The Assessment of Density Bonus in Building Renovation Interventions. The Case of the City of Florence in Italy

Abstract

:1. Introduction

2. Materials and Methods

2.1. Entity and Preconditions of Building Renovation

2.1.1. Current Condition of the Existing European Building Stock

2.1.2. Energy Savings

- The elaboration of a long-term strategy in each Member State, aimed to support the renovation of national, public and private buildings in order to achieve a decarbonized, highly energy-efficient building stock by 2050;

- The acceleration of the transformation of existing buildings into nearly zero-energy buildings by 2050, and the imposition of the nearly-zero energy requirement for all new constructions starting from 2021;

- The support for upgrading all buildings through smart technologies.

2.1.3. Saving Soil

- Ensure that land consumption does not exceed demographic growth (indicator 11.3.1);

- Provide universal access to safe, inclusive and accessible, green and public spaces;

- Reach a land degradation neutral world, as an essential item to maintain the functions and services of the ecosystem (indicator SDG 15.3.1).

2.1.4. How to Act

2.2. Density Bonus: Overview and Focus on the Italian Case

2.3. Economic Balance Sheet Model

2.4. Research Method

- (1)

- The impacts on infrastructural demand, on landscape and environment determined by the renovation intervention must always be monetizable; specifically, their economic values are evaluated according to the actions needed to mitigate them, or in the mere monetization according to the principle of indemnity; hence, economic impacts are included in CapEx (mitigation actions) or in OpEx (indemnity) [61];

- (2)

- Since renovation interventions mainly involve private buildings, the economic benefit has not been considered;

- (3)

- The time variable has been assumed constant (business operation), without considering the heterogeneity of renovation cases, leading to different durations; it is assumed that in interventions that require longer periods, this would be overcome through an organizational upgrade and a related cost increase;

- (4)

- The business has been considered to have no asset, hence the acquisition cost of the asset to renovate has been included in the economic balance as the initial market value (MV−).

