Abstract

This paper explores the green building attributes that significantly influenced rental depreciation for conventional buildings from expert perspectives using Malaysia as a case study. The objectives of this study include: (1) identifying the green building attributes for rental depreciation and (2) prioritizing the green attributes via the Analytic Hierarchy Process (AHP) technique. To achieve these objectives, firstly the study identified the green building attributes from the literature and from green building guidelines. The attributes were then validated by expert valuers via a semi-structured interview. Secondly, the attributes were utilized to develop the AHP-designed questionnaire and used to gather feedback from real estate experts. Ten (10) responses were analyzed using the descriptive and AHP techniques. This study has identified the rank of prioritized green building attributes, where the findings suggest the central role of indoor environment quality (EQ), where it ranked the highest in contributing to conventional purpose-built office (PBO) rental depreciation, followed by energy efficiency (EE), green site planning and management (SM), materials and resources (MR), innovation (IN), and water efficiency (WE). The findings allow researchers and practitioners to create strategies for reducing the impact of conventional building rental depreciation and obsolescence due to green building attributes.

1. Introduction

The popularity of green buildings has increased in recent years due to the awareness of the importance of balancing development from the perspectives of the environment, economy, and society. The concept of sustainable development arises from the effort to safeguard the physical environment occupied by humans, to ensure that the physical environment is in good condition and able to fulfil its needs [1] via free, active, and meaningful participation from local, national, and global dimensions [2]. Several countries, including Malaysia, have taken a proactive role in supporting and engaging in any effort to promote sustainable development [3]. The Green Building Index (GBI), for instance, is part of the initiatives that were introduced to encourage sustainability and develop more eco-friendly products in the construction industry as well as raising stakeholders’ awareness [4]. Furthermore, the government has also introduced energy policies such as the Renewable Energy Act 2011, to ensure better environmental quality and reduce the negative impacts of fossil fuels including health issues, destruction of nature, landscapes, biodiversity, and energy security struggles [5]. All these initiatives are strongly related to the built environment. It is high time for the stakeholders to implement sustainable principles toward real estate to reduce the detrimental effects on the environment.

Sustainable or green buildings have gained much attention due to the benefits accrued, especially from the environmental features and energy efficiency. Generally, new sustainable technologies reduce the emissions from the operation and raw material consumption [6]. Green buildings are designed and constructed with the highest attention to the indoor environmental quality for human occupation [7] and are proven to improve the indoor air quality (IAQ) for occupants [8]. Poor IAQ is identified as the source of various symptoms of illness in office workers [9]. Studies also acknowledged that the demand for green buildings increases from the tenants’ perspectives. Green benefits such as superior air quality, efficient systems, and recycling were willing to be paid by the tenants [10]. In addition, a substantial number of valuers in the previous study agreed that green features create higher rent and lower vacancy rates compared with conventional buildings [11]. In addition, the spill over impact of green buildings towards their adjoining building was revealed to bring a positive outcome from a socio-economic perspective [12]. Investors are beginning to consider green buildings in their property portfolios and are willing to pay a premium price for green-certified buildings [13]. Apart from that, firms substantially consider benefits such as water and waste recycling and reduction in electricity and water bills [14]. As a result, it has brought changes to the behaviors of the commercial property market to incorporate the sustainability features and benefits into the valuation practice. In addition, with the spike in COVID-19 cases recently, the built environment offers an interesting solution for infectious disease control [15].

Regarding the real estate market in Kuala Lumpur, Malaysia, the KL structure plan 2020 highlighted the significant number of older office buildings experiencing technological obsolescence. As green buildings become mainstream in the office market, the conventional older office buildings may depreciate faster and be less desirable [16,17]. New environmental attributes may impact the system’s inbuilt environment, triggering obsolescence that has yet to be realized [18]. Sustainable obsolescence should be considered in the built environment widely since it is gaining significant momentum due to the changing nature of buildings, society, and increased importance from investors’ and stakeholders’ perspectives [19]. Studies suggest that sustainable and green buildings achieved better performance in rental premium compared with conventional buildings. An analysis of commercial buildings in the US produces a rental premium of 7.9% for LEED-certified buildings compared with conventional buildings [20]. Energy Star and LEED-certified buildings also performed in comparison to conventional buildings by having 7.3% to 8.6% and 15.2% to 17.3% rental premium, respectively [21].

Fuerst and McAllister [22] managed to analyze the impact of dual certification on rental value. The results suggest that dual certification achieved a 9% rental premium, while LEED and Energy Star obtained slightly lower than the dual certification of about 3% to 5% rental premium. Ref. [23] provides a different perspective of analysis by incorporating the impact of political alignment alongside the sustainable buildings towards rental premium. Overall, the study witnessed a rental premium of 5% for sustainable buildings. Ref. [24] established that this type of building obtained a rental premium of 6% compared with conventional buildings. In the UK, the BREEAM certified buildings surprisingly managed to obtain a greater rental premium compared with US studies with 19.7% [25]. Therefore, these rental premium performances give rise to the sustainable obsolescence in the conventional office building in the real estate market and should be considered as the new form or attribute of obsolescence in the office building [18].

In this study, the obsolescence impact on buildings due to the introduction of green buildings in the commercial property market is also determined by the knowledge and practice of the real estate professionals in the market. Since they are the ones responsible for providing professional advice on the ‘worth’ or ‘value’ of property, there is a need to study their perspective on whether rental depreciation or obsolescence may as well originate from the sustainable or green building features. Selected studies have highlighted a significant number of valuers who agreed to the importance of integrating sustainability in real estate valuation [11,26,27]. In addition, the role of sustainability in reducing the impact of depreciation and obsolescence should be reflected in valuation to encourage market participants to see the benefits of green building in the valuer’s price estimates [25,27]. The existing accounts fail to resolve the relationship between sustainable or green features and office rental depreciation and obsolescence from the perspective of real estate professionals in Malaysia.

This paper explores the green building attributes that significantly influenced rental depreciation for conventional buildings from the expert perspectives using Malaysia as a case study. The objectives of this study include: (1) identifying the green building attributes for rental depreciation and (2) prioritizing the green attributes via the AHP technique. To achieve these objectives, firstly the study identified the green building attributes from the literature and green building guidelines. The attributes were then validated by valuers. Secondly, the attributes were utilized to develop the AHP-design questionnaire and used to gather feedback from real estate experts. The responses were analyzed using the descriptive and AHP techniques. By achieving these objectives, this study is expected to provide substantial insight into the prioritized green building attributes in real estate depreciation studies from the theoretical and practical domains in Malaysia.

