Exploring the Impact of Digital Inclusive Finance on Agricultural Carbon Emissions: Evidence from the Mediation Effect of Capital Deepening

Abstract

1. Introduction

2. Literature Review

2.1. Financial Development and Carbon Emissions

2.2. Digital Inclusive Finance and Carbon Emissions

2.3. Digital Financial Inclusion and Agricultural Carbon Emissions

2.4. Literature Summary

3. Theoretical Mechanism

4. Methodology and Data

4.1. Methodology

4.1.1. Benchmark Regression Model

4.1.2. Mediation Effect Model

4.1.3. Quantile Regression Model

4.1.4. Spatial Durbin Model

4.2. Variables

4.2.1. Dependent Variable

4.2.2. Independent Variable

4.2.3. Mediating Variable

4.2.4. Other Variables

4.3. Data Source

5. Current Situation Analysis

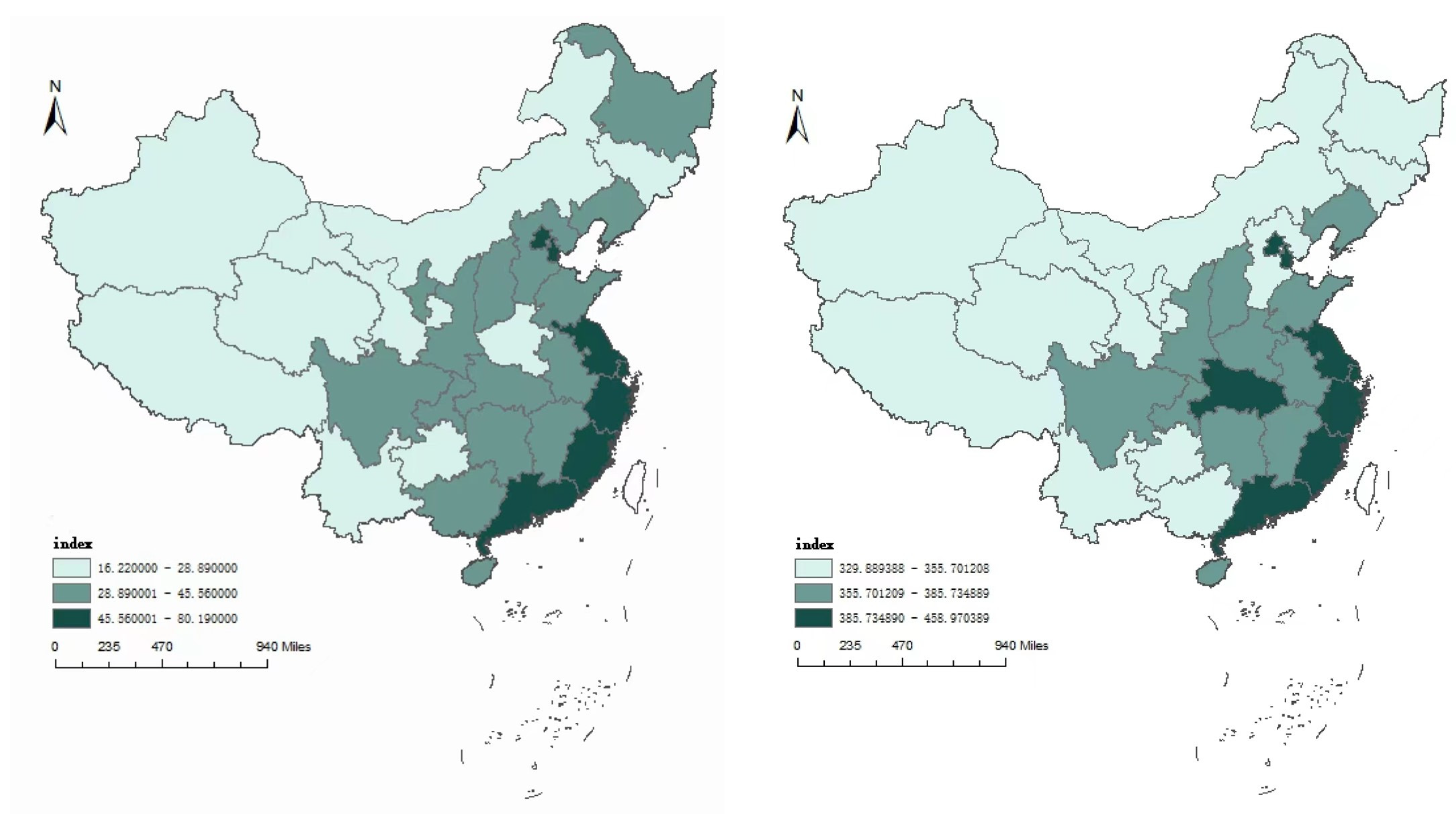

