Long-Term Planning for a Mixed Urban Freight Fleet with EVs and ICEVs in the USA

Abstract

:1. Introduction

2. Materials and Methods

2.1. Methodology

2.1.1. Assumptions

- The EV and ICEV fleets are homogeneous. This means that all EVs and ICEVs have the same characteristics (e.g., load capacity).

- The EVs charge fully charge overnight, and do not recharge during the day.

- The available grid capacity is enough to accommodate all charging stations.

- The available grid capacity is cumulative and distributed equally across all hub locations.

- The demand nodes represent aggregate demand points and not specific client locations, and are located at the center of the neighborhoods of the study area.

- The demand at each demand node is the same.

- The hub locations already exist and are owned by the freight carrier.

- We consider the existing customer demand for each of the hubs based on the outbound number of vehicles on an average day.

- We do not take into account any degradation of the lithium-ion batteries used in the freight EVs for the lifetime costs of these vehicles.

2.1.2. Model Formulation

2.2. Data

3. Solution Approach

4. Model Testing

5. Results

5.1. Sensitivity Analysis

5.2. Planning Decisions

5.3. Model Application across the US

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Amazon’s 2021 Sustainability Report. 2021. Available online: https://sustainability.aboutamazon.com/2021-sustainability-report.pdf (accessed on 5 April 2024).

- FedEx, Charged up about Our Future. 2022. Available online: https://www.fedex.com/en-us/sustainability/electric-vehicles.html (accessed on 7 May 2023).

- UPS, Sustainable Services, Electrifying Our Future. 2022. Available online: https://about.ups.com/us/en/social-impact/environment/sustainable-services/electric-vehicles—about-ups.html (accessed on 7 May 2023).

- USPS Intends to Deploy over 66,000 Electric Vehicles by 2028, Making One of the Largest Electric Vehicle Fleets in the Nation. 2022. Available online: https://about.usps.com/newsroom/national-releases/2022/1220-usps-intends-to-deploy-over-66000-electric-vehicles-by-2028.htm (accessed on 7 May 2023).

- Gonzalez, J.N.; Gomez, J.; Vassallo, J.M. Do urban parking restrictions and Low Emission Zones encourage a greener mobility? Transp. Res. Part D Transp. Environ. 2022, 107, 103319. [Google Scholar] [CrossRef]

- Figliozzi, M.A.; Boudart, J.A.; Feng, W. Economic and Environmental Optimization of Vehicle Fleets: Impact of Policy, Market, Utilization, and Technological Factors. Transp. Res. Rec. 2011, 2252, 1–6. [Google Scholar] [CrossRef]

- Chen, Z.; Carrel, A.L.; Gore, C.; Shi, W. Environmental and economic impact of electric vehicle adoption in the U.S. Environ. Res. Lett. 2021, 16, 045011. [Google Scholar] [CrossRef]

- İmre, Ş.; Çelebi, D.; Koca, F. Understanding barriers and enablers of electric vehicles in urban freight transport: Addressing stakeholder needs in Turkey. Sustain. Cities Soc. 2021, 68, 102794. [Google Scholar] [CrossRef]

- Tarei, P.K.; Chand, P.; Gupta, H. Barriers to the adoption of electric vehicles: Evidence from India. J. Clean. Prod. 2021, 291, 125847. [Google Scholar] [CrossRef]

- Mehar, S.; Zeadally, S.; Rémy, G.; Senouci, S.M. Sustainable Transportation Management System for a Fleet of Electric Vehicles. IEEE Trans. Intell. Transp. Syst. 2015, 16, 1401–1414. [Google Scholar] [CrossRef]

- Feng, W.; Figliozzi, M.A. Conventional vs. Electric Commercial Vehicle Fleets: A Case Study of Economic and Technological Factors Affecting the Competitiveness of Electric Commercial Vehicles in the USA. Procedia-Soc. Behav. Sci. 2012, 39, 702–711. [Google Scholar] [CrossRef]

- Laporte, G.; Nobert, Y. An exact algorithm for minimizing routing and operating costs in depot location. Eur. J. Oper. Res. 1981, 6, 224–226. [Google Scholar] [CrossRef]

