Spatial–Temporal Evolution Patterns and Influencing Factors of China’s Urban Housing Price-to-Income Ratio

Abstract

:1. Introduction

2. Materials and Methods

2.1. Data Sources

2.2. Research Method

2.2.1. Housing Price-to-Income Ratio Model

2.2.2. Rank-Size Rule

2.2.3. Markov Chain

2.2.4. Random Forest Model

3. Results

3.1. Static Distribution Characteristics of Housing Price-to-Income Ratio

3.1.1. Evolutionary Characteristics of Scale Distribution of Housing Price-to-Income Ratio

3.1.2. Global Spatial Autocorrelation Characteristics of Housing Price-to-Income Ratio

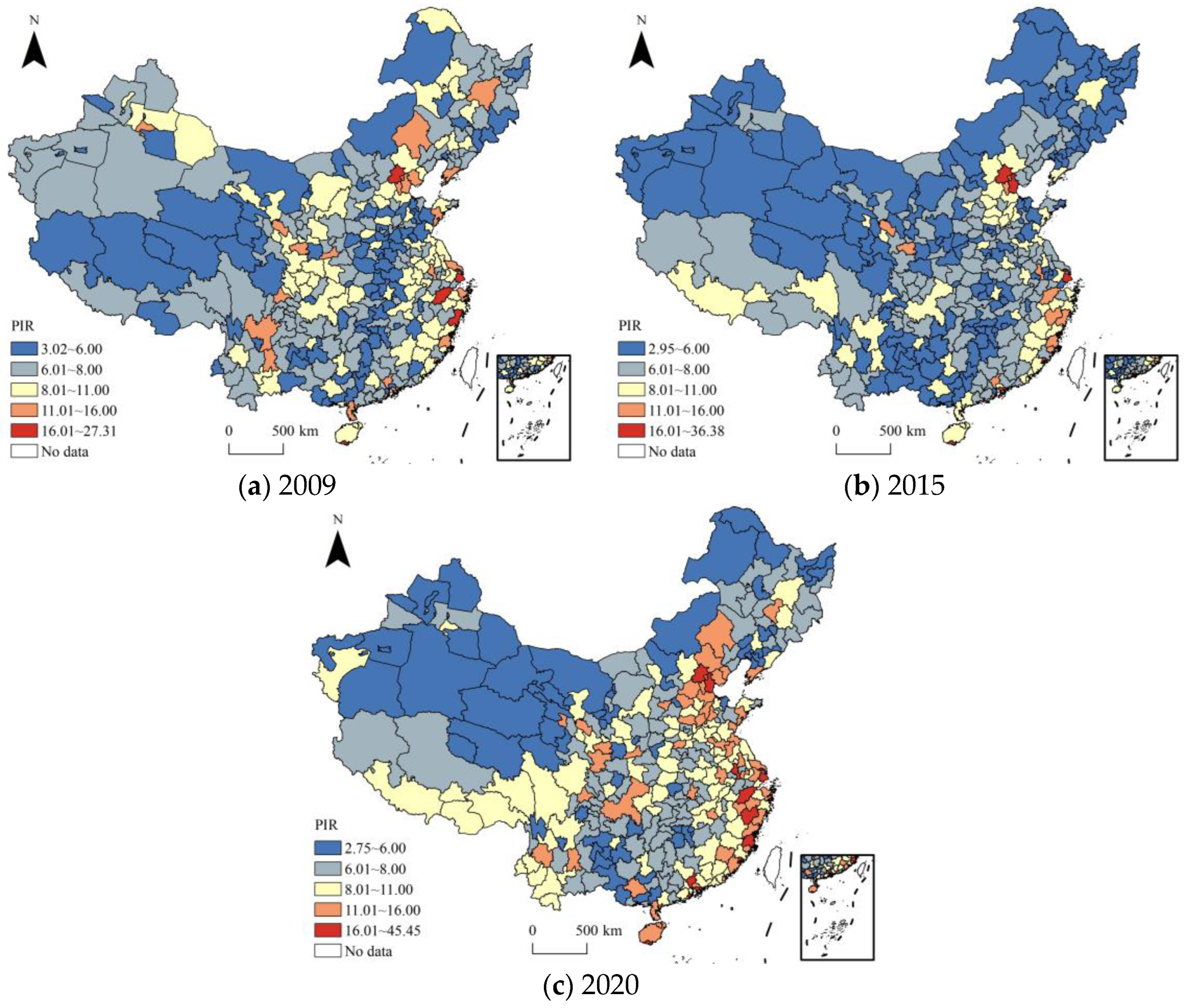

3.1.3. Spatial Distribution Pattern of Housing Price-to-Income Ratio