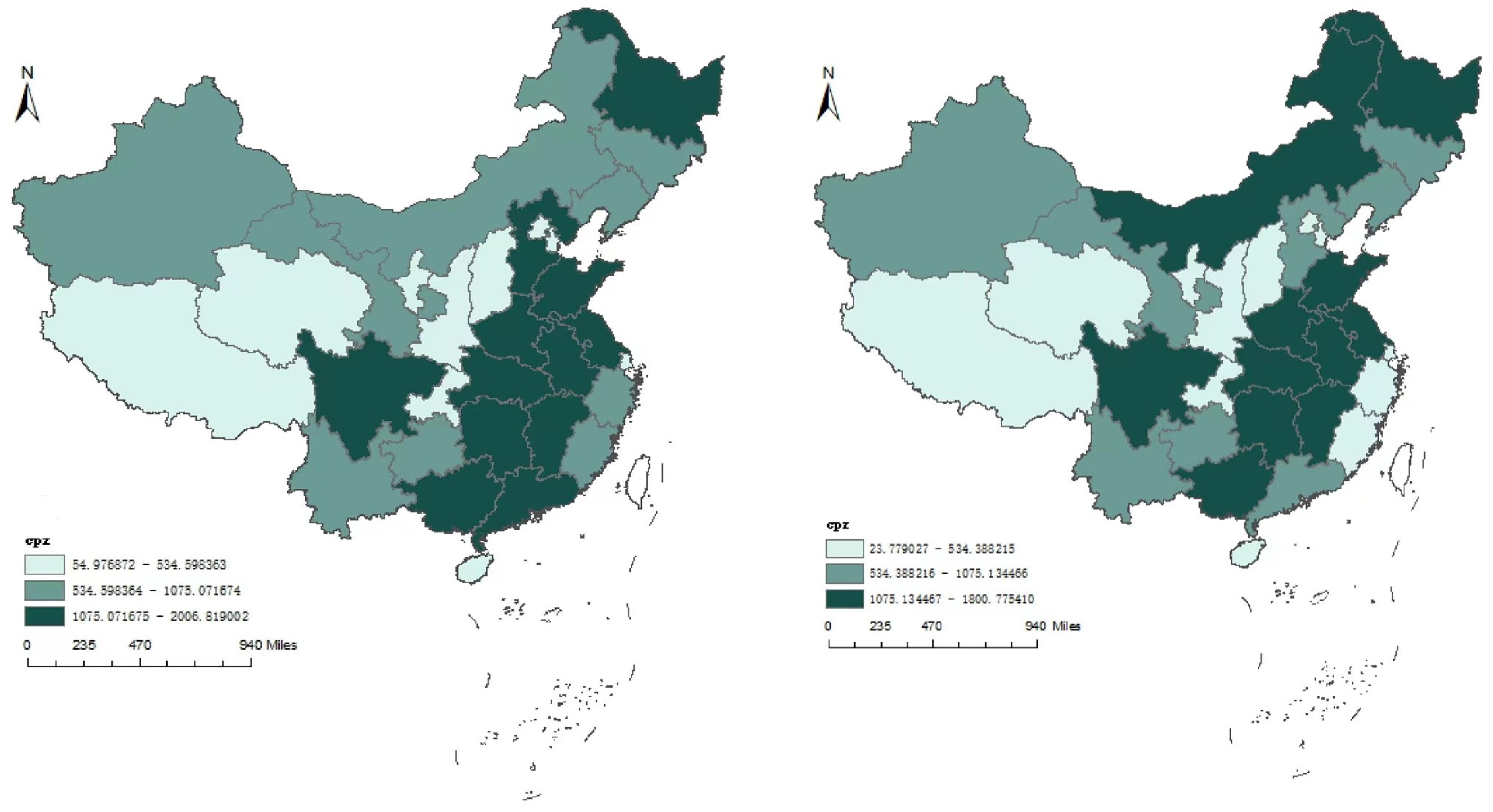

5.1. Spatial Distribution Characteristics of Digital Inclusive Finance

5.2. Spatial Distribution Characteristics of Agricultural Carbon Emissions

6. Empirical Analysis

6.1. Benchmark Regression Results

6.2. Robustness Tests

- (1)

- Replacing the independent variable

- (2)

- Replacing the dependent variable

6.3. Endogeneity Tests

6.4. Heterogeneity Tests

6.4.1. Regional Heterogeneity Tests

6.4.2. Digital Inclusive Finance Heterogeneity Tests

6.4.3. Carbon Source Heterogeneity Tests

6.5. Mechanism Verification

6.6. Further Analysis

6.6.1. Quantile Regression Model Regression Results

6.6.2. Spatial Panel Durbin Model Regression Results

7. Discussion

7.1. Research Conclusions

7.2. Suggestions

- (1)

