Investigating Industry 5.0 and Its Impact on the Banking Industry: Requirements, Approaches and Communications

Abstract

:1. Introduction

- -

- What are the indicators of industrial revolution 5.0 for successful entry into Banking 5?

- -

- What connection can be found between the identified indicators?

- -

- Which indicators should be focused on for successful word Banking 5.0?

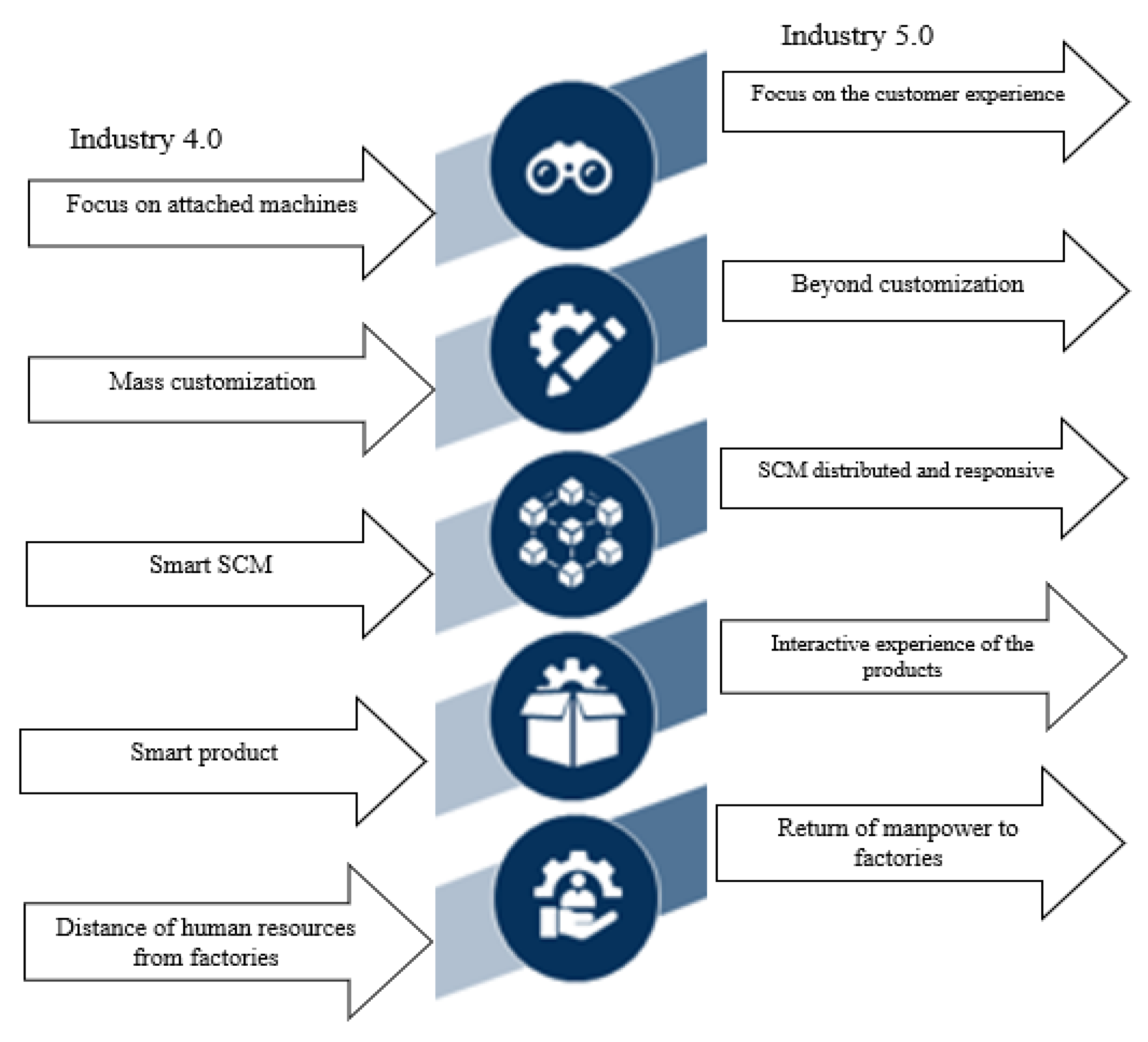

The Idea of Industry 5.0

2. Theoretical Background

3. Research Methodology

- 1.

- Structural Self-Interactive Matrix Formation (SSIM)

- V: The factor of row i causes the factor of column j to be realized.

- A: The factor of column j causes the factor of row i to be realized.

- X: Both row and column factors cause each other to be realized (factors i and j have a two-way relationship)

- O: There is no relationship between the row and column factor.

- 2.

- Obtaining the initial achievement matrix

- If the symbol of house ij is the letter V, the number one is placed in that house and the number zero is placed in the symmetrical house.

- If the symbol of house ij is the letter A, the number zero is placed in that house and the number one is placed in the symmetrical house.

- If the symbol of house ij is the letter X, the number one is placed in that house and the number one is placed in the symmetrical house.

- If the symbol of house ij is the letter O, the number zero is placed in that house and the number zero is placed in the symmetrical house.

