Application of Prospect Theory in the Context of Predictive Maintenance Optimization Based on Risk Assessment

Abstract

:1. Introduction

- In front of a risky choice with possible gains, individuals are risk-averse, opting for solutions with a lower expected utility but with a higher certainty.

- In front of a risky choice with possible losses, individuals are risk-seeking, opting for solutions with a lower expected utility as long as it has the potential to avoid losses.

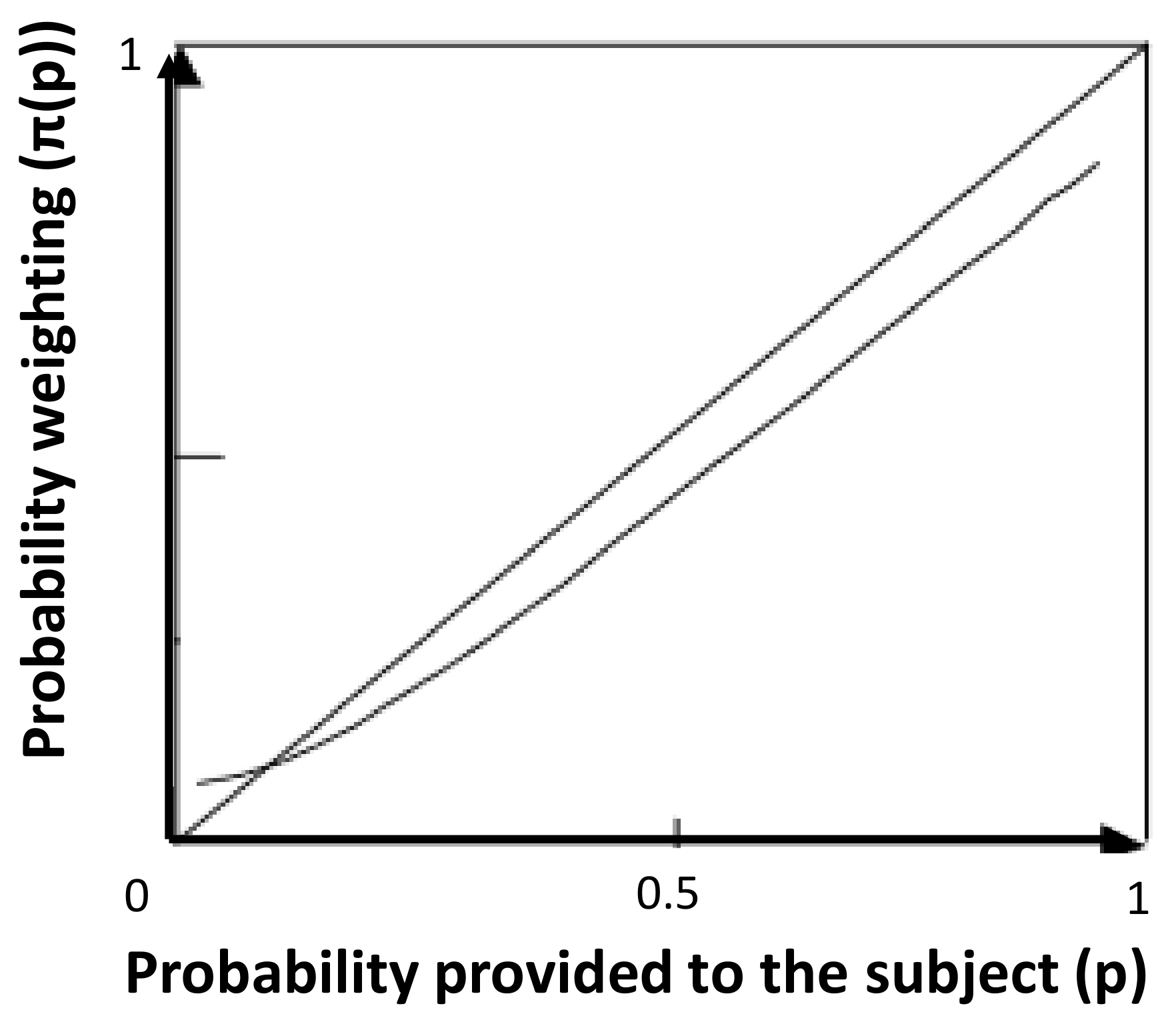

- Individuals overestimate low probabilities and underestimate medium probabilities. In financial terms, this means that investors heavily weight extreme events whose probability of occurrence is very low, such as market crashes, for example. This may induce a higher risk premium than expected utility theory models. On the other hand, speaking of gains, this distortion of probabilities explains why individuals participate in games of chance, even unfavorable ones, when there is a high number of winnings.