2. Literature Review

2.1. Green Building and Rental Depreciation

Green building studies in relation to rental or value depreciation realize some of the demanding issues in the practice of real estate valuation and appraisal worldwide. Depreciation elements such as obsolescence and deterioration will affect buildings and their occupants in several ways, including a reduction in functional use, demand for occupancy, and attractiveness of the buildings. The sustainable building or green building is drawn from the established notion that possesses the key benefits in economic, social, and environmental aspects. The World Green Building Council (WGBC) describes green building as “….to significantly reduce or eliminate the negative impact of buildings on the environment and on the building occupants, green building design and construction practices address: sustainable site planning, safeguarding water and water efficiency, energy efficiency, conservation of materials and resources, and indoor environmental quality”.

Several benefits of sustainable buildings have been identified by researchers in the past. From the evidence-based studies, the sustainable building was proven to generate rental and market value premium compared with the non-sustainable building. Other studies emphasized the benefits in terms of economics, social, and environmental perspectives. The sustainable building possesses an added value in terms of economic feasibility, whereas for offices it can lower the health care cost, contribute to a higher level of workers’ productivity, higher rental value, higher staff retention rates, and lower the energy usage and its operating cost [28]. Muldavin [29] has developed an extensive list of sustainable benefits that would later turn into financial benefits suitable in the context of real estate research. In addition, Boyd [30] translated the benefits into their impact on the value of the property. Sustainable building benefits such as improved working environments and reduced building operating costs bring positive impact, although greater capital cost contributes to negative impact to property value due to lower initial return on capital. These benefits possibly contribute to commercial property depreciation and obsolescence. The impact of sustainability towards commercial property value and rental has been under extensive study and was proven to substantially generate rental and market price premiums for sustainable buildings compared with the non-sustainable buildings [25,31,32].

The study of sustainable depreciation and obsolescence is an interesting topic to embark upon judging from the several issues governing conventional commercial real estate. Thus, the issues of sustainable depreciation and obsolescence will send a worrying sign of the faster acceleration of depreciation to conventional commercial property owners and investors. Currently, several issues have been identified for conventional buildings due to the introduction of sustainable buildings in the commercial property market. Firstly, conventional buildings may experience loss of function, usage, and technological features due to the inability to keep up to date with the latest technology of sustainable buildings such as energy and water-efficient features. With the introduction of sustainable buildings to the market, the current building features and technology standards have been raised. Conventional buildings without these evolutionary features will experience loss of functions and technology as they are not compatible with the current standard.

In addition, the functionality of buildings may reduce substantially as the tenants will search for other premises that can cater to their occupancy needs. This situation will send a negative signal to conventional property investors and owners as their property cannot compete in terms of functionality, technology, and usage with sustainable buildings. It will give rise to functional and technological obsolescence because of an inability to reach the current standard of building requirements (sustainable standards). Secondly, conventional buildings will suffer the loss of image and reputation with the introduction of a new green building grading system such as the GBI classifications, GreenRE ratings, and Malaysian Carbon Reduction and Environmental Sustainability Tools (MyCREST) star ratings.

Green certification is considered an added value to commercial buildings due to their adherence to the requirements sets by certification bodies in Malaysia. Despite this, conventional buildings without this recognition may be viewed as a secondary class of building, thus their reputation will fall short behind the sustainable buildings. Therefore, these buildings may have difficulty in attracting investors and tenants, thus reducing their investment potential of generating a higher return. Previously, commercial buildings were rated with grades such as A, B, and others; nowadays, the introduction of eco-label buildings further adds to the existing rating of commercial buildings. Thus, it provides additional marketing means for eco-label buildings that can be utilized to attract investors and tenants compared with dull and plain conventional buildings. Conventional buildings will lose their marketability due to the loss of image and reputation originating from sustainability recognition of other buildings in the commercial property market.

In Malaysia’s perspective, the introduction of the green building (GB) may accelerate the depreciation of conventional buildings in the form of functional obsolescence and physical deterioration. Even though the sustainability concept has been applied extensively and accepted in society, there is still an unclear perspective on the factors of sustainability that will be treated as obsolescence [19]. Thus, Reed and Warren-Myers [19] proposed the idea of sustainability as the new form of obsolescence alongside the traditional obsolescence factors such as physical, functional, and economics. Surman [32] highlights the risk of ‘sustainability impairment’, whereby older buildings without energy-efficient features will suffer physical deterioration and obsolescence with regard to declining market value, since energy-efficient buildings are market standard and up-to-date. From the valuation perspective, Baum [33] stressed that the obsolescence elements should be considered in the assessment of value and included in the treatment of initial and terminal yields. Whipple [34] argued that buildings may become obsolete if the desirability and usefulness are diminished, originating from the technological changes or improvement in asset performance of comparable properties. Buildings without these evolutionary features will become less desirable and valuable from the investor’s perspective. Thus, it is important to recognize the impact of green buildings on the depreciation of the commercial property market.

2.2. Benefits of Green Buildings: Rental and Occupancy Premium

Several studies have embarked on the investigation between sustainable features or energy efficiency towards commercial property value, rental, occupancy, and others. The result of the analysis overall concludes that the green buildings achieve superior performance in terms of sales and rental premium compared with the conventional buildings. The study has implied that green buildings such as LEED and Energy Star labeled achieved better performance in the rental market and sales premium in the commercial property market [21] and were significantly influenced by thermal efficiency and sustainability in green buildings [20]. An analysis of commercial buildings in the US produces a rental premium of 7.9% for LEED-certified buildings compared with conventional buildings [20]. Additionally, the study also witnesses the relationship between energy cost and rental, where every one-dollar cost saved produces a rental increment of 3.5% for Energy Star buildings. Meanwhile, Energy Star and LEED-certified buildings performed against conventional buildings by having 7.3% to 8.6% and 15.2% to 17.3% rental premium, respectively [21]. Another study suggests that dual certification achieved a 9% rental premium, while LEED and Energy Star obtained slightly lower than the dual certification of about 3% to 5% rental premium [22].

On the other hand, other research has provided different perspectives of analysis by incorporating the impact of political alignment alongside the sustainable buildings towards rental premium [23]. Overall, the results witnessed a rental premium of 5% for green buildings. If political location was taken into consideration, the rental premium for green buildings varied between liberal and conservative locations. It was found that rental premiums for green buildings in the politically liberal location were higher (6%) compared with conservative locations (2%). Using energy-efficient labeled buildings as a case study, this type of building obtained a rental premium of 6% compared with conventional buildings [24]. In the UK, the BREEAM certified buildings surprisingly managed to obtain a greater rental premium compared with US studies with 19.7% [25]. Most of the researchers subjected to this review agreed that sustainability and energy efficiency contribute to the premium of sales and rental values. Nevertheless, other research has disputed these findings, where their investigation found no significant contribution of BREEAM and EPC rating towards the rental of commercial buildings in the UK [35].

