The Economic Potential of Agrivoltaic Systems in Apple Cultivation—A Hungarian Case Study

Abstract

:1. Introduction

2. Literature Review

2.1. Exploring Global Agrivoltaics: Case Studies and Research Perspectives

2.2. The European and Hungarian Electricity Market

2.3. Key Facts of the European and Hungarian Apple Production

2.4. Effect of AV System on Apple Production

2.5. Economic Background

3. Materials and Methods

3.1. Project Description and Objectives

3.2. Economic Indicators for Implementing Agrivoltaic Systems in Hungary

4. Results and Discussion

4.1. Investment Analysis

4.2. Unit Cost of Electricity and Apple Production

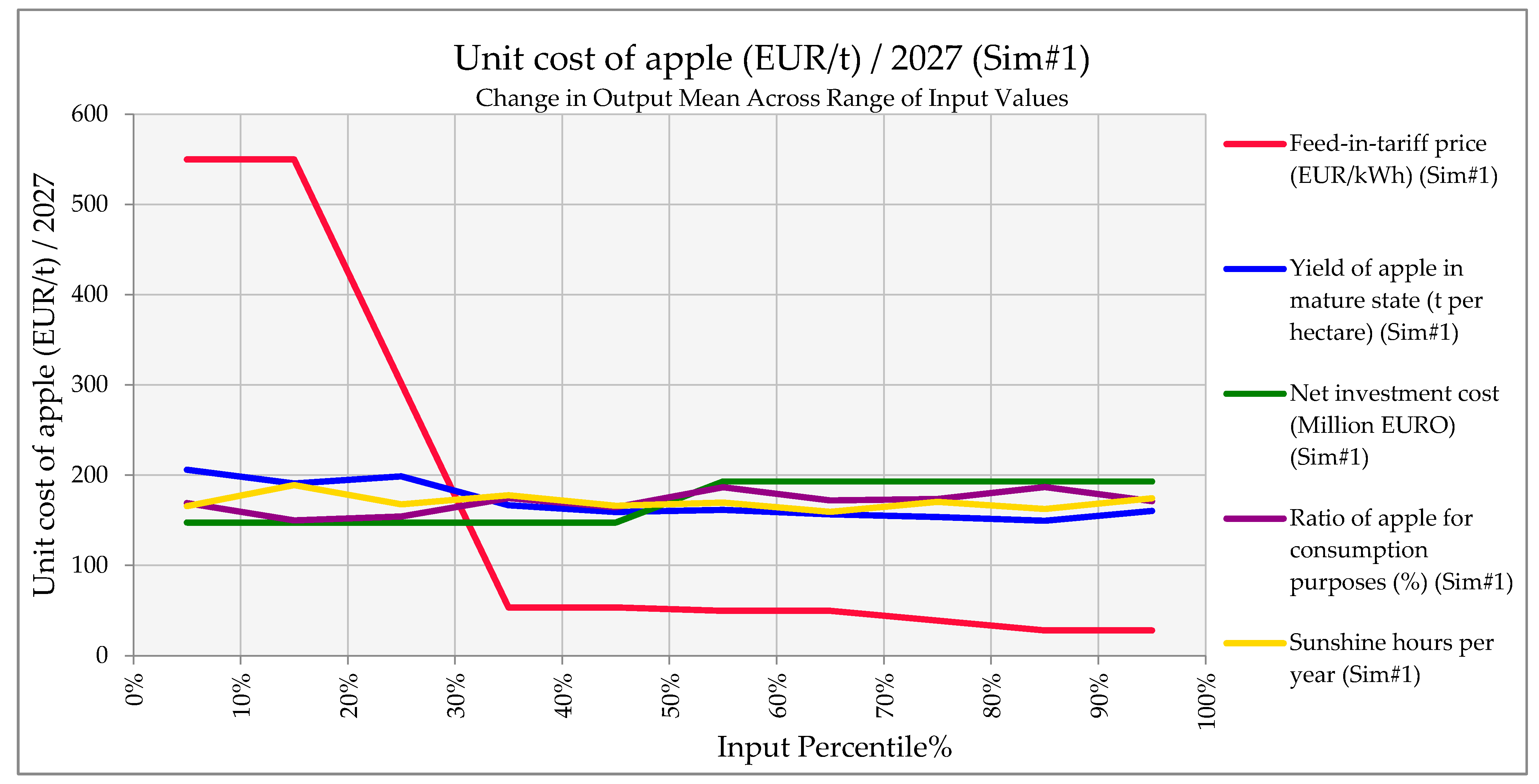

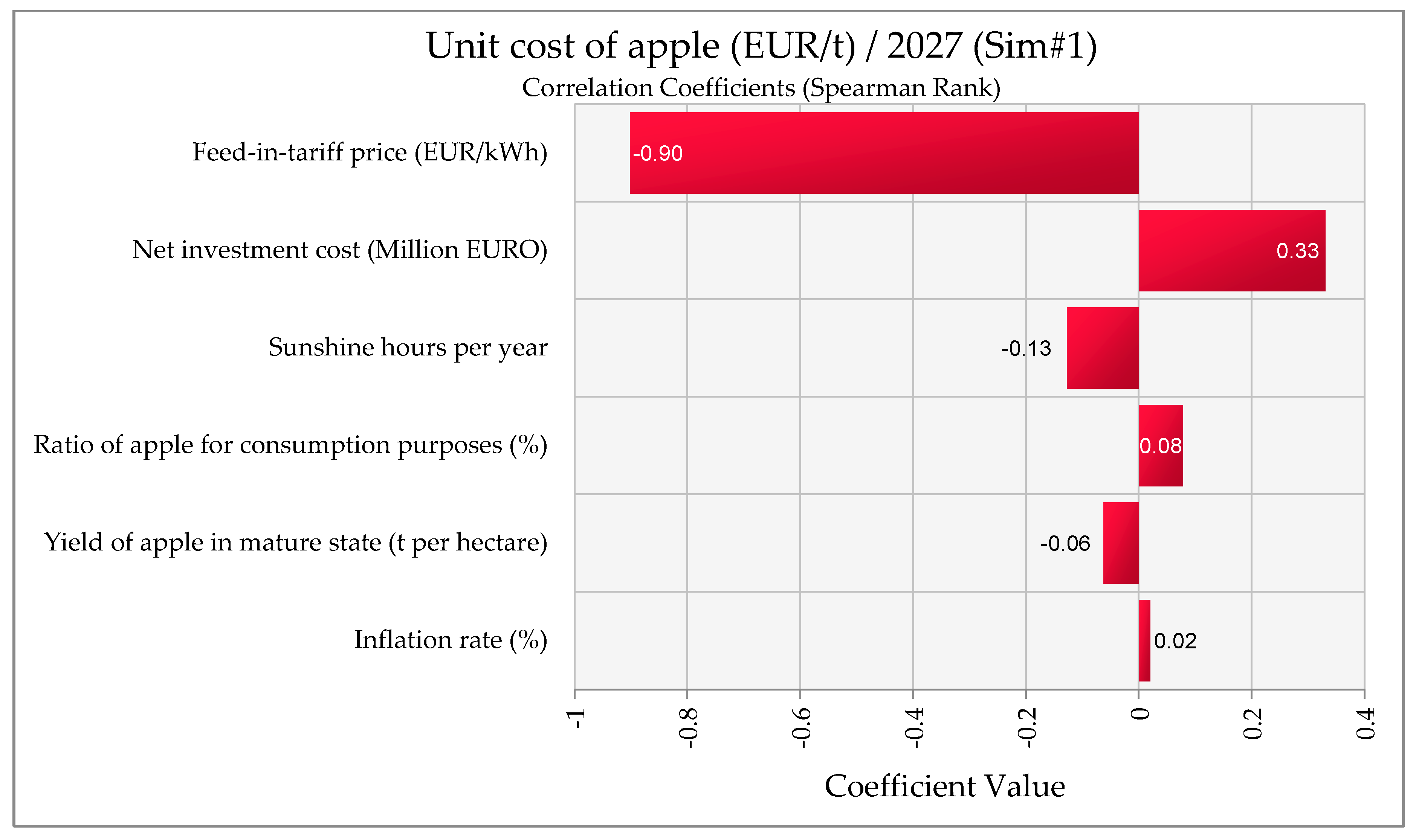

4.2.1. Unit Cost of Apple Production

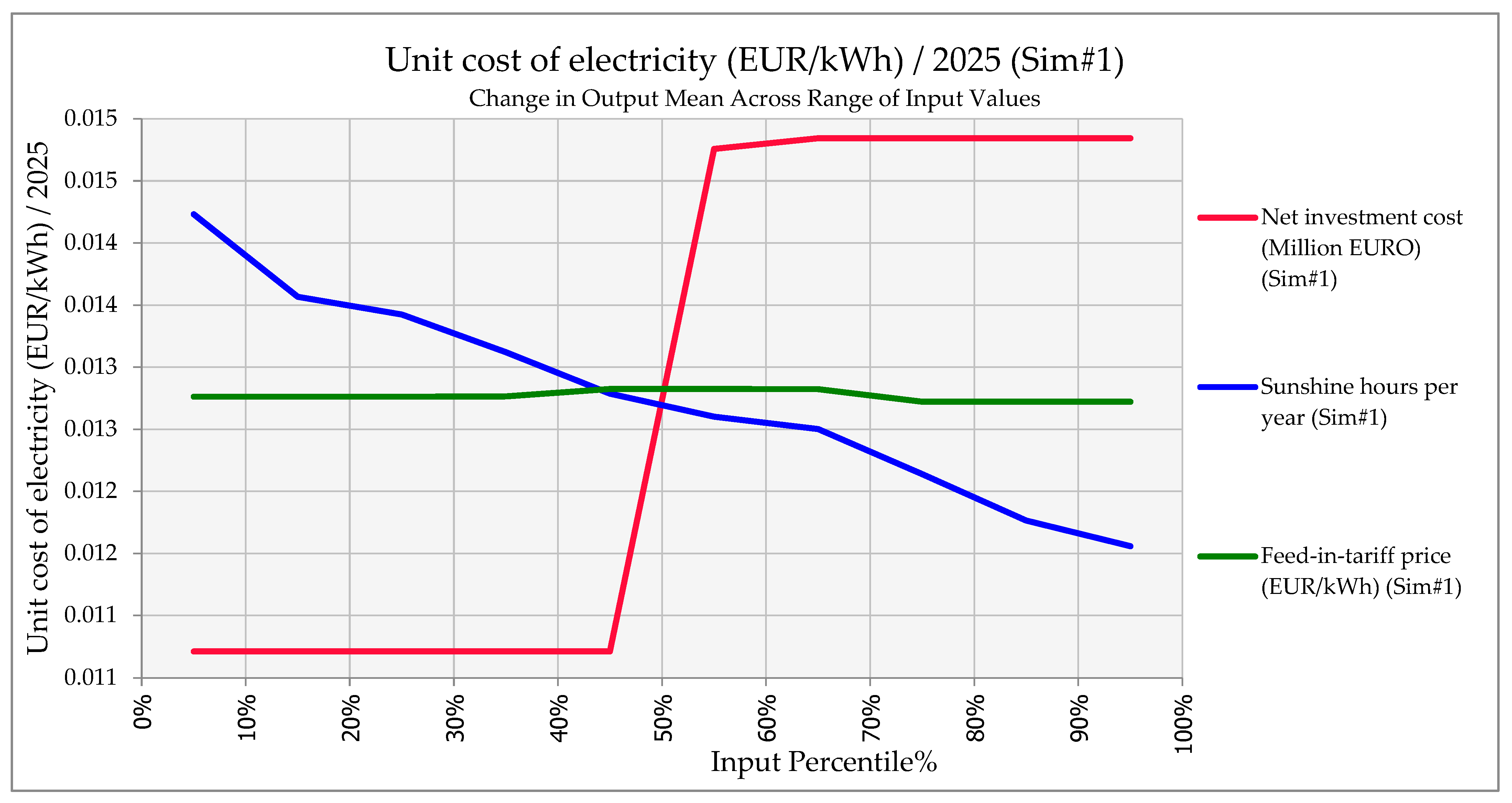

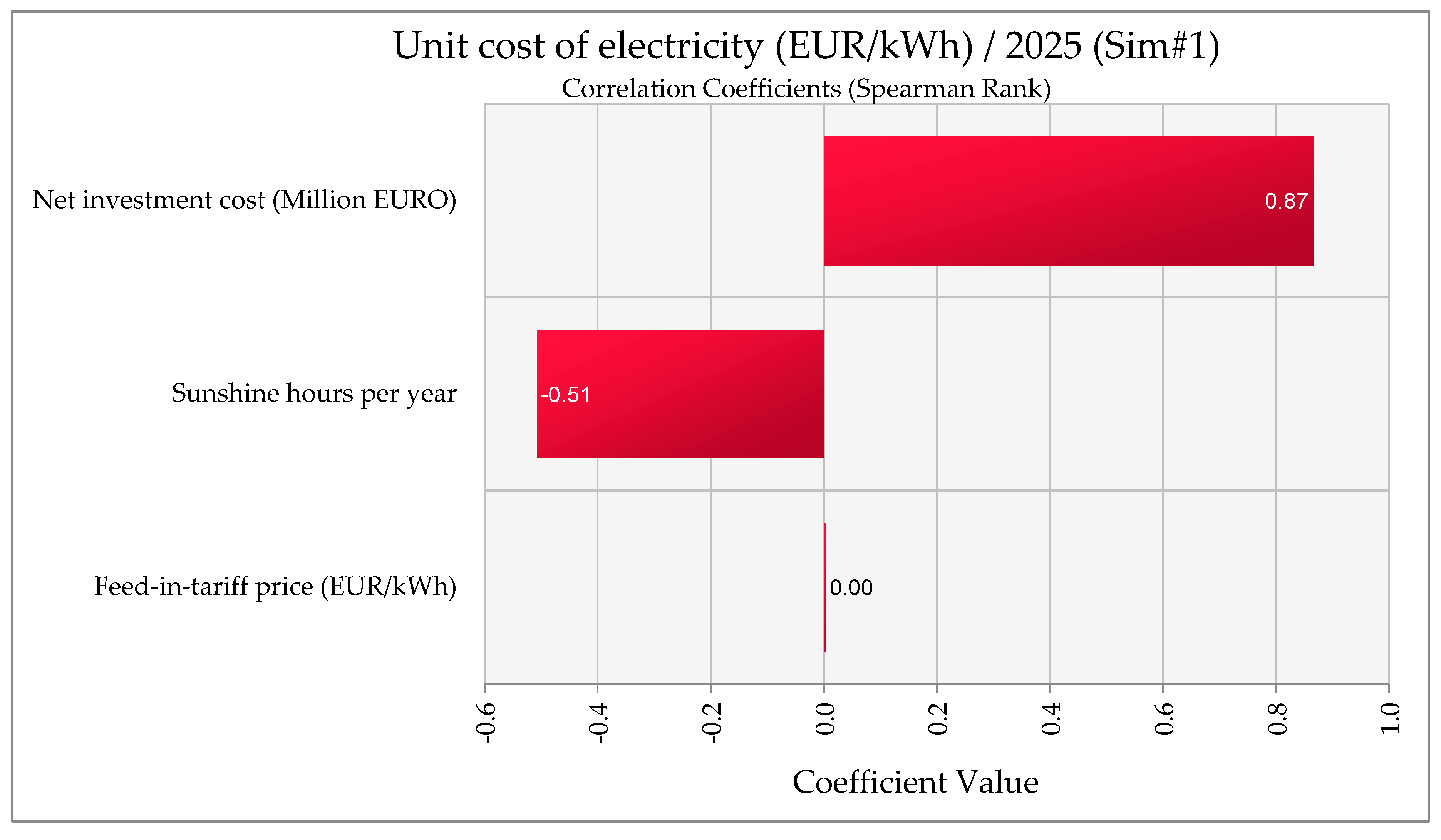

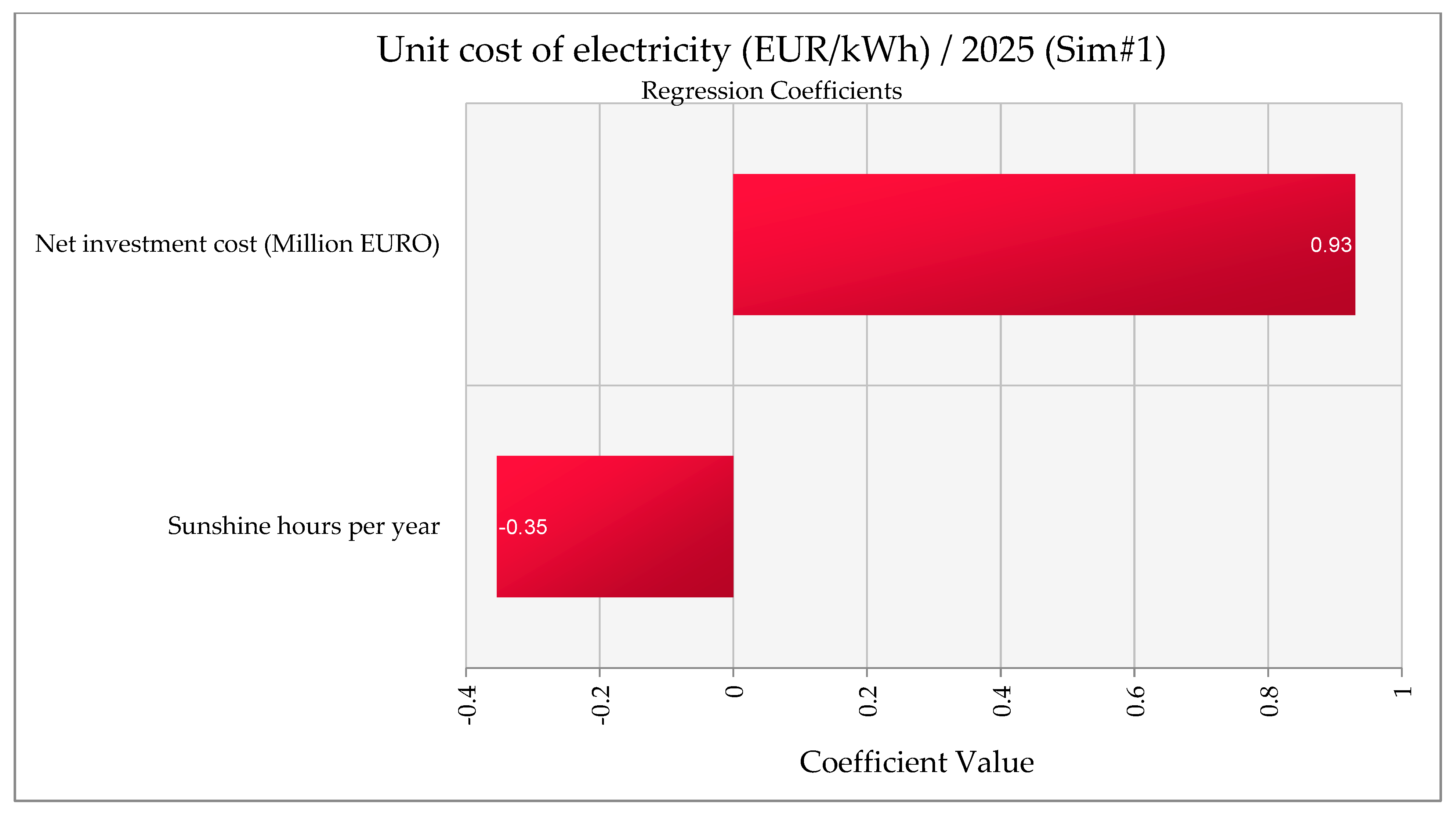

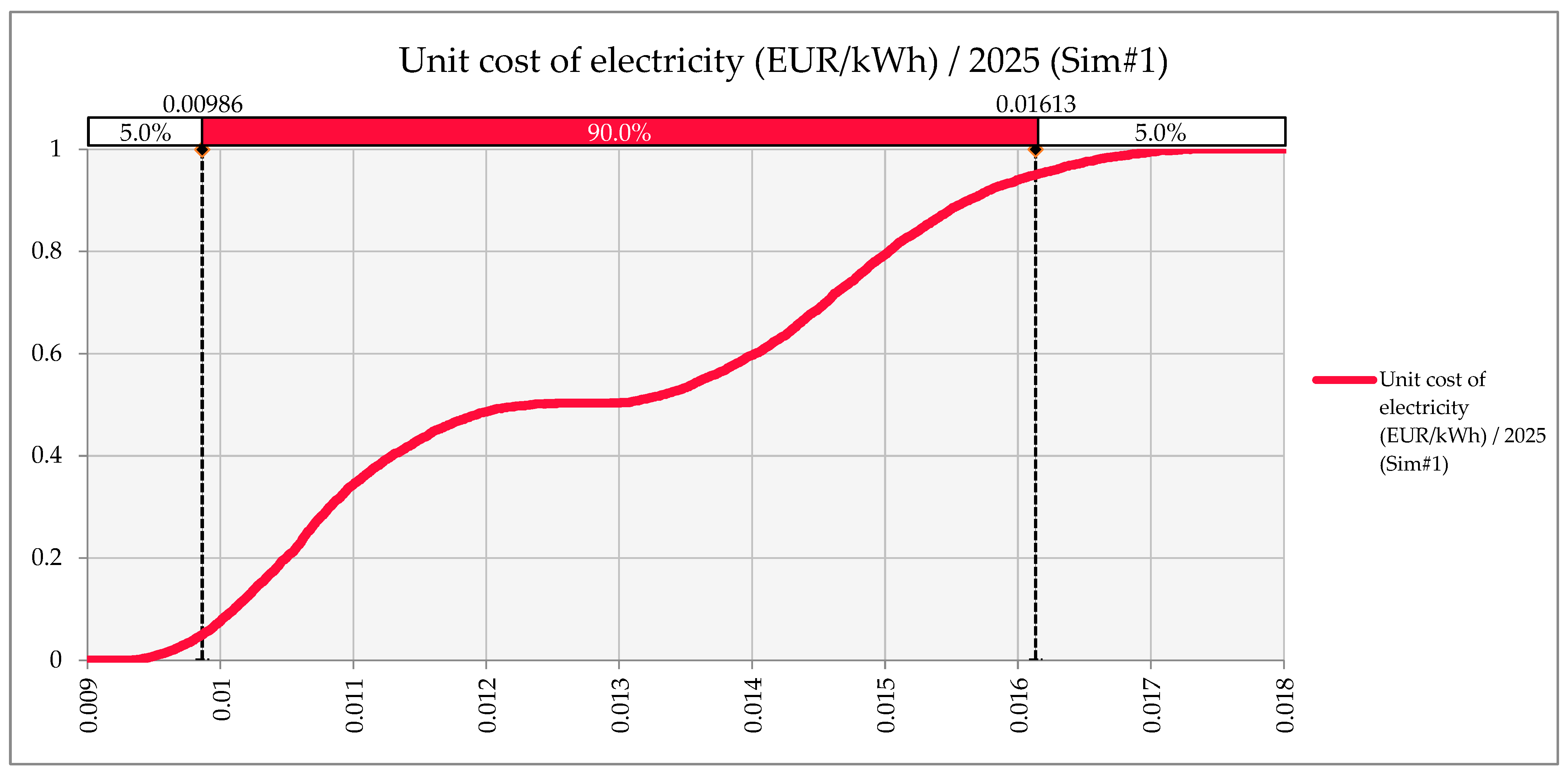

4.2.2. Unit Cost of Electricity

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AVS | Agrivoltaic systems |

| CAPEX | Capital expenditure |

| CDCF | Cumulative discounted cash flow (DCF) |

| ConAPS | Conventional apple production system |

| DF | Discount factor |

| FIT | Feed-in-tariff price |

| GCR | Ground–coverage ratio |

| GM-PV | Ground-mounted photovoltaic system |

| GWp | Gigawatt-peak |

| HN | Hail net |

| IRR | Internal rate of return |

| JPY | Japanese Yen |

| KRW | South Korean Won |

| kW | Kilowatt |

| kWac | Kilowatt alternating current |

| kWh | Kilowatt-hour |

| kWh/a | Kilowatt-hours per annum (per year) |

| kWh/ha | kilowatt-hours per hectare per year |

| kWp | Kilowatt-peak |

| LCOE | Levelized cost of electricity |

| MW | Megawatt |

| MWp | Megawatt peak |

| NPV | Net present value |

| OPEX | Operating Expenses |

| PI | Profitability index |

| PV | Photovoltaic |

| SPV | Solar photovoltaic |

| UCa2027 | Unit cost of apples in 2027 (first harvest year) |

| UCe2025 | Unit cost of electricity in 2025 (first year of operation) |

Appendix A

Appendix A.1. Agrivoltaics in Asia

Appendix A.1.1. Japan

Appendix A.1.2. China

Appendix A.1.3. South Korea

Appendix A.1.4. India

Appendix A.2. Agrivoltaics in Europe

Appendix A.2.1. Germany

Appendix A.2.2. Italy

Appendix A.2.3. France

Appendix A.3. Agrivoltaics in the United States

