Patent Leadership Changes and Technological Competence in Atomic Layer Deposition Technology of Global Leading Companies, Countries, and Subindustries

Abstract

:1. Introduction

- Research question 1 (longitudinal study): how have technological leadership changes in the field of ALD patents progressed among companies, countries, and subindustries over the past 20 years?

- Research question 2 (comparative study): how have the various competencies in the ALD patent portfolio differed by company, country, and subindustry during the past 20 years?

2. Literature Review

3. Data and Methodology

3.1. Patent Data

3.2. Patent Index

3.3. Strategic Matrix Analysis

4. Research Results

4.1. Longitudinal Study—Leadership Change Analysis of ALD Patents

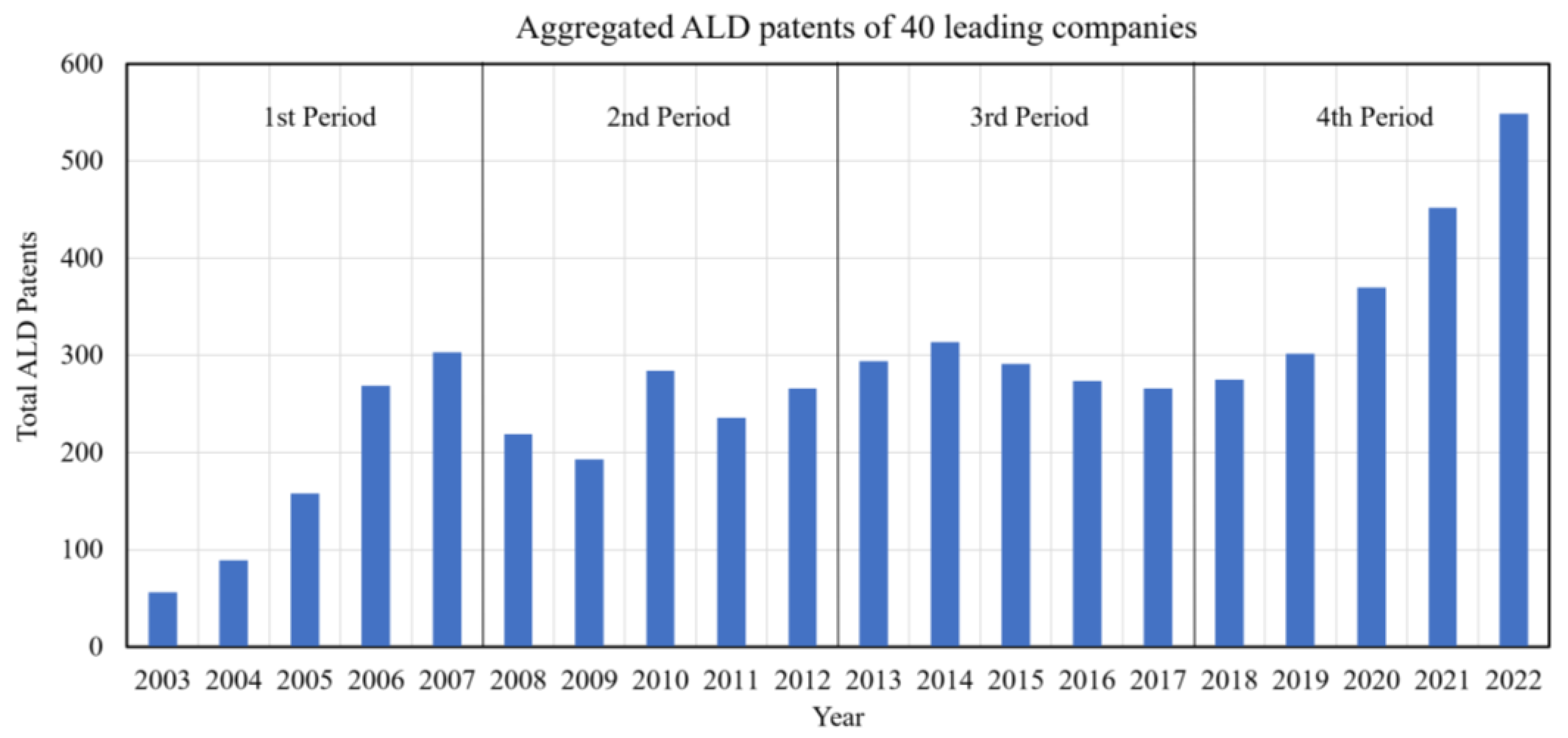

4.1.1. ALD Patents of 40 Leading Companies

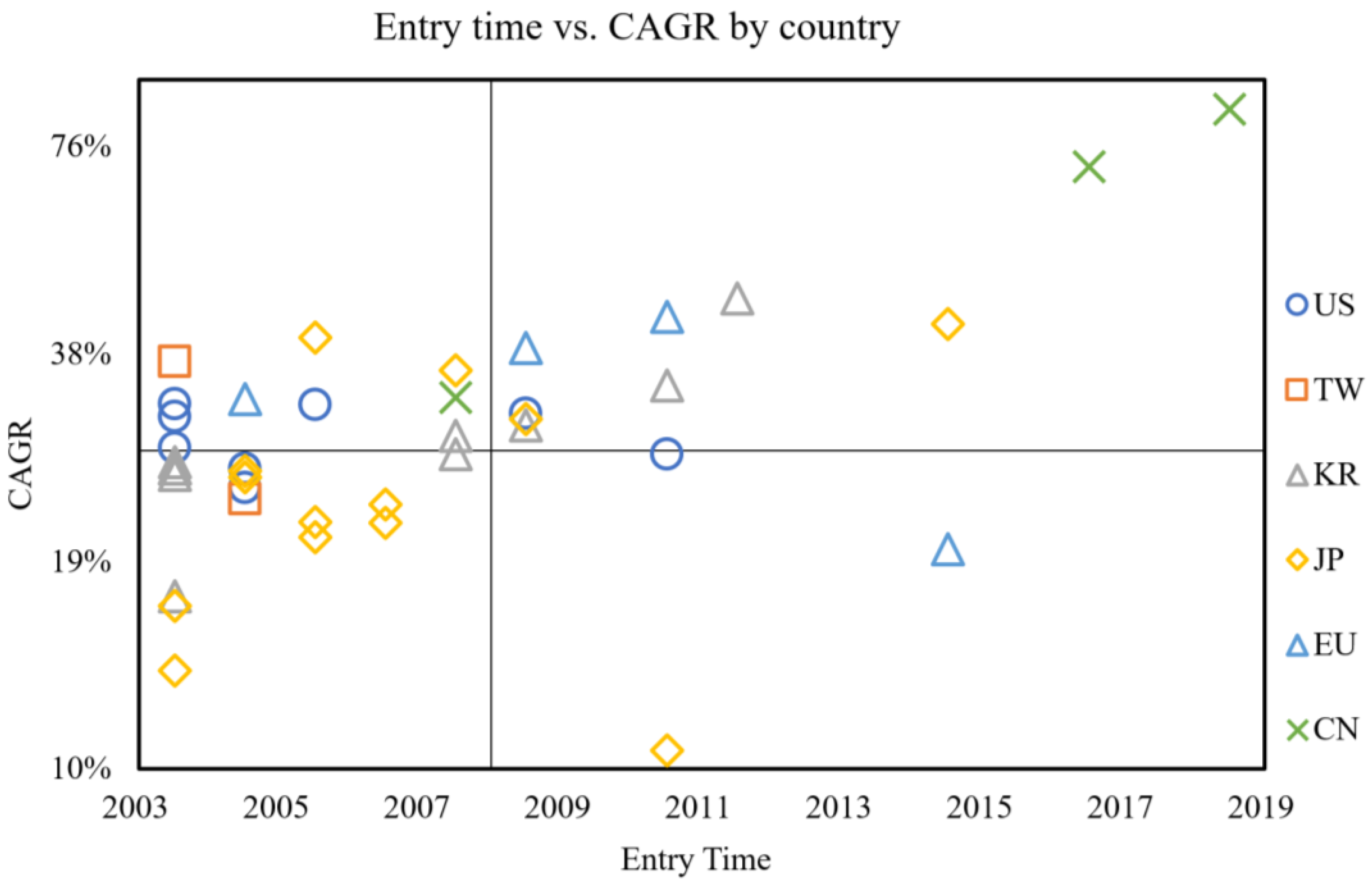

4.1.2. ALD Patent Catch-Up Analysis from the Country Perspective

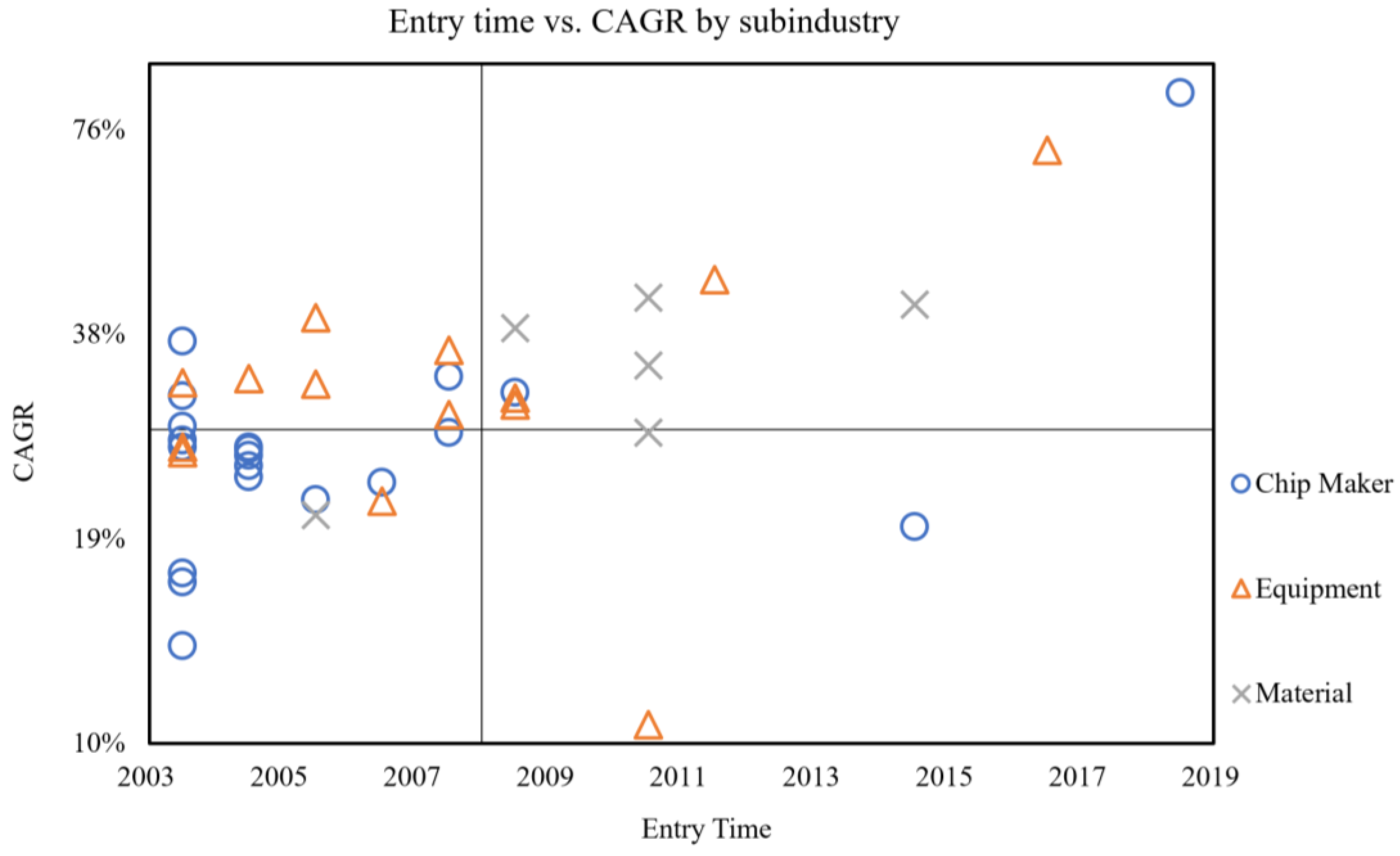

4.1.3. ALD Patent Catch-Up Analysis from the Subindustry Perspective

