Lean, Agile, and Six Sigma: Efficiency and the Challenges of Today’s World: Is It Time for a Change?

Abstract

:1. Introduction

2. Materials and Methods

- Have the crises of recent years (COVID-19 pandemic, energy crisis, the war in Ukraine) had a significant impact on the economic situation of companies?

- Did the strategies and concepts used by companies to manage their processes, such as Lean Management, Agile, and Six Sigma, help them navigate through these crises?

- Does combining these strategies, e.g., Lean and Agile, have a positive impact on companies’ efficiency?

- Do these management concepts also have a positive impact on energy efficiency, which is extremely important in view of rising energy prices, or are new solutions needed?

- Are companies changing their existing methods of managing their processes and resources?

3. Results

3.1. Analysis of the Literature

- 5S and Visual Workplace, which provide visual indicators that make it easy to identify energy use targets, which can help employees and managers to be aware of energy consumption and opportunities for reduction;

- Standardized work: workplace procedures that take into account the best practices for reducing energy consumption in training materials, standard operation and maintenance of equipment, and 5S checklists;

- Poka-yoke—not making mistakes also reduces energy consumption;

- Total Productive Maintenance (TPM): by systematically maintaining equipment, plants can reduce defects in the production process and reduce energy costs by over 20%;

- Train employees to identify energy losses and increase equipment efficiency through maintenance and operation;

- Kaizen—to increase equipment performance;

- SMED—to reduce set-up and changeover times;

- VSM helps to understand how energy is used throughout the process;

- Selecting equipment with the right (optimal) parameters (performance, speed): e.g., an outdated machine has a much higher performance than required.

“The waste of energy and resources is typically overlooked or excluded from lean problem solving on the grounds that it is too complex for the front line to address, cuts across too many functions, or both”.

