Valuing Reciprocal Synergies in Merger and Acquisition Deals Using the Real Option Analysis

Abstract

:1. Introduction: Purpose and Research Question

2. Existing Frameworks

2.1. Resources, Capabilities and Core Competencies: The VRIO Framework

2.2. Competence-Based Synergy Testing in M&As with the ARCTIC Research Framework: An Approach

2.3. Exploring Competence-Based Synergy Potential in Strategic Transactions: Dyer, Kale, and Singh’s Framework

2.4. Measuring Competence-Based Synergies in M&A with a Real Option: Dunis & Klein Approach

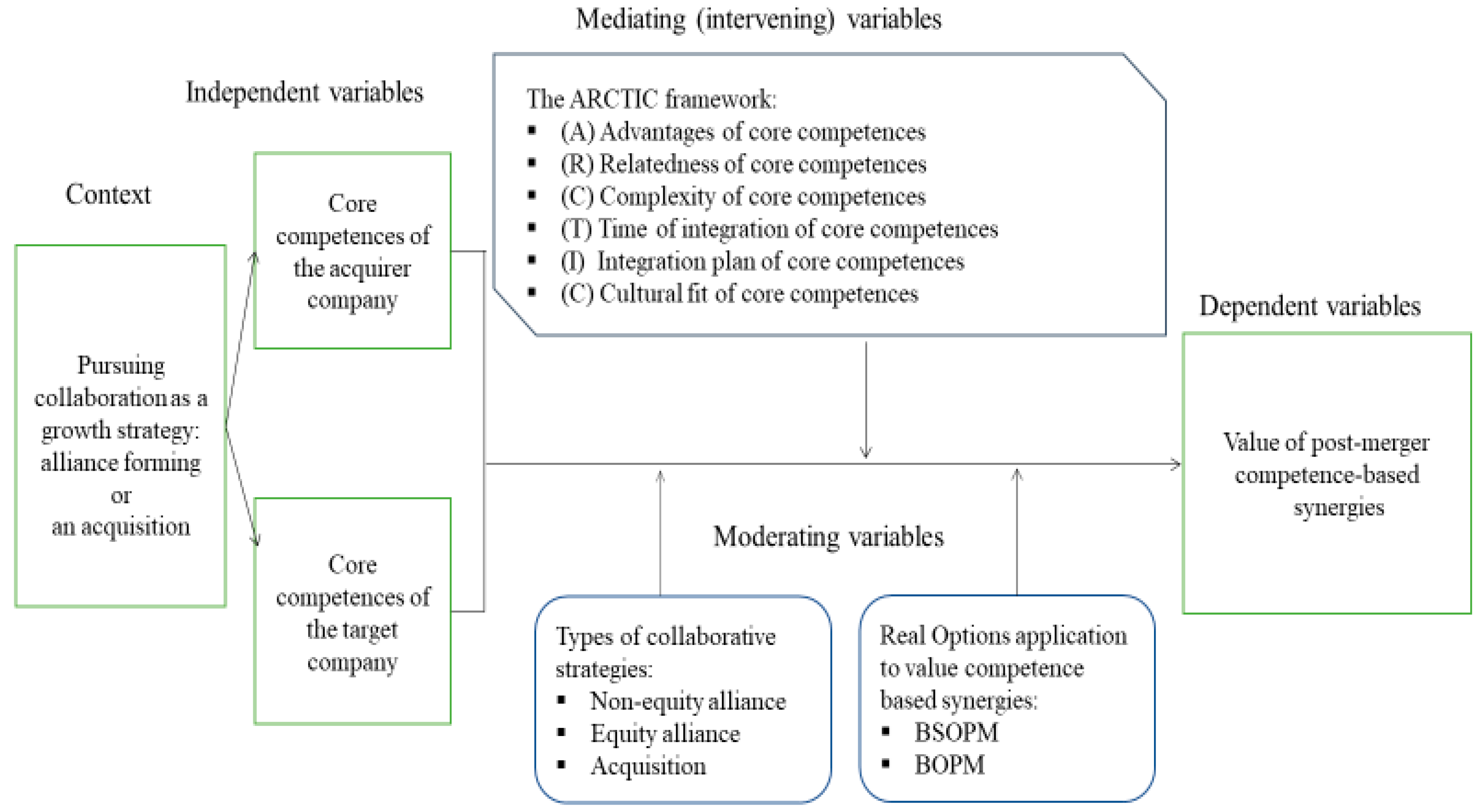

3. Research Design and Methodology

The Theoretical Framework of the Research

4. Empirical Testing of the ARCTIC Framework: Findings and Results

4.1. L’Oréal’s Acquisition of The Body Shop in 2006: What Went Wrong?

4.1.1. The First Step Is to Assess the Core Competencies of Collaborative Partners in Terms of Their Compatibilities, Similarities, and Complementarily

