Exploring Risk Factors Affecting Sustainable Outcomes of Global Public–Private Partnership (PPP) Projects: A Stakeholder Perspective

Abstract

1. Introduction

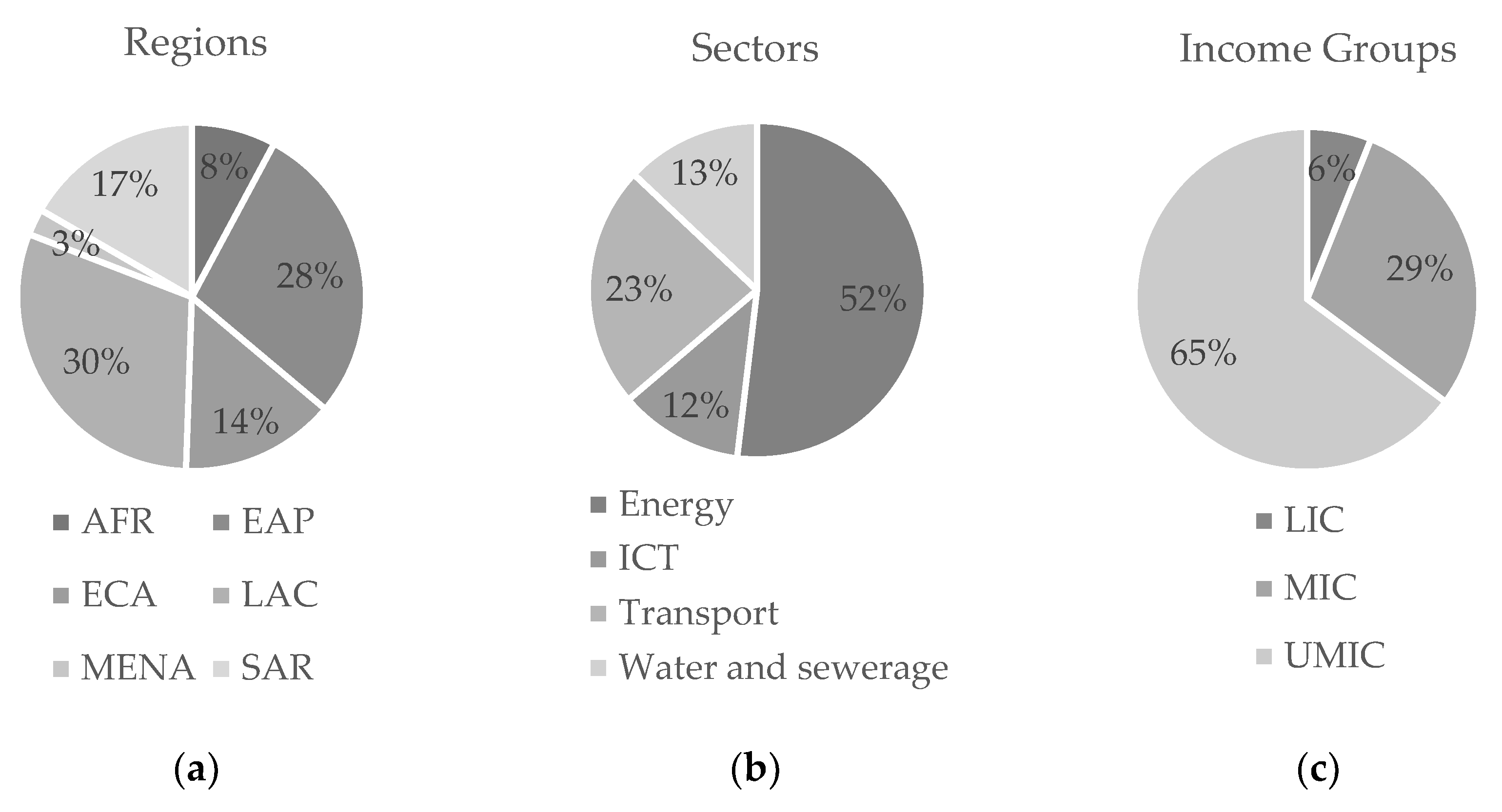

2. Overview of World Bank PPI Database

3. Literature Review

3.1. Risk Allocation and Stakeholders in a PPP Project

3.2. Risk Determinants in Global Risk Transmission

4. Risk Determinants of Project Outcome

4.1. Domestic Risk Determinants

4.1.1. Market Risk

4.1.2. Fiscal Risk

4.1.3. Country Risk

4.1.4. Currency Risk

4.1.5. Credit Risk and Liquidity Risk

4.1.6. Construction Risk

4.1.7. Sectoral-Specific Risk

4.2. International Risk Determinants

4.2.1. Risks Transmitted through the Global Real Economy

4.2.2. Risk Transmitted through the Global Financial Market

5. Materials and Methods

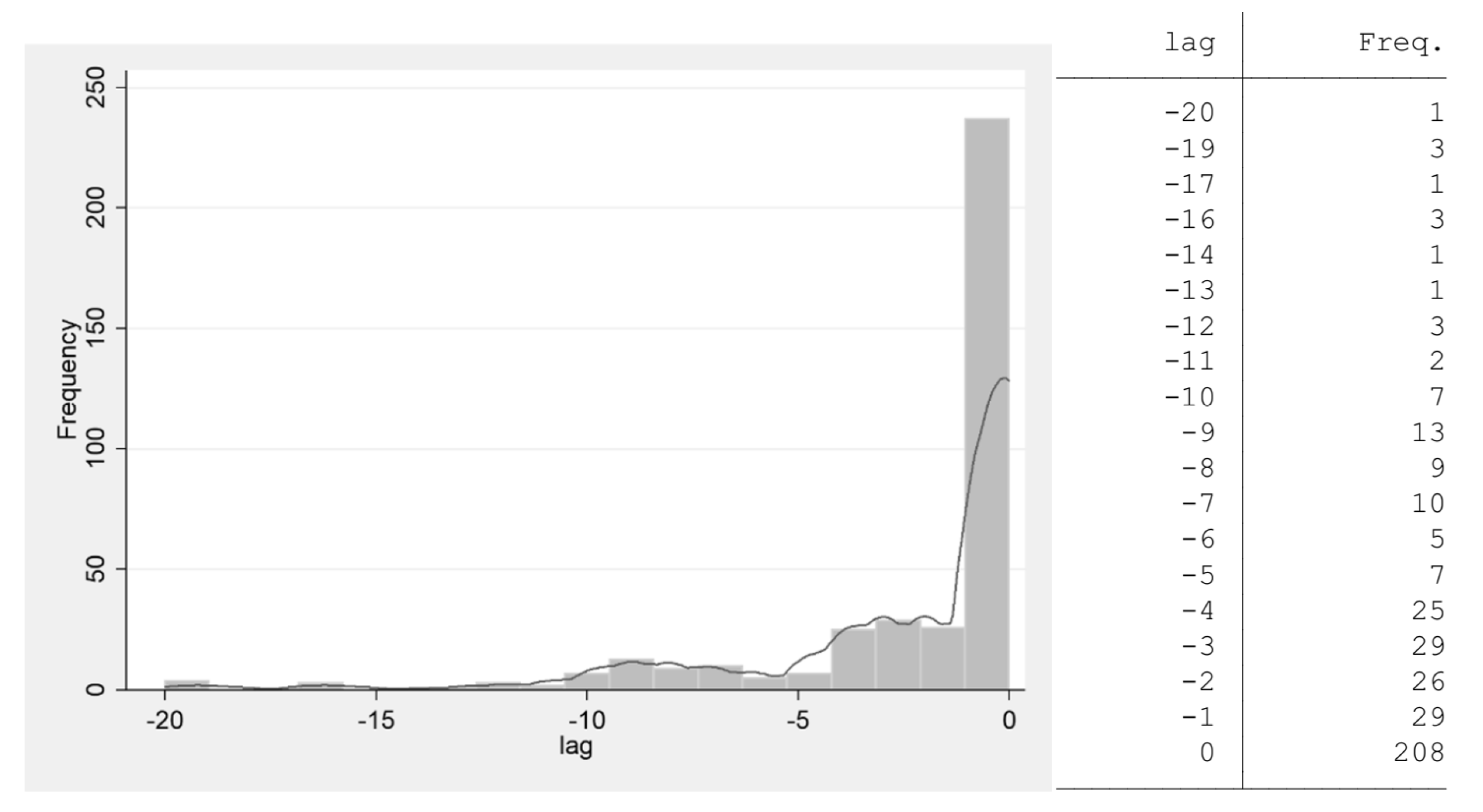

5.1. Data Description

5.2. Model Specification

6. Results and Discussion

6.1. Model Effectiveness

6.2. Analysis of the Empirical Results

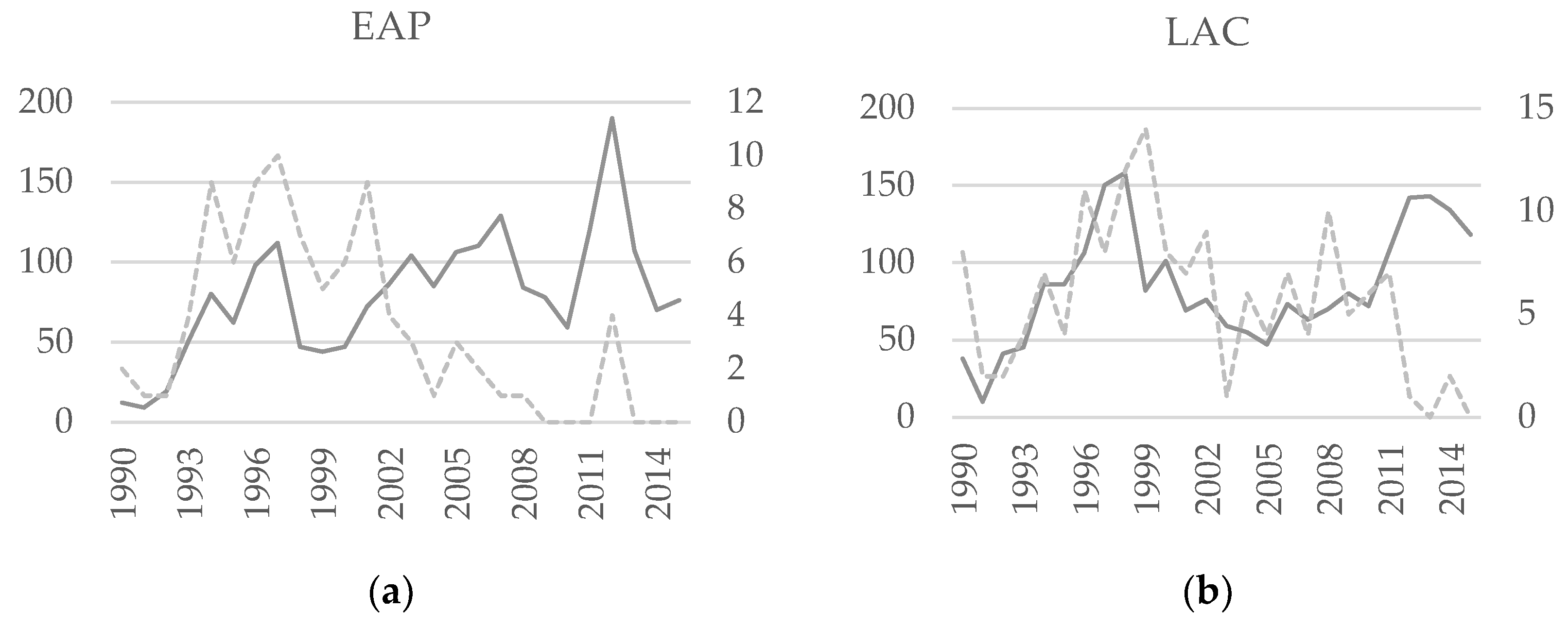

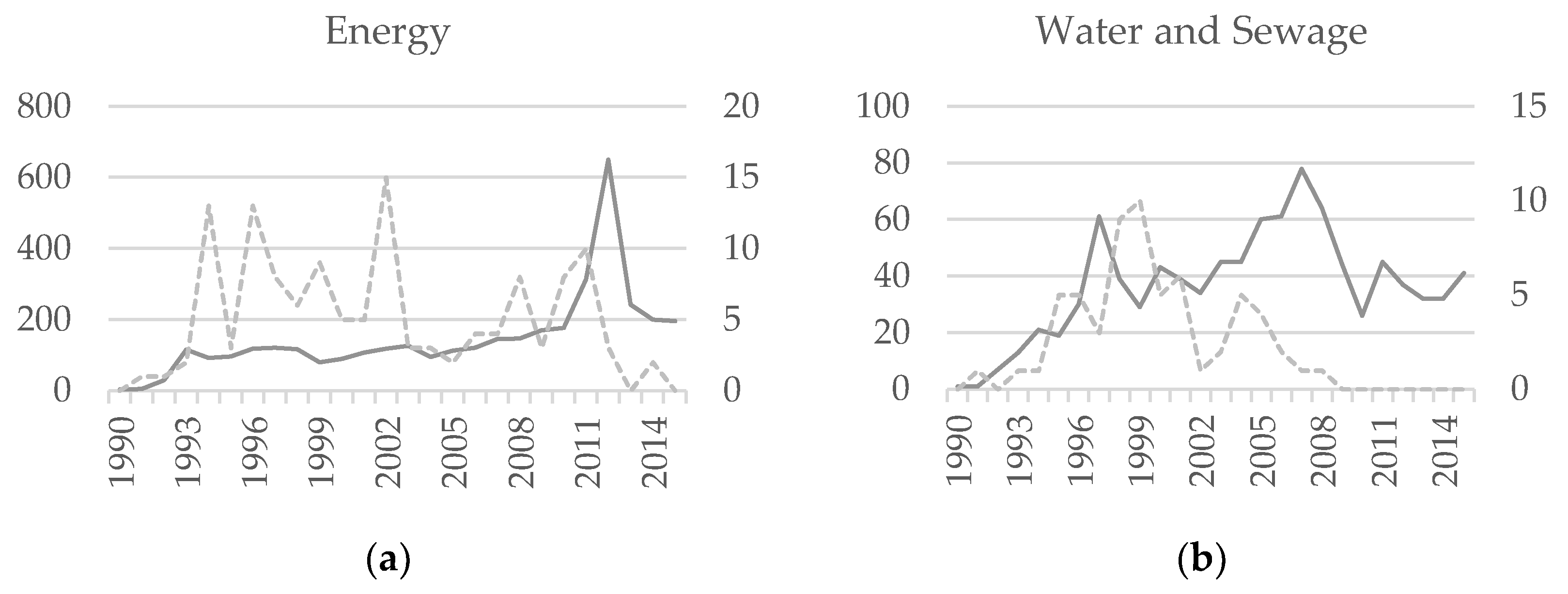

6.3. Sectoral and Regional and Project Type Differences

6.4. Policy Implications and Recommendations

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Description of the Variables

- (1)

- Has the private investor exited (cancellation) or considered exiting (distress) the project? FAIL (discrete)—1 if the project is listed as being “distressed” or “cancelled”, 0 if otherwise. Source: World Bank’s PPI database.

- (1)

- Rule of Law: the extent to which agents have confidence in and abide by the rules of society; includes the quality of contract enforcement and property rights, the police, and the courts, as well as the likelihood of crime and violence: RULE (continuous)—country’s average annual score for this criterion in the WGI (1996–2015 if available). Source: World Bank’s WGI database. [First Stage]

- (2)