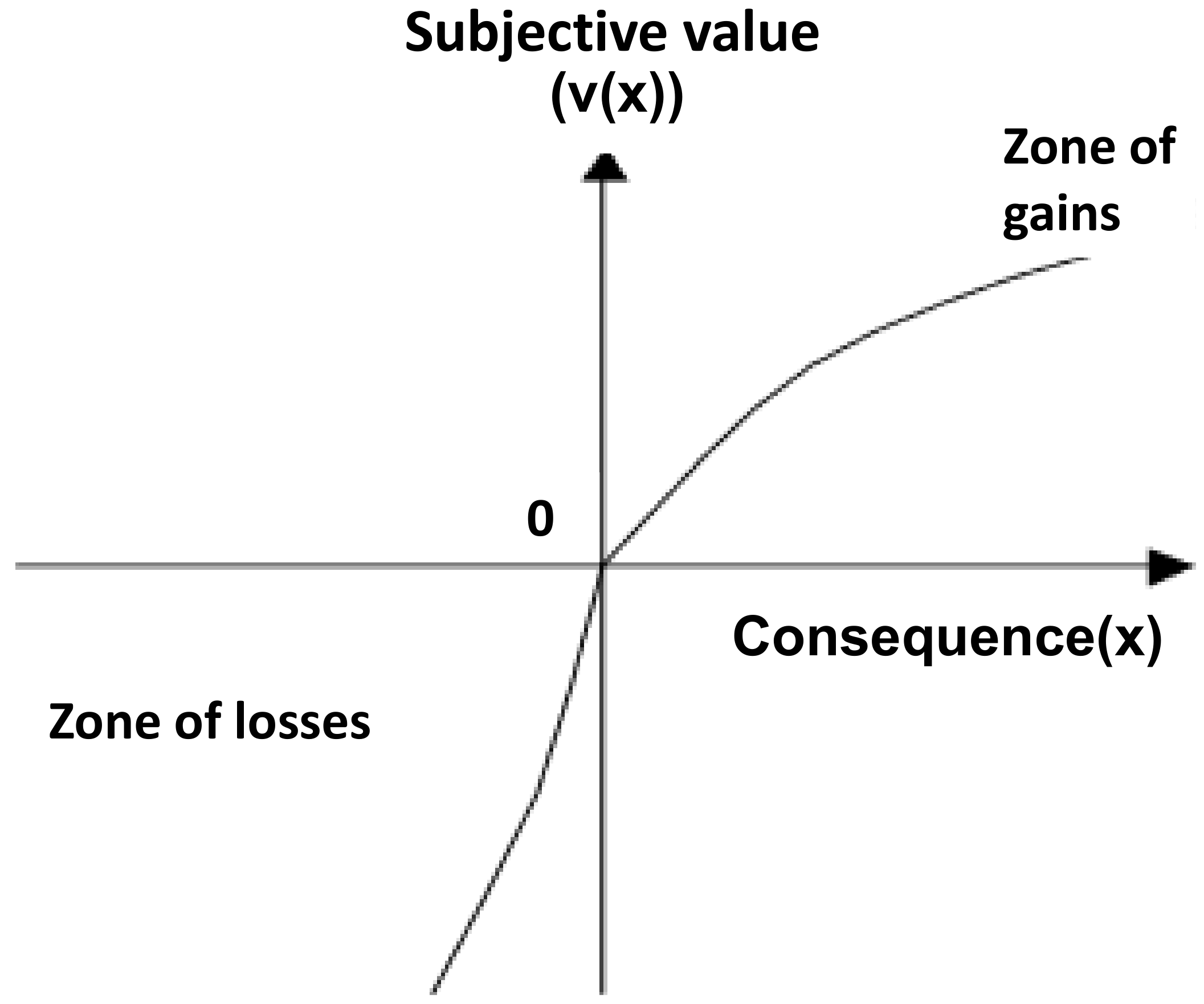

- Consequences defined in terms of deviation from the reference point.

- A value function that is concave for gains and convex for losses, with a slope steeper for losses than for gains.

- A non-linear transformation of the probability scale, overestimating events of low probability and underestimating events that are more probable.