4.1.2. The Second Step Is to Apply the ARCTIC Framework to Predict a Reciprocal Synergy in M&A Deals

4.2. Natura’s Acquisition of The Body Shop in Late 2017: Targeting Global Growth?

4.2.1. The First Step Is to Assess the Core Competencies of Collaborative Partners in Terms of Their Compatibilities, Similarities, and Complementarily

4.2.2. The Second Step Is to Apply the ARCTIC Framework to Predict a Reciprocal Synergy in M&A Deals

4.2.3. The Third Step Is Defining the Type of Competence-Based Synergy that Both Companies Would Experience

4.2.4. The Fourth Step Is Measuring Competence-Based Synergies in M&A with a Real Options Valuation

4.3. Natura’s Acquisition of Avon Products Inc. in 2019: Creating a Global Cosmetic Powerhouse?

4.3.1. The First Step Is to Assess the Core Competencies of Collaborative Partners in Terms of Their Compatibilities, Similarities, and Complementarily

4.3.2. The Second Step Is to Apply the ARCTIC Framework to Predict a Reciprocal Synergy in M&A Deals

4.3.3. The Third Step Is Defining the Type of Competence-Based Synergy that Both Companies Would Experience

4.3.4. The Fourth Step Is Valuing the Reciprocal Synergy of M&A Deal with a Real Option Application

5. Discussion

6. Conclusions, Research Limitations, and Future Work

Funding

Acknowledgments

Conflicts of Interest

References

- Alhenawi, Yasser, and Sudha Krishnaswami. 2015. The long-term impact of merger synergies on performance and value. The Quarterly Review of Economics and Finance 58: 93–118. [Google Scholar] [CrossRef]

- Alhenawi, Yasser, and Martha L. Stilwell. 2018. Toward a complete definition of relatedness in merger and acquisition transactions. Review of Quantitative Finance and Accounting 53: 1–46. [Google Scholar] [CrossRef]

- Andrade, Gregor, Mark Mitchell, and Erik Staffors. 2001. New evidence and perspective on the merger. Journal of Economic Perspectives 15: 103–20. [Google Scholar] [CrossRef]

- Arzuaga, Susel, Ann Palomino Brown, and Martin Rich. 2014. Generating Theory from Secondary Data: A Variation on Eisenhardt’s Case Study Method. Paper presented at the 13th European Conference on Research Methodology for Business and Management Cass Business School City University, London, UK, June 16–17; Edited by A. Brown and M. Rich. South Oxfordshire: Academic Conferences and Publishing International Ltd. [Google Scholar]

- Barney, Jay B. 1996. Gaining and Sustaining Competitive Advantage. Boston: Addison-Wesley. [Google Scholar]

- Bauer, Florian, and Kurt Matzler. 2014. Antecedents on M&A success: The role of strategic complementary, cultural fit, and degree and speed on integration. Strategic Management Journal 35: 269–91. [Google Scholar]

- BBC News. 2017. Body Shop Bought by Brazil’s Natura. June 27. Available online: https://www.bbc.com/news/business-40417961 (accessed on 17 October 2019).

- Bijlsma-Frankema, Katinka. 2001. On managing cultural integration and cultural change processes in mergers and acquisitions. Journal of European Industrial Training 25: 192–207. [Google Scholar] [CrossRef]

- Birks, Melanie, and Jane Mills. 2011. Grounded Theory: A Practical Guide. London: Sage. [Google Scholar]

- Black, Thomas R. 1993. Evaluating Social Science Research. London: Sage. [Google Scholar]

- Black, Fischer, and Myron Scholes. 1973. The Pricing of Options and Corporate Liabilities. Journal of Political Economy 81: 637–54. [Google Scholar] [CrossRef] [Green Version]

- Bloomberg. 2017. Brazil’s Natura Set to Buy Body Shop in $1.1 Billion Deal. Available online: https://www.bloomberg.com/news/articles/2017-06-09/brazil-s-natura-set-to-acquire-body-shop-in-1-1-billion-deal (accessed on 17 October 2019).

- Bowman, Edward H. 1978. Strategy, annual reports, and alchemy. California Management Review 20: 64–71. [Google Scholar] [CrossRef]

- Butler, Sarah. 2017. L’Oréal to sell Body Shop to Brazil’s Natura in €1bn deal. The Guardian. June 9. Available online: https://www.theguardian.com/business/2017/jun/09/loreal-body-shop-natura-aesop (accessed on 17 October 2019).

