Abstract

With the strategic background of accelerating the transformation of the low-carbon economy in China, how to better help the new energy automobile industry realize green and high-quality development under the goal of “dual-carbon” with the strengthening of science and technology has become one of the most important issues nowadays, and it is of great significance to explore the relationship between financial technology (fintech) and the environmental, social, and governance (ESG) performance of the new energy automobile (NEV) industry. Using panel data from NEV companies listed on the Shanghai and Shenzhen A-share markets between 2011 and 2022, this study applies text mining techniques to construct a fintech index and analyze the transmission mechanisms through which fintech influences ESG performance. The findings show that fintech directly improves ESG outcomes for NEV companies, a result that remains robust across a series of validation tests. The analysis reveals that fintech reduces financing constraints and enhances corporate environmental information disclosure, which in turn drives better ESG performance. Furthermore, the impact of fintech is particularly pronounced in state-owned enterprises, large-scale firms, and technologically advanced NEV companies, as evidenced by heterogeneity analysis. This study provides empirical insights into fintech’s role in advancing sustainable development in the NEV sector, offering guidance for policymakers and industry stakeholders aiming to align technological progress with environmental and social governance objectives.

1. Introduction

Currently, financial technology (hereafter, fintech) has become a critical driver of productivity within the financial sector, playing an essential role in shaping the future of financial services. As the financial industry confronts significant technological challenges, it is increasingly important to enhance its internal innovation capacity. By fostering an ecosystem that prioritizes technological advancements, the financial sector can position itself as the primary engine of innovation. In this regard, science and technology must evolve into a foundational element of the financial industry’s high-quality development, contributing to its ability to address contemporary challenges and foster sustainable growth [1]. Fintech has emerged as a powerful engine for the real economy, providing critical support to key sectors and integrating innovative financial solutions into products and services. According to the China Sustainable Investment Forum (An international exchange platform focusing on responsible investment and sustainable development issues) report, by the end of September 2023, the size of sustainable investment assets in China reached approximately 33 trillion yuan, with sustainable public funds amounting to about 510.424 billion yuan and a total of 747 sustainable public funds, which shows the financial technology for the development of new energy vehicles and other high-tech enterprises provides policy support and market power. And environmental, social, and governance (ESG) factors have been shown to have a significant impact on companies’ long-term value and investment returns [2]. Companies with high ESG performance usually receive lower costs of capital and higher market ratings. The Chinese government also actively promotes the integration of fintech and green development to support environmental protection and sustainable development [3]. This integration not only injects new vitality into the development of the real economy but also provides a new way for companies to improve their ESG performance.

Since China proposed 2020 “carbon peak” and “carbon neutral” goals (the “dual-carbon” goals), monitoring the ESG performance of enterprises has become a crucial tool for achieving sustainable development. Enterprises, as the microscopic drivers of real economic development, play a central role in fostering sustainable economic and social progress. Only by promoting the sustainable development of companies can we promote the high-quality development of the economy and society [4]. Consequently, exploring ways to enhance the ESG performance of businesses is crucial for advancing the “dual-carbon” goals and promoting the overall high-quality development of the economy and society. With an increasing number of enterprises dedicating resources to ESG investments and enhancing ESG-related disclosures, the growing body of literature underscores the positive impact of strong ESG performance. Research indicates that the ESG performance of companies is influenced by both internal governance structures and external regulatory frameworks. In particular, a robust internal governance system has been shown to correlate with enhanced corporate social responsibility performance, highlighting the significance of effective management practices in driving sustainability [5]. Furthermore, digital transformation serves as an important means of optimizing resource allocation, thereby enhancing enterprise ESG performance. Additionally [6], the financial performance gap and the balance of power within board structures significantly contribute to improved ESG performance [7]. Among the external factors, media attention, public demand for environmental protection and the monitoring role of institutional investors are also effective in promoting the environmental performance of enterprises [8,9]. In addition, environmental assessments by local government officials contribute to corporate ESG performance [10].

Fintech, often referred to as “finance + technology” [11] or as a fusion of finance and technology, fundamentally involves leveraging various new technologies to innovate financial services [12]. This innovation enhances efficiency, increases convenience, and effectively reduces operating costs. The Financial Stability Board (International organizations that coordinate transnational financial regulation and set and enforce global financial standards) defines fintech as the application of big data, blockchain, data mining, and other technologies to modernize traditional financial markets and service models, thereby achieving automated and refined operations in large-scale scenarios. Previous studies indicate that fintech can address issues of underinvestment and overinvestment at the governance level, thereby improving investment efficiency [13], alleviating information asymmetry [14], and enhancing the total factor productivity of enterprises [15]. This, in turn, promotes the innovation and development of small and medium-sized enterprises. However, some scholars have cautioned that the growth of fintech may lead to an increase in financial risks and could potentially generate systemic risks, thereby impacting financial stability [16].

Then, as a representative of low-carbon enterprises, new energy automobile (NEV) companies are crucial to promoting sustainable economic and social development, and improving the ESG performance of new energy automobile enterprises is essential to realizing the “dual-carbon” goal and promoting high-quality economic and social development. In the NEV industry, the pressures of global carbon emission reduction and the growing consumer demand for environmentally friendly vehicles have led to heightened attention on the industry’s ESG performance [17]. By leveraging financial technology, NEV companies can optimize their energy management and production processes while enhancing their ESG performance through improved supply chain transparency and social responsibility practices. This alignment with environmental protection trends not only helps companies attract green investments and consumer support but also provides them with a competitive advantage in a fiercely contested market [18]. Concurrently, the rapid advancement of fintech is reshaping traditional financial services. By offering innovative financial products and services and refining decision-making processes, fintech tools such as big data, blockchain, and artificial intelligence have demonstrated their effectiveness in enhancing information transparency, risk management, and capital utilization efficiency within enterprises. Consequently, these advancements contribute to the improvement of ESG performance among NEV companies [19]. Furthermore, ESG criteria are increasingly integrated into supply chain evaluation systems, further promoting corporate green innovation [20].

At present, academia has ignored the impact of fintech on the ESG performance of NEV enterprises. Therefore, this paper selects data from A-share listed NEV companies in Shanghai and Shenzhen from 2011 to 2022 to examine the impact of fintech development on the ESG performance of these companies and the underlying mechanisms. The empirical results show that the development of fintech significantly promotes the ESG performance of NEV enterprises. After considering a series of robustness tests such as endogeneity and lag of explanatory variables, the conclusions of this paper still hold. The mechanism study further finds that the development level of fintech improves the quality department of environmental information disclosure of NEV enterprises and alleviates the inhibitory effect of financing constraints on the ESG performance of NEV enterprises. In addition, the heterogeneity test shows that fintech has a more significant impact on state-owned NEV enterprises, large-scale NEV enterprises, and high-tech NEV enterprises.

