Abstract

While previous studies have focused on the form of payment methods as a criterion, this study proposes payment delay as a new criterion and examines the relationship between consumers’ need for closure (NFC) and temporal construal in payment situations. Three empirical studies were conducted with participants who had experience with plastic card payments to ensure they understood the concept of payment delay. Participants with a low NFC tended to construe payment situations more abstractly, leading to increased purchase intentions for hedonic products when payment was delayed and for utilitarian products when it was not. In contrast, participants with a high NFC exhibited higher purchase intentions for hedonic products when payment was delayed but no significant difference for utilitarian products based on payment delay. The findings provide implications for strategies to mitigate excessive hedonic consumption through credit card payments and address reluctance toward credit card use stemming from consumers’ aversion to debt or uncertainty.

1. Introduction

As technology advances, various online and mobile payment methods, such as digital wallets (e.g., Apple Pay, Samsung Pay, Google Wallet), one-click payments, and peer-to-peer payment apps (e.g., PayPal, Venmo), are becoming increasingly common. Mobile payment refers to payment made via mobile devices like smartphones, smartwatches, or tablets utilizing wireless communication technologies (Dahlberg et al. 2008; Choi et al. 2020). Due to the widespread use of personal mobile devices, mobile payment enables consumers to engage in electronic transactions quickly, efficiently, and conveniently, anytime and anywhere (Kim et al. 2010), and is recognized as a primary payment method for consumers (Choi et al. 2020).

In the research stream, constructs such as perceived usefulness, perceived ease of use, compatibility, and innovativeness have been examined to better understand behavioral intentions to adopt new payment methods (e.g., Kim et al. 2010; Verkijika 2018). Nevertheless, the fundamental characteristics of consumer payment method options have not changed significantly from the past in terms of whether the money is immediately deducted (e.g., cash, debit cards) or deducted later (e.g., credit cards). According to studies on the physical properties of the payment method, the “pain of paying” is greater when paying with cash because the cash outflow is transparent compared to plastic cards (Prelec and Loewenstein 1998). For this reason, many studies have revealed the “credit card premium”, in which people spend more when paying with a credit card (Feinberg 1986).

This study focuses on the feature of whether or to what extent there is a delay in payment rather than the physical form of the payment method. For example, debit cards fall into the same category as credit cards in terms of being plastic cards with low transparency. However, in terms of the timing of payment completion, debit and credit cards can be classified as different types, as payment with debit cards is completed immediately, while payment with credit cards is delayed.

Whether and to what extent payment is delayed will likely affect the consumer’s purchasing behavior. As this study focuses on the temporal perspective of payment methods, individual differences in the degree of sensitivity to delay in payment completion are examined. For example, individuals with a strong aversion to debt (Prelec and Loewenstein 1998; Wilcox et al. 2011) or a strong desire for quick closure are more likely to be concerned about payment delays and do not prefer payment by credit card, which defers payment completion into the future. This study suggests that the need for closure (NFC) explains these individual differences.

In the following sections, the theoretical background regarding the key concepts and theories of this study and the rationale for the hypotheses are presented. Following this, three empirical studies are conducted. The purpose of Study 1 is to identify whether the construal level theory, the main theory of this research, applies to payment situations and whether its effects are observed. Specifically, it examines whether consumers’ construal levels vary depending on the payment delay. Second, if the construal level varies with payment delay, consumers’ purchase intentions may differ depending on the product type. Study 2 investigates whether the relationship between payment delay and purchase intention is moderated by product type and individuals’ NFC levels. Third, the purpose of Study 3 is to enhance the generalizability of Study 2’s findings. While the degree of payment delay is assigned to participants as an experimental condition in Study 2, in Study 3, participants are allowed to choose the length of their payment delay. Additionally, a different product category is used as the stimulus to verify whether the same effects are observed. Finally, the results of the research are summarized, and both theoretical and practical implications are discussed. The limitations and suggestions for future research are also presented.

2. Theoretical Background and Hypotheses

2.1. Payment Delay

With the advent of plastic card-type payment methods, consumers’ customary cash payments have decreased, and cards have become common, replacing cash as the primary payment method (Thomas et al. 2011; Hoelzl et al. 2011). Recently, FinTech technology has appeared, and both cash and card payments are possible through various web and mobile mechanisms, leading to another big change in consumer payment behavior (e.g., Seldal and Nyhus 2022).

Existing studies have classified payment methods into cash and plastic cards based on the physical characteristics of the payment method itself, that is, “the form of payment” (Prelec and Loewenstein 1998; Raghubir and Srivastava 2008; Thomas et al. 2011). According to this view, the difference between cash and plastic cards is transparency, meaning the vividness of consumers’ experiences of money outflow (Bagchi and Block 2011; Raghubir and Srivastava 2008). When paying in cash, it is easy to see money expended, and it is relatively easy to remember the amount through the counting process, so payment is highly emphasized in terms of physical form and amount (Soman 2003).

In contrast, when paying with a card, both the physical payment behavior and the salience of the amount are weakened because it is only necessary to confirm and sign the payment amount. The higher the transparency of the payment method, the greater the pain of payment. Therefore, it can be seen that cash payments, where money outflow is obvious, are more painful than card payments (Bagchi and Block 2011; Raghubir and Srivastava 2008). Based on this logic, previous studies have identified a phenomenon called the “credit card premium”, in which, all things being equal, people spend more and faster when paying with a credit card than with cash (Feinberg 1986; Hirschman 1979; McCall and Belmont 1996; Prelec and Simester 2001; Soman 2001; Raghubir and Srivastava 2008).

An individual’s perception and behavior in a payment situation are influenced not only by the physical characteristics of the payment method but also by the time when the payment is actually made. Cash payments result in an immediate depletion of the consumer’s wealth. When paying by debit card, there is a minor delay until depletion occurs, but it is relatively immediate (Soman 2001). However, there is a large temporal delay when paying by credit card. Although the transparency level of these two card payment methods is equally low, debit card payments withdraw money from the consumer’s bank account at the time of payment, whereas credit card payments involve a delay between payment and actual depletion (Soman 2003).

2.2. Construal Level Theory: Temporal Perspective in Payment Situation

Construal level theory (CLT) explains the effect of psychological distance on an individual’s thoughts and actions and provides a framework linking distance and the construal level (Trope et al. 2007). Psychological distance consists of four dimensions: temporal, spatial, social, and hypothetical distances (Trope and Liberman 2003, 2010). Psychological distance is an individual’s subjective experience of how close or distant one is from him- or herself, here and now, in time and space, socially and probabilistically. When an object or event is psychologically close, a low-level construal is made, which is concrete and complex. Individuals tend to think inconsistently depending on the context and think in secondary and superficial terms (Trope and Liberman 2003; Trope et al. 2007). However, psychologically distant cases lead to higher-level construal, which is abstract and simple. Individuals tend to think consistently and noncontextually and think in primary and central terms (Trope and Liberman 2003; Trope et al. 2007).

According to TCT, which deals with temporal distance, distant future situations are construed at a higher level using abstract schema, whereas near future situations are construed at a lower level using concrete features (Chandran and Menon 2004; Liberman and Trope 1998; Trope and Liberman 2000; Trope et al. 2007). How does temporal distance affect the attractiveness of alternatives or individual preferences? Temporal delay heightens higher-level values and diminishes lower-level values (Trope and Liberman 2003). If the low-level value of an option is more positive, the option is more attractive in the near future, whereas if the high-level value of the option is more positive, the option is more attractive in the distant future (Trope and Liberman 2003). In other words, preferences for the near future are determined based on low-level factors such as concrete features of an object or event. In contrast, preferences for the distant future are determined based on high-level factors such as abstract features (Fujita et al. 2006; Trope and Liberman 2000, 2003).

Prior studies have explained the role of feasibility and desirability in choosing between near future options and distant future options by applying TCT. In goal-directed behavior, desirability is the value of the end-state of the behavior, i.e., why one behaves in a particular way, and feasibility is the process or means leading to the end state, i.e., how the behavior is implemented (Liberman and Trope 1998; Trope et al. 2007). Liberman and Trope (1998) found that undergraduate students who participated in an experiment placed more weight on how interesting the assignment was, i.e., desirability, when choosing a distant future assignment. They placed more weight on the difficulty of performing the assignment, i.e., feasibility, when choosing a near future assignment. Accordingly, desirability is more important than feasibility in a decision about the distant future than about the near future.

2.3. NFC (Need for Closure)

Whether an individual seeks immediate closure may also influence consumer behavior in payment situations. Some may avoid long-term repayment contracts and prefer short-term contracts (Prelec and Loewenstein 1998), and this tendency can be further strengthened when purchasing certain products. NFC can be defined as the “desire for a firm answer to a question and an aversion toward ambiguity” (Kruglanski and Webster 1996, p. 264). Since NFC is akin to a person’s goal, for people with a high NFC, negative emotions are induced when closure is threatened, and positive emotions are induced when closure is promoted and attained (Kruglanski and Webster 1996). Literature on consumer NFC indicates that NFC influences various consumer behaviors, such as search effort (Vermeir and Van Kenhove 2005), product evaluation (Zhang et al. 2002), and purchase intention (Kardes et al. 2002).

NFC may be temporarily increased by situational factors such as noise and time pressure, but in general, the construct refers to individual trait differences in motivation to reach a firm answer and a conclusion quickly (Kruglanski and Webster 1991; Kim 2013). Webster and Kruglanski (1994) developed a 42-item NFC scale with five dimensions, arguing that individuals with a high NFC prefer order and structure over chaos, as it facilitates quick decision-making. These individuals seek firm, reliable knowledge for consistent predictions, feel uneasy with ambiguity, prefer quick conclusions, and avoid challenges to their beliefs that might hinder cognitive closure (Brizi and Biraglia 2021; Kruglanski and Webster 1996; Roets et al. 2015). In decision-making, consumers low in NFC are comfortable with ambiguity and uncertainty; they embrace unpredictability and unresolved situations (Kim 2013). In contrast, consumers high in NFC prefer predictability and quick conclusion, since they have a strong need to avoid ambiguity and uncertainty (Kim 2013). Thus, they are expected to prefer immediate payment, as they are concerned about the payment until it is completed.

