The Triple Pathway to Loyalty: Understanding How Banks’ Corporate Social Responsibility Influences Customers via Moral Identity, Service Quality, and Relationship Quality

Abstract

1. Introduction

2. Literature Review and Hypotheses Development

2.1. Theoretical Foundations of the Study

2.2. CSR

2.3. Consumer Moral Identity

2.4. Perceived Service Quality

2.5. Relationship Quality

2.6. Research Hypotheses and Conceptual Framework

3. Methodology

3.1. Measurement and Scaling

| Construct | Definition | Source |

|---|---|---|

| Corporate social responsibility (second-order construct) | Economic responsibility: Corporations create profits and shareholder value through the provision of products and services, while also generating employment opportunities and promoting economic development. Legal responsibility: Corporations comply with laws and regulations, operate with integrity, and prevent illegal activities. Ethical responsibility: Corporations practice business ethics and conduct their operations in ways that meet societal expectations, being responsible to stakeholders such as employees, customers, and the community. Philanthropic responsibility: Corporations voluntarily allocate resources to improve social welfare, give back to the community, and demonstrate a positive corporate citizenship image. | Bai & Chang [87]; García-Sánchez and García-Sánchez [88] |

| Consumer moral identity | Internalized moral identity: Individuals internalize moral traits as a core part of their self-concept, forming a stable moral self-perception. Symbolized moral identity: Individuals manifest their moral identity through specific actions, shaping an external moral image. | Aquino & Reed [40]; Reed & Aquino [89] |

| Service quality | The consumer’s overall assessment of a service’s excellence or superiority, based on the perceived performance across key service attributes that align with expectations, such as reliability, responsiveness, and assurance. | Parasuraman et al. [90]; Kang and James [91]; Karatepe [92]; |

| Relationship quality | Satisfaction: The overall level of contentment consumers feel towards the bank’s services. Trust: The perception of a bank’s integrity and reliability by consumers. | Bhattacherjee et al. [93]; Chen [58] |

| Loyalty | Consumer behavior of repeatedly purchasing and using bank services. | Amin [48]; Raza et al. [67] |

3.2. Data Collection and Sampling

4. Data Analysis

5. Discussion and Conclusion

5.1. Research Finding and Practical Implications

5.2. Theoretical Implications

5.3. Research Limitations and Future Research Directions

5.4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| CSR | Corporate social responsibility |

| CMI | Consumer moral identity |

| PSQ | Perceived service quality |

| LOY | Loyalty |

| RQ | Relationship quality |

| AVE | Average Variance Extracted |

| HTMT | Heterotrait–monotrait |

Appendix A

| Constructs | Research Items | References |

|---|---|---|

| Economic Responsibility (ECONR) | This bank creates reasonable investment returns for shareholders. (ECONR1) This bank generates employment opportunities for society. (ECONR2) This bank provides customers with high-value services. (ECONR3) This bank promotes local economic development. (ECONR4) | [134,135] |

| Legal Responsibility (LEGR) | This bank strictly complies with all applicable laws and regulations. (LEGR1) This bank has established a comprehensive corporate governance and internal control mechanism. (LEGR2) This bank pays taxes honestly and does not engage in tax evasion. (LEGR3) This bank signs legally compliant contracts with customers and business partners. (LEGR4) | [134,135] |

| Ethical Responsibility (ETHR) | This bank considers the interests of all stakeholders when conducting its business. (ETHR1) This bank implements a fair and transparent performance evaluation and promotion system. (ETHR2) This bank respects and protects customer privacy. (ETHR3) This bank has established a code of ethical conduct to guide employee behavior. (ETHR4) | [134,135] |

| Philanthropic Responsibility (PHIR) | This bank allocates resources to support public welfare initiatives such as education, culture, and sports. (PHIR1) Employees of this bank actively participate in community volunteer services. (PHIR2) This bank donates to disaster relief efforts and supports disadvantaged groups. (PHIR3) This bank enhances its corporate reputation through charitable activities. (PHIR4) | [134,135] |

| Internalized Moral Identity (IMI) | Being a moral person is very important to me. (IMI1) I consider myself a principled person. (IMI2) I frequently reflect on my moral conduct. (IMI3) Regardless of changes in the external environment, my moral beliefs remain consistent. (IMI4) | [40,89] |

| Symbolized Moral Identity (SMI) | I want others to see me as an honest and upright person. (SMI1) I openly express my moral stance. (SMI2) I enjoy participating in charitable or volunteer activities that reflect my personal morals. (SMI3) Purchasing or using products with ethical controversies makes me feel uneasy. (SMI4) | [40,89] |

| Perceived Service Quality (PSQ) |

The bank services meet my needs well. (PSQ1) I am satisfied with the quality of the bank services I received. (PSQ2) I feel the services I received from this bank are better than those I received from others. (PSQ3) I feel the services I received from this firm are more reliable than those I received from others. (PSQ4) | [136] |

| Satisfaction (SAT) | I am satisfied with the services provided by this bank. (SAT1) The services offered by this bank meet my expectations. (SAT2) Interacting with this bank makes me feel pleasant. (SAT3) Overall, I am satisfied with the services of this bank. (SAT4) | [19,137] |

| Trust (TRU) | I believe this bank treats me honestly. (TRU1) I consider this bank to be trustworthy. (TRU2) This bank cares about my best interests. (TRU3) I trust that this bank has the capability to provide high-quality services. (TRU4) | [137] |

| Loyalty (LOY) | I will continue to use the services of this bank. (LOY1) Over the past year, I have increased the frequency of using this bank’s services. (LOY2) I intend to continue using this bank’s services in the future. (LOY3) When I need banking services, this bank is my first choice. (LOY4) | [19] |

References

- Jouini, F.; Chouchen, M.A.; Messai, A.S. Corporate Social Responsibility, Efficiency, and Risk in US Banking. Risks 2025, 13, 10. [Google Scholar] [CrossRef]

- Tasnia, M.; Syed Jafaar Alhabshi, S.M.B.; Rosman, R.; Kabir, M.R. Corporate social responsibility and the financial performance of global banks: The moderating role of corporate tax. J. Sustain. Financ. Invest. 2025, 1–22. [Google Scholar] [CrossRef]

- Seo, K.; Moon, J.; Lee, S. Synergy of corporate social responsibility and service quality for airlines: The moderating role of carrier type. J. Air Transp. Manag. 2015, 47, 126–134. [Google Scholar] [CrossRef]

- Chuah, S.H.-W.; El-Manstrly, D.; Tseng, M.-L.; Ramayah, T. Sustaining customer engagement behavior through corporate social responsibility: The roles of environmental concern and green trust. J. Clean. Prod. 2020, 262, 121348. [Google Scholar] [CrossRef]