Based on the review of the selected research, only a small number of researchers embarked on the investigation of measuring the impact of sustainability and energy efficiency towards occupancy rates. Buildings with Energy Star acquired a significant occupancy premium of 10% to 11% [21]. This contradicts the other findings, where it was found that there was a rather small positive occupancy premium obtained for Energy Star buildings [22]. In addition, LEED-certified buildings recorded an occupancy premium of 16% to 18%. Other investigations on green buildings managed to show an occupancy premium of 8.9% compared with conventional buildings [23]. Therefore, the literature suggests that green buildings have the potential of generating higher rental and occupancy rates compared with conventional buildings. Therefore, it is important to note that the inherent benefits may contribute to the depreciation and obsolescence of non-green buildings. By identifying the green building attributes, the conventional or non-green buildings may be able to upgrade their building according to the current standard of sustainability in order to reduce the risk of depreciation and obsolescence.

2.3. Attributes of Green Buildings Affecting Rental Depreciation

Researchers are now looking into the relationship between green building attributes and rental depreciation. Recent studies have revealed various attributes of green buildings that may influence the rental or value of conventional office buildings. Sustainable design features such as flexibility and adaptability, energy efficiency and water saving, the use of environmentally friendly materials and products, high functionality in connection with comfort and health of users and occupants, construction quality, compliance with/over-compliance with legal requirements in the areas of environmental and health protection, and reduced impacts on the local and global environment have been proposed to significantly influence the valuation parameters for real estate properties [36].

According to an investigation conducted by Wan Rodi [16], the main factors of green building attributes relevant to rental depreciation consist of green building status, materials, sustainable design configuration, sustainable site and soil characteristics, rooftop and on-site greenery, building management system, HVAC system, lighting system, water conservation system, indoor environmental monitoring system, and on-site renewable energy system. In Malaysia, the Green Building Index (GBI) has developed a very strong framework for green building certification for buildings. Within this framework, it covers every aspect of green building attributes that might influence the market value of a building. Green building status certified by GBI has shown to be a significant factor influencing the rate of depreciation for an office building in Kuala Lumpur apart from the building age factor [37]. Based on the literature review and reference to the GBI framework, the study has developed the green building attributes that may influence the rental depreciation for an office building in Malaysia.

2.4. Positioning This Study

This section addresses the knowledge gaps highlighted in the current studies to provide a rationale for this research. Overall, the literature has provided knowledge involving the importance of integrating green buildings in real estate valuation and investment apart from their benefits to rental value. Despite this, the current knowledge lacks evidence regarding the perspective of real estate experts on this topic in practice. Therefore, this study addresses this gap by highlighting the attributes of green buildings towards rental depreciation among real estate experts.

3. Methods

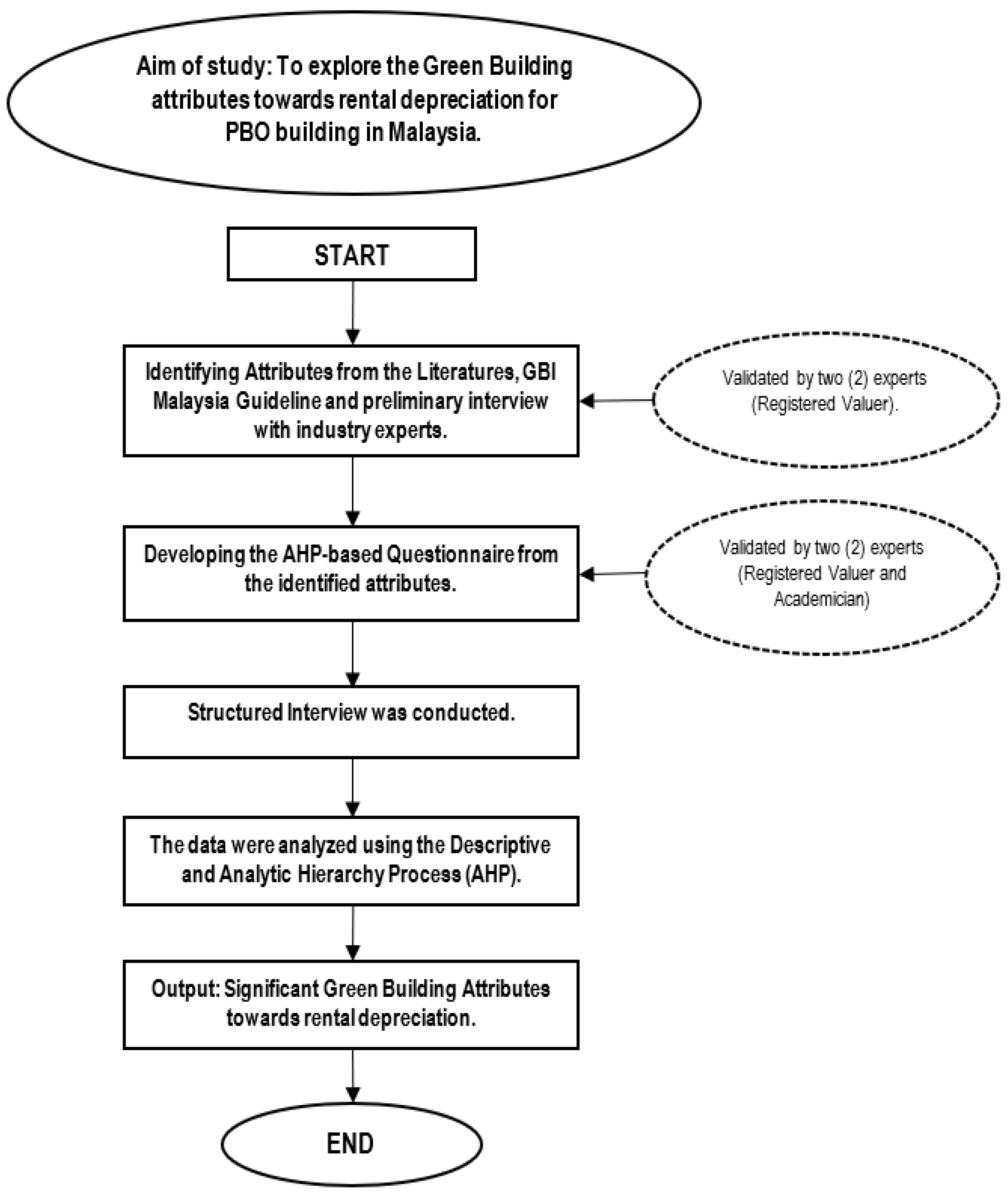

Figure 1 refers to the study design diagram. In this study, a questionnaire was used to achieve the objective of the study by collecting data from random samples. In real estate depreciation studies, the questionnaire was extensively used to obtain professional opinions on the factors of land and building influencing rental and market value depreciation and obsolescence. Accordingly, this study employs the structured interview approach to collect data and the results are published. Samples were derived from real estate professionals in the field of commercial property valuation and management. The use of these professionals was necessary to obtain their perception of the green building design that may contribute to the depreciation of commercial office buildings in Malaysia.

