Proprietary Varieties’ Influence on Economics and Competitiveness in Land Use within the Hop Industry

Abstract

:1. Introduction

2. Materials and Methods

2.1. Proprietary Hop Variety Supply and Market Share

2.2. Calculating HHI

- n refers to the number of varieties in the market;

- S refers to the percent market share for a variety.

3. Results and Discussion

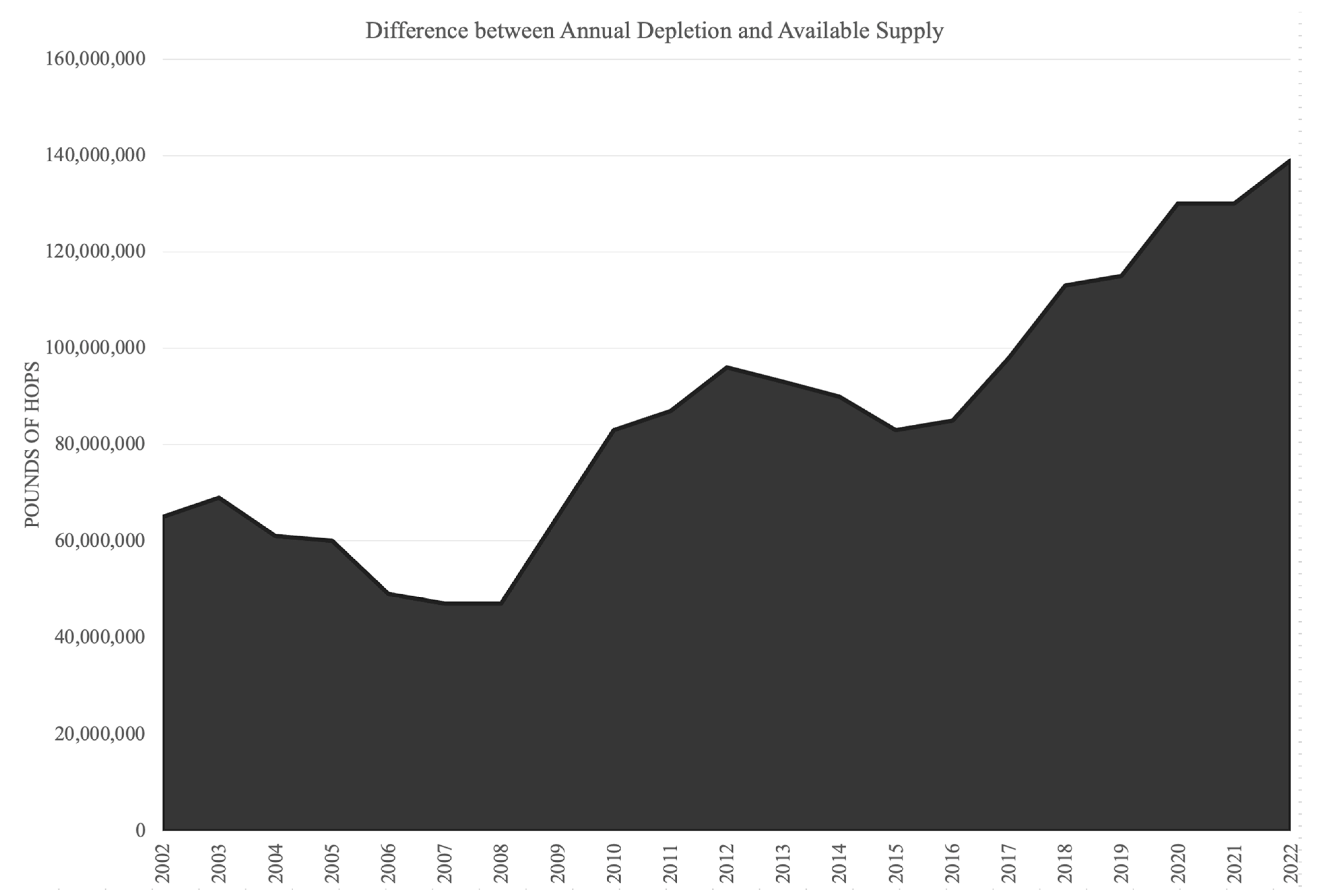

3.1. Acreage and Production Linked to Proprietary Hop Varieties

3.2. Prices of Hops Linked to the Intellectual Property

3.3. Discussion

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Štěrba, K.; Pavel Čejka, P.; Čulík, J.; Jurková, M.; Krofta, K.; Pavlovič, M.; Mikyška, A.; Olšovská, J. Determination of Linalool in Different Hop Varieties Using a New Method Based on Fluidized-Bed Extraction with Gas Chromatographic–Mass Spectrometric Detection. J. Am. Soc. Brew. Chem. 2015, 73, 151–158. [Google Scholar] [CrossRef]

