Six-Gear Roadmap towards the Smart Factory

Abstract

:Featured Application

Abstract

1. Introduction

2. Conceptual Modeling Methodology

3. Review of Similar Concepts and Models

3.1. Academic Contributions

3.2. Industial Contributions

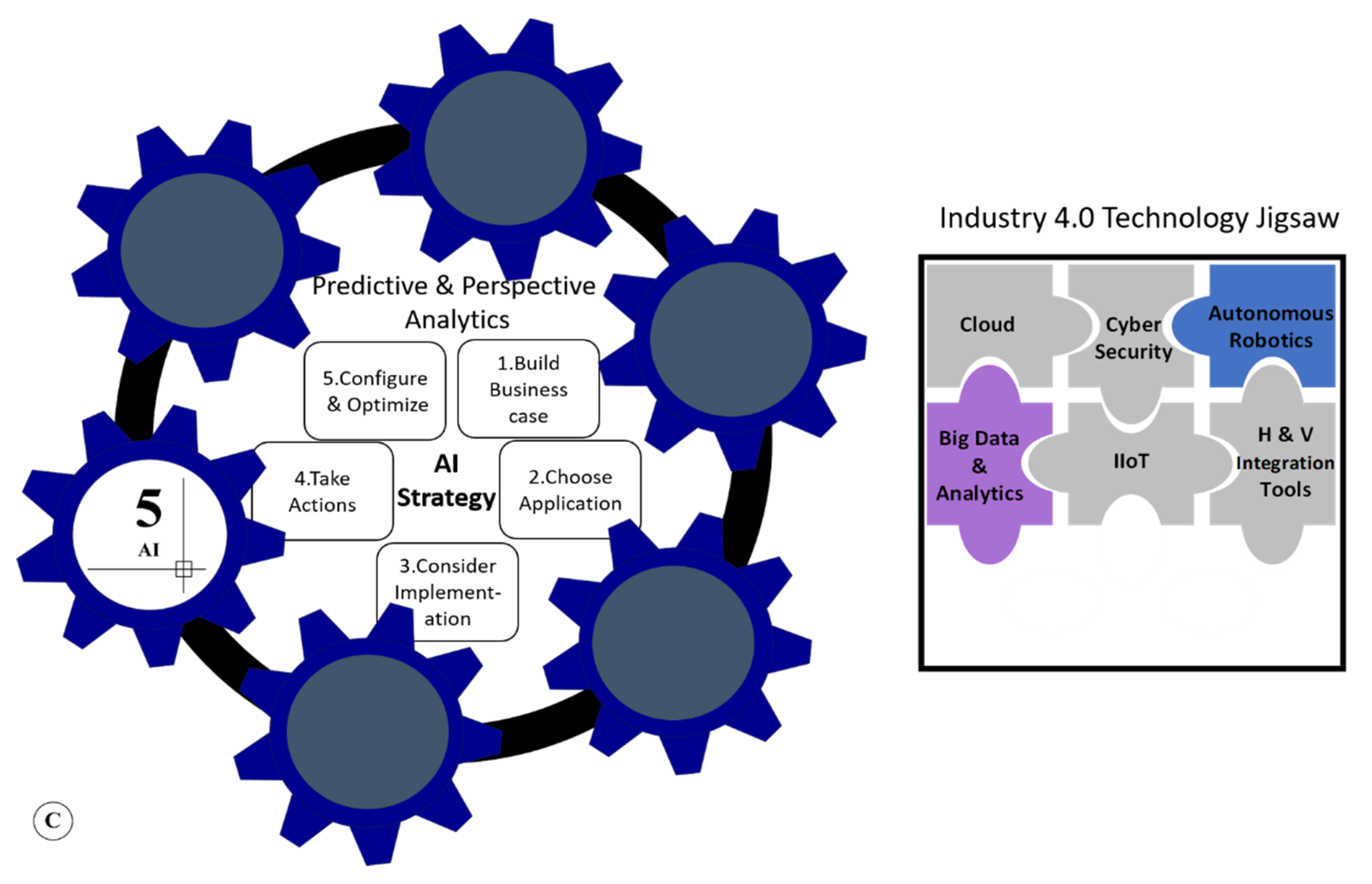

4. Technology Jigsaw Map

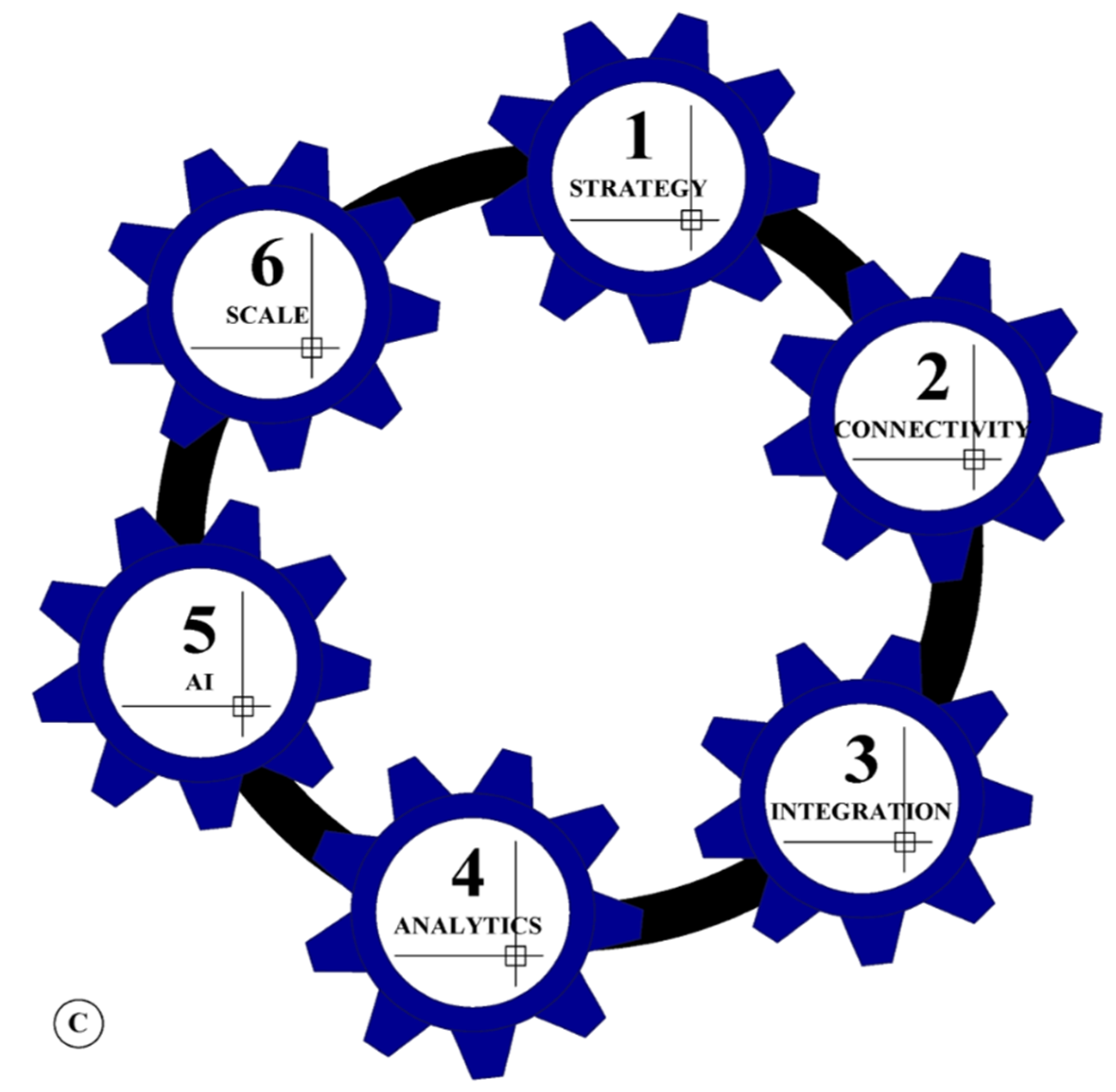

5. The Six-Gear Roadmap

5.1. Gear 1: Strategy

5.2. Gear 2: Connectivity

5.2.1. IT/Network Infrastructure

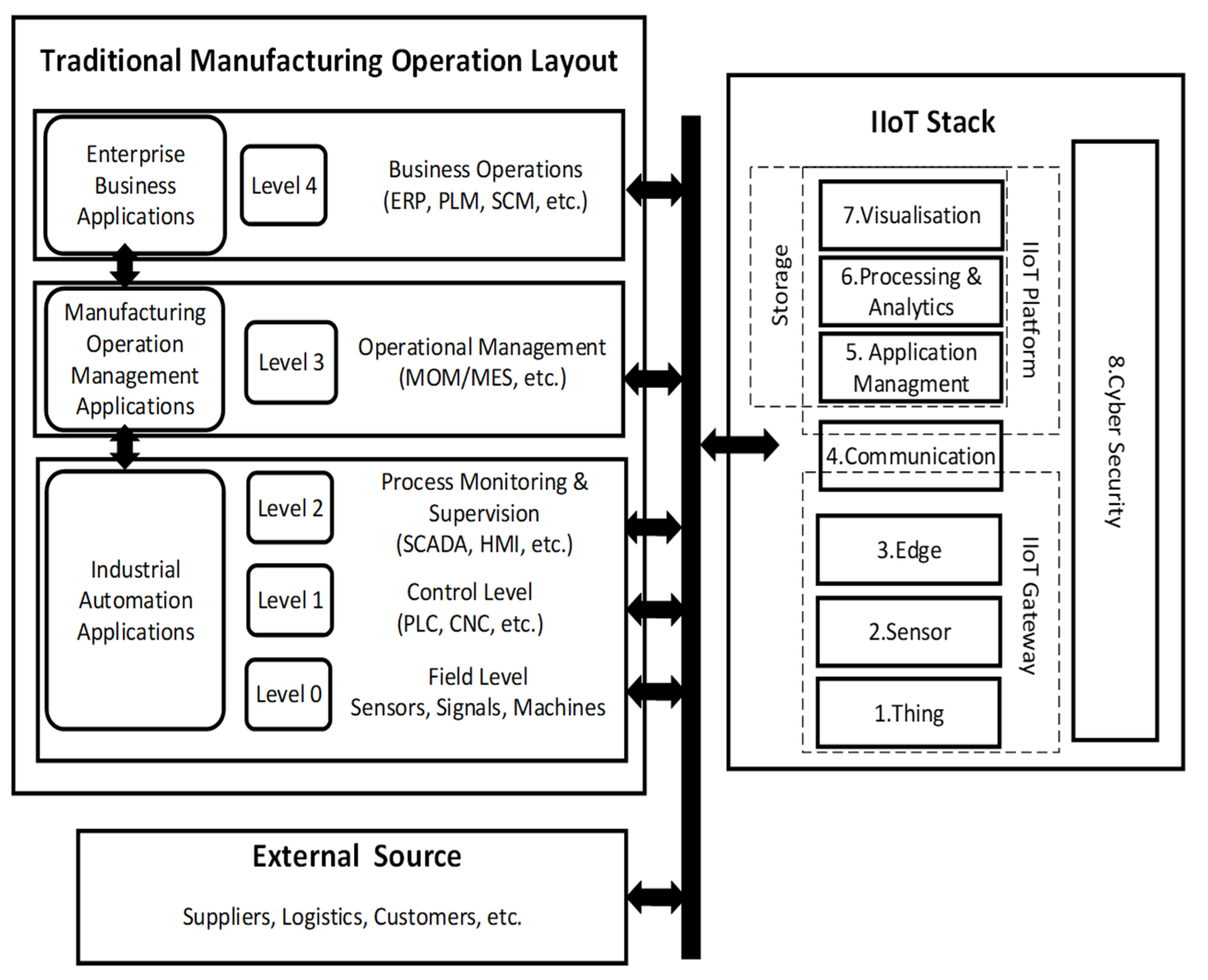

5.2.2. Industrial Internet of Things (IIoT) Connectivity

5.2.3. Cybersecurity Strategy

5.3. Gear 3: Integration

5.4. Gear 4: Analytics

5.5. Gear 5: AI (Artificial Intelligence)

5.6. Gear 6: Scale

5.6.1. Scaling the Roadmap Gears

5.6.2. Other Advanced Technologies for Smart Manufacturing

6. Other Challenges of Digital Transformation for Manufacturing SMEs

6.1. Finance

6.2. Managing Change

6.3. Skills

7. Discussion

8. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Reference | Type | General Features | Industry 4.0 Technology Trends |

|---|---|---|---|

| [11] | Technology review | Industry 4.0 technologies and trends relevant to the developments of smart manufacturing. | IoT, BD, CPS, ML, AD, R |

| [10] | Technology review | Characteristics: Context awareness, modularity, heterogeneity, interoperability, compositionality. | IC, IoT, CC, AD, ES, CS, SP, DA, PM, CPS, VT |

| Enabling factors: law and regulations, innovation education and training, data sharing systems. | |||