3. Experimentation and Results

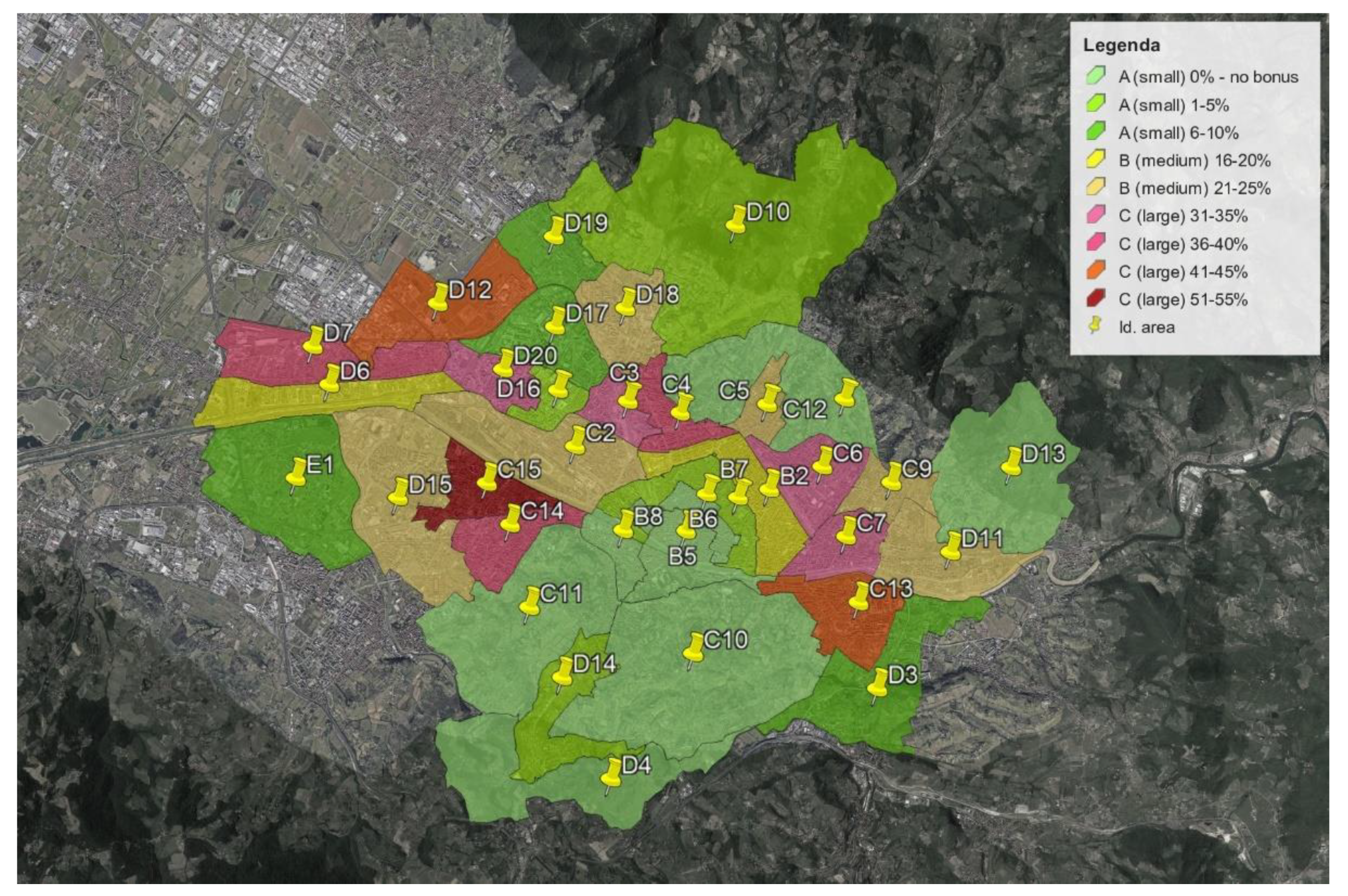

3.1. Experimentation Area

- CapEx (using Formula (9)) and OpEx (using Formula (10)) analysis for the estimation of renovation costs (Formula (8)), considering the specific and heterogeneous characteristics of the areas within the city of Florence;

- Market Analysis for the estimation of the market value in the examined areas, considering both the “to be restored” and “new” condition for estates (using Real Estate Market Observatory of the Revenue Agency database);

- Calculation of the density bonus for each area (using Formula (7)).

3.2. CapEx and Opex Analyses

3.3. Market Analysis

3.4. Density Bonus Calculation

3.5. Results Analysis

- on 32.28% of the municipal area, with no need for incentives;

- on 17.91% of the municipal area, with a 1–5% bonus;

- on 12.41% of the municipal area, with a 6–10% bonus;

- on 4.40% of the municipal area, with a 16–20% bonus;

- on 15.10% of the municipal area, with a 21–25% bonus;

- on 5.43% of the municipal area, with a 31–35% bonus;

- on 5.52% of the municipal area, with a 36–40% bonus;

- on 5.39% of the municipal area, with a 41–45% bonus.

4. Discussion and Conclusions

- The first one is specifically related to the research model and considers its limits and possible future developments;

- The second one is independent from the research model and concerns the effects of renovation interventions, supported by density bonus, on the context where this incentive is introduced.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- European Commission. The European Green Deal. Brussels, 11.12.2019 COM (2019) 640 Final. Available online: https://ec.europa.eu/info/sites/default/files/european-green-deal-communication_en.pdf (accessed on 29 October 2021).

- Eurostat. Energy Data 2020 Edition. Available online: https://ec.europa.eu/eurostat/documents/3217494/11099022/KS-HB-20-001-EN-N.pdf/bf891880-1e3e-b4ba-0061-19810ebf2c64?t=1594715608000 (accessed on 29 October 2021).

- European Commission. A Renovation Wave for Europe—Greening Our Buildings, Creating Jobs, Improving Lives. Brussels, 14.10.2020 COM (2020) 662 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52020DC0662&from=EN (accessed on 29 October 2021).

- Eurostat. Regional Yearbook Is an Online Eurostat Publication. Available online: https://ec.europa.eu/eurostat/documents/3217494/13389103/KS-HA-21-001-EN-N.pdf/1358b0d3-a9fe-2869-53a0-37b59b413ddd?t=1631630029904 (accessed on 29 October 2021).

- Eurostat. Quality of Housing. Available online: https://ec.europa.eu/eurostat/cache/digpub/housing/bloc-1c.html?lang=en (accessed on 29 October 2021).

- Kaklauskas, A.; Zavadskas, E.K.; Lepkova, N.; Raslanas, S.; Dauksys, K.; Vetloviene, I.; Ubarte, I. Sustainable Construction Investment, Real Estate Development, and COVID-19: A Review of Literature in the Field. Sustainability 2021, 13, 7420. [Google Scholar] [CrossRef]

- European Commission. Impact of COVID-19 Crisis on Construction. 2021. Available online: https://ec.europa.eu/eurostat/statisticsexplained/index.php?title=Impact_of_Covid-19_crisis_on_construction (accessed on 29 October 2021).