- Murtagh, B.A.; Niwattisyawong, S.R. An Efficient Method for the Multi-Depot Location-Allocation Problem. J. Oper. Res. Soc. 1982, 33, 629–634. [Google Scholar]

- Gendron, B.; Crainic, T.G. A branch-and-bound algorithm for depot location and container fleet management. Locat. Sci. 1995, 3, 39–53. [Google Scholar] [CrossRef]

- Campbell, J.F. Hub Location and the p-Hub Median Problem. Oper. Res. 1996, 44, 923–935. [Google Scholar] [CrossRef]

- Bourbeau, B.; Gabriel Crainic, T.; Gendron, B. Branch-and-bound parallelization strategies applied to a depot location and container fleet management problem. Parallel Comput. 2000, 26, 27–46. [Google Scholar] [CrossRef]

- Taherkhani, G.; Alumur, S.A. Profit maximizing hub location problems. Omega 2019, 86, 1–15. [Google Scholar] [CrossRef]

- Çağrı, K.; Bektaş, T.; Jabali, O.; Laporte, G. The impact of depot location, fleet composition and routing on emissions in city logistics. Transp. Res. Part B Methodol. 2016, 84, 81–102. [Google Scholar] [CrossRef]

- Mohammadi, M.; Torabi, S.; Tavakkoli-Moghaddam, R. Sustainable hub location under mixed uncertainty. Transp. Res. Part E Logist. Transp. Rev. 2014, 62, 89–115. [Google Scholar] [CrossRef]

- Anderluh, A.; Hemmelmayr, V.C.; Rüdiger, D. Analytic hierarchy process for city hub location selection—The Viennese case. Transp. Res. Procedia 2020, 46, 77–84. [Google Scholar] [CrossRef]

- Charting the Course for Early Truck Electrification. 2022. Available online: https://rmi.org/insight/electrify-trucking (accessed on 6 April 2024).

- Ahani, P.; Arantes, A.; Melo, S. A portfolio approach for optimal fleet replacement toward sustainable urban freight transportation. Transp. Res. Part D Transp. Environ. 2016, 48, 357–368. [Google Scholar] [CrossRef]

- Sayarshad, H.R.; Mahmoodian, V.; Bojović, N. Dynamic Inventory Routing and Pricing Problem with a Mixed Fleet of Electric and Conventional Urban Freight Vehicles. Sustainability 2021, 13, 6703. [Google Scholar] [CrossRef]

- Hiermann, G.; Hartl, R.F.; Puchinger, J.; Vidal, T. Routing a Mix of Conventional, Plug-in Hybrid, and Electric Vehicles. HAL 2019, 272, 235–248. [Google Scholar] [CrossRef]

- Goeke, D.; Schneider, M. Routing a mixed fleet of electric and conventional vehicles. Eur. J. Oper. Res. 2015, 245, 81–99. [Google Scholar] [CrossRef]

- All-New, All-Electric E-Transit Custom from Ford Pro Is Set to Spark the EV Revolution for Small Businesses. 2022. Available online: https://media.ford.com/content/fordmedia/feu/en/news/2022/09/08/all-new–all-electric-e-transit-custom-from-ford-pro-is-set-to-s. (accessed on 16 December 2022).

- Metro Neighborhoods in King County. 2012. Available online: https://www5.kingcounty.gov/sdc/Metadata.aspx?Layer=neighborhood (accessed on 6 March 2023).

- Koordinates US Cities GIS Data. 2023. Available online: https://koordinates.com/data/ (accessed on 28 October 2023).

- Distance on a Sphere: The Haversine Formula. 2017. Available online: https://community.esri.com/t5/coordinate-reference-systems-blog/distance-on-a-sphere-the-haversine-formula (accessed on 6 March 2023).

- Washington State Profiles and Energy Estimates. 2023. Available online: https://www.eia.gov/state/?sid=WA#tabs-4 (accessed on 1 May 2023).

- Nicholas, M. Estimating Electric Vehicle Charging Infrastructure Costs Across Major U.S. Metropolitan Areas; ICCT: Washington, DC, USA, 2019. [Google Scholar]

- Electric Vehicle Charging Speeds—U.S. Department of Transportation. 2023. Available online: https://www.transportation.gov/rural/ev/toolkit/ev-basics/charging-speeds (accessed on 1 May 2023).

