Spatiotemporal Evolution of Entrepreneurial Activities and Its Driving Factors in the Yangtze River Delta, China

Abstract

1. Introduction

2. Literature Review

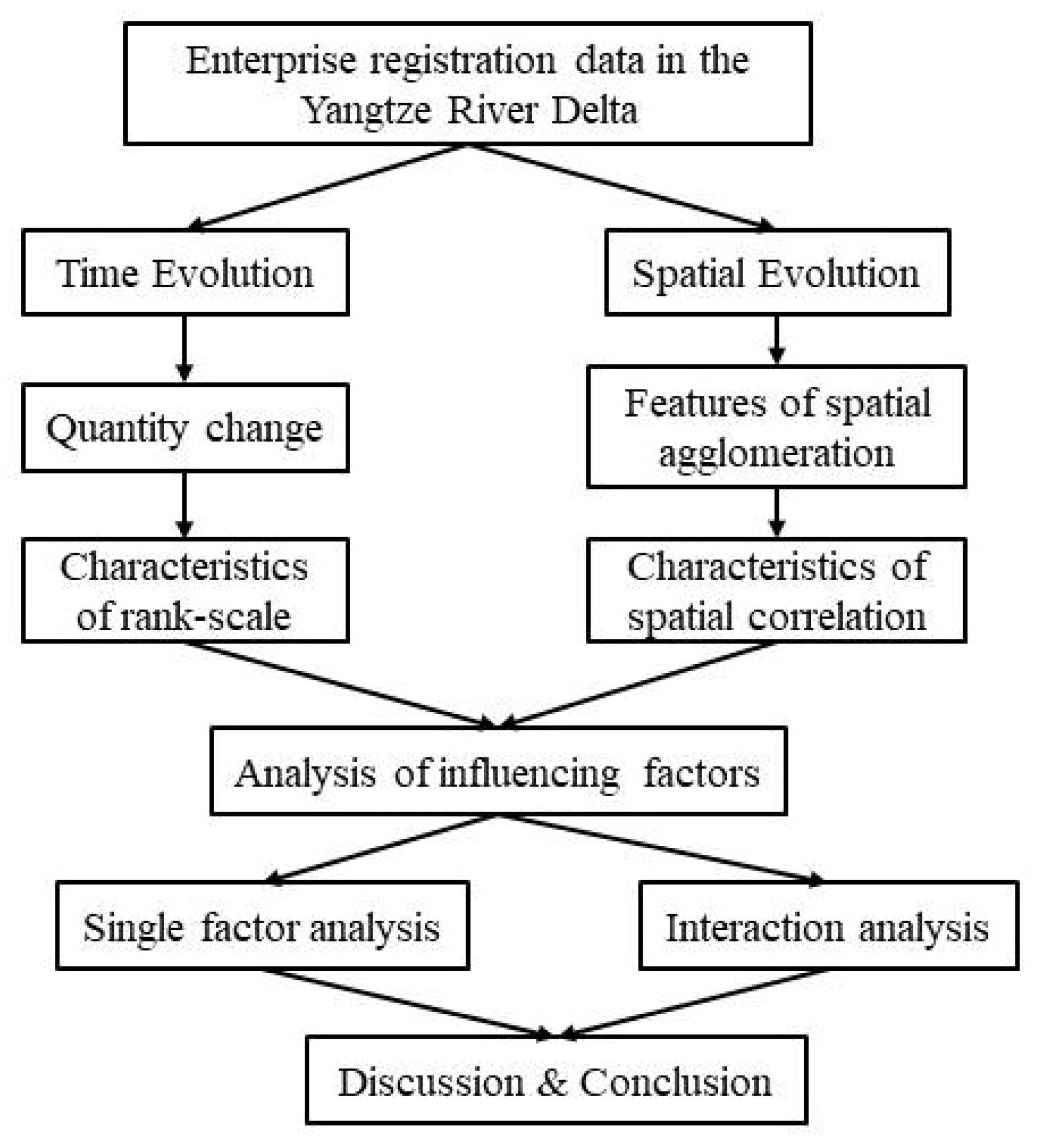

3. Materials and Methods

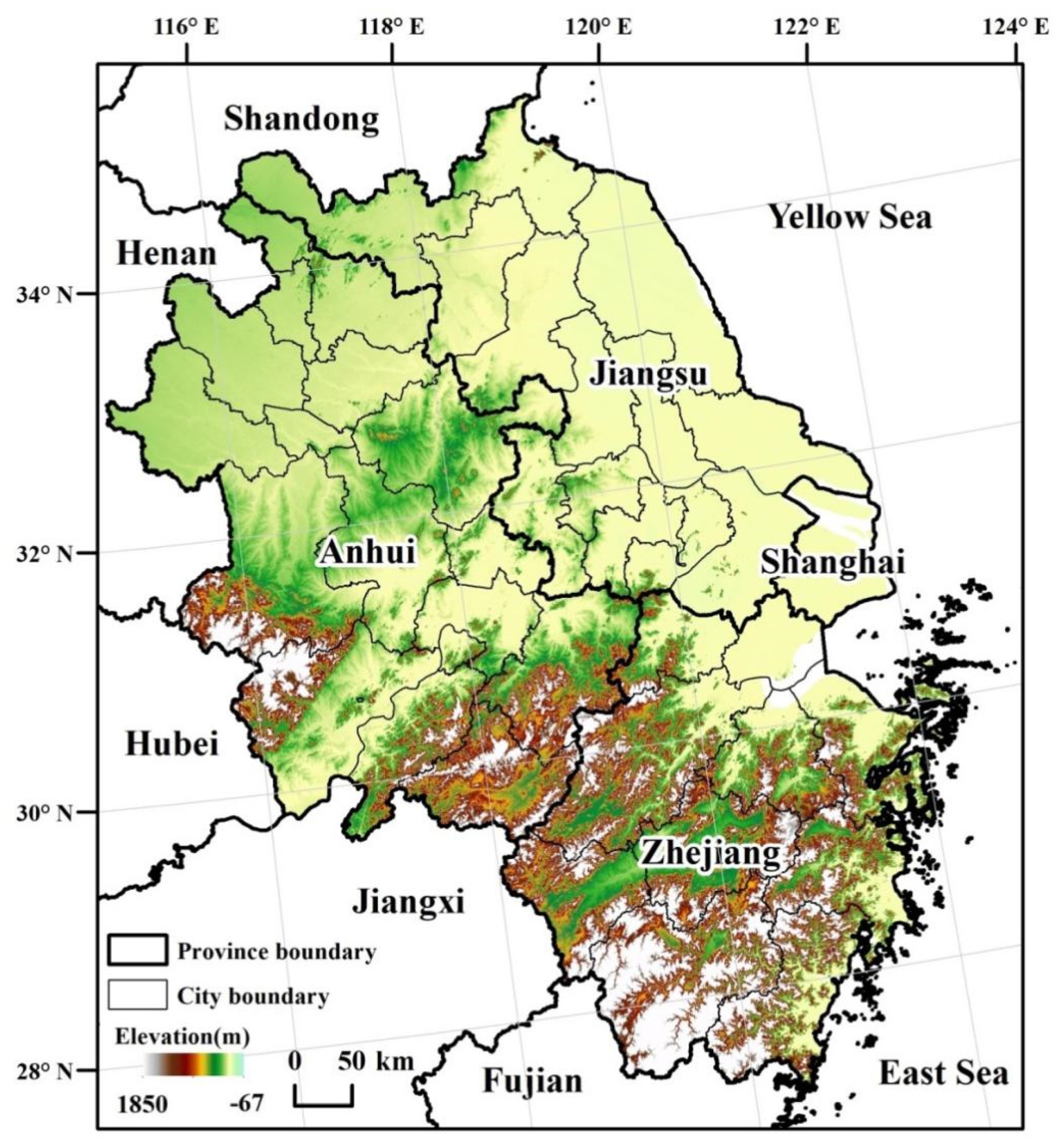

3.1. Study Area

3.2. Data Sources

3.3. Research Methods

3.3.1. Rank-Scale Rule

3.3.2. Kernel Density Estimation

3.3.3. Spatial Correlation Analysis

3.3.4. Geographic Detector

4. Results

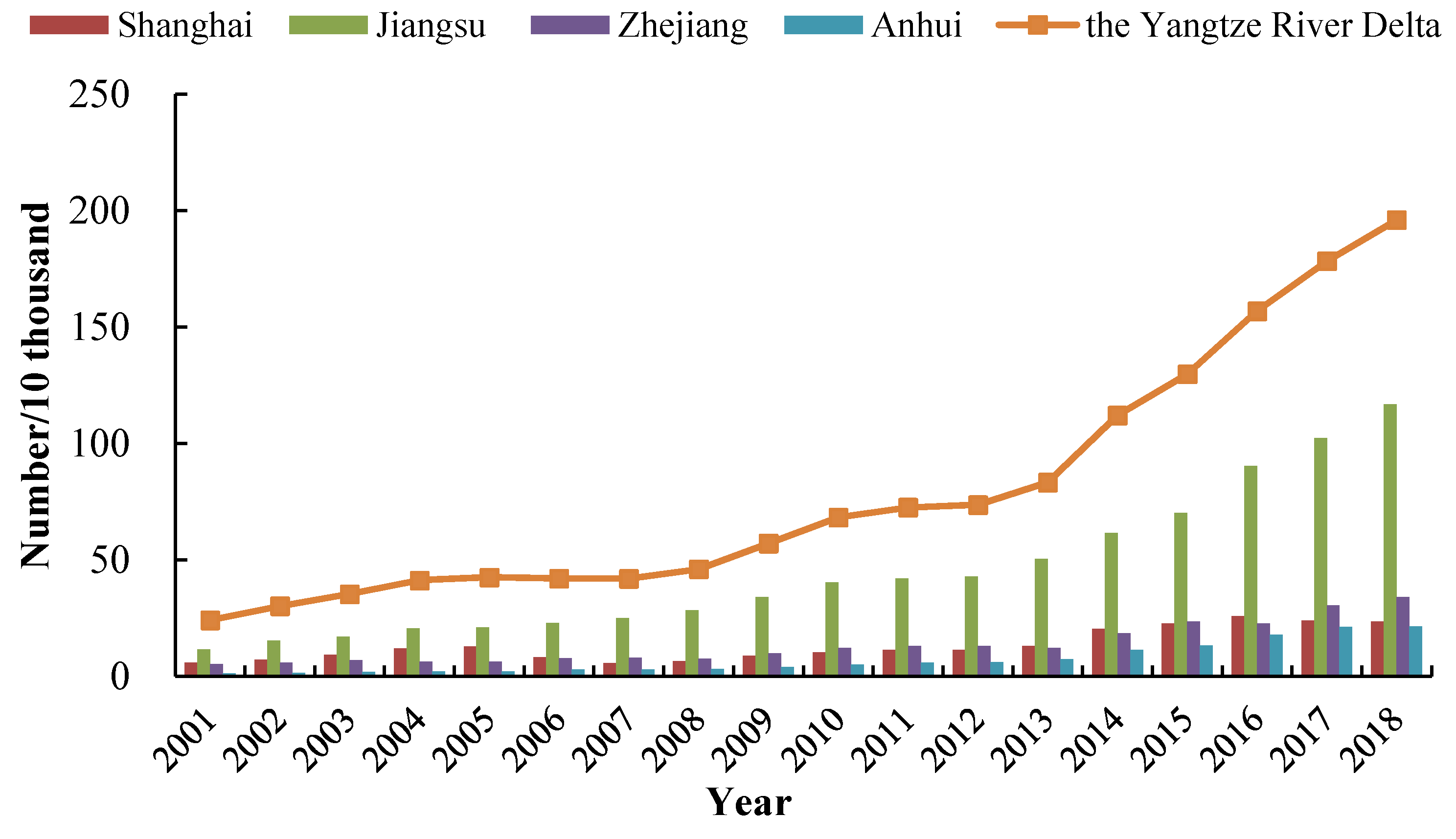

4.1. Changes in Time Series of Entrepreneurial Activities

4.1.1. Overall Quantitative Changes

4.1.2. Characteristics of Rank-Scale

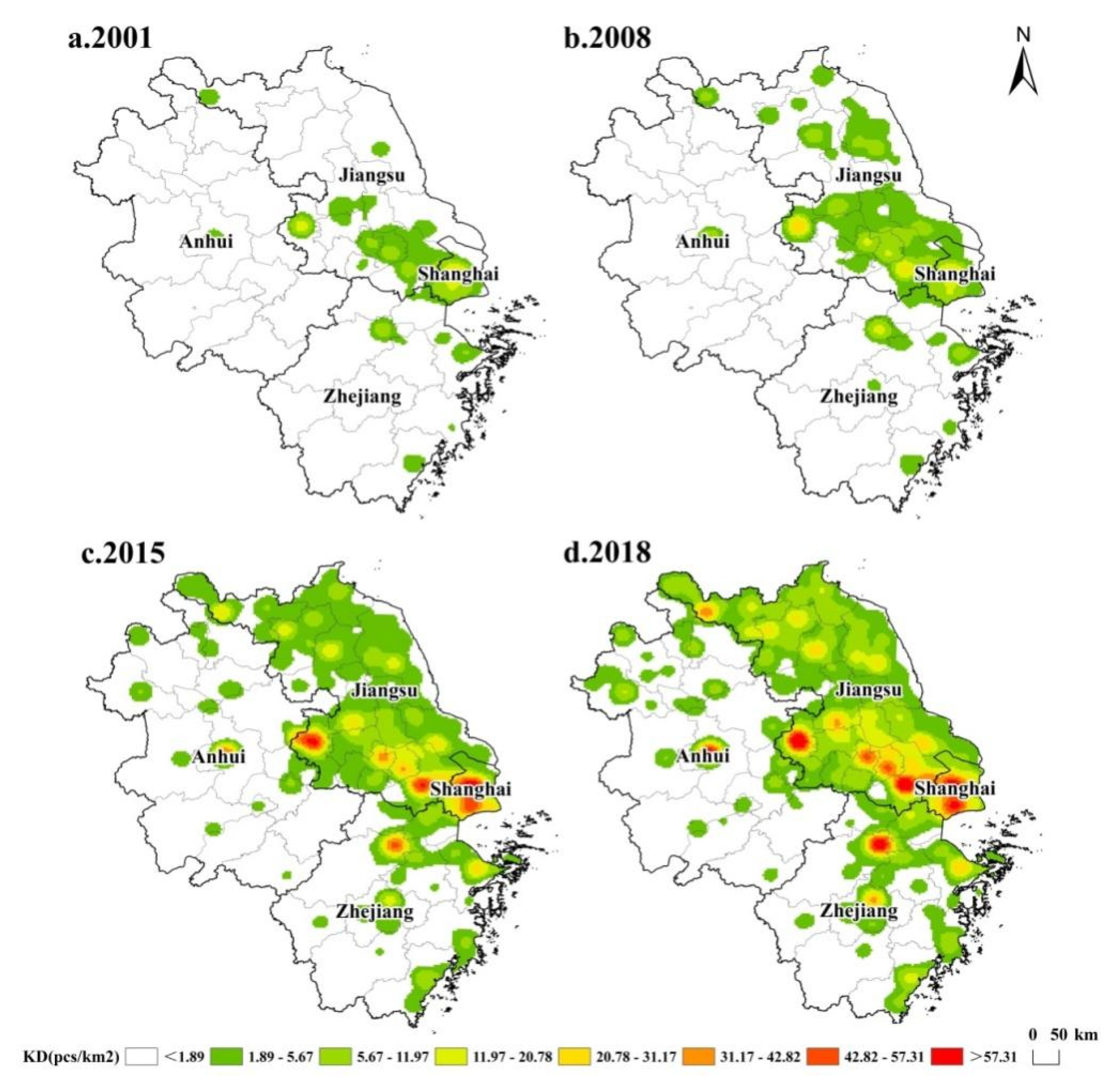

4.2. Spatial Evolution of Entrepreneurial Activities

4.2.1. Features of Spatial Agglomeration

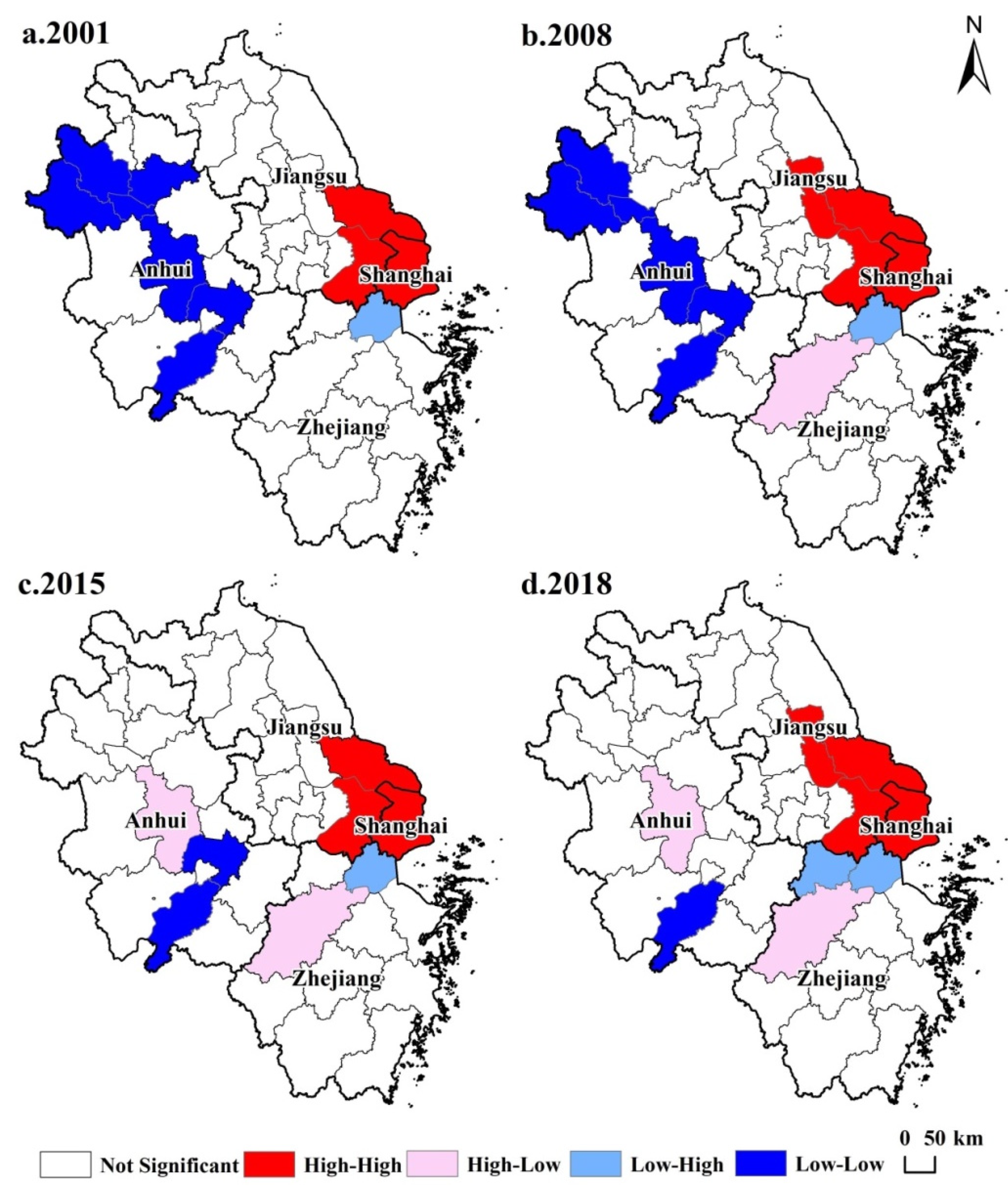

4.2.2. Characteristics of Spatial Correlation

4.3. Analysis of Driving Factors

4.3.1. Selection of Driving Factors

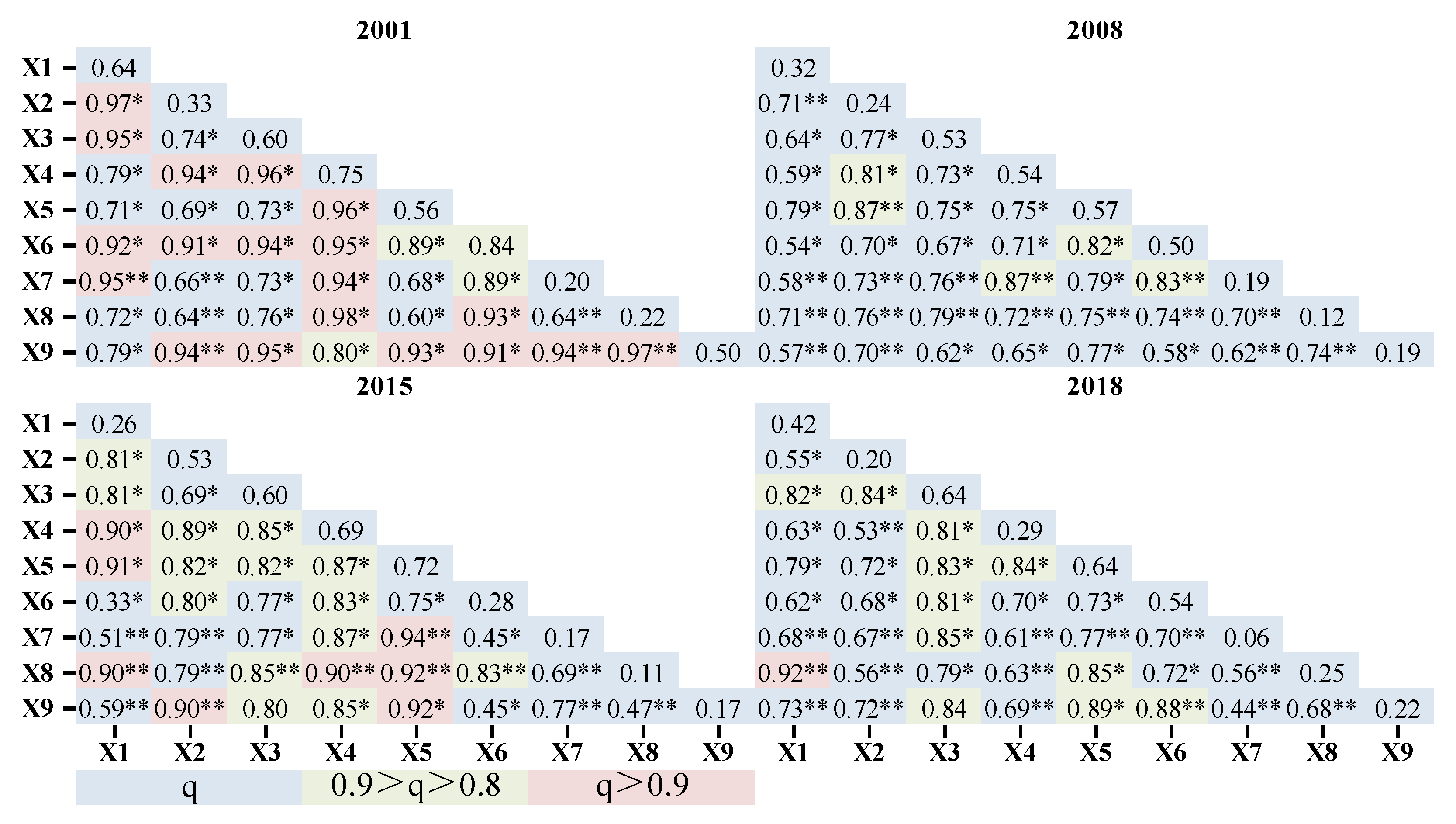

4.3.2. Single Factor Analysis

4.3.3. Interaction Analysis

4.3.4. Analysis of Impact Mechanism

- (1)