- Rabiei-Dastjerdi, H.; McArdle, G.; Matthews, S.A.; Keenan, P. Gap analysis in decision support systems for real-estate in the era of the digital earth. Int. J. Digital Earth 2020, 14, 1–18. [Google Scholar] [CrossRef]

- Sonn, J.W.; Kang, M.; Choi, Y. Smart city technologies for pandemic control without lockdown. Int. J. Urban Sci. 2020, 24, 149–151. [Google Scholar] [CrossRef]

- Bertoldi, P.; Economidou, M.; Palermo, V.; Boza-Kiss, B.; Todeschi, V. How to finance energy renovation of residential buildings: Review of current and emerging financing instruments in the EU. WIREs Energy Environ. 2021, 10, e384. Available online: https://wires.onlinelibrary.wiley.com/doi/epdf/10.1002/wene.384 (accessed on 29 October 2021). [CrossRef]

- Bianco, V.; Sonvilla, P.M. Supporting energy efficiency measures in the residential sector. The case of on-bill schemes. Energy Rep. 2021, 7, 4298–4307. [Google Scholar] [CrossRef]

- Amoruso, F.M.; Sonn, M.-H.; Chu, S.; Schuetze, T. Sustainable Building Legislation and Incentives in Korea: A Case-Study-Based Comparison of Building New and Renovation. Sustainability 2021, 13, 4889. [Google Scholar] [CrossRef]

- Diluiso, F.; Guastella, G.; Pareglio, S. Changes in urban green spaces’ value perception: A meta-analytic benefit transfer function for european cities. Land Use Policy 2021, 101, 105116. [Google Scholar] [CrossRef]

- Paolo Cirillo, G. La Premialità Edilizia, la Compensazione Urbanistica e Il Trasferimento dei Diritti Edificatori; Federalismi.it, Rome, Italy: 2019; Volume 20, pp. 1–27. Available online: https://www.federalismi.it/ApplOpenFilePDF.cfm?artid=40520&dpath=document&dfile=29102019211426.pdf&content=La%2Bpremialit%C3%A0%2Bedilizia%2C%2Bla%2Bcompensazione%2Burbanistica%2Be%2Bil%2Btrasferimento%2Bdei%2Bdiritti%2Bedificatori%2B%2D%2Bstato%2B%2D%2Bdottrina%2B%2D%2B (accessed on 29 October 2021).

- Conticelli, E.; Proli, S.; Tondelli, S. Integrating energy efficiency and urban densification policies: Two italian case studies. Energy Build. 2017, 155, 308–323. [Google Scholar] [CrossRef]

- Beghelli, S.; Guastella, G.; Pareglio, S. Governance fragmentation and urban spatial expansion: Evidence from europe and the united states. [Governance-Fragmentierung und urbane räumliche Expansion: Erkenntnisse aus Europa und den USA]. Rev. Reg. Res. 2020, 40, 13–32. [Google Scholar] [CrossRef]

- Paetz, M.M.D.; Pinto-Delas, K. From Red Lights to Green Lights: Town Planning Incentives for Green Building. In Proceedings of the Talking and Walking Sustainability International Conference, Auckland, New Zealand, 20–23 February 2007; Available online: https://www.thesustainabilitysociety.org.nz/conference/2007/papers/PAETZ-From%20Red%20Lights%20to%20Green%20Lights.pdf (accessed on 29 October 2021).

- Abair, J.W. Green buildings: When it means to be green and the evolution of green building laws. Urban Law 2008, 40, 623–632. [Google Scholar]

- Miller, N.; Spivey, J.; Florance, A. Does green pay off? J. Real Estate Portf. Manag. 2008, 144, 385–400. [Google Scholar] [CrossRef]

- Qian, Q.K.; Fan, K.; Chan, E.H.W. Regulatory incentives for green buildings: Gross floor area concessions. Build. Res. Inf. 2016, 44, 675–693. [Google Scholar] [CrossRef]

- Presidenza del Consiglio dei Ministri del Governo Italiano, Piano Nazionale di Ripresa e Resilienza (PNRR). 2021. Available online: https://www.governo.it/sites/new.governo.it/files/PNRR_2021_0.pdf (accessed on 29 October 2021).

- Battisti, F.; Campo, O.; Forte, F. A methodological approach for the assessment of potentially buildable land for tax purposes: The italian case study. Land 2020, 9, 8. [Google Scholar] [CrossRef]

- Bezemer, D.J. The economy as a complex system: The balance sheet dimension. Adv. Complex Syst. 2012, 15, 1250047. [Google Scholar] [CrossRef]

- Kulikova, L.I.; Garyntsev, A.G.; Gafieva, G.M. The Balance sheet as information model. Procedia Econ. Financ. 2015, 24, 339–343. [Google Scholar] [CrossRef]

- Rudd, A.; Siegel, L.B. Using an Economic Balance Sheet for Financial Planning. J. Wealth Manag. 2014, 162, 15–23. [Google Scholar] [CrossRef]

- Chlodnicka, H.; Zimon, G. Balance Sheet Model for Small Economic Entities. Econ. Soc. Dev. Book Proc. 2019, 6, 243–250. [Google Scholar] [CrossRef]

- Dichev, I.D. On the balance sheet-based model of financial reporting. Account. Horiz. 2008, 22, 453–470. [Google Scholar] [CrossRef]

