Debt-Driven Property Boom, Land-Based Financing and Trends of Housing Financialization: Evidence from China

Abstract

:1. Introduction

2. Literature Review: Housing Financialization in China’s Context

2.1. Definition

2.2. Housing-Centred Debt Expansion Globally and Property Financialization in China

3. Empirical Studies: Stylized Facts of China’s Debt-Driven Property Boom

3.1. Data and Methods

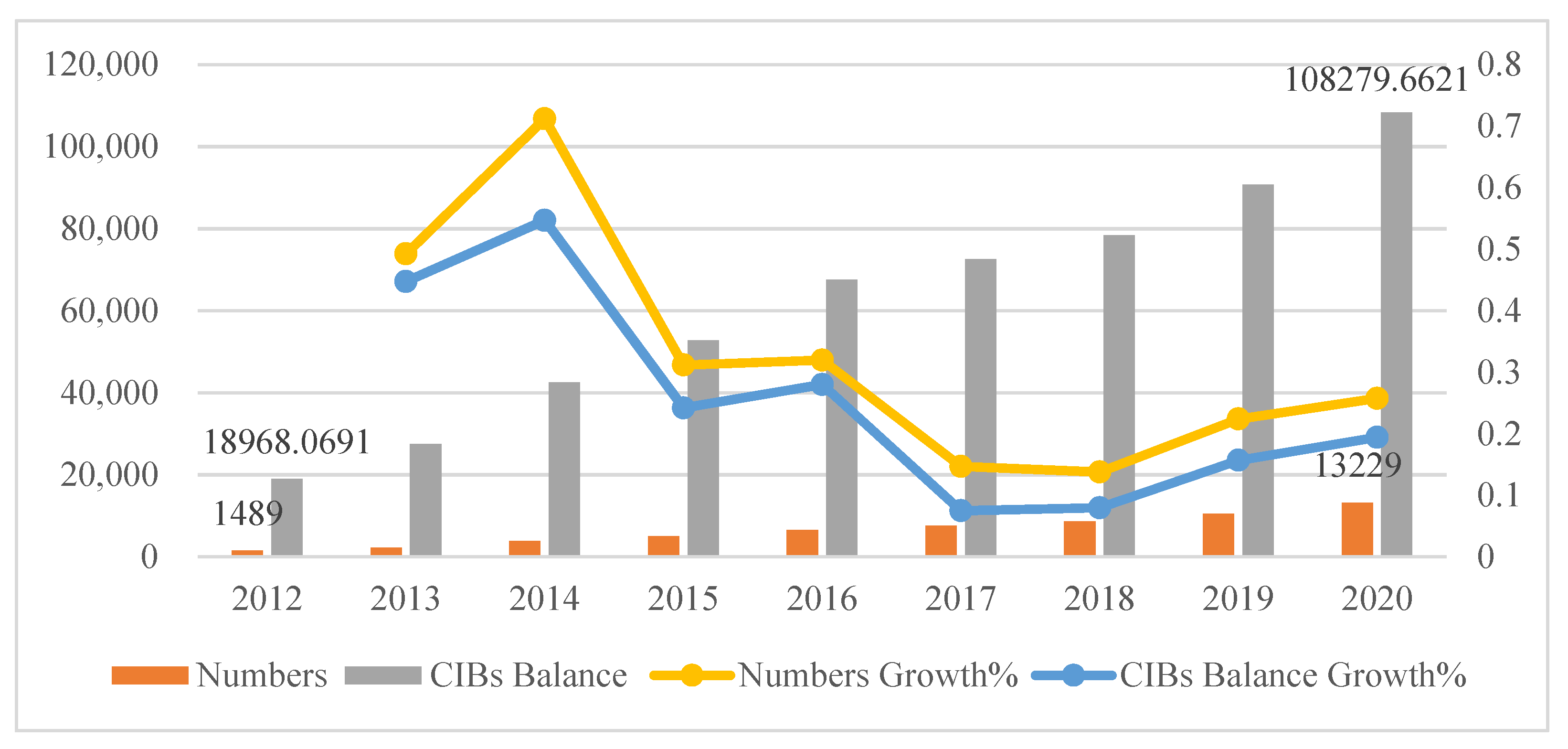

3.2. Descriptive Statistics and Hypotheses

3.3. Model Specifications

4. Estimation Results

4.1. Debt-Driven Housing Investment Model Results

4.2. Debt-Driven Infrastructure Model Results

4.3. Endogenous Problems and the Solution

4.4. Robustness Test and Summary

5. Dual Financing Circulation Mechanism: A New Approach from a Property Financialization Perspective

5.1. Land-Based Dual Financing Circulation and Expanded Debts: Essential Feature of the Financialized Economy

5.1.1. Land-Based Financing Circulation for Local Governmental Financing

5.1.2. Property-Based Financing Circulation for Residents, Developers and Financial Institutions

5.2. Infrastructure as an Economic Growth Engine, Properties as Asset Appreciation and Lands as Collateral in China’s Case

5.2.1. Governmental Financing Based on Infrastructure and Market Financing Based on Properties

5.2.2. Tendency of Financialization in Property Markets

6. Discussion

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Krippner, G.R. The Financialization of the American Economy. Socio Econ. Rev. 2005, 3, 173–208. [Google Scholar] [CrossRef]

- Epstein, G.A. Financialization and the World Economy; Edward Elgar Publishing: Cheltenham, UK, 2005. [Google Scholar]

- Palley, T. Financialization: The Economics of Finance Capital Domination; Springer: New York, NY, USA, 2016. [Google Scholar]

- Aalbers, M.B. The variegated financialization of housing. Int. J. Urban Reg. Res. 2017, 41, 542–554. [Google Scholar] [CrossRef]

