Abstract

Focusing on the fit between external environmental demands and internal capabilities (external fit), as well as the fit among internal capabilities (internal fit) from a dynamic capabilities perspective, this study explores the mechanisms through which environmental dynamism enhances firm innovation performance. By employing a unified moderated mediation model based on data from 254 small- and medium-sized manufacturing firms in Korea, this research reveals that explorative learning mediates the relationship between environmental dynamism and firm innovation performance. This study further reveals, however, that this mediating effect varies depending on the levels of absorptive capacity and exploitative learning. Specifically, the mediating effect of explorative learning on the relationship between environmental dynamism and innovation performance is stronger in firms with high levels of both absorptive capacity and exploitative learning. These results show that the positive impact of environmental dynamism on innovation performance is not consistently observed across all firms. For instance, when operating in dynamic environments, firms lacking absorptive capacity tend to face challenges in achieving explorative learning successfully, and those with high absorptive capacity but weak exploitative learning are also likely to struggle to achieve high innovation performance. These findings highlight the critical roles of dynamic capabilities in cultivating and harmonizing various internal organizational factors to respond to environmental changes more effectively and enhance innovation performance.

1. Introduction

In a fast-changing business environment, firms increasingly rely on innovation for sustainability and competitive advantage [1,2,3]. In this connection, while previous studies have explored various antecedents of innovation, environmental dynamism, which can be characterized by rapid environmental change and unpredictability, has emerged as a key factor driving firms to seek innovation avenues [4,5]. However, research on the direct relationship between environmental dynamism and firm innovation performance has been inconsistent, with findings ranging from positive to negative to no significant relationships [6,7,8,9]. As noted in the literature, these discrepancies are often attributed to contextual factors influencing how environmental dynamism translates into innovation performance [7,10,11].

To address these inconsistencies by further clarifying the relationship between environmental dynamism and innovation performance, more recent studies have proposed various contingency models based primarily on the strategic fit concept, which emphasizes aligning internal resources, capabilities, and others with the dynamic external environment for improved innovation performance [10,12,13,14]. These contingency models have relied on two separate approaches—moderation and mediation [11]. The moderation approach examines whether and how the impact of environmental dynamism on innovation performance depends on internal factors of an organization, such as dynamic capabilities and entrepreneur orientation [15,16]. In contrast, the mediation approach explores whether and how the effect of environmental dynamism on innovation performance is mediated by internal organizational factors like external knowledge acquisition, absorptive capacity, and dynamic capabilities [7,17,18,19].

There is no doubt that existing studies based on either approach have made important contributions to our understanding of how organizations respond to environmental dynamism. However, these studies have a notable limitation: they tend to focus on a single internal factor of an organization, such as absorptive capacity or knowledge acquisition, either as a moderator or as a mediator that aligns with the dynamic external environment (external fit). This narrow focus tends to overlook the alignment or interplay among multiple internal factors within an organization (internal fit). In other words, these studies often oversimplify the complex interactions between various internal organizational factors, such as resources and capabilities, which are essential for effectively and efficiently addressing environmental dynamism to enhance innovation performance.

For example, studies focusing on the mediating effects of individual internal organizational factors include those by Permana and Ellitan [17], as well as Li and Liu [18], who demonstrate how dynamic capabilities mediate the relationship between environmental dynamism and firm performance. Similarly, Kim, Li, Yoo, and Kim [7] highlight that external knowledge acquisition serves as a mediator in the relationship between environmental dynamism and innovation. Building on this idea, Kumar and Bhatia [2] further investigate the mediating role of technological factors within the context of Industry 4.0. On the other hand, a different group of studies has investigated the moderating role of individual internal resources and capabilities. Singh, Charan, and Chattopadhyay [15] highlight how dynamic capabilities moderate the relationship between environmental dynamism and firm performance. Buli [16] explores the moderating effect of entrepreneurial orientation, while Feng, Zhao, Wang, and Zhang [20] consider the moderating role of environmental dynamism in the relationship between knowledge management capabilities and innovation performance.

On the contrary, both resource-based and dynamic capabilities perspectives suggest that firms tend to employ a combination of resources and capabilities simultaneously, adjusting their relative emphasis based on specific environmental contingencies. The resource-based perspective argues that unique ‘bundles’ of internal resources and capabilities are crucial for firms to effectively respond to external environments and secure sustainable competitive advantage [21,22].

Similarly, the dynamic capabilities perspective emphasizes the critical role of adapting, integrating, and reconfiguring various organizational resources and capabilities simultaneously in response to the demands of changing environments [23,24,25]. Therefore, when researchers analyze the moderating or mediating effects of internal resources and capabilities on the relationship between environmental dynamics and innovation performance, studying these resources and capabilities individually may not fully capture the complexity of how organizations adapt to dynamic environments to remain competitive.

With this background, it is argued that to understand the relationship between environmental dynamism and innovation performance more thoroughly, it is essential to consider both internal fit and external fit within an integrated framework that incorporates both mediators and moderators simultaneously. This comprehensive approach allows us to examine how these fits interact to influence firm innovation performance. However, the interplay between internal fit and external fit and their combined impact on innovation performance remains largely unexplored [19].

To address this research gap, this study proposes a comprehensive moderated mediation model that integrates multiple internal and external factors together. This model aims to reconcile the resource-based perspective with the structure–conduct–performance (SCP) framework from a dynamic capabilities perspective, providing a holistic understanding of the complex interplay among various internal and external factors that influence the relationship between environmental dynamism and firm innovation performance. Specifically, this study seeks to examine the following three key research issues in an integrated manner: (1) whether environmental dynamism positively impacts firm innovation performance, (2) the mechanisms through which environmental dynamism affects firm innovation performance, and (3) the conditions under which the effect of environmental dynamism on firm innovation performance is more pronounced.

This study focuses on organizational learning as a mechanism for developing capabilities that enable effective strategic responses to environmental changes, introducing explorative and exploitative learning [26,27], along with absorptive capacity [28,29,30], as critical internal factors that allow firms to cope with environmental dynamism more effectively. The interplay between absorptive capacity and organizational ambidexterity, which are key components of dynamic capabilities, enables firms to integrate and reconfigure their resources and capabilities to capitalize on changing environmental conditions.

Based on data from 254 small- and medium-sized manufacturing firms in Korea, this study first explores the role of explorative learning as a mediator in the relationship between environmental dynamism and innovation performance. Extending this mediation model, this study further examines how the mediation effect of explorative learning varies with both absorptive capacity and exploitative learning within a unified moderated mediation model. In doing so, the study offers a comprehensive framework that explores the complex interplay among environmental dynamism, multiple internal factors, and innovation performance.

Academically, this research contributes to the relevant literature by incorporating internal fit into external fit through a dynamic capabilities lens, thereby expanding the concept of strategic fit applied to this field of research. This study illustrates how firms can effectively leverage their internal capabilities to foster innovation in dynamic environments. Practically, it highlights the necessity of a holistic approach to managing internal capabilities, emphasizing the importance of their synergistic interactions among themselves and their alignment with external environmental conditions to achieve improved innovation performance. This framework provides managers with valuable insights into effective and efficient strategic decision-making and resource allocation, thereby promoting innovation and ensuring success in rapidly changing markets.

The remainder of this paper is structured as follows. Section 2 reviews the theoretical background to establish the conceptual foundation of this research. Section 3 proposes the research model and hypotheses regarding key constructs, outlining the conceptual framework. Section 4 and Section 5 present the methodology for empirical analyses and the results, respectively. Finally, Section 6 offers the conclusions and discussions, including theoretical and practical implications, research limitations, and avenues for future research.

