Optimizing Sustainable Entrepreneurial Ecosystems: The Role of Government-Certified Incubators in Early-Stage Financing

Abstract

1. Introduction

2. Theoretical Analysis and Research Hypotheses

2.1. Weak Networks in Entrepreneurial Ecosystems

2.2. Signaling Mechanisms Mitigate Weak Networks in Entrepreneurial Ecosystems

2.3. Government-Certified Incubator as an Effective Signal in the Network

2.3.1. Why Do Incubators Need to Be Certified by the Government?

2.3.2. Validity of Government Certification

2.4. Signal Interaction Effects

3. Data and Methodology

3.1. Data Background

3.1.1. Empirical Setting: China Torch Programme—Incubator Survey

3.1.2. Sample Selection

3.2. Variable Design and Measurement

3.3. Empirical Model

4. Results

4.1. Descriptive Statistics

4.2. Hypothesis Tests

4.3. Robustness Checks

5. Discussion and Conclusions

5.1. Contribution to Theory and Practice

5.2. Limitations and Extensions

5.3. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Carpenter, R.E.; Petersen, B.C. Capital Market Imperfections, High-Tech Investment, and New Equity Financing. Econ. J. 2002, 112, F54–F72. [Google Scholar] [CrossRef]

- Berger, A.N.; Udell, G.F. A More Complete Conceptual Framework for SME Finance. J. Bank. Financ. 2006, 30, 2945–2966. [Google Scholar] [CrossRef]

- Islam, M.; Fremeth, A.; Marcus, A. Signaling by Early Stage Startups: US Government Research Grants and Venture Capital Funding. J. Bus. Ventur. 2018, 33, 35–51. [Google Scholar] [CrossRef]

- Zimmerman, M.A.; Zeitz, G.J. Beyond Survival: Achieving New Venture Growth by Building Legitimacy. Acad. Manag. Rev. 2002, 27, 414–431. [Google Scholar] [CrossRef]

- Pollock, T.G.; Chen, G.; Jackson, E.M.; Hambrick, D.C. How Much Prestige Is Enough? Assessing the Value of Multiple Types of High-Status Affiliates for Young Firms. J. Bus. Ventur. 2010, 25, 6–23. [Google Scholar] [CrossRef]

- Arthurs, J.D.; Busenitz, L.W.; Hoskisson, R.E.; Johnson, R.A. Signaling and Initial Public Offerings: The Use and Impact of the Lockup Period. J. Bus. Ventur. 2009, 24, 360–372. [Google Scholar] [CrossRef]

- Colombo, O. The Use of Signals in New-Venture Financing: A Review and Research Agenda. J. Manag. 2020, 47, 237–259. [Google Scholar] [CrossRef]

- Bafera, J.; Kleinert, S. Signaling Theory in Entrepreneurship Research: A Systematic Review and Research Agenda. Entrep. Theory Pract. 2023, 47, 2419–2464. [Google Scholar] [CrossRef]

- Meuleman, M.; De Maeseneire, W. Do R&D Subsidies Affect SMEs’ Access to External Financing? Res. Policy 2012, 41, 580–591. [Google Scholar] [CrossRef]

- Lee, P.M.; Pollock, T.G.; Jin, K. The Contingent Value of Venture Capitalist Reputation. Strateg. Organ. 2011, 9, 33–69. [Google Scholar] [CrossRef]

- Li, L.; Chen, J.; Gao, H.; Xie, L. The Certification Effect of Government R&D Subsidies on Innovative Entrepreneurial Firms’ Access to Bank Finance: Evidence from China. Small Bus. Econ. 2019, 52, 241–259. [Google Scholar] [CrossRef]

- Chen, J.; Heng, C.S.; Tan, B.C.Y.; Lin, Z. The Distinct Signaling Effects of R&D Subsidy and Non-R&D Subsidy on IPO Performance of IT Entrepreneurial Firms in China. Res. Policy 2018, 47, 108–120. [Google Scholar] [CrossRef]

- Van Rijnsoever, F.J.; Van Weele, M.A.; Eveleens, C.P. Network Brokers or Hit Makers? Analyzing the Influence of Incubation on Start-up Investments. Int. Entrep. Manag. J. 2017, 13, 605–629. [Google Scholar] [CrossRef]

