Abstract

The cement industry, as a high energy-consuming industry, has been included in the carbon emissions trading system (ETS) in the context of the carbon neutrality goals. Benchmark allocation of carbon quotas may have a significant impact on cement companies. To study this impact, we constructed a system dynamics (SD) model for a cement company with the three subsystems of “demand and production”, “economic efficiency”, and “carbon emission and carbon trading” based on company competitiveness theory. A company competitiveness index was established from the SD model. Through computer simulation, the influence of the annual decline coefficient of the benchmark value and the innovation investment rate on a cement company’s competitiveness under different circumstances were compared and analyzed. This study puts forward suggestions for low-carbon development, such as setting a reasonable range of annual decline coefficient of the benchmark value (0.97–0.99) and promoting investment in emission-reduction technologies in multiple phases.

1. Introduction

Human economic activities have relied heavily on fossil energy sources for a long time, leading to a significant increase in greenhouse gas emissions [1]. The Sixth Assessment Report issued by the United Nations Intergovernmental Panel on Climate Change (IPCC) highlighted that those human activities had caused the warming of the atmosphere, oceans, and land. Widespread and rapid changes are occurring in the atmosphere, oceans, cryosphere, and biosphere [2]. The severe negative impacts of climate change are prompting the international community to take substantial measures to reduce greenhouse gas emissions [3]. Among these measures, ETS has become one of the most important tools for many countries to achieve their carbon neutrality goals due to its flexibility and cost-effectiveness [4].

As an environmental policy, ETS has three major essentials: industry coverage, carbon emission cap, and carbon quota allocation [5]. Multiple carbon quota allocation methods have been developed. The grandfathering, benchmarking, and auction methods are now mainstream carbon quota allocation methods [6]. To reduce the burden of carbon-intensive companies, carbon quota is mainly allocated free (grandfathering and benchmarking), supplemented by paid allocation (auction) [4].

ETS pilot sites in China currently include Beijing, Tianjin, Shanghai, Chongqing, Hubei, Guangdong, and Shenzhen. Industries covered include electricity, heat, cement, steel, petroleum, aviation, automotive, and paper. Subsequently, in 2017, a nationally unified ETS for the power industry was established. Currently, 2162 power companies are included in the nationally unified ETS, covering more than 4.5 billion tons of carbon emissions annually.

The construction industry generates more than one-third of global carbon emissions, and is one of the main sources of greenhouse gas emissions [7]. Cement, as the major building material, generates a large amount of CO2 during the clinker calcination and fuel combustion stages of its production [8]. According to statistics, the cement industry accounts for about 8% of global anthropogenic carbon emissions, a figure that is expected to rise as urbanization levels increase [9]. The cement industry is one of the industries most affected by environmental policies, and its carbon trading costs are second only to those of the power industry [10,11]. However, the changes in costs, sales, profits, and carbon intensity of cement companies resulting from the relevant rules in the ETS have been less intensively studied. The above elements are closely interconnected. Changes in one of them will cause changes in others. Therefore, a simple mathematical approach cannot reveal the relationships between them and cannot inform the impacts of carbon quota benchmark allocation on the overall competitiveness of a cement company in dynamic environments. System dynamics can provide an appropriate way to solve this issue.

Therefore, to address this research gap, this paper takes cement companies as the research object and analyzes the influence mechanism of carbon quota benchmark allocation on the competitiveness of cement companies. A system dynamics model is developed innovatively to guide cement companies’ energy-saving and green development, and promote the transformation and upgrading of companies. It also provides policy recommendations for unifying the carbon trading market in China’s cement industry.

The remaining chapters are organized as follows: Section 2 introduces the literature related to benchmark allocation in ETS, corporate competitiveness, and low-carbon strategies of cement companies. Section 3 explains the system dynamics model. Section 4 presents a case study and the simulation results. Section 5 is the conclusion section.

2. Literature Review

2.1. ETS and Benchmark Allocation

Most scholars believe that while ETS leads to higher commodity prices in emission-controlled industries, it has the policy effect of reducing carbon emissions and decreasing carbon intensity in these industries [10,12]. The allocation of carbon quotas, as a prerequisite and core element for ETS, significantly affects the smooth implementation of environmental policies and the achievement of carbon emission reduction [6].

Researchers have compared the fairness, efficiency, and feasibility of different carbon quota allocation methods. The grandfathering method is based on companies’ historical carbon emissions as the standard [13]. Companies are concerned with maximizing their current profits under this method. The benchmarking method uses industry average or advanced emission levels as the standard [14]. Companies focus on the impact of current decisions on future profits under this method. The auction method is to put all quotas into the trading market for uniform auction, which puts economic pressure on carbon-intensive companies and is less feasible at the early stage of ETS implementation [15].

The practice of European Union Carbon Emissions Trading System (EU ETS) shows that the allocation of carbon quota has gradually transitioned from the grandfathering method to the benchmarking method, and then to the full auction method [16]. In comparison, it is more fair and feasible to apply the benchmarking method in industries with relatively uniform processes and products at this stage, such as the power generation and cement industry [17]. The benchmarking method could effectively reduce competitive distortions and opportunities for large gains [18], reduce the risk of carbon leakage [11,18,19], and encourage companies to invest in emission-reduction technologies to improve energy efficiency [20,21].

2.2. Company Competitiveness under the Benchmark Allocation

The Organization for Economic Co-operation and Development (OECD) states that environmental policies will impact a company’s competitiveness through channels such as profits, turnover, investment, cost pass-through, value-added, production, employment, carbon emissions, and export trade [22]. The benchmarking method focuses on peer-to-peer comparisons; thus, studying the competitiveness of emission-controlled companies using this method is critical [23]. Current studies have come to different conclusions about whether and to what extent benchmark allocation affects the competitiveness of emission-controlled companies. On the one hand, several studies have concluded that benchmark allocation helps to improve a company’s competitiveness. Porter [24] developed the hypothesis that favorable environmental policies would stimulate innovation, potentially offsetting additional costs and improving a company’s competitiveness over time. Yu et al. [25] and Xiao et al. [26] discovered that non-energy industries could improve their financial performance and total factor productivity by taking responsibility for emission reduction. Wang et al. [27] believed that companies would use low-carbon competitiveness to expand their market share when they voluntarily reduce carbon intensity to an advanced level. On the other hand, some scholars believe that benchmark allocation hurts a company’s competitiveness. Chen et al. [28] demonstrated that Porter’s hypothesis did not materialize in China because of the significant lag effect of policies in promoting corporate innovation. Manufacturing companies would decrease production or investment in green technologies, hurting green innovation and reducing cash flows and projected revenues. Zhang et al. [29] identified a marked employment reduction in China’s pilot emission-control industries in recent years. Reducing production is still the primary approach for power, heat, and oil exploration companies to reduce carbon emissions. In addition, some studies suggested a weak impact of the benchmark allocation. Robin et al. [30] found little change in profits for most emissions-controlled industries, with steel and cement companies losing a small market share. Demailly et al. [11,31] concluded that the benchmarking method had little impact on production levels and profitability in iron and steel industry. When the additional costs can be effectively passed on to consumers, the impact on company profits and revenues is minimal.

Based on the existing literature, whether the benchmark allocation will have an impact on the competitiveness of emission-controlled companies, which aspects will have an impact, and to what extent, are closely related to the characteristics of an industry and the specific design of a policy.

2.3. Carbon-Reduction Measures in Cement Companies

Regarding the technical roadmap for carbon emission reduction in cement companies, the International Energy Agency (IEA) [32] has identified multiple approaches, including improving energy-use efficiency, developing co-disposal technologies, and reducing the clinker-cement ratio, carbon capture, and other alternative cementitious material technologies. These actions could help decouple cement production growth from direct carbon emissions, leading to a 24% reduction in the cement industry’s emissions by 2050. Reducing carbon emissions during clinker production is the primary driver of carbon emission reduction in the cement industry [33]. Specifically, ways to reduce carbon emissions from the cement industry include alternative fuels, energy-efficient kilns, replacement of clinker with mineral components, carbon capture and utilization, and CO2 mineralization [34,35,36]. In addition, to reduce the pressure on companies to invest in emission reduction, some governments grant subsidies and incentives to carbon-intensive companies. For example, British Columbia provided a C$14 million ($10.7 million) grant to help Lafarge Holcim, a building material manufacturer, transition to low-carbon fuels [37].

2.4. Application of System Dynamics in the Cement Industry

System dynamics is a simulation method used to study the nonlinear behavior of complex systems over time, often used in industry for techno-economic analysis, emissions forecasting, and policy experiments [38]. Tang et al. [1] reviewed many quantitative models and found that “system” is the keyword in the studies of ETS, which has been considered a typical system involving various interacting factors. Therefore, system dynamics is suitable for analysis of the interactions between the economy, environment, and policy in an industry or company. In the cement industry, SD has been used to evaluate the comprehensive benefits of investment in abatement technologies [39,40,41], forecast cement prices during the policy implementation period [42], predict cement demand [43], and estimate carbon emissions under different scenarios and policies [44,45].

Proao et al. [39] divided the whole system of the cement industry into the cement demand subsystem (SD-CD), the cement production subsystem (SD-CP), the carbon estimation and capture subsystem (SD-CCU), and the cost and profit subsystem (SD-C&P) to research the economic feasibility of carbon capture and utilization technology. Their study systematically analyzed the economic performance of implementing carbon capture technology and the impact on the overall cash flow of cement companies under different market and government conditions. Wei et al. [46] developed a system dynamics model that included six subsystems: economic, technological, human resource, environmental, market, and policy, to simulate a low-carbon sustainable development path for companies.

3. Methodology

3.1. System Framework for Cement Companies

When the theory of company core competitiveness was first proposed, Prahalad and Hamel [47] defined it as cumulative learning within the company, especially concerning the problem of how to coordinate multiple production skills and integrate various technological streams. Hamel et al. [48] considered that there were three types of company competitiveness: (i) competitiveness related to market entry (e.g., sales, branding, logistics, technical support); (ii) competitiveness related to integration (e.g., quality, inventory); and (iii) competitiveness related to function (e.g., products with unique features). Barton [49] analyzed company competitiveness from the perspective of knowledge learning, arguing that company proprietary knowledge, technology systems, and management systems were also part of it.