4.2. Comparative Study—Patent Matrix Analysis of ALD Patents

4.2.1. Entry Time and Growth Competence Matrix Analysis

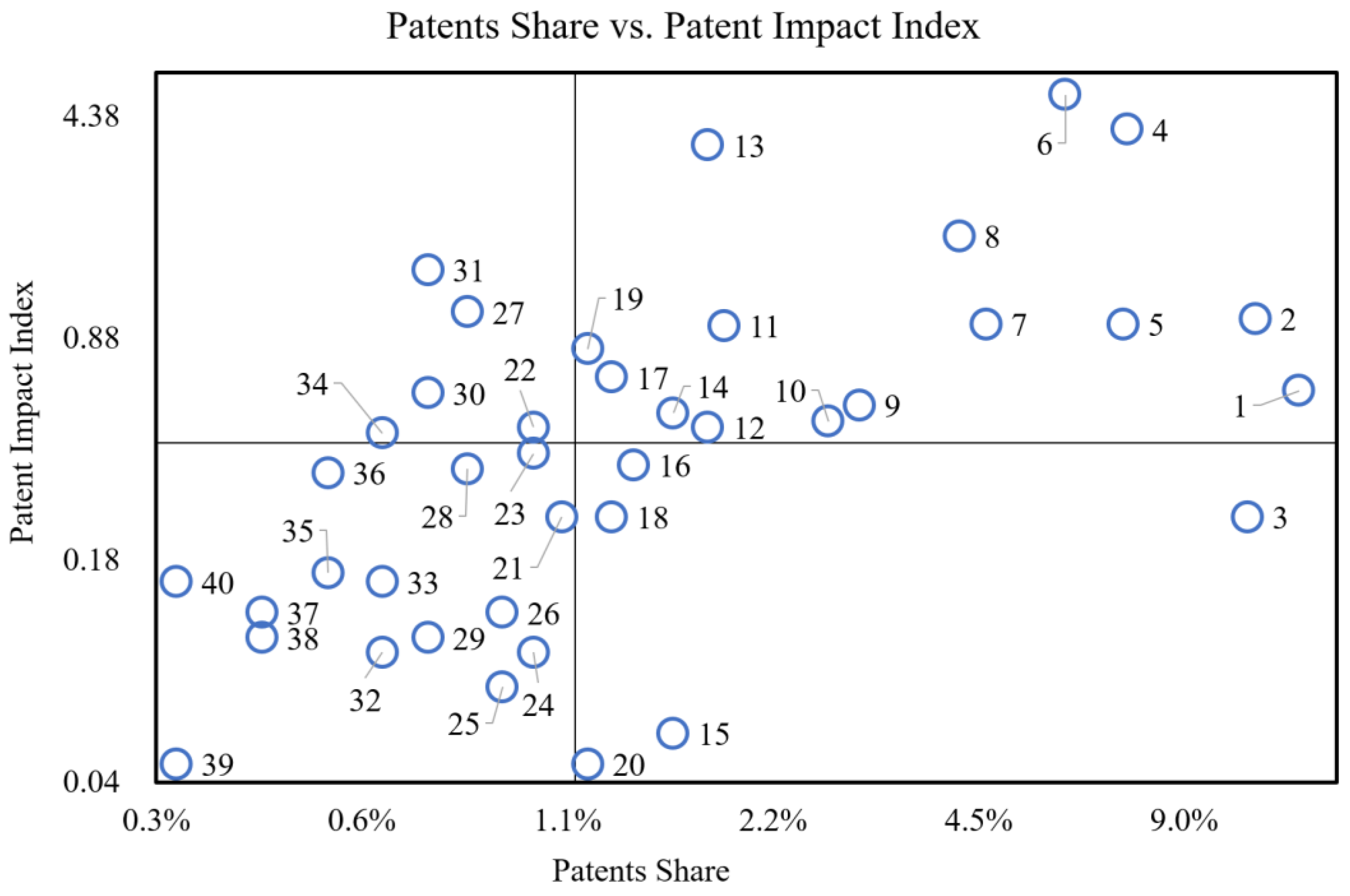

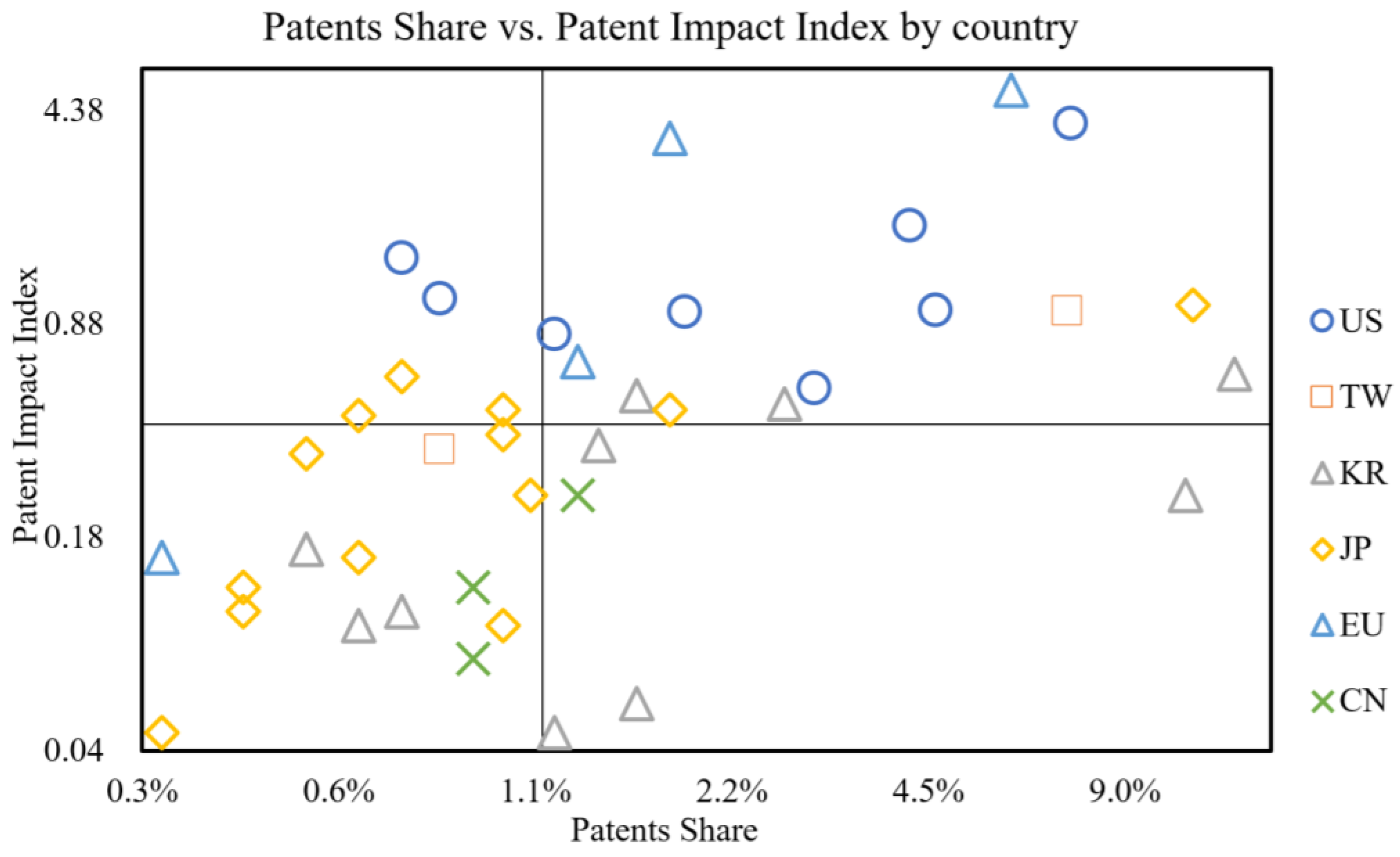

4.2.2. Quantitative and Impact Competence Matrix Analysis

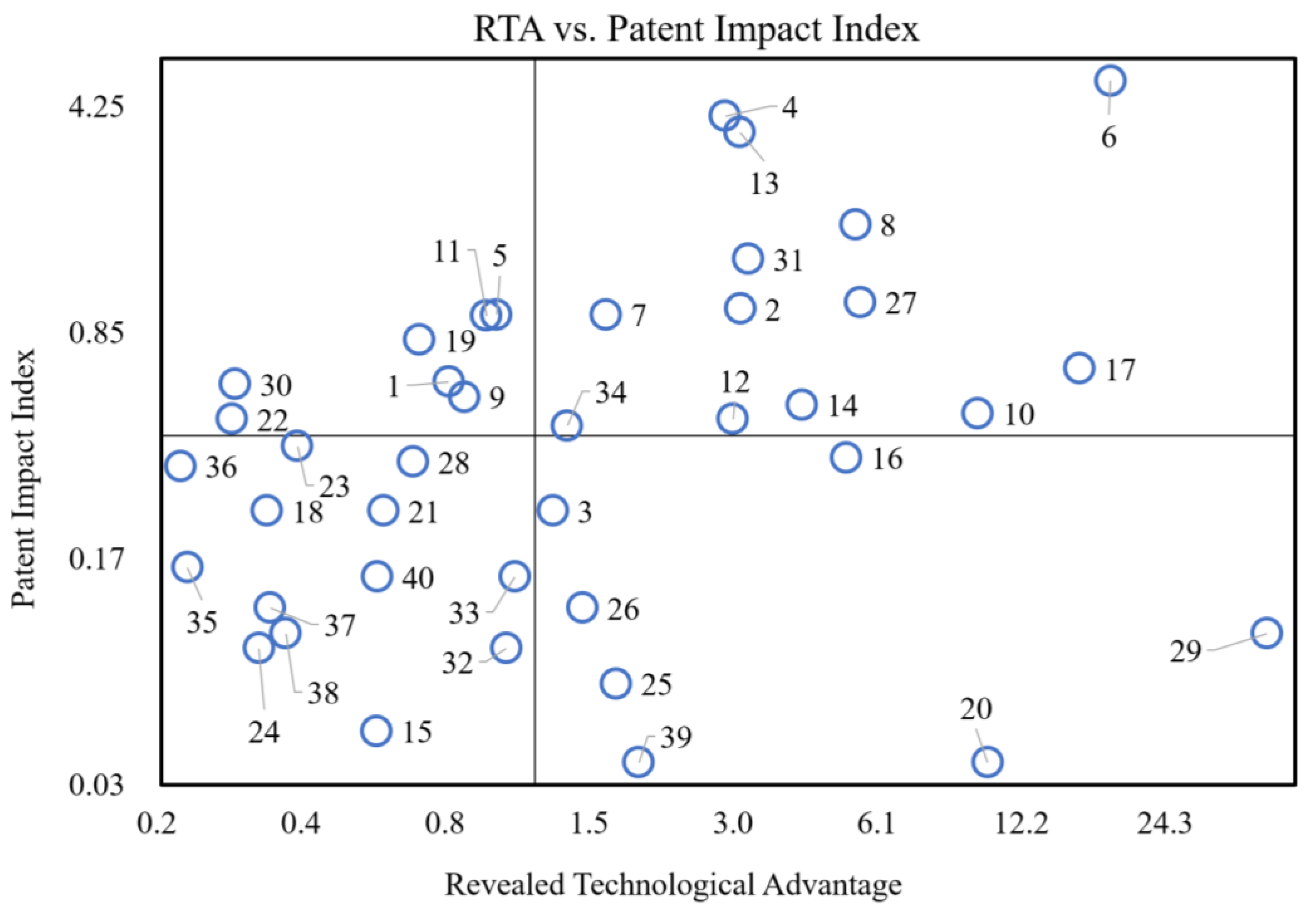

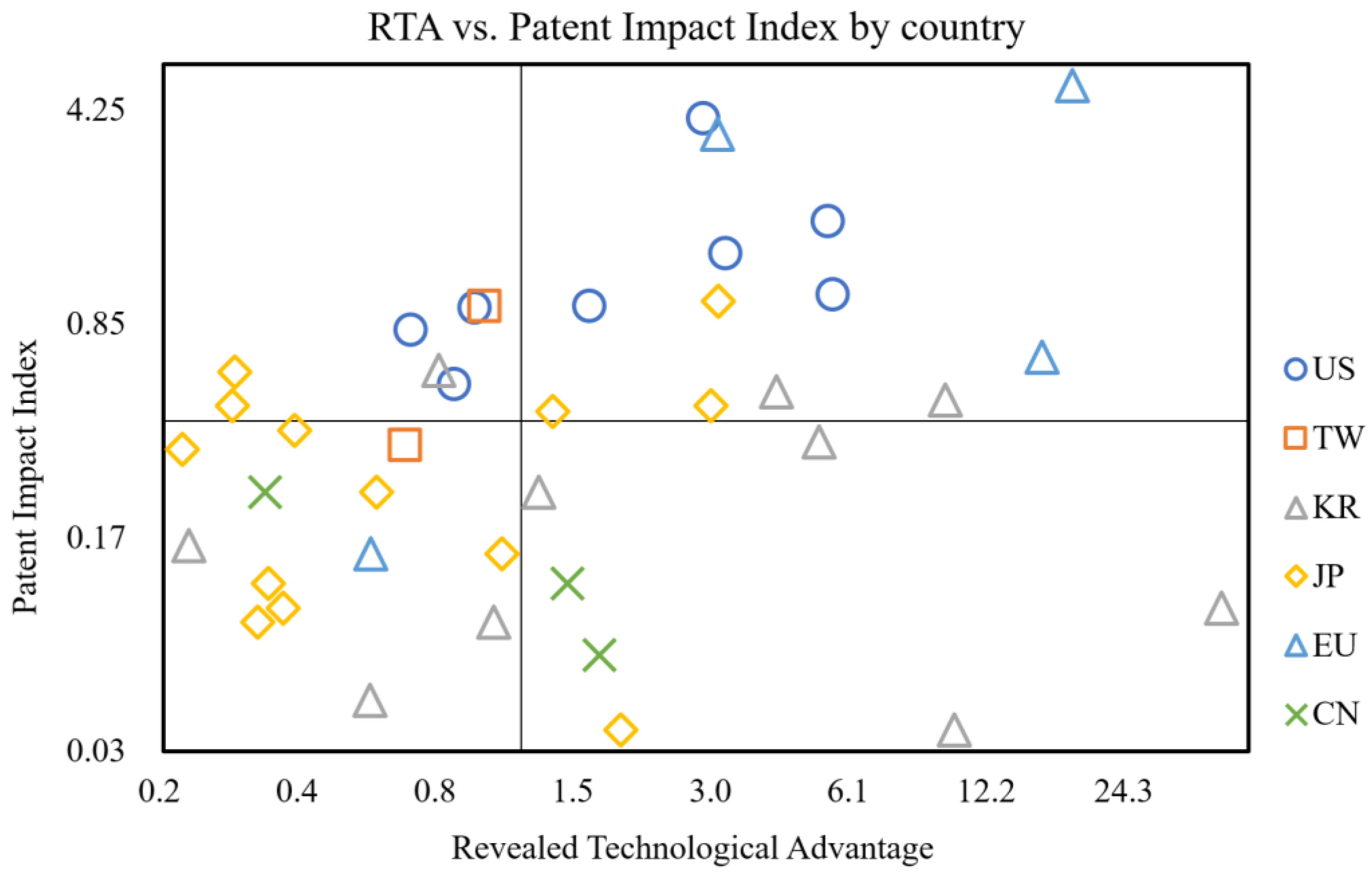

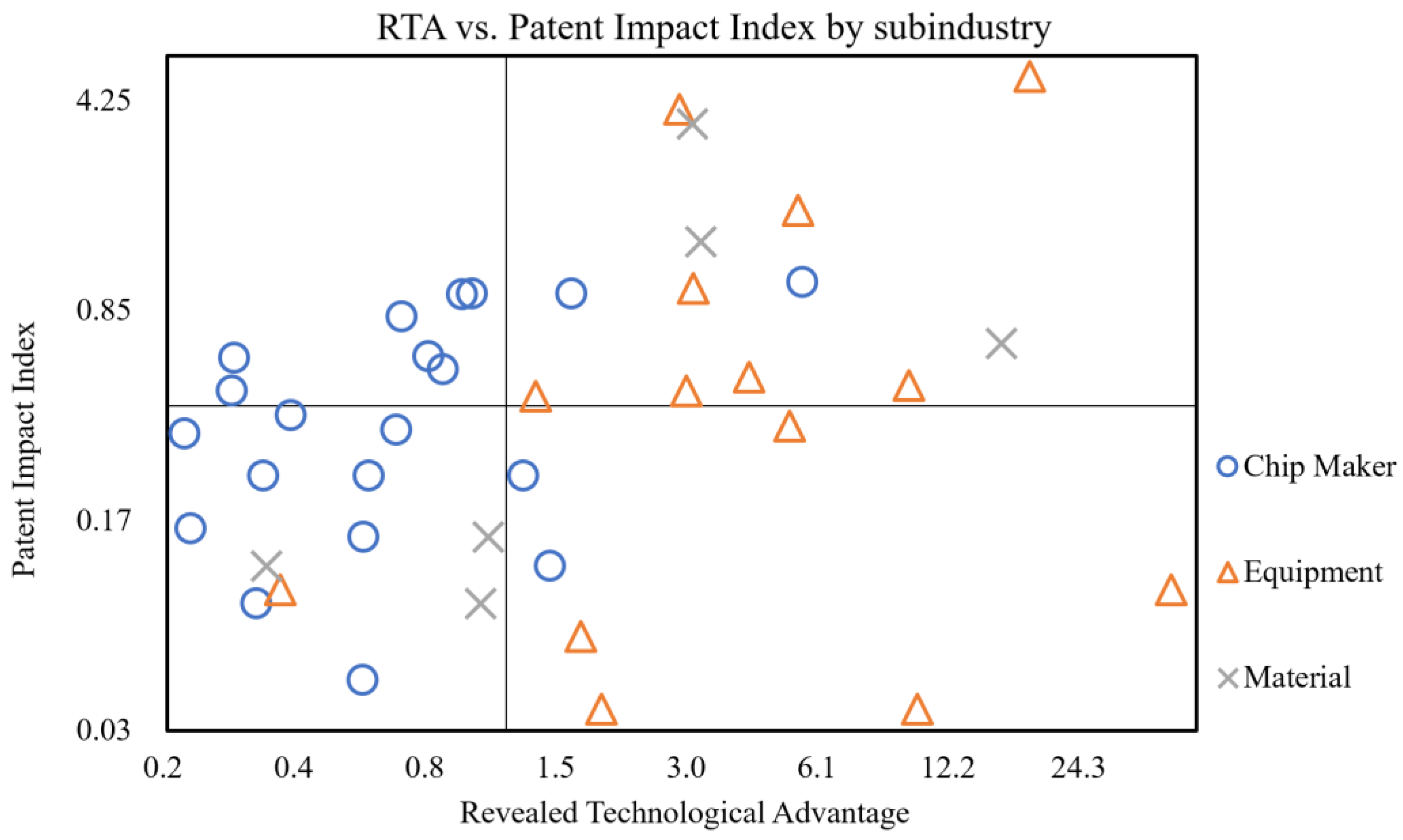

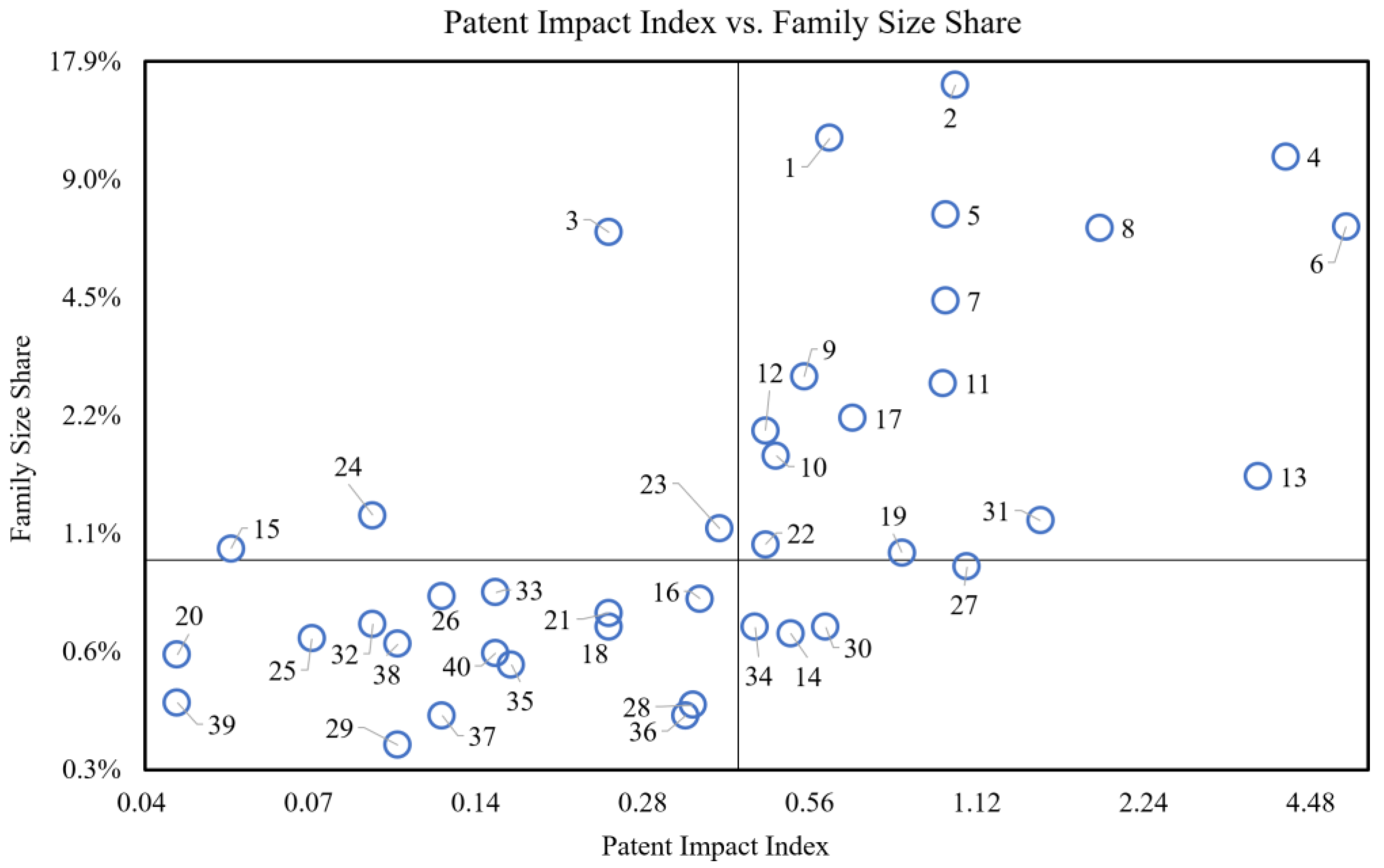

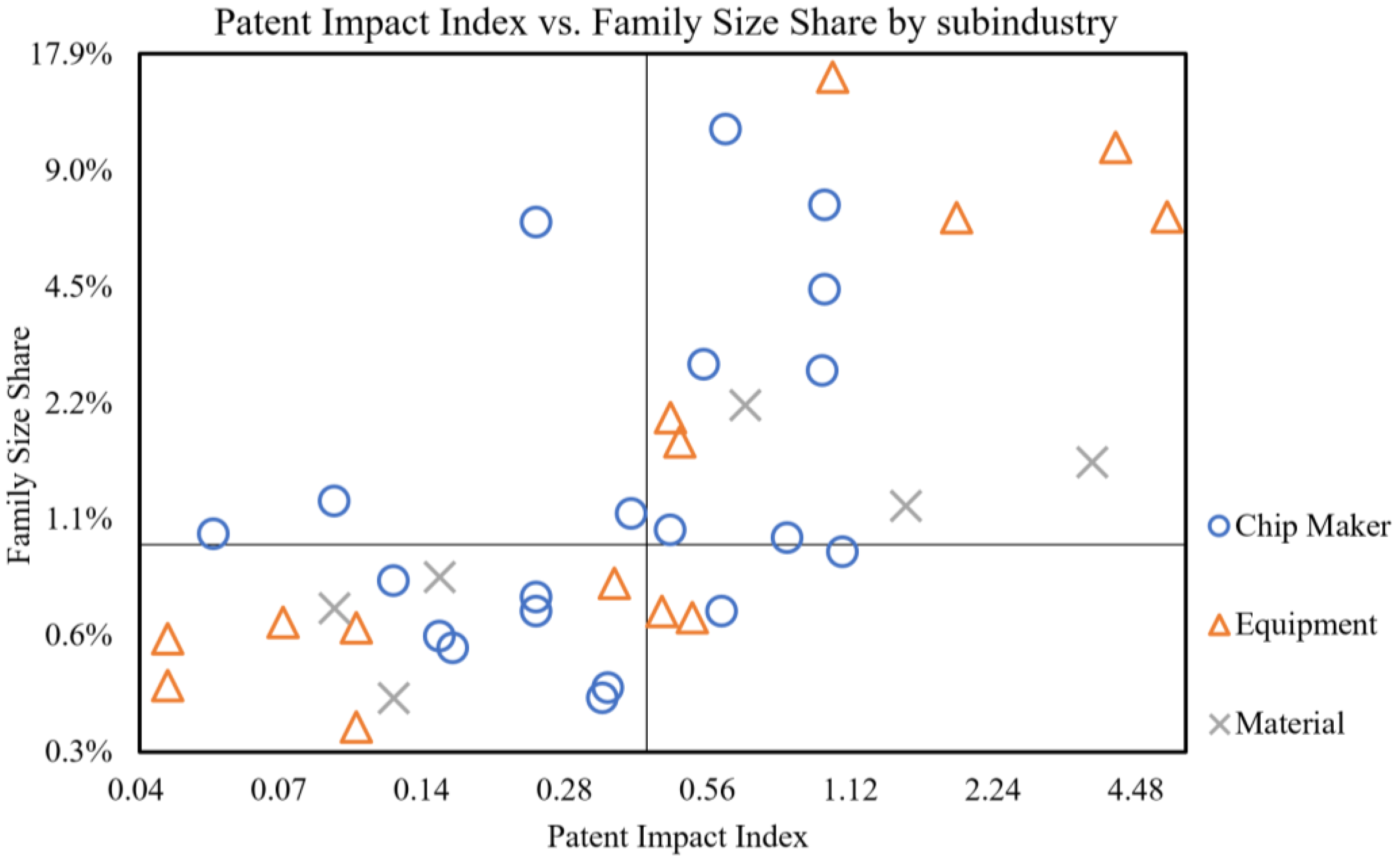

4.2.3. Technology Specialization and Impact Competence Matrix Analysis

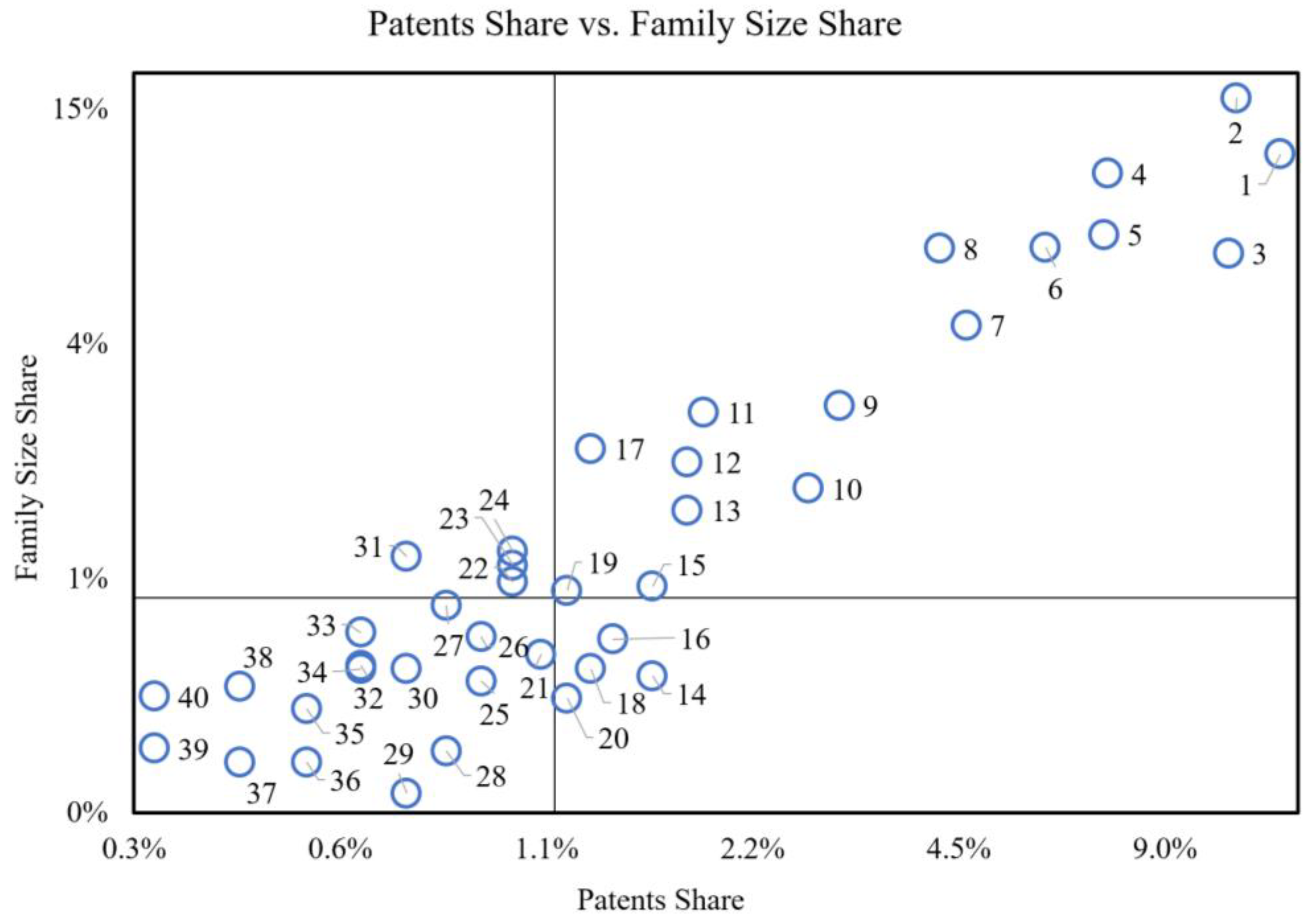

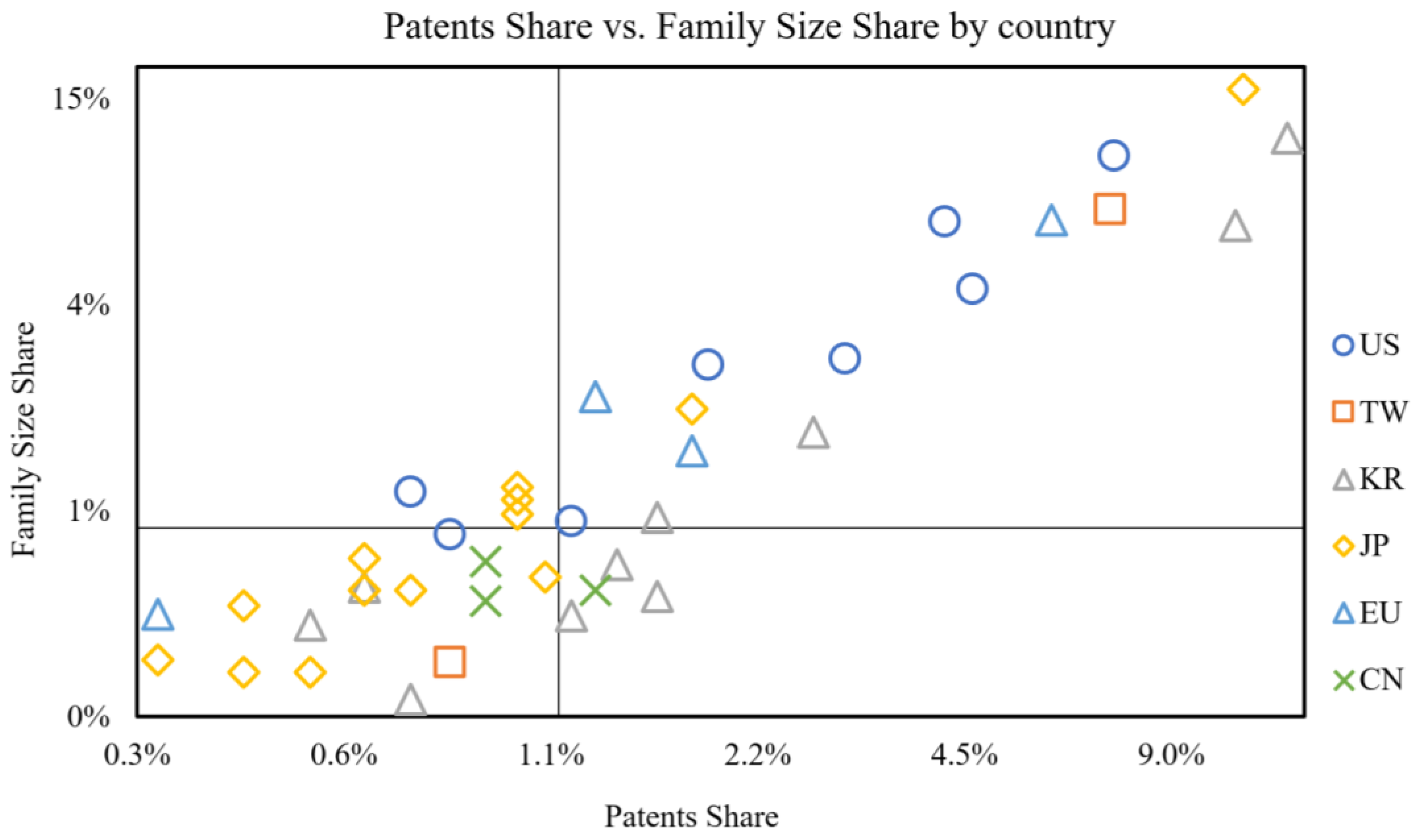

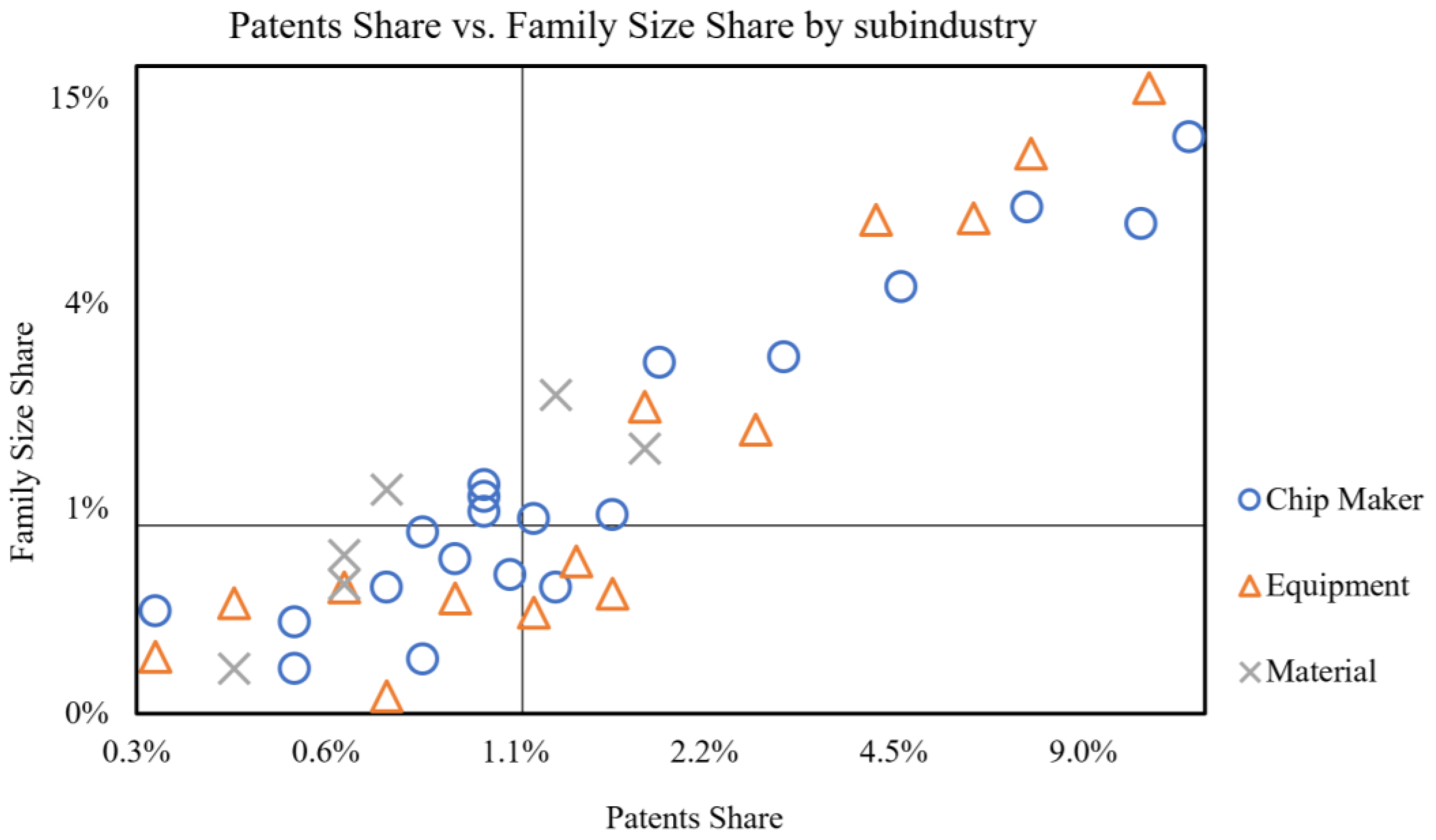

4.2.4. Quantitative and International Competence Matrix Analysis

4.2.5. Impact and International Competence Matrix Analysis

5. Discussion and Conclusions

5.1. Theoretical Implications and Discussions

5.2. Managerial and Policy Implications

5.3. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kamal, K.Y. The Silicon Age: Trends in Semiconductor Devices Industry. J. Eng. Sci. Technol. Rev. 2022, 15, 110–115. [Google Scholar] [CrossRef]

