Factors Influencing Stakeholders’ Decision to Invest in Residential Properties: A Perceptual Analysis of Flood-Risk Areas

Abstract

1. Introduction

2. Determinants of Investment in Flood-Risk Areas

3. Materials and Methods

3.1. Research Questions

- (i)

- What factors do property investors consider in making residential housing decisions in flood-risk areas?

- (ii)

- How well do the estate agents understand the requirements of property investors when making residential housing decisions?

- (iii)

- Compare and rank the perceptual analysis of the responses obtained in (i) and (ii).

- (iv)

- What inferences can be drawn from their perceptual analysis?

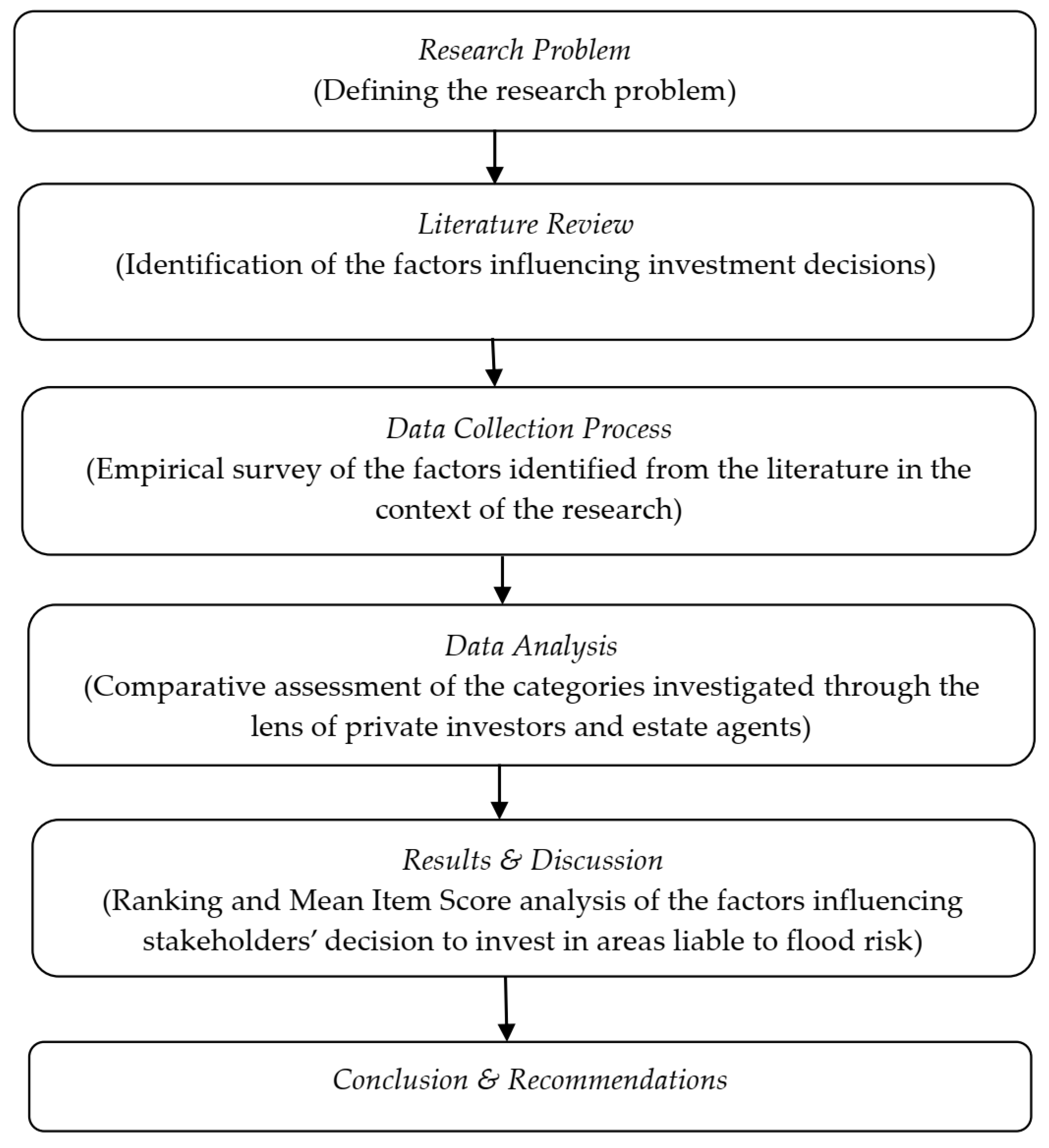

3.2. Research Process

3.3. Study Area

3.4. Data Collection

3.5. Survey Procedure

| Category | Factors | Code |

|---|---|---|

| Locational | The property’s actual location | F1 |

| The possibility that the actual place the property is located will be flooded | F2 | |