- 3.

- Compatibility of access matrix

- 4.

- Determining the level of variables

- 5.

- Drawing the network of interactions

4. Analysis

5. Discussion, Conclusions and Limitation and Industry Future

5.1. Discussion

5.2. Conclusions

5.3. Limitation

5.4. The Future of the Banking Industry

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

- Research questionnaires

- Dear expert

- As a banking system expert, we ask you to answer the questions of this research carefully. The research results will be used only for scientific development:

- General questions:

- Country:

- Gender:

- Education:

- Work experience:

- Expert Questions:

- Tip: How to answer questions and scoring pattern

- Specify the effect of the elements in each row on the elements in the column.

- If the variable i affects j, enter a V.

- If the variable j affects i, enter the symbol A.

- If both variables i and j affect each other, enter an X.

- If none of them affect each other, enter O.

- Note: Please fill only the matrix above the original diameter.

- Determine the type of relationships of the following variables based on the signs in the guide:

| Variables | KHS | TMBE | HEMS | KER | PZM | EMJ | RNC | RAM | PNM | RA | SEC | BTM | STC | MB |

| KHS | ||||||||||||||

| TMBE | ||||||||||||||

| HEMS | ||||||||||||||

| KER | ||||||||||||||

| PZM | ||||||||||||||

| EMJ | ||||||||||||||

| RNC | ||||||||||||||

| RAM | ||||||||||||||

| PNM | ||||||||||||||

| RA | ||||||||||||||

| SEC | ||||||||||||||

| BTM | ||||||||||||||

| STC | ||||||||||||||

| MB |

- Reduce the heavy costs of having a branch = KHS Health and safety of employees = SEC

- Redesign work with human element optimization = TMBE Improve the customer experience = BTM

- Human-machine cooperation at different levels= HEMS

- Stability and continuity of the workforce = STC

- Human creativity in robotic production= KER

- Health Care’s = MB

- Environmental sustainability = PZM

- Create new jobs = EMJ

- Labor welfare = RNC

- Excellent customer relationship = RAM

- Respond to the changing needs of customers = PNM

- Ethical behavior = RA

References

- Maddikunta, P.K.R.; Pham, Q.-V.; B, P.; Deepa, N.; Dev, K.; Gadekallu, T.R.; Ruby, R.; Liyanage, M. Industry 5.0: A survey on enabling technologies and potential applications. J. Ind. Inf. Integr. 2021, 26, 100257. [Google Scholar] [CrossRef]

- Nethravathi, P.S.R.; Bai, G.V.; Spulbar, C.; Suhan, M.; Birau, R.; Calugaru, T.; Hawaldar, I.T.; Ejaz, A. Business intelligence appraisal based on customer behaviour profile by using hobby-based opinion mining in India: A case study. Econ. Res.-Ekon. Istraživanja 2020, 33, 1889–1908. [Google Scholar] [CrossRef]

- Motienko, A. Integration of information and communication system for public health data collection and intelligent transportation system in large city. Transp. Res. Procedia 2020, 50, 466–472. [Google Scholar] [CrossRef]

- Brettel, M.; Friederichsen, N.; Keller, M.; Rosenberg, M. How virtualization, decentralization and network building change the manufacturing Landscape. Int. J. Mech. Ind. Sci. Eng. 2014, 8, 37–44. [Google Scholar]

- Hermann, M.; Pentek, T.; Otto, B. Design Principles for Industrie 4.0 Scenarios. In Proceedings of the 2016 49th Hawaii International Conference on System Sciences (HICSS), Koloa, HI, USA, 5–8 January 2016; pp. 3928–3937. [Google Scholar]

- Mehdiabadi, A.; Tabatabeinasab, M.; Spulbar, C.; Karbassi Yazdi, A.; Birau, R. Are We Ready for the Challenge of Banks 4.0? Designing a Roadmap for Banking Systems in Industry 4.0. Int. J. Financ. Stud. 2020, 8, 32. [Google Scholar] [CrossRef]

- Jamal, A.A.; Majid, A.A.M.; Konev, A.; Kosachenko, T.; Shelupanov, A. A review on security analysis of cyber physical systems using Machine learning. Mater. Today Proc. 2021, in press.

- Sung, Y.A.; Kim, K.W.; Kwon, H.J. Big Data analysis of Korean travelers’ behavior in the post-COVID-19 Era. Sustainability 2021, 13, 310. [Google Scholar] [CrossRef]

- Soo, A.; Ali, S.M.; Shon, H.K. 3D printing for membrane desalination: Challenges and future prospects. Desalination 2021, 520, 115366. [Google Scholar] [CrossRef]

- Parmar, H.; Khan, T.; Tucci, F.; Umer, R.; Carlone, P. Advanced robotics and additive manufacturing of composites: Towards a new era in Industry 4.0. Mater. Manuf. Processes 2022, 37, 483–517. [Google Scholar] [CrossRef]

- Yu, Q.; Qin, Z.; Ji, F.; Chen, S.; Luo, S.; Yao, M.; Wu, X.; Liu, W.; Sun, X.; Zhang, H.; et al. Low-temperature tolerant strain sensors based on triple crosslinked organohydrogels with ultrastretchability. Chem. Eng. J. 2021, 404, 126559. [Google Scholar] [CrossRef]

