Can Urban Sprawl Promote Enterprise Innovation? Evidence from A-Share Listed Companies in China

Abstract

:1. Introduction

2. Literature Review

3. Theoretical Framework

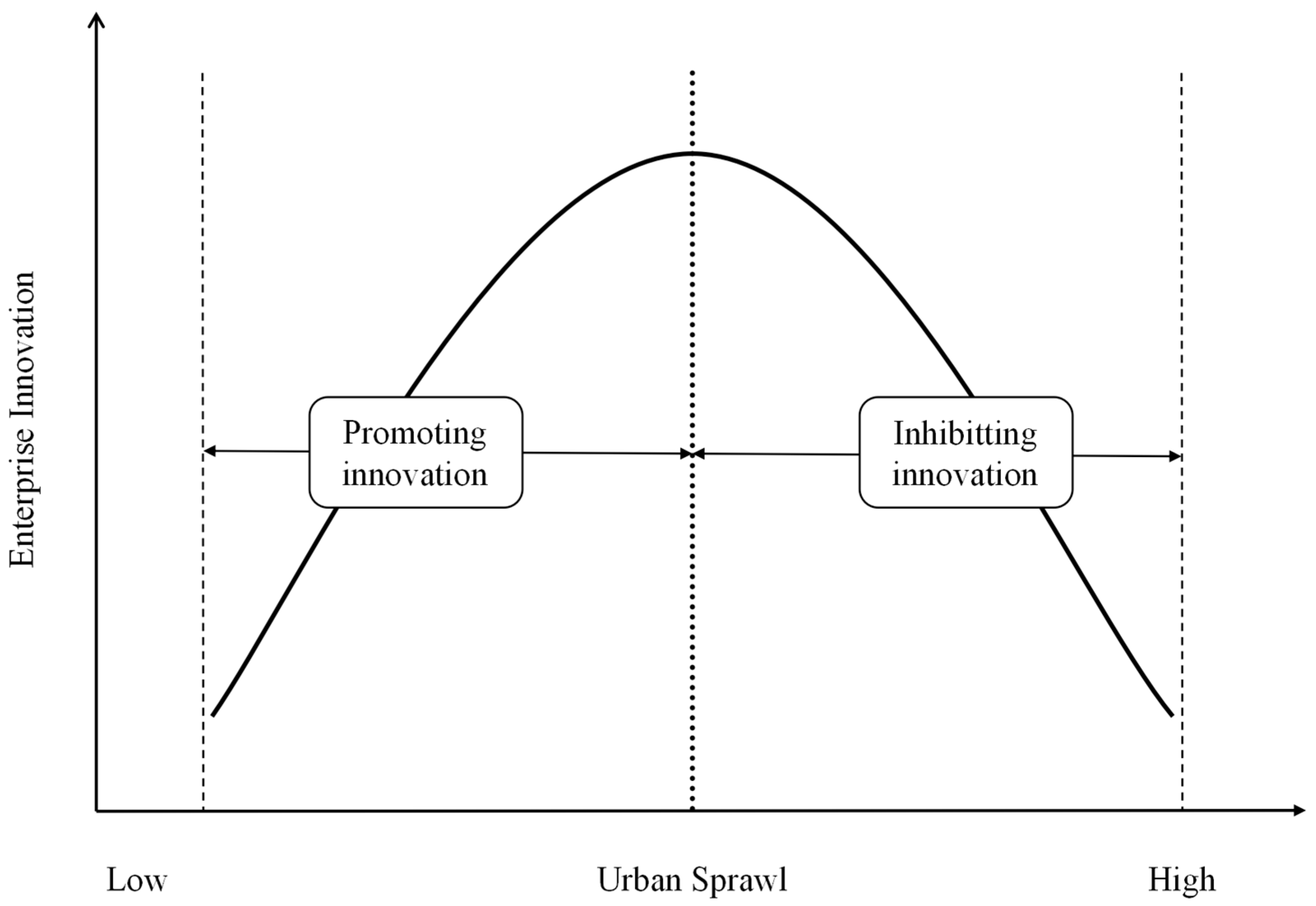

3.1. Urban Sprawl and Enterprise Innovation

3.2. Urban Sprawl, Regional Integration, and Enterprise Innovation

4. Methods and Data

4.1. Model

4.2. Main Variables

4.2.1. Dependent Variables

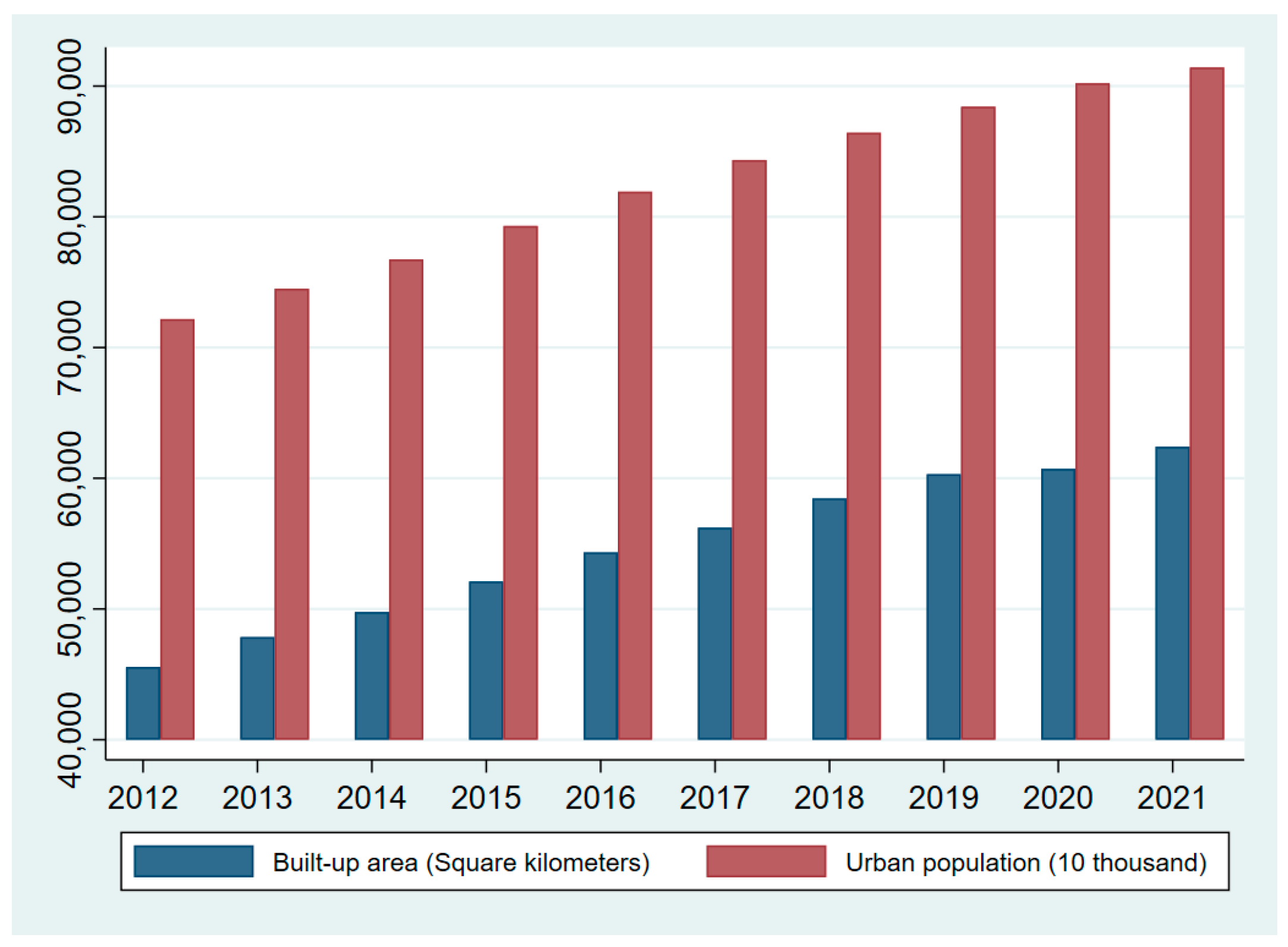

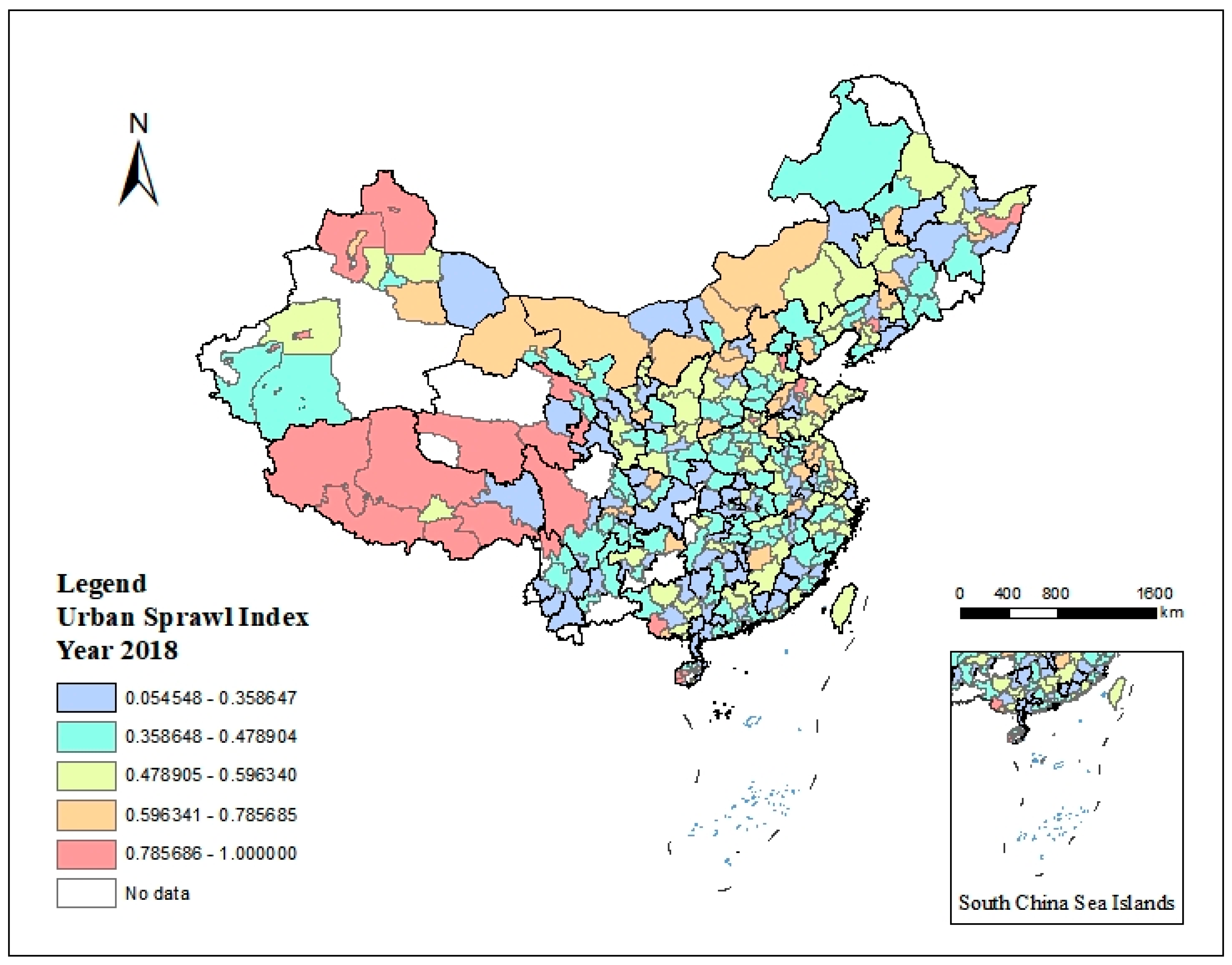

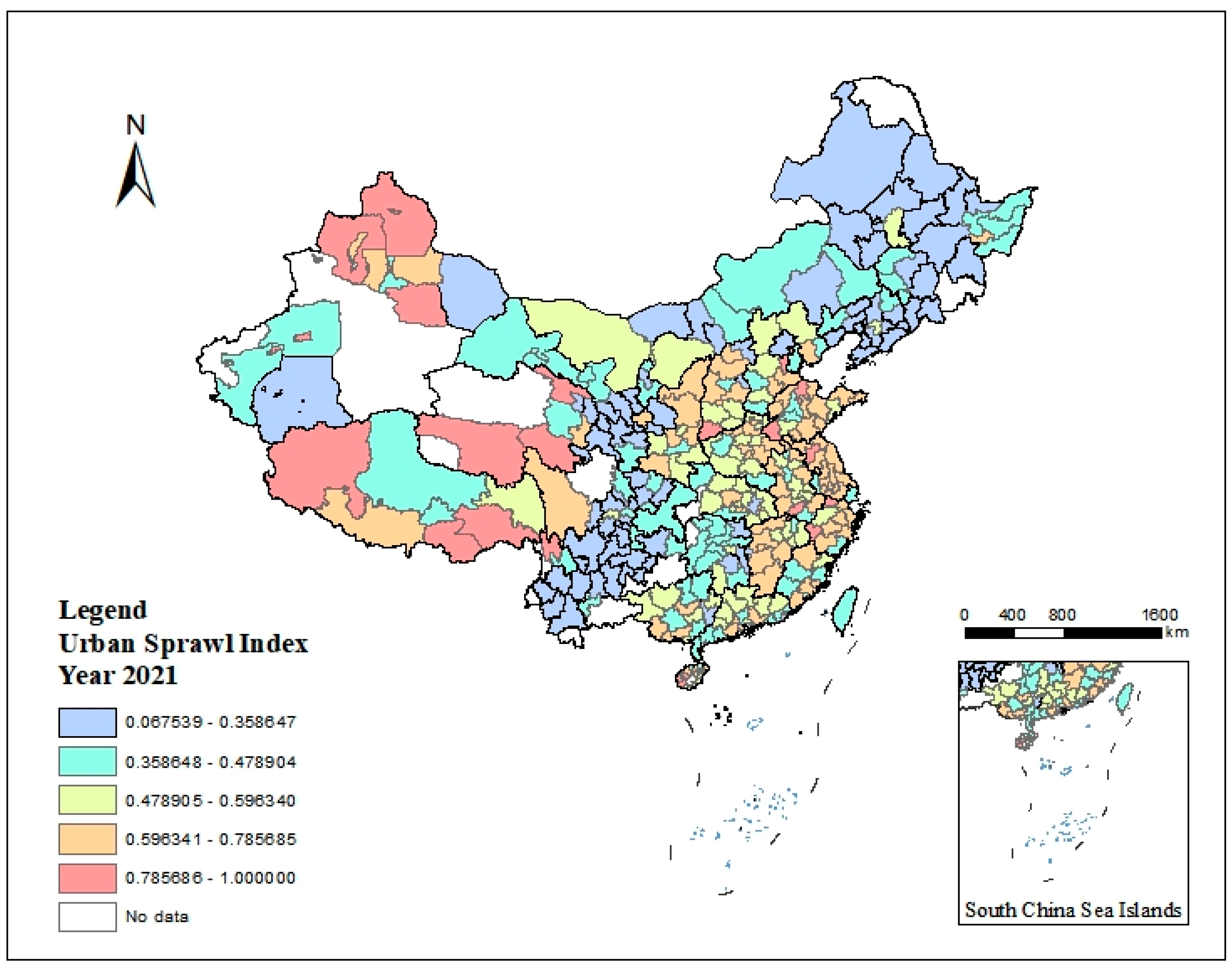

4.2.2. Independent Variables

4.2.3. Control Variables

4.2.4. Regional Integration

4.3. Data Sources and Description of Variables

5. Results

5.1. Benchmark Regression

