Comparative Analysis of Carbon Tax and Carbon Market Strategies for Facilitating Carbon Neutrality in China’s Coal-Fired Electricity Sector

Abstract

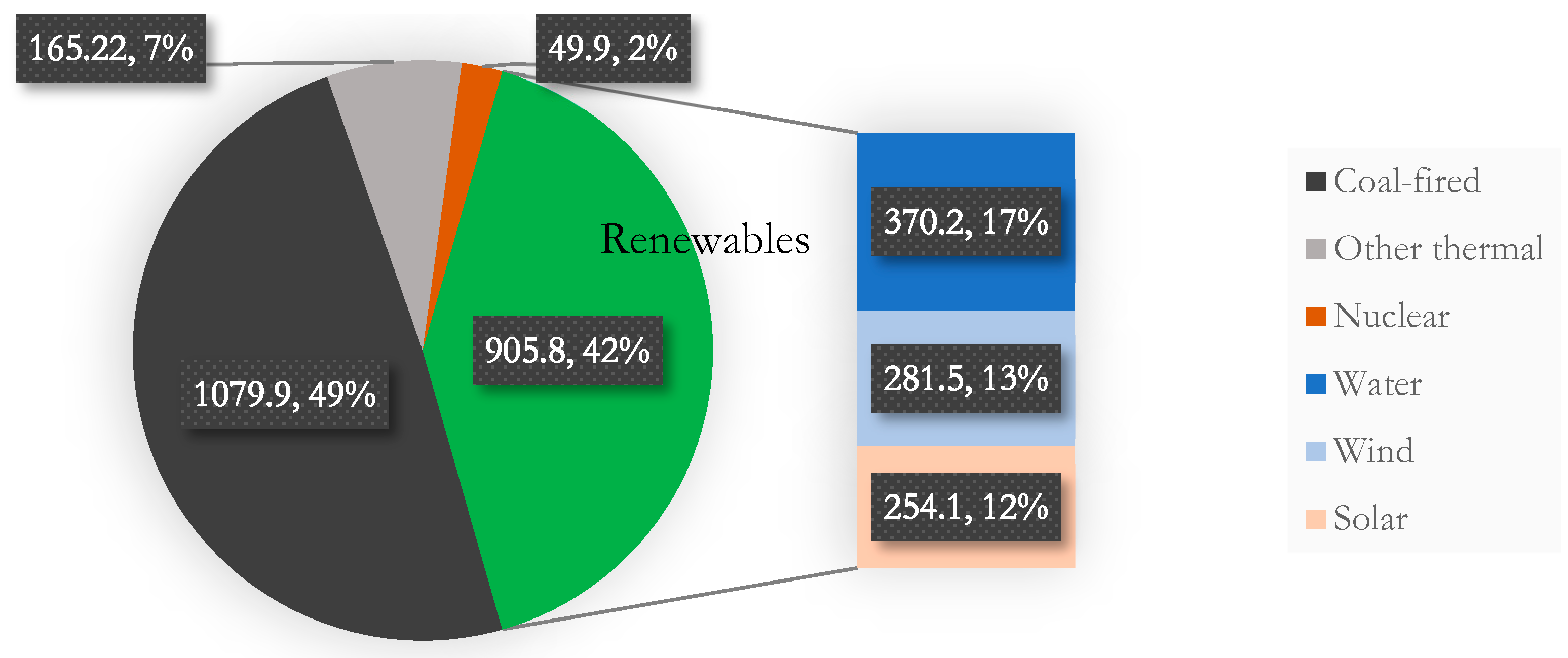

1. Introduction

- (1)

- The linkage between coal and electricity prices needs to be clarified, and the effect of electricity price volatility on thermal coal prices should be quantified in the context of electricity market reform.

- (2)

- A transmission system model should be able to characterize the influence intensity and rules of different types of carbon pricing (i.e., carbon taxes and the carbon market) in relation to coal-based electricity prices.