- Mudita, K.; Ikhide, S. Balance sheet channel in developing countries: Review, evaluation and integration. J. Econ. Int. Financ. 2011, 2, 742–748. [Google Scholar]

- Belussi, L.; Barozzi, B.; Bellazzi, A.; Danza, L.; Devitofrancesco, A.; Fanciulli, C.; Scrosati, C. A review of performance of zero energy buildings and energy efficiency solutions. J. Build. Eng. 2019, 25, 100772. [Google Scholar] [CrossRef]

- Annunziata, E.; Frey, M.; Rizzi, F. Towards nearly zero-energy buildings: The state-of-art of national regulations in Europe. Energy 2013, 57, 125–133. [Google Scholar] [CrossRef]

- Vieites, E.; Vassileva, I.; Arias, J.E. European initiatives towards improving the energy efficiency in existing and historic buildings. Energy Procedia 2015, 75, 1679–1685. [Google Scholar] [CrossRef]

- Bastasin, C. Saving Europe: Anatomy of A Dream; Brookings Institution Press: Washington, DC, USA, 2015. [Google Scholar]

- Guarini, M.R.; Battisti, F. Benchmarking Multi-criteria Evaluation: A Proposed Method for the Definition of Benchmarks in Negotiation Public-Private Partnerships. In Proceedings of the Computational Science and Its Applications—ICCSA 2014. 14th International Conference, Guimarães, Portugal, 30 June–3 July 2014, Part III. Lecture Notes in Computer Science; Murgante, B., Ed.; Springer International Publishing: Cham, Switzerland, 2014; Volume 8581, pp. 208–223. [Google Scholar] [CrossRef]

- Torre, C.M.; Morano, P.; Tajani, F. Saving soil for sustainable land use. Sustainability 2017, 9, 350. [Google Scholar] [CrossRef]

- Kuhlman, T.; Reinhard, S.; Gaaff, A. Estimating the costs and benefits of soil conservation in Europe. Land Use Policy 2010, 27, 22–32. [Google Scholar] [CrossRef]

- European Commission. The Implementation of the Soil Thematic Strategy and Ongoing Activities. Brussels, 13.2.2012 COM (2012) 46 Final. Available online: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2012:0046:FIN:EN:PDF (accessed on 29 October 2021).

- European Commission. Roadmap to a Resource Efficient Europe. Brussels, 20.9.2011 COM (2011) 571 Final. Available online: http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52011DC0571 (accessed on 29 October 2021).

- European Commission. Decision No 1386/2013/EU of the European Parliament and of the Council of 20 November 2013 on A General Union Environment Action Programme to 2020 ‘Living Well, Within the Limits of Our Planet’. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32013D1386&from=EN (accessed on 29 October 2021).

- European Commission. Guidelines on Best Practice to Limit, Mitigate or Compensate Soil Sealing; Publications Office of the European Union: Luxembourg, 2012; ISBN 978-92-79-26210-4. [Google Scholar] [CrossRef]

- United Nations Development Programme. Available online: https://www.undp.org/sustainable-development-goals?utm_source=EN&utm_medium=GSR&utm_content=US_UNDP_PaidSearch_Brand_English&utm_campaign=CENTRAL&c_src=CENTRAL&c_src2=GSR&gclid=Cj0KCQjwt-6LBhDlARIsAIPRQcIHyMs9aHjYEr4DRaA3-br1xK4zq2e9ojJ1r0asCcnA0lwE7tMLSB0aAgydEALw_wcB (accessed on 29 October 2021).

- Guarini, M.R.; Chiovitti, A.; Battisti, F.; Morano, P. An Integrated Approach for the Assessment of Urban Transformation Proposals in Historic and Consolidated Tissues. In Computational Science and Its Applications—ICCSA 2017. ICCSA 2017. Lecture Notes in Computer Science; Gervasi, O., Ed.; Springer: Cham, Switzerland, 2017; Volume 10406. [Google Scholar] [CrossRef]

- Andersen, H.T. The new urban politics of Europe: The area-based approach to regeneration policy. In Governing European Cities; Routledge: London, UK, 2019; pp. 233–253. [Google Scholar]

- Natividade-Jesus, E.; Almeida, A.; Sousa, N.; Coutinho-Rodrigues, J. A case study driven integrated methodology to support sustainable urban regeneration planning and management. Sustainability 2019, 11, 4129. [Google Scholar] [CrossRef]

- Battisti, F.; Guarini, M.R. Public interest evaluation in negotiated public-private partnership. Int. J. Multicriteria Decis. Mak. 2017, 7, 54–89. [Google Scholar] [CrossRef]

- Density Bonus on World Bank Website. Available online: https://urban-regeneration.worldbank.org/node/20#:~:text=A%20density%20bonus%20is%20an,for%20specified%20public%20policy%20goals.&text=The%20density%20bonus%20program%20was%20introduced%20in%20New%20York%20City%20in%201961 (accessed on 5 December 2021).

