on means of transport in local tax policy in Poland. Evidence of City Counties. J. Manag. Financ. Sci. 2017, X, 9–35. [Google Scholar] [CrossRef]

- Dziuba, J. Tax Revenues from Transportation Means in Cities with County Rights in the Context of Financial Independence Rule. Stud. Ekon. 2014, 198, 135–145. [Google Scholar]

- Giżyński, J.; Burchat, M. The role of selected local taxes in financing the basic local government unit. Przestrz. Ekon. Społeczeństwo 2017, 12/II, 243–262. [Google Scholar]

- Skica, T.; Kiebala, A.; Wołowiec, T. Stimulating local competitiveness of communities: The case of the tax on means of transport. Stud. Reg. Lokal. 2011, 2, 92–117. [Google Scholar]

- Suproń, B. The impact of tax on means of transportation on the activities of international road carriers in the West Pomeranianvoivodeship. Nierównościspołeczne A Wzrostgospodarczy 2018, 56, 404–417. [Google Scholar]

- Aras, G.; Tezcan, N.; Furtuna, O.K. The value relevance of banking sector multidimensional corporate sustainability performance. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 1062–1073. [Google Scholar] [CrossRef]

- Esra Atukalp, M. Determining the relationship between stock return and financial performance: An analysis on Turkish deposit banks. J. Appl. Stat. 2021, 48, 2643–2657. [Google Scholar] [CrossRef] [PubMed]

- Aczel, A.; Sounder pandian, J. Complete Business Statistics; McGraw-Hill/Irwin: New York, NY, USA, 2009. [Google Scholar]

- Statistics Poland. Area and Population in the Territorial Profile in 2017. In Statistical Information and Elaborations; Central Statistical Office: Warsaw, Poland, 2018. [Google Scholar]

- Statistics Poland. Local Data Bank. Available online: https://bdl.stat.gov.pl/bdl/dane/podgrup/wymiary (accessed on 24 February 2022).

- Resolution No. CXXI/1909/14 of the Cracow City Council of 5 November, 2014 on exemption from tax on means of transport (Official Journal of the Lesser Poland Voivodeship 2014 item 6437).

- Resolution No. XI/332/19 of the Szczecin City Council of 22 October 2019 on the tax on means of transport (Official Journal of the West Pomeranian Voivodeship 2019 item. 5432).

- Resolution No. XLIX/1009/17 of the Katowice City Council of 23 November, 2017 on exemption from tax on means of transport (Official Journal of the Silesian Voivodeship 2017 item 6570).

- Inci, E.; Taspinar, Z.; Ulengin, B. A choice experiment on preferences for electric and hybrid cars in Istanbul. Transp. Res. Part D 2022, 107, 103295. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).