2. Literature Review and Theoretical Background

2.1. Environmental Dynamism and Innovation Performance

The relationship between environmental dynamism and innovation performance is a key focus in organizational research and strategic management [6,8,31,32,33,34]. Environmental dynamism refers to the rate of change in factors such as technology, market conditions, and competitor behaviors [35,36]. In dynamic environments, firms face challenges like technological advancements, market volatility, shorter product life cycles, and unpredictable competitor actions, which increase the risk of obsolescence and necessitate the development of new products, markets, and technologies.

Research has consistently shown that firms in dynamic environments are more likely to prioritize innovation as a strategic response to environmental changes, which is often linked to enhanced innovation performance by helping firms remain competitive and adapt to rapid changes [9,37]. Many studies empirically demonstrate a positive relationship between environmental dynamism and innovation performance, suggesting that greater dynamism leads to higher innovation output [6,34]. However, some studies report conflicting results, showing either a negative or no significant relationship between the two [8,31]. These studies argue that high levels of environmental dynamism can introduce uncertainty and risk, complicating innovation efforts by increasing complexity and resource demands. Moreover, internal capabilities such as culture, leadership, and resources play a critical role in determining how effectively firms respond to environmental changes through innovation, either facilitating or hindering their innovation processes and outcomes [38].

As it became clear that the relationship between environmental dynamism and innovation performance is not always positive or straightforward, various studies have investigated this complex relationship across different contexts and organizational settings. The concept of strategic fit from strategic management has been widely used to examine this relationship [10,13,38]. Strategic fit refers to aligning a firm’s resources and capabilities with external opportunities, which can be achieved through strategy. This alignment requires firms to possess the necessary resources and capabilities to effectively execute and support their strategic initiatives [39]. To enhance organizational performance, management must optimize both external fit and internal fit. Strategic fit is broadly categorized into two types: internal fit and external fit [10,40,41,42].

2.1.1. Internal Fit

Internal fit refers to the alignment and consistency among various internal factors within an organization, such as structure, processes, and resources [40,43]. It emphasizes how well these factors work together to support the overall strategy, enabling firms to leverage their resources effectively and improve performance [44]. This concept aligns with the resource-based perspective, which highlights the importance of a firm’s unique combination of resources and capabilities as the key driver of sustainable competitive advantage [21,22,45]. The McKinsey 7S Model is a classic example of illustrating internal fit, emphasizing the significance of aligning seven internal elements to achieve organizational effectiveness [46].

Empirical research has extensively explored how internal alignment influences performance. For instance, Zhou and Wu [47] demonstrate that technological capability mediates the relationship between strategic flexibility and exploratory innovation, emphasizing the need to align flexibility with technological strengths in dynamic environments. Similarly, Khan, Atlas, Ghani, Akhtar, and Khan [48] highlight that dynamic management capabilities—encompassing human capital, social capital, and cognition—mediate the relationship between dominant logic and innovation performance in SMEs. Building on this work, further research has shown that networking capability, when aligned with inter-organizational knowledge mechanisms, fosters co-learning and networked innovations, ultimately enhancing innovation performance [49].

Furthermore, the dynamic capabilities perspective offers valuable insights into internal fit. Zhang, Chu, Ren, and Xing [50] emphasize that aligning open innovation processes with dynamic capabilities—such as sensing, seizing, and transforming—is crucial for achieving product innovation and sustaining competitiveness. Similarly, aligning knowledge resources with innovation capabilities, supported by strong management commitment, significantly enhances innovation performance and serves as a key driver of competitive advantage [51].

In summary, internal fit plays a critical role in improving firm performance and innovation outcomes by aligning various resources and capabilities. However, while these studies emphasize the importance of internal alignment, they often overlook how internal factors fit with external environmental conditions. This highlights the need for a more comprehensive approach that integrates both internal fit and external fit to fully understand firm performance and innovation outcomes.

2.1.2. External Fit

External fit examines how well a firm’s internal capabilities, structure, and strategies align with external market conditions. Closely tied to the structure–conduct–performance (SCP) paradigm from the industrial organization literature [52,53], this concept emphasizes that a firm’s performance depends on aligning its strategic choices, structural arrangements, and capabilities with market conditions and the competitive landscape.

The SCP paradigm and the external fit concept complement each other in explaining organizational performance. While the SCP paradigm broadly links market structure, strategic choices, and performance, external fit provides a more focused perspective on how firms align internal factors like strategy, structure, and processes with external conditions [54]. Together, they offer a robust theoretical foundation for understanding how firms achieve superior performance by aligning internal strategies with external environments [55,56,57,58].

Empirical research highlights the critical role of internal resources and capabilities—such as dynamic capabilities, absorptive capacity, organizational learning, knowledge management, and entrepreneurial orientation—in moderating or mediating the relationship between environmental dynamism and innovation performance. These factors are essential for achieving external fit and driving superior performance.

For instance, Seo, Kim, and Kim [19] demonstrate that absorptive capacity and strategic prospecting mediate the relationship between environmental dynamism and innovation performance, with firms possessing strong absorptive capacity better able to align strategic initiatives with external changes. Similarly, Permana and Ellitan [17] show that dynamic capabilities mediate the impact of environmental dynamism and managerial capabilities on firm performance in SMEs, a finding corroborated by Li and Liu [18], who also highlight the mediating role of dynamic capabilities in this relationship.

Expanding on these insights, Dhir, Aniruddha, and Mital [59] propose a serial multiple mediator model, showing that alliance network heterogeneity and absorptive capacity sequentially mediate the relationship between environmental dynamism and innovation performance. In a related vein, Kim, Li, Yoo, and Kim [7] empirically demonstrate that environmental dynamism enhances innovation through external knowledge acquisition. Furthermore, Kumar and Bhatia [2] find that environmental dynamism positively influences the adoption of Industry 4.0 technologies, which subsequently improves firm performance through mediators such as organizational agility, flexibility, and technological capabilities.

While many studies focus on mediation effects, others explore the moderating role of internal resources and capabilities. For example, Singh, Charan, and Chattopadhyay [15] find that dynamic capabilities moderate the relationship between environmental dynamism and firm performance, emphasizing the need to align such capabilities with environmental conditions to gain a competitive advantage. Similarly, Buli [16] highlights how entrepreneurial orientation (EO)—encompassing risk-taking, proactiveness, and innovativeness—moderates the impact of environmental dynamism on firm performance, suggesting that firms with strong EO are better equipped to thrive in dynamic environments.

Research has also examined how firm-level resources influence innovation performance under environmental dynamism as a moderator. For instance, Feng, Zhao, Wang, and Zhang [20] reveal that robust knowledge management capabilities significantly enhance innovation performance in highly dynamic environments.

These studies have greatly advanced the literature on external fit by identifying key internal resources and capabilities affecting the relationship between environmental dynamism and innovation performance. However, most focus on single resources or capabilities in isolation, often overlooking complex interactions and synergies among organizational factors necessary for effectively navigating dynamic market conditions [60,61,62,63]. This reductionist approach limits the understanding of how various internal factors collectively address external challenges.

According to resource-based and dynamic capabilities perspectives, a firm’s competitive advantage stems not from any single resource or capability in isolation but from the integration and reconfiguration of multiple resources and capabilities [21,22,23,24,25]. These perspectives emphasize that firms must coordinate and leverage multiple internal resources to navigate dynamic external environments and enhance innovation performance.

Previous studies, while useful for specific analytical purposes, often rely on reductionist approaches that inadequately capture the complexity of how firms utilize multiple resources and capabilities simultaneously, adjusting their emphasis based on environmental contingencies [23]. This predominant focus on individual resources may lead to an incomplete understanding of how firms (re)configure and deploy internal capabilities in response to environmental dynamism.

