1. Introduction

The building sector plays a significant role in global carbon dioxide emissions, accounting for approximately one-third of energy- and process-related emissions, both directly and indirectly [

1]. High energy consumption is associated with a wide range of threats, including environmental impacts, among others. Energy performance projects have been introduced as one of the most-effective ways to reduce energy consumption and improve the overall energy efficiency of buildings [

2]. In Energy Performance Contracting (EPC) projects, energy savings are the central means of earning income and covering project costs, enabling these projects to quickly establish themselves in energy-intensive markets [

3,

4,

5]. EPC projects are not limited to developed countries, as a considerable number of developing countries have already embraced them as a primary strategy for reducing energy costs [

6,

7]. Nevertheless, despite the significant growth of these projects in both developed and developing countries, their market in many energy-intensive countries, such as Iran, is still in its early stages [

8,

9].

Despite the obvious advantages of EPC projects, they are typically subjected to risks [

10], necessitating a combination of various factors to achieve success [

11,

12,

13]. The inherent riskiness of these projects hampers their development in newly established and emerging markets, where risk analysis plays a crucial role in driving market growth [

10]. Consequently, numerous research studies have been conducted on EPC risks in both developed and developing markets. Some studies have investigated the risks faced by Energy Service Companies (ESCOs), which are the main players in implementing EPC projects, at both the European level [

14,

15] and in specific countries such as Finland [

16] and Sweden [

17]. Moreover, significant research has been carried out on risk identification and analysis in emerging markets, including China’s EPC projects, contributing to the development of that market. For example, Da-li et al. [

18] investigated different risks associated with the development of EPC markets in China and proposed various measures to mitigate them. Liu et al. [

19] analyzed the threats and weaknesses for the development of China’s EPC projects using the Analytic Network Process (ANP)-Strengths, Weaknesses, Opportunities, and Threats (SWOT) method. Various methods have been employed to analyze risks in EPC projects. Lee et al. [

20] utilized sensitivity analysis and Monte Carlo techniques to quantitatively simulate risk assessment. Other researchers have employed qualitative methods to analyze risks. Wang et al. [

21] identified and prioritized the risks of EPC projects by comparing the best–worst method with other techniques to validate the proposed model. Another study [

22] ranked identified risks using a new approach called Multi-Attributive Border Approximation area Comparison (MABAC) method, considering decision-makers’ bounded rationality and behavioral psychology. Additionally, Garbuzova-Schlifter et al. [

23] applied the Analytic Hierarchy Process (AHP) method to rank EPC risks in Russia’s market.

Despite the application of various approaches by researchers to analyze risks in EPC projects, the interrelationship between risks is often overlooked, limiting the applicability of these studies and making risk management challenging, particularly in developing markets that face multiple risks. Moreover, the implementation of high-risk projects in new markets can result in early project failure, thereby diminishing the effectiveness of energy efficiency policies. To address these issues, this study aims to achieve several objectives. Firstly, it seeks to identify a comprehensive range of risks specific to EPC projects in emerging markets, with a particular focus on the case of Iran. Secondly, it aims to establish a network of relationships among these risks to deepen the understanding of risk management. Thirdly, the study aims to prioritize the identified risks to enhance the likelihood of identifying effective solutions. Lastly, it aims to rank three low-risk project types as alternatives during the initial stages of market development to increase the probability of success for EPC projects.

To address the aforementioned objectives, a hybrid Multi-Criteria Decision-Making (MCDM) technique that combines Decision-Making Trial and Evaluation Laboratory (DEMATEL), ANP, and VIekriterijumsko KOmpromisno Rangiranje (VIKOR) is employed. This proposed approach not only establishes a network of risks and their priorities, but also ranks the most-favorable alternatives. By offering a more-accurate depiction of the risks and their interrelationships, this method facilitates policymakers in making more-effective decisions. Similar approaches have been successfully utilized by researchers in various industries to tackle complex problems [

24]. Some notable studies in this regard include the identification and ranking of risks in product lifecycle management by [

25], the control of information security risks [

26], and optimal vendor selection for recycled materials [

27].

