Data-Driven Risk Warning of Electricity Sales Companies in the Whole Business Process

Abstract

1. Introduction

- The early warning method based on the indicator system for identifying the risk level of electricity sales companies relies on expert experience in setting risk thresholds, which is influenced by subjective factors. Additionally, the method has a certain degree of lag and cannot be updated in real time to reflect the actual conditions of the electricity sales company.

- The current research on early warning methods primarily analyzes a certain part of the electricity sales company and lacks comprehensive risk warnings throughout the whole transaction process, which is unable to meet the requirements of its sustainable development.

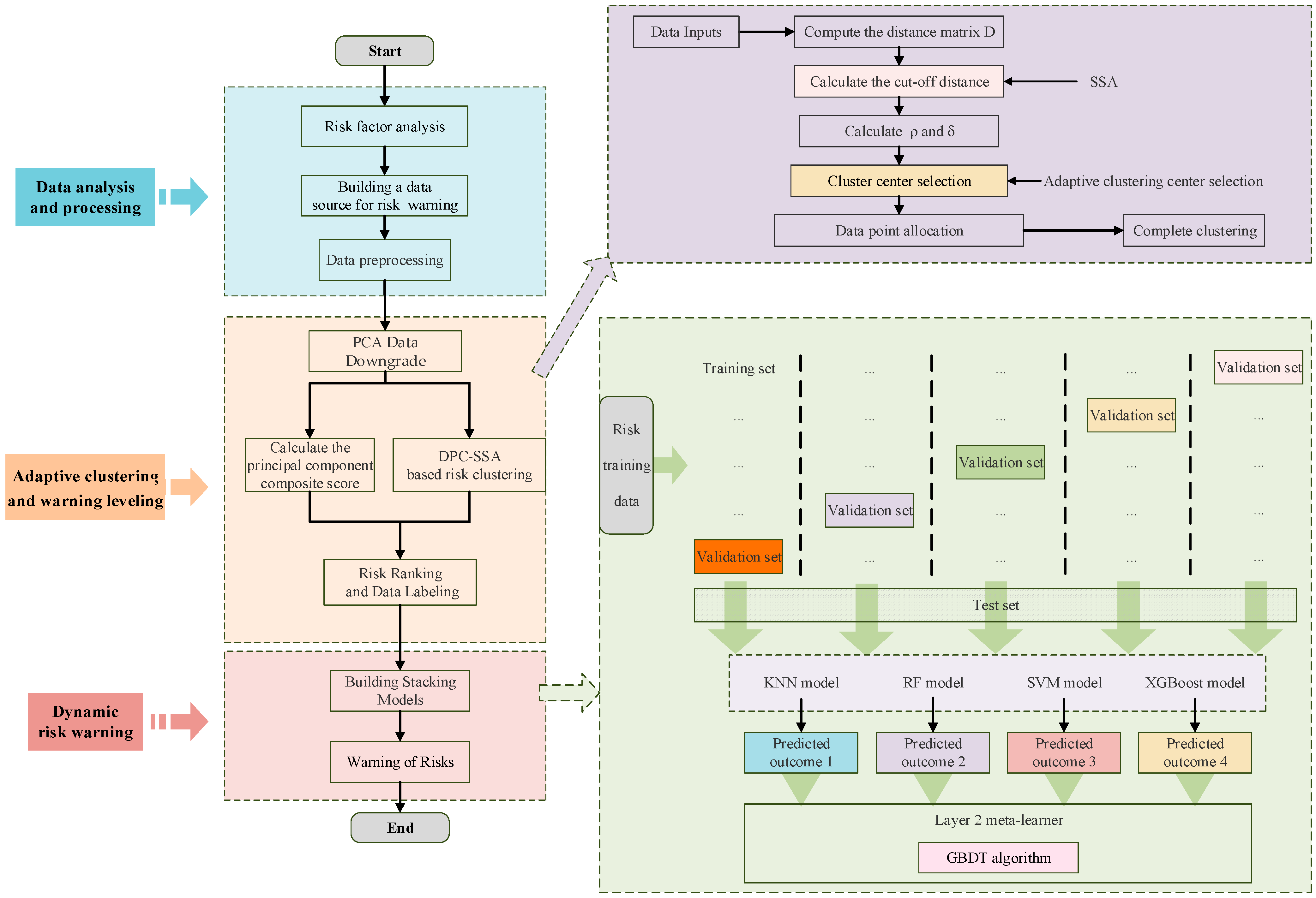

- (1)

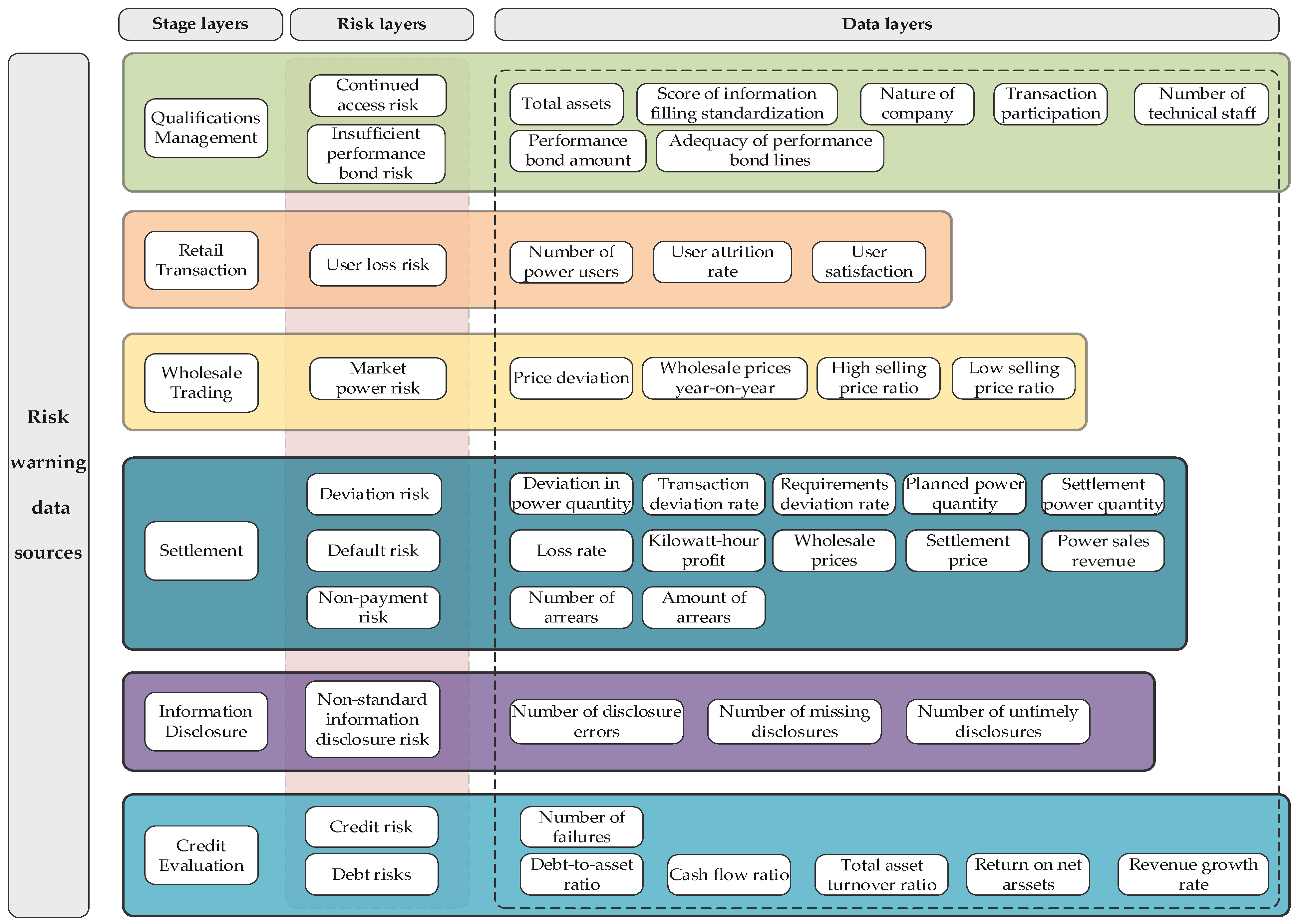

- Based on the data relevance of the whole business process, this method analyzes the risk factor clusters throughout the whole process. Risk warning data sources for electricity sales companies are identified from the Qualifications Management, Retail Transaction, Wholesale Trading, Settlement, Information Disclosure, and Credit Evaluation processes to improve comprehensiveness.

- (2)

- The key elements of risk assessment are refined using PCA, and DPC-SSA is applied for adaptive clustering and automatic classification of risk warning levels based on historical business data. The stacking model is employed to implement dynamic risk early warning for electricity sales companies. This method enables the scientific management and control of risks generated by electricity sales companies, reduces losses from potential risks, im-proves the stability and reliability of the electricity market, and fosters a more favorable business environment for market participants. This method ensures that electricity sales companies can participate sustainably in the electricity market.