- Plummer, L.; Allison, T.; Connelly, B. Better Together? Signaling Interactions in New Venture Pursuit of Initial External Capital. Acad. Manag. J. 2015, 59, 1585–1604. [Google Scholar] [CrossRef]

- Eddleston, K.A.; Ladge, J.J.; Mitteness, C.; Balachandra, L. Do You See What I See? Signaling Effects of Gender and Firm Characteristics on Financing Entrepreneurial Ventures. Entrep. Theory Pract. 2016, 40, 489–514. [Google Scholar] [CrossRef]

- Guzman, J.; Kacperczyk, A. (Olenka) Gender Gap in Entrepreneurship. Res. Policy 2019, 48, 1666–1680. [Google Scholar] [CrossRef]

- Bothner, M.S.; Podolny, J.M.; Smith, E.B. Organizing Contests for Status: The Matthew Effect vs. the Mark Effect. Manag. Sci. 2011, 57, 439–457. [Google Scholar] [CrossRef]

- Hausberg, J.P.; Korreck, S. Business Incubators and Accelerators: A Co-Citation Analysis-Based, Systematic Literature Review. J. Technol. Transf. 2020, 45, 151–176. [Google Scholar] [CrossRef]

- Hargadon, A.B.; Kenney, M. Misguided Policy? Following Venture Capital into Clean Technology. Calif. Manag. Rev. 2012, 54, 118–139. [Google Scholar] [CrossRef]

- Deyanova, K.; Brehmer, N.; Lapidus, A.; Tiberius, V.; Walsh, S. Hatching Start-Ups for Sustainable Growth: A Bibliometric Review on Business Incubators. Rev. Manag. Sci. 2022, 16, 2083–2109. [Google Scholar] [CrossRef]

- Cassar, G. The Financing of Business Start-Ups. J. Bus. Ventur. 2004, 19, 261–283. [Google Scholar] [CrossRef]

- Paoloni, P.; Modaffari, G. Business incubators vs start-ups: A sustainable way of sharing knowledge. J. Knowl. Manag. 2022, 26, 1235–1261. [Google Scholar] [CrossRef]

- Vaznyte, E.; Andries, P. Entrepreneurial Orientation and Start-Ups’ External Financing. J. Bus. Ventur. 2019, 34, 439–458. [Google Scholar] [CrossRef]

- Florida, R.; Kenney, M. Venture Capital and High Technology Entrepreneurship. J. Bus. Ventur. 1988, 3, 301–319. [Google Scholar] [CrossRef]

- Levin, R.C.; Klevorick, A.K.; Nelson, R.; Winter, S. Appropriating the Returns from Industrial Research and Development. Brook. Pap. Econ. Act. 1987, 18, 783–832. [Google Scholar] [CrossRef]

- Villanueva, J.; Van de Ven, A.H.; Sapienza, H.J. Resource Mobilization in Entrepreneurial Firms. J. Bus. Ventur. 2012, 27, 19–30. [Google Scholar] [CrossRef]

- Kleinert, S.; Volkmann, C.; Grünhagen, M. Third-party signals in equity crowdfunding: The role of prior financing. Small Bus Econ. 2020, 54, 341–365. [Google Scholar] [CrossRef]

- Pollock, T.G.; Gulati, R. Standing out from the Crowd: The Visibility-Enhancing Effects of IPO-Related Signals on Alliance Formation by Entrepreneurial Firms. Strateg. Organ. 2007, 5, 339–372. [Google Scholar] [CrossRef]

- van Rijnsoever, F.J. Meeting, Mating, and Intermediating: How Incubators Can Overcome Weak Network Problems in Entrepreneurial Ecosystems. Res. Policy 2020, 49, 103884. [Google Scholar] [CrossRef]

- Hemmert, M.; Cross, A.R.; Cheng, Y.; Kim, J.-J.; Kohlbacher, F.; Kotosaka, M.; Waldenberger, F.; Zheng, L.J. The Distinctiveness and Diversity of Entrepreneurial Ecosystems in China, Japan, and South Korea: An Exploratory Analysis. Asian Bus. Manag. 2019, 18, 211–247. [Google Scholar] [CrossRef]

- Hu, Y.; Ahmad, A.J.; Lu, D. Performance Management Challenges at Chinese Business Incubators: A Systematic Literature Review. Technol. Forecast. Soc. Chang. 2023, 190, 122414. [Google Scholar] [CrossRef]