5.1.1. Urban Sprawl and Enterprise Innovation

5.1.2. Urban Sprawl, Regional Integration, and Enterprise Innovation

5.2. Robustness Checks

5.2.1. Two-Stage Least-Squares Regression

5.2.2. Regression by Year

5.2.3. Substituting Variables

5.2.4. Other Robustness Tests

6. Further Analysis

6.1. Heterogeneity of Region

6.2. Heterogeneity of City Size

6.3. Heterogeneity of Enterprise and Industry Characteristics

7. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Tsai, Y.-H. Quantifying Urban Form: Compactness versus “Sprawl”. Urban Stud. 2005, 42, 141–161. [Google Scholar] [CrossRef]

- McMillen, D.P. Employment Densities, Spatial Autocorrelation, and Subcenters in Large Metropolitan Areas. J. Reg. Sci. 2004, 44, 225–244. [Google Scholar] [CrossRef]

- Cladera, J.R.; Duarte, C.R.M.; Moix, M. Urban Structure and Polycentrism: Towards a Redefinition of the Sub-centre Concept. Urban Stud. 2009, 46, 2841–2868. [Google Scholar] [CrossRef]

- Dadashpoor, H.; Shahhossein, G. Defining urban sprawl: A systematic review of 130 definitions. Habitat Int. 2024, 146, 103039. [Google Scholar] [CrossRef]

- George, L.; Waldfogel, J. Who Affects Whom in Daily Newspaper Markets? J. Polit. Econ. 2003, 111, 765–784. [Google Scholar]

- Chen, Y.; Rosenthal, S.S. Local amenities and life-cycle migration: Do people move for jobs or fun? J. Urban Econ. 2008, 64, 519–537. [Google Scholar] [CrossRef]

- Lee, S. Ability sorting and consumer city. J. Urban Econ. 2010, 68, 20–33. [Google Scholar] [CrossRef]

- Kakar, K.A.; Prasad, C. Impact of Urban Sprawl on Travel Demand for Public Transport, Private Transport and Walking. Transp. Res. Procedia 2020, 48, 1881–1892. [Google Scholar] [CrossRef]

- Navamuel, E.L.; Morollon, F.R.; Cuartas, B.M. Energy consumption and urban sprawl: Evidence for the Spanish case. J. Clean. Prod. 2018, 172, 3479–3486. [Google Scholar] [CrossRef]

- Du, H.; Ma, Y.; An, Y. The impact of land policy on the relation between housing and land prices: Evidence from China. Q. Rev. Econ. Financ. 2011, 51, 19–27. [Google Scholar] [CrossRef]