Figure 1.

Study design.

They possess significant knowledge of property, be it residential, commercial, or industrial. Thus, the adoption of real estate professionals as a subject sample is necessary since they represent the profession that can influence the commercial property market value and rental. This approach was selected due to several benefits, including the ability of the researcher to explain complex questions to the respondents and to control the context and environment during the interview session [38].

3.1. Developing the Survey

In this study, the green depreciation factors were initially drawn from the features and characteristics developed from the literature review and also in reference to the Green Building Index (GBI) Malaysia assessment criteria. Prior to the development of a structured interview questionnaire, these factors were validated by two (2) registered valuers. They agreed that these green building factors may influence the depreciation of a conventional building. Next, the factors were arranged in a hierarchical model that is suitable for the AHP analysis.

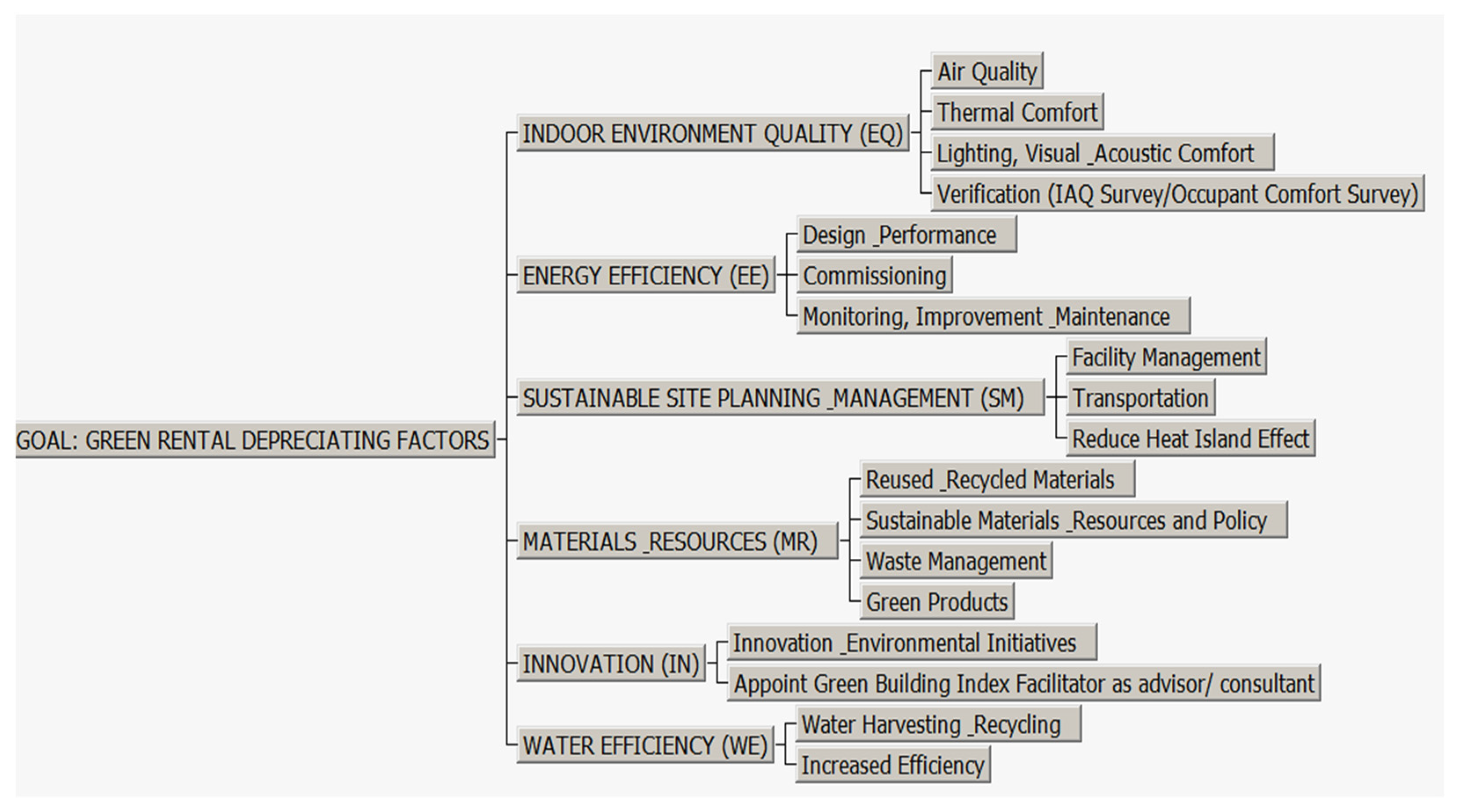

According to the principle of AHP, the development of a hierarchy model should have some degree of judgment. In reference to Figure 2, the first stage involves a statement of the goal or the AHP assessment objective: to investigate the green building features that contribute to the commercial real estate depreciation and obsolescence. The second stage concerns the general context of the green features influencing rental depreciation. This stage, known as criteria level 1 is represented by six (6) key attributes: energy efficiency, indoor environmental quality, sustainable site planning and management, material and resources, water efficiency, and innovation. Likewise, criteria level 2 focuses on the sub-attributes within the six (6) key attributes. Figure 2 below shows the Green Rental Depreciation Hierarchy Model for this study.

Figure 2.

Green rental depreciation hierarchy model.

The AHP-based questionnaire was developed based on the variables of green buildings in Figure 1 to obtain the pairwise comparison matrices. Specifically, the AHP-structured questionnaire consists of several parts. Part A, the background of the respondents, consisted of questions designed to obtain the background information of the respondents including job title, working experience, and field of work, either valuation, property management, or real estate agent.

