Efficiency Measurement and Trend Analysis of the Hydrogen Energy Industry Chain in China

Abstract

:1. Introduction

2. Literature Review

2.1. Resilience and Security Levels of Industrial and Supply Chains

2.2. Research on Measurement of Industrial Chain Efficiency

2.2.1. Definition and Dimensions of Industrial Chain Efficiency

2.2.2. Industrial Chain Efficiency Indicator System

2.2.3. Industrial Chain Efficiency Measurement Models

2.3. Current Status, Trends, and Countermeasures of Hydrogen Energy Development

3. Theoretical Analysis

3.1. Efficiency Affects the High-Quality Development of the Hydrogen Energy Industry

3.2. Main Factors Influencing the Efficiency of the Hydrogen Energy Chain

4. Study Design

4.1. Measurement Modelling

4.2. Trend Modelling

4.3. Selection of Indicators

5. Empirical Analyses

5.1. Data Sources

5.2. Efficiency Measures

5.2.1. Phase 1: SBM-DEA Results Analysis

5.2.2. Phase 2: Analysis of Factors Affecting SFA Efficiency

- (1)

- The regression coefficients for the economic development level are negative for the slack variables of the number of employees and fixed assets and significant at the 1% level for business costs. A higher level of economic development enables the introduction of more advanced technologies and automated equipment, reducing redundancy in workforce size. At the same time, a more in-depth analysis of fixed asset investments and the adoption of advanced process technologies correspondingly decrease redundancy in fixed asset inputs, leading to more effective resource allocation. This indicates that higher regional economic development positively impacts the comprehensive technical efficiency of the hydrogen energy industry. Improved economic conditions contribute to enhanced industrial chain efficiency in various ways. First, higher regional economic levels facilitate increased investments from the government and enterprises in the clean energy sector, providing sufficient financial support for the research and development, production, and application of the hydrogen energy industry. Second, economically advanced regions tend to attract highly skilled and innovative talent, providing intellectual support for the efficient operation of the hydrogen energy industry chain. Third, in more developed regions, the closer cooperation among upstream, midstream, and downstream enterprises generates synergistic effects, improving the overall efficiency of the industrial chain.

- (2)

- The regression coefficients of government support are positive for the slack variables of the number of employees and fixed assets, with significant impacts on all three slack variables (number of employees, operating costs, and fixed assets). Direct subsidies for scenarios with high application potential, such as midstream hydrogen pipelines and downstream fuel cells in the industrial chain, can promote hydrogen consumption and accelerate the process of green hydrogen substitution. Investing more research funds into hydrogen energy can guide technological innovation activities towards the hydrogen energy industry, supporting its high-quality development. However, this suggests that government policies in the hydrogen energy industry exhibit considerable variability and frequent adjustments, introducing uncertainties to the stable development of the industrial chain. Fluctuations in subsidy policy and their implementation can constrain financial investments in hydrogen energy projects, which, in turn, affects their progress and quality. Optimizing resource allocation and providing consistent policy guidance are essential to mitigate these challenges and enhance the efficiency of the industry chain.

- (3)

- The degree of regional industrial agglomeration has a significant positive impact on the input slack variables for the number of employees and fixed assets but negatively affects operating costs. A higher contribution of secondary industry to regional GDP amplifies the positive impact on enterprise efficiency. However, the hydrogen energy industry chain faces structural challenges. The upstream segments, such as equipment manufacturing and raw material production, remain relatively weak, while downstream segments focusing on applications and markets are relatively constrained in driving overall industrial development.