- Glaeser, E.L. Urban Growth and Housing Supply. Econ. Geogr. 2006, 3, 71–89. [Google Scholar] [CrossRef]

- Batabyal, A.A.; Beladi, H. The effects of probabilistic innovations on Schumpeterian economic growth in a creative region. Econ. Model. 2016, 53, 224–230. [Google Scholar] [CrossRef]

- Curci, F. The Taller the letter? Agglomeration Determinants and Urban Structure. In Proceedings of the 55th Congress of the European Regional Science Association, World Renaissance: Changing Roles for People and Places, Lisbon, Portugal, 25–28 August 2015; pp. 25–28. [Google Scholar]

- Hamidi, S.; Zandiatashbar, A.; Bonakdar, A. The relationship between regional compactness and regional innovation capacity (RIC): Empirical evidence from a national study. Technol. Forecast. Soc. Chang. 2019, 142, 394–402. [Google Scholar] [CrossRef]

- Hamidi, S.; Zandiatashbar, A. Does urban form matter for innovation productivity? A national multi-level study of the association between neighbourhood innovation capacity and urban sprawl. Urban Stud. 2018, 56, 1576–1594. [Google Scholar] [CrossRef]

- Brueckner, J.K.; Largey, A.G. Social interaction and urban sprawl. J. Urban Econ. 2008, 64, 18–34. [Google Scholar] [CrossRef]

- Leyden, K.M. Social Capital and the Built Environment: The Importance of Walkable Neighborhoods. Am. J. Public Health 2003, 93, 1546–1551. [Google Scholar] [CrossRef]

- Tang, C.; Guan, M.; Dou, J. Understanding the impact of High Speed Railway on urban innovation performance from the perspective of agglomeration externalities and network externalities. Technol. Soc. 2021, 67, 101760. [Google Scholar] [CrossRef]

- Agrawal, A.; Cockburn, I.; Galasso, A.; Oettl, A. Why are some regions more innovative than others? The role of small firms in the presence of large labs. J. Urban Econ. 2014, 81, 149–165. [Google Scholar] [CrossRef]

- Kumar, A.; Kober, B. Urbanization, human capital, and cross-country productivity differences. Econ. Lett. 2012, 117, 14–17. [Google Scholar] [CrossRef]

- Liu, H.; Cui, C.; Chen, X.; Xiu, P. How can regional integration promote corporate innovation? A peer effect study of R&D expenditure. J. Innov. Knowl. 2023, 8, 100444. [Google Scholar] [CrossRef]

- He, Z.; Wintoki, M.B. The cost of innovation: R&D and high cash holdings in U.S. firms. J. Corp. Financ. 2016, 41, 280–303. [Google Scholar] [CrossRef]

- Wan, Q.; Chen, J.; Yao, Z.; Yuan, L. Preferential tax policy and R&D personnel flow for technological innovation efficiency of China’s high-tech industry in an emerging economy. Technol. Forecast. Soc. Chang. 2022, 174, 121228. [Google Scholar] [CrossRef]

- Shefer, D.; Frenkel, A. R&D, firm size and innovation: An empirical analysis. Technovation 2005, 25, 25–32. [Google Scholar] [CrossRef]

- Zhang, Y.; Xing, C.; Wang, Y. Does green innovation mitigate financing constraints? Evidence from China’s private enterprises. J. Clean. Prod. 2020, 264, 121698. [Google Scholar] [CrossRef]

- Ang, R.; Shao, Z.; Liu, C.; Yang, C.; Zheng, Q. The relationship between CSR and financial performance and the moderating effect of ownership structure: Evidence from Chinese heavily polluting listed enterprises. Sustain. Prod. Consum. 2022, 30, 117–129. [Google Scholar] [CrossRef]

- Aghion, P.; Bloom, N.; Blundell, R.; Griffith, R.; Howitt, P. Competition and Innovation: An Inverted-U Relationship. Q. J. Econ. 2005, 120, 701–728. [Google Scholar] [CrossRef]

- Benfratello, L.; Schiantarelli, F.; Sembenelli, A. Banks and innovation: Microeconometric evidence on Italian firms. J. Financ. Econ. 2008, 90, 197–217. [Google Scholar] [CrossRef]

- Brown, J.R.; Martinsson, G.; Petersen, B.C. Do financing constraints matter for R&D? Eur. Econ. Rev. 2012, 56, 1512–1529. [Google Scholar] [CrossRef]

- Dai, X.; Chapman, G. R&D tax incentives and innovation: Examining the role of programme design in China. Technovation 2022, 113, 102419. [Google Scholar] [CrossRef]