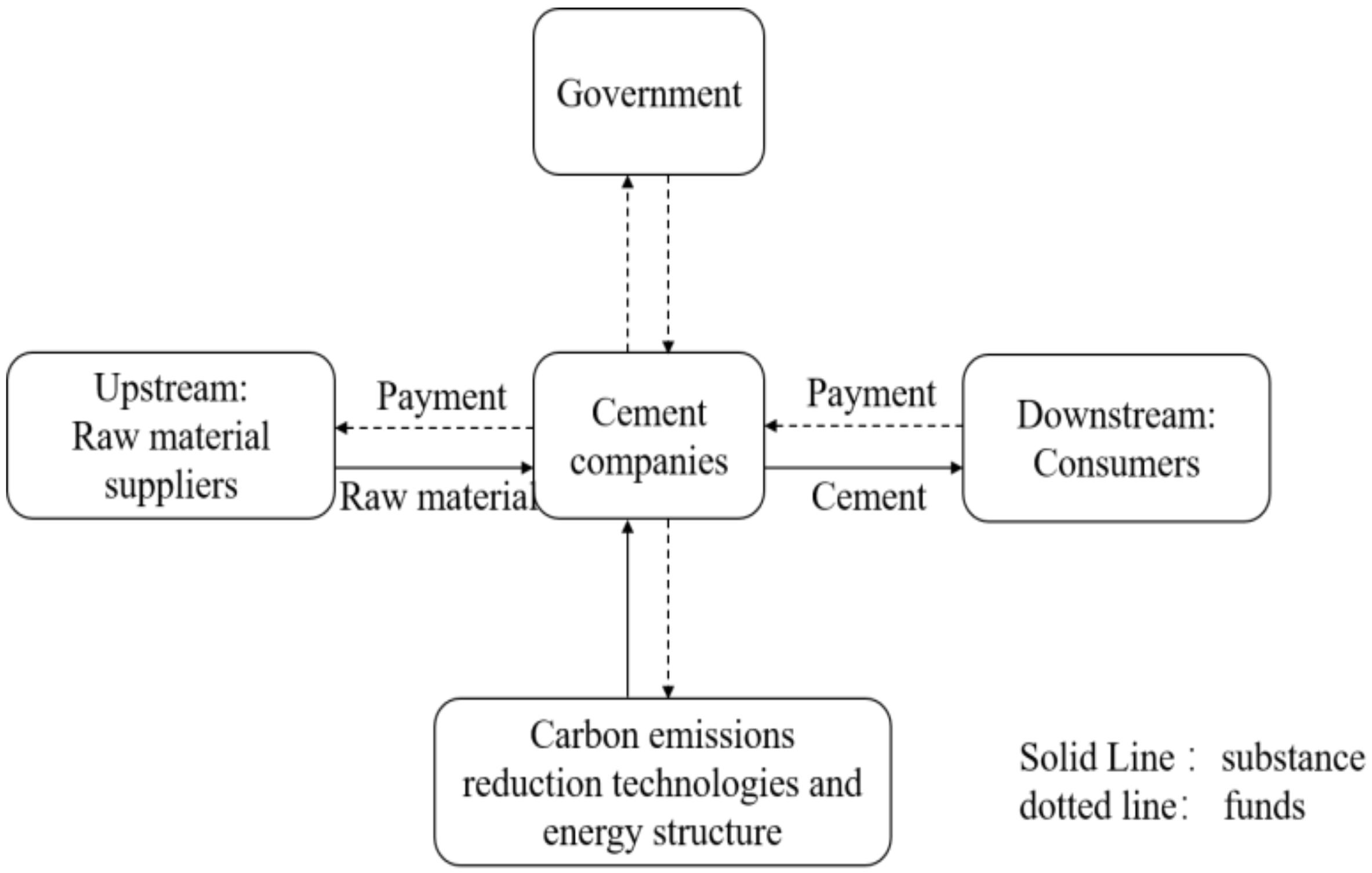

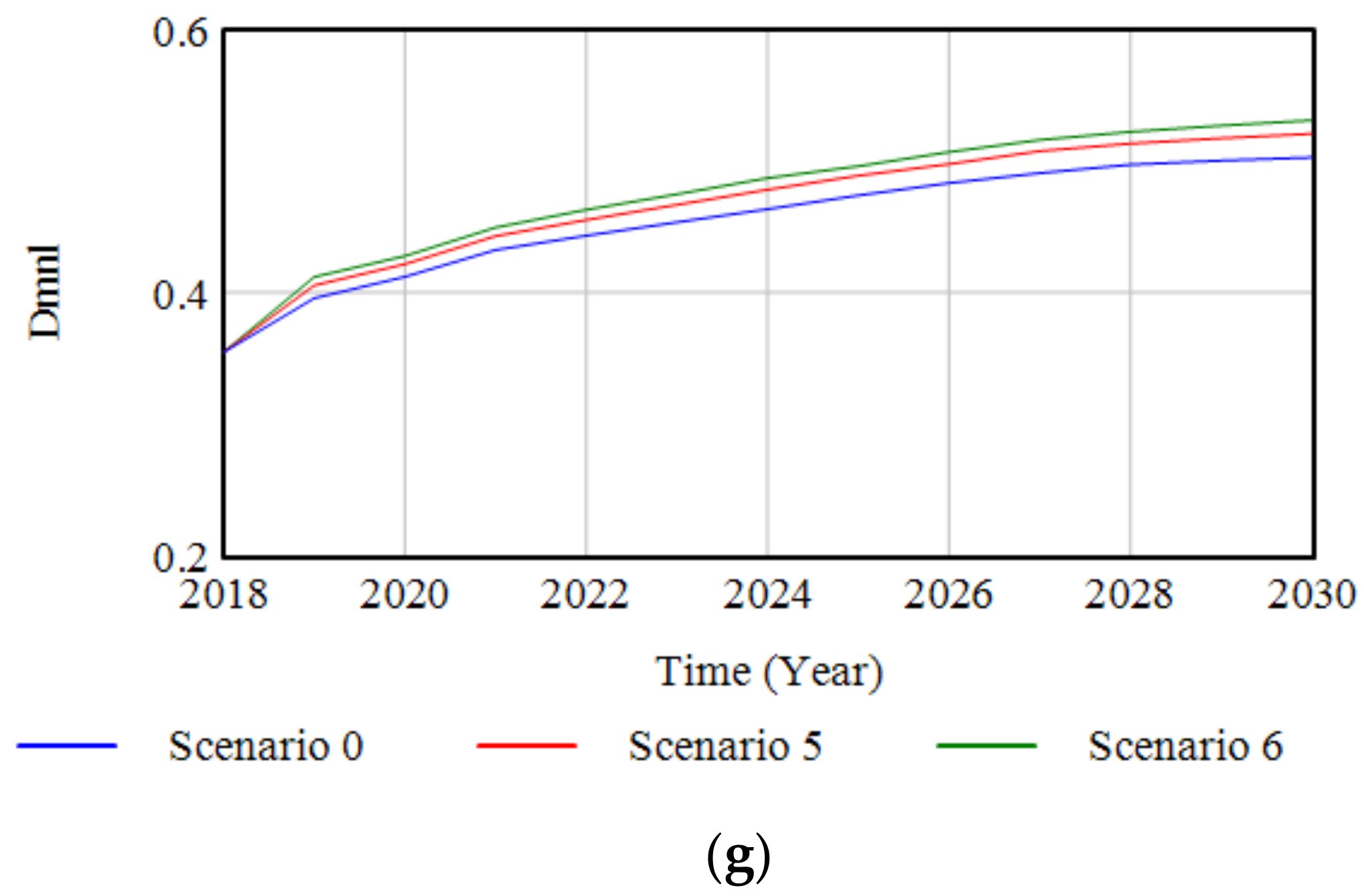

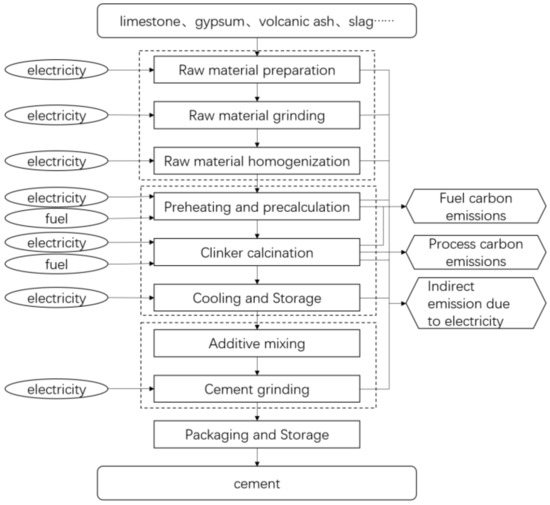

Based on the above-mentioned theory of company competitiveness, we further explored the various roles and processes in the production and trading of cement companies, forming the logical basis of the model structure. As shown in Figure 1, upstream suppliers provide raw materials, such as limestone, clay, and cement additives to the cement company, where cement is produced through raw material grinding, clinker calcination, and cement grinding. The company then sells the product to downstream consumers and makes a profit. The levels of emission-reduction technologies and energy structure largely determine carbon emissions. Under the government’s strict carbon-trading scheme, cement companies receive free quotas for the current year, calculated based on production and an established benchmark. If the annual carbon emissions exceed the quota, a company will be required to purchase carbon credits on the carbon trading market, and if there is any surplus, sell the remainder on the market. To reduce carbon intensity and reach a target close to or below the benchmark value, a cement company would invest in more emission-reducing equipment and cleaner energy. If the carbon emission intensity of a cement company reaches an advanced level in the industry, the government will also provide carbon emission-reduction incentives.

Figure 1.

Logistics and capital flow of the cement company.

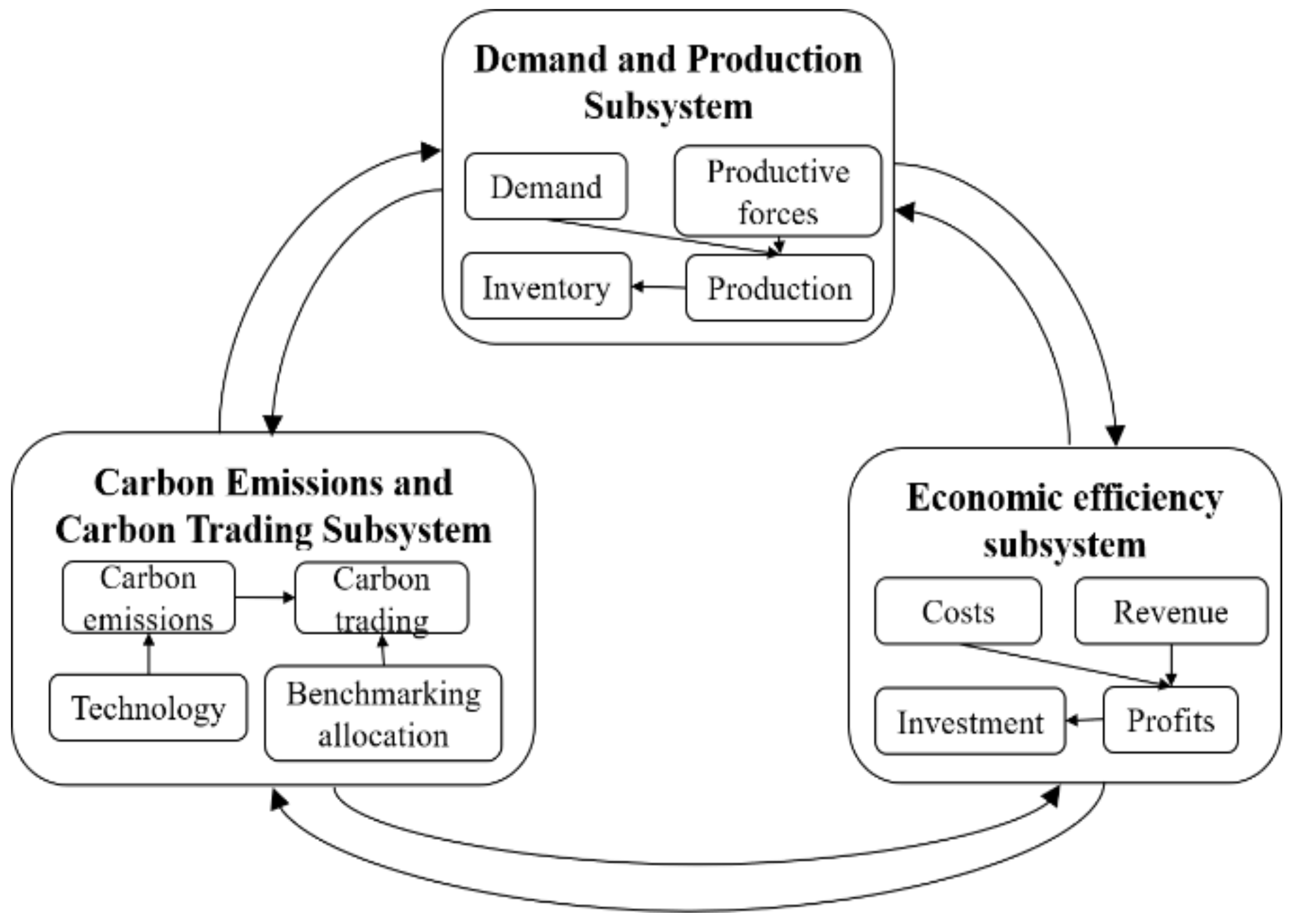

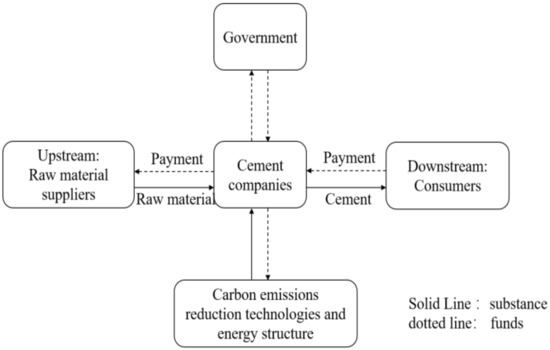

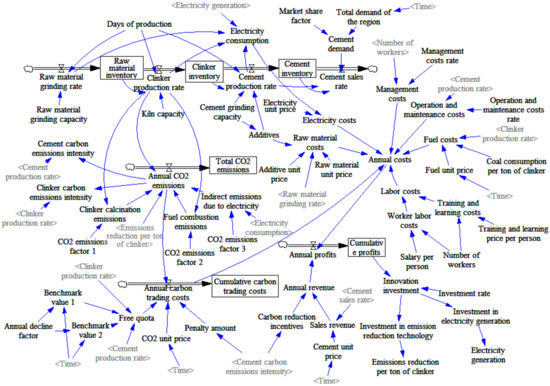

Three subsystems were defined to build a system dynamics model based on the relationships between cement companies and other stakeholders: the demand and production subsystem, the economic efficiency subsystem, and the carbon emission and carbon trading subsystem. As shown in Figure 2, the three subsystems are closely related. The demand and production of cement largely control a company’s carbon emissions. The amount of carbon trading determined by carbon emissions and benchmark value influences economic efficiency. The improvement in economic efficiency and expansion of scale would motivate companies to develop new energy strategies, invest in carbon emission-reduction technologies to reduce carbon trading costs, and continuously enhance production levels.