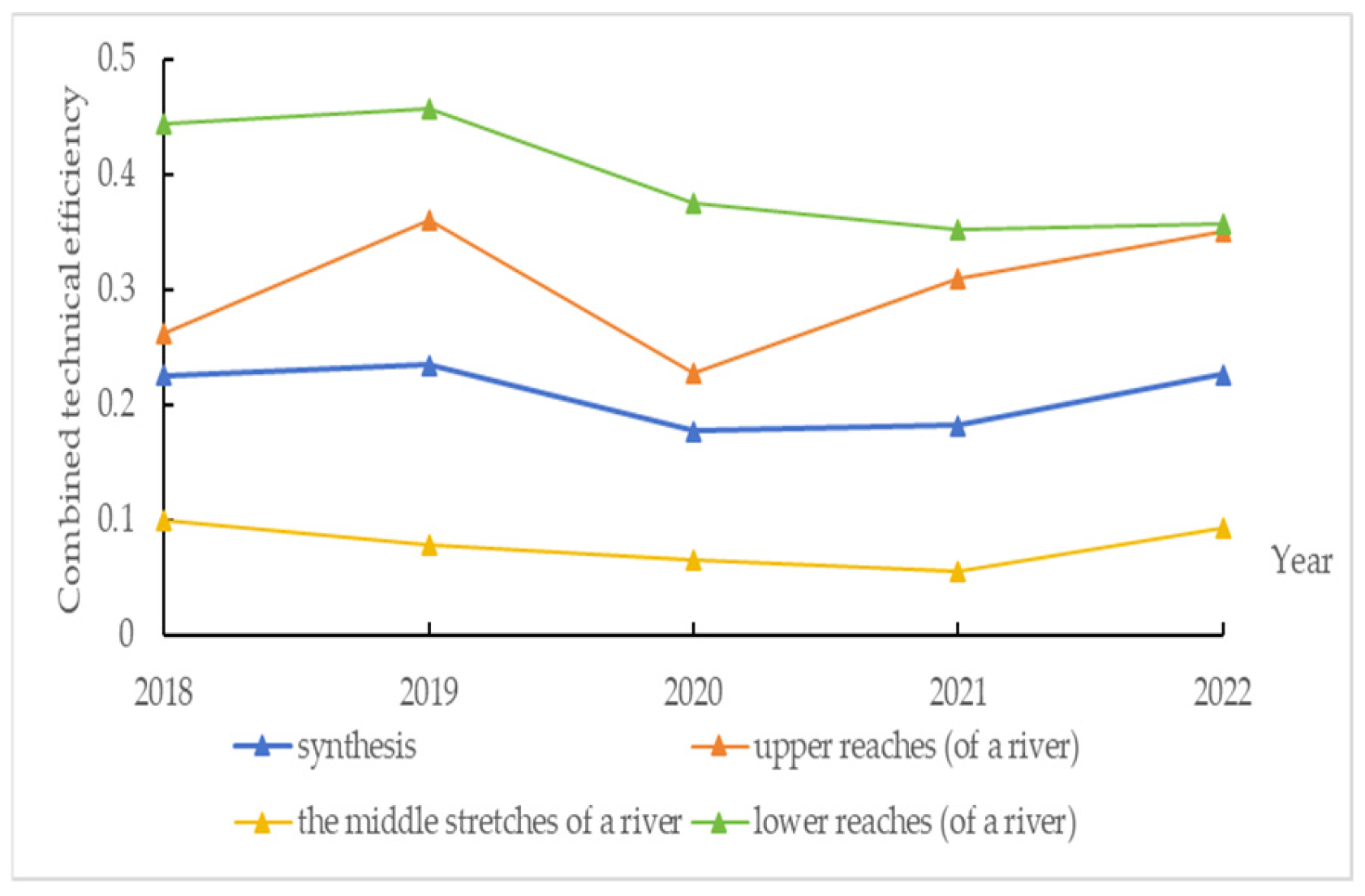

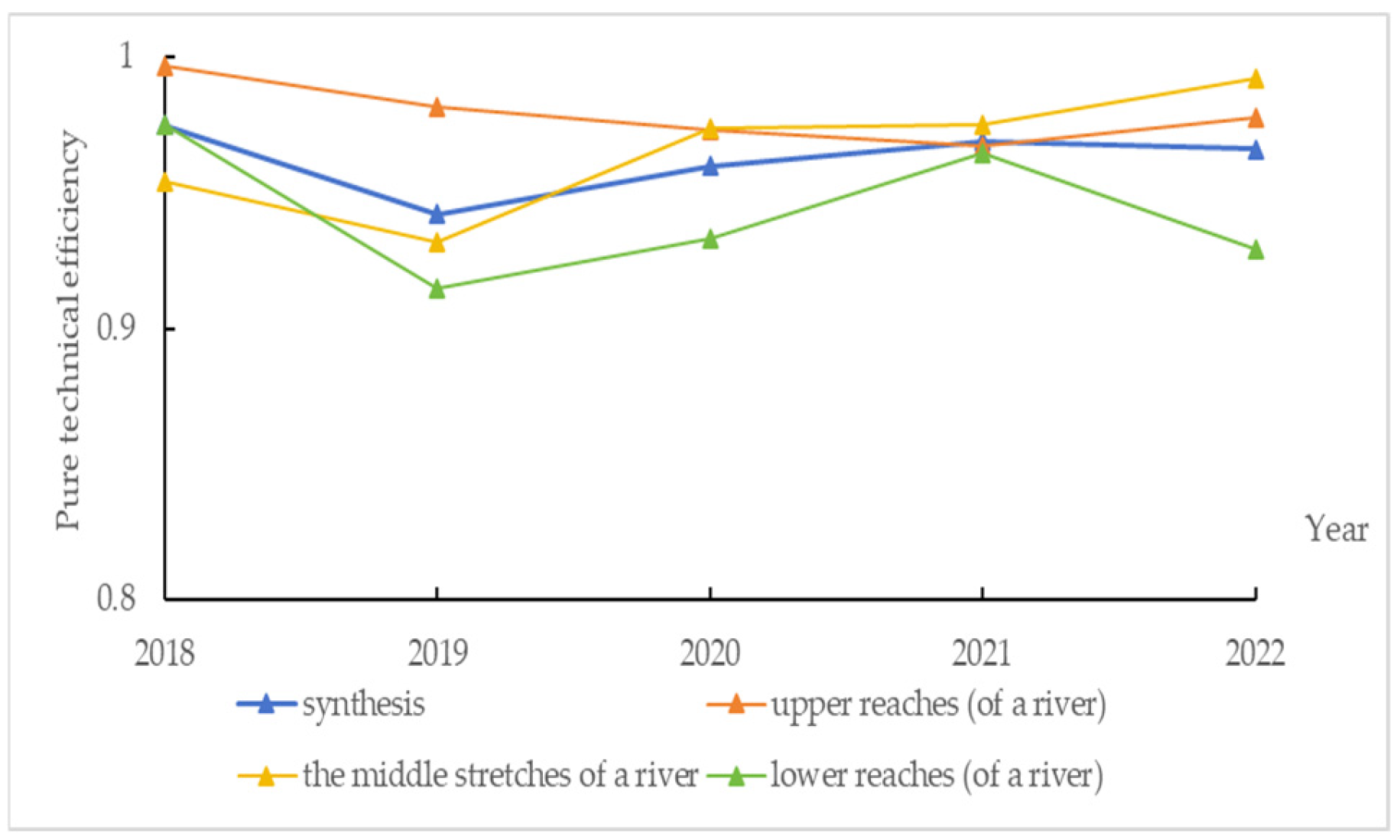

5.2.3. Phase 3: SBM-DEA Results Analysis

5.3. Trend Analysis

6. Conclusions, Suggestions, and Discussion

6.1. Conclusions

- (1)

- The overall comprehensive technical efficiency level of China’s hydrogen energy industry chain was low from 2018 to 2022, primarily due to low pure technical efficiency and scale efficiency, which hindered the improvement of overall technical efficiency. This emphasizes the need for simultaneous improvements in both pure technical efficiency and scale efficiency. Moreover, there was an imbalance in the efficiency development of the various segments of the industry chain, with the comprehensive technical efficiency of the midstream lagging behind that of the upstream and downstream, becoming a bottleneck. An analysis of the factors influencing the external environment reveals that the level of economic development, government support, and regional industrial agglomeration significantly impact the efficiency of the hydrogen energy industry chain [31]. After removing the influence of the external environment, the comprehensive technical efficiency of the hydrogen energy industry chain further decreased, while pure technical efficiency increased [32]. As a result, China’s hydrogen energy industry chain faces deep-seated issues, such as an irrational industrial structure, weak infrastructure, gaps in core technology, and an uneconomical industrial scale, all of which impede the improvement of the chain’s efficiency.

- (2)