| Crop | Shading Rate Range | Influence on Crop Yield | Electricity Production | Location | Capacity of AVS | Investment Cost | Ref. |

|---|---|---|---|---|---|---|---|

| Rice | 27% to 39% | Sustains at least 80% of yield | 28% density: 284 million MWh/yr. (29% of Japanese electricity demand, 2018) | Japan | 231 million kW | NA | [83] |

| Corn | NA | Control: 3.35 kg/m2 Low Density: 3.54 kg/m2 High Density: 3.23 kg/m2 | HD: 2974 kWh/a LD: 1487 kWh/a | Ichihara City, Chiba Prefecture, Japan | 4.5 kW | NA | [103] |

| Soybeans | NA | Crop production decreased by less than 20%. | LAOR: 35% generate 17.8 GWh/year | Kyoto Prefecture, Japan | 50 kWac | 320,000 JPY/kWac | [104] |

| Lettuce | 70% 50% | No significant effect on crop yield Significant effect on crop yield | 6.5 to18 kWh/m2 | Montpellier, France | NA | NA | [46,105,106] |

| Lettuces and cucumbers | Lettuce: 32% in FD and 48% in HD Cucumber: 37% in FD and 62% in HD | NA | Montpellier, France | NA | NA | [46] | |

| Potatoes | 50% | Potato plants beneath the PV modules had more leaves than those in the reference area. | 2447 kWh | Belgium | NA | NA | [107] |

| Winter wheat, potatoes, celeriac | NA | Winter wheat yields increased by 3%. Potato yields increased by 11%. Celeriac yields increased by 12%. | 246 MWh | Germany | 194.4 kW | NA | [108] |

| Apple | NA | NA | 996 kWh/kWp/a | Germany | 700 kWp | 1387 k EUR/ha | [14] |

| Tomato transplants (Solanum lycopersicum var. Legend) | NA | Control Fully Irrigated (a): 88.42 (kg/row) Control Fully Irrigated (b): 68.13 (kg/row) Row Full Irrigated (a): 53.59 (kg/row) Row Full Irrigated (b): 32.76 (kg/row) Panel Full Irrigated (a): 33.61(kg/row) Panel Full Irrigated (b): 21.64 (kg/row) | NA | Oregon State University Vegetable Farm (Corvallis, OR, USA) | 482 kW | NA | [109] |

| Soybean | AV1 = 27%, AV2 = 16%, AV3 = 9%, AV4 = 18% | Total pod number decreased by 13% on average in all AV conditions compared to open field conditions. | NA | Monticelli d’Ongina, Italy | NA | NA | [110] |

| Turmeric (Curcuma longa) | 70–75% shading of SPV | Crop production decreased by approximately 15% due to underneath cultivation. | 1120 kWh | Jatni campus, Odisha, India | 0.675 kWp | 742.92 USD | [89] |

| Apple | 50–55% | Reductions in yield by 32% and 27% in 2019 and 2020. | NA | La Pugère, France | NA | NA | [10] |