| [38] | Technology review, issues, challenges, and conceptual framework of interoperability | 5 principles: Accessibility, Multilingualism, Security, Open-source, Multilateral | CC, BD, IoT, MC, CPS, ICT |

| 3 applications: Smart Factory/Manufacturing, Smart City, Smart Products. | |||

| 4 architecture levels: Operational, Systematical, Technical, Semantic. | |||

| [39] | Technology review of internet connected devices in manufacturing | Impact and value of Industry 4.0 and internet connected technologies that enable | IoT |

| new products, services and business models. | |||

| [40] | Technology review of Industry 4.0 developments and practices for sustainable manufacturing | Conceptual perspective of Industry 4.0 integration. | CPS |

| Micro and Macro integration perspective: Horizontal, Vertical, and End-to-end integration within the smart factory and across the entire product life cycle and value chain. | |||

| Micro and Macro opportunities for sustainable manufacturing. | |||

| [35] | Conceptual model for implementing Industry 4.0 technologies in smart manufacturing | 3 stage implementations: Vertical Integration, Advanced Automation, Flexibilization. | IoT, CC, BD, DA |

| 2 technology layers: | |||

| Front- end Technology: Smart Manufacturing, Smart Products, Smart Supply Chain, Smart Working. | |||

| Base- end Technology: IoT, Cloud, BD Analytics. | |||

| [7] | Conceptual model for implementing CPS’s for manufacturing applications | 5 level architecture (5C): Smart Connection, Conversion and Cyber, Cognition and Configure. | CPS, DA |

| [6] | Technology review and conceptual roadmap for digitalisation of the manufacturing industry | 6 management principles: Strategy, Marketing, Human Resources, IT Resources, Manufacturing Technology and Supply Chain. | IoT, CC, BD, B, CS, AR, R, AD, CPS, VT |

| 12 design principles. | |||

| 14 technology trends. | |||

| [42] | Literature review, framework architecture for smart manufacturing technologies | 4-layer architecture: sensory, integration, intelligent and response | IoT, BD, IC, CPS, MES, |

| [5] | Industrial technology report (BCG) | 9 technology pillars for transforming industrial production. | IoT, R, BD, CS, VT, HVI, CC, AD |

| [43] | Industrial technology review report (Automation Alley) | Emerging technology trends, implications, action plans, case studies. | IoT, R, BD, CS, AI, AD, VT, CC |

| [8] | Industrial report on smart factory transition (Deloitte) | 5 Features of smart factory. | CS, IoT, AI, AD, AR, R, DA |

| 5 Benefits of a smart factory. | |||

| 6 Impact on manufacturing processes. | |||

| 5 Areas of consideration. | |||

| 4 Practical steps towards the smart factory. | |||

| [9] | Industrial Research, Digital Transformation Framework (LNS Research) | History and future potential of manufacturing systems technologies. | BD, HVI, CC, DA, AI, ML, |

| 5 layers: Strategic objectives, Operational excellence, Operational architecture, Business case development, Solution selection. | |||

| 4 recommended actions for digital transformation and smart manufacturing. | |||

| [44] | Industrial Research, Operational Architecture Framework on applying data analytics. (LNS Research) | Operational architecture framework that focuses on applying data and analytics within the Digital Transformation Framework | BD, AI, CC, IoT |

| 4 layers: Industrial operations, Compute and storage, Big data model, Industrial Analytics and Apps | |||

| [29] | Industrial white paper (Festo) | 10 practical tips guide for implementing an Industry 4.0 project. | - |

| [45] | Industrial white paper (ABI research) | 5-steps guide to master a digital transition journey. | IoT, R, AR, PLM |

| 4 challenges in digital transformation and | |||

| 4 Industry 4.0 technologies that make human the central beneficiaries. | |||

| [46] | Industrial white paper (Bosch-Rexroth) | 3 steps approach for implementing connectivity aspects of Industry 4.0. | IoT |

| [28] | Knowledge base hub white paper (Sensor City) | 5-part guide that addresses challenges and presents advice on IoT Adoption. | IoT |

| Case studies on how manufacturers can work towards successful IoT adoption. | |||

| [47] | Industrial white paper (Six Degrees) | 5 steps approach to lay stable IT foundations for the transition to Industry 4.0 ready cloud environment. | IoT, BD, AI, DT, AR, R |

| [15] | Industrial white paper Maturity index for digital transformation (Acatech) | 6 Maturity stages: Computerization, Connectivity, Visibility, Transparency, Predictive capacity, Adaptability. | BD, ML, HVI, CPS |

| 4 Structural areas: Resources, information systems, Culture, Organizational Structure. | |||

| 5 Functional areas: Production, Logistics, Services, Marketing, Sales. | |||

| [37] | ATI framework for digital transformation | 4 steps: Address digital capability, Leverage digital ecosystem, Stretch collaboration, Create space and safety. | IoT, AR, VR, |

| Platform Name | Company | General Features |

|---|---|---|

| ThingWorx | PTC | IIoT-C, DA, AI, MOM, AR, DT |

| MindSpher | Siemens | IIoT-C, DA, AI, MOM, CB, DT |

| Tulip Manufacturing Apps | Tulip | IIoT-C, DA, MOM, CB |

| Watson IoT | IBM | IIoT-C, DA, AI |

| Nexceed (PPM) | BOSCH | IIoT-C, DA |

| Kinetic | Cisco | IIoT-C, DA |

| WISE-PasS | Advantech | IIoT-C, DA, AI, CB |

| Cumulocity IoT | Software AG | IIoT-C, DA, CB |

| AWS IoT | Amazon Web Services | IIoT-C, DA, AI, CB |

| Predix | GE Digital | IIoT-C, DA, AI, CB, DT |

| Azure IoT | Microsoft | IIoT-C, DA, AI, CB |

| SMas | Datahone | IIoT-C, DA, MOM, MES, CB |

| FactoryWiz | FactoryWiz | IIoT-C, DA, MOM, MES |

| machinemetrics | MachineMetrics | IIoT-C, DA, MOM, MES, AI, CB |

| ForcamForce | FORCAM | IIoT-C, DA, MOM |

| keyprod | Keyprod | IIoT-C, DA, MOM, MES |

| Smooth Monitor AX | Yamazaki Mazak | IIoT-C, DA |

| Panorama E2 | CODRA | IIoT-C, DA |

| Lumada | Hitachi | IIoT-C, DA, AI, CB |

| KepServer | PTC | IIoT-C, Software Bridge |

| OPCrouter | Inray industrie software | IIoT-C, Software Bridge |

References

- PlatformIndustrie4.0. Digitization of Industrie Platform Industrie 4.0; Federal Ministry for Economic Affairs and Energy (BMWi): Berlin, Germany, 2016. [Google Scholar]