- The trend analysis of the 2018–2022 period reveals two levels of differentiation in the efficiency development of 30 enterprises within China’s hydrogen energy industry chain, spanning the upstream, middle, and downstream sectors. High-efficiency enterprises demonstrate a more scientific and rational allocation of resources, with little to no redundancy in input and output. In contrast, low-efficiency enterprises exhibit significant redundancy in resource allocation, leading to unnecessary waste. To improve production efficiency, reduce costs, and enhance competitiveness, it is essential to further identify and utilize these resources. While some enterprises exhibit high-efficiency levels, the majority remain at middle and low-efficiency levels. The current state of these enterprises presents significant challenges in making quick changes, and it is unlikely that they can independently improve their efficiency without external support or intervention. Within each segment of the industrial chain, high-efficiency enterprises can serve as industry leaders, guiding other firms toward technological innovation and reform. By sharing experiences and technologies with low-efficiency enterprises or forming industry alliances, they can enhance communication and collaboration, thereby helping lower-performing enterprises to improve their efficiency. A key area for future research is determining how to effectively integrate point-to-point and area-driven approaches, using key points to drive broader industry development. The overall efficiency level of China’s hydrogen energy industry chain remains relatively low, mainly due to an unbalanced industrial structure, weak infrastructure, limited breakthroughs in core technologies, and diseconomies of scale. To address these challenges, prioritizing the development of leading enterprises is recommended. By allowing these firms to serve as anchors for industry-wide progress, they can drive advancements in other enterprises, ultimately facilitating an overall improvement in the efficiency of the hydrogen energy industrial chain.

