Study on the Dynamic Evolution of Transverse Collusive Bidding Behavior and Regulation Countermeasures Under the “Machine-Managed Bidding” System

Abstract

:1. Introduction

2. Related Literature

2.1. Study on Transverse Collusive Bidding Behavior

2.2. The Application of Evolutionary Game Theory in Transverse Collusive Bidding Behavior

3. Model Building

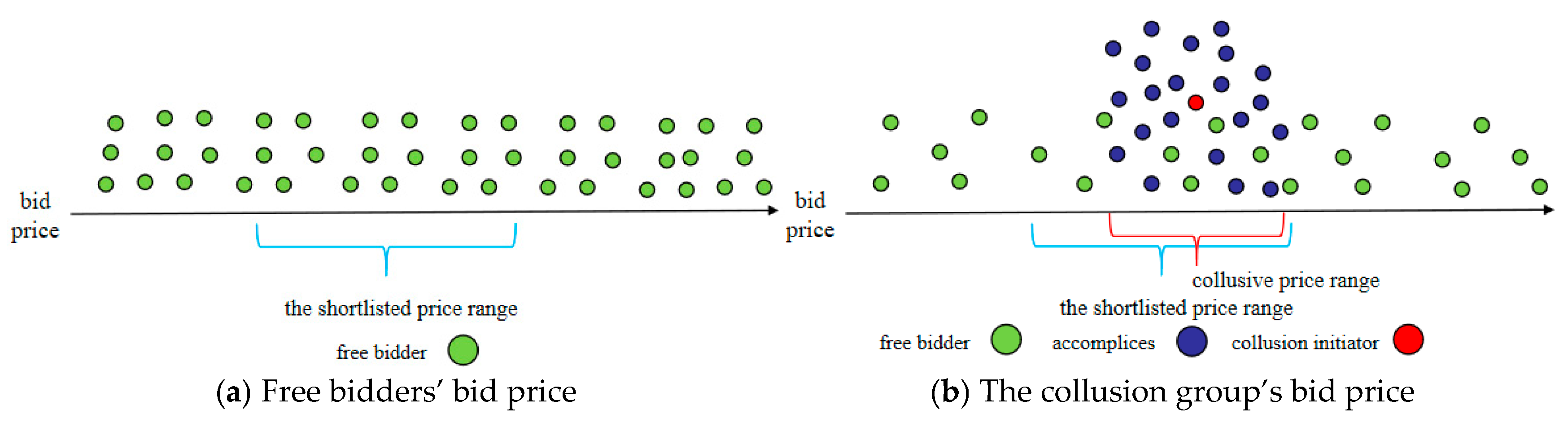

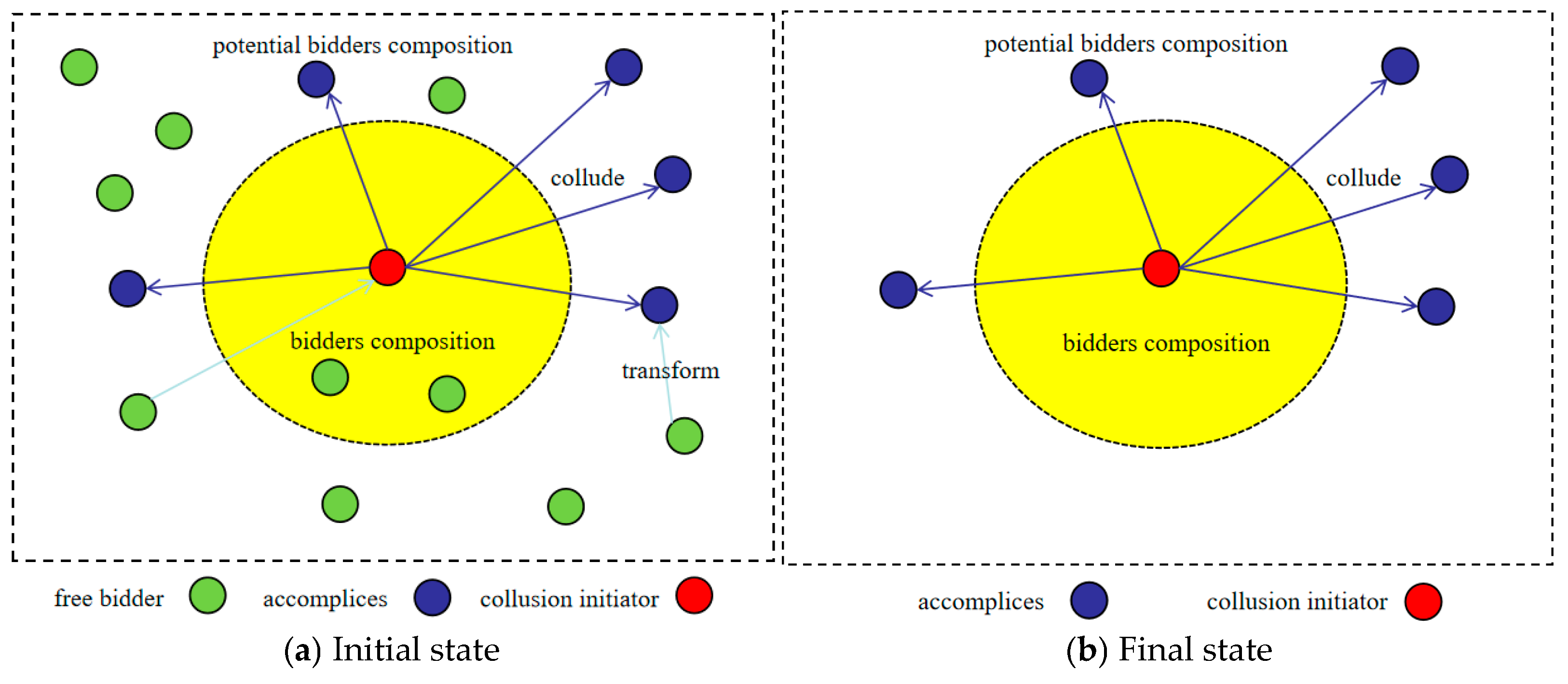

3.1. Description of the Problem

3.2. Model Assumption

3.3. Construction of the Evolutionary Game Model

3.4. Examination of Equilibrium Points and Stability in the Game Model