The remainder of this paper is organized as follows. Section 2 provides a comprehensive review of the existing literature on the relationship between fintech and firms’ ESG performance, synthesizing key findings and theoretical frameworks from the domains of financial technology and ESG factors. Section 3 outlines the data sources and explains the rationale behind the selection of key variables, offering transparency regarding the construction of the research sample and the operational definitions of the variables used. Section 4 presents the empirical results, followed by a detailed discussion that highlights the significant role of fintech in enhancing the ESG performance of NEV firms, particularly through improvements in financing efficiency and the quality of information disclosure. Section 5 conducts a heterogeneity analysis, exploring the differential impact of fintech on various types of firms, such as state-owned versus non-state-owned, small versus large, and high-tech versus non-high-tech enterprises. Section 6 delves into the underlying mechanisms, examining how fintech contributes to ESG performance by alleviating financing constraints and enhancing operational transparency. Finally, Section 7 provide a comprehensive summary of the findings and a critical discussion, respectively, while offering policy recommendations that emphasize the need for differentiated government policies tailored to firm-specific characteristics. These policies would support the integration of fintech and ESG principles, thereby fostering the sustainable development of the new energy vehicle industry.

The potential contributions of this paper are as follows: (1) It utilizes the number of search results for keywords related to fintech in Baidu News to assess the development level of fintech in prefecture-level cities and municipalities directly under the Central Government. Furthermore, it evaluates the impact of fintech on the ESG performance of NEV enterprises, providing a reference for these enterprises in their sustainable development strategies. (2) This study incorporates fintech into the analytical framework of ESG performance, thereby enriching the existing literature on the ESG performance of enterprises. (3) It examines the influence of fintech on the ESG performance of NEV enterprises from two perspectives: the quality of corporate environmental information disclosure and financing constraints, offering micro-empirical evidence to explore how fintech facilitates the sustainable development of enterprises through specific mechanisms. (4) Finally, this paper investigates the effect of fintech on the ESG performance of NEV enterprises across different technologies, considering three factors: enterprise ownership, enterprise size, and high-tech status, thus providing a theoretical basis for the tailored sustainable development of NEV enterprises.

2. Theoretical Analysis and Research Hypothesis

2.1. The Direct Impact of Fintech on the ESG Performance of NEV Enterprises

Through cutting-edge technological advancements such as the Internet, blockchain, and big data, fintech not only transforms traditional financial models but also enhances the synergy between economic development and the ecological environment, thereby promoting the sustainable development of NEV enterprises [21]. On one hand, fintech can swiftly capture and identify information, accurately analyze the value needs of various stakeholders, and rationally allocate economic resources both within and outside the enterprise to meet these needs, thereby comprehensively improving the environmental and social performance of NEV enterprises [22]. On the other hand, blockchain technology, as provided by fintech, can foster in-depth collaboration between environmental regulatory authorities and financial institutions, ensuring the authenticity and security of data from NEV enterprises. This technology helps to eliminate information barriers and enables real-time tracking of the environmental behaviors and production activities of these enterprises [23]. In the context of the “dual-carbon” goal and the requirements of a green economy, emerging high-tech solutions facilitate the establishment of efficient, low-energy operational and production modes, thereby enhancing the energy utilization efficiency of products and processes. This fundamentally improves the environmental performance of NEV enterprises. Additionally, technological empowerment may transform the management practices within these enterprises, reducing irrational behaviors among managers during the decision-making process and minimizing the occurrence of erroneous decisions [24]. Consequently, this leads to improved operational efficiency and enhanced ESG performance of NEV enterprises [25].

Fintech has been shown to significantly improve resource allocation and energy utilization in the production, operations, and supply chain management of NEV companies [26]. Through innovative technologies such as big data, cloud computing, and blockchain, fintech promotes greater efficiency and sustainability. In the environmental dimension, fintech enables companies to more accurately monitor energy consumption and emissions throughout their production chains through real-time data analytics. This capability allows for the optimization of production processes, helping to reduce both energy waste and environmental pollution [27]. For example, blockchain technology plays a crucial role in ensuring the authenticity and transparency of environmental data, thereby improving environmental compliance through digital solutions. This not only ensures that companies meet their environmental responsibilities, but also increases accountability and trust in environmental reporting. In addition, big data analytics enable NEV companies to quickly identify environmental risks and implement targeted control measures. By leveraging these insights, companies can proactively improve their environmental performance and mitigate negative environmental impacts, contributing to the broader goal of sustainable industrial development.

In the social responsibility dimension, fintech has had a significant impact on enhancing corporate accountability and credibility, particularly by improving the transparency and accessibility of corporate information. The data transparency and real-time tracking capabilities facilitated by fintech enable stakeholders to gain deeper insights into corporate investments and efforts in social responsibility initiatives, especially in areas such as social welfare and employee benefits [28]. The integration of these technological tools not only improves the efficiency of external company relations but also increases public scrutiny of corporate behavior. This, in turn, strengthens the motivation of companies to uphold their social responsibilities, as they are more likely to be held accountable by the public [29]. In addition, the application of blockchain technology within the supply chain will ensure compliance in the procurement of raw materials and production processes, helping to prevent corporate social responsibility failures and improve overall social performance.

In the corporate governance dimension, fintech has the potential to significantly improve the effectiveness of governance structures and mitigate management risks through the use of data-driven decision support systems, smart contracts, and other technological innovations [30]. By leveraging data analysis, fintech provides a more scientific basis for decision-making, enabling managers to identify potential governance gaps and management risks. This not only reduces information asymmetry and decision-making errors but also improves the overall quality of corporate governance. In addition, blockchain technology plays a critical role in ensuring transparency and fairness in the corporate decision-making process. It helps limit irrational decision-making and prevents the misallocation of resources or the transfer of benefits within the organization. By fostering transparency and accountability, these technologies strengthen the governance capabilities of boards and management teams, ultimately contributing to the long-term development and sustainability of the business. Therefore, the following hypothesis is proposed in this study:

H1:

Fintech can directly promote the ESG performance of NEV enterprises.

2.2. The Influence Mechanism of Fintech and ESG Performance of NEV Enterprises

In the current rapidly evolving market environment, the application of financial technologies, especially big data and artificial intelligence, has emerged as a key driver of environmental protection and sustainable development for enterprises. For example, NEV companies can leverage these advanced technologies to collect and analyze vast amounts of environmental data in real time, such as emission levels, energy consumption efficiency, and carbon footprints throughout the supply chain, from raw material purchase to end-use. These data not only serve as an accurate tool for internal environmental management but also increase transparency by providing investors and regulators with more accurate and reliable financial and environmental information [31]. For example, big data analytics allow companies to track and refine carbon emissions at each stage of the production process in real time, enabling them to improve manufacturing practices, reduce resource waste, and more accurately measure the effectiveness of their environmental policies and initiatives. In addition, artificial intelligence can help companies predict future environmental trends and market demands, enabling proactive design of green technologies. This not only strengthens market competitiveness but also supports the company’s commitment to social responsibility and sustainable development.

