Analytical Implications of Mortgage Lending Value and Bottom Value

Abstract

:1. Introduction

- The property income is equal to the sum of land income and building income;

- The land’s income is independent of the property usage;

- The incomes are levelled in time (land and property) in accordance with the estimative principle of the “Permanence of the Conditions”;

- The cost and time implications of building demolition are negligible.

2. Literature Review

3. Methodological Structure of the Model

3.1. Existing Use of the Property

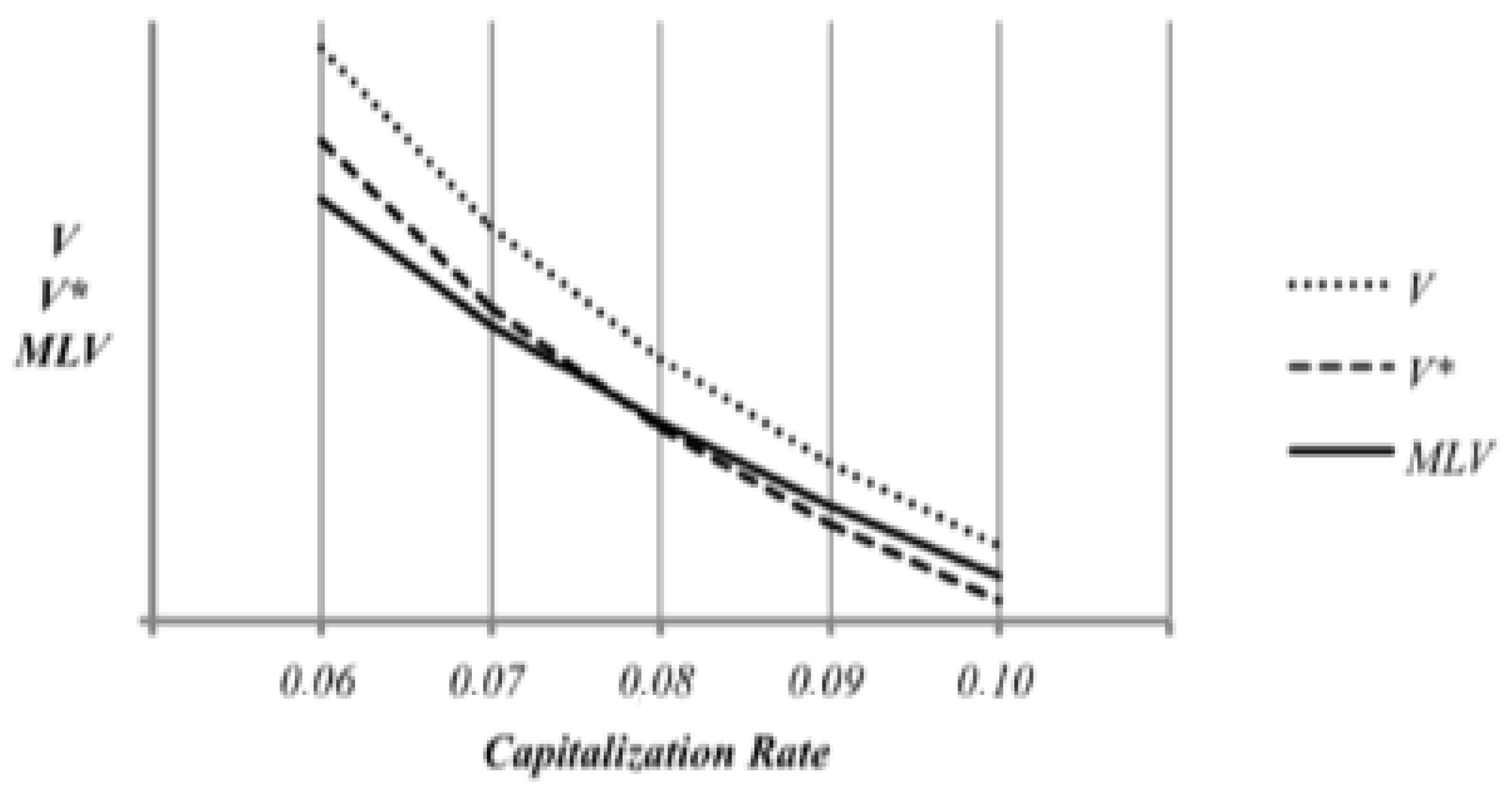

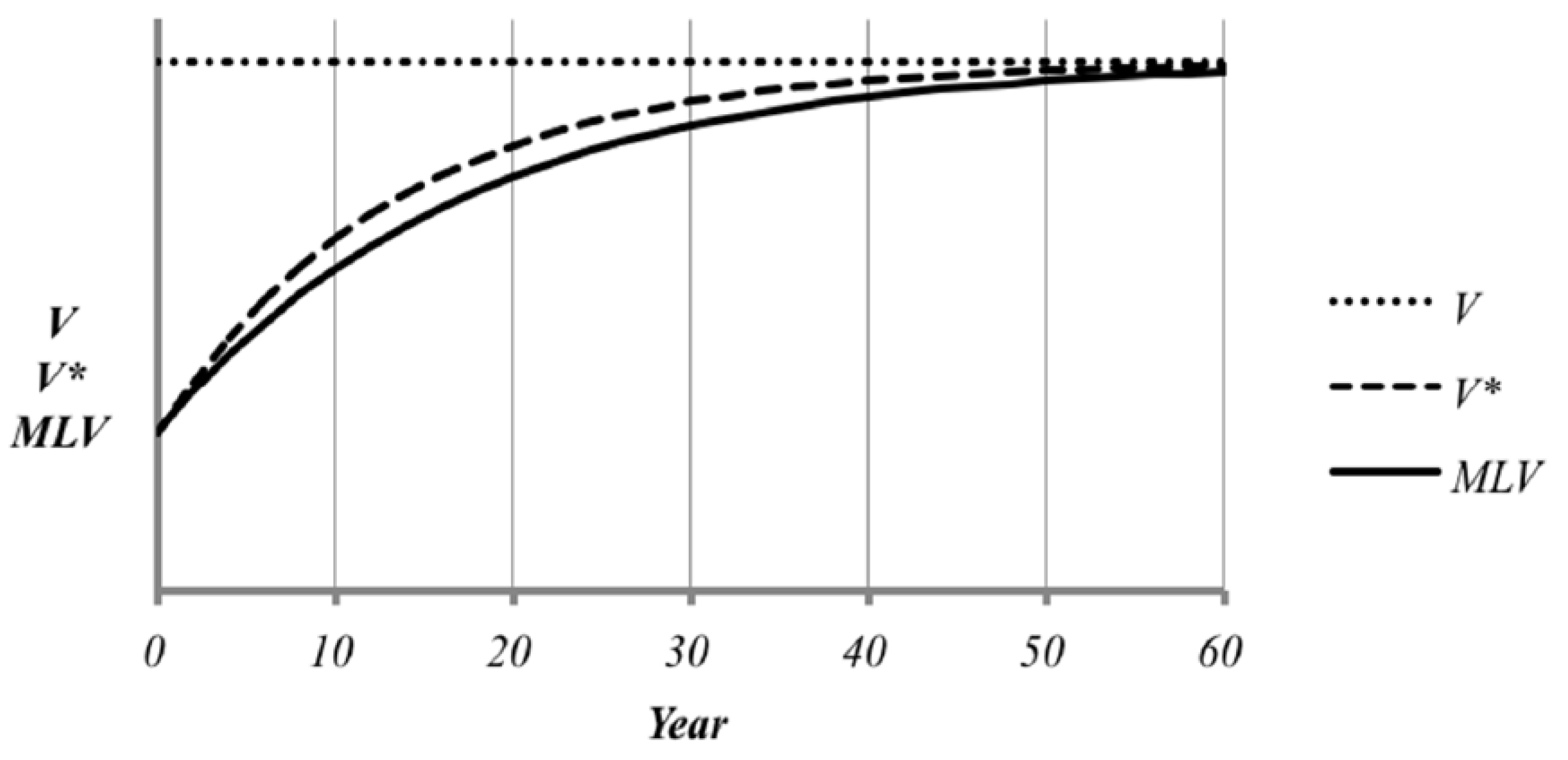

3.2. The MLV and the Discount Rate of Market Values

3.3. The MLV and the Debt Coverage Ratio

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wild, T. Opinion of the European Banking Authority on Mortgage Lending Value (MLV); European Banking Authority: Paris, France, 2015. [Google Scholar]

- International Valuation Standard Council. International Valuation Application 2—Valuation for Lending Purposes; IVSC: London, UK, 2011. [Google Scholar]

