Research on the Changing Trends in Electricity Prices in Gansu Province Considering High Future Penetration of Sustainable Energy

Abstract

:1. Introduction

2. Methodology

3. Power Side Cost Calculation

3.1. Operating Period Model

3.2. Thermal Power Cost Calculation

3.3. Wind Power Cost Calculation

3.4. Photovoltaic Cost Calculation

3.5. Hydropower Cost Calculation

3.6. Cost Estimation of Electrochemical Energy Storage

3.7. Cost Calculation of Pumped Storage

3.8. Power Side Cost Calculation

4. Cost Calculation of Power Grid Side

4.1. “Cost + Benefit” Calculation Model

4.2. Grid-Side Cost Calculation Model

5. Morphological Evolution Analysis of New Power System

5.1. An Evolutionary Analysis Approach Based on Planning

5.2. Load–Storage Collaborative Planning Model of Source Network

5.3. Production Run Simulation Model

6. Case Study—Gansu Province as an Example

7. Conclusions

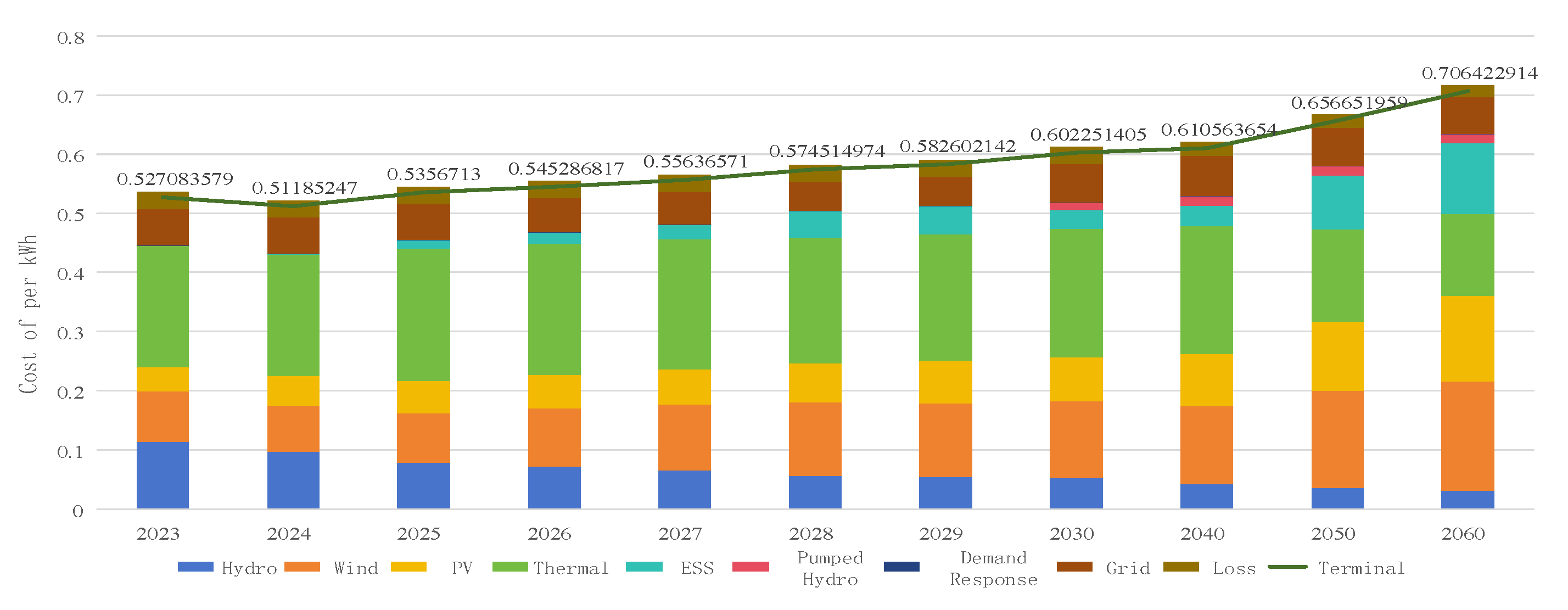

- (1)