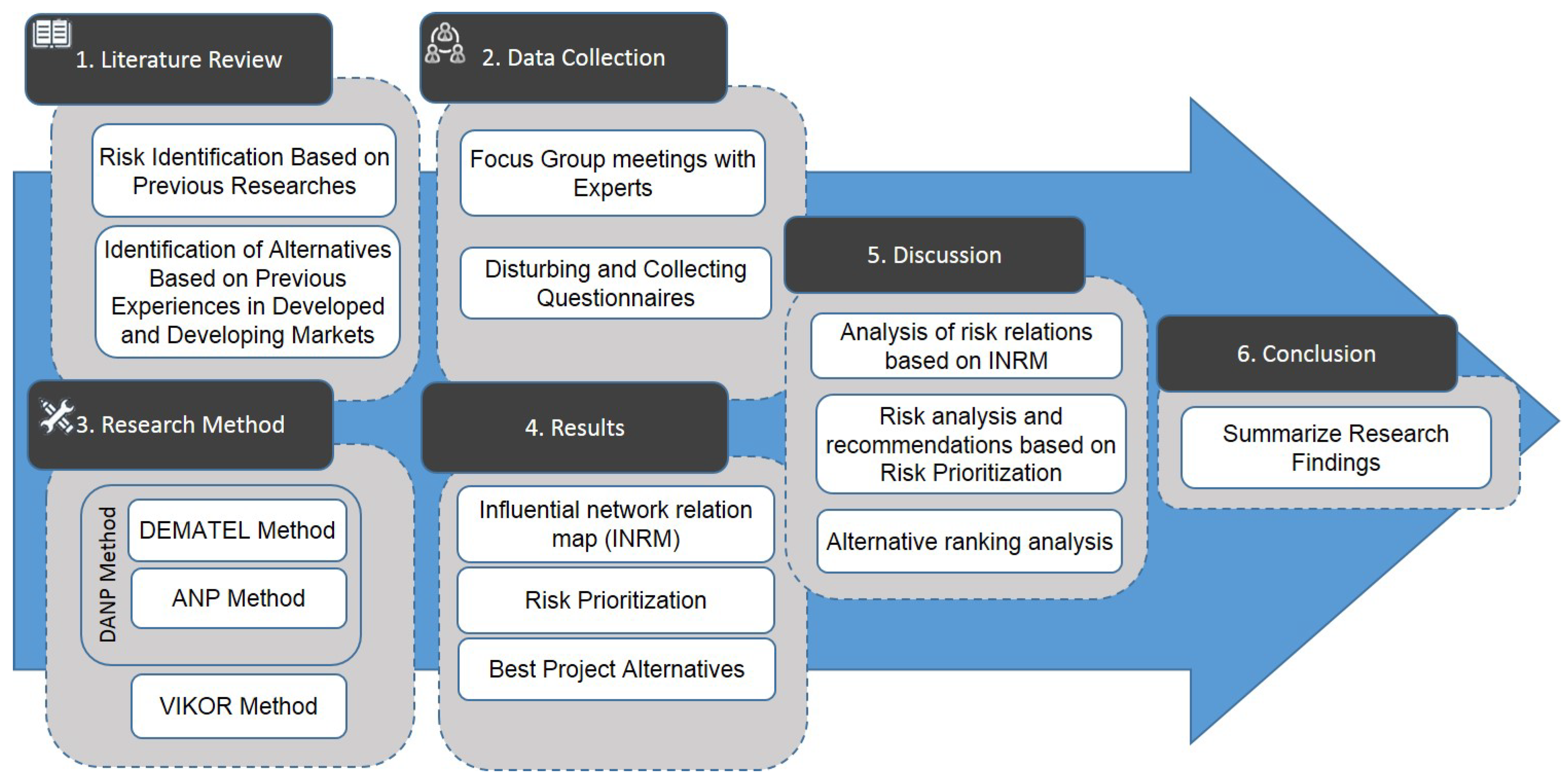

Figure 1 illustrates the six-stage research process undertaken in this study. In the initial stage (

Section 2.2), a comprehensive set of risks in both developed and developing markets was identified. Subsequently, a selection of relevant projects was identified based on successful experiences in developed and developing markets (

Section 2.3). The second stage involved the integration and categorization of the identified factors through focus group meetings, followed by the distribution of questionnaires (

Section 3.1). In the third stage, the collected questionnaire data were utilized to compute the proposed research method (

Section 3.2). The results are presented in

Section 4 and analyzed in

Section 5. Finally, a summary of the research findings and their implications is provided in

Section 6.