Figure 2.

Subsystem framework diagram of the system dynamics model.

3.2. The Stock-Flow Diagram of the System Dynamics Model

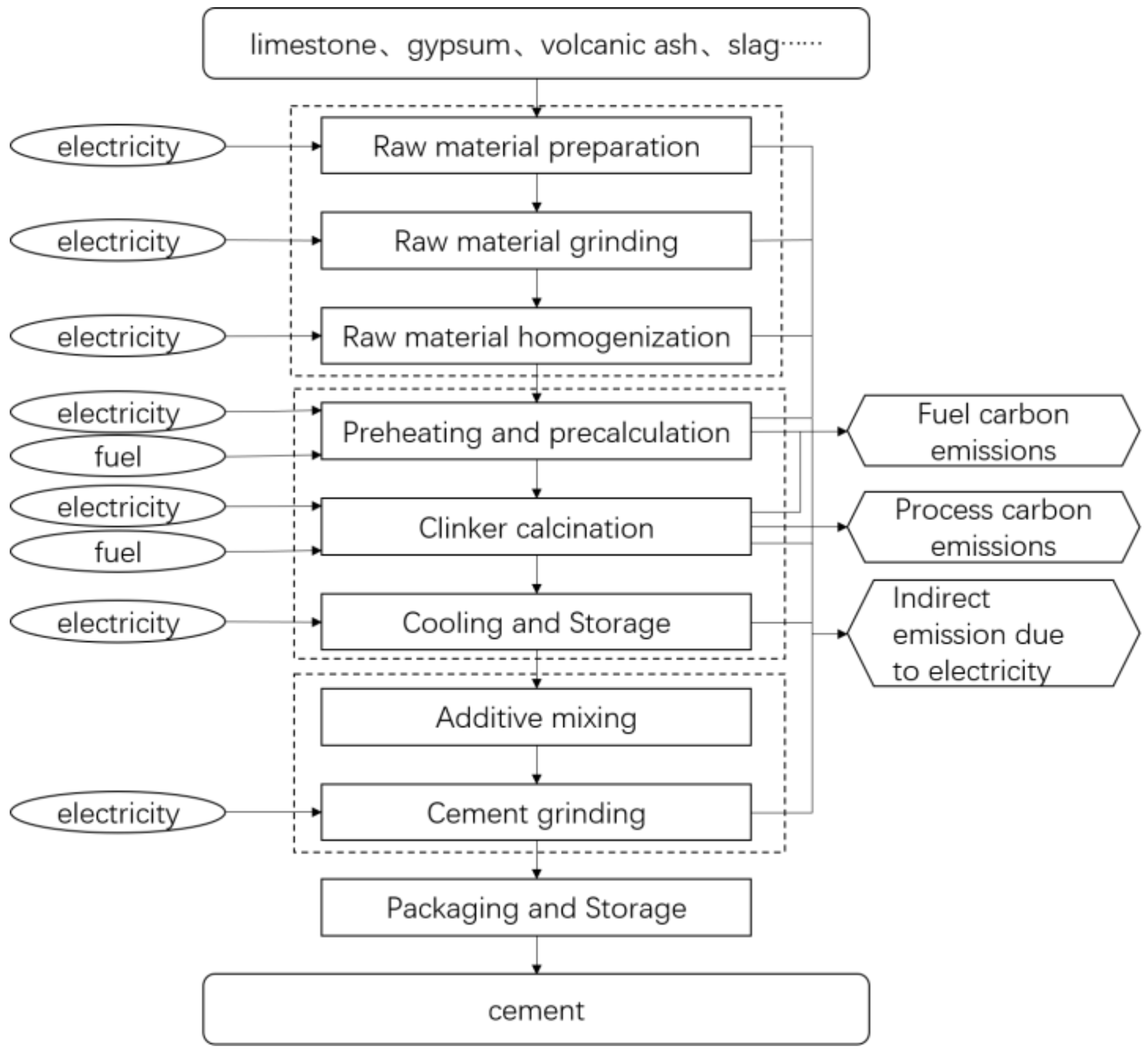

In the demand and production subsystem, the regional cement demand is derived from a demand function developed by Zhang et al. [50]. As shown in Figure 3, the cement production consists of three main processes: raw materials extraction and grinding, clinker calcination, and cement grinding. The raw materials extraction and grinding process includes crushing, grinding, and homogenization of limestone. The clinker calcination process includes preheating, pre-decomposition, high-temperature calcination, and cooling. The majority of CO2 is generated during this process. In the cement grinding process, clinker is mixed with additives, such as gypsum, blast furnace slag, or volcanic ash, before grinding. These three processes of the main sources of electricity consumption in cement companies.

Figure 3.

Cement production process flow chart.

In the economic efficiency subsystem, total company costs include raw material costs, fuel costs, electricity costs, carbon trading costs, management costs, labor costs, and operation and maintenance costs. Total company revenue is earned from sales revenue and government carbon-reduction incentives. As the accumulated profits increase, cement companies draw funds from them and invest in emission reduction and power generation projects, aiming to reduce carbon emissions per unit of clinker and increase power generation capacity. The amount of investment in various advanced carbon reduction technologies varies, as does the effectiveness of emission reduction. The functional relationship between investment and emission reduction for each carbon reduction technology refers to the study of Price and Tan et al. [51,52].

In the carbon emission and carbon trading subsystem, carbon emissions originate from three main components: clinker calcination emissions, fuel combustion emissions, and indirect emissions due to electricity consumption. The cost of carbon trading is determined by carbon emissions, free quota, and carbon price. When carbon emissions exceed the free quota, the excess amount must be purchased on the carbon emission trading market. The free quota is determined by the production and benchmark value of cement or clinker. In addition, an annual reduction factor is often used to adjust the benchmark value based on the macro carbon reduction plan. In this study, we used two benchmark values for cement and clinker, and a reduction factor set by the ETS of Guangdong Province, China.

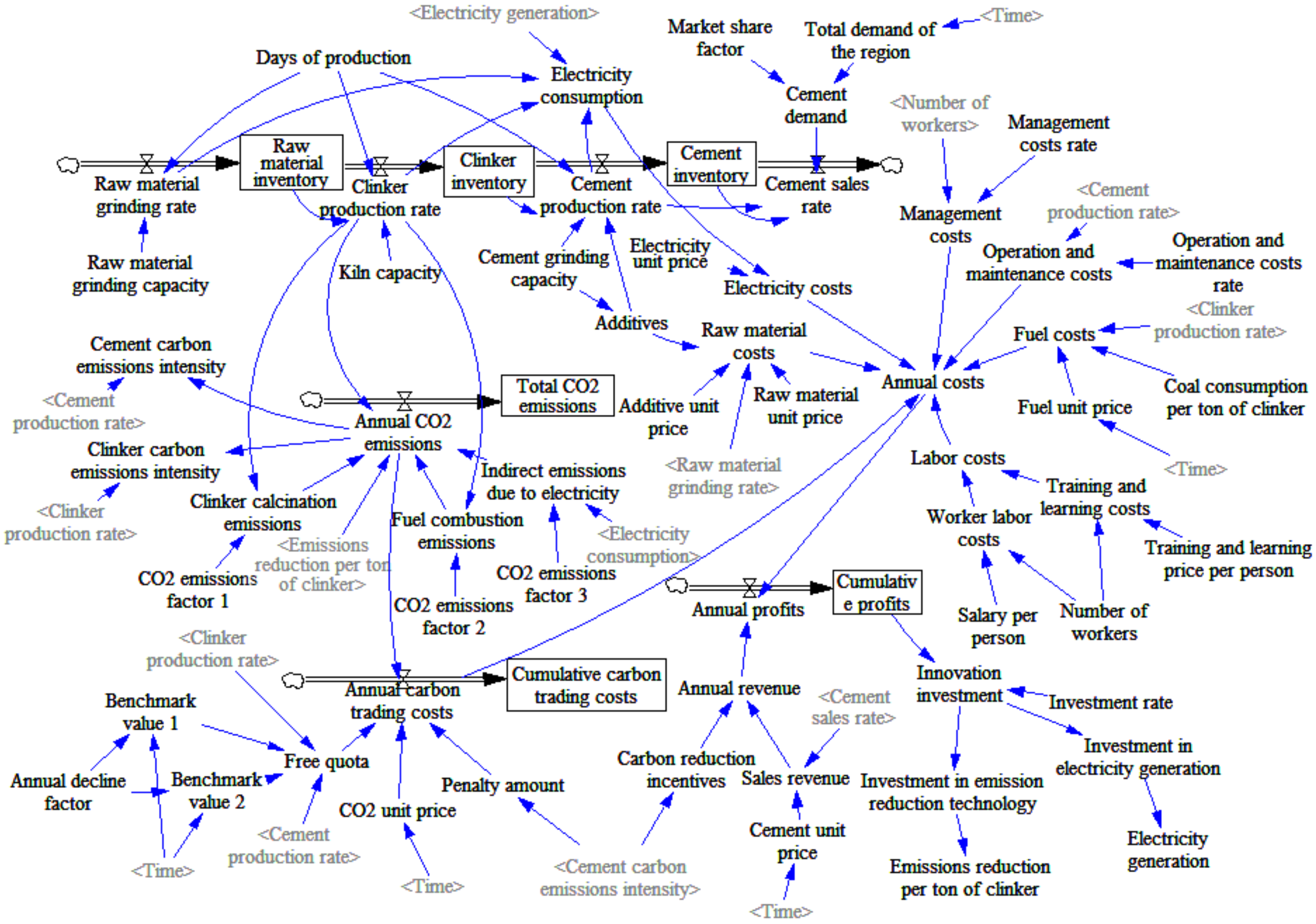

Based on the system conceptualization, the stock-flow diagram that determines the quantitative relationship between variables was established, as shown in Figure 4. It shows multiple feedback loops. For example, the profits gained by a company would continue to be invested in enhancing carbon emission-reduction capacity and improving energy structure, which will eventually be reflected in the total cost and revenue after cement production and sales. This is a positive feedback loop. Moreover, due to the rapid rise in carbon prices, a company would set the expected carbon intensity according to the industry benchmark level and relevant government policy texts in response to the rising carbon emission trading costs. The larger the gap between the expected and actual carbon intensities, the more a company will increase its investment in innovation to decrease this gap for cleaner production. This is a negative feedback loop.

Figure 4.

Stock flow diagram of the system dynamics model.

All model equations are detailed in Appendix A. The following basic assumptions were used in model development:

- the government has developed a mature carbon trading market without considering carbon tax;

- the issue of corporate profit distribution is not considered;

- the domestic market can meet the needs of companies for raw materials;

- the market has a sound regulatory and information-sharing mechanism to avoid system collapse caused by other non-market behaviors;

- only the spot market for carbon emissions trading is considered, and the forward market is not considered;

- only carbon trading within the cement industry is considered, and carbon trading between the cement industry and other industries is not considered;

- the export trade of cement is not considered;

- only the sales of cement products are considered, and the sales of clinker and concrete are not considered.