- Fields, D.; Uffer, S. The financialisation of rental housing: A comparative analysis of New York City and Berlin. Urban Stud. 2016, 53, 1486–1502. [Google Scholar] [CrossRef]

- Chua, B.H. Financialising public housing as an asset for retirement in Singapore. Int. J. Hous. Policy 2015, 15, 27–42. [Google Scholar] [CrossRef]

- Pereira, A.L.D.S. Financialization of housing in Brazil: New frontiers. Int. J. Urban Reg. Res. 2017, 41, 604–622. [Google Scholar] [CrossRef]

- Pike, A.; Pollard, J. Economic geographies of financialization. Econ. Geogr. 2010, 86, 29–51. [Google Scholar] [CrossRef]

- Christophers, B. The limits to financialization. Dialogues Hum. Geogr. 2015, 5, 183–200. [Google Scholar] [CrossRef]

- Kaika, M.; Ruggiero, L. Land financialization as a ‘lived’process: The transformation of Milan’s Bicocca by Pirelli. Eur. Urban Reg. Stud. 2016, 23, 3–22. [Google Scholar] [CrossRef] [Green Version]

- Wijburg, G.; Aalbers, M.B.; Heeg, S. The financialisation of rental housing 2.0: Releasing housing into the privatised mainstream of capital accumulation. Antipode 2018, 50, 1098–1119. [Google Scholar] [CrossRef] [Green Version]

- Turner, A. Between debt and the devil. In Between Debt and the Devil; Princeton University Press: Princeton, NJ, USA, 2017. [Google Scholar] [CrossRef]

- Newell, G.; Chau, K.W.; Wong, S.K. The significance and performance of infrastructure in China. J. Prop. Invest. Financ. 2009. [Google Scholar] [CrossRef] [Green Version]

- Du, X.; Huang, Z.; Wu, C. Land finance and economic growth in China—An analysis based on Inter-Provincial panel data (in Chinese). Financ. Trade Econ. 2009, 1, 60–64. [Google Scholar]

- Yan, Y.; Tao, L.; Joyce, M. Local Government Land Competition and Urban Economic Growth in China. Urban Dev. Stud. 2013, 20, 73–79. (In Chinese) [Google Scholar]

- Pan, F.; Zhang, F.; Zhu, S.; Wójcik, D. Developing by borrowing? Inter-jurisdictional competition, land finance and local debt accumulation in China. Urban Stud. 2017, 54, 897–916. [Google Scholar] [CrossRef]