- Ding, X.; Guo, M.; Kuai, Y.; Niu, G. Social trust and firm innovation: Evidence from China. Int. Rev. Econ. Financ. 2023, 84, 474–493. [Google Scholar] [CrossRef]

- Su, K.; Wu, J.; Lu, Y. With trust we innovate: Evidence from corporate R&D expenditure. Technol. Forecast. Soc. Chang. 2022, 182. [Google Scholar] [CrossRef]

- Xu, R.; Shen, Y.; Liu, M.; Li, L.; Xia, X.; Luo, K. Can government subsidies improve innovation performance? Evidence from Chinese listed companies. Econ. Model. 2023, 120, 106151. [Google Scholar] [CrossRef]

- Lin, H.-L.; Li, H.-Y.; Yang, C.-H. Agglomeration and productivity: Firm-level evidence from China’s textile industry. China Econ. Rev. 2011, 22, 313–329. [Google Scholar] [CrossRef]

- Brülhart, M.; Sbergami, F. Agglomeration and growth: Cross-country evidence. J. Urban Econ. 2009, 65, 48–63. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Resseger, M.G. The complementarity between cities and skills. J. Reg. Sci. 2010, 50, 221–244. [Google Scholar] [CrossRef]

- Duranton, G.; Puga, D. The Economics of Urban Density. J. Econ. Perspect. 2020, 34, 3–26. [Google Scholar] [CrossRef]

- Fragkias, M.; Lobo, J.; Strumsky, D.; Seto, K.C. Does Size Matter? Scaling of CO2 Emissions and U.S. Urban Areas. PLoS ONE 2013, 8, e64727. [Google Scholar] [CrossRef] [PubMed]

- Baldwin, R.E.; Okubo, T. Heterogeneous firms, agglomeration and economic geography: Spatial selection and sorting. J. Econ. Geogr. 2006, 6, 323–346. [Google Scholar] [CrossRef]

- van der Panne, G. Agglomeration externalities: Marshall versus Jacobs. J. Evol. Econ. 2004, 14, 593–604. [Google Scholar] [CrossRef]

- Rotem-Mindali, O. Retail fragmentation vs. urban livability: Applying ecological methods in urban geography research. Appl. Geogr. 2012, 35, 292–299. [Google Scholar] [CrossRef]

- Dewa, D.D.; Buchori, I.; Sejati, A.W.; Liu, Y. Shannon Entropy-based urban spatial fragmentation to ensure sustainable development of the urban coastal city: A case study of Semarang, Indonesia. Remote. Sens. Appl. Soc. Environ. 2022, 28, 100839. [Google Scholar] [CrossRef]

- Huang, D.; Liu, Z.; Zhao, X.; Zhao, P. Emerging polycentric megacity in China: An examination of employment subcenters and their influence on population distribution in Beijing. Cities 2017, 69, 36–45. [Google Scholar] [CrossRef]

- Mouratidis, K.; Poortinga, W. Built environment, urban vitality and social cohesion: Do vibrant neighborhoods foster strong communities? Landsc. Urban Plan. 2020, 204, 103951. [Google Scholar] [CrossRef]

- Sun, S.; Li, X. Productive services agglomeration, financial development and regional innovation efficiency in the Yangtze River Economic Zone. Finance Res. Lett. 2022, 50, 103221. [Google Scholar] [CrossRef]

- Broersma, L.; Oosterhaven, J. Regional labor productivity in the netherlands: Evidence of agglomeration and congestion effects. J. Reg. Sci. 2009, 49, 483–511. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, Q.; Zhou, L.-A. Career Incentives of City Leaders and Urban Spatial Expansion in China. Rev. Econ. Stat. 2020, 102, 897–911. [Google Scholar] [CrossRef]

- Du, J.; Peiser, R.B. Land supply, pricing and local governments’ land hoarding in China. Reg. Sci. Urban Econ. 2014, 48, 180–189. [Google Scholar] [CrossRef]

- Gyourko, J.; Molloy, R. Regulation and Housing Supply. In Handbook of Regional Science and Urban Economics; Elsevier: Amsterdam, The Netherlands, 2015; Volume 5, pp. 1289–1337. [Google Scholar] [CrossRef]

- Han, L.; Kung, J.K.-S. Fiscal incentives and policy choices of local governments: Evidence from China. J. Dev. Econ. 2015, 116, 89–104. [Google Scholar] [CrossRef]

- Chen, T.; Kung, J.-S. Do land revenue windfalls create a political resource curse? Evidence from China. J. Dev. Econ. 2016, 123, 86–106. [Google Scholar] [CrossRef]

- Wang, Z.; Tian, W.J.; Zhang, Q.H. Policy on Minimum Price of Industrial Land Transfer and Local Economic Growth. J. Econ. 2024, 24, 271–285. (In Chinese) [Google Scholar] [CrossRef]