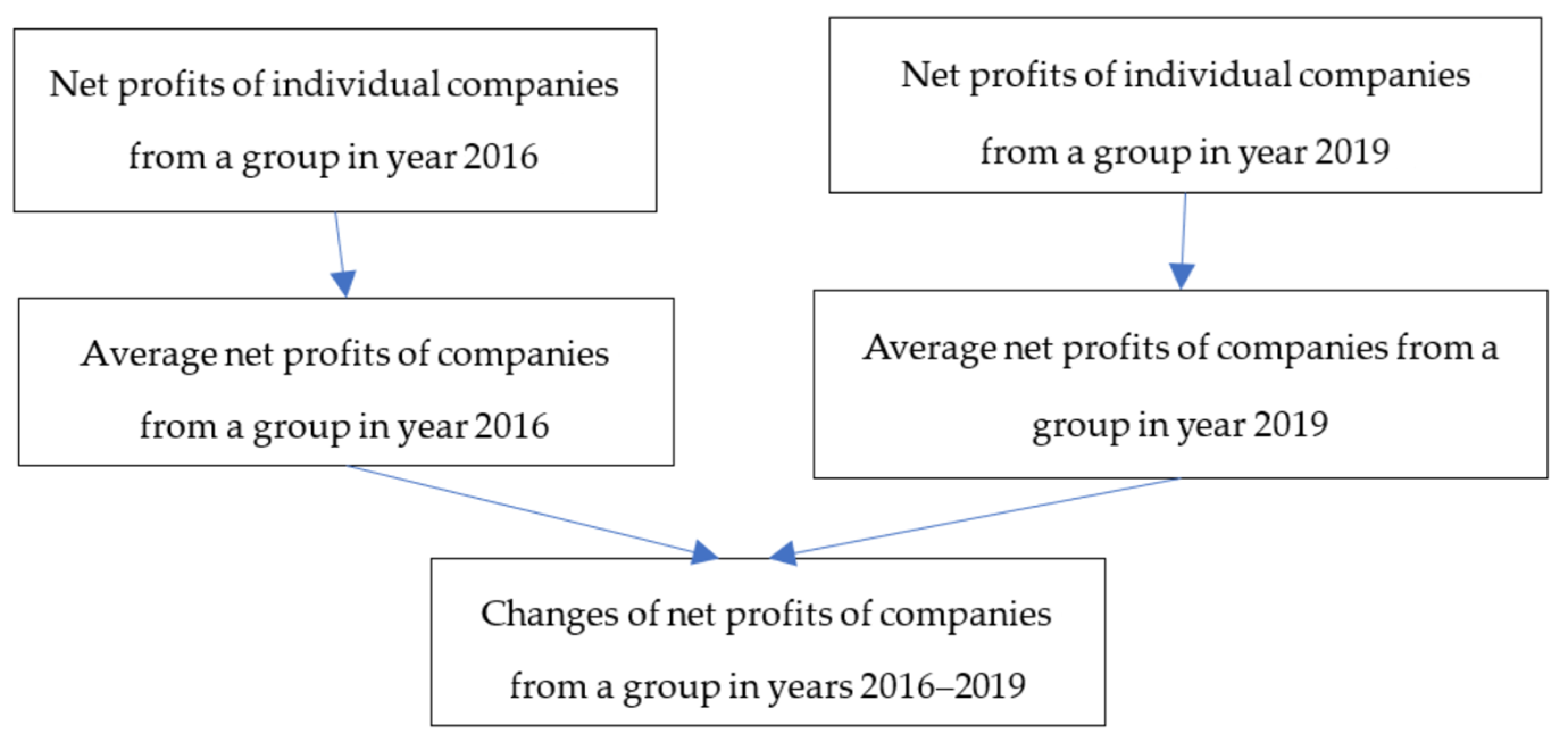

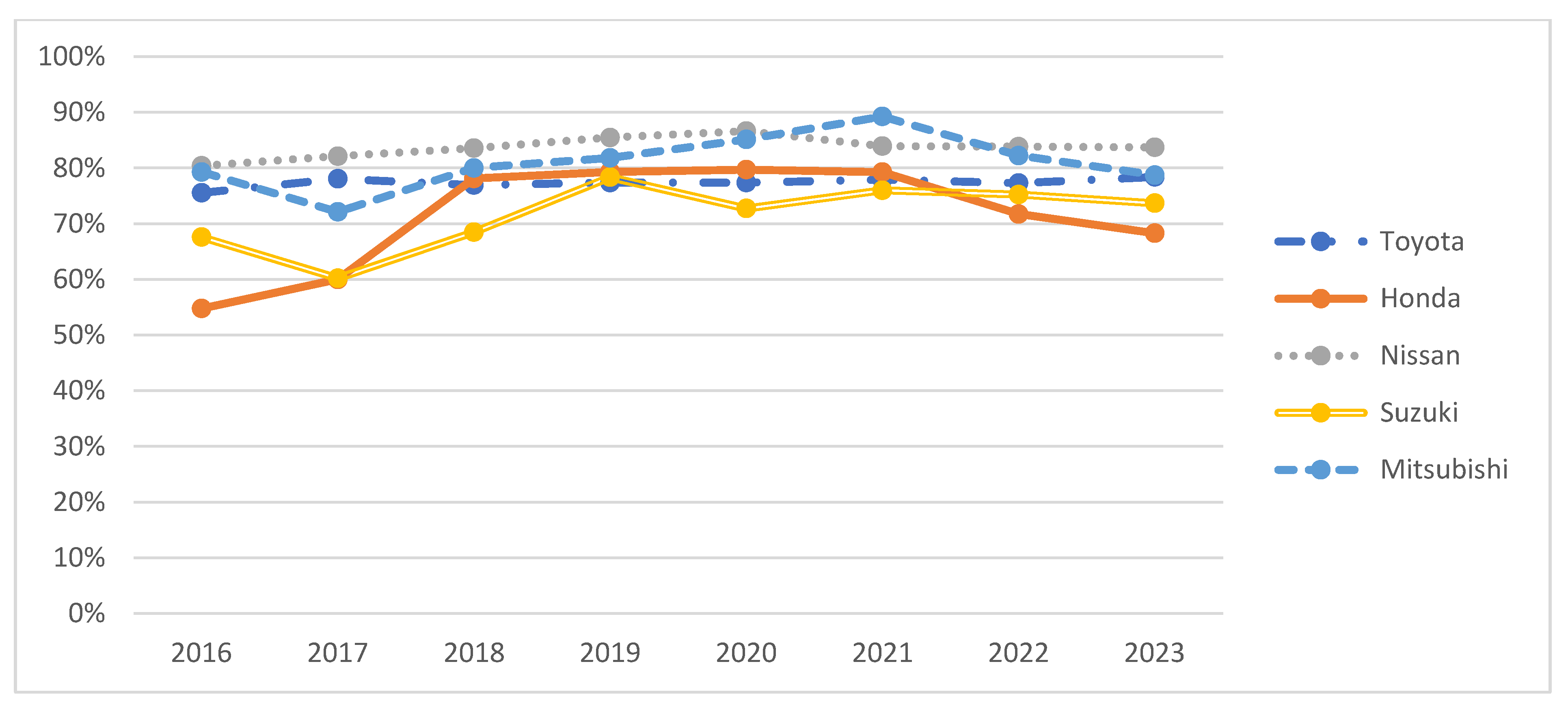

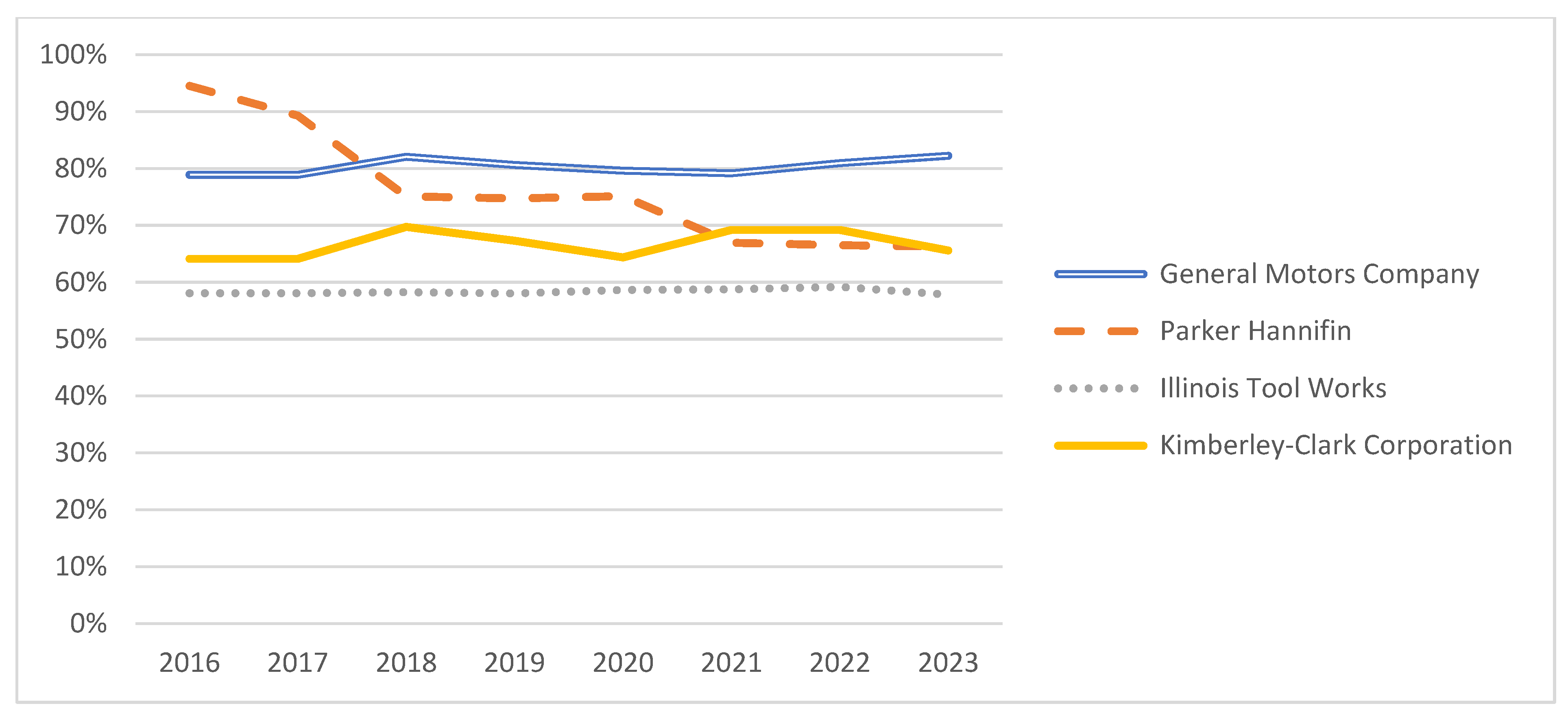

3.2. Analysis and Comparison of Companies’ Financial Performance

- Lean Management:

- Japanese companies (Toyota Motor Corporation, Toyota, Japan; Honda, Minato City, Japan; Nissan, Yokohama, Japan; Suzuki, Hamamatsu, Japan; Mitsubishi Motors Corporation, Minato City, Japan).