Therefore, it is expected that the effects of the construal level theory in payment situations will vary depending on consumers’ perceived temporal distance from payment delay and their NFC levels. When the payment is completed immediately, the payment situation is construed on a low-level with a concrete perspective because the temporal distance to payment is closer psychologically. In contrast, when payment is delayed and completed in the future, the payment situation is construed on a high level with an abstract perspective because the temporal distance to the payment is more distant psychologically. Therefore, people are expected to construe the situation more abstractly when payment is delayed compared to when payment is not delayed, with a more distant temporal perspective.

However, consumers with high NFC are expected to avoid delays in payment because they perceive uncompleted payments as an unresolved situation that remains to be paid. They do not view payment delays as merely a matter for the distant future, and they remain concerned about payments until they are completed. Therefore, their decision-making is more influenced by the ongoing status of the payment and the resulting psychological burden rather than by considerations of desirability and feasibility based on temporal distance. Therefore, consumers with a high NFC are expected to not construe the situation differently depending on payment delay, unlike consumers with low NFC.

In the following three studies of the present research, the case in which payment is not delayed is operationally defined as a debit card payment. When paying with a debit card, the amount is withdrawn from an individual’s bank account balance at the same time as the purchase, and the payment is completed immediately. In the case of payment delay, to reflect consumers’ actual credit card use, the conditions are divided into a near future (1-month delay) and a distant future (3-month delay) condition according to the temporal distance. The case in which payment is delayed by one month is operationally defined as a credit card lump sum payment, and the case in which payment is delayed by three months is operationally defined as a credit card 3-month interest-free installment payment. Therefore, the following hypotheses are suggested and examined by comparing the no-delay condition with the one-month delay condition, as well as the no-delay condition with the three-month delay condition.

H1.

Consumers with a low NFC construe the payment situation more abstractly when payment is delayed than when it is not delayed.

H2.

Consumers with a high NFC do not differ in their construal level of abstractness of the payment situation, regardless of whether payment is delayed or not.

2.4. Temporal Construal Theory: The Role of Desirability and Feasibility

As the temporal distance increases, desirability has a more significant influence on choice, emphasizing the higher-level abstract purpose of increasing hedonic pleasure in individuals’ lives. In contrast, feasibility focuses on the lower-level concrete purposes of preserving means such as money, time, and necessities (Kivetz and Simonson 2002b).

When the choice options and outcomes are relatively abstract, it is easier to make a hedonic choice because the psychological cost or pain of choosing an indulgence over an easily justifiable option is lower (Kivetz and Simonson 2002b). Kivetz and Keinan (2006) argued that excessive self-control or a farsighted attitude could have negative long-term consequences. According to them, regret about choosing virtue over vice increases over time because, as the perspective moves to the distant future, a consumer is freed from the indulgence guilt caused by choosing a hedonic good and experiences regret for having missed out on the pleasure of life by choosing a utilitarian good. Kivetz and Simonson (2002b) empirically revealed that when participants chose to receive a reward in the distant future, they preferred hedonic luxury goods over cash, which is a utilitarian necessity. That is, when the outcome of an action or decision is distant in time and more abstract, people tend to choose hedonic over utilitarian goods.

Accordingly, when the payment is completed immediately without delay, the payment situation will be construed on a more concrete, lower level because consumers perceive the temporal distance to the payment to be psychologically closer. Thus, as feasibility is considered important, products with utilitarian value will be preferred. In contrast, when the payment is completed in a distant future or delayed, the payment situation will be construed on a more abstract, higher level because consumers perceive the temporal distance to the payment psychologically as being more distant. Thus, as desirability is considered important, products with hedonic value will be preferred.

An important characteristic of hedonic consumption is that a pleasurable experience is expected (Nowlis et al. 2004; Loewenstein 1987). The more distant temporal perspective allows consumers to make hedonic choices because the consequences are abstract, and a wistful feeling of missing out on the pleasures of life is accentuated (Kivetz and Keinan 2006). Specifically, as the temporal distance is more distant and the consumer construal level is abstract, desirability is emphasized, hedonic value becomes more important, and, thus, the consumer is more likely to choose a hedonic option. As the temporal distance becomes nearer and the consumer construal level becomes more concrete, feasibility is emphasized, utilitarian value becomes more important, and, thus, they are more likely to choose a utilitarian option.

Therefore, consumers with a low NFC will have different purchase intentions depending on product types because their construal level of the payment situation differs depending on whether payment is delayed or not, and accordingly, their perception of the importance of desirability and feasibility will differ. When payment is delayed such as credit card payments, they feel the temporal distance is more distant and construe the purchase situation more abstractly. Therefore, as desirability is important, they are more likely to purchase products emphasizing hedonic value. In contrast, when payment is completed immediately, they feel the temporal distance is nearer, construing the situation more concretely. Thus, as feasibility is important, consumers with a low NFC are more likely to purchase products emphasizing utilitarian value.

On the other hand, hedonic consumption is inherently disadvantaged compared to utilitarian consumption because purchasing a hedonic product is based on a desire or wants, whereas purchasing a utilitarian product is based on a reason or need (Kivetz and Simonson 2002b; Patrick and Park 2006). Therefore, hedonic consumption induces both positive (e.g., pleasure, feel good, happy) and negative emotions (e.g., guilt, regret, embarrassment), resulting in emotional ambivalence (Rook 1987; Kivetz and Simonson 2002b; Ramanathan and Williams 2007).

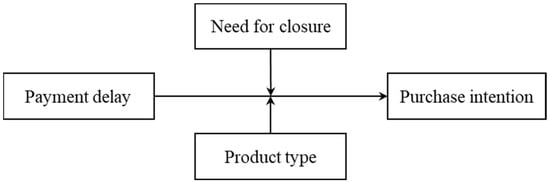

Since consumers with a high NFC are more likely to perceive the payment delay as an unresolved situation with debt to pay back rather than as simply an event in the distant future with abstract construal, their purchase intention is more affected by concerns about uncompleted payments. The idea of uncompleted payment is likely to diminish the pleasure of consumption felt by consumers with high NFC. The tendency to complete payments quickly to enhance the enjoyment of consumption may be greater in intrinsically pleasurable consumption, that is, hedonic purchases. Therefore, if a consumer with a high NFC purchases a hedonic product using a delayed payment method, these negative emotions may persist until the payment is completed. Delayed negative emotions such as guilt or regret will undermine the pleasure of consumption. Therefore, they would like to complete the payment for a hedonic product purchase immediately if possible. In contrast, when purchasing a utilitarian product, payment delay does not affect their purchase intention because buying such product is based on justifiable reasons and needs. Thus, the following hypotheses are suggested, and Figure 1 illustrates the research model.

Figure 1.

Research model.

H3a.

Consumers with a low NFC are more likely to purchase hedonic products when payment is delayed than when payment is not delayed.

H3b.

Consumers with a low NFC are more likely to purchase utilitarian products when payment is not delayed than when payment is delayed.

H4a.

Consumers with a high NFC are more likely to purchase hedonic products when payment is not delayed than when payment is delayed.

H4b.

Consumers with a high NFC do not differ in their intention to purchase utilitarian products depending on whether payment is delayed or not.

3. Study 1

This study hypothesized that consumers with a low NFC would engage in high-level construal when faced with payment delays compared to when there is no delay. In contrast, consumers with a high NFC would show no difference in construal level regardless of when payment is made. Construal level is measured as the degree of perceived abstractness of the situation. Most previous studies have applied psychological distance to the time of consumption, while this study applies it to the time of payment, arguing that the TCT effect is attributed to the time of payment rather than the time of consumption. Therefore, it is necessary to confirm that there is no difference in the perception of the time of consumption between the payment delay conditions.

3.1. Method

3.1.1. Pretest

To select the product category for the experiment, 18 participants (10 females, Mage = 22.91) were asked to freely list recently purchased items, categorizing them as either utilitarian or hedonic. The pretest procedures were adapted from Thomas et al. (2011) and adjusted for this study. The results showed that participants identified sneakers as a product that could belong to both utilitarian and hedonic categories; thus, sneakers were selected as the experimental product.

3.1.2. Procedure

A total of 166 participants (78 females, Mage = 23.05, age range: 19–28) were recruited from among undergraduate and graduate students enrolled in business courses at a university. Participants were required to be knowledgeable about both credit card and debit card use and to have experience using at least one of them. They were randomly assigned to one of three payment delay conditions: no delay (i.e., debit card; n = 56), 1-month delay (i.e., credit card lump sum; n = 54), and 3-month delay (i.e., credit card 3-month installments; n = 56), and then read the scenario for purchasing sneakers. The following procedures were adapted from Chatterjee and Rose (2012) and Thomas et al. (2011) and modified for this study.

Payment delay conditions were manipulated through payment methods and descriptions in the purchase situation scenario. Scenarios for each condition were presented as follows: In the no-delay condition, paying with a debit card completes the payment immediately, as the amount is withdrawn from your bank account at the time of purchase. In the 1-month delay condition, paying with a credit card in a lump sum delays the payment by about 1 month after the purchase. In the 3-month delay condition, paying with a credit card in a 3-month interest-free installment plan starts payments approximately 1 month after purchase and completes the total payment over 3 months.

They were then asked to answer three items measuring the level of construal (i.e., perceived abstractness) (Cronbach’s α = 0.79; Chandran and Menon 2004; Liberman and Trope 1998): “I have a picture in my head when I imagine the payment situation in the scenario” (1 = totally disagree, 7 = totally agree; reversed coding); “When I think about the payment situation in the scenario, it is vague” (1 = totally disagree, 7 = totally agree); and “The payment situation in the scenario is (1 = concrete, 7 = abstract)”.