3.2. Analysis on Spatial–Temporal Evolution Characteristics of Housing Price-to-Income Ratio

3.2.1. Time Evolution Characteristics of Housing Price-to-Income Ratio

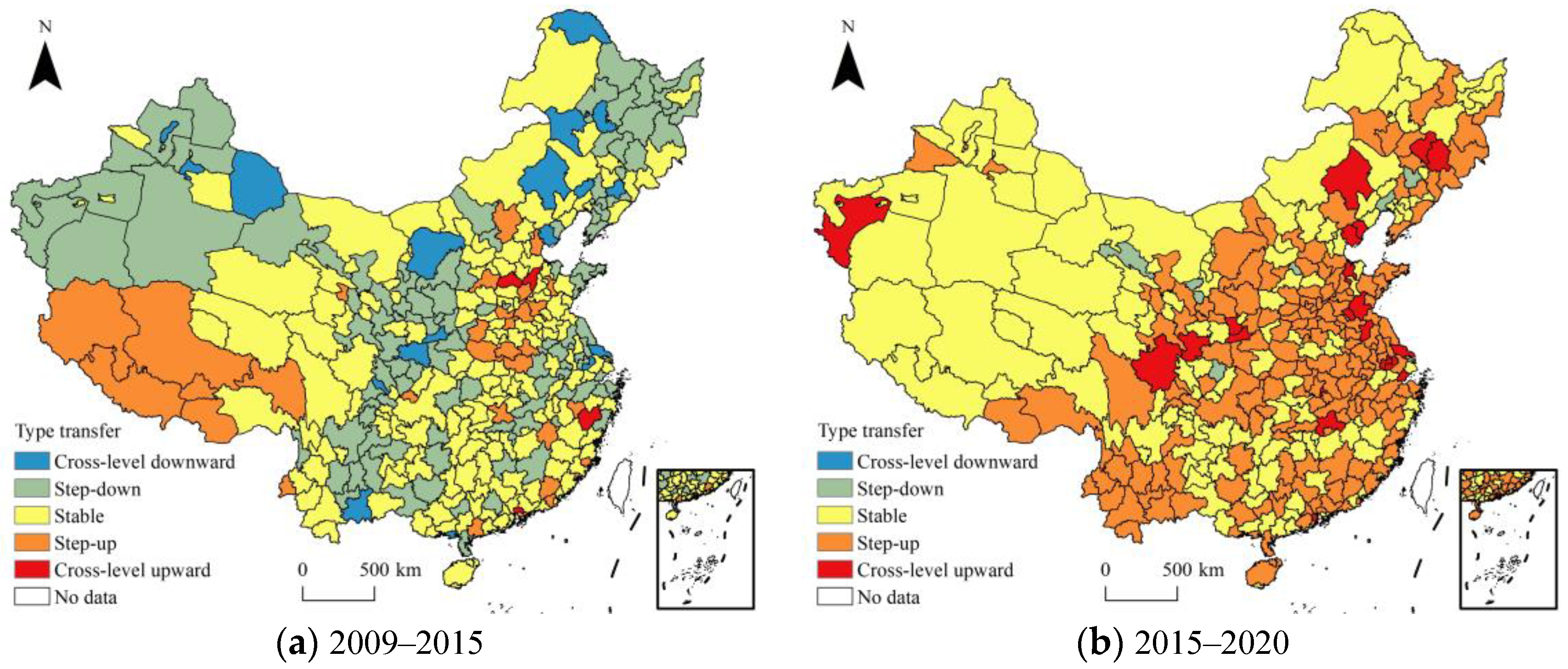

3.2.2. Spatial Evolution Characteristics of Housing Price-to-Income Ratio

3.3. Influencing Factors of Spatial Pattern of Housing Price-to-Income Ratio

3.3.1. Selection of Influencing Factors

3.3.2. Identify and Analyze Influencing Factors

3.3.3. Influence Law of Dominant Factors

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Damen, S.; Vastmans, F.; Buyst, E. The effect of mortgage interest deduction and mortgage characteristics on house prices. J. Hous. Econ. 2016, 34, 15–29. [Google Scholar] [CrossRef]