In the context of a rapidly changing business landscape, a more holistic approach is essential to understand how firms orchestrate their internal resources and capabilities to adapt to dynamic environments and achieve superior performance [64]. Developing a comprehensive model that incorporates multiple internal capabilities and their interactions would offer a more realistic understanding of how firms respond effectively to environmental dynamism and drive innovation.

2.2. Dynamic Capabilities in Organizational Learning: Absorptive Capacity and Organizational Ambidexterity

Research on dynamic capabilities emphasizes the importance of considering multiple internal capabilities and their interactions when examining the relationship between environmental dynamism and innovation performance. Dynamic capabilities are defined as a firm’s ability to integrate, build, and reconfigure its resources and competencies to address rapidly changing environments [23]. Grounded in the evolutionary theory of the firm and the resource-based perspective, dynamic capabilities extend these theories by focusing on continuous adaptation and reconfiguration of internal resources in response to environmental changes [1,24]. The evolutionary theory, as articulated by Nelson and Winter [65], emphasizes routines and processes that evolve over time, while the resource-based perspective focuses on leveraging firm-specific resources for competitive advantage [21,22].

Dynamic capabilities enable firms to adapt to rapid environmental changes and sustain competitive advantage. They are unique to each organization, shaped by its history and culture, and difficult for competitors to imitate [23]. These capabilities are not static but evolve as firms learn and respond to new challenges [66]. From this perspective, unlike ordinary capabilities, which focus on operational efficiency, dynamic capabilities are forward-looking and involve strategic decision-making for future actions [67].

Dynamic capabilities consist of three components: sensing, seizing, and transforming [1]. Sensing involves identifying opportunities and threats through strong environmental scanning and market signal interpretation [23]. Seizing refers to mobilizing resources and making strategic decisions to capture opportunities [24]. Transforming focuses on renewing and reconfiguring resources to maintain competitiveness by adapting processes, structures, and strategies to changing market demands [1].

Although previous studies have used various approaches to measure dynamic capabilities based on Teece’s dimensions of sensing, seizing, and transforming, many scholars argue that these capabilities are difficult to identify and operationalize [68,69,70,71]. As a result, proxy variables are often used, particularly in the field of organizational learning, where researchers focus on specific learning and strategic processes. Key constructs representing dynamic capabilities include absorptive capacity and organizational ambidexterity.

2.2.1. Absorptive Capacity

Absorptive capacity, defined as a firm’s ability to recognize, assimilate, and apply external knowledge, is pivotal for the development and enhancement of dynamic capabilities for several reasons [28,29]. First, it enhances a firm’s ability to sense opportunities and threats in the external environment. Dynamic capabilities rely on the continuous monitoring of external signals to identify shifts in the market, technological advancements, and emerging trends. Absorptive capacity equips firms with the tools not only to detect these changes but also to internalize and interpret them effectively [72]. Second, absorptive capacity facilitates the assimilation and transformation of new knowledge, which is crucial for innovation and strategic renewal. The process of transforming and exploiting external knowledge allows firms to renew and reconfigure their existing resource base, thus aligning with the core tenets of dynamic capabilities. These continuous renewal and reconfiguration enable firms to maintain their competitive edge in dynamic and often turbulent environments [73]. Last, absorptive capacity supports the development of a learning organization. Firms that excel in absorptive capacity cultivate an environment where continuous learning and knowledge sharing are ingrained in the organizational culture. This cultural aspect is vital for the sustainability of dynamic capabilities, as it ensures that the firm remains agile and responsive over time.

2.2.2. Organizational Ambidexterity

Organizational ambidexterity refers to a firm’s ability to balance explorative and exploitative learning [74,75]. Explorative learning involves departing from existing knowledge to acquire new skills and capabilities, fostering innovation through experimentation, novel ideas, and market exploration [76,77,78]. It emphasizes risk-taking and adaptability. In contrast, exploitative learning focuses on refining and extending existing knowledge, improving efficiency, and implementing incremental innovations by optimizing established routines and technologies [75,77,78].

Each learning approach presents challenges. Firms focused solely on exploitative learning may improve short-term performance but risk falling into a competency trap, limiting their ability to adapt to environmental changes [79,80]. Conversely, excessive focus on explorative learning may renew knowledge but lead to a cycle of search and failure without tangible results [80]. Therefore, balancing both types of learning is essential for long-term success and sustainability, especially in dynamic environments.

While organizational ambidexterity is crucial, scholars highlight the challenges of managing the conflicting demands of explorative and exploitative learning. Achieving high levels of both simultaneously is difficult, as they compete for limited resources and require different structures, strategies, and routines [81,82]. From this perspective, explorative and exploitative learning are viewed as opposing ends of a continuum, where prioritizing one reduces focus on the other.

Nonetheless, recent studies on external exploration suggest that explorative and exploitative learning can coexist complementarily through domain separation in inter-organizational contexts [5,82,83,84,85]. This approach mitigates trade-offs by balancing exploration and exploitation across distinct, loosely connected domains, each specializing in one type of learning. In this framework, the two learning processes are seen as orthogonal, enabling firms to pursue both at high levels simultaneously while addressing resource constraints [81,85,86].

The combination of external exploration and internal exploitation has gained significant attention in strategic alliance research. Lavie and Rosenkopf [83] found that firms synchronize exploration and exploitation across domains over time in their alliance portfolios. Similarly, Rothaermel and Alexandre [73] provided evidence of the mutually reinforcing effects of externally sourcing new technologies and internally leveraging known technologies.

Building on these insights, scholars have increasingly recognized organizational ambidexterity as a critical component of dynamic capabilities. This recognition stems from several key considerations. Firstly, organizational ambidexterity enables firms to capitalize on opportunities without sacrificing operational efficiency. Dynamic capabilities require the ability not only to sense and identify opportunities but also to seize them effectively. By simultaneously engaging in high levels of exploration and exploitation, firms can better sense and seize opportunities. This dual capability allows them to integrate new technologies or market insights from external sources while maintaining their core business operations, ensuring they can exploit new opportunities without disrupting existing processes [87,88].

Secondly, the ability to pursue both exploration and exploitation at high levels concurrently allows firms to flexibly adapt their processes, structures, and strategies in response to environmental changes without needing to reallocate resources between these activities. This flexibility ensures that firms can continuously align their internal capabilities with external demands, thereby sustaining their competitive advantage [89]. This approach aligns with the dynamic capabilities framework by enabling firms to transform their operations in response to new insights without disrupting ongoing activities [90].

Organizational ambidexterity fosters a culture that balances innovation with stability. By integrating external exploration with internal exploitation, firms create a cultural environment where new ideas can flourish alongside operational excellence. This cultural balance is essential for the long-term sustainability of dynamic capabilities, as it enables firms to cope with both incremental and radical changes in their environments effectively [91].

2.2.3. Unlocking Dynamic Capabilities: The Interplay Between Absorptive Capacity and Organizational Ambidexterity

As discussed, absorptive capacity and organizational ambidexterity complement each other in explaining dynamic capabilities. Integrating these concepts into the framework of dynamic capabilities offers a more comprehensive understanding of how firms sustain competitive advantage in dynamic environments.

Absorptive capacity enhances a firm’s ability to sense and assimilate new knowledge, supporting the sensing and seizing processes of dynamic capabilities [72]. Organizational ambidexterity balances exploration and exploitation, which is crucial for resource reconfiguration and the transforming process of dynamic capabilities [92].