- van Weele, M.A.; van Rijnsoever, F.J.; Groen, M.; Moors, E.H.M. Gimme Shelter? Heterogeneous Preferences for Tangible and Intangible Resources When Choosing an Incubator. J. Technol. Transf. 2020, 45, 984–1015. [Google Scholar] [CrossRef]

- Dvouletý, O.; Longo, M.C.; Blažková, I.; Lukeš, M.; Andera, M. Are Publicly Funded Czech Incubators Effective? The Comparison of Performance of Supported and Non-Supported Firms. Eur. J. Innov. Manag. 2018, 21, 543–563. [Google Scholar] [CrossRef]

- Ayatse, F.A.; Kwahar, N.; Iyortsuun, A.S. Business Incubation Process and Firm Performance: An Empirical Review. J. Glob. Entrep. Res. 2017, 7, 2. [Google Scholar] [CrossRef]

- van Weele, M.; van Rijnsoever, F.J.; Eveleens, C.P.; Steinz, H.; van Stijn, N.; Groen, M. Start-EU-up! Lessons from International Incubation Practices to Address the Challenges Faced by Western European Start-Ups. J. Technol. Transf. 2018, 43, 1161–1189. [Google Scholar] [CrossRef]

- Connelly, B.L.; Certo, S.T.; Reutzel, C.R.; DesJardin, M.R.; Zhou, Y.S. Signaling Theory: State of the Theory and Its Future. J. Manag. 2024, 51, 24–61. [Google Scholar] [CrossRef]

- Connelly, B.L.; Certo, S.T.; Ireland, R.D.; Reutzel, C.R. Signaling Theory: A Review and Assessment. J. Manag. 2011, 37, 39–67. [Google Scholar] [CrossRef]

- Wu, A. The Signal Effect of Government R&D Subsidies in China: Does Ownership Matter? Technol. Forecast. Soc. Chang. 2017, 117, 339–345. [Google Scholar] [CrossRef]

- Kleer, R. Government R&D Subsidies as a Signal for Private Investors. Res. Policy 2010, 39, 1361–1374. [Google Scholar] [CrossRef]

- Grimaldi, R.; Grandi, A. Business Incubators and New Venture Creation: An Assessment of Incubating Models. Technovation 2005, 25, 111–121. [Google Scholar] [CrossRef]

- Bruneel, J.; Ratinho, T.; Clarysse, B.; Groen, A. The Evolution of Business Incubators: Comparing Demand and Supply of Business Incubation Services across Different Incubator Generations. Technovation 2012, 32, 110–121. [Google Scholar] [CrossRef]

- Ucbasaran, D.; Westhead, P.; Wright, M.; Flores, M. The Nature of Entrepreneurial Experience, Business Failure and Comparative Optimism. J. Bus. Ventur. 2010, 25, 541–555. [Google Scholar] [CrossRef]

- Hoenig, D.; Henkel, J. Quality Signals? The Role of Patents, Alliances, and Team Experience in Venture Capital Financing. Res. Policy 2015, 44, 1049–1064. [Google Scholar] [CrossRef]

- Hashai, N.; Zahra, S. Founder team prior work experience: An asset or a liability for startup growth? Strateg. Entrep. J. 2022, 16, 155–184. [Google Scholar] [CrossRef]

- Häussler, C.; Harhoff, D.; Mueller, E. To Be Financed or Not…—The Role of Patents for Venture Capital-Financing; ZEW: Mannheim, Germany, 2012. [Google Scholar]

- Mann, R.J.; Sager, T.W. Patents, Venture Capital, and Software Start-Ups. Res. Policy 2007, 36, 193–208. [Google Scholar] [CrossRef]

- Hoenen, S.; Kolympiris, C.; Schoenmakers, W.; Kalaitzandonakes, N. The Diminishing Signaling Value of Patents between Early Rounds of Venture Capital Financing. Res. Policy 2014, 43, 956–989. [Google Scholar] [CrossRef]

- Murphy, P.J.; Kickul, J.; Barbosa, S.D.; Titus, L. Expert Capital and Perceived Legitimacy: Female-Run Entrepreneurial Venture Signalling and Performance. Int. J. Entrep. Innov. 2007, 8, 127–138. [Google Scholar] [CrossRef]