- Cartwright, Susan, and Richard Schoenberg. 2006. Thirty years of mergers and acquisitions research: Recent advances and future opportunities. British Journal of Management 17: S1–S5. [Google Scholar]

- Chang, Sea-Jin, and Philip M. Rosenzweig. 2001. The choice of entry mode in sequential foreign direct investment. Strategic Management Journal 22: 747–76. [Google Scholar] [CrossRef]

- Charmaz, Kathy. 2006. Constructing Grounded Theory. A Practical Guide through Qualitative Analysis. London: Sage. [Google Scholar]

- Chi, Tailan. 2000. Option to acquire or divest a joint venture. Strategic Management Journal 21: 665–87. [Google Scholar] [CrossRef]

- Chi, Tailan, and Anju Seth. 2009. A dynamic model of the choice of mode for exploiting complementary capabilities. Journal of International Business Studies 40: 365–87. [Google Scholar] [CrossRef]

- Chi, Tailan, Jing Li, Lenos G. Trigeorgis, and Andrianos E. Tsekrekos. 2019. Real option theory in international business. Journal of International Business Studies 50: 525–53. [Google Scholar] [CrossRef]

- Chirjevskis, Andrejs, and Lev Joffe. 2007. How to Create Competence-based Synergy in M&A? The Icfai Journal of Mergers & Acquisitions IV: 43–61. [Google Scholar]

- Čirjevskis, Andrejs. 2015. Empirical testing of the ARCTIC model for assessment of competence-based synergy in the acquisition process. Journal of Business Management 9: 63–73. [Google Scholar]

- Čirjevskis, Andrejs. 2019. Managing Competence-Based Synergy in Acquisitions Processes: Empirical Evidence from Global ICT and Cosmetic Industries. Interactive Session 3.1.16, Track: 6—Strategy, Organization, and Management. Copenhagen: Academy of International Business (AIB), Available online: https://documents.aib.msu.edu/events/2019/AIB2019_Program.pdf (accessed on 28 April 2020).

- Čirjevskis, Andrejs. 2020. Brazilian Natura & Co: Creating Cosmetic Powerhouse. Empirical Evidence of Competence-Based Synergies in M&A processes. Paper presented at “From Innovation to Sustainable Business Models” Specialized Conference of Academy of Management (USA) “Advancing Management Research in Latin America”, Mexico City, Mexico; Available online: https://na.eventscloud.com/ehome/index.php?eventid=450962&tabid=1014207 (accessed on 14 April 2020).

- CISION. 2020. PR Newswire. 2020. Natura & Co to Close Acquisition of Avon, Creating the World’s Fourth-Largest Pure-Play Beauty Group. Available online: https://www.prnewswire.com/news-releases/natura-co-to-close-acquisition-of-avon-creating-the-worlds-fourth-largest-pure-play-beauty-group-300980823.html (accessed on 12 April 2020).

- CISION PR Newswire. 2019. Natura & Co and Avon join forces to create a Direct-to-Consumer Global Beauty Leader. Vila Jaguara: Natura & Co., Available online: https://www.prnewswire.com/news-releases/natura-co-and-avon-join-forces-to-create-a-direct-to-consumer-global-beauty-leader-300855548.html (accessed on 1 November 2019).

- Coff, Russel W. 2002. Human capital, shared expertise, and the likelihood of impasse in corporate acquisitions. Journal of Management 28: 107–28. [Google Scholar] [CrossRef]

- Coles, Jeffrey L., Zhichuan (Frank) Li, and Albert Y. Wang. 2018. Industry Tournament Incentives. Review of Financial Studies 31: 1418–59. [Google Scholar] [CrossRef]

- Collis, Jill, and Roger Hussy. 2009. Business Research, 3rd ed. London: Palgrave Macmillan, pp. 164–66. [Google Scholar]

- O’Connor, Cliodhna, and Helene Joffe. 2020. Intercoder Reliability in Qualitative Research: Debates and Practical Guidelines. International Journal of Qualitative Methods Volume 19: 1–13. [Google Scholar] [CrossRef]

- Cox, John, Stephen A. Ross, and Mark Rubinstein. 1979. Option Pricing: A Simplified Approach. Journal of Financial Economics 7: 229–63. [Google Scholar] [CrossRef]

- Coyne, Kevin P., Stephen J. D. Hall, and Patricia Gorman Clifford. 1997. Is Your Core Competence a Mirage? McKinsey Quarterly 1: 40–55. [Google Scholar]

- Cuff, Madeleine. 2017. Revealed: The Inside Story of Natura’s Body Shop Buyout. BusinessGreen. Available online: https://www.businessgreen.com/bg/interview/3022787/revealed-the-inside-story-of-naturas-body-shop-buyout (accessed on 17 October 2019).