- Al-Hassani, S.T.S. 1001 Inventions Muslim Heritage in Our World, 2nd ed.; The Foundation for Science, Technology and Civilization (FSTC): Manchester, UK, 2006; ISBN 978-0-9552426-1-8. [Google Scholar]

- Schroeder, W. Germany’s Industry 4.0 Strategy, Rhine Capitalism in the Age of Digitisation; Friedrich-Ebert-Stiftung (FES): London, UK, 2016. [Google Scholar]

- Bassett, R. The Dangers of DIY Connectivity. In How An Integrated IIoT Suite Supports Digital Transformation, Automation.com; International Society of Automation: Research Triangle Park, NC, USA, 2020. [Google Scholar]

- Rüßmann, M.; Lorenz, M.; Gerbert, P.; Waldner, M.; Justus, J.; Engel, P.; Harnisch, M. Industry 4.0: The Future of Productivity and Growth in Manufacturing Industries; The Boston Consulting Group (BCG): Boston, MA, USA, 2015. [Google Scholar]

- Ghobakhloo, M. The future of manufacturing industry: A strategic roadmap toward Industry 4.0. J. Manuf. Technol. Manag. 2018, 29, 910–936. [Google Scholar] [CrossRef] [Green Version]

- Lee, J.; Bagheri, B.; Kao, H.-A.A. Cyber-Physical Systems architecture for Industry 4.0-based manufacturing systems. Manuf. Lett. 2015, 3, 18–23. [Google Scholar] [CrossRef]

- Burke, R.; Mussomeli, A.; Laaper, S.; Hartigan, M.; Sniderman, B. The Smart Factory-Responsive, Adaptive, Connected Manufacturing; Deloitte University Press: New York, NY, USA, 2017. [Google Scholar]

- Hughes, A. Smart Manufacturing-Smart Companies Have Made Smart Manufacturing the Center of the Enterprise; LNS Research: Cambridge, MA, USA, 2017. [Google Scholar]

- Mittal, S.; Khan, M.A.; Romero, D.; Wuest, T. Smart manufacturing: Characteristics, technologies and enabling factors. J. Eng. Manuf. 2019, 233, 1342–1361. [Google Scholar] [CrossRef]

- Ahuett-Garza, H.; Kurfess, T. A brief discussion on the trends of habilitating technologies for Industry 4.0 and Smart manufacturing. Manuf. Lett. 2018, 15, 60–63. [Google Scholar] [CrossRef]

- Buer, S.V.; Strandhagen, J.O.; Chan, F.T.S. The link between Industry 4.0 and lean manufacturing: Mapping current research and establishing a research agenda. Int. J. Prod. Res. 2018, 56, 2924–2940. [Google Scholar] [CrossRef] [Green Version]

- Angel, M. How Industry 4.0 is Transforming Lean Manufacturing. 2015. Available online: https://tulip.co/blog/lean-manufacturing/how-industry-4-0-is-transforming-lean-manufacturing (accessed on 10 March 2020).

- Klitou, D.; Conrads, J.; Rasmussen, M.; CARSA.; Probst, L.; Pedersen, B.; PwC. Germany Industrie 4.0; European Commission Directorate Digital Transformation Monitor, European Commission: Brussels, Belgium, 2017. [Google Scholar]

- Schuh, G.; Anderl, R.; Dumitrescu, R.; Krüger, A.; Hompel, M.T. Industrie 4.0 Maturity Index-Managing the Digital Transformation of Companies; Acatech STUDY: Munich, Germany, 2020. [Google Scholar]

- Made Smarter Review. In HM UK Government: Industrial Strategy Green Paper, 2017; Department for Business, Energy & Industrial Strategy: London, UK, 2017.

- Kennedy, S. Made in China 2025; Centre For Strategic & International Studies (CSIS): Washington, DC, USA, 2015; Available online: https://www.csis.org/analysis/made-china-2025 (accessed on 22 May 2019).

- America Makes. Available online: https://www.americamakes.us/about/ (accessed on 22 May 2019).

- Eun-Ha, J. Smart Industry Korea. Netherlands Enterprise Agency, 2015. Available online: https://www.rvo.nl/sites/default/files/2015/10/Smart%20Industry%20in%20Korea.pdf (accessed on 22 May 2019).

- Schröder, C. The Challenges of Industry 4.0 for Small and Medium-Sized Enterprises; Friedrich-Ebert-Stiftung (FES): London, UK, 2017. [Google Scholar]

- Walters, R. Robotics Answers: Japan Out to Lead The next Industrial Revolution. ACCJ J. 2015. Available online: https://journal.accj.or.jp/robotics-answers-japan-out-to-lead-the-next-industrial-revolution/#:~:text=Japans%20Robot%20Strategy%E2%80%93Vision%2C%20Strategy,Japan%20as%20a%20robotics%20superpower.&text=The%20strategy%20also%20has%20a,the%20clock%2C%20non%2Dstop (accessed on 28 September 2020).

- Schönfuß, B.; McFarlane, D.; Athanassopoulou, N.; Salter, L.; de Silva, L.; Ratchev, S. Prioritising Low Cost Digital Solutions Required by Manufacturing SMEs: A Shoestring Approach. In Proceedings of the Service Oriented, Holonic and Multiagent Manufacturing Systems for Industry of the Future, SOHOMA 2019, Valencia, Spain, 3–4 October 2019; Springer: Cham, Switzerland, 2020; pp. 290–300. [Google Scholar]

- CBI. From Ostrich to Magpie-Increasing Business Take-Up of Proven Ideas and Technologies; CBI: New Delhi, India, November 2017; Available online: https://www.cbi.org.uk/media/1165/cbi-from-ostrich-to-magpie.pdf (accessed on 10 March 2020).

- IndustryWeek. Manufacturing Operations-Getting Ready for the Next Normal. Industry Insight, September 2020. Available online: https://app.assetsmanu.endeavorb2b.com/e/es.aspx?s=893956921&e=982659&elq=05ff343ba8e140139e47a115e2ad56e9 (accessed on 10 March 2020).

- Pwc. Industry 4.0: Building the Digital Enterprise Aerospace, Defence and Security Key Findings; Global Industry 4.0 Survey—Industry Key Findings. Pwc, 2016. Available online: https://www.pwc.co.uk/who-we-are/regions/west/industry-4-0-aerospace-key-findings.pdf (accessed on 10 March 2020).