The impact of fintech on NEV companies extends beyond data collection and analysis, playing a vital role in improving overall corporate ESG performance [32]. In fact, fintech is improving the quality and frequency of environmental disclosure, a key component as ESG investing continues to gain traction as a mainstream investment strategy. As a result, companies are increasingly adopting higher standards for disclosing non-financial information, including real-time monitoring of carbon emissions, energy consumption efficiency, and green product certifications, while meeting their social and environmental responsibilities. This increased transparency allows investors to gain a clearer understanding of a company’s environmental risks and efforts to reduce emissions, enabling them to make more informed and accurate investment decisions [33]. In addition, accurate and real-time disclosure of environmental management data enables companies to effectively manage their public image, strengthen their corporate responsibility profile, and build a trusted brand. This not only improves their reputation with consumers, investors, and regulators but also reinforces their commitment to sustainable development and corporate accountability.

By improving the disclosure of environmental information, NEV companies can not only better comply with increasingly stringent environmental regulations and meet evolving market demands but also continuously optimize their environmental management strategies, thereby advancing their long-term sustainability goals. For example, through the application of financial technology, companies can accurately monitor energy consumption throughout the production process, enabling them to adjust energy use patterns in real time, reduce carbon intensity, and realize cost savings [34]. Furthermore, by proactively disclosing environmental data, NEV companies can actively engage in global climate change initiatives and contribute to the broader goal of sustainable development. This transparency not only reinforces their commitment to corporate social responsibility but also enhances their market reputation. As a result, these efforts significantly improve companies’ ESG performance while laying a solid foundation for their long-term financial stability and sustainable growth [35]. Therefore, the following hypothesis is proposed in this study:

H2:

Financial technologies in the NEV sector directly promote ESG performance by enhancing the quality of environmental information disclosure.

NEV companies often face significant capital requirements as they pursue technological innovation and market expansion. The high R&D investment in the industry, the rapid pace of technological advancement, and the long timelines to profitability make innovation in the sector inherently risky and capital-intensive. These characteristics result in high sunk costs, creating significant challenges for NEV companies in securing financing. Traditional financing channels often prove inadequate, particularly in the face of capital market fluctuations, leading to financing constraints that can hinder growth and innovation [36]. However, the rapid development of fintech offers novel solutions to these challenges. By increasing financing efficiency and reducing information asymmetry, fintech offers unique advantages that can alleviate the financial pressures faced by NEV enterprises. These technological developments enable better access to capital, providing new opportunities for growth and investment in the sector, while also increasing the transparency and attractiveness of companies to potential investors.

Fintech plays a pivotal role in enabling banks and financial institutions to more accurately assess the credit risk of NEV companies, especially in the absence of traditional financial data. By leveraging big data analytics, artificial intelligence, and machine learning technologies, fintech facilitates a more comprehensive assessment of a company’s risk profiles. For example, using historical data on a company’s production processes, market performance, and environmental impact, fintech can develop an advanced credit scoring model that helps financial institutions assess the repayment capacity of NEV companies [37]. These risk assessment models not only improve the efficiency of credit assessment for NEV companies but also mitigate the biases and uncertainties inherent in traditional financing processes. As a result, fintech is improving the accessibility of financial support for these companies, reducing barriers to financing, and encouraging greater investment in the growing new energy vehicle sector [38].

Furthermore, fintech platforms offer NEV companies more flexible and diversified funding options. By pooling the resources of a large number of small investors, these platforms enable companies to bypass the cumbersome procedures typically associated with traditional bank loans and secure the funds they need directly from public investors. This approach not only lowers the barriers to funding but also enables NEV companies to quickly raise capital for research and development (R&D) or expansion efforts [39]. Crowdfunding platforms, in particular, provide a viable solution for firms facing funding constraints, especially in their early stages or during periods of financial constraint [40].

In summary, fintech has a crucial role to play in alleviating the financing challenges faced by NEV enterprises. By improving the accuracy of credit assessments, expanding financing channels, and increasing the transparency and efficiency of the financing process, fintech helps firms secure more stable and accessible financial support. These measures not only ease the financial pressure on companies but also provide a solid financial foundation for continued innovation and investment in environmental technologies. As a result, fintech contributes to the long-term improvement of ESG performance, supporting both the sustainable growth of NEV companies and their commitment to environmental responsibility. Therefore, the following hypothesis is proposed in this study:

H3:

Financial technology plays a direct role in promoting the ESG performance of new energy automobile enterprises by alleviating their financing constraints.

3. Data and Variables

The empirical sample used in this paper is the ESG rating and financial data of A-share listed companies in Shanghai and Shenzhen from 2011 to 2022. Screening sample standards include (1) excluding delisting, “ST”, and “*ST” listed companies and (2) eliminating ESG information and lack of financial information of listed companies. In addition, all explained continuous variables and control variables were 1% and 99% after end processing. Finally, 367 listed companies from 2011 to 2022 were selected for a total of 12 years of data, with 3415 articles making up the total amount of observation for the panel data. In order to reduce the influence of outliers and the top and bottom 1% of all continuous variables in the end processing, the corresponding data from the CSMAR database and wind database were included.

3.1. Indicator Construction

3.1.1. Explanatory Variable (Fintech)

Referring to the research conducted by Du et al. and Wang et al. [41,42], the text mining method is employed to construct the fintech index. This process incorporates insights from several key documents, including the “13th Five-Year Plan for National Science and Technology Innovation”, the “China Fintech Operation Report (2018)”, the “China Fintech and Digital Inclusive Finance Development Report (2022)”, and the “Big Data Enterprise Development Plan (2016–2020)”, along with relevant significant news articles. The analysis focuses on 48 keywords related to financial technology, such as blockchain, Internet finance, natural language processing, speech recognition, semantic search, intelligent data analysis, smart contracts, cloud computing services, credit reporting, big data, digital currency, mobile payment, mobile Internet, virtual reality, quantitative finance, green computing, concurrent heterogeneous data, and intelligent financial contracts. These keywords are then matched with data from cities at all levels, including municipalities directly under the central government, corresponding to the relevant years. Subsequently, web crawler technology is used to extract source texts from the Baidu News website and retrieve the number of search results associated with each keyword. The search results for keywords at the same level or from all municipalities directly under the central government are aggregated to ensure comprehensive data collection.

3.1.2. Explained Variable: Environmental, Social, and Governance Performance of NEV Enterprises (ESG)

This article selects the ESG rating in China as a measure of the ESG performance of new energy automobile enterprises. Since 2009, the China Securities Index has been evaluating the ESG performance of securities issuers, including A-share and bond issuers. Currently, it encompasses all A-share listed companies, and the index has received widespread recognition from both industry and academia [43]. The China ESG rating is categorized into nine levels: C, CC, BB, BBB, CCC, B, A, AA, and AAA, corresponding to a scoring system of 1 to 9 points, respectively. A higher score indicates better ESG performance among new energy automobile enterprises.

