Abstract

The energy-saving and low-carbon development model is one of the important symbols of high-quality economic development. This article attempts to study the environmental effects of green finance from both theoretical and empirical perspectives, that is, to test whether green finance policies contribute to achieving energy conservation and emission reduction. This article is based on provincial panel data from 2007 to 2020 in China and constructs a dynamic spatial Durbin model to examine the impact of green finance on environmental pollution and energy intensity. The results indicate that (1) green finance can achieve a dual effect of energy conservation and emission reduction simultaneously and has a significant promoting effect on energy conservation and emission reduction in neighboring regions. This conclusion is still valid after conducting robustness tests. (2) The energy-saving and emission-reduction effects of green finance exhibit significant regional heterogeneity, indicating that the performance of green finance is more outstanding in the eastern region with a higher level of economic development. (3) Mechanism testing has found that green finance can achieve energy-saving and emission-reduction effects through four channels: environmental regulation, credit allocation, enterprise profits, and enterprise innovation. Therefore, in order to further promote high-quality economic development, we need to build a comprehensive and multi-level green finance system, enrich the green finance policy toolbox, and smooth the transmission channels of green finance to promote green and stable economic development.

1. Introduction

With the intensification of global climate change and the prominent issue of environmental pollution, sustainable development and green environmental protection have become the focus and development strategy of global governments. As the world’s largest developing country, China bears a crucial responsibility in addressing climate change and promoting low-carbon and environmentally friendly development models. In reviewing the development history of the past forty years, we can affirm that China has achieved brilliant results in economic development, successfully transitioning to the world’s second largest economy, and achieving the goal of lifting the whole population out of poverty. However, it cannot be ignored that in the process of rapid economic development, production methods have been too extensive, production efficiency has been relatively low, and development characteristics such as high pollution, high energy consumption, and high emissions have caused serious damage to the ecological environment, leading to the increasingly prominent contradiction between economic development and low-carbon environmental protection, which restricts high-quality economic development [1,2]. Green finance, as an emerging financial development model, is widely regarded as one of the effective paths to promote sustainable development and achieve green environmental protection [3,4,5]. The key point is that green finance guides credit resources to environmentally friendly and low-carbon production areas, promoting the reduction of pollutant emissions and the development of renewable energy, and achieving a positive interaction between sustainable economic development and environmental protection by improving green production technology and energy-utilization efficiency. The concept of green finance in China has been proposed and related policies have been implemented for many years, making it possible to empirically test its energy-saving and emission-reduction effects, and it has also become a key research topic in the academic community. In the Guidance on the Construction of Green Financial System jointly issued by the People’s Bank of China and seven other ministries and commissions in 2016, green finance is defined as economic activities that support environmental improvement, address climate change, and conserve and efficiently utilize resources, namely, financial services provided for project investment and financing, project operation, and risk management in the fields of environmental protection and energy conservation, clean energy, green transportation, and green building [6]. According to data released by the central bank, as of the end of June 2023, the green credit balance of 21 major banks reached CNY 25 trillion, a year-on-year increase of 33%, and the loan scale ranked first in the world; In the first half of 2023, the premium income of green insurance was CNY 115.9 billion; the balance of loans for energy conservation and environmental protection industries reached CNY 3 trillion, a year-on-year increase of 53%. Overall, green finance is gradually moving from the initial exploration stage to the mature stage and continues to provide sufficient support for green transformation. In the future, green finance will radiate more vitality [7,8]. To quantitatively evaluate the energy-saving and emission-reduction effects of green finance in China at an empirical level, this article uses the spatial Durbin model to conduct research in order to provide detailed empirical evidence for policy departments and provide feasible policy recommendations for optimizing the policy effects of green finance.

In order to achieve energy conservation and emission reduction in the process of sustainable economic development, researchers have conducted extensive research on the economic factors that affect energy conservation and emission reduction, gradually forming an academic consensus that environmental policies and technological innovation significantly affect energy conservation and emission reduction [9,10,11]. The key mechanism for achieving energy-saving and emission-reduction goals through environmental policy factors is that environmental policies force the optimization and upgrading of industrial structure, thereby reducing corporate pollution emissions and improving energy efficiency [12,13]. The significant impact of environmental policies on industrial structural upgrading has been fully validated in the academic community [14,15] and, based on these research findings, targeted policy recommendations have been provided for the government to formulate reasonable environmental regulations [16,17,18], greatly improving the energy-saving and emission-reduction effects of environmental policy tools. In terms of technological innovation factors, the main way to achieve energy conservation and emission reduction is for enterprises to increase their R&D investment in technological innovation in order to increase profits or enhance their probability of survival in the market. During this process, technology transitions and positive externalities of energy conservation and emission reduction occur [19,20,21]. Technological innovation is not only a survival weapon for individual enterprises, but also a driving force for the continued development of a country’s economy [22,23,24]. Therefore, the academic community has formed a consensus on the positive role of technological innovation factors and deeply explored various factors and mechanisms that affect enterprise innovation [25,26].

Based on the established fact that finance has become an important factor in rapid economic development, the academic community has gradually conducted research on the energy-saving and emission-reduction effects of financial instruments and defined the corresponding policies as green finance policies [27,28]. The key to whether financial instruments can successfully assist in achieving energy conservation and emission reduction lies in whether they will have an impact on corporate financing constraints [29,30,31,32,33]. When financial policies incorporate corporate environmental performance into credit standards, financial instruments impose environmental protection constraints on enterprises, and only when enterprises meet the environmental requirements of financial policies can they smoothly obtain credit support. Therefore, financial instruments have a significant impact on the financing constraints of enterprises, guiding them towards an environmentally friendly transformation [34,35,36], and are beneficial for energy conservation and emission reduction in the economy and society. However, it should be noted that existing research on the energy-saving and emission-reduction effects of green finance still focuses on testing the effectiveness of policy [37,38,39,40,41], and there is little literature on the effects of transmission mechanism and spatial spillover of financial instruments on energy-saving and emission reduction [42,43]. Further research on this issue will help strengthen the energy-saving and emission-reduction effects of financial instruments, thereby providing government departments with more diverse policy tools in addressing climate change and environmental protection.

In view of this, the focus of this article is to study the transmission mechanism and policy space spillover effects of green finance on energy conservation and emission reduction from both theoretical and empirical aspects. Firstly, the paper analyzes the mechanism of green finance in achieving energy conservation and emission reduction through theoretical analysis, providing a solid theoretical mechanism for empirical analysis in the future and ensuring the construction of a reasonable econometric model. Secondly, this article tests the policy effectiveness of green finance in energy conservation and emission reduction through the spatial Durbin model, exploring the local and spillover effects of green finance policies on energy conservation and emission reduction. Finally, this study conducted an empirical test on the mechanism of green finance promoting energy conservation and emission reduction.

The research results found that green finance mainly acts on energy conservation and emission reduction through macro-level environmental regulations and credit allocation, micro-level enterprise profits, and enterprise innovation. The research results of this paper provide empirical evidence and policy implications for financial instruments in addressing climate change and environmental protection. The empirical results of this article profoundly reveal the important role of green finance in energy conservation and emission reduction. The policy implications of these results are also very clear: in the process of transforming China’s economic development mode and moving towards high-quality development, attention should not only be paid to the technological changes and significant improvements in total factor productivity brought about by technological innovation but also to the important role of green finance in achieving economic green development. By formulating more rational green finance policies and corresponding tools, new credit support should be injected into the real economy and leading enterprises to achieve green transformation, thereby achieving the goals of energy conservation, emission reduction, and high-quality economic development.