- Zacharias, J.; He, J. Hong Kong’s urban planning experiment in enhancing pedestrian movement from underground space to the surface. Tunn. Undergr. Space Technol. 2018, 82, 1–8. [Google Scholar] [CrossRef]

- Urban Planning in Singapore. The Little Country with Big Plans. Available online: http://www.ratio.com.au/the-little-country-with-big-plans (accessed on 5 December 2021).

- Il Giornale Dell’Architettura. Available online: https://ilgiornaledellarchitettura.com/2020/04/22/rigenerazione-urbana-in-italia-facciamo-il-punto/ (accessed on 29 October 2021).

- Consiglio Nazionale degli Architetti, Pianificatori, Paesaggisti e Conservatori. Il Piano Nazionale per la Rigenerazione Urbana Sostenibile. Available online: http://www.awn.it/attachments/article/731/CNAPPC_Piano_Nazionale_per_la_Rigenerazione_Urbana_Sostenibile.pdf (accessed on 29 October 2021).

- Roberts, P.; Sykes, H. (Eds.) Urban Regeneration: A Handbook; Sage: New York, NY, USA, 1999. [Google Scholar]

- Cepiku, D.; Guga, E.; Marchese, B. Collaborative governance for urban regeneration in Italy. In Collaborative Governance for Local Economic Development; Routledge: London, UK, 2019; pp. 135–150. [Google Scholar]

- Trono, A.; Zerbi, M.C.; Castronuovo, V. Urban Regeneration and Local Governance in Italy: Three Emblematic Cases. In Local Government and Urban Governance in Europe; Springer: Cham, Switzerland; Berlin, Germany, 2017; pp. 171–192. [Google Scholar]

- Pogliani, L. Expanding inclusionary housing in Italy. J. Hous. Built Environ. 2014, 29, 473–488. [Google Scholar] [CrossRef]

- Saka, N.; Olanipekun, A.O.; Omotayo, T. Reward and compensation incentives for enhancing green building construction. Environ. Sustain. Indic. 2021, 11, 100138. [Google Scholar] [CrossRef]

- Falco, E.; Chiodelli, F. The transfer of development rights in the midst of the economic crisis: Potential, innovation and limits in Italy. Land Use Policy 2018, 72, 381–388. [Google Scholar] [CrossRef]

- Bobryshev, A.N.; Uryadova, T.N.; Lyubenkova, E.P.; Yakovenko, V.S.; Alekseeva, O.A. Analytical and management approaches to modeling of the accounting balance sheet. Life Sci. J. 2014, 11, 502–506. [Google Scholar]

- Layard, P.R.G. Cost-Benefit Analysis; Cambridge University Press: Cambridge, UK, 1994. [Google Scholar]

- Boardman, A.E.; Greenberg, D.H.; Vining, A.R.; Weimer, D.L. Cost-Benefit Analysis: Concepts and Practice; Cambridge University Press: Cambridge, UK, 2017. [Google Scholar]

- Brent, R.J. Applied Cost-Benefit Analysis; Edward Elgar Publishing: Cheltenham, UK, 2006. [Google Scholar]

- Guarini, M.R.; Battisti, F. A model to assess the feasibility of public-private partnership for social housing. Buildings 2017, 7, 44. [Google Scholar] [CrossRef]

- Fattinnanzi, E.; Acampa, G.; Battisti, F.; Campo, O.; Forte, F. Applying the depreciated replacement cost method when assessing the market value of public property lacking comparables and income data. Sustainability 2020, 12, 8993. [Google Scholar] [CrossRef]

- Nomisma. Real Estate Market Observatory. Available online: https://www.nomisma.it/servizi/osservatori/osservatori-di-mercato/osservatorio-immobiliare (accessed on 26 November 2021).

- Scenari Immobiliari Independent Research Institute. Real Value Database. Available online: https://realvalue.scenari-immobiliari.it/home (accessed on 26 November 2021).

- Real Estate Market Observatory of the Revenue Agency. Available online: https://www1.agenziaentrate.gov.it/servizi/Consultazione/ricerca.htm (accessed on 26 November 2021).