- American companies (General Motors Company, Detroit, MI, USA; Parker Hannifin, Hong Kong; Illinois Tool Works, Glenview, IL, USA; Kimberley-Clark Corporation, Irving, TX, USA; Textron, Providence, RI, USA; General Electric, Hong Kong; 3M, Saint Paul, MI, USA).

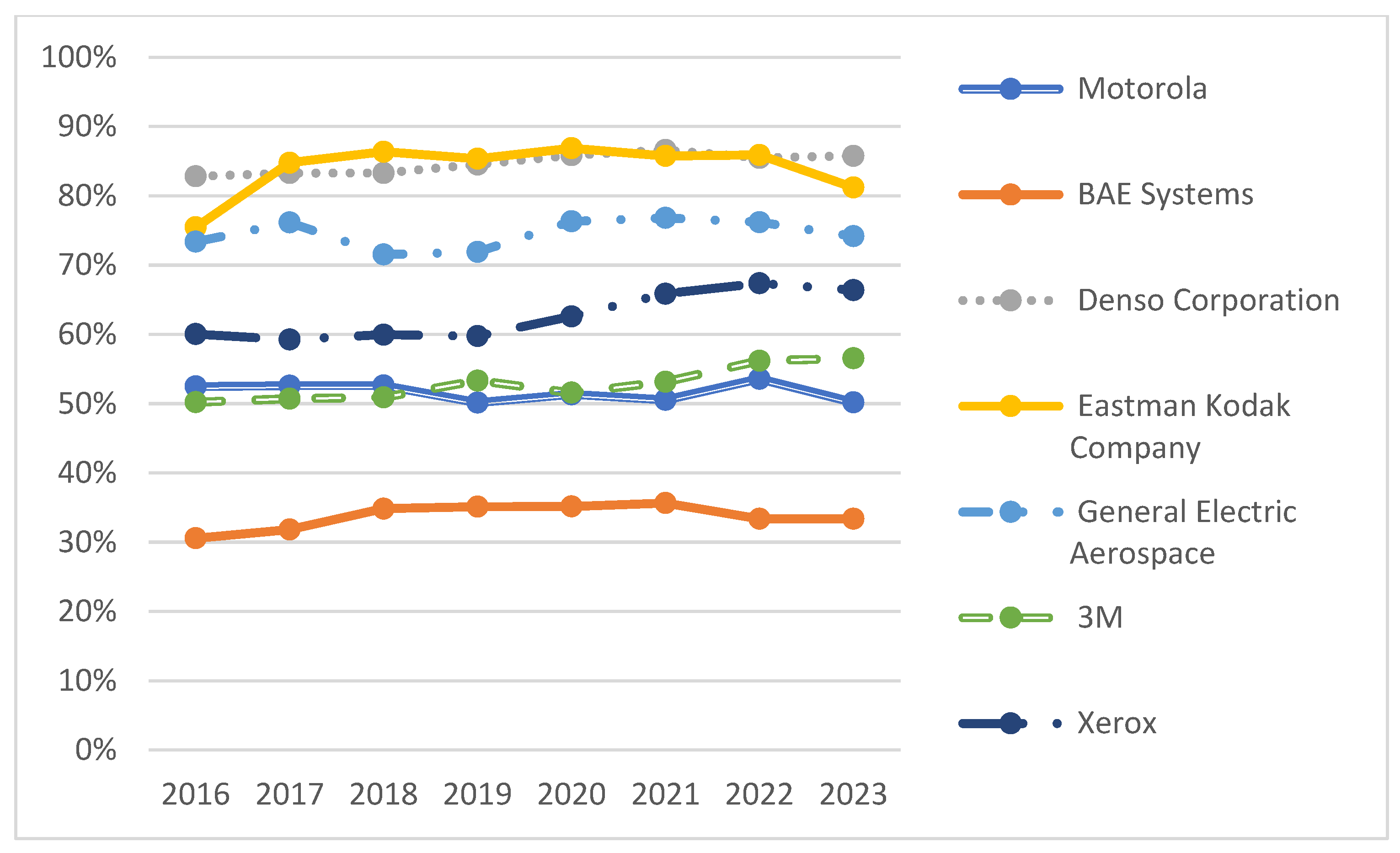

- Six Sigma (Motorola, Chicago, IL, USA; BAE Systems, London, UK; Denso Corporation, Kariya, Japan; Eastman Kodak Company, Rochester, NY, USA; Xerox, Norwalk, CT, USA; Boeing, Arlington County, VA, USA).