Based on the above literature review, it is not difficult to find that existing studies have mainly examined whether environmental regulations, technological innovation, and other perspectives are beneficial for energy conservation and emission reduction [44,45,46,47]. Some of the literature also considers the impact of green finance on energy conservation and emission reduction [48,49,50] but neglects the spatial and transmission mechanisms of the economic effects of green finance. Therefore, we cannot help but ask the following questions: does green finance have energy-saving and emission-reduction effects? and is there any significant heterogeneity or regionalism between different regions in China? Therefore, it is necessary to attach great importance to the regional differences in the impact of green finance. More importantly, if green finance has energy-saving and emission-reduction effects, what is its transmission mechanism or action mechanism? How can we design reasonable policy tools for different transmission channels? In this context, we conducted empirical research on green finance in order to provide answers to the aforementioned issues. The possible innovation of this article is reflected in (1) focusing on examining whether there is heterogeneity in the impact of green finance on energy conservation and emission reduction. As there are significant differences in economic development between regions in China, adopting a one-size-fits-all policy without considering regional differences will have the opposite effect. (2) This article analyzes the transmission mechanism by which green finance promotes energy conservation and emission reduction, and it provides solid data reference for policy formulation through empirical testing.

The other contents of the paper are as follows: Section 2 is a theoretical explanation; Section 3 discusses the empirical design, mainly introducing the econometric models used and the selection of corresponding variables; the fourth section is the analysis of empirical results, the fifth section is the discussion, and the final section includes the research conclusion and policy implications.

2. Theoretical Mechanism

The official definition of the concept of green finance in China was born in the report Guiding Opinions on Building a Green Financial System jointly issued by seven ministries, including the People’s Bank of China and the Ministry of Finance, in 2016, which gave the definition of green finance: to support economic activities that improve the environment, cope with climate change and save and use resources efficiently, that is, to provide financial services for project investment and financing, project operation and risk management in the fields of environmental protection, energy conservation, clean energy, green transportation and green buildings [6]. As can be seen from the above definition, the concept of green finance has not been formally proposed in China for a long time, but the concept of the financial sector taking responsibility for environmental governance has a long history. This means that while focusing on economic development, the Chinese government will also focus on environmental protection, actively take financial measures to deal with climate change, and correctly handle the harmonious development of the relationship between man and nature.

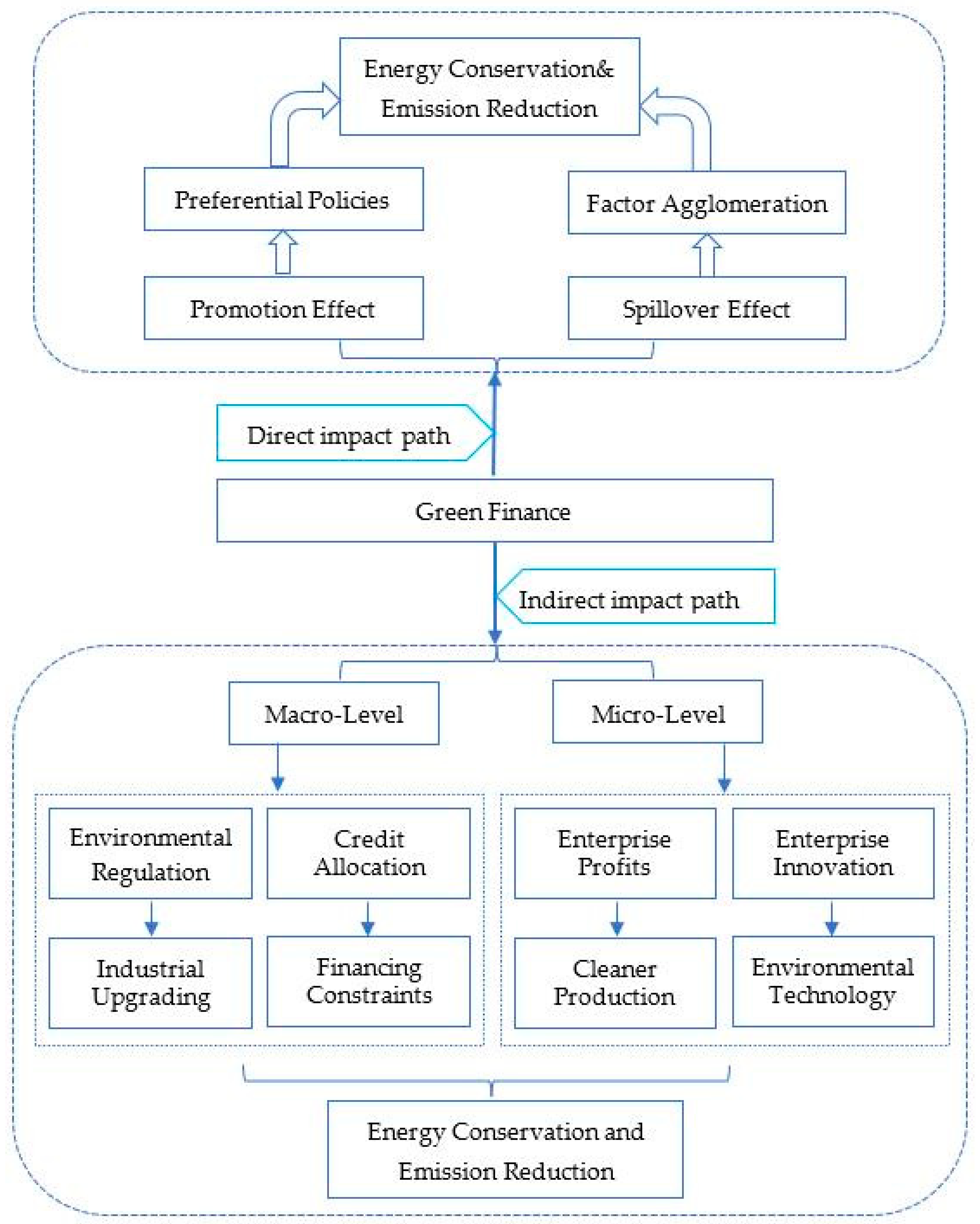

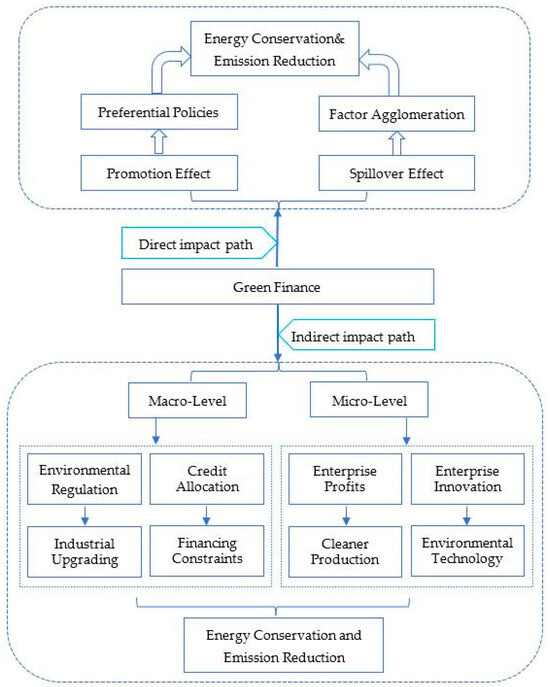

Green finance plays a direct role in energy conservation and emission reduction by influencing credit resource allocation, setting access conditions, and guiding enterprises’ transformation and upgrading [51,52]. The direct impact process can be simply summarized as promoting effect and spillover effect [53]. The mechanism diagram of the energy-saving and emission-reduction effects of green finance is shown in Figure 1. The promoting effect of green finance on energy conservation and emission reduction refers to financial institutions setting entry conditions for green credit, including enterprises that meet the requirements of green development, in the scope of credit compliance objects, limiting the credit subsidy qualifications of high energy consuming and highly polluting enterprises, thereby imposing regulatory factors on the layout of enterprise development, guiding enterprises to vigorously develop their own green transformation and ultimately achieve the policy goal of energy conservation and emission reduction [54].