- Murtagh, B. Urban regeneration and the social economy. In The Routledge Companion to Urban Regeneration; Routledge: London, UK, 2013; pp. 219–228. [Google Scholar]

- Ishizaka, A.; Nemery, P. Multi-Criteria Decision Analysis: Methods and Software; John Wiley & Sons: Hoboken, NJ, USA, 2013. [Google Scholar]

- Capolongo, S.; Sdino, L.; Dell’Ovo, M.; Moioli, R.; Della Torre, S. How to assess urban regeneration proposals by considering conflicting values. Sustainability 2019, 11, 3877. [Google Scholar] [CrossRef]

- Garau, C.; Pavan, V.M. Evaluating urban quality: Indicators and assessment tools for smart sustainable cities. Sustainability 2018, 10, 575. [Google Scholar] [CrossRef]

- Daniels, B.; Zaunbrecher, B.S.; Paas, B.; Ottermanns, R.; Ziefle, M.; Roß-Nickoll, M. Assessment of urban green space structures and their quality from a multidimensional perspective. Sci. Total Environ. 2018, 615, 1364–1378. [Google Scholar] [CrossRef]

| Examined Areas | |||

|---|---|---|---|

| Area Code and Name | Size (Hectares) | Type | |

| B2 | Lungarno-Donatello-Beccaria-Libertà | 208.5 | Central areas |

| B5 | Centro Storico (Signoria-Duomo-Pitti-San Niccolò) | 181 | Old town |

| B6 | Centro Storico (Stazione Centrale-San Lorenzo-Sant’Ambrogio) | 88 | |

| B7 | Centro Storico (Viali-Lungarno Vespucci-Lungarno della Zecca Vecchia) | 185 | |

| B8 | Centro Storico (San Frediano-Porta Romana) | 82.7 | |

| C2 | San Jacopino-Ponte alle Mosse-Cascine | 395 | Semi-central areas |

| C3 | Dalmazia-Romito | 95 | |

| C4 | Poggetto-Statuto-Ponte Rosso | 117 | |

| C5 | Le Cure | 80.5 | |

| C6 | Campo di Marte | 200.4 | |

| C7 | Madonnone-San Salvi-Bellariva | 140 | |

| C9 | Coverciano | 111 | |

| C10 | Bobolino-Poggio Imperiale -Pian dei Giullari | 917 | |

| C11 | Marignolle-Monte Oliveto-Le Campora | 614 | |

| C12 | La Pietra-Camerata | 464 | |

| C13 | Piazza Ferrucci-Ricorboli-Bandino-Viale Europa-Anconella | 218 | |

| C14 | Pignone-Legnaia-Soffiano-Monticelli | 160 | |

| C15 | Isolotto | 159 | |

| D3 | Nave a Rovezzano-Ponte a Ema | 373 | Peripheral |

| D4 | Cascine del Riccio-Certosa | 444 | |

| D6 | Periferica/Le Piagge | 242 | |

| D7 | Peretola-Brozzi-Quaracchi-San Donnino | 288 | |

| D10 | Careggi-Cercina-Trespiano | 1346 | |

| D11 | Varlungo-Rovezzano | 250 | |

| D12 | Cupolina-Osmannoro | 334 | |

| D13 | Settignano | 515 | |

| D14 | Galluzzo-Le Due Strade-San Gaggio | 225 | |

| D15 | Arcingrosso-San Bartolo a Cintoia-Ponte a Greve | 498 | |

| D16 | San Donato-Villa Demidoff-Toscanini | 77.9 | |

| D17 | Carlo del Prete-Firenze Nova-Nuovo Pignone-Mercafir | 225 | |

| D18 | Morgagni-Le Panche | 212 | |

| D19 | Castello-Il Sodo | 163 | |

| D20 | Novoli-Carraia | 121 | |

| E1 | Ponte a Greve-Ugnano-Mantignano | 510 | Suburbs |

| - | Total | 10,240 | - |

| CapEx Analysis (Hypothesis: Building Renovation, Residential Sector, 2000–4000 sqm) | |||

|---|---|---|---|

| Areas | Criterion | Estimated Value | |

| CCbuild | Old town | Limited traffic zone, lack of elevators, extra-ordinary inter-floor height, valuable constructive components | 1250 |

| Central areas | Unrestricted accessibility, material procurement limitations, high-rise buildings | 1100 | |

| Semi-central areas | Unrestricted accessibility, no limitations, ordinary inter-floor height, low-rise buildings | 1000 | |

| Peripheral | Possible urbanization deficiencies, no accessibility limitations, ordinary inter-floor height, various building typologies | 950 | |

| Suburbs | Possible urbanization deficiencies, no accessibility limitations, ordinary inter-floor height, low-rise buildings | 900 | |

| CCurb (building renovation) | All areas | q < 2000 sqm | 9.82 |

| 2000 sqm < q < 4000 sqm | 48.01 | ||

| q > 4000 sqm | 28.92 | ||

| CCct | Basic units > 160 sqm | 20% of “basic cost” | 23.39 |

| 110 sm < Basic units < 160 sqm | 18% of “basic cost” | 21.05 | |

| Basic units < 110 sqm | 16% of “basic cost” | 18.71 | |

| Basic cost | Residential use | 233.92 | |

| Real mitigation cost (RMC) | All areas | Depending on prescription; not considered | |

| Administrative mitigation cost (AMC)—unavailable urban standard (UUS) | Old town | Unavailable additional standards | 110 |