3.1.3. Mediating Variables

- Enterprise Environmental Information Disclosure Quality (EIDQ)

Building on the framework established by Wang et al. [44], this study classifies corporate environmental information into two primary categories: monetary and non-monetary information. The monetized category includes indicators related to the disclosure of environmental liabilities, environmental performance, and governance practices. In contrast, non-monetized information includes aspects such as environmental management system disclosures, environmental certifications, and the channels through which environmental information is communicated. Monetary information is assigned a value of 2 if both quantitative and qualitative data are disclosed. If only qualitative data are disclosed, a value of 1 is assigned, and a value of 0 is assigned for non-disclosure. For the non-monetized category, indicators that are disclosed receive a score of 2, while those that are not disclosed receive a score of 0. Together, these categories include 25 scoring indicators across five dimensions. The overall Environmental Information Disclosure Quality is calculated by summing the scores of these indicators and applying a logarithmic transformation. A higher score on this index indicates a more robust level of environmental transparency and higher quality disclosure by the company.

- 2.

- Financing constraints (SA)

In this paper, we construct an index using the following formula, referring to Hadlock and Pierce’s measure of corporate financing constraints [45]:

where size is the natural logarithm of the firm’s total assets. In addition, age is defined as the firm’s age, calculated as the observation year (current statistical cut-off date) minus the year the firm was founded. The higher the Corporate Financing Constraints Index SA, the greater the financing constraints of the enterprise.

3.1.4. Other Control Variables

To ensure accuracy and reliability, this paper incorporates control variables based on existing literature related to financial science and technology, new energy automobile enterprises, and ESG. These variables are considered from both enterprise-level and regional-level perspectives.

At the enterprise level:

- Enterprise Size (Size): Large-scale NEV enterprises possess significant advantages in production capacity. To achieve sustainable development, these enterprises often engage in scientific and technological innovations to enhance their competitiveness, thereby improving their ESG performance.

- Asset–Liability Ratio (LEV): The asset–liability ratio is a key indicator of a NEV company’s ability to secure external financing. A higher LEV indicates that these companies may face greater challenges in managing debt repayment. This financial pressure may affect various ESG dimensions, ultimately affecting their overall ESG performance. In this study, the leverage ratio is calculated by dividing total liabilities by total assets.

- Return on Assets (ROA): The profitability of NEV companies, as measured by the net profit margin on total assets, plays a key role in supporting their financial stability and project financing. Improved profitability can promote long-term sustainability and strengthen ESG performance. In this paper, ROA is presented as the ratio of net profit to total assets.

- Total Asset Turnover (ATO): The efficiency with which NEV companies use their total assets to generate revenue is an important factor in assessing their financial health and operational effectiveness. A higher total asset turnover indicates better financial soundness, which can lead to better ESG performance over time through sustainable investments. Total asset turnover is measured as the ratio of sales revenue to the company’s average total assets.

- Cash Flow Ratio (Cashflow): A higher liquidity level within a company signifies a stronger capacity to fulfill short-term debt obligations. Adequate cash flow not only supports long-term investments in ESG-related initiatives, such as renewable energy projects and environmental protection technologies, but also enhances the enterprise’s risk management capabilities. The cash flow ratio is measured as the ratio of net cash flow to total assets.

- Stock Proportion (INV): A high inventory ratio in new energy automobile enterprises may result in an excess of material products, consequently increasing resource consumption and environmental burden. On the other hand, efficient inventory management and control can help reduce waste and improve resource use, thereby improving the ESG performance of these companies. In this study, inventory is represented by the ratio of inventory to total assets.

- Fixed Assets Ratio (FIXED): A higher fixed assets ratio indicates that NEV enterprises are investing more in production equipment and other infrastructure for research and development (R&D) and production. Consequently, this increased investment in production capacity correlates with greater resource allocation efficiency and long-term stability, which, in turn, influences the ESG performance of NEV enterprises. In this paper, the fixed asset ratio is defined as the ratio of fixed assets to total assets.

- Operating Income Growth Rate (Growth): This metric reflects an enterprise’s market performance and competitiveness. A high growth rate signifies that NEV companies possess favorable development prospects in the market, which facilitates their investment in technological innovation and environmental management, thereby supporting their ESG initiatives. In this study, the growth rate is calculated by comparing the current year’s operating profit with the previous year’s total operating profit.

- Board Size (Board): An increased board size enhances the governance capacity of new energy automobile enterprises, thereby improving the transparency and accountability of these organizations, which subsequently influences their ESG performance. In this paper, board size is represented by the natural logarithm of the number of board members.

- Independent Director Proportion (Indep): Independent directors play a critical role in a company’s governance structure, offering objective oversight and responsible recommendations. As a result, a higher proportion of independent directors is associated with a more robust corporate governance framework, which promotes greater transparency and fairness in decision-making and operational management. This, in turn, contributes to improved ESG performance for the enterprise. In this study, the proportion of independent directors is represented by the ratio of the number of independent directors to the total number of directors on the board.

Regional level:

- Regional Financial Development Level (AreaFin): A well-developed financial system optimizes resource allocation, allowing funds to flow towards more innovative and socially responsible projects. This enables NEV enterprises to access more convenient financing channels, thereby enhancing their performance. This paper measures the regional financial development level using the ratio of the balance of deposits and loans held by urban financial institutions to the gross domestic product of the region.

- Regional Economic Development Level (Inpgdp): New energy automobile enterprises operating in regions with a high level of economic development are more likely to achieve profitability and receive robust support for their sustainable development strategies, which in turn enhances their ESG performance. This is based on per capita GDP and the exponential growth of the regional economic development level.

The variable definitions and measurements are shown in Table 1.

Table 1.

Variable definition and measurement.

3.2. Model Building

To evaluate the ESG performance of companies in the financial science and technology sector of NEV, this paper establishes the following basic econometric model:

In this model, i denotes the enterprise, t signifies time, indicates the ESG performance level of the i-th enterprise in year t, and reflects the financial technology development level for the same year. quantifies the impact of fintech on the ESG performance of NEV companies. The vectors include a set of control variables that operate at both the corporate and regional levels, whereas vector contains the regression coefficients associated with these control variables. Furthermore, accounts for individual fixed effects, captures year fixed effects, and denotes an independent and identically distributed random error term. Equation (2) illustrates the direct effect of fintech on the ESG performance of NEV companies.

To investigate the internal operational mechanism linking fintech and the ESG performance of these companies, we examine the indirect effect of fintech by incorporating EIDQ and SA as intermediary indicators. Consequently, the following measurement model is established:

Among these factors, and represent the quality of corporate environmental information disclosure and financing constraints, respectively. , along with × and × , illustrate the direct and indirect effects of financial technology on the ESG performance of NEV companies, with the quality of corporate environmental information disclosure and financing constraints serving as intermediary variables.

3.3. Descriptive Statistics

According to the descriptive statistics presented in Table 2, notable differences exist in the ESG performance and financial technology application levels among NEV companies. The average ESG score stands at 4.227, while the average financial technology index is 4.967. These figures suggest that, while the overall performance of these companies in terms of sustainability and technological innovation is relatively stable, there is considerable variation within the data. The scale of the enterprises is concentrated, with an average value of 22.283 and an average asset–liability ratio of 0.441, reflecting a moderate overall financial status; however, some enterprises are experiencing greater financial pressure. Profitability and cash flow exhibit certain disparities, with an average net profit margin on total assets of 0.042 and an average cash flow ratio of 0.719, suggesting relatively healthy liquidity. Regarding board governance, the average proportion of independent directors stands at 2.109, indicating a relatively sound governance structure. Additionally, significant differences are noted in regional financial development and economic development levels, recorded at 37.260 and 3.776, respectively.

