Factors Affecting the Land Investment Decisions in the Old Members of the European Union: A Systematic Literature Review

Abstract

:1. Introduction and Objective

2. Methodology

2.1. Scoping

- RQ1. How do the farmer’s socio-demographic characteristics, farm specialization, and initial farm size interact to influence farm growth and the decision to invest in land?

- RQ2. How do external factors, including policy, land regulation, and macroeconomic conditions, impact farm-size growth and investment decisions in the agricultural sector?

- RQ3. What methodological approaches and models are most prevalent in the literature for analysing farm growth, and how do these approaches address the interaction between endogenous and exogenous factors affecting farm-size expansion?

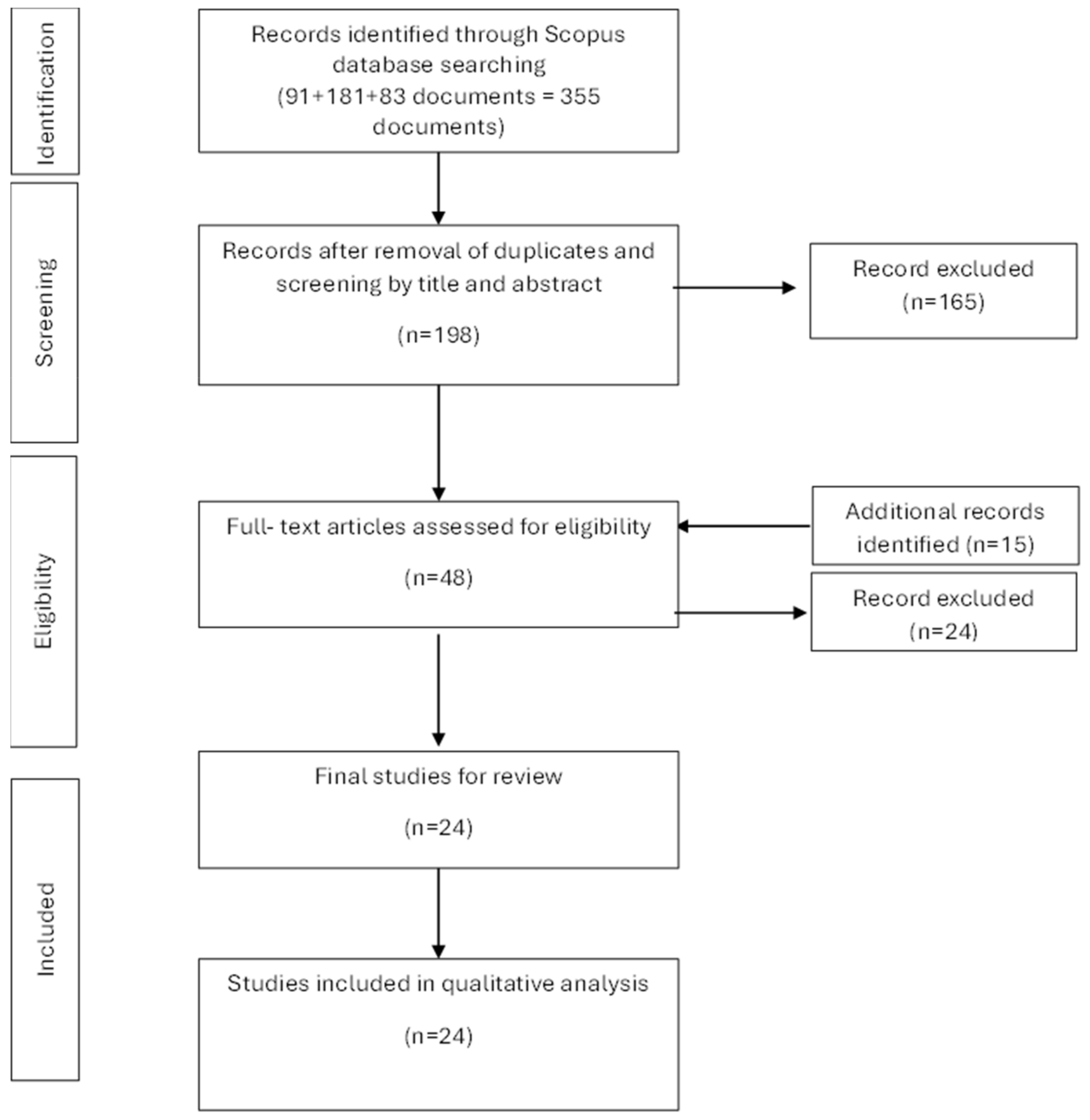

2.2. Planning

2.3. Identification

- Search string: “farm size” and “farm growth” and “structural change”.Output: 91 documents on Scopus from 1992–2024.