- Business Rates—City of Seattle. 2023. Available online: https://www.seattle.gov/city-light/business-solutions/business-billing-and-account-information/business-rates#burienseatacshorelineandunincorporatedkingcountybusinesses (accessed on 1 May 2023).

- Petroleum and Other Liquids—U.S. Energy Information Administration. 2023. Available online: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=emm_epmru_pte_y48se_dpg&f=m (accessed on 1 May 2023).

- Fuel Economy—U.S. Department of Energy. 2022. Available online: https://www.fueleconomy.gov/feg/noframes/44952.shtml (accessed on 1 May 2023).

- How Many Miles & Years Do Ford Transits Last? (8 Important Facts). 2020. Available online: https://motorandwheels.com/do-ford-transits-last-long/ (accessed on 7 June 2023).

- Electric Vehicle Charger Maintenance Basics. 2022. Available online: https://www.365pronto.com/blog/electric-vehicle-charger-maintenance (accessed on 7 June 2023).

- How Many Miles Will A Mercedes Metris Last? 2023. Available online: https://vehq.com/how-many-miles-will-a-mercedes-metris-last/ (accessed on 7 June 2023).

- US Electricity Profile 2021. 2022. Available online: https://www.eia.gov/electricity/state/ (accessed on 1 August 2023).

- State Gas Price Averages. 2023. Available online: https://gasprices.aaa.com/state-gas-price-averages/ (accessed on 1 August 2023).

- 2017 Mercedes-Benz Metris Passenger Van Review. 2017. Available online: https://www.automoblog.net/2017-mercedes-benz-metris-passenger-van-review/ (accessed on 7 July 2023).

- Amazon.com Announces Fourth Quarter Results. 2023. Available online: https://ir.aboutamazon.com/news-release/news-release-details/2023/Amazon.com-Announces-Fourth-Quarter-Results/default.aspx (accessed on 25 July 2023).

- Bestuzheva, K.; Besançon, M.; Chen, W.K.; Chmiela, A.; Donkiewicz, T.; van Doornmalen, J.; Eifler, L.; Gaul, O.; Gamrath, G.; Gleixner, A.; et al. The SCIP Optimization Suite 8.0. arXiv 2021, arXiv:2112.08872. [Google Scholar]

- Alp, O.; Tan, T.; Udenio, M. Transitioning to sustainable freight transportation by integrating fleet replacement and charging infrastructure decisions. Omega 2022, 109, 102595. [Google Scholar] [CrossRef]

- Melander, L.; Nyquist-Magnusson, C.; Wallström, H. Drivers for and barriers to electric freight vehicle adoption in Stockholm. Transp. Res. Part D Transp. Environ. 2022, 108, 103317. [Google Scholar] [CrossRef]

| Parameters | Values | Units | Source |

|---|---|---|---|

| 15 | years | [36] | |

| 14 | years | [38] | |

| 10 | years | [37] | |

| 7,548,000,000 × 12 | kWh/year | [30] | |

| 5432 | USD | [31] | |

| 49,575 | USD/vehicle | [26] | |

| 37,960 | kWh/one full charge per day for a year | [26] | |

| USD/mile | [33] | ||

| USD/mile | [34] | ||

| 14,205 | USD/vehicle | [36] | |

| 25,200 | USD/vehicle | [38] | |

| 33,000 | USD/vehicle | [41] | |

| 4000 | USD/charger | [37] | |

| 5500 | USD | [42] |

| Scenario | Description | |

|---|---|---|

| Baseline | All inputs are used as presented in the Section 2.2 | |

| External cost | Scenario 1 | Electricity cost is variable |

| External cost | Scenario 2 | Gasoline cost is variable |

| External cost | Scenario 3 | Electricity and gasoline costs are variable |

| Incentive | Scenario 4 | EV purchase cost incentive is variable |

| Scenario | EV Charging Cost (USD) | ICEV Refueling Cost (USD) | Total Fuel Cost (USD) | Total Fuel Cost Change (%) |