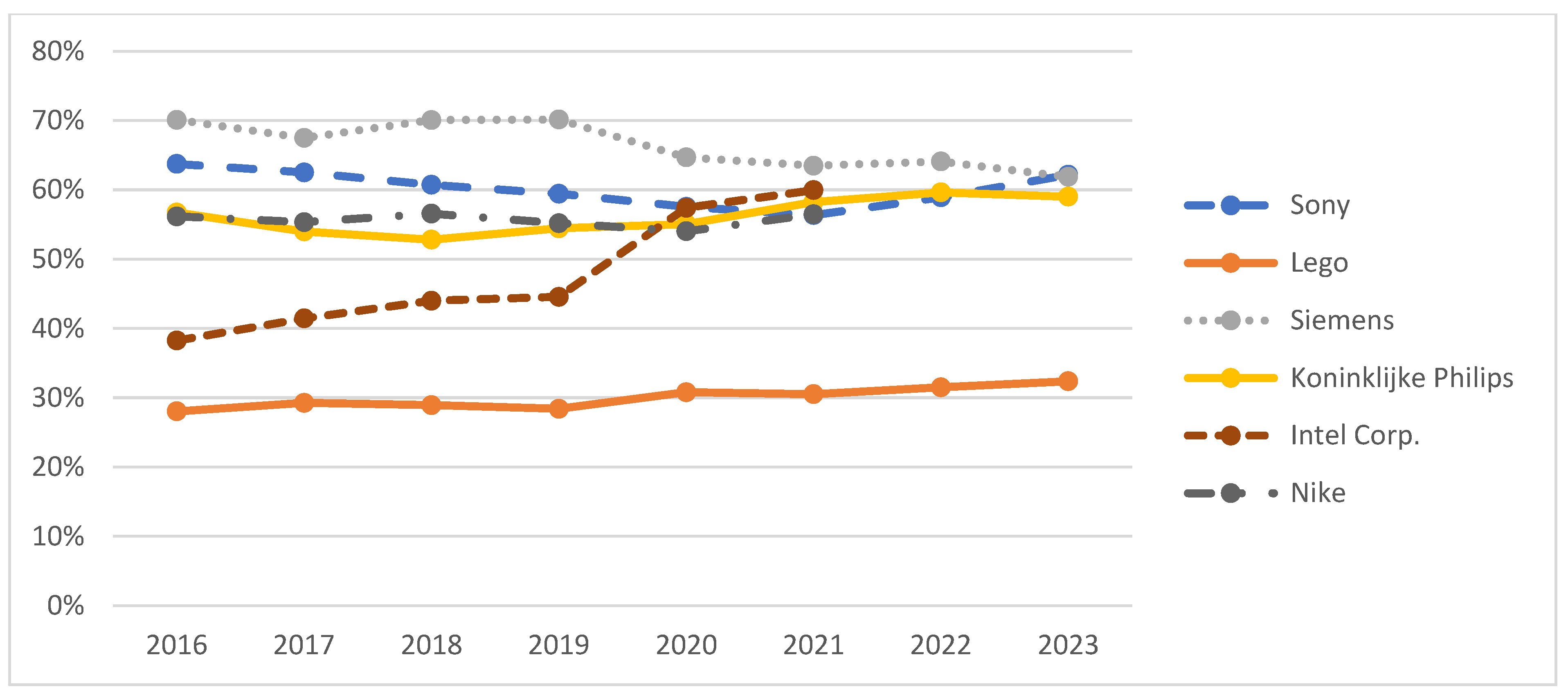

- Agile (Sony, Minato City, Japan; Lego, Billund, Denmark; Siemens, Munich, Germany; Koninklijke Philips, Amsterdam, The Netherlands).

- Combining these concepts:

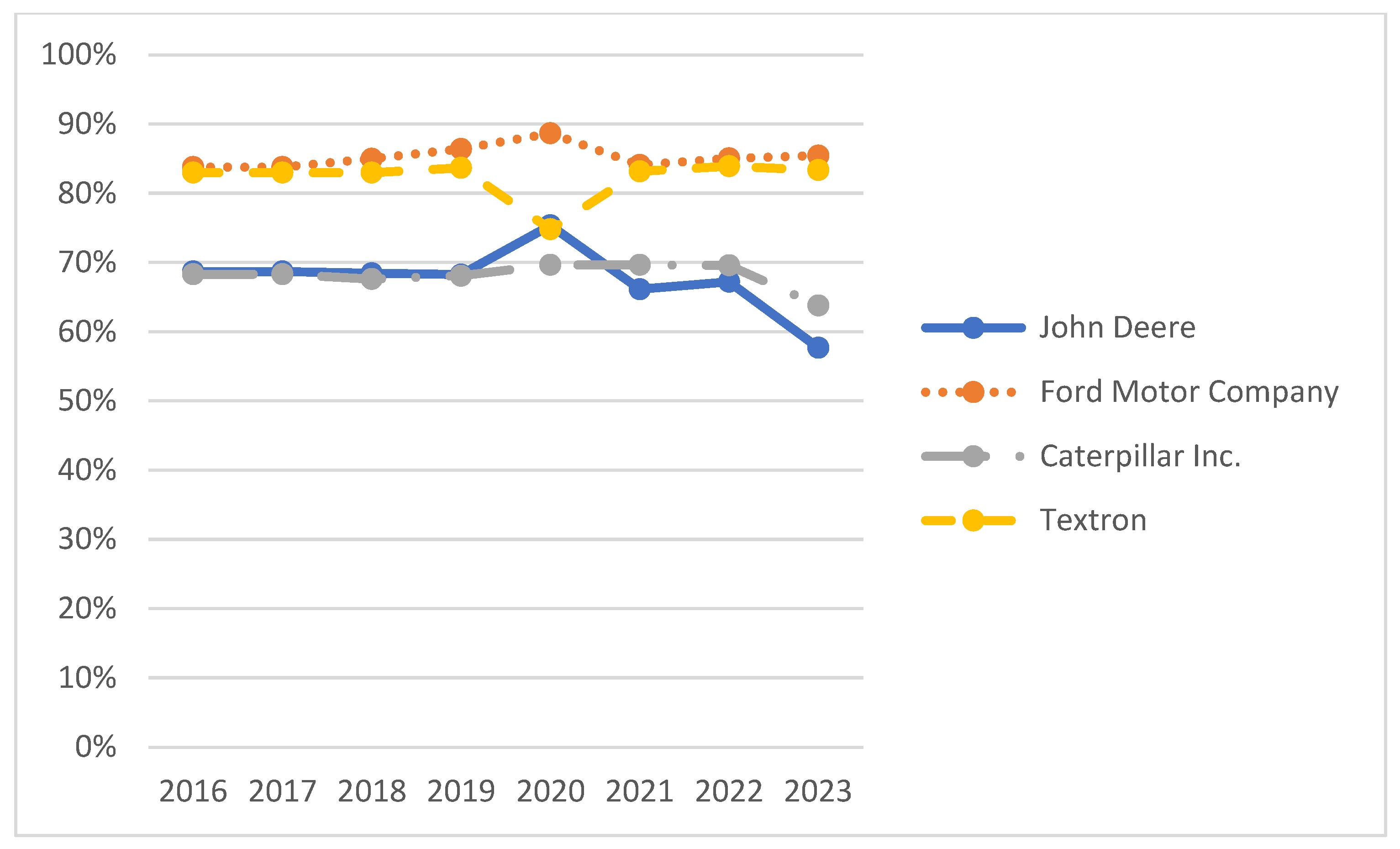

- LeanSixSigma (John Deere, Moline, IL, USA; Ford Motor Company, Dearborn, MI, USA; Caterpillar Inc., Irving, TX, USA; Textron, Providence, RI, USA).

- LeanAgile (Intel Corp., Santa Clara, CA, USA; Nike, Inc., Beaverton, OR, USA).

- A total of 15 Global corporations—the world’s largest manufacturing companies (Bayer, Leverkusen, Germany; IKEA, Delft, The Netherlands; Thyssenkrupp, Essen, Germany; Siemens, Munich, Germany; ABB, Zürich, Switzerland; Schneider Electric, Rueil-Malmaison, France; Continental, Hanover, Germany; BMW, Munich, Germany; Bosh, Stuttgart, Germany; Procter & Gamble, Cincinnati, OH, USA; Coca-Cola, Atlanta, GA, USA; PepsiCo, Harrison, NY, USA; Adidas, Herzogenaurach, Germany; Inditex, Arteixo, Spain; Zalando, Berlin, Germany).