- Green, T.; Peloza, J. How does corporate social responsibility create value for consumers? J. Consum. Mark. 2011, 28, 48–56. [Google Scholar] [CrossRef]

- Sen, S.; Du, S.; Bhattacharya, C.B. Corporate social responsibility: A consumer psychology perspective. Curr. Opin. Psychol. 2016, 10, 70–75. [Google Scholar] [CrossRef]

- Quezado, T.C.C.; Cavalcante, W.Q.F.; Fortes, N.; Ramos, R.F. Corporate social responsibility and marketing: A bibliometric and visualization analysis of the literature between the years 1994 and 2020. Sustainability 2022, 14, 1694. [Google Scholar] [CrossRef]

- Fatma, M.; Rahman, Z. Consumer perspective on CSR literature review and future research agenda. Manag. Res. Rev. 2015, 38, 195–216. [Google Scholar] [CrossRef]

- Alvarado-Herrera, A.; Bigne, E.; Aldas-Manzano, J.; Curras-Perez, R. A scale for measuring consumer perceptions of corporate social responsibility following the sustainable development paradigm. J. Bus. Ethics 2017, 140, 243–262. [Google Scholar] [CrossRef]

- Gangi, F.; Mustilli, M.; Varrone, N. The impact of corporate social responsibility (CSR) knowledge on corporate financial performance: Evidence from the European banking industry. J. Knowl. Manag. 2018, 23, 110–134. [Google Scholar] [CrossRef]

- Öberseder, M.; Schlegelmilch, B.B.; Murphy, P.E.; Gruber, V. Consumers’ perceptions of corporate social responsibility: Scale development and validation. J. Bus. Ethics 2014, 124, 101–115. [Google Scholar]

- Pérez, A.; Del Bosque, I.R. Corporate social responsibility and customer loyalty: Exploring the role of identification, satisfaction and type of company. J. Serv. Mark. 2015, 29, 15–25. [Google Scholar]

- Loureiro, S.M.; Sardinha, I.M.D.; Reijnders, L. The effect of corporate social responsibility on consumer satisfaction and perceived value: The case of the automobile industry sector in Portugal. J. Clean. Prod. 2012, 37, 172–178. [Google Scholar]

- He, H.; Harris, L. The impact of Covid-19 pandemic on corporate social responsibility and marketing philosophy. J. Bus. Res. 2020, 116, 176–182. [Google Scholar]

- Wu, B.; Yang, Z. The impact of moral identity on consumers’ green consumption tendency: The role of perceived responsibility for environmental damage. J. Environ. Psychol. 2018, 59, 74–84. [Google Scholar]

- García-Madariaga, J.; Rodríguez-Rivera, F. Corporate social responsibility, customer satisfaction, corporate reputation, and firms’ market value: Evidence from the automobile industry. Span. J. Mark.-ESIC 2017, 21, 39–53. [Google Scholar] [CrossRef]

- Ashforth, B.E.; Mael, F. Social identity theory and the organization. Acad. Manag. Rev. 1989, 14, 20–39. [Google Scholar]

- Haski-Leventhal, D.; Roza, L.; Meijs, L.C. Congruence in corporate social responsibility: Connecting the identity and behavior of employers and employees. J. Bus. Ethics 2017, 143, 35–51. [Google Scholar]

- Rather, R.A. Investigating the impact of customer brand identification on hospitality brand loyalty: A social identity perspective. J. Hosp. Mark. Manag. 2018, 27, 487–513. [Google Scholar]

- Yankovskaya, V.; Gerasimova, E.B.; Osipov, V.S.; Lobova, S.V. Environmental CSR from the standpoint of stakeholder theory: Rethinking in the era of artificial intelligence. Front. Environ. Sci. 2022, 10, 953996. [Google Scholar] [CrossRef]

- Hillenbrand, C.; Money, K.; Pavelin, S. Stakeholder-defined corporate responsibility for a pre-credit-crunch financial service company: Lessons for how good reputations are won and lost. J. Bus. Ethics 2012, 105, 337–356. [Google Scholar]

- Han, H.; Al-Ansi, A.; Chi, X.; Baek, H.; Lee, K.-S. Impact of environmental CSR, service quality, emotional attachment, and price perception on word-of-mouth for full-service airlines. Sustainability 2020, 12, 3974. [Google Scholar] [CrossRef]

- Gangi, F.; Meles, A.; D’Angelo, E.; Daniele, L.M. Sustainable development and corporate governance in the financial system: Are environmentally friendly banks less risky? Corp. Soc. Responsib. Environ. Manag. 2019, 26, 529–547. [Google Scholar]

- Weber, O.; Feltmate, B. Sustainable Banking: Managing the Social and Environmental Impact of Financial Institutions; University of Toronto Press: Toronto, ON, Canada, 2016. [Google Scholar]

- Carroll, A.B. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Khan, A.; Chen, C.-C.; Suanpong, K.; Ruangkanjanases, A.; Kittikowit, S.; Chen, S.-C. The impact of CSR on sustainable innovation ambidexterity: The mediating role of sustainable supply chain management and second-order social capital. Sustainability 2021, 13, 12160. [Google Scholar] [CrossRef]

- Khan, A.; Chen, L.-R.; Hung, C.-Y. The Role of Corporate Social Responsibility in Supporting Second-Order Social Capital and Sustainable Innovation Ambidexterity. Sustainability 2021, 13, 6994. [Google Scholar] [CrossRef]

- Tao, Y.-T.; Lin, M.-D.; Khan, A. The impact of CSR on green purchase intention: Empirical evidence from the green building Industries in Taiwan. Front. Psychol. 2022, 13, 1055505. [Google Scholar]

- Bianchi, E.; Bruno, J.M.; Sarabia-Sanchez, F.J. The impact of perceived CSR on corporate reputation and purchase intention. Eur. J. Manag. Bus. Econ. 2019, 28, 206–221. [Google Scholar]

- Aracil, E. Corporate social responsibility of Islamic and conventional banks: The influence of institutions in emerging countries. Int. J. Emerg. Mark. 2019, 14, 582–600. [Google Scholar]

- Forcadell, F.J.; Aracil, E. European banks’ reputation for corporate social responsibility. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 1–14. [Google Scholar]

- Araújo, J.; Pereira, I.V.; Santos, J.D. The effect of corporate social responsibility on brand image and brand equity and its impact on consumer satisfaction. Adm. Sci. 2023, 13, 118. [Google Scholar] [CrossRef]

- Al-Haddad, S.; Sharabati, A.-A.A.; Al-Khasawneh, M.; Maraqa, R.; Hashem, R. The influence of corporate social responsibility on consumer purchase intention: The mediating role of consumer engagement via social media. Sustainability 2022, 14, 6771. [Google Scholar] [CrossRef]