- Ji, Y.; Guo, X.; Zhong, S.; Wu, L. Land financialization, uncoordinated development of population urbanization and land urbanization, and economic growth: Evidence from China. Land 2020, 9, 481. [Google Scholar] [CrossRef]

- Mian, A.; Sufi, A. House of Debt: How They (and You) Caused the Great Recession, and How We Can Prevent It from Happening again; University of Chicago Press: Chicago, IL, USA, 2015. [Google Scholar] [CrossRef]

- Bai, Y.; Lin, B.-X.; Wang, Y.; Wu, L. Corporate ownership, debt, and expropriation: Evidence from China. China J. Account. Stud. 2013, 1, 13–31. [Google Scholar] [CrossRef]

- Shi, Y.; Guo, S.; Sun, P. The role of infrastructure in China’s regional economic growth. J. Asian Econ. 2017, 49, 26–41. [Google Scholar] [CrossRef]

- Agnes, P. The “end of geography” in financial services? Local embeddedness and territorialization in the interest rate swaps industry. Econ. Geogr. 2000, 76, 347–366. [Google Scholar] [CrossRef]

- Clark, G.L. London in the European financial services industry: Locational advantage and product complementarities. J. Econ. Geogr. 2002, 2, 433–453. [Google Scholar] [CrossRef]

- Zhao, S.X.; Zhang, L.; Wang, D.T. Determining factors of the development of a national financial center: The case of China. Geoforum 2004, 35, 577–592. [Google Scholar] [CrossRef] [Green Version]

- Engelen, E. The case for financialization. Compet. Change 2008, 12, 111–119. [Google Scholar] [CrossRef]

- O’Neill, P.; Clark, G.L.; Dixon, A.D.; Monk, A.H. Infrastructure investment and the management of risk. Manag. Financ. Risks Glob. Local 2009. [Google Scholar] [CrossRef]

- Stockhammer, E. Financialization, income distribution and the crisis. In Financial Crisis, Labour Markets and Institutions; Routledge: Oxfordshire, UK, 2013; pp. 116–138. [Google Scholar]

- Demir, F. The rise of rentier capitalism and the financialization of real sectors in developing countries. Rev. Radic. Political Econ. 2007, 39, 351–359. [Google Scholar] [CrossRef] [Green Version]

- Lin, B.; Wang, D.; Chen, S. Heterogeneous Efficiency Firms,Resource Reallocation Mechanism of Financial Frictions and Economic Fluctuations. J. Financ. Res. 2018, 458, 17–32. (In Chinese) [Google Scholar]

- Zhang, M.; Partridge, M.D.; Song, H. Amenities and the geography of innovation: Evidence from Chinese cities. Ann. Reg. Sci. 2020, 65, 105–145. [Google Scholar] [CrossRef] [Green Version]

- Aalbers, M. Financialization of Housing; Taylor & Francis: Oxfordshire, UK, 2016. [Google Scholar]

- Wu, F.; Chen, J.; Pan, F.; Gallent, N.; Zhang, F. Assetization: The Chinese path to housing financialization. Ann. Am. Assoc. Geogr. 2020, 110, 1483–1499. [Google Scholar] [CrossRef]

- Wu, F. Land financialisation and the financing of urban development in China. Land Use Policy 2022, 112, 104412. [Google Scholar] [CrossRef]

- Zalewski, D.A.; Whalen, C.J. Financialization and income inequality: A post Keynesian institutionalist analysis. J. Econ. Issues 2010, 44, 757–777. [Google Scholar] [CrossRef]

- Fernandez, R. Financialization and housing: Between globalization and varieties of capitalism. In The Financialization of Housing; Routledge: London, UK, 2016; pp. 81–100. [Google Scholar]

- Chaney, T.; Sraer, D.; Thesmar, D. The collateral channel: How real estate shocks affect corporate investment. Am. Econ. Rev. 2012, 102, 2381–2409. [Google Scholar] [CrossRef] [Green Version]