| The distance to the workplace | F3 | |

| The proximity of shopping malls/market to the property’s precise location | F4 | |

| The proximity of worship centres to the property’s precise location | F5 | |

| The accessibility of transportation services | F6 | |

| The proximity of healthcare facilities to the property’s precise location | F7 | |

| The population density where the property is situated | F8 | |

| Neighbourhood | The property’s neighbourhood road network | F9 |

| The neighbourhood’s serenity | F10 | |

| The neighbourhood’s topography/terrain | F11 | |

| Availability of electricity and other infrastructural supplies | F12 | |

| The susceptibility of the neighbourhood to flooding | F13 | |

| The neighbourhood’s drainage system | F14 | |

| The neighbourhood’s crime rate | F15 | |

| The neighbourhood’s level of pollution | F16 |

| Category | Factors | Code |

|---|---|---|

| Structural | The size of the building and/or land | F17 |

| The size of the living and/or dining area | F18 | |

| The number of bathrooms in the property | F19 | |

| The interior and exterior façades of the property | F20 | |

| The design and aesthetics of the property | F21 | |

| The condition and age of the property | F22 | |

| The availability of parking space | F23 | |

| The number of rooms within a property | F24 | |

| Market/Economic | The investment cost compared with its associated benefits | F25 |

| The analysis of the market conditions | F26 | |

| The future economic conditions | F27 |

| Category | Factors | Code |

|---|---|---|

| Behavioural | Sentiment (bias) regarding investment | F28 |

| Experience in real estate investment | F29 | |

| Reliance on other people’s investment decisions | F30 | |

| Psychological preparedness to cope with flooding | F31 | |

| Financial preparedness to cope with flooding | F32 | |

| Emotional attachment and willingness to take risks | F33 | |

| Attitude towards risk that is independent of financial circumstances | F34 | |

| Behavioural influence | F35 | |

| Risk | The risk level associated with the property’s location | F36 |

| The level of risk awareness | F37 |

3.6. Methods of Analysis

4. Results and Discussion

5. Perceptions and Considerations

6. Conclusions and Recommendations

- (a)

- From the private investors’ purview, eight factors were recorded as the most important factors influencing property investment decisions in areas prone to flooding: F1 (the actual location of the property), F3 (the distance to the workplace), F6 (the accessibility of transportation services), F10 (the neighbourhood’s serenity), F12 (the availability of electricity and other infrastructural supplies), F13 (the susceptibility of the neighbourhood to flooding), F15 (the neighbourhood’s crime rate), and F16 (the neighbourhood’s level of pollution).

- (b)

- From the estate agents’ purview, only five factors were recorded: F1 (the actual location of the property), F2 (the possibility that the actual location of the property will be flooded), F6 (the accessibility of transportation services), F9 (the property’s neighbourhood road network), and F12 (the availability of electricity and other infrastructural supplies).

- (c)

- In comparison, only three factors—F1 (the actual location of the property), F6 (the accessibility of transportation services), and F12 (the availability of electricity and other infrastructural supplies)—were common to both groups of respondents.

- (d)

- In calculating the results of the decision criteria rule table, the opinion of each respondent was calculated on a five-point Likert scale. For evaluating the perceptual analysis on which this paper was developed, a decision criterion was applied to ensure uniformity. As a result, since the research focused on a developing nation, the researchers opted for the use of a unified measurement system for the proper classification of the results. Despite the range of different studies defining their own methods of classification, this study used the computation of finite-degree classification of the results—which is a unified measurement method in higher educational institutions—as a clustering technique for making informed decisions.

- (e)

- According to the perception plot, the highest determinants were the locational factors, followed by the neighbourhood factors. The plot also shows that behavioural factors have the highest bearing on the investment decisions for private investors, at 4.4, followed by the economic factors at 4.0 and the locational factors at 3.6. The plot also shows that neighbourhood factors have the highest bearing on the investment decisions for estate agents, at 4.6, followed by the economic factors at 4.0 and the locational factors at 3.6. This implies that there are various degrees of correlation between the factors examined in this study.