Integrating these as core components of dynamic capabilities provides a more meaningful way to understand and operationalize these constructs. This integrated framework addresses the limitations of conventional models that merely aggregate sensing, seizing, and transforming scores, overlooking the interplay among internal resources. By combining absorptive capacity and organizational ambidexterity, it offers a more comprehensive understanding of dynamic capabilities for both research and practical applications.

3. Research Model and Hypotheses

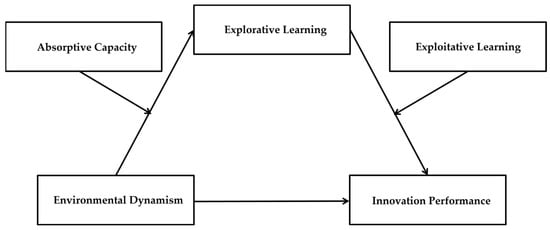

This study presents a comprehensive research model, as illustrated in Figure 1, designed to examine our hypotheses within a unified moderated mediation framework. Our theoretical framework and hypotheses are structured to systematically investigate the three key research issues mentioned in the introduction of this paper, following the approach for testing dual-staged moderated mediation hypotheses proposed by Hayes [93].

Figure 1.

Research model.

In the first section, we develop a theoretical argument that addresses our initial research issue. We begin by examining the total effect of environmental dynamism on innovation performance. Building on this foundation, we then explore the mediating role of explorative learning in this relationship in the second section to deal with the second research issue. The third and fourth sections introduce absorptive capacity and exploitative learning as moderators in the mediation model to address the third research issue. We propose hypotheses suggesting that these individual moderators affect each path of the mediation model that explorative learning constitutes.

In the fifth section, we present a dual-staged moderated mediation model to deal with the third research issue more completely. In this model, we posit that the mediating effect of explorative learning on the environmental dynamism–innovation performance relationship is contingent upon two critical organizational capabilities: absorptive capacity and exploitative learning. This dual-staged model offers a more comprehensive understanding of the complex interplay among environmental dynamism, absorptive capacity, organizational ambidexterity, and innovation performance.

3.1. Relationship Between Environmental Dynamism and Innovation Performance

Dynamic environments can pose various challenges or threats to firms, including rapid changes in customer needs and technologies, and these challenges are likely to push firms to be more innovative through organizational learning and knowledge acquisition [24,29]. As argued by D’Aveni [94], dynamic environments often lead to the rapid obsolescence of existing products and technologies, thereby creating a pressing need for continuous innovation. Firms operating in such environments are required to allocate more resources to R&D and innovative activities to stay ahead of competitors and meet changing market demands [4]. The costs of inaction in rapidly changing markets may be higher than the risks associated with innovation, encouraging firms to be more risk-taking in their innovation efforts [35].

Dynamic environments can also provide opportunities for firms to proactively develop new products, services, and processes to take advantage of evolving customer needs and technological advancements [1]. In addition, dynamic environments can offer firms the chance to enter new markets or segments, which is caused by changing customer preferences and technological disruptions and may necessitate the development of new products and services [24]. These environments can create opportunities for firms to form strategic alliances and partnerships, enabling them to access complementary resources and capabilities necessary for innovation in rapidly changing markets [84]. These opportunities, coupled with the challenges of changing environments, can serve as catalysts for increased innovation performance as firms strive to maintain their competitive position in turbulent environments. Based on these arguments, we propose the following hypothesis:

Hypothesis 1.

Environmental dynamism will have a positive effect on a firm’s innovation performance.

3.2. Mediation Hypothesis: The Role of Explorative Learning

It is argued that environmental dynamism is likely to strengthen a firm’s explorative learning, which, in turn, can lead to improved innovation performance. First, dynamic environments, characterized by rapid changes in customer needs, technologies, and competitive behaviors, appear to push firms to engage in explorative learning. This is because explorative learning can bring new knowledge, experimentation, and risk-taking that are essential for developing novel solutions and innovations to effectively cope with turbulent environments [4,26]. Furthermore, as environmental dynamism increases, the value of existing knowledge and capabilities diminishes, necessitating a shift towards explorative learning to generate new knowledge and capabilities [80].

Next, explorative learning tends to enable firms to develop more innovations in the form of new products or services, as it allows firms to generate novel ideas and knowledge that can be integrated into the design and development of new offerings [95]. Moreover, explorative learning may allow firms to cultivate cognitive flexibility, enabling them to approach problems from various angles. This flexibility or adaptability can lead to innovative solutions and breakthroughs, as evidenced by the positive relationship between explorative learning and improvisational creativity in SMEs [96]. Furthermore, explorative learning tends to encourage a culture that embraces experimentation and risk-taking. By viewing failures as opportunities for learning, firms can undertake ambitious projects that may result in significant innovations. This experimentation is critical in fields like green technology, where explorative processes drive long-term innovations [97]. Additionally, explorative learning seems to foster a self-reinforcing effect, bringing new product development into a virtuous cycle of continuous innovation and improvement. This process of continuous exploration and innovation can significantly enhance a firm’s technological innovation performance [98].

In summary, as firms engage in more explorative learning in response to environmental dynamism, they are likely to generate a broader range of new knowledge, cultivate cognitive flexibility to approach problems, and foster a culture embracing experimentation and risk-taking, thereby significantly enhancing their innovation performance [29]. As such, a firm’s explorative learning acts as an important mediating mechanism through which environmental dynamism positively influences innovation performance. Therefore, we propose the following hypothesis:

Hypothesis 2.

Explorative learning will mediate the positive effect of environmental dynamism on a firm’s innovation performance.

3.3. Moderated Mediation Hypothesis: The Role of Absorptive Capacity

As discussed above, environmental dynamism tends to create a greater need for firms to engage in explorative learning to generate new knowledge necessary for adapting to rapidly changing environmental conditions [4]. However, firms vary in their capacity to conduct explorative learning effectively, even when faced with similar levels of environmental dynamism. Since firms cannot rely solely on their internal knowledge base to secure all the knowledge necessary for innovation, they often need to acquire new knowledge from external sources. So, variations in firms’ abilities to conduct explorative learning may be attributed to differences in their levels of absorptive capacity [28,29]. This is because absorptive capacity enables firms to effectively acquire valuable external information and knowledge, which can be a critical source for creating new ideas and knowledge through the explorative learning process.

Research suggests that firms with strong absorptive capacity demonstrate superior exploration abilities when facing environmental changes [5]. Absorptive capacity acts as a catalyst, amplifying the positive effects of dynamic environments on explorative learning [99]. This moderating effect stems from a firm’s enhanced ability to identify, interpret, and integrate valuable external information and knowledge, which is crucial in turbulent environments. Specifically, absorptive capacity influences a firm’s ability to recognize the value of new external information and knowledge, which is particularly critical in dynamic environments where market signals are often ambiguous or rapidly evolving [28,99]. Consequently, firms with higher absorptive capacity are better positioned to identify promising opportunities and emerging trends, thereby reinforcing the positive relationship between environmental dynamism and explorative learning [100].

Moreover, absorptive capacity strengthens a firm’s learning processes. Higher absorptive capacity enables firms to more effectively assimilate and transform new knowledge gained through exploration activities [30]. This, in turn, contributes to further enhancing the effectiveness of the organization’s explorative learning process, especially in dynamic environments. Based on these arguments, we propose the following hypothesis:

Hypothesis 3.

The positive effect of environmental dynamism on explorative learning will be stronger in firms with higher absorptive capacity.