- Financial strength is the essential condition determining entrepreneurial activities. Funding is the cornerstone of entrepreneurial activities, and the basis for ensuring that all innovative thinking and ideas are transformed into material conditions. Funds to enable entrepreneurs to carry out their activities are usually provided as bank loans [58], and the year-end loan balance of financial institutions per capita is an important indicator of the regional financial environment, which can reflect the ease of obtaining financial support for entrepreneurial activities. The greater the financial strength, the looser the financial policy environment in the region, which helps entrepreneurs solve financial problems, obtain investments and other resources, and ensure the smooth development of entrepreneurial activities. In addition, the latter often emphasize entrepreneurial opportunities, and transforming new formats and ideas into a commercial format is an important means of achieving entrepreneurial success and maintaining a competitive edge. Therefore, strong financial support can provide timely means to support entrepreneurial activities, which is a basic element for maintaining the vitality of regional entrepreneurship. Our study showed that financial strength has a high single-factor explanatory power for entrepreneurial activities and is generally conducive to the efficiency of the other driving factors.

- (2)

- The degree of informationization is crucial in determining the level of entrepreneurial activities. The 21st century is the era of informationization and networking. For entrepreneurial activities in these times, the degree of informationization determines the ability of a region to utilize and deploy resources. The greater the number of postal and telecommunications businesses per capita, the more developed regional informationization is, and the greater the investment in informationization. A high level of informationization is not only conducive to accelerating the efficient circulation of knowledge and the other elements of innovation and promoting the flow and dissemination of entrepreneurial resources through social networks but is also conducive to local entrepreneurs