- Control of corruption: the extent to which power is exercised for private gain; includes both petty and grand forms of corruption, as well as “capture” of the state by elites and private interests: CORRUPT (continuous)—country’s average annual score for this criterion in the WGI (1996–2015 if available). Source: World Bank’s WGI database. [First Stage]

- (3)

- Voice and accountability: the extent to which a country’s citizens can participate in selecting their government; includes freedom of expression, freedom of association, and a free media: VOICE (continuous)—country’s average annual score for this criterion in the WGI (1996–2015 if available). Source: World Bank’s WGI database. [First Stage]

- (1)

- Average rate of per capita GDP growth—this is a proxy for capacity to pay: GDP p.c. growth (continuous). Source: World Bank [Significant] [First Stage]

- (2)

- Standard deviation in real exchange rate: Real effective ex. (continuous). Source: World Bank [Significant] [First Stage]

- (3)

- Average of inflation rate: Inflation (continuous). Source: World Bank [Significant]

- (4)

- Average change in real interest rate: Real interest rate (continuous). Source: World Bank [Significant]

- (1)

- Financial Exposure: Average of change in FDI net inflows: Net FDI inflow (continuous). Source: World Bank [Significant] [First Stage]

- (2)

- Trade Exposure: Average of the ratio of total exports plus imports divided by GDP: Openness (continuous). Source: World Bank [Significant] [First Stage]

- (3)

- Average of short-term debt to exports ratio: St. debt to exports (continuous). Source: World Bank

- (4)

- Average ratio of fuel and industrial exports to total exports: Ratio ind. exports (continuous). Variables for manufacturing exports ratio and agricultural exports ratio was not included due to the concern of multicollinearity, because they equal to 100% minus fuel and industrial material exports. Source: World Bank

- (5)