- (1)

- Theoretically, our proposed multivariate stochastic analysis model—which comprises historical trends, carbon-pricing shocks, and market uncertainty—quantifies the effects of different carbon-pricing mechanisms on coal-based electricity prices. This offers a powerful tool for studying the transmission paths and effects of carbon constraints on the electricity industry. Existing models focus more on the carbon-pricing effects of specific periods on coal-based electricity. Our model, however, not only provides short-term market risk information for coal-based electricity plants but also quantifies the pricing effect of long-term emission-reduction measures. This study, therefore, reveals both the amount of carbon emission reduction and the corresponding revenues that could be generated by administrative orders (carbon tax) and market tools (carbon trading) in the coal-based electricity industry.

- (2)

- Practically, we propose effective carbon-pricing methods for coal-based power marketization in two dimensions—energy transformation and energy security—balancing different power costs based on measuring the carbon revenue potential of different power sources. Existing studies mainly provide specific carbon-pricing schemes for the coal-based electricity industry at the regional level. However, the unreasonable linkage of natural gas prices, carbon prices, and electricity prices triggered the current EU energy crisis. Thus, we further calculate the reasonable fluctuation range of the carbon price and design an optimal combination that bridges carbon and electricity indicators, obtained by adjusting their volatility range. Our findings can help emerging economies understand carbon pricing’s effects on the basic energy price system in the pursuit of carbon neutrality, providing a reference for governments to formulate effective emission-reduction policies.

2. Literature Review

2.1. Electricity Price Forecasting and the Factors That Influence It

- (1)

- Multiagent models construct the price processes of load and demand by simulating the operations of several heterogeneous and interrelated systems (e.g., generators and plants) [33,34]. These predictions are more suitable for markets with little price uncertainty (e.g., regulated power markets) than for competitive markets.

- (2)

- Fundamental models aim to capture the physical and economic characteristics of electricity production and trading [35]. Since the results of such models are sensitive to violations of their assumptions (e.g., regarding physical and economic relationships), the more detailed the model, the more complex the parameter adjustments with regard to risks in practical application.

- (3)

- Derived from the financial sector, reduced-form models do not aim to provide accurate price forecasts. Rather, they focus on replicating the characteristics of daily electricity prices, reflecting marginal distribution at a certain point, dynamic price changes, and relationships among commodities. Such models are mainly used for derivative prices and risk management.

- (4)

- Statistical models apply mathematical methods to historical price information or other price-related information to predict current prices (Nowotarski and Weron 2018 [36]). The prediction accuracy of these methods depends on data quality and the efficiency of the algorithm.

- (5)

- Computational intelligence models, or artificial intelligence models, use artificial intelligence to deal with complex problems that traditional methods cannot solve [37,38]. The advantage of such models is that they can flexibly deal with certain complex and nonlinear problems. However, the high complexity of such models results in inaccurate medium- and long-term predictions.