- A total of 156 Polish manufacturing companies from industries: Chemicals, Wood, Paper, Furniture, Electrical, Rubber, Automotive, Clothing and Cosmetics, Pharmaceuticals, Food

3.3. Interviews

- Have costs increased or the economic situation worsened at a time of economic disruption and instability caused by the COVID-19 pandemic, the war in Ukraine, and fluctuating energy prices?

- Has the company had to make changes to its process organization?

- Has the increase in energy prices forced a change in previously used logistics strategies (Just-In-Time), and have inventories increased?

- Is Lean crisis-proof?

- Rising costs of raw materials and energy (the war in Ukraine).

- Supply chain problems (caused by the COVID-19 pandemic).

- Increase in labor costs (increase in the minimum wage).

“Lean is not immune to crises, and companies should adapt to phenomena in the modern world, which is facilitated by companies’ use of “lean thinking” and “lean management”. As far as JIT is concerned, even if a company experiences an increase in transportation costs (as a result of rising energy prices), this does not mean that it is necessary to increase delivery volumes and inventories, because the distance between the manufacturer and its supplier can be shortened”.

4. Discussion and Conclusions

- Lean Management generally has a positive impact on energy efficiency through the elimination of waste.

- Lean Manufacturingis considered one of the most effective methods of increasing energy efficiency, especially when using tools such as 5S, Visual Workplace, work standardization, poka-yoke, and Total Productive Maintenance (TPM, SMED, value stream mapping).

- Six Sigma and Agile can also help to reduce energy consumption by improving processes (and thus increasing energy efficiency) in both production and logistics.

- Even greater benefits can be achieved by combining Lean and Agile or Lean and Six Sigma concepts and using hybrid solutions.

- Benefits can also be achieved by combining the digital technologies of Industry 4.0 with the tools of Lean Manufacturing.

- In order to achieve high energy efficiency, a detailed analysis of energy and resource consumption is necessary, using specialized methods and tools, not just traditional process improvement methods.

- One method aimed at analyzing energy consumption and its reduction is the “Leanergy”.

- The analysis of the financial results of companies from individual analyzed groups showed that the differences in their effectiveness are very large, which proves that it is not only the management concept itself that is important, but also how it was implemented and how the company and its processes are managed, and perhaps also other factors.

- In general, the situation was better in companies using combinations of strategies (Lean and Agile or Lean and Six Sigma), confirming the views presented in the literature.

- It is not apparent that any of the management concepts used are helping to increase the efficiency of production processes, but on the other hand it is also not apparent that the increase in energy prices is impairing their efficiency, which may indicate that despite crises these companies are able to keep costs under control or that they are introducing innovative solutions that allow them to avoid the negative effects of these crises.

- The rise in fuel and energy prices has not caused a move away from the Just-In-Time concept. Companies that have used Just-In-Time continue to do so. However, there are opinions that the Just-In-Time system may need to be modified, e.g., to Just-In-Case.

- The majority of respondents believe that although Lean organizations are not immune to crises, Lean allows them to navigate through these crises more easily. If they did not use “Lean”, their situation would be worse.

- Lean, in its classic form, has to be combined with other concepts: Agile, Six Sigma.

- Lean can significantly enhance an organization’s ability to survive and adapt in crises thanks to its focus on efficiency, flexibility, and continuous improvement. However, full resilience to crises requires implementing innovative solutions (e.g., Industry 4.0).

- Companies try to reduce energy consumption, using renewable energy sources.

- Extending the research to more companies from different industries and regions, of different sizes;

- Conducting analyses of groups of companies by industry.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Espinoza, O.; Bond, B.H.; Buehlmann, U. Energy and the U.S. hardwood industry—Part 1: Responses to increasing prices. Bioresources 2011, 6, 3883–3898. [Google Scholar] [CrossRef]

- Espinoza, O.; Bond, B.H.; Buehlmann, U. Energy and the U.S. hardwood industry—Part 2: Profile and impact of prices. Bioresources 2011, 6, 3899–3914. [Google Scholar] [CrossRef]

- The Impact of Energy Costs on European Firms’ Profitability. BACH Bank for the Accounts of Companies Harmonized. Outlook #12 November 2023. Available online: https://www.bach.banque-france.fr/asset/documents/Outlook12.pdf (accessed on 11 July 2024).

- Herman, R.; Nistor, C.; Jula, N.M. The Influence of the Increase in Energy Prices on the Profitability of Companies in the European Union. Sustainability 2023, 15, 15404. [Google Scholar] [CrossRef]

- Rasheed, Q. Energy Prices and the Financial Performance of DifferentIndustries in Pakistan. Glob. J. Manag. Bus. Res. CFinanceVolume 2019, 19, 17–29. [Google Scholar]

- Zhang, Y.; Zhao, X.; Fu, B. Impact of energy saving on the financial performance of industrial enterprises in China: An empirical analysis based on propensity score matching. J. Environ. Manag. 2022, 317, 115377. [Google Scholar] [CrossRef]

- André, C.; Costa, H.; Demmou, L.; Franco, G. Rising energy prices and productivity: Short-run pain, long-term gain? In OECD Economics Department Working Papers; OECD Publishing: Paris, France, 2023; Volume 1755. [Google Scholar]

- Bamiatzi, V.; Bozos, K.; Cavusgil, S.T.; Hult, G.T.M. Revisiting the Firm, Industry, and Country Effects on Profitability under Recessionary and Expansion Periods: A Multilevel Analysis. Strateg. Manag. J. 2016, 37, 1448–1471. [Google Scholar] [CrossRef]

- Teixeira, P.; Sá, J.C.; Silva, F.J.G.; Ferreira, L.P.; Santos, G.; Fontoura, P. Connecting lean and green with sustainability towards a conceptual model. J. Clean. Prod. 2021, 322, 129047. [Google Scholar] [CrossRef]

- Francis, A.; Thomas, A. Exploring the relationship between lean construction and environmental sustainability: A review of existing literature to decipher broader dimensions. J. Clean. Prod. 2020, 252, 119913. [Google Scholar] [CrossRef]