Figure 1.

Mechanism for energy conservation and emission reduction in green finance.

The development of enterprises cannot do without the support of credit funds provided by financial institutions. Green finance upgrades the environmental performance of enterprises to credit indicators, which can impose green development requirements on enterprises in terms of funding supply, vigorously promote clean production, and effectively promote energy conservation and emission reduction. The spillover effect of green finance on energy conservation and emission reduction refers to the principle that green finance adheres to the principle of first establishing and then breaking in the process of assisting economic development, promoting energy conservation and low-carbon transformation of enterprises [55]. Green finance in this process brings effects such as capital agglomeration and talent agglomeration, driving the rapid extension of relevant green industrial chains, forming a considerable scale of industrial agglomeration effect, thereby achieving economic structure optimization and enhancing resource allocation efficiency and other advantages to achieve more energy-saving and emission-reduction effects. The spillover effect of green finance on energy conservation and emission-reduction targets is mainly attributed to the economic agglomeration effect. Economic agglomeration refers to the combination of economic factors and their structures within a certain geographical space, which optimizes and improves economic structure and production efficiency, thereby stimulating economies of scale and achieving energy conservation and emission reduction [56,57].

Green finance not only has direct impact mechanisms that affect energy conservation and emission reduction, but it also has rich indirect impact mechanisms, which can be briefly summarized from both macro and micro levels. The indirect transmission mechanism at the macro level includes environmental regulation and credit allocation [58]. The formulation of government environmental regulations depends on the pollutants generated by real economic production activities. The government attaches great importance to the rapid development of the economy. The previous rough development model has caused serious damage to the ecological environment, and environmental pollution and climate change issues have become increasingly severe. It is not sufficient to rely solely on enterprises to shoulder the responsibility of environmental protection spontaneously. Therefore, the government has implemented a series of environmental regulations to solve the pollution emissions generated by production activities and correct the negative externalities they bring. In the context of high-intensity environmental regulation, highly energy-consuming and highly polluting enterprises face serious environmental pressure, with a high demand for green transformation and an urgent need to introduce green production technologies. This process will inevitably increase the governance costs of enterprises in the short term, squeeze out operational investment, and lead to an expansion of the demand for green credit [59]. At this time, green finance provides financing channels for such enterprises for green transformation, thus effectively improving the energy-saving and emission-reduction effects of enterprises.

In addition, the energy-saving and emission-reduction effects of green finance are also reflected in the indirect path of credit allocation. Resource mismatch is one of the main characteristics of market economy failure, and there is also a mismatch problem in relation to the credit resources required by enterprises. Green finance has become an effective tool to correct credit mismatch. Enterprises engaged in high levels of energy consumption and producing high rates of pollution are more frequently state-owned enterprises, and their difficulty in obtaining credit support is much lower than non-state-owned enterprises, leading to distortion and mismatch in traditional credit allocation, and subsequently causing serious energy loss and environmental pollution [60]. After the emergence of green finance, previously highly polluting and energy-consuming enterprises faced strict environmental constraints and credit-access thresholds, which increased the risk of their elimination and incentivized them to increase green R&D investment and reduce energy consumption and pollution emissions. Similarly, due to the emergence of green finance, enterprises engaged in clean production face richer financing channels and receive sufficient credit support, alleviating financial constraints on their own development and greatly reducing the risk of being eliminated, thus promoting energy conservation and emission-reduction effects [61].

In addition to the indirect action paths at the macro level mentioned above, green finance also has indirect action paths that cannot be ignored at the micro level, which can be briefly summarized as enterprise profits and innovation. The key logic of green finance achieving energy conservation and emission reduction through corporate profits is that financing constraints affect the company’s own profits. Green finance has made enterprises pay more attention to investing in clean technologies and equipment, greatly promoting R&D investment and increasing profits [62]. For clean enterprises, decision makers who relax financing constraints and increase profits will further increase investment in clean production projects, which is beneficial for energy conservation and emission reduction. For polluting enterprises, green finance imposes penalties on their financing, reducing their credit scale for engaging in environmentally polluting projects, thus affecting their own profits. In order to enhance corporate profits, green finance policies will force polluting enterprises to increase their investment in energy-saving technology and pollution control to meet the access needs of green credit, thereby optimizing energy-saving effects and pollution emissions.

Green finance can also contribute to energy conservation and emission reduction through corporate innovation [63]. The main channel for enterprises to achieve energy conservation and emission reduction in the production process is to improve their own production technology and environmental protection technology innovation, and the level of an enterprise’s technological innovation heavily relies on research and development investment. Green financial policies play an important role in enterprise innovation, which cannot be ignored. Enterprises can obtain sufficient capital demand through green finance channels when engaging in green innovation research and development, which is beneficial for enterprises to carry out technological innovation in energy conservation and emission reduction, thereby reducing energy consumption and pollution in the social production process. For clean enterprises, green finance plays an important incentive role in enterprise innovation, ensuring the smooth development and breakthrough of green technology for this type of enterprise. Similarly, for polluting enterprises, as they strive to obtain support from green finance policies, they will inevitably increase their investment in green technology research and development to meet credit requirements, which subtly promotes energy conservation and emission reduction for polluting enterprises [64].

3. Empirical Design

3.1. Model Setting

Due to the strong spatial correlation between environmental pollution and energy intensity, this article incorporates spatial factors into the research framework. In addition, considering that there is a certain degree of path dependence and inertia between pollutant emissions and energy consumption, that is, the current pollution emissions and energy consumption are affected by the previous period, the lagged terms of the two have been included in the model to reduce endogenous effects. Based on this, the following dynamic spatial Durbin model was constructed to investigate the energy-saving and emission-reduction effects of green finance development:

where i and t represent the province and time, respectively. EP and EI are the dependent variables, with the former being the variable of environmental pollution level and the latter being the variable of energy intensity. The energy-saving and emission-reduction effects are measured through EP and EI. GF is the core explanatory variable and the level of green finance development. X is the control variable. is the spatial weight matrix, and this article uses a binary spatial weight matrix, which means when regions are adjacent, , and when not adjacent, . and are regional fixed effects and random disturbance terms, respectively.

In addition, in order to examine the macro and micro pathways of the energy-saving and emission-reduction effects of green finance, based on models (1) and (2), the product term of green finance and regulatory variables was introduced to analyze the moderating effects of environmental regulation, credit allocation, enterprise performance, and enterprise innovation on the energy-saving and emission reduction effects of green finance. The model settings are as follows:

In models (3) and (4), variable M is the moderating variable, which includes environmental regulation, credit allocation, enterprise operating performance, and enterprise innovation. The definition of other variables is the same as in the above model.

3.2. Variable Design

(1) Explained variables: environmental pollution level (EP) and energy intensity (EI). This article uses the carbon emission intensity per unit of GDP (EP1) and the industrial wastewater discharge per unit of GDP (EP2) to measure the degree of environmental pollution. For the calculation of carbon emissions, this article refers to the research of Shao et al. (2019) and uses 17 types of energy such as raw coal, washed coal, and coke reported in the China Energy Statistical Yearbook to collect various energy consumption, average low calorific value, and CO2 emission coefficients and calculate the total carbon emissions [65]. In addition, the energy input of industrial raw materials is deducted from the calculation of carbon emissions. This article uses the total energy consumption per unit of GDP (EI1) and industrial electricity consumption per unit of GDP (EI2) to measure energy intensity. The specific definition of variables is shown in Table 1.