2.2. Price Transmission of Carbon Pricing

2.3. Characteristics of China’s Electricity Market

3. Coal-Fired Electricity Price System Coupled with Carbon Pricing

3.1. Transmission Mechanism of Carbon Pricing’s Effect on Coal-Fired Electricity Prices

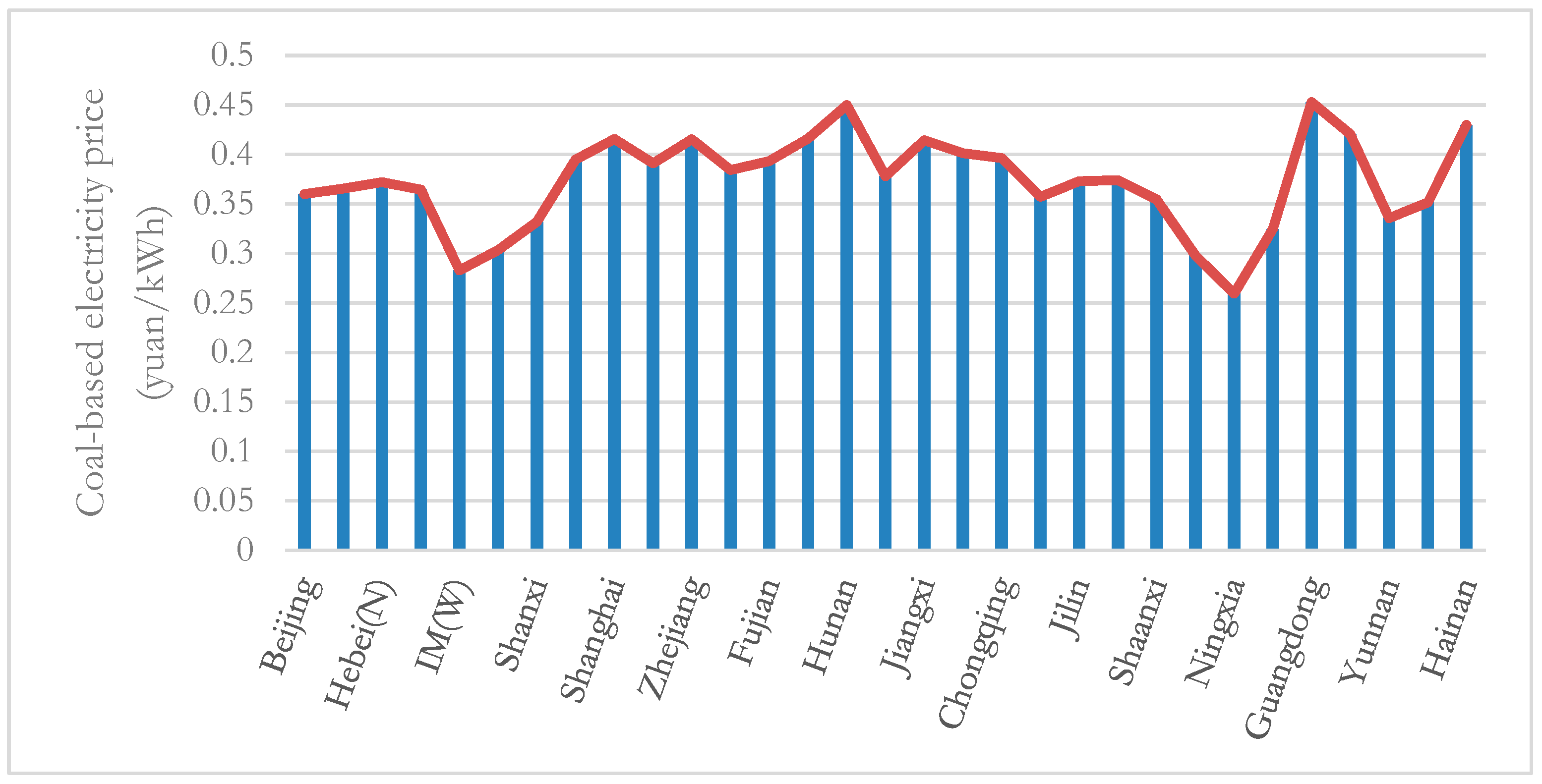

3.2. Market-Oriented Price of Coal-Fired Electricity

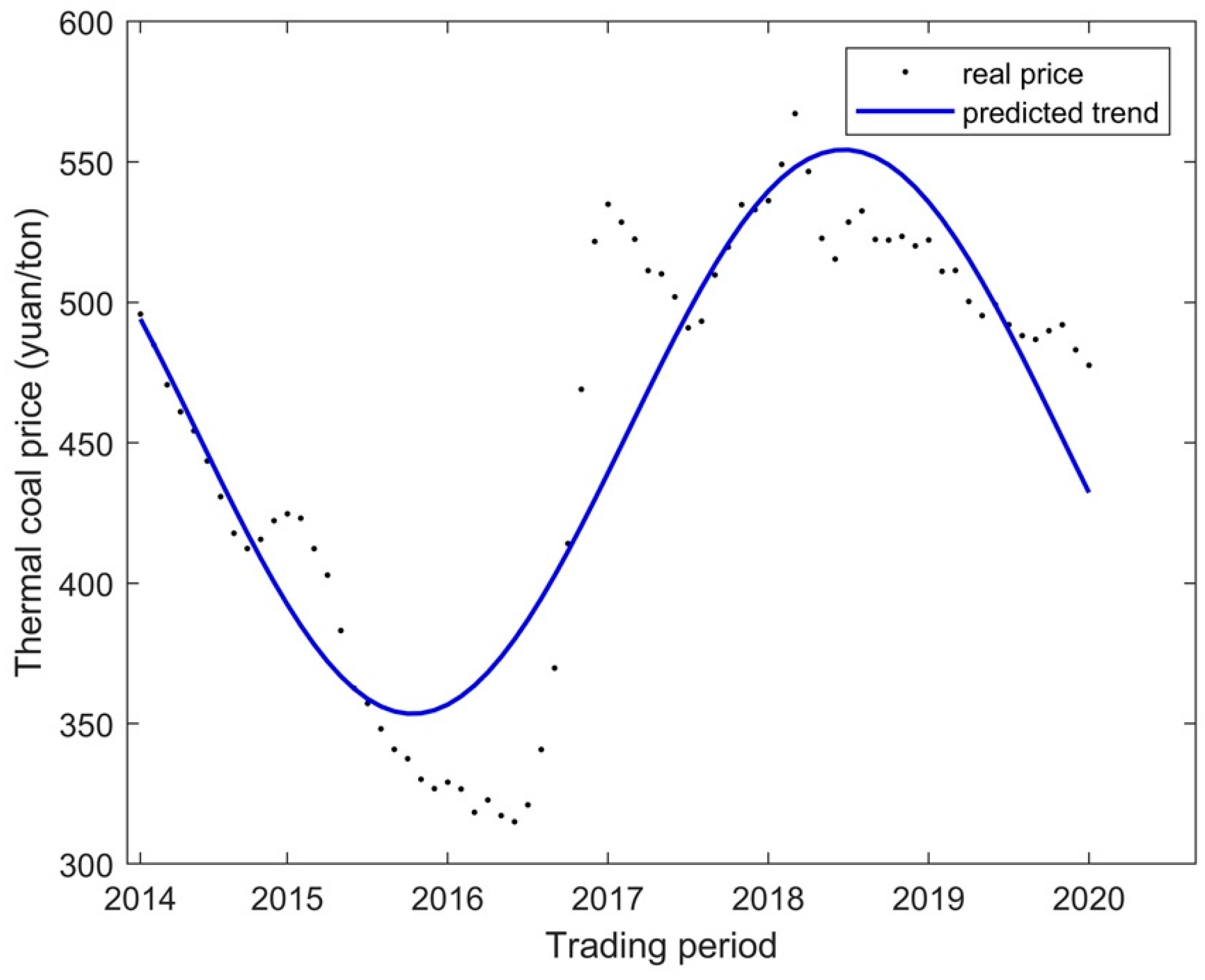

3.3. Expression of Thermal Coal Price

3.4. Expression of Coal-Based Electricity Price Based on Thermal Coal Price Volatility

4. Medium- and Long-Term Price Forecast of Coal-Based Electricity Under Carbon Pricing

4.1. Influence of Thermal Coal Price on Coal-Based Electricity Price

4.2. Influence of the Carbon Market and Carbon Tax on the Coal-Based Electricity Price Trend

4.3. Emission-Reduction Efficiency of Coal-Based Electricity Industry Under the Effects of the Carbon Tax and Carbon Market

5. Conclusions and Policy Recommendations

5.1. Conclusions

5.2. Recommendations for Carbon-Pricing Policies in Emerging Market Countries

5.3. Recommendations for Carbon Market Development

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Vrontisi, Z.; Fragkiadakis, K.; Kannavou, M.; Capros, P. Energy system transition and macroeconomic impacts of a European decarbonization action towards a below 2 °C climate stabilization. Clim. Change 2020, 162, 1857–1875. [Google Scholar] [CrossRef]

- Hadziosmanovic, M.; Lloyd, S.M.; Bjrn, A.; Paquin, R.L.; Nadine Mengis, N.; Matthews, H.D. Using cumulative carbon budgets and corporate carbon disclosure to inform ambitious corporate emissions targets and long-term mitigation pathways. J. Ind. Ecol. 2022, 26, 1747–1759. [Google Scholar] [CrossRef]

- Yuan, J.; Na, C.; Lei, Q.; Xiong, M.; Guo, J.; Hu, Z. Coal use for power generation in China. Resour. Conserv. Recycl. 2018, 129, 443–453. [Google Scholar] [CrossRef]

- Liu, D.; Zeng, X.; Su, B.; Wang, W.; Sun, K.; Sadia, U.H. A social network analysis regarding electricity consumption and economic growth in China. J. Clean. Prod. 2020, 274, 122973. [Google Scholar] [CrossRef]