- Kahn, M.E. Does sprawl reduce the black/white housing consumption gap? Hous. Policy Debate 2001, 12, 77–86. [Google Scholar] [CrossRef]

- Lopez, R.; Hynes, H.P. Sprawl in the 1990s: Measurement, Distribution and Trends. Urban Aff. Rev. 2003, 38, 325–355. [Google Scholar] [CrossRef]

- Wang, X.; Shi, R.; Zhou, Y. Dynamics of urban sprawl and sustainable development in China. Socio-Econ. Plan. Sci. 2020, 70, 100736. [Google Scholar] [CrossRef]

- Galster, G.; Hanson, R.; Ratcliffe, M.R.; Wolman, H.; Coleman, S.; Freihage, J. Wrestling Sprawl to the Ground: Defining and measuring an elusive concept. Hous. Policy Debate 2001, 12, 681–717. [Google Scholar] [CrossRef]

- Hamidi, S.; Ewing, R.; Preuss, I.; Dodds, A. Measuring Sprawl and Its Impacts. J. Plan. Educ. Res. 2015, 35, 35–50. [Google Scholar] [CrossRef]

- Song, Y.; Knaap, G.-J. Measuring Urban Form: Is Portland Winning the War on Sprawl? J. Am. Plan. Assoc. 2004, 70, 210–225. [Google Scholar] [CrossRef]

- Fallah, B.N.; Partridge, M.D.; Olfert, M.R.; Fallah, B.N.; Partridge, M.D.; Olfert, M.R. Urban sprawl and productivity: Evidence from US metropolitan areas. Pap. Reg. Sci. 2011, 90, 451–473. [Google Scholar] [CrossRef]

- Parsley, D.C.; Wei, S.-J. Convergence to the Law of One Price Without Trade Barriers or Currency Fluctuations. Q. J. Econ. 1996, 111, 1211–1236. [Google Scholar] [CrossRef]

- Haans, R.F.J.; Pieters, C.; He, Z. Thinking about U: Theorizing and testing U- and inverted U-shaped relationships in strategy research. Strat. Manag. J. 2016, 37, 1177–1195. [Google Scholar] [CrossRef]

- You, Z.; Feng, Z.; Yang, Y. Kilometer grid data set of terrain relief degree in China. J. Glob. Change Data Repos. (Chinese and English) 2018. (In Chinese) [Google Scholar] [CrossRef]

| Variables | Definition |

|---|---|

| lnpatent | Logarithm of the number of patent applications in the current year plus one |

| sprawl | Continuous variable |

| sprawl2 | Continuous variable |

| lnsalare | Logarithm of house prices |

| revexp | Ratio of fiscal revenues to fiscal expenditures |

| gdpave | Logarithm of per capita GDP |

| forgdp | Ratio of foreign direct investment to regional GDP |

| intpop | Internet penetration |

| urbare | Urbanization rate |

| FirmAge | ln(current year − year of incorporation + 1) |

| Size | Natural logarithm of total assets for the year |

| Lev | Total liabilities at year-end divided by total assets at year-end |

| SOE | Whether it is a state-owned enterprise: state-controlled enterprises take a value of 1; otherwise, 0 |

| Top1 | Number of shares held by the largest shareholder/total number of shares |

| Fixed | Proportion of net fixed assets to total assets |

| Growth | (current year’s operating income/previous year’s operating income) − 1 |

| Variables | Observations | Average Value | Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|