Next, Part B covers the question of the importance of the six (6) key features of green buildings in contributing to the depreciation of office buildings. Since this study uses the AHP analysis, questions should also be designed based on the method and AHP concept. This section is further divided into two (2) levels: the main criteria and sub-criteria. The main criteria compare the importance between six (6) key attributes while the sub-criterion compares the sub-elements in the six (6) key attributes to determine the scale of importance in influencing commercial real estate depreciation. To ensure the validity of the instrument, two experts in the field of real estate valuation, consisting of a registered valuer and a real estate academician, were approached to read through the questionnaire.

3.2. Collecting Survey Data

Specifically, this study targeted sample consists of professionals in the real estate industry such as valuers, estate agents, and academicians in Klang Valley, Malaysia. Respondents who were selected should possess the necessary experience in the property market for at least 5 years; this will ensure that they are well knowledgeable in the property market sector. In general, the population of the registered valuers and estate agents as of 2021 was around 6700 persons. In this study, ten (10) questionnaires were received from seven (7) registered valuers/ estate agents and three (3) real estate academicians with vast knowledge and experience in the PBO real estate market.

The literature on the AHP applications in engineering and management research suggests that there is no strict requirement on the minimum sample size for the AHP analysis [39]. The number of samples is considered adequate since studies such as Ref. [40] and Ref. [41] also employed a small sample size between 8 to 10. Within their studies, Ref. [40] approached eight (8) experts in surveying their teaching quality, while [41] uses ten (10) respondents to identify key selection criteria for an intelligent building (IB) system. In addition, the AHP method may become impractical for a survey with a large sample size since the ‘cold-called’ respondents may provide arbitrary answers that lead to a high degree of inconsistency [42]. During the interview session, the participants were given a pairwise comparison questionnaire with green building factors that might correlate with the rental depreciation. Each participant session was conducted separately and the results by the other participants remained confidential. The data collection period started on 1 October 2020 to 25 December 2020.

3.3. Analyzing the Survey Data

Analytic Hierarchy Process (AHP)

This study applied the AHP framework [43]. Specifically, two key steps must be followed namely: (1) the development of the hierarchical structure; (2) the assessment of weight for each element in each stage or stage [44]. The first step, the development of the hierarchical structure, refers to the construction of stage 1 to 3 criteria that form the basis of the analysis. The literature review and further analysis showed that the green building design features’ construct can be structured hierarchically according to key attributes such as passive and active design. After the hierarchical framework is built, the next step is to develop a relationship of mutually independent hierarchy through expert interviews and to analyze the attributes that may affect the AHP’s objectives.

The next step, namely the evaluation weight for each element in each level or stage involves several formulas. First, the pairwise comparison matrix method (pairwise comparison matrix) is built for each element in the hierarchical structure. The main element becomes the criteria for the low-level elements.

The pairwise comparisons on one level develop a symmetric matrix A, as follows:

where

Wi is weight of attributes i;

n is number of attributes.

To derive matrix A, the number of comparisons needed is n(n − 1)/2. The task is to estimate the weights having their ratios. W is described as vector or of weight:

The eigenvalue method from matrix algebra is used to obtain the weights. The matrix equation when all the weight ratios are fully consistent as follows:

AW = nW

Nonetheless, the pairwise comparisons normally are inconsistent and the largest eigenvalue λmax of the matrix A is used instead of n:

AW = λmax W

Ref. [43] has shown that λmax is always greater than or equal to n, and the closer it is to n the more consistent the values of A. The consistency index CI and consistency ratio CR are calculated:

where ACI is index of randomly generated weights.

CI = (λmax − n)/(n − 1);

CR = CI/ACI,

The CR should be very small with a cut-off rule of 0.10.

To demonstrate the AHP calculations, we use a scale from 1/9 to 9. If selections A and B are identifiable, then A and B each are given a value of 1. If for example, A is better than/preferred to B, then A is rated 3 and B is rated 1/3. If A is much preferred over B, then A, for example, is given a value of 7 and B is given a 1/7 value. The criteria result can be observed in Table 1 below using the above example. Using only three (3) criteria to facilitate, the table can be summarized as follows:

Table 1.

Calculation of criteria.

The above procedure is repeated for the comparison between the attributes for each of the criteria made. The process of assessment among these options shall be conducted for all criteria. Specifically, the assessments should be conducted by experts in the field of study. The following Table 2 depicts the comparison between the attributes (3 choices) for criteria 1 (EE), while Table 3 and Table 4 illustrate the comparison between attributes Criteria 2 (IN) and Criteria 3 (WE).

Table 2.

Paired comparison matrix for the energy efficiency (EE) attribute.

Table 3.

Paired comparison matrix for the innovation (IN) attribute.

Table 4.

Paired comparison matrix for the water efficiency (WE) attribute.

The final stage of AHP evaluation weight consists of rating synthesis. Mainly, it is the sum of the weights obtained from each attribute after weighing the criteria. Overall, the value of an option is as follows:

Wi = input value in row.

Wj = input value in column.

The formula above can also be translated into Table form, assuming there are three criteria such as in Table 5 below. The priority weight for the first level criteria is obtained by multiplying the weighted value of the criteria by the values attributes as follows:

Table 5.

Pairwise comparison matrix for the first level.

The process is repeated for each of the attributes under the criteria. The following Table 6, Table 7 and Table 8 depicts the pairwise comparison matrix for attributes in energy efficiency (EE), innovation (IN), and water efficiency (WE). While Table 9 illustrates the ranking of criteria for Energy Efficiency attributes.

Table 6.

Paired comparison matrix for the energy efficiency (EE) attribute in %.

Table 7.

Paired comparison matrix for the innovation (IN) attribute in %.

Table 8.

Paired comparison matrix for the water efficiency (WE) attribute in %.

Table 9.

Ranking of criteria for energy efficiency (EE) attributes.