- BDO. Industry 4.0 Report. BDO, June 2016. Available online: https://www.bdo.co.uk/en-gb/insights/industries/manufacturing/industry-4-0-report (accessed on 10 March 2020).

- Fettrman, P. Manufacturing Metrices: Driving Operational Performance; LNS Research: Cambridge, MA, USA, 2018. [Google Scholar]

- Sensorcity. 2020 Guide to IoT Adoption. Sensor City, 2020; Available online: https://sensorcity.lpages.co/iot_whitepaper.html (accessed on 12 January 2020).

- FESTO. Practical Tips for Industry 4.0 Implementation; FESTO, 2019; Available online: https://www.festo.com/cms/en-gb_gb/65731.htm (accessed on 3 March 2019).

- Sufian, A.T.; Abdullah, B.M.; Ateeq, M.; Wah, R.; Clements, D. A Roadmap Towards the Smart Factory. In Proceedings of the 12th International Conference on Developments in eSystems Engineering (DeSE), Kazan, Russia, 7–10 October 2019; pp. 978–983. [Google Scholar]

- Webster, J.; Watson, R.T. Analyzing the Past to Prepare for the Future: Writing a Literature Review. MIS Q. 2002, 26, xiii–xxiii. [Google Scholar]

- Barnes, B. Cisco Partners with Mazak and MEMEX to Connect Machines; Cisco, 2015; Available online: https://blogs.cisco.com/manufacturing/cisco-partners-with-mazak-and-memex-to-connect-machines (accessed on 31 May 2019).

- Jacob, D. Quality 4.0 Impact and Strategy Handbook: Getting Digitally Connected to Transform. Quality Management; LNS Research: Cambridge, MA, USA, 2017. [Google Scholar]

- Shaw, G. The Future Computed: AI & Manufacturing; Microsoft Corporation: Redmond, WA USA, 2019. [Google Scholar]

- Frank, A.G.; Dalenogare, L.S.; Ayala, N.F. Industry 4.0 technologies: Implementation patterns in manufacturing companies. Int. J. Prod. Econ. 2019, 210, 15–26. [Google Scholar] [CrossRef]

- Rathmann, C. Industrial Internet of Things (IOT) and Digital Transformation–IoT, Digital Transformation and the Role of Enterprise Software; IFS World: Linköping, Sweden, 2017; Available online: https://www.ifsworld.com/us/sitecore/media-library/assets/2017/09/14/industrial-iot-and-digital-transformation (accessed on 20 October 2020).

- ATI. Digital Transformation: Aerospace Technology Institute (ATI). February 2017. Available online: https://www.ati.org.uk/media/f41fb3nc/ati-insight-01-digital-transformation.pdf (accessed on 20 October 2020).

- Lu, Y. Industry 4.0: A survey on technologies, applications and open research issues. J. Ind. Inf. Integr. 2017, 6, 1–10. [Google Scholar] [CrossRef]

- Roblek, V.; Meško, M.; Krapež, A. A Complex View of Industry 4.0. SAGE Open 2016, 6. [Google Scholar] [CrossRef] [Green Version]

- Stock, T.; Seliger, G. Opportunities of Sustainable Manufacturing in Industry 4.0. Procedia CIRP 2016, 40, 536–541. [Google Scholar] [CrossRef] [Green Version]

- Lee, J.; Davari, H.; Singh, J.; Pandhare, V. Industrial Artificial Intelligence for industry 4.0-based manufacturing systems. Manuf. Lett. 2018, 18, 20–23. [Google Scholar] [CrossRef]

- Lu, H.-P.; Weng, C.-I. Smart manufacturing technology, market maturity analysis and technology roadmap in the computer and electronic product manufacturing industry. Technol. Forecast. Sco. Chang. 2018, 133, 85–94. [Google Scholar] [CrossRef]

- Kampe, N. Technology in Industry Report. Automation Alley, 2018. Available online: https://automationalley.com/techreport (accessed on 21 October 2020).

- Hughes, A. Analytics Really Do Matter-Driving Digital Transformation and the Smart Manufacturing Enterprise; LNS Research: Cambridge, MA, USA, 2018; Available online: https://blog.lnsresearch.com/atmebook-thankyou-0?submissionGuid=842936d3-e00b-477a-a523-ed7cb47199d7 (accessed on 21 October 2020).

- ABIresearch. Five Steps to Master Digital Transformation; ABI Research: New York, NY, USA, 2018; Available online: https://resources.ptc.com/c/abi-digital-transformation (accessed on 10 March 2020).

- Minturn, A.; Lomax, M.; Streatfield, P. A practical roadmap for the implantation of Industry 4.0. Bosch Rexroth Group, 2018. Available online: https://www.boschrexroth.com/en/gb/trends-and-topics/industry-4-0/industry-4-0-white-paper/industry-4-0-white-paper-1 (accessed on 10 March 2019).

- Wright, J. Roadmap to Industry 4.0 Laying Stable Foundations. Six Degrees: The Manufacturer. 2020. Available online: https://info.themanufacturer.com/roadmap-to-industry-40 (accessed on 10 March 2020).

- Bonneau, V.; Copigneaux, B.; IDATE; Probst, L.; Pedersen, B.; Lonkeu, O.-K. European Commission Directorate: Digital Transformation Monitor. 2017. Available online: https://ec.europa.eu/growth/tools-databases/dem/monitor/content/industry-40-aeronautics-iot-applications (accessed on 31 May 2019).

- Wójcicki, J. Industry 4.0: The Future of Smart Manufacturing. Industry 4.0 Magazine, 16 February 2018; p. 13. Available online: https://www.industry40summit.com/latest-news/magazine (accessed on 1 January 2019).

- Albert, M. Plain Talk about Data-Driven Manufacturing. Modern Machine Shop, August 2016. Available online: https://www.mmsonline.com/blog/post/plain-talk-about-data-driven-manufacturing (accessed on 31 May 2019).

- Savani, S. Industry Focus- Aerospace- How Organisations in the Sector can Capitalise on Industry 4.0. Industry 4.0 Magazine, 16 August 2018. Available online: https://www.industry40summit.com/latest-news/magazine(accessed on 1 January 2019).

- Cisco. The Ultimate Guide to Smart Manufacturing; Cisco, 2018; Available online: https://www.cisco.com/c/dam/m/digital/elq-cmcglobal/OCA/Assets/manufacturing/Cisco_Ultimate_Guide_to_Manufacturing.pdf?dtid=oemzzz000233&ccid=cc000101&ecid=2718&oid=ebkxa008584 (accessed on 3 March 2019).