2. Design of Risk Warning Method for Electricity Sales Companies

2.1. Data Analysis and Processing

2.2. Adaptive Clustering and Risk Warning Level Classification

2.3. Dynamic Risk Warning

3. Data Analysis and Processing

3.1. Analysis of Risk Factors in the Whole Process

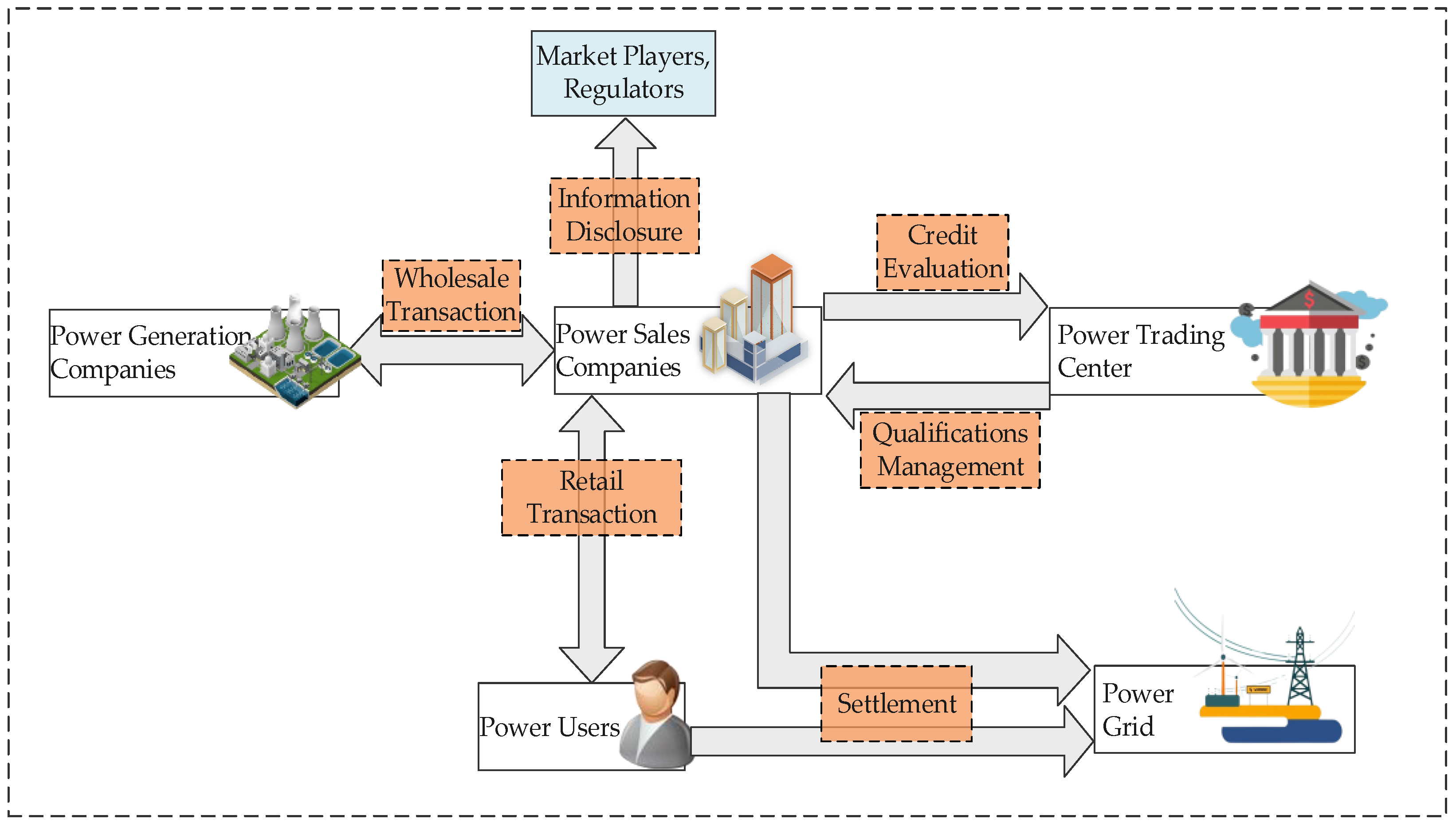

- Qualification Management Stage [38]. In this stage, third-party organizations review an electricity sales company’s eligibility, technical staffing, and performance bond in accordance with the “Regulations on the Management of Electricity Sales Companies”. Requirements for market entry, technical staffing, and performance bond indicate the company’s profitability and risk resilience to a certain extent.

- Retail Transaction Stage. In this stage, the electricity sales company enters agency purchase contracts with power users. Metrics such as the number of power users, user churn rate, and user satisfaction reflect the service quality and competitiveness of the electricity sales company.

- Wholesale Transaction Stage. During wholesale transactions, an electricity sales company’s purchasing behavior reflects whether it leverages market power for improper benefits, impacting transaction stability and security.

- Settlement Stage. Upon transaction completion, the power trading center performs settlement calculations and assesses the company’s deviations. The company’s deviation and profit-loss status indicate its technical strength and operational capability [39].

- Information Disclosure Stage. Beyond regular transactions, the electricity sales company must disclose its operational, financial, and pricing information. The frequency of disclosure errors, omissions, and delays reflects the company’s level of responsibility to a certain extent.

- Credit Evaluation Stage. In this stage, the power trading center evaluates the electricity sales company’s credit status and financial condition, indicating its creditworthiness and financial health.

3.2. Construction of Risk Warning Data Source

4. Adaptive Clustering and Risk Level Classification

4.1. Principal Component Analysis

- (1)

- Preprocess the dataset X to eliminate the effects of dimensionality.

- (2)

- Calculate the covariance matrix V:

- (3)

- Perform eigen decomposition on the covariance matrix to compute the eigenvalues and corresponding eigenvectors , arrange the eigenvalues in descending order, and obtain the cumulative contribution rate λ.

- (4)

- Based on the set cumulative contribution rate, select the top m eigenvalues and their corresponding eigenvectors , where the eigenvectors form the loading coefficient matrix. The extracted m principal components are denoted as :

- (5)

- Calculate the composite score of principal components. The principal component score matrix is , and the composite score is calculated as:where is the weight vector after normalizing the contribution rate.