- Search string: “agricultural land price*” OR “agricultural land market*” OR “agricultural land value” OR “farmland market” OR “farmland price*” AND “buyer*”.Output: 181 documents on Scopus from 1984–2024.

- Search string: “investment behaviour” AND “investment*” AND “farm” OR “agriculture”.Output: 83 documents on Scopus from 1968–2024.

2.4. Screening

2.5. Eligibility

2.6. Presentation

3. Theoretical Studies Review

3.1. Internal Farm Characteristics

3.2. Exogenous Factors

4. Empirical Study Review

4.1. Farm-Size Growth

4.2. Investment Decision

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Bartolini, F.; Viaggi, D. The Common Agricultural Policy and the Determinants of Changes in EU Farm Size. Land Use Policy 2013, 31, 126–135. [Google Scholar] [CrossRef]

- Schimmenti, E.; Asciuto, A.; Mandanici, S. Andamento Dei Valori Fondiari in Italia Ed in Sicilia. AESTIMUM 2013, 62, 89–110. [Google Scholar] [CrossRef]

- Bradfield, T.; Butler, R.; Dillon, E.J.; Hennessy, T. The Factors Influencing the Profitability of Leased Land on Dairy Farms in Ireland. Land Use Policy 2020, 95, 104649. [Google Scholar] [CrossRef]

- Cotteleer, G.; Gardebroek, C.; Luijt, J. Market Power in a GIS-Based Hedonic Price Model of Local Farmland Markets. Land Econ. 2008, 84, 573–592. [Google Scholar] [CrossRef]

- European Parliament State of Play of Farmland Concentration in the EU: How to Facilitate the Access to Land for Farmers. Available online: https://www.europarl.europa.eu/doceo/document/TA-8-2017-0197_EN.html (accessed on 27 April 2017).

- Elhorst, J.P. The Estimation of Investment Equations at the Farm Level. Eur. Rev. Agric. Econ. 1993, 20, 167–182. [Google Scholar] [CrossRef]

- Lefebvre, M.; Raggi, M.; Paloma, G.Y.; Viaggi, D. An Analysis of the Intention-Realisation Discrepancy in EU Farmers’ Land Investment Decisions. RAEStud 2014, 95, 51–75. [Google Scholar] [CrossRef]

- Swinnen, J.; Van Herck, K.; Vranken, L. The Diversity of Land Markets and Regulations in Europe, and (Some of) Its Causes. J. Dev. Stud. 2016, 52, 186–205. [Google Scholar] [CrossRef]

- Bradfield, T.; Butler, R.; Dillon, E.J.; Hennessy, T.; Loughrey, J. The Impact of Long-Term Land Leases on Farm Investment: Evidence from the Irish Dairy Sector. Land Use Policy 2023, 126, 106553. [Google Scholar] [CrossRef]

- Binswanger, H.; Deininger, K.; Feder, G. Agricultural Land Relations in the Developing World. Am. J. Agric. Econ. 1995, 75, 1242–1248. [Google Scholar] [CrossRef]

- De Noni, I.; Ghidoni, A.; Menzel, F.; Bahrs, E.; Corsi, S. Exploring Drivers of Farmland Value and Growth in Italy and Germany at Regional Level. Aestimum 2019, 74, 77–99. [Google Scholar] [CrossRef]

- Ciaian, P.; Kancs, D.; Swinnen, J.; Van Herck, K.; Vranken, L. Sales Market Regulations for Agricultural Land in EU Member States and Candidate Countries. AgEcon Search 2012, 14. [Google Scholar] [CrossRef]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G. Preferred Reporting Items for Systematic Reviews and Meta-Analyses: The PRISMA Statement. Int. J. Surg. 2010, 8, 336–341. [Google Scholar] [CrossRef]