- United States Environmental Protection Agency [EPA]. The Lean and Energy Toolkit: Achieving Process Excellence Using Less Energy 2007. Available online: https://nepis.epa.gov/Exe/ZyNET.exe/P1001XIJ.TXT?ZyActionD=ZyDocument&Client=EPA&Index=2006+Thru+2010&Docs=&Query=&Time=&EndTime=&SearchMethod=1&TocRestrict=n&Toc=&TocEntry=&QField=&QFieldYear=&QFieldMonth=&QFieldDay=&IntQFieldOp=0&ExtQFieldOp=0&XmlQuery=&File=D%3A%5Czyfiles%5CIndex%20Data%5C06thru10%5CTxt%5C00000005%5CP1001XIJ.txt&User=ANONYMOUS&Password=anonymous&SortMethod=h%7C-&MaximumDocuments=1&FuzzyDegree=0&ImageQuality=r75g8/r75g8/x150y150g16/i425&Display=hpfr&DefSeekPage=x&SearchBack=ZyActionL&Back=ZyActionS&BackDesc=Results%20page&MaximumPages=1&ZyEntry=1&SeekPage=x&ZyPURL (accessed on 7 April 2025).

- Androniceanu, A.; Enache, I.C.; Valter, E.N.; Raduica, F.F. Increasing energy efficiency based on the kaizen approach. Energies 2023, 16, 1930. [Google Scholar] [CrossRef]

- Gogula, V.; Wan, H.D.; Kuriger, G. Impact of lean tools on energy consumption. Sist. Telemática 2011, 9, 33–53. [Google Scholar] [CrossRef]

- Salah, S.A.; Mustafa, A. Integration of Energy Saving with Lean Production in a Food Processing Company. J. Mach. Eng. 2021, 21, 118–133. [Google Scholar] [CrossRef]

- Baysan, S.; Kabadurmus, O.; Cevikcan, E.; Satoglu, S.I.; Durmusoglu, M.B. A simulation-based methodology for the analysis of the effect of lean tools on energy efficiency: An application in power distribution industry. J. Clean. Prod. 2019, 211, 895–908. [Google Scholar] [CrossRef]

- ISO 14040; Environmental Management—Life Cycle Assessment—Principles and Framework. ISO: Geneva, Switzerland, 2006.

- Heravi, G.; Rostami, M.; Kebria, M.F. Energy consumption and carbon emissions assessment of integrated production and erection of buildings’ pre-fabricated steel frames using lean techniques. J. Clean. Prod. 2020, 253, 120045. [Google Scholar] [CrossRef]

- Gonce, A.; Somers, K. Lean for Green Manufacturing. McKinsey & Company Report; McKinsey & Company: Singapore, 2010. [Google Scholar]

- Kuriger, G.; Chen, F. Lean and green: A current state view. In Proceedings of the Industrial Engineering Research Conference, Xiamen, China, 29–31 October 2010. [Google Scholar]

- Phong, T.L.; Minh, N.D. Integration of Lean Methodology and Energy Management in Wooden Industry. Int. J. Energy Econ. Policy 2022, 12, 124–131. [Google Scholar] [CrossRef]

- Potthoff, L.; Gunnemann, L. Resilience of Lean Production Systems: A Systematic Literature Review. Procedia CIRP 2023, 120, 1315–1320. [Google Scholar] [CrossRef]

- Fiorello, M.; Gladysz, B.; Corti, D.; Wybraniak-Kujawa, M.; Ejsmont, K.; Sorlini, M. Towards a smart lean green production paradigm to improve operational performance. J. Clean. Prod. 2023, 413, 137418. [Google Scholar] [CrossRef]

- Apak, S.; Üngör Tuncer, G.; Atay, E. Hydrogen economy and innovative Six sigma applications for energy efficiency. Procedia Soc. Behav. Sci. 2012, 41, 410–417. [Google Scholar] [CrossRef]

- Ebirim, W.; Montero, D.J.P.; Ani, E.C.; Ninduwezuor-Ehiobu, N.; Usman, F.O.; Olu-lawal, K.A. The role of agile project management in driving innovation in energy-efficient HVAC solutions. Eng. Sci. Technol. J. 2024, 5, 662–673. [Google Scholar] [CrossRef]

- Ghorbanioskalaei, E.; Herrera, E.M.; Ammouriova, M.; Juan, A.A. On the Use of Agile Optimization for Efficient Energy Consumption in Smart Cities’s Transportation and Mobility. Future Transp. 2022, 2, 868–885. [Google Scholar] [CrossRef]

- Maryniak, A. Building Resilience Attributes of Supply Chains from the Perspective of their Types. Manag. Syst. Prod. Eng. 2022, 30, 253–261. [Google Scholar] [CrossRef]

- Peñaloza, G.A.; Formoso, C.T.; Saurin, T.A. Safety Performance Measurement Systems Based on Resilience Engineering. In Proceedings of the 25th Annual Conference of the International Group for Lean Construction (IGLC), Heraklion, Greece, 9–12 July 2017; Walsh, K., Sacks, R., Brilakis, I., Eds.; LC3 2017 Volume II. pp. 903–910. [Google Scholar]

- Amjad, M.S.; Rafique, M.Z.; Khan, M.A. Modern divulge in production optimization: An implementation framework of LARG manufacturing with Industry 4.0. Int. J. Lean Six Sigma 2021, 12, 992–1016. [Google Scholar] [CrossRef]

- Hundal, G.S.; Thiyagarajan, S.; Alduraibi, M.; Laux, C.M.; Furterer, S.L.; Cudney, E.A.; Antony, J. Lean Six Sigma as an organizational resilience mechanism in health care during the era of COVID-19. Int. J. Lean Six Sigma 2021, 12, 762–783. [Google Scholar] [CrossRef]

- Alba-Baena, N. Lean-Sigma as a Strategy in Supply Chain Management During the COVID-19 Pandemic Crisis-Lessons Learned. In Supply Chain Management Strategies and Methodologies: Experiences from Latin America; Springer International Publishing: Cham, Switzerland, 2023; pp. 123–147. [Google Scholar]

- Islam, M.S.; Hoque, I.; Rahman, S.M.; Salam, M.A. Evaluating supply chain resilience using supply chain management competencies in the garment industry: A post COVID analysis. J. Ind. Prod. Eng. 2023, 40, 323–342. [Google Scholar] [CrossRef]

- Kuiper, A.; Lee, R.H.; van Ham, V.J.; Does, R.J. A reconsideration of Lean Six Sigma in healthcare after the COVID-19 crisis. Int. J. Lean Six Sigma 2022, 13, 101–117. [Google Scholar] [CrossRef]

