Does Digital Financial Inclusion Affect Agricultural Eco-Efficiency? A Case Study on China

Abstract

:1. Introduction

1.1. Background and Research Motivation

1.2. Literature Review and Contribution

2. Materials and Methods

2.1. Theoretical Analysis and Research Hypothesis

2.2. Research Methods

2.3. Variable Description and Data Sources

3. Empirical Results and Analysis

Tests of the Benchmark Model

4. Further Discussion and Conclusions

4.1. Mechanism Analysis

4.2. Robustness Test

4.3. Conclusions and Suggestions

- (1)

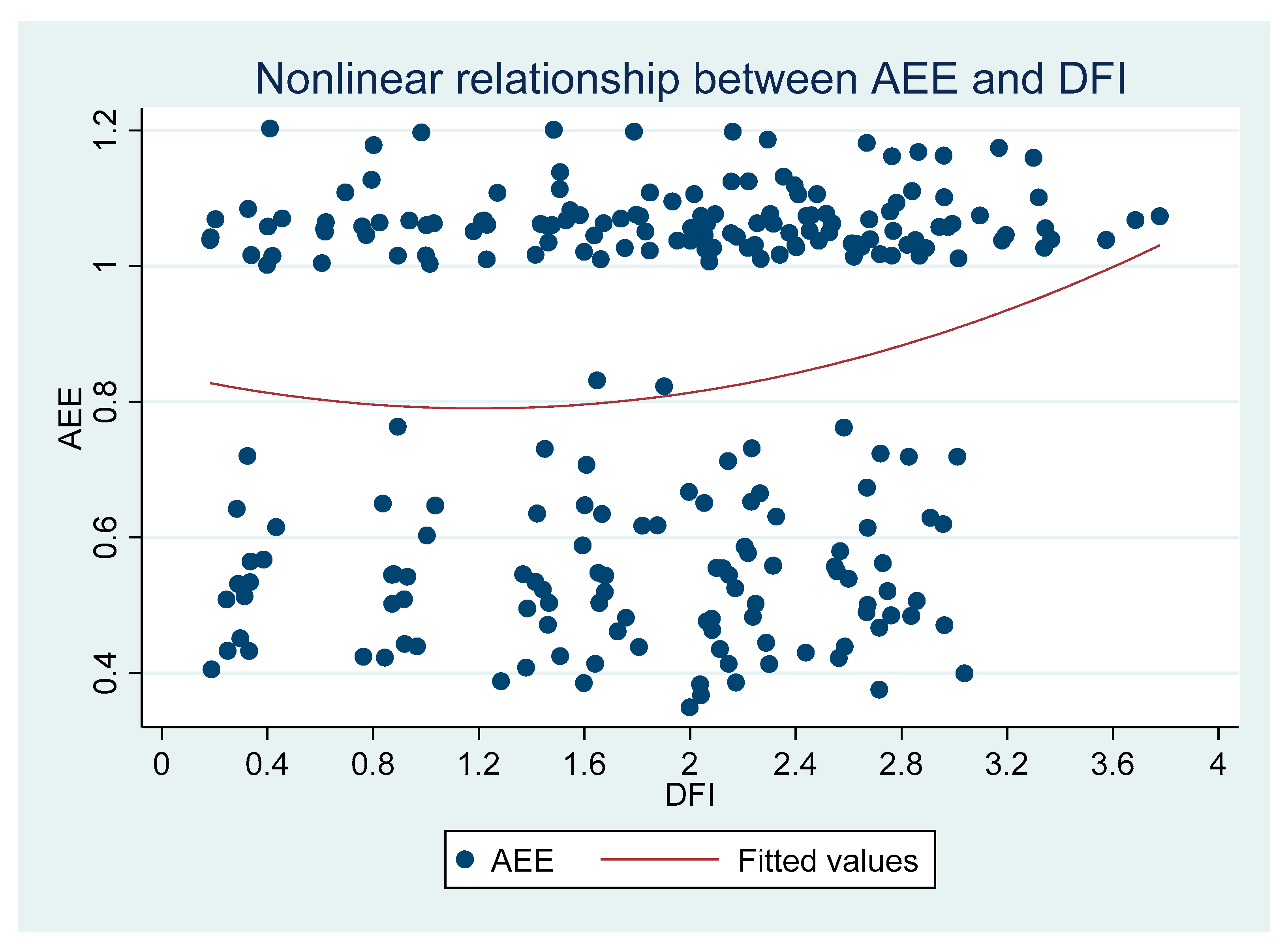

- Digital financial inclusion has a positive “U”-shaped nonlinear relationship with agricultural eco-efficiency, which indicates that digital financial inclusion has two stages of impact on agricultural eco-efficiency. In the early stage of the development of digital financial inclusion, due to the low level of rural financial development, backward infrastructure, and other factors, digital financial inclusion is difficult to improve agricultural eco-efficiency by driving agricultural technological progress and innovation [33]. With the increasingly mature development of digital financial inclusion in rural areas, a large amount of capital input and advanced digital information level will improve the efficiency of agricultural technology, enhance the ability of green innovation in agriculture, reduce pollutant emissions in the process of agricultural production, and thus promote the improvement of agricultural eco-efficiency [34].

- (2)

- Digital financial inclusion has heterogeneous effects on agricultural eco-efficiency in different regions of China. Among them, digital financial inclusion has a stronger “U” -shaped nonlinear relationship with the agricultural eco-efficiency in the central region of mainland China, while its influence on the agricultural eco-efficiency in the other two regions is not obvious [35], indicating that digital financial inclusion has regional differences in the impact on agricultural eco-efficiency [36].

- (3)

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

AEE Measures

References