- Whitaker, M.; Heath, G.A.; Donoughue, P.O.; Vorum, M. Life cycle greenhouse gas emissions of coal-fired electricity generation. J. Ind. Ecol. 2012, 16 (Suppl. S1), S53–S72. [Google Scholar] [CrossRef]

- Kaya, Y.; Yamaguchi, M.; Geden, O. Towards net zero CO2 emissions without relying on massive carbon dioxide removal. Sustain. Sci. 2019, 14, 1739–1743. [Google Scholar] [CrossRef]

- Liu, H.; Zhang, Z.; Chen, Z.; Dou, D. The impact of China’s electricity price deregulation on coal and power industries: Two-stage game modeling. Energy Policy 2019, 134, 110957. [Google Scholar] [CrossRef]

- Ekins, P.; Zenghelis, D. The costs and benefits of environmental sustainability. Sustain. Sci. 2021, 16, 949–965. [Google Scholar] [CrossRef] [PubMed]

- Zhao, J.; Mattauch, L. When standards have better distributional consequences than carbon taxes. J. Environ. Econ. Manag. 2022, 166, 102747. [Google Scholar] [CrossRef]

- Khalilpour, R. Multi-level investment planning and scheduling under electricity and carbon market dynamics: Retrofit of a power plant with PCC (post-combustion carbon capture) processes. Energy 2014, 64, 172–186. [Google Scholar] [CrossRef]

- He, S.; Yin, J.; Zhang, B.; Wang, Z. How to upgrade an enterprise’s low-carbon technologies under a carbon tax: The trade-off between tax and upgrade fee. Appl. Energy 2018, 227, 564–573. [Google Scholar] [CrossRef]

- Zheng, X.; Wu, C.; He, S. Impacts of market segmentation on the over-capacity of the thermal electricity generation industry in China. J. Environ. Manag. 2020, 279, 111761. [Google Scholar] [CrossRef] [PubMed]

- Mitridati, L.; Kazempour, J.; Pinson, P. Design and game-Theoretic analysis of community-Based market mechanisms in heat and electricity systems. Omega-Int. J. Manag. Sci. 2021, 99, 102177. [Google Scholar] [CrossRef]

- Karimi, H.; Bahmani, R.; Jadid, S. Stochastic multi-objective optimization to design optimal transactive pricing for dynamic demand response programs: A bi-level fuzzy approach. Int. J. Electr. Power Energy Syst. 2021, 125, 106487. [Google Scholar] [CrossRef]

- Mays, J.; Morton, D.P.; O’Neill, R.P. Investment effects of pricing schemes for non-convex markets. Eur. J. Oper. Res. 2021, 289, 712–726. [Google Scholar] [CrossRef]

- Veselov, F.V.; Novikova, T.V.; Khorshev, A.A. Technological renovation of thermal power plants as a long-term check factor of electricity price growth. Therm. Eng. 2015, 62, 843–852. [Google Scholar] [CrossRef]

- Liu, M.; Margaritis, D.; Zhang, Y. Market-driven coal prices and state-administered electricity prices in China. Energy Econ. 2013, 40, 167–175. [Google Scholar] [CrossRef]

- Rentier, G.; Lelieveldt, H.; Kramer, G.J. Varieties of coal-fired power phase-out across Europe. Energy Policy 2019, 132, 620–632. [Google Scholar] [CrossRef]

- Hall, N.L.; Jeanneret, T.D.; Rai, A. Cost-reflective electricity pricing: Consumer preferences and perceptions. Energy Policy 2016, 95, 62–72. [Google Scholar] [CrossRef]

- Chai, S.; Huo, W.; Li, Q.; Ji, Q.; Shi, X. Effects of carbon tax on energy transition, emissions and economy amid technological progress. Appl. Energy 2025, 377, 124578. [Google Scholar] [CrossRef]

- Han, X.; Hong, Z.; Su, Y.; Wang, Z. Optimal operations of energy storage systems in multi-application scenarios of grid ancillary services based on electricity price forecasting. Int. J. Energy Res. 2021, 45, 7145–7160. [Google Scholar] [CrossRef]

- Jasinski, T. Use of new variables based on air temperature for forecasting day-ahead spot electricity prices using deep neural networks: A new approach. Energy 2020, 213, 118784. [Google Scholar] [CrossRef]