- Muhammad, N.; Upadhyay, A.; Kumar, A.; Gilani, H. Achieving operational excellence through the lens of lean and Six Sigma during the COVID-19 pandemic. Int. J. Logist. Manag. 2022, 33, 818–835. [Google Scholar] [CrossRef]

- De Marchi, M.; Friedrich, F.; Riedl, M.; Zadek, H.; Rauch, E. Development of a Resilience Assessment Model for Manufacturing Enterprises. Sustainability 2023, 15, 16947. [Google Scholar] [CrossRef]

- Habibi Rad, M.; Mojtahedi, M.; Ostwald, M.J. The Integration of Lean and Resilience Paradigms: A Systematic Review Identifying Current and Future Research Directions. Sustainability 2021, 13, 8893. [Google Scholar] [CrossRef]

- Braglia, M.; Castellano, D.; Gabbrielli, R.; Marrazzini, L. Energy Cost Deployment (ECD): A novel lean approach to tackling energy losses. J. Clean. Prod. 2020, 246, 119056. [Google Scholar] [CrossRef]

- Riche, J.P. Leanergy (TM): How lean manufacturing can improve energy efficiency. Chimia 2013, 67, 700–702. [Google Scholar] [CrossRef]

- Seryak, J.; Epstein, G.; D’Antonio, M. Lost Opportunities in Industrial Energy Efficiency: New Production, Lean Manufacturing and Lean Energy. In Proceedings of the Twenty-Eighth Industrial Energy Technology Conference, New Orleans, LA, USA, 9–12 May 2006. [Google Scholar]

- Krix, J.; Aydin, S. Lean Energy Management for Efficient Energy Usage. ATZ Autotechnol. 2011, 11, 58–63. [Google Scholar] [CrossRef]

- Wen, X.; Cao, H.; Hon, B.; Chen, E.; Li, H. Energy value mapping: A novel lean method to integrate energy efficiency into production management. Energy 2021, 217, 119353. [Google Scholar] [CrossRef]

- Arana-Landín, G.; Uriarte-Gallastegi, N.; Landeta-Manzano, B.; Laskurain-Iturbe, I. The Contribution of Lean Management—Industry 4.0 Technologies to Improving Energy Efficiency. Energies 2023, 16, 2124. [Google Scholar] [CrossRef]

- Kaswan, M.S.; Rathi, R.; Antony, J.; Cross, J.; Garza-Reyes, J.A.; Singh, M.; Sony, M. Integrated Green Lean Six Sigma-Industry 4.0 approach to combat COVID-19: From literature review to framework development. Int. J. Lean Six Sigma 2023, 15, 50–79. [Google Scholar] [CrossRef]

- Powell, D.; Lodgaard, E.; Mogos, M.F. Quick-Scan–Towards a Strategy for Responsive and Resilient Value Chains. Procedia CIRP 2021, 104, 1355–1360. [Google Scholar] [CrossRef]

- Costa, F.; Alemsan, N.; Bilancia, A.; Tortorella, G.L.; Staudacher, A.P. Integrating industry 4.0 and lean manufacturing for a sustainable green transition: A comprehensive model. J. Clean. Prod. 2024, 465, 142728. [Google Scholar] [CrossRef]

- Zhou, P.; Han, M.; Shen, Y. Impact of Intelligent Manufacturing on Total-Factor Energy Efficiency: Mechanism and Improvement Path. Sustainability 2023, 15, 3944. [Google Scholar] [CrossRef]

- Chu, Z.; Zhang, Z.; Tan, W.; Chen, P. Revolutionizing energy practices: Unleashing the power of artificial intelligence in corporate energy transition. J. Environ. Manag. 2024, 357, 120806. [Google Scholar] [CrossRef]

- Song, M.; Pan, H.; Vardanyan, M.; Shen, Z. Evaluating the energy efficiency-enhancing potential of the digital economy: Evidence from China. J. Environ. Manag. 2023, 344, 118408. [Google Scholar] [CrossRef]

- Trabucco, M.; De Giovanni, P. Achieving Resilience and Business Sustainability during COVID-19: The Role of Lean Supply Chain Practices and Digitalization. Sustainability 2021, 13, 12369. [Google Scholar] [CrossRef]

- Albalushi, J.; Mishra, R.; Abebe, M. Supply Chain Resilience Meets Quality Management. Int. J. Prof. Bus. Rev. 2023, 8, 12. [Google Scholar] [CrossRef]

- Reyes, J.; Mula, J.; Madroñero, M.D. Development of a conceptual model for lean supply chain planning in industry 4.0: Multidimensional analysis for operations management. Prod. Plan. Control 2021, 34, 1209–1224. [Google Scholar] [CrossRef]

- Delhi, S.I.N. Springer India-New Delhi. Maintaining quality, saving energy, improving efficiency. Auto Tech. Rev. 2016, 5, 72–75. [Google Scholar] [CrossRef]

- Toyota Motor Corporation Is Driving the Trend to Carbon Neutrality, by Ken Silverstein|Feb 17, 2023. Available online: https://www.environmentenergyleader.com/2023/02/toyota-motor-corporation-is-driving-the-trend-to-carbon-neutrality/ (accessed on 11 July 2024).

- McKinsey Quarterly, Bringing Lean Thinking to Energy, February 1, 2014|Article, By Markus Hammer, Paul Rutten, and Ken Somers. Available online: https://www.mckinsey.com/capabilities/operations/our-insights/bringing-lean-thinking-to-energy. (accessed on 11 July 2024).