- Coluccia, B.; Valente, D.; Fusco, G.; De Leo, F.; Porrini, D. Assessing agricultural eco-efficiency in Italian Regions. Ecol. Indic. 2020, 116, 106483. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, C.; Zhou, M. Does digital financial inclusion promote agricultural production for rural households in China? Research based on the Chinese family database (CFD). China Agric. Econ. Rev. 2020, 13, 475–494. [Google Scholar] [CrossRef]

- Li, T.; Liao, G. The Heterogeneous Impact of Financial Development on Green Total Factor Productivity. Front. Energy Res. 2020, 8, 29. [Google Scholar] [CrossRef] [Green Version]

- Song, J.; Chen, X. Eco-efficiency of grain production in China based on water footprints: A stochastic frontier approach. J. Clean. Prod. 2019, 236, 117685. [Google Scholar] [CrossRef]

- Eder, A.; Salhofer, K.; Scheichel, E. Land tenure, soil conservation, and farm performance: An eco-efficiency analysis of Austrian crop farms. Ecol. Econ. 2020, 180, 106861. [Google Scholar] [CrossRef]

- Zeng, L.; Li, X.; Ruiz-Menjivar, J. The effect of crop diversity on agricultural eco-efficiency in China: A blessing or a curse? J. Clean. Prod. 2020, 276, 124243. [Google Scholar] [CrossRef]

- Liu, Y.; Zou, L.; Wang, Y. Spatial-temporal characteristics and influencing factors of agricultural eco-efficiency in China in recent 40 years. Land Use Policy 2020, 97, 104794. [Google Scholar] [CrossRef]

- Liao, J.; Yu, C.; Feng, Z.; Zhao, H.; Wu, K.; Ma, X. Spatial differentiation characteristics and driving factors of agricultural eco-efficiency in Chinese provinces from the perspective of ecosystem services. J. Clean. Prod. 2020, 288, 125466. [Google Scholar] [CrossRef]

- Akbar, U.; Li, Q.L.; Akmal, M.A.; Shakib, M.; Iqbal, W. Nexus between agro-ecological efficiency and carbon emission transfer: Evidence from China. Environ. Sci. Pollut. Res. Int. 2021, 28, 18995–19007. [Google Scholar] [CrossRef]

- Zhuang, X.; Li, Z.; Zheng, R.; Na, S.; Zhou, Y. Research on the Efficiency and Improvement of Rural Development in China: Based on Two-Stage Network SBM Model. Sustainability 2021, 13, 2914. [Google Scholar] [CrossRef]

- He, C.; Du, H. Urbanization, inclusive finance and urban-rural income gap. Appl. Econ. Lett. 2021, 1–5. [Google Scholar] [CrossRef]