- Leskelä, M.; Ritala, M. Atomic Layer Deposition (ALD): From Precursors to Thin Film Structures. Thin Solid Films 2002, 409, 138–146. [Google Scholar] [CrossRef]

- Bown, C.P. The US–China Trade War and Phase One Agreement. SSRN Electron. J. 2021. [Google Scholar] [CrossRef]

- Varas, A.; Varadarajan, R.; Goodrich, J.; Yinug, F. Government Incentives and US Competitiveness in Semiconductor Manufacturing. 2020. Available online: https://www.eusemiconductors.eu/sites/default/files/uploads/20200916_GovIncentivesUSCompinSCManufacturing.pdf (accessed on 5 January 2025).

- Li, Y. From Classic Failures to Global Competitors: Business Organization and Economic Development in the Chinese Semiconductor Industry. Available online: https://www.researchgate.net/profile/Yin-Li-9/publication/304581717_From_Classic_Failures_to_Global_Competitors_Business_Organization_and_Economic_Development_in_the_Chinese_Semiconductor_Industry/links/577c04da08ae213761cab7bc/From-Classic-Failures-to-Global-Competitors-Business-Organization-and-Economic-Development-in-the-Chinese-Semiconductor-Industry.pdf (accessed on 3 January 2025).

- Maydan, D. The Future of Equipment Development and Semiconductor Production. Mater. Sci. Eng. A 2001, 302, 1–5. [Google Scholar] [CrossRef]

- Liu, Y.-Z.; Lu, W.-M.; Tran, P.P.; Pham, T.A.K. Sustainable Energy and Semiconductors: A Bibliometric Investigation. Sustainability 2024, 16, 6548. [Google Scholar] [CrossRef]

- Duan, X.; Niu, C.; Sahi, V.; Chen, J.; Wallace Parce, J.; Empedocles, S.; Goldman, J.L. High-Performance Thin-Film Transistors Using Semiconductor Nanowires and Nanoribbons. Nature 2003, 425, 274–278. [Google Scholar] [CrossRef]

- Yuan, G.; Wang, N.; Huang, S.; Liu, J. A Brief Overview of Atomic Layer Deposition and Etching in the Semiconductor Processing. In Proceedings of the 2016 17th International Conference on Electronic Packaging Technology (ICEPT), Wuhan, China, 16–19 August 2016. [Google Scholar] [CrossRef]