Table 1.

Description of variables.

(2) Core explanatory variable: green finance level (GF). In 2016, the People’s Bank of China and the Ministry of Finance jointly issued the Guiding Opinions on Building a Green Financial System, which explained the connotations of green finance. The Guiding Opinions clearly state that green finance is a financial service provided for green environmental protection projects to support economic activities such as environmental improvement, climate change response, and efficient resource utilization. Therefore, this article selects four dimensions of indicators: green credit, green insurance, green securities, and green investment, and obtains the level of green finance in China by standardizing the raw data and using the entropy method [6].

(3) Moderating variables: In order to test the macro regulatory path and micro mechanism of the energy-saving and emission-reduction effects of green finance, the variables environmental regulation (ER), credit allocation (CA), enterprise operating performance (OP), and enterprise innovation (TI) were added to the model [53,54].

(4) Control variables: Considering the numerous factors that affect energy conservation and emission reduction, this article includes variables such as labor productivity (labor), urbanization level (urban), economic development level (pgdp), openness to the outside world (open), marketization level (market), and foreign investment level (fdi) [62,63].

The research sample of this paper came from the panel data of 30 provinces and cities in China from 2007 to 2020 (Xizang was not included in this study, due to the serious lack of data; Xizang is the new name, and the previous name of the province was Tibet), and the original data came from the China Statistical Yearbook, China Energy Statistical Yearbook, China Environmental Statistical Yearbook, China Industrial Statistical Yearbook, and provincial and municipal yearbooks.

4. Empirical Analysis

4.1. Analysis of the Impact of Green Finance

Before conducting parameter estimation on the spatial panel model, it was necessary to apply the spatial correlation test. By conducting spatial correlation tests on the OLS estimation residuals, as shown in Table 2, Table 3, Table 4 and Table 5, it was found that the Moran’s I corresponding to each regression equation was significant at least at the 5% level. From this, it could be seen that the dependent variables in the model had significant spatial correlations, and it was necessary to establish a spatial panel model. This article uses a dynamic spatial Durbin model with spatiotemporal bidirectional fixed effects for regression analysis, and the results are shown in Table 2.

Table 2.

Spatial Durbin model regression results.

From Table 2, it can be seen that when the dependent variables are environmental pollution and energy intensity, the estimated coefficients of green finance are significantly negative at the 1% level, indicating that green finance policies effectively reduce pollutant emissions while also reducing energy consumption. That is to say, the development of green finance can effectively improve energy conservation and emission-reduction effects [66,67]. This conclusion also confirms the theoretical analysis mentioned earlier. The research results indicate that there has been a significant energy-saving and emission reduction effect associated with China’s green finance, providing important empirical evidence for addressing environmental protection and improving the level of green development. At present, governments around the world are facing the test of climate change and increasing environmental damage, and there is an urgent need for effective policy tools to respond. The research results of this article can provide important inspiration. By vigorously developing green finance, the government can not only help alleviate financing constraints in the real economy but also contribute to energy conservation and emission reduction, which is conducive to achieving the dual policy goals of sustainable development and environmental protection, leaving valuable green resources for the development of future generations of humanity.

On the one hand, green finance policies have increased financial support for environmentally friendly and low-carbon industries, guiding enterprises to expand production and investment in clean products, expanding the popularization and use of green products, and promoting the development of green industries. On the other hand, green finance policies have raised the loan threshold for enterprises and increased their production costs. However, in order to achieve long-term and sustainable development, enterprises will seek cleaner technologies and increase investment in energy-saving and emission-reduction facilities, which will help to promote rapid progress in pollution-control technology. Therefore, green finance policies have forced enterprises to upgrade and innovate their technology, improving their energy utilization efficiency and thus bringing about significant improvements in environmental quality.

The spatial lag coefficient of green finance variables is significantly negative, showing a strong spatial spillover effect, indicating that green finance in neighboring regions has a significant inhibitory effect on local environmental pollution and energy consumption. The explanation for this conclusion is that when the green finance policies in a region can significantly promote energy efficiency improvement and improve environmental conditions, it easily causes imitation in neighboring regions. Therefore, this guides the green finance policies in the jurisdiction, thereby reducing the gap in energy conservation and emission-reduction performance with neighboring regions. In addition, the estimated coefficients of the time lag terms for environmental pollution variables and energy intensity variables are significantly positive at the 1% level, indicating that environmental pollution and energy intensity exhibit significant path-dependence characteristics in the time dimension. That is, if the pollution emission intensity in the previous period was relatively high, then the pollution emission in the next period may also be at a higher level, which means that the difficulty of pollution control work cannot be underestimated. The estimated coefficients of the spatial lag terms for environmental pollution variables and energy intensity variables are significantly positive at the 1% level, showing a strong spatial spillover effect. That is, the pollution emissions and energy consumption of neighboring regions affect the energy-saving and emission-reduction effects in the local area. This also indicates that the governance of environmental pollution requires joint efforts from all regions to achieve joint prevention and control.

From the results of the controlling variables, it can be seen that the estimated coefficients of labor productivity, urbanization level, and economic development level are significantly positive, indicating that improvements in labor productivity, urbanization level, and economic development have promoting effects on reducing pollution emissions and energy consumption. The estimated coefficients for the degree of openness to the outside world and marketization are negative but not significant, while the estimated coefficients for the level of foreign investment are significantly negative, indicating that the introduction of foreign technology contributes to the progress of clean technology and thus benefits energy conservation and emission reduction.

The economic intuition of this research result is obvious: in the context of a new era of development, China’s economy is shifting towards a path of high-quality development, which is not only reflected in the improvement in economic efficiency but also in the level of green economic development. Therefore, policy departments can use financial instruments to impose environmental constraints on enterprises, guide them to engage in cleaner and greener production activities, and improve the quality of economic and social development. In addition, high-quality economic development not only relies on the blueprint formulated by the government, but also on the cooperation of local governments to achieve high-quality economic development. Therefore, enriching the toolbox of green finance and deeply exploring the connotation of green finance are necessary to form effective policies to promote green economic development. This also provides positive insights for current policy making. At present, the downward pressure on China’s economy has increased, and excessive reliance on strict environmental regulations will exacerbate the economic pressure. Therefore, adopting relatively mild financial policy tools is particularly important.

4.2. Regional Heterogeneity Analysis of Green Finance

Due to China’s vast territory and varying natural conditions in various regions, population, resource endowment, and economic foundation all contribute to uneven regional economic development. Therefore, the energy-saving and emission-reduction effects of green finance may vary in different regions. Therefore, this article divides the entire sample into three sub samples—the eastern region, the central region, and the western region—to examine the energy-saving and emission-reduction effects of green finance policies in different regions. In order to save space, only the estimated time and spatial lag terms of green finance variables and environmental pollution variables are provided in the table, and the regression results are shown in Table 3 and Table 4.

Table 3.

Regional heterogeneity test of emission-reduction effects.

Table 3.