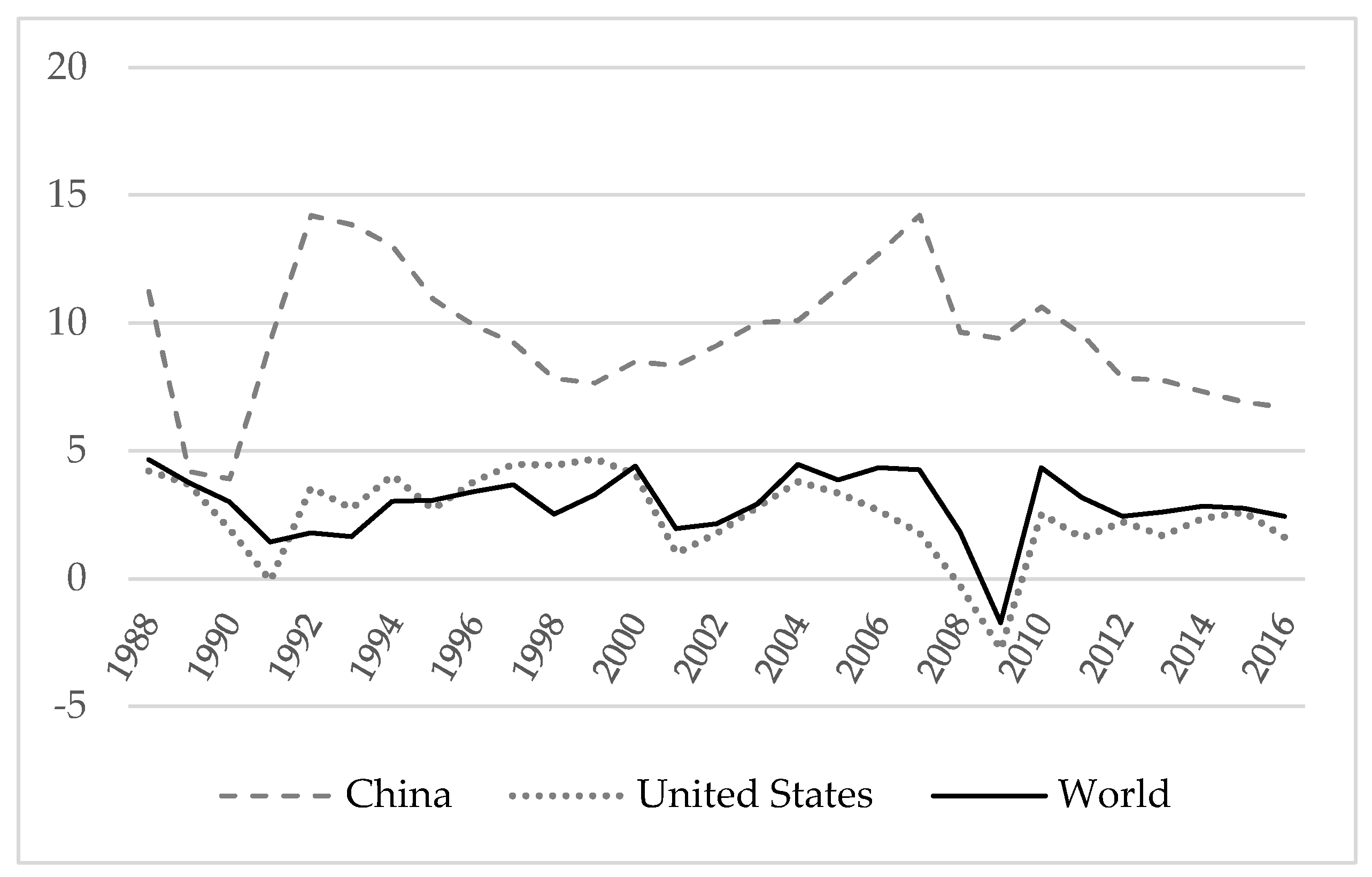

- GDP growth: GDP Growth (continuous). Source: World Bank

- a.

- U.S. [Significant]

- b.

- China

- (6)

- Financial indicators (continuous). Source: Federal Reserve Economic Data

- a.

- LIBOR (std.) [Significant]

- b.

- BRENT Crude Oil (ac.)

- c.

- Nasdaq Composite Index [Significant]

- (1)

- Political risk guarantee: MLS (discrete)—1 if the project received a political risk guarantee from MFIs, 0 if otherwise. Source: World Bank’s PPI database.

- (2)

- Contracted with federal or local government? Central Gov. (discrete)—1 if the project was contracted with the federal government, 0 if otherwise. Source: World Bank’s PPI database. [Significant]

- (3)

- Average net lending (cash surplus or deficit): Fiscal Position (continuous). Source: World Bank [Significant]

- (4)

- Contract period: Contract Period (continuous). Source: World Bank’s PPI database.

- Sectoral variables (discrete)—the following variables are binary in nature; 1 if the condition is present, 0 if otherwise. Source: World Bank’s PPI database.

- (1)

- ENERGY [Significant]

- (2)

- ICT

- (3)

- TRANSPORT

- (4)

- WATER

- Country dummies (discrete)—the following variables are binary in nature; 1 if the condition is present, 0 if otherwise. Source: World Bank’s PPI database.

- (1)

- LIC [Significant]/MIC/UMIC

- (2)

- AFR[Significant]/EAP/ECA/LAC/MENA

- Time dummies (discrete)—time period between 2007 and 2008 (global financial crisis) and between 2010 and 2011 (sovereign debt crisis) are of particular interest; 1 if the condition is present, 0 if otherwise. Source: World Bank’s PPI database.

- (1)

- D0708D if Investment Year = 2008/2009 or if Financial Closure Year = 2008/2009

- (2)

- D1011D if Investment Year = 2011/2012 or if Financial Closure Year = 2012/2013 [Significant]

- Type of transaction (discrete)—the following variables are binary in nature; 1 if the condition is present, 0 if otherwise. Source: World Bank’s PPI database.

- a.

- Brownfield

- b.

- Greenfield [Significant]

Appendix B. Model Results

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) | (18) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GDP p.c. growth (av.) | −1.123 | −0.594 | −0.882 | −1.088 | −4.795 ** | 0.183 | 0.122 | −1.178 | −1.467 | −1.085 | −0.745 | −0.863 | −0.904 | −0.877 | −0.568 | −0.0262 | −1.051 | −0.785 |

| (−0.63) | (−0.33) | (−0.50) | (−0.61) | (−2.31) | (0.10) | (0.06) | (−0.65) | (−0.83) | (−0.59) | (−0.42) | (−0.48) | (−0.51) | (−0.49) | (−0.32) | (−0.01) | (−0.59) | (−0.44) | |

| Inflation (av.) | 0.0655 ** | 0.0722 ** | 0.0652 ** | 0.0629 ** | 0.112 ** | 0.0830 ** | 0.0641 ** | 0.0648 ** | 0.0627 ** | 0.0633 ** | 0.0654 ** | 0.0674 ** | 0.0678 ** | 0.0647 ** | 0.0712 ** | 0.0341 * | 0.0628** | 0.0673 ** |

| (3.99) | (4.30) | (3.99) | (3.77) | (3.96) | (4.31) | (3.79) | (3.80) | (3.82) | (3.53) | (3.92) | (4.04) | (4.11) | (3.89) | (4.31) | (1.71) | (3.79) | (4.09) | |

| Fiscal position (av.) | −0.0000579 | −0.0000608 | −0.0000578 | −0.0000636 | −0.0000924 ** | −0.0000480 | −0.0000491 | −0.0000532 | −0.0000568 | −0.0000385 | −0.0000579 | −0.0000568 | −0.0000529 | −0.0000538 | −0.0000638 | −0.0000255 | −0.0000489 | −0.0000542 |

| (−1.38) | (−1.47) | (−1.40) | (−1.52) | (−2.00) | (−1.15) | (−1.13) | (−1.24) | (−1.36) | (−0.92) | (−1.39) | (−1.37) | (−1.25) | (−1.28) | (−1.51) | (−0.64) | (−1.17) | (−1.30) | |

| Openness (av.) | 0.00608 ** | 0.00612 ** | 0.00586 ** | 0.00605 ** | 0.00514 ** | 0.00779 ** | 0.00640 ** | 0.00575 ** | 0.00520 ** | 0.00566 ** | 0.00587 ** | 0.00593 ** | 0.00609 ** | 0.00587 ** | 0.00614 ** | 0.00781 ** | 0.00583 ** | 0.00603 ** |

| (4.85) | (4.77) | (4.63) | (4.75) | (3.95) | (5.62) | (4.81) | (4.56) | (3.97) | (4.44) | (4.67) | (4.69) | (4.82) | (4.62) | (4.85) | (6.02) | (4.60) | (4.80) | |

| Net FDI inflow (ac.) | 0.267 ** | 0.248 * | 0.260 ** | 0.276 ** | 0.242 * | 0.301 ** | 0.282 * | 0.280 ** | 0.264 ** | 0.246 * | 0.273 ** | 0.263 ** | 0.266 ** | 0.262 ** | 0.260 * | 0.314 ** | 0.256* | 0.263** |

| (2.05) | (1.87) | (1.97) | (2.09) | (1.74) | (1.99) | (1.93) | (2.07) | (1.96) | (1.82) | (2.04) | (1.96) | (1.99) | (1.96) | (1.91) | (2.03) | (1.91) | (1.96) | |

| Real effective ex. (std.) | −0.144 ** | −0.148 ** | −0.138 ** | −0.151 ** | −0.142 ** | −0.135 ** | −0.155 ** | −0.156 ** | −0.160 ** | −0.145 ** | −0.148 ** | −0.150 ** | −0.142 ** | −0.147 ** | −0.138 ** | −0.0518 | −0.145 ** | −0.148 ** |

| (−2.47) | (−2.47) | (−2.27) | (−2.51) | (−2.34) | (−2.32) | (−2.58) | (−2.60) | (−2.46) | (−2.26) | (−2.47) | (−2.49) | (−2.37) | (−2.45) | (−2.24) | (−0.97) | (−2.40) | (−2.45) | |

| PPP experience | −0.565 ** | −0.577 ** | −0.599 ** | −0.594 ** | −0.448 * | −0.455 ** | −0.587 ** | −0.622 ** | −0.589 ** | −0.574 ** | −0.577 ** | −0.558 ** | −0.612 ** | −0.600 ** | −0.591 ** | −1.146 ** | −0.623 ** | −0.600 ** |

| (−2.58) | (−2.64) | (−2.77) | (−2.73) | (−1.86) | (−1.98) | (−2.67) | (−2.73) | (−2.69) | (−2.61) | (−2.65) | (−2.54) | (−2.81) | (−2.76) | (−2.67) | (−3.63) | (−2.86) | (−2.75) | |

| MLS | 0.0345 | 0.0351 | 0.0463 | 0.0319 | 0.00827 | 0.0181 | 0.0258 | 0.0178 | −0.00527 | −0.0116 | 0.0350 | 0.0160 | 0.0292 | 0.0296 | 0.0438 | 0.0128 | 0.0239 | 0.0252 |

| (0.29) | (0.29) | (0.39) | (0.27) | (0.07) | (0.15) | (0.21) | (0.15) | (−0.04) | (−0.10) | (0.29) | (0.13) | (0.25) | (0.25) | (0.37) | (0.09) | (0.20) | (0.21) | |

| Central Gov. | −0.104 | −0.0791 | −0.0977 | −0.134 | 0.0281 | −0.0133 | −0.0530 | −0.0671 | −0.0634 | −0.0222 | −0.0752 | −0.0792 | −0.0546 | −0.0751 | −0.0739 | 0.0499 | −0.0746 | −0.0741 |