- Uwayezu, E.; Vries, W.T.D. Access to affordable houses for the low-income urban dwellers in Kigali: Analysis based on sale prices. Land 2020, 9, 85. [Google Scholar] [CrossRef] [Green Version]

- Bangura, M.; Lee, C.L. Housing price bubbles in Greater Sydney: Evidence from a submarket analysis. Hous. Stud. 2022, 37, 143–178. [Google Scholar] [CrossRef]

- Weicher, J.C. The affordability of new homes. Real. Estate. Econ 1977, 5, 209–226. [Google Scholar] [CrossRef]

- Malpezzi, S. Urban housing and financial markets: Some international comparisons. Urban Stud. 1990, 27, 971–1022. [Google Scholar] [CrossRef]

- Gan, Q.; Hill, R.J. Measuring housing affordability: Looking beyond the median. J. Hous. Econ. 2009, 18, 115–125. [Google Scholar] [CrossRef] [Green Version]

- Suhaida, M.S.; Tawil, N.M.; Hamzah, N.; Che-Ani, A.I.; Basri, H.; Yuzaineec, M.Y. Housing affordability: A conceptual overview for house price index. Procedia Eng. 2011, 20, 346–353. [Google Scholar] [CrossRef] [Green Version]

- Hu, Y.; Oxley, L. Bubbles in US regional house prices: Evidence from house price-income ratios at the State level. Appl. Econ. 2018, 50, 3196–3229. [Google Scholar] [CrossRef]

- Costello, G.; Fraser, P.; Groenewold, N. House prices, non-fundamental components and interstate spillovers: The Australian experience. J. Bank. Financ. 2011, 35, 653–669. [Google Scholar] [CrossRef]

- Feng, Q.; Wu, G.L. Bubble or riddle? An asset-pricing approach evaluation on China’s housing market. Econ. Model. 2015, 46, 376–383. [Google Scholar] [CrossRef]

- Zhang, C.C.; Jia, S.; Yang, R.D. Housing affordability and housing vacancy in China: The role of income inequality. J. Hous. Econ. 2016, 33, 4–14. [Google Scholar] [CrossRef]

- Shen, L. Are house prices too high in China. China Econ. Rev. 2012, 23, 1206–1210. [Google Scholar] [CrossRef]

- Liu, W.C. The study on the stationarity of housing price-to-rent and housing price-to-income ratios in China. World Acad. Sci. Eng. Technol. 2014, 8, 30–34. [Google Scholar]

- Leung, K.M.; Yiu, C.Y.; Lai, K.K. Responsiveness of sub-divided unit tenants’ housing consumption to income: A study of Hong Kong informal housing. Hous. Stud. 2022, 37, 50–72. [Google Scholar] [CrossRef]

- Liu, W.C. Do multiple housing bubbles exist in China? Further evidence from generalized sup ADF tests. J. Econ. Forecast. 2016, 19, 135–145. [Google Scholar]

- Ge, T.; Wu, T. Urbanization, inequality and property prices: Equilibrium pricing and transaction in the Chinese housing market. China Econ. Rev. 2017, 45, 310–328. [Google Scholar] [CrossRef]

- Yin, S.G.; Ma, Z.F.; Song, W.X.; Liu, C.H. Spatial justice of Chinese metropolis: A perspective of housing price-to-income ratios of Nanjing, China. Sustainability 2019, 11, 1808. [Google Scholar] [CrossRef] [Green Version]

- Lin, Y.J.; Chang, C.O.; Chen, C.L. Why homebuyers have a high housing affordability problem: Quantile regression analysis. Habitat Int. 2014, 43, 41–47. [Google Scholar] [CrossRef]

- Li, P.; Song, S.F. What Pushes Up China’s Urban Housing Price So High? Chin. Econ. 2016, 49, 128–141. [Google Scholar] [CrossRef]

- Gan, L.; Ren, H.; Xiang, W.; Wu, K.; Cai, W.G. Nonlinear influence of public services on urban housing prices: A case study of China. Land 2021, 10, 1007. [Google Scholar] [CrossRef]

- Chen, N.K.; Cheng, H.L. House price to income ratio and fundamentals: Evidence on long-horizon forecastability. Pac. Econ. Rev. 2017, 22, 293–311. [Google Scholar] [CrossRef]