- Dagnino, Giovanni Battista, and Maria Cristina Cinici. 2016. Research Method for Strategic Management. Routledge. London and New York: Taylor & Francis Group, p. 363. [Google Scholar]

- De Carolis, Donna Marie. 2003. Competences and imitability in the pharmaceutical industry: An analysis of their relationship with firm performance. Journal of Management 29: 27–50. [Google Scholar] [CrossRef]

- Dunis, Christian L., and Til Klein. 2005. Analyzing Mergers and Acquisitions in European Financial Services: An Application of Real Options. European Journal of Finance 11: 339–55. [Google Scholar] [CrossRef]

- Dyer, Jeffrey H., Prashant Kale, and Harbir Singh. 2004. When to Ally and When to Acquire. Harvard Business Review 82: 108–15. [Google Scholar]

- Eisenhardt, Kathleen M., and Melissa E. Graebner. 2007. Theory building from cases: Opportunities and challenges. Academy of Management Journal 50: 25–32. [Google Scholar] [CrossRef]

- Fontanella-Khan, James, and A. Schipani. 2019. Body Shop Parent Agrees to Buy Avon in an All-Stock Deal. Financial Times. Available online: https://www.ft.com/content/fbed818c-7c4b-11e9–81d2-f785092ab560 (accessed on 1 November 2019).

- Ghemawat, Pankaj. 2007. Managing differences: The central challenge of global strategy. Harvard Business Review 85: 58–68. [Google Scholar]

- Giroud, Xavier, and Holger M. Mueller. 2011. Corporate governance, product market competition, and equity prices. Journal of Finance 66: 563–600. [Google Scholar] [CrossRef] [Green Version]

- Grant, Robert M. 1996. Toward a Knowledge-Based Theory of the Firm. Strategic Management Journal 17: 109–22. [Google Scholar] [CrossRef]

- HBS Working Knowledge. 2017. Amazon-Whole Foods Deals Is a Big Win for Consumers. Available online: https://www.forbes.com/sites/hbsworkingknowledge/2017/06/17/amazon-whole-foods-deal-is-a-big-win-for-consumers/#706c71347232 (accessed on 17 January 2018).

- Hitt, Michael A., David King, Hema Krishnan, Marianna Makri, Mario Schijven, Katsuhiko Shimizu, and Hong Zhu. 2009. Merger and Acquisition: Overcoming pitfalls, building synergy, and creating value. Business Horizon 52: 523–29. [Google Scholar] [CrossRef] [Green Version]

- John, Doris Rajakumari, and K. Bhagyalakshmi. 2017. L’Oréal’s Body Shop Acquisition. What Went Wrong? [Case]. Bangalore: Amit Research Centers Headquarters. Available online: https://www.thecasecentre.org (accessed on 17 October 2019).

- Kodukula, Prasad, and Chandra Papudesu. 2006. Project Valuation Using Real Options: A Practitioner’s Guide. Fort Lauderdale: Ross Publishing, Inc., pp. 40–135. [Google Scholar]

- Kogut, Bruce. 1985. Designing global strategies: Comparative and competitive value-added chains. Sloan Management Review 26: 15–28. [Google Scholar]

- L’Oréal Finance. 2017. L’Oréal and Natura Enter into Exclusive Discussions Regarding The Body Shop. L’Oréal Finance. Available online: https://www.loreal-finance.com/eng/news/loreal-and-natura-enter-into-exclusive-discussions-regarding-the-body-shop-1193.htm (accessed on 17 October 2019).

- Lawrence, C. 2018. DZone. Will Walmart’s Bet on IBM Blockchain Pay Off. Available online: https://dzone.com/articles/will-walmarts-bet-on-ibm-blockchain-pay-off29 (accessed on 29 April 2019).

- Li, Zhichuan (Frank). 2014. Mutual monitoring and corporate governance. Journal of Banking & Finance 45: 255–69. [Google Scholar]

- Li, Jing, Charles Dhanaraj, and Richard L. Shockey Jr. 2008. Joint venture evolution: Extending the real options approach. Managerial and Decision Economics 29: 317–36. [Google Scholar] [CrossRef]

- Li, Zhichuan (Frank), Shannon Lin, Shuna Sun, and Alan Tucker. 2018. Risk-Adjusted Inside Debt. Global Finance Journal 35: 12–42. [Google Scholar] [CrossRef] [Green Version]

- Lodorfos, George, and Agyenin Boateng. 2006. The role of culture in the merger and acquisition process: Evidence from the European chemical industry. Management Decision 44: 1405–21. [Google Scholar] [CrossRef]

- Loukianova, Anna, Egor Nikulin, and Andrey Vedernikov. 2017. Valuing synergies in strategic mergers and acquisitions using the real options approach. Investment Management and Financial Innovations 14: 236–47. [Google Scholar] [CrossRef] [Green Version]

- Merchant, Hermant. 2004. Revisiting shareholder value creation via international joint ventures: Examining interactions among firm- and context-specific variables. Canadian Journal of Administrative Sciences 21: 129–45. [Google Scholar] [CrossRef]

- Moura, Júlia, and Filipe Oliveira. 2019. Natura Buys Avon and Becomes the 4th Largest Beauty Company in The World. Folha de S. Paulo. Available online: https://www1.folha.uol.com.br/internacional/en/business/2019/05/natura-buys-avon-and-becomes-the-4th-largest-beauty-company-in-the-world.shtml (accessed on 1 November 2019).