- Zhang, J.; Li, Y.; Cao, K.; Chen, R. Advances in Atomic Layer Deposition. Nanomanuf. Metrol. 2022, 5, 191–208. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Chang, K.-C. The Relationship between a Firm’s Patent Quality and Its Market Value—The Case of US Pharmaceutical Industry. Technol. Forecast. Soc. Change 2010, 77, 20–33. [Google Scholar] [CrossRef]

- Wang, M.; He, H.; Fang, X.; Li, H. The Development Status and Future Trends of Lubricant Additives Technology: Based on Patents Analysis. PLoS ONE 2024, 19, e0304888. [Google Scholar] [CrossRef]

- Lee, K.; Ki, J. Rise of Latecomers and Catchup Cycles in the World Steel Industry. Res. Policy 2017, 46, 365–375. [Google Scholar] [CrossRef]

- Choung, J.-Y.; Hwang, H.-R.; Choi, J.-H.; Rim, M.-H. Transition of Latecomer Firms from Technology Users to Technology Generators: Korean Semiconductor Firms. World Dev. 2000, 28, 969–982. [Google Scholar] [CrossRef]

- Landini, F.; Lee, K.; Malerba, F. A History-Friendly Model of the Successive Changes in Industrial Leadership and the Catchup by Latecomers. Res. Policy 2017, 46, 431–446. [Google Scholar] [CrossRef]

- Altenburg, T.; Schmitz, H.; Stamm, A. Breakthrough? China’s and India’s Transition from Production to Innovation. World Dev. 2008, 36, 325–344. [Google Scholar] [CrossRef]

- Lee, K.; Lim, C.; Song, W. Emerging Digital Technology as a Window of Opportunity and Technological Leapfrogging: Catchup in Digital TV by the Korean Firms. Int. J. Technol. Manag. 2005, 29, 40. [Google Scholar] [CrossRef]

- Guennif, S.; Ramani, S.V. Explaining Divergence in Catching-up in Pharma between India and Brazil Using the NSI Framework. Res. Policy 2012, 41, 430–441. [Google Scholar] [CrossRef]

- Yun, J.J.; Zhao, X.; Jeong, E.; Kim, S.; Kim, K.; Hahm, S.D. The Signal of Post Catchup in Open Innovation Dynamics. Sci. Technol. Soc. 2023, 28, 151–170. [Google Scholar] [CrossRef]

- Seol, S.; Yoon, K.; Cho, D. Successful Technological Catchup Strategy: Empirical Evidence from Telecommunication Equipment Industry. IEEE Trans. Eng. Manag. 2024, 71, 11746–11757. [Google Scholar] [CrossRef]