6.2. Recommendations

- (1)

- Continuously improve the level of key core technologies. Relying on national science and technology programs, it is essential to vigorously support the development of foundational materials, core components, critical equipment, and disruptive technologies within the hydrogen energy sector. Projects, such as hydrogen-powered aircraft, liquid hydrogen transport ships, offshore wind-to-hydrogen equipment, and integrated wind-solar-hydrogen storage and refueling systems, should be progressively advanced. A comprehensive hydrogen energy equipment system should be developed, covering the entire industrial chain of production, storage, transportation, and application. It is necessary to accelerate innovation in proton exchange membrane fuel cells, focusing on the development of critical materials, improving performance indicators, and expanding batch production capabilities. Efforts should be made to continuously enhance the reliability, stability, and durability of fuel cells [33]. Support should also be provided for the development of new fuel cells and other related innovations. It is necessary to promote the R&D and manufacturing of core components and essential equipment, as well as the improvement of renewable energy hydrogen conversion efficiency and the scaling of hydrogen production per unit. It is also necessary to overcome the technical challenges related to hydrogen energy infrastructure and push forward the development of key core technologies across the production, storage, transport, and application of green, low-carbon hydrogen energy [34].

- (2)

- Emphasize the development of industrial innovation support platforms. By focusing on critical areas and key segments of the hydrogen energy sector, efforts should be made to establish multi-level and diversified innovation platforms that accelerate the convergence of talent, technology, funding, and other essential innovation factors. Universities, research institutes, and enterprises should collaborate to establish key laboratories and cutting-edge interdisciplinary research platforms to carry out applied basic research and explore advanced hydrogen energy technologies. Relying on leading enterprises to integrate high-quality innovation resources in the industry, the establishment of industrial innovation centers, engineering research centers, technology innovation centers, and manufacturing innovation centers should be prioritized, fostering efficient collaborative innovation.

- (3)

- Promote the development of a specialized talent pool for hydrogen energy. Driven by the need for technological innovation in the hydrogen energy sector, efforts should be made to attract and cultivate high-end talent to strengthen the R&D capabilities in basic frontier technologies related to hydrogen energy. The focus should be on accelerating the cultivation of professional talents in hydrogen energy technology and equipment, thereby reinforcing the innovation foundation necessary for the industry’s growth. A sound mechanism for talent cultivation and training systems should be established. The development of local hydrogen energy talent has become a key consideration for enterprises when selecting project locations. Driven by favorable policies and industrial demand, the challenge of hydrogen energy talent shortages has seen breakthroughs in Chinese universities. Since 2019, programs, such as “Hydrogen Energy Technology Application” and “Hydrogen Energy Science and Engineering”, have been included in the undergraduate curriculum of Chinese universities. Beyond undergraduate programs, the development of hydrogen energy disciplines has expanded to include master’s and doctoral levels. Establishing a comprehensive training model encompassing undergraduate, master’s, and doctoral programs will provide strong support for cultivating talent within the hydrogen energy industry. This will accelerate the development of hydrogen energy-related disciplines and specialties and expanding the pool of hydrogen energy innovation and R&D professionals [35].

- (4)

- Actively pursue international collaboration in hydrogen energy technology innovation. It is necessary to encourage joint research and development of hydrogen energy science and technology, promote cooperation in the innovation of key core technologies, materials, and equipment across the entire industry chain, and actively build an international hydrogen energy innovation chain and industry chain. It is also necessary to take an active role in the development of international hydrogen energy industry standards and to adhere to the principle of joint construction and shared benefits, exploring partnerships in hydrogen energy trade, infrastructure development, and product innovation with countries involved in the “Belt and Road” initiative. Finally, it is necessary to strengthen project cooperation with countries and regions with leading hydrogen energy technologies, and to jointly explore international markets.

- (5)

- The establishment of a standardization and regulatory framework for the hydrogen energy industry is crucial for ensuring safety within the sector. Formulating national and industry-specific standards for hydrogen energy production, storage, transmission, and utilization, and clarifying industrial norms will help prevent safety incidents caused by improper operations or equipment failures [36]. At the same time, strengthening industrial supervision is necessary to ensure that enterprises and individuals adhere to relevant regulations, thereby enhancing the safety standards of the hydrogen energy industry. Achieving high-quality and sustainable development in the hydrogen energy sector requires coordination across the entire industry chain. This includes securing top-tier equipment from upstream manufacturers, ensuring the safe transport and storage of hydrogen by midstream companies, and facilitating its correct use by downstream consumers. Industry-wide synergy and cooperation bolster the risk resistance of the entire hydrogen energy chain. A flexible regulatory framework should be established to avoid a “one-size-fits-all” approach.