3. Materials and Methods

The AHP method [

62] is often considered impractical for real-world problems due to a lack of interdependencies [

63]. The ANP method [

64] was proposed as a solution to address this limitation. However, the ANP method derives the weighted super-matrix by dividing each factor in each column by the number of clusters, resulting in each column having the same weight and not considering the influence of clusters on each other [

27,

65]. To overcome these challenges, this research utilizes the DANP technique, which combines the DEMATEL method with ANP [

66,

67].

In the DANP method, the interrelationships among the risks are measured using the DEMATEL method [

68]. This approach generates an Influential Network Relation Map (INRM) that depicts the relationships among the risk factors. The risk weights are then determined using DANP. These risk weights are subsequently used in conjunction with the VIKOR method [

69] to rank the alternatives. A schematic diagram illustrating the DANP with VIKOR method is shown in

Figure 2. While the DANP with VIKOR method demonstrates notable advantages in addressing the limitations of traditional AHP and ANP approaches, it is essential to acknowledge a potential limitation in the DANP technique itself. The DANP method heavily relies on expert judgments to establish the influential network relation map, which may introduce subjectivity and bias into the decision-making process.

3.1. Data Collection

To ensure a robust and comprehensive data collection process, this study engaged in an extensive eight-month endeavor involving more than 20 focus group meetings. The focus group meetings were attended by a panel of experts with diverse backgrounds, as detailed in

Table 2, all of whom possessed significant experience in Iran’s EPC market.

The data collection process began with the identification of 68 risk factors derived from existing research and the integration of six types of projects based on experienced markets, resulting in a total of 44 risk factors. Among these, 35 risks were sourced from the existing literature, while an additional 9 risks were contributed through expert opinions gathered during the focus group meetings (as described in

Section 3.1). Subsequently, to gain deeper insights into the interrelationships among the identified risks, experts from the focus groups classified these risks based on their previous studies and personal opinions.

The classification process involved categorizing risks with similar roots or underlying causes into distinct risk groups. The rationale behind this classification was to understand how risks within the same category might be interconnected and how they collectively influence specific dimensions of the EPC market in Iran. Consequently, this categorization enabled the study to explore the interdependencies among the identified risks and shed light on the complex dynamics that shape the overall risk landscape in the context of EPC projects. As a result of this classification process, the 44 risk factors were further organized into 13 factors and four dimensions, as elaborated in

Section 5.

Moreover, to ensure a representative sample, 140 verified questionnaires were distributed among Iranian ESCOs and building energy companies officially registered in the Ministry of Energy. The design of these questionnaires is presented in

Appendix B. The selection of this target population was based on their expertise and direct involvement in the Iran EPC market. Out of the 140 questionnaires, 106 were successfully collected and used for subsequent calculations and analysis. While the focus group meetings and questionnaires were designed to yield robust insights, it is important to acknowledge potential limitations associated with data collection. The reliance on expert opinions and self-reporting through questionnaires might introduce subjectivity and response bias. Nevertheless, measures, such as the validation process by the focus group, were taken to mitigate such limitations and ensure the rigor of the data-collection process. The inputs and outputs of the focus group meetings are visually depicted in

Figure 3, providing a clear overview of the data-gathering process.

3.2. The DEMATEL Process

3.2.1. Step 1: Construct the Direct Relationship Matrix (A)

After collecting the questionnaires and calculating the average scores, the direct relationship matrix

A was constructed. In this matrix,

represents the influence of criterion

i on criterion

j.

3.2.2. Step 2: Normalized Direct Relationship Matrix (X)

Matrix

is obtained by normalizing the matrix

A through the following equations. Based on Equation (3), the maximum amount for the total sum of values in each row and column is divided by the corresponding entries in the direct relationship matrix.

3.2.3. Step 3: Compute the Total Relation Matrix ()

Matrix

X represents direct relationships between the entries, and

denotes indirect (second-hand) relations, and so on. The total relationship matrix

T is given as follows.

Now, the sums of the rows and columns were taken to obtain matrices R and S.

Therefore, represents the importance degree of each factor within the whole system and denotes the net influence given by or received by the factors in the system. If this value is positive, factor i is characterized as a cause, and whenever the value is negative, the factor is identified as an effect.

3.3. The DANP Process

3.3.1. Step 4: Formation of Unweighted Super-Matrix ()

In this step, the total relationship matrix

is used as the basis for calculations. The values of the entries in all columns are summed to normalize this matrix. As a result, the matrix

is obtained from the entries of matrix

T, and matrix

is derived from the clusters of matrix

T.