- Klein, J.; Dawar, N. Corporate social responsibility and consumers’ attributions and brand evaluations in a product–harm crisis. Int. J. Res. Mark. 2004, 21, 203–217. [Google Scholar] [CrossRef]

- Pérez, A.; Rodríguez del Bosque, I. Measuring CSR image: Three studies to develop and to validate a reliable measurement tool. J. Bus. Ethics 2013, 118, 265–286. [Google Scholar]

- Birindelli, G.; Ferretti, P.; Intonti, M.; Iannuzzi, A.P. On the drivers of corporate social responsibility in banks: Evidence from an ethical rating model. J. Manag. Gov. 2015, 19, 303–340. [Google Scholar]

- Miralles-Quirós, M.M.; Miralles-Quirós, J.L.; Redondo-Hernández, J. The impact of environmental, social, and governance performance on stock prices: Evidence from the banking industry. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 1446–1456. [Google Scholar]

- Nizam, E.; Ng, A.; Dewandaru, G.; Nagayev, R.; Nkoba, M.A. The impact of social and environmental sustainability on financial performance: A global analysis of the banking sector. J. Multinatl. Financ. Manag. 2019, 49, 35–53. [Google Scholar]

- Cui, Y.; Geobey, S.; Weber, O.; Lin, H. The impact of green lending on credit risk in China. Sustainability 2018, 10, 2008. [Google Scholar] [CrossRef]

- Aquino, K.; Reed II, A. The self-importance of moral identity. J. Personal. Soc. Psychol. 2002, 83, 1423. [Google Scholar]

- Chowdhury, R.M.; Fernando, M. The relationships of empathy, moral identity and cynicism with consumers’ ethical beliefs: The mediating role of moral disengagement. J. Bus. Ethics 2014, 124, 677–694. [Google Scholar]

- He, Y.; Lai, K.K. The effect of corporate social responsibility on brand loyalty: The mediating role of brand image. Total Qual. Manag. Bus. Excell. 2014, 25, 249–263. [Google Scholar] [CrossRef]

- Chowdhury, R.M. Emotional intelligence and consumer ethics: The mediating role of personal moral philosophies. J. Bus. Ethics 2017, 142, 527–548. [Google Scholar] [CrossRef]

- Mostafa, R.B.; ElSahn, F. Exploring the mechanism of consumer responses to CSR activities of Islamic banks: The mediating role of Islamic ethics fit. Int. J. Bank Mark. 2016, 34, 940–962. [Google Scholar] [CrossRef]

- Bravo, R.; Matute, J.; Pina, J.M. Corporate identity management in the banking sector: Effects on employees’ identification, identity attractiveness, and job satisfaction. Serv. Bus. 2016, 10, 687–714. [Google Scholar] [CrossRef]

- Pérez, A.; del Mar García de los Salmones, M.; Liu, M.T. Maximising business returns to corporate social responsibility communication: An empirical test. Bus. Ethics A Eur. Rev. 2019, 28, 275–289. [Google Scholar]

- Lai, C.-S.; Chiu, C.-J.; Yang, C.-F.; Pai, D.-C. The effects of corporate social responsibility on brand performance: The mediating effect of industrial brand equity and corporate reputation. J. Bus. Ethics 2010, 95, 457–469. [Google Scholar]

- Amin, M. Internet banking service quality and its implication on e-customer satisfaction and e-customer loyalty. Int. J. Bank Mark. 2016, 34, 280–306. [Google Scholar] [CrossRef]

- Kant, R.; Jaiswal, D. The impact of perceived service quality dimensions on customer satisfaction: An empirical study on public sector banks in India. Int. J. Bank Mark. 2017, 35, 411–430. [Google Scholar] [CrossRef]

- Pakurár, M.; Haddad, H.; Nagy, J.; Popp, J.; Oláh, J. The service quality dimensions that affect customer satisfaction in the Jordanian banking sector. Sustainability 2019, 11, 1113. [Google Scholar] [CrossRef]

- Parasuraman, A.; Zeithaml, V.A.; Berry, L. SERVQUAL: A multiple-item scale for measuring consumer perceptions of service quality. J. Retail. 1988, 64, 12–40. [Google Scholar]

- Shankar, A.; Jebarajakirthy, C. The influence of e-banking service quality on customer loyalty: A moderated mediation approach. Int. J. Bank Mark. 2019, 37, 1119–1142. [Google Scholar]

- Kaura, V.; Durga Prasad, C.S.; Sharma, S. Service quality, service convenience, price and fairness, customer loyalty, and the mediating role of customer satisfaction. Int. J. Bank Mark. 2015, 33, 404–422. [Google Scholar]

- Yilmaz, V.; Ari, E.; Gürbüz, H. Investigating the relationship between service quality dimensions, customer satisfaction and loyalty in Turkish banking sector: An application of structural equation model. Int. J. Bank Mark. 2018, 36, 423–440. [Google Scholar]

- Levy, S.; Hino, H. Emotional brand attachment: A factor in customer-bank relationships. Int. J. Bank Mark. 2016, 34, 136–150. [Google Scholar]

- Nadlifatin, R.; Lin, S.-C.; Rachmaniati, Y.P.; Persada, S.F.; Razif, M. A pro-environmental reasoned action model for measuring citizens’ intentions regarding ecolabel product usage. Sustainability 2016, 8, 1165. [Google Scholar] [CrossRef]

- Paulet, E.; Parnaudeau, M.; Relano, F. Banking with ethics: Strategic moves and structural changes of the banking industry in the aftermath of the subprime mortgage crisis. J. Bus. Ethics 2015, 131, 199–207. [Google Scholar] [CrossRef]

- Chen, S.C. To use or not to use: Understanding the factors affecting continuance intention of mobile banking. Int. J. Mob. Commun. 2012, 10, 490–507. [Google Scholar]

- Kashif, M.; Shukran, S.S.W.; Rehman, M.A.; Sarifuddin, S. Customer satisfaction and loyalty in Malaysian Islamic banks: A PAKSERV investigation. Int. J. Bank Mark. 2015, 33, 23–40. [Google Scholar]

- Leninkumar, V. The relationship between customer satisfaction and customer trust on customer loyalty. Int. J. Acad. Res. Bus. Soc. Sci. 2017, 7, 450–465. [Google Scholar]

- Rajaobelina, L.; Bergeron, J. Antecedents and consequences of buyer-seller relationship quality in the financial services industry. Int. J. Bank Mark. 2009, 27, 359–380. [Google Scholar]

- Bapat, D. Exploring the antecedents of loyalty in the context of multi-channel banking. Int. J. Bank Mark. 2017, 35, 174–186. [Google Scholar] [CrossRef]