|---|---|---|---|---|

| Baseline | 171,622.9 | 0 | 171,622.9 | 0 |

| Scenario 1 | ||||

| Electricity cost change (%) | ||||

| −30 | 120,136.0 | 0 | 120,136.0 | −30 |

| −20 | 137,298.3 | 0 | 137,298.3 | −20 |

| −10 | 154,460.6 | 0 | 154,460.6 | −10 |

| +10 | 188,785.2 | 0 | 188,785.2 | +10 |

| +20 | 205,947.4 | 0 | 205,947.4 | +20 |

| +30 | 197,929.0 | 98,444.3 | 296,373.2 | +73 |

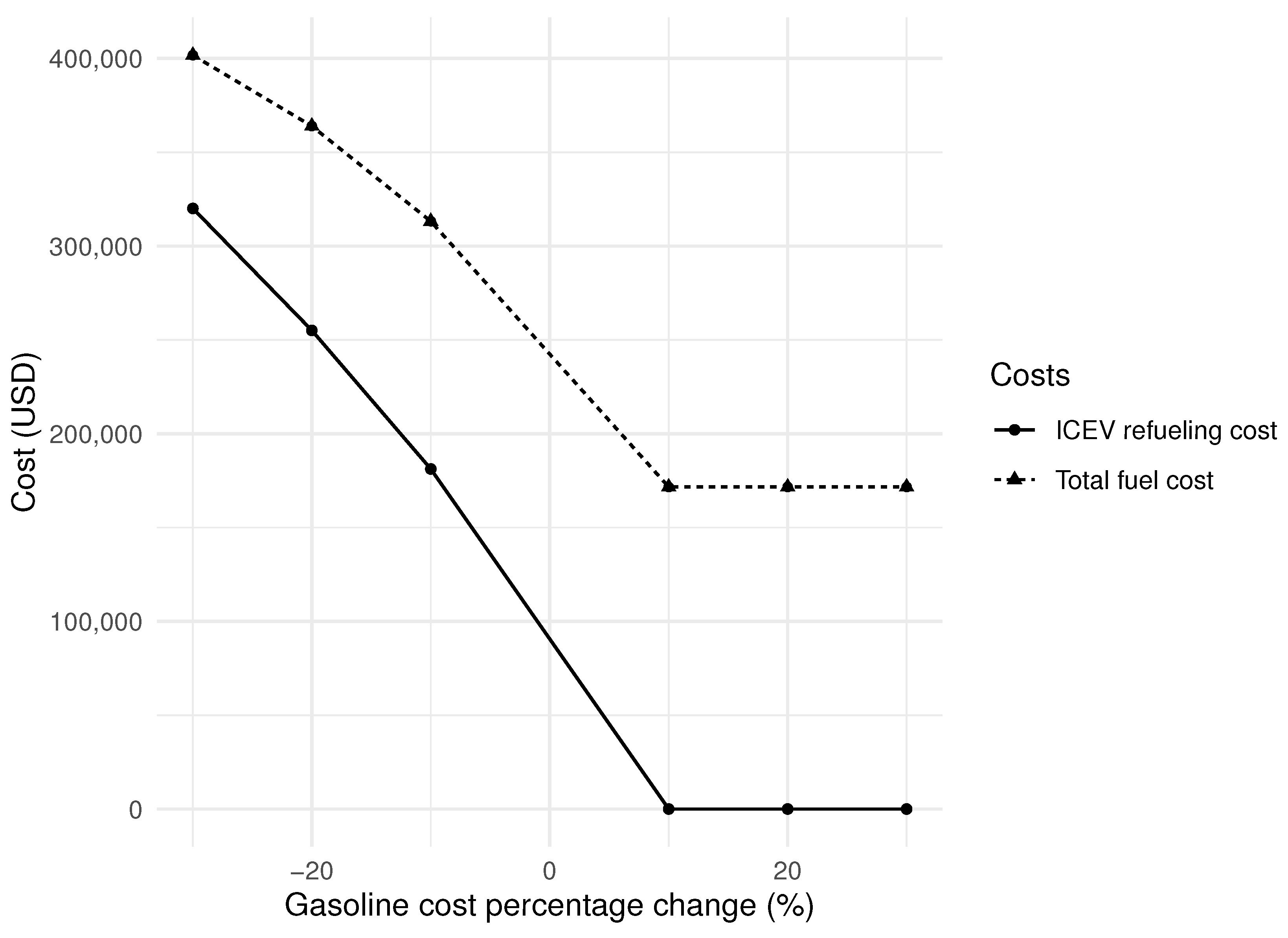

| Scenario | EV Charging Cost (USD) | ICEV Refueling Cost (USD) | Total Fuel Cost (USD) | Total Fuel Cost Change (%) |