3.4. Moderated Mediation Hypothesis: The Role of Exploitative Learning Capabilities

While exploration and exploitation have traditionally been seen as competing for scarce organizational resources, recent research suggests they can be complementary rather than mutually exclusive [81,86]. When they are viewed as orthogonal aspects of organizational learning, firms can pursue both simultaneously without disturbing each other. This perspective allows firms to leverage the benefits of both learning modes to enhance innovation performance. We consider the positive interaction effect of these two types of learning on organizational performance as a manifestation of organizational ambidexterity. Thus, we argue that a firm’s exploitative learning capabilities likely moderate the relationship between explorative learning and innovation performance positively. This moderation effect can be explained through several mechanisms.

First, organizational resources are often limited, but information and knowledge from outside sources can be abundant, allowing firms to access resources available externally as well as their own [101]. This external access may arise because these resources are public goods or because firms have formed strategic alliances with others that possess complementary resources [81]. Access to external resources can significantly alleviate the constraints imposed by the scarcity of internal resources, and this may allow firms to engage in explorative learning while maintaining an exploitative learning process, thereby fostering a balanced approach to innovation.

Second, firms can effectively manage exploration and exploitation by separating these activities across different but complementary domains [73,81,86]. For example, firms might pursue an exploratory approach to product development while leveraging their existing commercialization infrastructures for manufacturing, sales, and service. In this scenario, the resources required for product R&D differ fundamentally from those needed for downstream activities. Hence, firms can engage in extensive exploration in product R&D while maintaining a high level of exploitation in such areas as manufacturing, sales, and service at the same time. Separating explorative and exploitative learning in complementary domains can lead to synergistic effects that enhance innovation performance. The commercial success of new products from explorative learning is ultimately determined by a firm’s level of exploitative learning in areas such as manufacturing, sales, and service. While explorative learning drives innovation through experimentation and discovery, exploitative learning ensures these products are efficiently produced, marketed, and serviced. This integration is crucial because even groundbreaking technologies can fail commercially if not supported by effective production and marketing strategies [81,86]. Many venture firms with cutting-edge technologies struggle to achieve market success due to insufficient production capabilities or market knowledge. This underscores the importance of exploitative learning in transforming innovative ideas into commercially viable products. By refining processes and leveraging existing knowledge, firms can optimize their operations to support new product launches effectively. Exploitative learning thus plays a pivotal role in enhancing the positive impact of explorative learning on innovation performance. It provides the necessary infrastructure and expertise to bring new products to market successfully, ensuring that innovations become tangible offerings that meet customer needs and drive business growth [101].

Last, firms engaged in explorative learning often acquire fragmented knowledge from various external sources. While this diverse knowledge can stimulate innovative ideas, its fragmented nature makes it challenging to integrate into cohesive new insights [102]. Without a comprehensive understanding of these fragments, firms may only access surface-level insights rather than the essence of new knowledge. Therefore, integrating and further developing novelty requires complementary problem-solving efforts by acquiring firms [85]. For this, existing knowledge can play an important role in facilitating the integration and development of new knowledge. Firms with a strong base of existing knowledge can more effectively contextualize and connect new information to their current understanding, enabling them to identify patterns, relationships, and potential applications that might not be apparent otherwise. Furthermore, existing knowledge can provide a foundation for absorbing and interpreting new information, allowing firms to more quickly assess its relevance and potential value. This ability to rapidly process and contextualize new knowledge can significantly enhance a firm’s capacity to innovate. For example, a pharmaceutical firm with extensive knowledge in one therapeutic area might more readily integrate new findings from a different field, recognizing potential cross-applications or synergies that could lead to innovative drug development. This interplay between explorative and exploitative learning suggests that firms capable of pursuing both types of learning at high levels while effectively balancing and integrating these approaches are better positioned to achieve superior innovation outcomes.

In summary, firms with a strong exploitative knowledge base are better equipped to translate their exploration efforts into innovative outcomes in response to environmental changes [103]. Based on this reasoning, we propose the following hypothesis:

Hypothesis 4.

The positive effect of explorative learning on a firm’s innovation performance will be stronger in firms with high exploitative learning capabilities.

3.5. Dual-Staged Moderated Mediation Hypothesis: The Roles of Absorptive Capacity and Exploitative Learning

Building on our previous arguments, we posit that the positive indirect effect of environmental dynamism on innovation performance, mediated by explorative learning, is more pronounced in firms with both higher absorptive capacity and higher exploitative learning. As discussed above, absorptive capacity enhances a firm’s ability to recognize and acquire valuable external knowledge, thereby positively moderating the relationship between environmental dynamism and explorative learning, while exploitative learning enables the firm to commercialize this knowledge more efficiently by leveraging existing processes and routines, thereby positively moderating the relationship between explorative learning and innovation performance [104]. The combination of these two moderators, absorptive capacity and exploitive learning, amplifies a firm’s ability to translate environmental dynamism into enhanced innovation performance through explorative learning. As such, in highly dynamic environments, the capacity to rapidly identify and acquire new knowledge (absorptive capacity) and efficiently apply it to commercialization efforts within existing operational frameworks (exploitative learning) becomes crucial. So, firms excelling in both absorptive capacity and exploitative learning can respond to environmental changes more quickly and effectively, thereby strengthening the mediating role of explorative learning in translating environmental dynamism into innovation outcomes. Based on these arguments, we propose the following hypothesis:

Hypothesis 5.

The positive indirect effect of environmental dynamism on innovation performance mediated by explorative learning will be more pronounced in firms with both higher absorptive capacity and higher exploitative learning.

4. Methodology

4.1. Sample and Data Collection

To test our hypotheses, we conducted a survey targeting small- and medium-sized manufacturing enterprises in Korea with 20 to 299 employees, as listed in the 2019 Directory of Korean Enterprises by the Korea Economic Daily [105]. From this directory, we selected fifteen 4-digit manufacturing industries based on their varying average R&D intensity from the results of the Korean Enterprise Innovation Survey. These fifteen 4-digit industries were classified into the following seven 3-digit industries: food, chemicals, fabricated metal products, communications equipment, precision instruments, electrical equipment, and special-purpose machinery. From these industries, we identified 1706 firms as our effective target population after excluding those with inaccurate contact details, less than four years of operation, or lacking product development activities.

Data for our analysis were gathered using a structured questionnaire. Initially, we developed the questionnaire based on existing literature. We then conducted a preliminary test with five senior executives from relevant SMEs to evaluate the clarity and relevance of the questions and made necessary revisions based on their feedback. A pilot test followed, with 14 senior executives from similar industries examining response patterns, leading to further adjustments. Before distributing the finalized questionnaire for our main study, we verified the contact information of our target respondents, the heads of the selected firms, via phone. In accordance with Nunally’s data collection guidelines [106], we mailed the questionnaires three times at four-week intervals and followed up with phone calls to encourage participation. This process yielded 288 responses. After reviewing the returned questionnaires, we retained 266 by excluding those with incomplete or insincere answers. Additional exclusions were made for responses that did not address key study items or were identified as outliers. Ultimately, 254 questionnaires constituted our study sample, resulting in an effective response rate of 14.9%, which aligns with rates observed in similar studies.

Industry distribution was as follows: food (14.6%), chemicals (18.5%), fabricated products (13.8%), communications equipment (12.6%), precision equipment (11.0%), electrical equipment (16.5%), and special-purpose machinery (13.0%). As for respondent demographics, 51.2% were presidents or vice presidents, 18.9% were directors, and 29.9% held department head positions or lower. On average, respondents had been in their current roles for 12.5 years.

To check for potential non-response bias, we compared the characteristics of early and late respondents, following the methodology of Armstrong and Overton [107]. Early respondents were those who responded to the initial round of the survey, whereas late respondents replied in subsequent rounds. We found no significant differences between these two groups regarding firm age (p = 0.695), number of employees (p = 0.690), and R&D intensity (p = 0.533), indicating that non-response bias was not a significant issue in our study.