Table 2.

Descriptive statistics of variables.

4. Empirical Analysis and Findings

4.1. Analysis of Benchmark Regression Results

Table 3 shows the results of the benchmark regression analysis. Column ESG (1) shows the regression results without the inclusion of control variables, while column ESG (2) introduces control variables based on the specification in column ESG (1). The results show that the fintech coefficient remains significantly positive in both cases, suggesting a robust relationship between fintech and ESG performance. Moreover, in column ESG (2), the adjusted R2 value increases with the inclusion of control variables, suggesting that these variables help mitigate the potential influence of confounding factors, thereby increasing the explanatory power of the model. Column ESG (3), as well as column ESG (4) and column ESG (2), respectively, are fixed on the basis of urbanness and time to carry out the regression results, and they also include the financial science and technology of NEV enterprise ESG performance of regression results that were significantly positive and significant at the 1% level. Finally, in column ESG (5), both city and year fixed effects are controlled for, and the regression coefficients continue to show statistical significance at the 1% level, supporting the validity of hypothesis H1.

Table 3.

Benchmark regression results.

The regression analysis also shows that the relationships between the control variables and the ESG performance of NEV companies are generally in line with theoretical expectations. In particular, the coefficient on company size (Size) is positive and statistically significant at the 1% level, indicating that larger NEV companies tend to have better ESG performance. In contrast, the coefficient for the leverage ratio (LEV) is significantly negative at the 1% significance level, suggesting that higher levels of debt are detrimental to innovation and hence to ESG performance. In addition, the coefficients for the proportion of independent directors (Indep) are significantly positive, reinforcing the notion that strong corporate governance practices contribute positively to the ESG performance of NEV companies.

Given that the ESG performance of NEV companies is built around three key dimensions—environmental impact, social responsibility, and corporate governance—this study further examines the specific influence of fintech on each of these dimensions. To achieve this, this paper regresses the impact of fintech on the environmental (E), social (S), and governance (G) dimensions individually, following the regression model presented in Equation (2). The results of these regressions, presented in columns (6) to (8), show a significantly positive impact of fintech on all three ESG dimensions. The results suggest that the development of fintech broadly contributes to improving the overall ESG performance of NEV companies. In particular, fintech has a notably strong impact on the environmental and social responsibility dimensions, with regression coefficients of 0.079 and 0.434, respectively, both statistically significant at the 1% level. This shows that fintech plays a crucial role in encouraging investment in green innovation, environmental compliance, and socially responsible business practices. However, when looking at corporate governance (G), while fintech still has a positive impact, its regression coefficient of 0.267 is relatively modest and remains statistically significant at the 1% level. This suggests that while fintech may help improve resource allocation and reduce information asymmetry, its impact on governance structures and internal controls may still be challenging.

Furthermore, among the control variables, company size, cash flow ratio, and size of directors are found to have a positive impact on the ESG performance of NEV companies. Conversely, the debt–equity ratio has a significant negative correlation with ESG performance, suggesting that higher levels of debt may hinder companies’ ability to invest in sustainable practices and governance improvements.

4.2. Robustness Test

This paper conducts robustness tests using three methods: (1) The instrumental variable method: Following the study by Goldsmith et al. [46], we use the interaction of national fintech growth rate and lagged regional fintech level (lagged by one period) as an instrument for regional fintech development. The results of this instrumental variable regression are shown in column ESG (5) of Table 4. (2) The one-period lag of explanatory variables: To further validate the results, we re-estimate the model with a one-period lag of the explanatory variable fintech. The regression coefficient obtained is statistically significant at the 1% level, as shown in column ESG (6) of Table 4, confirming the robustness of the initial results. (3) Fixed effects control: by incorporating fixed effects and further controlling for urban, individual, and year fixed effects, the resulting regression coefficient remains significant at the 1% level, consistent with previous conclusions. (4) Alternative explanatory variables: We also replace the original explanatory variables by using the average value of the ESG Rating Index within the same industry for the same year as a proxy for annual ESG performance. As shown in column ESG (8), the results remain significant, further confirming the robustness of the conclusions.

Table 4.

Robustness test.

5. Mechanism Analysis

Previous research suggests that the advancement of fintech has played a key role in improving the ESG performance of NEV enterprises. To further investigate the mechanisms through which fintech influences the ESG performance of these enterprises, this paper examines information transparency and external financing as key entry points. The analysis is primarily conducted from two perspectives: enhancing the transparency of corporate environmental information disclosure and alleviating financing constraints. By focusing on these two key factors, the analysis aims to shed light on how fintech advances contribute to the overall ESG performance of NEV companies.

5.1. Enterprise Environmental Information Disclosure Quality

The results of the mechanism analysis presented in Table 5, column EIDQ (1), indicate that the quality of environmental information disclosure by NEV companies positively influences their ESG performance. This suggests that by enhancing the quality of their environmental information disclosure, NEV enterprises can optimize their approaches to environmental protection and energy conservation, thereby reinforcing their commitment to both environmental and social responsibilities, ultimately improving their ESG performance. Furthermore, the ESG column (9) indicates that fintech indirectly contributes to the ESG performance of new energy vehicle companies by improving the quality of environmental disclosure. The results indicate that the coefficient for fintech is significantly positive at the 1% level, confirming that fintech can enhance ESG performance by improving the quality of environmental information disclosure.

Table 5.

Results of mechanism analysis.

5.2. Financing Constraints

For many NEV enterprises, it is challenging to sustain high R&D expenditures amid fierce market competition solely by relying on limited internal funds. External financing serves as a crucial source for these enterprises to secure R&D funding necessary for sustainable development [47]. Consequently, when faced with significant financing constraints, NEV enterprises often experience limitations imposed by financial barriers, leading to a reduction in their investments in corporate social responsibility. Fintech can alleviate the challenges these enterprises face in obtaining external aid and financing through mechanisms such as big data technology. This, in turn, encourages NEV enterprises to prioritize long-term investments and sustainable development, directing financial resources towards green and low-carbon industries. This shift in financial allocation not only supports the sustainable development of enterprises but also contributes to the broader goal of environmental sustainability [48].

The findings presented in columns SA (2) and ESG (10) of Table 5 suggest that alleviating financing constraints can encourage enterprises to focus on long-term business performance and sustainable development, which is beneficial for enhancing ESG performance. Notably, the coefficient of fintech in column ESG SA (2) is significantly negative at the 1% level, confirming the mechanism by which fintech can mitigate the financial constraints faced by firms through channels such as the degree of information asymmetry within organizations. In summary, hypotheses H2 and H3 in this study are valid.