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Nisar, A. Significance of Real Estate Market Amid Taxation, Waning Interest Rates. Pakistan & Gulf Economist. Cover Story Published on 6 March 2017, Updated on 19 April 2018. 2017. Available online: https://www.pakistangulfeconomist.com/2017/03/06/significance-of-real-estate-market-amid-taxation-waning-interest-rates/ (accessed on 7 April 2023).

- Onwuanyi, N. Between Abuja and Lagos: Insights of price and value in residential real estate. J. Afr. Real Estate Res. 2018, 3, 107–129. [Google Scholar] [CrossRef]

- Onwuanyi, N. Information accessibility in property markets: A comparison of Nigeria and the UK. J. Manag. Econ. Stud. 2021, 3, 1–15. [Google Scholar] [CrossRef]

- Onwuanyi, N.; Oyetunji, A.K. The relevance of inter-market research to knowledge accessibility in property markets: Lessons for Nigeria from the U.K. Prop. Manag. 2021, 39, 702–725. [Google Scholar] [CrossRef]

- Minguzzi, G. The Role of Real Estate in the Economy; British Property Federation: London, UK, 2014; Available online: http://www.bpf.org.uk (accessed on 13 April 2018).

- Kok, N.; Koponen, E.; Martınez-Barbosa, C.A. Big data in real estate? From manual appraisal to automated valuation. J. Portf. Manag. 2018, 43, 202–211. [Google Scholar] [CrossRef]

- Savills World Research. Global Real Estate: Trends in the World’s Largest Asset Class; HSBC Global Real Estate Report 2017; HSBC Holdings Plc: London, UK, 2017; Available online: https://sp.hsbc.com.my/liquid/6642.html (accessed on 12 July 2020).

- Adebimpe, O.A.; Oladokun, Y.O.M.; Odedairo, B.O.; Oladokun, V.O. Developing flood resilient buildings in Nigeria: A guide. J. Environ. Earth Sci. 2018, 8, 143–150. [Google Scholar]

- Ating, E.E. Environmental and ecological problems of Nigeria. J. Environ. Ecol. 2003, 1, 1–30. [Google Scholar]

- Brockhoff, R.C.; Koop, S.H.; Snel, K.A. Pluvial flooding in Utrecht: On its way to a flood proof city. Water 2019, 11, 1501. [Google Scholar] [CrossRef]

- Askew, A. Climate and water—A call for international action. Hydrol. Sci. J. 1991, 36, 391–404. [Google Scholar] [CrossRef]

- Udosen, C. Flood problems in Uyo Local Government Area; Eroflod Consulting Services: Uyo, Nigeria, 1999. [Google Scholar]

- Etuonovbe, K.A. The devastating effect of flooding in Nigeria. In Proceedings of the Bridging the Gap between Cultures 2011, Marrakech, Morocco, 18–22 May 2011; pp. 1–15. [Google Scholar]

- Aderogba, K.A. Global warming and challenges of floods in Lagos metropolis, Nigeria. Acad. Res. Int. 2012, 2, 448–468. Available online: http://www.savap.org.pk/journals/ARInt./Vol.2(1)/2012(2.1-46).pdf (accessed on 17 May 2023).

- Aderogba, K.A. Qualitative studies of recent floods and sustainable growth and development of cities and towns in Nigeria. Int. J. Basic Appl. Sci. 2012, 1, 187–203. [Google Scholar] [CrossRef]

- Agbonkhese, O.; Agbonkhese, E.; Aka, E.; Joe-Abaya, J.; Ocholi, M.; Adekunle, A. Flood menace in Nigeria: Impacts, remedial and management strategies. Civ. Environ. Res. 2014, 6, 32–40. [Google Scholar]

- Mbina, A.A.; Edem, E.E. Challenges of urban waste management in Uyo Metropolis, Nigeria. Civ. Environ. Res. 2015, 7, 196–205. [Google Scholar]

- Hallegatte, S.; Vogt-Schilb, A.; Bangalore, M.; Rozenberg, J. Unbreakable: Building the Resilience of the Poor in the Face of Natural Disasters. Climate Change and Development; World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Centre for Research on the Epidemiology of Disasters Reduction Risk; UN Office for Disaster (CREDUNDR). The Human Cost of Disasters—An Overview of the Last 20 Years 2000–2019; World ReliefWeb: New York, NY, USA, 2020; pp. 1–17. Available online: https://reliefweb.int/report/world/human-cost-disasters-overview-last-20-years-2000-2019 (accessed on 17 May 2023).