| lnpatent | 21882 | 3.767 | 1.674 | 0.693 | 10.63 |

| sprawl | 21882 | 0.411 | 0.122 | 0 | 1 |

| sprawl2 | 21882 | 0.184 | 0.115 | 0 | 1 |

| lnsalare | 21882 | 2.471 | 0.733 | 0.583 | 4.023 |

| revexp | 21882 | 0.734 | 0.206 | 0.0681 | 1.107 |

| gdpave | 21882 | 9.568 | 4.011 | 0.646 | 21.55 |

| forgdp | 21882 | 4.019 | 2.792 | 0.000322 | 28.21 |

| intpop | 21882 | 45.37 | 24.43 | 1.010 | 97.78 |

| urbare | 21882 | 110.9 | 147.0 | 0.201 | 497.1 |

| FirmAge | 21882 | 2.829 | 0.365 | 0.693 | 4.143 |

| Size | 21882 | 22.09 | 1.319 | 17.81 | 28.64 |

| Lev | 21882 | 0.400 | 0.206 | 0.00752 | 1.957 |

| SOE | 21882 | 0.316 | 0.465 | 0 | 1 |

| Top1 | 21882 | 0.341 | 0.149 | 0 | 0.900 |

| Fixed | 21882 | 0.200 | 0.147 | 1.23 × 10−5 | 0.885 |

| Growth | 21882 | 0.361 | 13.36 | −0.985 | 1878 |

| Variables | Benchmark Regressions | Level of Regional Integration | |||

|---|---|---|---|---|---|

| lnpatent | lnpatent | lnpatent | Above Average | Below Average | |

| (1) | (2) | (3) | (4) | (5) | |

| sprawl | 1.6133 *** | 2.3825 *** | 2.1719 *** | 2.0121 *** | 1.7874 *** |

| (0.5009) | (0.3508) | (0.5112) | (0.4861) | (0.4384) | |

| sprawl2 | −2.4848 *** | −2.7492 *** | −2.3427 *** | −2.0963 *** | −2.0353 *** |

| (0.4531) | (0.3032) | (0.4653) | (0.5736) | (0.3080) | |

| lnsalare | 0.2534 *** | 0.1934 *** | 0.1189 * | 0.2749 ** | |

| (0.0584) | (0.0468) | (0.0594) | (0.0965) | ||

| revexp | 0.6723 *** | 0.6300*** | 1.0620 *** | 0.2810 | |

| (0.0883) | (0.0859) | (0.0733) | (0.2030) | ||

| gdpave | −0.0050 | −0.0127 | −0.0262 *** | −0.0127 | |

| (0.0070) | (0.0080) | (0.0079) | (0.0142) | ||

| forgop | −0.0023 | 0.0010 | 0.0180 | 0.0066 | |

| (0.0062) | (0.0038) | (0.0123) | (0.0066) | ||

| intpop | 0.0038 ** | 0.0055 *** | 0.0067 *** | 0.0033 | |

| (0.0017) | (0.0015) | (0.0019) | (0.0022) | ||

| urbare | −0.0009 *** | −0.0009 *** | −0.0007 *** | −0.0010 * | |

| (0.0002) | (0.0002) | (0.0002) | (0.0006) | ||

| FirmAge | −0.2089 *** | −0.1716 *** | −0.2262 ** | ||

| (0.0473) | (0.0438) | (0.0864) | |||

| Size | 0.6795 *** | 0.6513 *** | 0.7137 *** | ||

| (0.0347) | (0.0586) | (0.0219) | |||

| Lev | 0.0155 | 0.1336 | −0.0923 | ||

| (0.1806) | (0.1594) | (0.1990) | |||

| SOE | 0.1188 *** | 0.1195 * | 0.0845 * | ||

| (0.0273) | (0.0684) | (0.0468) | |||

| Top1 | −0.3114 *** | −0.2056 | −0.4320 ** | ||

| (0.0781) | (0.1364) | (0.1854) | |||

| Fixed | −0.9889 *** | −0.7035 ** | −1.2473 *** | ||

| (0.3314) | (0.3241) | (0.3268) | |||

| Growth | −0.0026 *** | −0.0026 *** | −0.0017 | ||

| (0.0002) | (0.0002) | (0.0032) | |||

| Control variables | 3.5605 *** | 2.1613 *** | −11.8199 *** | −11.4892 *** | −12.2570 *** |

| (0.1243) | (0.1851) | (0.7298) | (1.4892) | (0.5248) | |

| Province-fixed effects | YES | YES | YES | YES | YES |

| Industry-fixed effects | YES | YES | YES | YES | YES |

| Year-fixed effects | YES | YES | YES | YES | YES |

| 21882 | 21882 | 21882 | 10955 | 10642 | |

| 0.1667 | 0.1757 | 0.4069 | 0.3971 | 0.4300 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, Z.; Zhang, B.; Yuan, C.; Han, Z.; Liu, J. Can Urban Sprawl Promote Enterprise Innovation? Evidence from A-Share Listed Companies in China. Land 2024, 13, 710. https://doi.org/10.3390/land13050710

Jiang Z, Zhang B, Yuan C, Han Z, Liu J. Can Urban Sprawl Promote Enterprise Innovation? Evidence from A-Share Listed Companies in China. Land. 2024; 13(5):710. https://doi.org/10.3390/land13050710

Chicago/Turabian StyleJiang, Zeru, Bo Zhang, Chunlai Yuan, Zhaojie Han, and Jiangtao Liu. 2024. "Can Urban Sprawl Promote Enterprise Innovation? Evidence from A-Share Listed Companies in China" Land 13, no. 5: 710. https://doi.org/10.3390/land13050710

APA StyleJiang, Z., Zhang, B., Yuan, C., Han, Z., & Liu, J. (2024). Can Urban Sprawl Promote Enterprise Innovation? Evidence from A-Share Listed Companies in China. Land, 13(5), 710. https://doi.org/10.3390/land13050710