| Maize (Zea mays L.) | 29.5% and 13.4% for double-density and single-density, respectively. | NA | Po Valley, Northern Italy | NA | NA | [15] |

References

- IRENA. Global Energy Transformation: A Roadmap to 2050; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- Executive Summary—Hungary 2022—Analysis. Available online: https://www.iea.org/reports/hungary-2022/executive-summary (accessed on 7 December 2023).

- Tumiwa, J.R.; Tuegeh, O.; Bittner, B.; Nagy, A. The Challenges to Developing Smart Agricultural Village in the Industrial Revolution 4.0. Tor. Int. Stud. 2022, 1, 25–45. [Google Scholar] [CrossRef]

- Mizik, T.; Gyarmati, G. Economic and Sustainability of Biodiesel Production—A Systematic Literature Review. Clean Technol. 2021, 3, 19–36. [Google Scholar] [CrossRef]

- Popp, J.; Harangi-Rákos, M.; Pető, K.; Nagy, A. Bioenergy: Risks to Food-, Energy- and Environmental Security. Appl. Stud. Agribus. Commer. 2013, 7, 121–130. [Google Scholar] [CrossRef]

- Vida, V.; Szűcs, I. Pork Production and Consumption Issues from the Perspective of the Religion and the World’s Growing Population. Appl. Stud. Agribus. Commer. 2020, 14, 121–128. [Google Scholar] [CrossRef]

- Maity, R.; Sudhakar, K.; Abdul Razak, A.; Karthick, A.; Barbulescu, D. Agrivoltaic: A Strategic Assessment Using SWOT and TOWS Matrix. Energies 2023, 16, 3313. [Google Scholar] [CrossRef]

- Dupraz, C.; Marrou, H.; Talbot, G.; Dufour, L.; Nogier, A.; Ferard, Y. Combining Solar Photovoltaic Panels and Food Crops for Optimising Land Use: Towards New Agrivoltaic Schemes. Renew. Energy 2011, 36, 2725–2732. [Google Scholar] [CrossRef]

- Büchele, M. Lucas’ Anleitung zum Obstbau, 33rd ed.; Verlag Eugen Ulmer: Stuttgart, Germany, 2018; ISBN 9783818618681. [Google Scholar]

- Juillion, P.; Lopez, G.; Fumey, D.; Lesniak, V.; Génard, M.; Vercambre, G. Shading Apple Trees with an Agrivoltaic System: Impact on Water Relations, Leaf Morphophysiological Characteristics and Yield Determinants. Sci. Hortic. 2022, 306, 111434. [Google Scholar] [CrossRef]

- Trommsdorff, M. An Economic Analysis of Agrophotovoltaics: Opportunities, Risks and Strategies towards a More Efficient Land Use. Available online: https://www.wipo.uni-freiburg.de/CENworkpapers-en/files/cen-paper-03-2016trommsdorff.pdf (accessed on 11 November 2022).