- Okupe, L. Private sector initiative in housing development in Nigeria—How feasible? Hous. Today 2002, 1, 21–26. [Google Scholar]

- Enisan, G. Effect of accommodation pressure on housing affordability in Ikeja, Lagos, Nigeria. FUTY J. Environ. 2017, 11, 64–75. [Google Scholar]

- Federal Government of Nigeria (FGN). National Housing Policy Draft; Federal Government of Nigeria (FGN): Abuja, Nigeria, 2004.

- Adeaga, O. Flood Hazard Mapping and Risk Management in Parts of Lagos; University of Lagos Akoka: Lagos, Nigeria, 2008. [Google Scholar]

- Adeloye, A.J.; Rustum, R. Lagos (Nigeria) flooding and influence of urban planning. Proc. Inst. Civ. Eng. Urban Des. Plan. 2011, 164, 175–187. [Google Scholar] [CrossRef]

- Ali, N.; Alias, A.; Othman, K.N. EIA in Malaysia: Preliminary review on the implementation issues and challenges towards sustainable development. In Proceedings of the 1st International Conference on Innovation and Technology for Sustainable Built Environment 2012 (ICITSBE 2012) 2012, Perak, Malaysia, 16–17 April 2012; Available online: https://ir.uitm.edu.my/id/eprint/42898/1/42898.pdf (accessed on 4 May 2023).

- Ali, A.S.; Chua, S.J.L. Factors influencing buyers’ and investors’ decisions in acquiring property in hillside areas. Ain Shams Eng. J. 2023, 14, 101827. [Google Scholar] [CrossRef]

- Basu, A.S.; Gill, L.W.; Pilla, F.; Basu, B. Assessment of variations in runoff due to landcover changes using the SWAT Model in an Urban River in Dublin, Ireland. Sustainability 2022, 14, 534. [Google Scholar] [CrossRef]

- Basu, A.S.; Basu, B.; Pilla, F.; Sannigrahi, S. Investigating the performance of Green Roof for effective runoff reduction corresponding to different weather patterns: A case study in Dublin, Ireland. Hydrology 2022, 9, 46. [Google Scholar] [CrossRef]

- Ayoola, A.B.; Oladapo, A.R.; Ojo, B.; Oyetunji, A.K. Modelling coastal externalities effects on residential housing values. Int. J. Hous. Mark. Anal. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic prices and implicit markets: Product differentiation in pure competition. J. Political Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Sirmans, S.G.; Macpherson, D.A.; Zietz, E.N. The composition of hedonic pricing models. J. Real Estate Lit. 2005, 13, 1–44. [Google Scholar] [CrossRef]

- Oladokun, V.O.; Proverbs, D. Flood risk management in Nigeria: A review of the challenges and opportunities. Int. J. Saf. Secur. Eng. 2016, 6, 485–497. [Google Scholar] [CrossRef]

- Chin, T.L.; Chau, K.W. A critical review of literature on the hedonic price model. Int. J. Hous. Sci. Its Appl. 2003, 27, 145–165. [Google Scholar]

- Baumann, D.D.; Sims, J.H. Flood insurance: Some determinants of adoption. Econ. Geogr. 1978, 54, 189–196. [Google Scholar] [CrossRef]

- Webb, J.R. Real estate investment acquisition rules for life insurance companies and pension funds: A survey. Real Estate Econ. 1984, 12, 495–520. [Google Scholar] [CrossRef]

- Webb, J.R.; Mcintosh, W. Real estate investment acquisition rules for REITS: A survey. J. Real Estate Res. 1986, 1, 77–98. Available online: https://www.jstor.org/stable/44095185 (accessed on 17 May 2023). [CrossRef]

- Louargand, M.A. A survey of pension fund real estate portfolio risk management practices. J. Real Estate Res. 1992, 7, 361–373. [Google Scholar] [CrossRef]

- Sah, V.; Gallimore, P.; Clements, J.S. Experience and real estate investment decision-making: A process-tracing investigation. J. Prop. Res. 2010, 27, 207–219. [Google Scholar] [CrossRef]

- Hennighausen, H.; Suter, J.F. Flood risk perception in the housing market and the impact of a major flood event. Land Econ. 2020, 96, 366–383. Available online: muse.jhu.edu/article/758939 (accessed on 4 May 2023). [CrossRef]

