The Mutual Relationships Between ESG, Total Factor Productivity (TFP), and Energy Efficiency (EE) for Chinese Listed Firms

Abstract

1. Introduction

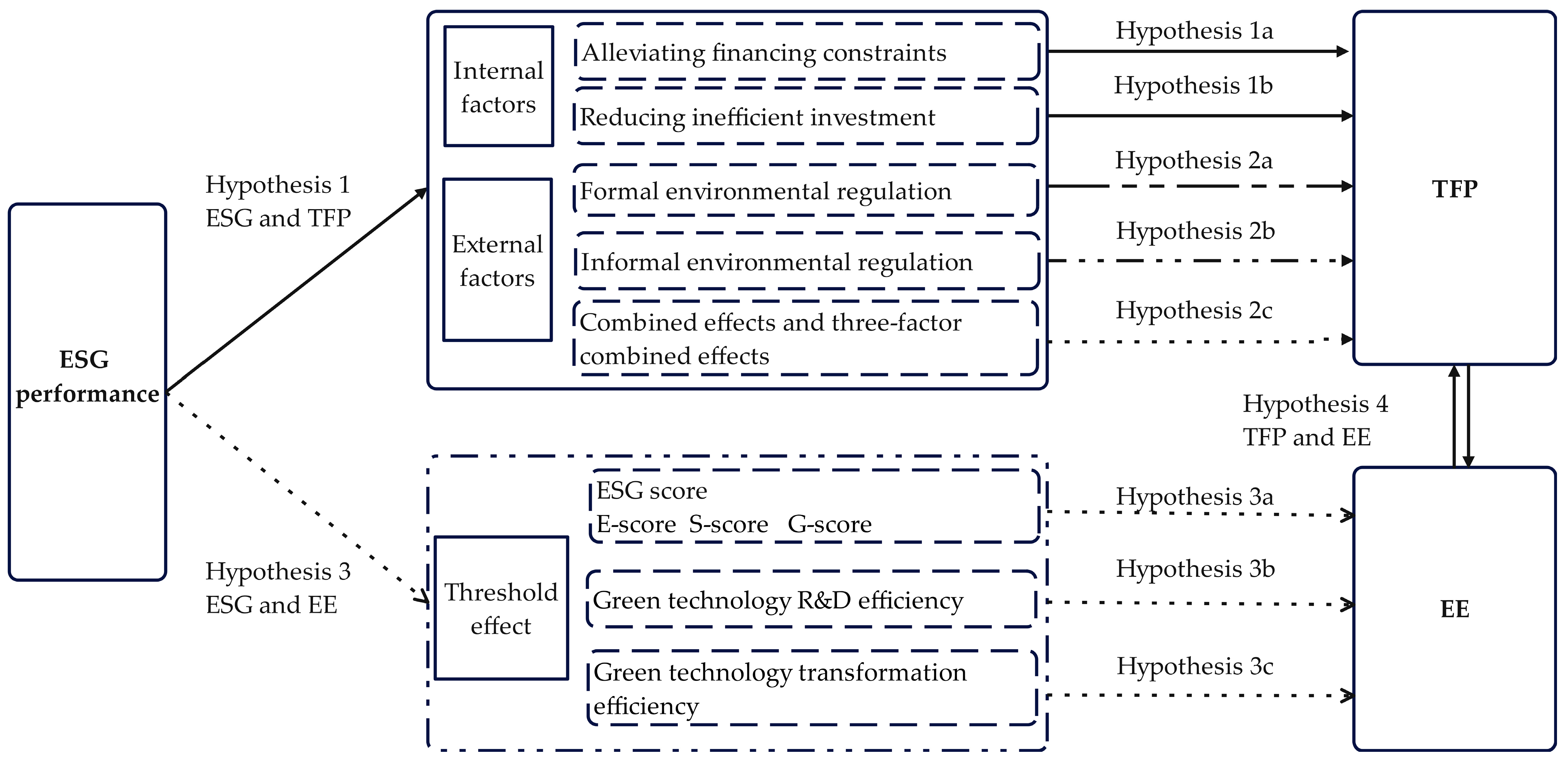

2. Literature Review and Theoretical Hypotheses

2.1. The Relationship Between ESG and TFP

2.2. The Relationship Between ESG and EE

2.3. The Relationship Between EE and TFP

3. Materials and Methods

3.1. Data Sources

3.2. Variable Selection

3.2.1. Dependent Variables

3.2.2. Core Variable

3.2.3. Mediator Variables

3.2.4. Moderator Variables

3.2.5. Threshold Variables

3.2.6. Control Variables

3.3. Model Construction

3.3.1. Model Construction for the Relationship Between ESG and TFP

3.3.2. Model Construction for the Nonlinear Relationship Between ESG and EE

3.3.3. Model Construction for the Relationship Between EE and TFP

4. Empirical Results

4.1. Relationship Between ESG and TFP

4.1.1. Benchmark Regression and Robustness Check

4.1.2. Mechanisms Analysis

4.1.3. Moderate Effect Analysis

4.1.4. Heterogeneity Analysis

4.2. Relationships Between ESG and EE

4.2.1. Threshold Effect Test

4.2.2. Threshold Regression Results

4.2.3. Robustness Tests

4.2.4. Heterogeneity Discussion

4.3. The Relationship Between EE and TFP

5. Research Conclusions and Policy Recommendations

5.1. Research Conclusions

5.2. Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| TFP | Total factor productivity |

| EE | Energy efficiency |

| ESG | Environment, social, and governance |

| E score | Environment performance score |

| S score | Social performance score |

| G score | Governance performance score |

| KZ | Kaplan and Zingales index |

| NEI | Inefficient investment |

| FER | Formal environmental regulation |

| IER | Informal environmental regulation |

| SOEs | State-owned enterprises |

| Non-SOEs | Non-state-owned enterprises |

| HPEs | Heavy-polluting enterprises |

| Non-HPEs | Non-heavy-polluting enterprises |

| High-AA | High analysts’ attention |

| Low-AA | Low analysts’ attention |

| GRDE | Green technology research and development efficiency |

| GTTE | Green technology transformation efficiency |

References

- Wu, S.; Fan, M.; Wu, L.; Liu, Z.; Xiang, Y. Path to Green Development: How Do ESG Ratings Affect Green Total Factor Productivity? Sustainability 2024, 16, 10653. [Google Scholar] [CrossRef]

- Solow, R. Technical Change and the Aggregate Production Function. Rev. Econ. Stat. 1957, 39, 312–320. [Google Scholar] [CrossRef]

- Santos, J.; Borges, A.S.; Domingos, T. Exploring the links between total factor productivity and energy efficiency: Portugal, 1960–2014. Energy Econ. 2021, 101, 105407. [Google Scholar] [CrossRef]

- Tripathy, P.; Jena, P.K.; Mishra, B.R. Systematic literature review and bibliometric analysis of energy efficiency. Renew. Sustain. Energy Rev. 2024, 200, 114583. [Google Scholar] [CrossRef]

- IEA. Energy Efficiency Market Report 2014; IEA: Paris, France, 2014. [Google Scholar]

- Rai, V.; Henry, A.D. Agent-based modelling of consumer energy choices. Nat. Clim. Chang. 2016, 6, 556–562. [Google Scholar] [CrossRef]

- Ben-Salha, O.; Zmami, M.; Waked, S.S.; Raggad, B.; Najjar, F.; Alenazi, Y.M. Assessing the Impacts of Transition and Physical Climate Risks on Industrial Metal Markets: Evidence from the Novel Multivariate Quantile-on-Quantile Regression. Atmosphere 2025, 16, 233. [Google Scholar] [CrossRef]

- Puttachai, W.; Phadkantha, R.; Yamaka, W. The threshold effects of ESG performance on the energy transitions: A country-level data. Energy Rep. 2022, 8, 234–241. [Google Scholar] [CrossRef]

- Bifulco, G.M.; Savio, R.; Paolone, F.; Tiscini, R. The CSR committee as moderator for the ESG score and market value. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 3231–3241. [Google Scholar] [CrossRef]

- Veeravel, V.; Sadharma, E.K.S.; Kamaiah, B. Do ESG disclosures lead to superior firm performance? A method of moments panel quantile regression approach. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 741–754. [Google Scholar] [CrossRef]

- Zhou, G.; Liu, L.; Luo, S. Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Bus. Strategy Environ. 2022, 31, 3371–3387. [Google Scholar] [CrossRef]