Furthermore, since our study relied on a single respondent to collect data for both independent and dependent variables simultaneously, we assessed the potential for common method bias. To address this issue, we conducted a common latent factor (CLF) test in AMOS, incorporating items from all four constructs. We introduced a new latent variable that was linked to all observed variables, with these paths constrained to be equal and the variance of the common factor fixed at 1. Unlike the Harman Single Factor technique, this approach has the advantage of retaining the research model’s latent factors and their relationships. The common variance was calculated as the square of the path coefficient of each path before standardization. In our model, this value was 0.34, which is well below the acceptable threshold of 0.5 [108], suggesting that common method bias is not a substantial issue in this study.

4.2. Measurement

4.2.1. Environmental Dynamism

To assess environmental dynamism, we adapted a five-item scale from previous studies by Jansen, Van Den Bosch, and Volberda [4]. This scale primarily captures changes in various environmental factors within an industry. Respondents were asked to rate their agreement with each statement on a 7-point Likert scale (1 = “strongly disagree”, 7 = “strongly agree”). The scale included the following items: “Product technologies in our industry change quickly”; “Environmental changes in our industry are intense”; “The tastes and preferences of customers in our industry change quickly”; “New products are frequently introduced in our industry”; and “The rate of change in our competitors’ strategic and tactical behavior in the market is very high”.

4.2.2. Innovation Performance

For our purpose, innovation performance refers to the degree of success in achieving corporate goals through the new product development program [109]. To measure innovation performance, we adopted the scale from Song, Dyer, and Thieme [109]. Respondents were asked to rate their agreement with each of the following statements on a 7-point Likert scale (1 = “strongly disagree”, 7 = “strongly agree”): “The overall performance of our new product development program has met our objectives”, “From an overall profitability standpoint, our new product development program has been successful”, “Compared with our major competitors, our overall new product development program is far more successful”, “Compared to its major competitors, our company takes less time to develop its new products”, and “Compared to competitors, the overall quality of our new products is higher”.

4.2.3. Absorptive Capacity

Following the operational definition from prior research [28,110], we measured a firm’s absorptive capacity using R&D intensity, calculated as the ratio of total R&D expenditures to total revenues.

4.2.4. Explorative Learning

To measure a firm’s explorative learning, which refers to seeking new knowledge and competencies, we relied on a four-item scale adapted from the existing study [111]. Respondents rated their agreement with each statement on a 7-point Likert scale (1 = “strongly disagree”, 7 = “strongly agree”). The scale included the following items: “Our company has learned new product development skills and processes (e.g., new product design and prototyping, new product launch timing) new to the industry”, “Our company has acquired new product technologies from its perspective”, “Our company has acquired new management and organizational skills (e.g., technology and customer trend prediction, new technology identification, R&D) that are critical to innovation”, and “Our company has strengthened its innovation skills in areas without prior experience”.

4.2.5. Exploitative Learning

To measure a firm’s exploitative learning, which refers to utilizing or leveraging existing knowledge and competencies, we used a four-item scale from prior research [111]. Participants used the same 7-point Likert scale to rate their agreement with each statement. The scale comprises the following items: “Our company has improved its current knowledge and skills on familiar products and technologies”, “Our company has invested in improving skills to take advantage of stabilized technologies that increase the productivity of its current operations”, “Our company has already improved the skills of the product development process with considerable experience”, and “Our company has strengthened knowledge and skills to increase the efficiency of existing innovation activities”.

4.2.6. Control Variables

This study controls for the effects of industry type, firm age, firm size (number of employees), and venture certification status, which may influence a firm’s product innovation performance, as suggested by existing literature. Specifically, based on previous studies indicating that the frequency of product innovation varies by industry characteristics [5,112], we controlled for the effects of the seven industries in our study using dummy variables. In addition, product innovation is recognized as a resource-intensive activity, with firms possessing abundant resources being more likely to take on the risks associated with new product development [113]. Moreover, considering the contrasting perspectives that older firms, with their accumulated experience and knowledge, may focus more on new product development [114], while others argue that older firms may prioritize product improvement due to organizational inertia, we controlled for the effect of firm age. Lastly, venture-certified firms generally tend to emphasize innovation activities more than other firms [114]. Therefore, we included the status of venture certification as a control variable and coded venture-certified firms as “1” and other firms as “0”.

5. Analyses and Results

5.1. Method of Analyses

To assess the reliability and validity of our measurements, we first conducted a confirmatory factor analysis using AMOS 28. Subsequently, we employed PROCESS Macro v. 4.2 to examine our mediation and moderated mediation hypotheses. PROCESS Macro is a tool for OLS and logistic regression-based path analysis, widely used for estimating indirect effects in various models. It is particularly useful for conditional process analysis, which combines mediation and moderation, providing bootstrap confidence intervals for examining the significance of mediation and moderated mediation effects. We calculated the lower limit confidence interval (LLCI) and upper limit confidence interval (ULCI) of a 95% bootstrap CI for indirect effects from 5000 bootstrap samples.

Following the approach proposed in the literature [93], we conducted analyses using PROCESS Macro models 4 and 21 sequentially to test the dual-staged moderated mediation hypotheses of this study.

5.2. Confirmatory Factor Analysis (Measurement Model)

We conducted a confirmatory factor analysis (CFA) to assess the reliability and validity of the measurements in our study. This assessment involved examining factor loadings (standardized coefficients), t-values (critical ratios), average variance extracted (AVE), composite reliability (CR), Cronbach’s Alpha, and discriminant validity. First, we assessed construct reliability using composite reliability (CR) and Cronbach’s Alpha. As shown in Table 1, both CR and Cronbach’s Alpha values exceeded the recommended minimum of 0.7, indicating high reliability [115]. We then evaluated the unidimensionality of our constructs through convergent and discriminant validity. All items exhibited significant factor loadings greater than the cutoff value of 0.60, with t-values (critical ratios) exceeding 1.96, indicating that the parameter estimates are statistically significant at the 0.05 level. High factor loadings with statistically significant t-values indicate strong relationships between latent and observed variables. Finally, the AVE for each scale surpassed the threshold of 0.5, demonstrating adequate convergent validity [116].

Table 1.

Results of confirmatory factor analysis.

To assess discriminant validity, we examined the inter-construct correlations. As presented above the diagonal in Table 2, the square root of the AVE for each factor was greater than its correlations with other factors, confirming satisfactory discriminant validity [117]. Lastly, the goodness-of-fit indices for our CFA model, as noted in Table 1, indicated an acceptable fit: χ2 = 249.443, df = 113, p < 0.01, χ2/df = 2.207, TLI(NNFI) = 0.937, CFI = 0.948, and RMSEA = 0.069 [118]. After completing the CFA, we generated factor scores for the four latent variables in our study to use in the path analysis of our moderated mediation model.

Table 2.

Descriptive statistics and correlation matrix (N = 254).

5.3. Test of Hypotheses

5.3.1. Descriptive Statistics and Correlations

Table 2 presents the means, standard deviations, and correlations among the variables. As anticipated, all correlations among the variables were significant and positive, aligning with the hypothesized directions of the relationships. To assess multicollinearity, we calculated the variance inflation factor (VIF) for each regression equation. The highest VIF value was 2.31, well below the common threshold of 10, indicating that multicollinearity was not a concern. Given that regression analysis in this study was conducted using survey data, which is often susceptible to heteroscedasticity due to various factors inherent in survey responses, we employed robust standard errors to control for potential issues. Specifically, we used the HC4 estimator proposed by Cribari-Neto to ensure more reliable inference testing [119].