Example for AHP manual calculation for energy efficiency (EE) attributes:

Stage 1: change matrix to a decimal number

Stage 2: iteration: quadratic the above matrix

| W11= | (1.000 × 1.000) | + | (0.200 × 5.000) | + | (3.000 × 0.333) | = | 2.990 |

| W12= | (5.000 × 1.000) | + | (1.000 × 5.000) | + | (5.000 × 0.333) | = | 11.650 |

| W13= | (0.333 × 1.000) | + | (0.2000 × 5.000) | + | (1.000 × 0.333) | = | 1.660 |

| W14= | (1.000 × 0.200) | + | (1.000 × 0.2000) | + | (3.000 × 0.200 | = | 1.000 |

| W15= | (5.000 × 0.200) | + | (1.000 × 1.000) | + | (5.000 × 0.200) | = | 3.000 |

| W16= | (0.333 × 0.200) | + | (0.200 × 1.000) | + | (0.200 × 1.000) | = | 0.466 |

| W17= | (1.000 × 3.000) | + | (0.200 × 5.000) | + | (3.000 × 1.000) | = | 7.000 |

| W18= | (5.000 × 3.000) | + | (1.000 × 5.000) | + | (5.000 × 1.000) | = | 25.000 |

| W19= | (0.333 × 3.000) | + | (0.200 × 5.000) | + | (1.000 × 1.000) | = | 2.990 |

| Normal Value | Total Row | Priority Vector | ||

| 2.990 | 11.650 | 1.660 | 16.300 | 0.292 |

| 1.000 | 3.000 | 0.466 | 4.466 | 0.080 |

| 7.000 | 25.000 | 2.990 | 34.990 | 0.628 |

| 55.756 | 1.000 |

To estimate the consistency of the AHP, the following calculations are employed:

Since the matrix is 3 (i.e., consists of 3 factors), the value of the consistency index obtained:

The matrix is consistent if CI is less or equal to 0.1. Overall, the consistency ratio for this study was recorded as smaller than 0.1. Using Expert Choice 11 software (Expert Choice V. 11.1.3238, Expert Choice Inc., Arlington, VA, United States), the feedback was recorded to quantify the pairwise comparison of green design elements and further prioritized. If the answers provided are inconsistent, the participants will be asked to re-evaluate the answer and change the selection to achieve a satisfactory consistency reading.

4. Results and Discussions

4.1. Results from the AHP Analysis

This section discusses the findings from the analysis using the AHP approach. It consists of a discussion on the ranking of GB criteria and sub-criteria that are significant in influencing PBO rental depreciation and obsolescence from the perspective of respondents. Specifically, the main criteria consist of the main attributes for green buildings. In reference to Table 10, the findings suggest that the environment quality (EQ) ranks the highest in contributing to conventional PBO office rental depreciation (32.7%), followed by energy efficiency (EE) (29.0%), sustainable site planning and management (SM) (11.8%), materials and resources (MR) (8.9%), and innovation (IN) (9.0%). Water efficiency (WE) was ranked the least significant at 8.6 percent in contributing to rental depreciation.

Table 10.

Composite priority weights for ‘attribute–sub-attribute’ parameters of PBO green building attributes influencing rental depreciation and obsolescence for the conventional office building.

Apart from the main criteria, findings from the AHP approach propose the rank for eighteen (18) green building sub-features contributing to conventional office buildings’ rental depreciation and obsolescence. The AHP pairwise comparison for the sub-attributes among the different major attributes was done using the global priority for each criterion. The global priority is determined by the result of the multiplication of each priority on the first level by its respective priority on the second level.

Firstly, the combined response highlights the top five (5) rank consisting of air quality (EQ), design and performance (EE), commissioning (EE), lighting, visual, and acoustic comfort (EQ), and thermal comfort (EQ). Secondly, the middle five ranks include monitoring, improvement, and maintenance (EE), facility management (SM), verification (IAQ survey/occupant comfort survey) (EQ), innovation and environmental initiatives (IN), and waste management (MR), while eight (8) sub-attributes were ranked least significant such as water harvesting and recycling (WE), reused and recycled materials (MR), sustainable materials and resources and policy (MR), increased efficiency (WE), green products (MR), reduce heat island effect (SM), transportation (SM), and lastly green building index facilitator (IN). Table 10 demonstrates the summary results for the sub-criteria.

Firstly, the respondents suggest that the environment quality criterion ranks the highest green building feature influencing rental depreciation and obsolescence for the conventional office building. Sub-criteria items such as lighting, visual, and acoustic comfort were significant since they can contribute to a good quality working environment among tenants. A previous study shows that tenants are willing to pay for improved air quality and access to natural light in the workspace [45], alongside good indoor quality and temperature control as preferable green attributes by tenants [10].

Secondly, energy efficiency was the second most important, judging from the combined responses. Real estate professionals viewed the energy-efficient system as part of the building components that increase the rental value for an office building. The previous finding agreed that energy-efficient features were significant among property valuers since valuers agreed that it can bring a positive impact to value and increase net income or rental [26,46]. Next, the results have indicated the sustainable site planning and management attributes as the third most significant in influencing rental depreciation and obsolescence variables. This result is supported by a previous study indicating that sub-elements such as integrated planning should be considered in valuation as they may influence the market or rental value of the subject property [26]. The fourth-ranking attribute of green buildings—materials and resources—were proposed by respondents to have an impact on rental value depreciation and obsolescence. Green building materials and resources were perceived by valuers as having a longer lifecycle, reducing maintenance or replacement cost, greater design flexibility, and improvement for workers [26].

Innovation and water efficiency were considered the least significant between green building attributes based on the results. It may be contributed by perspectives of valuers that view these two (2) attributes are not strongly correlated with the rental value of the office building [26]. Since Malaysia is one of the nations with ample water resources, the respondents seemed nonchalant with the water efficiency attribute. Locations with abundant water resources may influence the water-saving preference as evidenced in [47]. Table 10 below depicts the results of composite priority weights for the attribute and sub-attribute parameters of PBO green building.

4.2. Implications

Overall, this study has contributed to the body of knowledge pertinent to the understanding of green building attributes and rental depreciation. The study’s implications consist of theoretical and practical aspects. Firstly, the study fills the knowledge gap by identifying the green building attributes in rental depreciation for conventional buildings. A clear understanding of this issue may lead to the improved performance of conventional buildings. As Malaysia is fast becoming an emerging market for green buildings, researchers can use the list of green building attributes identified for their real estate research. Moreover, the methodology can be used by other scholars in perspective studies or by integrating the methodology with market-based research models in their countries. Lastly, future research can be done by comparing different locations such as cities or countries.

From the practical perspective, the list of identified attributes in this study can be utilized by property managers of conventional buildings to upgrade their buildings according to the prioritized attributes since it can reduce depreciation and obsolescence risks. Moreover, the real estate agents can market their green office building listings by highlighting this study’s results to convince their prospective clients of the benefits of green buildings. Finally, the green building organizations may use this study to encourage the conventional building owner to upgrade their building to a green building and become certified.

5. Conclusions and Future Directions

The results have identified the most important green building criteria. The study’s main objective is to explore the significant green building attributes that will contribute to the rental depreciation for conventional PBO buildings. Thus, to arrive at the final conclusions, it was crucial to measure the level of green building attributes and sub-attributes against one another through the assessment done with the stakeholder in the real estate industry in Malaysia.