For the manipulation check of the payment delay, participants responded to the following three items to measure their perceived temporal distance for each condition (Cronbach’s α = 0.88; Chandran and Menon 2004): “When do you think the payment will be completed?” (1 = now, 7 = later; 1 = near future, 7 = distant future) and “How much time do you think is left until the payment is completed?” (1 = not much time left, 7 = a lot of time left).

To assess whether there were differences in participants’ perceived timing of consumption across the payment delay conditions, we measured when they thought they would consume the purchased product in the given scenario with the following two items (Cronbach’s α = 0.93): “When do you think you will consume the product you purchased in the given scenario?” (1 = now, 7 = later; 1 = near future, 7 = distant future).

Participants were asked to respond on a 7-point scale to determine whether the sneakers used as experimental products leaned toward utilitarian or hedonic products, assessing whether they primarily consume sneakers for utilitarian or hedonic purposes (1 = utilitarian purpose, 7 = hedonic purpose).

Next, participants answered the 20-item NFC scale, a reduced version of the measurement of Webster and Kruglanski (1994) (e.g., “I enjoy being in uncertainty about what might happen” and “I tend to put off important decisions until the last minute”; 1 = not at all, 7 = very much), which includes four items in each of the five dimensions comprising the NFC (Houghton and Grewal 2000). All items were rated on a 7-point scale (Cronbach’s α = 0.70). Finally, participants answered questions about their monthly average card use frequency, monthly average card payment amount, and monthly average disposable income.

3.2. Results

3.2.1. Manipulation Checks

A t-test was conducted to examine the manipulation of payment delay, and, as expected, participants perceived the temporal distance as being more distant in the 1-month delay condition than the no-delay condition (Mno-delay = 1.40, M1-month delay = 3.33; t = −8.14, p = 0.00), in the 3-month delay than the no-delay condition (Mno-delay = 1.40, M3-month delay = 4.23; t = −12.58, p = 0.00), and in the 3-month delay condition than the 1-month delay condition (M1-month delay = 3.33, M3-month delay = 4.23; t = −3.25, p = 0.00).

As expected, there was no difference in the perceived time of consumption depending on the payment delay conditions (Mno-delay = 2.25, M1-month delay = 2.13; t = 0.47, p = 0.64; Mno-delay = 2.25, M3-month delay = 2.09; t = 0.55, p = 0.59; M1-month delay = 2.13, M3-month delay = 2.09; t = 0.14, p = 0.89). It was confirmed that the temporal construal effect shown in this study is due to the time of payment, not the time of consumption. Furthermore, it was confirmed that sneakers do not lean toward either utilitarian or hedonic product types (Mutilitarian-hedonic = 3.80, t(165) = −1.53, p = 0.13).

3.2.2. Hypothesis Test

Regression analysis was conducted on the perceived abstractness, using payment delay (−1 = no-delay, 0 = 1-month delay, 1 = 3-month delay), mean-centered NFC, and their interaction as independent variables. Monthly average card usage frequency, card payment amount, and disposable income were included as covariates to control for their effects, none of which was found to be significant.

The results showed that both the main effects of payment delay (β = 0.35, t(162) = 5.04, p = 0.00) and NFC (β = −0.31, t(162) = −4.49, p = 0.00), as well as their interaction effect (β = −0.17, t(162) = −2.46, p = 0.02), were significant (Table 1).

Table 1.

Regression analysis results for perceived abstractness.

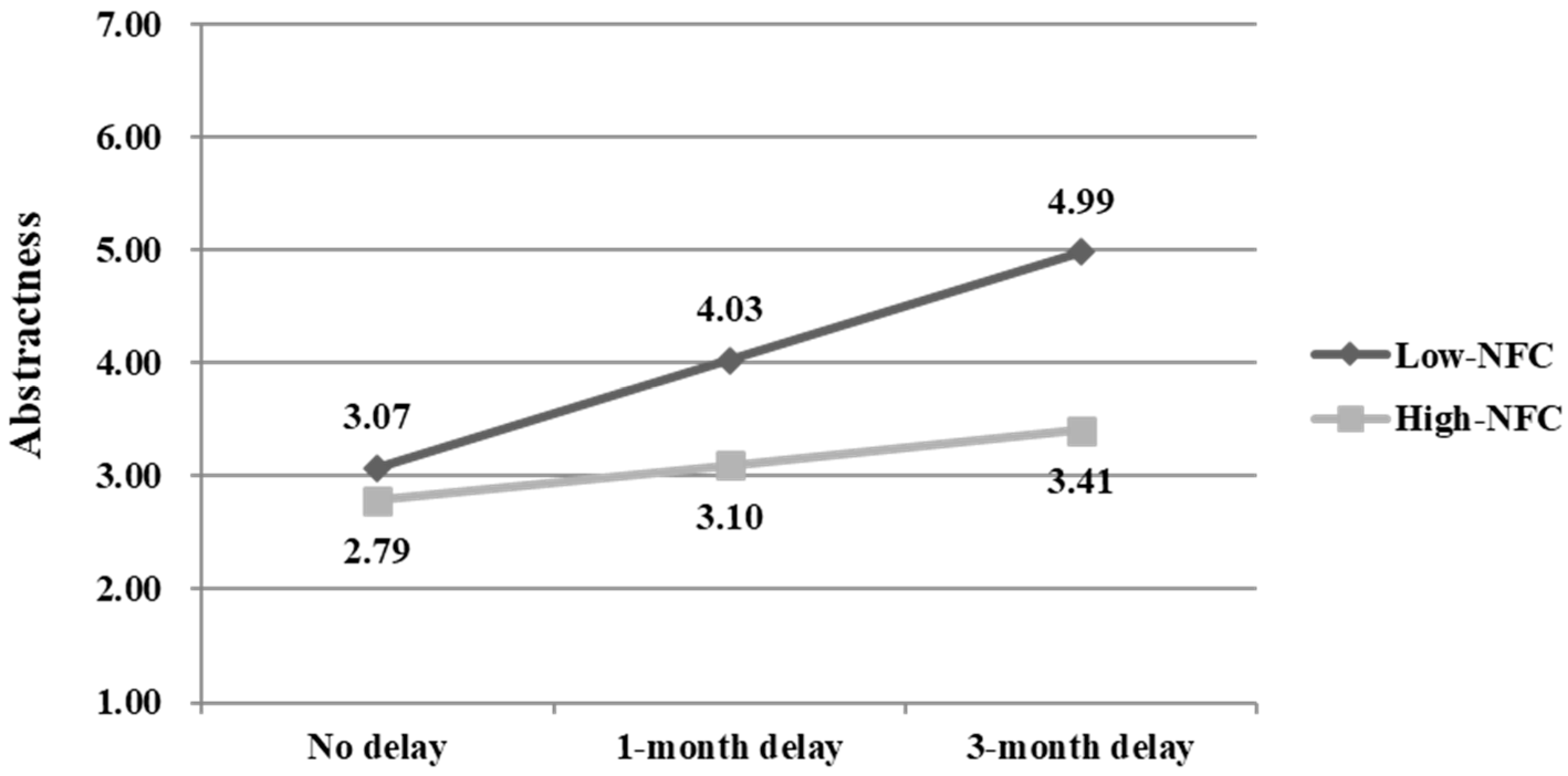

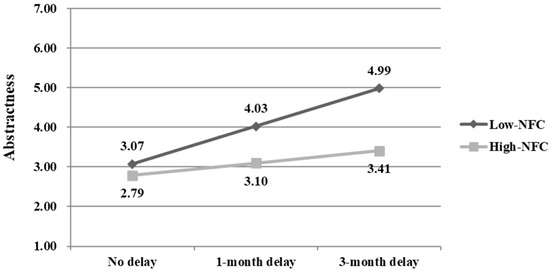

A spotlight analysis (Aiken and West 1991) was conducted at one standard deviation (SD) above and below the mean of the NFC (Figure 2). To examine whether participants with a low NFC perceive greater abstractness when payment is delayed compared to when it is not delayed, comparisons were made between the no-delay and the 1-month delay conditions and between the no-delay and the 3-month delay conditions.

Figure 2.

Perceived abstractness as a function of payment delay and NFC.

The results showed that the perceived abstractness was higher when payment was delayed for 1 month compared to when there was no delay (Mno-delay = 3.07 vs. M1-month delay = 4.03; β = 0.55, t(106) = 4.52, p = 0.00). It was also higher when payment was delayed for 3 months compared to when there was no delay (Mno-delay = 3.07 vs. M3-month delay = 4.99; β = 0.61, t(108) = 5.15, p = 0.00). Participants with a low NFC perceived situations where they made payments with a credit card installment over 3 months as more abstract than situations where they paid with a debit card or made a one-time credit card payment, supporting H1.

To examine whether there were differences in the level of perceived abstractness according to payment delay among participants with a high NFC, we compared the no-delay and 1-month delay conditions and the no-delay and 3-month delay conditions, respectively. The results showed that there was no difference in perceived abstractness when payment was not delayed compared to when it was delayed by one month (Mno-delay = 2.79 vs. M1-month delay = 3.10; β = 0.04, t(106) = 0.31, p = 0.76), whereas there was a marginal difference in perceived abstractness between when payment was not delayed and when it was delayed by 3 months (Mno-delay = 2.79 vs. M3-month delay = 3.41; β = 0.21, t(108) = 1.75, p = 0.08).

In other words, participants with a high NFC perceived no difference in abstractness between debit card payments and credit card lump-sum payments, but they perceived credit card 3-month installment payments as slightly more abstract than debit card payments. Thus, H2 was partially supported.