- Gerwanski, J. Does it pay off? Integrated reporting and cost of debt: European evidence. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2299–2319. [Google Scholar] [CrossRef]

- Lavin, J.F.; Montecinos-Pearce, A.A. Heterogeneous firms and benefits of ESG disclosure: Cost of debt financing in an emerging market. Sustainability 2022, 14, 15760. [Google Scholar] [CrossRef]

- Li, W.; Hu, H.; Hong, Z. Green finance policy, ESG rating, and cost of debt—Evidence from China. Int. Rev. Financ. Anal. 2024, 92, 103051. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, J.; Ullah, H. Exploring the multidimensional perspective of retail investors’ attention: The mediating influence of corporate governance and information disclosure on corporate environmental performance in China. Sustainability 2023, 15, 11818. [Google Scholar] [CrossRef]

- Liu, H.; Lyu, C. Can ESG ratings stimulate corporate green innovation? Evidence from China. Sustainability 2022, 14, 12516. [Google Scholar] [CrossRef]

- Liu, Y.; Zhang, H.; Zhang, F. The power of CEO growing up in poverty: Enabling better corporate environmental, social, and governance (ESG) performance. Corp. Soc. Responsib. Environ. Manag. 2023, 31, 1610–1633. [Google Scholar] [CrossRef]

- Kim, K.; Kim, T.-N. CEO career concerns and ESG investments. Financ. Res. Lett. 2023, 55, 103819. [Google Scholar] [CrossRef]

- Baratta, A.; Cimino, A.; Longo, F.; Solina, V.; Verteramo, S. The impact of ESG practices in industry with a focus on carbon emissions: Insights and future perspectives. Sustainability 2023, 15, 6685. [Google Scholar] [CrossRef]

- Olley, G.S.; Pakes, A. The dynamics of productivity in the telecommunications equipment industry. Econometrica 1996, 64, 1263–1297. [Google Scholar] [CrossRef]

- Sun, Y.; Rahman, M.M.; Xinyan, X.; Siddik, A.B.; Islam, M.E. Unlocking environmental, social, and governance (ESG) performance through energy efficiency and green tax: SEM-ANN approach. Energy Strateg. Rev. 2024, 53, 101408. [Google Scholar] [CrossRef]

- Li, H.; Clancey-Shang, D.; Fu, C.; Li, T. Does the world need more traditional energy? A comparative analysis of ESG activities, free cash flow, and capital market implications. Int. Rev. Financ. Anal. 2025, 99, 103919. [Google Scholar] [CrossRef]

- Lee, C.-C.; Zhong, Q.; Wen, H.; Song, Q. Blessing or curse: How does sustainable development policy affect total factor productivity of energy-intensive enterprises? Socio-Econ. Plan. Sci. 2023, 89, 101709. [Google Scholar] [CrossRef]

- Zhang, M.; Wu, D.; Huang, G. Minimum wage level and corporate ESG performance. Financ. Res. Lett. 2024, 67, 105783. [Google Scholar] [CrossRef]

- Xue, Q.; Jin, Y.; Zhang, C. ESG rating results and corporate total factor productivity. Int. Rev. Financ. Anal. 2024, 95, 103381. [Google Scholar] [CrossRef]

- Zhang, F.; Lai, X.; Guo, C. ESG disclosure and investment-financing maturity mismatch: Evidence from China. Res. Int. Bus. Financ. 2024, 70, 102312. [Google Scholar] [CrossRef]

- Min, B.S.; Smyth, R. Corporate governance, globalization and firm productivity. J. World Bus. 2014, 49, 372–385. [Google Scholar] [CrossRef]

- Chen, S.; Song, Y.; Gao, P. Environmental, social, and governance (ESG) performance and financial outcomes: Analyzing the impact of ESG on financial performance. J. Environ. Manag. 2023, 345, 118829. [Google Scholar] [CrossRef]

- Bahadori, N.; Kaymak, T.; Seraj, M. Environmental, social, and governance factors in emerging markets: The impact on firm performance. Bus. Strategy Dev. 2021, 4, 411–422. [Google Scholar] [CrossRef]

- Baran, M.; Kuźniarska, A.; Makieła, Z.J.; Sławik, A.; Stuss, M.M. Does ESG reporting relate to corporate financial performance in the context of the energy sector transformation? Evidence from Poland. Energies 2022, 15, 477. [Google Scholar] [CrossRef]

- Bruna, M.G.; Loprevite, S.; Raucci, D.; Ricca, B.; Rupo, D. Investigating the marginal impact of ESG results on corporate financial performance. Financ. Res. Lett. 2022, 47, 102828. [Google Scholar] [CrossRef]

- Samet, M.; Jarboui, A. How does corporate social responsibility contribute to investment efficiency? J. Multinatl. Financ. Manag. 2017, 40, 33–46. [Google Scholar] [CrossRef]

- He, G.; Liu, Y.; Chen, F. Research on the impact of environment, society, and governance (ESG) on firm risk: An explanation from a financing constraints perspective. Financ. Res. Lett. 2023, 58, 104038. [Google Scholar] [CrossRef]

- Liu, L.; Zhao, S. Local government debt, financing constraints and firms’ green total factor productivity. Int. Rev. Financ. Anal. 2025, 97, 103874. [Google Scholar] [CrossRef]

- Hall, B.H.; Moncada-Paternò-Castello, P.; Montresor, S.; Vezzani, A. Financing constraints, R&D investments and innovative performances: New empirical evidence at the firm level for Europe. Econ. Innov. New Technol. 2016, 25, 183–196. [Google Scholar] [CrossRef]

- Ferragina, A.M.; Mazzotta, F.; Sekkat, K. Financial constraints and productivity growth across the size spectrum: Microeconomic evidence from Morocco. Eurasian Bus. Rev. 2016, 6, 361–381. [Google Scholar] [CrossRef]

- Wei, J.; He, X.; Wu, Y. ESG Performance Empowers Financial Flexibility in Manufacturing Firms—Empirical Evidence from China. Sustainability 2025, 17, 1171. [Google Scholar] [CrossRef]

- Yu, X.; Chen, Y. Does ESG advantage promote total factor productivity (TFP)? Empirical evidence from China’s listed enterprises. Appl. Econ. 2024, 1–17. [Google Scholar] [CrossRef]

- Bai, X.; Han, J.; Ma, Y.; Zhang, W. ESG performance, institutional investors’ preference and financing constraints: Empirical evidence from China. Borsa Istanb. Rev. 2022, 22, S157–S168. [Google Scholar] [CrossRef]

- Preston, L.E.; O’Bannon, D.P. The corporate social-financial performance relationship: A typology and analysis. Bus. Soc. 1997, 36, 419–429. [Google Scholar] [CrossRef]

- Lin, Y.E.; Teng, S.; Yu, B.; Lam, K.S. ESG Rating, Rating Divergence and Investment Efficiency: International Evidence. Q. Rev. Econ. Financ. 2025, 100, 101975. [Google Scholar] [CrossRef]

- Bilyay-Erdogan, S.; Danisman, G.O.; Demir, E. ESG performance and investment efficiency: The impact of information asymmetry. J. Int. Financ. Mark. Inst. Money 2024, 91, 101919. [Google Scholar] [CrossRef]

- Lian, Y.; Weng, X. ESG performance and investment efficiency. Financ. Res. Lett. 2024, 62, 105084. [Google Scholar] [CrossRef]

- Deng, X.; Li, W.; Ren, X. More sustainable, more productive: Evidence from ESG ratings and total factor productivity among listed Chinese firms. Financ. Res. Lett. 2023, 51, 103439. [Google Scholar] [CrossRef]

- Ma, J.; Gao, D.; Sun, J. Does ESG performance promote total factor productivity? Evidence from China. Front. Ecol. Evol. 2022, 10, 1063736. [Google Scholar] [CrossRef]

- Tan, X.; Liu, G.; Cheng, S. How does ESG performance affect green transformation of resource-based enterprises: Evidence from Chinese listed enterprises. Resour. Policy 2024, 89, 104559. [Google Scholar] [CrossRef]

- Zeng, S.; Gu, Y.; Su, B.; Li, T. Energy consumption transition and green total factor productivity in Chinese prefecture-level cities. Energy Econ. 2024, 142, 108156. [Google Scholar] [CrossRef]