| (−1.07) | (−0.81) | (−0.99) | (−1.35) | (0.27) | (−0.13) | (−0.53) | (−0.69) | (−0.65) | (−0.22) | (−0.78) | (−0.82) | (−0.55) | (−0.78) | (−0.76) | (0.42) | (−0.78) | (−0.77) | |

| Real interest rate (ac.) | −0.0128 * | −0.0136 * | −0.0125 * | −0.0127 * | −0.0174 ** | −0.0164 ** | −0.0137 * | −0.0131 * | −0.0129 * | −0.0139 * | −0.0129 * | −0.0134 * | −0.0130 * | −0.0131 * | −0.0122 | −0.0124 | −0.0132* | −0.0136* |

| (−1.78) | (−1.87) | (−1.71) | (−1.76) | (−2.24) | (−2.20) | (−1.87) | (−1.79) | (−1.77) | (−1.77) | (−1.79) | (−1.86) | (−1.80) | (−1.81) | (−1.64) | (−1.58) | (−1.83) | (−1.87) | |

| St. debt to exports | −0.00318 | −0.00492 | −0.00442 | −0.00271 | −0.00581 | −0.00120 | −0.00475 | −0.00532 | −0.00546 | −0.00461 | −0.00410 | −0.00472 | −0.00490 | −0.00444 | −0.00499 | −0.000228 | −0.00455 | −0.00457 |

| (−0.86) | (−1.35) | (−1.20) | (−0.71) | (−1.52) | (−0.32) | (−1.27) | (−1.42) | (−1.47) | (−1.21) | (−1.10) | (−1.27) | (−1.33) | (−1.20) | (−1.34) | (−0.05) | (−1.23) | (−1.24) | |

| Ratio ind. exports | 0.00160 | 0.00397 | 0.00346 | 0.00283 | 0.00682 ** | 0.00279 | 0.00318 | 0.00320 | 0.00332 | 0.00426 | 0.00350 | 0.00393 | 0.00393 | 0.00357 | 0.00404 | 0.000573 | 0.00354 | 0.00361 |

| (0.58) | (1.52) | (1.30) | (1.07) | (2.29) | (1.06) | (1.20) | (1.20) | (1.27) | (1.61) | (1.32) | (1.49) | (1.49) | (1.35) | (1.53) | (0.18) | (1.34) | (1.37) | |

| LIBOR (std.) | 0.762 ** | 0.751 ** | 0.755 ** | 0.767 ** | 0.691 ** | 0.641 ** | 0.746 ** | 0.770 ** | 0.761 ** | 0.799 ** | 0.771 ** | 0.750 ** | 0.737 ** | 0.755 ** | 0.705 ** | 0.557 ** | 0.745 ** | 0.745 ** |

| (5.11) | (4.99) | (5.03) | (5.09) | (4.45) | (4.17) | (4.92) | (5.09) | (5.03) | (4.85) | (5.12) | (4.99) | (4.89) | (5.04) | (4.58) | (3.39) | (4.98) | (4.97) | |

| China GDP growth | −0.00930 | −0.0142 | −0.00949 | −0.00748 | −0.0334 | −0.0302 | −0.0134 | −0.00756 | −0.00488 | −0.00988 | −0.00924 | −0.0151 | −0.0113 | −0.0103 | −0.0145 | 0.0100 | −0.00991 | −0.0136 |

| (−0.37) | (−0.56) | (−0.38) | (−0.29) | (−1.18) | (−1.12) | (−0.52) | (−0.29) | (−0.19) | (−0.39) | (−0.36) | (−0.59) | (−0.45) | (−0.41) | (−0.57) | (0.34) | (−0.39) | (−0.53) | |

| U.S. GDP growth | 0.214 ** | 0.208 ** | 0.210 ** | 0.216 ** | 0.114 * | 0.159 ** | 0.223 ** | 0.222 ** | 0.222 ** | 0.217 ** | 0.217 ** | 0.209 ** | 0.213 ** | 0.215 ** | 0.187 ** | 0.227 ** | 0.216 ** | 0.210 ** |

| (4.37) | (4.20) | (4.26) | (4.32) | (1.76) | (3.04) | (4.39) | (4.44) | (4.37) | (4.41) | (4.36) | (4.22) | (4.29) | (4.30) | (3.61) | (4.06) | (4.33) | (4.23) | |

| LIC | 0.574 ** | |||||||||||||||||

| (2.40) | ||||||||||||||||||

| MIC | −0.0310 | |||||||||||||||||

| (−0.28) | ||||||||||||||||||

| UMIC | −0.0801 | |||||||||||||||||

| (−0.75) | ||||||||||||||||||

| AFR | 0.306 ** | |||||||||||||||||

| (1.99) | ||||||||||||||||||

| EAP | 0.735 ** | |||||||||||||||||

| (2.63) | ||||||||||||||||||

| ECA | −0.700 ** | |||||||||||||||||

| (−3.45) | ||||||||||||||||||

| LAC | 0.151 | |||||||||||||||||

| (1.23) | ||||||||||||||||||

| MENA | 0 | |||||||||||||||||

| (omitted) | ||||||||||||||||||

| SAR | −0.908 ** | |||||||||||||||||

| (−2.20) | ||||||||||||||||||

| BRENT (ac.) | 0.0144 | |||||||||||||||||

| (1.42) | ||||||||||||||||||

| ENERGY | −0.284 ** | |||||||||||||||||

| (−3.24) | ||||||||||||||||||

| ICT | 0.164 | |||||||||||||||||

| (1.14) | ||||||||||||||||||

| TRANSPORT | 0.129 | |||||||||||||||||

| (1.43) | ||||||||||||||||||

| WATER | 0.133 | |||||||||||||||||

| (1.32) | ||||||||||||||||||

| GOVRISK | −0.0661 | |||||||||||||||||

| (−0.81) | ||||||||||||||||||

| MARRISK | −0.262 ** | |||||||||||||||||

| (−2.10) | ||||||||||||||||||

| Contract period | −0.00713 | |||||||||||||||||

| (−1.46) | ||||||||||||||||||

| Greenfield | −0.143 * | |||||||||||||||||

| (−1.74) | ||||||||||||||||||

| Brownfield | 0.0925 | |||||||||||||||||

| (0.98) | ||||||||||||||||||

| _cons | −1.752 ** | −1.758 ** | −1.675 ** | −1.730 ** | −2.175 ** | −1.948 ** | −1.760 ** | −1.615 ** | −1.556 ** | −1.590 ** | −1.765 ** | −1.725 ** | −1.741 ** | −1.654 ** | −1.723 ** | −1.291 ** | −1.548 ** | −1.705 ** |

| (−5.06) | (−5.03) | (−4.73) | (−5.01) | (−5.21) | (−5.31) | (−4.95) | (−4.55) | (−4.43) | (−4.30) | (−5.07) | (−4.97) | (−5.01) | (−4.63) | (−4.91) | (−2.74) | (−4.26) | (−4.91) | |

| N | 3784 | 3784 | 3784 | 3784 | 3784 | 3784 | 3784 | 3724 | 3784 | 3784 | 3784 | 3784 | 3784 | 3784 | 3784 | 2533 | 3784 | 3784 |

References

- Inderst, G.; Stewart, F. Institutional Investment in Infrastructure in Emerging Markets and Developing Economies; World Bank Publications: Washington, DC, USA, 2014. [Google Scholar] [CrossRef]

- Akintoye, A.; Hardcastle, C.; Beck, M.; Chinyio, E.; Asenova, D. Achieving best value in private finance initiative project procurement. Constr. Manag. Econ. 2003, 21, 461–470. [Google Scholar] [CrossRef]

- International Bank for Reconstruction and Development/The World Bank. Guidance on PPP Contractual Provisions, 2019th ed.; International Bank for Reconstruction and Development/The World Bank: Washington, DC, USA, 2019. [Google Scholar]

- Buchanan, N.; Klingner, D.E. Performance-based contracting: Are we following the mandate? J. Public Procure 2007, 7, 301–332. [Google Scholar] [CrossRef]

- Tate, W.L.; Ellram, L.M.; Bals, L.; Hartmann, E.; van der Valk, W. An Agency Theory perspective on the purchase of marketing services. Ind. Mark. Manag. 2010, 39, 806–819. [Google Scholar] [CrossRef]

- Xu, Y.; Chan, A.P.C.; Yeung, J.F.Y. Developing a Fuzzy Risk Allocation Model for PPP Projects in China. J. Constr. Eng. Manag. 2010, 136, 894–903. [Google Scholar] [CrossRef]

- Park, C.Y.; Jung, W.; Han, S.H. Risk Perception Gaps Between Construction Investors and Financial Investors of International Public-Private Partnership (PPP) Projects. Sustainability 2020, 12, 9003. [Google Scholar] [CrossRef]

- Lee, M.; Han, X.; Quising, P.F.; Villaruel, M.L. Hazard analysis on public-private partnership projects in developing Asia. J. Infrastruct. Policy Dev. 2020, 4, 50–72. [Google Scholar] [CrossRef]

- Liang, Y.; Wang, H. Sustainable Performance Measurements for Public-Private Partnership Projects: Empirical Evidence from China. Sustainability 2019, 11, 3653. [Google Scholar] [CrossRef]

- Bocchini, P.; Frangopol, D.M.; Ummenhofer, T.; Zinke, T. Resilience and Sustainability of Civil Infrastructure: Toward a Unified Approach. J. Infrastruct. Syst. 2014, 20, 4014004. [Google Scholar] [CrossRef]

- Ke, Y.; Wang, S.; Chan, A.P.C.; Cheung, E. Research Trend of Public-Private Partnership in Construction Journals. J. Constr. Eng. Manag. 2009, 135, 1076–1086. [Google Scholar] [CrossRef]