3.3. Discussion

Participants with a low NFC perceived situations more abstractly when payments were delayed by one month or three months compared to when payments were not delayed. In other words, consumers with a low NFC engage in high-level construal, perceiving a greater temporal distance when payment is delayed than when payment is immediate.

For participants with a high NFC, there was no significant difference in the level of perceived abstractness among the payment delay conditions. However, there was a marginal but significant difference in the level of perceived abstractness between the no-delay condition and the 3-month delay condition.

Study 1 revealed that payment delay influences consumers’ perception of temporal distance, demonstrating the effects of construal level theory. The results provide the initial evidence that the perceived abstractness of payment situations varies according to the payment delay conditions and consumer’s level of NFC. The specific implications will be discussed in the final section of this paper.

4. Study 2

Due to varying levels of construal about situations based on payment delay, low-NFC consumers perceive differences in the importance of desirability and feasibility, which may lead to different purchase intentions depending on the product type. Specifically, it is expected that when payment is delayed, the purchase intention for hedonic products will be higher, while when payment is not delayed, purchase intention for utilitarian products will be higher. However, consumers with a high NFC do not abstractly construe situations where payment is delayed; rather, they are more influenced by concerns about uncompleted payments. Particularly, to avoid prolonged negative emotions induced by hedonic purchases, it is expected that purchase intention for hedonic products would be lower when payment is delayed, while purchase intention for utilitarian products would not vary based on payment delay.

4.1. Method

4.1.1. Pretest

A survey was conducted with 29 participants (11 females, Mage = 29.01, age range: 23–41) to select product categories for the experiment aimed at identifying products commonly or frequently purchased in supermarkets. The pretest procedures were adapted from Thomas et al. (2011) and adjusted for this study. To control for the influence of consumption timing, we selected products consumed immediately after purchase and typically consumed entirely in a single consumption occasion. Products were categorized into either utilitarian or hedonic items. The survey results revealed that participants commonly considered water, milk, fruits, instant rice, energy drinks, and instant noodles as utilitarian products, while chocolate, ice cream, beer, snacks, carbonated beverages, and coffee beverages were selected as hedonic products.

4.1.2. Design and Participants

A total of 248 individuals (122 females, Mage = 30.76) participated in the experiment. Participants were recruited using an online panel from a survey company, with the same requirement criteria as those used in Study 1. The age distribution of the participants was as follows: the 10s (1.6%), the 20s (68.4%), the 30s (24.8%), the 40s (2.8%), and the 50s (2.4%). Participants’ occupations included 53.4% students (undergraduate 35.1%, graduate 18.3%) and 46.6% office workers (clerical 27.8%, service 13.2%, managerial 2.4%, technical 2.0%, professionals 1.2%). The experiment was designed as a 3 (payment delay: no delay, 1-month delay, 3-month delay) × 2 (product type: utilitarian, hedonic) mixed design. Payment delay was a between-subject factor, with participants randomly assigned to the no-delay (n = 80), the 1-month delay (n = 88), or the 3-month delay conditions (n = 80), while product type served as a within-subject factor.

4.1.3. Procedure

The following procedures were adapted from Chatterjee and Rose (2012) and Thomas et al. (2011) and modified for this study. Participants were given a questionnaire divided into two parts. First, they read scenarios corresponding to each payment delay condition and then responded to items measuring purchase intention for 12 products (the order of presentation of 6 utilitarian and 6 hedonic products was randomized) using a scale from 1 (will not purchase) to 7 (will purchase). The scenarios described a situation where participants responded to a consumer survey conducted by a new supermarket opening in their neighborhood, asking what products they usually buy. Three payment delay conditions were manipulated as in Study 1.

For the manipulation check of the payment delay, participants responded to the same three items as in Study 1 (Cronbach’s α = 0.87) and items measuring the product types used in the experiment (1 = utilitarian purposes, 7 = hedonic purposes). To assess whether participants’ perceived timing of consumption differed across the payment delay conditions, two items identical to those in Study 1 were measured (Cronbach’s α = 0.82).

In the second part of the questionnaire, similar to Study 1, 20 items were presented to measure NFC levels (Cronbach’s α = 0.70). Finally, the participants responded to questions about their monthly average card use frequency, monthly average card payment amount, and monthly average disposable income.

4.2. Results

4.2.1. Manipulation Checks

As expected, the results of the manipulation check for payment delay revealed that participants perceived greater temporal distance in the 1-month delay condition than in the no-delay condition (Mno-delay = 1.34 vs. M1-month delay = 3.33; t(247) = −14.91, p = 0.00), in the 3-month delay than the no-delay condition (Mno-delay = 1.34 vs. M3-month delay = 4.68; t(247) = −27.27, p = 0.00), and in the 3-month delay than the 1-month delay condition (M1-month delay = 3.33 vs. M3-month delay = 4.68; t(247) = −8.99, p = 0.00).

Products that scored between 3.5 and 4.5 were considered to not clearly belong to either category and were thus excluded from the analysis (Mfruit = 3.56, Menergy drink = 4.36, Mcoffee = 4.49). Utilitarian products included bottled water, milk, instant rice, and instant noodles, while hedonic products included chocolate, ice cream, beer, snacks, and carbonated beverages. A 2 (product type: utilitarian, hedonic) × 3 (payment delay: no delay, 1-month delay, 3-month delay) ANOVA was conducted using participants’ utilitarian–hedonic scores as the dependent variable, confirming the successful manipulation of product types. The results revealed only a significant main effect of product type (Mutilitarian = 2.49 vs. Mhedonic = 5.99; F(1, 490) = 1877.38, p = 0.00), indicating that participants responded that they would consume hedonic products for hedonic purposes more than utilitarian products.

Further, as expected, participants’ perceived timing of consumption did not significantly differ across the payment delay conditions (Mno-delay = 2.09 vs. M1-month delay = 1.86; t(247) = 1.68, p = 0.10; Mno-delay = 2.09 vs. M3-month delay = 1.89; t(247) = 1.25, p = 0.21; M1-month delay = 1.86 vs. M3-month delay = 1.89; t(247) = −0.19, p = 0.85). This confirms that the temporal construal effect observed in this study is attributable to payment timing rather than consumption timing.

4.2.2. Hypothesis Test

Regression analysis was conducted on purchase intention, using payment delay (−1 = no delay, 0 = 1-month delay, 1 = 3-month delay), product types, mean-centered NFC, and their interactions as independent variables. Monthly average card usage frequency, card payment amount, and disposable income were included as covariates to control for their effects, none of which was found to be significant.

The main effects of payment delay (β = −0.13, t(488) = −3.43, p = 0.00) and product type (β = −0.27, t(488) = −7.07, p = 0.00) were both significant. The two-way interactions of payment delay × NFC (β = −0.28, t(488) = −7.03, p = 0.00) and product type × NFC (β = −0.17, t(488) = −2.46, p = 0.00) were significant. Furthermore, the three-way interaction of payment delay × product type × NFC was significant (β = −0.29, t(488) = −7.45, p = 0.00), while other effects were not significant (Table 2).

Table 2.

Regression analysis results for purchase intention.