- Kaisa, S.; Isabelle, S. Does Investor Gender Matter for the Success of Female Entrepreneurs? Gender Homophily and the Stigma of Incompetence in Entrepreneurial Finance. Organ. Sci. 2022, 34, 680–699. [Google Scholar] [CrossRef]

- Brush, C.; Edelman, L.F.; Manolova, T.; Welter, F. A Gendered Look at Entrepreneurship Ecosystems. Small Bus. Econ. 2019, 53, 393–408. [Google Scholar] [CrossRef]

- Alsos, G.; Ljunggren, E. The Role of Gender in Entrepreneur-Investor Relationships: A Signaling Theory Approach. Entrep. Theory Pract. 2016, 41, 567–590. [Google Scholar] [CrossRef]

- Yang, S.; Kher, R.; Newbert, S.L. What Signals Matter for Social Startups? It Depends: The Influence of Gender Role Congruity on Social Impact Accelerator Selection Decisions. J. Bus. Ventur. 2020, 35, 105932. [Google Scholar] [CrossRef]

- Marlow, S.; McAdam, M. Analyzing the Influence of Gender upon High–Technology Venturing within the Context of Business Incubation. Entrep. Theory Pract. 2012, 36, 655–676. [Google Scholar] [CrossRef]

- Avnimelech, G.; Rechter, E. How and Why Accelerators Enhance Female Entrepreneurship. Res. Policy 2023, 52, 104669. [Google Scholar] [CrossRef]

- Enginsoy, S. The Global Startup Ecosystem Rankings by StartupBlink. Available online: https://www.startupblink.com/blog/the-global-startup-ecosystem-rankings-by-startupblink/ (accessed on 6 December 2023).

- Braune, E.; Lantz, J.-S.; Sahut, J.-M.; Teulon, F. Corporate Venture Capital in the IT Sector and Relationships in VC Syndication Networks. Small Bus. Econ. 2021, 56, 1221–1233. [Google Scholar] [CrossRef]

- Hall, G.; Hutchinson, P.; Michaelas, N. Industry Effects on the Determinants of Unquoted SMEs’ Capital Structure. Int. J. Econ. Bus. 2000, 7, 297–312. [Google Scholar] [CrossRef]

- Galloway, T.L.; Miller, D.R.; Sahaym, A.; Arthurs, J.D. Exploring the Innovation Strategies of Young Firms: Corporate Venture Capital and Venture Capital Impact on Alliance Innovation Strategy. J. Bus. Res. 2017, 71, 55–65. [Google Scholar] [CrossRef]

- Mustafa, A. A Gentle Introduction to Complementary Log-Log Regression. Available online: https://towardsdatascience.com/a-gentle-introduction-to-complementary-log-log-regression-8ac3c5c1cd83 (accessed on 12 December 2023).

- Rosenbaum, P.R.; Rubin, D.B. Constructing a Control Group Using Multivariate Matched Sampling Methods That Incorporate the Propensity Score. Am. Stat. 1985, 39, 33–38. [Google Scholar] [CrossRef]

- Austin, P.C. Optimal Caliper Widths for Propensity-Score Matching When Estimating Differences in Means and Differences in Proportions in Observational Studies. Pharm. Stat. 2011, 10, 150–161. [Google Scholar] [CrossRef]

- Janeway, W.H.; Nanda, R.; Rhodes-Kropf, M. Venture Capital Booms and Start-Up Financing. Annu. Rev. Financ. Econ. 2021, 13, 111–127. [Google Scholar] [CrossRef]

- Stevenson, R.; Kier, A.S.; Taylor, S.G. Do Policy Makers Take Grants for Granted? The Efficacy of Public Sponsorship for Innovative Entrepreneurship. Strateg. Entrep. J. 2021, 15, 231–253. [Google Scholar] [CrossRef]

| Part A: Region and Year Distribution of Startups and Incubators | ||||||||

|---|---|---|---|---|---|---|---|---|

| Province | 2016 | 2017 | 2018 | 2019 | ||||

| Startups | Incubators | Startups | Incubators | Startups | Incubators | Startups | Incubators | |