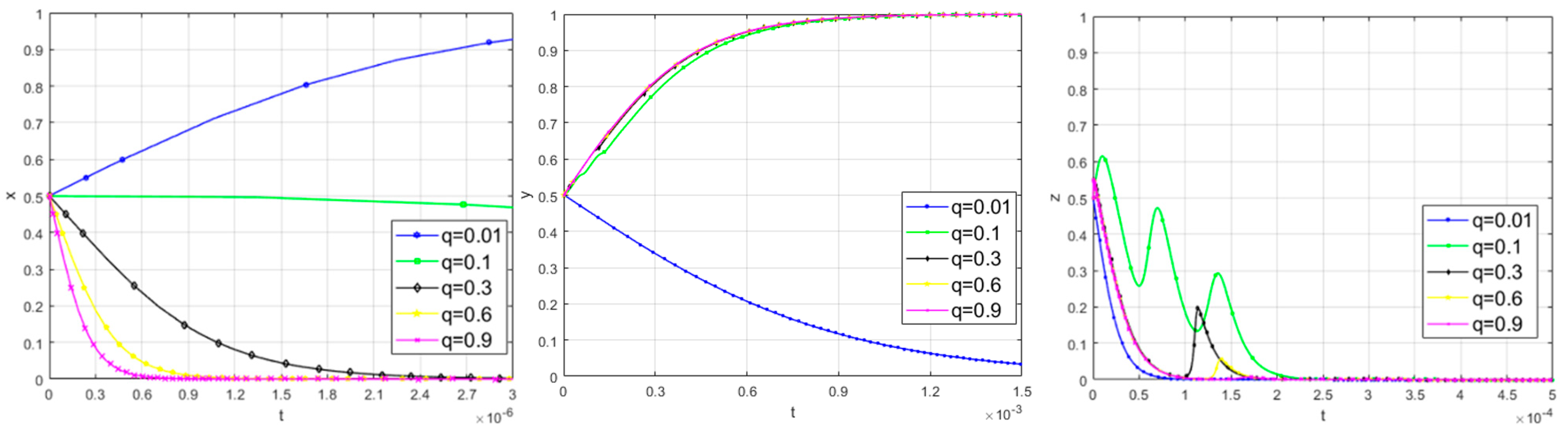

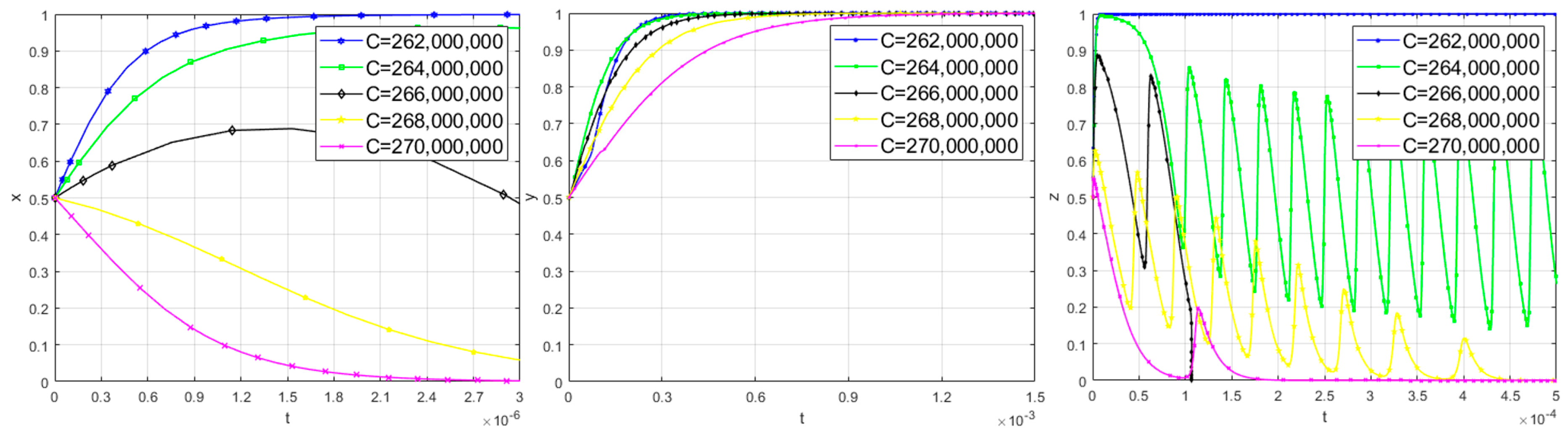

4. Numerical Simulation

- (1)

- The probability of detecting transverse collusive bidding

- (2)

- Construction costs

- (3)

- The technical parameters of transverse collusive bidding

- (4)