In developing the assessment framework, researchers strictly follow a multitude of processes and stages. First, the literature reviews and green building guidelines were extensively examined to develop the attributes. To achieve the prioritizing objective that is relevant to the local context, expert panels were approached to obtain their feedback on the study. The outcome of the exercise produced relative importance of the selected main criteria and sub-criteria using the AHP method. Overall, the respondents’ priorities were toward indoor environmental quality (IEQ) and energy efficiency (EE), with both factors accounting for more than 60% of the weightings.

Indoor environmental quality (IEQ) was the most important factor for all experts in contributing to rental depreciation for conventional PBO buildings. With the global pandemic effects, PBO buildings with good IEQ may become much more in demand compared with conventional buildings, that in turn reduces the rental value for conventional buildings. Green buildings are shown to have better IEQ, which indirectly improves the occupants’ quality of life, health, productivity, and financial value. Next, energy efficiency was the second most important factor. The rising awareness of reducing the energy consumption of a building due to the rising cost of fossil fuel and electricity tariffs may lead to this result. The old conventional building consumes high energy compared with the green building. This, in turn, makes it less favorable for prospective tenants and unable to achieve higher rental value in the market.

Overall, rental depreciation and obsolescence for the purpose-built office (PBO) depend on the building quality and performance as their key attributes. Therefore, it is important to identify the current trend and features of green buildings since they can contribute to the downgraded quality and performance of older and conventional PBO buildings. The expert opinions gathered and analyzed via the AHP method provide good preliminary insight for the real estate industry to incorporate the green office building attributes into their conventional buildings. It may reduce the risk of rental depreciation and obsolescence due to demand and technological changes. Although this study may provide a relevant contribution, some limitations should be addressed in future research; for instance, introducing other green elements in buildings or comparison between locations.

Author Contributions

Conceptualization, W.N.W.R., A.I.C.-A. and S.N.K.; methodology, W.N.W.R. and N.N.; investigation, W.N.W.R. and A.H.C.; formal analysis, W.N.W.R. and A.I.C.-A.; resources, A.I.C.-A. and S.N.K.; writing—review and editing, W.N.W.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Ministry of Higher Education (MoHE) Malaysia under the Fundamental Research Grant Scheme (FRGS), grant number FRGS/1/2019/SS08/UKM/02/8. The APC was funded by the Ministry of Higher Education (MoHE) Malaysia under the Fundamental Research Grant Scheme (FRGS).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Not applicable.

Acknowledgments

The authors would like to dedicate their heartiest thanks to the participants of the present study, Ministry of Higher Education (MoHE) Malaysia, Universiti Teknologi Mara (UiTM), Universiti Kebangsaan Malaysia (UKM), Universiti Sains Malaysia (USM), University of Malaya (UM) and Ajman University for providing support and assistance.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Zamhari, S.K.; Perumal, C. Challenges and strategies towards a sustainable community. Geogr. Malays. J. Soc. Space 2016, 12, 10–24. [Google Scholar]

- Malek, J.A. Multi-dimensional development for Maran District: A symbiosis. Geogr. Malays. J. Soc. Space 2015, 11, 124–135. [Google Scholar]

- Kalsum, N.; Isa, M. Sustainable campus and academic staffs awareness and behavior in Malaysia’s institutions of higher learning: A case study of UPSI. Geogr. Malays. J. Soc. Space 2016, 12, 89–99. [Google Scholar]

- Yeong, L.S.; Putuhena, F.; Puong, L.L.; Baharun, A. Assessing the Contribution Factors for the Enhancement of Green Building Index (GBI) in the Malaysian Construction Industry. J. Kejuruter. 2015, 27, 49–56. [Google Scholar] [CrossRef]

- Azlina, A.A.; Mahirah, K.; Sin, M.S. Willingness to pay for renewable energy: Evidence from Malaysian’s Households. J. Ekon. Malaysia 2018, 52, 153–161. [Google Scholar] [CrossRef]

- Tan, C.L.; Goh, Y.N.; Yeo, S.F.; Ching, S.L.; Chan, H.S. An examination of the factors influencing the green initiative and competitiveness of private higher education institutions in Malaysia. J. Pengur. 2017, 51, 87–99. [Google Scholar] [CrossRef]

- Aigbavboa, C.; Thwala, W.D. Performance of a green building’s indoor environmental quality on building occupants in South Africa. J. Green Build. 2019, 14, 131–148. [Google Scholar] [CrossRef]

- Phillips, H.; Handy, R.; Sleeth, D.; Thiese, M.S.; Schaefer, C.; Stubbs, J. Taking The ‘Leed’ In Indoor Air Quality: Does Certification Result In Healthier Buildings? J. Green Build. 2020, 15, 55–66. [Google Scholar] [CrossRef]

- Arifin, K.; Aiyub, K.; Zakaria, H. Evaluation of indoor air quality elements and their relation to employee health symptoms in government offices around the Federal Territory of Putrajaya. Malays. J. Soc. Space 2021, 17, 166–180. [Google Scholar] [CrossRef]

- Robinson, S.; Simons, R.; Eunkyu, L. Which Green Office Building Features Do Tenants Pay for? A Study of Observed Rental Effects. J. Real Estate Res. 2017, 39, 467–492. [Google Scholar] [CrossRef]

- Jasimin, T.H.; Ali, H.M. Valuation of Green Commercial Office Building: A Preliminary Study of Malaysian Valuers ’ Insight. Int. J. Soc. Behav. Educ. Econ. Bus. Ind. Eng. 2015, 9, 1156–1161. [Google Scholar]

- Suh, M.J.; Pearce, A.R.; Song, Y.; Kwak, Y.H.; Kim, J.I.; Zhang, Y. The impact of LEED-energy star-certified office buildings on the market value of adjoining buildings in New York City. J. Green Build. 2019, 14, 31–52. [Google Scholar] [CrossRef]

- Heinzle, S.L.; Yip, A.B.Y.; Xing, M.L.Y. The Influence of Green Building Certification Schemes on Real Estate Investor Behaviour: Evidence from Singapore. Urban Stud. 2013, 50, 1970–1987. [Google Scholar] [CrossRef]

- Abraham, P.S.; Gundimeda, H. Greening offices: Willingness to pay for green-certified office spaces in Bengaluru, India. Environ. Dev. Sustain. 2020, 22, 1–9. [Google Scholar] [CrossRef]

- Pinheiro, M.D.; Luís, N.C. COVID-19 Could Leverage a Sustainable Built Environment. Sustainability 2020, 12, 5863. [Google Scholar] [CrossRef]

- Rodi, W.N.W.; Ani, A.I.C.; Tawil, N.M.; Ting, K.H.; Mahamood, N.M. A preliminary study on the relevancy of sustainable building design to commercial property depreciation. J. Fundam. Appl. Sci. 2017, 9, 162–183. [Google Scholar] [CrossRef]

- Lorenz, D.; Lützkendorf, T. Sustainability and property valuation: Systematisation of existing approaches and recommendations for future action. J. Prop. Investig. Financ. 2011, 29, 644–676. [Google Scholar] [CrossRef]

- Butt, T.; Camilleri, M.; Paul, P.; Jones, K. Obsolescence types and the built environment–definitions and implications. Int. J. Environ. Sustain. Dev. 2015, 14, 20–39. [Google Scholar] [CrossRef]

- Reed, R.; Warren-myers, G. Is Sustainability the 4 th Form of Obsolescence? In Proceedings of the 16th Pacific Rim Real Estate Society (PRRES) Conference, Wellington, NZ, USA, 24–27 January 2010.