- Leverage the technological effects of digital inclusive finance. According to the results of the panel fixed model, digital inclusive finance has a significant reduction effect on carbon emissions in agricultural and pastoral areas. Actively promoting the development of digital inclusive finance can help to expand agricultural production. Relying on China’s digital countryside and network construction, agricultural technology is gradually innovating and developing. To reduce carbon emissions in agricultural and pastoral areas, emphasis should be placed on leveraging the technological effects of digital inclusive finance, ensuring low-carbon upgrading of agriculture and animal husbandry while increasing production.

- (2)

- Give full play to the driving effect of digital inclusive finance. Make full use of various media to disseminate and promote new agricultural technologies so that farmers can learn more about new technology and use it in agricultural production. Integrating the various impacts of 5G, accelerate the construction of 5G base stations to realize faster platform information transmission for digital financial inclusion. Strengthen the construction and digital upgrading of rural broadband networks, mobile Internet, and other network information infrastructure; improve the communication quality of farmers; and expand the coverage of rural networks. Actively promote knowledge of digital inclusive finance and enhance its utilization in rural areas. Strengthen the promotion of digital inclusive finance in rural areas and improve the understanding and recognition of digital inclusive finance among farmers. Government and financial institution personnel should actively conduct digital inclusive finance education and training, promote the business products and characteristic services of digital inclusive finance, enable farmers and the public to understand more digital inclusive finance knowledge, master the application methods of various financial products, improve the financial literacy of agricultural operators, and gradually eliminate the digital divide.

- (3)

- Conduct product innovation by region and situation. According to the spatial clustering characteristics of agricultural carbon emissions, the regional clustering characteristics of agricultural carbon emissions are obvious, and the regional heterogeneity of digital inclusive finance has a significant impact. Moreover, the impact of digital inclusive finance on various carbon sources is different. Therefore, targeted product innovation should be conducted for different regions and carbon emission sources. Adapt to local conditions and develop digital inclusive finance based on the actual situation of each region, effectively reducing agricultural carbon emissions. Financial institutions should promote digital transformation; fully utilize big data and cloud computing technology; increase and innovate the types of financial service products; and develop more digital inclusive financial products with high operability, low transaction costs, and differentiation for rural areas in a targeted manner to improve the accuracy of financial service supply and demand matching.

- (4)

- Promote the emission reduction effect of capital deepening. Digital inclusive finance has promoted the development of capital deepening. Further, reduce the carbon emissions of agriculture and animal husbandry through the substitution of agricultural capital for human resources and the improvement of the technological level. Actively innovate agricultural technology based on actual investment and development of agricultural capital. Improve the development efficiency of digital inclusive finance, actively leverage the role of agricultural capital deepening in carbon reduction, and promote the reduction in agricultural carbon emissions. Continuously increase the amount of financial investment in agriculture and improve the quality of agricultural capital investment. According to the actual situation of provinces, counties, and townships, coordinate and integrate financial funds related to agriculture and ensure that the funds for the development of agricultural mechanization are used for the specified purposes.

- (5)

- Strengthen regional connections and cooperation. According to the results of the spatial econometric model, although the development of digital inclusive finance in a region plays a role in reducing agricultural carbon emissions, due to the spatial clustering characteristics of agricultural carbon emissions, surrounding areas can increase the agricultural carbon emissions in an area. Therefore, it is necessary to strengthen communication between the local and surrounding areas and ensure the effective implementation of carbon reduction work in the entire agricultural and animal husbandry industry through project cooperation or policy formulation. When developing development plans, the development of digital inclusive finance in adjacent areas should be included in the same planning system. On the one hand, strengthening the exchange and cooperation of digital inclusive finance-related activities between provincial regions and promoting regions with good development of digital inclusive finance will have a significant negative impact on agricultural carbon emissions in a region through knowledge and technology spillovers. On the other hand, measures should be taken to control the “siphon effect.” Resources should not be piled up in core development areas but should be reasonably allocated based on the advantages and characteristics of each region. If necessary, underdeveloped areas should be given a certain degree of tilt, thus forming a diversified, coordinated, and complementary digital development pattern.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Cheng, Q.W.; Xu, A.X.; Chen, Q. The Implementation Path of Agricultural Carbon Reduction under the Background of the “Dual Carbon” Goal—Based on the Verification of Digital Inclusive Finance. J. Southwest Univ. Natl. (Humanit. Soc. Sci. Ed.) 2022, 43, 115–126. [Google Scholar]