- Mun, Johnathan. 2002. Real Options Analysis, Tools, and Techniques for Valuing Strategic Investments and Decisions. Hoboken: John Wiley and Sons, pp. 11–262. [Google Scholar]

- Natura, Aesop, The Body Shop. 2017. A Purpose-Driven, Global, Multichannel Cosmetics Group. Available online: https://natu.infoinvest.com.br/enu/6815/Equity%20story_v26_London_11Sep.pdf (accessed on 17 October 2019).

- Natura, Aesop, The Body Shop. 2019. Natura &Co and Avon: Creating a Leading Direct-to-Customer Global Beauty Group. Available online: https://www.avonworldwide.com/dam/jcr:e423d61e-19d1-4bdd-b273-99229f3e7970/natura-co-avon-webcast.pdf (accessed on 1 November 2019).

- Netz, Joakim, Martin Svensson, and Ethel Brundin. 2019. Business disruptions and affective reactions: A strategy-as-practice perspective. Long Range Planning. Long Range Planning. Available online: https://doi.org/10.1016/j.lrp.2019.101910 (accessed on 28 April 2020).

- News News. 2017. The Body Shop, the Brazilians, Bought It [Video clip]. Available online: https://www.youtube.com/watch?v=eJZXJnFhEEI (accessed on 25 April 2019).

- Nguyen, Han, and Brian H. Kleiner. 2003. The effective management of mergers. Leadership and Organization Development Journal 24: 447–54. [Google Scholar] [CrossRef]

- NYU Stern. 2019. Natura Cosmeticos SA GARCH Volatility Analysis. V-Lab. Available online: https://vlab.stern.nyu.edu/analysis/VOL.NATU3:BZ-R.GARCH (accessed on 17 October 2019).

- Osborne, J. David, Charles I. Stubbart, and Arkalgud Ramaprasad. 2001. Strategic groups and competitive enactment: A study of dynamic relationships between mental models and performance. Strategic Management Journal 22: 435–54. [Google Scholar] [CrossRef]

- Penrose, Edith. 1959. A Theory of the Growth of the Firm. Oxford: Basil Blackwell. [Google Scholar]

- Penrose, Edith, and Christos N. Pitelis. 2009. The Theory of the Growth of the Firm. Oxford: Oxford University Press, p. 665. [Google Scholar]

- Prahalad, Coimbatore Krishnarao, and Gary Hamel. 1990. May-June. The core competence of the organization. Harvard Business Review, 79–93. [Google Scholar]

- Ralph, Nicholas, Melanie Birks, and Ysanne Chapman. 2014. Contextual Positioning: Using Documents as Extant Data in Grounded Theory Research. SAGE Open 4: 1–7. [Google Scholar] [CrossRef] [Green Version]

- Rugman, Alan M., and Alain Verbeke. 2002. Edith Penrose’s contribution to the resource-based view of strategic management. Strategic Management Journal 23: 769–80. [Google Scholar] [CrossRef]

- Sahu, Benudhar, and Indu Pereru. 2019. Natura’s Acquisition of Avon Products. ICRM No. 319-0284-8. Hyderabad: IBS Center for Management Research. [Google Scholar]

- Schipani, Andres. 2018. Body Shop Owner Natura Targets Global Growth. Financial Times. February 4. Available online: https://www.ft.com/content/d4c868a0-091b-11e8-8eb7-42f857ea9f09 (accessed on 17 October 2019).

- Sekaran, Uma, and Roger Bougie. 2018. Research Methods for Business: A Skill-Building Approach. Chichester: Wiley, p. 448. [Google Scholar]

- Sharma, Nilosha. 2016. Instagram: Exploring an Innovative Monetization Model. Bangalore: AMITY Research Centers Headquarter, pp. 1–12. [Google Scholar]

- Siggelkow, Nicolaj. 2007. Persuasion with case studies. Academy of Management Journal 50: 20–24. [Google Scholar] [CrossRef]

- Spanner, Gary E., José Pablo Nuño, and Charu Chandra. 1993. Time-based strategies—Theory and practice. Long Range Planning 26: 90–101. [Google Scholar] [CrossRef]

- Straits Research. 2020. Available online: https://straitsresearch.com/blog/top-10-cosmetic-companies-in-the-world-2020 (accessed on 12 April 2020).

- Strategic Management Society, and Strategy Practice IG. 2020. What Do We Do? Available online: https://www.strategicmanagement.net/ig-strategy-practice/overview (accessed on 27 March 2020).