- Levy, B.; Spiller, P.T. The institutional foundations of regulatory commitment: A comparative analysis of telecommunications regulation. J. Law Econ. Organ. 1994, 10, 201–246. [Google Scholar]

- Benatti, N.; Groiss, M.; Kelly, P.; Lopez-Garcia, P. Environmental regulation and productivity growth in the euro area: Testing the porter hypothesis. J. Environ. Econ. Manag. 2024, 126, 102995. [Google Scholar] [CrossRef]

- Lee, J.W.; Lee, Y.H. Effects of environmental regulations on the total factor productivity in Korea from 2006–2014. Asian J. Technol. Innov. 2022, 30, 68–89. [Google Scholar] [CrossRef]

- Porter, M.E. Towards a dynamic theory of strategy. Strateg. Manag. J. 1991, 12, 95–117. [Google Scholar] [CrossRef]

- Hu, J.; Yu, X.R.; Han, Y.M. Can ESG rating promote green transformation of enterprises. J. Quant. Technol. Econ. 2023, 40, 90–111. [Google Scholar] [CrossRef]

- Chen, Y.P.V.; Zhuo, Z.; Huang, Z.; Li, W. Environmental regulation and ESG of SMEs in China: Porter hypothesis re-tested. Sci. Total Environ. 2022, 850, 157967. [Google Scholar] [CrossRef] [PubMed]

- Du, X. Can environmental regulation promote high-quality economic development?: Evidence from China. Econ. Anal. Policy 2023, 80, 1762–1771. [Google Scholar] [CrossRef]

- Bai, C.; Liu, H.; Zhang, R.; Feng, C. Blessing or curse? Market-driven environmental regulation and enterprises’ total factor productivity: Evidence from China’s carbon market pilots. Energy Econ. 2023, 117, 106432. [Google Scholar] [CrossRef]

- Ren, X.; Ren, Y. Public environmental concern and corporate ESG performance. Financ. Res. Lett. 2024, 61, 104991. [Google Scholar] [CrossRef]

- He, F.; Guo, X.; Yue, P. Media coverage and corporate ESG performance: Evidence from China. Int. Rev. Financ. Anal. 2024, 91, 103003. [Google Scholar] [CrossRef]

- Xiong, B.; Wang, R. Effect of environmental regulation on industrial solid waste pollution in China: From the perspective of formal environmental regulation and informal environmental regulation. Int. J. Environ. Res. Public Health 2020, 17, 7798. [Google Scholar] [CrossRef]

- Liu, Y.; She, Y.; Liu, S.; Lan, H. Supply-shock, demand-induced or superposition effect? The impacts of formal and informal environmental regulations on total factor productivity of Chinese agricultural enterprises. J. Clean. Prod. 2022, 380, 135052. [Google Scholar] [CrossRef]

- Li, X.; Wang, R.; Shen, Z.; Song, M. Government environmental signals, government–Enterprise collusion and corporate pollution transfer. Energy Econ. 2024, 139, 107935. [Google Scholar] [CrossRef]

- Li, S.; Xu, X.; Zhu, F. Can heterogeneous environmental policies mitigate ESG divergence?-Based on corporate green innovation and bleaching green behavioral options. Sustain. Futures 2024, 8, 100351. [Google Scholar] [CrossRef]

- Jin, X.; Qi, H.; Huang, X. Green financial regulation and corporate strategic ESG behavior: Evidence from China. Financ. Res. Lett. 2024, 65, 105581. [Google Scholar] [CrossRef]

- Işık, C.; Ongan, S.; Islam, H.; Balsalobre-Lorente, D.; Sharif, A. ECON-ESG factors on energy efficiency: Fostering sustainable development in ECON-growth-paradox countries. Gondwana Res. 2024, 135, 103–115. [Google Scholar] [CrossRef]

- Litvinova, T.N.; Saipidinov, I.M.; Toshpulatov, A.S.; Bandurina, I.P. The contribution of ESG management to the improvement of energy efficiency of green business in Russia and Central Asia. In ESG Management of the Development of the Green Economy in Central Asia; Popkova, E.G., Sergi, B.S., Eds.; Springer: Cham, Switzerland, 2023; pp. 429–437. [Google Scholar] [CrossRef]

- Bond, K.; McCrone, A.; Kortenhorst, J. The Speed of the Energy Transition: Gradual or Rapid Change? World Economic Forum: Geneva, Switzerland, 2019. [Google Scholar]

- Li, W.; Padmanabhan, P.; Huang, C.H. ESG and debt structure: Is the nature of this relationship nonlinear? Int. Rev. Financ. Anal. 2024, 91, 103027. [Google Scholar] [CrossRef]

- Jiang, L.; Zhou, H.; He, S. Does energy efficiency increase at the expense of output performance: Evidence from manufacturing firms in Jiangsu province, China. Energy 2021, 220, 119704. [Google Scholar] [CrossRef]

- Papa, M.; Wieczorek-Kosmala, M.; Losa, A.; Swałek, A. The impact of ESG regulation on environmental decoupling—An exploratory study on Polish listed companies. Sustainability 2024, 16, 7309. [Google Scholar] [CrossRef]

- Ren, C.; Ting, I.W.K.; Lu, W.M.; Kweh, Q.L. Nonlinear effects of ESG on energy-adjusted firm efficiency: Evidence from the stakeholder engagement of apple incorporated. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1231–1246. [Google Scholar] [CrossRef]

- Wang, J.; Ma, J.; Li, X.; Wang, C. Nonlinear impact of economic policy uncertainty on corporate ESG performance: Regional, industrial and managerial perspectives. Int. Rev. Financ. Anal. 2025, 97, 103772. [Google Scholar] [CrossRef]

- Imperiale, F.; Pizzi, S.; Lippolis, S. Sustainability reporting and ESG performance in the utilities sector. Util. Policy. 2023, 80, 101468. [Google Scholar] [CrossRef]

- Yuan, W.; Li, M.; Lu, W.; Fan, M. Research on ESG performance and OFDI willingness: Based on the fusion of financing constraints and productivity threshold. J. Environ. Manag. 2025, 373, 123391. [Google Scholar] [CrossRef]

- Demiral, M.; Demiral, Ö. Socio-economic productive capacities and energy efficiency: Global evidence by income level and resource dependence. Environ. Sci. Pollut. Res. 2023, 30, 42766–42790. [Google Scholar] [CrossRef]

- Solovova, Y.V. Energy and social efficiency in the context of the functioning of the modern economy. J. Sci. Pub. Econ. 2022, 112, 48–58. [Google Scholar]

- Song, A.; Rasool, Z.; Nazar, R.; Anser, M.K. Towards a greener future: How green technology innovation and energy efficiency are transforming sustainability. Energy 2024, 290, 129891. [Google Scholar] [CrossRef]

- Antonioli, D.; Mazzanti, M. Towards a green economy through innovations: The role of trade union involvement. Ecol. Econ. 2017, 131, 286–299. [Google Scholar] [CrossRef]

- Hunjra, A.I.; Zhao, S.; Tan, Y.; Bouri, E.; Liu, X. How do green innovations promote regional green total factor productivity? Multidimensional analysis of heterogeneity, spatiality and nonlinearity. J. Clean. Prod. 2024, 467, 142935. [Google Scholar] [CrossRef]

- Wang, Z.; Tang, P. Substantive digital innovation or symbolic digital innovation: Which type of digital innovation is more conducive to corporate ESG performance? Int. Rev. Econ. Financ. 2024, 93, 1212–1228. [Google Scholar] [CrossRef]

- Zhang, C.; Jin, S. What Drives Sustainable Development of Enterprises? Focusing on ESG Management and Green Technology Innovation. Sustainability 2022, 14, 11695. [Google Scholar] [CrossRef]

- Zhang, Z.; Hou, Y.; Li, Z.; Li, M. From symbolic to substantive green innovation: How does ESG ratings optimize corporate green innovation structure. Financ. Res. Lett. 2024, 63, 105401. [Google Scholar] [CrossRef]

- Geng, Y.; Chen, J.; Liu, R. ESG rating disagreement and corporate green innovation bubbles: Evidence from Chinese A-share listed firms. Int. Rev. Financ. Anal. 2024, 95, 103495. [Google Scholar] [CrossRef]

- Song, P.; Gu, Y.; Su, B.; Tanveer, A.; Peng, Q.; Gao, W.; Wu, S.; Zeng, S. The impact of green technology research and development (R&D) investment on performance: A case study of listed energy companies in Beijing, China. Sustainability 2023, 15, 12370. [Google Scholar] [CrossRef]

- Zeng, S.; Tanveer, A.; Fu, X.; Gu, Y.; Irfan, M. Modeling the influence of critical factors on the adoption of green energy technologies. Renew. Sustain. Energy Rev. 2022, 168, 112817. [Google Scholar] [CrossRef]

- NRDC; MOST. Implementation Program on Further Improving the Market—Oriented Green Technology Innovation System (2023–2025); No. 1885. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/202212/t20221228_1344205.html (accessed on 10 September 2024).