- Schaeffer, E. Industry X. 0: Realizing Digital Value in Industrial Sectors, 1st ed.; Kogan Page: London, UK, 2017; ISBN 9783868816549. [Google Scholar]

- Perry, M.J. Evaluation and Choosing an IoT Platform, 1st ed.; O’Reilly: Sebastopol, CA, USA, 2016; ISBN 978-1-491-95203-0. [Google Scholar]

- Pittman, K. The IIoT in a Nutshell. In Advanced Manufacturing, Engineering. 2017. Available online: https://www.engineering.com/AdvancedManufacturing/ArticleID/15282/The-IIoT-in-a-Nutshell.aspx (accessed on 1 May 2019).

- (IIC PUB:G1:V1.80:20170131). The Industrial Internet of Things Volume G1: Reference Architecture. 2017.

- Weyrich, M.; Ebert, C. Reference Architectures for the Internet of Things. IEEE Softw. 2016, 33, 112–116. [Google Scholar] [CrossRef]

- BMWI. Reference Architectural Model Industrie 4.0 (RAMI4.0) In A Reference Framework For. Digitalisation Platform Industrie 4.0 Berlin, Germany. 9 August 2018.

- (ISO/IEC 30141:2018). Internet of Things (IoT)–Reference Architecture. 2018.

- Papakostas, N.; O’Connor, J.; Byrne, G. Internet of Things in Manufacturing-Applications Areas, Challenges and Outlook. In Proceedings of the International Conference on Information Society (i-Society), Dublin, Ireland, 10–13 October 2016; pp. 126–131. [Google Scholar]

- Sabella, R.; Thuelig, A.; Carrozza, M.C.; Ippolito, M. Industrial Automation enabled by Robotics, Machine Intelligence and 5G.; ERICSSON Technology Review. ERICSSON, February 2018. Available online: https://www.ericsson.com/assets/local/publications/ericsson-technology-review/docs/2018/etr_2018-02_robotics_web-feb18.pdf (accessed on 10 March 2020).

- Hawkridge, G.; Hernandez, M.P.; Silva, L.d.; Terrazas, G.; Tlegenov, Y.; McFarlane, D.; Thorne, A. Trying Together Solutions for Digital Manufacturing: Assessment of Connectivity Technologies & Approaches. In Proceedings of the 4th IEEE International Conference on Emerging Technologies and Factory Automation (ETFA), Zaragoza, Spain, 10 September 2019; pp. 1383–1387. [Google Scholar]

- Gulliford, S. We Need to Talk about this IoT. Genserv, 2018. Available online: https://www.gemserv.com/we-need-to-talk-about-this-iot-thing (accessed on 5 May 2019).

- (EU 2016/679). General Data Protection Regulation (GDPR); EU: Brussels, Belgium, 2016.

- Network & Information Systems (NIS) Guidance. 2018. Available online: https://www.gov.uk/government/collections/nis-directive-and-nis-regulations-2018 (accessed on 3 March 2019).

- Department for Digital, Culture Media & Sport. Secure by Design: Improving the Cyber Security of Consumer Internet of Things Report; Department for Digital, Culture Media & Sport: London, UK, 2017. [Google Scholar]

- (IIC PUB:G4:V1.0:PB:20160926). The Industrial Internet of Things Volume G4: Security Framework. 2016.

- Gurela, T. Industry 4.0 and the Factory Network. I4.0 Today (1) February 2018. Available online: http://i40today.com/magazines/ (accessed on 1 May 2019).

- Cisco. The Journey to IoT Value (Challenges, Breakthroughs, and Best Practices); Connected Futures-Executive Insights. 2017. Available online: https://www.slideshare.net/CiscoBusinessInsights/journey-to-iot-value-76163389 (accessed on 1 May 2019).

- Schuldenfrei, M. Horizontal and Vertical Integration in Industry 4.0. Manufacturing Business Technology: Business Intelligence. 2019. Available online: https://www.mbtmag.com/business-intelligence/article/13251083/horizontal-and-vertical-integration-in-industry-40 (accessed on 10 April 2020).

- (ANSI/ISA-95). The International Society of Automation (ISA), 2010.

- Davidson, M.; Goodwin, G. The Evolution of Manufacturing Software Platforms: Past, Present, and Future; LNS Research: Cambridge, MA, USA, 2013; Available online: https://www.lnsresearch.com/research-library/research-articles/the-evolution-of-manufacturing-software-platforms-past-present-and-future (accessed on 5 May 2020).

- Radovilsky, Z. Enterprise Resource Planning (ERP). In The Internet Encyclopedia; Hossein, B., Ed.; John Wiley & Sons: Hoboken, NJ, USA, 2004; Volume 1, p. 707. ISBN 9780471222026. [Google Scholar]

- Fetterman, P. Plant Data and Connectivity-Strategic Building Blocks for Industrial Transformation; LNS Research, ptc. August 2019. Available online: https://www.ptc.com/en/resources/iiot/white-paper/lns-plant-data-and-connectivity (accessed on 5 May 2020).

- Lav, Y. Industry 4.0: Harnessing the Power of ERP and MES Integration. Industry Week, 2017. Available online: https://www.industryweek.com/supply-chain-technology/industry-40-harnessing-power-erp-and-mes-integration (accessed on 1 August 2019).

- Cline, G. The Challenges and Opportunities of OT & IT Integration. Aberdeen, October 2017. Available online: https://www.aberdeen.com/opspro-essentials/challenges-opportunities-ot-integration/ (accessed on 1 August 2019).

- Relayr. Build vs Buy. Relayr, 2019. Available online: https://relayr.io/buildorbuy/ (accessed on 2 May 2020).

- Immerman, G. Optimizing Equipment Utilization-A case study Interview with Wiscon Products. Machinnemetrics, 2019. Available online: https://www.machinemetrics.com/wiscon-products-case-study (accessed on 2 May 2020).

- Forcam. GKN Aerospace 20% Reduction In Operation Time. Forcam GmnH, 2020. Available online: https://forcam.com/en/media-category/success-stories-en/ (accessed on 2 May 2020).

- Inray_Industriessoftware. OPC Router-The communication Middleware. Available online: https://www.opc-router.com/ (accessed on 15 April 2020).

- MAC-Solutions. KEPServerEX by Kepware: The World’s Best-Selling OPC Server. Available online: https://www.mac-solutions.net/en/products/industrial-data-comms/opc-communications-suite (accessed on 15 April 2020).

- PTC. Woodward’s Digital Transformation, PTC: Thingworks case studies. 2018. Available online: https://www.ptc.com/en/case-studies/woodward (accessed on 5 June 2020).