- Ma, D.; Zhai, P.; Zhang, D.; Ji, Q. Excess stock returns and corporate environmental performance in China. Financ. Innov. 2024, 10, 41. [Google Scholar] [CrossRef]

- Luo, J.; Klein, T.; Walther, T.; Ji, Q. Forecasting realized volatility of crude oil futures prices based on machine learning. J. Forecast. 2024, 43, 1422. [Google Scholar] [CrossRef]

- Ren, X.; Jiang, W.; Ji, Q.; Zhai, P. Seeing is believing: Forecasting crude oil price trend from the perspective of images. J. Forecast. 2024, 43, 2809. [Google Scholar] [CrossRef]

- Hobman, E.V.; Frederiks, E.R.; Stenner, K.; Meikle, S. Uptake and usage of cost-reflective electricity pricing: Insights from psychology and behavioural economics. Renew. Sustain. Energy Rev. 2016, 57, 455–467. [Google Scholar] [CrossRef]

- Wong, J.B.; Zhang, Q. Impact of carbon tax on electricity prices and behavior. Financ. Res. Lett. 2022, 44, 102098. [Google Scholar] [CrossRef]

- Chai, S.; Cao, M.; Li, Q.; Ji, Q.; Liu, Z. Exploring the nexus between ESG disclosure and corporate sustainable growth: Moderating role of media attention. Financ. Res. Lett. 2023, 58, 104519. [Google Scholar] [CrossRef]

- Lee, D.; Ooka, R.; Ikeda, S.; Choi, W.; Kwak, Y. Model predictive control of building energy systems with thermal energy storage in response to occupancy variations and time-variant electricity prices. Energy Build. 2020, 225, 110291. [Google Scholar] [CrossRef]

- Aslam, F.; Ali, I.; Amjad, F.; Ali, H.; Irfan, I. On the inner dynamics between Fossil fuels and the carbon market: A combination of seasonal-trend decomposition and multifractal cross-correlation analysis. Environ. Sci. Pollut. Res. 2023, 30, 25873–25891. [Google Scholar] [CrossRef]

- Wu, F.; Ji, Q.; Ma, Y.; Zhang, D. Investor sentiments and extreme risk spillovers from oil to stock markets: Evidence from asian countries. J. Asia Pac. Econ. 2024, 29, 1257–1283. [Google Scholar] [CrossRef]

- Ohler, A.; Mohammadi, H.; Loomis, D.G. Electricity restructuring and the relationship between fuel costs and electricity prices for industrial and residential customers. Energy Policy 2020, 142, 111559. [Google Scholar] [CrossRef]

- Bower, J.; Bunn, D.W. Model-based comparisons of pool and bilateral markets for electricity. Energy J. 2020, 21, 1–29. [Google Scholar] [CrossRef]

- Aggarwal, S.K.; Saini, L.M.; Kumar, A. Electricity price forecasting in deregulated markets: A review and evaluation. Int. J. Electr. Power Energy Syst. 2009, 31, 13–22. [Google Scholar] [CrossRef]

- Dutta, G.; Mitra, K. A literature review on dynamic pricing of electricity. J. Oper. Res. Soc. 2017, 68, 1131–1145. [Google Scholar] [CrossRef]

- Nowotarski, J.; Weron, R. Recent advances in electricity price forecasting: A review of probabilistic forecasting. Renew. Sustain. Energy Rev. 2018, 81, 1548–1568. [Google Scholar] [CrossRef]

- Haluzan, M.; Verbic, M.; Zoric, J. Performance of alternative electricity price forecasting methods: Findings from the Greek and Hungarian power exchanges. Appl. Energy 2020, 277, 115599. [Google Scholar] [CrossRef]

- Deng, Z.; Liu, C.; Zhu, Z. Inter-hours rolling scheduling of behind-the-meter storage operating systems using electricity price forecasting based on deep convolutional neural network. Int. J. Electr. Power Energy Syst. 2021, 125, 106499. [Google Scholar] [CrossRef]

- Foramitti, J.; Savin, I.; van den Bergh, J.C.J.M. Emission tax vs. permit trading under bounded rationality and dynamic markets. Energy Policy 2021, 148, 112009. [Google Scholar] [CrossRef]