- Xiao, R.; Chen, X.; Qian, L. Heterogeneous environmental regulation, government support and enterprises’ green innovation efficiency: From the perspective of two-stage value chain. Fin. Trade Res. 2022, 9, 79–93. [Google Scholar] [CrossRef]

- Zeng, S.; Li, T.; Wu, S.; Gao, W.; Li, G. Does green technology progress have a significant impact on carbon dioxide emissions? Energy Econ. 2024, 133, 107524. [Google Scholar] [CrossRef]

- Piao, Z.; Miao, B.; Zheng, Z.; Xu, F. Technological innovation efficiency and its impact factors: An investigation of China’s listed energy companies. Energy Econ. 2022, 112, 106140. [Google Scholar] [CrossRef]

- Avilés-Sacoto, S.V.; Cook, W.D.; Güemes-Castorena, D.; Zhu, J. Modelling efficiency in regional innovation systems: A two-stage data envelopment analysis problem with shared outputs within groups of decision-making units. Eur. J. Oper. Res. 2020, 287, 572–582. [Google Scholar] [CrossRef]

- Hosseini, K.; Stefaniec, A. Efficiency assessment of Iran’s petroleum refining industry in the presence of unprofitable output: A dynamic two-stage slacks-based measure. Energy 2019, 189, 116112. [Google Scholar] [CrossRef]

- Miao, C.-L.; Duan, M.-M.; Zuo, Y.; Wu, X.-Y. Spatial heterogeneity and evolution trend of regional green innovation efficiency—An empirical study based on panel data of industrial enterprises in China’s provinces. Energy Policy 2021, 156, 112370. [Google Scholar] [CrossRef]

- Tang, K.; Qiu, Y.; Zhou, D. Does command-and-control regulation promote green innovation performance? Evidence from China’s industrial enterprises. Sci. Total Environ. 2020, 712, 136362. [Google Scholar] [CrossRef]

- García-Pozo, A.; Marchante-Mera, A.J.; Campos-Soria, J.A. Innovation, environment, and productivity in the Spanish service sector: An implementation of a CDM structural model. J. Clean. Prod. 2018, 171, 1049–1057. [Google Scholar] [CrossRef]

- Jorgenson, D.W. The role of energy in the U.S. economy. Natl. Tax J. 1978, 31, 209–220. [Google Scholar] [CrossRef]

- Santos, J.; Domingos, T.; Sousa, T.; St. Aubyn, M. Useful Exergy Is Key in Obtaining Plausible Aggregate Production Functions and Recognizing the Role of Energy in Economic Growth: Portugal 1960–2009. Ecol. Econ. 2018, 148, 103–120. [Google Scholar] [CrossRef]

- Khan, S.; Murshed, M.; Ozturk, I.; Khudoykulov, K. The roles of energy efficiency improvement, renewable electricity production, and financial inclusion in stimulating environmental sustainability in the Next Eleven countries. Renew. Energy 2022, 193, 1164–1176. [Google Scholar] [CrossRef]

- Wang, Q.; Ma, Z.; Wang, X.; Wu, D. State shareholding in privately-owned enterprises and their ESG performance: Evidence from China. Financ. Res. Lett. 2024, 60, 104891. [Google Scholar] [CrossRef]

- Ni, K.; Zhang, R.; Tan, L.; Lai, X. How ESG enhances corporate competitiveness: Mechanisms and Evidence. Financ. Res. Lett. 2024, 69, 106249. [Google Scholar] [CrossRef]

- Pyles, M.K. Examining portfolios created by Bloomberg ESG scores: Is disclosure an alpha factor? J. Impact ESG Invest. 2020, 1, 39–52. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 70, 317–341. [Google Scholar] [CrossRef]

- Chen, D.; Chen, S.; Jin, H.; Lu, Y. The impact of energy regulation on energy intensity and energy structure: Firm-level evidence from China. China Econ. Rev. 2020, 59, 101351. [Google Scholar] [CrossRef]

- Kaplan, S.N.; Zingales, L. Do investment-cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 1997, 112, 169–215. [Google Scholar] [CrossRef]

- Richardson, S. Over-investment of free cash flow. Rev. Account. Stud. 2006, 11, 159–189. [Google Scholar] [CrossRef]

- Li, J.; Wu, T.; Liu, B.; Zhou, M. Can digital transformation enhance corporate ESG performance? The moderating role of dual environmental regulations. Financ. Res. Lett. 2024, 62, 105241. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Sobel, M.E. Asymptotic Confidence Intervals for Indirect Effects in Structural Equation Models. Sociol. Methodol. 1982, 13, 290–312. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef]

- Liu, R.; He, C. Study on the threshold effect of environmental regulation on income inequality of urban residents. China Soft Sci. 2021, 8, 41–52. [Google Scholar]

- Ho, K.-C.; Yan, C.; Gozgor, G.; Gu, Y. Energy related public environmental concerns and intra-firm pay gap in polluting enterprises: Evidence from China. Energy Econ. 2024, 130, 107320. [Google Scholar] [CrossRef]

- Kopyrina, O.; Wu, K.; Ying, Z. Greening through central inspection: The role of legitimacy pressure and risk-taking. Pac. Basin Financ. J. 2022, 77, 101894. [Google Scholar] [CrossRef]

- Wu, J. Environmental compliance: The good, the bad, and the super green. J. Environ. Manag. 2009, 90, 3363–3381. [Google Scholar] [CrossRef]

- He, X.; Jing, Q.; Chen, H. The impact of environmental tax laws on heavy-polluting enterprise ESG performance: A stakeholder behavior perspective. J. Environ. Manag. 2024, 344, 118578. [Google Scholar] [CrossRef]

- Kong, G.; Wang, S.; Wang, Y. Fostering firm productivity through green finance: Evidence from a quasi-natural experiment in China. Econ. Model. 2022, 115, 105979. [Google Scholar] [CrossRef]

- Shen, N.; Liao, H.; Deng, R.; Wang, Q. Different types of environmental regulations and the heterogeneous influence on the environmental total factor productivity: Empirical analysis of China’s industry. J. Clean. Prod. 2019, 211, 171–184. [Google Scholar] [CrossRef]

- Chen, L.; Shen, Q.; Yu, X.; Chen, X. Knowledge spillovers along the sustainable supply chain of China’s listed companies: The role of long-term orientation. J. Innov. Knowl. 2024, 9, 100478. [Google Scholar] [CrossRef]

- Tong, Y.; Lau, Y.W.; Ngalim, S.M.B. Do pilot zones for green finance reform and innovation avoid ESG greenwashing? Evidence from China. Heliyon 2024, 10, e33710. [Google Scholar] [CrossRef] [PubMed]

- Khamisu, M.S.; Paluri, R.A.; Sonwaney, V. Stakeholders’ perspectives on critical success factors for environmental social and governance (ESG) implementation. J. Environ. Manag. 2024, 365, 121583. [Google Scholar] [CrossRef]

- Malik, F.; Wang, F.; Li, J.; Naseem, M.A. Impact of environmental disclosure on firm performance: The mediating role of green innovation. Rev. Contab. 2023, 26, 14–26. [Google Scholar] [CrossRef]

- Bang, J.; Ryu, D.; Yu, J. ESG controversies and investor trading behavior in the Korean market. Financ. Res. Lett. 2023, 54, 103750. [Google Scholar] [CrossRef]

- Lin, Z. Does ESG performance indicate corporate economic sustainability? Evidence based on the sustainable growth rate. Borsa Istanb. Rev. 2024, 24, 485–493. [Google Scholar] [CrossRef]

- Aljebrini, A.; Dogruyol, K.; Ahmaro, I.Y.Y. How strategic planning enhances ESG: Evidence from mission statements. Sustainability 2025, 17, 595. [Google Scholar] [CrossRef]