- Ross, F.; Brachmann, R.; Renner, U.; Holzner, P. Ermittlung des Verkehrswertes von Grundstücken und des Wertesbaulicher Anlagen; OppermannVerlag: Rodenberg, Germany, 2005. [Google Scholar]

- Sommer, G.; Kröll, R. Lehrbuch zur Grundstückswertermittlung; LuchterhandVerlag: Wiesbaden, Germany, 2005. [Google Scholar]

- Rössler, R.; Langner, J. Schützung und Ermittlung von Grundstückswerten, 8th ed.; Luchterland Fachverlag: Munich, Germany, 2004; pp. S65–S78. [Google Scholar]

- Metzner, S. Einflussfaktoren auf Zwangsversteigerungserlöse bei Eigentumswohnungen. Grund. Grund. 2005, 4, S214–S220. [Google Scholar]

- Adolf, W. Der nachhaltige erzielbare Ertrag -ein veralteter Begriff? Grund. Grund. 2005, 4, Sl93–S197. [Google Scholar]

- Werth, A. VomVerkehrswertunabhängigeBeleihungswerteimBlcikfeld der Europäischen Union. Grund. Grund. 1998, 5, S257–S266. [Google Scholar]

- Rüchardt, K. Der Beleihungswert; Fritz Knapp Verlag: Frankfurt am Main, Germany, 2001. [Google Scholar]