6. Heterogeneity Analysis

Due to the distinct characteristics of various enterprises, the financial impacts on corporate ESG performance related to science and technology are likely to differ. To explore how fintech impacts the ESG performance of firms with distinct attributes and to mitigate heterogeneity bias, this paper will conduct a heterogeneity analysis from three perspectives: financial status, property rights, and high-tech classification. Additionally, it will explore the potential reasons for these differences.

6.1. Heterogeneity of Corporate Property Rights

Differences in the nature of corporate ownership may influence the role of fintech in enhancing the ESG performance of NEV enterprises. Consequently, this paper categorizes the sample enterprises into state-owned and non-state-owned enterprises based on ownership characteristics, aiming to investigate the varying impacts of fintech on their ESG performance. In China, state-owned enterprises (SOEs) hold a unique economic status, characterized by closer government-enterprise relations, greater access to capital, superior corporate governance systems, and a heightened sense of social responsibility. Thus, examining the influence of differing property rights on the ESG performance of enterprises is critical to promoting the green financial development of technology. This study divides all samples into two sub-samples based on their state-owned status and employs a benchmark regression model for group testing. Table 6, columns 1 and 2, presents the ESG performance results of new energy automotive enterprises under varying property rights concerning financial technology. Specifically, column 1 displays the regression results for non-state-owned enterprise samples, while column 2 illustrates the results for state-owned enterprise samples.

Table 6.

Heterogeneous regression results.

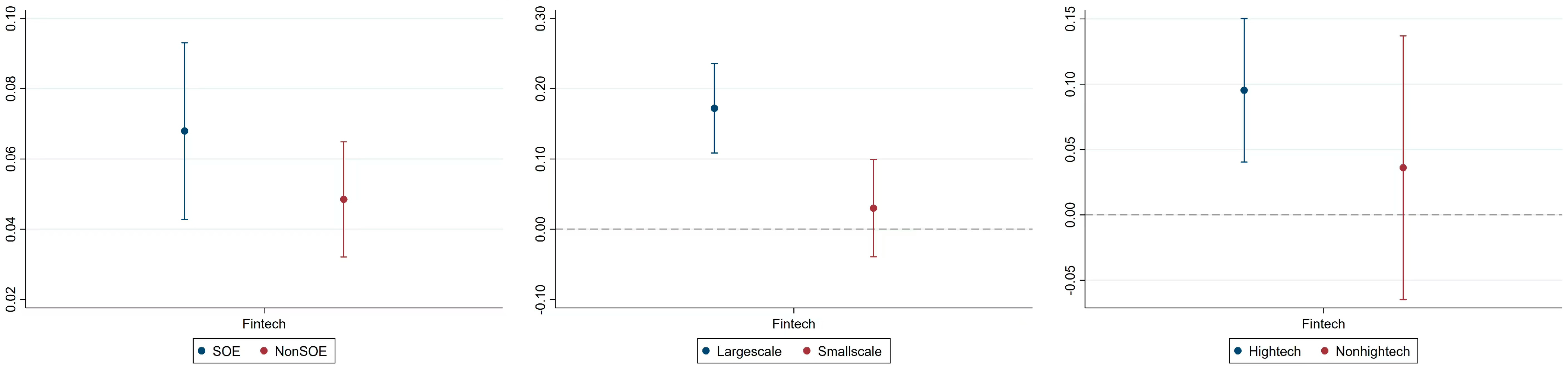

The results suggest that fintech has a statistically significant positive impact on the ESG performance of non-state-owned NEV companies, as shown by the red dots and their confidence intervals in the left panel of Figure 1. However, in the case of state-owned enterprises, fintech appears to have a negligible impact on improving ESG performance. State-owned enterprises benefit from stronger policy support and easier access to credit, which reduces their reliance on alternative financing channels. In contrast, non-state-owned companies face greater funding constraints and are more dependent on external sources of finance. The development of fintech expands financing channels for non-SOE NEV enterprises, reducing their financing costs and improving financing efficiency. Consequently, this provides more financial support for the ESG practices of non-SOE NEVs. Therefore, the advancement of fintech is beneficial for enhancing the ESG performance of new energy automobile SOEs.

Figure 1.

Heterogeneity regression results visualization.

6.2. Company Size Heterogeneity

The financial promotion of new energy automobile enterprises in science and technology highlights the positive role of ESG performance, which may vary due to differences in enterprise scale and performance. To examine whether there are significant differences in the impact of fintech on the ESG performance of NEV enterprises of varying sizes, this paper employs the median enterprise size for each year as a standard for division, categorizing the sample into two groups: small enterprises and large enterprises. The analysis results are presented in columns (3) and (4) of Table 6. The influence coefficient of fintech on the ESG performance of small-scale NEV enterprises is not statistically significant. In contrast, the regression coefficient of fintech on the ESG performance of large-scale NEV enterprises is 0.160, which is significant at the 1% level. This indicates that the development of fintech can effectively enhance the ESG performance of large-scale NEV enterprises, while its impact on small-scale enterprises is minimal. Visualization of the heterogeneity regression, as indicated in the middle panel of Figure 1, also shows this result. This disparity may arise from the fact that, compared with small-scale enterprises, large enterprises can more easily secure credit from traditional financial markets due to their size, and they also have access to diversified financing channels. Consequently, this enables them to better engage in environmental protection and social responsibility practices. Therefore, the advancement of fintech plays a crucial role in improving the ESG performance of large-scale enterprises within the NEV sector.

6.3. High-Tech Heterogeneity

The production and operation of most new energy automobile enterprises are centered on high and new technology. This study categorizes new energy automobile enterprises into those with “high and new technology enterprise aptitude” and those without. It explores the differences in ESG performance between high-tech and non-high-tech new energy automobile enterprises, particularly in relation to financial technology. The results presented in columns 5 and 6 of Table 6 indicate that fintech significantly enhances the ESG performance of high-tech NEV enterprises, and visualization of the heterogeneity regression, as in the right panel of Figure 1, also demonstrates this result, as shown by the blue dots and their narrow confidence intervals. However, it does not have a significant impact on the ESG performance of non-high-tech NEV enterprises. This discrepancy can be attributed to the superior technical innovation capabilities of high-tech NEV enterprises, which enable them to leverage big data analysis and blockchain technology for compliance and risk management, thereby improving operational efficiency and transparency and achieving better ESG performance.

7. Conclusions and Recommendations

The findings of this study provide valuable insights and policy implications aimed at promoting fintech, standardizing ESG information disclosure, and realizing the strategic goal of “dual carbon”. This report indicates that the party’s commitment to high-quality development is the foremost task in the comprehensive construction of a modern socialist country. Achieving high-quality development is contingent upon fostering a green and low-carbon economy and society. In the context of the “dual-carbon” target, exploring the role of fintech in enhancing the ESG performance of NEV enterprises holds significant practical importance. This paper utilizes data listed on the Shanghai and Shenzhen stock exchanges from 2011 to 2022 to examine the impact of fintech development on the ESG performance of these companies. The regional level of fintech development in relevant regions was assessed using a Baidu News advanced search crawler. The results indicate that fintech significantly improves NEV ESG performance.