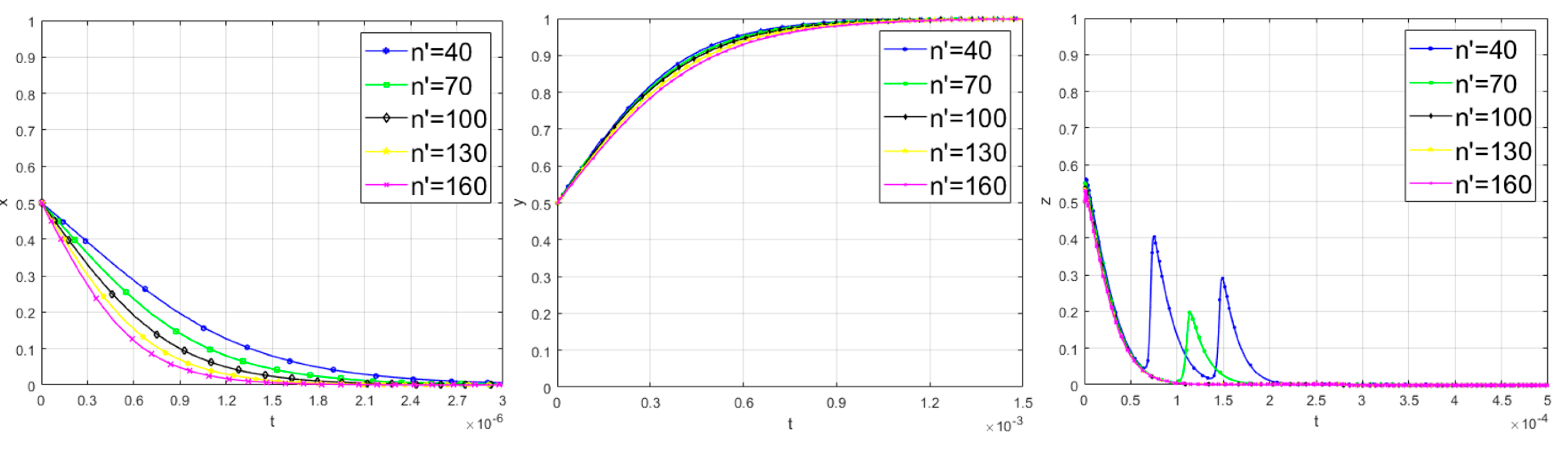

- The number of high-credit bidders

- (5)

- The number of low-credit bidders

- (6)

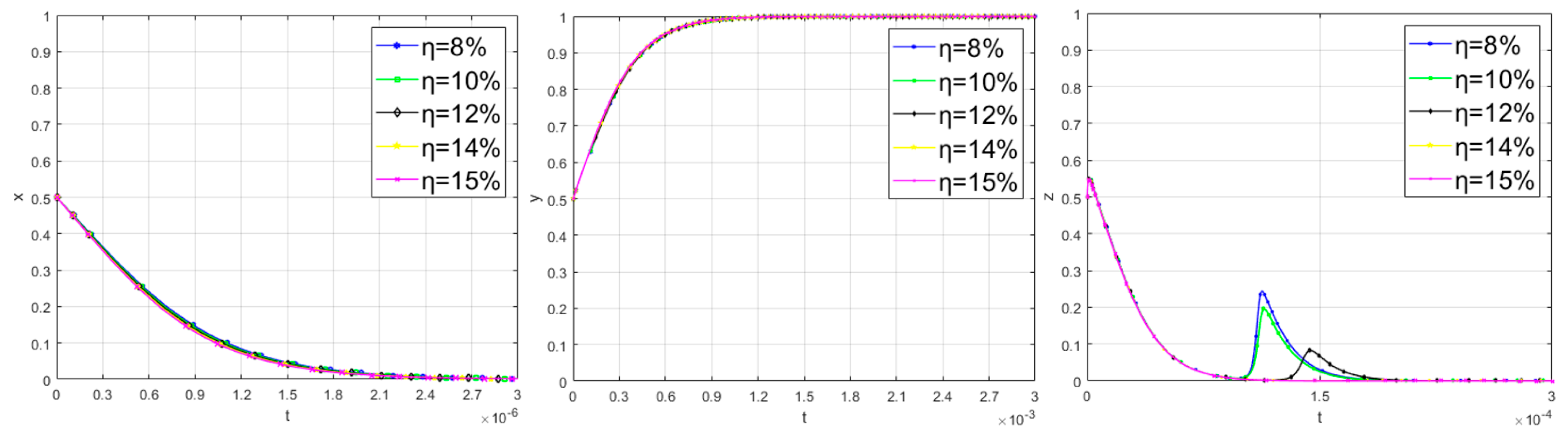

- The weighting of the integrity evaluation

- (7)

- Active regulation costs

- (8)

- The costs associated with preparing bid documents

5. Discussion

5.1. Research Findings

5.2. Theoretical Implications

5.3. Policy Implications

6. Conclusions and Limitations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Kawai, K.; Nakabayashi, J. Detecting large-scale collusion in procurement auctions. J. Polit. Econ. 2022, 130, 1364–1411. [Google Scholar] [CrossRef]

- Liu, D.C.; Zhang, X.Y.; Fu, Q.S. Research on the pathways of collusion paths among the bidding body under the machine-managed bidding model. J. Railw. Eng. 2024, 1, 11. [Google Scholar]

- Xiao, L.; Ye, K.; Zhou, J.; Ye, X.; Tekka, R.S. A social network-based examination on bid riggers’ relationships in the construction industry: A case study of China. Buildings 2021, 11, 363. [Google Scholar] [CrossRef]

- Wang, X.; Arditi, D.; Ye, K. Coupling effects of economic, industrial, and geographical factors on collusive bidding decisions. J. Constr. Eng. Manag. 2022, 148, 04022042. [Google Scholar] [CrossRef]