- Stöcker, O.M. Realkredit und Pfandsicherheit—Der Beleihungswertim Bankenaufsichtsrecht; Fritz Knapp Verlag: Frankfurt am Main, Germany, 2004. [Google Scholar]

- Kierig, J. Zumneuen Pfandbriefgesetz und dem Entwurf der Beleihungswertermittlungsverordnung (BelWertV). Vortrag auf dem 14, Werterrnittlungsforurn, Jahreskongress. 2006. Available online: https://www.gesetze-im-internet.de/belwertv/BJNR117500006.html (accessed on 16 March 2022).

- Crosby, N.; French, N. Bank lending on business property—How do valuations aid the process? In Proceedings of the 19th ERES Conference, Athens, Greece, 22–25 June 1999. [Google Scholar]

- White, D.; Turner, J. Immobilienbewertung: Internationale Märkteverlangeninternationale Verfahren—BeleihungsobjektekönnenStichtagsbewertung ‘sprengen’. Immob.-Ztg. 1999. Available online: https://www.iz.de/unternehmen/news/-immobilienbewertu-internationa-maerk-verlang-internationaleverfahr-beleihungsobjek-koenn-stichtagsbewertu-spreng--marktentwicklungberuecksichtig--te--12183?crefresh=1 (accessed on 16 March 2022).