Regional heterogeneity test of emission-reduction effects.

| Variable | Eastern Region | Central Region | Western Region | |||

|---|---|---|---|---|---|---|

| EP1 | EP2 | EP1 | EP2 | EP1 | EP2 | |

| GF | −0.092 *** | −0.103 *** | −0.049 *** | −0.051 *** | −0.022 ** | −0.024 ** |

| (−4.45) | (−4.55) | (−2.77) | (−2.85) | (−2.47) | (−2.33) | |

| W*GF | −0.042 *** | −0.052 *** | −0.025 ** | −0.028 ** | −0.013 ** | −0.016 ** |

| (−3.65) | (−3.14) | (−2.13) | (−2.35) | (−2.04) | (−2.17) | |

| L.EI | 0.514 *** | 0.533 *** | 0.603 *** | 0.611 *** | 0.675 *** | 0.688 *** |

| (3.54) | (3.82) | (3.12) | (2.85) | (2.92) | (2.71) | |

| W*EI | 0.208 *** | 0.225 *** | 0.274 *** | 0.282 *** | 0.315 *** | 0.322 *** |

| (3.02) | (3.17) | (3.25) | (3.41) | (3.42) | (3.59) | |

| Control variables | yes | yes | yes | yes | yes | yes |

| R2 | 0.812 | 0.806 | 0.793 | 0.787 | 0.764 | 0.766 |

Note: Only the estimated results of important variables are listed in the table, and other annotations are the same as Table 2. “**”and “***” represent a significance probability of 5% and 1%, respectively.

Table 4.

Regional heterogeneity test of energy-saving effects.

Table 4.

Regional heterogeneity test of energy-saving effects.

| Variable | Eastern Region | Central Region | Western Region | |||

|---|---|---|---|---|---|---|

| EI1 | EI2 | EI1 | EI2 | EI1 | EI2 | |

| GF | −0.115 *** | −0.121 *** | −0.063 ** | −0.069 ** | −0.034 ** | −0.041 ** |

| (−3.13) | (−3.37) | (−2.42) | (−2.36) | (−2.42) | (−2.26) | |

| W*GF | −0.053 *** | −0.0588 *** | −0.028 ** | −0.031 ** | −0.019 ** | −0.020 ** |

| (−3.08) | (−3.26) | (−2.31) | (−2.09) | (−2.27) | (−2.31) | |

| L.EP | 0.401 *** | 0.424 *** | 0.511 *** | 0.528 *** | 0.604 *** | 0.612 *** |

| (3.24) | (3.37) | (3.54) | (3.61) | (2.85) | (2.93) | |

| W*EP | 0.246 *** | 0.267 *** | 0.202 *** | 0.219 *** | 0.311 *** | 0.321 *** |

| (3.41) | (3.54) | (3.18) | (3.23) | (3.15) | (3.23) | |

| Control variables | yes | yes | yes | yes | yes | yes |

| R2 | 0.823 | 0.813 | 0.805 | 0.798 | 0.782 | 0.774 |

Note: same as Table 3. “**”and “***” represent a significance probability of 5% and 1%, respectively.

According to the estimated results in Table 3 and Table 4, the estimated coefficients of green finance variables in the eastern, central, and western regions are significantly negative at the level of at least 5%, indicating that green finance policies have significantly promoted regional energy conservation and emission-reduction effects. Moreover, the absolute values of the estimated coefficients of green finance variables in the eastern region are significantly higher than those in the central and western regions. This is because since the reform and opening up, industry in the eastern coastal areas has developed rapidly, undertaking the important task of meeting the demand of foreign markets. Industrial production capacity has gradually concentrated in the eastern region, resulting in the gathering of more polluting enterprises.

According to the Second National Pollution Source Census Bulletin released by the State Council Information Office, Guangdong Province, Zhejiang Province, Jiangsu Province, Shandong Province, and Hebei Province in the eastern region account for 52.94% of the total number of pollution sources in the country, while the proportion of pollution sources in the central and western regions decreases in sequence. The green finance policies in the eastern region can strictly restrict the financing activities of highly polluting and high-emission enterprises. The policies do not support projects that exceed pollution standards and instead force high-pollution enterprises to carry out clean technology research and development and promote the green transformation of enterprises. Therefore, the implementation of green finance policies has a greater impact on the eastern region, which has a larger proportion of heavily polluting enterprises.

China has a vast territory and significant differences in natural resource endowments among different regions, which further forms a differentiated feature of policy effectiveness among different regions. The empirical results also verify the above conclusion that there are differences in green finance policies among different regions. If a one-size-fits-all policy model is adopted, it will inevitably lead to policy conflicts and unsatisfactory regulatory effects. Therefore, when formulating or implementing green finance policy bills, government departments should tailor their policies to local conditions and implement them accordingly. Only by constructing green finance policy regulations that are in line with their own needs can they achieve the desired policy effects. In fact, policy departments across China have also noticed the above-mentioned issues and made corresponding adjustments in practical operations. The above heterogeneous research results further confirm the rationality and effectiveness of the government’s differentiation practices, providing important reference values for further strengthening policy tools.

In addition, compared with the central and western regions, the eastern region faces stronger environmental regulations and more intense market competition. The eastern region has responded more actively to the call for green finance to serve the real economy. As a compensatory environmental regulation, green finance policies have, to some extent, compensated for the increased production costs of administrative order-based environmental regulations, which helps improve enterprises’ economic performance and generate greater energy-saving and emission-reduction effects.

Also, the financial infrastructure in the eastern region is well-established, and financial reform, opening up, and innovation are far ahead, with more abundant green financial tools. From the regional distribution of environmental protection industry chain enterprises in China, environmental protection industry enterprises are mainly distributed in the southeast coastal areas, mainly in Shandong Province, Jiangsu Province, Fujian Province, and Guangdong Province. Therefore, the green finance policy has greatly promoted an increase in research and development expenditure and quantities of patent authorization among green enterprises in the eastern region, improved the level of green innovation of enterprises, accelerated the pace of enterprise transformation and upgrading, and made a prominent contribution to energy conservation and emission reduction. The estimated coefficient of the green finance spatial lag term is significantly negative, showing a strong spatial spillover effect, and the absolute value of the estimated coefficient in the eastern region is greater than that in the central and western regions, indicating that the demonstration effect of green finance policies in the eastern region is greater.

4.3. Robustness Analysis

The above conclusion is based on the spatial adjacency weight matrix, without considering the case of non-adjacency between provinces. Therefore, in order to test the robustness of the above research conclusions, this paper takes the geographical distance matrix () and the economic distance matrix () as the new spatial weight matrix to re-estimate the spatial measurement of the model. The geographical distance weight matrix was set to and is the distance between two provinces. The economic distance matrix was set as , where and are the average per capita GDP of different provinces from 2007 to 2020. In the robustness test, carbon emission intensity (EP1) and energy consumption (EI1) were selected as explained variables, and the estimated results are shown in Table 5.

Table 5.

Robustness test results.

Table 5.

Robustness test results.

| Variable | Emission-Reduction Effect | Energy−Saving Effect | ||

|---|---|---|---|---|

| W2 | W3 | W2 | W3 | |

| GF | −0.058 *** | −0.047 *** | −0.081 *** | −0.092 *** |

| (−3.32) | (−3.17) | (−3.12) | (−3.24) | |

| W*GF | −0.024 *** | −0.033 *** | −0.037 *** | −0.032 *** |

| (−3.49) | (−2.85) | (−3.23) | (−3.41) | |

| Control variables | yes | yes | Yes | yes |

| R2 | 0.851 | 0.842 | 0.857 | 0.878 |

| N | 420 | 420 | 420 | 420 |

Note: same as Table 3. “***” represents a 1% significance probability.

As can be seen from the Table 5, the estimation coefficient of green finance is significantly negative, and the result of the control lag term of the green finance variable is also significantly negative. Therefore, even if the spatial econometric model of the geographical distance matrix and spatial economic weight matrix is adopted for the regression test, the robustness of the conclusion that the development of green finance promotes energy conservation and emission reduction can be guaranteed. The above tests not only ensure the robustness of the research results, but also ensure the accuracy and pertinence of the policy tests in this article. The robustness results confirm the significant spatial spillover effect of green finance, which provides a useful reference for local governments to strengthen green finance policies for energy conservation and emission reduction. By optimizing the synergy and interaction of green finance policies among local governments, the policy effectiveness of financial policy tools can be further strengthened.