- Bryceson, K.P.; Leigh, S.; Sarwar, S.; Grøndahl, L. Affluent Effluent: Visualizing the invisible during the development of an algal bloom using systems dynamics modelling and augmented reality technology. Environ. Model. Softw. 2022, 147, 105253. [Google Scholar] [CrossRef]

- Vinoth, S.; Vemula, H.L.; Haralayya, B.; Mamgain, P.; Hasan, M.F.; Naved, M. Application of cloud computing in banking and e-commerce and related security threats. Mater. Today Proc. 2022, 51, 2172–2175. [Google Scholar] [CrossRef]

- Srinivasan, S.; Batra, R.; Chan, H.; Kamath, G.; Cherukara, M.J.; Sankaranarayanan, S.K. Artificial Intelligence-Guided De Novo Molecular Design Targeting COVID-19. ACS Omega 2021, 6, 12557–12566. [Google Scholar] [CrossRef] [PubMed]

- Koç, P.; Gülmez, A. Analysis of relationships between nanotechnology applications, mineral saving and ecological footprint: Evidence from panel fourier cointegration and causality tests. Resour. Policy 2021, 74, 102373. [Google Scholar] [CrossRef]

- Gorodetsky, V.; Larukchin, V.; Skobelev, P. Conceptual model of digital platform for enterprises of industry 5.0. In International Symposium on Intelligent and Distributed Computing; Springer: Cham, Switzerland, 2019; pp. 35–40. [Google Scholar]

- Kagermann, H. Change through digitization—value creation in the age of industry 4.0. In Management of Permanent Change; Springer: Wiesbaden, Germany, 2015; pp. 23–45. [Google Scholar] [CrossRef]

- Schwab, K. The Fourth Industrial Revolution, 1st ed.; World Economic Forum: CH-1223 Cologny/Geneva Switzerland, 2017. [Google Scholar]

- Xu, X.; Lu, Y.; Vogel-Heuser, B.; Wang, L. Industry 4.0 and Industry 5.0—Inception, conception and perception. J. Manuf. Syst. 2021, 61, 530–535. [Google Scholar] [CrossRef]

- Breque, M.; De Nul, L.; Petridis, A. Industry 5.0: Towards a Sustainable, Human-Centric and Resilient European Industry; Publications Office of European Commission: Brussels, Belgium, 2021. [Google Scholar] [CrossRef]

- European Economic and Social Committee. Industry 5.0. Available online: https://ec.europa.eu/info/research-and-innovation/research-area/industrial-research-and-innovation/industry-50_en (accessed on 28 September 2021).

- Tange, K.; De Donno, M.; Fafoutis, X.; Dragoni, N. A systematic survey of industrial Internet of Things security: Requirements and fog computing opportunities. IEEE Commun. Surv. Tutor. 2020, 22, 2489–2520. [Google Scholar] [CrossRef]

- Nahavandi, S. Industry 5.0—A human-centric solution. Sustainability 2019, 11, 4371. [Google Scholar] [CrossRef] [Green Version]

- Shahabi, V.; Azar, A.; Faezy Razi, F.; Fallah Shams, M.F. Analysis of factors affecting the development of the banking service supply chain in the Industry 4.0. Manag. Res. Iran. 2022, in press.

- Broo, D.G.; Kaynak, O.; Sait, S.M. Rethinking engineering education at the age of industry 5.0. J. Ind. Inf. Integr. 2022, 25, 100311. [Google Scholar]

- Doyle-Kent, M.; Kopacek, P. Industry 5.0: Is the Manufacturing Industry on the Cusp of a New Revolution? In Proceedings of the International Symposium for Production Research 2019; Springer: Cham, Switzerland, 2019; pp. 432–441. [Google Scholar]

- Paschek, D.; Mocan, A.; Draghici, A. Industry 5.0-The expected impact of next Industrial Revolution. In Proceedings of the Thriving on Future Education, Industry, Business, and Society, Proceedings of the Make Learn and TIIM International Conference, Piran, Slovenia, 15–17 May 2019; pp. 15–17. [Google Scholar]

- Huxley, T.H. The Darwinian Hypothesis; Amazon Digital Press LLC: Bellevue, WA, USA, 2018. [Google Scholar]

- Shahabi, V.; Razi, F.F. Modeling the effect of electronic banking expansion on profitability using neural networks and system dynamics approach. Qual. Res. Financ. Mark. 2019, 11, 197–210. [Google Scholar] [CrossRef]

- Nicoletti, B. Industry 5.0 and Banking 5.0. In Banking 5.0. Palgrave Studies in Financial Services Technology; Palgrave Macmillanl: Cham, Switzerland, 2021. [Google Scholar] [CrossRef]

- Polop, F.; Levis, S.; Pini, N.; Enría, D.; Polop, J.; Provensal, M.C. Factors associated with hantavirus infection in a wild host rodent from Cholila, Chubut Province, Argentina. Mamm. Biol. 2018, 88, 107–113. [Google Scholar] [CrossRef]