4.2. DPC-SSA Algorithm

4.2.1. Truncation Distance Optimization

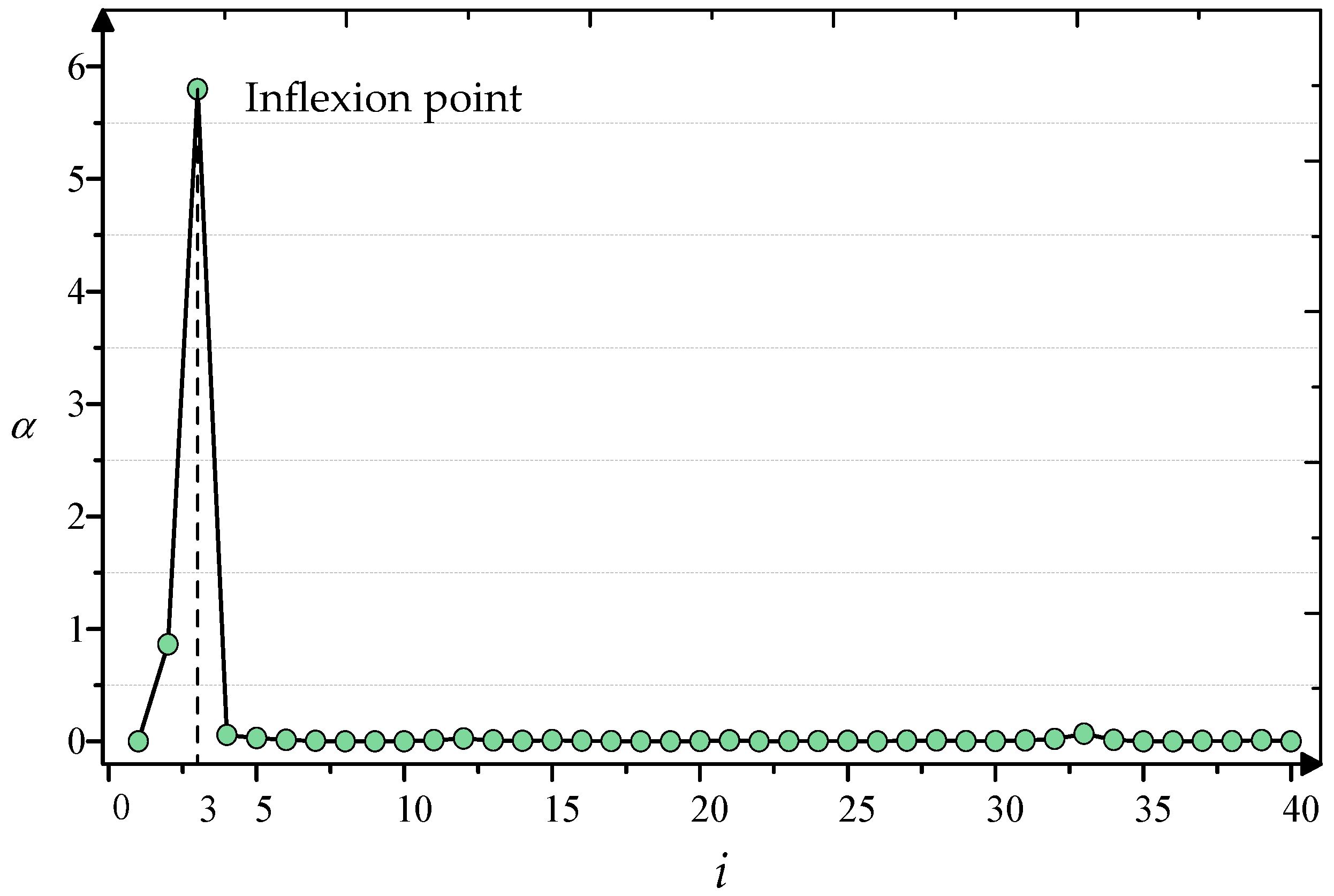

4.2.2. Adaptive Cluster Center Selection

5. Construction of Risk Warning Model for Electricity Sales Companies

5.1. Stacking Model

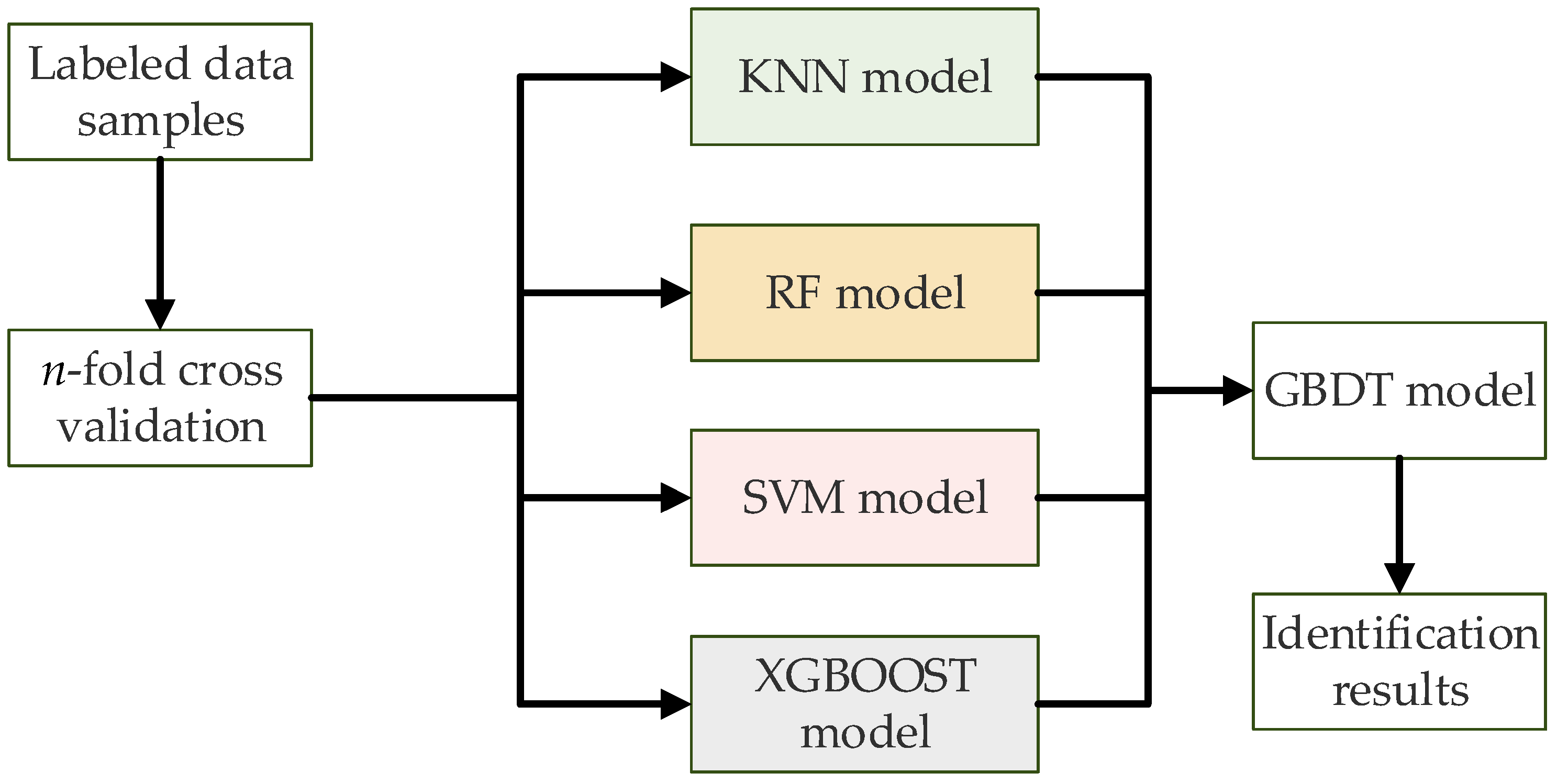

- (1)

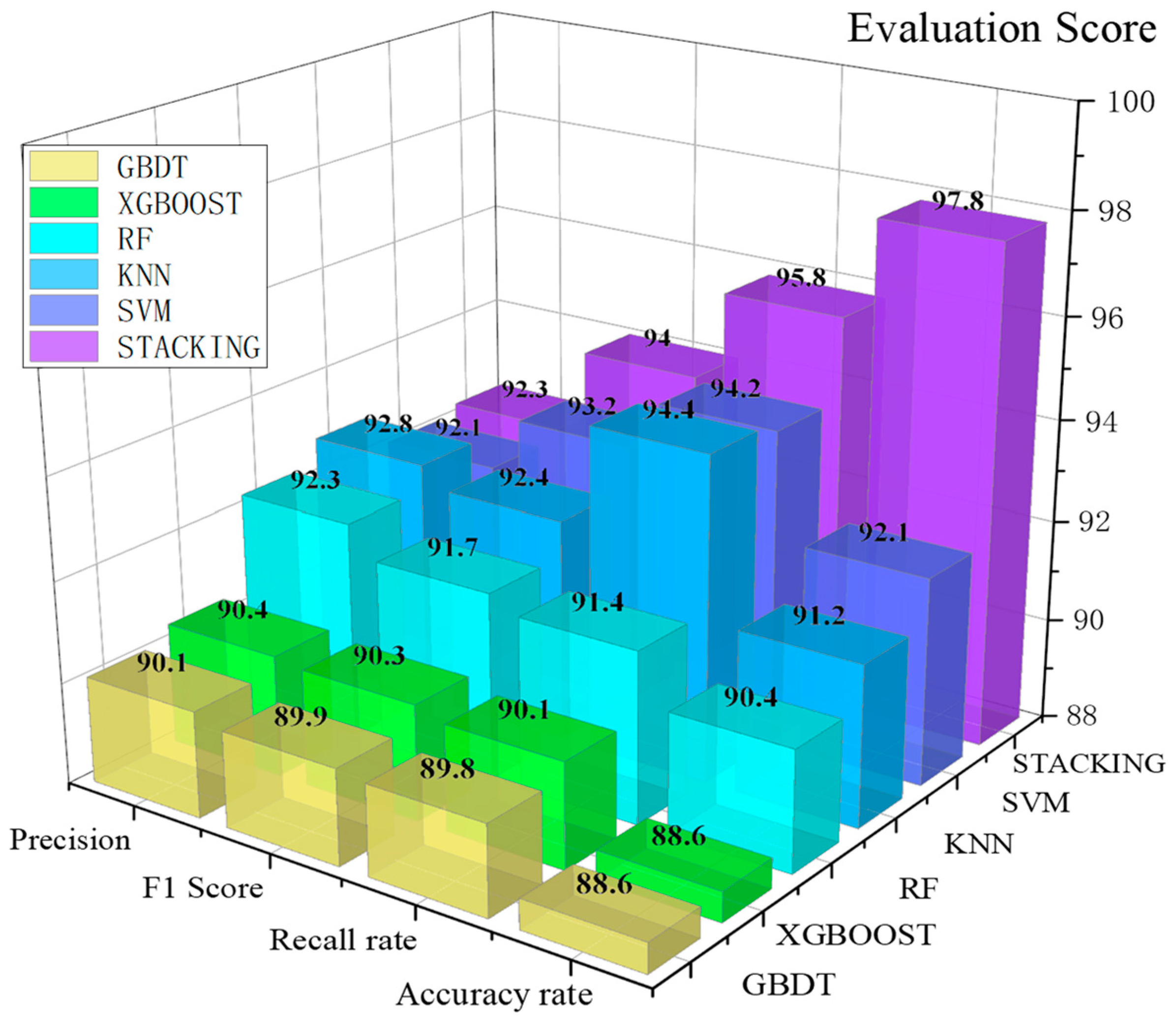

- Selection of base learners. When selecting base learners, each base model should have distinct learning characteristics to ensure varied strengths in handling different data aspects. Therefore, this paper employs Support Vector Machines (SVM) [47], Random Forest (RF) [48], K-Nearest Neighbors (KNN) [49], and Extreme Gradient Boosting (XGBoost) [50] as base learners in the risk identification model.