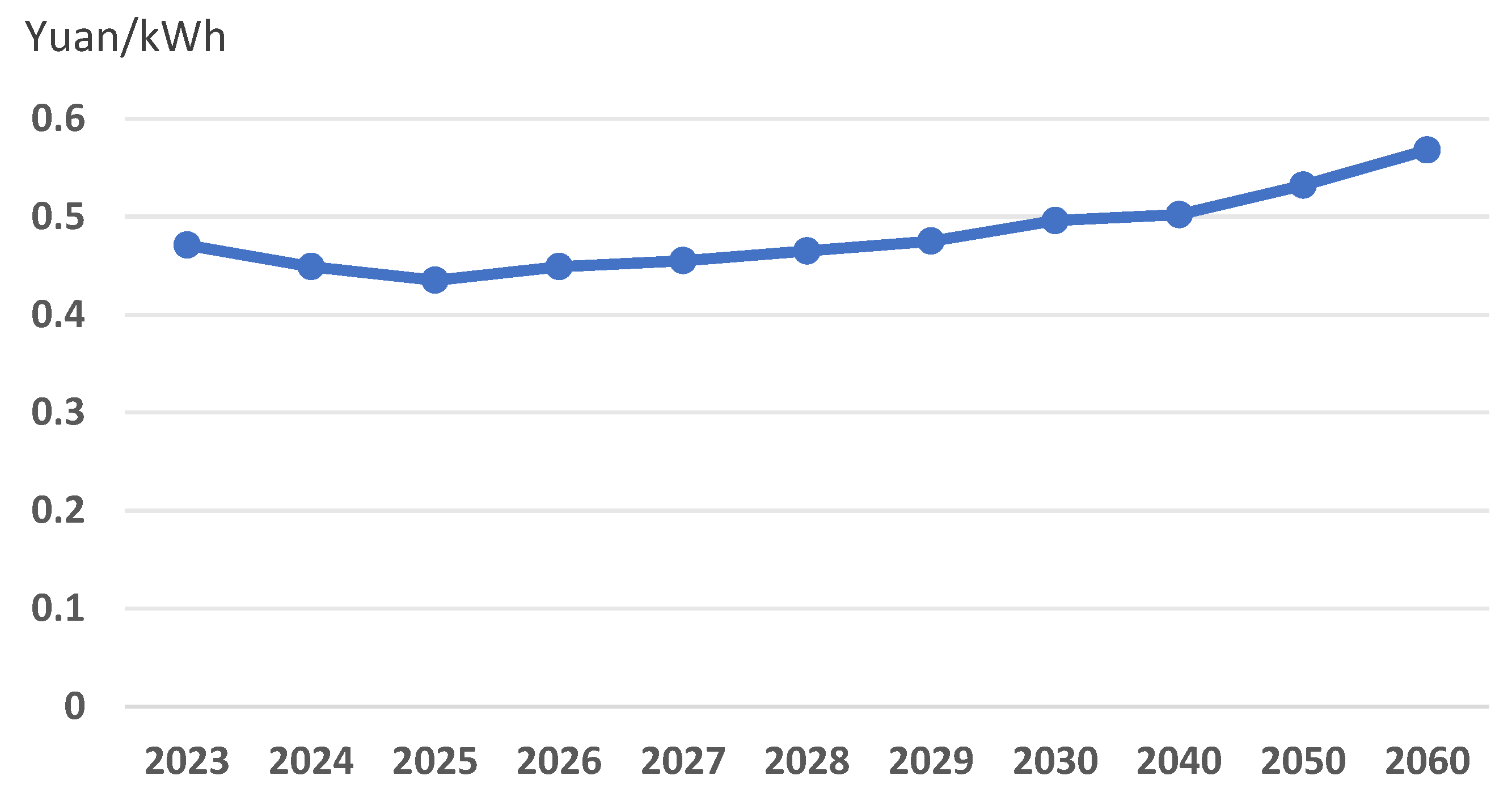

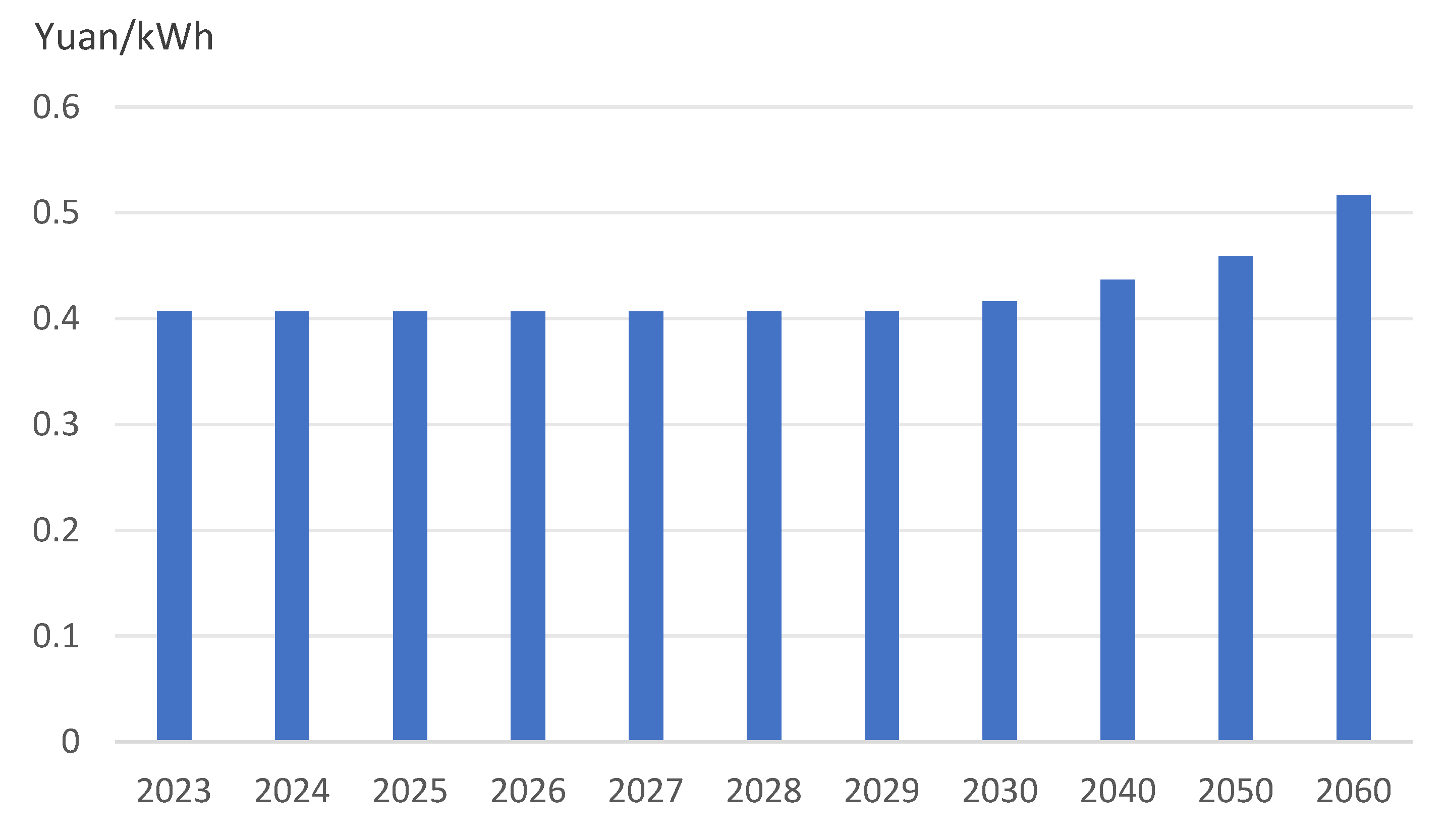

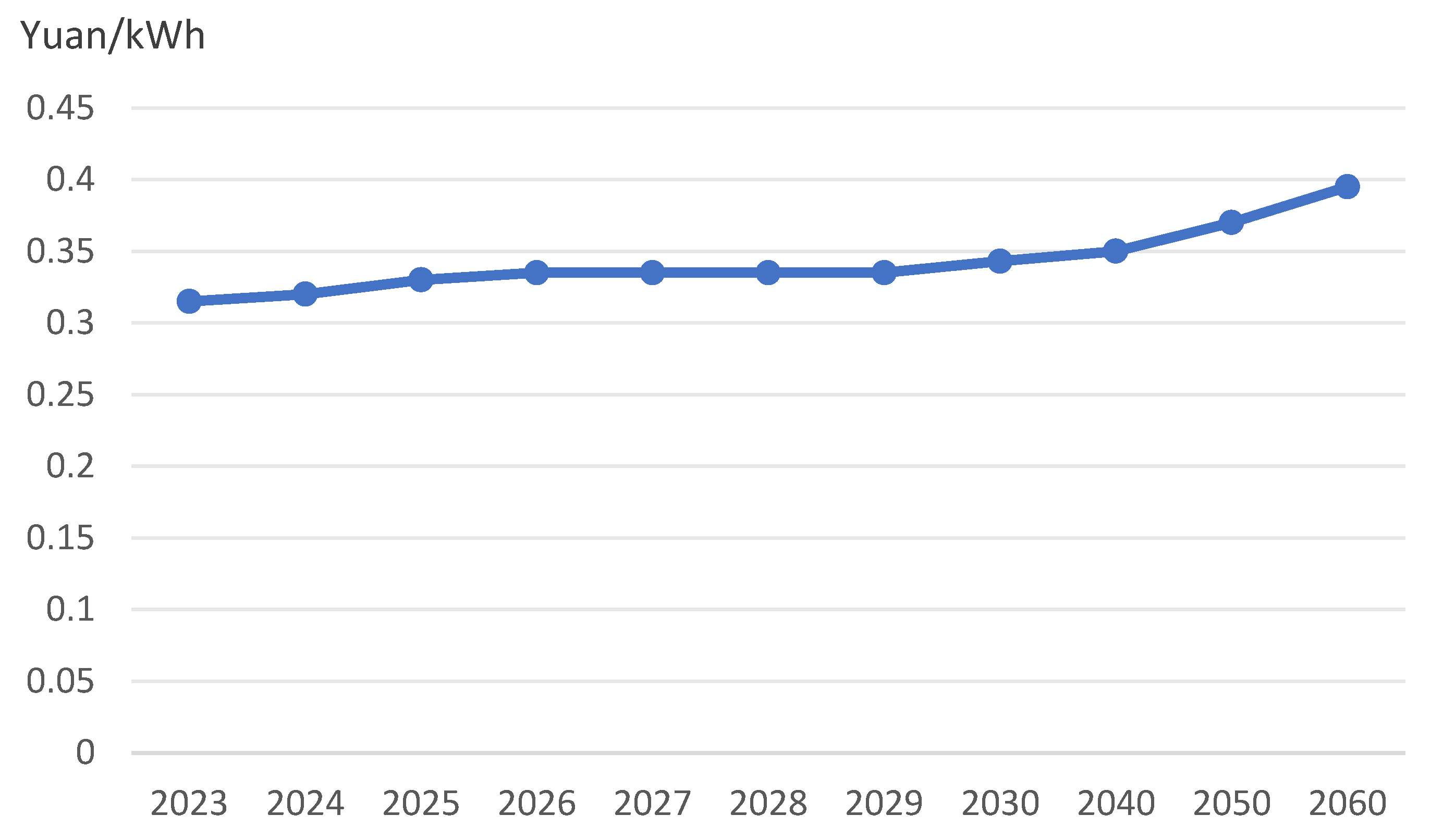

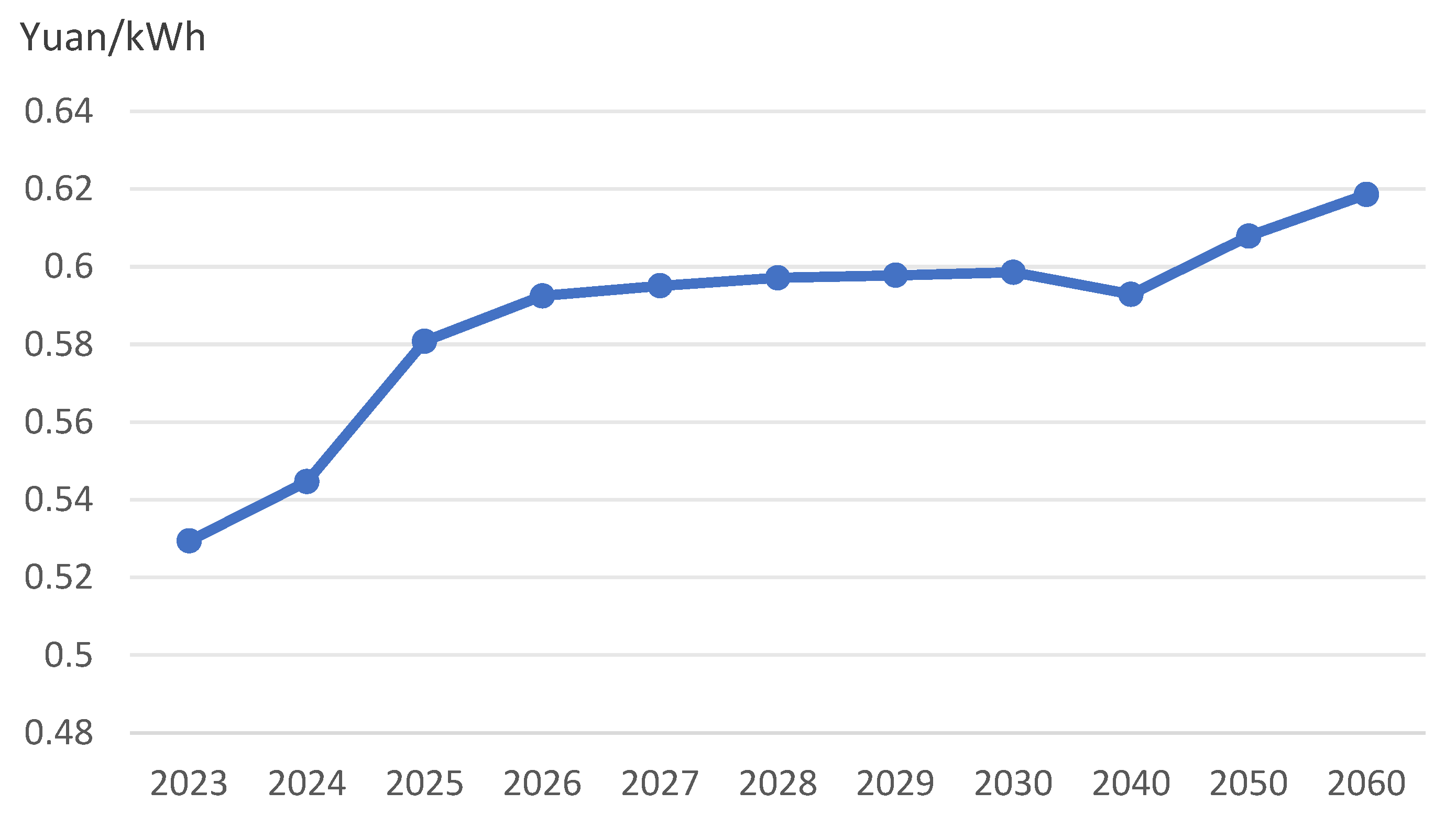

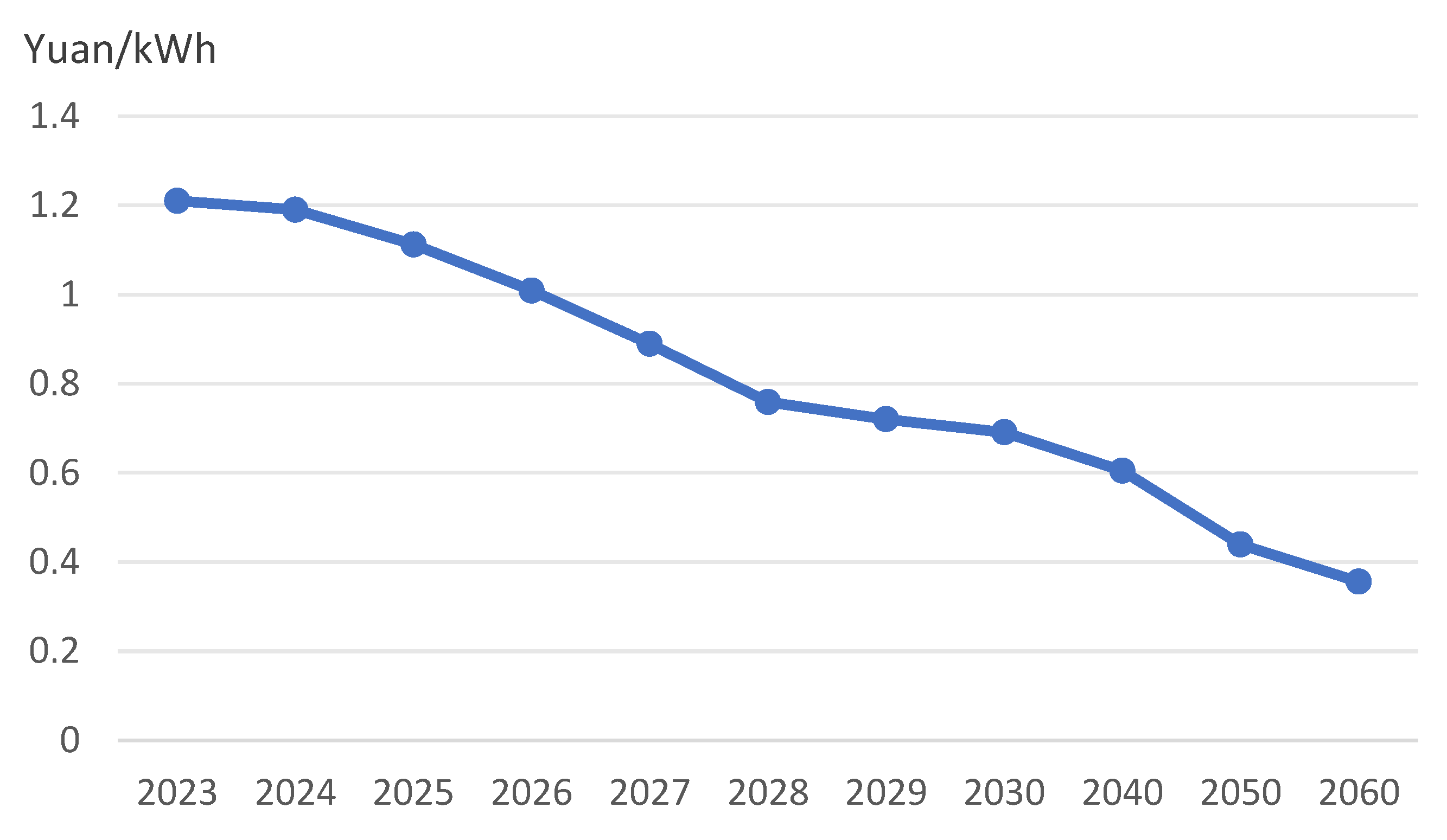

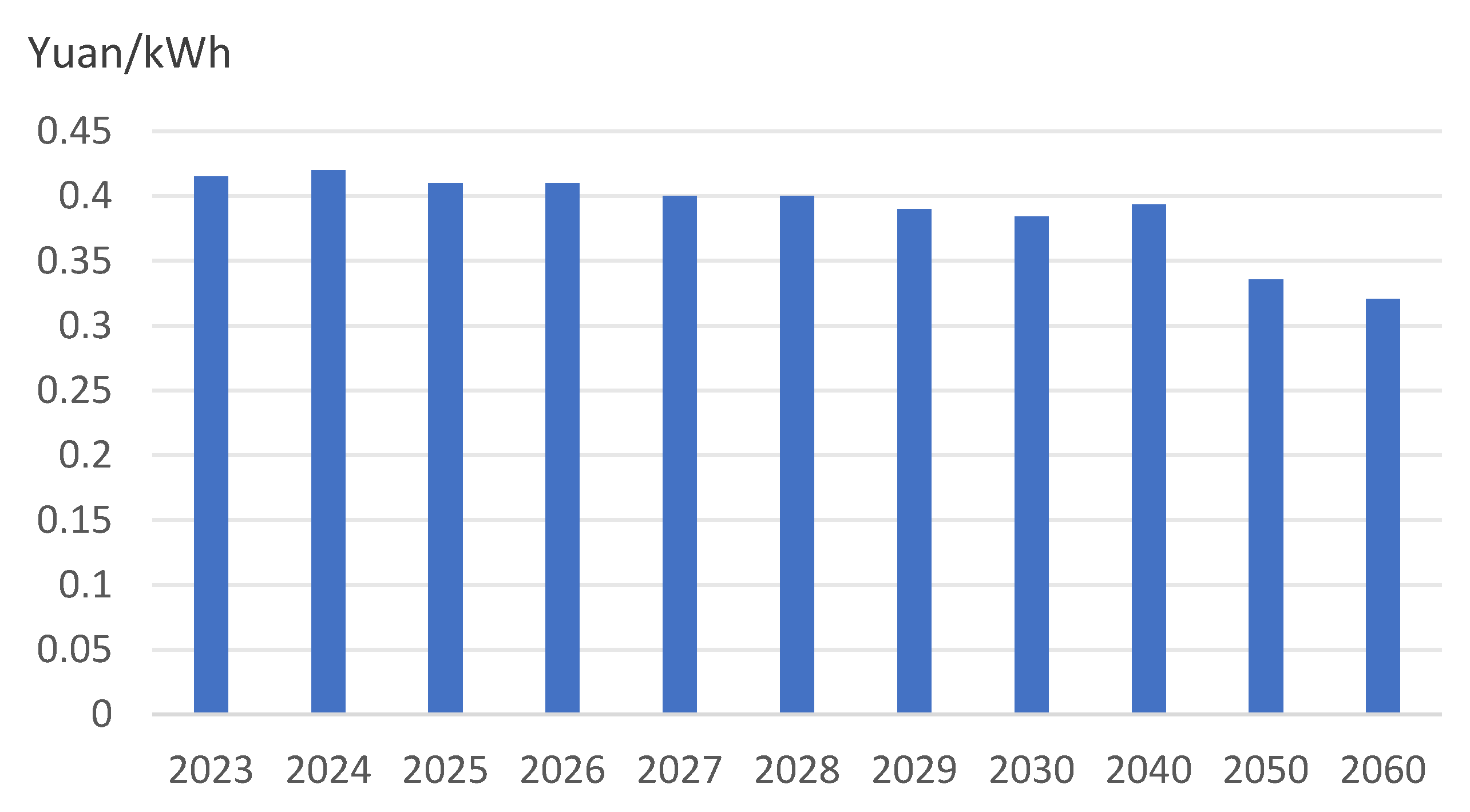

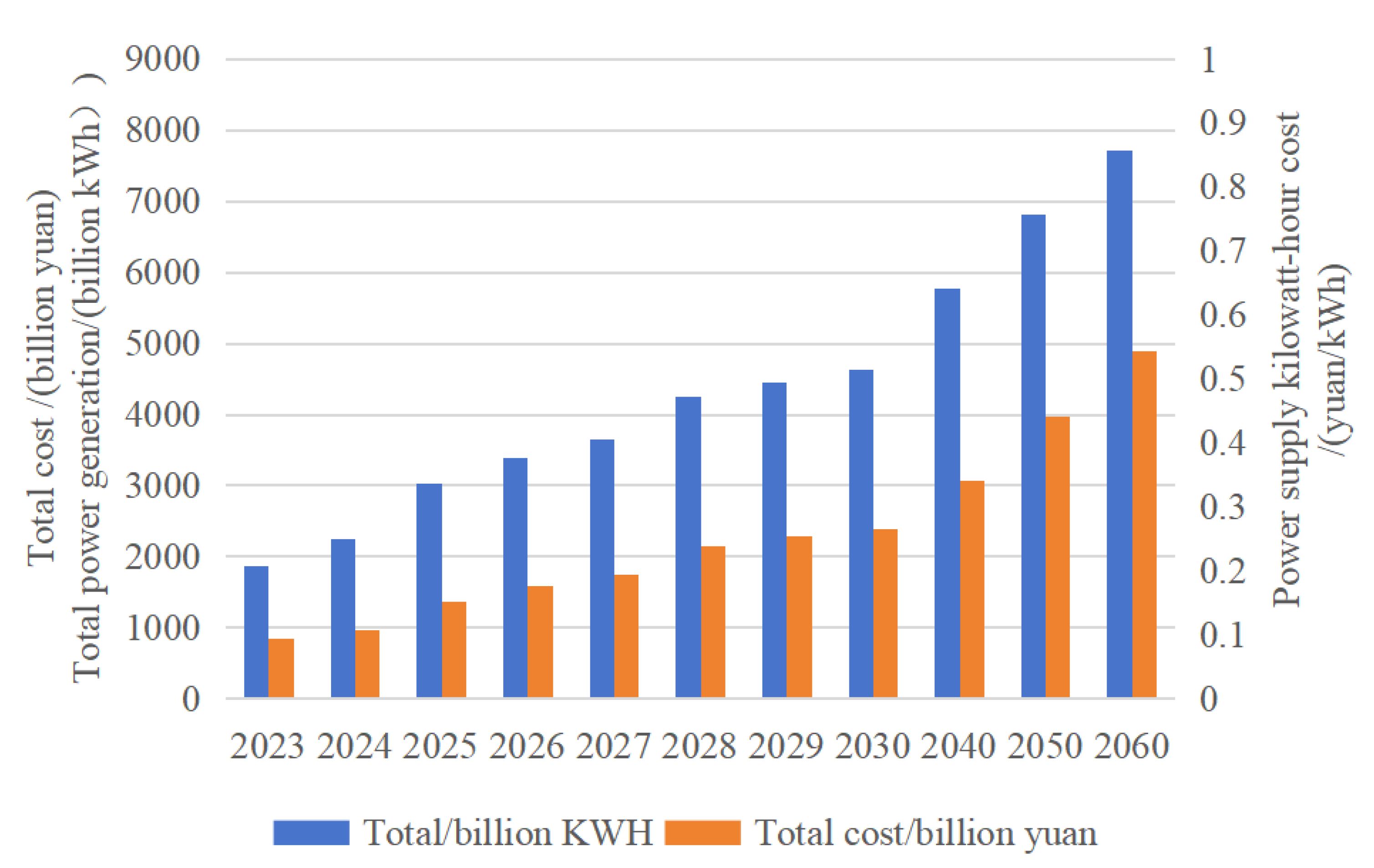

- In the future, the terminal electricity price of Gansu Province will show an overall rising trend. In the composition of the terminal electricity price, the proportion of wind power, photovoltaic, and energy storage will gradually increase, while the proportion of thermal power and hydropower will gradually decrease.

- (2)