- David, L.; Kaulihowa, T. The Impact of E-Banking on Commercial Banks’ Performance in Namibia. Int. J. Econ. Financ. Res. 2018, 4, 313–321. [Google Scholar]

- Meher, B.K.; Hawaldar, I.T.; Mohapatra, L.; Spulbar, C.; Birau, R.; Rebegea, C. The impact of digital banking on the growth of Micro, Small and Medium Enterprises (MSMEs) in India: A case study. Bus. Theory Pract. 2021, 22, 18–28. [Google Scholar] [CrossRef]

- Frost, J.; Gambacorta, L.; Huang, Y.; Shin, H.S.; Zbinden, P. BigTech and the Changing Structure of Financial Intermediation; BIS Working Papers No 779; Bank for International Settlements: Basel, Switzerland, 2019; Available online: https://www.bis.org/publ/work779.pdf (accessed on 3 January 2022)BIS Working Papers No 779.

- Özdemir, V.; Hekim, N. Birth of industry 5.0: Making sense of big data with artificial intelligence, “the internet of things” and next-generation technology policy. Omics A J. Integr. Biol. 2018, 22, 65–76. [Google Scholar] [CrossRef] [PubMed]

- Haleem, A.; Javaid, M. Industry 5.0 and its applications in orthopaedics. J. Clin. Orthop. Trauma 2019, 10, 807–808. [Google Scholar] [CrossRef] [PubMed]

- Demir, K.A.; Döven, G.; Sezen, B. Industry 5.0 and Human-Robot Co-working. Procedia Comput. Sci. 2019, 158, 688–695. [Google Scholar] [CrossRef]

- Johansson, H. Profinet Industrial Internet of Things Gateway for the Smart Factory. Master’s Thesis, Chalmers University of Technology, Gothenburg, Sweden, 2017. [Google Scholar]

- Gotfredsen, S. Bringing back the human touch: Industry 5.0 concept creating factories of the future. Manuf. Mon. Dostęp 2016, 11, 2018. [Google Scholar]

- Østergaard, E.H. Industry 5.0—Return of the Human Touch. 2016. Available online: https://blog.universal-robots.com/industry-50-return-of-the-human-touch (accessed on 3 January 2022).

- Rendall, M. The New Terminology: CRO and Industry 5.0. 2017. Available online: https://www.automation.com/automation-news/article/the-new-terminology-cro-and-industry-50 (accessed on 3 January 2022).

- Soni, R.R.; Hawaldar, I.T.; Vaswani, A.S.; Spulbar, C.; Birau, R.; Minea, E.L.; Mendon, S.; Criveanu, M.M. Predicting financial distress in the Indian textile sector. Ind. Text. 2021, 72, 503–508. [Google Scholar] [CrossRef]

- Cappiello, A. The digital (r)evolution of insurance business models. Am. J. Econ. Bus. Adm. 2020, 12, 1–3. [Google Scholar] [CrossRef]

- Gassmann, O.; Frankenberger, K.; Csik, M. The St. Gallen Business Model Navigator. 2014. Available online: www.im.ethz.ch/education/HS13/MIS13/Business_Model_Navigator.pdf (accessed on 3 January 2022).

- Schlick, J.; Stephan, P.; Loskyll, M.; Lappe, D. Industries 4.0 in der praktischenAnwendung. In Industrie 4.0 to Produktion, Automatisierung und Logistik: Anwendung. Technologien. Migration; Bauernhansl, T., Hompel, M.T., Vogel-Heuser, B., Eds.; Springer: Wiesbaden, Germany, 2014; pp. 57–84. [Google Scholar]

- Roeder, J.; Cardona, D.R.; Palmer, M.; Werth, O.; Muntermann, J.; Breitner, M.H. Make or break: Business model determinants of FinTech venture success. In Proceedings of the Multikonferenz Wirtschaftsinformatik, Lüneburg, Germany, 6–9 March 2018. [Google Scholar]

- Alkhowaiter, W.A. Digital payment and banking adoption research in Gulf countries: A systematic literature review. Int. J. Inf. Manag. 2020, 53, 102102. [Google Scholar] [CrossRef]

- Farsi, M.; Erkoyuncu, J.A. Industry 5.0 Transition for an Advanced Service Provision. In Proceedings of the The 10th International Conference on Through-Life Engineering Services 2021 (TESConf 2021), Twente, The Netherlands, 16–17 November 2021. [Google Scholar] [CrossRef]

- Aslam, F.; Aimin, W.; Li, M.; Ur Rehman, K. Innovation in the era of IoT and industry 5.0: Absolute innovation management (AIM) framework. Information 2020, 11, 124. [Google Scholar] [CrossRef] [Green Version]

- Jünger, M.; Mietzner, M. Banking goes digital: The adoption of FinTech services by German households. Financ. Res. Lett. 2020, 34, 101260. [Google Scholar] [CrossRef]

- Al Faruqi, U. Future Service in Industry 5.0. J. Sist. Cerdas 2019, 2, 67–79. [Google Scholar] [CrossRef]