- Li, Y.; Zhong, Q.; Xie, L. Has Inclusive Finance Narrowed the Income Gap between Urban and Rural Areas? An Empirical Analysis Based on Coastal and Noncoastal Regions’ Panel Data. J. Coast. Res. 2020, 106, 305–308. [Google Scholar] [CrossRef]

- Yang, Y.; Fu, C. Inclusive Financial Development and Multidimensional Poverty Reduction: An Empirical Assessment from Rural China. Sustainability 2019, 11, 1900. [Google Scholar] [CrossRef] [Green Version]

- Li, J.; Wu, Y.; Xiao, J.J. The impact of digital finance on household consumption: Evidence from China. Econ. Model. 2019, 86, 317–326. [Google Scholar] [CrossRef] [Green Version]

- Xie, W.; Wang, T.; Zhao, X. Does digital financial inclusion Promote Coastal Rural Entrepreneurship? J. Coast. Res. 2020, 103, 240–245. [Google Scholar] [CrossRef]

- Sus, T.; Yemets, O.; Tsiupa, O. Financial policy of stimulating innovative development of the agricultural sector and mechanism of its implementation: Foreign experience. Financ. Credit Act.—Probl. Theory Pract. 2020, 4, 347–355. [Google Scholar] [CrossRef]

- Huang, Y.; Li, L.; Yu, Y. Does urban cluster promote the increase of urban eco-efficiency? Evidence from Chinese cities. J. Clean. Prod. 2018, 197, 957–971. [Google Scholar] [CrossRef]

- Huang, Y.; Li, L.; Yu, Y. Do urban agglomerations outperform non-agglomerations? A new perspective on exploring the eco-efficiency of Yangtze River Economic Belt in China. J. Clean. Prod. 2018, 202, 1056–1067. [Google Scholar] [CrossRef]

- Bianchi, M.; del Valle, I.; Tapia, C. Measuring eco-efficiency in European regions: Evidence from a territorial perspective. J. Clean. Prod. 2020, 276, 123246. [Google Scholar] [CrossRef]

- Zavorotin, E.; Gordopolova, A.; Tiurina, N. Method of introducing innovation to land use in agriculture. Balt. J. Econ. Stud. 2018, 4, 74–79. [Google Scholar] [CrossRef]

- Liu, Y.; Zhu, J.; Li, E.Y.; Meng, Z.; Song, Y. Environmental regulation, green technological innovation, and eco-efficiency: The case of Yangtze river economic belt in China. Technol. Forecast. Soc. Chang. 2020, 155, 119993. [Google Scholar] [CrossRef]

- Yanlin, X.; Zijun, L.; Liang, W. Temporal-spatial differences in and influencing factors of agricultural eco-efficiency in Shandong Province, China. Ciência Rural 2019, 50. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring China’s Digital Financial Inclusion: Index Compilation and Spatial Characteristics; Working Paper; Institute of Digital Finance, Peking University: Beijing, China, 2019. [Google Scholar]

- Magarey, R.D.; Klammer SS, H.; Chappell, T.M.; Trexler, C.M.; Pallipparambil, G.R.; Hain, E.F. Eco-efficiency as a strategy for optimizing the sustainability of pest management. Pest Manag. Sci. 2019, 75, 3129–3134. [Google Scholar] [CrossRef]

- Chen, W.; Si, W.; Chen, Z.-M. How technological innovations affect urban eco-efficiency in China: A prefecture-level panel data analysis. J. Clean. Prod. 2020, 270, 122479. [Google Scholar] [CrossRef]

- Yang, B.; Wang, Z.; Zou, L.; Zou, L.; Zhang, H. Exploring the eco-efficiency of cultivated land utilization and its influencing factors in China’s Yangtze River Economic Belt. J. Environ. Manag. 2021, 294, 112939. [Google Scholar] [CrossRef]

- Zhang, Y.; Mao, Y.; Jiao, L.; Shuai, C.; Zhang, H. Eco-efficiency, eco-technology innovation and eco-well-being performance to improve global sustainable development. Environ. Impact Assess. Rev. 2021, 89, 106580. [Google Scholar] [CrossRef]

- Liu, Z.; Zhang, H.; Zhang, Y.-J.; Zhu, T.-T. How does industrial policy affect the eco-efficiency of industrial sector? Evidence from China. Appl. Energy 2020, 272, 115206. [Google Scholar] [CrossRef]