- Paramati, S.R.; Mo, D.; Gupta, R. The effects of stock market growth and renewable energy use on CO2 emissions: Evidence from g20 countries. Energy Econ. 2017, 66, 360–371. [Google Scholar] [CrossRef]

- Wang, J.; Wang, J.; Wang, Y.W. How does the development of digital finance affect the carbon intensity of manufacturing? China Popul. Resour. Environ. 2022, 32, 1–11. [Google Scholar]

- Chen, L.; Hu, W.T. A Study on the Synergistic Effects of Financial Development, Technological Progress, and Carbon Emissions: Based on VAR Analysis of Carbon Emissions in 30 Provinces in China from 2005 to 2017. Learn. Explor. 2020, 6, 117–124. [Google Scholar]

- Zhao, H. How does digital finance affect carbon emissions? Evidence from an emerging market. Sustainability 2021, 13, 12303. [Google Scholar] [CrossRef]

- Omri, A.; Daly, S.; Rault, C. Financial development, environmental quality, trade and economic growth: What causes what in MENA countries. Energy Econ. 2015, 48, 242–252. [Google Scholar] [CrossRef]

- Salahuddin, M.; Alam, K.; Ozturk, I.; Sohag, K. The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew. Sustain. Energy Rev. 2017, 81 Pt 2, 2002–2010. [Google Scholar] [CrossRef]

- Yessengali, O.; Murat, I. The impact of financial development on energy demand in transition economies. Glob. Econ. J. 2018, 18, 20180014. [Google Scholar] [CrossRef]

- Dasgupta, S.; Laplante, B.; Mamingi, N. Pollution and capital markets in developing countries. SSRN Electron. J. 1998, 42, 310–335. [Google Scholar] [CrossRef]

- Xiong, L.; Qi, S.Z. Financial Development and Regional Carbon Emissions in China: Based on the STIRPAT Model and Dynamic Panel Data Analysis. J. China Univ. Geosci. (Soc. Sci. Ed.) 2016, 16, 63–73. [Google Scholar]

- He, L.; Zhang, L.; Zhong, Z.; Wang, D.; Wang, F. Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. J. Clean. Prod. 2018, 208, 363–372. [Google Scholar] [CrossRef]

- Wang, W. County Finance and Green Total Factor Productivity Growth: Evidence from the Upper Reaches of the Yangtze River Economic Belt. Forum Stat. Inf. 2017, 32, 69–77. [Google Scholar]

- Shahbaz, M.; Solarin, S.A.; Mahmood, H. Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ. Model. 2013, 35, 145–152. [Google Scholar] [CrossRef]

- Lee, K.H.; Min, B. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 2015, 108, 534–542. [Google Scholar]

- Liu, S.; Liu, M. Green Finance, Economic Growth, and Environmental Change—Is it possible for the Northwest Regional Environmental Index to achieve the “Paris Commitment”? Contemp. Econ. Sci. 2020, 42, 71–84. [Google Scholar]

- Yang, X.Q.; Cai, L.M.; Zhang, J.S. A Study on the Relationship between Financial Innovation, Industrial Structure Upgrading, and Carbon Emissions from a Spatial Perspective. J. Xi’an Univ. Sci. Technol. 2022, 42, 791–799. [Google Scholar]

- Dogan, E.; Seker, F. Determinants of co2 emissions in the european union: The role of renewable and non-renewable energy. Renew. Energy 2016, 94, 429–439. [Google Scholar] [CrossRef]

- Bekhet, H.A.; Matar, A.; Yasmin, T. CO2 emissions, energy consumption, economic growth, and financial development in gcc countries: Dynamic simultaneous equation models. Renew. Sustain. Energy Rev. 2017, 70, 117–132. [Google Scholar] [CrossRef]

- Yan, C.L.; Li, T.; Lan, W. Financial development, innovation, and carbon dioxide emissions. Financ. Res. 2016, 1, 14–30. [Google Scholar]

- Li, D.S.; Xu, H.F.; Zhang, S.Y. Financial Development, Technological Innovation, and Carbon Emission Efficiency: Theoretical and Empirical Research. Explor. Econ. Issues 2018, 2, 169–174. [Google Scholar]

- Zhu, D.B.; Ren, L.; Liu, Y. Inclusive Financial Development, Economic Growth, and Carbon Emissions in China. China Popul. Resour. Environ. 2018, 2, 66–76. [Google Scholar]

- Sun, Z.H.; Chen, Y.L. Analysis of Financial Support, Technological Progress, and Energy Efficiency Based on Carbon Emission Constraints. Bus. Res. 2017, 5, 58–66. [Google Scholar]