- In terms of the growth of electricity price, the main growth of electricity price comes from the power supply side, and the change of electricity price on the grid side is small.

- (3)

- The prediction in this paper is based on the current technical and economic status quo. Due to the relatively long prediction time, considering that there may be breakthroughs in material science and energy utilization technology in the future, which will bring major innovations to the energy system, the prediction results in this paper are only for reference.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhang, N. China’s new energy power generation has entered a new stage of affordable development. New Energy Technol. 2022, 9, 1–3. [Google Scholar]

- Gao, Y.; Li, S.; Yan, X. Study on the Impact Trend of High-percentage Renewable Energy Access on Electricity Price Based on System Balance. Water Power 2023, 49, 91–95. [Google Scholar]

- Ni, C.; Liu, X. Battery Capacity Configuration and Economic Analysis of Photovoltaics Energy Storage System. Zhejiang Electr. Power 2019, 38, 1–10. [Google Scholar]

- Guo, X.; Huang, X.; Zhang, K.; Han, G.; Han, P.; Zhu, L. Research on Development Status and Price of Natural Gas Power Generation in China. Zhejiang Electr. Power 2020, 39, 109–117. [Google Scholar]

- Shen, X.; Zou, B. Influence of Renewable Energy on Average Electricity rice and Peak Electricity Price. Ind. Control Comput. 2023, 36, 159–161. [Google Scholar]

- Liu, J.; Li, L.; Wu, M.; Chen, H.; Chen, H. A two-stage optimal operation strategy for distributed pumped storage power plant and new energy power generation jointly participating in spot market. Zhejiang Electr. Power 2023, 42, 50–58. [Google Scholar]

- Xiang, Z.; Tang, J.; Xu, L.; Gan, W.; Sun, L.; Yang, L. An optimization model of benchmark electricity price for coal fired power generation considering the uncertainty of carbon price and electricity price. Zhejiang Electr. Power 2023, 42, 59–65. [Google Scholar]

- Yue, J.; Zhang, L. Research on Wind Power Economy Based on Operation Period Price and Externality. Sci. Technol. Ind. 2012, 12, 141–144+157. [Google Scholar]

- Bai, Y.; Wang, X.; Li, X.; Gao, T. Economic and environmental benefits analysis of centralized PV power generation projects in ultra-high altitude areas. Sol. Energy 2023, 10, 21–29. [Google Scholar]

- Zhang, Y.; Chen, N.; Huang, B.; Wang, C.X.; Li, J.T. Methodology for calculating VRE equivalent feed-In tariff based on system cost and its application. Electr. Power 2022, 55, 1–8. [Google Scholar]