- Beltrán, A.; Maddison, D.; Elliott, R.J.R. Is flood risk capitalised into property values? Ecol. Econ. 2018, 146, 668–685. [Google Scholar] [CrossRef]

- Baker, E.J. Household preparedness for the aftermath of hurricanes in Florida. Appl. Geogr. 2011, 31, 46–52. [Google Scholar] [CrossRef]

- Koerth, J.; Vafeidis, A.T.; Hinkel, J. Household-level coastal adaptation and its drivers: A systematic case study review. Risk Anal. 2017, 37, 629–646. [Google Scholar] [CrossRef] [PubMed]

- Slovic, P.; Finucane, M.L.; Peters, E.; MacGregor, D.G. Risk as analysis and risk as feelings: Some thoughts about affect, reason, risk, and rationality. Risk Anal. 2004, 24, 311–322. [Google Scholar] [CrossRef]

- Griffin, R.J.; Yang, Z.; Ter Huurne, E.; Boerner, F.; Ortiz, S.; Dunwoody, S. After the flood: Anger, attribution, and the seeking of information. Sci. Commun. 2008, 29, 285–315. [Google Scholar] [CrossRef]

- O’Neill, E.; Brereton, F.; Shahumyan, H.; Clinch, J.P. The impact of perceived flood exposure on flood-risk perception: The role of distance. Risk Anal. 2016, 36, 2158–2186. [Google Scholar] [CrossRef] [PubMed]

- Dunwoody, S.; Neuwirth, K. Coming to terms with the impact of communication on scientific and technological risk judgments. In Risky Business: Communicating Issues of Science, Risk and Public Policy; Wilkins, L., Patterson, P., Eds.; Greenwood Press: New York, NY, USA, 1991; pp. 11–30. [Google Scholar]

- Dohle, S.; Keller, C.; Siegrist, M. Examining the relationship between affect and implicit associations: Implications for risk perception. Risk Anal. 2010, 30, 1116–1128. [Google Scholar] [CrossRef] [PubMed]

- Tversky, A.; Kahneman, D. Rational choice and the framing of decisions. J. Bus. 1986, 59, 251–278. Available online: https://www.jstor.org/stable/23527za59 (accessed on 17 May 2023). [CrossRef]

- Kahneman, D. A perspective on judgment and choice: Mapping bounded rationality. Am. Psychol. 2003, 58, 697–720. [Google Scholar] [CrossRef]

- Slovic, P. Perception of risk. Science 1987, 236, 220–231. [Google Scholar] [CrossRef]

- Juliusson, E.Á.; Karlsson, N.; Gärling, T. Weighing the past and the future in decision making. Eur. J. Cogn. Psychol. 2005, 17, 561–575. [Google Scholar] [CrossRef]

- Sagi, A.; Friedland, N. The cost of richness: The effect of the size and diversity of decision sets on post-decision regret. J. Personal. Soc. Psychol. 2007, 93, 515–524. [Google Scholar] [CrossRef] [PubMed]

- Solomon, S.; Qin, D. Climate Change: The Physical Science Basis. Contribution of Working Group One to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2007. [Google Scholar]

- Buchanan, M.K.; Oppenheimer, M.; Parris, A. Values, bias, and stressors affect intentions to adapt to coastal flood risk: A case study from New York City. Weather. Clim. Soc. 2019, 11, 809–821. [Google Scholar] [CrossRef]

- Kamali, M.K.; Hojjat, S.A.; Rajabi, M.A. Studying Noise Effect on Property Valuation; Paper Reference Number: MME08 PN 37. 2008. Available online: https://citeseerx.ist.psu.edu/document?repid=rep1&type=pdf&doi=73a2bbcd29d192c7008104a3ea9aa94078f1bbfa (accessed on 4 May 2023).

- Sean, S.L.; Hong, T.T. Factors affecting the purchase decision of investors in the residential property market in Malaysia. J. Surv. Constr. Prop. 2014, 5, 1–13. [Google Scholar] [CrossRef]

- Wong, W.-C.; Azhari, A.; Adiana Hiau Abdullah, N.; Yin Yip, C. Estimating the impact of crime risk on housing prices in Malaysia. Int. J. Hous. Mark. Anal. 2020, 13, 769–789. [Google Scholar] [CrossRef]

- Maleki, M.Z.; Zain, M.F.M. Factors that influence distance to facilities in a sustainable efficient residential site design. Sustain. Cities Soc. 2011, 1, 236–243. [Google Scholar] [CrossRef]

- Abass, M. The Making of African Megacities: A Case of Lagos, Nigeria. Demography, Urbanisation and Mobility. 2021. Available online: https://revistaidees.cat/en/the-making-of-african-megacities-a-case-of-lagos-nigeria/ (accessed on 17 May 2023).