- Liu, G.C.; Zhang, J.; Feng, C. Financial System Reform and Economic Efficiency Improvement: Empirical Analysis from Provincial Panel Data. Manag. World 2017, 6, 9–22+187. [Google Scholar]

- Beck, T.; Levine, R. Stock markets, banks, and growth: Panel evidence. J. Bank. Financ. 2004, 28, 423–442. [Google Scholar] [CrossRef]

- Xu, Z.; Gao, Y.; Huo, Z.F. The pollution reduction effect of digital finance. Financ. Sci. 2021, 4, 28–39. [Google Scholar]

- He, M.B.; Yang, X.W. Digital inclusive finance, carbon emissions, and total factor productivity. Financ. Forum 2021, 26, 18–25. [Google Scholar]

- Shen, Y.; Tang, H.Y.; Zhou, P.F. Can digital inclusive finance improve agricultural total factor productivity—Empirical Testing Based on Provincial Panel Data. J. Shanghai Lixin Sch. Account. Financ. 2021, 33, 15–27. [Google Scholar]

- Luo, W.L.; Liu, S.T.; Wang, Y.P. The Development of Digital Inclusive Finance and Carbon Reduction: An Empirical Test Based on County Panel Data. Fujian Financ. 2022, 2022, 3–15. [Google Scholar]

- Hamdi, H.; Sbia, R.; Shahbaz, M. The nexus between electricity consumption and economic growth in Bahrain. Econ. Model. 2014, 38, 227–237. [Google Scholar] [CrossRef]

- Wang, B.Y.; Zhang, W.G. Interprovincial Differences and Influencing Factors of Agricultural Ecological Efficiency in China: Based on Panel Data Analysis of 31 Provinces from 1996 to 2015. China Rural Econ. 2018, 1, 46–62. [Google Scholar]

- Huang, Y.C.; Huang, Y.S.; Hu, S.L.; Jia, L. Can digital finance promote green and low-carbon development? J. Nanjing Univ. Financ. Econ. 2022, 4, 88–97. [Google Scholar]

- Xu, W.C.; Mao, Y.J.; Qu, X.S. Research on the Impact of Rural Financial Development on Agricultural Carbon Emissions: Taking 17 Provincial-level Cities in Henan Province as an Example. Credit Inf. 2022, 40, 86–92. [Google Scholar]

- Wei, W.; Changcun, W.; Qi, C. The Impact of Agricultural Technology Progress on Agricultural Energy Use and Carbon Emissions: Analysis Based on GTAP-E Model. Agric. Technol. Econ. 2018, 2, 30–40. [Google Scholar]

- Sun, C.W.; Liu, X.Y.; Lin, J. Research on the Measurement and Convergence of China’s Total Factor Productivity under Carbon Intensity Constraints. Financ. Res. 2010, 6, 17–33. [Google Scholar]

- Zheng, W.T.; Zhao, H.Y.; Zhao, M.C. Is the development of digital finance beneficial for environmental pollution control—Discussion on the Regulating Role of Local Resource Competition. Ind. Econ. Res. 2022, 1, 1–13. [Google Scholar]

- Zhang, Z.P.; Wang, Q. Does the development of digital inclusive finance have a capital substitution effect on agricultural production—Empirical Research Based on Peking University Digital Inclusive Finance Index and CFPS Data. Financ. Rev. 2021, 13, 98–116+120. [Google Scholar]

- Yan, H. Transformation of the Urbanization of China’s Western Region. Inq. Into Econ. Issues 2013, 2, 69–74. [Google Scholar]

- Guo, W.; Zeng, X.X. Has green credit improved industrial green total factor productivity—Empirical research based on spatial Durbin model. Econ. Issues 2021, 8, 44–55. [Google Scholar]

- Sun, S.H.; Liu, C.M.; Chen, X.N. Digital Countryside, Network Spillovers, and Agricultural Green Total Factor Productivity. Agric. Resour. Reg. China 2022, 6, 1–19. [Google Scholar]

- Zhang, M.; Peng, S.G.; Liu, X. Analysis of carbon emission effects of land intensive use from the perspective of spatial interaction. Resour. Dev. Mark. 2022, 38, 1296–1303+1313. [Google Scholar]

- Chao, X.; Xue, Z.; Sun, Y. How the New Digital Infrastructure Affects the Upgrading of Foreign Trade: Evidence from Chinese Cities. Sustainability 2020, 42, 46–59. [Google Scholar]

- Wen, Z.L.; Ye, B.J. Mediation Effects Analysis: Methodology and Model Development. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Machado, J.A.F.; Silva, J.M.C.S. Quantiles Via Moments. J. Econom. 2019, 213, 145–173. [Google Scholar] [CrossRef]