getting a timely and practical grasp of the relevant regional policies and market information so that they can share off-site sources of entrepreneurship and innovation. This can also optimize the incubation of the local entrepreneurial platform and policy environment, making the area suitable for sources of information and entrepreneurial innovation. The degree of informationization has increasingly fluctuated in its effects on the entrepreneurial activities in the Yangtze River Delta. The single-factor explanatory power rose from 0.5589 in 2001 to 0.6428 in 2018. Interactions with other factors also showed strong synergistic determinism.

- (3)

- Economic foundation and vitality of innovation are synergistic factors affecting entrepreneurial activities. The former reflects the overall developmental environment of a given place: the higher the level of economic development, the better the overall developmental environment of a region and the better the conditions for obtaining various advantageous resources. However, this does not imply a higher level of entrepreneurship. Studies have confirmed that, with increasing levels of economic development in developing countries, entrepreneurship has not shown the same trend of substantial increase. However, with the growth of large and medium-sized enterprises, the rapid development of regional economics can provide more employment opportunities. A continual rise in wages motivates potential entrepreneurs to avoid risks and choose employment [58]. In addition, the vitality of innovation represented by the number of patents granted per 10,000 people did not have a strong explanatory power for entrepreneurial activities in the Yangtze River Delta region, because regions with a strong vitality of innovation struggle to implement entrepreneurial activities owing to widespread problems in the developmental environment or insufficient entrepreneurial support, such as a lack of funds. These results indicated that only when the overall level of regional development is high, the vitality of innovation is solid and other factors are simultaneously available do all these factors play a synergistic role in promoting entrepreneurial activities.