- Ladhari, R.; Ladhari, I.; Morales, M. Bank service quality: Comparing Canadian and Tunisian customer perceptions. Int. J. Bank Mark. 2011, 29, 224–246. [Google Scholar] [CrossRef]

- Roy, S.K.; Balaji, M.; Soutar, G.; Lassar, W.M.; Roy, R. Customer engagement behavior in individualistic and collectivistic markets. J. Bus. Res. 2018, 86, 281–290. [Google Scholar] [CrossRef]

- Fullerton, G. The moderating effect of normative commitment on the service quality-customer retention relationship. Eur. J. Mark. 2014, 48, 657–673. [Google Scholar] [CrossRef]

- Sumaedi, S.; Juniarti, R.P.; Bakti, I.G.M.Y. Understanding trust & commitment of individual saving customers in Islamic banking: The role of ego involvement. J. Islam. Mark. 2015, 6, 406–428. [Google Scholar]

- Raza, S.A.; Umer, A.; Qureshi, M.A.; Dahri, A.S. Internet banking service quality, e-customer satisfaction and loyalty: The modified e-SERVQUAL model. TQM J. 2020, 32, 1443–1466. [Google Scholar] [CrossRef]

- Rajaobelina, L. The impact of customer experience on relationship quality with travel agencies in a multichannel environment. J. Travel Res. 2018, 57, 206–217. [Google Scholar] [CrossRef]

- Mbama, C.I.; Ezepue, P.O. Digital banking, customer experience and bank financial performance: UK customers’ perceptions. Int. J. Bank Mark. 2018, 36, 230–255. [Google Scholar] [CrossRef]

- Hossain, T.M.T.; Akter, S.; Kattiyapornpong, U.; Dwivedi, Y. Reconceptualizing integration quality dynamics for omnichannel marketing. Ind. Mark. Manag. 2020, 87, 225–241. [Google Scholar] [CrossRef]

- Perez, A.; Rodríguez del Bosque, I. Personal traits and customer responses to CSR perceptions in the banking sector. Int. J. Bank Mark. 2017, 35, 128–146. [Google Scholar] [CrossRef]

- Xie, Y.; Zheng, X. How does corporate learning orientation enhance industrial brand equity? The roles of firm capabilities and size. J. Bus. Ind. Mark. 2020, 35, 231–243. [Google Scholar] [CrossRef]

- Lichtenstein, D.R.; Drumwright, M.E.; Braig, B.M. The effect of corporate social responsibility on customer donations to corporate-supported nonprofits. J. Mark. 2004, 68, 16–32. [Google Scholar]

- Gallego-Álvarez, I.; Pucheta-Martínez, M.C. Environmental strategy in the global banking industry within the varieties of capitalism approach: The moderating role of gender diversity and board members with specific skills. Bus. Strategy Environ. 2020, 29, 347–360. [Google Scholar] [CrossRef]

- Shen, C.-H.; Wu, M.-W.; Chen, T.-H.; Fang, H. To engage or not to engage in corporate social responsibility: Empirical evidence from global banking sector. Econ. Model. 2016, 55, 207–225. [Google Scholar]

- Shakil, M.H.; Mahmood, N.; Tasnia, M.; Munim, Z.H. Do environmental, social and governance performance affect the financial performance of banks? A cross-country study of emerging market banks. Manag. Environ. Qual. Int. J. 2019, 30, 1331–1344. [Google Scholar]

- Fombrun, C.J.; Gardberg, N.A.; Barnett, M.L. Opportunity platforms and safety nets: Corporate citizenship and reputational risk. Bus. Soc. Rev. 2000, 105, 85–106. [Google Scholar]

- Aramburu, I.A.; Pescador, I.G. The effects of corporate social responsibility on customer loyalty: The mediating effect of reputation in cooperative banks versus commercial banks in the Basque country. J. Bus. Ethics 2019, 154, 701–719. [Google Scholar]

- Vitell, S.J. A case for consumer social responsibility (CnSR): Including a selected review of consumer ethics/social responsibility research. J. Bus. Ethics 2015, 130, 767–774. [Google Scholar]

- Grappi, S.; Romani, S.; Bagozzi, R.P. Consumer response to corporate irresponsible behavior: Moral emotions and virtues. J. Bus. Res. 2013, 66, 1814–1821. [Google Scholar]

- Khan, M.M.; Fasih, M. Impact of service quality on customer satisfaction and customer loyalty: Evidence from banking sector. Pak. J. Commer. Soc. Sci. (PJCSS) 2014, 8, 331–354. [Google Scholar]

- Monferrer Tirado, D.; Moliner Tena, M.Á.; Estrada Guillén, M. Ambidexterity as a key factor in banks’ performance: A marketing approach. J. Mark. Theory Pract. 2019, 27, 227–250. [Google Scholar]

- Sayani, H. Customer satisfaction and loyalty in the United Arab Emirates banking industry. Int. J. Bank Mark. 2015, 33, 351–375. [Google Scholar]

- Yao, T.; Qiu, Q.; Wei, Y. Retaining hotel employees as internal customers: Effect of organizational commitment on attitudinal and behavioral loyalty of employees. Int. J. Hosp. Manag. 2019, 76, 1–8. [Google Scholar]

- van Esterik-Plasmeijer, P.W.; Van Raaij, W.F. Banking system trust, bank trust, and bank loyalty. Int. J. Bank Mark. 2017, 35, 97–111. [Google Scholar]

- Kaabachi, S.; Obeid, H. Determinants of Islamic banking adoption in Tunisia: Empirical analysis. Int. J. Bank Mark. 2016, 34, 1069–1091. [Google Scholar]

- Bai, X.; Chang, J. Corporate social responsibility and firm performance: The mediating role of marketing competence and the moderating role of market environment. Asia Pac. J. Manag. 2015, 32, 505–530. [Google Scholar]

- García-Sánchez, I.-M.; García-Sánchez, A. Corporate social responsibility during COVID-19 pandemic. J. Open Innov. Technol. Mark. Complex. 2020, 6, 126. [Google Scholar]

- Reed II, A.; Aquino, K.F. Moral identity and the expanding circle of moral regard toward out-groups. J. Personal. Soc. Psychol. 2003, 84, 1270. [Google Scholar]

- Parasuraman, A.; Zeithaml, V.A.; Berry, L.L. Servqual: A multiple-item scale for measuring consumer perceptions of service quality. J. Retail. 1988, 64, 12–40. [Google Scholar]

- Kang, G.D.; James, J. Service quality dimensions: An examination of Grönroos’s service quality model. Manag. Serv. Qual. Int. J. 2004, 14, 266–277. [Google Scholar]

- Karatepe, O.M.; Yavas, U.; Babakus, E. Measuring service quality of banks: Scale development and validation. J. Retail. Consum. Serv. 2005, 12, 373–383. [Google Scholar] [CrossRef]