- Li, Z.; Zou, F.; Tan, Y.; Zhu, J. Does Financial Excess Support Land Urbanization-An Empirical Study of Cities in China. Land 2021, 10, 635. [Google Scholar] [CrossRef]

- Zhong, J.; Li, T. Impact of Financial Development and Its Spatial Spillover Effect on Green Total Factor Productivity: Evidence from 30 Provinces in China. Math. Probl. Eng. 2020, 2020, 5741387. [Google Scholar] [CrossRef] [Green Version]

- Li, Z.; Chen, L.; Dong, H. What are bitcoin market reactions to its-related events? Int. Rev. Econ. Financ. 2020, 73, 1–10. [Google Scholar] [CrossRef]

- Li, T.; Zhong, J.; Huang, Z. Potential Dependence of Financial Cycles between Emerging and Developed Countries: Based on ARIMA-GARCH Copula Model. Emerg. Mark. Financ. Trade 2019, 56, 1237–1250. [Google Scholar] [CrossRef]

- Li, Z.; Dong, H.; Floros, C.; Charemis, A.; Failler, P. Re-examining Bitcoin Volatility: A CAViaR-based Approach. Emerg. Mark. Financ. Trade 2021. [CrossRef]

- Kawabata, T. Private governance schemes for green bond standard: Influence on public authorities’ policy making. Green Financ. 2020, 2, 35–54. [Google Scholar] [CrossRef]

- Li, Z.; Zhong, J. Impact of economic policy uncertainty shocks on China’s financial conditions. Financ. Res. Lett. 2019, 35, 101303. [Google Scholar] [CrossRef]

- Gorelick, J.; Walmsley, N. The greening of municipal infrastructure investments: Technical assistance, instruments, and city champions. Green Financ. 2020, 2, 114–134. [Google Scholar] [CrossRef]

- Kemfert, C.; Schmalz, S. Sustainable finance: Political challenges of development and implementation of framework conditions. Green Financ. 2019, 1, 237–248. [Google Scholar] [CrossRef]

- Li, Z.; Dong, H. The Influential Factors on Outward Foreign Direct Investment: Evidence from the “The Belt and Road”. Emerg. Mark. Financ. Trade 2019, 55, 3211–3226. [Google Scholar] [CrossRef]

- Matei, I. Is financial development good for economic growth? Empirical insights from emerging European countries. Quant. Financ. Econ. 2020, 4, 653–678. [Google Scholar] [CrossRef]

- Li, Z.; Liao, G.; Albitar, K. Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. Bus. Strategy Environ. 2020, 29, 1045–1055. [Google Scholar] [CrossRef]

- Sukharev, O.S. Structural analysis of income and risk dynamics in models of economic growth. Quant. Financ. Econ. 2020, 4, 1–18. [Google Scholar] [CrossRef]

- Li, Z.; Liao, G.; Wang, Z.; Huang, Z. Green loan and subsidy for promoting clean production innovation. J. Clean. Prod. 2018, 187, 421. [Google Scholar] [CrossRef]

- Li, T.; Huang, Z.; Drakeford, B.M. Statistical measurement of total factor productivity under resource and environmental constraints. Natl. Account. Rev. 2019, 1, 16–27. [Google Scholar] [CrossRef]

- Liu, Y.; Li, Z.; Xu, M. The Influential Factors of Financial Cycle Spillover: Evidence from China. Emerg. Mark. Financ. Trade 2020, 56, 1336–1350. [Google Scholar] [CrossRef]

- Li, T.; Li, X. Does structural deceleration happen in China? Evidence from the effect of industrial structure on economic growth quality. Natl. Account. Rev. 2020, 2, 155–173. [Google Scholar] [CrossRef]