| Jiangsu | 28,312 | 548 | 38,579 | 610 | 39,638 | 695 | 45,241 | 832 |

| Guangdong | 19,271 | 576 | 28,109 | 754 | 37,284 | 962 | 39,993 | 1013 |

| Shandong | 13,387 | 216 | 17,486 | 303 | 20,697 | 378 | 20,788 | 358 |

| Zhejiang | 10,846 | 160 | 15,464 | 235 | 19,787 | 321 | 21,390 | 363 |

| Henan | 8066 | 162 | 10,479 | 148 | 10,928 | 169 | 10,929 | 167 |

| Hubei | 5917 | 67 | 11,463 | 176 | 12,619 | 192 | 13,939 | 216 |

| Shanghai | 7485 | 156 | 8911 | 176 | 9781 | 180 | 9611 | 175 |

| Beijing | 6341 | 101 | 8099 | 105 | 11,391 | 152 | 11,377 | 130 |

| Sichuan | 6580 | 108 | 8423 | 143 | 9192 | 147 | 10,077 | 168 |

| Tianjin | 6474 | 108 | 5531 | 71 | 5532 | 72 | 5582 | 81 |

| Others | 47,158 | 1053 | 65,706 | 1342 | 73,079 | 1581 | 79,574 | 1703 |

| Sum | 159,837 | 3255 | 21,8250 | 4063 | 249,928 | 4849 | 268,501 | 5206 |

| Part B: Technical Area and Year Distribution of Startups | ||||||||

| Field | 2016 | 2017 | 2018 | 2019 | ||||

| Information Technology | 82,373 | 107,826 | 122,916 | 130,256 | ||||

| Advanced Manufacture | 25,825 | 34,983 | 36,937 | 40,375 | ||||

| Biomedicine and Devices | 13,719 | 17,452 | 20,260 | 22,471 | ||||

| New Materials | 9634 | 11,568 | 13,161 | 14,015 | ||||

| New Energy | 7717 | 9679 | 10,922 | 11,613 | ||||

| Cultural Creativity | 7222 | 17,559 | 24,313 | 27,234 | ||||

| Modern Agriculture | 5288 | 8072 | 8805 | 9141 | ||||

| Environmental Protection | 5090 | 6713 | 7682 | 8451 | ||||

| Modern Transport | 1428 | 2322 | 2791 | 2907 | ||||

| Aerospace | 828 | 1061 | 1192 | 1159 | ||||

| Earth, Space and Oceans | 624 | 727 | 732 | 717 | ||||

| Nuclear Applied Technology | 89 | 288 | 217 | 162 | ||||

| Sum | 159,837 | 218,250 | 249,928 | 268,501 | ||||

| Variable Type | Variable Name | Symbol | Description |

|---|---|---|---|

| Dependent variable | Whether receive venture capital | Dummy variable with a value of 1 for venture capital received in the current year and 0 otherwise | |

| Independent variable | Whether affiliated with GCI | Dummy variable, affiliation to GCI in the current year, takes the value of 1, otherwise 0 | |

| Control variables | Startup size | The registered capital of the startup, taken in logarithms (Unit: 1000¥) | |

| Startup Age | Take the logarithm of the difference between the statistical year and the year of establishment of the startup | ||

| Startup Revenue | Take the logarithm of the annual operating income for that year (Unit: 1000¥) | ||

| R&D Level | Take the logarithm of the startup’s R&D expenditure (Unit: 1000¥) | ||

| Human Capital | The proportion of employees with a college degree or above in the startup | ||

| Moderating variables | Founder’s previous experience | The dummy variable takes a value of 1 for serial entrepreneurs and 0 for first-time entrepreneurs | |

| The intellectual property status of the startup | Take the logarithm of the number of invention patents obtained by the startup in the current year | ||

| The gender of the main founders | The dummy variable takes a value of 1 when the founder’s gender is female, and 0 when it is male |