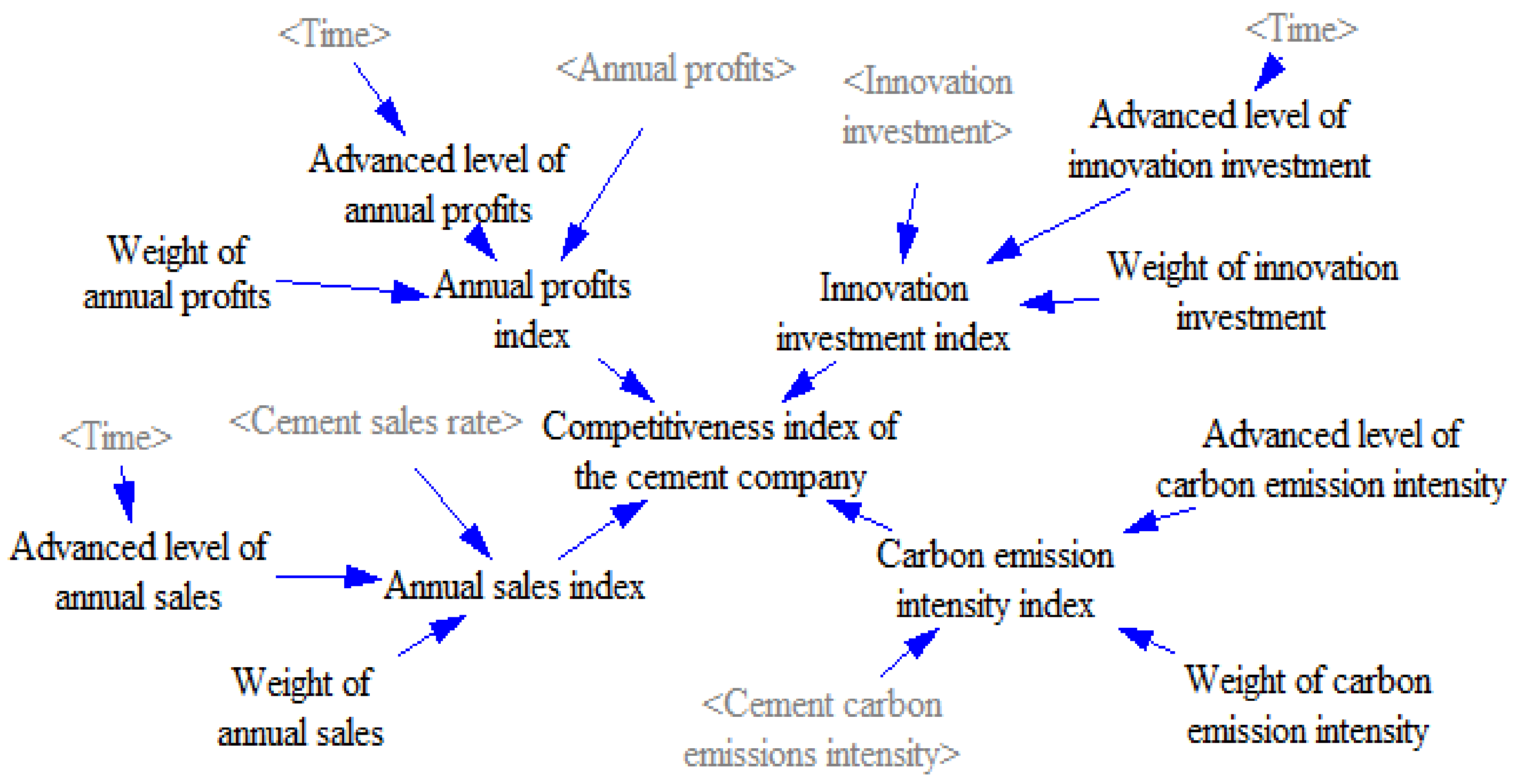

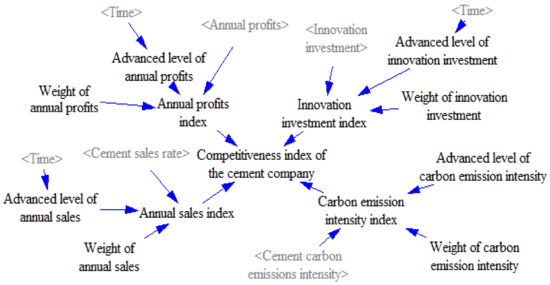

A competitiveness index for the cement company was constructed to study the impact of profits, sales, carbon emission intensity, and innovation investment on competitiveness. As shown in Figure 5, the annual profits index, annual sales index, carbon emission intensity index, and innovation investment index were determined by the company’s own level, the advanced level of the industry, and the weight of each index. The advanced level of the industry was determined according to the levels of the leading cement companies. The weights of individual competitiveness indexes refer to Gao [53] (Table 1). Then individual indexes were normalized the competitiveness index calculated.

Figure 5.

Composition of competitiveness index.

Table 1.

Weights of individual competitiveness indexes.

The relevant functions of the competitiveness index are as follows:

- Competitiveness index of the cement company = annual profits index+ annual sales index + innovation investment index + carbon emission intensity index

- Annual profits index = (annual profits/advanced level of annual profits) * weight of annual profits

- Annual sales index = (cement sales rate/advanced level of annual sales) * weight of annual sales

- Innovation investment index = (innovation investment/advanced level of Innovation investment) * weight of innovation investment

- Carbon emission intensity index = (advanced level of carbon emission intensity/cement carbon emissions intensity) * weight of carbon emission intensity

4. Case Study

4.1. Case Description

A case study was conducted using the proposed system dynamics modeling methodology. In the case study, the competitiveness of a cement company (T Cement) with a large market share in Guangdong Province, China, was studied. The study period was from 2018 to 2030, with a time step of one year. The data in the case study were obtained from the China Statistical Yearbook, China Electricity Yearbook, policy documents issued by the Department of Ecology and Environment and Guangdong Carbon Emission Trading Exchange, industry technical standards for energy conservation and emission reduction, and the annual reports and annual social responsibility reports of T Cement. Parameter setting is detailed in Appendix B. Annual data for the two leading companies—H Cement and J Cement—were also collected to calculate the competitiveness index.

The parameters related to cement production were taken from all the production lines of T Cement in Guangdong Province, as shown in Table 2. The benchmark value of carbon quota benchmark allocation in ETS of Guangdong Province was 0.884, and the annual decline factor of the benchmark value was 0.99. According to the company’s annual report, T Cement’s annual innovation investment rate was 1.5% of the accumulated profits.

Table 2.

Production data of T Cement.

4.2. Model Development and Validation

After setting the parameters, a computational model was developed using VENSIM software. To validate the model, first, the intuitionistic test and the unit test were conducted using the test function in the VENSIM software, and the model passed both tests. Additionally, a baseline scenario (Scenario 0) was developed based on real-world data. The simulation results from the baseline scenario (i.e., the annual costs, annual revenue, and annual profit) were compared with the real data of T Cement company for 2018–2021 as a test of authenticity. As shown in Table 3, the test results showed that the deviations between the simulated results and real-world values did not exceed 5%. This proves that the model is an accurate representation of the real world.

Table 3.

Authenticity test.

4.3. Simulation Experiments Design

Simulation experiments were designed and conducted to investigate the effects of benchmark value and innovation investment rate on a cement company’s competitiveness. Multiple scenarios were generated. In the first set of experiments, the annual decline factor of 0.99 in the baseline scenario was changed to 0.97 and 0.95 in Scenarios 1 and 2, respectively. In 2022, four Chinese ministries and commissions jointly issued the “Guide to the Implementation of Energy-saving and Carbon-reducing Renovation and Upgrading System in the Cement Industry”. The guide explicitly requires that by 2025, the proportion of clinker capacity above the benchmark energy efficiency will reach 30%, and clinker capacity below the benchmark energy efficiency will be eliminated. This means that the requirements for cement companies to save energy and reduce carbon emissions will be gradually increased, and the free quota will be reduced. This set of simulation experiments could test the impacts of increasingly stringent carbon quota benchmarks on cement companies.

In the second set of experiments, the innovation investment rate in the baseline scenario was changed in Scenarios 3 and 4 to study the effects of additional innovation investment. Most of the leading cement companies put forward plans to increase innovation investment under the pressure of energy consumption control [54]. Therefore, in order to analyze the impact of changes in innovation investment on the competitiveness of companies, Scenarios 3 and 4 set the investment rate to increase by 1.8% and 2%, respectively. In both scenarios, the annual decline factor remained unchanged.

According to the emission-reduction technology roadmap and the emission-reduction measures of large cement enterprises in China, nine common emission reduction technologies with high emission reduction potential were identified and summarized in Table 4. Then, based on the study of Price and Tan et al. [51,52], the unit investment and the emission reduction of each technology were derived. These technologies were ranked based on their cost-effectiveness, and will be employed in order when additional investment is available.

Table 4.

Investment and potential of emission-reduction technologies.

In the last set of experiments (Scenarios 5 and 6), both the decline factor and investment rate were adjusted simultaneously to test their compound effects, with Scenario 6 having a larger adjustment than Scenario 5. The specific information of all the scenarios is summarized in Table 5.

Table 5.

Scenario design for the system dynamics model.

4.4. Results and Discussion

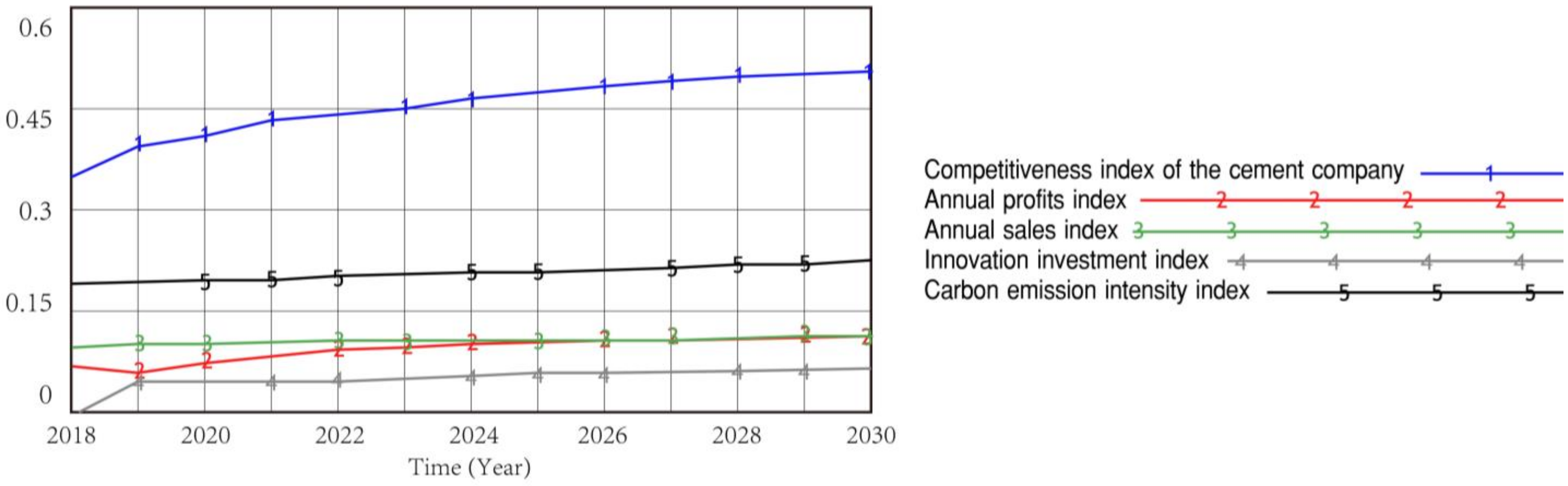

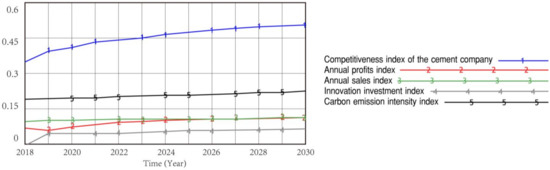

Firstly, the simulation results under the baseline scenario are shown in Figure 6. According to the definition of the competitiveness index, the larger the competitiveness index, the closer to 1, the stronger the competitiveness of a cement company. From Figure 6, it can be seen that there is an increase in the competitiveness index over time due to the implementation of carbon trading policies. This means that benchmark allocation has a positive impact on the competitiveness of cement companies. Specifically, there is no significant change in the annual sales index. The annual profits index decreases in the first year and maintains an increasing trend in 2019–2024. It contributes significantly to the growth of the competitiveness index by 2024. After 2024, the innovation investment index and the carbon emissions intensity index show a slight upward trend. The growth of the competitiveness index in this period is mainly due to these two indexes, although they rise slowly.

Figure 6.

Diagram of competitiveness index of the cement company under the benchmark scenario.