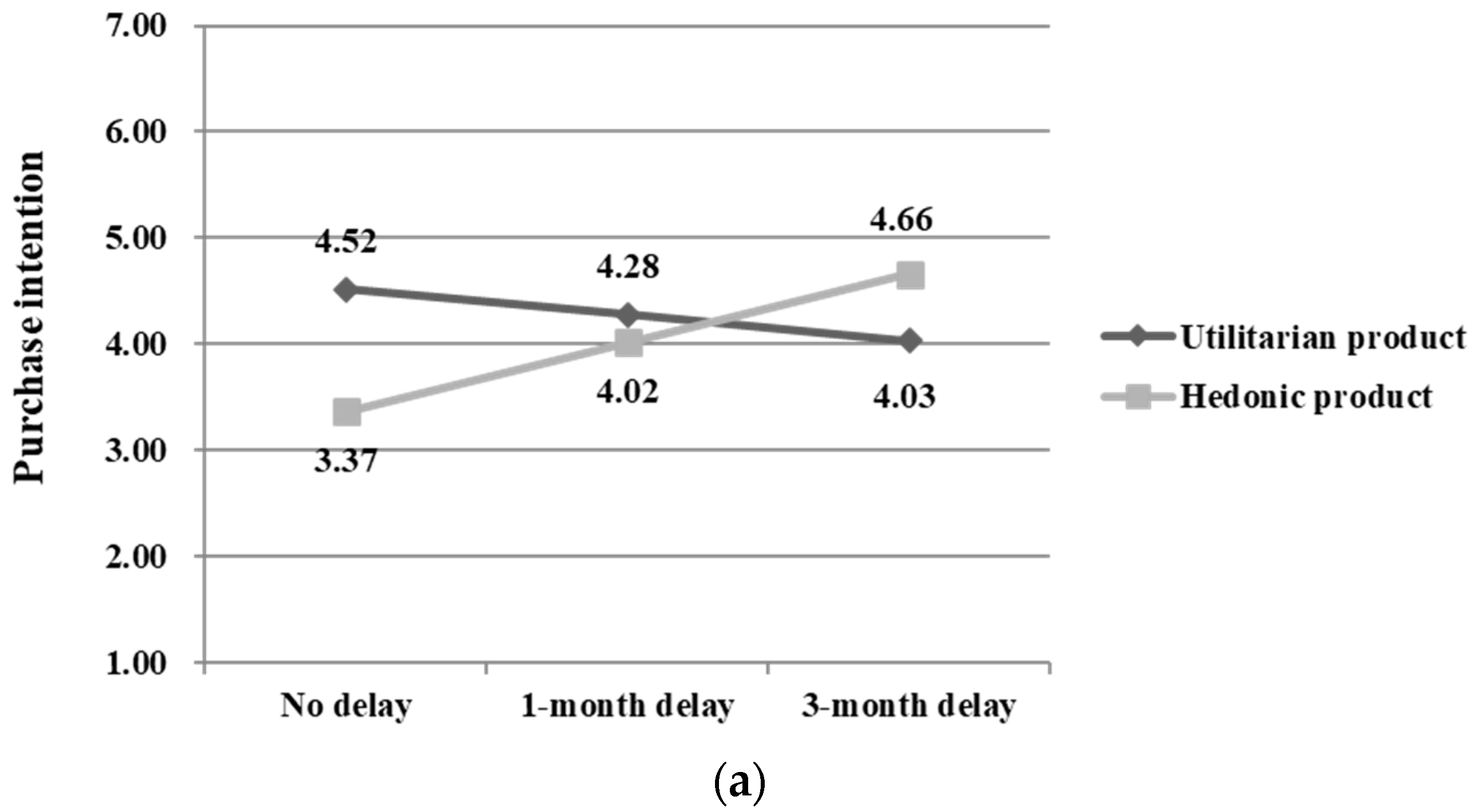

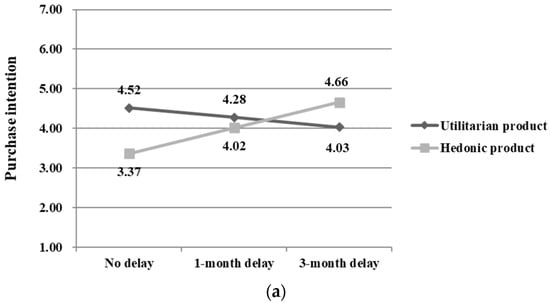

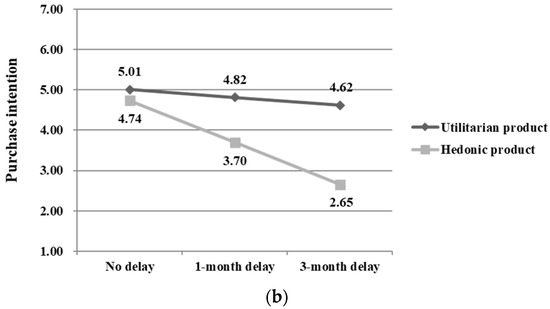

Spotlight analyses were conducted at one SD above and below the mean of the NFC to analyze the interaction effects of H3a, H3b, H4a, and H4b (Figure 3a,b). As expected, for participants with a low NFC, the interaction effect of payment delay × product type was significant (β = 0.28, t(488) = 5.22, p = 0.00), indicating that the influence of payment delay on purchase intentions varied depending on product type. Specifically, to examine whether there were differences in purchase intentions for hedonic products when payment was delayed (vs. not delayed), comparisons were made between the no-delay and both the 1-month delay and the 3-month delay conditions. The results showed no significant difference in purchase intentions between the no-delay and 1-month delay conditions (Mno-delay = 3.37 vs. M1-month delay = 4.02; β = −0.03, t(328) = −0.33, p = 0.74), but purchase intentions were higher when payment was delayed for 3 months than when there was no delay (Mno-delay = 3.37 vs. M3-month delay = 4.66; β = 0.62, t(312) = 6.76, p = 0.00). In other words, participants with a low NFC showed no difference in purchase intention for hedonic products between paying with a debit card and paying with a credit card lump sum. However, they showed higher purchase intention for hedonic products when paying with credit card 3-month installments compared to debit card payments. Therefore, H3a was partially supported.

Figure 3.

(a) Purchase intention of participants with a low NFC. (b) Purchase intention of participants with a high NFC.

For participants with a low NFC, to examine whether there were differences in purchase intentions for utilitarian products when payment was not delayed (vs. delayed), comparisons were made between the no-delay and both the 1-month delay and the 3-month delay conditions. The results showed no significant difference in purchase intention between the no-delay and 1-month delay conditions (Mno-delay = 4.52 vs. M1-month delay = 4.28; β = 0.09, t(328) = 0.93, p = 0.35), but purchase intention was higher when payment was not delayed compared to when it was delayed for 3 months (Mno-delay = 4.52 vs. M3-month delay = 4.03; β = −0.21, t(312) = −2.34, p = 0.02). In other words, participants with a low NFC showed no difference in purchase intention for utilitarian products between paying with a debit card and paying with a credit card lump sum. However, they had higher purchase intentions for utilitarian products when making debit card payments compared to paying with credit card 3-month installments. Thus, H3b was partially supported.

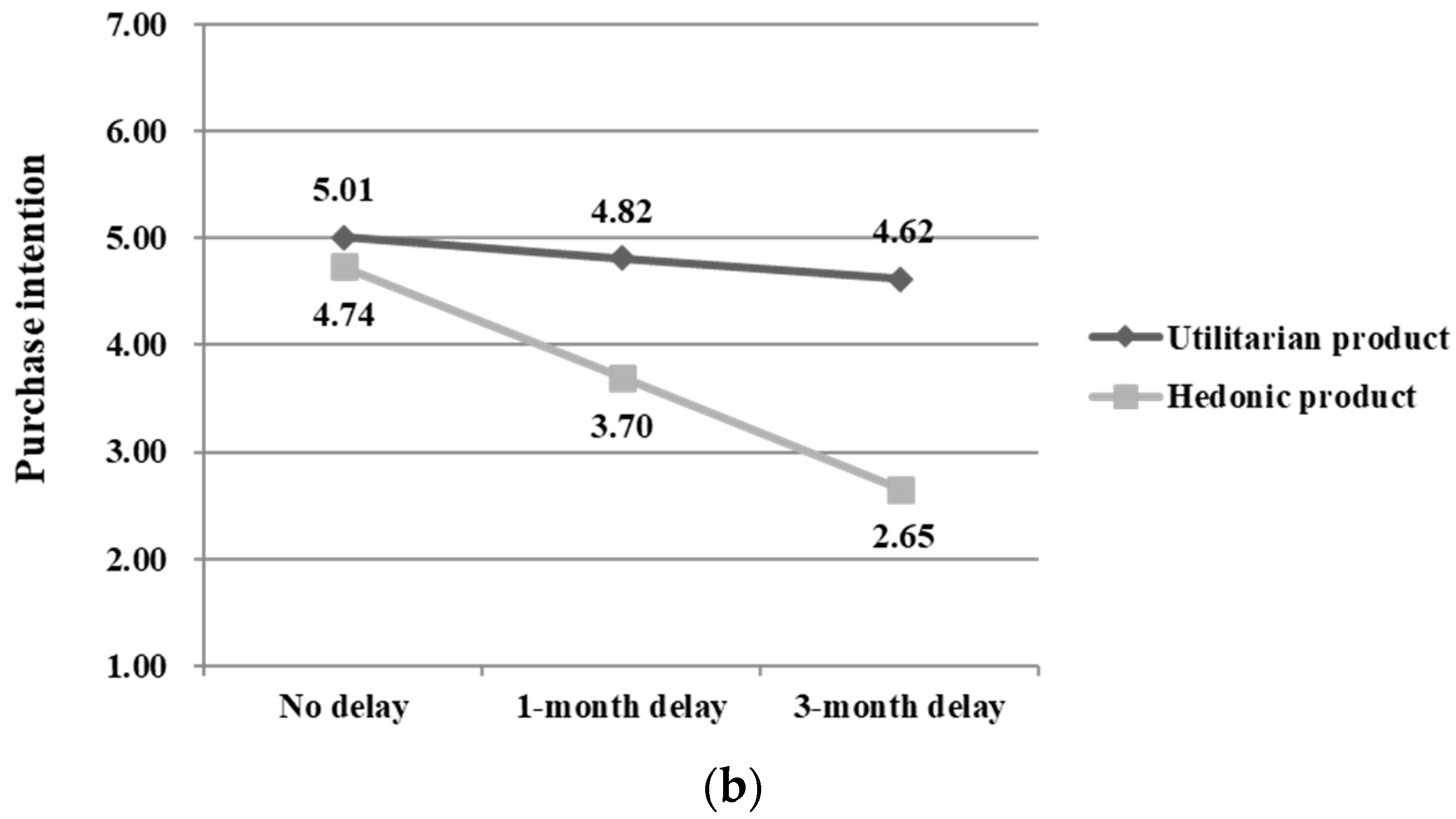

For participants with a high NFC, the interaction effect of payment delay and product type was significant (β = −0.27, t = −5.10, p = 0.00). Specifically, to investigate whether purchase intention for hedonic products was higher when payment was not delayed (vs. delayed), comparisons were made between the no-delay and both the 1-month delay and the 3-month delay conditions. The results showed that purchase intention was marginally higher when payment was not delayed compared to a 1-month delay (Mno-delay = 4.74 vs. M1-month delay = 3.70; β = −0.18, t(328) = −1.85, p = 0.07) and significantly higher when payment was not delayed compared to a 3-month delay (Mno-delay = 4.74 vs. M3-month delay = 2.65; β = −0.91, t(312) = −10.21, p = 0.00). In other words, participants with high a NFC showed marginally higher purchase intentions for hedonic products when paying with a debit card compared to paying with a credit card lump sum and higher purchase intentions for hedonic products when paying with a debit card compared to paying with credit card 3-month installments. Therefore, H4a was partially supported.

For participants with a high NFC, comparisons were made between the no-delay condition and both the 1-month delay and the 3-month delay conditions to examine whether there were differences in purchase intention for utilitarian products depending on payment delay. The results showed no significant differences in purchase intention between the no-delay and 1-month delay conditions (Mno-delay = 5.01 vs. M1-month delay = 4.82; β = 0.07, t(328) = 0.71, p = 0.48), as well as between the no-delay and 3-month delay conditions (Mno-delay = 5.01 vs. M3-month delay = 4.62; β = −0.14, t(312) = −1.57, p = 0.12). In other words, participants with a high NFC showed no differences in purchase intention for utilitarian products when paying with a debit card, credit card lump sum, or credit card 3-month installment payments. Thus, H4b was supported.