- NBSC (National Bureau of Statistics China). China City Statistical Yearbook 2010–2021; China Statistical Publishing House: Beijing, China, 2010–2021. [Google Scholar]

- NBSC (National Bureau of Statistics China). China Statistical Yearbook for Regional Economy 2010–2021; China Statistical Publishing House: Beijing, China, 2010–2021. [Google Scholar]

- MHURDC (Ministry of Housing and Urban-Rural Development of the People’s Republic of China). China Urban Construction Statistical Yearbook 2009–2020; China Statistical Publishing House: Beijing, China, 2009–2020. [Google Scholar]

- Shen, J.F.; Shum, W.Y.; Cheong, T.S.; Wang, L. COVID-19 and regional income inequality in China. Front. Public Health 2021, 9, 687152. [Google Scholar] [CrossRef] [PubMed]

- Lu, H.; Zhao, P.; Hu, H.; Zeng, L.G.; Sheng, K.; Lv, W.D. Transport infrastructure and urban-rural income disparity: A municipal-level analysis in China. J. Transp. Geogr. 2022, 99, 103293. [Google Scholar] [CrossRef]

- Tan, M.H. Uneven growth of urban clusters in megaregions and its policy implications for new urbanization in China. Land Use Policy 2017, 66, 72–79. [Google Scholar] [CrossRef]

- Arshad, S.; Hu, S.; Ashraf, B.N. Zipf’s law, the coherence of the urban system and city size distribution: Evidence from Pakistan. Phys. A 2019, 513, 87–103. [Google Scholar] [CrossRef]

- Modica, M. The impact of the European Union integration on the city size distribution of the Member States. Habitat Int. 2017, 70, 103–113. [Google Scholar] [CrossRef]

- Reggiani, A.; Nijkamp, P. Did Zipf anticipate spatial connectivity structures? Environ. Plan. B 2015, 42, 468–489. [Google Scholar] [CrossRef]

- Hierro, M.; Maza, A. Foreign-born internal migrants: Are they playing a different role than natives on income convergence in Spain? Appl. Geogr. 2010, 30, 618–628. [Google Scholar] [CrossRef]

- Jiang, H.; Chen, S.P. Dwelling unit choice in a condominium complex: Analysis of willingness to pay and preference heterogeneity. Urban Stud. 2016, 53, 2273–2292. [Google Scholar] [CrossRef]

- Flores-Segovia, M.A.; Castellanos-Sosa, F.A. Proximity effects and labour specialization transitions in Mexico: A spatial Markov chain analysis. Reg. Stud. 2021, 55, 575–589. [Google Scholar] [CrossRef]

- Du, Q.; Wu, M.; Xu, Y.D.; Bai, L.B.; Yu, M. Club convergence and spatial distribution dynamics of carbon intensity in China’s construction industry. Nat. Hazard. 2018, 94, 519–536. [Google Scholar] [CrossRef]

- Breiman, L. Random forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Wang, S.J.; Liu, Z.T.; Chen, Y.X.; Fang, C.L. Factors influencing ecosystem services in the Pearl River Delta, China: Spatiotemporal differentiation and varying importance. Resour. Conserv. Recycl. 2021, 168, 105477. [Google Scholar] [CrossRef]

- McAlexander, R.J.; Mentch, L. Predictive inference with random forests: A new perspective on classical analyses. Res. Polit. 2020, 7, 2053168020905487. [Google Scholar] [CrossRef] [Green Version]

- Medeiors, M.C.; Vasconcelos, G.F.R.; Veiga, A.; Zilberman, E. Forecasting inflation in a data-rich environment: The benefits of machine learning methods. J. Bus. Econ. Stat. 2021, 39, 98–119. [Google Scholar] [CrossRef]

- Li, L.; Niu, N.; Li, X. Factors affecting the long-term development of specialized agricultural villages north and south of Huai river. Land 2021, 10, 1215. [Google Scholar] [CrossRef]

- Wang, Y.; Zhan, Z.; Mi, Y.; Sobhani, A.; Zhou, H.Y. Nonlinear effects of factors on dockless bike-sharing usage considering grid-based spatiotemporal heterogeneity. Transp. Res. Part D 2022, 104, 103194. [Google Scholar] [CrossRef]

- Li, Y.S.; Li, A.H.; Wang, Z.F.; Wu, Q. Analysis on housing affordability of urban residents in mainland China based on multiple indexes: Taking 35 cities as examples. Ann. Data Sci. 2019, 6, 305–319. [Google Scholar] [CrossRef]