- Barron-Gafford, G.A.; Pavao-Zuckerman, M.A.; Minor, R.L.; Sutter, L.F.; Barnett-Moreno, I.; Blackett, D.T.; Thompson, M.; Dimond, K.; Gerlak, A.K.; Nabhan, G.P.; et al. Agrivoltaics Provide Mutual Benefits across the Food–Energy–Water Nexus in Drylands. Nat. Sustain. 2019, 2, 848–855. [Google Scholar] [CrossRef]

- Schindele, S.; Trommsdorff, M.; Schlaak, A.; Obergfell, T.; Bopp, G.; Reise, C.; Braun, C.; Weselek, A.; Bauerle, A.; Högy, P.; et al. Implementation of Agrophotovoltaics: Techno-Economic Analysis of the Price-Performance Ratio and Its Policy Implications. Appl. Energy 2020, 265, 16. [Google Scholar] [CrossRef]

- Trommsdorff, M.; Hopf, M.; Hörnle, O.; Berwind, M.; Schindele, S.; Wydra, K. Can Synergies in Agriculture through an Integration of Solar Energy Reduce the Cost of Agrivoltaics? An Economic Analysis in Apple Farming. Appl. Energy 2023, 350, 121619. [Google Scholar] [CrossRef]

- Amaducci, S.; Yin, X.; Colauzzi, M. Agrivoltaic Systems to Optimise Land Use for Electric Energy Production. Appl. Energy 2018, 220, 545–561. [Google Scholar] [CrossRef]

- Weselek, A.; Ehmann, A.; Zikeli, S.; Lewandowski, I.; Schindele, S.; Högy, P. Agrophotovoltaic Systems: Applications, Challenges, and Opportunities. A Review. Agron. Sustain. Dev. 2019, 39, 35. [Google Scholar] [CrossRef]

- pv Magazine Agrivoltaics: Where Are We Heading? Available online: https://www.pv-magazine.com/magazine-archive/agrivoltaics-where-are-we-heading/ (accessed on 26 November 2023).

- Tajima, M.; Iida, T. Evolution of Agrivoltaic Farms in Japan. AIP Conf. Proc. 2021, 2361, 030002. [Google Scholar]

- Chen, J.; Liu, Y.; Wang, L. Research on Coupling Coordination Development for Photovoltaic Agriculture System in China. Sustainability 2019, 11, 1065. [Google Scholar] [CrossRef]

- Campana, P.E.; Stridh, B.; Amaducci, S.; Colauzzi, M. Optimisation of Vertically Mounted Agrivoltaic Systems. J. Clean. Prod. 2021, 325, 129091. [Google Scholar] [CrossRef]

- Trommsdorff, M.; Vorast, M.; Durga, N.; Padwardhan, S.M. Potential of Agrivoltaics to Contribute to Socio-Economic Sustainability: A Case Study in Maharashtra/India. AIP Conf. Proc. 2021, 2361, 040001. [Google Scholar]

- Willockx, B.; Reher, T.; Lavaert, C.; Herteleer, B.; Van de Poel, B.; Cappelle, J. Design and Evaluation of an Agrivoltaic System for a Pear Orchard. Appl. Energy 2024, 353, 122166. [Google Scholar] [CrossRef]

- Ember Average Monthly Electricity Wholesale Prices in Selected Countries in the European Union (EU) from January 2020 to October 2023 (in Euros per Megawatt-Hour) [Graph]. Available online: https://www.statista.com/statistics/1267500/eu-monthly-wholesale-electricity-price-country/ (accessed on 21 November 2023).

- Sertolli, A.; Gabnai, Z.; Lengyel, P.; Bai, A. Biomass Potential and Utilization in Worldwide Research Trends—A Bibliometric Analysis. Sustainability 2022, 14, 5515. [Google Scholar] [CrossRef]

- Igbeghe, C.B.; Nagy, A.; Gabnai, Z.; Bai, A. Exploring Biomass Linkages in the Food and Energy Market—A Systematic Review. Energies 2024, 17, 563. [Google Scholar] [CrossRef]

- Electricity Price Statistics. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Electricity_price_statistics (accessed on 22 November 2023).

- Böhringer, C.; Rosendahl, K.E. Green Promotes the Dirtiest: On the Interaction between Black and Green Quotas in Energy Markets. J. Regul. Econ. 2010, 37, 316–325. [Google Scholar] [CrossRef]

- Aune, F.R.; Dalen, H.M.; Hagem, C. Implementing the EU Renewable Target through Green Certificate Markets. Energy Econ. 2012, 34, 992–1000. [Google Scholar] [CrossRef]

- Chen, C.; Zhu, Y.; Zeng, X.; Huang, G.; Li, Y. Analyzing the Carbon Mitigation Potential of Tradable Green Certificates Based on a TGC-FFSRO Model: A Case Study in the Beijing-Tianjin-Hebei Region, China. Sci. Total Environ. 2018, 630, 469–486. [Google Scholar] [CrossRef] [PubMed]

- Karakosta, O.; Petropoulou, D. The EU Electricity Market: Renewables Targets, Tradable Green Certificates and Electricity Trade. Energy Econ. 2022, 111, 106034. [Google Scholar] [CrossRef]

- Yi, Z.; Xin-gang, Z.; Xin, M.; Yu-zhuo, Z. Research on Tradable Green Certificate Benchmark Price and Technical Conversion Coefficient: Bargaining-Based Cooperative Trading. Energy 2020, 208, 118376. [Google Scholar] [CrossRef]

- Ueckerdt, F.; Hirth, L.; Luderer, G.; Edenhofer, O. System LCOE: What Are the Costs of Variable Renewables? Energy 2013, 63, 61–75. [Google Scholar] [CrossRef]

- Bhattacharya, S.; Giannakas, K.; Schoengold, K. Market and Welfare Effects of Renewable Portfolio Standards in United States Electricity Markets. Energy Econ. 2017, 64, 384–401. [Google Scholar] [CrossRef]

- Trunov, Y.V.; Solovyev, A.V.; Zavrazhnov, A.A.; Tarova, Z.N. Modeling the Productivity of Intensive and Super-Intensive Apple Orchards in the Midland of Russia. IOP Conf. Ser. Earth Environ. Sci. 2021, 845, 012043. [Google Scholar] [CrossRef]

- Apáti, F.; Soltész, M. Economic Aspects of Applying Hail Protection Nets in Apple Plantations. Int. J. Hortic. Sci. 2011, 17, 99–101. [Google Scholar] [CrossRef]

- Badiu, D.; Arion, F.; Muresan, I.; Lile, R.; Mitre, V. Evaluation of Economic Efficiency of Apple Orchard Investments. Sustainability 2015, 7, 10521–10533. [Google Scholar] [CrossRef]

- Goedegebure, J. Economic Aspects of Super-Intensive Apple Orchards. Acta Hortic. 1993, 349, 285–294. [Google Scholar] [CrossRef]

- European Commission. Production, Areas and Yields. In The Apple Market in the EU; European Commission: Brussels, Belgium, 2022; Volume 1. [Google Scholar]

- Apáti, F.; Lakner, Z. Investment Analysis of Hungarian Apple-Orchard and Fruit Storage Projects. Int. J. Hortic. Sci. 2016, 18, 157–162. [Google Scholar] [CrossRef]

- Szabó, V. Comparative Economic Analysis of Superintensive and Intensive Apple Orchards. Int. J. Hortic. Sci. 2014, 20, 45–48. [Google Scholar] [CrossRef]

- HCSO Fontosabb Gyümölcsfélék és a Szőlő Betakarított Területe. Available online: http://www.ksh.hu/stadat_files/mez/hu/mez0014.html (accessed on 7 January 2024).

- HCSO Gyümölcstermelés Megye és Régió Szerint. Available online: https://www.ksh.hu/stadat_files/mez/hu/mez0086.html (accessed on 7 January 2024).

- Muder, A.; Thünen-Institute of Farm Economics, Braunschweig, Germany; Garming, H.; Dreisiebner-Lanz, S.; Kerngast, K.; Rosner, F.; Kličková, K.; Kurthy, G.; Cimer, K.; Bertazzoli, A.; et al. Apple Production and Apple Value Chains in Europe. Eur. J. Hortic. Sci. 2022, 87, 1–22. [Google Scholar] [CrossRef] [PubMed]

- László, K. Almapiaci kilátások. Available online: https://fruitveb.hu/almapiaci-kilatasok/ (accessed on 7 January 2024).

- Felföldi, J.; Apáti, F. Operation Efficiency in the Fruit Production Chain—A Study Based on Real Cases. In Annals of the Polish Association of Agricultural and Agribusiness Economists; 2014; Volume 16, pp. 85–90. Available online: https://rnseria.com/resources/html/article/details?id=172798&language=en (accessed on 28 January 2024).