- (6)

- To optimize resource utilization and innovation, a hydrogen energy industry alliance should be established. This alliance would connect upstream and downstream enterprises, research institutions, and related stakeholders, promoting technical exchange, cooperation, and resource sharing. Collaborative innovation across the industry chain can drive efficiency and technological advancements. Building a comprehensive hydrogen storage and transportation network is another crucial step. Inspired by power grid dispatching and intelligent energy management in buildings, a unified hydrogen dispatching and management system should be implemented. Hydrogen can be transported from production sites to consumption areas through pipelines and high-pressure gas cylinders, reducing storage and transportation costs, while improving safety [37].

- (7)

- A structured industry improvement action plan should be formulated with the primary objective of enhancing efficiency, increasing technology research and development, and driving key technology innovations in the hydrogen energy sector. Introducing and assimilating international advanced technologies and equipment will accelerate the industry’s ability to innovate and adapt. Efforts should be made to expand infrastructure for hydrogen storage, production, transportation, and utilization. Optimizing hydrogen production structures is also critical, which includes increasing the proportion of hydrogen production by water electrolysis and improving the efficiency of hydrogen production from coal. To achieve sustainable and competitive industry growth, a unified energy system should be developed, ensuring seamless integration with global markets. Strengthened supervision will be necessary to maintain safety and environmental protection. Promoting international cooperation and exchanges will further advance the sector. Collaboration with internationally renowned enterprises and research institutions can drive joint research and development, accelerating the adoption and commercialization of cutting-edge hydrogen energy technologies.

6.3. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zhao, H.; Zhu, B.; Jiang, B. Comprehensive assessment and analysis of cavitation scale effects on energy conversion and stability in pumped hydro energy storage units. Energy Convers. Manag. 2025, 325, 119370. [Google Scholar] [CrossRef]

- Cheng, Q. Research on the Connotation, Mechanism and Measurement of Industrial and Supply Chains–Based the Toughness of Regional Industrial and Supply Chains and Its Enlightenment to Nantong. Shanghai Econ. 2022, 6, 25–40. [Google Scholar] [CrossRef]

- Shi, J.; Lu, D.; Xu, L. On the Fourth Global Industrial Chain Reconstruction with China’s Industrial Chain Upgrading. Res. Financ. Econ. Issues 2022, 4, 8–117. [Google Scholar] [CrossRef]

- Duan, W.; Wang, B. Theories and paths to enhance the resilience of industrial chain supply chain. Chin. Soc. Sci. Today 2023, 3. [Google Scholar]

- Song, M. Study on the Path to Enhancing China’s Industrial Chain Resilience. Ind. Eng. Innov. Manag. 2024, 7, 148–153. [Google Scholar] [CrossRef]

- Wen, H.; Liang, W.; Lee, C.C. Input–output Efficiency of China’s Digital Economy: Statistical Measures, Regional Differences, and Dynamic Evolution. J. Knowl. Econ. 2023, 15, 10898–10923. [Google Scholar] [CrossRef]

- Cheng, L.T.W.; Lee, S.K.; Li, S.K.; Tsang, C.K. Understanding resource deployment efficiency for ESG and financial performance: A DEA approach. Res. Int. Bus. Financ. 2023, 65, 101941. [Google Scholar] [CrossRef]

- Wang, Q.; Wu, S.; Huang, P.; Hueng, C.J. The influence of market liquidity on the efficiency of China’s pilot carbon markets. Financ. Res. Lett. 2025, 72, 106560. [Google Scholar] [CrossRef]

- Oldenhof, L.; Kersing, M.; Zoonen, V.L. Sphere transgressions in the Dutch digital welfare state: Causing harm to citizens when legal rules, ethical norms and quality procedures are lacking. Inf. Commun. Soc. 2024, 27, 2704–2720. [Google Scholar] [CrossRef]

- Tan, J. Research on the mechanism of digital economy to enhance the innovation efficiency of high-tech industry in the context of big data. Appl. Math. Nonlinear Sci. 2024, 9, 1–14. [Google Scholar] [CrossRef]

- Zoitovich, K.K.; Uralovich, A.N.; Jonuzokovich, A.A. Factor analysis of industrial efficiency indicators. J. Crit. Rev. 2020, 7, 515–517. [Google Scholar]

- Ang, F.; Ramsden, J.S. Analysing determinate components of an approximated Luenberger–Hicks–Moorsteen productivity indicator: An application to German dairy-processing firms. Agribusiness 2024, 40, 349–370. [Google Scholar] [CrossRef]