After the normalization of matrix

T using the clusters, the new matrix

is given by the following formula.

Furthermore, Equations (9) and (10) show the normalization process for matrix

.

Then, the unweighted matrix

is built as follows.

3.3.2. Step 5: Building the Weighted Super-Matrix

Equations (7)–(11) are performed as the previous step for the total relationship matrix of clusters in order to build the unweighted super-matrix

as follows.

Now, the unweighted super-matrix of clusters is multiplied by

to obtain the weighted super-matrix.

3.3.3. Step 6: Building the Limit Super-Matrix

Limiting the weighted super-matrix by increasing the power

k is continued until the amount of criteria weights remains unchanged. Therefore, the super-matrix is converged by

in order to build the limit super-matrix. The super-matrix obtains the final weights used for providing a ranking [

66].

3.4. The VIKOR Process

3.4.1. Step 7: Building the Normalized VIKOR Matrix

A decision matrix was built from the questionnaires collected. The entry

represents the influence of criteria

i on alternative

j. Then, the decision matrix is normalized using Equation (14).

3.4.2. Step 8: Determining Positive and Negative Ideal Solutions

In this step, the positive and negative ideal solutions are calculated by Equations (15) and (16).

3.4.3. Step 9: Calculating the Utility Measure (S) and Regret Measure (Q) for Each Alternative

In this step, the utility measure (

S) and regret measure (

Q) for each alternative is obtained by Equations (17) and (18), respectively. The weights

are those obtained by the DANP method.

3.4.4. Step 10: Calculating the VIKOR Index and Ranking of Alternatives

The VIKOR index should be measured first to choose and rank alternatives. The index is given as follows.

where the value

is obtained. Then, the alternatives are ordered based on the values of

Q,

S, and

R. Given the negative characteristic of risks, the best alternative is the one with a higher

Q and

S than the others, meaning that the associated alternative has a high distance from the ideal solution, and it is introduced as the desirable alternative.

5. Discussion

5.1. Influential Network Relation Map between Risks

Table 6 provides a characterization of the risks based on the values of

and

. The value of

indicates the importance degree of each factor, while values of

above the horizontal axis (positive) indicate the impact of the corresponding factor on other criteria (cause) and values below the horizontal axis (negative) imply that the factor is influenced by the others (effect).

5.1.1. Influential Relation of Risk Dimensions

According to

Figure 4a and

Table 6, the value of

for External risk dimensions (E) is 0.25, which is the highest value among the other risk dimensions. This indicates that external risks have a significant influence on all other risk dimensions, particularly on the influenced risk dimensions P and M. As external risks are beyond the control of EPC experts, decision-makers can positively impact other risks by effectively managing and controlling these external risks. A similar pattern can be observed for Contractual risks (C) with a

value of 0.19, indicating their significant influence on other criteria.

The value of for Project lifecycle risks (P) and Market and technology risks (M) is 0.91 and 0.87, respectively, making them the most-influential dimensions among the risk dimensions. This suggests a strong relationship of these dimensions with other criteria. While EPC experts have limited control over Project lifecycle risks (P) and Market and technology risks (M), their ability to manage External risks (E) and Contractual risks (C) directly affects the other risks.

Overall, the discussion highlights that, although managers may have limited control over certain risk dimensions, such as Project lifecycle risks (P) and Market and technology risks (M), their ability to effectively manage External risks (E) and Contractual risks (C) can have a positive impact on other risks.

5.1.2. Influential Relation of External Risks

According to

Figure 4e, political risks (E2) have a

value of 0.29, indicating their causal nature in relation to other risks within this dimension. Although political risks are ranked third in terms of their importance degree

, they have the most-significant direct impact on other risks across the dimensions E, C, P, and M. This implies that addressing political risks and managing factors such as unstable regulations can increase the likelihood of success in the EPC market in Iran.

The high importance degree of social risks (E3) with a value of 0.61 highlights the positive impact of promoting awareness by social decision-makers on project outcomes. By creating awareness and understanding of the benefits of EPC projects among the public, the adoption and implementation of such projects can be facilitated.

Regarding economic risks (E1), it is observed that they influence other risks and are influenced by political risks to a similar extent. An incremental increase in energy prices, as seen in markets such as Bulgaria [

8], can enhance the profitability of EPC projects and promote awareness of the EPC concept. This, in turn, can lead to better financing opportunities for EPC projects. Overall, the discussion emphasizes the significance of addressing political risks, promoting social awareness, and considering economic factors such as energy prices to create a favorable environment for the development of the EPC market in Iran.