- Zhou, J.; He, Y.; Li, R.; Lu, Y.; Huang, C. Dynamic Incentive Mechanism for Transmission and Distribution Tariff Considering Energy Transition Development. Power Syst. Technol. 2023, 1–10. [Google Scholar] [CrossRef]

- Li, J.; Luo, X.; Zhu, X.; Li, C.; Jia, C.; Zhang, Z.; Huang, J.; Chen, P. Peak Regulation Control Strategy of Wind-Thermal-Storage Combined Based on Green Certificate-Carbon Trading Mechanism. Electr. Power Constr. 2023, 44, 11–20. [Google Scholar]

- Liu, F.; Che, Y.; Tian, X.; Xu, D.; Zhou, H.; Li, Z. Cost Sharing Mechanisms of Pumped Storage Stations in the New-Type Power System: Reviewand Prospect. J. Shanghai Jiaotong Univ. 2023, 57, 757–768. [Google Scholar]

- Yao, J.; Wang, M.; Zhao, H.; Li, X.; Li, F.; Xie, Q.; Xu, Q. Optimal Allocation of Pumped Storage Capacity in Local Power Grid Considering Cost Recovery. Water Resour. Power 2022, 40, 208–211+197. [Google Scholar]

- Liu, Y.; He, Y.; Li, M.; Zhang, Y. Design of Price Market Linkage Mechanism and Economic Benefit Evaluation of Pumped Storage Power Station Under the Power Market Environment. Modern Electr. Power 2023, 40, 42–49. [Google Scholar]

- Su, Y.; Zhou, M.; Wu, Z.; Liu, J.; Wang, X.; Zhou, Z.; Wu, J. Externality Theory Based Cost Sharing Mechanism of Grid Side Energy Storage. Power Syst. Technol. 2024, 48, 110–122. [Google Scholar] [CrossRef]

- Ni, Y. Research on the Technical and Economic Aspects of Multi-Form Energy Storage to Promote New Energy Consumption Paths; Yanshan University: Qinhuangdao, China, 2021. [Google Scholar]

- Lu, X.; Chen, S.; Nielsen, C.P.; Zhang, C.; Li, J.; Xu, H.; Wu, Y.; Wang, S.; Song, F.; Wei, C.; et al. Combined solar power and storage as cost-competitive and grid-compatible supply for China’s future carbon-neutral electricity system. Proc. Natl. Acad. Sci. USA 2021, 118, e2103471118. [Google Scholar] [CrossRef] [PubMed]

- Chen, H.; Gao, X.Y.; Liu, J.Y.; Zhang, Q.; Yu, S.; Kang, J.N.; Yan, R.; Wei, Y.M. The grid parity analysis of onshore wind power in China: A system cost perspective. Renew. Energy 2020, 148, 22–30. [Google Scholar] [CrossRef]

- Vartiainen, E.; Masson, G.; Breyer, C.; Moser, D.; Román Medina, E. Impact of weighted average cost of capital, capital expenditure, and other parameters on future utility-scale PV levelised cost of electricity. Prog. Photovolt. Res. Appl. 2020, 28, 439–453. [Google Scholar] [CrossRef]

- Lee, C.Y.; Ahn, J. Stochastic modeling of the levelized cost of electricity for solar PV. Energies 2020, 13, 3017. [Google Scholar] [CrossRef]

- Marqusee, J.; Becker, W.; Ericson, S. Resilience and economics of microgrids with PV, battery storage, and networked diesel generators. Adv. Appl. Energy 2021, 3, 100049. [Google Scholar] [CrossRef]

- Bonkile, M.P.; Ramadesigan, V. Effects of sizing on battery life and generation cost in PV–wind battery hybrid systems. J. Clean. Prod. 2022, 340, 130341. [Google Scholar] [CrossRef]

- Li, Q.; Duan, H.; Xie, M.; Kang, P.; Ma, Y.; Zhong, R.; Gao, T.; Zhong, W.; Wen, B.; Bai, F.; et al. Life cycle assessment and life cycle cost analysis of a 40 MW wind farm with consideration of the infrastructure. Renew. Sustain. Energy Rev. 2021, 138, 110499. [Google Scholar] [CrossRef]

- Martinez, A.; Iglesias, G. Mapping of the levelised cost of energy for floating offshore wind in the European Atlantic. Renew. Sustain. Energy Rev. 2022, 154, 111889. [Google Scholar] [CrossRef]

- Feng, R.; Wencheng, L. LSSA-BP-based cost forecasting for onshore wind power. Energy Rep. 2023, 9, 362–370. [Google Scholar] [CrossRef]

- Johnston, B.; Foley, A.; Doran, J.; Littler, T. Levelised cost of energy, A challenge for offshore wind. Renew. Energy 2020, 160, 876–885. [Google Scholar] [CrossRef]

- Ali, S.; Jiang, J.; Murtaza, G.; Khan, M. Influence of real earning management on subsequent dividend payout decisions and corporate returns: A case of developing economy. Front. Environ. Sci. 2022, 10, 882809. [Google Scholar] [CrossRef]

- Adeyeye, K.A.; Ijumba, N.; Colton, J.S. A techno-economic model for wind energy costs analysis for low wind speed areas. Processes 2021, 9, 1463. [Google Scholar] [CrossRef]

- Chen, Z.; Wang, J.; Huang, S.; Yang, Z.; Zheng, F. Analysis ofeffective assets of’ power grid and relevant suggestions. China Power Enterp. Manag. 2021, 22, 51–54. [Google Scholar]

- Ma, B.; Niu, X. Economic Evaluation of Wind-thermal-bundled Cross-regional Power Supply for Electric Heating. Electr. Econ. 2020, 48, 89–95. [Google Scholar]