|---|---|---|---|---|

| Baseline | 171,622.9 | 0 | 171,622.9 | 0% |

| Scenario 2 | ||||

| Gasoline cost change (%) | ||||

| −30 | 81,651.0 | 320,088.2 | 401,739.2 | −134 |

| −20 | 108,884.0 | 255,088.7 | 363,972.8 | −112 |

| −10 | 132,003.9 | 181,222.0 | 313,225.8 | −83 |

| +10 | 171,622.9 | 0 | 171,622.9 | 0 |

| +20 | 171,622.9 | 0 | 171,622.9 | 0 |

| +30 | 171,622.9 | 0 | 171,622.9 | 0 |

| Scenario | EV Charging Cost (USD) | ICEV Refueling Cost (USD) | Total Fuel Cost (USD) | Total Fuel Cost Change (%) | |

|---|---|---|---|---|---|

| Baseline | 171,622.9 | 0 | 171,622.9 | 0% | |

| Scenario 3 | |||||

| Electricity cost change (%) | Gasoline cost change (%) | ||||

| −30 | +30 | 120,136.0 | 0 | 120,136.0 | −30 |

| −20 | +20 | 137,298.3 | 0 | 137,298.3 | −20 |

| −10 | +10 | 154,460.6 | 0 | 154,460.6 | −10 |

| +10 | −10 | 145,204.3 | 181,222.0 | 326,426.2 | +90 |

| +20 | −20 | 130,660.8 | 255,088.7 | 385,749.6 | +125 |

| +30 | −30 | 106,146.3 | 320,088.2 | 426,234.5 | +148 |

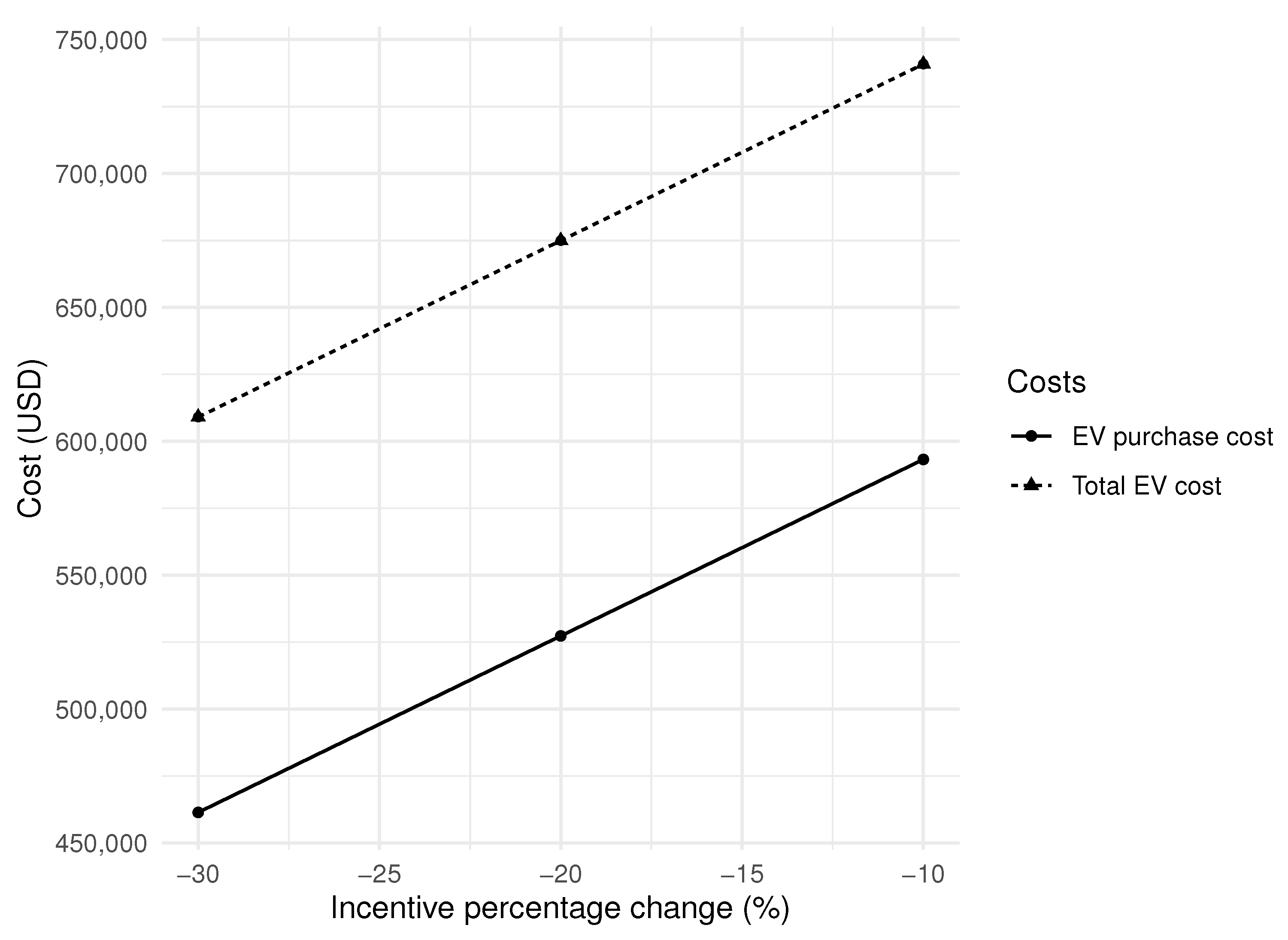

| Scenario | EV Maintenance Cost (USD) | EV Purchase Cost (USD) | Total EV Cost (USD) | Total EV Cost Change (%) |