- Napoli, G. Housing affordability in metropolitan areas. The application of a combination of the ratio income and residual income approaches to two case studies in Sicily, Italy. Buildings 2017, 7, 95. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.; Wang, S.J.; Li, G.D.; Zhang, H.G.; Jin, L.X.; Su, Y.X.; Wu, K.M. Identifying the determinants of housing prices in China using spatial regression and the geographical detector technique. Appl. Geogr. 2017, 79, 26–36. [Google Scholar] [CrossRef]

- Yap, H.J.B.; Ng, X.H. Housing affordability in Malaysia perception, price range, influencing factors and policies. Int. J. Hous. Mark. Anal. 2018, 11, 476–497. [Google Scholar] [CrossRef]

- Bai, Y.; Tan, M. Empirical testing of influencing factors of China’s housing prices: Evidence from provincial panel data. Res. World Econ. 2018, 9, 9–14. [Google Scholar] [CrossRef]

- Zhang, L.; Wang, H.; Song, Y.; Wen, H. Spatial spillover of house prices: An empirical study of the Yangtze delta urban agglomeration in China. Sustainability. 2019, 11, 544. [Google Scholar] [CrossRef] [Green Version]

- Yang, Z.; Zhao, L. A reexamination of housing price and household consumption in China: The dual role of housing consumption and housing investment. J. Real Estate Financ. Econ. 2018, 56, 472–499. [Google Scholar] [CrossRef]

- Wang, S.; Wang, J.; Wang, Y. Effect of land prices on the spatial differentiation of housing prices: Evidence from cross-county analyses in China. J. Geogr. Sci. 2018, 28, 725–740. [Google Scholar] [CrossRef]

| Year | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Zipf dimension | 0.3178 | 0.3352 | 0.3000 | 0.2994 | 0.3077 | 0.3110 | 0.3290 | 0.3667 | 0.4075 | 0.3948 | 0.3810 | 0.3806 |

| Goodness of fit | 0.9230 | 0.9212 | 0.9142 | 0.9326 | 0.9356 | 0.9436 | 0.9477 | 0.9546 | 0.9461 | 0.9151 | 0.9181 | 0.9179 |

| Year | Moran’s I | E(I) | Z(I) | p-Value |

|---|---|---|---|---|

| 2009 | 0.1431 | −0.0030 | 7.6264 | 0.0000 |

| 2010 | 0.1474 | −0.0030 | 7.9904 | 0.0000 |

| 2011 | 0.1242 | −0.0030 | 6.6784 | 0.0000 |

| 2012 | 0.1166 | −0.0030 | 6.2938 | 0.0000 |

| 2013 | 0.1085 | −0.0030 | 5.8946 | 0.0000 |

| 2014 | 0.1379 | −0.0030 | 7.4719 | 0.0000 |

| 2015 | 0.1651 | −0.0030 | 9.0325 | 0.0000 |

| 2016 | 0.1742 | −0.0030 | 9.4265 | 0.0000 |

| 2017 | 0.2076 | −0.0030 | 11.1278 | 0.0000 |

| 2018 | 0.1967 | −0.0030 | 10.6174 | 0.0000 |

| 2019 | 0.2136 | −0.0030 | 11.4410 | 0.0000 |

| 2020 | 0.1997 | −0.0030 | 10.7843 | 0.0000 |

| ti/ti+1 | 2009–2015 | 2015–2020 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 1 | 2 | 3 | 4 | 5 | |

| 1 | 0.8421 | 0.1559 | 0.0019 | 0.0000 | 0.0000 | 0.8040 | 0.1906 | 0.0054 | 0.0000 | 0.0000 |

| 2 | 0.1711 | 0.7333 | 0.0943 | 0.0013 | 0.0000 | 0.0603 | 0.7313 | 0.2084 | 0.0000 | 0.0000 |

| 3 | 0.0018 | 0.2157 | 0.7294 | 0.0530 | 0.0000 | 0.0000 | 0.0835 | 0.7570 | 0.1595 | 0.0000 |

| 4 | 0.0000 | 0.0000 | 0.2979 | 0.6525 | 0.0496 | 0.0000 | 0.0000 | 0.1197 | 0.8028 | 0.0775 |

| 5 | 0.0000 | 0.0000 | 0.0000 | 0.1579 | 0.8421 | 0.0000 | 0.0000 | 0.0000 | 0.0909 | 0.9091 |