5.3.2. Mediation Analysis: The Role of Explorative Learning

As the first step in testing the dual-staged moderated mediation hypothesis (Hypothesis 5), we employed PROCESS Macro model 4 to examine Hypotheses 1 and 2. Table 3 presents the results of the bootstrap significance tests for the mediation effect of explorative learning on the relationship between environmental dynamism and innovation performance (indirect effect), as well as the total and direct effects of this relationship. As shown in Table 3, the total effect (b = 0.258, CI = [0.129, 0.387]) and indirect effect (b = 0.176, CI = [0.108, 0.250]) were significant and positive, while the direct effect (b = 0.082, CI = [−0.035, 0.198]) was not significant.

Table 3.

Bootstrap significance test for indirect effects of environmental dynamism on innovation performance.

These findings demonstrate that environmental dynamism positively influences a firm’s innovation performance. Moreover, the results indicate that a firm’s explorative learning capabilities completely mediate the positive impact of environmental dynamism on innovation performance. Thus, both Hypotheses 1 and 2 were supported.

5.3.3. Moderation Analysis: The Role of Absorptive Capacity

As the second step, we used PROCESS Macro model 21 to test Hypothesis 3. This hypothesis posits that the impact of environmental dynamism on explorative learning capabilities varies depending on a firm’s level of absorptive capacity.

First, as shown in Table A1, Model 3, in Appendix A, we confirmed that explorative learning significantly moderates the positive effect of environmental dynamism on a firm’s innovation performance in a positive direction (b = 0.018, p < 0.01).

Next, as shown in Table 4, we conducted significance tests for the conditional effect to probe the moderation. These tests determine how the effect of environmental dynamism on explorative learning varied across different levels of absorptive capacity (+1 SD, 0, −1 SD).

Table 4.

Conditional effect of environmental dynamism on explorative learning at different levels of absorptive capacity.

As reported in Table 4, the significance and magnitude of the effect differed depending on the level of absorptive capacity. Specifically, the significant positive effect was largest in the group with high absorptive capacity (b = 0.422, p < 0.001), followed by the group with medium absorptive capacity (b = 0.288, p < 0.001). However, the effect was not significant in the group with low absorptive capacity (b = 0.155, p > 0.05).

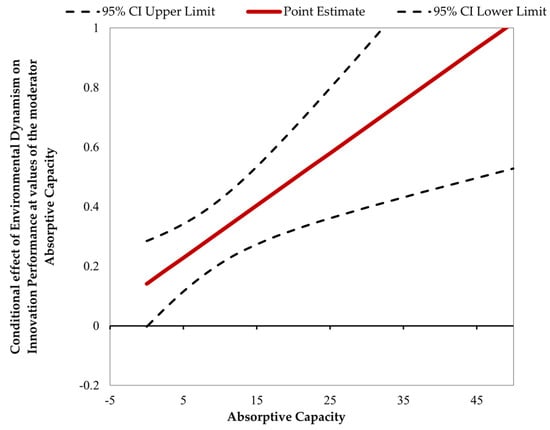

To more precisely probe the moderation, we employed the Johnson–Neyman (JN) technique. In contrast to the conventional pick-a-point approach presented in Table 4, where the selection of moderator values is often arbitrary (mean, +1SD, −1SD), the Johnson–Neyman technique offers a more comprehensive analysis. It identifies, across the full range of a continuous moderator, the specific points where the effect of an independent variable on the dependent variable transitions from significant to non-significant or vice versa [120].

The transition point, marking the boundary between significant and non-significant interaction effects, was found at an R&D intensity (absorptive capacity) level of 0.131 (M = 0.131). When M > 0.131, the positive effect of environmental dynamism on explorative learning was significant; however, it was not significant when M < 0.131. Thus, the effect was significant and positive among firms with high absorptive capacity but not among those with low absorptive capacity. Figure 2 illustrates the JN plot, showing the conditional effect of environmental dynamism on explorative learning at varying levels of absorptive capacity.

Figure 2.

Johnson–Neyman plot: conditional effect of environmental dynamism on explorative learning as a function of absorptive capacity.

Collectively, the results from the regression analysis in Table A1 in Appendix A, the significance tests for the conditional effect in Table 4, and the Johnson–Neyman (JN) analysis provide empirical support for Hypothesis 3, which posits that the positive effect of environmental dynamism on explorative learning will be stronger in firms with higher absorptive capacity.

Our results suggest that, among firms facing similar external environmental dynamism, those with higher absorptive capacity are likely to achieve superior explorative learning relative to their competitors with lower absorptive capacity. These findings are consistent with prior research, which suggests that rapid environmental changes prompt firms to invest more in explorative learning to acquire new knowledge. In this context, a firm’s ability to absorb and assimilate externally sourced knowledge is crucial for enhancing its capacity to learn new knowledge [121].

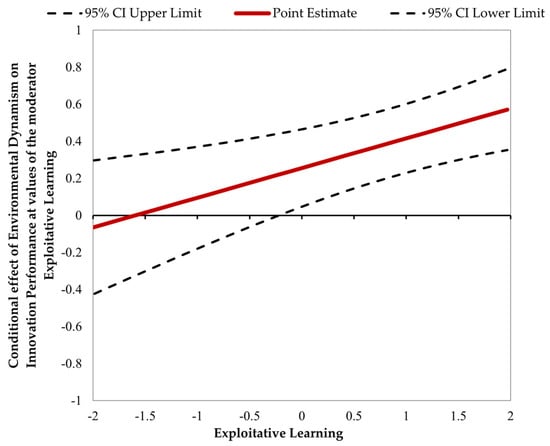

5.3.4. Moderation Analysis: The Role of Exploitative Learning

As with the previous analysis, PROCESS macro model 21 was utilized to test Hypothesis 4. This hypothesis suggests that a firm’s exploitative learning level moderates the relationship between explorative learning and innovation performance. In other words, the effect of explorative learning on a firm’s innovation performance varies depending on the level of exploitative learning, which acts as a second-stage moderator in the mediation process.

The results presented in Table A1, Model 5, in Appendix A, demonstrate a significant positive interaction effect between explorative and exploitative learning on a firm’s innovation performance (b = 0.160, p < 0.01).

Furthermore, the results in Table 5 present the conditional effects of explorative learning at different levels of exploitative learning, demonstrating stronger effects in firms with high exploitative learning. Specifically, the conditional effect was positive and significant in groups with high (b = 0.448, p < 0.001) and medium (b = 0.282, p < 0.001) exploitative learning but not significant in the group with low exploitative learning (b = 0.116, p > 0.05).

Table 5.

Conditional effect of explorative learning on innovation performance at different levels of exploitative learning.

A subsequent Johnson–Neyman test identified the transition point for exploitative learning at −0.218 (M = −0.218). The positive effect of explorative learning on innovation performance was significant when M > −0.218 but not significant when M < −0.218. Notably, 40.55% of the cases in the data fell within the region of the moderator’s distribution below −0.218 (Figure 3). Collectively, these results provide support for Hypothesis 4.

Figure 3.

Johnson–Neyman plot: conditional effect of explorative learning capabilities on innovation performance as a function of exploitative learning.

5.3.5. Dual-Staged Moderated Mediation Analysis Hypothesis: The Roles of Absorptive Capacity and Exploitative Learning

Table 6 presents the test results for the dual-staged moderated mediation model proposed in Hypothesis 5, using PROCESS Macro model 21. This hypothesis posits that the indirect effect of environmental dynamism on innovation performance, mediated by explorative learning, is more pronounced in groups with both high absorptive capacity and high exploitative learning.

Table 6.

Bootstrap significance test for the conditional indirect effect of environmental dynamism on innovation performance at values of absorptive capacity and exploitative learning.