- Marrou, H.; Guilioni, L.; Dufour, L.; Dupraz, C.; Wery, J. Microclimate under Agrivoltaic Systems: Is Crop Growth Rate Affected in the Partial Shade of Solar Panels? Agric. For. Meteorol. 2013, 177, 117–132. [Google Scholar] [CrossRef]

- Marrou, H.; Dufour, L.; Wery, J. How Does a Shelter of Solar Panels Influence Water Flows in a Soil–Crop System? Eur. J. Agron. 2013, 50, 38–51. [Google Scholar] [CrossRef]

- Elamri, Y.; Cheviron, B.; Lopez, J.-M.; Dejean, C.; Belaud, G. Water Budget and Crop Modelling for Agrivoltaic Systems: Application to Irrigated Lettuces. Agric. Water Manag. 2018, 208, 440–453. [Google Scholar] [CrossRef]

- Miller, S.S.; Hott, C.; Tworkoski, T. Shade Effects on Growth, Flowering and Fruit of Apple. J. Appl. Hortic. 2015, 17, 101–105. [Google Scholar] [CrossRef]

- Kumpanalaisatit, M.; Setthapun, W.; Sintuya, H.; Pattiya, A.; Jansri, S.N. Current Status of Agrivoltaic Systems and Their Benefits to Energy, Food, Environment, Economy, and Society. Sustain. Prod. Consum. 2022, 33, 952–963. [Google Scholar] [CrossRef]

- Elkadeem, M.R.; Zainali, S.; Lu, S.M.; Younes, A.; Abido, M.A.; Amaducci, S.; Croci, M.; Zhang, J.; Landelius, T.; Stridh, B.; et al. Agrivoltaic Systems Potentials in Sweden: A Geospatial-Assisted Multi-Criteria Analysis. Appl. Energy 2024, 356, 122108. [Google Scholar] [CrossRef]

- Trommsdorff, M.; Gruber, S.; Keinath, T.; Hopf, M.; Hermann, C.; Schönberger, F.; Gudat, C.; Boggio, A.T.; Gajewski, M.; Högy, P.; et al. Agri-Photovoltaik: Chance Für Landwirtschaft Und Energiewende; Fraunhofer Institute for Solar Energy Systems ISE: Freiburg im Breisgau, Germany, 2024. [Google Scholar]

- Dinesh, H.; Pearce, J.M. The Potential of Agrivoltaic Systems. Renew. Sustain. Energy Rev. 2016, 54, 299–308. [Google Scholar] [CrossRef]

- Toyoda, T.; Yajima, D.; Araki, K.; Nishioka, K. Design Optimization of Agri-photovoltaic Systems in Different Climate Regions. IEEJ Trans. Electr. Electron. Eng. 2023, 19, 208–214. [Google Scholar] [CrossRef]

- Hilbers, J. Agri-PV-Projekt Obstbau am DLR Rheinpfalz—Obstbau.org. Available online: https://www.obstbau.org/rubriken/kernobst/agri-pv-projekt-obstbau-am-dlr-rheinpfalz.html (accessed on 15 January 2024).

- Hilbers, J. Agri-PV in Aller Munde—Obstbau.org. Available online: https://www.obstbau.org/rubriken/technik/agri-pv-in-aller-munde.html (accessed on 15 January 2024).

- Csedő, Z.; Sinóros-Szabó, B.; Zavarkó, M. Seasonal Energy Storage Potential Assessment of WWTPs with Power-to-Methane Technology. Energies 2020, 13, 4973. [Google Scholar] [CrossRef]

- Constantin, M.; Sapena, J.; Apetrei, A.; Pătărlăgeanu, S.R. Deliver Smart, Not More! Building Economically Sustainable Competitiveness on the Ground of High Agri-Food Trade Specialization in the EU. Foods 2023, 12, 232. [Google Scholar] [CrossRef]

- Szőke, E. Hungary Launches Its Largest Solar Power Plant to Date. Ceenergy News, 12 June 2023. [Google Scholar]

- Moreda, G.P.; Muñoz-García, M.A.; Alonso-García, M.C.; Hernández-Callejo, L. Techno-Economic Viability of Agro-Photovoltaic Irrigated Arable Lands in the EU-Med Region: A Case-Study in Southwestern Spain. Agronomy 2021, 11, 593. [Google Scholar] [CrossRef]

- Csigai, K.; Hrotkó, K. Effect of Rootstocks and Spacing on Growth and Yield in Early Bearing “Jonica” and “Gala Must” Apple Trees. Acta Hortic. 2007, 732, 475–479. [Google Scholar] [CrossRef]

- Ezzat, A.; El-Sherif, A.R.; Elgear, D.; Szabó, S.; Holb, I.J. A Comparison of Fruit and Leaf Parameters of Apple in Three Orchard Training Systems. Zemdirbyste 2020, 107, 373–382. [Google Scholar] [CrossRef]

- Nábrádi, A.; Szőllősi, L. Key Aspects of Investment Analysis. Appl. Stud. Agribus. Commer. 2007, 1, 53–56. [Google Scholar] [CrossRef]

- Szűcs, I.; Szőllősi, L. A Beruházások Ökonómiai Megítélése; András, N., Tibor, P., Katalin, T.G., Ház, S.K., Eds.; ÜZEMTAN I.: Budapest, Hungary, 2008; pp. 46–59. ISBN 9789639732704. [Google Scholar]

- Metropolis, N.; Ulam, S. The Monte Carlo Method. J. Am. Stat. Assoc. 1949, 44, 335–341. [Google Scholar] [CrossRef]

- Bai, A.; Balogh, P.; Nagy, A.; Csedő, Z.; Sinóros-Szabó, B.; Pintér, G.; Prajapati, S.K.; Singh, A.; Gabnai, Z. Economic Evaluation of a 1 MWel Capacity Power-to-Biomethane System. Energies 2023, 16, 8009. [Google Scholar] [CrossRef]

- MTAKFI. Climate. Available online: https://www.mtafki.hu/inmaps/pdf/Hungary-in-Maps_45.pdf (accessed on 20 November 2023).

- Solar Energy—Hungary. Available online: https://www.statista.com/outlook/io/energy/renewable-energy/solar-energy/hungary (accessed on 18 January 2024).

- Inflation Report. Hungarian National Bank. Available online: https://www.mnb.hu/en/publications/reports/inflation-report (accessed on 29 February 2024).

- Hargrave, M. Weighted Average Cost of Capital (WACC): Definition and Formula. Available online: https://www.investopedia.com/terms/w/wacc.asp (accessed on 15 January 2024).

- Average Risk Free Investment Rate in Hungary 2015–2022. Available online: https://www.statista.com/statistics/885881/average-risk-free-rate-hungary/ (accessed on 15 January 2024).

- Damodaran, A. Country Risk: Determinants, Measures and Implications—The 2022 Edition. SSRN Electron. J. 2022. [Google Scholar] [CrossRef]

- Damodaran, A. Equity Risk Premiums (ERP): Determinants, Estimation and Implications—The 2023 Edition. SSRN Electron. J. 2023. [Google Scholar] [CrossRef]

- Agostini, A.; Colauzzi, M.; Amaducci, S. Innovative Agrivoltaic Systems to Produce Sustainable Energy: An Economic and Environmental Assessment. Appl. Energy 2021, 281, 116102. [Google Scholar] [CrossRef]

- Malu, P.R.; Sharma, U.S.; Pearce, J.M. Agrivoltaic Potential on Grape Farms in India. Sustain. Energy Technol. Assess. 2017, 23, 104–110. [Google Scholar] [CrossRef]

- Pascaris, A.S.; Schelly, C.; Burnham, L.; Pearce, J.M. Integrating Solar Energy with Agriculture: Industry Perspectives on the Market, Community, and Socio-Political Dimensions of Agrivoltaics. Energy Res. Soc. Sci. 2021, 75, 102023. [Google Scholar] [CrossRef]

- Baji Gál Imréné Szarvas, N.; Gyura, G.; Jókuthy, L.; Papp, D. Financing the Hungarian Renewable Energy Sector: Challenges and Opportunities. Available online: https://mnb.hu/letoltes/20210121-financing-the-hungarian-renewable-energy-sector.pdf (accessed on 10 January 2024).

- OECD OECD Statistics. Available online: https://stats.oecd.org/Index.aspx?DataSetCode=RE (accessed on 23 January 2024).

- Chalgynbayeva, A.; Mizik, T.; Bai, A. Cost–Benefit Analysis of Kaposvár Solar Photovoltaic Park Considering Agrivoltaic Systems. Clean Technol. 2022, 4, 1054–1070. [Google Scholar] [CrossRef]

- Walston, L.J.; Barley, T.; Bhandari, I.; Campbell, B.; McCall, J.; Hartmann, H.M.; Dolezal, A.G. Opportunities for Agrivoltaic Systems to Achieve Synergistic Food-Energy-Environmental Needs and Address Sustainability Goals. Front. Sustain. Food Syst. 2022, 6, 932018. [Google Scholar] [CrossRef]

- Ghosh, A. Nexus between Agriculture and Photovoltaics (Agrivoltaics, Agriphotovoltaics) for Sustainable Development Goal: A Review. Sol. Energy 2023, 266, 112146. [Google Scholar] [CrossRef]

- Jing, R.; Liu, J.; Zhang, H.; Zhong, F.; Liu, Y.; Lin, J. Unlock the Hidden Potential of Urban Rooftop Agrivoltaics Energy-Food-Nexus. Energy 2022, 256, 124626. [Google Scholar] [CrossRef]

- Gonocruz, R.A.; Nakamura, R.; Yoshino, K.; Homma, M.; Doi, T.; Yoshida, Y.; Tani, A. Analysis of the Rice Yield under an Agrivoltaic System: A Case Study in Japan. Environments 2021, 8, 65. [Google Scholar] [CrossRef]

- Irie, N.; Kawahara, N.; Esteves, A.M. Sector-Wide Social Impact Scoping of Agrivoltaic Systems: A Case Study in Japan. Renew. Energy 2019, 139, 1463–1476. [Google Scholar] [CrossRef]

- Bellini, E. Giant Agrivoltaic Project in China. Available online: https://www.pv-magazine.com/2020/09/03/giant-agrivoltaic-project-in-china/ (accessed on 26 November 2023).