- Serret, A.; Trello, J. Reducing house prices, reducing mortgage risks. A methodology for measuring mortgage risk. In Proceedings of the ENHR Conference, Cambridge, UK, 2–6 July 2004. [Google Scholar]

- Adair, A.; Hutchison, N. The reporting of risk in real estate appraisal property risk scoring. J. Prop. Invest. Financ. 2005, 23, S254–S268. [Google Scholar] [CrossRef]

- Joslin, A. An investitgation into the expression of uncertainity in property valuation. J. Prop. Invest. Financ. 2005, 23, 269–285. [Google Scholar] [CrossRef]

- Crosby, N.; Hughes, C.; Murdoch, J. Influences on secured lending property valuations in the UK. In Proceedings of the ERES Conference, Milan, Italy, 2–5 June 2004. [Google Scholar]

- Bretten, J.; Wyatt, P. Variance in commercial property valuations for lending purposes: An empirical study. J. Prop. Invest. Financ. 2001, 19, S267–S282. [Google Scholar] [CrossRef]

- Ciuna, M.; De Ruggiero, M.; Salvo, F.; Simonotti, M. Measurements of rationality for a scientific approach to the market-oriented methods. J. Real Estate Lit. 2016, 24, 403–427. [Google Scholar]

- Bienert, S. Projektfinanzierung in der Immobilienwirtschajt; Deutscher Universitätsverlag: Wiesbaden, Germany, 2005. [Google Scholar]

- Pitschke, C. Die Finanzierung Gewerblicher Immobilien—Projektentwick Lungen unter Basel II; Immobilien Informations Verlag Rudolf Müller: Köln, Germany, 2004. [Google Scholar]

- Renaud, B. The 1985 to 1994 Global Real Estate Cycle—Its Causes and Consequence. In The World Bank—Financial Sector Development Department; Policy Research Working Paper No. 1452; The World Bank: Washington, DC, USA, 1995. [Google Scholar]

- Maier, K.M. Risiko Management Immobilienwesen—Leitfaden für Theorie und Praxis, 1st ed.; Fritz Knapp Verlag: Frankfurt am Main, Germany, 1999. [Google Scholar]

- Ropeter, S. lnvestitionsanalyse für Gewerbeimmobilien; Immobilien Informations Verlag Rudolf Müller: Köln, Germany, 1998. [Google Scholar]

- Wüstefeld, H. Risiko und Rendite von Immobilieninvestments, 1st ed.; Fritz Knapp Verlag: Frankfurt am Main, Germany, 2000; pp. 51–228. [Google Scholar]

- Pfnür, A.; Armonat, S. Immobilien Kapitalanlage Institutioneller Investoren: Risikomanagement und Portfolioplanung; Ergebnisbericht zur Empirischen Untersuchung, Universitat Hamburg/Eversmann & Partner—Corporate Real Estate: Hamburg, Germany, 2001. [Google Scholar]

- PWC. VI—European house prices. In European Economie Outlook; Pricewaterhouse Coopers: London, UK, 2004; pp. S25–S30. [Google Scholar]

- Milleker, D.F. International Housing Markets: How Diffìcult a Retum to Normal? Working Paper No. 37; Allianz Group: Frankfurt am Main, Germany, 2005. [Google Scholar]

- Tsatsaronis, K. What drives housing price dynamics: Cross-country evidence. BIS Quarterly Review, 1 March 2004. [Google Scholar]

- Jorion, P. Value at Risk, 2nd ed.; McGraw-Hill: New York, NY, USA, 2000. [Google Scholar]

- Poppensieker, T. Skategisches Risikomanagement. In Deutschengroβbanken; Deutscher Universitätsverlag: Wiesbaden, Germany, 1997. [Google Scholar]

- French, N.; Gabrielli, L. Uncertainty and feasibility studies: An Italian case study. J. Prop. Invest. Financ. 2006, 24, 49–67. [Google Scholar] [CrossRef] [Green Version]

- Benevenuti, A. Financial and estimating indicators for assessment of mortgage lending value. Aestimum 2012, 621–628. [Google Scholar] [CrossRef]