As shown in Table 6, the confidence interval for the index of moderated mediation indicates a statistically significant dual-staged moderation of the indirect effect (Index = 0.003, CI = [0.001, 0.006]). This result confirms that the indirect effect of environmental dynamism on innovation performance, mediated by explorative learning, is moderated by both absorptive capacity and exploitative learning. Specifically, this indirect effect is strongest in the group with high levels of both absorptive capacity and exploitative learning (b = 0.189, CI = [0.105, 0.285]). However, in the group with low exploitative learning, the indirect effect is not moderated by absorptive capacity, and this is the case even for the group with a high level of absorptive capacity (b = 0.049, CI = [−0.047, 0.150]). These results provide support for Hypothesis 5.

These findings suggest that as environmental changes and uncertainties increase, firms are more likely to enhance explorative learning to overcome these challenges. However, the effectiveness of such explorative learning varies across firms. Specifically, for explorative learning to result in tangible innovation outcomes, the synergistic combination of two internal capabilities—absorptive capacity and exploitative learning—is crucial. Neither capability alone is sufficient; both are essential for maximizing innovation performance. Without these complementary internal capabilities working in tandem, explorative learning may not significantly enhance innovation performance across all firms.

6. Discussion and Conclusions

This study examines the mechanisms through which environmental dynamism enhances innovation performance by focusing on the external fit between a firm’s external environment and its internal capabilities as well as the internal fit among the firm’s internal capabilities themselves. By integrating the concepts of external fit and internal fit into a unified moderated mediation model, this study aims to elucidate the roles of various internal capabilities in the relationship between environmental dynamism and innovation performance. This study identifies the strategic pathways and internal capabilities required to improve innovation performance in response to environmental dynamism, highlighting the importance of aligning these internal capabilities with the external environment to enhance innovation outcomes.

This research reveals that firms tend to adopt strategic pathways that strengthen explorative learning in dynamic environments, which is a key route to improving innovation performance. However, it also indicates that not all firms can expect improved innovation performance simply by adopting an explorative learning approach. This research further reveals that differences in innovation performance among firms can be attributed not only to the level of explorative learning but also to the levels of other internal capabilities, namely, absorptive capacity and exploitative learning. Specifically, firms with high absorptive capacity are more effective at enhancing explorative learning in response to environmental dynamism, thereby improving innovation performance.

Furthermore, this study finds that exploitative learning plays an important role in translating explorative learning into tangible innovation outcomes. Environmental dynamism drives firms to strengthen explorative learning, which is further enhanced by high absorptive capacity. Moreover, in this process, exploitative learning is vital in translating explorative learning into tangible innovation outcomes.

These findings collectively suggest that even if firms detect changes in external environments and adopt an explorative learning approach, those lacking high absorptive capacity are likely to have difficulty in implementing this approach successfully. Additionally, firms with high absorptive capacity that successfully cultivate an explorative learning capability may still fail to achieve high innovation performance if they lack a strong exploitative learning capability. This study underscores the importance of cultivating and harmonizing a diverse range of internal capabilities to help firms respond more effectively to dynamic environments and improve innovation performance.

From an academic perspective, this study makes several important contributions. First, it integrates the SCP paradigm and the resource-based perspective through the dynamic capabilities framework, demonstrating that the combination of external fit (alignment between external environments and internal capabilities) and internal fit (alignment among internal capabilities) provides a clearer explanation of the positive relationship between environmental dynamism and innovation performance. This contributes to advancing research on the relationship between environmental dynamism and innovation performance, which previously lacked consistent conclusions.

Existing studies based on the SCP paradigm often focus solely on external fit, oversimplifying the role of internal capabilities by relying on a single capability to explain how firms respond to environmental dynamism. In contrast, the dynamic capabilities literature, rooted in the resource-based perspective, emphasizes the need for firms to adapt, integrate, and reconfigure multiple internal resources to address market changes. By applying an integrated model that incorporates both types of fit, this study highlights various combinations of internal capabilities identified in the dynamic capabilities literature as essential for enhancing innovation performance in response to environmental changes.

Second, this study offers valuable insights into organizational learning by emphasizing the importance of balancing exploration and exploitation to enhance innovation performance and suggests practical ways to achieve this balance. While both are critical, the study underscores that cultivating explorative learning capabilities is particularly vital in dynamic environments. These findings align with prior research indicating that a balance between exploration and exploitation contributes more significantly to performance improvement in highly dynamic contexts.

Finally, this study advances the understanding of dynamic capabilities by addressing limitations in their operationalization and measurement. Traditional approaches have treated dynamic capabilities—sensing, seizing, and transforming—as distinct constructs and quantified them using a simplistic additive model that overlooks the complex interactions among these components. In contrast, this study employs a dual-staged moderated mediation model to demonstrate that both individual organizational learning processes and their interactions significantly influence innovation performance. It further reveals nuanced differences in how firms deploy internal capabilities to respond to environmental dynamism, offering a more comprehensive and integrated perspective on dynamic capabilities.

From a managerial perspective, this study provides several important implications. First, managers must develop a strong awareness of environmental dynamism and ensure that their firm’s internal capabilities are aligned with these external changes to drive innovation outcomes. Second, firms should invest in building and harmonizing a diverse set of internal capabilities, particularly explorative learning, absorptive capacity, and exploitative learning, as all three are essential for translating environmental dynamism into enhanced innovation performance. Third, managers should prioritize strengthening their firm’s absorptive capacity, as it plays a critical role in enhancing explorative learning and enabling firms to adapt effectively to dynamic environments. Absorptive capacity serves as the foundation for implementing explorative learning strategies in response to environmental changes. Fourth, while explorative learning is particularly vital in dynamic environments, managers must also maintain a focus on exploitative learning. This study emphasizes the importance of balancing exploration and exploitation to achieve superior innovation outcomes. Finally, managers should view their organization’s capabilities as an interconnected system that requires careful balancing and continuous development. This systemic perspective is crucial for navigating dynamic market conditions and sustaining long-term competitiveness.

The limitations of this study and the directions for future research are as follows. Above all, the findings of this study can be limited in generalizability as it focuses on specific small- and medium-sized manufacturing enterprises in Korea. Future research should be expanded to include diverse national and industrial contexts. Considering the advancements in mobile and AI technologies, which drive innovation in IT and service sectors, applying the research model of this study to service industries could yield meaningful insights.

In addition, while this study focuses on explorative learning, absorptive capacity, and exploitative learning as internal capabilities that should fit with the external environment, there may be other internal capabilities influencing innovation performance. Future research could deepen the understanding of the relationship between environmental dynamism and innovation performance by considering additional mediators or moderators, such as organizational culture and leadership style.

Finally, while this study employed OLS regression analysis based on cross-sectional survey data, the relationship between a firm’s response to environmental dynamism and innovation performance warrants long-term investigation. Future studies using panel data analysis could provide deeper insights into this relationship.

Author Contributions

Conceptualization: K.K.; methodology: C.Y.K. and E.-H.S.; validation: K.K. and C.Y.K.; formal analysis: K.K.; investigation: C.Y.K.; resources: K.K.; data collection: E.-H.S.; writing—original draft preparation: K.K. and C.Y.K.; writing—review and editing: C.Y.K. and K.K.; visualization: K.K. and E.-H.S.; supervision, C.Y.K. All authors have read and agreed to the published version of the manuscript.

Funding

This paper was supported by Konkuk University in 2022, grant number 2022-A019-0040.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

Author Eun-Hwa Seo was employed by the company Rest and Conversation, Inc. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Appendix A

Table A1.

Hierarchical multiple regression for innovation performance and explorative learning.

Table A1.