- Guo, Y.; Xu, W.; Zhang, Z. Leverage, consumer finance, and housing prices in China. Emerg. Mark. Financ. Trade 2016, 52, 461–474. [Google Scholar] [CrossRef]

- Syz, J. Property Derivatives: Price, Hedging and Applications; John Willey and Sons: New York, NY, USA, 2008. [Google Scholar]

- Li, R.Y.M.; Chau, K.W. Econometric Analyses of International Housing Markets; Routledge: Oxfordshire, UK, 2016. [Google Scholar]

- Phang, S.-Y. Housing Finance Systems: Market Failures and Government Failures; Springer: New York, NY, USA, 2013. [Google Scholar]

- Iacoviello, M. House prices, borrowing constraints, and monetary policy in the business cycle. Am. Econ. Rev. 2005, 95, 739–764. [Google Scholar] [CrossRef] [Green Version]

- Zhao, Y. Land finance in China: History, logic and choice. Urban Dev. Stud. 2014, 21, 1–13. [Google Scholar]

- Milberg, W.; Winkler, D. Financialisation and the dynamics of offshoring in the USA. Camb. J. Econ. 2010, 34, 275–293. [Google Scholar] [CrossRef]

- Guironnet, A.; Attuyer, K.; Halbert, L. Building cities on financial assets: The financialisation of property markets and its implications for city governments in the Paris city-region. Urban Stud. 2016, 53, 1442–1464. [Google Scholar] [CrossRef]

- Lim, G.; McNelis, P.D. Quasi-monetary and quasi-fiscal policy rules at the zero-lower bound. J. Int. Money Financ. 2016, 69, 135–150. [Google Scholar] [CrossRef]

- Aveline-Dubach, N. The financialization of rental housing in Tokyo. Land Use Policy 2022, 112, 104463. [Google Scholar] [CrossRef] [Green Version]

- Chen, J.; Wu, F.; Lu, T. The financialization of rental housing in China: A case study of the asset-light financing model of long-term apartment rental. Land Use Policy 2022, 112, 105442. [Google Scholar] [CrossRef]

- Schwartz, H.M.; Seabrooke, L. Varieties of residential capitalism in the international political economy: Old welfare states and the new politics of housing. In The Politics of Housing Booms and Busts; Springer: Berlin, Germany, 2009; pp. 1–27. [Google Scholar]

- Jordà, Ò.; Schularick, M.; Taylor, A.M. The great mortgaging: Housing finance, crises and business cycles. Econ. Policy 2016, 31, 107–152. [Google Scholar] [CrossRef] [Green Version]

- O’Brien, P.; Pike, A. ‘Deal or no deal?’ Governing urban infrastructure funding and financing in the UK city deals. Urban Stud. 2019, 56, 1448–1476. [Google Scholar] [CrossRef] [Green Version]

- Yang, D.Y.-R.; Chang, J.-C. Financialising space through transferable development rights: Urban renewal, Taipei style. Urban Stud. 2018, 55, 1943–1966. [Google Scholar]

- Brown, A.; Robertson, M. Economic Evaluation of Systems of Infrastructure Provision: Concepts, Approaches, Methods, IBUILD/Leeds Report; University of Leeds: Leeds, UK, 2014. [Google Scholar]

- Kong, Q.; Kong, H.; Miao, S.; Zhang, Q.; Shi, J. Spatial Coupling Coordination Evaluation between Population Growth, Land Use and Housing Supply of Urban Agglomeration in China. Land 2022, 11, 1396. [Google Scholar] [CrossRef]

- Su, M.; Zhao, Q. The Fiscal Framework and Urban Infrastructure Finance in China; World Bank Publications: Washington, DC, USA, 2006; Volume 4051. [Google Scholar]

- Li, Z.; Wu, M.; Chen, B.R. Is road infrastructure investment in China excessive? Evidence from productivity of firms. Reg. Sci. Urban Econ. 2017, 65, 116–126. [Google Scholar] [CrossRef]

- Mazzucato, M. The Entrepreneurial State: Debunking Public vs. PrivateSector Myths; Anthem Press: London, UK, 2013. [Google Scholar]