4.4. Analysis of the Impact Mechanism of Green Finance

In order to save space, this paper mainly selects carbon emission intensity (EP1) and energy consumption (EI1) as explained variables on the part of the mechanism test, and the estimated results are shown in Table 6. In Table 6, we focus on the estimated coefficients of variables GF*ER, GF*CA, GF*OP, and GF*TI. According to the estimated results in Table 6, it can be seen that the estimated coefficient of the cross term of green finance policy and the adjustment variable is significantly negative at the level of 1%, and the coefficient of the spatial lag term of the cross term is also significantly negative, indicating that green credit policy can achieve environmental protection and resource saving through four channels: environmental regulation, credit allocation, business performance, and enterprise innovation. This conclusion is also a good verification of the above theoretical analysis.

Table 6.

Regression results of mechanism test.

The previous theoretical analysis section pointed out that the transmission mechanism of green finance energy conservation and emission reduction can be divided into macro-level and micro-level factors. At the macro level, green finance mainly relies on factors such as environmental regulations and credit allocation to achieve energy-saving and emission-reduction effects. At the micro level, green finance achieves policy effects on energy conservation and emission reduction through factors such as corporate profits and innovation. Through the testing of the transmission mechanism in this section, we firmly believe that the above transmission mechanisms are effective in the Chinese market. When formulating green finance policies, government departments should focus on whether the above transmission paths are smooth, in order to use green finance tools to achieve a dynamic balance between sustainable development and environmental protection.

The verification of transmission mechanisms helps financial policy tools to achieve optimal regulatory effects. Only by clarifying the economic logic and transmission links behind economic phenomena can reasonable policy tools be formulated and policy transmission efficiency be strengthened. In reality, green finance policies may have more diverse channels of action. This article focuses on only the more important mechanism paths at the macro and micro levels, with the aim of making empirical tests more concise and providing more robust empirical evidence for policy operations.

5. Discussion

The focus of this study is to examine whether green finance policies play an important role in the process of energy conservation and emission reduction, in other words, whether green finance can significantly promote the achievement of energy conservation and emission-reduction goals. The empirical results confirm the positive role of green finance in environmental protection; that is, implementing green finance policies in China can accelerate economic development and improve the environmental quality on which residents rely for survival. This study is different from previous studies. Previous studies have focused on analyzing the impact of environmental regulations or financial perspectives on enterprises’ energy conservation and emission reduction. However, this article adopts a combination of theory and empirical approach, constructing energy-conservation and emission-reduction indicators to empirically test the impact of green finance policies, thereby enriching the relevant research perspectives and content of green finance.

This article also fully considers the differences between regions in China, in order to test whether the energy-saving and emission-reduction effects of green finance policies are the same in different regions. The empirical results reveal that green finance policies have differentiated regulatory effects among different regions, especially for regions with higher levels of financial development, where their energy-saving and emission-reduction effects are more pronounced. In fact, it is well known that credit resources have a decisive impact on the development of enterprises. When a region’s financial development is at a high level, the financing channels for enterprises in that region are relatively abundant. Therefore, when green finance imposes environmental constraints, it forces enterprises to carry out technological innovation or assume more environmental responsibilities, thereby achieving the policy goals of energy conservation and emission reduction. The research findings have important implications for policy authorities. In real economic regulation, not only can environmental constraints constrain the transformation and upgrading of enterprises, but financial tools can also be used to guide enterprises towards a more environmentally friendly development path.

In addition, this study empirically tested the transmission channels of green finance on energy conservation and emission reduction, verifying that green finance mainly plays a positive leading role in enterprises’ energy conservation and emission reduction through channels such as environmental regulation, credit allocation, enterprise profits, and enterprise innovation. Empirical analysis of the transmission mechanism can provide theoretical support for policy authorities. In other words, policy authorities can use green financial tools to constrain enterprises and lead them towards the path of green development in the pursuit of high-quality economic development. At the same time, when strengthening the effectiveness of green finance policies, we can focus on the four transmission channels mentioned above, break through the bottlenecks in each transmission path, and strive to maximize the effectiveness of green finance policies.

6. Conclusions and Policy Recommendations

With the intensification of global climate change and the prominent issue of environmental pollution, sustainable development and green environmental protection have become the focus and development strategy of global governments. This article takes 30 regions in China from 2007 to 2020 as samples to examine the mechanism of green finance in promoting energy conservation and emission reduction. The following conclusions are drawn: (1) using environmental pollution and energy intensity as explanatory variables, a spatial Durbin model was established for empirical analysis. It was found that green finance can achieve a dual effect of energy conservation and emission reduction and has a significant promoting effect on energy conservation and emission reduction in neighboring regions. This conclusion remains valid after robustness testing. (2) The entire sample was divided into three sub samples: the eastern region, the central region, and the western region, and the model was regressed. It was found that the energy-saving and emission-reduction effects of green finance exhibit significant regional heterogeneity, that is, the performance of green finance is more outstanding in the eastern region with higher economic development levels. (3) Mechanism testing found that green finance can achieve energy-saving and emission-reduction effects through four channels: environmental regulation, credit allocation, enterprise profits, and enterprise innovation.

Based on the above research conclusions, this article proposes the following policy recommendations: firstly, vigorously promote the radiation field of green finance policies, enrich the green finance policy toolbox, and smooth its energy-conservation and emission-reduction transmission channels. The research results fully validate the positive impact of green finance on energy conservation and emission reduction. In order to effectively address the current severe issues of climate change and improve the quality of the human living environment, it is difficult to rely solely on traditional administrative directive laws and regulations to coordinate sustainable development, energy conservation, and emission reduction. Therefore, by expanding the green financial market to guide enterprises to take on more social responsibility for environmental protection, we can achieve a balance between economic development and environmental protection and alleviate the contradiction between the two.

Secondly, we propose actively promoting coordinated development between regions and narrowing the development gap between regions to ensure that the promotion effect of green finance on energy conservation and emission reduction is maximized. The research results indicate that green finance in China has energy-saving and emission-reduction effects across regions including the east and west, but the policy effects of energy saving and emission reduction have differentiated characteristics across regions. This result also means that there is still great room for improvement in China’s green finance policies in terms of energy conservation and emission reduction. Policy departments should pay attention to issues such as imbalanced and insufficient development between regions, actively reduce development differences between regions, and optimize the policy effectiveness of green finance in energy conservation and emission reduction, providing solid financial guarantees for achieving China’s strategic goals for high-quality economic development.

Thirdly, a cross-regional linkage mechanism should be established for green finance policies to alleviate the bottom-up competition effect of neighboring governments in energy conservation and emission reduction. Due to the phenomena of promotion tournaments faced by local governments, they neglect their responsibility to protect the environment in pursuit of rapid economic development, resulting in a bottom-up competition effect on energy conservation and emission reduction, which is not conducive to achieving the policy goal of coordinating economic development and environmental protection. Therefore, the formulation of green finance policies among regions should fully consider the above issues and optimize the design of reasonable green finance policies to form effective incentive effects for energy conservation and emission reduction, injecting new policy vitality into China’s development goals of meeting standards and carbon neutrality.