|---|---|---|---|---|

| Baseline | 147,648 | 659,136 | 806,784 | 0 |

| Scenario 4 | ||||

| Incentive—EV cost change (%) | ||||

| −30 | 147,648.0 | 461,395.2 | 609,043.2 | −25 |

| −20 | 147,648.0 | 527,308.8 | 674,956.8 | −16 |

| −10 | 147,648.0 | 593,222.4 | 740,870.4 | −8 |

| Scenario | Number of EVs | Number of ICEVs | EV Share (%) | |

|---|---|---|---|---|

| Baseline | 192 | 0 | 100 | |

| Scenario 1 | ||||

| Electricity cost change (%) | ||||

| −30 | 192 | 0 | 100 | |

| −20 | 192 | 0 | 100 | |

| −10 | 192 | 0 | 100 | |

| +10 | 192 | 0 | 100 | |

| +20 | 192 | 0 | 100 | |

| +30 | 162 | 30 | 84.4 | |

| Scenario 2 | ||||

| Gasoline cost change (%) | ||||

| −30 | 72 | 120 | 37.5 | |

| −20 | 102 | 90 | 53.1 | |

| −10 | 132 | 60 | 68.8 | |

| +10 | 192 | 0 | 100 | |

| +20 | 192 | 0 | 100 | |

| +30 | 192 | 0 | 100 | |

| Scenario 3 | ||||

| Electricity cost change (%) | Gasoline cost change (%) | |||

| −30 | +30 | 192 | 0 | 100 |

| −20 | +20 | 192 | 0 | 100 |

| −10 | +10 | 192 | 0 | 100 |

| +10 | −10 | 132 | 60 | 68.8 |

| +20 | −20 | 102 | 90 | 53.1 |

| +30 | −30 | 72 | 120 | 37.5 |

| Scenario 4 | ||||

| Incentive—EV cost change (%) | ||||

| −30 | 192 | 0 | 100 | |

| −20 | 192 | 0 | 100 | |

| −10 | 192 | 0 | 100 | |

| State | Gasoline Prices per Gallon | Difference to WA (%) |

|---|---|---|

| Washington | $4.950 | 0 |

| Mississippi | $3.253 | −41.38 |

| California | $4.998 | +0.97 |

| State | Electricity Prices per kWh | Difference to WA (%) |

|---|---|---|

| Washington | $0.0875 | 0 |

| Idaho | $0.0817 | −6.86 |

| Hawaii | $0.3031 | +110.39 |

| High Miles | Low Miles | |

|---|---|---|

| High price spread | San Diego | Portland |

| Low price spread | Dallas | New York City |

| City | Gasoline Price ($/gallon) | Electricity Price ($/kWh) | Price Spread |

|---|---|---|---|

| Dallas | 3.42 | 0.0914 | 3.3286 |

| New York City | 3.93 | 0.1611 | 3.7689 |

| Portland | 5.79 | 0.1965 | 5.5935 |

| San Diego | 4.69 | 0.0895 | 4.6005 |

| City | Average Distance (Miles) |

|---|---|

| Dallas | 18.5 |

| New York City | 9.1 |

| Portland | 9.4 |

| San Diego | 19.0 |

| Scenario | Number of EVs | Number of ICEVs | EV Share (%) | |

|---|---|---|---|---|

| Baseline | 3 | 137 | 2.1 | |

| Scenario 1 | ||||

| Electricity cost change (%) | ||||

| −30 | 20 | 120 | 14.3 | |