- Khanboubi, F.; Boulmakoul, A.; Tabaa, M. Impact of digital trends using IoT on banking processes. Procedia Comput. Sci. 2019, 151, 77–84. [Google Scholar] [CrossRef]

- Mbama, C. Digital Banking Services, Customer Experience and Financial Performance in UK Banks. Doctoral Dissertation, Sheffield Hallam University, Sheffield, UK, 2018. [Google Scholar]

- Ozkeser, B. Lean innovation approach in Industry 5.0. Eurasia Proc. Sci. Technol. Eng. Math. 2018, 2, 422–428. [Google Scholar]

- Skobelev, P.O.; Borovik, S.Y. On the way from Industry 4.0 to Industry 5.0: From digital manufacturing to digital society. Industry 4.0 2017, 2, 307–311. [Google Scholar]

- Sonono, B.; Ortstad, R. The Effects of the Digital Transformation Process on Banks’ Relationship with Customers: Case Study of a Large Swedish Bank. Master’s Thesis, Department of Business Studies Uppsala University, Uppsala, Sweden, 2017. Available online: https://www.diva-portal.org/smash/get/diva2:1115984/FULLTEXT01.pdf (accessed on 3 January 2022).

- Kumar, S.; Shukla, G.P.; Dubey, R.K.D. Barriers to Financial Inclusion: An ISM Micmac Analysis. Int. J. Account. Financ. Rev. 2020, 5, 74–89. [Google Scholar] [CrossRef]

- Khalilzadeh, M.; Katoueizadeh, L.; Zavadskas, E.K. Risk identification and prioritization in banking projects of payment service provider companies: An empirical study. Front. Bus. Res. China 2020, 14, 15. [Google Scholar] [CrossRef]

- Owlia, M.; Roshani, K.; Abooei, M. Interpretive Structural Modeling (ISM) of Intellectual Capital Components. J. Ind. Eng. Int. 2020, 16, 41–56. [Google Scholar] [CrossRef]

- Hakimi, H.; Divandari, A.; Keimasi, M.; Haghighikaffash, M. Development of Retail Banking Customer Experience Creation Model from Manageable Factors by Organization Using Interpretive Structural Modeling (ISM). J. Bus. Manag. 2019, 11, 565–584. [Google Scholar]

- Rizvi, N.U.; Kashiramka, S.; Singh, S.; Sushil. A hierarchical model of the determinants of non-performing assets in banks: An ISM and MICMAC approach. Appl. Econ. 2019, 51, 3834–3854. [Google Scholar] [CrossRef]

- Longo, F.; Padovano, A.; Umbrello, S. Value-oriented and ethical technology engineering in Industry 5.0: A human-centric perspective for the design of the factory of the future. Appl. Sci. 2020, 10, 4182. [Google Scholar] [CrossRef]

- Bednar, P.M.; Welch, C. Socio-technical perspectives on smart working: Creating meaningful and sustainable systems. Inf. Syst. Front. 2020, 22, 281–298. [Google Scholar] [CrossRef] [Green Version]

- Mendon, S.; Nayak, S.; Nayak, R.; Spulbar, C.; Bai Gokarna, V.; Birau, R.; Anghel, L.C.; Stanciu, C.V. Exploring the sustainable effect of mediational role of brand commitment and brand trust on brand loyalty: An empirical study. Econ. Res.-Ekon. Istraživanja 2022, 1–23. [Google Scholar] [CrossRef]

- Camussone, P.F. Digital for job: The future of work—Solution. Digit. World 2017, 2, 1–15. [Google Scholar]

- Prognos, A.G. Digitalisierung in der Versicherungswirtschaft; Studie. Hg. v. vbw Vereinigung der BayerischenWirtschaft e. V.: München, Germany, 2017. [Google Scholar]

| Business Model Components | Traditional Bank | Digital Model | Banking 5.0 Model |

|---|---|---|---|

| Philosophy | Providing services | Digital Banking | Embedded banking, personalization, humanization |

| Suggested value | Limited services of the branch network and staff, performed at specific times, services depend on the qualifications and experience of the bank employee. | Unlimited, can go beyond the geographical location of the banking institution and have access 24 h a day | Instant Services, FinTech, Stability, + Services |

| Proximity | It takes time and money | Fast service, communication via SMS and email newsletter | Advanced CRM |

| Segmentation | Segmentation | Online, in the branch | A customer department |

| Location | However, flexibility is limited to a small number of service channels | Flexible and performed through any channel suitable for the customer | Online, mobile, chat robot |

| Platform, context, platform | Old systems | Digital and automatic | Multi-service platforms, artificial intelligence, API |

| Processes | Bureaucratic | Bureaucratic | Flexible and pure |

| Persons | The operator’s duties are performed by a bank employee | The operator’s tasks are performed by the bank customer or automatically | Human-Robot Collaboration, Robotics Consultants, RPA |

| Partnership | Limited to bank insurance | Unity and participation | Ecosystem, FinTech, Big Tech |

| Pricing | Top, taking into account bank costs for personnel and maintenance departments | Low service, often free | Pricing risk, machine learning |