- InVima. Coflax. Available online: https://invma.co.uk/case-studies/Colfax (accessed on 15 April 2020).

- Marr, B. Big Data: The 5 vs Everyone Must Know. Linkedin, 2014. Available online: https://www.linkedin.com/pulse/20140306073407-64875646-big-data-the-5-vs-everyone-must-know/ (accessed on 14 April 2020).

- Cisco. Kinetic Edge & Fog Processing Module White Paper. Cisco, 2018. Available online: https://www.cisco.com/c/dam/en/us/solutions/collateral/internet-of-things/cisco-kinetic-efm-whitepaper.pdf (accessed on 5 June 2019).

- Angel, M. Manufacturing KPIs: 34 Key Production Metrics You Should Know; In Manufacturing, Tulip. 2018. Available online: https://tulip.co/blog/manufacturing/how-to-calculate-34-manufacturing-kpis/#:~:text=The%20goal%20of%20this%20post%20is%20to%20explain,the%20result%20by%20100%20to%20calculate%20asset%20utilization (accessed on 1 October 2020).

- Hughes, A. Manufacturing Metrics In An IoT World-Measuring The Progress of The Industrial Internet of Things; MESA International and LNS Research. GE Digital, 2016. Available online: https://www.ge.com/digital/sites/default/files/download_assets/LNS_Research-Manufacturing-Metrics-the-Matter-2016-GE-Digital.pdf (accessed on 1 August 2019).

- Hahn, T. Industrial AI applications. In Proceedings of the Industrie 4.0 Forum, HANNOVER MESSE: Big Data Value Association (BDV). April 2019. Available online: http://www.bdva.eu/sites/default/files/BDVA_SMI_Discussion_Paper_Web_Version.pdf (accessed on 30 April 2019).

- Bregulla, V. Industrial Companies See the Massive Value of AI in the Coming Decade. Hewlett Packard (HP), 2019. Available online: https://www.hpe.com/us/en/newsroom/blog-post/2018/09/industrial-companies-see-the-massive-value-of-ai-in-the-coming-decade.html (accessed on 5 May 2019).

- Accenture. Manufacturing the Future: Artificial Intelligence Will Fuel the Next Wave of Growth for Industrial Equipment Company. Accenture, 2019. Available online: https://www.accenture.com/t20180327T080053Z__w__/us-en/_acnmedia/PDF-74/Accenture-Pov-Manufacturing-Digital-Final.pdf#zoom=50 (accessed on 12 March 2020).

- Rolls-Royce. Predictive Maintenance. 2020. Available online: https://www.rolls-royce.com/country-sites/india/discover/2018/data-insight-action-latest/module-navigation/leveraging-robust-data-and-actionable-insights/predictive-maintenance.aspx (accessed on 12 March 2020).

- Seifert, R.W.; Markoff, R. How Industry 4.0 is Transforming the Aircraft Industry. International Institute for Management Development (IMD), 2019. Available online: https://www.imd.org/contentassets/42912243085149818f87ba1945858dfa/tc073-19-print.pdf (accessed on 12 March 2020).

- InVima. Unleashing the Smart Factory. InVMA Limited, 2019. Available online: https://www.invma.co.uk/unleashing-the-smart-factory (accessed on 5 May 2019).

- Kopanias, G. Production Planning & Scheduling powered by Artificial Intelligence. In Proceedings of the Internet of Manufacturing, Farnborough, UK, 15 May 2019; Flexciton: London, UK, 2019. [Google Scholar]

- Plutoshift. Breaking Ground on Implementing AI: Instituting Strategic AI Programs-Moving from Promise to Productivity. Plutoshift, 2019. Available online: https://plutoshift.com/resources/whitepapers/ (accessed on 2 February 2020).

- Khalifeh, A.; Darabkh, K.A.; Khasawneh, A.M.; Alqaisieh, I.; Salameh, M.; AlAbdala, A.; Alrubaye, S.; Alassaf, A.; Al-HajAli, S.; Al-Wardat, R.; et al. Wireless Sensor Networks for Smart Cities: Network Design, Implementation and Performance Evaluation. Electronics 2021, 10, 218. [Google Scholar] [CrossRef]

- Froiz-Míguez, I.; Lopez-Iturri, P.; Fraga-Lamas, P.; Celaya-Echarri, M.; Blanco-Novoa, Ó.; Azpilicueta, L.; Falcone, F.; Fernández-Caramés, T.M. Design, Implementation, and Empirical Validation of an IoT Smart Irrigation System for Fog Computing Applications Based on LoRa and LoRaWAN Sensor Nodes. Sensors 2020, 20, 6865. [Google Scholar] [CrossRef]

- Rosero-Montalvo, P.D.; Erazo-Chamorro, V.C.; López-Batista, V.F.; Moreno-García, M.N.; Peluffo-Ordóñez, D.H. Environment Monitoring of Rose Crops Greenhouse Based on Autonomous Vehicles with a WSN and Data Analysis. Sensors 2020, 20, 5905. [Google Scholar] [CrossRef]

- García, L.; Parra, L.; Jimenez, J.M.; Parra, M.; Lloret, J.; Mauri, P.V.; Lorenz, P. Deployment Strategies of Soil Monitoring WSN for Precision Agriculture Irrigation Scheduling in Rural Areas. Sensors 2021, 21, 1693. [Google Scholar] [CrossRef]

- Baire, M.; Melis, A.; Lodi, M.B.; Dachena, C.; Fanti, A.; Farris, S.; Pisanu, T.; Mazzarella, G. WSN Hardware for Automotive Applications: Preliminary Results for the Case of Public Transportation. Electronics 2019, 8, 1483. [Google Scholar] [CrossRef] [Green Version]

- Baire, M.; Melis, A.; Lodi, M.B.; Tuveri, P.; Dachena, C.; Simone, M.; Fanti, A.; Fumera, G.; Pisanu, T.; Mazzarella, G. A Wireless Sensors Network for Monitoring the Carasau Bread Manufacturing Process. Electronics 2019, 8, 1541. [Google Scholar] [CrossRef] [Green Version]

- Krima, S.; Hedberg, T.; Feeney, A.B. Securing the Digital Threat for Smart Manufacturing: A Reference Model. for Blockchain-Based Product Data Traceability; National Institute of Standards and Technology (NIST), U.S. Department of Commerce: Washington, DC, USA, 2019. [Google Scholar]

- Bellamy, S. What Is Blockchain Technology and How Is It Changing the Manufacturing Industry? The Manufacturer, 2019. Available online: https://www.themanufacturer.com/articles/blockchain-technology-changing-manufacturing-industry/ (accessed on 2 July 2020).