Therefore, explicit competitiveness, represented by annual profits and annual sales, significantly reflects a company’s production capacity and marketing capability and maintains the company’s competitiveness trend in the first five years. There is also implicit competitiveness represented by a company’s innovation investment and carbon emissions intensity, which characterizes its innovation capacity and clean production capacity. In the context of carbon neutrality, benchmark values will continue to tighten. Cement companies will strive to improve their low-carbon levels and sustainability under the stimulus of benchmark allocation. Therefore, implicit competitiveness is becoming increasingly important after implementing the benchmark allocation, and in the long run, it will profoundly influence a company’s overall competitiveness.

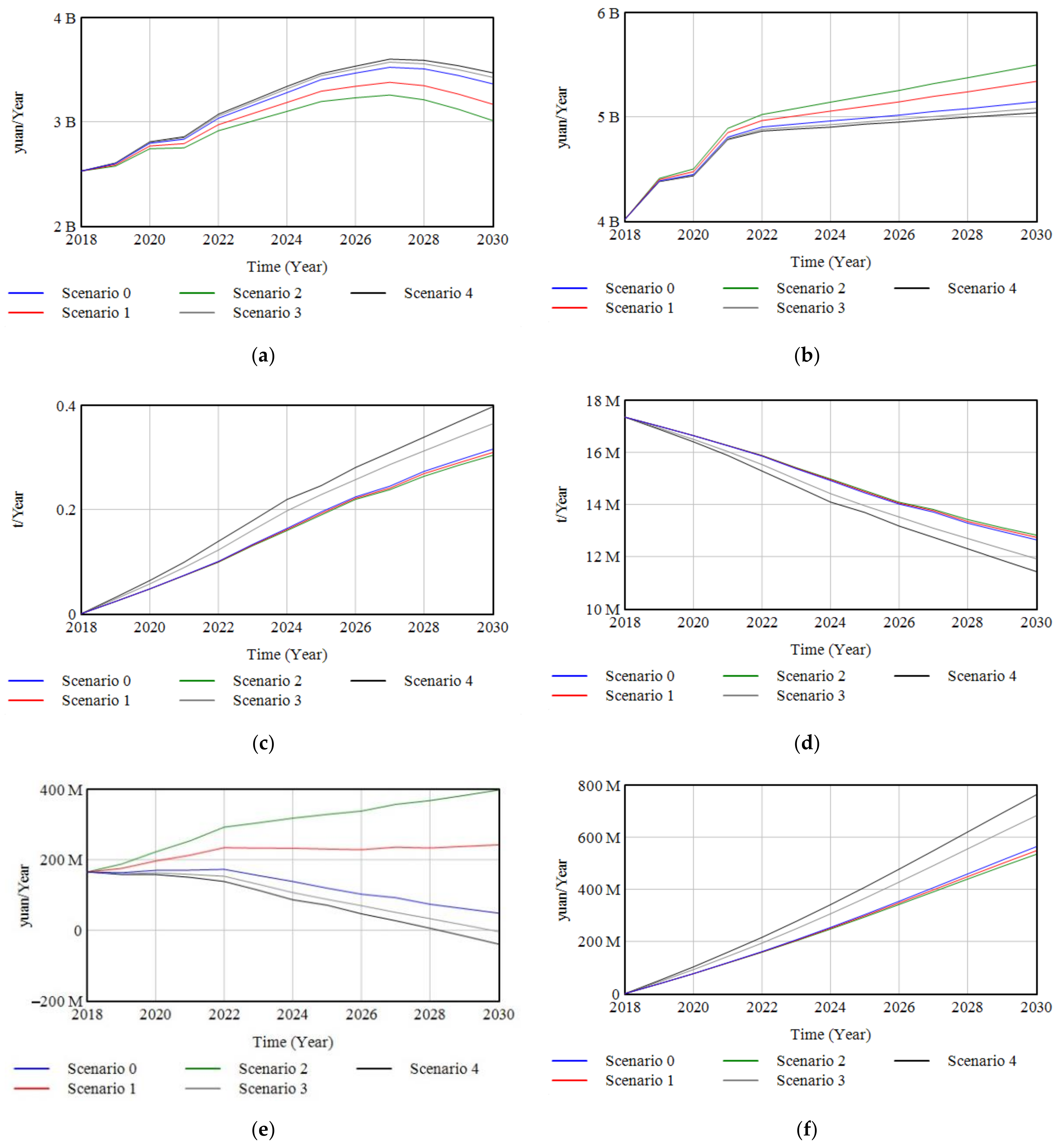

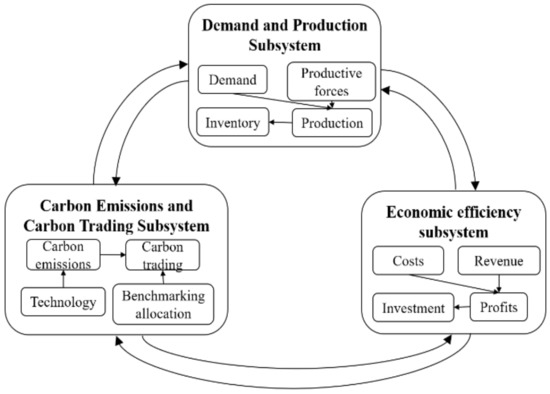

4.4.1. Simulation Results and Analysis of Single Scenarios

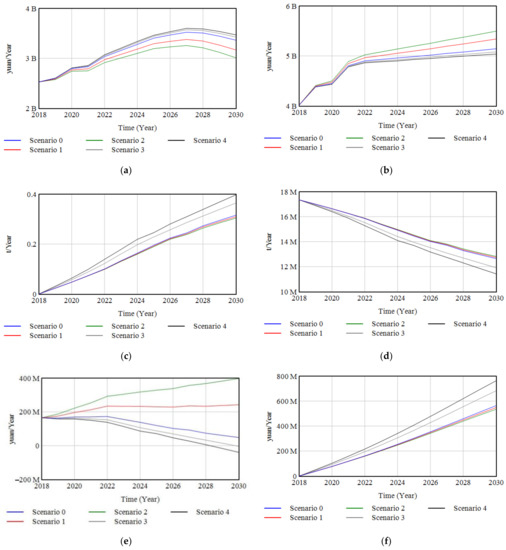

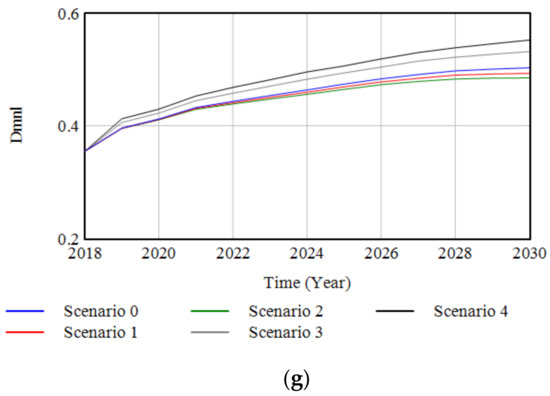

Figure 7a–g show the simulation results of the first and second sets of scenarios. The annual profits, annual costs, emission reduction per ton of clinker, annual CO2 emissions, annual carbon trading costs, innovation investment, and competitiveness index under Scenarios 1–4 were presented and compared with the baseline scenario. In all scenarios, annual costs trend upward as raw material and fuel prices rise (Figure 7b). Annual profits trend upward until 2027, and then appear to have a downward trend (Figure 7a). The main reason is that the demand for cement decreases after 2027, resulting in lower annual sales and annual revenue.

Figure 7.

Variation of indicators in a single scenario. (a) Annual profits; (b) annual costs; (c) emission reduction per ton of clinker; (d) annual CO2 emissions; (e) annual carbon trading costs; (f) innovation investment; (g) competitiveness index of the cement company.

In Scenarios 1 and 2, the benchmark value decreases as the annual decline factor decreases, leading to a reduction in free quota and a widening of the gap between carbon emissions and free quota. Therefore, the carbon trading costs rise with the increase in carbon price (Figure 7e). This results in a higher total cost than other scenarios. Annual CO2 emissions do not change noticeably from the baseline scenario when the benchmark value decreases (Figure 7d). Compared to the baseline scenario (the annual decline factor of 0.99), by 2030, the competitiveness index will decrease by 1.9% at an annual decline factor of 0.97, and rapidly decrease by 3.6% at an annual decline factor of 0.95. The reason might be that, in the face of rapid tightening benchmarks, the company is under unaffordable economic pressure and needs to temporarily reduce investment in abatement projects. This is detrimental to the company’s competitiveness and the achievement of emission-reduction targets. So the annual decline factor of the benchmark value should have a lower limit. In view of the decrease in the competitiveness index, the annual decline factor of 0.97–0.99 is appropriate.

In Scenarios 3 and 4, the investment rate rises, and there is a significant increase in innovation investment compared to the other three scenarios (Figure 7f). The higher the rate of innovation investment, the more emission reductions per unit of clinker and the lower the annual CO2 emissions (Figure 7c,d). This might be primarily due to the gradual introduction of CCUS technology. CCUS technology is effective in reducing CO2 emissions, but the investment is high (Table 4). With the increase in innovation investment rate, the cement company will gradually introduce CCUS technology, which could bring significant effect on emission reduction. Moreover, the gap between carbon emissions and free quota will decrease, leading to a decrease in carbon trading costs (Figure 7e). After 2028, the carbon trading costs are even negative. That is, the annual CO2 emissions of the company are less than the free quota, and the company could sell this allowance of carbon emissions to the carbon trading market for extra earnings. This is the key reason why annual profits are higher and annual costs are lower in Scenario 4 than in other scenarios.