- An, Y.; Zhai, X. SVR-DEA model of carbon tax pricing for China’s thermal power industry. Sci. Total Environ. 2020, 734, 139438. [Google Scholar] [CrossRef]

- Li, G.; Zhang, R.; Masui, T. CGE modeling with disaggregated pollution treatment sectors for assessing China’s environmental tax policies. Sci. Total Environ. 2021, 761, 143264. [Google Scholar] [CrossRef]

- Harpprecht, C.; Oers, L.; Northey, S.A.; Yang, Y.; Steubing, B. Environmental impacts of key metals’ supply and low-carbon technologies are likely to decrease in the future. J. Ind. Ecol. 2021, 25, 1543–1559. [Google Scholar] [CrossRef]

- Yin, G.; Zhou, L.; Duan, M.; He, W.; Zhang, P. Impacts of carbon pricing and renewable electricity subsidy on direct cost of electricity generation: A case study of China’s provincial power sector. J. Clean. Prod. 2018, 205, 375–387. [Google Scholar] [CrossRef]

- Song, Y.; Liu, T.; Liang, D.; Wang, S. Reasonable initial price interval calculation of carbon market. Resour. Sci. 2019, 41, 1438–1449. (In Chinese) [Google Scholar] [CrossRef]

- Zhang, X.; Loeschel, A.; Lewis, J.; Zhang, D.; Yan, J. Emissions trading systems for global low carbon energy and economic transformation. Appl. Energy 2020, 279, 115858. [Google Scholar] [CrossRef]

- Leroutier, M. Carbon pricing and power sector decarbonisation: Evidence from the UK. J. Environ. Econ. Manag. 2022, 111, 102580. [Google Scholar] [CrossRef]

- Xue, M.; Liang, Q.; Wang, C. Price transmission mechanism and socio-economic effect of carbon pricing in Beijing: A two-region social accounting matrix analysis. J. Clean. Prod. 2019, 211, 134–145. [Google Scholar] [CrossRef]

- Cui, H.; Wei, P. Analysis of thermal coal pricing and the coal price distortion in China from the perspective of market forces. Energy Policy 2017, 106, 148–154. [Google Scholar] [CrossRef]

- Li, H.; Tian, X.; Zou, T. Impact analysis of coal-electricity pricing linkage scheme in China based on stochastic frontier cost function. Appl. Energy 2015, 151, 296–305. [Google Scholar] [CrossRef]

- Fan, J.; Ke, R.; Yu, S.; Wei, Y. How does coal-electricity price linkage impact on the profit of enterprises in China? Evidence from a Stackelberg game model. Resour. Conserv. Recycl. 2018, 129, 383–391. [Google Scholar] [CrossRef]

- Zhang, W.; Liu, L. Investment decisions of fired power plants on carbon utilization under the imperfect carbon emission trading schemes in China. Processes 2019, 7, 828. [Google Scholar] [CrossRef]

- Hu, X.R.; Wu, H.H.; Ni, W.L.; Wang, Q.W.; Zhou, D.Q.; Liu, J.F. Quantifying the dynamical interactions between carbon pricing and environmental protection tax in China. Energy Econ. 2023, 126, 106912. [Google Scholar] [CrossRef]

- Xu, H.T.; Pan, X.F.; Li, J.M.; Feng, S.H.; Guo, S.C. Comparing the impacts of carbon tax and carbon emission trading, which regulation is more effective? J. Environ. Manag. 2023, 330, 117156. [Google Scholar] [CrossRef] [PubMed]

- Jiang, H.D.; Dong, K.Y.; Qing, J.; Teng, Q. The role of technical change in low-carbon transformation and crises in the electricity market: A CGE analysis with R&D investment. Energy Econ. 2023, 125, 106897. [Google Scholar]

- Lai, G.; Yu, X.; Wu, G.; Lan, Z. High-Quality Development and Decoupling Economic Growth from Air Pollution: Evidence from Daily Electricity Consumption in Fujian. Sustainability 2025, 17, 1489. [Google Scholar] [CrossRef]

- Uddin, M.A.; Chang, B.H.; Aldawsari, S.H.; Li, R. The Interplay Between Green Finance, Policy Uncertainty and Carbon Market Volatility: A Time Frequency Approach. Sustainability 2025, 17, 1198. [Google Scholar] [CrossRef]