5.1.3. Influential Relation of Legal and Contractual Risks

Based on

Figure 4d, the importance degree of Contractual risks (C2) is 0.44, which aligns with previous research indicating that the use of standardized contract models directly contributes to better project acceptance and execution procedures [

15]. Developing contractual models tailored to the conditions of the Iranian market, through research and analysis, can significantly help in managing this risk.

The importance degree of legal risks (C1) and credit risks (C3) is approximately the same, with a value of 0.36. This emphasizes the importance of having stable legislation and addressing restrictive bureaucratic processes related to EPC projects. Additionally, it underscores the significance of trust and credibility between the parties involved in the contract.

5.1.4. Influential Relation of Market and Technological Risks

As shown in

Figure 4c, the positive value of

for demand risks (M1) indicates the influence of motivation factors on crucial risks related to finance (M2) and technology (M3). The presence of bidirectional arrows between finance risks (M2) and technology risks (M3) suggests a direct relationship between these two aspects. This implies that having control over finance risks contributes to the utilization of better equipment and the reduction of technology-related risks. Furthermore, mitigating technology risks enhances profitability and improves project finances.

With an importance degree of 0.61, both finance risks (M2) and technology risks (M3) are emphasized as crucial factors directly impacting the successful implementation of projects. This highlights the need for effective management of these risks to ensure project success.

5.1.5. Influential Relation of Project Lifecycle Risks

Figure 4b illustrates the high importance of all three factors within the project lifecycle dimension. Planning and design risks (P1) have an importance degree of 0.67, followed by execution risks (P2) with 0.70, and operation and maintenance risks (P3) with 0.71. This implies that EPC experts can increase the likelihood of project success by effectively managing these risks. The direct impact of planning and design risks (P1) on other risks suggests that, by mitigating risks within this factor, experts can better control other risks. Additionally, the mutual relationship between execution risks (P2) and operation and maintenance risks (P3) emphasizes the direct association between these two phases, further underscoring the importance of addressing these risks appropriately.

5.2. Risk Factors’ Priorities (Weights)

According to

Table 9, operation and maintenance risks (P3) are ranked first, indicating their high priority among EPC projects. This highlights the significant importance of effectively managing these risks for the success of the project. The negative value of

in

Table 6 for this risk factor suggests its influenced nature, meaning that the occurrence of other risks has a negative impact on the operation and maintenance risks. This can lead to dissatisfaction among energy users and ultimately result in the failure of EPC projects. According to

Table 11, the findings of this study underscore the significance of Operation and Maintenance (O&M) risks. Additionally, it is noteworthy to mention that the identified risks in other studies, namely financial risks and market risks, closely align with the most-influential risk identified in our study, which is the political risk. The results reveal that political risk has the greatest impact on other risk factors. Political stability and government policies directly influence the financial climate and market conditions for such projects. As a result, political risk emerges as a critical determinant that shapes the landscape for other risks in the EPC domain, making it a central focus of concern in both our study and other related research.

In terms of ranking, five risk factors are listed from first to fifth: P3, P2, M3, M2, and P1. Except for design and planning risks (P1), all other factors exhibit an influenced nature (effect). However, it should be noted that the role of design and planning risks (P1) is particularly important as they enable experts influence other risks by effectively controlling the planning and design stages.

In order to effectively manage project lifecycle risks (P) and market risks (M), managers and policymakers should focus on addressing other causal risks such as political risks (E2), economic risks (E1), legal risks (C1), and awareness risks (E2). These risks have a substantial negative value of

in

Table 6, indicating their causative nature and the potential to influence other risks. Managers have more control over these risks, making them important targets for risk mitigation.

Policy-makers are recommended to take actions to address these risks by establishing stable rules and regulations, increasing public awareness about EPC projects, and implementing measures to control inflation rates. Additionally, EPC experts should prioritize the management of highly causal risks such as design and planning risks (P1), execution risks (P2), and technology risks (M3) in order to effectively control operation and maintenance risks (P3) and finance risks (M2). Investing in human resources training and promoting awareness, in conjunction with managing other risks, can contribute to better control of execution risks.