- Kauko, T. Innovation in urban real estate: The role of sustainability. Prop. Manag. 2019, 37, 197–214. [Google Scholar] [CrossRef]

- Sun, Y.; Li, G.; Xi, Q. Technical Opportunity, Industry Heterogeneity and Innovation Agglomeration in Metropolis: Taking the Manufacturing Industry of Beijing as an Example. Sci. Geogr. Sin. 2019, 39, 252–258. (In Chinese) [Google Scholar] [CrossRef]

- Puffert, D.J. Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages; Perez, C., Ed.; Edward Elgar: Cheltenham, UK; Northampton, MA, USA, 2002. [Google Scholar]

- Qin, Y.; Zhu, H.; Zhu, R. Changes in the distribution of land prices in urban China during 2007–2012. Reg. Sci. Urban Econ. 2016, 57, 77–90. [Google Scholar] [CrossRef]

- Guo, S.; Shi, Y. Infrastructure investment in China: A model of local government choice under land financing. J. Asian Econ. 2018, 56, 24–35. [Google Scholar] [CrossRef]

- Chen, J.; Wu, F. Housing and land financialization under the state ownership of land in China. Land Use Policy 2022, 112, 104844. [Google Scholar] [CrossRef]

- Wu, L.; Bian, Y. Housing, consumption and monetary policy: How different are the first-, second-and third-tier cities in China? Appl. Econ. Lett. 2018, 25, 1107–1111. [Google Scholar] [CrossRef]

- Hsing, Y.-t. Land and territorial politics in urban China. China Q. 2006, 187, 575–591. [Google Scholar] [CrossRef]

- Shiuh-Shen, C. Chinese eco-cities: A perspective of land-speculation-oriented local entrepreneurialism. China Inf. 2013, 27, 173–196. [Google Scholar] [CrossRef]

- Wijburg, G. The de-financialization of housing: Towards a research agenda. Hous. Stud. 2021, 36, 1276–1293. [Google Scholar] [CrossRef]

| Public Investment Area | Amount: Billions |

|---|---|

| Transportation infrastructure (e.g., railway, highways and airport) | 1500 |

| Post-disaster reconstruction | 1000 |

| Public housing (e.g., low-rent housing and shantytowns transformation) | 400 |

| Infrastructure in rural area (e.g., water, electricity and gasoline network) | 370 |

| Innovations and structural adjustment | 370 |

| Energy conservation and emission reduction | 210 |

| Technology, education, cultural and health care | 150 |

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|---|

| Aggregate Financing to Real Economy | 17,316.9 | 15,876.1 | 15,406.3 | 17,799.9 | 26,153.6 | 22,492 | 25,673.5 |

| Financialization level | 29.20% | 24.67% | 22.36% | 23.85% | 31.43% | 24.47% | 25.91% |

| Real Estate Investment (billion RMB) | 8601.34 | 9503.56 | 9597.89 | 10,258.06 | 10,979.85 | 12,016.48 | 13,219.43 |

| Public Infrastructure Investment (billion RMB) | 7445.4 | 8944.07 | 10,487.96 | 12,253.8 | 14,355.6 | 14,866.20 | 15,329.25 |

| GDP (billion RMB) | 59,296.32 | 64,356.31 | 68,885.82 | 74,639.51 | 83,203.59 | 91,928.11 | 98,651.52 |

| Population (million persons) | 1355.16 | 1362.46 | 1370.88 | 1379.84 | 1388.34 | 1396.53 | 1403.85 |

| Density (persons per sqr km) | 2817.61 | 2850.03 | 2775.55 | 2809.45 | 2796.58 | 2894.29 | 3008.10 |

| Land Revenue (billionRMB) | 43,745.30 | 34,377.37 | 31,220.65 | 36,461.68 | 51,984.48 | ||

| Reprice (RMB per sqr meters) | 6237 | 6324 | 6793 | 7476 | 7892 | 8726 | 9310 |