- (2)

- Selection of meta-learner. To prevent overfitting, the meta-learner should have strong generalization capabilities to effectively refine and optimize the base learners’ predictions. Therefore, Gradient Boosting Decision Trees (GBDT) [51] are selected as the meta-learner for the second layer. The structure of the stacking model is illustrated in Figure 6.

5.2. Performance Metrics of the Stacking Model

6. Simulation Verification and Analysis

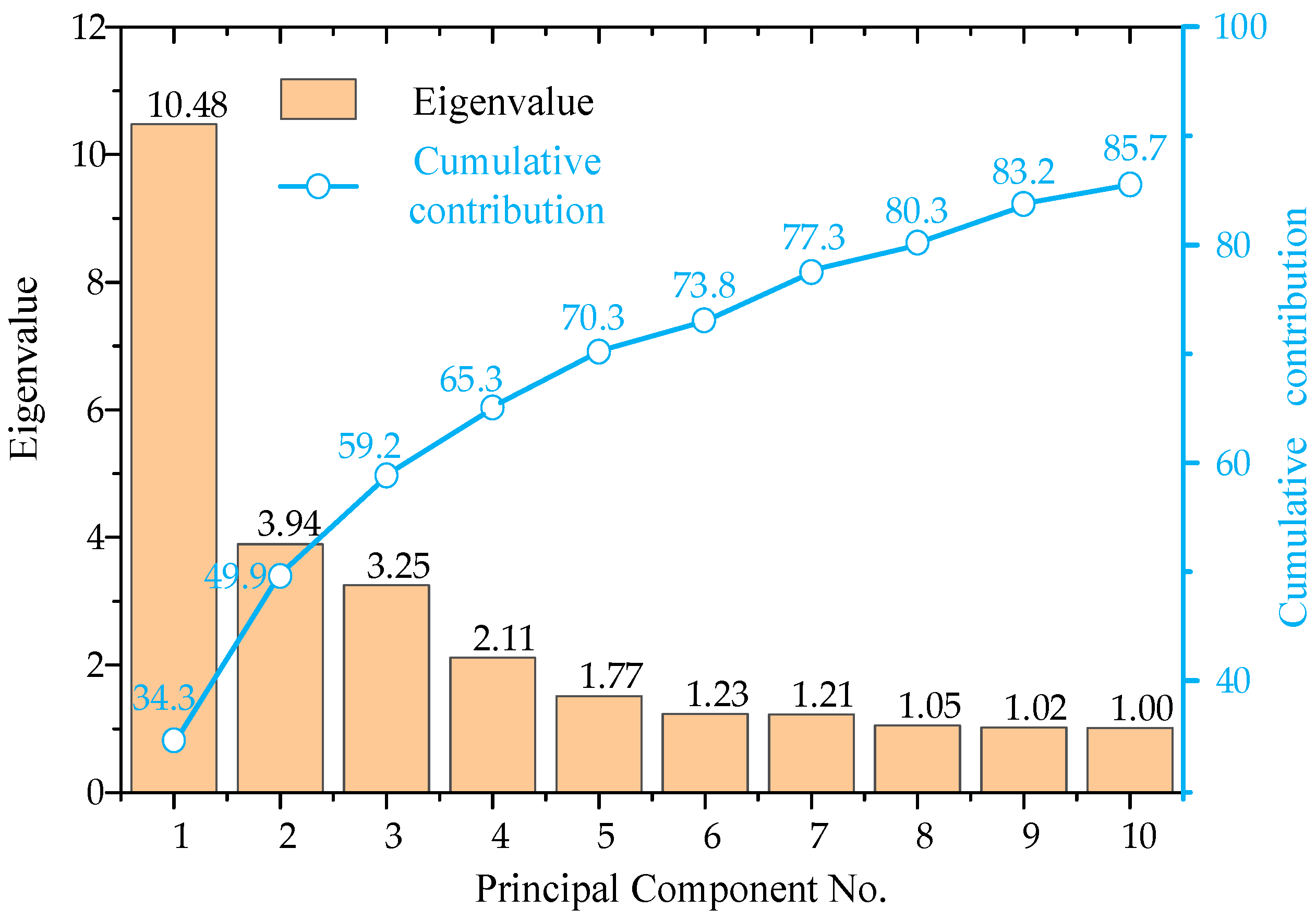

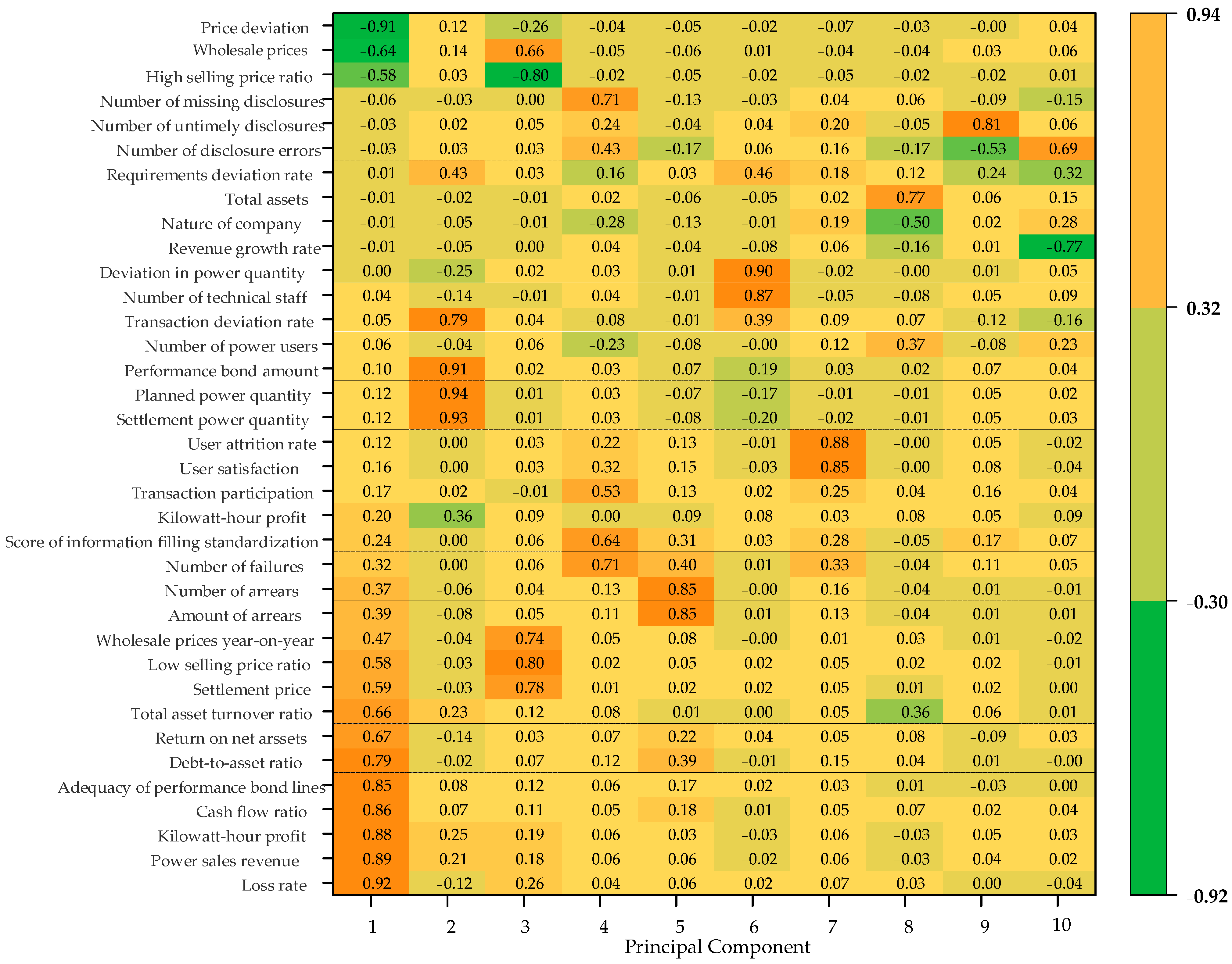

6.1. Extraction of Principal Components of Data

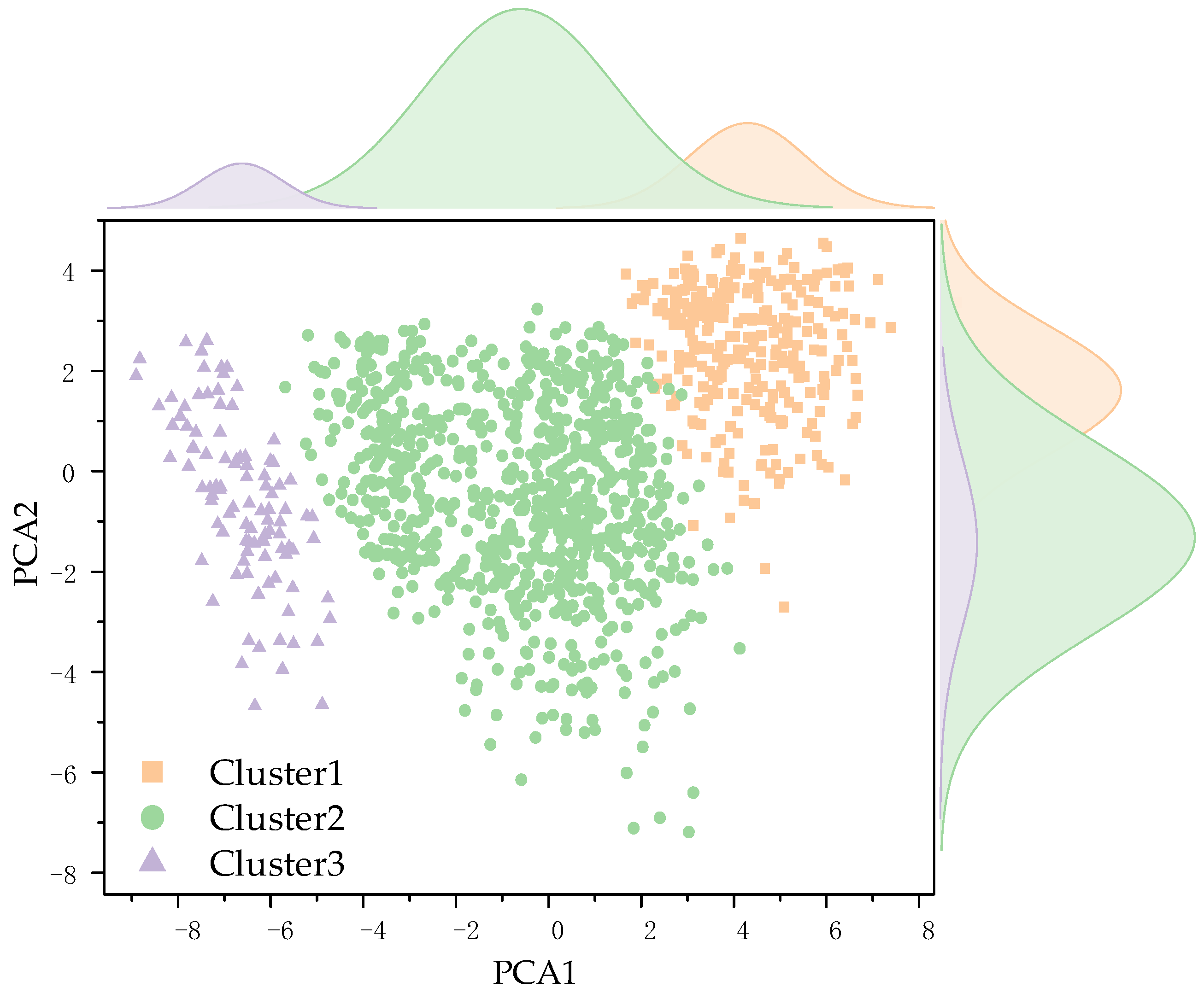

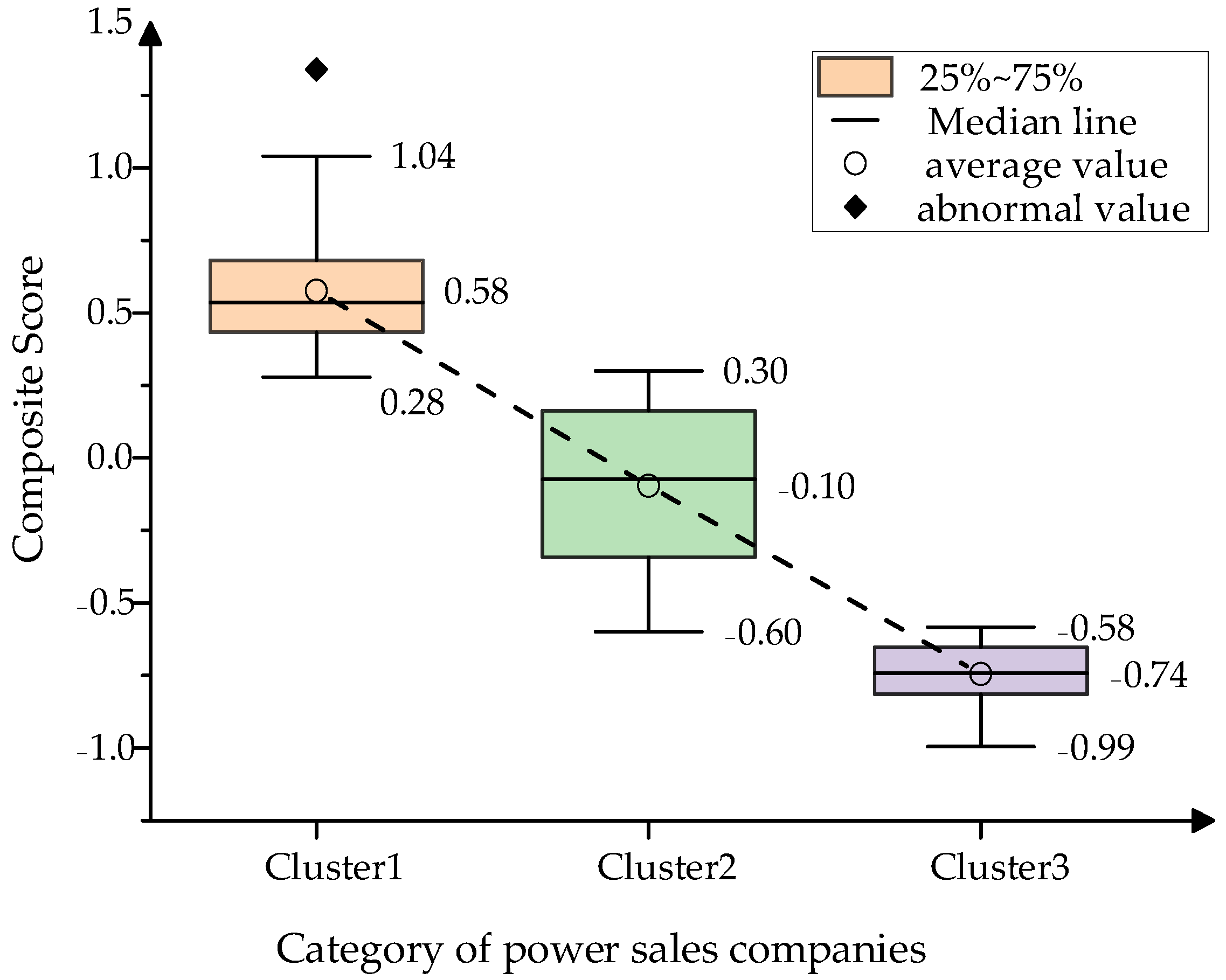

6.2. Risk Clustering of Electricity Sales Companies

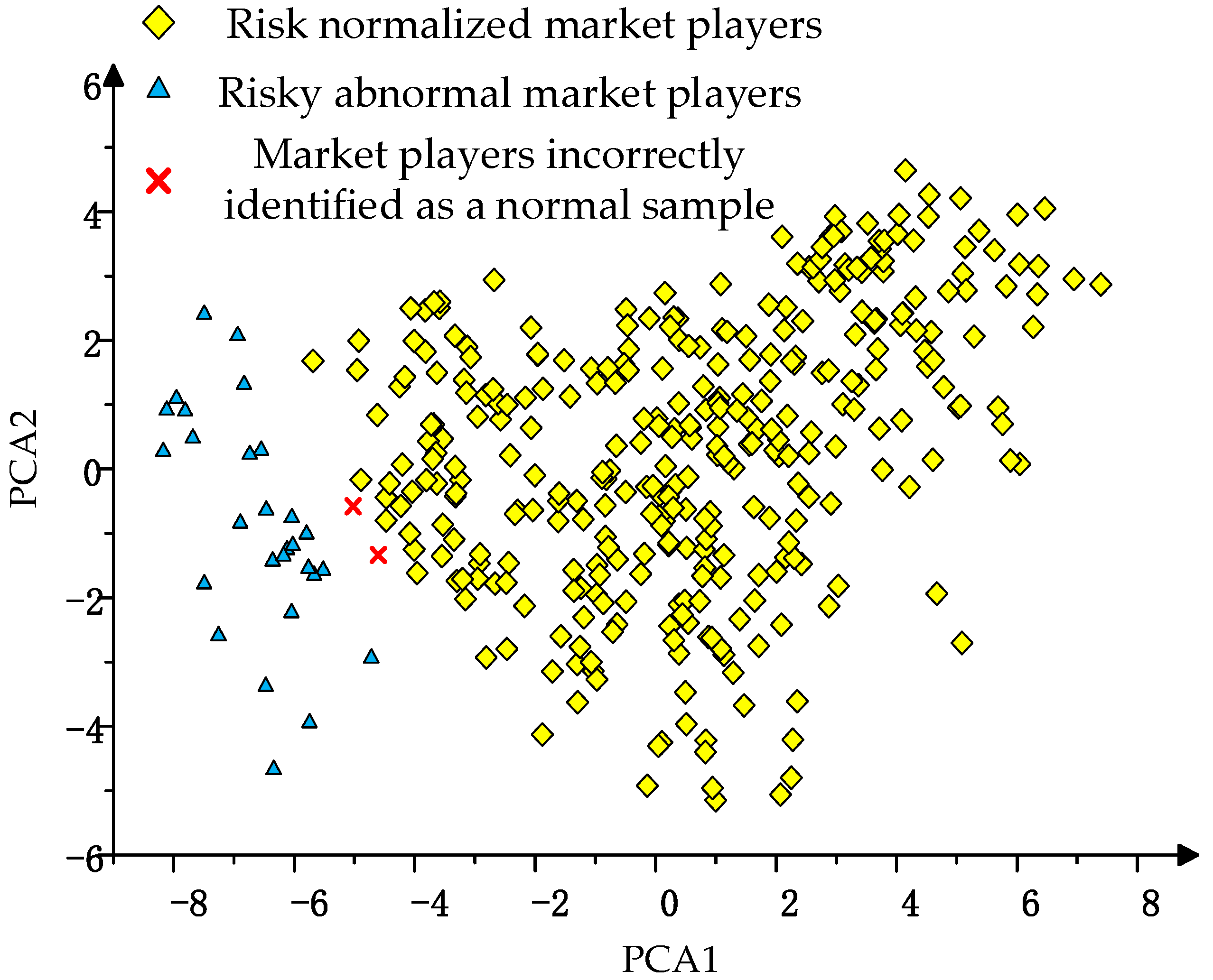

6.3. Classification of Risk Warning Levels

6.4. Analysis of Risk Warning Results

7. Conclusions

- (1)

- PCA facilitates extracting key factors representing risk features from business data, reducing the amount of data for management and processing.

- (2)

- The proposed DPC-SSA clustering algorithm addresses cutoff distance issues and manual cluster center determination in DPC, providing effective clustering results for risk data.

- (3)

- Using principal component scores for adaptive risk level classification reduces the impact of subjective human factors, improving classification accuracy.

- (4)

- The constructed stacking model, applied to risk warning for electricity sales companies, exhibits high warning accuracy and enables dynamic warning and tracking of high-risk companies, allowing them to participate in the electricity market in a sustainable manner.

- (5)