- Aust, V.; Morais, A.I.; Pinto, I. How does foreign direct investment contribute to Sustainable Development Goals? Evidence from African countries. J. Clean. Prod. 2020, 245, 118823. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, Y.; Wu, X.; Li, J. Exploring the Risk Factors of Infrastructure PPP Projects for Sustainable Delivery: A Social Network Perspective. Sustainability 2020, 12, 4152. [Google Scholar] [CrossRef]

- Francis, R.; Bekera, B. A metric and frameworks for resilience analysis of engineered and infrastructure systems. Reliab. Eng. Syst. Saf. 2014, 121, 90–103. [Google Scholar] [CrossRef]

- South, A.J.; Levitt, R.E.; Dewulf, G.P. Dynamic stakeholder networks and the governance of PPPs. In Advances in Public-Private Partnerships; American Society of Civil Engineers: Reston, VA, USA, 2017; pp. 499–515. [Google Scholar]

- Wegrzyn, J.; Wojewnik-Filipkowska, A. Stakeholder Analysis and Their Attitude towards PPP Success. Sustainability 2022, 14, 1570. [Google Scholar] [CrossRef]

- Burke, R.; Demirag, I. Risk transfer and stakeholder relationships in Public Private Partnerships. Account. Forum 2017, 41, 28–43. [Google Scholar] [CrossRef]

- Moykkynen, H.; Pantelias, A. Viability gap funding for promoting private infrastructure investment in Africa: Views from stakeholders. J. Econ. Policy Reform 2021, 24, 253–269. [Google Scholar] [CrossRef]

- El-Gohary, N.; Osman, H.; El-Diraby, T. Stakeholder management for public private partnerships. Int. J. Proj. Manag. 2006, 24, 595–604. [Google Scholar] [CrossRef]

- De Schepper, S.; Dooms, M.; Haezendonck, E. Stakeholder dynamics and responsibilities in Public-Private Partnerships: A mixed experience. Int. J. Proj. Manag. 2014, 32, 1210–1222. [Google Scholar] [CrossRef]

- Kong, Z.; Ma, H.; Lv, K.; Shi, J.J.J. Liability of Foreignness in Public-Private Partnership Projects. J. Constr. Eng. Manag. 2023, 149, 4023085. [Google Scholar] [CrossRef]

- Chudik, A.; Fratzscher, M. Liquidity, Risk and the Global Transmission of the 2007-08 Financial Crisis and the 2010–2011 Sovereign Debt Crisis. Eur. Econ. Rev. 2012, 2012, 2023452. [Google Scholar] [CrossRef]

- Mazher, K.M.; Chan, A.P.C.; Choudhry, R.M.; Zahoor, H.; Edwards, D.J.; Ghaithan, A.M.; Mohammed, A.; Aziz, M. Identifying Measures of Effective Risk Management for Public-Private Partnership Infrastructure Projects in Developing Countries. Sustainability 2022, 14, 14149. [Google Scholar] [CrossRef]

- Shi, L.; Zhang, L.; Onishi, M.; Kobayashi, K.; Dai, D. Contractual Efficiency of PPP Infrastructure Projects: An Incomplete Contract Model. Math. Probl. Eng. 2018, 2018, 3631270. [Google Scholar] [CrossRef]

- Williamson, O.E. The Economic Institutions of Capitalism; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Jiang, Y.; Peng, M.W.; Yang, X.; Mutlu, C.C. Privatization, governance, and survival: MNE investments in private participation projects in emerging economies. J. World Bus. 2015, 50, 294–301. [Google Scholar] [CrossRef]

- Zhang, X.Q. Critical success factors for public-private partnerships in infrastructure development. J. Constr. Eng. Manag. 2005, 131, 3–14. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P.C. Review of studies on the Critical Success Factors for Public-Private Partnership (PPP) projects from 1990 to 2013. Int. J. Proj. Manag. 2015, 33, 1335–1346. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Lam, P.T.I.; Wen, Y.; Ameyaw, E.E.; Wang, S.; Ke, Y. Cross-Sectional Analysis of Critical Risk Factors for PPP Water Projects in China. J. Infrastruct. Syst. 2015, 21, 1. [Google Scholar] [CrossRef]

- Ansell, C.; Gash, A. Collaborative governance in theory and practice. J. Public Adm. Res. Theory 2008, 18, 543–571. [Google Scholar] [CrossRef]

- Irun, B.; Monferrer, D.; Angel Moliner, M. Network market orientation as a relational governance mechanism to public-private partnerships. J. Bus. Res. 2020, 121, 268–282. [Google Scholar] [CrossRef]

- Fleta-Asin, J.; Munoz, F.; Rosell-Martinez, J. Public-private partnerships: Determinants of the type of governance structure. Public Manag. Rev. 2020, 22, 1489–1514. [Google Scholar] [CrossRef]

- Slotterback, C.S. Public Involvement in transportation project planning and design. J. Archit. Plan. Res. 2010, 27, 144–162. [Google Scholar]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Harper Collins: Boston, MA, USA, 1984. [Google Scholar]

- Freeman, R.E.; Wicks, A.C.; Parmar, B. Stakeholder theory and “the corporate objective revisited”. Organ. Sci. 2004, 15, 364–369. [Google Scholar] [CrossRef]

- Clarkson, M.B.E. A Stakeholder framework for analyzing and evaluating corporate social performance. Acad. Manag. Rev. 1995, 20, 92–117. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Agle, B.R.; Wood, D.J. Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Okudan, O.; Cevikba, M. Alternative Dispute Resolution Selection Framework to Settle Disputes in Public-Private Partnership Projects. J. Constr. Eng. Manag. 2022, 148, 4022086. [Google Scholar] [CrossRef]

- Dai, J.; Jiang, S.; Cheng, Z. Exploring the Applicability of the PPP in Tourist Toilets: Reflections on the Laoshan Case in China. Buildings 2023, 13, 790. [Google Scholar] [CrossRef]

- Tserng, H.P.; Ho, S.-P.; Chou, J.-S.; Lin, C. Proactive measures of governmental debt guarantees to facilitate public-private partnerships project. J. Civ. Eng. Manag. 2014, 20, 548–560. [Google Scholar] [CrossRef]

- Irwin, T. Public Money for Private Infrastructure: Deciding When to Offer Guarantees, Output-Based Subsidies, and Other Fiscal Support; World Bank: Washington, DC, USA, 2003. [Google Scholar]

- Wang, Y.; Chen, L.; Zhuang, J. Pricing of Credit Default Swaps from the Perspective of Credit Enhancement in PPP Projects. J. Constr. Eng. Manag. 2023, 149, 5023006. [Google Scholar] [CrossRef]

- Ho, S.P. Model for financial renegotiation in public-private partnership projects and its policy implications: Game theoretic view. J. Constr. Eng. Manag. 2006, 132, 678–688. [Google Scholar] [CrossRef]

- Weber, B.; Alfen, H.W. Infrastructure as an Asset Class: Investment Strategies, Project Finance and PPP.; Wiley: West Sussex, UK, 2010. [Google Scholar]

- Cesa-Bianchi, A. Housing cycles and macroeconomic fluctuations: A global perspective. J. Int. Money Financ. 2013, 37, 215–238. [Google Scholar] [CrossRef]

- Wang, S.Q.; Tiong, R.L.K.; Ting, S.K.; Ashley, D. Evaluation and management of foreign exchange and revenue risks in China’s BOT projects. Constr. Manag. Econ. 2000, 18, 197–207. [Google Scholar] [CrossRef]

- Nielsen, B.B.; Asmussen, C.G.; Weatherall, C.D. The location choice of foreign direct investments: Empirical evidence and methodological challenges. J. World Bus. 2017, 52, 62–82. [Google Scholar] [CrossRef]

- Liu, H.J.; Love, P.E.D.; Sing, M.C.P.; Smith, J. Ex Post Evaluation of Economic Infrastructure Assets: Significance of Regional Heterogeneities in Australia. J. Infrastruct. Syst. 2019, 25, 5019005. [Google Scholar] [CrossRef]

- Gatti, S. Project Finance in Theory and Practice: Designing, Structuring, and Financing Private and Public Projects; Academic Press: Burlington, MA, USA, 2008. [Google Scholar]

- Songer, A.D.; Molenaar, K.R. Selecting design-build: Public and private sector owner attitudes. J. Manag. Eng. 1996, 12, 47–53. [Google Scholar] [CrossRef]

- Cao, F.; Wang, C. Accountability, Corruption and the Attention Paid to User Satisfaction in PPP Specifications: Evidence from China. Buildings 2023, 13, 492. [Google Scholar] [CrossRef]

- Albalate, D.; Bel, G.; Gragera, A. Politics, risk, and white elephants in infrastructure PPPs. Util. Policy 2019, 58, 158–165. [Google Scholar] [CrossRef]

- Krugman, P.R.; Obstfeld, M. International Economics: Theory and Policy, 7th ed.; Pearson: London, UK, 2012. [Google Scholar]

- Appleyard, D.R.; Field, A.J.J.; Cobb, S.L. International Economics; McGraw Hill: New York, NY, USA, 2002. [Google Scholar]

- Bhasin, N.; Paul, J. Exports and outward FDI: Are they complements or substitutes? Evidence from Asia. Multinatl. Bus. Rev. 2016, 24, 62–78. [Google Scholar] [CrossRef]

- Rugman, A.M.; Verbeke, A.; Nguyen, Q.T.K. Fifty Years of International Business Theory and Beyond. Manag. Int. Rev. 2011, 51, 755–786. [Google Scholar] [CrossRef]

- Dovern, J.; van Roye, B. International transmission and business-cycle effects of financial stress. J. Financ. Stab. 2014, 13, 1–17. [Google Scholar] [CrossRef]