- Teece, David J., Gary Pisano, and Amy Shuen. 1997. Dynamic capabilities and strategic management. Strategic Management Journal 18: 509–33. [Google Scholar] [CrossRef]

- Trigeorgis, Lenos, and Jeffrey J. Reuer. 2017. Real options theory in strategic management. Strategic Management Journal 38: 42–63. [Google Scholar] [CrossRef]

- Tsang, Eric W. K. 2013. Case study methodology: Causal explanation, contextualization, and theorizing. Journal of International Management 19: 195–202. [Google Scholar] [CrossRef]

- Weber, Robert Philip. 1990. Basic Content Analysis. Newbury Park: Sage. [Google Scholar]

- Witt, Ulrich. 2016. What kind of innovation do we need to secure our future? The Journal of Open Innovation: Technology, Market, and Complexity 2: 1–14. [Google Scholar] [CrossRef] [Green Version]

- WorldGovernmentBond. 2019. Brazil 10 Years Bond—Historical Data. Available online: http://www.worldgovernmentbonds.com/bond-historical-data/brazil/10-years/ (accessed on 17 October 2019).

- YahooFinance. 2019. Natura Cosmeticos S.A. (NATU3.SA). Available online: https://finance.yahoo.com/quote/NATU3.SA/financials?p=NATU3.SA&.tsrc=fin-srch (accessed on 17 October 2019).

- Yin, Robert K. 1984. Case Study Research: Design and Methods. Newbury Park: Sage. [Google Scholar]

- Yin, Robert K. 2009. Case Study Research: Design and Methods, 4th ed. Newbury Park: Sage. [Google Scholar]

- Zenger, Todd. 2016. Do M&A Deals Ever Really Create Synergies. Harvard Business Review. Available online: https://hbr.org/2016/07/do-ma-deals-ever-really-create-synergies (accessed on 27 April 2020).

| Core competences of L’Oréal (Loreal) and The Body Shop (TBS) | (A) | (R) | (C) | (T) | (I) | (C) |

|---|---|---|---|---|---|---|

| Loreal Core competence in R&D | Yes | No | Yes | Yes | No | No |

| Loreal Core competence in supply chain management | Yes | No | Yes | Yes | No | No |

| Loreal Core competence in brand management | Yes | No | Yes | Yes | No | No |

| Loreal Core competence in customers’ loyalty | Yes | No | Yes | Yes | No | No |

| Loreal Core competence in the product range | Yes | No | Yes | Yes | No | No |

| TBS Core competence in brand management | No | No | Yes | Yes | No | No |

| TBS Core competence in running a global store network | No | No | No | Yes | No | No |

| TBS Core competence in maintaining high-quality ingredients | No | No | Yes | Yes | No | No |

| TBS Core competence in supply chain management | No | No | Yes | Yes | No | No |

| Core competences of Natura Cosméticos S.A. (Natura) and The Body Shop (TBS) | (A) | (R) | (C) | (T) | (I) | (C) |

|---|---|---|---|---|---|---|

| Natura Core competence in the research of users’ needs and behaviors | Yes | Yes | Yes | Yes | Yes | Yes |

| Natura Core competence in high-quality ingredients | Yes | Yes | Yes | Yes | Yes | Yes |

| Natura core competence in brand management | Yes | Yes | Yes | Yes | Yes | Yes |

| Natura core competence in e-commerce | Yes | Yes | Yes | Yes | Yes | Yes |

| Natura Core competence in delivering natural cosmetics and an ethical approach to producing cosmetics | Yes | Yes | Yes | Yes | Yes | Yes |

| TBS Core competence in brand management | Yes | Yes | Yes | Yes | Yes | Yes |

| TBS Core competence in running a global store network | Yes | Yes | Yes | Yes | Yes | Yes |

| TBS Core competence in maintaining high-quality ingredients | Yes | Yes | Yes | Yes | Yes | Yes |

| TBS Core competence in supply chain management | Yes | Yes | Yes | Yes | Yes | Yes |

| Option Variables | Sources | Data |

|---|---|---|

| The price of the underlying asset at time t S(t) | The number of shares outstanding for Natura Cosméticos before the acquisition in 03.09.2017 was 860,743,000 with a price per share of 15.8 BRL (YahooFinance 2019) or $5.09 (BRL/US$ = 0.3222 at 04.09.2017) | Thus, the market capitalization of Natura Cosméticos was $4,280,020,834 or $4.3 bn. The market capitalization of The Body Shop, as a private company, was defined as being worth $1.1 bn, the price that Natura Cosméticos paid to L’Oréal. S(t) is $5.4 bn |