- This risk warning method does not require risk data labels, can self-update on the basis of transaction data, and provides real-time, effective warnings for high-risk electricity sales companies.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Principal Component | Explanation Factor | Risks |

|---|---|---|

| 1 | Total asset turnover ratio Return on net assets Debt-to-asset ratio Adequacy of performance bond lines Cash flow ratio Kilowatt-hour profit Power sales revenue Loss rate | Default risk Debt risk Insufficient performance bond risk |

| 2 | Performance bond amount Transaction deviation rate Planned power quantity Settlement power quantity | Deviation risk Insufficient performance bond risk |

| 3 | Wholesale price Wholesale prices year-on-year Low selling price ratio Settlement price | Market power risk |

| 4 | Score of information filling standardization Number of missing disclosures Number of failures | Continued access risk Credit risk Non-standard information disclosure risk |

| 5 | Number of arrears Amount of arrears | Non-payment risk |

| 6 | Deviation in power quantity Number of technical staff | Deviation risk Continued access risk |

| 7 | User satisfaction User attrition rate | User loss risk |

| 8 | Total assets | Continued access risk |

| 9 | Number of untimely disclosures | Non-standard information disclosure risk |

| 10 | Number of disclosure errors | Non-standard information disclosure risk |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|

| 0.014 | 0.028 | −0.030 | −0.015 | −0.024 | −0.042 | 0.037 | −0.578 | 0.013 | −0.077 |

| 0.009 | 0.039 | −0.008 | −0.015 | −0.021 | −0.082 | 0.333 | 0.445 | −0.141 | −0.301 |

| −0.011 | 0.022 | 0.033 | −0.003 | −0.001 | 0.004 | 0.508 | −0.005 | 0.021 | −0.065 |

| −0.016 | 0.006 | 0.263 | −0.004 | −0.018 | 0.021 | 0.048 | 0.016 | −0.003 | 0.058 |

| 0.145 | −0.014 | 0.038 | −0.041 | −0.002 | −0.106 | −0.055 | −0.017 | −0.036 | −0.073 |