| Variable Type | Characteristic Variable | Variable Description |

|---|---|---|

| Economic factors | Economic development level (X1) | GDP per capita (yuan) |

| Industrial structure level (X2) | The added value of the tertiary industry as a percentage of GDP (%) | |

| Real estate investment density (X3) | Real estate development investment per land (10,000 yuan/km2) | |

| Resident consumption level (X4) | Retail sales of social consumer goods per capita (yuan/person) | |

| Urban salary level (X5) | Average salary of on-the-job employees (yuan) | |

| Demographic factor | Urban development level (X6) | Proportion of urban population (%) |

| Population attraction level (X7) | Permanent Resident Population/Household Registration Population (%) | |

| Real estate activity (X8) | Proportion of real estate employees (%) | |

| Talent potential (X9) | Number of college students per 10,000 people (person) | |

| Social factors | Public service investment (X10) | Local financial expenditure/resident population (yuan/person) |

| Cultural development level (X11) | 100-person public library collection (volume/100-person) | |

| Medical and health care level (X12) | Number of health institutions per 10,000 people (pieces) | |

| Urban greening level (X13) | Green coverage rate of built-up area (%) | |

| Anticipation factor | Economic development expectations (X14) | GDP growth rate (%) |

| Housing price growth expectations (X15) | Residential price growth rate (%) | |

| Revenue growth expectations (X16) | Growth rate of disposable income of urban residents (%) |

| Characteristic Variable | 2009 | 2015 | 2020 | |||

|---|---|---|---|---|---|---|

| %IncMSE | IncNodePurity | %IncMSE | IncNodePurity | %IncMSE | IncNodePurity | |

| X1 | 0.1931 | 80.4632 | 0.1186 | 72.6816 | 0.4577 | 175.2361 |

| X2 | 0.7790 | 305.0705 | 1.2890 | 244.6612 | 3.0922 | 784.7567 |

| X3 | 2.4888 | 304.8894 | 3.1482 | 603.2903 | 6.0972 | 1463.4815 |

| X4 | 1.5575 | 159.7646 | 0.7492 | 226.9651 | 2.0959 | 606.8249 |

| X5 | 0.3797 | 179.4400 | 0.7055 | 180.3104 | 1.7010 | 536.0614 |

| X6 | 0.3076 | 68.9961 | 0.2746 | 140.4697 | 1.2012 | 284.4809 |

| X7 | 0.6179 | 132.3534 | 0.2775 | 145.3878 | 0.5314 | 473.3038 |

| X8 | 1.0445 | 254.2366 | 0.5038 | 175.5695 | 1.7182 | 493.1011 |

| X9 | 1.9162 | 242.3198 | 0.6800 | 169.9107 | 0.3570 | 192.1998 |

| X10 | 0.5629 | 107.0695 | 0.8931 | 434.7505 | 0.5365 | 237.1809 |

| X11 | 0.2048 | 114.0109 | 0.2258 | 240.8432 | −0.0544 | 148.4339 |

| X12 | 0.0273 | 69.6812 | 0.1805 | 81.3871 | 0.8612 | 322.6669 |

| X13 | 0.3931 | 150.5935 | 0.1453 | 76.7444 | 0.0783 | 104.5517 |

| X14 | −0.0448 | 84.7003 | −0.0106 | 69.4876 | 0.0279 | 85.8699 |

| X15 | 0.0860 | 155.1304 | 0.2928 | 129.6063 | 0.2847 | 167.8503 |

| X16 | 0.2391 | 146.2415 | 0.1225 | 70.5995 | 0.1469 | 120.4598 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, W.; Yin, S.; Gong, H. Spatial–Temporal Evolution Patterns and Influencing Factors of China’s Urban Housing Price-to-Income Ratio. Land 2022, 11, 2224. https://doi.org/10.3390/land11122224

Hu W, Yin S, Gong H. Spatial–Temporal Evolution Patterns and Influencing Factors of China’s Urban Housing Price-to-Income Ratio. Land. 2022; 11(12):2224. https://doi.org/10.3390/land11122224

Chicago/Turabian StyleHu, Wei, Shanggang Yin, and Haibo Gong. 2022. "Spatial–Temporal Evolution Patterns and Influencing Factors of China’s Urban Housing Price-to-Income Ratio" Land 11, no. 12: 2224. https://doi.org/10.3390/land11122224