- Anselin, L. Spatial Effects in Econometric Practice in Environmental and Resource Economics. Am. J. Agric. Econ. 2001, 83, 705–710. [Google Scholar] [CrossRef]

- Tian, Y.; Zhang, Y.L. Research on the Effectiveness Evaluation, Target Reconstruction, and Path Optimization of Carbon Emission Reduction in China’s Agriculture. Resour. Environ. Arid Areas 2019, 33, 1–7. [Google Scholar]

- He, Y.Q.; Chen, R.; Wu, H.Y. A Dynamic Study on the Spatial Pattern and Influencing Factors of Agricultural Carbon Emissions in China. Chin. J. Ecol. Agric. 2018, 26, 1269–1282. [Google Scholar]

- Min, J.S.; Hu, H. Estimation of greenhouse gas emissions from agricultural production in China. China Popul. Resour. Environ. 2012, 22, 21–27. [Google Scholar]

- Xu, X.X.; Zhou, J.M.; Shu, Y. Estimated Capital Stock of Three Industries in China’s Provinces and Regions. Stat. Res. 2007, 5, 6–13. [Google Scholar]

- Li, G.C.; Fan, L.X.; Feng, Z.C. Capital Accumulation, Institutional Changes, and Agricultural Growth: An Empirical Estimation of China’s Agricultural Growth and Capital Stock from 1978 to 2011. Manag. World 2014, 5, 67–79+92. [Google Scholar]

| Intestinal Fermentation Factors | Fecal Management Factors | |

|---|---|---|

| Cows | 395.56 | 24.55 |

| Horses | 122.76 | 11.18 |

| Donkeys | 68.21 | 6.14 |

| Mules | 68.21 | 6.14 |

| Pigs | 6.82 | 27.28 |

| Goats | 34.11 | 1.16 |

| Sheep | 34.11 | 1.02 |

| Province | Early Rice | Late Rice | Midseason Rice |

|---|---|---|---|

| Beijing | 0 | 0 | 13.23 |

| Tianjin | 0 | 0 | 11.34 |

| Hebei | 0 | 0 | 15.33 |

| Shanxi | 0 | 0 | 6.62 |

| Inner Mongolia | 0 | 0 | 8.93 |

| Liaoning | 0 | 0 | 9.24 |

| Jilin | 0 | 0 | 5.57 |

| Heilongjiang | 0 | 0 | 8.31 |

| Shanghai | 12.41 | 27.5 | 53.87 |

| Jiangsu | 16.07 | 27.6 | 53.55 |

| Zhejiang | 14.37 | 34.5 | 57.96 |

| Anhui | 16.75 | 27.6 | 51.24 |

| Fujian | 7.74 | 52.6 | 43.47 |

| Jiangxi | 15.47 | 45.8 | 65.42 |

| Shandong | 0 | 0 | 21 |

| Henan | 0 | 0 | 17.85 |

| Hubei | 17.51 | 39 | 58.17 |

| Hunan | 14.71 | 34.1 | 56.28 |

| Guangdong | 15.05 | 51.6 | 57.02 |

| Guangxi | 12.41 | 49.1 | 47.78 |

| Hainan | 13.43 | 49.4 | 52.29 |

| Chongqing | 6.55 | 18.5 | 25.73 |

| Sichuan | 6.55 | 18.5 | 25.73 |

| Guizhou | 5.1 | 21 | 22.05 |

| Yunnan | 2.38 | 7.6 | 7.25 |

| Tibet | 0 | 0 | 6.83 |

| Shaanxi | 0 | 0 | 12.51 |

| Gansu | 0 | 0 | 6.83 |

| Qinghai | 0 | 0 | 0 |

| Ningxia | 0 | 0 | 7.35 |

| Xinjiang | 0 | 0 | 10.5 |

| Variables | Definition | Variable Characterization | Obs | Mean | Std. Dev. |

|---|---|---|---|---|---|

| cpz | Agricultural carbon emissions | Total agricultural carbon emissions | 341 | 854.3848 | 548.615 |

| index | Digital inclusive finance | Digital inclusive finance index (100) | 341 | 2.304609 | 1.033629 |

| kl | Capital labor ratio | Capital stock/number of people in the primary industry | 341 | 6.966548 | 7.627917 |

| str | Agricultural industrial structure | Total agricultural production/agriculture–forestry–stockbreeding production | 341 | 0.5279481 | 0.0877235 |

| edu | Rural education level | (Number of illiterates ×0+ number of primary school graduates ×6+ junior high school graduates ×9+ Number of high school and technical secondary school graduates ×12+ number of college and undergraduate graduates ×16/total population above 6 years | 341 | 7.703152 | 0.8280648 |