- Bonetti, L.; Lai, A.; Stacchezzini, R. Stakeholder engagement in the public utility sector: Evidence from Italian ESG reports. Util. Policy 2023, 84, 101649. [Google Scholar] [CrossRef]

- Silva, M.E.; de Campos, S.A.P. Stakeholders’ dialogue and engagement. In Responsible Consumption and Production. Encyclopedia of the UN Sustainable Development Goals; Filho, W.L., Azul, A.M., Brandli, L., Özuyar, P.G., Wall, T., Eds.; Springer: Cham, Switzerland, 2020; pp. 691–699. [Google Scholar] [CrossRef]

- Xie, F.; Zhang, B.; Wang, N. Non-linear relationship between energy consumption transition and green total factor productivity: A perspective on different technology paths. Sustain. Prod. Consum. 2021, 28, 91–104. [Google Scholar] [CrossRef]

- Baz, K.; Zhu, Z. Life cycle analysis of green technologies: Assessing the impact of environmental policies on carbon emissions and energy efficiency. Geosci. Front. 2025, 16, 102004. [Google Scholar] [CrossRef]

- Liu, H.; Lee, H. The Role of Ownership Structure in the Relationship Between Environmental, Social, and Governance Practices and Financial Reporting Quality: Evidence from China. Sustainability 2024, 16, 10687. [Google Scholar] [CrossRef]

- Jiang, G.; Yuan, P.; Yang, F. The effect of state capital injection on firms’ pollution emissions: Evidence from China. J. Environ. Manag. 2023, 331, 117269. [Google Scholar] [CrossRef] [PubMed]

- Yu, Z.; Shen, Y.; Jiang, S. The effects of corporate governance uncertainty on state-owned enterprises’ green innovation in China: Perspective from the participation of non-state-owned shareholders. Energy Econ. 2022, 115, 106402. [Google Scholar] [CrossRef]

- Yang, Y.; Han, J. Digital transformation, financing constraints, and corporate environmental, social, and governance performance. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 3189–3202. [Google Scholar] [CrossRef]

- Marquis, C.; Yin, J.; Yang, D. State-Mediated Globalization Processes and the Adoption of Corporate Social Responsibility Reporting in China. Manag. Organ. Rev. 2017, 13, 167–191. [Google Scholar] [CrossRef]

- Tian, Z.; Zhu, B.; Lu, Y. The governance of non-state shareholders and corporate ESG: Empirical evidence from China. Finance Res. Lett. 2023, 56, 104162. [Google Scholar] [CrossRef]

- Zhong, Y.; Zhao, H.; Yin, T. Resource bundling: How does enterprise digital transformation affect enterprise ESG development? Sustainability 2023, 15, 1319. [Google Scholar] [CrossRef]

- Zhao, Z.; Zhao, Y.; Lv, X.; Li, X.; Zheng, L.; Fan, S.; Zuo, S. Environmental regulation and green innovation: Does state ownership matter? Energy Econ. 2024, 136, 107762. [Google Scholar] [CrossRef]

- Wang, K.; Jiang, W. State ownership and green innovation in China: The contingent roles of environmental and organizational factors. J. Clean. Prod. 2021, 314, 128029. [Google Scholar] [CrossRef]

- Chang, H.-J.; Cheema, A.; Mises, L. Conditions for successful technology policy in developing countries—Learning rents, state structures, and institutions. Econ. Innov. New Technol. 2002, 11, 369–398. [Google Scholar] [CrossRef]

- Knapp, D.; Bayrle-Kelso, N.; Nigg-Stock, A.; Brecht, L. The impact of governmental regulations and environmental activities on innovation efficiency. Sustainability 2025, 17, 467. [Google Scholar] [CrossRef]

| Variables | N | Mean | Median | Min | Max | SD |

|---|---|---|---|---|---|---|

| TFP | 6095 | 1.940 | 1.939 | 1.638 | 2.220 | 0.122 |

| EE | 6095 | 0.005 | 0.002 | 0.000 | 0.042 | 0.007 |

| ESG | 6095 | 0.293 | 0.287 | 0.141 | 0.547 | 0.083 |

| E score | 6095 | 0.129 | 0.086 | 0.004 | 0.600 | 0.142 |

| S score | 6095 | 0.145 | 0.128 | 0.037 | 0.369 | 0.069 |

| G score | 6095 | 0.651 | 0.693 | 0.320 | 0.840 | 0.136 |

| GRDE | 6095 | 0.554 | 0.535 | 0.178 | 0.987 | 0.195 |

| GTTE | 6095 | 0.555 | 0.536 | 0.177 | 0.988 | 0.196 |

| KZ | 6095 | −1.064 | −1.066 | −1.242 | −0.906 | 0.065 |

| NEI | 6095 | 0.206 | 0.144 | 0.002 | 1.589 | 0.236 |

| FER | 6095 | 0.183 | 0.144 | 0.009 | 0.690 | 0.143 |

| IER | 6095 | 249.397 | 175.773 | 7.085 | 1273.994 | 264.447 |

| Size | 6095 | 23.230 | 23.180 | 20.576 | 26.652 | 1.210 |

| OC | 6095 | 0.371 | 0.357 | 0.082 | 0.764 | 0.159 |

| Lev | 6095 | 0.490 | 0.500 | 0.084 | 0.866 | 0.187 |

| Roa | 6095 | 0.046 | 0.039 | −0.153 | 0.234 | 0.058 |

| Far | 6095 | 0.240 | 0.202 | 0.002 | 0.748 | 0.177 |

| Rev | 6095 | 22.603 | 22.570 | 19.642 | 26.233 | 1.356 |

| Growth | 6095 | 0.154 | 0.109 | −0.466 | 1.833 | 0.322 |

| Variables | TFP_OP | TFP_OP | TFP_LP | TFP_OP | TFP_OP | TFP_LP | TFP_OP | TFP_OP |

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| ESG | 0.128 *** | 0.0457 *** | 1.020 *** | 0.0530 *** | 0.136 *** | 1.060 *** | 0.0508 *** | 0.0600 *** |

| (6.79) | (3.18) | (8.20) | (4.07) | (6.67) | (7.91) | (3.26) | (4.27) | |

| Size | 0.0554 *** | 0.0454 *** | 0.571 *** | 0.0963 *** | 0.0550 *** | 0.568 *** | 0.0463 *** | 0.0968 *** |

| (48.67) | (25.60) | (76.00) | (75.07) | (45.97) | (72.22) | (24.71) | (71.36) | |

| OC | 0.0314 *** | −0.0378 *** | 0.310 *** | 0.0208 *** | 0.0335 *** | 0.322 *** | −0.0324 *** | 0.0229 *** |

| (4.60) | (−3.93) | (6.87) | (4.38) | (4.66) | (6.82) | (−3.19) | (4.61) | |

| Lev | 0.115 *** | 0.0519 *** | 0.923 *** | 0.0263 *** | 0.116 *** | 0.930 *** | 0.0484 *** | 0.0249 *** |

| (15.06) | (7.01) | (18.33) | (4.92) | (14.45) | (17.63) | (6.18) | (4.43) | |

| Roa | 0.279 *** | 0.243 *** | 2.407 *** | 0.114 *** | 0.296 *** | 2.516 *** | 0.254 *** | 0.121 *** |

| (12.88) | (16.53) | (16.86) | (7.06) | (12.96) | (16.80) | (16.31) | (7.13) | |

| Far | −0.0897 *** | −0.0780 *** | −0.876 *** | −0.0671 *** | −0.0902 *** | −0.875 *** | −0.0827 *** | −0.0673 *** |

| (−12.54) | (−9.49) | (−18.57) | (−13.61) | (−11.96) | (−17.67) | (−9.56) | (−12.94) | |

| Growth | 0.0282 *** | 0.0292 *** | 0.150 *** | 0.00512 ** | 0.0264 *** | 0.141 *** | 0.0282 *** | 0.00427 * |