- Cashin, P.; Mohaddes, K.; Raissi, M. China’s slowdown and global financial market volatility: Is world growth losing out? Emerg. Mark. Rev. 2017, 31, 164–175. [Google Scholar] [CrossRef]

- Song, J.; Hu, Y.; Feng, Z. Factors Influencing Early Termination of PPP Projects in China. J. Manag. Eng. 2018, 34, 5017008. [Google Scholar] [CrossRef]

- Yu, Y.; Chan, A.P.C.; Chen, C.; Darko, A. Critical Risk Factors of Transnational Public-Private Partnership Projects: Literature Review. J. Infrastruct. Syst. 2018, 24, 4017042. [Google Scholar] [CrossRef]

- Ng, S.T.; Wong, Y.M.W.; Wong, J.M.W. Factors influencing the success of PPP at feasibility stage—A tripartite comparison study in Hong Kong. Habitat Int. 2012, 36, 423–432. [Google Scholar] [CrossRef]

- Hammami, M.; Ruhashyankiko, J.F.; Yehoue, E.B. Determinants of public-private partnerships in infrastructure. Int. Monet. Fund 2006, 2006, 99. [Google Scholar]

- Reside, R.E. Global Determinants of Stress and Risk in Public-Private Partnerships (PPP) in Infrastructure. J. Int. Bus. Res. 2009, 8, 133. [Google Scholar]

- Reside, R.E.; Mendoza, A.M. Determinants of Outcomes of Public-Private Partnerships (PPP) in Infrastructure in Asia. UP School of Economics Discussion Papers. 2010. Available online: http://hdl.handle.net/10419/46616 (accessed on 13 July 2022).

- Jimenez, A.; Russo, M.; Kraak, J.M.; Jiang, G.F. Corruption and Private Participation Projects in Central and Eastern Europe. Manag. Int. Rev. 2017, 57, 775–792. [Google Scholar] [CrossRef]

- Jimenez, A.; Salvaj, E.; Lee, J.Y. Policy risk, distance, and private participation projects in Latin America. J. Bus. Res. 2018, 88, 123–131. [Google Scholar] [CrossRef]

- Dailami, M.; Klein, M. Government Support to Private Infrastructure Projects in Emerging Markets. Policy Research Working Paper Series. 1998. Available online: https://books.google.co.jp/books?hl=zh-CN&lr=&id=OAt2r9QCSroC&oi=fnd&pg=PA1&dq=Government+support+to+private+infrastructure+projects+in+emerging+markets&ots=hLb3vDueXw&sig=xSqhMtAj_4E7VVfLrT2uZIL0oxw&redir_esc=y#v=onepage&q=Government%20support%20to%20private%20infrastructure%20projects%20in%20emerging%20markets&f=false (accessed on 21 July 2022).

- Chiang, Y.-H.; Cheng, E.W.L. Perception of Financial Institutions toward Financing PFI Projects in Hong Kong. J. Constr. Eng. Manag. 2009, 135, 833–840. [Google Scholar] [CrossRef]

- Hwang, B.-G.; Zhao, X.; Gay, M.J.S. Public private partnership projects in Singapore: Factors, critical risks and preferred risk allocation from the perspective of contractors. Int. J. Proj. Manag. 2013, 31, 424–433. [Google Scholar] [CrossRef]

- Choi, S.M.; Kim, H.; Ma, X. Trade policies and growth in emerging economies: Policy experiments. Rev. World Econ. 2021, 157, 603–629. [Google Scholar] [CrossRef]

- Zhao, Y. Borrowing constraints and the trade balance-output comovement. Econ. Model. 2013, 32, 34–41. [Google Scholar] [CrossRef]

- Carbonara, N.; Pellegrino, R. Revenue guarantee in public-private partnerships: A win-win model. Constr. Manag. Econ. 2018, 36, 584–598. [Google Scholar] [CrossRef]

- Shu, X.; Smyth, S.; Haslam, J. Post-decision project evaluation of UK public-private partnerships: Insights from planning practice. Public Money Manag. 2021, 41, 477–486. [Google Scholar] [CrossRef]

- Tyson, J.; Karpowicz, I.; Delgado Coelho, M.; Burger, P. The Effects of the Financial Crisis on Public-Private Partnerships. In International Monetary Fund Paper No.09-144; International Monetary Fund: Washington, DC, USA, 2011. [Google Scholar] [CrossRef][Green Version]

- Jimenez, A.; Bayraktar, S.; Lee, J.Y.; Choi, S.-J. The multi-faceted impact of host country risk on the success of private participation in infrastructure projects. Multinatl. Bus. Rev. 2022, 30, 17–39. [Google Scholar] [CrossRef]

- Henisz, W.J. The Institutional Environment for Economic Growth. Econ. Politics 2000, 12, 1–31. [Google Scholar] [CrossRef]

- Soomro, M.A.; Zhang, X. Evaluation of the Functions of Public Sector Partners in Transportation Public-Private Partnerships Failures. J. Manag. Eng. 2016, 32, 4015027. [Google Scholar] [CrossRef]

- Xiao, Z.; Lam, J.S.L. Willingness to take contractual risk in port public-private partnerships under economic volatility: The role of institutional environment in emerging economies. Transp. Policy 2019, 81, 106–116. [Google Scholar] [CrossRef]

- Lomoro, A.; Mossa, G.; Pellegrino, R.; Ranieri, L. Optimizing Risk Allocation in Public-Private Partnership Projects by Project Finance Contracts. The Case of Put-or-Pay Contract for Stranded Posidonia Disposal in the Municipality of Bari. Sustainability 2020, 12, 806. [Google Scholar] [CrossRef]

- Holburn, G.L.F.; Zelner, B.A. Political capabilities, policy risk, and international investment strategy: Evidence from the global electric power generation industry. Strateg. Manag. J. 2010, 31, 1290–1315. [Google Scholar] [CrossRef]

- Pan, X.; Guo, S.; Han, C.; Wang, M.; Song, J.; Liao, X. Influence of FDI quality on energy efficiency in China based on seemingly unrelated regression method. Energy 2020, 192, 116463. [Google Scholar] [CrossRef]

- Benassy-Quere, A.; Fontagne, L.; Lahreche-Revil, A. Exchange-rate strategies in the competition for attracting foreign direct investment. J. Jpn. Int. Econ. 2001, 15, 178–198. [Google Scholar] [CrossRef]

- Jiang, X.; Lu, K.; Xia, B.; Liu, Y.; Cui, C. Identifying Significant Risks and Analyzing Risk Relationship for Construction PPP Projects in China Using Integrated FISM-MICMAC Approach. Sustainability 2019, 11, 5206. [Google Scholar] [CrossRef]

- Chowdhury, A.N.; Chen, P.-H.; Tiong, R.L.K. Credit enhancement factors for the financing of independent power producer (IPP) projects in Asia. Int. J. Proj. Manag. 2015, 33, 1576–1587. [Google Scholar] [CrossRef]

- Sung, T.; Park, D.; Park, K.Y. Short-Term External Debt and Foreign Exchange Rate Volatility in Emerging Economies: Evidence from the Korea Market. Emerg. Mark. Financ. Trade 2014, 50, 138–157. [Google Scholar] [CrossRef]

- Jayasena, N.S.; Chan, D.W.M.; Kumaraswamy, M.M.; Saka, A.B. Applicability of public-private partnerships in smart infrastructure development: The case of Hong Kong. Int. J. Constr. Manag. 2023, 23, 1932–1944. [Google Scholar] [CrossRef]

- Liang, X.; Li, P. Empirical Study of the Spatial Spillover Effect of Transportation Infrastructure on Green Total Factor Productivity. Sustainability 2021, 13, 326. [Google Scholar] [CrossRef]

- Spoann, V.; Fujiwara, T.; Seng, B.; Lay, C.; Yim, M. Assessment of Public-Private Partnership in Municipal Solid Waste Management in Phnom Penh, Cambodia. Sustainability 2019, 11, 1228. [Google Scholar] [CrossRef]

- Munir, K.; Bukhari, M. Impact of globalization on income inequality in Asian emerging economies. Int. J. Sociol. Soc. Policy 2020, 40, 44–57. [Google Scholar] [CrossRef]

- Kolerus, C.; Saborowski, C. China’s Footprint in Global Commodity Markets; International Monetary Fund: Washington, DC, USA, 2016. [Google Scholar]

- Aastveit, K.A.; Bjornland, H.C.; Thorsrud, L.A. What drives oil prices? Emerging versus developed economies. J. Appl. Econom. 2015, 30, 1013–1028. [Google Scholar] [CrossRef]

- Gauvin, L.; Rebillard, C.C. Towards recoupling? Assessing the global impact of a Chinese hard landing through trade and commodity price channels. World Econ. 2018, 41, 3379–3415. [Google Scholar] [CrossRef]

- McFadden, D. Conditional Logit Analysis of Qualitative Choice Behavior. In Frontier of Econometrics; Zarembka, P., Ed.; Academic Press: New York, NY, USA, 1974. [Google Scholar]

- Newey, W.K. Efficient estimation of limited dependent variable models with endogenous explanatory variables. J. Econom. 1987, 36, 231–250. [Google Scholar] [CrossRef]

- Rivers, D.; Vuong, Q.H. Limited information estimators and exogeneity tests for simultaneous probit models. J. Econom. 1988, 39, 347–366. [Google Scholar] [CrossRef]

- Stock, J.; Watson, M. Introduction to Econometrics, 3rd ed.; Addison-Wesley: Boston, MA, USA, 2011. [Google Scholar]

- Cameron, A.C.; Trivedi, P.K. Microeconometrics Using Stata, Revised ed.; Stata Press: College Station, TX, USA, 2010. [Google Scholar]

- Baum, C.F. An Introduction to Modern Econometrics Using Stata; Stata Press: College Station, TX, USA, 2006. [Google Scholar]

- Campos, J.; Ericsson, N.R.; Hendry, D.F. General-to-Specific Modeling: An Overview and Selected Bibliography. Federal Reserve International Finance Discussion Papers. 2005. Available online: https://www.federalreserve.gov/pubs/ifdp/2005/838/ifdp838.pdf (accessed on 17 August 2022).