- Wong, C.-Y.; Yeung, H.W.; Huang, S.; Song, J.; Lee, K. Geopolitics and the Changing Landscape of Global Value Chains and Competition in the Global Semiconductor Industry: Rivalry and Catchup in Chip Manufacturing in East Asia. Technol. Forecast. Soc. Change 2024, 209, 123749. [Google Scholar] [CrossRef]

- Guo, Y.; Zheng, G. Recombinant Capabilities, R&D Collaboration, and Innovation Performance of Emerging Market Firms in High-Technology Industry. IEEE Trans. Eng. Manag. 2022, 70, 2431–2446. [Google Scholar] [CrossRef]

- Rho, S.; Lee, K.; Kim, S.H. Limited Catchup in China’s Semiconductor Industry: A Sectoral Innovation System Perspective. Millenn. Asia 2015, 6, 147–175. [Google Scholar] [CrossRef]

- Chiang, M.-H. Taiwan Semiconductor Manufacturing Company: A Key Chip in the Global Political Economy. East Asian Policy 2023, 15, 36–46. [Google Scholar] [CrossRef]

- Mathews, J.A. Catchup Strategies and the Latecomer Effect in Industrial Development. New Political Econ. 2006, 11, 313–335. [Google Scholar] [CrossRef]

- Zhang, Z.; Li, X.; Xiong, J.; Yan, J.; Xu, L.; Wang, R. A Global Race to Dominate the Internet of Things: How China Caught Up. J. Bus. Strategy 2021, 43, 199–209. [Google Scholar] [CrossRef]

- Wang, F.; Chen, J.; Wang, Y.; Lutao, N.; Vanhaverbeke, W. The Effect of R&D Novelty and Openness Decision on Firms’ Catch-up Performance: Empirical Evidence from China. Technovation 2014, 34, 21–30. [Google Scholar] [CrossRef]

- Hansen, U.E.; Ockwell, D. Learning and Technological Capability Building in Emerging Economies: The Case of the Biomass Power Equipment Industry in Malaysia. Technovation 2014, 34, 617–630. [Google Scholar] [CrossRef]

- Vernon, R. International Investment and International Trade in the Product Cycle. In International Business; Routledge: London, UK, 2017; pp. 99–116. [Google Scholar] [CrossRef]

- Christensen, C.M. EXPLORING the LIMITS of the technology s-curve. part ii: Architectural technologies. Prod. Oper. Manag. 2009, 1, 358–366. [Google Scholar] [CrossRef]

- Park, K.-H.; Lee, K. Linking the Technological Regime to the Technological Catchup: Analyzing Korea and Taiwan Using the US Patent Data. Ind. Corp. Change 2006, 15, 715–753. [Google Scholar] [CrossRef]

- Breschi, S.; Malerba, F.; Orsenigo, L. Technological Regimes and Schumpeterian Patterns of Innovation. Econ. J. 2000, 110, 388–410. [Google Scholar] [CrossRef]

- Joo, S.H.; Lee, K. Samsung’s Catchup with Sony: An Analysis Using US Patent Data. J. Asia Pac. Econ. 2010, 15, 271–287. [Google Scholar] [CrossRef]

- Prahalad, C. The Core Competence of the Corporation. In Knowledge and Strategy; Elsevier: Amsterdam, The Netherlands, 1999; pp. 41–59. [Google Scholar] [CrossRef]

- Shin, J.-S. Dynamic Catchup Strategy, Capability Expansion and Changing Windows of Opportunity in the Memory Industry. Res. Policy 2017, 46, 404–416. [Google Scholar] [CrossRef]

- Seo, E.; Choung, J.; Hwang, H. The Changing Patterns of Knowledge Production of Catchup Firms during the Forging-Ahead Period: Case Study of Samsung Electronics Co. (SEC). IEEE Trans. Eng. Manag. 2019, 66, 621–635. [Google Scholar] [CrossRef]

- Ernst, H. Patenting Strategies in the German Mechanical Engineering Industry and Their Relationship to Company Performance. Technovation 1995, 15, 225–240. [Google Scholar] [CrossRef]

- Malerba, F.; Orsenigo, L. Schumpeterian Patterns of Innovation Are Technology-Specific. Res. Policy 1996, 25, 451–478. [Google Scholar] [CrossRef]

- Korotky, S.K. Semi-Empirical Description and Projections of Internet Traffic Trends Using a Hyperbolic Compound Annual Growth Rate. Bell Labs Tech. J. 2013, 18, 5–21. [Google Scholar] [CrossRef]

- Soete, L. The Impact of Technological Innovation on International Trade Patterns: The Evidence Reconsidered. In Output Measurement in Science and Technology; Elsevier eBooks: Amsterdam, The Netherlands, 1987; pp. 47–76. [Google Scholar] [CrossRef]

- Schubert, A.; Braun, T. Relative Indicators and Relational Charts for Comparative Assessment of Publication Output and Citation Impact. Scientometrics 1986, 9, 281–291. [Google Scholar] [CrossRef]

- Lanjouw, J.; Pakes, A.; Putnam, J. How to Count Patents and Value Intellectual Property: Uses of Patent Renewal and Application Data. J. Ind. Econ. 1998, 46, 405–432. [Google Scholar] [CrossRef]

- Harhoff, D.; Scherer, F.M.; Vopel, K. Citations, Family Size, Opposition and the Value of Patent Rights. Res. Policy 2003, 32, 1343–1363. [Google Scholar] [CrossRef]

- Mullen, E.; Morris, M.A. Green Nanofabrication Opportunities in the Semiconductor Industry: A Life Cycle Perspective. Nanomaterials 2021, 11, 1085. [Google Scholar] [CrossRef]

- Godfrey, R. Strategic Management; Routledge: London, UK, 2015. [Google Scholar] [CrossRef]

- Lee, K. Making a Technological Catchup: Barriers and Opportunities. Asian J. Technol. Innov. 2005, 13, 97–131. [Google Scholar] [CrossRef]

- Lee, G.K. Understanding the Timing of “Fast-Second” Entry and the Relevance of Capabilities in Invention vs. Commercialization. Res. Policy 2009, 38, 86–95. [Google Scholar] [CrossRef]

- Shivakumar, S.; Wessner, C.; Howell, T. Japan Seeks to Revitalize Its Semiconductor Industry; Center for Strategic and International Studies (CSIS): Washington, DC, USA, 2023. [Google Scholar]

- Khramova, E.; Meissner, D.; Sagieva, G. Statistical Patent Analysis Indicators as a Means of Determining Country Technological Specialisation. SSRN Electron. J. 2013. [Google Scholar] [CrossRef]

- Danish, M.S.; Sharma, R.; Dhanora, M. Impact of Patent Quality on Firm Performance: A Case of Indian Pharmaceutical Industry. Int. J. Innov. Technol. Manag. 2020. [Google Scholar] [CrossRef]

- Chen, D.-Z.; Lin, W.-Y.C.; Huang, M.-H. Using Essential Patent Index and Essential Technological Strength to Evaluate Industrial Technological Innovation Competitiveness. Scientometrics 2007, 71, 101–116. [Google Scholar] [CrossRef]

| Two-Dimensional Patent Competence Matrix | A Pair of Patent Indicators | Correlation Coefficient |

|---|---|---|

| Entry Time and Growth Competence Matrix | Entry Time vs. CAGR | 0.656 |

| Quantitative and Impact Competence Matrix | Patent Share vs. PII | 0.341 |

| Technology Specialization and Impact Competence Matrix | RTA vs. PII | 0.204 |

| Quantitative and International Competence Matrix | Patent Share vs. FSS | 0.932 |

| Impact and International Competence Matrix | PII vs. FSS | 0.457 |

| Year | Total Patents (a) | 40 Leading Companies’ Patent (b) | b/a (%) |

|---|---|---|---|

| 2003 | 95 | 56 | 58.9% |

| 2004 | 143 | 89 | 62.2% |

| 2005 | 205 | 158 | 77.1% |

| 2006 | 302 | 269 | 89.1% |

| 2007 | 326 | 303 | 92.9% |

| 2008 | 269 | 219 | 81.4% |

| 2009 | 261 | 193 | 73.9% |

| 2010 | 405 | 284 | 70.1% |

| 2011 | 382 | 236 | 61.8% |

| 2012 | 429 | 266 | 62.0% |

| 2013 | 486 | 294 | 60.5% |

| 2014 | 526 | 314 | 59.7% |

| 2015 | 560 | 291 | 52.0% |

| 2016 | 536 | 274 | 51.1% |

| 2017 | 548 | 266 | 48.5% |

| 2018 | 530 | 275 | 51.9% |

| 2019 | 552 | 302 | 54.7% |

| 2020 | 619 | 370 | 59.8% |

| 2021 | 662 | 452 | 68.3% |

| 2022 | 670 | 549 | 81.9% |

| Total | 8506 | 5460 | 64.2% |

| Rank | Company (Subindustry a) [Country b] | Number of Patents | Entry Year | CAGR of Accumulated Patents | Patents Share | RTA | PII | FSS |