- Tajani, F.; Morano, P. An empirical-deductive model for the assessment of the mortgage lending value of properties as securities for credit exposures. J. Eur. Real Estate Res. 2018, 11, 44–70. [Google Scholar] [CrossRef]

- Süchting, P. Theorie und Politik der Unternehmensfinanzierung, 6th ed.; Betriebswirtschaftlicher Verlag Dr. Th. Gabler GmbH: Wiesbaden, Germany, 1995. [Google Scholar]

- Rode, D. Grundzlige des Hypothekarkredits. In Handbuch des Hypothekarkredits—lmmobilienfinanzierung in Deutschland unf Europa, 3rd ed.; Konrad, R., Ed.; Fritz Knapp Verlag GmbH: Frankfurt am Main, Germany, 1993; pp. S23–S101. [Google Scholar]

- Rüchardt, K. Bewertung und Krediturtei. In Handbuch des Hypothekarkredits—lmmobilienfinanzierung in Deutschland und Europa; Konrad, R., Ed.; Fritz Knapp Verlag GmbH: Frankfurt am Main, Germany, 1993; pp. 143–261. [Google Scholar]

- Paschedag, H. Darlehens∙und Hypothekenfìnanzierung. In Handbuchlmmobilien-Banking—Vor der Traditionellenlmmobilien Finanzierungzumlmmobilien-Investmentbanking; Schulte, K.-W., Achleitner, A.K., Knobloch, B., Eds.; Immobilien Informations Verlag Rudolf Müller GmbH & Co. KG: Koln, Germany, 2002; pp. 69–87. [Google Scholar]

- Steffan, F.; Scholz, H. Finanzierungsanfragen, Objekte und Partner des Hypothekarkredits. In Handbuch des Hypothekarkredits: Lmmobilienfinanzierung in Deutschland und Europa, 3rd ed.; Konrad, R., Ed.; Fritz Knapp Verlag GmbH: Frankfurt am Mam, Germany, 1993; pp. 101–143. [Google Scholar]

- Low, S.; Sebag-Montefiore, M.; Dübel, A. Study on the Financial Integration of European Mortgage Markets; working paper; Mercer Oliver Wyman: London, UK, 2003. [Google Scholar]

- Gondring, H.; Lorenz, T. Basel II—Auswirkungen auf die lmmobilienwirtschaft; Akademie der Immobilienwirtschaft (ADI): Stuttgart, Germany, 2001. [Google Scholar]

- Bienert, S.; Brunauer, W. The mortgage lending value: Prospects for development within Europe. J. Prop. Invest. Financ. 2007, 25, 542–578. [Google Scholar] [CrossRef]

- European Parliament and Council of The European Union Industry. Directive 98/32/Ec; European Union: Luxembourg, 1998. [Google Scholar]

- TEGoVA. European Valuation Standards, 9th ed.; TEGoVA: Brussels, Belgium, 2020. [Google Scholar]

- Regulation (EU) of the European Parliament and of the Council of 26 June 2013 on Prudential Requirements for Credit Institutions and Investment Firms and Amending, 575. 2013. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32013R0575 (accessed on 16 March 2022).

- Ciuna, M.; D’Amato, M.; Salvo, F. Appraising building area’s index numbers using Repeat Value Model. A case study in Paternò (CT), in Dynamics of Land Values and Agricultural Policies. In Proceedings of the MediaMond International Proceedings, Bologna, Italy, 9–13 May 2013; pp. 63–71. [Google Scholar]

- Ciuna, M.; D’Amato, M.; Salvo, F. The appraisal smoothing in the real estate indices, in Dynamics of Land Values and Agricultural Policies. In Proceedings of the MediaMond International Proceedings, Bologna, Italy, 9–13 May 2013; pp. 73–83. [Google Scholar]

- Salvo, F.; Ciuna, M.; De Ruggiero, M. Property prices index numbers and derived indices. Prop. Manag. 2014, 32, 139–153. [Google Scholar] [CrossRef]