- Dutta, T. Build an Integrated 360-Degree View of the Customer. IBM, 2014. Available online: https://www.ibmbigdatahub.com/blog/build-integrated-360-degree-view-customer (accessed on 14 April 2020).

- Riley, S. Fundamentals of the digital supply chain. SoftwareAG, June 2018. Available online: https://info.softwareag.com/Fundamentals-of-Supply-Chain-Management.html (accessed on 2 May 2019).

- Tao, F.; Qi, Q.; Wang, L.; Nee, A.Y.C. Digital Twins and Cyber–Physical Systems toward Smart Manufacturing and Industry 4.0; Correlation and Comparison. Engineering 2019, 5, 653–661. [Google Scholar] [CrossRef]

- Qi, Q.; Tao, F. Digital Twin and Big Data Towards Smart Manufacturing and Industry 4.0: 360 Degree Comparison. IEEE Access 2018, 6, 3585–3593. [Google Scholar] [CrossRef]

- GE. The Digital Twin–Compressing Time-to-Value for Digital Industrial Companies; General Electric. GE Digital, 2018. Available online: https://www.ge.com/digital/lp/digital-twin-compressing-time-value-digital-industrial-companies (accessed on 6 April 2020).

- ABIresearch. The Power of IoT Platforms for Building AR Applications. ABI Research, 2017. Available online: https://invma.co.uk/application/files/9715/6690/2754/WP_ABI-Research_The-Power-of-IoT-Platforms-for-Building-AR-Applications_EN.pdf (accessed on 6 April 2020).

- Hunter, L. Augmented Reality for the Industrial Enterprise; O’Reilly: Sebastopol, CA USA, 2017. [Google Scholar]

- Pistrui, D. Robotics: Technology in Industry Report; Kampe, N., Ed.; Automation Alley: Troy, MI, USA, 2018; Available online: https://automationalley.com/techreport (accessed on 18 October 2020).

- Sala, A.L. Additive Manufacturing & Advanced Materials: Technology in Industry Report; Kampe, N., Ed.; Automation Alley: Troy, MI, USA, 2018; Available online: https://automationalley.com/techreport (accessed on 18 October 2020).

- Tyrrell, M. 5G networked aerospace production. In Features, Aerospace Manufacturing. 2019. Available online: https://www.aero-mag.com/5g-networked-aerospace-production/ (accessed on 20 October 2020).

- Make UK. Bouncing Back Smarter-Innovation Monitor 2020. Make UK, October 2020. Available online: https://www.makeuk.org/insights/reports/innovation-monitor-2020 (accessed on 18 October 2020).

- The Growth Company. Made Smarter. Available online: https://www.madesmarter.uk/ (accessed on 4 January 2020).

- LCR4.0. LCR4.0 START Strategies for Digital Adoption. Available online: https://lcr4.uk/project/lcr4-0-start/ (accessed on 18 October 2020).

- MTC. Digital Manufacturing Accelerator (DMA). Available online: http://www.the-mtc.org/event-items/digital-manufacturing-accelerator (accessed on 18 October 2020).

- McFarlane, D.; Ratchev, S.; Thorne, A.; Parlikad, A.K.; de Silva, L.; Schönfuß, B.; Hawkridge, G.; Terrazas, G.; Tlegenov, Y. Digital Manufacturing on a Shoestring: Low Cost Digital Solutions for SMEs. In Proceedings of the Service Oriented, Holonic and Multi-agent Manufacturing Systems for Industry of the Future, SOHOMA 2019, Valencia, Spain, 3–4 October 2019; Springer: Cham, Switzerland, 2020; pp. 40–51. [Google Scholar]

- European Factories of The Future Research Association (EFFRA). Factories of The Future Roadmap. Available online: https://www.effra.eu/factories-future-roadmap (accessed on 2 February 2021).

- European Technology Chamber. Advanced Manufacturing Council. Available online: https://eutec.org/tec-councils/advanced-manufacturing/ (accessed on 2 February 2021).

- Barriball, E.; George, K.; Marcos, I.; Radtke, P. Jump-Starting Resilient and Reimagined Operations; McKinsey & Company: New York, NY, USA, 2020; Available online: https://www.mckinsey.com/business-functions/operations/our-insights/jump-starting-resilient-and-reimagined-operations (accessed on 18 October 2020).

- Pwc. COVID-19: What it Means for Industrial Manufacturing. Pwc, 2020. Available online: https://www.pwc.com/us/en/library/covid-19/coronavirus-impacts-industrial-manufacturing.html (accessed on 18 October 2020).

- Countryman, T.; Rasmus, R.; McKinney, J.; Diaz, M.F.; COVID-19: Adapting manufacturing operations to new normal. In Insights- Covid-19- Supply Chain & Operations: Accenture. 2020. Available online: https://www.accenture.com/gb-en/insights/consulting/coronavirus-supply-chain-manufacturing-operations (accessed on 18 October 2020).

- Rao, S. The Three Rs for the Next Normal; Manufacturing Leadership Council & National Association of Manufacturers: Manufacturing Leadership Journal; September 2020; Available online: https://www.manufacturingleadershipcouncil.com/2020/09/30/the-three-rs-for-the-next-normal/ (accessed on 18 October 2020).

- KTN. KTP Helps Embed Industry 4.0 Techniques to Transform Business Visibility and Efficiency; Case Study: KTN; June 2020; Available online: https://www.ktp-uk.org/case-study/ktp-helps-embed-industry-4-0-techniques-to-transform-business-visibility-and-efficiency-for-beverston-engineering/ (accessed on 1 June 2020).

- Made Smarter. Beverston Engineering Building A Brighter Future Case Study. Made Smarter, 2021. Available online: https://www.madesmarter.uk/resources/case-study-beverston-engineering (accessed on 15 January 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sufian, A.T.; Abdullah, B.M.; Ateeq, M.; Wah, R.; Clements, D. Six-Gear Roadmap towards the Smart Factory. Appl. Sci. 2021, 11, 3568. https://doi.org/10.3390/app11083568

Sufian AT, Abdullah BM, Ateeq M, Wah R, Clements D. Six-Gear Roadmap towards the Smart Factory. Applied Sciences. 2021; 11(8):3568. https://doi.org/10.3390/app11083568

Chicago/Turabian StyleSufian, Amr T., Badr M. Abdullah, Muhammad Ateeq, Roderick Wah, and David Clements. 2021. "Six-Gear Roadmap towards the Smart Factory" Applied Sciences 11, no. 8: 3568. https://doi.org/10.3390/app11083568