| (8.43) | (15.85) | (6.78) | (2.21) | (7.54) | (6.12) | (14.39) | (1.76) | |

| Age | 0.00733 *** | 0.00793 *** | ||||||

| (4.97) | (5.15) | |||||||

| TAT | 0.147 *** | 0.147 *** | ||||||

| (80.12) | (75.85) | |||||||

| Indep | −0.0391 *** | −0.0353 *** | ||||||

| (−3.10) | (−2.64) | |||||||

| Salary | −0.0476 *** | −0.0485 *** | ||||||

| (−40.45) | (−39.00) | |||||||

| Tobin Q | −0.00117 | −0.00137 * | ||||||

| (−1.63) | (−1.75) | |||||||

| Constant | 0.553 *** | 0.865 *** | −4.970 *** | 0.536 *** | 0.556 *** | −4.922 *** | 0.841 *** | 0.537 *** |

| (23.78) | (21.64) | (−32.42) | (29.91) | (22.80) | (−30.71) | (19.93) | (28.44) | |

| Ind/Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm | No | Yes | No | No | No | No | Yes | No |

| N | 6095 | 6095 | 6095 | 6095 | 5459 | 5459 | 5459 | 5459 |

| Adj.R2 | 0.600 | 0.908 | 0.736 | 0.813 | 0.603 | 0.740 | 0.908 | 0.815 |

| Variables | TFP | KZ | TFP | TFP | NEI | TFP |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| ESG | 0.128 *** | −0.0182 *** | 0.126 *** | 0.128 *** | −0.196 *** | 0.129 *** |

| (6.79) | (−2.98) | (6.70) | (6.79) | (−3.47) | (6.83) | |

| KZ | −0.0867 ** | |||||

| (−2.19) | ||||||

| NEI | −0.131 *** | |||||

| (3.93) | ||||||

| Size | 0.0554 *** | −0.0474 *** | 0.0513 *** | 0.0554 *** | 0.00123 | 0.0554 *** |

| (48.67) | (−128.42) | (23.36) | (48.67) | (0.36) | (48.66) | |

| OC | 0.0314 *** | −0.00882 *** | 0.0307 *** | 0.0314 *** | −0.0136 | 0.0315 *** |

| (4.60) | (−3.97) | (4.48) | (4.60) | (−0.67) | (4.61) | |

| Lev | 0.115 *** | 0.0229 *** | 0.117 *** | 0.115 *** | 0.0222 | 0.115 *** |

| (15.06) | (9.26) | (15.22) | (15.06) | (0.97) | (15.05) | |

| Roa | 0.279 *** | −0.204 *** | 0.261 *** | 0.279 *** | −0.144 ** | 0.279 *** |

| (12.88) | (−29.03) | (11.30) | (12.88) | (−2.23) | (12.90) | |

| Far | −0.0897 *** | −0.00123 | −0.0898 *** | −0.0897 *** | −0.0635 *** | −0.0894 *** |

| (−12.54) | (−0.53) | (−12.56) | (−12.54) | (−2.97) | (−12.49) | |

| Growth | 0.0282 *** | −0.0406 *** | 0.0247 *** | 0.0282 *** | 0.0551 *** | 0.0279 *** |

| (8.43) | (−37.41) | (6.65) | (8.43) | (5.52) | (8.33) | |

| Constant | 0.553 *** | 0.0506 *** | 0.557 *** | 0.553 *** | 0.243 *** | 0.551 *** |

| (23.78) | (6.71) | (23.89) | (23.78) | (3.50) | (23.71) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Ind/Year | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 6095 | 6095 | 6095 | 6095 | 6095 | 6095 |

| Adj.R2 | 0.600 | 0.852 | 0.600 | 0.600 | 0.0362 | 0.600 |

| Sobel | 0.002 * (z = 1.765) | 0.002 ** (z = 2.423) | ||||

| Proportion of total effect that is mediated | 0.012 | 0.201 | ||||

| Ratio of indirect to direct effect | 0.013 | 0.199 | ||||

| Ratio of total to direct effect | 1.013 | 1.008 | ||||

| Variables | TFP | TFP | TFP | TFP | TFP | TFP |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| ESG | 0.531 *** | 0.138 *** | 0.515 *** | 0.128 *** | 0.133 *** | 0.132 *** |

| (22.10) | (7.23) | (21.67) | (6.79) | (6.95) | (6.93) | |

| FER | 0.0387 *** | 0.0113 | 0.0181 ** | 0.0221 ** | ||

| (3.48) | (1.35) | (2.13) | (2.53) | |||

| ESG_FER | 0.345 ** | 0.346 *** | 0.230 ** | 0.200 * | ||

| (2.56) | (3.43) | (2.21) | (1.91) | |||

| IER | 0.0293 *** | 0.00984 ** | 0.0110 ** | 0.0101 ** | ||

| (5.16) | (2.28) | (2.51) | (2.30) | |||

| ESG_IER | −0.131 * | −0.173 *** | −0.145 *** | −0.177 *** | ||

| (−1.80) | (−3.17) | (−2.62) | (−3.09) | |||

| FER_IER | 0.106 *** | 0.111 *** | ||||

| (2.92) | (3.05) | |||||

| ESG_FER_IER | −1.046 ** | |||||

| (−2.14) | ||||||

| Size | 0.0553 *** | 0.0552 *** | 0.0552 *** | 0.0552 *** | ||

| (48.60) | (48.38) | (48.35) | (48.37) | |||

| OC | 0.0311 *** | 0.0294 *** | 0.0294 *** | 0.0295 *** | ||

| (4.54) | (4.27) | (4.28) | (4.28) | |||

| Lev | 0.115 *** | 0.116 *** | 0.116 *** | 0.116 *** | ||

| (15.13) | (15.19) | (15.21) | (15.23) | |||

| Roa | 0.279 *** | 0.277 *** | 0.277 *** | 0.278 *** | ||

| (12.91) | (12.80) | (12.79) | (12.83) | |||

| Far | −0.0907 *** | −0.0880 *** | −0.0883 *** | −0.0884 *** | ||

| (−12.65) | (−12.23) | (−12.27) | (−12.28) | |||

| Growth | 0.0284 *** | 0.0281 *** | 0.0282 *** | 0.0281 *** | ||

| (8.49) | (8.40) | (8.45) | (8.43) | |||

| Constant | 1.779 *** | 0.551 *** | 1.782 *** | 0.554 *** | 0.550 *** | 0.549 *** |

| (237.89) | (23.72) | (248.76) | (23.83) | (23.67) | (23.66) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Ind/Year | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 6095 | 6095 | 6095 | 6095 | 6095 | 6095 |

| Adj.R2 | 0.285 | 0.601 | 0.287 | 0.601 | 0.602 | 0.602 |

| Variables | SOEs | Non-SOEs | HPEs | Non-HPEs | High-AA | Low-AA |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| ESG | 0.165 *** | 0.0873 *** | 0.162 *** | 0.0603 ** | 0.108 *** | 0.175 *** |

| (5.95) | (3.50) | (5.61) | (2.49) | (5.02) | (4.92) | |

| Size | 0.0512 *** | 0.0583 *** | 0.0535 *** | 0.0547 *** | 0.0527 *** | 0.0600 *** |

| (33.53) | (33.44) | (27.28) | (39.81) | (35.42) | (30.70) | |

| OC | 0.0242 ** | 0.0324 *** | 0.0290 ** | 0.0179 ** | 0.0307 *** | 0.0249 ** |

| (2.42) | (3.35) | (2.56) | (2.13) | (3.66) | (2.21) | |

| Lev | 0.114 *** | 0.111 *** | 0.0842 *** | 0.122 *** | 0.141 *** | 0.0995 *** |

| (10.89) | (9.96) | (6.59) | (13.00) | (13.70) | (8.68) | |

| Roa | 0.312 *** | 0.284 *** | 0.224 *** | 0.303 *** | 0.302 *** | 0.308 *** |

| (9.07) | (10.49) | (6.30) | (11.43) | (10.87) | (7.89) | |

| Far | −0.0715 *** | −0.112 *** | −0.0612 *** | −0.166 *** | −0.0837 *** | −0.100 *** |

| (−7.63) | (−10.05) | (−5.46) | (−16.67) | (−9.57) | (−8.44) | |

| Growth | 0.0409 *** | 0.0169 *** | 0.0350 *** | 0.0234 *** | 0.0128 *** | 0.0425 *** |

| (8.21) | (3.91) | (6.22) | (5.80) | (3.01) | (8.12) | |

| Constant | 0.638 *** | 0.502 *** | 0.601 *** | 0.600 *** | 0.607 *** | 0.449 *** |