5.3. Ranking of Alternatives

According to

Table 10, the implementation of public packaged projects (A2) is ranked highest in terms of success probability and lowest in terms of risk probability, based on the calculated risk weights and the opinions of the respondents. This indicates that these projects have a higher likelihood of success and lower overall risk compared to the other alternatives considered. The success of public packaged projects can be attributed to several factors. Firstly, these projects, which involve public buildings, hospitals, schools, and universities, typically have a higher profit margin for Energy Service Companies (ESCOs) compared to small or medium-scale projects. This profitability factor plays a role in mitigating the overall risk associated with the projects.

Furthermore, the implementation of a considerable number of similar public projects helps with reducing execution risks (P2) and operation and maintenance risks (P3). This is because the experience gained from executing multiple projects of the same nature allows for better planning and execution, resulting in a more-efficient management of risks. Additionally, the successful implementation of these public projects contributes to raising awareness among the public about the concept of energy performance, which in turn helps with better controlling social risks (E3) and finance risks (M2). Once public projects have been successfully implemented and external risks and contractual risks have been effectively controlled, it becomes more feasible to undertake projects in the industrial sector or municipalities. These projects can leverage the experience gained from the successful execution of public projects and benefit from the improved risk management practices.

In conclusion, the ranking of alternatives suggests that starting with the implementation of public packaged projects can provide a solid foundation for EPC projects, given their higher success probability and lower risk probability. This can be followed by gradually expanding into other sectors and municipalities, utilizing the knowledge and risk mitigation strategies gained from previous projects.

While public packaged projects appear to be the most-favorable alternative, it is essential to consider potential challenges and limitations that may arise during their implementation, especially in emerging markets such as Iran. One of the primary challenges in executing public packaged projects could be the complex bureaucratic processes and regulatory requirements that often accompany public-sector initiatives. Overcoming administrative hurdles and ensuring streamlined approvals can be critical to expedite project execution and maintain the anticipated success probability. Additionally, although public projects may offer higher profit margins for Energy Service Companies (ESCOs), they may also entail longer payment cycles and potential cash flow challenges. Addressing financial risks and ensuring timely payments from public entities may require careful negotiation and contractual arrangements.

To address these challenges and ensure the successful implementation of public packaged projects and subsequent expansion, several strategies and recommendations can be considered. These include: (1) engaging in proactive collaboration with relevant government authorities to streamline administrative processes and secure necessary approvals efficiently; (2) developing robust and comprehensive contractual agreements that explicitly address financial risks and ensure payment certainty; (3) leveraging the experience gained from successful public projects to continuously refine risk management practices and enhance project execution efficiency.

6. Conclusions

In conclusion, this research has highlighted the significance of analyzing risks and their relationships in the successful implementation of Energy Performance Contracting (EPC) projects in developing countries with high energy consumption. By applying a hybrid MCDM method combining the DEMATEL, ANP, and VIKOR techniques, several important findings and recommendations have been obtained. Firstly, the influential network relation map provided insights into the interdependencies among different risk dimensions and factors. External risks, particularly political risks, were identified as having the greatest direct impact on other risks. On the other hand, project lifecycle risks had a significant cause or effect relationship with other risks. This highlights the need for effective risk management strategies, particularly in relation to external risks and project lifecycle risks. Secondly, the risk priorities (weights) were calculated using the DANP method. Operation and maintenance risks emerged as the highest-priority risk factor among the EPC projects. This emphasizes the importance of focusing on effective maintenance and operation practices to ensure project success. Lastly, the most-advantageous alternatives for implementing EPC projects were ranked based on risk priorities and feedback from respondents. Public packaged projects, such as public buildings, hospitals, schools, and universities, were identified as the most-practical and -promising alternative, with the highest success probability in the early stages of market development. These projects offer higher profitability for ESCOs and contribute to raising awareness about energy performance among the public.

To enhance the success of EPC projects in emerging markets facing political and legal challenges, decision-makers should prioritize the establishment of stable and supportive laws and regulations. This can help control political and legal contractual risks, along with other risks. Implementing public packaged projects can serve as a stepping stone to effectively manage risks related to operation and maintenance, execution, social factors, and finance. Furthermore, EPC experts should pay particular attention to controlling planning and design risks, as it enables them to influence and mitigate other risks.

Overall, the findings of this research provide valuable insights and recommendations for the risk management and implementation of EPC projects in developing countries. By considering the identified risks, their relationships, and the recommended strategies, decision-makers and stakeholders can enhance the success and sustainability of EPC projects, contributing to improved energy efficiency and reduced carbon emissions.