- Koutsos, T.M.; Menexes, G.C.; Dordas, C.A. An Efficient Framework for Conducting Systematic Literature Reviews in Agricultural Sciences. Sci. Total Environ. 2019, 682, 106–117. [Google Scholar] [CrossRef]

- Akimowicz, M.; Magrini, M.-B.; Ridier, A.; Bergez, J.-E.; Requier-Desjardins, D. What Influences Farm Size Growth? An Illustration in Southwestern France. Appl. Econ. Perspect. Policy 2013, 35, 242–269. [Google Scholar] [CrossRef]

- Boehlje, M. Alternative Models of Structural Change in Agriculture and Related Industries. Agribusiness 1992, 8, 219–231. [Google Scholar] [CrossRef]

- Zimmermann, A.; Heckelei, T.; Domínguez, I.P. Modelling Farm Structural Change for Integrated Ex-Ante Assessment: Review of Methods and Determinants. Environ. Sci. Policy 2009, 12, 601–618. [Google Scholar] [CrossRef]

- Plogmann, J.; Mußhoff, O.; Odening, M.; Ritter, M. Farm Growth and Land Concentration. Land Use Policy 2022, 115, 106036. [Google Scholar] [CrossRef]

- Bremmer, J.; Oude Lansink, A. Analysis of Farm Development in Dutch Agriculture and Horticulture. In Proceedings of the 13th International Management Congress, Wageningen, The Netherlands, 7–12 July 2002. [Google Scholar]

- Goddard, E.; Weersink, A.; Chen, K.; Turvey, C.G. Economics of Structural Change in Agriculture. Can. J. Agric. Econ./Rev. Can. d’Agroecon. 1993, 41, 475–489. [Google Scholar] [CrossRef]

- Weiss, C.R. Farm Growth and Survival: Econometric Evidence for Individual Farms in Upper Austria. Am. J. Agric. Econ. 1999, 81, 103–116. [Google Scholar] [CrossRef]

- Appel, F.; Balmann, A. Predator or Prey? Effects of Farm Growth on Neighbouring Farms. J. Agric. Econ. 2023, 74, 214–236. [Google Scholar] [CrossRef]

- Rodgers, L. Structural Change in Agriculture. 1988. [Google Scholar]

- Gale, H. Longitudinal Analysis of Farm Size over the Farmer’s Life Cycle. Rev. Agric. Econ. 1994, 16, 113–123. [Google Scholar] [CrossRef]

- Huber, R.; Flury, C.; Finger, R. Factors Affecting Farm Growth Intentions of Family Farms in Mountain Regions: Empirical Evidence for Central Switzerland. Land Use Policy 2015, 47, 188–197. [Google Scholar] [CrossRef]

- Oskam, A.J.; Goncharova, N.V.; Verstegen, J.A.A.M. The Decision to Invest and the Investment Level: An Application to Dutch Glasshouse Horticulture Firms. In Proceedings of the International Association of Agricultural Economists’ 2009 Conference, Beijing, China, 16–22 August 2009. [Google Scholar]

- Oude Lansink, A.G.J.M.; Verstegen, J.A.A.M.; Van Den Hengel, J.J. Investment Decision Making in Dutch Greenhouse Horticulture. NJAS Wagening. J. Life Sci. 2001, 49, 357–368. [Google Scholar] [CrossRef]

- Eurostat, November 2022. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Farms_and_farmland_in_the_European_Union_-_statistics#Farms_in_2020 (accessed on 14 March 2024).

- Puddu, M. Effects of 2013 CAP Reform on Land Market: Regionalized Farm Payments and Changes in Farmers’ Intended Behaviour. Ph.D. Thesis, Università di Bologna, Bologna, Italy, 2014. [Google Scholar]

- Viaggi, D. La Variabilità Dei Mercati Fondiari. Terra e Vita 2009, 44, 20–21. [Google Scholar]

- European Commission; Joint Research Centre. Agricultural Land Market Regulations in the EU Member States; Publications Office: Luxembourg, 2021. [Google Scholar]

- European Economic and Social Committee Land Grabbing—A Warning for Europe and a Threat to Family Farming. January 2015. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52014IE0926 (accessed on 14 March 2024).