This conclusion remains robust even after addressing potential endogeneity concerns and conducting various robustness tests, including the one-period lag of explanatory variables. Mechanistic analysis reveals that fintech enhances ESG performance by improving the quality of environmental information disclosure and alleviating financing constraints faced by NEV companies. Furthermore, fintech exerts a more pronounced impact on the ESG performance of state-owned enterprises, large enterprises, and high-tech enterprises within the NEV sector. The research findings of this paper offer several policy recommendations for advancing fintech, standardizing ESG information disclosure, and achieving the strategic goal of “dual carbon”.

7.1. Making Full Use of the Technological Advantages of Fintech

The deep integration of finance and technology has been facilitated by the rapid development of fintech. NEV enterprises should actively adopt advanced fintech tools to optimize capital flow and cost control through big data analysis, blockchain technology, and other means, thereby enhancing internal management and transparency. Furthermore, by employing scientific and technological methods for real-time monitoring of operational data, these enterprises can more swiftly identify and mitigate potential environmental and social risks, ultimately improving their performance in the realm of ESG. Additionally, government departments should be inspired to provide policy and technical support, encouraging technological innovation and facilitating the green transformation of the NEV industry.

7.2. Strengthen Information Disclosure and Transparency

The enhancement of ESG performance relies not only on the internal management of enterprises but also on the effective oversight by external stakeholders. NEV companies should improve the transparency of their information disclosure by regularly publishing ESG reports that detail their initiatives and achievements in ESG. This practice will help bolster their reputation and reinforce investor trust. Concurrently, regulators should advocate for the standardization of information disclosure within the industry, ensuring that new energy automobile enterprises can effectively compare and assess their ESG performance. Ultimately, these efforts will contribute to the long-term, sustainable growth of the new energy vehicle market.

7.3. Strengthen Cross-Border Cooperation and Ecological Construction

In the pursuit of sustainable development, NEV enterprises, along with other businesses, governments, and universities, will establish integrated innovation platforms focused on NEV, smart energy, and intelligent transportation for future mobility. This collaboration will be characterized by open cooperation, benefit sharing, technology transfer, and joint research and development, ultimately creating an ecosystem of shared resources and collective innovation. A foundation for joint research on key cross-cutting technologies will enhance the integration and innovative capabilities of NEV and related enterprises, supported by advancements in financial technology and ESG performance. Concurrently, the government should facilitate such cross-border cooperation by building platforms and providing policy support to encourage collaboration and mutual development among enterprises.

7.4. Implement Differentiation Policy

The financial development levels of science and technology vary significantly across different sectors, and the nature of new energy automobile enterprises also differs. Therefore, the government and relevant financial institutions should implement differentiated policies to optimize the sustainable development of these enterprises. Banking institutions should offer suitable financing options to lower their financing costs and encourage adherence to ESG standards for non-state-owned enterprises. In contrast, for large-scale NEV enterprises, government departments should promote the use of fintech to leverage their advantages, thereby enhancing the role of leading enterprises in fostering the integrated development of small and medium-sized NEV businesses. This approach aims to establish competitive NEV industrial clusters, improve the modernization of the industrial chain, and achieve sustainable economic, resource, and environmental development through the utilization of fintech.

Author Contributions

Conceptualization, X.H.; formal analysis, D.L.; investigation, X.H.; data curation, M.S.; writing—original draft preparation, D.L.; writing—review and editing, X.H.; visualization, M.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Conflicts of Interest

All authors declare no conflicts of interest.

References

- Choudhary, P.; Thenmozhi, M. Fintech and financial sector: ADO analysis and future research agenda. Int. Rev. Financ. Anal. 2024, 93, 103201. [Google Scholar] [CrossRef]

- Huang, D.Z.X. Environmental, social and governance factors and assessing firm value: Valuation, Signaling and stakeholder perspectives. Account. Financ. 2022, 62, 1983–2010. [Google Scholar] [CrossRef]

- Galeone, G.; Ranaldo, S.; Fusco, A. ESG and FinTech: Are they connected? Res. Int. Bus. Financ. 2024, 69, 102225. [Google Scholar] [CrossRef]

- Ding, J.; Li, L.; Zhao, J. How does fintech prompt corporations toward ESG sustainable development? Evidence from China. Energy Econs. 2024, 131, 107387. [Google Scholar] [CrossRef]

- Li, T.T.; Wang, K.; Sueyoshi, T.; Derek, D.W. ESG: Research progress and future prospects. Sustainability 2021, 13, 11663. [Google Scholar] [CrossRef]

- Zhong, Y.; Zhao, H.; Yin, T. Resource bundling: How does enterprise digital transformation affect enterprise ESG development? Sustainability 2023, 15, 1319. [Google Scholar] [CrossRef]

- Bahadır, O.; Akarsu, S. Does Company Information Environment Affect ESG–Financial Performance Relationship? Evidence from European Markets. Sustainability 2024, 16, 2701. [Google Scholar] [CrossRef]

- Xie, H.; Qin, Z.; Li, J. Entrepreneurship and Corporate ESG Performance—A Case Study of China’s A-Share Listed Companies. Sustainability 2024, 16, 7964. [Google Scholar] [CrossRef]

- Lei, X.; Yu, J. Striving for sustainable development: Green financial policy, institutional investors, and corporate ESG performance. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 1177–1202. [Google Scholar] [CrossRef]

- Sabbaghi, O. The impact of news on the volatility of ESG firms. Glob. Financ. J. 2022, 51, 100570. [Google Scholar] [CrossRef]

- Goldstein, I.; Jiang, W.; Karolyi, G.A. To FinTech and beyond. Rev. Financ. Stud. 2019, 32, 1647–1661. [Google Scholar] [CrossRef]

- Thakor, A.V. Fintech and banking: What do we know? J. Financ. Intermed. 2020, 41, 100833. [Google Scholar] [CrossRef]

- Yu, J.; Chiriko, A.Y.; Kim, S.S.; Moon, H.G.; Choi, H.; Han, H. ESG management of hotel brands: A management strategy for benefits and performance. Int. J. Hosp. Manag. 2025, 125, 103998. [Google Scholar] [CrossRef]

- Soana, M.G. Does ESG contracting align or compete with stakeholder interests? J. Int. Financ. Mark. Inst. Money 2024, 96, 102058. [Google Scholar] [CrossRef]

- Liu, D. Can fintech promote SME innovation? Appl. Econ. Lett. 2024, 3, 1–6. [Google Scholar] [CrossRef]

- Chen, B.; Yang, X.; Ma, Z. Fintech and financial risks of systemically important commercial banks in China: An inverted U-shaped relationship. Sustainability 2022, 14, 5912. [Google Scholar] [CrossRef]

- Jin, X.; Qi, H.; Huang, X. Green financial regulation and corporate strategic ESG behavior: Evidence from China. Financ. Res. Lett. 2024, 65, 105581. [Google Scholar] [CrossRef]