| gov | Government intervention | Agricultural, forestry, and water subsidies/total government expenditure | 341 | 0.1157818 | 0.0339396 |

| mac | Mechanized degree | Total power of the agricultural machinery | 341 | 3332.937 | 2921.85 |

| disb | Proportion of natural disasters | Crop disaster area/agricultural sowing area | 341 | 0.1408618 | 0.1145498 |

| rgdp | Actual per capita agriculture–forestry–stockbreeding production. | Actual capita agriculture–forestry–stockbreeding production/number of people in the primary industry | 341 | 4.069768 | 2.066237 |

| urb | Urbanization | Urban population/rural population | 341 | 1.820467 | 1.635456 |

| zpop | Population situation | Population growth rate (%) | 341 | 0.5030584 | 1.004845 |

| zrgdp | Economic growth situation | Real per capita GDP growth rate (%) | 341 | 8.050862 | 2.966363 |

| fin | Financial development level | Sum of deposit and loan balances of financial institutions/GDP | 341 | 3.454536 | 1.132274 |

| lncpz | ||||

|---|---|---|---|---|

| index | −0.0270 | −0.524 * | −0.0579 * | −0.295 * |

| (−1.81) | (−2.43) | (−2.66) | (−2.21) | |

| _cons | 6.470 *** | 6.630 *** | 5.327 *** | 4.968 *** |

| (188.02) | (68.99) | (5.85) | (6.53) | |

| Control variable | No | No | Yes | Yes |

| Province FE | Yes | Yes | Yes | Yes |

| Year FE | No | Yes | No | Yes |

| R2 | 0.0831 | 0.2947 | 0.4047 | 0.5613 |

| lncpz | lncpzq | |||

|---|---|---|---|---|

| L.index | −0.501 * | −0.301 * | ||

| (−2.51) | (−2.14) | |||

| index | −0.133 *** | −0.056 5 *** | ||

| (−11.90) | (−4.97) | |||

| _cons | 6.621 *** | 4.933 *** | −0.828 *** | −0.966 * |

| (73.50) | (6.28) | (−32.22) | (−2.42) | |

| Control variable | No | Yes | No | Yes |

| Province FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | No | No | No |

| R2 | 0.3089 | 0.5581 | 0.7548 | 0.8069 |

| lncpz | ||||

|---|---|---|---|---|

| 2SLS Phase I | 2SLS Phase II | 2SLS Phase I | 2SLS Phase II | |

| index | −1.031 *** | −0.477 ** | ||

| (−6.64) | (−2.85) | |||

| interaction term | −0.042 *** | −0.041 *** | ||

| (−6.70) | (−6.34) | |||

| _cons | 1.312 *** | 4.608 *** | 0.376 | 2.244 *** |

| (24.21) | (26.72) | (0.74) | (5.59) | |

| Control variable | No | No | Yes | Yes |

| Province FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| R2 | 0.9962 | 0.9926 | 0.9961 | 0.9963 |

| Eastern | Central | Western | |

|---|---|---|---|

| index | −0.0669 ** | 0.0429 | 0.0262 |

| (-3.47) | (2.13) | (0.89) | |

| _cons | 3.983 * | 8.791 *** | 6.218 *** |

| (3.07) | (11.60) | (6.18) | |

| Control variable | Yes | Yes | Yes |

| Province FE | Yes | Yes | Yes |

| Year FE | No | No | Yes |

| R2 | 0.7128 | 0.3138 | 0.3639 |

| lncpz | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Coverage _breadth | 0.0586 | −0.104 | ||||

| (0.40) | (−0.62) | |||||

| Usage_depth | −0.343 ** | −0.195 ** | ||||

| (−3.08) | (−2.78) | |||||

| Digitization _level | −0.165 * | −0.0678 | ||||

| (−2.20) | (−1.97) | |||||

| _cons | 6.400 *** | 6.581 *** | 6.496 *** | 4.879 *** | 4.836 *** | 5.037 *** |

| (111.39) | (107.39) | (132.43) | (5.74) | (6.78) | (6.04) | |

| Control variable | No | No | No | Yes | Yes | Yes |

| Province FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.1519 | 0.3654 | 0.2494 | 0.5244 | 0.5768 | 0.5378 |

| lncpz | ||||||

|---|---|---|---|---|---|---|

| Payment | −0.000508 * | |||||

| (−2.69) | ||||||

| Insurance | −0.000108 ** | |||||

| (−2.95) | ||||||

| Monetary fund | −0.0000995 | |||||

| (−0.78) | ||||||

| Investment | −0.000510 ** | |||||

| (−2.79) | ||||||

| Credit | −0.000982 ** | |||||

| (−3.06) | ||||||

| Credit_ investigation | −0.000263 * | |||||

| (−2.11) | ||||||

| _cons | 5.473 *** | 5.393 *** | 5.776 *** | 4.790 *** | 5.149 *** | 6.495 *** |