- Del Giudice, V.; De Paola, P.; Forte, F. The appraisal of office towers in bilateral monopoly’s market: Evidence from application of Newton’s physical laws to the Directional Centre of Naples. Int. J. Appl. Eng. Res. 2016, 11, 9455–9459. [Google Scholar]

- Del Giudice, V.; De Paola, P. Undivided real estate shares: Appraisal and interactions with capital markets. Appl. Mech. Mater. 2014, 584–586, 2522–2527. [Google Scholar] [CrossRef]

- De Ruggiero, M.; Forestiero, G.; Manganelli, B.; Salvo, F. Buildings Energy Performance in a Market Comparison Approach. Buildings 2017, 7, 16. [Google Scholar] [CrossRef]

- Acampa, G.; Forte, F.; De Paola, P.B.I.M. Models and evaluations. In Green Energy and Technology; Springer: Berlin/Heidelberg, Germany, 2020; pp. 351–363. [Google Scholar]

- Del Giudice, V.; Massimo, D.E.; De Paola, P.; Forte, F.; Musolino, M.; Malerba, A. Post Carbon City and Real Estate Market: Testing the Dataset of Reggio Calabria Market Using Spline Smoothing Semiparametric Method. In New Metropolitan Perspective; Springer International Publishing: Cham, Switzerland, 2019; ISBN 978-3-319-92098-6. [Google Scholar]

- Engle, R.F. Autoregressive conditional heteroscedasticity with estimates of variance of United Kingdom inflation. Econometrica 1982, 50, 987–1008. [Google Scholar] [CrossRef]

- Sornette, D.; Johansen, A.; Bouchaud, J.P. Stock market crashes, precursors and replicas. J. Phys. I 1996, 6, 167–175. [Google Scholar] [CrossRef] [Green Version]

- Sornette, D.; Johansen, A. Large financial crashes. Physica A 1997, 245, 411–422. [Google Scholar] [CrossRef] [Green Version]

- Yang, D.; Zhang, Q. Drift-independent volatility estimation based on high, low, open and close prices. J. Bus. 2000, 73, 477–491. [Google Scholar] [CrossRef] [Green Version]

- Andersen, T.G.; Bollerslev, T.; Diebold, F.X.; Labys, P. Modeling and forecasting realized volatility. Econometrica 2003, 71, 579–625. [Google Scholar] [CrossRef] [Green Version]

- Cajueiro, D.O.; Tabak, B.M. Testing for time-varying long-range dependence in volatility for emerging markets. Physica A 2005, 346, 577–588. [Google Scholar] [CrossRef]

- Wang, F.Z.; Yamasaki, K.; Havlin, S.; Stanley, H.E. Multifactor analysis of multiscaling in volatility return intervals. Phys. Rev. E 2009, 79, 16103. [Google Scholar] [CrossRef] [PubMed] [Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Salvo, F.; De Ruggiero, M.; Tavano, D.; De Paola, P.; Del Giudice, F.P. Analytical Implications of Mortgage Lending Value and Bottom Value. Buildings 2022, 12, 799. https://doi.org/10.3390/buildings12060799

Salvo F, De Ruggiero M, Tavano D, De Paola P, Del Giudice FP. Analytical Implications of Mortgage Lending Value and Bottom Value. Buildings. 2022; 12(6):799. https://doi.org/10.3390/buildings12060799

Chicago/Turabian StyleSalvo, Francesca, Manuela De Ruggiero, Daniela Tavano, Pierfrancesco De Paola, and Francesco Paolo Del Giudice. 2022. "Analytical Implications of Mortgage Lending Value and Bottom Value" Buildings 12, no. 6: 799. https://doi.org/10.3390/buildings12060799

APA StyleSalvo, F., De Ruggiero, M., Tavano, D., De Paola, P., & Del Giudice, F. P. (2022). Analytical Implications of Mortgage Lending Value and Bottom Value. Buildings, 12(6), 799. https://doi.org/10.3390/buildings12060799