- Eichholtz, P.; Kok, N.; Quigley, J.M. The Economics of Green Building. Rev. Econ. Statist. 2010, 95, 50–63. [Google Scholar] [CrossRef]

- Wiley, J.A.; Benefield, J.D.; Johnson, K.H. Green design and the market for commercial office space. J. Real Estate Finance. Econ. 2010, 41, 228–243. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P. Eco-labeling in commercial office markets: Do LEED and Energy Star offices obtain multiple premiums? Ecol. Econ. 2011, 70, 1220–1230. [Google Scholar] [CrossRef]

- Harrison, D.; Seiler, M. The political economy of green office buildings. J. Prop. Investig. Financ. 2011, 29, 551–565. [Google Scholar] [CrossRef]

- Kok, N.; Jennen, M. The impact of energy labels and accessibility on office rents. Energy Policy 2012, 46, 489–497. [Google Scholar] [CrossRef]

- Chegut, A.; Eichholtz, P.; Kok, N. Supply, Demand, and the Value of Green Buildings. Urban Stud. 2014, 51, 22–43. [Google Scholar] [CrossRef]

- Ismail, W.; Majid, R. The impact of Green Features on property valuation procedure. In Proceedings of the International Real Estate Research Symposium (IRERS), Putrajaya, Malaysia, 29–30 April 2014. [Google Scholar]

- Warren-myers, G. Real Estate Valuation and Valuing Sustainability: A Case Study of Australia. Pac. Rim Prop. Res. J. 2015, 19, 81–100. [Google Scholar] [CrossRef]

- Babawale, G.K.; Oyalowo, B. Incorporating Sustainability into Real Estate Valuation: The Perception of Nigerian Valuers. J. Sustain. Dev. 2011, 4, 236–248. [Google Scholar] [CrossRef]

- Muldavin, S. Ten Principles for Sustainable Property Underwriting & Valuation; RICS Property World: Fall, DC, USA, 2009. [Google Scholar]

- Boyd, T. Can we assess the worth of environmental and social characteristics in investment property? In Proceedings of the Pacific Rim Real Estate Society Conference, Auckland, New Zealand, 22–25 January 2006. [Google Scholar]

- Kok, N.; Jennen, M. The Value of Energy Labels in the European Office Market; Maastrict University: Maastrict, The Netherlands; RSM Erasmus: Rotterdam, The Netherlands, 2011; p. 26. [Google Scholar]

- Surmann, M.; Brunauer, W.; Bienert, S. How does energy efficiency influence the Market Value of office buildings in Germany and does this effect increase over time? J. Eur. Real Estate Res. 2015, 8, 243–266. [Google Scholar] [CrossRef]

- Baum, A. Property Investment Depreciation and Obsolescence; Routledge: London, UK, 1991. [Google Scholar]

- Whipple, R. Property Valuation and Analysis; The Law Book Company: Riverwood, NSW, Australia, 1995. [Google Scholar]

- Fuerst, F.; McAllister, P. The impact of Energy Performance Certificates on the rental and capital values of commercial property assets. Energy Policy 2011, 39, 6608–6614. [Google Scholar] [CrossRef]

- Lorenz, D.; Lützkendorf, T. Sustainability in property valuation: Theory and practice. J. Prop. Investig. Financ. 2008, 26, 482–521. [Google Scholar] [CrossRef]

- Rodi, W.N.W.; Hwa, T.K.; Medeena, M.N.; Shahrin, S.A.; Isa, A.M. Depreciation between Conventional and Green Office Buildings. Procedia Econ. Financ. 2015, 31, 661–670. [Google Scholar] [CrossRef] [Green Version]

- Seale, C. Researching Society and Culture, 3rd ed.; Sage Publications Ltd.: London, UK, 2015. [Google Scholar]

- Darko, A.; Chan, A.P.C.; Ameyaw, E.E.; Owusu, E.K.; Pärn, E.; Edwards, D.J. Review of application of analytic hierarchy process (AHP) in construction. Int. J. Constr. Manag. 2019, 19, 436–452. [Google Scholar] [CrossRef]

- Lam, K.; Zhao, X. An application of quality function deployment to improve the quality of teaching. Int. J. Qual. Reliab. Manag. 1998, 15, 389–413. [Google Scholar] [CrossRef]

- Wong, J.K.W.; Li, H. Application of the analytic hierarchy process (AHP) in multi-criteria analysis of the selection of intelligent building systems. Build. Environ. 2008, 43, 108–125. [Google Scholar] [CrossRef]

- Cheng, E.; Li, H. Construction partnering process and associated critical success factors: Quantitative investigation. J. Manag. Eng. 2002, 18, 194–202. [Google Scholar] [CrossRef]

- Saaty, T. Decision making with the analytic hierarchy process. Int. J. Serv. Sci. 2008, 1, 83. [Google Scholar] [CrossRef] [Green Version]

- Shiau, Y.-C.; Tsai, T.-P.; Wang, W.-C.; Huang, M.-L. Use questionnaire and AHP techniques to develop subcontractor selection system. NIST Spec. Publ. Space 2002, 35–40. [Google Scholar]

- Robinson, S.; Simons, R.; Lee, E.; Kern, A. Demand for Green Buildings: Office Tenants’ Stated Willingness-to-Pay for Green Features. J. Real Estate Res. 2016, 38, 423–452. [Google Scholar] [CrossRef]

- Warren-myers, G. Is the valuer the barrier to identifying the value of sustainability? J. Prop. Investig. Financ. 2013, 31, 345–359. [Google Scholar] [CrossRef]

- Simons, R.A.; Robinson, S.; Lee, E. Green Office Buildings: A Qualitative Exploration of Green Office Building Attributes. J. Sustain. Real Estate 2014, 6, 211–232. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).