- Jiang, S.; Tang, D.; Zhao, L.; Liang, C.; Cui, N.; Gong, D.; Wang, Y.; Feng, Y.; Hu, X.; Peng, Y. Effects of Different Photovoltaic Shading Levels on Kiwifruit Growth, Yield and Water Productivity under “Agrivoltaic” System in Southwest China. Agric. Water Manag. 2022, 269, 107675. [Google Scholar] [CrossRef]

- Kim, S.; Kim, S. Optimization of the Design of an Agrophotovoltaic System in Future Climate Conditions in South Korea. Renew. Energy 2023, 206, 928–938. [Google Scholar] [CrossRef]

- Pulipaka, S.; Peparthy, M.; Vorast, M.; Y.V.K., R. Agrivoltaics in India; Indo-German Energy Forum Support Office (IGEF-SO). National Solar Energy Federation of India (NSEFI): New Delhi, India, 2023. [Google Scholar]

- Giri, N.C.; Mohanty, R.C. Agrivoltaic System: Experimental Analysis for Enhancing Land Productivity and Revenue of Farmers. Energy Sustain. Dev. 2022, 70, 54–61. [Google Scholar] [CrossRef]

- Bhambhani, A. BayWa Completes Agrivoltaic Facility in the Netherlands. Available online: https://taiyangnews.info/baywa-completes-agrivoltaic-facility-in-the-netherlands/ (accessed on 26 November 2023).

- Ali Khan Niazi, K.; Victoria, M. Comparative Analysis of Photovoltaic Configurations for Agrivoltaic Systems in Europe. Prog. Photovolt. 2023, 31, 1101–1113. [Google Scholar] [CrossRef]

- First Agri-PV Research Facility for Apples in Germany. Available online: https://www.baywa-re.com/en/news/details/first-agri-pv-research-facility-for-apples-in-germany (accessed on 26 November 2023).

- Toledo, C.; Scognamiglio, A. Agrivoltaic Systems Design and Assessment: A Critical Review, and a Descriptive Model towards a Sustainable Landscape Vision (Three-Dimensional Agrivoltaic Patterns). Sustainability 2021, 13, 6871. [Google Scholar] [CrossRef]

- Bhambhani, A. Total Quadran to Explore Agrivoltaic Segment in France. Available online: https://taiyangnews.info/markets/total-quadran-to-explore-agrivoltaic-segment-in-france/ (accessed on 26 November 2023).

- pv magazine Cero Generation Achieves Financial Close for Its 70 MW Agrivoltaic Solar PV Project in Lazio, Italy. Available online: https://www.pv-magazine.com/press-releases/cero-generation-achieves-financial-close-for-its-70-mw-agrivoltaic-solar-pv-project-in-lazio-italy/ (accessed on 26 November 2023).

- Spaes, J. Agrivoltaics Prevail in France’s Tender for Innovative PV Technologies. Available online: https://www.pv-magazine.com/2021/01/05/agrivoltaics-prevail-in-frances-tender-for-innovative-pv-technologies/ (accessed on 26 November 2023).

- UMass Amherst Study Will Assess Impact of Dual-Use Solar-Agriculture Installations in Massachusetts. Available online: https://www.umass.edu/news/article/umass-amherst-study-will-assess-impact (accessed on 22 November 2023).

- Jack’s Solar Garden. Available online: https://www.jackssolargarden.com/the-vision (accessed on 22 November 2023).

- Kennedy, R. Jack’s Solar Garden Blends Agriculture, Solar Energy, and Community. Available online: https://pv-magazine-usa.com/2022/08/18/jacks-solar-garden-blends-agriculture-solar-energy-and-community/ (accessed on 22 November 2023).

- Sheep Join Forces with the Solar Industry. Available online: https://www.revisionenergy.com/solar-information/stories-inspiration/customer-profiles/solar-grazing-skowhegan (accessed on 26 November 2023).

- Fong, X. Sun-Raised Farms Is Changing the Sustainability Movement One Solar Panel and Furry Animal at a Time. Available online: https://qcexclusive.com/sun-raised-farms-is-changing-the-sustainability-movement-one-solar-panel-and-furry-animal-at-a-time/ (accessed on 26 November 2023).

- UMassAmherst. Center for Agriculture, Food, and the Environment. Clean Energy Extension. Dual-Use: Agriculture and Solar Photovoltaics. Available online: https://ag.umass.edu/sites/ag.umass.edu/files/fact-sheets/pdf/fs_-_dual-use_-_agriculture_and_solar_pv_012524_0.pdf (accessed on 26 November 2023).

- Sekiyama, T.; Nagashima, A. Solar Sharing for Both Food and Clean Energy Production: Performance of Agrivoltaic Systems for Corn, A Typical Shade-Intolerant Crop. Environments 2019, 6, 65. [Google Scholar] [CrossRef]

- Nakata, H.; Ogata, S. Integrating Agrivoltaic Systems into Local Industries: A Case Study and Economic Analysis of Rural Japan. Agronomy 2023, 13, 513. [Google Scholar] [CrossRef]

- Marrou, H.; Wery, J.; Dufour, L.; Dupraz, C. Productivity and Radiation Use Efficiency of Lettuces Grown in the Partial Shade of Photovoltaic Panels. Eur. J. Agron. 2013, 44, 54–66. [Google Scholar] [CrossRef]

- Valle, B.; Simonneau, T.; Sourd, F.; Pechier, P.; Hamard, P.; Frisson, T.; Ryckewaert, M.; Christophe, A. Increasing the Total Productivity of a Land by Combining Mobile Photovoltaic Panels and Food Crops. Appl. Energy 2017, 206, 1495–1507. [Google Scholar] [CrossRef]

- Willockx, B.; Research Group Energy and Automation Faculty of Engineering Technology, KU Leuven. Ghent. Belgium; Herteleer, B.; Cappelle, J. Combining Photovoltaic Modules and Food Crops: First Agrivoltaic Prototype in Belgium. Renew. Energy Power Qual. J. 2020, 18, 266–271. [Google Scholar] [CrossRef]

- Trommsdorff, M.; Kang, J.; Reise, C.; Schindele, S.; Bopp, G.; Ehmann, A.; Weselek, A.; Högy, P.; Obergfell, T. Combining Food and Energy Production: Design of an Agrivoltaic System Applied in Arable and Vegetable Farming in Germany. Renew. Sustain. Energy Rev. 2021, 140, 110694. [Google Scholar] [CrossRef]

- AL-agele, H.A.; Proctor, K.; Murthy, G.; Higgins, C. A Case Study of Tomato (Solanum Lycopersicon Var. Legend) Production and Water Productivity in Agrivoltaic Systems. Sustainability 2021, 13, 2850. [Google Scholar] [CrossRef]

- Potenza, E.; Croci, M.; Colauzzi, M.; Amaducci, S. Agrivoltaic System and Modelling Simulation: A Case Study of Soybean (Glycine max L.) in Italy. Horticulturae 2022, 8, 1160. [Google Scholar] [CrossRef]