- Qiang, M.; Lai, H.; Lyu, Z. Carbon Emissions Trading and Employment: Evidence from China. Sustainability 2025, 17, 1404. [Google Scholar] [CrossRef]

- Kim, W.; Chattopadhyay, D.; Park, J.B. Impact of carbon cost on wholesale electricity price: A note on price pass-through issues. Energy 2010, 35, 3441–3448. [Google Scholar] [CrossRef]

- Nelsons, T.; Kelley, S.; Orton, F. A literature review of economic studies on carbon pricing and Australian wholesale electricity markets. Energy Policy 2012, 49, 217–224. [Google Scholar] [CrossRef]

- He, J.; Ye, Z. Basic principles and equilibrium model of carbon cost pass-through in power industry. Ecol. Econ. 2019, 35, 45–49. [Google Scholar]

- Song, Y.; Liu, T.; Liang, D.; Li, Y.; Song, X. A fuzzy stochastic model for carbon price prediction under the effect of demand-related policy in China’s carbon market. Ecol. Econ. 2019, 157, 253–265. [Google Scholar] [CrossRef]

- Tu, Q.; Betz, R.; Mo, J.; Fan, Y.; Liu, Y. Achieving grid parity of wind power in China—Present levelized cost of electricity and future evolution. Appl. Energy 2019, 250, 1053–1064. [Google Scholar] [CrossRef]

- Bashir, M.F.; Ma, B.; Shahbaz, M.; Jiao, Z. The nexus between environmental tax and carbon emissions with the roles of environmental technology and financial development. PLoS ONE 2020, 15, e0242412. [Google Scholar] [CrossRef] [PubMed]

- Tost, M.; Hitch, M.; Lutter, S.; Feiel, S.; Moser, P. Carbon prices for meeting the Paris Agreement and their impact on key metals. Extr. Ind. Soc. 2020, 7, 593–599. [Google Scholar] [CrossRef]

- Gugler, K.; Haxhimusa, A.; Liebensteiner, M. Effectiveness of climate policies: Carbon pricing vs. subsidizing renewables. J. Environ. Econ. Manag. 2021, 106, 102405. [Google Scholar] [CrossRef]

| Indicator System | Factors |

|---|---|

| Market factors | Market historical load, system load rate, overcapacity/shortage, historical energy reserve, and generation capacity [19,20] |

| Nonstrategic uncertainty | Weather, temperature, crude oil price, natural gas price, fuel price, and energy reserve [21,22,23] |

| Random uncertainty | Circuit interruption emergency and circuit blocking [24,25] |

| Behavior index | Historical electricity price, flexible load, bidding strategy, and price shock [26,27,28] |

| Time effect | Settlement period (day, month, and season), holiday, and seasonal variation [29,30,31] |

| Basic Elements | Price |

|---|---|

| Capture cost | 300 yuan/ton |

| Transportation | 80–120 yuan/ton |

| Sequestration | 5–10 yuan/ton |

| Oil displacement | 10–45 yuan/ton |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Wang, X.; Qin, Q. Comparative Analysis of Carbon Tax and Carbon Market Strategies for Facilitating Carbon Neutrality in China’s Coal-Fired Electricity Sector. Sustainability 2025, 17, 1961. https://doi.org/10.3390/su17051961

Li Y, Wang X, Qin Q. Comparative Analysis of Carbon Tax and Carbon Market Strategies for Facilitating Carbon Neutrality in China’s Coal-Fired Electricity Sector. Sustainability. 2025; 17(5):1961. https://doi.org/10.3390/su17051961

Chicago/Turabian StyleLi, Yin, Xu Wang, and Qi Qin. 2025. "Comparative Analysis of Carbon Tax and Carbon Market Strategies for Facilitating Carbon Neutrality in China’s Coal-Fired Electricity Sector" Sustainability 17, no. 5: 1961. https://doi.org/10.3390/su17051961

APA StyleLi, Y., Wang, X., & Qin, Q. (2025). Comparative Analysis of Carbon Tax and Carbon Market Strategies for Facilitating Carbon Neutrality in China’s Coal-Fired Electricity Sector. Sustainability, 17(5), 1961. https://doi.org/10.3390/su17051961