| (20.60) | (13.91) | (15.09) | (21.14) | (19.74) | (11.02) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Ind/Year | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 3340 | 2755 | 2223 | 3871 | 3484 | 2608 |

| Adj.R2 | 0.585 | 0.634 | 0.561 | 0.647 | 0.610 | 0.585 |

| p value (χ2) | 0.0295 ** | 0.0039 *** | 0.0023 *** | |||

| Variables | Number of Thresholds | Value | F-Value | p-Value | RSS | MSE | Confidence Interval | 10% | 5% | 1% |

|---|---|---|---|---|---|---|---|---|---|---|

| ESG | Single | 26.245 | 13.040 | 0.007 | 3114.408 | 0.429 | [25.224, 26.466] | 8.859 | 10.549 | 12.560 |

| E score | Double | 15.464 | 16.300 | 0.000 | 2911.486 | 0.414 | [15.373,15.796] | 6.263 | 7.250 | 9.805 |

| 14.286 | 26.780 | 0.000 | 2900.448 | 0.412 | [13.863, 14.618] | 9.372 | 12.679 | 19.532 | ||

| S score | Single | 11.548 | 25.190 | 0.000 | 2724.281 | 0.381 | [11.397, 11.639] | 13.124 | 14.671 | 17.548 |

| G score | Double | 41.071 | 27.250 | 0.000 | 3118.843 | 0.438 | [38.049, 42.173] | 6.979 | 8.704 | 11.552 |

| 63.847 | 13.780 | 0.010 | 3112.813 | 0.438 | [58.429, 64.419] | 6.981 | 8.208 | 12.947 | ||

| GRDE | Single | 0.359 | 12.170 | 0.000 | 3114.781 | 0.429 | [0.313,0.369] | 7.033 | 8.244 | 10.152 |

| GTTE | Double | 0.283 | 8.710 | 0.037 | 3116.262 | 0.430 | [0.246, 0.289] | 7.006 | 7.979 | 10.964 |

| 0.665 | 7.870 | 0.050 | 3112.884 | 0.429 | [0.598,0.675] | 6.679 | 7.859 | 11.138 |

| Model 1 | |

|---|---|

| Threshold Variable: ESG | |

| ESG (ESG ≤ 26.245) | 0.00410 *** |

| (2.66) | |

| ESG (ESG > 26.245) | 0.00827 *** |

| (8.00) | |

| Constant | 9.375 *** |

| (30.37) | |

| Control Variables | Yes |

| Controls | Yes |

| Adj.R2 | 0.0459 |

| Model 2 | Model 3 | Model 4 | |||

|---|---|---|---|---|---|

| Threshold Variable: E Score | Threshold Variable: S Score | Threshold Variable: G Score | |||

| ESG (E ≤ 14.286) | 0.0114 *** | ESG (S ≤ 11.548) | 0.0123 *** | ESG (G ≤ 41.071) | 0.00726 *** |

| (10.05) | (10.28) | (3.01) | |||

| ESG (14.268 < E ≤ 15.464) | 0.0136 *** | ESG (S > 11.548) | 0.0107 *** | ESG (41.071 < G ≤ 63.847) | 0.00582 *** |

| (10.42) | (11.61) | (4.01) | |||

| ESG (E > 15.464) | 0.0101 *** | ESG (G > 63.847) | 0.00928 *** | ||

| (11.15) | (9.01) | ||||

| Constant | 8.281 *** | Constant | 8.515 *** | Constant | 9.188 *** |

| (28.64) | (28.39) | (29.83) | |||

| Controls | Yes | Controls | Yes | Controls | Yes |

| Adj.R2 | 0.0468 | Adj.R2 | 0.0358 | Adj.R2 | 0.0475 |

| Model 5 | Model 6 | ||

|---|---|---|---|

| Threshold Variable: GRDE | Threshold Variable: GTTE | ||

| ESG (GRDE ≤ 0.359) | 0.00689 *** | ESG (GTTE ≤ 0.283) | 0.00592 *** |

| (6.03) | (4.40) | ||

| ESG (GRDE > 0.359) | 0.0104 *** | ESG (0.283 < GTTE ≤ 0.665) | 0.00987 *** |

| (11.29) | (10.20) | ||

| ESG (GTTE > 0.665) | 0.0108 *** | ||

| (11.79) | |||

| Constant | 9.471 *** | Constant | 9.450 *** |

| (30.43) | (30.19) | ||

| Controls | Yes | Controls | Yes |

| Adj.R2 | 0.0465 | Adj.R2 | 0.0453 |

| Variables | Number of Thresholds | Value | F-Value | p-Value | RSS | MSE | Confidence Interval | 10% | 5% | 1% |

|---|---|---|---|---|---|---|---|---|---|---|

| ESG | Single | 27.1502 | 17.36 | 0.003 | 2667.136 | 0.416 | [26.2147,27.3011] | 9.151 | 10.897 | 14.429 |

| E score | Double | 15.4636 | 17.16 | 0.003 | 2642.283 | 0.422 | [15.2824,15.6448] | 6.763 | 8.787 | 13.182 |

| 13.9535 | 21.19 | 0.007 | 2633.366 | 0.421 | [13.7119,14.3763] | 7.938 | 12.928 | 18.755 | ||

| S score | Double | 12.0314 | 29.19 | 0.000 | 2692.986 | 0.425 | [11.714,12.3337] | 15.242 | 17.424 | 22.917 |

| 7.3761 | 14.58 | 0.087 | 2686.803 | 0.424 | [6.7412,7.6179] | 13.494 | 16.451 | 19.907 | ||

| G score | Double | 39.2857 | 20.98 | 0.000 | 2421.369 | 0.392 | [37.5,42.1734] | 6.708 | 7.733 | 10.481 |

| 77.6942 | 15.98 | 0.003 | 2415.118 | 0.391 | [64.419,78.0554] | 6.356 | 7.681 | 10.506 | ||

| GRDE | Single | 0.3661 | 13.33 | 0.007 | 2668.811 | 0.416 | [0.3349,0.3761] | 6.438 | 7.331 | 11.293 |

| GTTE | Singe | 0.2684 | 10.83 | 0.013 | 2669.848 | 0.417 | [0.2268,0.2733] | 6.611 | 7.42 | 11.439 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| ESG (ESG ≤ 27.1502) | 0.00526 *** | |||||

| (3.25) | ||||||

| ESG (ESG > 27.1502) | 0.00887 *** | |||||

| (7.96) | ||||||

| ESG (E ≤ 13.9535) | 0.0128 *** | |||||

| (10.44) | ||||||

| ESG (13.9535 < E ≤ 15.4636) | 0.0143 *** | |||||

| (10.40) | ||||||

| ESG (E > 15.4636) | 0.0109 *** | |||||

| (11.28) | ||||||

| ESG (S ≤ 7.3761) | 0.0172 *** | |||||

| (8.76) | ||||||

| ESG (7.3761 < S ≤ 12.0314) | 0.0143 *** | |||||

| (11.50) | ||||||

| ESG (S > 12.0314) | 0.0122 *** | |||||

| (12.25) | ||||||

| ESG (G ≤ 39.2857) | 0.0121 *** | |||||

| (5.10) | ||||||

| ESG (39.2857 < G ≤ 77.6942) | 0.0117 *** | |||||

| (10.59) | ||||||

| ESG (G > 77.6942) | 0.0104 *** | |||||

| (10.68) | ||||||

| ESG (GRDE ≤ 0.3661) | 0.00777 *** | |||||

| (6.49) | ||||||

| ESG (GRDE > 0.3661) | 0.0109 *** | |||||

| (11.16) | ||||||

| ESG (GTTE ≤ 0.2684) | 0.00616 *** | |||||

| (4.08) | ||||||

| ESG (GTTE > 0.2684) | 0.0113 *** | |||||

| (11.55) | ||||||

| Constant | 9.616 *** | 8.631 *** | 9.174 *** | 8.621 *** | 9.717 *** | 9.695 *** |

| (29.22) | (27.87) | (28.26) | (27.33) | (29.30) | (29.07) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Adj.R2 | 0.0372 | 0.0384 | 0.0326 | 0.0404 | 0.0380 | 0.0369 |

| Variables | Number of Thresholds | Value | F-Value | p-Value | RSS | MSE | Confidence Interval | 10% | 5% | 1% |