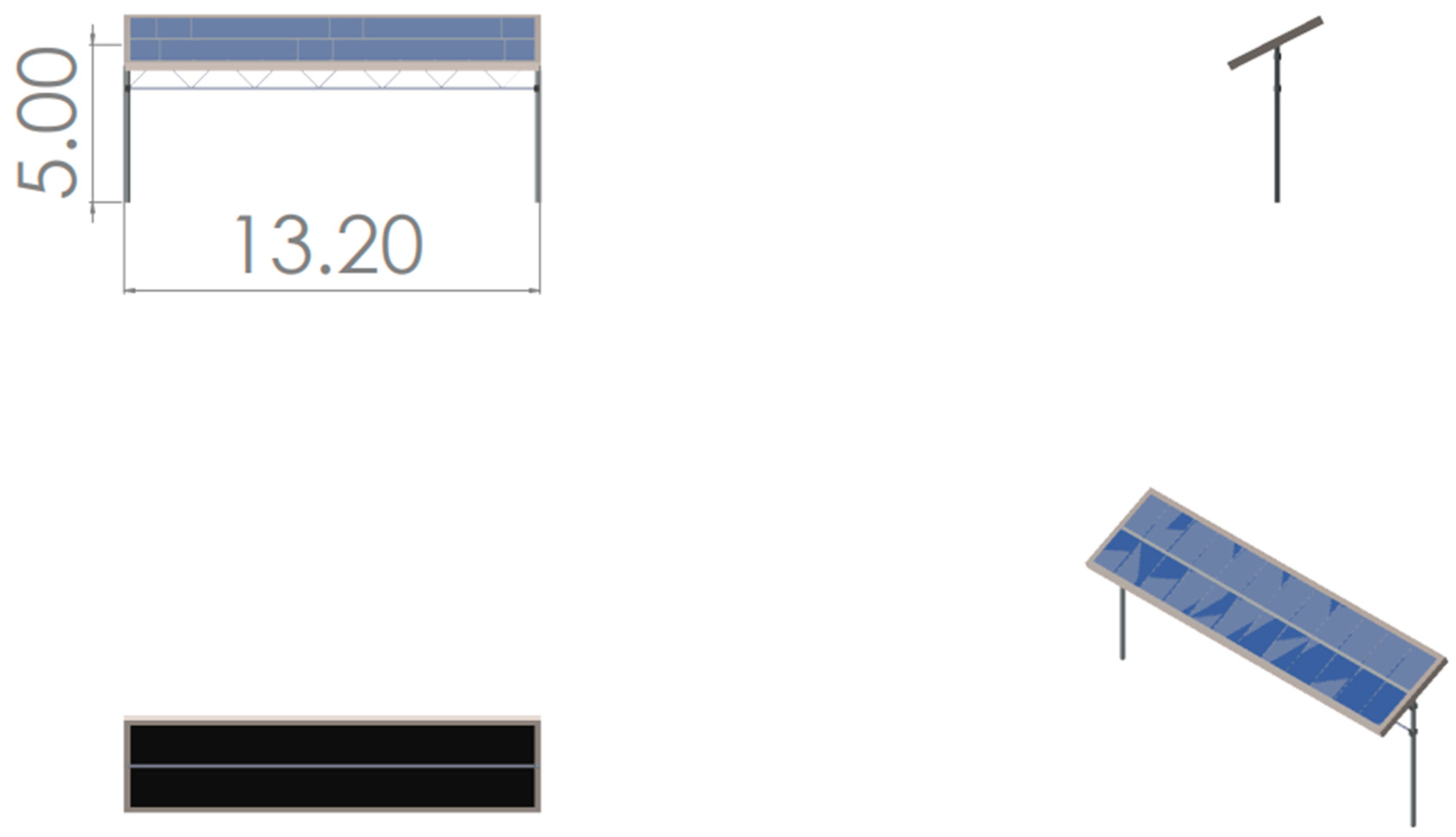

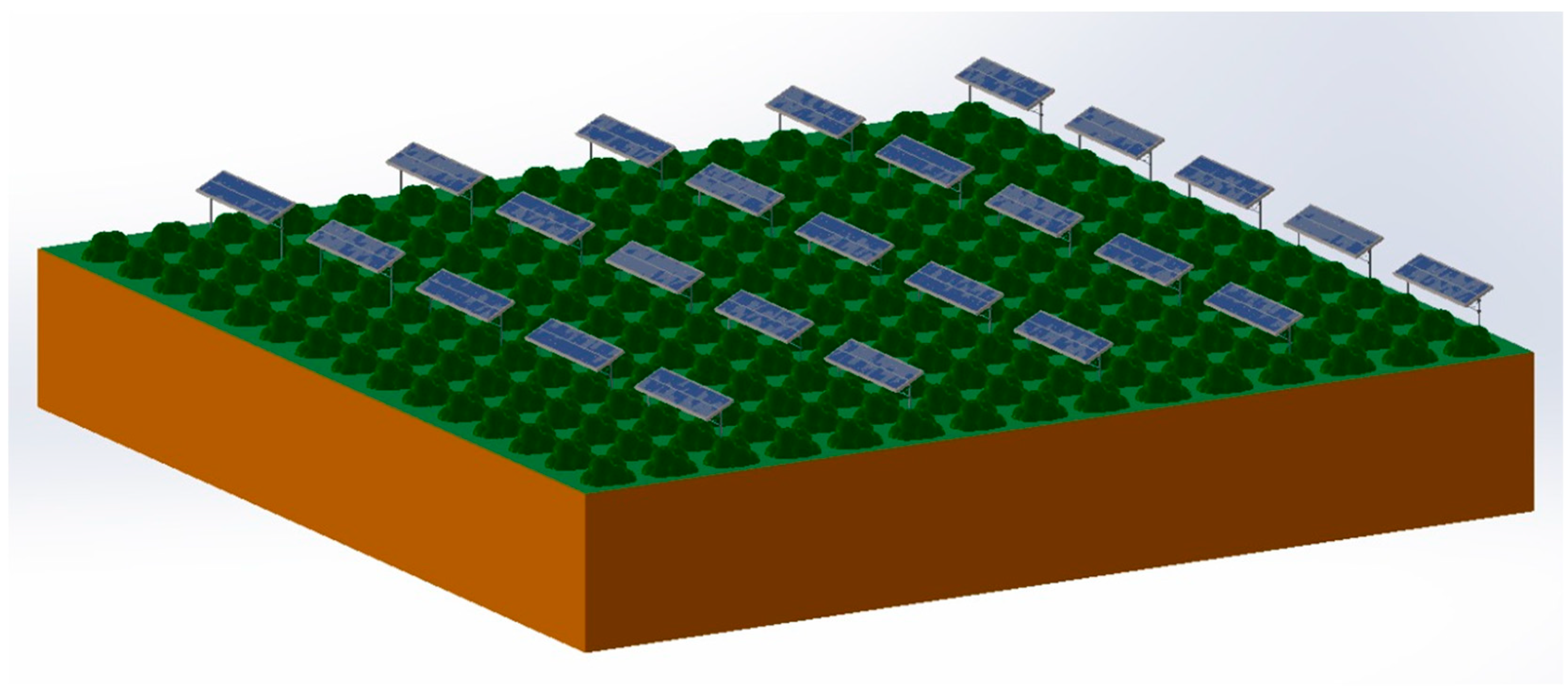

| APV Shed | Basic APV Shed | ||

|---|---|---|---|

| Area (ha) | 42 * | Basic APV Shed (kWp) | 251.12 * |

| Length (m) | 1.64 * | Basic APV Shed (width) | 26 1 |

| Width (m) | 1 1 | Basic APV Shed (length) | 106 1 |

| Weight (kg) of PV | 18.2 1 | Basic APV Shed (Area ha) | 0.2756 * |

| Area of each panel (m2) | 1.64 * | Total N° APV Shed | 239 * |

| Design of apple tree | kWp/ha | 911.16 * | |

| Height of structures (m) | 5 1 | PV capacity installed in each of the seven 6 ha plots (kWp/plots) | 5467 * |

| AVS width over the apple row (m) | 1.7 1 | Number of PV models | 866 * |

| Space within rows (m) | 1 1 | The overall module surface area (m2) | 866 * |

| Row to row distance (m) | 3.6 1 | GCR | 31% * |

| Available space for PV system within rows | 2.6 * | kW plant capacity | 5467 * |

| Indicators | Value |

|---|---|

| Investment cost (CAPEX) (EUR) | 23,386,364 |

| FIT price (EUR/kWh) | 0.087 |

| Sunshine hours per year | 2000 |

| Efficiency compared to the previous year (%) | 99 |

| Annual maintenance and repair (EUR/kW/year) | 2.1 |

| Annual insurance and video surveillance (EUR/kW/year) | 1.8 |

| Annual internet fee (EUR/kW/year) | 0.8 |

| Indicators | Value |

|---|---|

| Investment cost (CAPEX) (EUR/ha) | 41,885 |

| Cash flow in the 2nd year (revenue − cost) (EUR/ha) | −1047 |

| Cash flow in the 3rd year (revenue − cost) (EUR/ha) | −262 |

| Average yield in the mature state (from the 4th year) (t/ha/year) | 57.5 |

| Ratio of apple for consumption purposes (%) | 90 |

| Yield (class I and II) (t/ha/year) | 51.75 |

| Yield (industrial, juice apple) (t/ha/year) | 5.75 |

| Price (class I and II) (EUR/t) | 288 |

| Price (industrial, juice apple) (EUR/t) | 105 |

| Subsidy (Single area payment scheme) (EUR/ha/year) | 183 |

| Direct production cost (EUR/ha/year) | 11,518 |

| OPEX (direct production cost without depreciation) (EUR/ha/year) | 7853 |

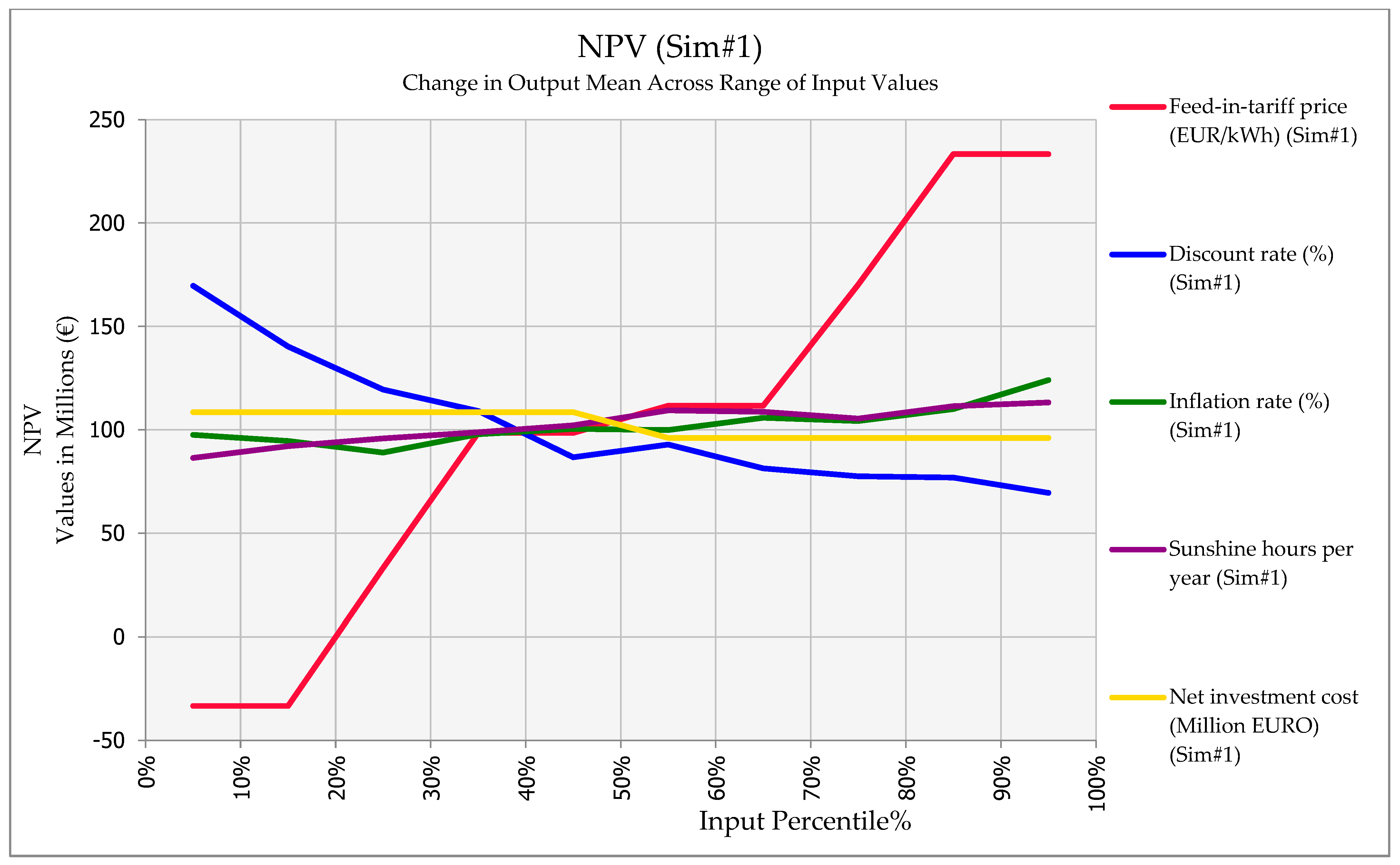

| Indicators | Intervals Used in the Simulation | A Short Explanation of the Value | Type of Distribution |

|---|---|---|---|

| Investment analysis | |||

| Net investment cost of PV system (million EUR) | 14–23.4 | Subsidized (40%): EUR 14 million (by the current Hungarian tender), non-subsidized: EUR 23.4 million. | Discrete uniform distribution |