| Payments | Key models are about staff and department maintenance | Articles are key to buying and maintaining servers and bundles | Pay as you go |

| Protection | physical protection | Password and PIN | cybersecurity |

| Row | Reference | Activity Area | Method | Results |

|---|---|---|---|---|

| 1 | [26] | Engineering knowledge in Industry 5.0 | Strategy development | To meet the challenges of the fifth industrial revolution, it was concluded that skills must overcome change, and the four sfollowing trategies must be developed:lifelong learning and interdisciplinary training (1), sustainability, flexibility, and design modules, (2)human-centered periods of practical data mastery and management (3), and human-agent interaction/machine/robot/computer experiences (4). |

| 2 | [3] | Powerful technologies and potential applications in Industry 5.0 | Questionnaire | In this work, survey-based training was provided forsupporting technologies and potential applications of Industry 5.0. This work began by defining some of the concepts of Industry 5.0 from the perspective of the industrial and academic communities, and then we discussed some of the potential applications of Industry 5.0 such as smart healthcare, cloud generation, supply chain management, production, etc. This was followed by a discussion about activating the keys. |

| 3 | [25] | The participation of robots with humans in banking in Industry 5.0 | Questionnaire | In the future banking system, Industry 5.0 will be the next industrial revolution and will originate from the industrial revolution 4.0. Collaborative robotics will play an important role in providing banking services by enabling humans and robots to work together. |

| 4 | [25] | Industry 5.0 | Interview | Industry 5.0 is a clear shift from mass automation to the capability enhancement process, and human resources move to the next level to achieve personalization processes by product customization. As a result, future questions need to be answered, such as: what skills are needed and should be developed, what kind of rules between human-machine interaction should be defined, and what effect AI may have, and what causes conflictbetween humans and artificial intelligence. |

| 5 | [6] | Banking in Industry 5.0 | Analytical | Banking 4.0 in Industry 4.0 creates an integrated value creation system that will be achieved through the cooperation of banks with industrial companies |

| 6 | [47] | Digital Banking | Meta-analysis | A review of 46 studies found that the best predictors for digital payment and banking acceptance in GCC countries are perceived trust, security, and utility. |

| 7 | [48] | Advanced Services in Industry 5.0 | Questionnaire | The goal of businesses is to continuously improve their service delivery to maintain customer satisfaction to maintain their competitive advantage in the industry. Industry 5.0, on the other hand, is characterized by a focus on industries working together to create shared value rather than producing goods and services for profit. This study examines the potential enablers for designing and deploying a highly effective enhancement. Providing advanced services refers to the provision of service solutions that meet the desired availability, functionality, and reliability in product-service contracts. The results of the research were presented in the form of a framework and a set of recommendations for the optimal future situation, with a phased timeline for the implementation of key enablers with a potential 2035 perspective to support the Industry 5.0 transition. |

| 8 | [49] | Innovation in the age of the Internet of Things and Industry 5.0 | Review | In this paper, absolute innovation management is proposed as a strategy to overcome the problem of business discontinuity. The Absolute Innovation Framework helps organizations to be reciprocal. This means that through this framework, organizations are in a position to explore and exploit and become more agile and responsive, and the period from idea generation to product launch is reduced, which is the key tool for sustainable competitive advantage. In addition, sheer innovation will increase productivity and, for the user/human-centered, increase the chances of business viability and product success. |

| 9 | [23] | Brain and machine collaboration in Industry 5.0 | Descriptive | Industry 5.0 will emerge when its three main elements (smart devices, intelligent systems, and intelligent automation) are fully integrated with the physical world in cooperation with human intelligence. The term “automation” describes autonomous robots as intelligent agents that work simultaneously with humans in the same workspace. Trust and confidence between the two parties will achieve promising performance, flawless production, minimal waste, and adjustable construction. Doing so will bring more people back to work and improve process efficiency. |

| 10 | [37] | Industry 5.0 | Descriptive | The next industrial revolution, regardless of its version, must be protected both in terms of information technology and environmental sustainability concerns. |

| 11 | [50] | Digital Banking | Questionnaire | A household’s level of trust and comfort with new technologies, financial literacy, and overall transparency affect its desire to change to Fintech. |

| 12 | [29] | The expansion of digital banking and the profitability of banks | Neural Networks/System Dynamics Approach | With the cooperation of Fintech, branch costs have been eliminated and this issue will greatly affect the profitability of banks. |

| 13 | [51] | Future Services in Industry 5.0 | Review | Society 5.0 is an idea that explains the revolution in people’s lives with the development of the fourth industrial revolution. The concept to be presented is how a revolution takes place in a society that uses both technology and the humanities. Some areas of work and needs are entering digitalization that uses artificial intelligence, big data, robotics, automation, machine learning, and the Internet of Things. |

| 14 | [16] | Digital platform for companies in Industry 5.0 | Review | This paper considers the concept of a digital ecosystem as an open, distributed, and self-organizing “system” of intelligent services capable of coordinating decisions and automatically resolving conflicts through multilateral negotiation. This classification suggests the services that should be provided by the advanced digital platform and describes their performance. This proves the leading role of multifactor systems as the basic software architecture and technology for the development of applications managed by the digital platform introduced. The results of the article can be used for many modern industrial companies. |