| Central areas | Unavailable additional standards | 110 | |

| Semi-central areas | Possibility of finding incremental standards in the measure of 50% | 55 | |

| Peripheral | Possibility of finding incremental standards in the measure of 100% | 0 | |

| Suburbs | Possibility of finding incremental standards in the measure of 100% | 0 | |

| Ratio GUA/UUS | - | 0.33 | |

| Administrative and technical charges (AC) | All areas | Flat rate of Ccbuild + Ccurb + CCct + RMC + AMC | 10.00% |

| Financial charges (FC) | All areas (hypothesis = 100% debt) | Flat rate of Ccbuild+ Ccurb + CCct + RMC + AMC + AC | 5% per year |

| OpEx Analysis | |||

| Business costs | All areas | Flat rate of CapEx | 5.00% |

| Renovation Costs (All Inclusive) | ||

|---|---|---|

| Old town | €/sqm | 1730 |

| Central areas | €/sqm | 1660 |

| Semi-central areas | €/sqm | 1430 |

| Peripheral | €/sqm | 1230 |

| Suburbs | €/sqm | 1180 |

| Market Analysis | |||

|---|---|---|---|

| Area Code and Name | Market Values (€/sm) | ||

| To Be Renovated | New Building | ||

| B2 | Lungarno-Donatello-Beccaria-Libertà | 2900 | 4200 |

| B5 | Centro Storico (Signoria-Duomo-Pitti-San Niccolò) | 3500 | 5980 |

| B6 | Centro Storico (Stazione Centrale-San Lorenzo-Sant’Ambrogio) | 2950 | 4800 |

| B7 | Centro Storico (Viali-Lungarno Vespucci-Lungarno della Zecca Vecchia) | 3100 | 4680 |

| B8 | Centro Storico (San Frediano-Porta Romana) | 3200 | 4920 |

| C2 | San Jacopino-Ponte alle Mosse-Cascine | 2050 | 3080 |

| C3 | Dalmazia-Romito | 2150 | 3025 |

| C4 | Poggetto-Statuto-Ponte Rosso | 2550 | 3300 |

| C5 | Le Cure | 2600 | 3520 |

| C6 | Campo di Marte | 2500 | 3300 |

| C7 | Madonnone-San Salvi-Bellariva | 2450 | 3245 |

| C9 | Coverciano | 2550 | 3520 |

| C10 | Bobolino-Poggio Imperiale -Pian dei Giullari | 2750 | 4290 |

| C11 | Marignolle-Monte Oliveto-Le Campora | 2800 | 4620 |

| C12 | La Pietra-Camerata | 2800 | 4400 |

| C13 | Piazza Ferrucci-Ricorboli-Bandino-Viale Europa-Anconella | 2500 | 3190 |

| C14 | Pignone-Legnaia-Soffiano-Monticelli | 2250 | 3080 |

| C15 | Isolotto | 2200 | 2860 |

| D3 | Nave a Rovezzano-Ponte a Ema | 2000 | 3080 |

| D4 | Cascine del Riccio-Certosa | 2300 | 3520 |

| D6 | Periferica/Le Piagge | 1600 | 2585 |

| D7 | Peretola-Brozzi-Quaracchi-San Donnino | 1700 | 2475 |

| D10 | Careggi-Cercina-Trespiano | 2100 | 3300 |

| D11 | Varlungo-Rovezzano | 2150 | 2970 |

| D12 | Cupolina-Osmannoro * | 2000 | 2650 |

| D13 | Settignano | 2800 | 4400 |

| D14 | Galluzzo-Le Due Strade-San Gaggio | 2400 | 3520 |

| D15 | Arcingrosso-San Bartolo a Cintoia-Ponte a Greve | 2000 | 2860 |

| D16 | San Donato-Villa Demidoff-Toscanini | 1950 | 3080 |

| D17 | Carlo del Prete-Firenze Nova-Nuovo Pignone-Mercafir | 1900 | 3025 |

| D18 | Morgagni-Le Panche | 2150 | 2970 |

| D19 | Castello-Il Sodo | 1800 | 2860 |

| D20 | Novoli-Carraia | 2000 | 2750 |

| E1 | Ponte a Greve-Ugnano-Mantignano | 1950 | 2970 |

| Elaboration Regarding Density Bonus | ||||

|---|---|---|---|---|

| Area Code and Name | Size (Hectares) | Minimum Bonus | Bonus Range | |

| B2 | Lungarno-Donatello-Beccaria-Libertà | 208.5 | 17% | 16–20% |

| B5 | Centro Storico (Signoria-Duomo-Pitti-San Niccolò) | 181 | −18% | no bonus |

| B6 | Centro Storico (Stazione Centrale-San Lorenzo-Sant’Ambrogio) | 88 | −4% | no bonus |

| B7 | Centro Storico (Viali-Lungarno Vespucci-Lungarno della Zecca Vecchia) | 185 | 3% | 1–5% |