| −20 | 20 | 120 | 14.3 | |

| −10 | 3 | 137 | 2.1 | |

| +10 | 3 | 137 | 2.1 | |

| +20 | 2 | 138 | 1.4 | |

| +30 | 1 | 139 | 0.7 | |

| Scenario 2 | ||||

| Gasoline cost change (%) | ||||

| −30 | 0 | 140 | 0 | |

| −20 | 0 | 140 | 0 | |

| −10 | 1 | 139 | 0.7 | |

| +10 | 20 | 120 | 14.3 | |

| +20 | 50 | 90 | 35.7 | |

| +30 | 110 | 30 | 78.6 | |

| Scenario 3 | ||||

| Electricity cost change (%) | Gasoline cost change (%) | |||

| −30 | +30 | 140 | 0 | 100 |

| −20 | +20 | 80 | 60 | 57.1 |

| −10 | +10 | 20 | 120 | 14.3 |

| +10 | −10 | 0 | 140 | 0 |

| +20 | −20 | 0 | 140 | 0 |

| +30 | −30 | 0 | 140 | 0 |

| Scenario 4 | ||||

| Incentive—EV cost change (%) | ||||

| −30 | 140 | 0 | 100 | |

| −20 | 80 | 60 | 57.1 | |

| −10 | 20 | 120 | 14.3 | |

| Scenario | Number of EVs | Number of ICEVs | EV Share (%) | |

|---|---|---|---|---|

| Baseline | 0 | 116 | 0 | |

| Scenario 1 | ||||

| Electricity cost change (%) | ||||

| −30 | 2 | 114 | 1.7 | |

| −20 | 2 | 114 | 1.7 | |

| −10 | 0 | 116 | 0 | |

| +10 | 0 | 116 | 0 | |

| +20 | 0 | 116 | 0 | |

| +30 | 0 | 116 | 0 | |

| Scenario 2 | ||||

| Gasoline cost change (%) | ||||

| −30 | 0 | 116 | 0 | |

| −20 | 0 | 116 | 0 | |

| −10 | 0 | 116 | 0 | |

| +10 | 2 | 114 | 1.7 | |

| +20 | 2 | 114 | 1.7 | |

| +30 | 26 | 90 | 22.4 | |

| Scenario 3 | ||||

| Electricity cost change (%) | Gasoline cost change (%) | |||

| −30 | +30 | 86 | 30 | 74.1 |

| −20 | +20 | 26 | 90 | 22.4 |

| −10 | +10 | 2 | 114 | 1.7 |

| +10 | −10 | 0 | 116 | 0 |

| +20 | −20 | 0 | 116 | 0 |

| +30 | −30 | 0 | 116 | 0 |

| Scenario 4 | ||||

| Incentive—EV cost change (%) | ||||

| −30 | 86 | 30 | 74.1 | |

| −20 | 2 | 114 | 1.7 | |

| −10 | 1 | 115 | 0.9 | |

| Scenario | Number of EVs | Number of ICEVs | EV Share (%) | |

|---|---|---|---|---|

| Baseline | 4 | 90 | 4.3 | |

| Scenario 1 | ||||

| Electricity cost change (%) | ||||

| −30 | 94 | 0 | 100 | |

| −20 | 94 | 0 | 100 | |

| −10 | 34 | 60 | 36.2 | |

| +10 | 4 | 90 | 4.3 | |

| +20 | 4 | 90 | 4.3 | |

| +30 | 4 | 90 | 4.3 | |

| Scenario 2 | ||||

| Gasoline cost change (%) | ||||

| −30 | 0 | 94 | 0 | |

| −20 | 0 | 94 | 0 | |

| −10 | 1 | 93 | 1.1 | |

| +10 | 94 | 0 | 100 | |

| +20 | 94 | 0 | 100 | |

| +30 | 94 | 0 | 100 | |

| Scenario 3 | ||||

| Electricity cost change (%) | Gasoline cost change (%) | |||