- Milewska, B.; Milewski, D. The Impact of Energy Consumption Costs on the Profitability of Production Companies in Poland in the Context of the Energy Crisis. Energies 2023, 16, 6519. [Google Scholar] [CrossRef]

| Waste Type | Energy Use |

|---|---|

| Overproduction | Energy consumed in operating equipment to make unnecessary products |

| Inventory | Energy used to heat, cool, and light inventory storage and warehousing space |

| Transportation and Motion | More energy used for transportation and delivery More space required for work-in-process (WIP) movement, increasing lighting, heating, and cooling demand, and energy consumption |

| Defects | Energy consumed for making defective products; space required for rework and repair; increasing energy use for heating, cooling, and lighting |

| Over processing | Energy consumed in operating equipment related to unnecessary processing |

| Waiting | Wasted energy from heating, cooling, and lighting during production downtime |

| Equipment | Quantity | Waste (Problems) | Lean Tool Application | % Energy Reduction |

|---|---|---|---|---|

| Drying oven | 20 | Over-heat, over-time drying | SW, right-size equipment, TPM | 39.1 |

| Sanding machine | 37 | Defect, no-load running | SMED, SW, Poka-yoke | 25.2 |

| Vacuum machine | 49 | No-load running | SW, 5S, TPM | 18.3 |

| Conveyor | 144 | No-load running | Visual, 5S, TPM. | 14.9 |

| Drill machine | 125 | Long cutting journey | SW, Poka-yoke, TPM | 13.7 |

| Cutting machine | 35 | No-load running, long cutting journey | SW, Poka-yoke, TPM | 9 |

| Compress machine | 4 | Defective | SMED, SW, Poka-yoke | 3.7 |

| CNC machine | 12 | - | TMP | 2 |

| Change of: | Net Profits | Share of COGS/Revenue | ||

|---|---|---|---|---|

| Firm | 2016–2019 | 2020–2023 | 2016–2019 | 2020–2023 |

| Lean Japan | 14.53% | 55.56% | 8.92% | −2.10% |

| Lean USA | 37.56% | 71.64% | −0.45% | 0.05% |

| Six Sigma | 71.52% | 22.13% | 2.03% | −0.09% |

| Agile | 287.63% | −75.71% | −0.54% | 8.05% |

| LeanSigma | 54.47% | 24.80% | −4.42% | −11.85% |

| LeanAgile | 64.53% | 3.88% | 7.23% | 18.06% |

| Multinational corporations | 31.38% | 19.76% | −0.06% | −3.99% |

| Polish companies | 134.14% | 143.27% | 0.46% | −0.22% |

| Change of: | Net Profits | Share of COGS/Revenue | ||

|---|---|---|---|---|

| Japanese Companies | 2016–2019 | 2020–2023 | 2016–2019 | 2020–2023 |

| Toyota Motor Corporation | −18.59% | 20.08% | 3.78% | 1.34% |

| Honda | 66.43% | 40.67% | 44.74% | −14.31% |

| Nissan | −57.13% | 78.72% | 6.30% | −3.38% |

| Suzuki | 34.46% | 17.79% | −14.43% | 8.96% |

| Mitsubishi Motors Corporation | 47.47% | 120.54% | 4.19% | −3.10% |

| US companies | 2016–2019 | 2020–2023 | 2016–2019 | 2020–2023 |

| General Motors Company | 134.70% | 60.43% | −1.92% | 3.28% |

| Parker Hannifin | 87.48% | 73.29% | −3.04% | −11.76% |

| Illinois Tool Works | −14.43% | 40.21% | −3.09% | −1.39% |

| Kimberley-Clark Corporation | 41.35% | −25.00% | 1.77% | 1.90% |

| Change of: | Net Profits | Share of COGS/Revenue | ||

|---|---|---|---|---|

| Firm | 2016–2019 | 2020–2023 | 2016–2019 | 2020–2023 |

| Motorola | 55.54% | 79.85% | −4.43% | −2.23% |

| BAE Systems | 52.38% | 38.49% | −12.71% | −4.96% |

| Denso Corporation | 13.02% | 271.29% | 2.03% | −0.09% |

| Eastman Kodak Company | 540.00% | −109.98% | 13.08% | −6.54% |

| 3M | 188.55% | −78.31% | 6.20% | 9.58% |

| Xerox | −17.60% | −11.98% | −0.49% | 6.06% |

| Boeing | −60.27% | −107.30% | 11.40% | −17.89% |

| Change of: | Net Profits | Share of COGS/Revenue | ||

|---|---|---|---|---|

| Agile | 2016–2019 | 2020–2023 | 2016–2019 | 2020–2023 |

| Sony | 572.05% | 29.48% | −6.75% | 8.04% |

| Lego | −99.38% | −439.87% | 8.51% | 5.02% |

| Siemens | 708.09% | 244.73% | 0.08% | 11.94% |

| Koninklijke Philips | −30.22% | −137.17% | −4.00% | 7.19% |

| LeanSixSigma | 2016–2019 | 2020–2023 | 2016–2019 | 2020–2023 |

| John Deere | 113% | 270% | −1% | −23% |

| Ford Motor Company | −99% | −440% | −5% | −4% |

| Caterpillar Inc. | 148% | 245% | −8% | −8% |

| Textron | −15% | 198% | 1% | 11% |

| LeanAgile | 2016–2019 | 2020–2023 | 2016–2019 | 2020–2023 |

| Intel Corp. | 80% | −92% | 14% | 36% |

| Nike, Inc. | 49.2% | 99.7% | 0.2% | −0.2% |

| Analysis of Literature | Analysis of Financial Results | Interviews |

|---|---|---|

| Lean Management, Six Sigma, and Agile have a positive impact on energy efficiency. Greater benefits can be achieved by combining Lean and Agile or Lean and Six Sigma concepts and by combining the digital technologies of Industry 4.0 with Lean Manufacturing. | There are significant differences in the efficiency of companies using a particular strategy. Companies that use a combination of strategies (Lean and Agile or Lean and Six Sigma) are more efficient. The increase in energy prices did not lead to a deterioration in the efficiency of companies using the strategies studied. | The increase in fuel and energy prices has not caused a departure from Just-In-Time. Although Lean organizations are not immune to crises, Lean allows them to navigate through them more easily. It is reasonable to combine Lean with other concepts: Agile, Six Sigma. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Milewska, B.; Milewski, D. Lean, Agile, and Six Sigma: Efficiency and the Challenges of Today’s World: Is It Time for a Change? Sustainability 2025, 17, 3617. https://doi.org/10.3390/su17083617

Milewska B, Milewski D. Lean, Agile, and Six Sigma: Efficiency and the Challenges of Today’s World: Is It Time for a Change? Sustainability. 2025; 17(8):3617. https://doi.org/10.3390/su17083617

Chicago/Turabian StyleMilewska, Beata, and Dariusz Milewski. 2025. "Lean, Agile, and Six Sigma: Efficiency and the Challenges of Today’s World: Is It Time for a Change?" Sustainability 17, no. 8: 3617. https://doi.org/10.3390/su17083617

APA StyleMilewska, B., & Milewski, D. (2025). Lean, Agile, and Six Sigma: Efficiency and the Challenges of Today’s World: Is It Time for a Change? Sustainability, 17(8), 3617. https://doi.org/10.3390/su17083617