- Wang, X.; Long, W.; Sang, M.; Yang, Y. Towards sustainable urbanization: Exploring the influence paths of the urban environment on bidders’ collusive willingness. Land 2022, 11, 280. [Google Scholar] [CrossRef]

- Wang, X.; Ye, K.; Chen, M.; Yao, Z. A conceptual framework for the inclusion of exogenous factors into collusive bidding price decisions. J. Manag. Eng. 2021, 37, 04021071. [Google Scholar] [CrossRef]

- Wang, X.; Ye, K.; Zhuang, T.; Liu, R. The influence of collusive information dissemination on bidder’s collusive willingness in urban construction projects. Land 2022, 11, 643. [Google Scholar] [CrossRef]

- Peng, Z.; Ye, K.; Li, J. Break the Cycle of Collusion: Simulation to Influence Mechanism of Cognitive Bias on To-Collude Decision Making. Buildings 2022, 12, 997. [Google Scholar] [CrossRef]

- Du, X.H. Game Analysis of Collusion Bidding in Public Procurement. J. Soochow Univ. (Phil. Soc. Sci. Ed.) 2017, 38, 97–103. [Google Scholar]

- Shi, J.H.; Li, Y.Y. Criminal law governance of collusive bidding crimes). J. Chongqing Univ. (Soc. Sci. Ed.) 2021, 27, 191–204. [Google Scholar]

- Zhang, Z.Y. Exploration and Governance Strategy of the Collusion in Projects Bidding. Constant Econ. 2022, 43, 10–16. [Google Scholar]

- Ballesteros-Pérez, P.; Skitmore, M.; Das, R.; del Campo-Hitschfeld, M.L. Quick abnormal-bid-detection method for construction contract auctions. J. Constr. Eng. Manag. 2015, 141, 04015010. [Google Scholar] [CrossRef]

- Huber, M.; Imhof, D. Machine learning with screens for detecting bid-rigging cartels. Int. J. Ind. Organ. 2019, 65, 277–301. [Google Scholar] [CrossRef]

- Razmi, P.; Buygi, M.O.; Esmalifalak, M. A machine learning approach for collusion detection in electricity markets based on nash equilibrium theory. J. Mod. Power Syst. Clean Energy. 2020, 9, 170–180. [Google Scholar] [CrossRef]

- Gautier, A.; Ittoo, A.; Van Cleynenbreugel, P. AI algorithms, price discrimination and collusion: A technological, economic and legal perspective. Eur. J. Law Econ. 2020, 50, 405–435. [Google Scholar] [CrossRef]

- Signor, R.; Ballesteros-Pérez, P.; Love, P.E. Collusion detection in infrastructure procurement: A modified order statistic method for uncapped auctions. IEEE Trans. Eng. Manag. 2021, 70, 464–477. [Google Scholar] [CrossRef]

- Rodríguez, M.J.G.; Rodríguez-Montequín, V.; Ballesteros-Pérez, P.; Love, P.E.; Signor, R. Collusion detection in public procurement auctions with machine learning algorithms. Autom. Constr. 2022, 133, 104047. [Google Scholar] [CrossRef]

- Silveira, D.; Vasconcelos, S.; Resende, M.; Cajueiro, D.O. Won’t get fooled again: A supervised machine learning approach for screening gasoline cartels. Energy Econ. 2022, 105, 105711. [Google Scholar] [CrossRef]

- Wallimann, H.; Imhof, D.; Huber, M. A machine learning approach for flagging incomplete bid-rigging cartels. Comput. Econ. 2023, 62, 1669–1720. [Google Scholar] [CrossRef]

- Wallimann, H.; Sticher, S. On suspicious tracks: Machine-learning based approaches to detect cartels in railway-infrastructure procurement. Transp. Policy 2023, 143, 121–131. [Google Scholar] [CrossRef]

- Zhou, J.E. Research on the Phenomenon and Governance Mechanism about Horizontal Collusion in the Bidding Field of Construction Projects. Master’s Thesis, Tianjin University of Technology, Tianjin, China, 2010. [Google Scholar]

- Wang, X. Research on the External Environmental Influence Mechanism and Governance Countermeasures of Collusive Bidding in Construction. Ph.D. Thesis, Chongqing University, Chongqing, China, 2022. [Google Scholar]