- Zhang, M.Z.; Wang, X.P.; Yu, D.H. Government subsidies on new energy automobile enterprise innovation structure. Influ. China’s Popul. Resour. Environ. 2024, 7, 35–46. [Google Scholar]

- Erel, I.; Liebersohn, J. Can FinTech reduce disparities in access to finance? Evidence from the Paycheck Protection Program. J. Financ. Econ. 2022, 146, 90–118. [Google Scholar] [CrossRef]

- Yan, B.; Cheng, M.; Wang, N.H. ESG overflow, green supply chain transmission and the enterprise green innovation. J. Econ. Res. 2024, 59, 72–91. [Google Scholar]

- Gao, D.; Tan, L.; Duan, K. Forging a path to sustainability: The impact of Fintech on corporate ESG performance. Eur. J. Financ. 2024, 1–19. [Google Scholar] [CrossRef]

- Jiang, B. Does fintech promote the sustainable development of renewable energy enterprises? Environ. Sci. Pollut. Res. 2023, 30, 65141–65148. [Google Scholar] [CrossRef] [PubMed]

- Nikkel, B. Fintech Forensics: Criminal Investigation and Digital Evidence in Financial Technologies. Forensic Sci. Int. Digit. Investig. 2020, 33, 200908. [Google Scholar] [CrossRef]

- Chen, W.; Arn, G.; Song, H.; Xie, Y. The influences of digital finance on green technological innovation in China’s manufacturing sector: The threshold effects of ESG performance. J. Clean. Prod. 2024, 467, 142953. [Google Scholar] [CrossRef]

- Qi, Y.D.; Xiao, X. Enterprise management reform in the era of digital economy. Manag. World 2020, 36, 135–152+250. [Google Scholar]

- Lee, J.; Serafin, A.M.; Courteau, C. Corporate disclosure, ESG and green fintech in the energy industry. J. World Energy Law Bus. 2023, 16, 473–491. [Google Scholar] [CrossRef]

- Zhu, Y.; Lin, Y.; Tan, Y.; Liu, B.; Wang, H. The potential nexus between fintech and energy consumption: A new perspective on natural resource consumption. Resour. Policy 2024, 89, 104589. [Google Scholar] [CrossRef]

- Liu, Y.; Saleem, S.; Shabbir, R.; Shabbir, M.S.; Irshad, A.; Khan, S. The relationship between corporate social responsibility and financial performance: A moderate role of fintech technology. Environ. Sci. Pollut. Res. 2021, 28, 20174–20187. [Google Scholar] [CrossRef]

- Shi, Y.; Dong, X.; Zhang, Q.; Zhou, Z. FinTech, urban entrepreneurial activity, and social security levels: Evidence from China. Financ. Res. Lett. 2024, 61, 104986. [Google Scholar] [CrossRef]

- Kartal, M.T.; Taşkın, D.; Shahbaz, M.; Depren, S.K.; Pata, U.K. Effects of Environment, Social, and Governance (ESG) disclosures on ESG scores: Investigating the role of corporate governance for publicly traded Turkish companies. J. Environ. Manag. 2024, 368, 122205. [Google Scholar] [CrossRef]

- Rezaee, Z.; Tuo, L. Are the Quantity and Quality of Sustainability Disclosures Associated with the Innate and Discretionary Earnings Quality? J. Bus. Ethics 2019, 155, 763–786. [Google Scholar] [CrossRef]

- Wen, H.; Ho, K.C.; Gao, J.; Yu, L. The fundamental effects of ESG disclosure quality in boosting the growth of ESG investing. J. Int. Financ. Mark. Inst. Money 2022, 81, 101655. [Google Scholar] [CrossRef]

- Wang, S.; Chen, F.; Yang, X. Environmental, social and governance performance: Can and how it improve internationalization of Chinese A-share listed enterprises. Heliyon 2024, 10, e33492. [Google Scholar] [CrossRef] [PubMed]

- Gao, Y.; Jin, S. Corporate nature, financial technology, and corporate innovation in China. Sustainability 2022, 14, 7162. [Google Scholar] [CrossRef]

- Lv, Y.; Wang, F.; Liu, G.; Ren, R. The impact of environmental court construction on the quality of corporate environmental information disclosure. Int. Rev. Financ. Anal. 2024, 95, 103512. [Google Scholar] [CrossRef]

- Mo, J.; Nie, H.; Wang, W.; Liu, Y. Exploring pathway to achieving carbon neutrality in China under uncertainty. Comput. Ind. Eng. 2023, 185, 109689. [Google Scholar] [CrossRef]

- Trotta, A.; Rania, F.; Strano, E. Exploring the linkages between FinTech and ESG: A bibliometric perspective. Res. Int. Bus. Financ. 2024, 69, 102200. [Google Scholar] [CrossRef]

- Liu, Z.; Li, X. The impact of bank fintech on ESG greenwashing. Financ. Res. Lett. 2024, 62, 105199. [Google Scholar] [CrossRef]

- Cumming, D.; Meoli, M.; Rossi, A.; Vismara, S. ESG and crowdfunding platforms. J. Bus. Ventur. 2024, 39, 106362. [Google Scholar] [CrossRef]

- Zhang, M.; Tian, J.; Ni, H.; Fang, G. Exploring teacher leadership and the factors contributing to it: An empirical study on Chinese private higher education institutions. SAGE Open 2021, 11, 21582440211002175. [Google Scholar] [CrossRef]

- Du, P.; Huang, S.; Hong, Y.; Wu, W. Can FinTech improve corporate environmental, social, and governance performance?—A study based on the dual path of internal financing constraints and external fiscal incentives. Front. Environ. Sci. 2022, 10, 1061454. [Google Scholar] [CrossRef]

- Wang, D.; Peng, K.; Tang, K.; Wu, Y. Does FinTech development enhance corporate ESG performance? Evidence from an emerging market. Sustainability 2022, 14, 16597. [Google Scholar] [CrossRef]

- Xie, H.H.; Lv, X. Responsible International Investment: ESG and China’s OFDI. Econ. Res. J. 2022, 3, 83–99. [Google Scholar]

- Wang, M.B.; Ye, T.; Kong, D.M. Green manufacturing and corporate environmental information disclosure: A policy experiment based on the establishment of green factories in China. Econ. Res. J. 2024, 59, 116–134. [Google Scholar]

- Hadlock, C.J.; Pierce, J.R. New evidence on measuring financial constraints: Moving beyond the KZ index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Goldsmith, P.; Sorkin, I.; Swift, H. Bartik instruments: What, when, why, and how. Am. Econ. Rev. 2020, 110, 2586–2624. [Google Scholar] [CrossRef]

- Xiao, S.; Zhao, S. Financial development, government ownership of banks and firm innovation. J. Int. Money Financ. 2012, 31, 880–906. [Google Scholar] [CrossRef]

- Zhang, J.; Qian, F. Digital economy enables common prosperity: Analysis of mediating and moderating effects based on green finance and environmental pollution. Front. Energy Res. 2023, 10, 1080230. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).