| (6.18) | (6.13) | (7.76) | (5.61) | (5.78) | (6.23) | |

| Control variable | Yes | Yes | Yes | Yes | Yes | Yes |

| Province FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.3954 | 0.3786 | 0.4770 | 0.4510 | 0.4094 | 0.4932 |

| Fertilizers | Pesticides | Agriculture Film | Agriculture Diesel | Agriculture Tillage | Irrigation | Husbandry | Rice Planting | Soil Emissions | |

|---|---|---|---|---|---|---|---|---|---|

| index | −0.309 ** | −0.212 | −0.0683 | 0.145 | −0.393 *** | −0.154 * | −1.005 *** | −0.276 | −0.252 * |

| (−3.57) | (−1.60) | (−0.62) | (0.71) | (-3.84) | (−2.13) | (−4.23) | (−0.98) | (−2.50) | |

| _cons | 3.720 *** | 1.471 | 1.183 | 0.637 | −1.438 | −0.0851 | 4.531 *** | 4.100 ** | 3.361 *** |

| (6.33) | (1.74) | (1.74) | (0.29) | (−1.84) | (−0.22) | (4.68) | (3.08) | (4.98) | |

| Control variable | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Province FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.6932 | 0.7209 | 0.5093 | 0.3545 | 0.5645 | 0.4454 | 0.6446 | 0.1477 | 0.6152 |

| lncpz | lnkl | lncpz | |

|---|---|---|---|

| (7) | (8) | (9) | |

| index | −0.295 * | 0.924 * | −0.225 *** |

| (−2.21) | (2.49) | (−3.69) | |

| lnkl | −0.0757 *** | ||

| (−4.53) | |||

| _cons | 4.968 *** | −0.187 | 4.954 *** |

| (6.53) | (−0.09) | (12.69) | |

| Control variable | Yes | Yes | Yes |

| Province FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| R2 | 0.5613 | 0.8879 | 0.5937 |

| lncpz | |||

|---|---|---|---|

| q30 | q60 | q90 | |

| index | −0.0376 * | −0.0477 ** | −0.0466 ** |

| (−2.16) | (−3.05) | (−3.12) | |

| _cons | 2.042 * | 3.160 *** | 3.912 *** |

| (2.56) | (4.48) | (5.74) | |

| Control variable | Yes | Yes | Yes |

| R2 | 0.9445 | 0.9353 | 0.9294 |

| lncpz | ||

|---|---|---|

| Index | −0.659 *** | −0.415 *** |

| (−8.42) | (−5.72) | |

| W × index | 0.648 *** | 0.390 *** |

| (8.26) | (5.22) | |

| Direct_index | −0.604 *** | −0.389 *** |

| (−8.21) | (−5.57) | |

| Indirect_index | 0.572 *** | 0.349 *** |

| (7.65) | (4.78) | |

| Total_index | −0.0327 ** | −0.0399 |

| (−3.13) | (−1.92) | |

| rho | 0.646 *** | 0.371 *** |

| (13.41) | (5.64) | |

| Sigma2_e | 0.00455 *** | 0.00317 *** |

| (12.52) | (12.86) | |

| Control variable | No | Yes |

| R2 | 0.2070 | 0.5958 |

| Log-likelihood | 414.4852 | 491.2942 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hong, H.; Sun, L.; Zhao, L. Exploring the Impact of Digital Inclusive Finance on Agricultural Carbon Emissions: Evidence from the Mediation Effect of Capital Deepening. Sustainability 2024, 16, 3071. https://doi.org/10.3390/su16073071

Hong H, Sun L, Zhao L. Exploring the Impact of Digital Inclusive Finance on Agricultural Carbon Emissions: Evidence from the Mediation Effect of Capital Deepening. Sustainability. 2024; 16(7):3071. https://doi.org/10.3390/su16073071

Chicago/Turabian StyleHong, Hua, Lili Sun, and Lijuan Zhao. 2024. "Exploring the Impact of Digital Inclusive Finance on Agricultural Carbon Emissions: Evidence from the Mediation Effect of Capital Deepening" Sustainability 16, no. 7: 3071. https://doi.org/10.3390/su16073071

APA StyleHong, H., Sun, L., & Zhao, L. (2024). Exploring the Impact of Digital Inclusive Finance on Agricultural Carbon Emissions: Evidence from the Mediation Effect of Capital Deepening. Sustainability, 16(7), 3071. https://doi.org/10.3390/su16073071