- Ojo, K.; Omotayo, A. The physical environment of Lagos State. In Living Condition of the People of Lagos State; Arowolo, O.O., Ed.; Lagos State University Press: Lagos, Nigeria, 1988. [Google Scholar]

- Odumosu, T. Locations and regional setting of Lagos state. In Lagos in Maps; Balogun, O.Y., Odumosu, T., Ojo, K., Eds.; Rex Charles: Ibadan, Nigeria, 1999. [Google Scholar]

- Ambode, A. Lagos GDP Hits $131 Billion. News of Nigeria. 2017. Available online: www.newsofnigeria.com (accessed on 25 June 2019).

- United Nations. The Millennium Development Goals Report; United Nations: New York, NY, USA, 2008; Available online: https://www.un.org/millenniumgoals/2008highlevel/pdf/newsroom/mdgreports/MDG_Report_2008_ENGLISH.pdf (accessed on 17 May 2023).

- Iwugo, K.O.; D’arcy, B.; Andoh, R. Aspects of land-based pollution of an African coastal megacity of Lagos. In Proceedings of the Diffuse Pollution Conference, Dublin, Ireland, 17–21 August 2003; pp. 14122–14124. [Google Scholar]

- Sarkar Basu, A.; Gill, L.W.; Pilla, F.; Basu, B. Assessment of climate change impact on the annual maximum flood in an urban river in Dublin, Ireland. Sustainability 2022, 14, 4670. [Google Scholar] [CrossRef]

- Kumar, P.; Debele, S.E.; Sahani, J.; Aragão, L.; Barisani, F.; Basu, B.; Bucchignani, E.; Charizopoulos, N.; Di Sabatino, S.; Domeneghetti, A.; et al. Towards an operationalisation of nature-based solutions for natural hazards. Sci. Total Environ. 2020, 731, 138855. [Google Scholar] [CrossRef]

- Kumar, P.; Debele, S.E.; Sahani, J.; Rawat, N.; Marti-Cardona, B.; Alfieri, S.M.; Basu, B.; Basu, A.S.; Bowyer, P.; Charizopoulos, N.; et al. An overview of monitoring methods for assessing the performance of nature-based solutions against natural hazards. Earth-Sci. Rev. 2021, 217, 103603. [Google Scholar] [CrossRef]

- Odunuga, S.; Oyebande, L.; Omojola, A.S. Socio-economic indicators and public perception on urban flooding in Lagos, Nigeria. Hydrology for Disaster Management. Niger. Assoc. Hydrol. Sci. 2012, 82–96. Available online: https://publications.unaab.edu.ng/index.php/NAHS/article/view/915 (accessed on 17 May 2023).

- Idowu, O.A.; Martins, O. Hydrograph analysis for groundwater recharge in the phreatic basement aquifer of the Opeki River basin, Southwestern Nigeria. Asset Ser. B 2007, 6, 132–141. [Google Scholar]

- Sojobi, A.O.; Balogun, I.I.; Salami, A.W. Climate change in Lagos state, Nigeria: What really changed? Environ. Monit. Assess. 2016, 188, 1–42. [Google Scholar] [CrossRef] [PubMed]

- Koko, F.A.; Yue, W.; Abubakar, A.G.; Hamed, R.; Alabsi, G.A. Analyzing urban growth and land cover change scenario in Lagos, Nigeria using multi-temporal remote sensing data and GIS to mitigate flooding. Geomat. Nat. Hazards Risk 2021, 12, 631–652. [Google Scholar] [CrossRef]

- Nigeria Hydrological Services Agency. 2020 Annual Flood Outlook. 2020. Available online: https://nihsa.gov.ng/wp-content/uploads/2020/06/2020-NIHSA-Annual-Flood-Outlook-AFO-5-2.pdf (accessed on 7 May 2023).