- Hu, L.; Chen, F.; Zhao, R. Does Digital Inclusive Finance Increase Industry Chain Resilience in China? Sustainability 2024, 16, 6028. [Google Scholar] [CrossRef]

- Amiri, S.; Alinaghian, M.; Khosroshahi, H. Optimizing greenness and pricing in green product development: Addressing cannibalization and enhancing market share in a duopoly markets. Environ. Dev. Sustain. 2024, 26, 1–46. [Google Scholar] [CrossRef]

- Feng, H.; Guanchun, L.; Jing, H. CSR performance and firm idiosyncratic risk in a data-rich environment: The role of retail investor attention. J. Int. Financ. Mark. Inst. Money 2023, 89, 101877. [Google Scholar] [CrossRef]

- Fiona, S.; Jennifer, P. Measuring the academic library:Translating today’s inputs and outputs into future impact and value. Inf. Learn. Sci. 2018, 119, 109–120. [Google Scholar] [CrossRef]

- Alireza, A.; Tofigh, A.; Maryam, N. A firm-specific Malmquist productivity index model for stochastic data envelopment analysis: An application to commercial banks. Financ. Innov. 2024, 10, 3705–3715. [Google Scholar] [CrossRef]

- Mansaray, S.S.; Hongyi, X.; Sawaneh, A.I. Assessing and enhancing operational efficiency in Sierra Leone’s retail banking sector: A comparative analysis using CCR and BCC DEA models. Manag. Decis. Econ. 2024, 45, 3705–3715. [Google Scholar] [CrossRef]

- Zhang, J.; Zhang, Y.; Chen, Y.; Wang, J.; Zhao, L.; Chen, M. Evaluation of Carbon Emission Efficiency in the Construction Industry Based on the Super-Efficient Slacks-Based Measure Model: A Case Study at the Provincial Level in China. Buildings 2023, 13, 2207. [Google Scholar] [CrossRef]

- Forghani, D.; Ibrahim, M.D.; Daneshvar, S. Improving weak efficiency frontier in a variable returns to scale stochastic data envelopment analysis model. RAIRO-Oper. Res. 2022, 56, 2159–2179. [Google Scholar] [CrossRef]

- Lou, Y.Y.; Yang, G.L.; Guan, Z.C.; Chen, X.L.; Pan, H.; Wang, T.; Zheng, H.J. A parallel data envelopment analysis and Malmquist productivity index model of virtual frontier for evaluating scientific and technological innovation efficiency at universities. Decis. Anal. J. 2024, 10, 100384. [Google Scholar] [CrossRef]

- Mohanty, A.; Mohapatra, G.A.; Tripathy, K.P. Smart hospitality using IoT enabled integrated face recognition, machine learning, and fuzzy AHP for analyzing customer satisfaction measurements. Int. J. Inf. Technol. 2024, 17, 1597–1605. [Google Scholar] [CrossRef]

- Peter, S.C.; Whelan, J.P.; Pfund, R.A. Text Comprehension Analyses to Improve Assessment Accuracy: Demonstration Using Gambling Disorder Screening. J. Gambl. Stud. 2022, 38, 1269–1287. [Google Scholar] [CrossRef]

- Zulqarnain, M.; Wei, W.; Ihsan, J. Evaluating the factors of coal consumption inefficiency in energy intensive industries of China: An epsilon-based measure model. Resour. Policy 2022, 78, 102800. [Google Scholar] [CrossRef]

- Ling, W. Hydrogen Energy in Shandong: Building on the Momentum and Joining the Trend of Our Times. Engineering 2021, 7, 726–727. [Google Scholar] [CrossRef]

- Zhang, X. The Development Trend of and Suggestions for China’s Hydrogen Energy Industry. Engineering 2021, 7, 719–721. [Google Scholar] [CrossRef]

- Xu, S.; Yu, B. The Current Development Status and Future Prospects of Hydrogen Energy Technology in China. J. Beijing Inst. Technol. (Soc. Sci. Ed.) 2021, 23, 1–12. [Google Scholar] [CrossRef]

- Gao, W. The concept of hydrogen energy continues to attract attention, with listed companies positioning themselves in a trillion-level market. Econ. Inf. Dly. 2022, 3. [Google Scholar] [CrossRef]

- Fried, H.O.; Lovell, C.A.K.; Schmidt, S.S.; Yaisawarng, S. Accounting for Environmental Effects and Statistical Noise in Data Envelopment Analysis. J. Product. Anal. 2002, 17, 157–174. [Google Scholar] [CrossRef]