| B8 | Centro Storico (San Frediano-Porta Romana) | 82.7 | −2% | no bonus |

| C2 | San Jacopino-Ponte alle Mosse-Cascine | 395 | 24% | 21–25% |

| C3 | Dalmazia-Romito | 95 | 35% | 31–35% |

| C4 | Poggetto-Statuto-Ponte Rosso | 117 | 36% | 36–40% |

| C5 | Le Cure | 80.5 | 24% | 21–25% |

| C6 | Campo di Marte | 200.4 | 34% | 31–35% |

| C7 | Madonnone-San Salvi-Bellariva | 140 | 35% | 31–35% |

| C9 | Coverciano | 111 | 22% | 21–25% |

| C10 | Bobolino-Poggio Imperiale -Pian dei Giullari | 917 | −4% | no bonus |

| C11 | Marignolle-Monte Oliveto-Le Campora | 614 | −12% | no bonus |

| C12 | La Pietra-Camerata | 464 | −6% | no bonus |

| C13 | Piazza Ferrucci-Ricorboli-Bandino-Viale Europa-Anconella | 218 | 42% | 41–45% |

| C14 | Pignone-Legnaia-Soffiano-Monticelli | 160 | 36% | 36–40% |

| C15 | Isolotto | 159 | 54% | 51–55% |

| D3 | Nave a Rovezzano-Ponte a Ema | 373 | 8% | 6–10% |

| D4 | Cascine del Riccio-Certosa | 444 | 0% | no bonus |

| D6 | Periferica/Le Piagge | 242 | 18% | 16–20% |

| D7 | Peretola-Brozzi-Quaracchi-San Donnino | 288 | 37% | 36–40% |

| D10 | Careggi-Cercina-Trespiano | 1.346 | 1% | 1–5% |

| D11 | Varlungo-Rovezzano | 250 | 24% | 21–25% |

| D12 | Cupolina-Osmannoro | 334 | 41% | 41–45% |

| D13 | Settignano | 515 | −12% | no bonus |

| D14 | Galluzzo-Le Due Strade-San Gaggio | 225 | 5% | 1–5% |

| D15 | Arcingrosso-San Bartolo a Cintoia-Ponte a Greve | 498 | 23% | 21–25% |

| D16 | San Donato-Villa Demidoff-Toscanini | 77.9 | 5% | 1–5% |

| D17 | Carlo del Prete-Firenze Nova-Nuovo Pignone-Mercafir | 225 | 6% | 6–10% |

| D18 | Morgagni-Le Panche | 212 | 24% | 21–25% |

| D19 | Castello-Il Sodo | 163 | 10% | 6–10% |

| D20 | Novoli-Carraia | 121 | 32% | 31–35% |

| E1 | Ponte a Greve-Ugnano-Mantignano | 510 | 9% | 6–10% |

| Summary of the Results | |||||

|---|---|---|---|---|---|

| Bonus Entity | Area of Application | Ratio | Bonus Entity | ||

| no bonus | sqm | 3305.70 | 32.28% | 62.60% | No bonus or small bonus |

| 1–5% | sqm | 1833.90 | 17.91% | ||

| 6–10% | sqm | 1271.00 | 12.41% | ||

| 11–15% | sqm | 0.00 | 0.00% | 19.50% | Medium bonus |

| 16–20% | sqm | 450.50 | 4.40% | ||

| 21–25% | sqm | 1546.5 | 15.10% | ||

| 26–30% | sqm | 0 | 0.00% | ||

| 31–35% | sqm | 556.4 | 5.43% | 17.89% | High bonus |

| 36–40% | sqm | 565 | 5.52% | ||

| 41–45% | sm | 552 | 5.39% | ||

| 46–50% | sqm | 0 | 0.00% | ||

| 51–55% | sqm | 159 | 1.55% | ||

| Total | 10,240.00 | 100.00% | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Battisti, F.; Campo, O. The Assessment of Density Bonus in Building Renovation Interventions. The Case of the City of Florence in Italy. Land 2021, 10, 1391. https://doi.org/10.3390/land10121391

Battisti F, Campo O. The Assessment of Density Bonus in Building Renovation Interventions. The Case of the City of Florence in Italy. Land. 2021; 10(12):1391. https://doi.org/10.3390/land10121391

Chicago/Turabian StyleBattisti, Fabrizio, and Orazio Campo. 2021. "The Assessment of Density Bonus in Building Renovation Interventions. The Case of the City of Florence in Italy" Land 10, no. 12: 1391. https://doi.org/10.3390/land10121391

APA StyleBattisti, F., & Campo, O. (2021). The Assessment of Density Bonus in Building Renovation Interventions. The Case of the City of Florence in Italy. Land, 10(12), 1391. https://doi.org/10.3390/land10121391