- Swinnen, J.F.M.; Van Herck, K.; Vranken, L. Land Market Regulations in Europe. SSRN J. 2014. [Google Scholar] [CrossRef]

- Balmann, A.; Graubner, M.; Müller, D.; Hüttel, S.; Seifert, S.; Odening, M.; Plogmann, J.; Ritter, M. Market Power in Agricultural Land Markets: Concepts and Empirical Challenges. Ger. J. Agric. Econ. 2021, 70, 213–235. [Google Scholar] [CrossRef]

- Ciaian, P.; Kancs, D.; Swinnen, J.F.M. EU Land Markets and the Common Agricultural Policy; Centre for European Policy Studies: Brussels, Belgium, 2010; ISBN 978-92-9079-963-4. [Google Scholar]

- European Commission; Joint Research Centre. The Capitalisation of CAP Subsidies into Land Rents and Land Values in the EU: An Econometric Analysis; Publications Office: Luxembourg, 2021. [Google Scholar]

- Moro, D.; Sckokai, P. The Impact of Decoupled Payments on Farm Choices: Conceptual and Methodological Challenges. Food Policy 2013, 41, 28–38. [Google Scholar] [CrossRef]

- O’Toole, C.; Hennessy, T. Do Decoupled Payments Affect Investment Financing Constraints? Evidence from Irish Agriculture. Food Policy 2015, 56, 67–75. [Google Scholar] [CrossRef]

- Gibrat, R. Les Inégalités Économiques; Recueil Sirey: Paris, France, 1931. [Google Scholar]

- Upton, M.; Haworth, S. The Growth of Farms. Eur. Rev. Agric. Econ. 1987, 14, 351–366. [Google Scholar] [CrossRef]

- Brenes-Muñoz, T.; Lakner, S.; Brümmer, B. What Influences the Growth of Organic Farms? Evidence from a Panel of Organic Farms in Germany. German J. Agric. Econ. 2016, 65, 1–15. [Google Scholar]

- Blundell, R.; Meghir, C. Bivariate Alternatives to the Tobit Model. J. Econom. 1987, 34, 179–200. [Google Scholar] [CrossRef]

- Lefebvre, M.; Gomez y Paloma, S.; Viaggi, D. EU Farmers’ Intentions to Invest in 2014–2020: Complementarity between Asset Classes. In Proceedings of the 15th International Association of Agricultural Economists (IAAE), Agriculture in an Interconnected World, Milan, Italy, 8–14 August 2015. [Google Scholar]

- Plantinga, A.J.; Lubowski, R.N.; Stavins, R.N. The Effects of Potential Land Development on Agricultural Land Prices. J. Urban Econ. 2002, 52, 561–581. [Google Scholar] [CrossRef]

- Bareille, F.; Chakir, R. The Impact of Climate Change on Agriculture: A Repeat-Ricardian Analysis. J. Environ. Econ. Manag. 2023, 119, 102822. [Google Scholar] [CrossRef]

- Moore, F.C.; Lobell, D.B. The Fingerprint of Climate Trends on European Crop Yields. Proc. Natl. Acad. Sci. USA 2015, 112, 2670–2675. [Google Scholar] [CrossRef] [PubMed]

- Slaboch, J.; Čechura, L. Land Pricing Model: Price Re-Evaluation Due to the Erosion and Climate Change Effects. AGRIS On-Line 2020, 12, 111–121. [Google Scholar] [CrossRef]