- Adegboyega, S.A.; Onuoha, O.C.; Adesuji, K.A.; Olajuyigbe, A.E.; Olufemi, A.A.; Ibitoye, M.O. An integrated approach to modelling of flood hazards in the rapidly growing city of Osogbo, Osun State, Nigeria. Space Sci. Int. 2018, 4, 1–15. [Google Scholar] [CrossRef]

- Abolade, O.; Muili, A.B.; Ikotun, S.A. Impacts of flood disaster in Agege local government area Lagos, Nigeria. Int. J. Dev. Sustain. 2013, 2, 2354–2367. [Google Scholar]

- Israel, A.O. Nature, the built environment and perennial flooding in Lagos, Nigeria: The 2012 flood as a case study. Urban Clim. 2017, 21, 218–231. [Google Scholar] [CrossRef]

- Murie, A. Secure and contented citizens? Home ownership in Britain. In Housing and Public Policy: Citizenship, Choice and Control; Marsh, A., Mullins, D., Eds.; Open University Press: Buckingham, UK, 1998; pp. 79–98. [Google Scholar]

- Seo, J.; Oh, J.; Kim, J. Flood risk awareness and property values: Evidences from Seoul, South Korea. Int. J. Urban Sci. 2021, 25, 233–251. [Google Scholar] [CrossRef]

- Wang, D.; Li, V.J.; Yu, H. Mass appraisal modeling of real estate in urban centers by geographically and temporally weighted regression: A case study of Beijing’s core area. Land 2020, 9, 143. [Google Scholar] [CrossRef]

- Bryman, A.; Bell, E.; Hirschsohn, P.; Dos Santos, A.; Du Toit, J.; Wagner, C.; Van Aardt, I.; Masenge, A. Research Methodology: Business and Management Contexts, 5th ed.; Oxford University Press: Cape Town, South Africa, 2014. [Google Scholar]

- Dudovskiy, J. Non-probability sampling. In The SAGE Handbook of Survey Methodology; SAGE Publications: Thousand Oaks, CA, USA, 2016; Available online: https://researchmethodology.net/sampling-in-primary-data-collection/non-probability-sampling/s (accessed on 4 May 2023).

- Bondinuba, F.K.; Stephens, M.; Jones, C.; Buckley, R. The motivations of microfinance institutions to enter the housing market in a developing country. Int. J. Hous. Policy. 2020, 20, 534–554. [Google Scholar] [CrossRef]

- George, D.; Mallery, P. SPSS for Windows Step by Step: A Simple Guide and Reference. 11.0 Update, 4th ed.; Allyn & Bacon: Boston, MA, USA, 2003. [Google Scholar]

- Taber, K.S. The use of Cronbach’s alpha when developing and reporting research instruments in science education. Res. Sci. Educ. 2018, 48, 1273–1296. [Google Scholar] [CrossRef]

- Robinson, J.P.; Shaver, P.R.; Wrightsman, L.S. (Eds.) Measures of Personality and Social Psychological Attitudes; Academic Press: San Diego, CA, USA, 1991. [Google Scholar]

- Cronbach, L.J. Coefficient alpha and the internal structure of tests. Psychometrika 1951, 16, 297–334. [Google Scholar] [CrossRef]

- Sijtsma, K. On the use, the misuse, and the very limited usefulness of Cronbach’s alpha. Psychometrika 2009, 74, 107–120. [Google Scholar] [CrossRef]

- Olajuyigbe, A.E.; Rotowa, O.O.; Durojaye, E. An assessment of flood hazard in Nigeria: The case of mile 12, Lagos. Mediterr. J. Soc. Sci. 2012, 3, 367–375. [Google Scholar]

- Adediran, I. How Flood Destroy Our Properties—Lagos Residents. Premium Times Newspaper. 2020. Available online: https://www.premiumtimesng.com/regional/ssouth-west/403613-how-flood-destroy-our-properties-lagos-residents.html (accessed on 7 April 2023).

- Lagos State Government (LASG, 2020). Lagos Urges Residents of Four LGAS with High Flood Risk to Remain Alert. Available online: https://environment.lagosstate.gov.ng/2020/07/09/lagos-urges-residents-of-four-lgas-with-high-flood-risk-to-remain-alert/ (accessed on 7 April 2023).