- Qiao, Z. Research on Supervision for the Electronic Bidding of Railway Construction Driven by Big Data. Ph.D. Thesis, Beijing Jiaotong University, Beijing, China, 2021. [Google Scholar]

- Zhang, Q.; Jin, L.; Chen, Y.; Jiang, G. Repeated game behavior between bidder and regulatory agency of construction engineering with intertemporal choice. RAIRO-Oper. Res. 2024, 58, 2001–2014. [Google Scholar] [CrossRef]

- Wang, Q.; Pan, L. Tripartite evolutionary game analysis of participants’ behaviors in technological innovation of mega construction projects under risk orientation. Buildings 2023, 13, 287. [Google Scholar] [CrossRef]

- Cheng, L.; Liu, G.; Huang, H.; Wang, X.; Chen, Y.; Zhang, J.; Yu, T. Equilibrium analysis of general N-population multi-strategy games for generation-side long-term bidding: An evolutionary game perspective. J. Clean. Prod. 2020, 276, 124123. [Google Scholar] [CrossRef]

- Sun, C.; Wang, M.; Man, Q.; Wan, D. Research on the BIM application mechanism of engineering-procurement-construction projects based on a tripartite evolutionary game. J. Constr. Eng. Manag. 2023, 149, 04022182. [Google Scholar] [CrossRef]

- Ma, C.; Chen, Y.; Nie, S. Four-Way Evolutionary Game Analysis of Government Project Bidding Collusion in a State of Limited Rationality Based on Prospect Theory. Comput. Intell. Neurosci. 2022, 2022, 6092802. [Google Scholar] [CrossRef]

- Cheng, X.; Cheng, M.; Liu, Y. The behavioral strategies of multiple stakeholders in the NIMBY facility public-private partnership project: A tripartite evolutionary game analysis based on prospect theory. Can. J. Civ. Eng. 2024. [Google Scholar] [CrossRef]

- Liu, X.; Zhang, Z.; Qi, W. The strategy analysis of grouped bid evaluation in reverse auction: A tripartite evolutionary game perspective. IEEE Syst. J. 2021, 16, 88–99. [Google Scholar] [CrossRef]

- Brown, J.; Loosemore, M. Behavioural factors influencing corrupt action in the Australian construction industry. Eng. Constr. Archit. Manag. 2015, 22, 372–389. [Google Scholar] [CrossRef]

- Zhang, M.J. Research on the Evolution Simulation of the Collusion Participants’ Behavior Decision-making in Construction Projects. Master’s Thesis, Chongqing University, Chongqing, China, 2020. [Google Scholar]

- Friedman, D. Evolutionary games in economics. Econom. J. Econom. Soc. 1991, 637–666. [Google Scholar] [CrossRef]

- Lyapunov, A.M. The general problem of the stability of motion. Int. J. Control 1992, 55, 531–534. [Google Scholar] [CrossRef]

- Xu, D.; Yang, Q. The systems approach and design path of electronic bidding systems based on blockchain technology. Electronics 2022, 11, 3501. [Google Scholar] [CrossRef]

- Carbone, C.; Calderoni, F.; Jofre, M. Bid-rigging in public procurement: Cartel strategies and bidding patterns. Crime Law Soc. Chang. 2024, 82, 249–281. [Google Scholar] [CrossRef]

- Ma, C.; Chen, Y.; Zhu, W.; Ou, L. How to effectively control vertical collusion in bidding for government investment projects-Based on fsQCA method. PLoS ONE 2022, 17, e0274002. [Google Scholar] [CrossRef] [PubMed]

- Lu, Y. Research on the whole process cost control of infrastructure projects in colleges and universities based on dbb model. Archit. Eng. Sci. 2022, 3, 24–28. [Google Scholar]

- Shrestha, P.P.; Fathi, M. Impacts of change orders on cost and schedule performance and the correlation with project size of DB building projects. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2019, 11, 04519010. [Google Scholar] [CrossRef]

- Park, J.; Kwak, Y.H. Design-bid-build (DBB) vs. design-build (DB) in the US public transportation projects: The choice and consequences. Int. J. Proj. Manag. 2017, 35, 280–295. [Google Scholar] [CrossRef]