4.3. Discussion

For consumers with a low NFC, there was no difference in purchase intention for hedonic products when payment was not delayed compared to a 1-month delay, but purchase intention was higher when payment was delayed for 3 months compared to no delay. When purchasing utilitarian products, there was no difference in purchase intention between the no-delay and 1-month delay conditions, but purchase intention was higher when there was no delay compared to when payment was delayed for 3 months. The results suggest that consumers with low NFC construe the situation differently depending on payment delay and perceive the importance of desirability and feasibility differently, which influences their purchase intentions for hedonic and utilitarian products.

For consumers with a high NFC, when purchasing hedonic products, their purchase intention was higher when payment was not delayed compared to a 1-month delay, although this difference was marginal; however, it was significantly higher than when payment was delayed for 3 months. When purchasing utilitarian products, there was no difference in purchase intentions regardless of payment delays. The results suggest that consumers with a high NFC anticipate that concerns about payment and the negative emotions induced by indulging will persist when payment is delayed, leading to higher purchase intention when payment is not delayed. However, payment delay did not influence their purchase intention for utilitarian products, which are typically driven by rational necessity.

The comparison between debit card and credit card lump sum payments suggests that while consumers acknowledge the delayed payment completion with credit cards, in today’s credit-card-prevalent society, this 1-month delay may not significantly affect purchase intention.

The results of Study 2 contribute to the scant research that addresses various individual characteristics in payment situations by considering consumers’ NFC. The specific implications will be discussed in the final section of this paper.

5. Study 3

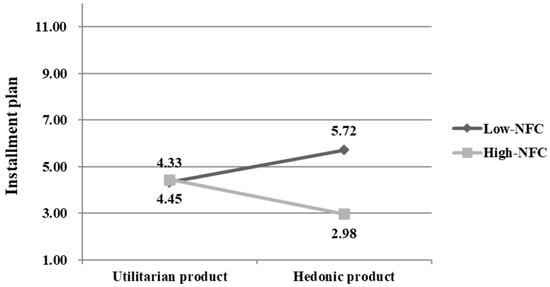

In Study 3, participants were asked to directly choose the payment delay for their purchases by selecting the number of months for interest-free installment plans on their credit cards, ranging from 1 month (i.e., lump sum payment) to 12 months. It was expected that consumers with a low NFC would choose longer installment periods when purchasing hedonic compared to utilitarian products, while consumers with a high NFC would choose longer installment periods when purchasing utilitarian products compared to hedonic products. Thus, the following hypotheses are suggested.

H5.

Consumers with a low NFC prefer delaying payment more when purchasing hedonic products compared to utilitarian products.

H6.

Consumers with a high NFC prefer delaying payment more when purchasing utilitarian products compared to hedonic products.

5.1. Method

5.1.1. Pretest

To select the product categories for the experiment, a pretest was conducted with 18 individuals (10 females, Mage = 32.91). The pretest procedures were adapted from Thomas et al. (2011) and adjusted for this study. Participants were asked to categorize products they had recently purchased or were planning to purchase as either utilitarian or hedonic products. Among the products that received the most responses, those with similar price levels were chosen. A desktop computer was chosen as the utilitarian product, while a capsule coffee machine was chosen as the hedonic product.

5.1.2. Procedure

Participants were recruited using an online panel from a survey company, with the same requirement criteria as those used in Study 1 and 2. A total of 135 participants (54 females, Mage = 34.22) took part in the experiment, with age groups comprising the 20s (51.9%), 30s (18.5%), 40s (16.3%), and 50s (13.3%). Participants’ occupations included 33.4% students (undergraduate 19.2%, graduate 14.2%) and 66.6% workers (clerical 34.8%, managerial 11.9%, service 9.5%, professional 7.4%, technical 3.0%). They were randomly assigned to one of two product type conditions: the utilitarian product (n = 69) or hedonic product conditions (n = 66). The following procedures were adapted from Chatterjee and Rose (2012) and Thomas et al. (2011) and modified for this study.

Participants were provided with a questionnaire divided into two parts. First, they read scenarios with product images corresponding to each product type condition. The scenario describes the situation where participants are planning to purchase a desktop computer or capsule coffee machine for each condition. Then, they were then asked to choose one of twelve installment periods ranging from 1 (i.e., lump-sum payment) to 12 months when informed they could pay for the product in interest-free installments for up to 12 months. Additionally, participants indicated whether the product used in the experiment was primarily for utilitarian or hedonic purposes (1 = utilitarian purpose, 7 = hedonic purpose).

In the second part of the survey, participants were presented with 20 items to measure their level of NFC (Cronbach’s α = 0.84). Finally, participants responded to questions about their monthly average card use frequency, card payment amount, and disposable income.

5.2. Results

5.2.1. Manipulation Checks

As intended, participants responded that they consume hedonic products for more hedonic purposes compared to utilitarian products (Mutilitarian = 2.41 vs. Mhedonic = 4.14; t(131) = −7.36, p = 0.00).

5.2.2. Hypothesis Test

A regression analysis was conducted on the installment months, with product type, mean-centered NFC, and their interaction as the independent variables. Monthly average card use frequency, card payment amount, and disposable income were included as covariates for control.

As a result, a significant two-way interaction between product type and NFC was observed (β = −0.36, t(131) = −3.58, p = 0.00), while other effects were not significant (Table 3).

Table 3.

Regression analysis results for installment months.

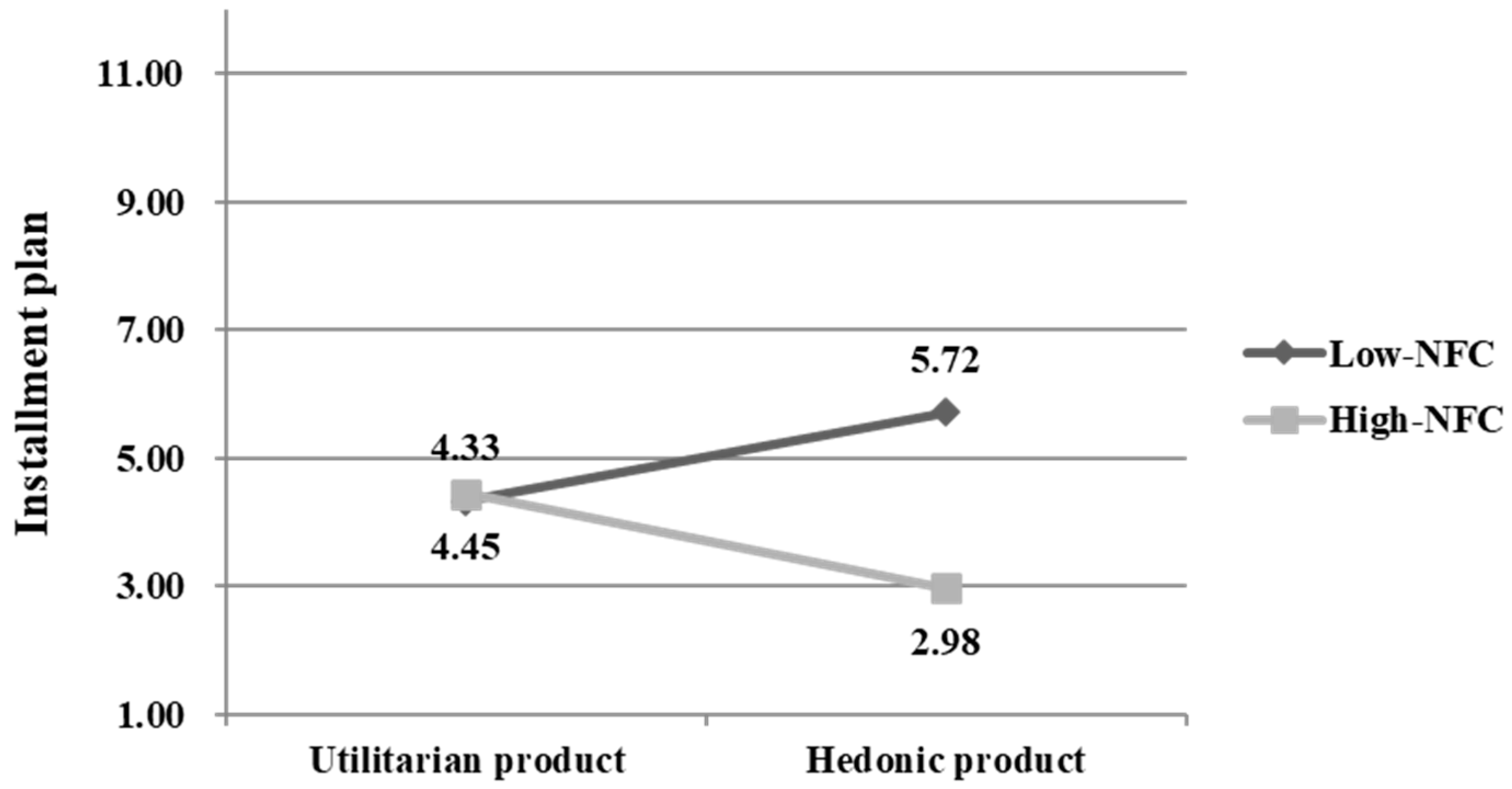

Spotlight analyses were conducted at one SD above and below the mean of NFC to analyze the interaction effects (Figure 4). Participants with a low NFC chose longer installment durations when purchasing hedonic compared to utilitarian products (Mutilitarian = 4.33 vs. Mhedonic = 5.72; β = 0.25, t(131) = 1.98, p = 0.05). Conversely, participants with a high NFC chose shorter installment months when purchasing hedonic compared to utilitarian products (Mutilitarian = 4.45 vs. Mhedonic = 2.98; β = −0.26, t(131) = −2.14, p = 0.03). Thus, Hypotheses 5 and 6 were supported.