- Pavlovič, M. Production character of the EU hop industry. Bulg. J. Agric. Sci. 2012, 18, 233–239. [Google Scholar]

- Pavlovič, M.; Čerenak, A.; Pavlovič, V.; Rozman, Č.; Pažek, K.; Bohanec, M. Development of DEX-HOP multi-attribute decision model for preliminary hop hybrids assessment. Comput. Electron. Agric. 2011, 75, 181–189. [Google Scholar] [CrossRef]

- Gan, L.; Hernandez, M.A. Making friends with your neighbors? Agglomeration and tacit collusion in the lodging industry. Rev. Econ. Stat. 2013, 95, 1002–1017. [Google Scholar] [CrossRef]

- MacKinnon, D.; Pavlovič, M. The delayed surplus response for hops related to market dynamics. Agric. Econ. 2022, 68, 293–298. [Google Scholar] [CrossRef]

- Devlin, A. A proposed solution to the problem of parallel pricing in oligopolistic markets. Stanf. Law Rev. 2007, 59, 1111–1151. [Google Scholar]

- Rees, R. Tacit Collusion. Compet. Policy. Oxf. Rev. Econ. Policy 1993, 9, 27–40. [Google Scholar] [CrossRef]

- Johnston, A.; Ozment, J. Concentration in the airline industry: Evidence of economies of scale? J. Transp. Manag. 2011, 22, 59–74. [Google Scholar] [CrossRef]

- Rhoades, S. Market Share Inequality, the HHI, and Other Measures of the Firm-Composition of a Market. Rev. Ind. Organ. 1995, 10, 657–674. [Google Scholar] [CrossRef]

- Dixit, A.K.; Stiglitz, J.E. Monopolistic Competition and Optimum Product Diversity. Am. Econ. Rev. 1977, 67, 297–308. [Google Scholar]

- MacAvoy, P. Testing for Competitiveness of Markets for Long Distance Telephone Services: Competition Finally? Rev. Ind. Organ. 1998, 13, 295–319. [Google Scholar] [CrossRef]

- Bugos, G.; Kevles, D. Plants as Intellectual Property. Osiris 1992, 7, 74–104. [Google Scholar] [CrossRef] [Green Version]

- USDA NASS. National Hop Reports (NHR) for Years 2000–2020. [Dataset]. United States Department of Agriculture National Agricultural Statistics Service (USDA NASS). 2020. Available online: https://www.nass.usda.gov/Statistics_by_State/Washington/Publications/Hops/index.php (accessed on 18 July 2022).

- MacKinnon, D.; Pavlovič, M. Global hop market analysis within the International Hop Growers’ Convention. Hop Bull. 2019, 26, 99–108. [Google Scholar]

- Comi, M. Other agricultures of scale: Social and environmental insights from Yakima Valley hop growers. J. Rural Stud. 2020, 80, 543–552. [Google Scholar] [CrossRef]

- USDA NASS. National Hop Reports (NHR) for Years 2000–2022. [Dataset]. United States Department of Agriculture National Agricultural Statistics Service (USDA NASS). 2022. Available online: https://www.nass.usda.gov/Statistics_by_State/Washington/Publications/Hops/index.php (accessed on 22 December 2022).

- Wright, B.; Williams, J. The Economic Role of Commodity Storage. Econ. J. 1982, 92, 596–614. [Google Scholar] [CrossRef] [Green Version]

- Anonymous. Yakima Chief Hops Welcomes Four New Grower-Owners. Brewbound Beer Ind. News 2019. Available online: https://www.brewbound.com/news/yakima-chief-hops-welcomes-four-new-grower-owners/ (accessed on 18 July 2022).

- Calkins, S. The New Merger Guidelines and the Herfindahl-Hirschman Index. Calif. Law Rev. 1983, 71, 402–429. [Google Scholar] [CrossRef] [Green Version]

- Depken, C. Free-Agency and the Competitiveness of Major League Baseball. Rev. Ind. Organ. 1999, 14, 205–217. [Google Scholar] [CrossRef]

- Brent, R. The meaning of ‘Complex Monopoly’. Mod. Law Rev. 1993, 56, 812–831. [Google Scholar] [CrossRef]

- Vermeulen, F. The Narrative Advantage. Lond. Bus. Sch. Rev. 2012, 23, 55–57. [Google Scholar] [CrossRef]

- USDA NASS. WA Hops 1915–2013. 2013. Available online: https://www.nass.usda.gov/Statistics_by_State/Washington/Publications/Historic_Data/index.php#hops (accessed on 18 July 2022).