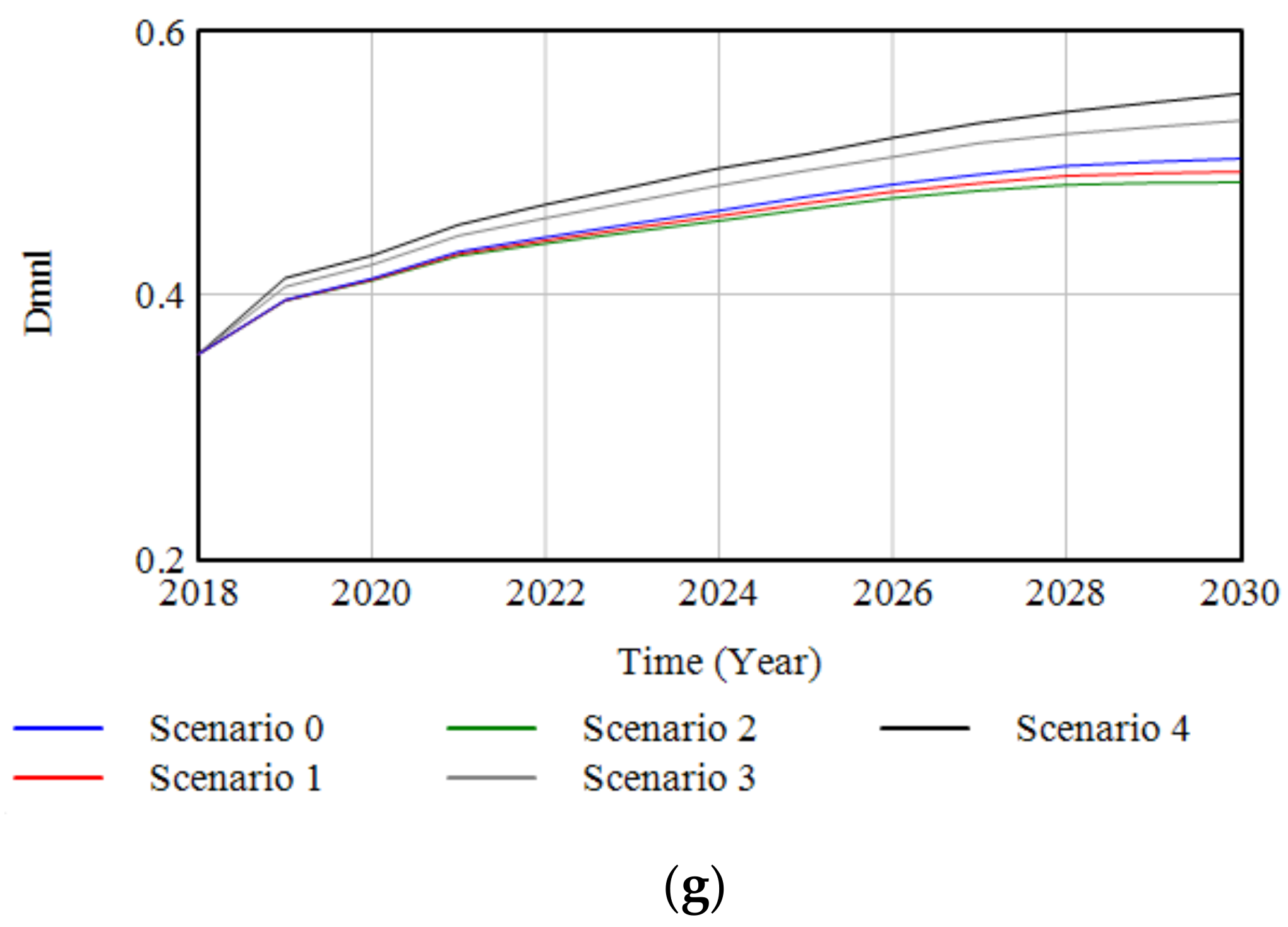

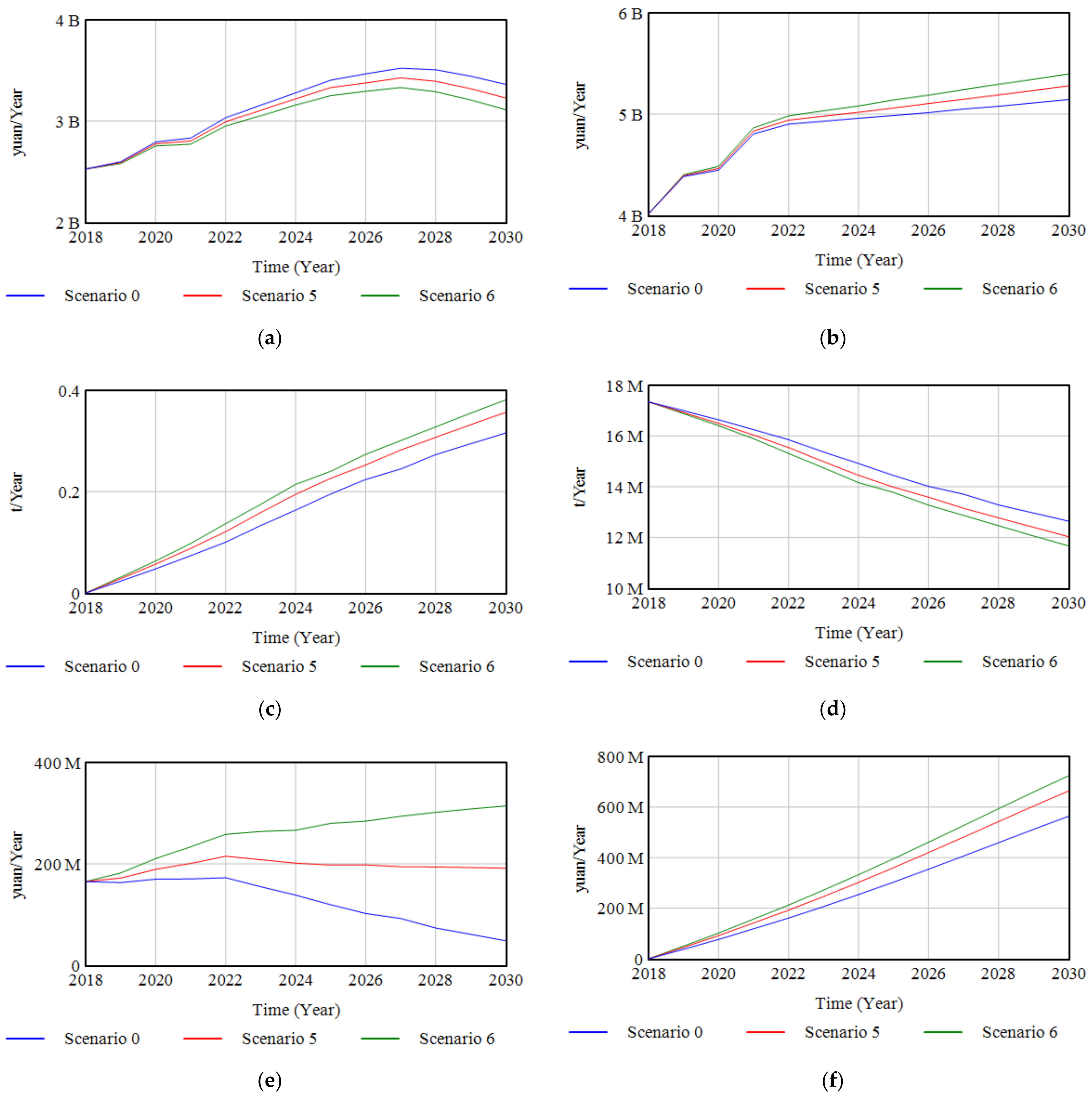

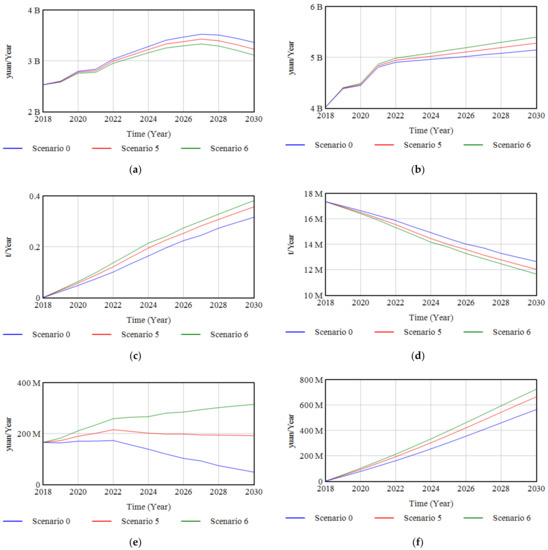

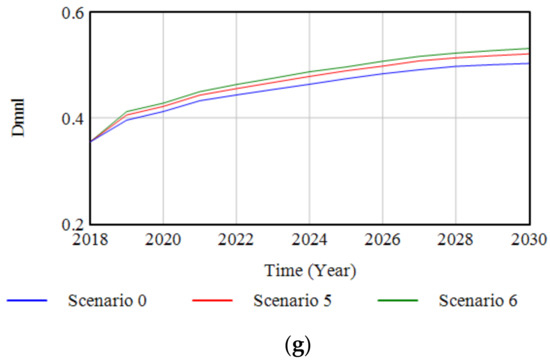

4.4.2. Simulation Results and Analysis of Combined Scenarios

The plots in Figure 8a–g show the simulation results of seven indicators from the third set of experiments under the combined scenarios, compared with the baseline scenario. Scenario 5 is the scenario in which the annual decline factor of the benchmark value and innovation investment rate adjust simultaneously but to a smaller extent than in Scenario 6. The curves representing Scenario 5 all lie between the other two curves representing the baseline scenario and Scenario 6 (Figure 8a–g). In particular, it can be seen from Figure 8e that the annual carbon trading costs tend to stabilize after 2022 under this scenario. This is because with the innovation investment rate of 1.8% and the annual decline factor of 0.97, the reduction in carbon emissions due to emerging technologies is approximately the same as the reduction in carbon quota due to the decrease in the benchmark value. In this case, the annual carbon trading costs would not fluctuate too much, which provides cement companies with some time to adapt to new environmental policies. This is another reason why an annual decline factor of 0.97–0.99 is appropriate.

Figure 8.

Variation of indicators in combined scenarios. (a) Annual profits; (b) annual costs; (c) emission reduction per ton of clinker; (d) annual CO2 emissions; (e) annual carbon trading costs; (f) innovation investment; (g) competitiveness index of the cement company.

Scenario 6 is the scenario with the lowest annual decline factor of the benchmark value and the highest innovation investment rate among the three scenarios. The comparison shows that the 2% innovation investment rate leads to the lowest annual CO2 emissions (Figure 8d). However, since the reduced carbon emissions cannot make up for the reduced free quota, the carbon trading costs tend to rise and then level off (Figure 8e). Although Scenario 6 has the highest carbon trading costs, the competitiveness index is the highest among these three scenarios (Figure 8g). The reduction in carbon intensity and increased innovation investment in Scenario 6 greatly enhances the company’s competitiveness.

Table 6 shows the competitiveness index of all the scenarios over time. It shows that the scenario with the highest innovation investment rate—Scenario 4—has the highest competitiveness index among all scenarios. This indicates that an increase in innovation investment is a critical factor in improving the competitiveness of the cement company. Not only is the innovation investment index part of the competitiveness index, but innovation investment effectively reduces the carbon intensity of products and the costs of carbon trading.

Table 6.

Competitiveness index of the cement company.

5. Conclusions

This study investigates the impact of the annual decline factor of benchmark value and innovation investment on the competitiveness of cement companies using a system dynamics model. The conclusions and recommendations are as follows.

First, the competitiveness of cement companies includes both explicit competitiveness, such as profits and sales, and implicit competitiveness, such as carbon emissions intensity and innovation investment. Cement companies with lower carbon intensity have low-carbon competitiveness, which would help them gain an advantage in industry competition. This advantage becomes more and more significant as the benchmark value gradually declines. Implicit competitiveness represents the level of sustainable development to a certain extent, and profoundly affects the overall competitiveness of cement companies.

Second, setting reasonable carbon reduction targets and lowering the benchmark value would enhance the competitiveness of cement companies. The rapid decline in the benchmark value leads to a rapid rise in carbon trading costs, which could bring tremendous economic pressure to cement companies. This can even discourage companies from investing in emission-reduction equipment and other advanced equipment, which is detrimental to competitiveness. The government should set a fair and economical decline factor of the benchmark value (0.97–0.99 is appropriate) according to the actual situation of the emission-controlled industry. This not only puts appropriate financial pressure on cement companies, but also stimulates them to make additional investments to reduce carbon emissions, achieving a win–win for business and the environment.

Finally, cement companies should promote investment in emission reduction in multiple phases. Against the background of structural adjustment in the cement industry, the scale of the leading companies is expanding, driving the industry to gradually improve production levels and emission-reduction levels. Cement companies that aim to improve competitiveness are bound to keep up with the industry’s leading levels and promote innovation investment in multiple stages. Innovation investment not only reflects competitiveness but also affects carbon intensity and trading costs. Cement companies should introduce, in a timely manner, technologies with high potential for emission reduction, such as alternative fuels and CCUS, to enhance low-carbon competitiveness and achieve cleaner production.

The limitation of this paper is that several assumptions in the SD model are slightly simplistic. Accordingly, we will provide examples on how to address them in the future. For future research, additional case studies and other greenhouse gases emissions in cement production can also be further discussed.

Author Contributions

Conceptualization, M.Z.; methodology, J.D., M.Z., and J.Z.; software, M.Z.; validation, J.D. and J.Z.; formal analysis, J.D. and J.Z.; investigation, M.Z.; data curation, M.Z.; writing—original draft preparation, M.Z.; writing—review and editing, J.D. and J.Z.; supervision, J.Z.; All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data used to support the findings of this study are available from the corresponding author upon reasonable request.

Conflicts of Interest

The authors declare that they have no conflict of interest.