| 15 | [52] | Digital Banking | Questionnaire | The purpose of this paper is to present the various applications of the Internet of Things in finance and to analyze the impact of digital trends and the Internet of Things on the practice of a traditional bank. Gathering information on different types of digital processes showed that one processes will be highly affected. |

| 16 | [53] | Digital Banking | SEM | Digital banking increases the profitability of banks. Features such as perceived value, convenience, quality of service, and digital banking innovation are effective in improving the customer experience and cause customer satisfaction and loyalty and improve the financial performance of banks. |

| 17 | [54] | Lean Innovation Approach in Industry 5.0 | Review | A lean approach to innovation management makes Industry 5.0 applications smooth. Value management as a method in this approach is a good solution. In this paper, the processes of research and development projects in Industry 5.0. are discussed. The platform is designed with a lean innovation approach. Therefore, sub-processes that have no value for the product are eliminated. Simplicity is based on the logic of pure innovation. Hence, every step should be considered as a bridge, whether it is valued or not. |

| 18 | [35] | Making sense of big data with artificial intelligence in Industry 5.0 | Review | This paper proposes Industry 5.0, which can co-produce knowledge from big data, based on the new concept of symmetric innovation. Industry 5.0 uses the Internet of Things, but with a three-dimensional symmetry in the design of the innovation ecosystem, it differs from previous automation systems: it places equal emphasis on accelerating and reducing innovation if declining returns become apparent. In addition, next-generation social science and humanities research. |

| 19 | [24] | Fintechs in Digital Banking | Review | Industry 4.0 reduces costs and provides shorter services with stronger services, and encourages markets to pay more attention to Fintech solutions. At the same time, the potential lack of quality of cybersecurity as a warning against the elimination of conventional jobs requires three groundings: strong business responsibility, well-educated customers, flexible and interdisciplinary regulations. |

| 20 | [55] | Digital production and digital community in Industry 5.0 | Review | A new paradigm image of Industry 5.0 can now be seen. This includes the influence of artificial intelligence on human life together with their “cooperation” with the aim of increasing human capacity and returning man to the “center of the universe.” This article describes modern technologies—from the Internet of Things to emergency intelligence—in the organizations in which the authors work. According to our minds, the convergence of these technologies provides the transition from Industry 4.0 to Industry 5.0. |

| 21 | [56] | Digital Banking | Analytical | Digital banks are transforming their business by personalizing services and having a strong relationship with customers. |