- Bhattacherjee, A.; Perols, J.; Sanford, C. Information technology continuance: A theoretic extension and empirical test. J. Comput. Inf. Syst. 2008, 49, 17–26. [Google Scholar] [CrossRef]

- Hair, J.F.; Anderson, R.E.; Babin, B.J.; Black, W.C. Multivariate Data Analysis: A Global Perspective; Pearson: Upper Saddle River, NJ, USA, 2010; Volume 7. [Google Scholar]

- Kline, R.B. Principles and Practice of Structural Equation Modeling; Guilford Publications: New York, NY, USA, 2023. [Google Scholar]

- Hair, J.F.; Sarstedt, M.; Pieper, T.M.; Ringle, C.M. The use of partial least squares structural equation modeling in strategic management research: A review of past practices and recommendations for future applications. Long Range Plan. 2012, 45, 320–340. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Danks, N.P.; Ray, S. Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R: A Workbook; Springer Nature: Cham, Switzerland, 2021. [Google Scholar]

- Nunnally, J.C. Psychometric Theory, 2nd ed.; McGraw Hill Book Company: New York, NY, USA, 1978. [Google Scholar]

- Dijkstra, T.K.; Henseler, J. Consistent partial least squares path modeling. MIS Q. 2015, 39, 297–316. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Danks, N.P.; Ray, S.; Hair, J.F. An introduction to structural equation modeling. In Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R: A Workbook; Springer: Cham, Switzerland, 2021; pp. 1–29. [Google Scholar]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Tenenhaus, M.; Vinzi, V.E.; Chatelin, Y.-M.; Lauro, C. PLS path modeling. Comput. Stat. Data Anal. 2005, 48, 159–205. [Google Scholar] [CrossRef]

- Wetzels, M.; Odekerken-Schröder, G.; Van Oppen, C. Using PLS path modeling for assessing hierarchical construct models: Guidelines and empirical illustration. MIS Q. 2009, 33, 177–195. [Google Scholar]

- Choi, B.; La, S. The impact of corporate social responsibility (CSR) and customer trust on the restoration of loyalty after service failure and recovery. J. Serv. Mark. 2013, 27, 223–233. [Google Scholar] [CrossRef]

- Pérez, A.; Rodríguez del Bosque, I. An integrative framework to understand how CSR affects customer loyalty through identification, emotions and satisfaction. J. Bus. Ethics 2015, 129, 571–584. [Google Scholar] [CrossRef]

- Chomvilailuk, R.; Butcher, K. Effects of quality and corporate social responsibility on loyalty. Serv. Ind. J. 2014, 34, 938–954. [Google Scholar]

- Castro-González, S.; Bande, B.; Fernández-Ferrín, P.; Kimura, T. Corporate social responsibility and consumer advocacy behaviors: The importance of emotions and moral virtues. J. Clean. Prod. 2019, 231, 846–855. [Google Scholar]

- Kim, S.-B.; Kim, D.-Y. The influence of corporate social responsibility, ability, reputation, and transparency on hotel customer loyalty in the US: A gender-based approach. SpringerPlus 2016, 5, 1537. [Google Scholar]

- Poolthong, Y.; Mandhachitara, R. Customer expectations of CSR, perceived service quality and brand effect in Thai retail banking. Int. J. Bank Mark. 2009, 27, 408–427. [Google Scholar]

- Khan, Z.; Ferguson, D.; Pérez, A. Customer responses to CSR in the Pakistani banking industry. Int. J. Bank Mark. 2015, 33, 471–493. [Google Scholar] [CrossRef]

- Pratihari, S.K.; Uzma, S.H. CSR and corporate branding effect on brand loyalty: A study on Indian banking industry. J. Prod. Brand Manag. 2018, 27, 57–78. [Google Scholar]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar]

- Islam, T.; Islam, R.; Pitafi, A.H.; Xiaobei, L.; Rehmani, M.; Irfan, M.; Mubarak, M.S. The impact of corporate social responsibility on customer loyalty: The mediating role of corporate reputation, customer satisfaction, and trust. Sustain. Prod. Consum. 2021, 25, 123–135. [Google Scholar]

- Chung, K.-H.; Yu, J.-E.; Choi, M.-G.; Shin, J.-I. The effects of CSR on customer satisfaction and loyalty in China: The moderating role of corporate image. J. Econ. Bus. Manag. 2015, 3, 542–547. [Google Scholar]

- Abbas, M.; Gao, Y.; Shah, S.S.H. CSR and customer outcomes: The mediating role of customer engagement. Sustainability 2018, 10, 4243. [Google Scholar] [CrossRef]

- Goyal, P.; Chanda, U. A Bayesian Network Model on the association between CSR, perceived service quality and customer loyalty in Indian Banking Industry. Sustain. Prod. Consum. 2017, 10, 50–65. [Google Scholar] [CrossRef]

- Amin, M.; Zahora Nasharuddin, S. Hospital service quality and its effects on patient satisfaction and behavioural intention. Clin. Gov. Int. J. 2013, 18, 238–254. [Google Scholar] [CrossRef]

- Hou, T.C.T. The relationship between corporate social responsibility and sustainable financial performance: Firm-level evidence from Taiwan. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 19–28. [Google Scholar] [CrossRef]

- Kuo, L.; Kuo, P.-W.; Chen, C.-C. Mandatory CSR disclosure, CSR assurance, and the cost of debt capital: Evidence from Taiwan. Sustainability 2021, 13, 1768. [Google Scholar] [CrossRef]

- Wang, L.-H.; Cao, X.-Y. Corporate governance, financial innovation and performance: Evidence from Taiwan’s Banking Industry. Int. J. Financ. Stud. 2022, 10, 32. [Google Scholar] [CrossRef]

- Yang, S.; Huang, Y.; Chan, H.-Y.; Yang, C.-H. The Impact of Corporate Social Responsibility Practices on Customer Value Co-Creation and Perception in the Digital Context: A Case Study of Taiwan Bank Industry. Sustainability 2023, 15, 8567. [Google Scholar] [CrossRef]

- Chang, C.-H. Proactive and reactive corporate social responsibility: Antecedent and consequence. Manag. Decis. 2015, 53, 451–468. [Google Scholar] [CrossRef]

- Liu, T.-K. ESG, corporate social responsibility and business effectiveness in Taiwan’s banking industry: Cost and risk perspectives. Asian Econ. Financ. Rev. 2024, 14, 12–28. [Google Scholar] [CrossRef]

- Lee, C.-Y.; Chang, W.-C.; Lee, H.-C. An investigation of the effects of corporate social responsibility on corporate reputation and customer loyalty–evidence from the Taiwan non-life insurance industry. Soc. Responsib. J. 2017, 13, 355–369. [Google Scholar] [CrossRef]