- Oyetunji, A.K. The Influence of Flood Risk on Investment Decisions in the Lagos Residential Property Market. PhD Thesis, Lancaster University, Lancaster Environment Centre (LEC), Lancaster, UK, 2022. [Google Scholar]

- Ihuah, P.W.; Benebo, A.M. An assessment of the causes and effects of abandonment of development projects on real property values in Nigeria. Int. J. Res. Appl. Nat. Soc. Sci. 2014, 2, 25–36. [Google Scholar]

- Elliot, P. Property values and infrastructure provision: A conceptual model of risk perception, amplification and worsenment. Nord. J. Surv. Real Estate Res. 2008, 3, 26–37. [Google Scholar]

- Gallimore, P.; Fletcher, M.; Carter, M. Modelling the influence of location on value. J. Prop. Valuat. Investig. 1996, 14, 6–19. [Google Scholar] [CrossRef]

- Amenyah, I.D.; Fletcher, E.A. Factors determining residential rental prices. Asian Econ. Financ. Rev. 2013, 3, 39–50. Available online: http://aessweb.com/journal-detail.php?id=5002 (accessed on 14 December 2022).

- Clark, D.E.; Herrin, W.E. The impact of public school attributes on home sale prices in California. Growth Chang. 2000, 31, 385–407. [Google Scholar] [CrossRef]

- Topcu, M.; Kubat, A.S. The analysis of urban features that affect land values in residential areas. In Proceedings of the 7th International Space Syntax Symposium; Koch, D., Marcus, M., Steen, J., Eds.; KTH: Stockholm, Sweden, 2009. [Google Scholar]

- Abidoye, R.B. Towards Property Valuation Accuracy: A Comparison of Hedonic Pricing Model and Artificial Neural Network. Ph.D. Thesis, Hong Kong Polytechnic University, Hong Kong, China, 2017. [Google Scholar]

- Thompson, A.A.; Strickland, A.J. Strategic Management: Concepts and Cases, 9th ed.; Irwin: Chicago, IL, USA, 1996. [Google Scholar]

- Zhang, Y.; Lindell, M.K.; Prater, C.S. Vulnerability of community businesses to environmental disasters. Disasters 2009, 33, 38–57. [Google Scholar] [CrossRef]

- Amaechi, C.V. Standards as Tools for Sustainability: A Tale on Sustainable Construction; Createspace Publishers—Amazon: Lancashire, UK, 2016. [Google Scholar]

| Variable | No. of Items | Private Investors’ | Estate Agents’ | ||

|---|---|---|---|---|---|

| Actual | Standardised Items | Actual | Standardised Items | ||

| Motivating Factors | 37 | 0.858 | 0.873 | 0.862 | 0.873 |

| Respondents | Distributed | Returned | Valid |

|---|---|---|---|

| Private Investors | 111 (100.00%) | 89 (80.18%) | 75 (84.27%) |

| Estate Agents | 186 (100.00%) | 93 (50.00%) | 75 (80.64%) |

| Range of Mean Score | Interpretation |

|---|---|

| 5.00 ≥ x ≤ 4.50 | Most significant |

| 4.49 ≥ x ≤ 3.50 | Significant |

| 3.49 ≥ x ≤ 2.40 | Moderately significant |

| 2.39 ≥ x ≤ 1.50 | Slightly significant |

| 1.00 ≥ x ≤ 1.49 | Less significant |

| 0.00 > x < 0.99 | Not significant |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oyetunji, A.K.; Amaechi, C.V.; Dike, E.C.; Ayoola, A.B.; Olukolajo, M.A. Factors Influencing Stakeholders’ Decision to Invest in Residential Properties: A Perceptual Analysis of Flood-Risk Areas. Buildings 2023, 13, 1560. https://doi.org/10.3390/buildings13061560

Oyetunji AK, Amaechi CV, Dike EC, Ayoola AB, Olukolajo MA. Factors Influencing Stakeholders’ Decision to Invest in Residential Properties: A Perceptual Analysis of Flood-Risk Areas. Buildings. 2023; 13(6):1560. https://doi.org/10.3390/buildings13061560

Chicago/Turabian StyleOyetunji, Abiodun Kolawole, Chiemela Victor Amaechi, Emmanuel Chigozie Dike, Adeyosoye Babatunde Ayoola, and Michael Ayodele Olukolajo. 2023. "Factors Influencing Stakeholders’ Decision to Invest in Residential Properties: A Perceptual Analysis of Flood-Risk Areas" Buildings 13, no. 6: 1560. https://doi.org/10.3390/buildings13061560

APA StyleOyetunji, A. K., Amaechi, C. V., Dike, E. C., Ayoola, A. B., & Olukolajo, M. A. (2023). Factors Influencing Stakeholders’ Decision to Invest in Residential Properties: A Perceptual Analysis of Flood-Risk Areas. Buildings, 13(6), 1560. https://doi.org/10.3390/buildings13061560