- Thu, M.K.; Hamilton, P.; Lee, J.H.; Kingsley, G.; Ashuri, B. A Critical Assessment of Material Price Adjustment Clauses for Transportation Design–Build Projects. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2024, 16, 04524008. [Google Scholar] [CrossRef]

- Vu, T.Q.; Pham, C.P.; Nguyen, T.A.; Nguyen, P.T.; Phan, P.T.; Nguyen, Q.L.H.T.T. Factors influencing cost overruns in construction projects of international contractors in Vietnam. J. Asian Financ. Econ. Bus. 2020, 7, 389–400. [Google Scholar] [CrossRef]

| Parameters | Implication |

|---|---|

| , | the number of high-credit and low-credit bidders |

| , | the number of high-credit and low-credit bidders in the collusion group |

| , | the number of high-credit and low-credit bidders in the free bidders |

| tender sum limit | |

| the weighting of the integrity evaluation | |

| high-credit and low-credit bidders’ credit coefficient | |

| the probability of detecting transverse collusive bidding | |

| the technical parameters of transverse collusive bidding | |

| active regulation costs | |

| fines imposed on the collusion initiator of transverse collusive bidding after the detection | |

| construction costs | |

| the bid price of collusion group participants | |

| the bid price of free bidders | |

| the costs associated with preparing bid documents | |

| , | the collusion initiator compensates high-credit and low-credit bidders involved in the collision with a one-time payment |

| Collusion Initiator | Free Bidders | Regulators | ||

|---|---|---|---|---|

| collude | bid | , , | , , | , , |

| non-bid | , , | , , | , , | |

| non-collude | bid | , , | , , | , , |

| non-bid | , , | , , | , , | |

| Equilibrium Points | Stability | |||

|---|---|---|---|---|

| / | ||||

| Uncertain | ||||

| Uncertain | ||||

| / | ||||

| Uncertain | ||||

| Uncertain | ||||

| / | ||||

| Uncertain |

| Equilibrium Points | Stability Conditions |

|---|---|

| Parameters | Implication | Initial Value |

|---|---|---|

| , | the number of high-credit and low-credit bidders | 70, 1130 |

| , | the number of high-credit and low-credit bidders in the collusion group | 35, 565 |

| , | the number of high-credit and low-credit bidders in the free bidders | 35, 565 |

| tender sum limit | 300,000,000 | |

| the weighting of the integrity evaluation | 10% | |

| high-credit and low-credit bidders’ credit coefficient | 1.1, 0.9 | |

| the probability of detecting transverse collusive bidding | 0.3 | |

| the technical parameters of transverse collusive bidding | 1.5 | |

| active regulation costs | 100,000 | |

| fines imposed on the collusion initiator of transverse collusive bidding after the detection | 3,000,000 | |

| construction costs | 270,000,000 | |

| the bid price of collusion group participants | 291,000,000 | |

| the bid price of free bidders | 276,000,000 | |

| the costs associated with preparing bid documents | 5000 | |

| , | the collusion initiator compensates high-credit and low-credit bidders involved in the collision with a one-time payment | 30,000, 24,000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Z.; Liu, J.; Zhang, Z.; Chen, B. Study on the Dynamic Evolution of Transverse Collusive Bidding Behavior and Regulation Countermeasures Under the “Machine-Managed Bidding” System. Buildings 2025, 15, 150. https://doi.org/10.3390/buildings15020150

Zhang Z, Liu J, Zhang Z, Chen B. Study on the Dynamic Evolution of Transverse Collusive Bidding Behavior and Regulation Countermeasures Under the “Machine-Managed Bidding” System. Buildings. 2025; 15(2):150. https://doi.org/10.3390/buildings15020150

Chicago/Turabian StyleZhang, Zongyuan, Jincan Liu, Zhitian Zhang, and Bin Chen. 2025. "Study on the Dynamic Evolution of Transverse Collusive Bidding Behavior and Regulation Countermeasures Under the “Machine-Managed Bidding” System" Buildings 15, no. 2: 150. https://doi.org/10.3390/buildings15020150

APA StyleZhang, Z., Liu, J., Zhang, Z., & Chen, B. (2025). Study on the Dynamic Evolution of Transverse Collusive Bidding Behavior and Regulation Countermeasures Under the “Machine-Managed Bidding” System. Buildings, 15(2), 150. https://doi.org/10.3390/buildings15020150