| −0.012 | 0.007 | 0.271 | −0.011 | −0.009 | 0.015 | 0.057 | 0.018 | 0.003 | 0.058 |

| −0.006 | 0.003 | 0.030 | −0.005 | 0.486 | −0.006 | 0.017 | 0.029 | −0.016 | 0.007 |

| 0.004 | 0.043 | −0.013 | −0.011 | 0.035 | −0.063 | 0.383 | −0.023 | 0.023 | 0.498 |

| 0.004 | −0.003 | 0.062 | −0.019 | 0.493 | −0.012 | −0.022 | 0.000 | −0.026 | 0.001 |

| −0.027 | −0.016 | −0.011 | 0.255 | −0.016 | 0.025 | −0.007 | 0.039 | 0.023 | 0.018 |

| 0.010 | 0.012 | 0.010 | −0.262 | 0.008 | 0.006 | −0.011 | −0.005 | −0.006 | −0.014 |

| −0.010 | −0.012 | −0.010 | 0.262 | −0.008 | −0.006 | 0.012 | 0.005 | 0.006 | 0.014 |

| −0.140 | 0.013 | 0.043 | 0.020 | 0.007 | 0.103 | −0.055 | 0.002 | 0.005 | −0.065 |

| −0.011 | 0.007 | 0.267 | −0.011 | −0.023 | 0.014 | 0.055 | 0.017 | 0.004 | 0.057 |

| −0.002 | −0.010 | −0.011 | 0.251 | −0.003 | −0.028 | 0.016 | −0.009 | 0.002 | 0.007 |

| −0.223 | 0.008 | 0.052 | 0.373 | 0.006 | 0.120 | −0.066 | −0.009 | 0.009 | −0.092 |

| 0.145 | −0.017 | 0.024 | −0.041 | −0.002 | −0.093 | −0.064 | −0.013 | −0.033 | −0.076 |

| 0.140 | −0.014 | −0.042 | −0.021 | −0.007 | −0.096 | 0.055 | 0.000 | −0.004 | 0.065 |

| 0.132 | −0.037 | 0.005 | −0.055 | 0.009 | −0.010 | −0.031 | 0.023 | 0.017 | −0.043 |

| −0.025 | −0.014 | 0.260 | 0.007 | 0.234 | 0.057 | 0.018 | 0.029 | 0.006 | −0.020 |

| 0.091 | −0.003 | −0.011 | −0.057 | −0.012 | 0.119 | 0.012 | 0.026 | −0.009 | −0.032 |

| 0.132 | −0.028 | 0.007 | −0.063 | 0.008 | −0.008 | 0.027 | 0.039 | −0.022 | −0.050 |

| 0.117 | −0.003 | 0.027 | −0.036 | 0.013 | −0.104 | −0.215 | −0.200 | 0.009 | 0.016 |

| 0.100 | −0.023 | −0.039 | −0.067 | 0.008 | 0.042 | 0.060 | 0.044 | 0.073 | −0.025 |

| −0.021 | −0.017 | 0.035 | 0.007 | −0.005 | 0.011 | −0.149 | 0.034 | −0.094 | 0.592 |