- USDA NASS. Hop Stocks Held by Growers, Dealers, and Brewers, United States (1000 Pounds). 2014. Available online: https://www.nass.usda.gov/Statistics_by_State/Washington/Publications/Historic_Data/index.php#hops (accessed on 18 July 2022).

- Pavlovič, M.; Pavlovič, V.; Rozman, Č.; Udovč, A.; Stajnko, D.; Wang, D.; Gavrić, M.; Srečec, S. Market value assessment of hops by modeling of weather attributes. Plant Soil Environ. 2013, 59, 267–272. [Google Scholar] [CrossRef] [Green Version]

- Mikyška, A.; Olšovská, J.; Slabý, M.; Štérba, K.; Čerenak, A.; Košir, I.J.; Pavlovič, M.; Kolenc, Z.; Krofta, K. Analytical and sensory profiles of Slovenian and Czech hop genotypes in single hopped beers. J. Inst. Brew. 2018, 124, 209–221. [Google Scholar] [CrossRef] [Green Version]

- Folwell, R.J. The U.S. Hop Marketing Order: The Price of Success is Misunderstanding; Department of Agricultural Economics, Washington State University: Pullman, WA, USA, 1982. [Google Scholar]

- Olšovská, J.; Štérba, K.; Pavlovič, M.; Čejka, P. Determination of energy value of beer. J. Am. Soc. Brew. Chem. 2015, 73, 165–169. [Google Scholar] [CrossRef] [Green Version]

| Variety Development Company | Market Share of U.S. Total Acreage in 2022 | Market Share of U.S. Total Production in 2022 | |

|---|---|---|---|

| 1 | Hop Breeding Company (HBC) | 49.05% | 49.12% |

| 2 | HopSteiner | 7.71% | 10.78% |

| 3 | Association for the Development of Hop Agronomy (ADHA) | 3.27% | 3.35% |

| 4 | Virgil Gamache Farms (VGF) | 3.20% | 2.88% |

| 5 | CLS Farms | 2.06% | 2.02% |

| TOTAL | 65.30% | 68.15% |

| Crop Year | HHI Values for Proprietary Varieties by Acreage | HHI Values for Proprietary Varieties by Production |

|---|---|---|

| 2000 | 0.0376 | 0.0729 |

| 2001 | 0.0900 | 0.1474 |

| 2002 | 0.0961 | 0.1709 |

| 2003 | 0.0755 | 0.1416 |

| 2004 | 0.0898 | 0.1586 |

| 2005 | 0.0904 | 0.1425 |

| 2006 | 0.0948 | 0.1791 |

| 2007 | 0.1200 | 0.2100 |

| 2008 | 0.1533 | 0.2441 |

| 2009 | 0.1642 | 0.2593 |

| 2010 | 0.1393 | 0.1903 |

| 2011 | 0.1496 | 0.2050 |

| 2012 | 0.1149 | 0.1618 |

| 2013 | 0.2024 | 0.2882 |

| 2014 | 0.1822 | 0.2700 |

| 2015 | 0.1841 | 0.2500 |

| 2016 | 0.1832 | 0.2292 |

| 2017 | 0.2661 | 0.3170 |

| 2018 | 0.3094 | 0.3628 |

| 2019 | 0.4058 | 0.4371 |

| 2020 | 0.4927 | 0.5394 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

MacKinnon, D.; Pavlovič, M. Proprietary Varieties’ Influence on Economics and Competitiveness in Land Use within the Hop Industry. Land 2023, 12, 598. https://doi.org/10.3390/land12030598

MacKinnon D, Pavlovič M. Proprietary Varieties’ Influence on Economics and Competitiveness in Land Use within the Hop Industry. Land. 2023; 12(3):598. https://doi.org/10.3390/land12030598

Chicago/Turabian StyleMacKinnon, Douglas, and Martin Pavlovič. 2023. "Proprietary Varieties’ Influence on Economics and Competitiveness in Land Use within the Hop Industry" Land 12, no. 3: 598. https://doi.org/10.3390/land12030598

APA StyleMacKinnon, D., & Pavlovič, M. (2023). Proprietary Varieties’ Influence on Economics and Competitiveness in Land Use within the Hop Industry. Land, 12(3), 598. https://doi.org/10.3390/land12030598