2. Cost Model of Predictive Maintenance

2.1. Assumptions

- The system under study is a single component.

- The system under study is part of a whole complex system, which has a duration of exploitation known beforehand called .

- One inspection is performed on the system with a regular step. The inspection provides an information on the actual health state of the system. For instance, the inspection gives a real estimation of the RUL. After simulations, the RUL is the expected interval of time the system is likely to operate before it fails [4,5,6]. The expression of RUL is given by: , where E[X] is the function that gives the expected value of a random variable X, f is the density function of failure probability distribution, T is the random variable describing the lifetime of the system and S is the survival function of the system.

- The inspection has no impact on the performance of the system.

- A primary inspection is required at the beginning of life of the system, but the health of the system is not supposed to require replacement because it is a new one.

- Between inspection i and i+1, one of the following scenarios may occur:

- -

- PdM scenario: the RUL of the system attains some threshold value called under which the system is considered as deteriorated: in fact, as the system’s life expectancy decreases, the chance of system failure increases. This may lead to high maintenance costs related to corrective replacement. Therefore, it is judicious to consider a RUL threshold for PdM in order to avoid as much as possible a potential failure. The system is replaced by a new one once the RUL of the system is under this threshold of RUL.

- -

- Non-PdM scenario: in this scenario, the system does not undergo PdM. In such case, the system can break down or not:

- *

- The system breaks down before inspection i+1, the system undergoes then corrective maintenance and is replaced by a new one. This happens with the probability of occurrence where is the time of inspection i, is the probability density function of failure distribution between inspections i and i+1.

- *

- The system works normally without failure until inspection i+1 with the complementary probability .

2.2. Maintenance Costs

2.2.1. Cost of Predictive Maintenance

2.2.2. Cost of Corrective Maintenance

2.2.3. Cost of Inspection

2.2.4. Cost of Operating Loss Capacity

2.3. Risks

2.3.1. Human Risks

2.3.2. Financial Risks

2.3.3. Environmental Risks

- l: the total number of chemicals emitted during a failure scenario.

- : the emission probabilities of pollutants where is the emission probability of pollutant j if system fails between inspection i and i+1.

- : the emission volumes of pollutants where is the emission volume of pollutant j during a failure scenario.

- : the density vector of chemicals where is the density value of chemical j emitted during a failure scenario.

- : the cost of damage per tonne emission where is the cost of damage per tonne emission of chemical j during a failure scenario.