| FIT prices (EUR/kWh) | 0–0.08–0.087–0.16 | Electricity prices may drop to zero or negative due to factors like surplus renewable energy, changing demand or supply conditions, grid constraints, and government policies. Large-scale storage of electricity cannot be economically stored. | Discrete uniform distribution |

| Sunshine hours per year | 1700–2000–2300 | Hungarian geographical conditions [67,68] | Triangle distribution |

| Discount rate (%) | 0–6.8–8 | Hungary’s discount rate range (0% to 6.8% to 8%) is influenced by the current 6.8% yield on 20-year government debt. The upper limit of 8% is considered as a ceiling. | Triangle distribution |

| Inflation rate (%) | 3–4–6 | Current core inflation in Hungary (6%) is expected to decrease significantly to 4% in the short term and around 3% in the long term [69]. | Triangle distribution |

| Yield of apple in mature state (t/ha) | 45–57.5–65 | sourced from expert opinions and references [40,44] | Truncated normal distribution |

| Ratio of apple for consumption purposes (%) | 80–90–95 | sourced from expert opinions and references [40,44] | Truncated normal distribution |

| Financial Planning: Expenditures and Revenues (Unit of Measurement: Thousand EUR): | Investment Year | Operational Years | ||||||

|---|---|---|---|---|---|---|---|---|

| 2023 | 2024 | 2026 | 2038 | 2039 | 2046 | 2053 | ||

| 1. Capital Expenditure (CAPEX) for PV System | 23,386 | |||||||

| 2. CAPEX for Apple Plantation | 1759 | |||||||

| 3. CAPEX after 15 Years for New Apple Plantation | - | 3168 | ||||||

| 4. Annual Operating Expenses (OPEX) | ||||||||

| Operation and Maintenance costs | PV System | - | 180 | 198 | 354 | 375 | 567 | 889 |

| Apple | - | 44 | 357 | 571 | 0 | 782 | 845 | |

| Total Annual OPEX | - | 224 | 555 | 925 | 375 | 1348 | 1735 | |

| 5. Annual Revenues | ||||||||

| Outputs and revenues | PV Energy Generated | - | 6592 | 6988 | 9917 | 10,211 | 12,524 | 15,361 |

| Apple | - | 0 | 713 | 1490 | 0 | 2374 | 2668 | |

| Total Annual Revenues | - | 6592 | 7701 | 11,407 | 10,211 | 14,898 | 18,029 | |

| Corporate Tax | 492 | 498 | 729 | 519 | 925 | 1146 | ||

| Annual CF (after taxpaying) | −25,146 | 5876 | 5935 | 8263 | 6149 | 10,526 | 12,481 | |

| (Cumulative) Discount Factors (DF) | 1.068 | 1.219 | 2.694 | 2.878 | 4.570 | 7.258 | ||

| Discounted Cash Flow (DCF) | −25,146 | 5500 | 4868 | 3067 | 2136 | 2,243 | 1720 | |

| Cumulative Discounted Cash Flow (CDCF) | −25,146 | −19,645 | −9455 | 36,464 | 38,601 | 56,648 | 70,157 | |

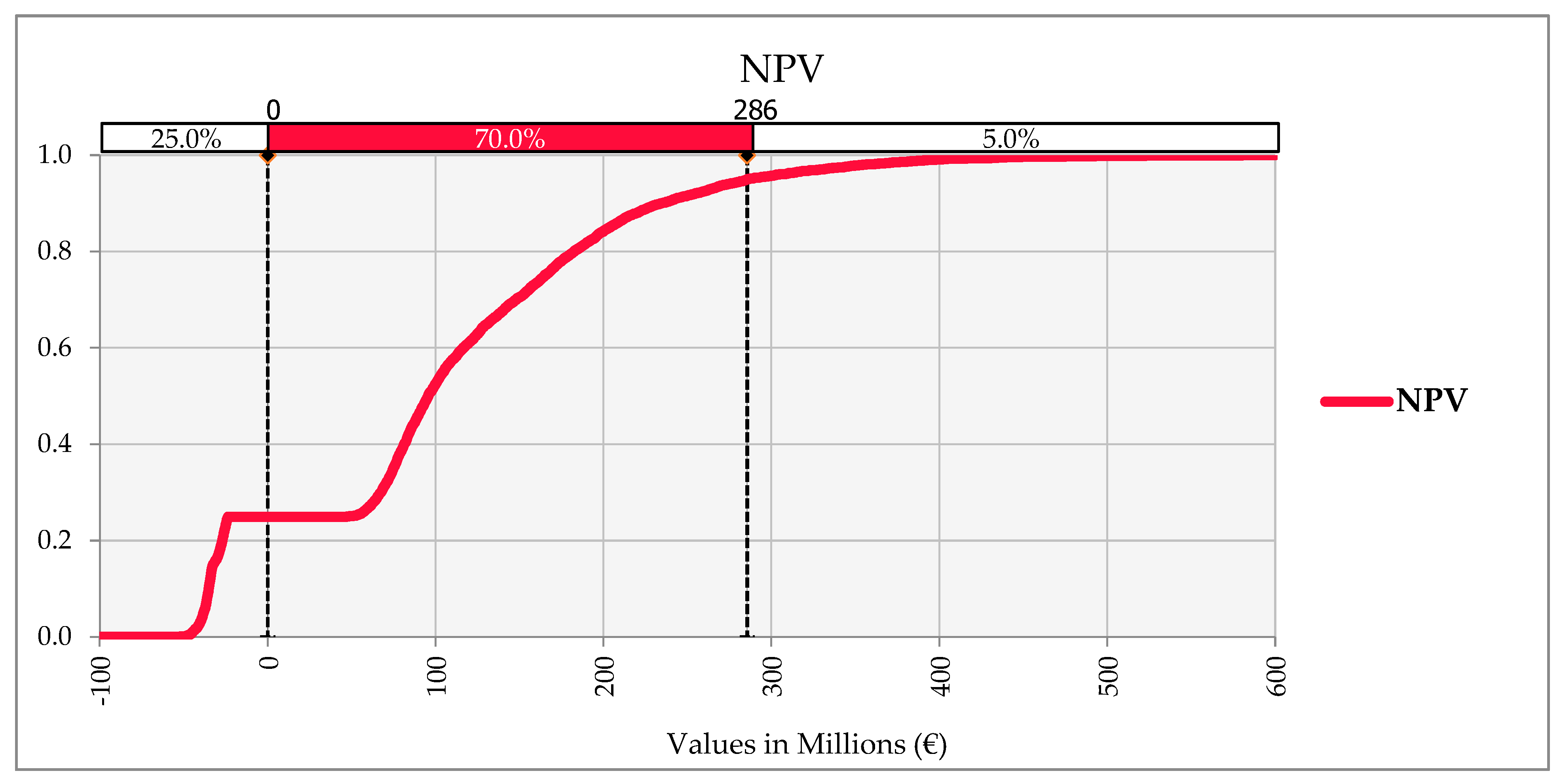

| Output Variables | Mean | Variance | Standard Deviation | Coefficient of Variation (%) |

|---|---|---|---|---|

| NPV | 102.6 (Million EUR) | 11,114,267,648.2 | 105.4 (Million EUR) | 102.77 |

| UCa2027 | 170.58 (EUR/t) | 49,927.84 | 223.45 (EUR/t) | 130.99 |

| UCe2025 | 0.0128 (EUR/kWh) | 0.0003 | 0.0161 (EUR/kWh) | 126.08 |

| Years | 2024 | 2026 | 2038 | 2039 | 2040 | 2053 |

|---|---|---|---|---|---|---|

| Total production cost (EUR) | 1,120,666 | 1,452,053 | 1,822,206 | 1,271,534 | 1,375,870 | 2,631,363 |

| Share of electricity in revenues | 1.00 | 0.91 | 0.87 | 1.00 | 1.00 | 0.85 |

| Share of apples in revenues | 0.00 | 0.09 | 0.13 | 0.00 | 0.00 | 0.15 |

| Production cost of electricity (EUR) | 1,120,666 | 1,317,682 | 1,584,243 | 1,271,534 | 1,375,870 | 2,242,002 |

| Production cost of apples (EUR) | 0 | 134,371 | 237,962 | 0 | 0 | 389,361 |

| Unit cost of electricity (EUR/kWh) | 0.015 | 0.018 | 0.024 | 0.020 | 0.021 | 0.040 |

| Unit cost of apples (EUR/t) | 0 | 56 | 99 | 0 | 0 | 161 |

| Unit cost of electricity in PV (without apples, EUR/kWh) | 0.013 | 0.013 | 0.017 | 0.018 | 0.018 | 0.029 |

| Unit cost of apples (without PV, EUR/t) | 0 | 196 | 285 | 0 | 0 | 399 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chalgynbayeva, A.; Balogh, P.; Szőllősi, L.; Gabnai, Z.; Apáti, F.; Sipos, M.; Bai, A. The Economic Potential of Agrivoltaic Systems in Apple Cultivation—A Hungarian Case Study. Sustainability 2024, 16, 2325. https://doi.org/10.3390/su16062325

Chalgynbayeva A, Balogh P, Szőllősi L, Gabnai Z, Apáti F, Sipos M, Bai A. The Economic Potential of Agrivoltaic Systems in Apple Cultivation—A Hungarian Case Study. Sustainability. 2024; 16(6):2325. https://doi.org/10.3390/su16062325

Chicago/Turabian StyleChalgynbayeva, Aidana, Péter Balogh, László Szőllősi, Zoltán Gabnai, Ferenc Apáti, Marianna Sipos, and Attila Bai. 2024. "The Economic Potential of Agrivoltaic Systems in Apple Cultivation—A Hungarian Case Study" Sustainability 16, no. 6: 2325. https://doi.org/10.3390/su16062325

APA StyleChalgynbayeva, A., Balogh, P., Szőllősi, L., Gabnai, Z., Apáti, F., Sipos, M., & Bai, A. (2024). The Economic Potential of Agrivoltaic Systems in Apple Cultivation—A Hungarian Case Study. Sustainability, 16(6), 2325. https://doi.org/10.3390/su16062325