- (4)

- Openness and market demand also promote entrepreneurial activities. The element of transparency, characterized by the ratio of total foreign trade imports and exports to GDP, reflects the level of openness of regional development to international markets. The higher the degree of opening up, the more conducive the given region is to expanding the consumer market for local products. Harmony with the global market is conducive to the dissemination and spillover of new knowledge, technologies, and formats, provides potential local entrepreneurs with new ideas and skills for entrepreneurship, and enhances its vitality. The total retail sales of consumer goods per capita reflects the dynamism of the regional economy and the level of consumption and also represents regional market demand. The higher the market demand, the stronger the vitality of the regional economy, the more frequent the circulation of factors, the more urgent the need for new products and technologies, and the stronger the promotion of innovation and entrepreneurial activities. We found that the impact of regional openness and market demand on entrepreneurial activities in the study area passed the 10% significance test. The indices of the explanatory power of openness and other factors in 2001 and 2015 were all above 0.8.

5. Discussion

5.1. Comparison of Spatial Differentiation in Entrepreneurial Platforms and Activities

5.2. Driving Mechanism of Entrepreneurial Activities Has Multiple Characteristics

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bishop, P.; Shilcof, D. The spatial dynamics of new firm births during an economic crisis: The case of Great Britain, 2004–2012. Entrep. Reg. Dev. 2017, 29, 215–237. [Google Scholar] [CrossRef]

- Van Stel, A.; Suddle, K. The impact of new firm formation on regional development in the Netherlands. Small Bus. Econ. 2008, 30, 31–47. [Google Scholar] [CrossRef]

- Yao, L.; Hu, Y. The impact of urban transit on nearby startup firms: Evidence from Hangzhou, China. Habitat Int. 2020, 99, 102155. [Google Scholar] [CrossRef]

- Wang, Z.; Wei, W. Regional economic resilience in China: Measurement and determinants. Reg. Stud. 2021, 55, 1228–1239. [Google Scholar] [CrossRef]

- Fu, W. Industrial clusters as hothouses for nascent entrepreneurs? The case of Tianhe Software Park in Guangzhou, China. Ann. Reg. Sci. 2016, 57, 253–270. [Google Scholar] [CrossRef]

- Alessandra, C.; Gianluca, O.; Francesco, Q. Local knowledge composition and the emergence of entrepreneurial activities across industries: Evidence from Italian NUTS-3 regions. Small Bus. Econ. 2021, 56, 613–635. [Google Scholar]

- Lee, J.; Xu, J. Why do businesses grow faster in urban areas than in rural areas? Reg. Sci. Urban Econ. 2020, 81, 103521. [Google Scholar] [CrossRef]

- Mark, P.; Shawn, M.; Amanda, L. Firm formation and survival in the shale boom. Small Bus. Econ. 2020, 55, 975–996. [Google Scholar]

- Pan, F.; Yang, B. Financial development and the geographies of startup cities: Evidence from China. Small Bus. Econ. 2019, 52, 743–758. [Google Scholar] [CrossRef]

- Michael, F.; Pamela, M. The effect of new business formation on regional development over time: The case of Germany. Small Bus. Econ. 2008, 30, 15–29. [Google Scholar]

- Lucia, N.; Pia, N.; Hans, W.; Sofia, W. Amenities and new firm formation in rural areas. J. Rural Stud. 2021, 85, 32–42. [Google Scholar]

- Udo, B.; Reinhold, G. Regional patterns and determinants of birth and survival of new firms in Western Germany. Entrep. Reg. Dev. 2007, 19, 293–312. [Google Scholar]

- Oyarzo, M.; Romaní, G.; Atienza, M.; Lufín, M. Spatio-temporal dynamics in municipal rates of business start-ups in Chile. Entrep. Reg. Dev. 2020, 32, 677–705. [Google Scholar] [CrossRef]

- Jessie, P.; Poon, H.; Diep, T.; Deborah, N. Social capital and female entrepreneurship in rural regions: Evidence from Vietnam. Appl. Geogr. 2012, 35, 308–315. [Google Scholar]

- Patrick, A.; Richard, F.; Karen, K.; Charlotta, M. The city and high-tech startups: The spatial organization of Schumpeterian entrepreneurship. Cities 2019, 87, 121–130. [Google Scholar]

- Cheng, S.; Li, H. Spatially Varying Relationships of New Firm Formation in the United States. Reg. Stud. 2011, 45, 773–789. [Google Scholar] [CrossRef]

- Cissé, I.; Dubé, J.; Brunelle, C. New business location: How local characteristics influence individual location decision? Ann. Reg. Sci. 2020, 64, 185–214. [Google Scholar] [CrossRef]

- Gao, J.; Feng, Y. Economic Transition, Firm Dynamics, and Restructuring of Manufacturing Spaces in Urban China: Empirical Evidence from Nanjing. Prof. Geogr. 2017, 69, 504–519. [Google Scholar] [CrossRef]

- Fu, W. Local entrepreneurship and cluster restructuring: An integrative theoretical perspective. Sci. Geogr. Sin. 2016, 36, 715–723. (In Chinese) [Google Scholar]

- Sun, B.; Zhu, P.; Li, W. Cultural diversity and new firm formation in China. Reg. Stud. 2019, 53, 1371–1384. [Google Scholar] [CrossRef]

- Wang, C.; Lin, G. Geography of knowledge sourcing, heterogeneity of knowledge carriers and innovation of clustering firms: Evidence from China’s software enterprises. Habitat Int. 2018, 71, 60–69. [Google Scholar] [CrossRef]

- Hojnik, B.B.; Crnogaj, K. Social impact, innovations, and market activity of social enterprises: Comparison of European countries. Sustainability 2020, 12, 1915. [Google Scholar] [CrossRef]