| −0.065 | −0.021 | 0.024 | 0.021 | −0.005 | 0.512 | −0.009 | 0.007 | −0.004 | 0.005 |

| −0.055 | −0.036 | 0.011 | 0.019 | −0.004 | 0.506 | −0.037 | 0.013 | −0.001 | −0.028 |

| 0.011 | 0.103 | −0.038 | 0.024 | 0.002 | −0.134 | −0.117 | −0.081 | 0.618 | −0.292 |

| −0.017 | 0.157 | 0.006 | 0.003 | −0.014 | −0.190 | −0.055 | 0.297 | 0.292 | 0.337 |

| 0.009 | 0.172 | −0.046 | 0.013 | 0.031 | −0.233 | −0.238 | 0.036 | −0.645 | −0.132 |

| −0.017 | 0.181 | −0.012 | 0.013 | 0.009 | 0.011 | −0.148 | 0.129 | 0.027 | −0.009 |

| −0.016 | 0.192 | −0.013 | 0.006 | −0.008 | 0.050 | −0.151 | 0.141 | 0.086 | −0.010 |

| −0.052 | 0.295 | 0.026 | −0.009 | −0.012 | −0.019 | 0.261 | −0.246 | −0.052 | 0.009 |

| −0.061 | 0.285 | 0.033 | −0.005 | 0.001 | −0.001 | 0.306 | −0.308 | −0.064 | −0.027 |

| 0.005 | 0.172 | −0.007 | −0.023 | 0.007 | −0.084 | −0.079 | 0.137 | −0.008 | −0.004 |

References

- Wang, Y.; Liu, C.; Yuan, W.; Li, L. MRL-Based Model for Diverse Bidding Decision-Makings of Power Retail Company in the Wholesale Electricity Market of China. Axioms 2023, 12, 142. [Google Scholar] [CrossRef]

- Wang, H.; Wang, C.; Zhao, W. Decision on Mixed Trading between Medium- and Long-Term Markets and Spot Markets for Electricity Sales Companies under New Electricity Reform Policies. Energies 2022, 15, 9568. [Google Scholar] [CrossRef]

- Qi, H.; Lin, Z.; Zheng, R. Construction of An Early Warning Model for Market Power Identification in the Electricity Spot Market Based on Improved BP Neural Networks. In Proceedings of the 2022 9th International Forum on Electrical Engineering and Automation (IFEEA), Zhuhai, China, 4–6 November 2022; pp. 1215–1220. [Google Scholar]

- Zhang, C.; Liao, J.; Li, Y.; Zhang, B.; Li, Y.; Li, J. A Data-Driven Risk Identification and Early Warning Model for Electricity Spot Markets. In Proceedings of the 2024 4th Power System and Green Energy Conference (PSGEC), Shanghai, China, 22–24 August 2024; pp. 291–295. [Google Scholar]

- Li, X.; Zheng, Z.; Luo, B.; Shi, D.; Han, X. The impact of electricity sales side reform on energy technology innovation: An analysis based on SCP paradigm. Energy Econ. 2024, 136, 107763. [Google Scholar] [CrossRef]

- Huang, J.; Chen, F.; Yang, T.; Sun, Y.; Yang, P.; Liu, G. Optimal Operation of Electricity Sales Company with Multiple VPPs Based on Stackelberg Game. In Proceedings of the 2023 5th International Conference on Power and Energy Technology (ICPET), Tianjin, China, 27–30 July 2023; pp. 1194–1199. [Google Scholar]

- Xu, X.; Zhang, Z.; Liu, B. Design of medium and long-term power market electricity purchase and sale strategy considering time-sharing power consumption deviation assessment. In Proceedings of the International Conference on Computer Graphics, Artificial Intelligence, and Data Processing (ICCAID 2022), Guangzhou, China, 23–25 December 2023; Volume 12604, pp. 544–550. [Google Scholar]

- Fram, P.; Rruka, J.; Sandal, K. Risk Management in Wholesale Electricity Markets: A Signal Processing Approach. In Proceedings of the 2022 International Conference on Renewable Energies and Smart Technologies (REST), Tirana, Albania, 28–29 July 2022; pp. 304–309. [Google Scholar]

- Zhang, X. A Long-term price risk early-warning model of electricity company based on EGARCH and VAR. In Proceedings of the 2010 International Conference on Advances in Energy Engineering ICAEE, Beijing, China, 19–20 June 2010; pp. 295–298. [Google Scholar]

- Xia, W.; Wang, Z.; Gao, C.; Yang, T.; Ming, H. Multi-angle Risk Identification and Comprehensive Evaluation of Electricity Retailers in the Electricity Sales Market Environment. In Proceedings of the 2022 IEEE International Conference on Power Systems and Electrical Technology (PSET), Aalborg, Denmark, 13–15 October 2022; pp. 415–420. [Google Scholar]

- Aghaei, J.; Charwand, M.; Gitizadeh, M. Robust risk management of retail energy service providers in midterm electricity energy markets under unstructured uncertainty. J. Energy Eng. 2017, 143, 04017030. [Google Scholar] [CrossRef]

- Charwand, M.; Gitizadeh, M. Risk-based procurement strategy for electricity retailers: Different scenario-based methods. IEEE Trans. Eng. Manag. 2018, 67, 141–151. [Google Scholar] [CrossRef]

- Wang, P.; Xu, K.; Dai, Y.; Yu, S. A Systematic Muti-level Evaluation Framework and Approach for Electricity Market Operation Based on Big Data. In Proceedings of the 2022 IEEE/IAS Industrial and Commercial Power System Asia, I&CPS Asia, Shanghai, China, 8–11 July 2022; pp. 1778–1783. [Google Scholar]

- Li, Y.; Li, J.; Shang, Y.; Qian, H. Risk Forecast to Electricity Retail Market Based Multiple Risk Factors of Electricity Retail Companies. In Proceedings of the 2020 5th International Conference on Power and Renewable Energy ICPRE, Shanghai, China, 12–14 September 2020; pp. 95–100. [Google Scholar]

- Fan, W.; Song, X.; Li, C. Market power evaluation of power retail market based on combination weighting method. In Proceedings of the 2024 3rd International Conference on Energy, Power and Electrical Technology ICEPET, Chengdu, China, 17–19 May 2024; pp. 1373–1377. [Google Scholar]

- Adelowo, J.; Bohland, M. Redesigning automated market power mitigation in electricity markets. Int. J. Ind. Organ. IJIO 2024, 97, 103108. [Google Scholar] [CrossRef]

- Li, H.; Lan, Q.; Xiong, Q. Methodology for Smooth Transition from Experience-Based to Data-Driven Credit Risk Assessment Modeling under Data Scarcity. Mathematics 2024, 12, 2410. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, H.; Xu, H. Identification of market power abuse in China’s electricity market. IOP Conf. Ser. Mater. Sci. Eng. 2020, 740, 012077. [Google Scholar] [CrossRef]

- Zhang, L.; Bai, X.; Chen, Y.; Wang, T.; Hu, F.; Li, M. Research on Power Market User Credit Evaluation Based on K-Means Clustering and Contour Coefficient. In Proceedings of the 2020 3rd International Conference on Robotics, Control and Automation Engineering (RCAE), Chongqing, China, 5–8 November 2020; pp. 64–68. [Google Scholar]

- De, G.; Tan, Z.; Li, M. A credit risk evaluation based on intuitionistic fuzzy set theory for the sustainable development of electricity retailing companies in China. Energy Sci. Eng. 2019, 7, 2825–2841. [Google Scholar] [CrossRef]

- Peng, Y. Construction and Evaluation of Credit Risk Early Warning Indicator System of Internet Financial Enterprises Based On AI and Knowledge Graph Theory. Procedia Comput. Sci. 2024, 243, 918–927. [Google Scholar] [CrossRef]

- Wang, W.; An, A. Identification of market power abuse in Chinese electricity market based on an improved cost-sensitive support vector machine. Int. J. Electr. Power Energy Syst. 2024, 158, 109907. [Google Scholar] [CrossRef]

- Baldissarro, G.; Bruni, M.E.; Iazzolino, G.; Morea, D.; Veltri, S. Does It Pay Off to Integrate ESG Performance into Bank Investment Portfolio Selection? Empirical Evidence in the European Energy Sector. Sustainability 2024, 16, 10766. [Google Scholar] [CrossRef]

- Sotiropoulos, D.N.; Koronakos, G.; Solanakis, S.V. Evolving Transparent Credit Risk Models: A Symbolic Regression Approach Using Genetic Programming. Electronics 2024, 13, 4324. [Google Scholar] [CrossRef]

- Zhou, Y.; Chong, C.H.; Ni, W.; Li, Z.; Zhou, X.; Ma, L. Data Modeling and Synchronization Method to Align Power Trading Rules for Integrated Energy Management Systems. Sustainability 2024, 16, 9073. [Google Scholar] [CrossRef]