Appendix A. Model Equations

All equations in the system dynamics model are as follows:

The demand and production subsystem

(01) Total demand of the region = WITH LOOKUP (Time, ([(2018,1.482 × 108)-(2030,1.58983 × 108)],(2018,1.482 × 108),(2019,1.671 × 108),(2020,1.708 × 108),(2021,1.701 × 108),(2022, 1.70636 × 108),(2023,1.70435 × 108),(2024,1.69966 × 108),(2025,1.69363 × 108),(2026,1.67689 × 108),(2027,1.65881 × 108),(2028,1.63805 × 108),(2029,1.61528 × 108),(2030,1.58983 × 108)))

(02) Market share factor = 0.12

(03) Cement demand = Total demand of the region * Market share factor

(04) Cement inventory = INTEG (Cement production rate—Cement sales rate, 24,000)

(05) Clinker inventory = INTEG (Clinker production rate—Cement production rate * 0.74, 40,000)

(06) Raw material inventory = INTEG (Raw material grinding rate—Clinker production rate * 1.6, 20,000)

(07) Cement grinding capacity = 64,000

(08) Kiln capacity = 47,500

(09) Raw material grinding capacity = 76,000

(10) Days of production = 310

(11) Additives = Cement grinding capacity * 0.3

(12) Raw material grinding rate = Days of production * Raw material grinding capacity

(13) Clinker production rate = IF THEN ELSE(Raw material inventory > 0, Days of production * Kiln capacity, 0)

(14) Cement production rate = IF THEN ELSE(Clinker inventory > 0:AND: Additives > 0, Days of production * Cement grinding capacity, 0)

(15) Cement sales rate = IF THEN ELSE(Cement inventory > 0, MIN(Cement production rate, Cement demand),0)

(16) Electricity consumption = Clinker production rate * 19 + Clinker production rate * 29 + Cement production rate * 34− Electricity generation

(17) Electricity generation = WITH LOOKUP (Investment in electricity generation, ([(0,0)-(6 × 108,2.626 × 108)],(0,0),(1 × 108,3.835 × 107),(2 × 108,7.865 × 107),(3 × 108,1.209 × 108), (4 × 108,1.664 × 108), (5 × 108,2.132 × 108),(6 × 108,2.626 × 108)))

(18) Number of workers = 900

The economic efficiency subsystem

(19) Annual profits = Annual revenue—Annual costs

(20) Annual costs = Labor costs + Raw material costs + Fuel costs + Electricity costs + Annual carbon trading costs + Management costs + Operation and maintenance costs

(21) Labor costs = Worker labor costs + Training and learning costs

(22) Raw material costs = Additive unit price * Additives + Raw material unit price * Raw material grinding rate

(23) Fuel costs = Coal consumption per ton of clinker * Clinker production rate * Fuel unit price

(24) Electricity costs = Electricity consumption * Electricity unit price

(25) Annual carbon trading costs = (Annual CO2 emissions—Free quota) * CO2 unit price + Penalty amount

(26) Management costs = Number of workers * Management costs rate

(27) Operation and maintenance costs = Cement sales rate * Operation and maintenance costs rate

(28) Annual revenue = Carbon reduction incentives + Sales revenue

(29) Carbon reduction incentives = IF THEN ELSE (Cement carbon emissions intensity < 0.5, 500,000, 0)

(30) Sales revenue = Cement unit price * Cement sales rate

(31) Training and learning price per person = 1000

(32) Salary per person = 80,000

(33) Innovation investment = Cumulative profits * Investment rate

(34) Investment in emission-reduction technology = Innovation investment * 0.7

(35) Investment in electricity generation = Innovation investment * 0.3

(36) Investment rate = 0.015

(37) Coal consumption per ton of clinker = 0.108

(38) Worker labor costs = Salary per person * Number of workers

(39) Training and learning costs = Training and learning price per person * Number of workers

(40) Cement unit price = WITH LOOKUP (Time, ([(2018,368)-(2030,446)], (2018,368),(2019,352), (2020,365),(2021,385),(2022,400),(2025,423),(2030,446)))

(41) Additive unit price = 63

(42) Fuel unit price = WITH LOOKUP (Time, ([(2018,895)-(2030,1700)], (2018,895),(2019,1127), (2020,1164),(2021,1389),(2022,1450),(2030,1700)))

(43) Raw material unit price = 42

(44) Electricity unit price = 0.73

(45) CO2 unit price = WITH LOOKUP (Time, ([(2018,43)-(2030,72)], (2018,43),(2019,45), (2019.91,49.6),(2021,54.2),(2022,60),(2030,72)))

(46) Management costs rate = 1200

(47) Operation and maintenance costs rate = 8.9

(48) Cumulative carbon trading costs = INTEG (Annual carbon trading costs,0)

(49) Cumulative profits = INTEG (Annual profits,0)

The carbon emission and carbon trading subsystem

(50) Total CO2 emissions = INTEG (Annual CO2 emissions,0)

(51) Annual CO2 emissions = Clinker calcination emissions + Fuel combustion emissions + Indirect emissions due to—Emission reduction per ton of clinker * Clinker production rate

(52) Clinker calcination emissions = CO2 emissions factor 1 * Clinker production rate

(53) Fuel combustion emissions = CO2 emissions factor 2 * Clinker production rate

(54) Indirect emissions due to electricity = CO2 emissions factor 3 * Electricity generation

(55) CO2 emissions factor 1 =0.65

(56) CO2 emissions factor 2 = 0.44

(57) CO2 emissions factor 3 = 0.0008042

(58) Free quota = Benchmark value 1* Clinker production rate + Benchmark value 2 * Cement production rate

(59) Benchmark value 1 = 0.884 * Annual decline factor ^(Time-2018)

(60) Benchmark value 2 = 0.025* Annual decline factor ^(Time-2018)

(61) Annual decline factor = 0.99

(62) Emission reduction per ton of clinker = WITH LOOKUP (Investment in emission-reduction technology, ([(0,0)-(7.717 × 108,0.536)], (0,0),(1.0716 × 108,0.095),(1.3566 × 108,0.122), (1.4136 × 108,0.13),(2.36835 × 108,0.218),(2.82435 × 108,0.243),(2.8842 × 108,0.248),(3.12645 × 108, 0.268),(3.29745 × 108,0.278),(7.717 × 108,0.536)))

(63) Cement carbon emissions intensity = Annual CO2 emissions/Cement production rate

(64) Clinker carbon emissions intensity = Annual CO2 emissions/Clinker production rate

(65) Penalty amount = IF THEN ELSE(Cement carbon emissions intensity > 0.72, 500,000, 0)

Others

(66) Competitiveness index of the cement company = Annual profits index+ Annual sales index + Innovation investment index + Carbon emission intensity index

(67) Annual profits index= (Annual profits/Advanced level of annual profits) * Weight of annual profits

(68) Advanced level of annual profits = WITH LOOKUP (Time, ([(2018,7 × 109)-(2030,2 × 1010)],(2018,9.42939 × 109),(2019,1.1013 × 1010),(2020,9.61939 × 109),(2021,8.14308 × 109),(2022,8.16872 × 109),(2023,8.15911 × 109),(2024,8.13667 × 109),(2025,8.10781 × 109),(2026,8.02766 × 109),(2027,7.9411 × 109),(2028,7.84172 × 109),(2029,7.73272 × 109),(2030,7.61089 × 109)))

(69) Weight of annual profits = 0.25

(70) Annual sales index = (Cement sales rate/Advanced level of annual sales) * Weight of annual sales

(71) Advanced level of annual sales = WITH LOOKUP (Time, ([(0,0)-(3000,8 × 107)], (2018,6.797 × 107),(2019,7.42 × 107),(2020,7.137 × 107),(2021,7.014 × 107),(2022,7.03609 × 107),(2023,7.02781 × 107),(2024,7.00848 × 107),(2025,6.98362 × 107),(2026,6.91459 × 107), (2027,6.84003 × 107),(2028,6.75443 × 107),(2029,6.66054 × 107),(2030,6.5556 × 107)))

(72) Weight of annual sales = 0.37

(73) Innovation investment index = (Innovation investment/Advanced level of Innovation investment) * Weight of innovation investment

(74) Advanced level of innovation investment = WITH LOOKUP (Time, ([(2018,0)-(2030,2 × 109)],(2018,0.1),(2019,1.41441 × 108),(2020,3.06636 × 108),(2021,4.50927 × 108),(2022,5.73073 × 108),(2023,6.95604 × 108),(2024,8.17991 × 108),(2025,9.40041 × 108),(2026,1.06166 × 109),(2027,1.18207 × 109),(2028,1.30119 × 109),(2029,1.41882 × 109),(2030,1.53481 × 109)))

(75) Weight of innovation investment = 0.17

(76) Carbon emission intensity index = (Advanced level of carbon emission intensity/Cement carbon emissions intensity) * Weight of carbon emission intensity

(77) Advanced level of carbon emission intensity = 0.795-RAMP(0.01, 2018, 2030)

(78) Weight of carbon emission intensity = 0.21

Appendix B. Parameters Setting

The parameters in the system dynamics model are valued and described as follows:

Table A1.

The parameters of demand and production subsystem.

Table A1.

The parameters of demand and production subsystem.

| Parameter | Value | Unit | Source |

|---|---|---|---|

| Total demand of the region | Table functions in Appendix A | t/year | China Statistical Yearbook, Zhang et al. [50] |

| Market share factor | 0.12 | - | T Cement company data |

| Raw material grinding capacity | 76,000 | t/d | T Cement company data |

| Kiln capacity | 47,500 | t/d | T Cement company data |

| Cement grinding capacity | 64,000 | t/d | T Cement company data |

| Clinker-cement ratio | 0.74 | - | T Cement company data |

| Raw material-clinker ratio | 1.60 | - | T Cement company data |

| Days of production | 310 | d/year | T Cement company data |

| Number of workers | 900 | people | T Cement company data |

| Electricity consumption of raw material grinding | 19 | kWh/t | Industry average, the norm of energy consumption per unit product of cement (GB16780-2021) |

| Electricity consumption of clinker calcination | 29 | kWh/t | Industry average, the norm of energy consumption per unit product of cement (GB16780-2021) |

| Electricity consumption of cement production | 34 | kWh/t | Industry average, the norm of energy consumption per unit product of cement (GB16780-2021) |

| Electricity generation | Table functions in Appendix A | kWh/year | Lu et al. [55] |

Table A2.

The parameters of economic efficiency subsystem.

Table A2.

The parameters of economic efficiency subsystem.

| Parameter | Value | Unit | Source |

|---|---|---|---|

| Training and learning price per person | 1000 | yuan/people·year | T Cement company data |

| Salary per person | 80.000 | yuan/people·year | T Cement company data |

| Management costs rate | 1200 | yuan/people·year | T Cement company data |

| Coal consumption per ton of clinker | 0.108 | tce/t | Industry average, the norm of energy consumption per unit product of cement (GB16780-2021) |

| Investment rate | 0.015 | - | T Cement company data |

| Additive unit price | 63 | yuan/t | Average market price |

| Raw material unit price | 42 | yuan/t | Average market price |

| Electricity unit price | 0.73 | yuan/kWh | Electricity price list of Guangdong Province |

| CO2 unit price | Table functions in Appendix A | yuan/t | Guangzhou Carbon Emissions Rights Exchange |

| Cement unit price | Table functions in Appendix A | yuan/t | China Cement Association |

| Fuel unit price | Table functions in Appendix A | yuan/t | China Coal Economic Network |

| Operation and maintenance costs rate | 8.9 | yuan/t·year | T Cement company data |

Table A3.

The parameters of carbon emission and carbon trading subsystem.

Table A3.

The parameters of carbon emission and carbon trading subsystem.

| Parameter | Value | Unit | Source |

|---|---|---|---|

| CO2 emissions factor 1 | 0.65 | - | Industry research data, Tan et al. [56] |

| CO2 emissions factor 2 | 0.44 | - | Industry research data, Tan et al. [56] |

| CO2 emissions factor 3 | 0.0008042 | tCO2/kWh | China Electricity Yearbook |

| Benchmark value 1 | 0.884 | tCO2/t.cl | Guangzhou Carbon Emissions Rights Exchange |

| Benchmark value 2 | 0.025 | tCO2/t | Guangzhou Carbon Emissions Rights Exchange |

| Annual decline factor | 0.99 | - | Guangzhou Carbon Emissions Rights Exchange |

| Emission reduction per ton of clinker | Table functions in Appendix A | tCO2/t.cl | Price, Tan et al. [51,52] |

Table A4.

Other parameters.

Table A4.