Figure 4.

Choice of installment duration plan.

5.3. Discussion

Participants with a low NFC preferred to delay payment more when purchasing hedonic than utilitarian products. In contrast, participants with a high NFC aimed to make the payment quickly when purchasing hedonic compared to utilitarian products.

The results of Study 3 contribute to enhancing the generalizability of the effects demonstrated in Study 2 by using a different product category and designing an experimental setting where consumers could choose the degree of payment delay. The practical implications of the findings will be discussed in the final section of this paper.

6. General Discussion

6.1. Conclusions

The current research demonstrated that consumers perceive the abstractness of payment situations differently based on their level of NFC and the extent to which payments are delayed. Participants with a low NFC perceived greater psychological distance and higher levels of abstractness when payment was delayed by 1 or 3 months compared to when payment was not delayed. Conversely, for participants with a high NFC, the degree of perceived abstractness did not vary significantly with payment delay. Thus, it is argued that the effect of temporal distance based on the construal level theory is manifested in payment situations.

Consumers with a low NFC differed in their construal levels depending on payment delay and perceived the importance of desirability and feasibility differently as the payments were delayed, which affected their purchase intentions for hedonic and utilitarian products. They showed a higher purchase intention for hedonic products when payment was delayed by 3 months compared to when it was not delayed, while their purchase intention for utilitarian products was higher when payment was not delayed than when it was delayed by 3 months. In contrast, purchase intentions of consumers with a high NFC were influenced by their anticipation that concerns about payment and negative emotions induced by hedonic consumption would persist. They exhibited a higher purchase intention for hedonic products when payment was not delayed than when it was delayed by 3 months, whereas payment delay did not significantly affect purchase intentions for utilitarian products.

Meanwhile, no significant difference was found in participants’ purchase intentions between the conditions of no delay and a 1-month delay. This suggests that consumers in modern society, accustomed to credit card usage, may not perceive a 1-month delay in a credit card lump-sum payment as significant enough to influence their purchase intentions.

Lastly, the findings revealed that participants with a low NFC preferred delaying payment more when purchasing hedonic than utilitarian products. In contrast, participants with a high NFC aimed to complete payment quickly when purchasing hedonic compared to utilitarian products.

6.2. Theoretical Contributions

First, previous studies have traditionally categorized payment methods based on their physical forms, such as plastic cards or cash. When paying with plastic cards, the outflow of money is less transparent compared to cash payments, resulting in a reduced perceived pain of payment. However, with the rise of FinTech, various convenient payment methods have been introduced through online and mobile platforms, gradually diminishing the emphasis on the physical form of payment. This shift prevents consumers from associating payments with any specific method, whether cash or plastic cards (Chatterjee and Rose 2012; Soman 2001), thereby reducing the influence of the physical payment method on consumer payment behavior. The findings of this study propose payment delay as a novel criterion for categorizing payment methods, highlighting the timing of when money is actually withdrawn, which could potentially affect consumer perceptions of wealth depletion. This contributes to the existing literature by offering a new perspective on how the timing of payments, rather than the physical form of payment, may have more significant impact on consumers’ payment behavior.

Second, while previous studies on payments have examined individual differences in self-control and spending tendencies (e.g., Keese 2012; Kivetz and Keinan 2006; Kivetz and Simonson 2002a; Prelec and Loewenstein 1998; Wilcox et al. 2011), this study focuses on individual perceptions of temporal distance. Although an individual’s NFC has been mentioned as a consumer characteristic related to the temporal aspect in some studies (e.g., Giacomantonio et al. 2010; Jonas and Huguet 2008; Lynch et al. 2010), empirical research directly addressing the combined effects of TCT and NFC is limited. Therefore, this study provides new evidence of the theoretical relationship between TCT and NFC, demonstrating that the impact of consumers’ perceived temporal distance on the perceived abstractness of a situation varies depending on their levels of NFC.

Third, unlike previous studies that primarily examined the effects of product types (hedonic or utilitarian) on product-related perceptions or purchase behavior, the results of this study explored the impact of product types on payment behaviors, such as choosing payment methods or payment delays. Therefore, these findings contribute academically by enriching the research stream on the effects of product types.

6.3. Practical Implications

First, to prevent consumers with a low NFC from engaging in excessive hedonic spending with credit cards, reducing the psychological distance associated with credit card payments may be beneficial. For instance, many credit card companies offer SMS or smartphone app notification services that provide users with transaction approvals, sometimes including cumulative monthly spending. In addition, sending notifications that specify the actual withdrawal date and the countdown to that date (e.g., “Withdrawal date: 26th, D-15”) can make the payment feel more immediate and tangible. This shift from perceiving credit card payments as abstract and distant to concrete and near could help consumers manage their spending and avoid accumulating debt due to excessive hedonic purchases.

Second, while there is generally a credit card premium effect, some consumers may strongly avoid credit card debt because of the delayed nature of payments (Prelec and Loewenstein 1998; Wilcox et al. 2011). As demonstrated in this study, consumers who prefer quick resolution and dislike unresolved situations were more likely to show higher purchase intention when using debit cards compared to credit cards. To alleviate these consumers’ aversion to credit card use, methods that simulate immediate payment completion could be effective. For example, linking real-time credit card transaction notifications from SMS or smartphone app alerts to budgeting apps could create the perception that money is immediately withdrawn from their available budget, reducing the psychological ambiguity surrounding credit card payments. This real-time integration would help consumers feel more in control of their finances and reduce their discomfort with deferred payments.

Third, businesses are often interested in encouraging consumers to complete payments as quickly as possible (Patrick and Park 2006). Whether a product is perceived as hedonic or utilitarian can vary depending on which attributes consumers prioritize during product evaluation (Dhar and Wertenbroch 2000; Okada 2005). For example, highlighting the hedonic features of a utilitarian product (such as the aesthetic design of a laptop) may lead consumers to perceive it as a hedonic purchase (Patrick and Park 2006), while emphasizing utilitarian aspects can shift perceptions in the opposite direction. According to the findings of this study, consumers with a low NFC are more likely to delay payments for hedonic products. Therefore, businesses could reduce payment delays by emphasizing the utilitarian aspects of hedonic products, making them appear more functional and necessary.

6.4. Limitations and Future Research

This study regarded consumer NFC as a personal trait and measured NFC level using a scale, while some previous studies have manipulated participants’ NFC through situational factors in experiments. For instance, individuals tend to seek closure more urgently when they are under time pressure (Kruglanski and Freund 1983). On the other hand, people’s NFC decreases when tasks are perceived as attractive or enjoyable (Webster 1993). Consumer payment behavior is often influenced by factors such as acceptability (e.g., situations where credit card payment is not feasible), accessibility (e.g., lack of nearby ATMs), and habits (e.g., habitual use of a specific payment method for certain expenses) (Soman 2001). Therefore, it would be meaningful to experimentally manipulate consumers’ NFC levels situationally to examine how their payment-related behaviors change in different situations.

In reality, consumers are influenced by various factors when choosing a payment method, such as cash discounts, benefits offered by card issuers, availability of interest-free installment plans with credit cards, and tax advantages, among others. To mitigate the influence of these potential factors, the experiment in this study was designed so that participants did not directly choose the payment method; instead, it was predetermined for them. Allowing participants to freely choose their payment method could create a more natural experimental setting that better reflects real-life decision-making. Therefore, future research could explore the benefits of using specific payment methods in greater depth.

The present research investigated card payment contexts where payment delays occur to examine whether perceived temporal distance varies according to individuals’ NFC. Investigating whether similar phenomena occur in online purchases or mobile payment situations would be valuable for understanding consumer payment behavior in the FinTech era. Furthermore, future research could broaden the scope of payment delays beyond purchase situations to include contexts such as revolving credit card or loan repayments (e.g., mortgages).

Funding

This study was supported by 2021 Research Grant from Kangwon National University.

Institutional Review Board Statement

The study was conducted according to the guidelines of the Declaration of Helsinki and the ethical standards of the researchers’ institution.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available upon reasonable request from the corresponding author.

Conflicts of Interest

The author declares no conflict of interest.

References

- Aiken, Leona S., and Stephan G. West. 1991. Multiple Regression: Testing and Interpreting Interactions. Newbury Park: Sage. [Google Scholar]

- Bagchi, Rajesh, and Lauren G. Block. 2011. Chocolate cake please! Why do consumers indulge more when it feels more expensive. Journal of Public Policy & Marketing 30: 294–306. [Google Scholar] [CrossRef]

- Brizi, Ambra, and Alessandro Biraglia. 2021. Do I have enough food? How need for cognitive closure and gender impact stockpiling and food waste during the COVID-19 pandemic: A cross-national study in India and the United States of America. Personality and Individual Differences 168: 110396. [Google Scholar] [CrossRef] [PubMed]

- Chandran, Sucharita, and Geeta Menon. 2004. When a day means more than a year: Effects of temporal framing on judgments of health risk. Journal of Consumer Research 31: 375–89. [Google Scholar] [CrossRef]

- Chatterjee, Promothesh, and Randall L. Rose. 2012. Do Payment Mechanisms Change the Way Consumers Perceive Products? Journal of Consumer Research 38: 1129–39. [Google Scholar] [CrossRef]

- Choi, Hanbyul, Jonghwa Park, Junghwan Kim, and Yoonhyuk Jung. 2020. Consumer preferences of attributes of mobile payment services in South Korea. Telematics and Informatics 51: 101397. [Google Scholar] [CrossRef]

- Dahlberg, Tomi, Niina Mallat, Jan Ondrus, and Agnieszka Zmijewska. 2008. Past, present and future of mobile payments research: A literature review. Electronic Commerce Research and Applications 7: 165–81. [Google Scholar] [CrossRef]

- Dhar, Ravi, and Klaus Wertenbroch. 2000. Consumer choice between hedonic and utilitarian goods. Journal of Marketing Research 37: 60–71. [Google Scholar] [CrossRef]