- Qiuying, L.; Longwu, L.; Zhenbo, W. Spatiotemporal Differentiation and the Factors Influencing Eco-Efficiency in China. J. Resour. Ecol. 2021, 12, 155–164. [Google Scholar] [CrossRef]

| Primary Indicators | Secondary Indicators | Characterization Variables | Variable Description |

|---|---|---|---|

| Input | Land | Crop sown area (one thousand hectares) | None |

| Labor | Agricultural practitioners (ten thousand people) | Agricultural personnel in the primary industry will be converted according to the proportion of the agricultural output value accounting for the total output value of agriculture, forestry, animal husbandry, and fishery | |

| Agricultural machinery | Total power of agricultural machinery (ten thousand kW) | None | |

| Irrigation water | Effective irrigation area (one thousand hectares) | None | |

| Chemical fertilizer | Application amount of agricultural chemical fertilizer (ten thousand tons) | None | |

| Pesticides | Pesticide usage (ton) | None | |

| Agricultural membrane | Agricultural membrane usage (ton) | None | |

| Energy sources | Agricultural diesel usage (ten thousand tons) | None | |

| Expected output | Total output agricultural value | Total agricultural production output value (RMB 100 million) | Unified conversion into the constant price-output value in 2011; |

| Unexpected output | Agricultural pollution emissions | Comprehensive index of agricultural non-point source pollution | It is calculated by entropy method; chemical fertilizer application is multiplied by fertilizer loss index, pesticide and agricultural membrane residue by corresponding residual coefficient; fertilizer loss coefficient, pesticide residual coefficient, and pesticide membrane residual coefficient are 0.65, 0.5, 0.1, respectively |

| Agricultural carbon emissions | Agricultural carbon emissions (ten thousand tons) | The number of carbon emission sources of chemical fertilizer, pesticide, agricultural membrane, agricultural diesel, agricultural irrigation, and tillage loss is multiplied by the corresponding emission coefficient; the corresponding emission coefficient, i.e., 0.8956, 4.934, 5.18, 0.5927, 20.476, 312.6 |

| The Whole Sample | Eastern China | Central China | Western China | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| VarName | Obs | Mean | SD | Obs | Mean | SD | Obs | Mean | SD | Obs | Mean | SD |

| AEE | 240 | 0.83 | 0.28 | 96 | 0.96 | 0.19 | 72 | 0.62 | 0.19 | 72 | 0.87 | 0.30 |

| DFI | 240 | 1.84 | 0.85 | 96 | 2.06 | 0.87 | 72 | 1.79 | 0.83 | 72 | 1.72 | 0.82 |

| DFI2 | 240 | 4.26 | 3.09 | 96 | 5.02 | 3.47 | 72 | 3.88 | 2.77 | 72 | 3.62 | 2.63 |

| DAM | 240 | 0.65 | 0.25 | 96 | 0.81 | 0.29 | 72 | 0.57 | 0.29 | 72 | 0.53 | 0.14 |

| PS | 240 | 2.67 | 2.88 | 96 | 2.07 | 1.08 | 72 | 4.25 | 1.08 | 72 | 1.90 | 0.75 |

| FSA | 240 | 0.11 | 0.03 | 96 | 0.09 | 0.03 | 72 | 0.12 | 0.03 | 72 | 0.13 | 0.02 |

| ARD | 240 | 4.26 | 2.94 | 96 | 4.96 | 3.53 | 72 | 4.49 | 3.53 | 72 | 3.10 | 1.91 |

| AIL | 240 | 73.20 | 86.32 | 96 | 91.82 | 98.41 | 72 | 90.28 | 98.41 | 72 | 31.31 | 35.54 |

| ER | 240 | 62,785.53 | 50,316.19 | 96 | 79,702.24 | 66,851.97 | 72 | 67,029.40 | 66,851.97 | 72 | 35,986.06 | 18,236.78 |

| Variable | Abbreviation | Characterization Variable | Source |

|---|---|---|---|

| Agricultural eco-efficiency | AEE | Calculated with the Super-efficiency SBM-DEA model | China Agricultural statistical yearbook, China Rural Statistical Yearbook, China financial statistical yearbook, China Statistical Yearbook |

| Digital financial inclusion | DFI | Peking University digital financial inclusion index | Peking University |

| The level of fiscal support for agriculture | FSA | Local fiscal expenditure on agriculture, forestry, and water conservancy/local fiscal expenditure in general budget | China Agricultural statistical yearbook, China Rural Statistical Yearbook, China financial statistical yearbook |

| Density of agricultural machinery | DAM | Total power of agricultural machinery/total sown area of crops | China Agricultural statistical yearbook, China Rural Statistical Yearbook |

| Planting structure | PS | Grain crop acreage/(crop sown acreage − grain crop acreage) | China Agricultural statistical yearbook, China Rural Statistical Yearbook |