- Naoum, S.G. Dissertation Research and Writing for Construction Students; Elsevier: Oxford, UK, 1998. [Google Scholar]

- Neter, J.; Wasserman, W.; Kutner, M.H. Applied Linear Statistical Models: Regression, Analysis of Variance and Experimental Designs, 2nd ed.; Irwin: Huntersville, NC, USA, 1985. [Google Scholar]

- Inderst, G. Infrastructure as an Asset Class. EIB Pap. 2011, 15, 70–105. [Google Scholar]

- Chunling, L.; Memon, J.A.; Thanh, T.L.; Ali, M.; Kirikkaleli, D. The Impact of Public-Private Partnership Investment in Energy and Technological Innovation on Ecological Footprint: The Case of Pakistan. Sustainability 2021, 13, 10085. [Google Scholar] [CrossRef]

- Shi, J.-g.; Si, H.; Wu, G.; Su, Y.; Lan, J. Critical Factors to Achieve Dockless Bike-Sharing Sustainability in China: A Stakeholder-Oriented Network Perspective. Sustainability 2018, 10, 2090. [Google Scholar] [CrossRef]

- Mundell, R.A. Capital mobility and stabilization policy under fixed and flexible exchange rates. Can. J. Econ. Political Sci. 1963, 29, 475–485. [Google Scholar] [CrossRef]

- Fleming, J.M. Domestic financial policies under fixed and floating exchange rates. IMF Staff Pap. 1962, 9, 369–379. [Google Scholar] [CrossRef]

- Gong, J.; Lu, Y.; Xu, Y.; Fu, J. Fiscal Pressure and Public-Private Partnership Investment: Based on Evidence from Prefecture-Level Cities in China. Sustainability 2022, 14, 14979. [Google Scholar] [CrossRef]

- Cong, X.; Ma, L. Performance Evaluation of Public-Private Partnership Projects from the Perspective of Efficiency, Economic, Effectiveness, and Equity: A Study of Residential Renovation Projects in China. Sustainability 2018, 10, 1951. [Google Scholar] [CrossRef]

- Sukasuka, G.N.; Musonda, I.; Ramabodu, M.S.; Zulu, S.L. Social Dimensions in Ex-Post Evaluation of Public Private Partnership Infrastructure Projects: A Scoping Review. Sustainability 2022, 14, 15808. [Google Scholar] [CrossRef]

- Fernandes, C.; Cruz, C.O.; Moura, F. Ex post evaluation of PPP government-led renegotiations: Impacts on the financing of road infrastructure. Eng. Econ. 2019, 64, 116–141. [Google Scholar] [CrossRef]

| Indicators | Indicator Description | Impact on Primary Stakeholders |

|---|---|---|

| GDP per capita | Average per capita GDP growth, indicating the level of affordability in a consecutive period (Source: World Bank) | End users |

| Openness (Trade Exposure) |

(Source: World Bank) | Government |

| Inflation | Average inflation rate (Source: World Bank) | End users/Contractors |

| Indicators | Indicator Description | Impact on Primary Stakeholders |

|---|---|---|

| Fiscal position | Average net lending in terms of either surplus or deficit (Source: World Bank) | Government |

| Indicators | Indicator Description | Impact on Primary Stakeholders |

|---|---|---|

| PPP experience | Discrete variable—1 if the country has implemented a PPP initiative before the underlying PPP project, 0 if otherwise (Source: World Bank’s PPI database) | Government/Private Partner |

| Federal or local government granted the contract | Discrete variable—1 if the project was contracted with the federal government, 0 if otherwise (Source: World Bank’s PPI database) | Government/Private Partner |

| Support from multilateral institutions (MLS) | Discrete variable—1 if the project received a political risk guarantee from MFIs, 0 if otherwise (Source: World Bank’s PPI database) | Government |

| Indicators | Indicator Description | Impact on Primary Stakeholders |

|---|---|---|

| FDI (Financial Exposure) | Average change in FDI net inflows (Source: World Bank) | Government |

| Exchange rate | Standard deviation in the real exchange rate (Source: World Bank) | Private Partners |

| Indicators | Indicator Description | Impact on Primary Stakeholders |

|---|---|---|

| Interest rate | Average change in real interest rate (Source: World Bank) | Lenders |

| Short-term debt | Average ratio of short-term debt to exports (Source: World Bank) | Lenders |

| Indicators | Indicator Description | Impact on Primary Stakeholders |

|---|---|---|

| External GDP growth (U.S./China) | GDP Growth (Source: World Bank) | All stakeholders |

| Indicators | Indicator Description | Impact on Primary Stakeholders |

|---|---|---|

| LIBOR fluctuations | Standard deviation of LIBOR (Source: Federal Reserve Economic Data) | Lenders |

| Stock market fluctuations | NASDAQ Composite Index (Source: Federal Reserve Economic Data) | Private Partners |

| Oil price fluctuations | BRENT Crude Oil Price (Source: Federal Reserve Economic Data) | Contractors |

| No. | Indicators | No. of Obs. | Average | St. D. | Min. | Max. |

|---|---|---|---|---|---|---|

| 1 | Project Status | 7286 | 0.0525666 | 0.2231819 | 0 | 0.58 |

| 2 | GDP per capita growth | 7266 | 0.0412766 | 0.0394792 | −0.2143894 | 0.1793668 |

| 3 | Inflation | 7242 | 34.63687 | 202.1898 | −12.59891 | 9630.281 |

| 4 | Fiscal Position | 6923 | −2756.323 | 14649.38 | −245670.3 | 9630.281 |

| 5 | Openness | 7266 | 58.33845 | 32.37531 | 0 | 215.8228 |

| 6 | PPP experience | 7286 | 0.9669229 | 0.1788503 | 0 | 1 |

| 7 | MLS | 7286 | 0.8734559 | 0.3324843 | 0 | 1 |

| 8 | Central Gov. | 7286 | 0.4360417 | 0.4959265 | 0 | 1 |

| 9 | Net FDI inflow (ac.) | 7266 | 0.041736 | 0.6104446 | −13.06869 | 6.226839 |

| 10 | Real exchange rate (std.) | 4301 | 2.593689 | 2.688933 | 0 | 87.86307 |

| 11 | Real interest rate | 7266 | 0.0846632 | 5.035214 | −40.7934 | 46.72787 |

| 12 | Short debt to exports (av.) | 6731 | 22.65931 | 16.96856 | 0 | 299.8865 |

| 13 | Ratio ind. exports (av.) | 7266 | 18.6997 | 17.07576 | 0 | 98.10608 |

| 14 | China GDP Growth | 6364 | 9.479046 | 2.067778 | 3.907114 | 14.23139 |

| 15 | U.S. GDP Growth | 6364 | 2.230547 | 1.528975 | −2.77553 | 4.6852 |

| 16 | LIBOR (std.) | 7286 | 0.2240708 | 0.2528473 | 0.005359 | 1.202141 |

| 17 | BRENT (ac.) | 7286 | 1.441581 | 17.67275 | −46.65 | 31.65 |

| 18 | Nasdaq (std.) | 7286 | 182.1118 | 107.9594 | 27.7693 | 581.6638 |

| Correlation Matrix | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 1. PPP experience | 1.00 | |||||||||

| 2. MLS | 0.07 | 1.00 | ||||||||

| 3. Central Gov. | 0.04 | −0.09 | 1.00 | |||||||

| 4. Real interest rate | −0.01 | 0.00 | −0.04 | 1.00 | ||||||

| 5. Short debt to exports (av.) | −0.04 | −0.03 | −0.09 | 0.10 | 1.00 | |||||

| 6.Ratio ind. exports (av.) | −0.06 | −0.16 | 0.17 | 0.00 | 0.25 | 1.00 | ||||

| 7. GDP per capita growth | 0.13 | 0.10 | −0.17 | −0.04 | −0.14 | −0.26 | 1.00 | |||

| 8. Inflation | −0.20 | 0.04 | −0.09 | 0.03 | 0.19 | −0.01 | −0.35 | 1.00 | ||

| 9. Fiscal Position | −0.03 | −0.02 | −0.06 | −0.04 | 0.08 | 0.00 | −0.01 | 0.00 | 1.00 | |

| 10. Openness | −0.05 | −0.06 | 0.15 | −0.01 | −0.09 | −0.09 | −0.03 | −0.04 | −0.15 | 1.00 |

| 11. Net FDI inflow (ac.) | −0.01 | −0.01 | −0.08 | 0.05 | −0.13 | 0.09 | 0.08 | 0.02 | −0.02 | −0.13 |

| 12. Real exchange rate (std.) | −0.07 | 0.00 | −0.02 | 0.00 | 0.08 | 0.04 | −0.13 | 0.20 | −0.14 | −0.17 |

| 13. China GDP Growth | 0.11 | 0.00 | −0.15 | −0.10 | −0.11 | −0.15 | 0.15 | 0.13 | 0.09 | 0.00 |

| 14. U.S. GDP Growth | −0.02 | 0.00 | −0.18 | 0.03 | 0.15 | 0.07 | −0.06 | 0.06 | 0.02 | −0.03 |

| 15. LIBOR (std.) | 0.02 | 0.01 | −0.15 | −0.10 | −0.05 | −0.02 | 0.11 | 0.01 | 0.09 | −0.04 |

| 16. BRENT (ac.) | 0.04 | 0.03 | −0.03 | −0.20 | −0.06 | −0.07 | 0.17 | −0.01 | 0.02 | 0.01 |