| Variable | N | Mean | Sd | Min | Max |

|---|---|---|---|---|---|

| 77,852 | 0.074 | 0.262 | 0.000 | 1.000 | |

| 77,852 | 0.547 | 0.435 | 0.000 | 1.000 | |

| 77,852 | 6.746 | 2.429 | 0.000 | 17.241 | |

| 77,852 | 1.226 | 0.594 | 0.000 | 2.303 | |

| 77,852 | 6.106 | 3.051 | 0.000 | 15.563 | |

| 77,852 | 2.804 | 2.958 | 0.000 | 15.277 | |

| 77,852 | 0.862 | 0.195 | 0.000 | 1.800 | |

| 77,852 | 0.312 | 0.463 | 0.000 | 1.000 | |

| 77,852 | 0.062 | 0.280 | 0.000 | 5.935 | |

| 77,852 | 0.148 | 0.355 | 0.000 | 1.000 | |

| ed | 77,852 | 0.617 | 0.486 | 0.000 | 1.000 |

| 77,852 | 0.424 | 0.494 | 0.000 | 1.000 | |

| 77,852 | 0.094 | 0.292 | 0.000 | 1.000 |

| 1.000 | |||||||

| 0.030 *** | 1.000 | ||||||

| 0.062 *** | 0.100 *** | 1.000 | |||||

| 0.017 *** | 0.111 *** | −0.016 *** | 1.000 | ||||

| 0.105 *** | 0.155 *** | 0.187 *** | 0.327 *** | 1.000 | |||

| 0.171 *** | 0.207 *** | 0.203 *** | 0.163 *** | 0.452 *** | 1.000 | ||

| 0.037 *** | 0.053 *** | 0.079 *** | −0.047 *** | −0.010 *** | 0.053 *** | 1.000 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| 0.314 *** | 0.301 * | 0.281 ** | 0.230 ** | 0.222 ** | |

| (0.107) | (0.105) | (0.106) | (0.107) | (0.107) | |

| 0.041 *** | 0.040 *** | 0.029 *** | 0.029 *** | ||

| (0.013) | (0.013) | (0.012) | (0.012) | ||

| −0.302 *** | −0.254 *** | −0.261 *** | −0.270 *** | ||

| (0.041) | (0.050) | (0.052) | (0.052) | ||

| 0.046 *** | 0.044 *** | 0.048 *** | 0.049 *** | ||

| (0.015) | (0.015) | (0.014) | (0.014) | ||

| 0.125 *** | 0.126 *** | 0.121 *** | 0.120 *** | ||

| (0.014) | (0.014) | (0.013) | (0.013) | ||

| 0.592 *** | 0.588 *** | 0.602 *** | 0.611 *** | ||

| (0.187) | (0.186) | (0.183) | (0.177) | ||

| −2.773 *** | −3.795 *** | −3.812 *** | −4.338 *** | −4.516 *** | |

| (0.076) | (0.207) | (0.205) | (0.250) | (0.423) | |

| Year Fixed Effects | No | No | Yes | Yes | Yes |

| Region Fixed Effects | No | No | No | Yes | Yes |

| Industry Fixed Effects | No | No | No | No | Yes |

| Wald chi2 | 8.65 | 261.23 | 296.32 | 468.57 | 706.86 |

| Prob > chi2 | 0.003 | 0.000 | 0.000 | 0.000 | 0.000 |

| Log likelihood | −15,112.21 | −14,681.45 | −14,662.81 | −14,352.25 | −14,247.41 |