| agricultural research investment | ARD | Multiplying scientific and technological investment by the proportion of agricultural gross output value in regional GDP | China Agricultural statistical yearbook, China Rural Statistical Yearbook, China financial statistical yearbook |

| agricultural innovation level | AIL | The number of applications for new varieties of agricultural plants | China Agricultural statistical yearbook, China Rural Statistical Yearbook, China Science and technology statistical yearbook |

| Cost-based environmental regulation | ER | The total amount of income from pollutant discharge fee of each province | China Environmental Statistical Yearbook, Statistical Yearbook of Provinces |

| Full Sample (1) | Eastern China (2) | Central China (3) | Western China (4) | |

|---|---|---|---|---|

| AEE | RAEE | RAEE | RAEE | |

| DFI | −0.1877 *** | |||

| (−4.7094) | ||||

| DFI2 | 0.0171 ** | |||

| (2.9159) | ||||

| L.DFI | 0.1932 | −0.0461 * | 0.0088 | |

| (1.52) | (−1.68) | (0.41) | ||

| L.DFI2 | −0.0081 | 0.0146 * | −0.0034 | |

| (−0.58) | (1.72) | (−0.45) | ||

| DAM | −0.1466 *** | −0.2182 *** | 0.0039 | −0.1586 * |

| (−5.2370) | (−5.04) | (0.08) | (−1.79) | |

| PS | −0.0010 | 0.0100 * | −0.0001 | −0.0655 ** |

| (−0.8153) | (1.68) | (−0.09) | (−2.47) | |

| FSA | −0.0523 | −1.6225 *** | −0.6904 | −0.3457 |

| (−0.3481) | (−2.78) | (−1.36) | (−1.17) | |

| lnARD | 0.0045 | 0.0467 | 0.0336 | 0.0635 |

| (1.6271) | (0.50) | (0.18) | (0.61) | |

| lnAIL | −0.0070 | 0.0150 | 0.0104 | −0.0000 |

| (−1.4033) | (1.35) | (1.39) | (−0.00) | |

| lnER | 0.0059 * | 0.0281 *** | 0.0570 * | 0.0027 |

| (2.1764) | (3.42) | (1.82) | (0.14) | |

| Individual effect | YES | YES | YES | YES |

| Time effect | YES | YES | YES | YES |

| _cons | 1.1011 *** | 0.2972 | −0.1408 | 0.5322 ** |

| (4.5404) | (0.84) | (−0.31) | (2.37) | |

| N | 176 | 84 | 63 | 60 |

| DGMM (1) | DGMM (2) | SGMM (3) | |

|---|---|---|---|

| AEE | AEE | AEE | |

| FRD | 0.0059 * | ||

| (2.1764) | |||

| DFI | −0.1825 *** | −0.1877 *** | −0.1497 *** |

| (−5.0325) | (−4.7094) | (−5.4450) | |

| DFI2 | 0.0189 ** | 0.0171 ** | 0.0321 *** |

| (2.8406) | (2.9159) | (5.8425) | |

| Control variables | YES | YES | YES |

| Individual effects | YES | YES | YES |

| Time effect | YES | YES | YES |

| _cons | 1.1011 *** | 1.1984 *** | 0.3586 * |

| (4.5404) | (7.0545) | (2.2372) | |

| N | 176 | 176 | 207 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, J.; Li, Z. Does Digital Financial Inclusion Affect Agricultural Eco-Efficiency? A Case Study on China. Agronomy 2021, 11, 1949. https://doi.org/10.3390/agronomy11101949

Ma J, Li Z. Does Digital Financial Inclusion Affect Agricultural Eco-Efficiency? A Case Study on China. Agronomy. 2021; 11(10):1949. https://doi.org/10.3390/agronomy11101949

Chicago/Turabian StyleMa, Jiehua, and Zhenghui Li. 2021. "Does Digital Financial Inclusion Affect Agricultural Eco-Efficiency? A Case Study on China" Agronomy 11, no. 10: 1949. https://doi.org/10.3390/agronomy11101949

APA StyleMa, J., & Li, Z. (2021). Does Digital Financial Inclusion Affect Agricultural Eco-Efficiency? A Case Study on China. Agronomy, 11(10), 1949. https://doi.org/10.3390/agronomy11101949