| Government expenditures | 11,974.03 | 12,921.55 | 15,033.56 | 16,035.14 | 17,322.83 | 18,819.63 | 20,374.32 |

| Taxation (billion RMB) | 53,890.88 | 59,139.91 | 62,661.93 | 64,691.69 | 68,672.72 | 75,954.79 | 76,980.13 |

| Pcdi | 26,467 | 28,844 | 31,195 | 33,616 | 36,396 | 39,251 | 42,359 |

| rates | 6.43% | 6.66% | 5.93% | 5.50% | 5.18% | 5.06% | 5.29% |

| Urban rates | 54.45% | 55.55% | 56.64% | 57.85% | 58.98% | 59.99% | 60.85% |

| Yi,t-1 | LnREIi,t, | Nationwide (1-1) | Naitionwide (1-2)-fe | Nationwide (1-3) | Naitionwide (1-4)-fe | Nationwide Year 2013–2016 (1-5) | Nationwide Year 2013–2016 (1-6)-fe | Nationwide Year 2017–2019 (1-7) | Nationwide Year 2017–2019 (1-8) |

|---|---|---|---|---|---|---|---|---|---|

| Xi,t-1 | LnAFRE/GDPi,t | 0.112 *** (3.78) | 0.088 ***(2.98) | 0.081 *** (2.46) | 0.072 *** (2.31) | ||||

| L.LnAFRE/GDPi,t-1 | 0.059 *** (2.16) | 0.055 ** (2.08) | 0.055 * (1.45) | 0.067 * (1.83) | |||||

| Controlled variables | Ln pricei,t | −0.187 * (−1.52) | −0.349 *** (−2.44) | −0.049 (−0.34) | −0.282 ** (−1.77) | −0.059 (−0.35) | −0.328 (−1.24) | 0.067 (0.35) | −0.304 (−1.10) |

| LnGDPi,t | 0.256 *** (3.43) | 0.207 ** (2.59) | 0.209 *** (2.71) | 0.172 ** (2.11) | 0.340 *** (2.85) | 0.0367 (0.26) | 0.273 *** (2.22) | −0.011 (−0.08) | |

| Ln densityi,t | −0.170 *** (−2.84) | −0.136 ** (−1.89) | −0.217 *** (−3.28) | −0.172 *** (−2.24) | −0.145 **(−1.91) | −0.246 *** (−2.57) | −0.190 ** (−2.12) | −0.310 *** (−2.90) | |

| LnLand Revenuei,t | 0.300 *** (10.34) | 0.268 ** (9.09) | 0.290 *** (9.25) | 0.259 *** (8.29) | 0.347 *** (8.44) | 0.256 *** (5.73) | 0.367 *** (8.28) | 0.263 *** (5.55) | |

| Lngovernmentexpendituresi,t | 0.463 *** (4.07) | 0.600 *** (3.34) | 0.556 *** (4.87) | 0.690 *** (3.73) | 0.273 * (1.53) | −0.154 (−0.49) | 0.365 ** (2.00) | −0.188 (−0.55) | |

| lnpcdii,t | −0.697*** (−4.04) | −0.609*** (−2.70) | −0.847 *** (−4.55) | −0.709 *** (−2.89) | −0.893 *** (−2.91) | 0.365 (0.76) | −0.963 *** (−3.01) | 0.506 (0.93) | |

| lnratesi,t | −0.308 *** (−3.79) | −0.248 *** (−2.70) | −0.291 *** (−3.36) | −0.232 *** (−2.66) | −0.793 *** (−3.25) | −0.494 * (−1.72) | −1.028 *** (−4.06) | −0.594 ** (−1.99) | |

| Dummy variables | Easti | 0.594 *** (4.24) | 0.586 *** (4.18) | 0.671 *** (3.97) | 0.621 *** (3.73) | ||||

| Middlei | 0.257 ** (1.84) | 0.287 ** (2.08) | 0.349 *** (2.18) ** | 0.369 *** (2.36) | |||||

| Westi | 0.144 (1.12) | 0.150 (1.17) | 0.278 (1.93) ** | 0.285 ** (2.02) | |||||