- Kijima, Y.; Schoemaker, R.; Tipka, A. Investigation of Radioxenon Probability Density Functions at IMS Radionuclide Stations Using a Monte Carlo Method for Background Estimation. Pure Appl. Geophys. 2024, 181, 1–11. [Google Scholar] [CrossRef]

- Nourelhouda, A.E. Green Entrepreneurship: External Environment Analysis on the Renewable Energy Industry in Jordan. J. Humanit. Arts Soc. Sci. 2022, 6, 275–302. [Google Scholar] [CrossRef]

- Ziobrowski, Z.; Rotkegel, A. Assessment of Hydrogen Energy Industry Chain Based on Hydrogen Production Methods, Storage, and Utilization. Energies 2024, 17, 1808. [Google Scholar] [CrossRef]

- Huo, H.; Wang, K.; Li, B. Model-based humidity observer for vehicle proton exchange membrane fuel cell based on a new sliding mode observer estimation technique. Int. J. Green Energy 2024, 21, 3601–3612. [Google Scholar] [CrossRef]

- Wei, L.; Yanming, W.; Yalin, X. Green hydrogen standard in China: Standard and evaluation of low-carbon hydrogen, clean hydrogen, and renewable hydrogen. Int. J. Hydrogen Energy 2022, 47, 24584–24591. [Google Scholar] [CrossRef]

- Ran, M.; Li, Y. Value Logic of Talent Cultivation Quality in Evaluation Model for Vocational Colleges in New Era. Educ. Reform Dev. 2024, 6, 51–56. [Google Scholar] [CrossRef]

- Sokhna, G.S.; Emmanuel, H.; Vincent, D. Hydrogen development in Europe: Estimating material consumption in net zero emissions scenarios. Int. Econ. 2023, 176, 100457. [Google Scholar] [CrossRef]

- Zhang, H.; Li, Z.; Xue, Y.; Chang, X.; Su, J.; Wang, P.; Guo, Q.; Sun, H. A Stochastic Bi-Level Optimal Allocation Approach of Intelligent Buildings Considering Energy Storage Sharing Services. IEEE Trans. Consum. Electron. 2024, 70, 5142–5153. [Google Scholar] [CrossRef]

| Item | China | Japan | Germany | United States |

|---|---|---|---|---|

| Industrial planning | Planning for the Hydrogen Energy Industry (2021–2035) | Sixth Energy Basic Plan | German National Hydrogen Strategy | U.S. Hydrogen Economy Roadmap-Reducing Emissions and Driving Hydrogen Growth Across the United States |

| Tax incentives | Hydrogen energy-related corporate income tax reduction and exemption, value-added tax incentives. | A series of fiscal and tax policies, such as the “hydrogen energy industry promotion tax system”. | Integrate into energy transformation and environmental protection policies, and indirectly support the hydrogen energy industry. | Publish the Deflation Reduction Act, a tax credit for clean hydrogen production. |

| Subsidies | Direct funding subsidies, R&D subsidies, project construction subsidies, etc. | Funds support the research and development of new energy technologies, the promotion of demonstration projects, and infrastructure construction. | Set up special funds, provide loans, enterprise costs, etc. | Funds support project research and development, demonstration applications, and infrastructure construction of the hydrogen energy industry. |

| Technical talent | Strengthen higher education and vocational education, and train hydrogen energy professionals. | Japan pays attention to education investment and cultivates local hydrogen energy technology talents. | Set up scholarships, provide research positions, and attract and train hydrogen energy talents. | Support the cultivation of talents in the hydrogen energy industry. |

| International cooperation | Carry out hydrogen energy technology exchanges and project cooperation with many countries and regions. | Carry out hydrogen energy trade and technical cooperation with Australia and other countries. | Carry out hydrogen energy technology exchanges and project cooperation with the European Hydrogen Energy Alliance, EU member states, and other countries. | Carry out hydrogen energy technology research and development and project demonstration with many countries. |

| Year | Combined Technical Efficiency | Pure Technical Efficiency | Scale Efficiency | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Synthesis | Upper Reaches (of a River) | The Middle Stretches (of a River) | Lower Reaches (of a River) | Synthesis | Upper Reaches (of a River) | The Middle Stretches (of a River) | Lower Reaches (of a River) | Synthesis | Upper Reaches (of a River) | The Middle Stretches (of a River) | Lower Reaches (of a River) | |

| 2018 | 0.4916 | 0.5816 | 0.3913 | 0.5221 | 0.7118 | 0.7582 | 0.6893 | 0.6900 | 0.6907 | 0.7671 | 0.5677 | 0.7567 |

| 2019 | 0.6356 | 0.7593 | 0.4839 | 0.6990 | 0.8184 | 0.8950 | 0.7670 | 0.7986 | 0.7767 | 0.8483 | 0.6309 | 0.8753 |