| Observations | 57,624 | 57,624 | 57,624 | 57,549 | 64,322 |

| (1) | (2) | (3) | |

|---|---|---|---|

| 0.166 ** | 0.206 * | 0.198 ** | |

| (0.110) | (0.108) | (0.108) | |

| 0.153 ** | |||

| (0.060) | |||

| 0.337 *** | |||

| (0.058) | |||

| 0.294 *** | |||

| (0.112) | |||

| 0.167 ** | |||

| (0.120) | |||

| −0.388 *** | |||

| (0.128) | |||

| 0.248 ** | |||

| (0.141) | |||

| 0.022 * | 0.024 *** | 0.028 *** | |

| (0.012) | (0.012) | (0.012) | |

| −0.274 *** | −0.287 *** | −0.270 *** | |

| (0.053) | (0.053) | (0.052) | |

| 0.049 *** | 0.047 *** | 0.049 *** | |

| (0.013) | (0.013) | (0.014) | |

| 0.118 *** | 0.114 *** | 0.120 *** | |

| (0.013) | (0.013) | (0.013) | |

| 0.613 *** | 0.625 *** | 0.612 *** | |

| (0.175) | (0.178) | (0.178) | |

| −4.058 *** | −3.958 *** | −3.947 *** | |

| (0.417) | (0.423) | (0.424) | |

| Year Fixed Effects | Yes | Yes | Yes |

| Region Fixed Effects | Yes | Yes | Yes |

| Industry Fixed Effects | Yes | Yes | Yes |

| Wald chi2 | 3035.19 | 2665.41 | |

| Prob > chi2 | 0.000 | 0.000 | |

| Log likelihood | −15,155.41 | −15,340.30 | |

| Observations | 57,165 | 57,165 | 57,165 |

| Model 1 | Model 2 | Model 3 | Model 4 | ||

|---|---|---|---|---|---|

| 1.364 ** | 0.234 ** | 0.214 ** | 0.256 *** | 0.101 ** | |

| (0.631) | (0.108) | (0.102) | (3.31) | (2.02) | |

| 0.364 *** | |||||

| (0.064) | |||||

| 0.236 *** | |||||

| (0.110) | |||||

| 0.187 *** | |||||

| (0.066) | |||||

| 0.200 *** | 0.027 *** | 0.026 ** | 0.024 | 0.052 *** | |

| (0.072) | (0.012) | (0.011) | (1.58) | (5.34) | |

| −1.532 *** | −0.311 *** | −0.259 *** | −0.350 *** | −0.113 *** | |

| (0.306) | (0.057) | (0.050) | (−6.37) | (−3.10) | |

| 0.295 *** | 0.045 *** | 0.046 ** | 0.067 *** | 0.079 *** | |

| (0.077) | (0.013) | (0.013) | (4.80) | (9.00) | |

| 0.748 *** | 0.104 ** | 0.115 ** | 0.169 *** | 0.184 *** | |

| (0.073) | (0.013) | (0.013) | (14.87) | (24.23) | |

| 3.909 *** | 0.500 *** | 0.580 *** | 0.535 *** | 0.767 *** | |

| (1.004) | (0.166) | (0.171) | (3.22) | (6.17) | |

| −27.402 *** | −4.358 *** | −3.935 *** | −5.525 *** | −4.104 *** | |

| (2.588) | (0.439) | (0.404) | (−10.10) | (−11.19) | |

| Year Fixed Effects | Yes | Yes | Yes | Yes | Yes |

| Region Fixed Effects | Yes | Yes | Yes | Yes | Yes |

| Industry Fixed Effects | Yes | Yes | Yes | Yes | Yes |

| Wald chi2/F | 97.79 | 732.66 | 749.99 | 1080.22 | 1707.10 |

| Prob >chi2/F | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Log likelihood | −28,412.32 | −15,023.51 | −15,243.71 | −4765.54 | −10,489.48 |