- Ács, Z.J.; Szerb, L.; Ortega-Argilés, R.; Aidis, R.; Coduras, A. The regional application of the global entrepreneurship and development index (GEDI): The case of Spain. Reg. Stud. 2015, 49, 1977–1994. [Google Scholar] [CrossRef]

- Yam, R.C.M.; Lo, W.; Tang, E.P.Y.; Lau, A.K.W. Analysis of sources of innovation, technological innovation capabilities, and performance: An empirical study of Hong Kong manufacturing industries. Res. Policy 2011, 40, 391–402. [Google Scholar] [CrossRef]

- Tang, D.; Mao, M.; Shi, J.; Hua, W. The Spatio-Temporal Analysis of Urban-Rural Coordinated Development and Its Driving Forces in Yangtze River Delta. Land 2021, 10, 495. [Google Scholar] [CrossRef]

- Wei, S.; Wang, L.; Cao, J. Spatial Distribution Characteristics and Impact Factors of Urban Innovative Capacities in the Yangtze River Delta Region: A Perspective from the “Business Startups and Innovation” Institutions and Platforms. Econ. Geogr. 2020, 40, 36–42. (In Chinese) [Google Scholar]

- Carree, M.; Thurik, A. The lag structure of the impact of business ownership on economic growth in OECD countries. Small Bus. Econ. 2007, 30, 101–110. [Google Scholar] [CrossRef]

- Fritsch, M.; Wyrwich, M. The effect of entrepreneurship on economic development—An empirical analysis using regional entrepreneurship culture. J. Econ. Geogr. 2017, 17, 157–189. [Google Scholar] [CrossRef]

- Kim, J. Does foreign direct investment matter to domestic entrepreneurship? The mediating role of strategic alliances. Glob. Econ. Rev. 2019, 48, 303–319. [Google Scholar] [CrossRef]

- Shweta, G.; Madan, L. Entrepreneurship and Economic Growth: Evidence from G-20 Economies. J. East-West Bus. 2021, 27, 140–159. [Google Scholar]

- Prieger, J.E.; Bampoky, C.; Blanco, L.R.; Liu, A. Economic growth and the optimal level of entrepreneurship. World Dev. 2016, 82, 95–109. [Google Scholar] [CrossRef]

- Li, L.; Niu, N.; Li, X. Factors Affecting the Long-Term Development of Specialized Agricultural Villages North and South of Huai River. Land 2021, 10, 1215. [Google Scholar] [CrossRef]

- Beugelsdijk, S.; Noorderhaven, N. Entrepreneurial attitude and economic growth: A cross-section of 54 regions. Ann. Reg. Sci. 2004, 38, 199–218. [Google Scholar] [CrossRef]

- Alvarez, C.; Urbano, D.; Coduras, A. Environmental conditions and entrepreneurial activity: A regional comparison in Spain. Int. J. Phys. Distrib. Logist. Manag. 2011, 18, 120–140. [Google Scholar]

- Sabrina, F.; Marina, J. Local culture as a context for entrepreneurial activities. Eur. Plan. Stud. 2017, 25, 1556–1574. [Google Scholar]

- Daymard, A. Determinants of female entrepreneurship in India. In OECD Economics Department Working Papers, No. 1191; OECD Publishing: Paris, France, 2015. [Google Scholar]

- Kaufmann, D.; Kraay, A.; Mastruzzi, M. The Worldwide Governance Indicators: Methodology and Analytical Issues. Hague J. Rule Law. 2017, 3, 220–246. [Google Scholar] [CrossRef]

- Khyareh, M.; Amini, H. Governance Quality, Entrepreneurship and Economic Growth. J. Compet. 2021, 13, 41–64. [Google Scholar] [CrossRef]

- Nwachukwu, C.; Chladkova, H.; Olatunji, F. Strategy formulation process and innovation performance nexus. Int. J. Qual. Res. 2018, 12, 147–164. [Google Scholar]

- Pawitan, G.; Widyarini, M.; Nawangpalupi, C. Moderating effect of demographic factors and entrepreneurial phase on the relationship between entrepreneurial competencies and innovation of ASEAN entrepreneurs. Pert. J. Soc. Sci. Hum. 2018, 26, 151–166. [Google Scholar]

- Pinto, B.; Lopes, J.; Carvalho, C.; Vieira, B.; Lopes, J. Education as a key to provide the growth of entrepreneurial intentions. Edu. Train. 2021, 63, 809–832. [Google Scholar] [CrossRef]

- Guerrero, M.; Peña-Legazkue, I. The effect of intrapreneurial experience on corporate venturing: Evidence from developed economies. Int. Entrep. Manag. J. 2013, 9, 397–416. [Google Scholar] [CrossRef]

- Dadzie, K.; Amponsah, D.; Dadzie, C.; Winston, E. How Firms Implement Marketing Strategies in Emerging Markets: An Empirical Assessment of the 4a Marketing Mix Framework. J. Mark. Theory Pract. 2017, 25, 234–256. [Google Scholar] [CrossRef]

- Lopes, J.; Oliveira, M.; Silveira, P.; Farinha, L.; Oliveira, J. Business Dynamism and Innovation Capacity, an Entrepreneurship Worldwide Perspective. J. Open Innov. Technol. Mark. Complex. 2021, 7, 94. [Google Scholar] [CrossRef]

- De Backer, K.; Sleuwaegen, L. Does foreign direct investment crowd out domestic entrepreneurship? Rev. Ind. Organ. 2003, 22, 67–84. [Google Scholar] [CrossRef]

- Salman, D. What is the role of public policies to robust international entrepreneurial activities on economic growth? Evidence from cross countries study. Fut. Bus. J. 2016, 2, 1–14. [Google Scholar] [CrossRef]

- National Bureau of Statistics. Available online: http://www.stats.gov.cn (accessed on 10 December 2021).