- Moreno-Pérez, O.M.; Arnalte-Mur, L.; Cerrada-Serra, P.; Martinez-Gomez, V.; Adamsone-Fiskovica, A.; Bjørkhaug; Brunori, G.; Czekaj, M.; Duckett, D.; Hernández, P.A.; et al. Actions to Strengthen the Contribution of Small Farms and Small Food Businesses to Food Security in Europe. Food Sec. 2024, 16, 243–259. [Google Scholar] [CrossRef]

| Paper | Models Implemented | Variables Considered |

|---|---|---|

| Farm growth and structural change | ||

| Weiss (1999) [21] | Heckman model characterised by a two-step approach. (1) Probit model to estimate the probability that the farms survive; (2) Four models: monotonic farm growth; non-monotonic farm growth, full-time farms, part-time farms | Farm structural characteristics: initial farm size Socio-demographic characteristics: age, presence of successor; agricultural-specific education, level of “general” education; number of family members, farmer’s marital status, off-farm (part-time farming), gender |

| Akimowicz et al. (2013) [15] | Three different models: - OLS, where dependent variable is logarithm of farm size; - Multinomial logit model, where dependent variable is increase/decrease in UAA; - Tobit model, where dependent variable is logarithm of growth intensity. | Farm characteristics: farm size, farm type; level of specialization; legal status Socio-demographic characteristic: age, presence of successor, off-farm and human capital, gender of the farmer, off-farm job, level of agricultural education, level of general education Local characteristic: department, type of area (urban, per-urban, rural, deep rural) |

| Bremmer et al. (2002) [19] | Two probit models with dependent variable assumes value equal to 1 - farm innovated or diversified - farm increased both farm area and productive area | Farm characteristics: initial farm size, degree of mechanization; specialization, solvency, profitability Socio-demographic characteristics: family labour input, age, presence of successor, education, off-farm income |

| Brenes-Muñoz et al. (2016) [41] | Two regression analyses in which the dependent variable is, respectively, the difference of the first logarithm of the UAA and agricultural revenue | Farm characteristics: initial farm size, agricultural revenues (t − 1), capital (as annual depreciation), labour (as annual work unit); specialisation (mixed farm, arable crops, pig and poultry farms), soil quality Socio-demographic characteristics: age, part-time farming Policy environment: subsidies for organic production |

| Investment decision | ||

| Elhorst (1993) [6] | Statistical model based on infrequency of purchase model developed by Blundell and Meghir (1987) [42] by altering it using logit regression model instead of probit regression model | Financial variables: short-run profit one year delayed, % of farm owned, and nominal interest rate Socio-demographic characteristics: age, presence of successor, family labour input; Internal characteristics: value of buildings and machinery External factor: output and input prices |

| Oskam et al. (2009) [26] | Heckman selection model | Farm structural characteristics: firm size, financial and economic characteristics: capital, wealth, debts, labour cost, revenue Socio-demographic: characteristics: age, presence of successor, new entry External factor: output price, energy price, price of capital |

| Factor Category | Influencing Factors | Type of Influence |

|---|---|---|

| Technological advancements | Adoption, mechanization, specialization | Positive: enhances productivity, may favour large farms |

| Farm characteristics | Size, managerial capacity, specialization | Positive: larger size and better management lead to growth |

| Demographic factors | Age of the farmer, presence of a successor, family work units | Mixed: younger farmers/successors may lead to expansion; older farmers may not invest |

| Macroeconomic conditions | Interest rates, inflation rates | Mixed: higher interest rates deter; inflation can increase land value |

| Policy environment | Subsidies, land regulations | Mixed: subsidies can increase land value; regulations may restrict market |

| Farm size and growth | Small-farm dynamics, specialization | Positive: small farms grow faster; specialization drives size changes |

| Investment behaviour | Financial position, successor presence | Mixed: financial health critical; successor presence encourages investment |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Russo, S.; Ghelfi, R.; Raggi, M.; Viaggi, D. Factors Affecting the Land Investment Decisions in the Old Members of the European Union: A Systematic Literature Review. Land 2024, 13, 527. https://doi.org/10.3390/land13040527

Russo S, Ghelfi R, Raggi M, Viaggi D. Factors Affecting the Land Investment Decisions in the Old Members of the European Union: A Systematic Literature Review. Land. 2024; 13(4):527. https://doi.org/10.3390/land13040527

Chicago/Turabian StyleRusso, Silvia, Rino Ghelfi, Meri Raggi, and Davide Viaggi. 2024. "Factors Affecting the Land Investment Decisions in the Old Members of the European Union: A Systematic Literature Review" Land 13, no. 4: 527. https://doi.org/10.3390/land13040527