- Chen, H.; Tan, K.; Xi, S.; Yang, X.; Wang, J.; Wang, Z. A Model for Calculating Operation Period Cost of Offshore Wind Power. Autom. Electr. Power Syst. 2014, 38, 135–139. [Google Scholar] [CrossRef]

- Ran, L.; Guo, J.; Yuan, T. Power System Operation Simulation of Large-Scale Energy Storage on New Energy Station. Distrib. Energy 2020, 5, 1–8. [Google Scholar]

- Zhao, H.; Sui, Z. Cost Analysis and Comparison of Wind photovoltaic-thermalstorageIntegration Project Based on Lcoe. Guangdong Electr. Power 2023, 36, 39–46. [Google Scholar]

- Zhang, Q.; Sui, L. Calculation Methods of Two step Hydropower Net Pricing. Proc. CSU-EPSA 2012, 24, 116–119. [Google Scholar]

- Liu, Y.; Teng, W.; Gu, Q.; Sun, X.; Tan, Y.; Fang, Z.; Li, J. Scaled-up diversified electrochemical energy storage LCOE and its economic analysis. Energy Storage Sci. Technol. 2023, 12, 312–318. [Google Scholar]

- Xu, R.; Zhang, J.; Liu, M.; Cao, C.; Cao, X. Analysis of life cycle cost of electrochemical energy storage and pumped storage. Adv. Technol. Electr. Eng. Energy 2021, 40, 10–18. [Google Scholar]

- Wang, Y.; Wang, K.; Wang, X.; Zhao, Z.; Yu, T.; Feng, M.; Huang, J.; Yang, N. Life Cyele Cost Modeling, Estimation and System Development of Pumped Storage Units. Electr. Power Inf. Commun. Technol. 2023, 21, 71–77. [Google Scholar]

- Sun, Q.; Zhang, C.; Li, C.; You, P.; Gao, X.; Zhao, Q.; Xu, Z.; Liu, S.; Li, Y. Prediction of Power System Cost and Price Level Under the Goal of Carbon Peak and Carbon Neutralization. Electr. Power 2023, 56, 9–16. [Google Scholar]

- Ren, D.; Xiao, J.; Hou, J.; Du, E.; Jin, C.; Zhou, Y. Wide-Area Power System Generation-Transmission-Storage Coordinated Planning Method Based on Multiple Flexibility Constraints and Time-Series Simulation. Electr. Power 2022, 55, 55–63. [Google Scholar]

- Ren, D.; Jin, C.; Hou, J.; Xiao, J.; Du, E.; Zhou, Y. Planning Model for Renewable Energy with Energy Storage Replacing Thermal Power Based on Time Series Operation Simulation. Electr. Power 2021, 54, 18–26. [Google Scholar]

| Power Supply/Year | 2030 | 2040 | 2050 | 2060 |

|---|---|---|---|---|

| Coal power | 3854 | 4509 | 4509 | 4509 |

| Hydroelectric | 1050 | 1050 | 1050 | 1050 |

| Pump storage | 780 | 1300 | 1800 | 1800 |

| Stored energy | 1124 | 1732 | 5417 | 9510 |

| Wind power | 7624 | 9246 | 12,947 | 14,570 |

| Solar power | 6969 | 10,081 | 15,725 | 21,505 |

| Total | 21,401 | 27,918 | 41,448 | 52,944 |

| Power Supply/Year | 2030 | 2040 | 2050 | 2060 |

|---|---|---|---|---|

| Coal power | 3500 | 3500 | 3500 | 3500 |

| Hydroelectric | 15,000 | 20,000 | 25,000 | 30,000 |

| Pump storage | 6300 | 6500 | 6700 | 6900 |

| Stored energy | 7200 | 6000 | 5000 | 3000 |

| Wind power | 7000 | 6500 | 6000 | 5500 |

| Solar power | 4600 | 4000 | 3500 | 3000 |

| Power Supply/Year | 2030 | 2040 | 2050 | 2060 |

|---|---|---|---|---|

| Coal power | 4543.30 | 4724.13 | 3693.58 | 3120.50 |

| hydroelectric | 3828.68 | 3865.23 | 3770.02 | 3704.58 |

| Energy storage (including extraction and storage) | 1873.16 | 1899.90 | 2417.67 | 2640.37 |

| Wind power | 1876.52 | 1824.69 | 1750.87 | 1693.91 |

| Solar power | 1484.84 | 1435.06 | 1383.34 | 1331.93 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, R.; Wang, X.; Liang, T.; Zhi, J.; Jin, Y.; Qian, J.; Li, H. Research on the Changing Trends in Electricity Prices in Gansu Province Considering High Future Penetration of Sustainable Energy. Sustainability 2024, 16, 3340. https://doi.org/10.3390/su16083340

Huang R, Wang X, Liang T, Zhi J, Jin Y, Qian J, Li H. Research on the Changing Trends in Electricity Prices in Gansu Province Considering High Future Penetration of Sustainable Energy. Sustainability. 2024; 16(8):3340. https://doi.org/10.3390/su16083340

Chicago/Turabian StyleHuang, Rong, Xiang Wang, Tian Liang, Jing Zhi, Yongsheng Jin, Jiaxin Qian, and Haibo Li. 2024. "Research on the Changing Trends in Electricity Prices in Gansu Province Considering High Future Penetration of Sustainable Energy" Sustainability 16, no. 8: 3340. https://doi.org/10.3390/su16083340

APA StyleHuang, R., Wang, X., Liang, T., Zhi, J., Jin, Y., Qian, J., & Li, H. (2024). Research on the Changing Trends in Electricity Prices in Gansu Province Considering High Future Penetration of Sustainable Energy. Sustainability, 16(8), 3340. https://doi.org/10.3390/su16083340