- Han, B.; Ma, Z.; Liu, Y.; Wang, M.; Lin, Y. Effect of Urban-Rural Income Gap on the Population Peri-Urbanization Rate in China. Land 2021, 10, 1255. [Google Scholar] [CrossRef]

- Li, H.; Song, W. Cropland Abandonment and Influencing Factors in Chongqing, China. Land 2021, 10, 1206. [Google Scholar] [CrossRef]

- Spigel, B.; Harrison, R. Toward a process theory of entrepreneurial ecosystems. Strateg. Entrep. J. 2018, 12, 151–168. [Google Scholar] [CrossRef]

- Wang, J.; Li, X.; Christakos, G.; Liao, Y.; Zhang, T.; Gu, X.; Zheng, X. Geographical detectors-based health risk assessment and its application in the neural tube defects study of the Heshun region, China. Int. J. Geogr. Inf. Sci. 2010, 24, 107–127. [Google Scholar] [CrossRef]

- Huggins, R.; Prokop, D. Network structure and regional innovation: A study of university-industry ties. Urban Stud. 2016, 54, 931–952. [Google Scholar] [CrossRef]

- Daniel, C. What is a startup firm? A methodological and epistemological investigation into research objects in economic geography. Geoforum 2019, 107, 77–87. [Google Scholar]

- Yang, C.; Xie, S.; Gan, C. Spatial Differences and Its Influencing Factors of Entrepreneurship Activity of Chinese Private Enterprises. Econ. Geogr. 2021, 41, 141–148. (In Chinese) [Google Scholar]

- Huggins, R.; Prokop, D.; Thompson, P. Entrepreneurship and the Determinants of Firm Survival within Regions: Human Capital, Growth Motivation and Locational Conditions. Entrep. Reg. Dev. 2017, 29, 357–389. [Google Scholar] [CrossRef]

- Cruz, S.; Teixeira, A. Spatial analysis of new firm formation in creative industries before and during the world economic crisis. Ann. Reg. Sci. 2021, 67, 385–413. [Google Scholar] [CrossRef]

- Wennekers, S.; Wennekers, A.; Thurik, R. Nascent Entrepreneurship and the Level of Economic Development. Small Bus. Econ. 2005, 24, 293–309. [Google Scholar] [CrossRef]

- Ding, Y.; Zhu, H.; He, Q. The Regional Differences and Determinants of Entrepreneurship in Guangdong Province: Based on Spatial Autocorrelation Analysis. Econ. Geogr. 2017, 37, 92–98. (In Chinese) [Google Scholar]

- Farinha, L.; Ferreira, J.; Nunes, S.; Ratten, V. Conditions Supporting Entrepreneurship and Sustainable Growth. Int. J. Soc. Ecol. Sustain. Dev. 2017, 8, 67–86. [Google Scholar] [CrossRef][Green Version]

- Singh, S.; Pravesh, R. Entrepreneurship Development in India: Opportunities and Challenges. Splint Int. J. Prof. 2017, 4, 75–81. [Google Scholar]

| Year | 2001 | 2008 | 2015 | 2018 |

|---|---|---|---|---|

| Moran’s I | 0.2463 | 0.3858 | 0.2558 | 0.3516 |

| Z-Score | 3.3230 | 3.8785 | 2.9062 | 3.5444 |

| p-Value | 0.0009 | 0.0001 | 0.0037 | 0.0004 |

| Year | X1 | X2 | X3 | X4 | X5 | X6 | X7 | X8 | X9 |

|---|---|---|---|---|---|---|---|---|---|

| 2001 | 0.6404 *** | 0.3331 * | 0.5982 *** | 0.7528 *** | 0.5589 *** | 0.8372 *** | 0.1959 | 0.2151 | 0.5000 *** |

| 2008 | 0.3242 | 0.2449 | 0.5306 *** | 0.5442 *** | 0.5686 ** | 0.5049 *** | 0.1930 | 0.1204 | 0.1911 |

| 2015 | 0.2580 * | 0.5332 *** | 0.5981 *** | 0.6941 *** | 0.7197 *** | 0.2785 * | 0.1723 | 0.1148 | 0.1740 |

| 2018 | 0.4176 | 0.1977 | 0.6369 *** | 0.2929 * | 0.6428 *** | 0.5356 *** | 0.0650 | 0.2494 * | 0.2205 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, H.; Chen, W.; Liu, Z. Spatiotemporal Evolution of Entrepreneurial Activities and Its Driving Factors in the Yangtze River Delta, China. Land 2022, 11, 216. https://doi.org/10.3390/land11020216

Zhang H, Chen W, Liu Z. Spatiotemporal Evolution of Entrepreneurial Activities and Its Driving Factors in the Yangtze River Delta, China. Land. 2022; 11(2):216. https://doi.org/10.3390/land11020216

Chicago/Turabian StyleZhang, Haipeng, Wei Chen, and Zhigao Liu. 2022. "Spatiotemporal Evolution of Entrepreneurial Activities and Its Driving Factors in the Yangtze River Delta, China" Land 11, no. 2: 216. https://doi.org/10.3390/land11020216

APA StyleZhang, H., Chen, W., & Liu, Z. (2022). Spatiotemporal Evolution of Entrepreneurial Activities and Its Driving Factors in the Yangtze River Delta, China. Land, 11(2), 216. https://doi.org/10.3390/land11020216