| 2020 | 0.5651 | 0.6831 | 0.4052 | 0.6518 | 0.7300 | 0.7516 | 0.7184 | 0.7204 | 0.7741 | 0.9088 | 0.5640 | 0.9048 |

| 2021 | 0.4339 | 0.5373 | 0.2464 | 0.6171 | 0.7124 | 0.7523 | 0.6353 | 0.7564 | 0.6091 | 0.7142 | 0.3879 | 0.8158 |

| 2022 | 0.7079 | 0.7633 | 0.6830 | 0.6805 | 0.8345 | 0.9017 | 0.8507 | 0.7577 | 0.8483 | 0.8465 | 0.8029 | 0.8981 |

| Variant | Number of Employees Input Slack Variables | Operating Cost Input Slack Variables | Fixed Asset Input Slack Variables |

|---|---|---|---|

| Constant term (math.) | 0.1392 × 105 *** (2250.5034) | −16.4422 *** (−15.8777) | 96.7367 *** (53.9019) |

| Level of economic development | −0.1935 × 104 *** (−28.6420) | 2.5233 *** (3.8880) | −7.5245 *** (−2.8047) |

| Government support | 0.1810 × 104 *** (44.5424) | −8.1900 *** (−3.6784) | 9.3941 ** (2.1783) |

| Degree of regional industrial agglomeration | −0.2174 × 104 *** (−1109.4432) | 13.0861 *** (8.4986) | −20.6460 *** (−5.3881) |

| 0.1811 × 109 *** (0.1811 × 109) | 0.6343 × 104 *** (0.6292 × 104) | 0.1411 × 104 *** (0.1107 × 104) | |

| 0.8174 *** (34.5089) | 0.2544 × 10−2 ** (2.0700) | 0.5880 *** (10.6837) | |

| LR | 101.7466 *** | 52.3148 *** | 42.4716 *** |

| Year | Combined Technical Efficiency | Pure Technical Efficiency | Scale Efficiency | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Synthesis | Upper Reaches (of a River) | The Middle Stretches (of a River) | Lower Reaches (of a River) | Synthesis | Upper Reaches (of a River) | The Middle Stretches (of a River) | Lower Reaches (of a River) | Synthesis | Upper Reaches (of a River) | The Middle Stretches (of a River) | Lower Reaches (of a River) | |

| 2018 | 0.2263 | 0.2622 | 0.0996 | 0.4442 | 0.9750 | 0.9966 | 0.9541 | 0.9749 | 0.2321 | 0.2631 | 0.1043 | 0.4556 |

| 2019 | 0.2351 | 0.3615 | 0.0786 | 0.4576 | 0.9423 | 0.9815 | 0.9321 | 0.9147 | 0.2495 | 0.3683 | 0.0843 | 0.5003 |

| 2020 | 0.1779 | 0.2282 | 0.0656 | 0.3761 | 0.9599 | 0.9732 | 0.9739 | 0.9333 | 0.1853 | 0.2345 | 0.0674 | 0.4030 |

| 2021 | 0.1828 | 0.3097 | 0.0558 | 0.3534 | 0.9690 | 0.9671 | 0.9752 | 0.9646 | 0.1886 | 0.3202 | 0.0572 | 0.3664 |

| 2022 | 0.2269 | 0.3512 | 0.0931 | 0.3572 | 0.9661 | 0.9778 | 0.9921 | 0.9295 | 0.2349 | 0.3592 | 0.0938 | 0.3843 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, P.; Lu, B.; Qu, Y.; Ibrahim, H.; Ding, H. Efficiency Measurement and Trend Analysis of the Hydrogen Energy Industry Chain in China. Sustainability 2025, 17, 3140. https://doi.org/10.3390/su17073140

Zhang P, Lu B, Qu Y, Ibrahim H, Ding H. Efficiency Measurement and Trend Analysis of the Hydrogen Energy Industry Chain in China. Sustainability. 2025; 17(7):3140. https://doi.org/10.3390/su17073140

Chicago/Turabian StyleZhang, Pengcheng, Boliang Lu, Yijie Qu, Haslindar Ibrahim, and Hao Ding. 2025. "Efficiency Measurement and Trend Analysis of the Hydrogen Energy Industry Chain in China" Sustainability 17, no. 7: 3140. https://doi.org/10.3390/su17073140

APA StyleZhang, P., Lu, B., Qu, Y., Ibrahim, H., & Ding, H. (2025). Efficiency Measurement and Trend Analysis of the Hydrogen Energy Industry Chain in China. Sustainability, 17(7), 3140. https://doi.org/10.3390/su17073140