Although this article analyzes the impact of green finance policies on enterprise energy conservation and emission reduction from both theoretical and empirical perspectives, there are still shortcomings in the study. Firstly, this article analyzes the energy-conservation and emission-reduction effects of green finance policies from different regional perspectives in China but does not introduce nonlinear econometric models into the empirical research to further investigate whether there are asymmetric regulatory effects of green finance policies, which makes the research conclusions lack generality. Secondly, in exploring the transmission mechanism of green finance policies, this article focuses on macro and micro perspectives and does not fully incorporate dynamic equilibrium mechanisms, making the mechanism analysis more profound and specific. Given the limitations of the aforementioned research, future research on this topic should focus more on the construction and analysis of equilibrium mechanisms, while incorporating the nonlinear characteristics of mechanism transmission, in order to provide policy authorities with a more solid theoretical foundation and empirical reference.

Author Contributions

Conceptualization, R.J.; methodology, R.J.; software, R.J.; validation, C.J.; formal analysis, R.J.; investigation, R.J.; resources, R.J.; data curation, R.J.; writing—original draft preparation, R.J.; writing—review and editing, H.W.; visualization, H.W.; supervision, C.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Guangdong Province Philosophy and Social Science Planning Project (grant no. GD23XYJ51).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original data come from the China Statistical Yearbook, China Energy Statistical Yearbook, China Environmental Statistical Yearbook, China Industrial Statistical Yearbook, and provincial and municipal yearbooks.

Acknowledgments

We are very grateful for editors and anonymous reviewers. We thank the support of the foundation as well.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Wei, L.; Yang, Y. Research on the evolution logic and environmental effects of China’s green finance policy. J. Northwest Normal Univ. 2020, 57, 101–111. [Google Scholar]

- Yuan, Y.; Li, D. Urban economic efficiency, environmental factors, and digital finance: Impacts on sustainable development in Chinese cities. Sustainability 2023, 15, 13319. [Google Scholar] [CrossRef]

- Shi, D. Green development and the new stage of global industrialization: Progress and comparison in China. China Ind. Econ. 2018, 10, 5–18. [Google Scholar]

- Liu, X.; Wen, Y. Should Chinese financial institutions bear environmental responsibility? basic facts, theoretical models, and empirical testing. Econ. Res. J. 2019, 54, 38–54. [Google Scholar]

- Desalegn, G.; Tangl, A. Enhancing green finance for inclusive green growth: A systematic approach. Sustainability 2022, 14, 7416. [Google Scholar] [CrossRef]

- Xiong, Y.; Dai, Y.; Wang, Y. Research on the impact of green finance on green total factor productivity. Explor. Financ. Theor. 2023, 5, 57–68. [Google Scholar]

- He, X.; Tang, L. Research on the impact of green finance on green total factor productivity: Based on the regulation and threshold effect of financial technology. Stat. Manag. 2023, 38, 96–102. [Google Scholar]

- Yin, Z.; Sun, X.; Xing, M. Research on the impact of green finance development on green total factor productivity. Stat. Decis. Mak. 2021, 37, 139–144. [Google Scholar]

- Shen, K.; Gong, J. Environmental pollution, technological progress, and China’s high energy consuming industries: An empirical analysis based on environmental total factor productivity. China Ind. Econ. 2011, 12, 25–34. [Google Scholar]

- Jie, M.; Wang, J.; Liu, D. Environmental regulation, technological innovation, and business performance. Nankai Manag. Rev. 2014, 17, 106–113. [Google Scholar]

- Zhang, K. Regional integration, environmental pollution, and social welfare. Financ. Res. 2020, 12, 114–131. [Google Scholar]

- Yao, Y.; Hu, D.; Yang, C. The impact and mechanism of fintech on green total factor productivity. Green Financ. 2021, 3, 198–221. [Google Scholar] [CrossRef]

- Wang, L.; Wang, Z.; Ma, Y. Heterogeneous environmental regulation and industrial structure upgrading: Evidence from China. Environ. Sci. Pollut. R. 2022, 29, 13369–13385. [Google Scholar] [CrossRef]

- Guan, S.; Liu, J.; Liu, Y. The nonlinear influence of environmental regulation on the transformation and upgrading of industrial structure. Int. J. Environ. Public Health 2022, 19, 8378. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.; Guan, S. The impact of environmental regulation on the upgrading of urban industrial structure: A quasi-natural experiment based on the two control zones policy. Sustainability 2023, 15, 13324. [Google Scholar] [CrossRef]

- Wu, H.; Hao, Y.; Ren, S. How do environmental regulation and environmental decentralization affect green total factor energy efficiency: Evidence from China. Energy Econ. 2020, 91, 104880. [Google Scholar] [CrossRef]

- Du, K.; Cheng, Y.; Yao, X. Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Econ. 2021, 98, 105247. [Google Scholar] [CrossRef]

- Zhao, B.; Wang, K.; Xu, R. Fiscal decentralization, industrial structure upgrading, and carbon emissions: Evidence from China. Environ. Sci. Pollut. R. 2023, 30, 39210–39222. [Google Scholar] [CrossRef] [PubMed]

- Murphy, J.; Gouldson, A. Environmental policy and industrial innovation: Integrating environment and economy through ecological modernization. Ecol. Mod. Read. 2020, 31, 275–294. [Google Scholar]

- Cao, S.; Nie, L.; Sun, H. Digital finance, green technological innovation and energy-environmental performance: Evidence from China’s regional economies. J. Clean. Prod. 2021, 327, 129458. [Google Scholar] [CrossRef]

- Jahanger, A.; Ozturk, I.; Onwe, J. Do technology and renewable energy contribute to energy efficiency and carbon neutrality? Evidence from top ten manufacturing countries. Sustain. Energy Technol. 2023, 56, 103084. [Google Scholar] [CrossRef]

- Sun, H.; Edziah, B.; Kporsu, A. Energy efficiency: The role of technological innovation and knowledge spillover. Technol. Forecast. Soc. 2021, 167, 120659. [Google Scholar] [CrossRef]

- Adebayo, T.; Kirikkaleli, D. Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: Application of wavelet tools. Environ. Dev. Sustain. 2021, 23, 16057–16082. [Google Scholar] [CrossRef]

- Amin, N.; Shabbir, M.; Song, H. A step towards environmental mitigation: Do green technological innovation and institutional quality make a difference? Technol. Forecast. Soc. 2023, 190, 122413. [Google Scholar] [CrossRef]

- Clohessy, T.; Acton, T. Investigating the influence of organizational factors on blockchain adoption: An innovation theory perspective. Ind. Manag. Data Syst. 2019, 119, 1457–1491. [Google Scholar] [CrossRef]

- Abduvakhidovna, Y. Factors influencing the implementation of the innovation strategy at industrial enterprises. World Bull. Manag. Law 2023, 19, 5–11. [Google Scholar]

- Soundarrajan, P.; Vivek, N. Green finance for sustainable green economic growth in India. Agric. Econ. 2016, 62, 35–44. [Google Scholar] [CrossRef]

- Ozili, P. Green finance research around the world: A review of literature. Int. J. Green Econ. 2022, 16, 56–75. [Google Scholar] [CrossRef]

- Zhu, W.; Zhu, Z.; Fang, S. Chinese students’ awareness of relationship between green finance, environmental protection education and real situation. Eurasia J. Math. Sci. Technol. Edu. 2017, 13, 3753–3769. [Google Scholar] [CrossRef]

- Muganyi, T.; Yan, L.; Sun, H. Green finance, fintech and environmental protection: Evidence from China. Environ. Sci. Ecotechnol. 2021, 7, 100107. [Google Scholar] [CrossRef]

- Zhang, W.; Zhu, Z.; Liu, X. Can green finance improve carbon emission efficiency? Environ. Sci. Pollut. R. 2022, 29, 68976–68989. [Google Scholar] [CrossRef] [PubMed]

- Umar, M.; Safi, A. Do green finance and innovation matter for environmental protection? A case of OECD economies. Energy Econ. 2023, 119, 106560. [Google Scholar] [CrossRef]