| Constants | 9.672 *** (9.09) | 9.741 *** (8.94) | 10.259 *** (9.11) | 10.160 *** (8.87) | 11.674 *** (5.51) | 8.893 *** (3.23) | 11.862 *** (5.18) | 8.609 *** (2.79) | |

| R2 | 0.92 | 0.56 | 0.91 | 0.55 | 0.95 | 0.58 | 0.95 | 0.56 | |

| rho | 0.68 | 0.90 | 0.65 | 0.90 | 0.86 | 0.987 | 0.83 | 0.99 | |

| Sample | 210 | 210 | 203 | 203 | 90 | 90 | 87 | 87 | |

| Hausman test | Chi-square | 193.93 | 20.44 | 28.94 | 29.30 | ||||

| p-value | 0.000 | 0.0088 | 0.0003 | 0.0003 | |||||

| FE or RE | FE | FE | FE | FE |

| Yi,t-1 | LnPIInvesti,t, | Nationwide (2-1) | Nationwide (2-2)-fe | Nationwide (2-3)-iv | East (2-4)-fe | Middle (2-5) | West (2-6)-fe |

|---|---|---|---|---|---|---|---|

| Xi,t-1 | LnAFRE/GDPi,t,t | 0.179 *** (3.19) | 0.177 *** (3.23) | 0.590 **(1.81) | 0.192 ***(3.15) | 0.424 * (1.73) | 0.094 * (1.59) |

| Controlled variables | LnGDPi,t | 1.393 *** (7.84) | 1.254 *** (6.61) | 1.411 *** (5.63) | 0.838 *** (3.63) | 2.770 *** (2.87) | 1.716 *** (4.57) |

| Lnpopulationi,t | −0.116 (−0.48) | −0.087 (−0.05) | 1.424 (0.58) | 0.606 (0.30) | −30.278 *** (−2.89) | 0.945 (0.39) | |

| LnLand Revenuei,t | 0.038 (0.72) | −0.024 (−0.44) | −0.036 (−0.56) | −0.122 * (−1.69) | 0.373 (1.47) | −0.107 * (−1.59) | |

| Ln ppricei,t | −0.608 *** (−2.67) | −0.606** (−2.25) | −0.387 (−1.09) | −0.790 *** (−3.15) | −2.875 *** (−2.68) | 0.983 *** (2.59) | |

| Lntaxationsi,t | −0.544 *** (−3.21) | 0.049 (0.23) | −0.271 (−0.77) | 0.262 (0.81) | −1.329 ** (−2.09) | −0.619 ** (−1.84) | |

| lnpcdii,t | 1.935 *** (7.35) | 1.419 *** (4.07) | 1.132 *** (2.46) | 2.039 *** (3.47) | 3.909 ** (2.01) | 0.725 (1.43) | |

| lnurbanratesi,t | −0.883 * (−1.68) | 1.229 * (1.74) | 1.720 ** (1.91) | 0.786 (0.84) | 0.261 (0.261) | −1.951 (−1.55) | |

| lnratesi,t | −0.143 (−0.61) | 0.030 (0.13) | −0.256 (−0.74) | 0.042 (0.19) | −0.593 (−0.82) | −1.052 *** (−3.08) | |

| Constants | −12.570 *** (−3.72) | −18.757 (−1.29) | −32.005 * (−1.63) | −25.029 * (−1.66) | 233.922 *** (2.79) | −17.397 (−17.397) | |

| Dummy variables | East | −0.015 (−0.06) | |||||

| Middle | 0.238 (0.97) | ||||||

| West | 0.502 ** (2.11) | ||||||

| IV ratio | lndebts | 0.719 ** (2.15) | |||||

| lnrdinvest | 0.013 (0.32) | ||||||

| lnrdratio | −0.075 (−0.94) | ||||||

| R2 | 0.80 | 0.80 | 0.73 | 0.90 | 0.85 | 0.93 | |

| F-test | 12.38 | 9.34 | 13.66 | 2.66 | 7.66 | ||

| rho | 0.65 | 0.94 | 0.97 | 0.98 | 0.999 | 0.97 | |

| Sample | 210 | 210 | 210 | 70 | 42 | 77 | |

| Hausman test | Chi-square | 39.14 | |||||

| p-value | 0.0000 | ||||||

| FE or RE | FE |

| Yi,t-1 | LnREIi,t, | Nationwide (1-9) | Naitionwide (1-10) | Nationwide (1-11) | Naitionwide (1-12) |