| Observations | 57,624 | 57,165 | 57,165 | 20,681 | 43,323 |

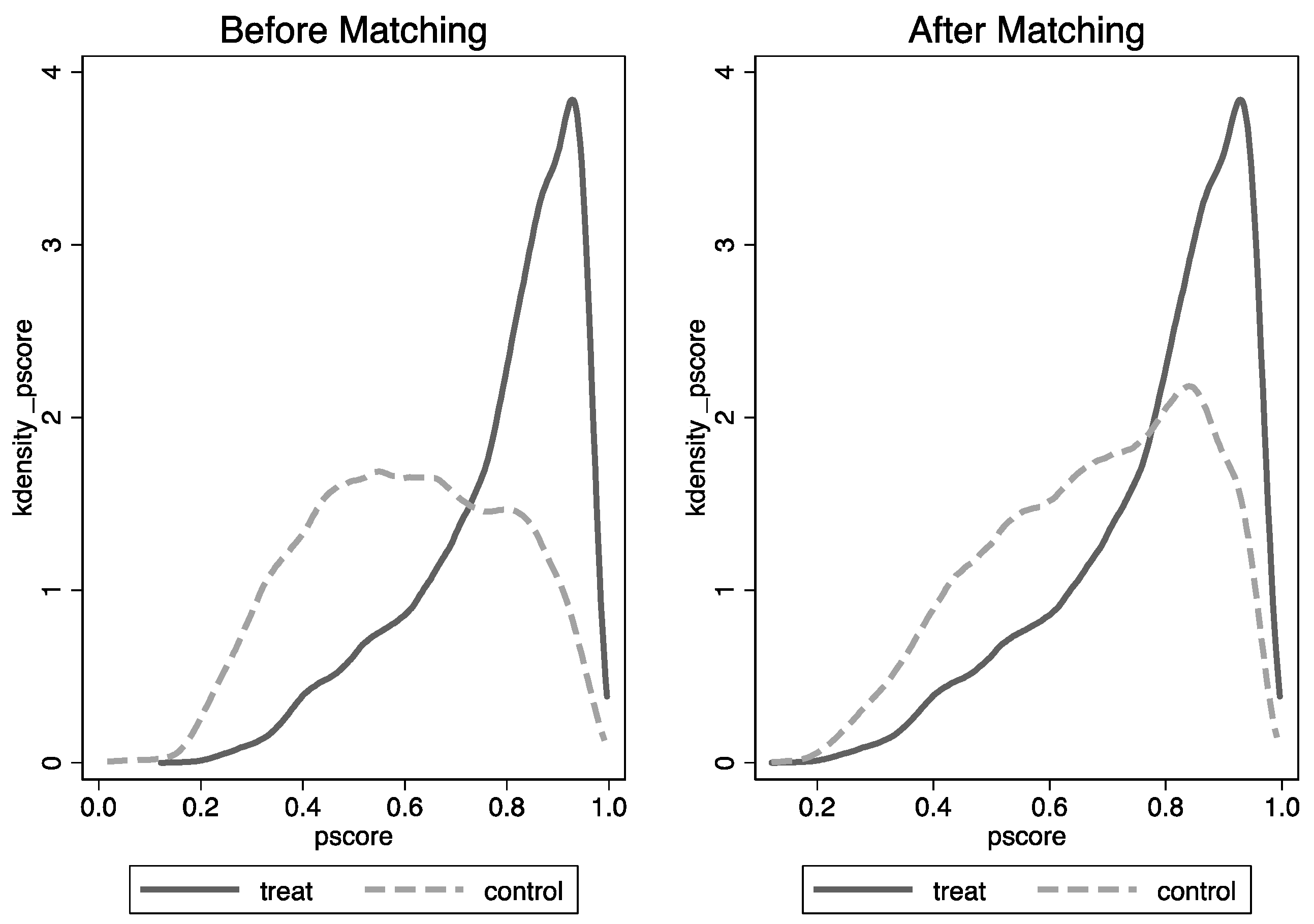

| Part A: Logistic Regression | Part B: PSTEST | |||

|---|---|---|---|---|

| Variable | Variable | Unmatched/Matched | %bias | |

| 0.066 *** (15.73) | U | 22.8 | ||

| M | −4.4 | |||

| −0.009 (−0.47) | U | 13.1 | ||

| M | −0.7 | |||

| 0.045 *** (12.21) | U | 32.3 | ||

| M | 0.5 | |||

| 0.151 *** (37.18) | U | 51.0 | ||

| M | −0.0 | |||

| 0.588 *** (11.71) | U | 14.6 | ||

| M | −1.6 | |||

| Variable | Sample | Treated | Controls | Difference | S.E. | T |

|---|---|---|---|---|---|---|

| Unmatched | 0.0788 | 0.0536 | 0.0252 *** | 0.0023 | 10.97 | |

| Matched | 0.0787 | 0.0685 | 0.0102 *** | 0.0038 | 2.71 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Du, J.; Li, J.; Liang, B.; Yan, Z. Optimizing Sustainable Entrepreneurial Ecosystems: The Role of Government-Certified Incubators in Early-Stage Financing. Sustainability 2025, 17, 3854. https://doi.org/10.3390/su17093854

Du J, Li J, Liang B, Yan Z. Optimizing Sustainable Entrepreneurial Ecosystems: The Role of Government-Certified Incubators in Early-Stage Financing. Sustainability. 2025; 17(9):3854. https://doi.org/10.3390/su17093854

Chicago/Turabian StyleDu, Jiang, Jing Li, Bingqing Liang, and Zhenjun Yan. 2025. "Optimizing Sustainable Entrepreneurial Ecosystems: The Role of Government-Certified Incubators in Early-Stage Financing" Sustainability 17, no. 9: 3854. https://doi.org/10.3390/su17093854

APA StyleDu, J., Li, J., Liang, B., & Yan, Z. (2025). Optimizing Sustainable Entrepreneurial Ecosystems: The Role of Government-Certified Incubators in Early-Stage Financing. Sustainability, 17(9), 3854. https://doi.org/10.3390/su17093854