- Zhang, K.; Li, Y.; Zhao, J. Has green credit promoted energy conservation and emission reduction? Financ. Econ. 2022, 1, 15–30. [Google Scholar]

- Lu, Y.; Gao, Y.; Zhang, Y. Can the green finance policy force the green transformation of high-polluting enterprises? A quasi-natural experiment based on “Green Credit Guidelines”. Energy Econ. 2022, 114, 106265. [Google Scholar] [CrossRef]

- Jiang, S.; Liu, X.; Liu, Z. Does green finance promote enterprises’ green technology innovation in China? Front. Environ. Sci. 2022, 10, 981013. [Google Scholar] [CrossRef]

- Yu, B.; Liu, L.; Chen, H. Can green finance improve the financial performance of green enterprises in China? Int. Rev. Econ. Financ. 2023, 88, 1287–1300. [Google Scholar] [CrossRef]

- Jin, Y.; Gao, X.; Wang, M. The financing efficiency of listed energy conservation and environmental protection firms: Evidence and implications for green finance in China. Energy Pol. 2021, 153, 112254. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Li, Y.; Rasoulinezhad, E. Green finance and the economic feasibility of hydrogen projects. Int. J. Hydrog. Energy 2022, 47, 24511–24522. [Google Scholar] [CrossRef]

- Madaleno, M.; Dogan, E.; Taskin, D. A step forward on sustainability: The nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ. 2022, 109, 105945. [Google Scholar] [CrossRef]

- Sharma, G.; Verma, M.; Shahbaz, M. Transitioning green finance from theory to practice for renewable energy development. Renew. Energy 2022, 195, 554–565. [Google Scholar] [CrossRef]

- Ainou, F.; Ali, M.; Sadiq, M. Green energy security assessment in Morocco: Green finance as a step toward sustainable energy transition. Environ. Sci. Pollut. R. 2023, 30, 61411–61429. [Google Scholar] [CrossRef] [PubMed]

- Ionescu, L. Transitioning to a low-carbon economy: Green financial behavior, climate change mitigation, and environmental energy sustainability. Geopolit. Hist. Int. Relat. 2021, 13, 86–96. [Google Scholar]

- Zhao, L.; Chau, K.; Tran, T. Enhancing green economic recovery through green bonds financing and energy efficiency investments. Econ. Anal. Policy 2022, 76, 488–501. [Google Scholar] [CrossRef]

- Fan, Y.; Wang, L. Text analysis of energy conservation and emission reduction policies from a three dimensional analysis perspective. Bus. Manag. 2024, 3, 150–159. [Google Scholar] [CrossRef]

- Han, J.; Ge, C. Can energy-saving and emission reduction fiscal policies promote green innovation in enterprises: A quasi natural experiment from a comprehensive demonstration city of energy conservation and emission reduction fiscal policies. Bus. Res. 2023, 5, 60–71. [Google Scholar] [CrossRef]

- Wang, J.; Huo, Y.; Jin, X. The impact of incentive regulation on green technology innovation of high energy consuming enterprises: Evidence from comprehensive demonstration cities of energy conservation and emission reduction fiscal policies. J. Financ. Econ. 2023, 11, 103–112. [Google Scholar] [CrossRef]

- Xue, F.; Chen, X. The carbon reduction effect of green fiscal policies: Evi-dence from comprehensive demonstration cities of energy conservation and emission reduction fiscal policies. Financ. Res. 2022, 48, 79–93. [Google Scholar] [CrossRef]

- Ding, N.; Wang, G.; Xia, Y. The impact of green finance on economic ecological development in northwest China: An empirical study based on panel data models. For. Econ. 2024. [Google Scholar] [CrossRef]

- Shao, C.; Duan, B. Research on the coupling mechanism of green finance and innovation driven development. J. Xi’an Univ. Financ. Econ. 2019, 32, 5–12. [Google Scholar] [CrossRef]

- He, Z. Green finance, carbon emission regulation, and enterprise green total factor productivity. Stat. Decis. Mak. 2024, 40, 155–159. [Google Scholar] [CrossRef]

- Pan, M.; Xie, Q.; Cui, R. Research on the impact of green finance on green technology innovation from the perspective of resource allocation. Econ. Issues 2024, 4, 52–59. [Google Scholar]

- Dong, X.; Shao, L. Can the pilot policy of green finance reform and innovation promote the optimization of energy consumption structure? Financ. Econ. 2024, 1, 66–76. [Google Scholar]

- Chen, T.; Li, X.; Li, Z. Research on the driving effects of energy consumption and financial support on green innovation in manufacturing industry. Forum Stat. Inf. 2024, 39, 66–79. [Google Scholar]

- Zhang, M. Green finance and enterprise green technology innovation. Contemp. Financ. Res. 2024, 7, 40–52. [Google Scholar]

- Zhang, M.; Zheng, L.; Xie, Y. Spatial spillover effect of green finance and clean energy on China’s provincial green economic development. Environ. Sci. Pollut. Res. 2023, 30, 74070–74092. [Google Scholar] [CrossRef] [PubMed]

- Kwilinski, A.; Lyulyov, O.; Pimonenko, T. Spillover effects of green fi-nance on attaining sustainable development: Spatial Durbin model. Computation 2023, 11, 199. [Google Scholar] [CrossRef]

- Guo, Q.; Dong, Y.; Feng, B.; Zhang, H. Can green finance development promote total-factor energy efficiency? Empirical evidence from China based on a spatial Durbin model. Energy Policy 2023, 2023, 113523. [Google Scholar] [CrossRef]

- Ma, Q.; Lu, M.; Guo, Q. Research on management methods for energy conservation and emission reduction in coal mines under the situation of low carbon economy. Mod. Ind. Econ. Inf. Technol. 2023, 13, 300–302. [Google Scholar] [CrossRef]

- Wang, W.; Dong, D. Empirical analysis and upgrading strategies of industrial structure development in northeast china under the background of environmental regulation. China Bus. Rev. 2024, 5, 147–151. [Google Scholar] [CrossRef]

- Cao, G.; Gao, X.; Wang, T. The impact of green credit on commercial bank risk: A multi term double difference verification based on China’s banking industry. Financ. Dev. Res. 2024, 2, 55–63. [Google Scholar]

- Zhang, Y. Research on the impact of green credit on the optimization of industrial structure in China. Mod. Shopp. Mall 2024, 5, 129–131. [Google Scholar] [CrossRef]

- Zhang, R.; Zhou, Y. Green finance, carbon emission intensity, and corporate ESG performance: An empirical study based on micro data of listed companies. Soc. Sci. 2024, 3, 126–140. [Google Scholar]

- Wang, R.; Qi, L.; Wang, L. Factors and complex configuration analysis of technological innovation in Chinese enterprises. Sci. Res. Manag. 2024, 45, 42–52. [Google Scholar] [CrossRef]

- Guo, K.; Tian, X. Green technology and industrial development mode green transformation. Tianjin Soc. Sci. 2024, 2, 99–107. [Google Scholar]

- Shao, S.; Zhang, K.; Dou, J. Energy conservation and emission reduction effects of economic agglomeration: Theory and Chinese experience. Manag. World 2019, 35, 36–60. [Google Scholar]

- Chen, D.; Hu, W.; Li, Y. Exploring the temporal and spatial effects of city size on regional economic integration: Evidence from the Yangtze River Economic Belt in China. Land Use Policy 2023, 132, 106770. [Google Scholar] [CrossRef]

- Chen, H.; Yi, J.; Chen, A. Green technology innovation and CO2 emission in China: Evidence from a spatial-temporal analysis and a nonlinear spatial Durbin model. Energy Policy 2023, 172, 113338. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).