|---|---|---|---|---|---|

| Xi,t-1 | LnAFRE/GDPi,t,t | 0.466 ** (1.85) | 0.480 ** (1.95) | 0.487 ** (1.99) | 0.487 ** (1.99) |

| L.LnAFRE/GDPi,t-1 | |||||

| IV- First stage | lnrfavgwage | 0.426 ** (1.98) | 0.422 ** (1.96) | 0.411 ** (1.89) | 0.411 ** (1.89) |

| numebersfinstitute | 5.85 × 10−6 (0.47) | 6.44 × 10−6 (0.51) | 6.55× 10−6 (0.52) | 6.55 × 10−6 (0.52) | |

| fpopulation | 0.002 (0.35) | 0.002 (0.30) | 0.002 (0.26) | 0.002 (0.26) | |

| lnrdinvest | −0.012 (−0.61) | 0.002 (0.04) | 0.002 (0.04) | ||

| lnrdratio | −0.032 (−0.38) | −0.032 (−0.38) | |||

| Controlled variables | Ln pricei,t | −0.260 (−1.25) | −0.256 (−1.21) | −0.255 (−1.20) | −0.255 (−1.20) |

| LnGDPi,t | 0.642 ** (2.09) | 0.659 ** (2.18) | 0.667 ** (2.21) | 0.667 ** (2.22) | |

| Ln densityi,t | −0.172 * (−1.67) | −0.173 * (−1.66) | −0.174 * (−1.65) | −0.174 * (−1.65) | |

| LnLand Revenuei,t | 0.297 *** (6.54) | 0.298 *** (6.49) | 0.299 *** (6.46) | 0.299 *** (6.46) | |

| Lngovernmentexpendituresi,t | −0.058 (−0.12) | −0.083 (−0.17) | −0.095 (−0.19) | −0.095 (−0.19) | |

| lnpcdii,t | −0.409 (−1.20) | −0.401 (−1.16) | −0.397 (−1.14) | −0.397 (−1.14) | |

| lnratesi,t | −0.595 ** (−2.32) | −0.609 *** (−2.40) | −0.615 *** (−2.43) | −0.615 *** (−2.43) | |

| Constants | 7.650 *** (3.73) | 7.568 *** (3.69) | 7.531 *** (3.66) | 7.531 *** (3.66) | |

| R2 | 0.14 | 0.11 | 0.10 | 0.10 | |

| rho | 0.5 | 0.63 | 0.62 | 0.62 | |

| Sample | 210 | 210 | 210 | 210 | |

| F test | F test | 6.98 | 6.73 | 6.61 | 6.61 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, J.; Tochen, R.; Dong, Y.; Ren, Z. Debt-Driven Property Boom, Land-Based Financing and Trends of Housing Financialization: Evidence from China. Land 2022, 11, 1967. https://doi.org/10.3390/land11111967

Li J, Tochen R, Dong Y, Ren Z. Debt-Driven Property Boom, Land-Based Financing and Trends of Housing Financialization: Evidence from China. Land. 2022; 11(11):1967. https://doi.org/10.3390/land11111967

Chicago/Turabian StyleLi, Jia, Rachel Tochen, Yaning Dong, and Zhuoran Ren. 2022. "Debt-Driven Property Boom, Land-Based Financing and Trends of Housing Financialization: Evidence from China" Land 11, no. 11: 1967. https://doi.org/10.3390/land11111967

APA StyleLi, J., Tochen, R., Dong, Y., & Ren, Z. (2022). Debt-Driven Property Boom, Land-Based Financing and Trends of Housing Financialization: Evidence from China. Land, 11(11), 1967. https://doi.org/10.3390/land11111967