Other parameters.

| Parameter | Value | Unit | Source |

|---|---|---|---|

| Weight of annual profits | 0.25 | - | Gao [53] |

| Weight of annual sales | 0.37 | - | Gao [53] |

| Weight of innovation investment | 0.17 | - | Gao [53] |

| Weight of carbon emission intensity | 0.21 | - | Gao [53] |

| Advanced level of annual profits | Table functions in Appendix A | yuan/year | H and J Company data |

| Advanced level of annual sales | Table functions in Appendix A | t/year | H and J Company data |

| Advanced level of innovation investment | Table functions in Appendix A | yuan/year | H and J Company data |

| Advanced level of carbon emission intensity | Table functions in Appendix A | tCO2/year | H and J Company data |

References

- Tang, L.; Wang, H.; Li, L.; Yang, K.; Mi, Z. Quantitative models in emission trading system research: A literature review. Renew. Sustain. Energy Rev. 2020, 132, 110052. [Google Scholar] [CrossRef]

- IPCC. AR6 Climate Change 2021: The Physical Science Basis; Intergovernmental Panel on Climate Change: Geneva, Switzerland, 2021. [Google Scholar]

- Wang, A.; Cao, S.; Yilmaz, E. Influence of types and contents of nano cellulose materials as reinforcement on stability performance of cementitious tailings backfill. Constr. Build. Mater. 2022, 344, 128179. [Google Scholar] [CrossRef]

- Luo, Y.; Li, X.; Qi, X.; Zhao, D. The impact of emission trading schemes on firm competitiveness: Evidence of the mediating effects of firm behaviors from the guangdong ETS. J. Environ. Manag. 2021, 290, 112633. [Google Scholar] [CrossRef] [PubMed]

- Peasco, C.; Anadón, L.; Verdolini, E. Systematic review of the outcomes and trade-offs of ten types of decarbonization policy instruments. Nat. Clim. Change 2021, 11, 274. [Google Scholar] [CrossRef]

- Peace, J.; Juliani, T. The coming carbon market and its impact on the American economy. Policy Soc. 2017, 27, 305–316. [Google Scholar] [CrossRef]

- Akan, M.O.A.; Dhavale, D.G.; Sarkis, J. Greenhouse gas emissions in the construction industry: An analysis and evaluation of a concrete supply chain. J. Clean. Prod. 2017, 167, 1195–1207. [Google Scholar] [CrossRef]

- Wang, Q.; Xu, X.; Liang, K. The impact of environmental regulation on firm performance: Evidence from the Chinese cement industry. J. Environ. Manag. 2021, 299, 113596. [Google Scholar] [CrossRef]

- Technology Roadmap-Low-Carbon Transition in the Cement Industry; International Energy Agency: Paris, France; World Business Council For Sustainable Development (WBCSD): Geneva, Switzerland, 2016.

- Wu, Q.; Ma, Z.; Meng, F. Long-term impacts of carbon allowance allocation in China: An IC-DCGE model optimized by the hypothesis of imperfectly competitive market. Energy 2022, 241, 122907. [Google Scholar] [CrossRef]

- Demailly, D.; Quirion, P. CO2 abatement, competitiveness and leakage in the European cement industry under the EU ETS: Grandfathering versus output-based allocation. Clim. Policy 2006, 6, 93–113. [Google Scholar] [CrossRef]

- Peng, H.; Qi, S.; Cui, J. The environmental and economic effects of the carbon emissions trading scheme in China: The role of alternative allowance allocation. Sustain. Prod. Consum. 2021, 28, 105–115. [Google Scholar] [CrossRef]

- Lyon, R.M. Equilibrium properties of auctions and alternative procedures for allocating transferable permits. J. Environ. Econ. Manag. 1986, 13, 129–152. [Google Scholar] [CrossRef]

- Zetterberg, L. Benchmarking in the European Union Emissions Trading System: Abatement incentives. Energy Econ. 2014, 43, 218–224. [Google Scholar] [CrossRef]

- Huebler, M.; Voigt, S.; Loeschel, A. Designing an emissions trading scheme for China—An up-to-date climate policy assessment. Energy Policy 2014, 75, 57–72. [Google Scholar] [CrossRef]

- Ellerman, A.; Marcantonini, C.; Zaklan, A. The EU ETS: Eight Years and Counting; Social Science Electronic Publishing: New York, NY, USA, 2014. [Google Scholar]

- Dai, F.; Xiong, L.; Ma, D. How to Set the Allowance Benchmarking for Cement Industry in China’s Carbon Market: Marginal Analysis and the Case of the Hubei Emission Trading Pilot. Sustainability 2017, 9, 322. [Google Scholar] [CrossRef]

- Sartor, O.; Palliere, C.; Lecourt, S. Benchmark-based allocations in EU ETS Phase 3: An early assessment. Clim. Policy 2014, 14, 507–524. [Google Scholar] [CrossRef]

- Branger, F.; Sato, M. Solving the Clinker Dilemma with Hybrid Output-based Allocation. Clim. Change Sustain. Dev. 2017, 140, 483–501. [Google Scholar] [CrossRef]

- Cong, R.; Wei, Y. Potential impact of (CET) carbon emissions trading on China’s power sector: A perspective from different allowance allocation options. Energy 2010, 35, 3921–3931. [Google Scholar] [CrossRef]

- Yang, W.; Pan, Y.; Ma, J.; Yang, T.; Ke, X. Effects of allowance allocation rules on green technology investment and product pricing under the cap-and-trade mechanism. Energy Policy 2020, 139, 111333. [Google Scholar] [CrossRef]

- Arlinghaus, J. Impacts of Carbon Prices on Indicators of Competitiveness: A Review of Empirical Findings; OECD Environment Working Papers No. 87; OECD: Paris, France, 2015. [Google Scholar]

- Zhang, Y.; Wang, A.; Tan, W. The impact of China’s carbon allowance allocation rules on the product prices and emission reduction behaviors of ETS-covered enterprises. Energy Policy 2015, 86, 176–185. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Yu, P.; Hao, R.; Cai, Z.; Sun, Y.; Zhang, X. Does emission trading system achieve the win-win of carbon emission reduction and financial performance improvement?—Evidence from Chinese A-share listed firms in industrial sector. J. Clean. Prod. 2022, 333, 130121. [Google Scholar] [CrossRef]

- Xiao, J.; Li, G.; Zhu, B.; Xie, L.; Huang, J. Evaluating the impact of carbon emissions trading scheme on Chinese firms’ total factor productivity. J. Clean. Prod. 2021, 306, 127104. [Google Scholar] [CrossRef]

- Wang, C.; Wang, Z.; Ke, R.Y.; Wang, J. Integrated impact of the carbon quota constraints on enterprises within supply chain: Direct cost and indirect cost. Renew. Sustain. Energy Rev. 2018, 92, 774–783. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, X.; Chen, F. Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Change 2021, 168, 120744. [Google Scholar] [CrossRef]

- Zhang, H.; Duan, M. China’s pilot emissions trading schemes and competitiveness: An empirical analysis of the provincial industrial sub-sectors. J. Environ. Manag. 2020, 258, 109997. [Google Scholar] [CrossRef]

- Smale, R.; Hartley, M.; Hepburn, C.; Ward, J.; Grubb, M. The impact of CO2 emissions trading on firm profits and market prices. Clim. Policy 2006, 6, 31–48. [Google Scholar] [CrossRef]

- Demailly, D.; Quirion, P. European Emission Trading Scheme and competitiveness: A case study on the iron and steel industry. Energy Econ. 2008, 30, 2009–2027. [Google Scholar] [CrossRef]

- Technology Roadmap-Low-Carbon Transition in the Cement Industry; International Energy Agency: Paris, France; World Business Council For Sustainable Development (WBCSD): Geneva, Switzerland, 2018.

- Branger, F.; Quirion, P. Reaping the carbon rent: Abatement and overallocation profits in the European cement industry, insights from an LMDI decomposition analysis. Energy Econ. 2015, 47, 189–205. [Google Scholar] [CrossRef]

- Rolfe, A.; Huang, Y.; Haaf, M.; Pita, A.; Rezvani, S.; Dave, A.; Hewitt, N.J. Technical and environmental study of calcium carbonate looping versus oxy-fuel options for low CO2 emission cement plants. Int. J. Greenh. Gas Control 2018, 75, 85–97. [Google Scholar] [CrossRef]

- Gardarsdottir, S.; Lena, E.D.; Romano, M.; Roussanaly, S.; Cinti, G. Comparison of Technologies for CO2 Capture from Cement Production—Part 2: Cost Analysis. Energies 2019, 12, 542. [Google Scholar] [CrossRef]

- Strunge, T.; Naims, H.; Ostovari, H.; Olfe-Kraeutlein, B. Priorities for supporting emission reduction technologies in the cement sector-A multi-criteria decision analysis of CO2 mineralisation. J. Clean. Prod. 2022, 340, 130712. [Google Scholar] [CrossRef]

- Report of the High-Level Commission on Carbon Pricing and Competitiveness; World Bank Group: Washington, DC, USA, 2019.

- Kunche, A.; Mielczarek, B. Application of System Dynamic Modelling for Evaluation of Carbon Mitigation Strategies in Cement Industries: A Comparative Overview of the Current State of the Art. Energies 2021, 14, 1464. [Google Scholar] [CrossRef]

- Proao, L.; Sarmiento, A.T.; Figueredo, M.; Cobo, M. Techno-economic evaluation of indirect carbonation for CO2 emissions capture in cement industry: A system dynamics approach. J. Clean. Prod. 2020, 263, 121457. [Google Scholar] [CrossRef]

- Yao, X.; Yuan, X.; Yu, S.; Lei, M. Economic feasibility analysis of carbon capture technology in steelworks based on system dynamics. J. Clean. Prod. 2021, 322, 129046. [Google Scholar] [CrossRef]

- Dong, S.; Wang, Z.; Li, Y.; Li, F.; Li, Z.; Chen, F.; Cheng, H. Assessment of Comprehensive Effects and Optimization of a Circular Economy System of Coal Power and Cement in Kongtong District, Pingliang City, Gansu Province, China. Sustainability 2017, 9, 787. [Google Scholar] [CrossRef]

- Ghaffarzadegan, N.; Tajrishi, A.T. Economic transition management in a commodity market: The case of the Iranian cement industry. Syst. Dyn. Rev. 2010, 26, 139–161. [Google Scholar] [CrossRef]

- Suryani, E.; Chou, S.; Hartono, R.; Chen, C. Demand scenario analysis and planned capacity expansion: A system dynamics framework. Simul. Model. Pract. Theory 2010, 18, 732–751. [Google Scholar] [CrossRef]

- Jokar, Z.; Mokhtar, A. Policy making in the cement industry for CO2 mitigation on the pathway of sustainable development—A system dynamics approach. J. Clean. Prod. 2018, 201, 142–155. [Google Scholar] [CrossRef]

- Ansari, N.; Seifi, A. A system dynamics model for analyzing energy consumption and CO2 emission in Iranian cement industry under various production and export scenarios. Energy Policy 2013, 58, 75–89. [Google Scholar] [CrossRef]

- Zhang, W.; Zhang, M.; Wu, S.; Liu, F. A complex path model for low-carbon sustainable development of enterprise based on system dynamics. J. Clean. Prod. 2021, 321, 128934. [Google Scholar] [CrossRef]

- Prahalad, C.K.; Hamel, G. The Core Competence of the Corporation. Harv. Bus. Rev. 1990, 68, 79–91. [Google Scholar]

- Prahalad, C.K.; Hamel, G. The Core Competence of the Corporation. Strateg. Learn. A Knowl. Econ. 2000, 3–22. [Google Scholar]

- Leonardbarton, D.; Deschamps, I. Managerial influence in the implementation of new technology. Manag. Sci. 1988, 34, 1252–1265. [Google Scholar] [CrossRef]

- Zhang, C.Y.; Han, R.; Yu, B.Y.; Wei, Y.M. Accounting process-related CO2 emissions from global cement production under Shared Socioeconomic Pathways. J. Clean. Prod. 2018, 184, 451–465. [Google Scholar] [CrossRef]

- Hasanbeigi, A.; Price, L.; Lu, H.; Lan, W. Analysis of energy-efficiency opportunities for the cement industry in Shandong Province, China: A case study of 16 cement plants. Energy 2010, 35, 3461–3473. [Google Scholar] [CrossRef]

- Tan, Q.; Wen, Z.; Chen, J. Goal and technology path of CO2 mitigation in China’s cement industry: From the perspective of co-benefit. J. Clean. Prod. 2016, 114, 299–313. [Google Scholar] [CrossRef]

- Gao, X. Research on Systematic Evaluation of Enterprise Low Carbon Competitiveness in the Perspective of Carbon Intangible Asset. Ph.D. Thesis, Southwest Jiaotong University, Chengdu, China, 2014. [Google Scholar]

- Ramos, L.C.; Stopiglia, F.S.; de Gouvea, M.T.; Guimaraes, D.H.P.; Dias, A.L.B.; Rosa, M.T.M.G. Efficient and Sustainable Engines: Case Study of a Cement Industry Aiming at Energy Management. Rev. Virtual Quim. 2022, 14, 21–25. [Google Scholar] [CrossRef]

- Lu, Z.; Chen, Y.; Fan, Q. Study on Feasibility of Photovoltaic Power to Grid Parity in China Based on LCOE. Sustainability 2021, 13, 12762. [Google Scholar] [CrossRef]

- Cao, Z.; Shen, L.; Zhao, J.; Liu, L.; Zhong, S.; Sun, Y.; Yang, Y. Toward a better practice for estimating the CO2 emission factors of cement production: An experience from China. J. Clean. Prod. 2016, 139, 527–539. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).