- Lee, C.-Y. Does corporate social responsibility influence customer loyalty in the Taiwan insurance sector? The role of corporate image and customer satisfaction. J. Promot. Manag. 2019, 25, 43–64. [Google Scholar] [CrossRef]

- Lin, L.; Hung, P.-H.; Chou, D.-W.; Lai, C.W. Financial performance and corporate social responsibility: Empirical evidence from Taiwan. Asia Pac. Manag. Rev. 2019, 24, 61–71. [Google Scholar]

- Cai, Y.; Yue, L.Q.; Lin, F.; Yan, S.; Yang, H. CSR as Hedging Against Institutional Transition Risk: Corporate Philanthropy After the Sunflower Movement in Taiwan. Adm. Sci. Q. 2025, 00018392241307852. [Google Scholar] [CrossRef]

- Pérez, A.; Rodríguez del Bosque, I. Corporate social responsibility and customer loyalty: Exploring the role of identification, satisfaction and type of company. J. Serv. Mark. 2015, 29, 15–25. [Google Scholar] [CrossRef]

- Kim, H.L.; Rhou, Y.; Uysal, M.; Kwon, N. An examination of the links between corporate social responsibility (CSR) and its internal consequences. Int. J. Hosp. Manag. 2017, 61, 26–34. [Google Scholar] [CrossRef]

- Jalilvand, M.R.; Nasrolahi Vosta, L.; Kazemi Mahyari, H.; Khazaei Pool, J. Social responsibility influence on customer trust in hotels: Mediating effects of reputation and word-of-mouth. Tour. Rev. 2017, 72, 1–14. [Google Scholar] [CrossRef]

- Yuen, K.F.; Thai, V.V.; Wong, Y.D.; Wang, X. Interaction impacts of corporate social responsibility and service quality on shipping firms’ performance. Transp. Res. Part A Policy Pract. 2018, 113, 397–409. [Google Scholar] [CrossRef]

- Maignan, I.; Ferrell, O. Corporate social responsibility and marketing: An integrative framework. J. Acad. Mark. Sci. 2004, 32, 3–19. [Google Scholar] [CrossRef]

- Chen, C.-C.; Khan, A.; Hongsuchon, T.; Ruangkanjanases, A.; Chen, Y.-T.; Sivarak, O.; Chen, S.-C. The Role of Corporate Social Responsibility and Corporate Image in Times of Crisis: The Mediating Role of Customer Trust. Int. J. Environ. Res. Public Health 2021, 18, 8275. [Google Scholar] [CrossRef]

- Sok, P.; O’cass, A. Achieving service quality through service innovation exploration–exploitation: The critical role of employee empowerment and slack resources. J. Serv. Mark. 2015, 29, 137–149. [Google Scholar] [CrossRef]

- Caceres, R.C.; Paparoidamis, N.G. Service quality, relationship satisfaction, trust, commitment and business-to-business loyalty. Eur. J. Mark. 2007, 41, 836–867. [Google Scholar]

| Construct | Indicator | Mean | Standard Deviation | Skewness | Kurtosis | Factor Loading | t-Value |

|---|---|---|---|---|---|---|---|

| Corporate social responsibility | ECONR (4 items) | 4.311 | 1.246 | −0.466 | −0.282 | 0.846 | 39.241 |

| LEGR (4 items) | 3.977 | 1.453 | −0.292 | −0.759 | 0.862 | 46.523 | |

| ETHR (4 items) | 3.682 | 1.497 | 0.048 | −0.995 | 0.902 | 86.799 | |

| PHIR (4 items) | 3.801 | 1.450 | −0.122 | −0.825 | 0.877 | 61.699 | |

| Consumer moral identity | IMI (4 items) | 3.914 | 1.477 | −0.302 | −0.752 | 0.936 | 123.980 |

| SMI (4 items) | 4.124 | 1.392 | −0.512 | −0.504 | 0.949 | 163.192 | |

| Perceived service quality | PSQ1 | 4.595 | 1.023 | −0.508 | 0.486 | 0.873 | 45.425 |

| PSQ2 | 4.624 | 1.040 | −0.628 | 0.686 | 0.878 | 50.027 | |

| PSQ3 | 4.500 | 1.097 | −0.480 | 0.133 | 0.876 | 53.330 | |

| PSQ4 | 4.411 | 1.122 | −0.433 | −0.038 | 0.845 | 33.776 | |

| Relationship quality | SAT (4 items) | 4.266 | 1.223 | −0.501 | −0.055 | 0.907 | 79.965 |

| TRU (4 items) | 4.569 | 1.122 | −0.713 | 0.453 | 0.919 | 91.804 | |

| Loyalty | LOY1 | 4.831 | 0.817 | −0.662 | 2.608 | 0.890 | 48.485 |

| LOY2 | 4.820 | 0.897 | −0.699 | 1.642 | 0.912 | 63.168 | |

| LOY3 | 4.846 | 0.913 | −0.650 | 1.284 | 0.919 | 68.780 | |

| LOY4 | 4.737 | 0.972 | −0.518 | 0.613 | 0.895 | 58.122 |

| Construct | Cronbach’s Alpha | Composite Reliability (Rho_a) | Composite Reliability (Rho_c) | Average Variance Extracted |

|---|---|---|---|---|

| CSR | 0.940 | 0.943 | 0.947 | 0.531 |

| CMI | 0.940 | 0.941 | 0.950 | 0.704 |

| PSQ | 0.891 | 0.891 | 0.924 | 0.754 |

| RQ | 0.903 | 0.905 | 0.922 | 0.599 |

| LOY | 0.926 | 0.926 | 0.947 | 0.817 |

| Construct | CSR | CMI | PSQ | RQ | LOY |

|---|---|---|---|---|---|

| CSR | 0.729 | ||||

| CMI | 0.388 | 0.839 | |||

| PSQ | 0.250 | 0.462 | 0.868 | ||

| RQ | 0.319 | 0.453 | 0.639 | 0.774 | |

| LOY | 0.341 | 0.480 | 0.680 | 0.743 | 0.904 |

| Construct Relationships | HTMT | Lower Bound of HTMT at a 95% Confidence Level | Upper Bound of HTMT at a 95% Confidence Level |

|---|---|---|---|

| CSR <-> CMI | 0.411 | 0.282 | 0.536 |

| CSR <-> PSQ | 0.276 | 0.144 | 0.418 |

| CSR <-> RQ | 0.350 | 0.215 | 0.484 |

| CSR <-> LOY | 0.372 | 0.236 | 0.495 |

| CMI <-> PSQ | 0.504 | 0.392 | 0.610 |

| CMI <-> RQ | 0.493 | 0.372 | 0.604 |

| CMI <-> LOY | 0.513 | 0.404 | 0.610 |

| PSQ <-> RQ | 0.718 | 0.616 | 0.804 |

| PSQ <-> LOY | 0.748 | 0.659 | 0.819 |

| RQ <-> LOY | 0.816 | 0.740 | 0.876 |

| Constructs | ECONR | ETHR | IMI | LEGR | LOY | PHIR | PSQ | SAT | SMI | Trust |