|---|---|---|---|---|---|---|---|---|

| 1 | Samsung (C) [KR] | 720 | 2003 | 25.9% | 13.2% | 0.759 | 0.600 | 11.5% |

| 2 | TEL (E) [JP] | 622 | 2005 | 40.2% | 11.4% | 3.090 | 1.010 | 15.7% |

| 3 | SK Hynix (C) [KR] | 604 | 2003 | 16.9% | 11.1% | 1.254 | 0.240 | 6.6% |

| 4 | AMAT (E) [US] | 403 | 2003 | 32.2% | 7.4% | 2.874 | 3.980 | 10.3% |

| 5 | TSMC (C) [TW] | 401 | 2003 | 37.1% | 7.3% | 0.956 | 0.970 | 7.3% |

| 6 | ASM (E) [EU] | 326 | 2004 | 32.7% | 6.0% | 18.343 | 5.120 | 6.8% |

| 7 | MICRON (C) [US] | 252 | 2004 | 24.3% | 4.6% | 1.621 | 0.970 | 4.4% |

| 8 | LAM (E) [US] | 227 | 2005 | 32.1% | 4.2% | 5.374 | 1.840 | 6.8% |

| 9 | IBM (C) [US] | 164 | 2003 | 30.8% | 3.0% | 0.820 | 0.540 | 2.8% |

| 10 | WONIK (E) [KR] | 147 | 2003 | 25.4% | 2.7% | 9.699 | 0.480 | 1.8% |

| 11 | Intel (C) [US] | 105 | 2003 | 27.8% | 1.9% | 0.910 | 0.960 | 2.7% |

| 12 | KOKUSAI (E) [JP] | 101 | 2007 | 36.0% | 1.8% | 2.981 | 0.460 | 2.1% |

| 13 | INTERMOLECULAR (M) [US] | 99 | 2008 | 38.8% | 1.8% | 3.082 | 3.550 | 1.6% |

| 14 | KC TECH (E) [KR] | 90 | 2007 | 28.9% | 1.6% | 4.151 | 0.510 | 0.6% |

| 15 | DB Hitek (C) [KR] | 87 | 2003 | 26.5% | 1.6% | 0.536 | 0.050 | 1.0% |

| 16 | JUSUNG (E) [KR] | 79 | 2003 | 25.9% | 1.4% | 5.146 | 0.350 | 0.8% |

| 17 | AIR LIQUID (M) [US] | 73 | 2010 | 43.0% | 1.3% | 15.799 | 0.660 | 2.2% |

| 18 | SEMICON MANUF (C) [CN] | 71 | 2007 | 32.9% | 1.3% | 0.317 | 0.240 | 0.6% |

| 19 | G.F. (C) [US] | 63 | 2004 | 25.9% | 1.2% | 0.659 | 0.810 | 1.0% |

| 20 | TES (E) [KR] | 63 | 2011 | 45.7% | 1.2% | 10.146 | 0.040 | 0.5% |

| 21 | FUJITSU (C) [JP] | 61 | 2004 | 25.7% | 1.1% | 0.555 | 0.240 | 0.7% |

| 22 | RENESAS (C) [JP] | 57 | 2004 | 25.2% | 1.0% | 0.268 | 0.460 | 1.1% |

| 23 | Sony (C) [JP] | 55 | 2006 | 23.0% | 1.0% | 0.367 | 0.380 | 1.2% |

| 24 | Panasonic (C) [JP] | 53 | 2003 | 13.2% | 1.0% | 0.305 | 0.090 | 1.2% |

| 25 | BEIJING NMC (E) [CN] | 50 | 2016 | 71.0% | 0.9% | 1.702 | 0.070 | 0.6% |

| 26 | YMTC (C) [CN] | 48 | 2018 | 86.1% | 0.9% | 1.447 | 0.120 | 0.8% |

| 27 | Eastman (C) [US] | 45 | 2008 | 31.2% | 0.8% | 5.511 | 1.060 | 0.9% |

| 28 | UMC (C) [TW] | 44 | 2004 | 23.4% | 0.8% | 0.641 | 0.340 | 0.4% |

| 29 | NCD (E) [KR] | 39 | 2008 | 29.9% | 0.7% | 38.910 | 0.100 | 0.3% |

| 30 | SHARP (C) [JP] | 36 | 2003 | 16.4% | 0.7% | 0.272 | 0.590 | 0.6% |

| 31 | ENTEGRIS (M) [US] | 36 | 2010 | 27.2% | 0.7% | 3.215 | 1.440 | 1.2% |

| 32 | LG Chem (M) [KR] | 34 | 2010 | 34.2% | 0.6% | 1.001 | 0.090 | 0.7% |

| 33 | TOPPAN (M) [JP] | 33 | 2014 | 42.0% | 0.6% | 1.043 | 0.150 | 0.8% |

| 34 | ULVAC (E) [JP] | 32 | 2008 | 30.6% | 0.6% | 1.343 | 0.440 | 0.6% |

| 35 | LGD (C) [KR] | 29 | 2007 | 27.2% | 0.5% | 0.216 | 0.160 | 0.5% |

| 36 | Kioxia (C) [JP] | 28 | 2005 | 21.7% | 0.5% | 0.209 | 0.330 | 0.4% |

| 37 | Resonac (M) [JP] | 24 | 2005 | 20.6% | 0.4% | 0.322 | 0.120 | 0.4% |

| 38 | Hitachi (E) [JP] | 23 | 2006 | 21.6% | 0.4% | 0.347 | 0.100 | 0.6% |

| 39 | Canon (E) [JP] | 19 | 2010 | 10.1% | 0.3% | 1.896 | 0.040 | 0.4% |

| 40 | OSRAM (C) [EU] | 17 | 2014 | 19.8% | 0.3% | 0.539 | 0.150 | 0.6% |

| Median (Threshold for the matrix) | 62.0 | 2007 and 2008 | 27.5% | 27.5% | 1.15% | 0.411 | 1.0% | |

| Total/Average | Total 5460 | N/A | N/A | N/A | Total 100% | Average 0.746 | Total 100% | |

| Year | Number of Patents by Country | Number of Patents by Subindustry | Total | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| KR | US | JP | EU | TW | CN | Chipmakers | Equipment | Material | ||

| 2003 | 44 | 4 | 7 | 0 | 1 | 0 | 51 | 5 | 0 | 56 |

| 2004 | 65 | 12 | 9 | 2 | 1 | 0 | 72 | 17 | 0 | 89 |

| 2005 | 119 | 19 | 17 | 3 | 0 | 0 | 131 | 26 | 1 | 158 |

| 2006 | 203 | 26 | 23 | 9 | 8 | 0 | 242 | 27 | 0 | 269 |

| 2007 | 226 | 32 | 27 | 4 | 13 | 1 | 280 | 21 | 2 | 303 |

| 2008 | 119 | 47 | 35 | 9 | 7 | 2 | 179 | 39 | 1 | 219 |

| 2009 | 95 | 35 | 40 | 12 | 5 | 6 | 139 | 54 | 0 | 193 |

| 2010 | 134 | 58 | 67 | 17 | 4 | 4 | 188 | 92 | 4 | 284 |

| 2011 | 106 | 41 | 65 | 17 | 6 | 1 | 140 | 89 | 7 | 236 |

| 2012 | 105 | 49 | 81 | 21 | 3 | 7 | 132 | 122 | 12 | 266 |

| 2013 | 66 | 76 | 100 | 32 | 18 | 2 | 130 | 146 | 18 | 294 |

| 2014 | 106 | 57 | 75 | 53 | 19 | 4 | 126 | 147 | 41 | 314 |

| 2015 | 59 | 69 | 74 | 51 | 29 | 9 | 124 | 123 | 44 | 291 |

| 2016 | 60 | 66 | 84 | 32 | 22 | 10 | 118 | 131 | 25 | 274 |

| 2017 | 53 | 57 | 78 | 32 | 41 | 5 | 123 | 117 | 26 | 266 |

| 2018 | 63 | 74 | 68 | 18 | 38 | 14 | 121 | 137 | 17 | 275 |

| 2019 | 49 | 89 | 73 | 27 | 51 | 13 | 126 | 143 | 33 | 302 |

| 2020 | 83 | 96 | 72 | 48 | 55 | 16 | 151 | 191 | 28 | 370 |

| 2021 | 61 | 172 | 82 | 46 | 59 | 32 | 178 | 250 | 24 | 452 |

| 2022 | 76 | 216 | 67 | 82 | 65 | 43 | 189 | 344 | 16 | 549 |

| Total | 1892 | 1295 | 1144 | 515 | 445 | 169 | 2940 | 2221 | 299 | 5460 |

| CAGR | 21.9% | 35.6% | 30.8% | 36.1% | 40.3% | 40.8% | 23.8% | 37.8% | 35.0% | 27.3% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, S.; Lee, H. Patent Leadership Changes and Technological Competence in Atomic Layer Deposition Technology of Global Leading Companies, Countries, and Subindustries. Sustainability 2025, 17, 2600. https://doi.org/10.3390/su17062600

Lee S, Lee H. Patent Leadership Changes and Technological Competence in Atomic Layer Deposition Technology of Global Leading Companies, Countries, and Subindustries. Sustainability. 2025; 17(6):2600. https://doi.org/10.3390/su17062600

Chicago/Turabian StyleLee, Seunghwan, and Heesang Lee. 2025. "Patent Leadership Changes and Technological Competence in Atomic Layer Deposition Technology of Global Leading Companies, Countries, and Subindustries" Sustainability 17, no. 6: 2600. https://doi.org/10.3390/su17062600

APA StyleLee, S., & Lee, H. (2025). Patent Leadership Changes and Technological Competence in Atomic Layer Deposition Technology of Global Leading Companies, Countries, and Subindustries. Sustainability, 17(6), 2600. https://doi.org/10.3390/su17062600