|---|---|---|---|---|---|---|---|---|---|---|

| ESG | Double | 27.1301 | 22.25 | 0.000 | 710.406 | 0.209 | [26.2851,27.3313] | 9.418 | 11.93 | 14.778 |

| 32.542 | 12.34 | 0.050 | 707.833 | 0.209 | [31.6165,32.7834] | 9.438 | 11.575 | 15.833 | ||

| E score | Double | 14.3763 | 11.88 | 0.020 | 701.613 | 0.211 | [13.4551,14.6179] | 6.461 | 8.003 | 12.329 |

| 15.6448 | 20.86 | 0.003 | 697.235 | 0.210 | [15.1918,15.9468] | 5.209 | 7.059 | 11.003 | ||

| S score | Single | 10.6106 | 41.76 | 0.000 | 784.757 | 0.233 | [10.399,11.0036] | 13.049 | 16.943 | 19.154 |

| G score | Double | 66.5563 | 15.28 | 0.003 | 808.128 | 0.243 | [66.165,72.2456] | 6.569 | 8.029 | 10.701 |

| 64.419 | 9.11 | 0.023 | 805.926 | 0.242 | [57.1192,66.165] | 6.822 | 8.315 | 11.99 | ||

| GRDE | None | |||||||||

| GTTE | Single | 0.4084 | 17.48 | 0.000 | 711.398 | 0.210 | [0.3811,0.4139] | 8.606 | 10.162 | 12.705 |

| Variables | Number of Thresholds | Value | F-Value | p-Value | RSS | MSE | Confidence Interval | 10% | 5% | 1% |

|---|---|---|---|---|---|---|---|---|---|---|

| ESG | Single | 39.5534 | 13.33 | 0.070 | 1402.523 | 0.484 | [37.9036,40.2877] | 11.675 | 14.701 | 16.94 |

| E score | Double | 14.6179 | 15.29 | 0.003 | 1186.770 | 0.432 | [14.3763,14.7992] | 8.219 | 10.221 | 12.223 |

| 14.7387 | 37.66 | 0.013 | 1170.738 | 0.426 | [14.4971,14.7992] | 8.237 | 10.769 | 49.852 | ||

| S score | None | |||||||||

| G score | Single | 39.2857 | 11.57 | 0.013 | 1155.874 | 0.411 | [37.5,41.0714] | 7.507 | 9.095 | 11.847 |

| GRDE | Single | 0.3788 | 18.2 | 0.000 | 1400.180 | 0.483 | [0.335,0.391] | 7.901 | 8.88 | 13.252 |

| GTTE | Double | 0.6271 | 13.02 | 0.007 | 1397.946 | 0.482 | [0.6225,0.6322] | 6.523 | 8.034 | 10.041 |

| 0.6322 | 9.8 | 0.043 | 1404.222 | 0.484 | [0.6271,0.6388] | 7.967 | 9.48 | 11.659 | ||

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| ESG (ESG ≤ 27.1301) | 0.00481 ** | ||||

| (2.18) | |||||

| ESG (27.1301 < ESG≤ 32.542) | 0.00831 *** | ||||

| (4.86) | |||||

| ESG (ESG > 32.542) | 0.00684 *** | ||||

| (5.14) | |||||

| ESG (E ≤ 14.3763) | 0.0105 *** | ||||

| (7.59) | |||||

| ESG (14.3763 < E ≤ 15.6448) | 0.0131 *** | ||||

| (8.05) | |||||

| ESG (E > 15.464) | 0.00885 *** | ||||

| (8.11) | |||||

| ESG (S ≤ 10.6106) | 0.00983 *** | ||||

| (6.89) | |||||

| ESG (S > 10.6106) | 0.00867 *** | ||||

| (8.06) | |||||

| ESG (G ≤ 64.419) | 0.00604 *** | ||||

| (3.78) | |||||

| ESG (64.419 < G ≤ 66.5563) | 0.0138 *** | ||||

| (6.05) | |||||

| ESG (G > 66.5563) | 0.00738 *** | ||||

| (6.41) | |||||

| ESG (GTTE ≤ 0.4084) | 0.00618 *** | ||||

| (4.84) | |||||

| ESG (GTTE > 0.4084) | 0.00795 *** | ||||

| (7.54) | |||||

| Constant | 6.880 *** | 6.691 *** | 6.566 *** | 6.585 *** | 6.849 *** |

| (17.53) | (17.33) | (17.09) | (17.12) | (17.47) | |

| Controls | Yes | Yes | Yes | Yes | Yes |

| Adj.R2 | −0.00283 | −0.00280 | −0.00707 | 0.0889 | −0.00639 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| ESG (ESG ≤ 39.5534) | 0.0202 *** | ||||

| (9.05) | |||||

| ESG (ESG > 39.5534) | 0.0169 *** | ||||

| (9.78) | |||||

| ESG (E ≤ 14.6179) | 0.0138 *** | ||||

| (7.22) | |||||

| ESG (14.6179 < E ≤ 14.7387) | 0.00719 | ||||

| (0.97) | |||||

| ESG (E > 14.7387) | 0.0126 *** | ||||

| (8.07) | |||||

| ESG (G ≤ 39.2857) | 0.00998 ** | ||||

| (2.35) | |||||

| ESG (G > 39.2857) | 0.0149 *** | ||||

| (8.79) | |||||

| ESG (GRDE ≤ 0.3788) | 0.00993 *** | ||||

| (5.01) | |||||

| ESG (GRDE > 0.3788) | 0.0144 *** | ||||

| (8.77) | |||||

| ESG (GTTE ≤ 0.6271) | 0.0141 *** | ||||

| (8.23) | |||||

| ESG (0.6271 < GTTE ≤ 0.6322) | 0.0268 *** | ||||

| (8.45) | |||||

| ESG (GTTE > 0.6322) | 0.0148 *** | ||||

| (9.05) | |||||

| Constant | 11.54 *** | 9.896 *** | 11.52 *** | 12.03 *** | 11.52 *** |

| (23.39) | (21.75) | (22.93) | (23.73) | (23.21) | |

| Controls | Yes | Yes | Yes | Yes | Yes |

| Adj.R2 | 0.0878 | 0.0945 | 0.0889 | 0.0903 | 0.0901 |

| Variables | OLS Regression | Variable Replacement | GMM Estimation | |||

|---|---|---|---|---|---|---|

| TFP_OPt+1 | EEt+1 | TFP_LPt+1 | EEt+1 | TFP_OPt+1 | EEt+1 | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| EE | 0.263 ** | 0.921 *** | 2.083 ** | 0.913 *** | 1.673 *** | 0.814 *** |

| (2.32) | (124.57) | (2.46) | (108.83) | (5.86) | (42.57) | |

| TFP_OP | 0.924 *** | 0.00120 *** | 0.732 *** | 0.00925 *** | ||

| (133.73) | (2.68) | (33.68) | (6.35) | |||

| TFP_LP | 0.946 *** | 0.000417 *** | ||||

| (124.93) | (3.42) | |||||

| Constant | 0.00697 | 0.00472 *** | −0.464 *** | 0.00960 *** | −0.172 *** | 0.00966 *** |

| (0.46) | (4.75) | (−4.90) | (8.80) | (−4.86) | (4.08) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Adj.R2 | 0.912 | 0.875 | 0.937 | 0.877 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gu, Y.; Zeng, S.; Peng, Q. The Mutual Relationships Between ESG, Total Factor Productivity (TFP), and Energy Efficiency (EE) for Chinese Listed Firms. Sustainability 2025, 17, 2296. https://doi.org/10.3390/su17052296

Gu Y, Zeng S, Peng Q. The Mutual Relationships Between ESG, Total Factor Productivity (TFP), and Energy Efficiency (EE) for Chinese Listed Firms. Sustainability. 2025; 17(5):2296. https://doi.org/10.3390/su17052296

Chicago/Turabian StyleGu, Yuxiao, Shihong Zeng, and Qiao Peng. 2025. "The Mutual Relationships Between ESG, Total Factor Productivity (TFP), and Energy Efficiency (EE) for Chinese Listed Firms" Sustainability 17, no. 5: 2296. https://doi.org/10.3390/su17052296

APA StyleGu, Y., Zeng, S., & Peng, Q. (2025). The Mutual Relationships Between ESG, Total Factor Productivity (TFP), and Energy Efficiency (EE) for Chinese Listed Firms. Sustainability, 17(5), 2296. https://doi.org/10.3390/su17052296