|---|---|---|---|---|---|---|---|---|---|---|

| ECONR1 | 0.718 | 0.355 | 0.228 | 0.455 | 0.474 | 0.365 | 0.282 | 0.302 | 0.263 | 0.354 |

| ECONR2 | 0.833 | 0.542 | 0.253 | 0.623 | 0.264 | 0.480 | 0.214 | 0.212 | 0.301 | 0.200 |

| ECONR3 | 0.884 | 0.559 | 0.205 | 0.716 | 0.263 | 0.555 | 0.176 | 0.153 | 0.219 | 0.199 |

| ECONR4 | 0.853 | 0.553 | 0.267 | 0.633 | 0.314 | 0.591 | 0.218 | 0.247 | 0.299 | 0.281 |

| ETHR1 | 0.602 | 0.722 | 0.260 | 0.748 | 0.228 | 0.564 | 0.153 | 0.148 | 0.233 | 0.207 |

| ETHR2 | 0.489 | 0.883 | 0.331 | 0.507 | 0.228 | 0.711 | 0.178 | 0.272 | 0.286 | 0.218 |

| ETHR3 | 0.488 | 0.917 | 0.405 | 0.511 | 0.235 | 0.785 | 0.214 | 0.285 | 0.329 | 0.199 |

| ETHR4 | 0.543 | 0.907 | 0.390 | 0.560 | 0.226 | 0.760 | 0.194 | 0.231 | 0.307 | 0.157 |

| IMI1 | 0.255 | 0.379 | 0.860 | 0.214 | 0.375 | 0.459 | 0.292 | 0.315 | 0.602 | 0.288 |

| IMI2 | 0.179 | 0.345 | 0.909 | 0.129 | 0.332 | 0.327 | 0.374 | 0.306 | 0.659 | 0.252 |

| IMI3 | 0.205 | 0.355 | 0.905 | 0.162 | 0.382 | 0.353 | 0.342 | 0.323 | 0.647 | 0.302 |

| IMI4 | 0.355 | 0.326 | 0.788 | 0.208 | 0.472 | 0.339 | 0.436 | 0.384 | 0.780 | 0.390 |

| LEGR1 | 0.741 | 0.565 | 0.186 | 0.837 | 0.187 | 0.517 | 0.089 | 0.149 | 0.176 | 0.136 |

| LEGR2 | 0.630 | 0.554 | 0.149 | 0.844 | 0.134 | 0.496 | 0.082 | 0.116 | 0.134 | 0.134 |

| LEGR3 | 0.535 | 0.520 | 0.075 | 0.794 | 0.218 | 0.455 | 0.157 | 0.123 | 0.108 | 0.098 |

| LEGR4 | 0.568 | 0.610 | 0.264 | 0.856 | 0.252 | 0.546 | 0.195 | 0.211 | 0.239 | 0.174 |

| LOY1 | 0.400 | 0.310 | 0.465 | 0.266 | 0.890 | 0.351 | 0.610 | 0.561 | 0.465 | 0.726 |

| LOY2 | 0.335 | 0.224 | 0.398 | 0.217 | 0.912 | 0.288 | 0.620 | 0.543 | 0.416 | 0.638 |

| LOY3 | 0.340 | 0.207 | 0.377 | 0.221 | 0.919 | 0.226 | 0.583 | 0.525 | 0.370 | 0.668 |

| LOY4 | 0.308 | 0.220 | 0.388 | 0.153 | 0.895 | 0.219 | 0.642 | 0.581 | 0.385 | 0.655 |

| PHIR1 | 0.511 | 0.651 | 0.322 | 0.453 | 0.281 | 0.798 | 0.174 | 0.258 | 0.280 | 0.212 |

| PHIR2 | 0.526 | 0.793 | 0.356 | 0.544 | 0.184 | 0.868 | 0.193 | 0.273 | 0.298 | 0.203 |

| PHIR3 | 0.516 | 0.712 | 0.353 | 0.541 | 0.179 | 0.877 | 0.148 | 0.221 | 0.271 | 0.171 |

| PHIR4 | 0.475 | 0.553 | 0.383 | 0.461 | 0.379 | 0.765 | 0.268 | 0.302 | 0.302 | 0.357 |

| PSQ1 | 0.236 | 0.193 | 0.340 | 0.176 | 0.590 | 0.199 | 0.873 | 0.496 | 0.384 | 0.488 |

| PSQ2 | 0.252 | 0.200 | 0.381 | 0.147 | 0.599 | 0.208 | 0.878 | 0.516 | 0.407 | 0.500 |

| PSQ3 | 0.209 | 0.199 | 0.397 | 0.136 | 0.591 | 0.203 | 0.876 | 0.514 | 0.414 | 0.456 |

| PSQ4 | 0.212 | 0.156 | 0.336 | 0.081 | 0.580 | 0.199 | 0.845 | 0.583 | 0.359 | 0.467 |

| SAT1 | 0.251 | 0.217 | 0.365 | 0.148 | 0.552 | 0.267 | 0.665 | 0.756 | 0.328 | 0.522 |

| SAT2 | 0.217 | 0.221 | 0.325 | 0.185 | 0.532 | 0.237 | 0.540 | 0.911 | 0.352 | 0.576 |