| Row | Variable | Code | Ref |

|---|---|---|---|

| 1 | Lifelong learning | YMO | [26] |

| Human-centered design modules | MTEM | ||

| Practical data management | MDE | ||

| 2 | Respond to the changing needs of customers | PNM | [19] |

| Excellent customer relationship | RAM | ||

| Maintain relationships with suppliers | HT | ||

| Agile response to a changing market | PCT | ||

| Stability and continuity of the workforce | STC | ||

| Labor welfare | RNC | ||

| Health and safety of employees | SEC | ||

| Competitive pricing | GR | ||

| Redesign work with human element optimization | TMBE | ||

| Transfer to automated systems | ESK | ||

| 3 | Profit maximization | HS | [20] |

| 4 | Health Cares | MB | [3] |

| 5 | Efficiency | EF | [27] |

| Agility | AG | ||

| Innovation | NO | ||

| Improve the customer experience | BTM | ||

| 6 | Cooperation with Fintech | HF | [6] |

| Use of identification algorithms and learning methods | EAY | ||

| 7 | Permanent access | DD | [48] |

| Development of reliability | TGE | ||

| 8 | Acceptance | AC | [47] |

| Trust | TRU | ||

| Perceived security | AD | ||

| Perceived usefulness | SD | ||

| Loyalty | LOY | ||

| Improving the financial performance of banks | BAB | ||

| 9 | Commercial durability | DT | [49] |

| 10 | Investment in the IT department of the bank | SFEB | [29] |

| Elimination of physical bank branches | HSFB | ||

| Reduce the heavy costs of having a branch | KHS | ||

| 11 | Standardization | STA | [23] |

| Legalization | REV | ||

| Executive transparency | SHE | ||

| Ethical behavior | RA | ||

| 12 | Environmental sustainability | PZM | [37] |

| 13 | Connecting organizations to each other | ESY | [52] |

| 14 | Financial knowledge | SM | [50] |

| Customer willingness to use Fintechs | TMBF | ||

| 15 | Human-machine cooperation at different levels | HEMS | [37] |

| 16 | Technology convergence | HF | [55] |

| Integrity | INT | ||

| 17 | Cybersecurity | AS | [24] |

| Customer training | AM | ||

| 18 | Personalization of services | SSK | [56] |

| 19 | Create new jobs | EMJ | [39] |

| Human creativity in robotic production | KER |

| Row | Country | Gender | Education | Work Experience |

|---|---|---|---|---|

| 1 | Swiss | Man | MA | 22 |

| 2 | USA | Man | PHD | 27 |

| 3 | Finland | Man | PHD | 19 |

| 4 | France | Man | MA | 16 |

| 5 | England | Man | MA | 17 |

| 6 | Australia | Man | PHD | 20 |

| 7 | China | Man | PHD | 21 |

| 8 | Iran | Man | PHD | 16 |

| 9 | Russia | Man | MA | 23 |

| 10 | Japan | Man | MA | 20 |

| Less Important | Essential | Very Essential |

|---|---|---|

| Competitive pricing Development of reliability Elimination of physical bank branches Standardization Technology convergence | Maintain relationships with suppliers Agile response to a changing market Profit maximization Performance Agility Innovation Cooperation with Fintech Use of identification algorithms and learning methods Permanent access The reception Trust Perceived security Perceived usefulness Loyalty Improving the financial performance of banks Commercial durability Transfer to automated systems Investment in the IT department of the bank Legalization Executive transparency Financial knowledge Customers’ desire to use Fintechs Integrity Cybersecurity Customer training Personalization of services Connecting organizations to each other | Respond to the changing needs of customers Excellent customer relationship Stability and stability of the workforce Labor welfare Health and safety of employees Healthcare Improve the customer experience Redesign work with human element optimization Reduce heavy branch costs Ethical behavior Environmental sustainability Human-machine cooperation at different levels Create new jobs Creativity and continuous human learning in robotics production |

| Variables | KHS | TMBE | HEMS | KER | PZM | EMJ | RNC | RAM | PNM | RA | SEC | BTM | STC | MB |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| KHS | A | A | O | O | O | O | V | V | V | V | V | O | A | |

| TMBE | V | O | V | V | V | V | O | V | V | V | V | V | ||

| HEMS | V | O | O | O | V | V | O | O | O | O | O | |||

| KER | V | V | V | V | O | V | V | V | V | X | ||||

| PZM | O | O | O | O | O | O | O | O | O | |||||

| EMJ | O | O | V | O | O | O | O | V | ||||||

| RNC | O | O | O | O | A | A | A | |||||||

| RAM | A | A | V | V | V | O | ||||||||

| PNM | V | X | O | O | O | |||||||||

| RA | O | O | O | O | ||||||||||

| SEC | V | O | V | |||||||||||

| BTM | A | V | ||||||||||||

| STC | A | |||||||||||||

| MB |

| Variables | KHS | TMBE | HEMS | KER | PZM | EMJ | RNC | RAM | PNM | RA | SEC | BTM | STC | MB |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| KHS | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 0 | 0 |

| TMBE | 1 | 0 | 1 | 0 | 1 | 1 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 1 |

| HEMS | 1 | 0 | 0 | 1 | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 0 |

| KER | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 1 |

| PZM | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| EMJ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 1 |

| RNC | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| RAM | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 0 |

| PNM | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 1 | 0 | 0 | 0 |

| RA | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 |

| SEC | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 1 |

| BTM | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| STC | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| MB | 1 | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 |

| Variables | KHS | TMBE | HEMS | KER | PZM | EMJ | RNC | RAM | PNM | RA | SEC | BTM | STC | MB |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| KHS | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| TMBE | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| HEMS | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| KER | 1 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| PZM | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| EMJ | 1 | 0 | 0 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 1 | 1 |

| RNC | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| RAM | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 0 | 1 | 1 | 1 | 1 |

| PNM | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| RA | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 1 | 1 | 1 | 0 |

| SEC | 1 | 0 | 0 | 1 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| BTM | 1 | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 1 | 1 | 1 |

| STC | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 1 | 1 | 1 |

| MB | 1 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Variables | Degree of Dependence | Influence Rate |

|---|---|---|

| KHS | 8 | 9 |

| TMBE | 1 | 14 |

| HEMS | 2 | 13 |

| KER | 7 | 12 |

| PZM | 5 | 1 |

| EMJ | 5 | 10 |

| RNC | 11 | 1 |

| RAM | 10 | 7 |

| PNM | 9 | 7 |

| RA | 9 | 5 |

| SEC | 10 | 10 |

| BTM | 11 | 6 |

| STC | 12 | 4 |

| MB | 11 | 12 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mehdiabadi, A.; Shahabi, V.; Shamsinejad, S.; Amiri, M.; Spulbar, C.; Birau, R. Investigating Industry 5.0 and Its Impact on the Banking Industry: Requirements, Approaches and Communications. Appl. Sci. 2022, 12, 5126. https://doi.org/10.3390/app12105126

Mehdiabadi A, Shahabi V, Shamsinejad S, Amiri M, Spulbar C, Birau R. Investigating Industry 5.0 and Its Impact on the Banking Industry: Requirements, Approaches and Communications. Applied Sciences. 2022; 12(10):5126. https://doi.org/10.3390/app12105126

Chicago/Turabian StyleMehdiabadi, Amir, Vahid Shahabi, Saeed Shamsinejad, Mohammad Amiri, Cristi Spulbar, and Ramona Birau. 2022. "Investigating Industry 5.0 and Its Impact on the Banking Industry: Requirements, Approaches and Communications" Applied Sciences 12, no. 10: 5126. https://doi.org/10.3390/app12105126