- Samadi, M.; Hajiabadi, M. Assessment of the collusion possibility and profitability in the electricity market: A new analytical approach. Int. J. Electr. Power Energy Syst. 2019, 112, 381–392. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhao, H.; Li, B.; Zhao, Y.; Qi, Z. Research on credit rating and risk measurement of electricity retailers based on Bayesian Best Worst Method-Cloud Model and improved Credit Metrics model in China’s power market. Energy 2022, 252, 124088. [Google Scholar] [CrossRef]

- Yu, X.; Zheng, D.; Zhou, L. Credit risk analysis of electricity retailers based on cloud model and intuitionistic fuzzy analytic hierarchy process. Int. J. Energy Res. 2021, 45, 4285–4302. [Google Scholar] [CrossRef]

- Allen, D.E.; Powell, R.J.; Singh, A.K. Take it to the limit: Innovative CVaR applications to extreme credit risk measurement. Eur. J. Oper. Res. 2016, 249, 465–475. [Google Scholar] [CrossRef]

- Dong, J.; Wang, D.; Liu, D.; Ainiwaer, P.; Nie, L. Operation Health Assessment of Power Market Based on Improved Matter-Element Extension Cloud Model. Sustainability 2019, 11, 5470. [Google Scholar] [CrossRef]

- Jin, L.; Cheng, C.; Wang, X.; Yu, J.; Long, H. Research on information disclosure strategies of electricity retailers under new electricity reform in China. Sci. Total Environ. 2020, 710, 136382. [Google Scholar] [CrossRef]

- Hao, Q.; Wang, S.; Zheng, J.; Zhong, X.; Zhang, J.; Xiao, C. Research on Revenue Risk of Electricity Retailers Considering Demand Response. In Proceedings of the 2022 IEEE 5th International Electrical and Energy Conference (CIEEC), Nangjing, China, 27–29 May 2022; pp. 2950–2955. [Google Scholar]

- Xiong, C.; Lv, X.; Li, X.; Zhong, H.; Feng, J. Market power evaluation in the electricity market based on the weighted maintenance object. Energy 2023, 284, 129294. [Google Scholar]

- Wang, X.; Huang, H.; Zhao, W.; Yang, X.; Kong, M. Risk Warning System of Market Power Monitoring in Electricity Market. IOP Conf. Ser. Earth Environ. Sci. 2021, 831, 012005. [Google Scholar] [CrossRef]

- Liu, D.; Zhang, Q.; Li, X.; Gu, Y.; Tan, Z. Identification of Potential Harmful Behaviors in Electricity Market Based on Cloud Model and Fuzzy Petri Net. Automat. Electric Power Syst. 2019, 43, 25–33. [Google Scholar]

- Davut, P.; Elçin, A.; Bilge, K. Introducing the overall risk scoring as an early warning system. Expert Syst. Appl. 2024, 246, 123232. [Google Scholar]

- Hua, H.; Chen, X.; Gan, L.; Sun, J.; Dong, N.; Liu, D. Demand-Side Joint Electricity and Carbon Trading Mechanism. IEEE Trans. Ind. Cyber-Phys. Syst. 2024, 2, 14–25. [Google Scholar] [CrossRef]

- Wang, L.; Cao, Z.; Li, P. Research on the mechanism of leader-follower product sales competition based on market access restrictions and forward contract considerations. Heliyon 2024, 10, e32372. [Google Scholar] [CrossRef]

- Zhou, N.; He, P.; Ding, W. Research on Settlement Risk Control of electricity Sales Company Base on the integration of Margin System and Business Process. In Proceedings of the 2022 China International Conference on Electricity Distribution CICED, Changsha, China, 7–8 September 2022; pp. 87–91. [Google Scholar]

- Alahmadi, M. Optimizing Data Quality for Sustainable Development: An Integration of Green Finance with Financial Market Regulations. Sustainability 2024, 16, 10418. [Google Scholar] [CrossRef]

- Qiao, K.; Chen, J.; Duan, S. Self-adaptive two-stage density clustering method with fuzzy connectivity. Appl. Soft Comput. 2024, 154, 111355. [Google Scholar] [CrossRef]

- Sarvani, A.; Hemalatha, S. Nature inspired-based remora optimisation algorithm for enhancement of density peak clustering. Cogent Eng. 2023, 10, 2278259. [Google Scholar]

- Yang, Y.; Wang, L.; Cheng, Z. Density peaks algorithm based on information entropy and merging strategy for power load curve clustering. J. Supercomput. 2023, 80, 8801–8832. [Google Scholar] [CrossRef]

- Liu, G.; Shu, C.; Liang, Z.; Peng, B.; Cheng, L. A Modified Sparrow Search Algorithm with Application in 3d Route Planning for UAV. Sensors 2021, 21, 1224. [Google Scholar] [CrossRef]

- Guo, L.; Qin, W.; Cai, Z.; Su, X. Hybrid Clustering Algorithm Based on Improved Density Peak Clustering. Appl. Sci. 2024, 14, 715. [Google Scholar] [CrossRef]

- Wang, Y.; Sun, Y.; Dan, Y.; Li, Y.; Cao, J.; Han, X. Online load-loss risk assessment based on stacking ensemble learning for power systems. Front. Energy Res. 2023, 11, 1281368. [Google Scholar] [CrossRef]

- Abd El Aal, A.K.; GabAllah, H.M.; Megahed, H.A.; Selim, M.K.; Hegab, M.A.; Fadl, M.E.; Rebouh, N.Y.; El-Bagoury, H. Geo-Environmental Risk Assessment of Sand Dunes Encroachment Hazards in Arid Lands Using Machine Learning Techniques. Sustainability 2024, 16, 11139. [Google Scholar] [CrossRef]

- Yang, W.; Chen, L.; Ke, T.; He, H.; Li, D.; Liu, K.; Li, H. Carbon Emission Trend Prediction for Regional Cities in Jiangsu Province Based on the Random Forest Model. Sustainability 2024, 16, 10450. [Google Scholar] [CrossRef]

- Ekinci, G.; Ozturk, H.K. Forecasting Wind Farm Production in the Short, Medium, and Long Terms Using Various Machine Learning Algorithms. Energies 2025, 18, 1125. [Google Scholar] [CrossRef]

- Liu, J.; Chu, Q.; Yuan, W.; Zhang, D.; Yue, W. WQI Improvement Based on XG-BOOST Algorithm and Exploration of Optimal Indicator Set. Sustainability 2024, 16, 10991. [Google Scholar] [CrossRef]

- Peng, S.; Feng, C.; Qiu, Z.; Zhang, Q.; Liu, W.; Gao, W. Enhanced Data-Driven Machine Learning Models for Predicting Total Organic Carbon in Marine–Continental Transitional Shale Reservoirs. Sustainability 2025, 17, 2048. [Google Scholar] [CrossRef]

- Liu, H.; Cui, Y.; Wang, J.; Yu, H. Analysis and Research on Rice Disease Identification Method Based on Deep Learning. Sustainability 2023, 15, 9321. [Google Scholar] [CrossRef]

| Identifying Values | True Values | |

|---|---|---|

| True Value 1 | True Value 2 | |

| Identifying values 1 | ||

| Identifying values 2 | ||

| Real Value | Identifying Value | |

|---|---|---|

| Positive Sample | Negative Sample | |

| Positive sample | 330 | 6 |

| Negative sample | 2 | 28 |

| Methods | No Data Labels Required | Real Time | Self-Update |

|---|---|---|---|

| Z-score warning method | √ | × | × |

| Neural networks warning methods | × | √ | √ |

| Warning method of this paper | √ | √ | √ |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, B.; Fu, T.; Wei, L.; Zheng, R.; Lin, Z.; Liu, H.; Qin, Z. Data-Driven Risk Warning of Electricity Sales Companies in the Whole Business Process. Sustainability 2025, 17, 3884. https://doi.org/10.3390/su17093884

Chen B, Fu T, Wei L, Zheng R, Lin Z, Liu H, Qin Z. Data-Driven Risk Warning of Electricity Sales Companies in the Whole Business Process. Sustainability. 2025; 17(9):3884. https://doi.org/10.3390/su17093884

Chicago/Turabian StyleChen, Biyun, Tianwang Fu, Liming Wei, Rong Zheng, Zhe Lin, Haiwei Liu, and Zhijun Qin. 2025. "Data-Driven Risk Warning of Electricity Sales Companies in the Whole Business Process" Sustainability 17, no. 9: 3884. https://doi.org/10.3390/su17093884

APA StyleChen, B., Fu, T., Wei, L., Zheng, R., Lin, Z., Liu, H., & Qin, Z. (2025). Data-Driven Risk Warning of Electricity Sales Companies in the Whole Business Process. Sustainability, 17(9), 3884. https://doi.org/10.3390/su17093884