| SAT3 | 0.265 | 0.304 | 0.358 | 0.158 | 0.531 | 0.341 | 0.491 | 0.899 | 0.434 | 0.623 |

| SAT4 | 0.208 | 0.209 | 0.302 | 0.142 | 0.530 | 0.259 | 0.449 | 0.917 | 0.343 | 0.607 |

| SMI1 | 0.288 | 0.311 | 0.707 | 0.178 | 0.433 | 0.319 | 0.415 | 0.393 | 0.910 | 0.357 |

| SMI2 | 0.323 | 0.332 | 0.734 | 0.213 | 0.382 | 0.332 | 0.396 | 0.401 | 0.899 | 0.330 |

| SMI3 | 0.278 | 0.283 | 0.716 | 0.162 | 0.408 | 0.308 | 0.374 | 0.340 | 0.941 | 0.361 |

| SMI4 | 0.299 | 0.308 | 0.689 | 0.177 | 0.435 | 0.307 | 0.466 | 0.394 | 0.905 | 0.378 |

| TRU1 | 0.242 | 0.171 | 0.289 | 0.125 | 0.600 | 0.228 | 0.430 | 0.694 | 0.329 | 0.840 |

| TRU2 | 0.246 | 0.187 | 0.221 | 0.148 | 0.535 | 0.195 | 0.403 | 0.594 | 0.270 | 0.831 |

| TRU3 | 0.277 | 0.202 | 0.351 | 0.157 | 0.721 | 0.247 | 0.544 | 0.445 | 0.362 | 0.806 |

| TRU4 | 0.236 | 0.190 | 0.323 | 0.111 | 0.608 | 0.252 | 0.448 | 0.430 | 0.329 | 0.815 |

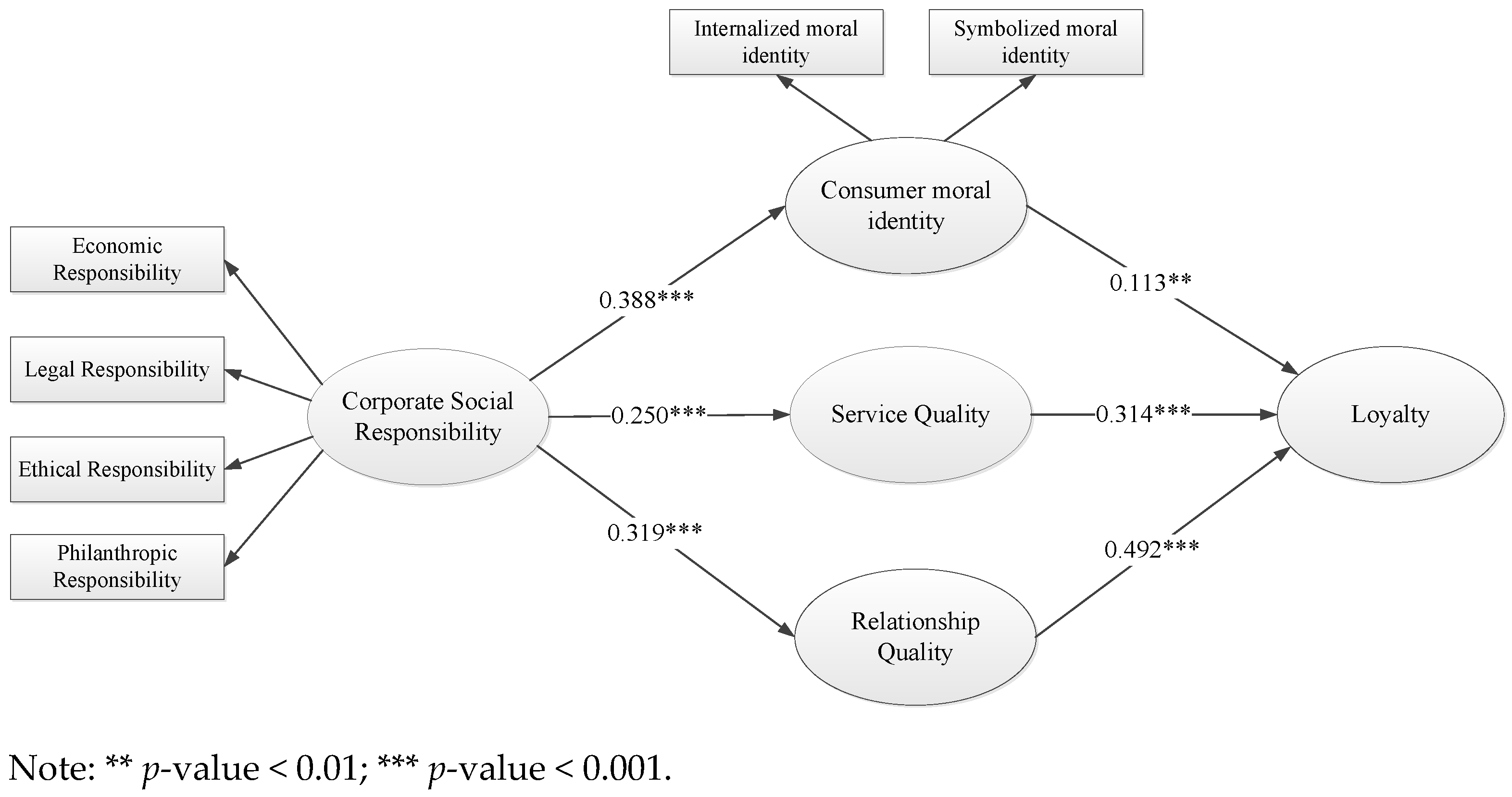

| Path | Standardized Path Coefficient | Standard Deviation (STDEV) | t-Value | p-Value |

|---|---|---|---|---|

| CSR -> CMI | 0.388 *** | 0.064 | 6.059 | 0.000 |

| CSR -> PSQ | 0.250 *** | 0.071 | 3.536 | 0.000 |

| CSR -> RQ | 0.319 *** | 0.068 | 4.657 | 0.000 |

| CMI -> LOY | 0.113 ** | 0.043 | 2.602 | 0.009 |

| PSQ -> LOY | 0.314 *** | 0.059 | 5.300 | 0.000 |

| RQ -> LOY | 0.492 *** | 0.058 | 8.486 | 0.000 |

| Indirect Influence | Indirect Path Coefficient | Standard Deviation (STDEV) | t-Value | p-Value |

|---|---|---|---|---|

| CSR -> CMI -> LOY | 0.044 * | 0.019 | 2.282 | 0.023 |

| CSR -> PSQ -> LOY | 0.078 ** | 0.029 | 2.685 | 0.007 |

| CSR -> RQ -> LOY | 0.157 *** | 0.042 | 3.750 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yen, Y.-C.; Chen, S.-C. The Triple Pathway to Loyalty: Understanding How Banks’ Corporate Social Responsibility Influences Customers via Moral Identity, Service Quality, and Relationship Quality. Sustainability 2025, 17, 3220. https://doi.org/10.3390/su17073220

Yen Y-C, Chen S-C. The Triple Pathway to Loyalty: Understanding How Banks’ Corporate Social Responsibility Influences Customers via Moral Identity, Service Quality, and Relationship Quality. Sustainability. 2025; 17(7):3220. https://doi.org/10.3390/su17073220

Chicago/Turabian StyleYen, Yun-Chan, and Shih-Chih Chen. 2025. "The Triple Pathway to Loyalty: Understanding How Banks’ Corporate Social Responsibility Influences Customers via Moral Identity, Service Quality, and Relationship Quality" Sustainability 17, no. 7: 3220. https://doi.org/10.3390/su17073220

APA StyleYen, Y.-C., & Chen, S.-C. (2025). The Triple Pathway to Loyalty: Understanding How Banks’ Corporate Social Responsibility Influences Customers via Moral Identity, Service Quality, and Relationship Quality. Sustainability, 17(7), 3220. https://doi.org/10.3390/su17073220