- Feinberg, Richard A. 1986. Credit cards as spending facilitating stimuli: A conditioning interpretation. Journal of Consumer Research 13: 348–56. [Google Scholar] [CrossRef]

- Fujita, Kentaro, Marlone D. Henderson, Juliana Eng, Yaacov Trope, and Nira Liverman. 2006. Spatial distance and mental construal of social events. Psychological Science 17: 278–82. [Google Scholar] [CrossRef]

- Giacomantonio, Mauro, Carsten K. W. De Dreu, and Lucia Mannetti. 2010. Now you see it, now you don’t: Interests, issues, and psychological distance in integrative negotiation. Journal of Personality and Social Psychology 98: 761–74. [Google Scholar] [CrossRef]

- Hirschman, Elizabeth C. 1979. Differences in consumer purchase behavior by credit card payment system. Journal of Consumer Research 6: 58–66. [Google Scholar] [CrossRef]

- Hoelzl, Erik, Maria Pollai, and Herbert Kastner. 2011. Hedonic evaluations of cars: Effects of payment mode on prediction and experience. Psychology & Marketing 28: 1115–29. [Google Scholar] [CrossRef]

- Houghton, David C., and Rajdeep Grewal. 2000. Please, let’s get an answer—Any Answer: Need for consumer cognitive closure. Psychology & Marketing 17: 911–34. [Google Scholar] [CrossRef]

- Jonas, Kai J., and Pascal Huguet. 2008. What day is today? A social–psychological investigation into the process of time orientation. Personality and Social Psychology Bulletin 34: 353–65. [Google Scholar] [CrossRef]

- Kardes, Frank R., David M. Sanbonmatsu, Maria L. Cronley, and David C. Houghton. 2002. Consideration set overvaluation: When impossibly favorable ratings of a set of brands are observed. Journal of Consumer Psychology 12: 353–61. [Google Scholar] [CrossRef]

- Keese, Matthias. 2012. Who feels constrained by high debt burdens? Subjective vs. objective measures of household debt. Journal of Economic Psychology 33: 125–41. [Google Scholar] [CrossRef]

- Kim, Changsu, Mirsobit Mirusmonov, and In Lee. 2010. An empirical examination of factors influencing the intention to use mobile payment. Computers in Human Behavior 26: 310–22. [Google Scholar] [CrossRef]

- Kim, Hyeongmin. 2013. How variety-seeking versus inertial tendency influences the effectiveness of immediate versus delayed promotions. Journal of Marketing Research 50: 416–26. [Google Scholar] [CrossRef]

- Kivetz, Ran, and Anat Keinan. 2006. Repenting hyperopia: An analysis of self-control regrets. Journal of Consumer Research 33: 273–82. [Google Scholar] [CrossRef]

- Kivetz, Ran, and Itamar Simonson. 2002a. Earning the right to indulge: Effort as a determinant of customer preferences toward frequency program rewards. Journal of Marketing Research 39: 155–70. [Google Scholar] [CrossRef]

- Kivetz, Ran, and Itamar Simonson. 2002b. Self-control for the righteous: Toward a theory of precommitment to indulgence. Journal of Consumer Research 29: 199–217. [Google Scholar] [CrossRef]

- Kruglanski, Arie W., and Donna M. Webster. 1991. Group members’ reactions to opinion deviates and conformists at varying degrees of proximity to decision deadline and of environmental noise. Journal of Personality and Social Psychology 61: 212–25. [Google Scholar] [CrossRef] [PubMed]

- Kruglanski, Arie W., and Donna M. Webster. 1996. Motivated closing of the mind: “Seizing” and “Freezing”. Psychological Review 103: 263–83. [Google Scholar] [CrossRef] [PubMed]

- Kruglanski, Arie W., and Tallie Freund. 1983. The freezing and unfreezing of lay inferences: Effects of impressional primacy, ethnic stereotyping, and numerical anchoring. Journal of Experimental Social Psychology 19: 448–68. [Google Scholar] [CrossRef]

- Liberman, Nira, and Yaacov Trope. 1998. The role of feasibility and desirability considerations in near and distant future decisions: A test of temporal construal theory. Journal of Personality and Social Psychology 75: 5–18. [Google Scholar] [CrossRef]

- Loewenstein, George. 1987. Anticipation and the valuation of delayed consumption. Economic Journal 97: 666–84. [Google Scholar] [CrossRef]

- Lynch, John G., Jr., Richard G. Netemeyer, Stephen A. Spiller, and Alessandra Zammit. 2010. A generalizable scale of propensity to plan: The long and the short of planning for time and for money. Journal of Consumer Research 37: 108–28. [Google Scholar] [CrossRef]

- McCall, Michael, and Heather J. Belmont. 1996. Credit card insignia and restaurant tipping: Evidence for an associative link. Journal of Applied Psychology 81: 609–13. [Google Scholar] [CrossRef]

- Nowlis, Stephen M., Naomi Mandel, and Deborah Brown McCabe. 2004. The effect of a delay between choice and consumption on consumption enjoyment. Journal of Consumer Research 31: 502–10. [Google Scholar] [CrossRef]

- Okada, Erica Mina. 2005. Justification effects on consumer choice of hedonic and utilitarian goods. Journal of Marketing Research 42: 43–53. [Google Scholar] [CrossRef]

- Patrick, Vanessa M., and C. Whan Park. 2006. Paying before consuming: Examining the robustness of consumers’ preference for prepayment. Journal of Retailing 82: 165–75. [Google Scholar] [CrossRef]

- Prelec, Drazen, and Duncan Simester. 2001. Always leave home without it: A further investigation of the credit-card effect on willingness to pay. Marketing Letters 12: 5–12. [Google Scholar] [CrossRef]

- Prelec, Drazen, and George Loewenstein. 1998. The red and the black: Mental accounting of savings and debt. Marketing Science 17: 4–28. [Google Scholar] [CrossRef]

- Raghubir, Priya, and Joydeep Srivastava. 2008. Monopoly money: The effect of payment coupling and form on spending behavior. Journal of Experimental Psychology: Applied 14: 213–25. [Google Scholar] [CrossRef] [PubMed]

- Ramanathan, Suresh, and Patti Williams. 2007. Immediate and delayed emotional consequences of indulgence: The moderating influence of personality type on mixed emotions. Journal of Consumer Research 34: 212–23. [Google Scholar] [CrossRef]

- Roets, Arne, Arie W. Kruglanski, Malgorzata Kossowska, Antonio Pierro, and Ying-yi Hong. 2015. The motivated gatekeeper of our minds: New directions in need for closure theory and research. In Advances in Experimental Social Psychology. Cambridge: Academic Press, vol. 52, pp. 221–83. [Google Scholar]

- Rook, Dennis W. 1987. The buying impulse. Journal of Consumer Research 14: 189–99. [Google Scholar] [CrossRef]

- Seldal, M. M. Naeser, and Ellen K. Nyhus. 2022. Financial vulnerability, financial literacy, and the use of digital payment technologies. Journal of Consumer Policy 45: 281–306. [Google Scholar] [CrossRef]

- Soman, Dilip. 2001. Effects of payment mechanism on spending behavior: The role of rehearsal and immediacy of payments. Journal of Consumer Research 27: 460–74. [Google Scholar] [CrossRef]

- Soman, Dilip. 2003. The effect of payment transparency on consumption: Quasi-experiments from the field. Marketing Letters 14: 173–83. [Google Scholar] [CrossRef]

- Thomas, Manoj, Kalpesh Kaushik Desai, and Satheeshkumar Seenivasan. 2011. How credit card payments increase unhealthy food purchases: Visceral regulation of vices. Journal of Consumer Research 38: 126–39. [Google Scholar] [CrossRef]

- Trope, Yaacov, and Nira Liberman. 2000. Temporal construal and time-dependent changes in preference. Journal of Personality and Social Psychology 79: 876–89. [Google Scholar] [CrossRef] [PubMed]

- Trope, Yaacov, and Nira Liberman. 2003. Temporal construal. Psychological Review 110: 403–21. [Google Scholar] [CrossRef] [PubMed]

- Trope, Yaacov, and Nira Liberman. 2010. Construal-level theory of psychological distance. Psychological Review 117: 440–63. [Google Scholar] [CrossRef]

- Trope, Yaacov, Nira Liberman, and Cheryl Wakslak. 2007. Construal levels and psychological distance: Effects on representation, prediction, evaluation, and behavior. Journal of Consumer Psychology 17: 83–95. [Google Scholar] [CrossRef] [PubMed]

- Verkijika, Silas Formunyuy. 2018. Factors influencing the adoption of mobile commerce applications in Cameroon. Telematics and Informatics 35: 1665–74. [Google Scholar] [CrossRef]

- Vermeir, Iris, and Patrick Van Kenhove. 2005. The influence of need for closure and perceived time pressure on search effort for price and promotional information in a grocery shopping context. Psychology & Marketing 22: 71–95. [Google Scholar] [CrossRef]

- Webster, Donna M. 1993. Motivated augmentation and reduction of the overattribution bias. Journal of Personality and Social Psychology 65: 261–71. [Google Scholar] [CrossRef]

- Webster, Donna M., and Arie W. Kruglanski. 1994. Individual differences in need for cognitive closure. Journal of Personality and Social Psychology 67: 1049–62. [Google Scholar] [CrossRef]

- Wilcox, Keith, Lauren G. Block, and Eric M. Eisenstein. 2011. Leave home without it? The effects of credit card debt and available credit on spending. Journal of Marketing Research 48: S78–S90. [Google Scholar] [CrossRef]

- Zhang, Shi, Frank R. Kardes, and Maria L. Cronley. 2002. Comparative advertising: Effects of structural alignability on target brand evaluations. Journal of Consumer Psychology 12: 303–11. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).