| 17. Nasdaq (std.) | 0.05 | −0.03 | −0.03 | −0.09 | −0.03 | 0.04 | −0.04 | −0.16 | 0.02 | −0.03 |

| Correlation Matrix (Cont’d) | 11 | 12 | 13 | 14 | 15 | 16 | 17 | |||

| 11. Net FDI inflow (ac.) | 1.00 | |||||||||

| 12. Real exchange rate (std.) | 0.08 | 1.00 | ||||||||

| 13. China GDP Growth | 0.16 | −0.09 | 1.00 | |||||||

| 14. U.S. GDP Growth | 0.08 | 0.12 | 0.05 | 1.00 | ||||||

| 15. LIBOR (std.) | 0.11 | 0.05 | 0.25 | −0.18 | 1.00 | |||||

| 16. BRENT (ac.) | 0.06 | −0.18 | 0.37 | 0.20 | 0.12 | 1.00 | ||||

| 17. Nasdaq (std.) | 0.00 | −0.01 | −0.38 | −0.24 | 0.17 | −0.08 | 1.00 |

| Model No. | Exogenous Variables | Endogenous Variables | Supporting Literature |

|---|---|---|---|

| Model 1 |

|

| [2,18,22,24,58,62,63,64,66,68,69,70,71,72,73,74] |

| Model 2 | Model 1+

| Same as Model 1 | [11,21,26,62,63,64,65,66,67,76,77,78,79,99] |

| Model 3 | Model 2+

| Model 1+

| [22,57,62,63,64,81,82,83] |

| Model 4 | Model 3+

| Same as Model 3 | [22,74] |

| Model 5 | Model 4+

| Same as Model 3 | [2,24,58,62,63,64,70,71,83,84,85] |

| Model 6 | Model 5

| Same as Model 3 | [22,45,57,58,89] |

| Model 7 | Model 5+

| Same as Model 3 | [22] |

| Model 8 | Model 5+

| Same as Model 3 | [22,57,58] |

| Model 9 | Model 5+

| Same as Model 3 | [22,57,58,90,91,92] |

| Model | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| GDP p.c. growth | −0.0717 | 0.322 | −0.538 | −0.670 | −1.742 | −1.355 | −1.585 | −1.413 | −1.334 |

| Inflation | 0.0725 ** | 0.0786 ** | 0.0712 ** | 0.0702 ** | 0.0533 ** | 0.0554 ** | 0.0544 ** | 0.0579 ** | 0.0539 ** |

| Fiscal position | 8.2 × ** | 8.36 × ** | −3.49 × * | −3.55 × | −3.49 × | −1.59 × | −3.93 × | −3.45 × | −3.47 × |

| Openness | 0.00293 ** | 0.00318 ** | 0.00648 ** | 0.00641 ** | 0.00653 ** | 0.00642 ** | 0.00638 ** | 0.00656 ** | 0.00663 ** |

| PPP exp. | 0.374 | 0.183 | 0.166 | −0.558 ** | −0.675 ** | −0.635 ** | −0.529 ** | −0.604 ** | |

| MLS | −0.0758 | −0.0371 | −0.0355 | 0.0237 | 0 | 0.026 | 0.0232 | 0.0268 | |

| Central Gov. | −0.0404 | −0.204 ** | −0.217 ** | −0.279 ** | −0.185 * | −0.224 ** | −0.281 ** | −0.260 ** | |

| FDI inflow | 0.260 ** | 0.268 ** | 0.338 ** | 0.341 ** | 0.310 ** | 0.336 ** | 0.344 ** | ||

| Exchange rate | −0.100 | −0.103 | −0.104 * | −0.133 ** | −0.0983 * | −0.116 * | −0.105 * | ||

| Interest rate | −0.0133 * | −0.0104 | −0.0151 ** | −0.00566 | −0.0137 * | −0.00884 | |||

| Debt to exports | −0.00151 | −0.00386 | −0.00169 | −0.00138 | −0.00133 | ||||

| Indl. Exports | 0.00384 | 0.00408 | 0.00478 * | 0.00380 | 0.00397 | ||||

| China GDP | 0.0170 | ||||||||

| U.S. GDP | 0.103 ** | ||||||||

| LIBOR | 0.595 ** | ||||||||

| BRENT | −0.00231 | ||||||||

| NASDAQ | 0.000615 * | ||||||||

| _cons | −2.379 ** | −2.745 ** | −2.500 ** | −2.456 ** | −1.614 ** | −1.622 ** | −1.768 ** | −1.665 ** | −1.726 ** |

| (−11.48) | (−5.49) | (−4.25) | (−4.20) | (−4.53) | (−4.65) | (−5.03) | (−4.58) | (−4.49) | |

| N Wald chi (2) test statistic | 6658 44.17 ** | 6658 69.26 ** | 4059 97.19 ** | 4059 97.86 ** | 3784 107.80 ** | 3381 112.14 ** | 3784 129.58 * | 3784 107.86 ** | 3784 108.30 ** |

| Variables | GDP p.c. Growth | Inflation | Fiscal Position | Openness | PPP exp. | Central Gov. | FDI Inflow | Exchange Rate |

|---|---|---|---|---|---|---|---|---|

| VIF | 1.85 | 1.06 | 1.09 | 1.22 | 1.05 | 1.48 | 1.37 | 1.26 |

| 1/VIF | 0.541 | 0.943 | 0.917 | 0.820 | 0.952 | 0.676 | 0.730 | 0.794 |

| Variables | Interest rate | Debt to exports | Indl. Exports | China GDP | U.S. GDP | LIBOR | BRENT | NASDAQ |

| VIF | 1.2 | 1.28 | 1.57 | 1.86 | 1.36 | 1.27 | 1.5 | 1.46 |

| 1/VIF | 0.833 | 0.781 | 0.637 | 0.538 | 0.735 | 0.787 | 0.667 | 0.685 |

| Mean VIF | 1.37 | |||||||

| Models with Dummies | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| LIC | 0.574 ** | ||||||||

| MIC | −0.0310 | ||||||||

| UMIC | −0.0801 | ||||||||

| AFR | 0.306 ** | ||||||||

| EAP | 0.735 ** | ||||||||

| ECA | −0.700 ** | ||||||||

| LAC | 0.151 | ||||||||

| MENA | 0 | ||||||||

| SAR | −0.908 ** | ||||||||

| _cons | 1.752 ** | 1.758 ** | 1.675 ** | 1.730 ** | −2.175 ** | 1.948 ** | 1.760 ** | 1.615 ** | 1.556 ** |

| N | 3784 | 3784 | 3784 | 3784 | 3784 | 3784 | 3784 | 3724 | 3784 |

| Models with Dummies (Cont’d) | (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) | (18) |

| ENERGY | −0.284 ** | ||||||||

| ICT | 0.164 | ||||||||

| TRANSPORT | 0.129 | ||||||||

| WATER | 0.133 | ||||||||

| GOVRISK | −0.0661 | ||||||||

| MARRISK | −0.262 ** | ||||||||

| Contract period | −0.00713 | ||||||||

| Greenfield | −0.143 * | ||||||||

| Brownfield | 0.0925 | ||||||||

| _cons | −1.590 ** | 1.765 ** | 1.725 ** | 1.741 ** | 1.654 ** | 1.723 ** | −1.291 ** | −1.548 ** | −1.705 ** |

| N | 3784 | 3784 | 3784 | 3784 | 3784 | 3784 | 2533 | (−4.26) | (−4.91) |

| Indicators | Impact | Impact on Primary Stakeholders |

|---|---|---|

| Domestic variables | ||

| Inflation | Positive | End users/Contractors |

| Openness/Trade Exposure | Positive | Government |

| PPP experience | Negative | Government/Private Partner |

| Federal or local government granted the contract | Negative | Government/Private Partner |

| FDI Inflow/Financial Exposure | Positive | Government |

| Exchange rate | Negative | Private Partners |

| International variables | ||

| U.S. GDP growth | Positive | All stakeholders |

| LIBOR fluctuations | Positive | Lenders |

| Stock market fluctuations | Positive | Private Partners |

| MDB Support Rate (Supported Projects/Total Projects in That Category) | |||||

|---|---|---|---|---|---|

| Income Groups | Regions | Sectors | |||

| LIC | 76.8% | AFR | 77.3% | Energy | 85.2% |

| MIC | 84.3% | EAP | 94.6% | ICT | 84.7% |

| UMIC | 89.7% | ECA | 85.9% | Transport | 90.7% |

| LAC | 83.5% | Water and sewerage | 92.3% | ||

| MENA | 74.3% | ||||

| SAR | 90.0% | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Z.; Wang, H. Exploring Risk Factors Affecting Sustainable Outcomes of Global Public–Private Partnership (PPP) Projects: A Stakeholder Perspective. Buildings 2023, 13, 2140. https://doi.org/10.3390/buildings13092140

Li Z, Wang H. Exploring Risk Factors Affecting Sustainable Outcomes of Global Public–Private Partnership (PPP) Projects: A Stakeholder Perspective. Buildings. 2023; 13(9):2140. https://doi.org/10.3390/buildings13092140

Chicago/Turabian StyleLi, Zilin, and Haotian Wang. 2023. "Exploring Risk Factors Affecting Sustainable Outcomes of Global Public–Private Partnership (PPP) Projects: A Stakeholder Perspective" Buildings 13, no. 9: 2140. https://doi.org/10.3390/buildings13092140

APA StyleLi, Z., & Wang, H. (2023). Exploring Risk Factors Affecting Sustainable Outcomes of Global Public–Private Partnership (PPP) Projects: A Stakeholder Perspective. Buildings, 13(9), 2140. https://doi.org/10.3390/buildings13092140