| −30 | +30 | 94 | 0 | 100 |

| −20 | +20 | 94 | 0 | 100 |

| −10 | +10 | 94 | 0 | 100 |

| +10 | −10 | 1 | 93 | 1.1 |

| +20 | −20 | 0 | 94 | 0 |

| +30 | −30 | 0 | 94 | 0 |

| Scenario 4 | ||||

| Incentive—EV cost change (%) | ||||

| −30 | 94 | 0 | 100 | |

| −20 | 94 | 0 | 100 | |

| −10 | 94 | 0 | 100 | |

| Scenario | Number of EVs | Number of ICEVs | EV Share (%) | |

|---|---|---|---|---|

| Baseline | 1 | 123 | 0.8 | |

| Scenario 1 | ||||

| Electricity cost change (%) | ||||

| −30 | 124 | 0 | 100 | |

| −20 | 124 | 0 | 100 | |

| −10 | 34 | 90 | 27.4 | |

| +10 | 1 | 123 | 0.8 | |

| +20 | 0 | 124 | 0 | |

| +30 | 0 | 124 | 0 | |

| Scenario 2 | ||||

| Gasoline cost change (%) | ||||

| −30 | 0 | 124 | 0 | |

| −20 | 0 | 124 | 0 | |

| −10 | 0 | 124 | 0 | |

| +10 | 124 | 0 | 100 | |

| +20 | 124 | 0 | 100 | |

| +30 | 124 | 0 | 100 | |

| Scenario 3 | ||||

| Electricity cost change (%) | Gasoline cost change (%) | |||

| −30 | +30 | 124 | 0 | 100 |

| −20 | +20 | 124 | 0 | 100 |

| −10 | +10 | 124 | 0 | 100 |

| +10 | −10 | 0 | 124 | 0 |

| +20 | −20 | 0 | 124 | 0 |

| +30 | −30 | 0 | 124 | 0 |

| Scenario 4 | ||||

| Incentive—EV cost change (%) | ||||

| −30 | 124 | 0 | 100 | |

| −20 | 124 | 0 | 100 | |

| −10 | 124 | 0 | 100 | |

| Research Question | Study Conclusions/Results |

|---|---|

| What is the best fleet composition? | The fleet composition is affected by the gasoline and electricity costs, and the distances traveled by vehicles. |

| At which hubs should we assign the new EVs and charging stations? | The hubs selected for the placement of EV chargers and EVs are the ones closest to demand nodes. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Goulianou, P.; Regan, A.; Goodchild, A. Long-Term Planning for a Mixed Urban Freight Fleet with EVs and ICEVs in the USA. Sustainability 2024, 16, 3144. https://doi.org/10.3390/su16083144

Goulianou P, Regan A, Goodchild A. Long-Term Planning for a Mixed Urban Freight Fleet with EVs and ICEVs in the USA. Sustainability. 2024; 16(8):3144. https://doi.org/10.3390/su16083144

Chicago/Turabian StyleGoulianou, Panagiota, Amelia Regan, and Anne Goodchild. 2024. "Long-Term Planning for a Mixed Urban Freight Fleet with EVs and ICEVs in the USA" Sustainability 16, no. 8: 3144. https://doi.org/10.3390/su16083144