| The exercise price (K) | Natura + Aesop EBITDA, and EV/EBITDA multiple and The Body Shop EBITDA, and the EV/EBITDA (Natura, Aesop, The Body Shop 2017, pp. 10, 20) | The hypothetical future market value of Natura equals $5.01 bn. The hypothetical future market value of The Body Shop equals $1.1 bn. Thus, the strike price (K) was $6.11 bn |

| For the risk-free rate (Rf), the domestic three-month rate of the acquirer’s country on the announcement day. | The annualized risk-free interest rate is Brazilian T-bonds rate taken from (WorldGovernmentBond 2019) | For Natura & Co. group, the domestic three-month rate of the acquirer’s country on the announcement day was 6.67% |

| Time in years (t) | Duration (t) getting synergy of the merger or acquisition (Natura, Aesop, The Body Shop 2017, p. 21) | According to Natura and Co group data, the merger was expected to be accretive to EBITDA of The Body Shop in the two years after completion |

| The standard deviation (σ) is the annualized standard deviation of weekly returns after the merger. | Natura & Co., group’s historical volatilities of the merged company within the first week after the merger (V-Lab, 2019) | Thus, expected volatility (σ) equals σ = 36% |

| Option Variables | Data | Option Variables | Data |

|---|---|---|---|

| T = | 2.0000 | d1 = | 0.2736 |

| S0/T = | 0.8838 | N(d1) = | 0.6078 |

| ln(S0/K) = | −0.1235 | d2 = | −0.2356 |

| variance/2 = | 0.0648 | N(d2) = | 0.4069 |

| [risk-free rate + variance/2] *T = | 0.2628 | −rT = | −0.1332 |

| square root of variance = | 0.3600 | e−rT = | 0.8753 |

| square root of T = | 1.4142 | S0*N(d1) = | US $3.28 |

| (square root of variance) *(square root of T) = | 0.5091 | K*e−rT*N(d2) = | US $2.18 |

| Real option value: the value of reciprocal synergies, C = | US$1.11 bn |

| Stepping Time: δt 0 | δt 1 | δt 2 | δt 3 | δt 4 | δt 5 |

|---|---|---|---|---|---|

| $16.86 | |||||

| $13.43 | |||||

| $10.69 | $10.69 | ||||

| $8.51 | $8.51 | ||||

| Underline value: | $6.78 | $6.78 | $6.78 | ||

| $5.40 | $5.40 | $5.40 | |||

| $4.30 | $4.30 | $4.30 | |||

| $3.42 | $3.42 | ||||

| $2.73 | $2.73 | ||||

| $2.17 | |||||

| $1.73 |

| Parameters That Affect the American Real Option’s Value | |

|---|---|

| Stepping time: δt (year) | 0.40 |

| Up factor: (u) | 1.256 |

| Down factor: (d) | 0.796 |

| Neutral risk probability: (p) | 0.502 |

| Stepping Time: δt 0 | δt 1 | δt 2 | δt 3 | δt 4 | δt 5 |

|---|---|---|---|---|---|

| $10.75 | |||||

| $7.48 | |||||

| $4.90 | $4.58 | ||||

| Real option’s value (value of synergies): | $3.08 | $2.57 | |||

| $1.88 | $1.41 | $0.67 | |||

| $1.12 | $0.77 | $0.33 | |||

| $0.41 | $0.16 | $0.00 | |||

| $0.08 | $0.00 | ||||

| $0.00 | $0.00 | ||||

| $0.00 | |||||

| $0.00 |

| Core competences of Natura Cosméticos S.A. (Natura), The Body Shop (TBS), and Avon Products Inc. (Avon) | (A) | (R) | (C) | (T) | (I) | (C) |

|---|---|---|---|---|---|---|

| Natura’s Core competence in the research of users’ needs and behaviors | Yes | Yes | Yes | Yes | Yes | Yes |

| Natura’s Core competence in high-quality ingredients | Yes | Yes | Yes | Yes | Yes | Yes |

| Natura’s Core competence in brand management | Yes | Yes | Yes | Yes | Yes | Yes |

| Natura’s Core competence in e-commerce | Yes | Yes | Yes | Yes | Yes | Yes |

| Natura’s Core competence in delivering natural cosmetics and an ethical approach to producing cosmetics | Yes | Yes | Yes | Yes | Yes | Yes |

| Avon’s Core competence in maintaining a global presence | Yes | Yes | Yes | Yes | Yes | Yes |

| Avon’s Core competence in maintaining an iconic brand | Yes | Yes | Yes | Yes | Yes | Yes |

| Avon’s Core competence in running strong direct marketing programs | No | No | Yes | Yes | No | No |

| Avon’s Core competence in developing personalized direct selling experiences | No | No | Yes | Yes | No | No |

| Avon’s Core competence in having a vast products mix | Yes | Yes | Yes | Yes | Yes | Yes |

| Option Variables | Sources | Data |

|---|---|---|

| The price of the underlying asset at time S(t) | Avon closed on Wednesday (22 May 2019) with a US$ 1.6 billion or R$ 6.4 billion market value. Natura was valued at US$ 6.7 billion or R$ 26.7 billion (Moura and Oliveira 2019); BRL/US$ = 0.2475 on 22 May 2019. | The price of the underlying asset at time S(t) equals US$ 8.3 bn. |

| The exercise price (K) is the hypothetical future market value without the studied merger. | Using EBIDTA multiples of Natura and Avon (CISION 2019), the hypothetical future market forecast before the merger (E) was defined. | Thus, the exercise price (E) equals US$11.0 bn. This is the combined hypothetical future market value of the target and an acquirer after one year without the merger. |

| The standard deviation (σ) is the annualized standard deviation of weekly returns after the merger. | Natura & Co group’s historical volatilities of the merged company within the first week after the merger (NYU Stern 2019). | The volatility announcement within 22–29 May 2019 period was 55%. |

| Time in years (t) | Duration (t) getting the synergy of the merger or acquisition (Natura, Aesop, The Body Shop 2019, p. 14). | According to the group data, Natura’s expected time for significant synergy capture is 36 months, thus time (T) equals 3 years. |

| For the risk-free rate (Rf), the domestic three-month rate of the acquirer’s country at announcement day. | The annualized risk-free interest rate is the Brazilian T-bonds rate (WorldGovernmentBond 2019). | The Brazilian T-bonds rate was 6.575% at the date of the announcement in May 2019, thus risk-free rate (Rf) = 6.575%. |

| Option Variables | Data | Option Variables | Data |

|---|---|---|---|

| T = | 3.0000 | d1 = | 0.3879 |

| S0/T = | 0.7545 | N(d1) = | 0.6509 |

| ln(S0/K) = | −0.2816 | d2 = | −0.5647 |

| variance/2 = | 0.1513 | N(d2) = | 0.2861 |

| [risk-free rate + variance/2]*T = | 0.6512 | −rT = | −0.1974 |

| square root of variance = | 0.5500 | e−rT = | 0.8209 |

| square root of T = | 1.7321 | S0*N(d1) = | US $5.40 |

| (square root of variance)*(square root of T) = | 0.9526 | K*e−rT*N(d2) = | US $2.58 |

| Real option value: the value of reciprocal synergies, C = | US$ 2.82 |

| Stepping Time: δt 0 | δt 1 | δt 2 | δt 3 | δt 4 | δt 5 |

|---|---|---|---|---|---|

| $69.85 | |||||

| $45.62 | |||||

| $29.79 | $29.79 | ||||

| $19.46 | $19.46 | ||||

| Underline value: | $12.71 | $12.71 | $12.71 | ||

| $8.30 | $8.30 | $8.30 | |||

| $5.42 | $5.42 | $5.42 | |||

| $3.54 | $3.54 | ||||

| $2.31 | $2.31 | ||||

| $1.51 | |||||

| $0.99 |

| Parameters That Affect the American Real Option’s Value | |

|---|---|

| Stepping time: δt (year) | 0.60 |

| Up factor: (u) | 1.531 |

| Down factor: (d) | 0.653 |

| Neutral risk probability: (p) | 0.441 |

| Stepping Time: δt 0 | δt 1 | δt 2 | δt 3 | δt 4 | δt 5 |

|---|---|---|---|---|---|

| $58.85 | |||||

| 35.05 $ | |||||

| $19.63 | $18.79 | ||||

| $10.55 | $8.88 | ||||

| Real option’s value (synergies): | $5.51 | $4.15 | $1.71 | ||

| $2.81 | $1.93 | $0.72 | |||

| $0.89 | $0.31 | $0.00 | |||

| $0.13 | $0.00 | ||||

| $0.00 | $0.00 | ||||

| $0.00 | |||||

| $0.00 |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Čirjevskis, A. Valuing Reciprocal Synergies in Merger and Acquisition Deals Using the Real Option Analysis. Adm. Sci. 2020, 10, 27. https://doi.org/10.3390/admsci10020027

Čirjevskis A. Valuing Reciprocal Synergies in Merger and Acquisition Deals Using the Real Option Analysis. Administrative Sciences. 2020; 10(2):27. https://doi.org/10.3390/admsci10020027

Chicago/Turabian StyleČirjevskis, Andrejs. 2020. "Valuing Reciprocal Synergies in Merger and Acquisition Deals Using the Real Option Analysis" Administrative Sciences 10, no. 2: 27. https://doi.org/10.3390/admsci10020027

APA StyleČirjevskis, A. (2020). Valuing Reciprocal Synergies in Merger and Acquisition Deals Using the Real Option Analysis. Administrative Sciences, 10(2), 27. https://doi.org/10.3390/admsci10020027