2.4. Optimization Process

2.4.1. Objective Function

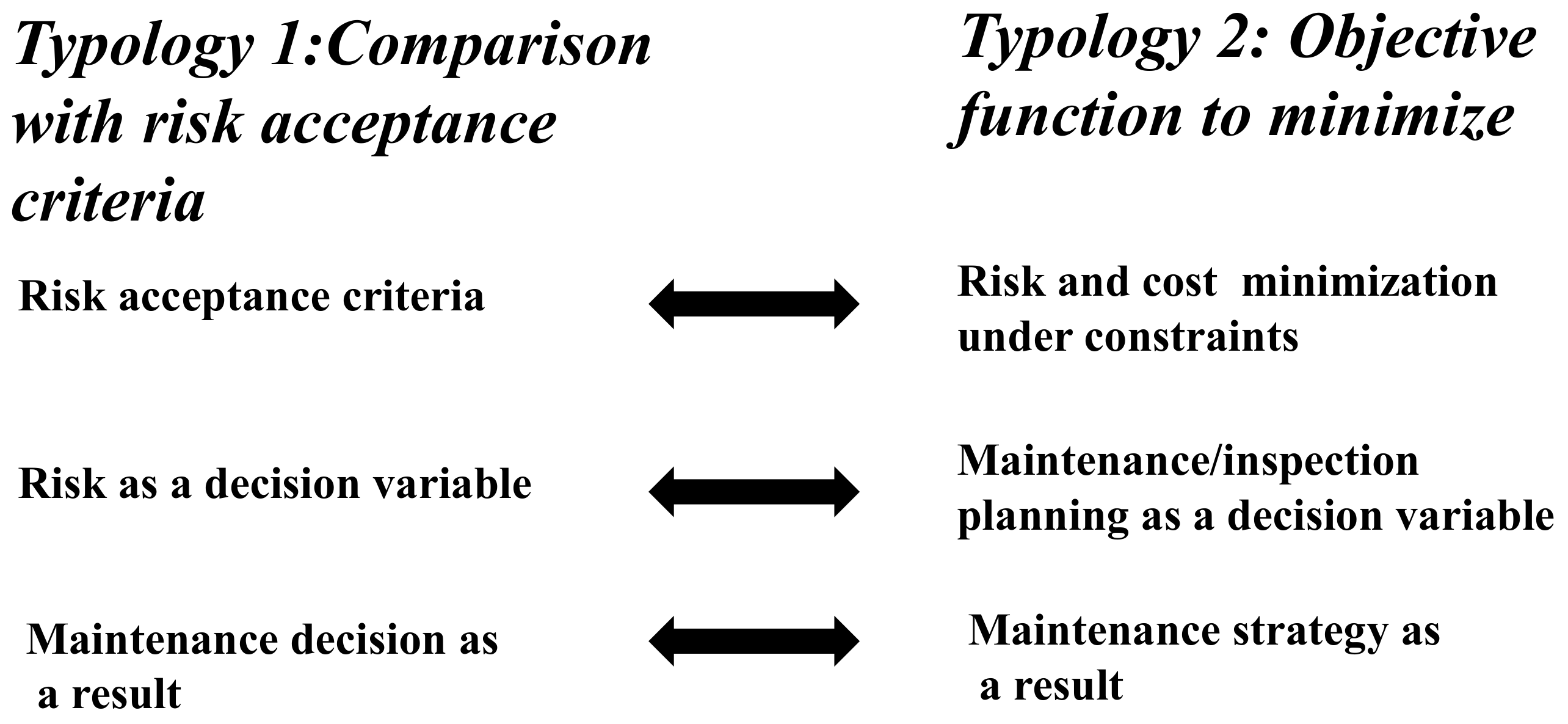

- Comparison of the evaluated risks with risk acceptance criteria: in this case, the decision variable is the risk which is evaluated and compared with risk acceptance criteria in order to determine the optimal time for maintenance [7].

- Optimization of an objective function: in this case, we aim at minimizing a risk/cost under constraints. The decision variables to determine are usually the maintenance/inspection plan [40].

2.4.2. Decision Variables

- : the limit of the RUL that indicates that a PdM should be performed on the system. It means:

- -

- If then the system should be maintained.

- -

- If then the system operates normally and does not need to be maintained.

- : the inspection step, i.e., the interval between two consecutive inspections that can be deduced easily from the optimal (see Equation (3)).

2.4.3. Constraints

- evaluating the different costs of maintenance.

- identifying the decision variables that minimize the total cost of maintenance: for a fixed value of , we determine the set of values of , that minimize the total cost described in Equation (18). Then, we repeat the same process for different values of . We obtain different values of for each preset value of and its corresponding set of values of determined as previously. The optimal is selected as the minimal value of for particular values of and .

3. Cost Model of Predictive Maintenance Considering Prospect Theory

3.1. Prospect Theory

- The framing effect: which is a cognitive bias describing how people decide based on whether the options are presented with positive connotations or negative connotations such as a loss or a gain.

- Non-linear preferences: the standard model of Von Neumann Morgenstern predicts that the risky prospect utility is a linear combination of the probabilities corresponding to the different possible consequences. This model is very simplistic and cannot take into consideration the complexity of the reality. Enough documentations are now available that demonstrate that the preferences are not linear.

- The importance of the source of information: people are usually averse to risk when they dispose of uncertain or ambiguous information on the situation of risk.

- Willingness for risk taking: the willingness for risk taking can exist for low probabilities of winning.

- Loss aversion: there is a real asymmetry between the attitude in losses and in gains that cannot be explained by income effects or decrease in risk aversion.

3.1.1. Valuation Function of a Set of Outcomes

3.1.2. Valuation Function

3.1.3. Probability Transformation Function

3.2. Application of Prospect Theory to Risks in Case of System Failure

3.2.1. Human Risks

3.2.2. Financial Risks

3.2.3. Environmental Risks

4. Case Study

4.1. Description of the System

4.2. System Characteristics

4.3. Economic Input Data

4.4. Numerical Results

5. Discussion

- A time of 30 min devoted to inspections and their interpretation

- Immobilization inducing a loss of 2 h, including staff as well as users in the event of failure and corrective maintenance

- A churn rate of 1% linked to the loss of users in the event of failure

- A perfect ability of the drowsiness detector to avoid accidents related to it

5.1. Variation of the Churn Rate

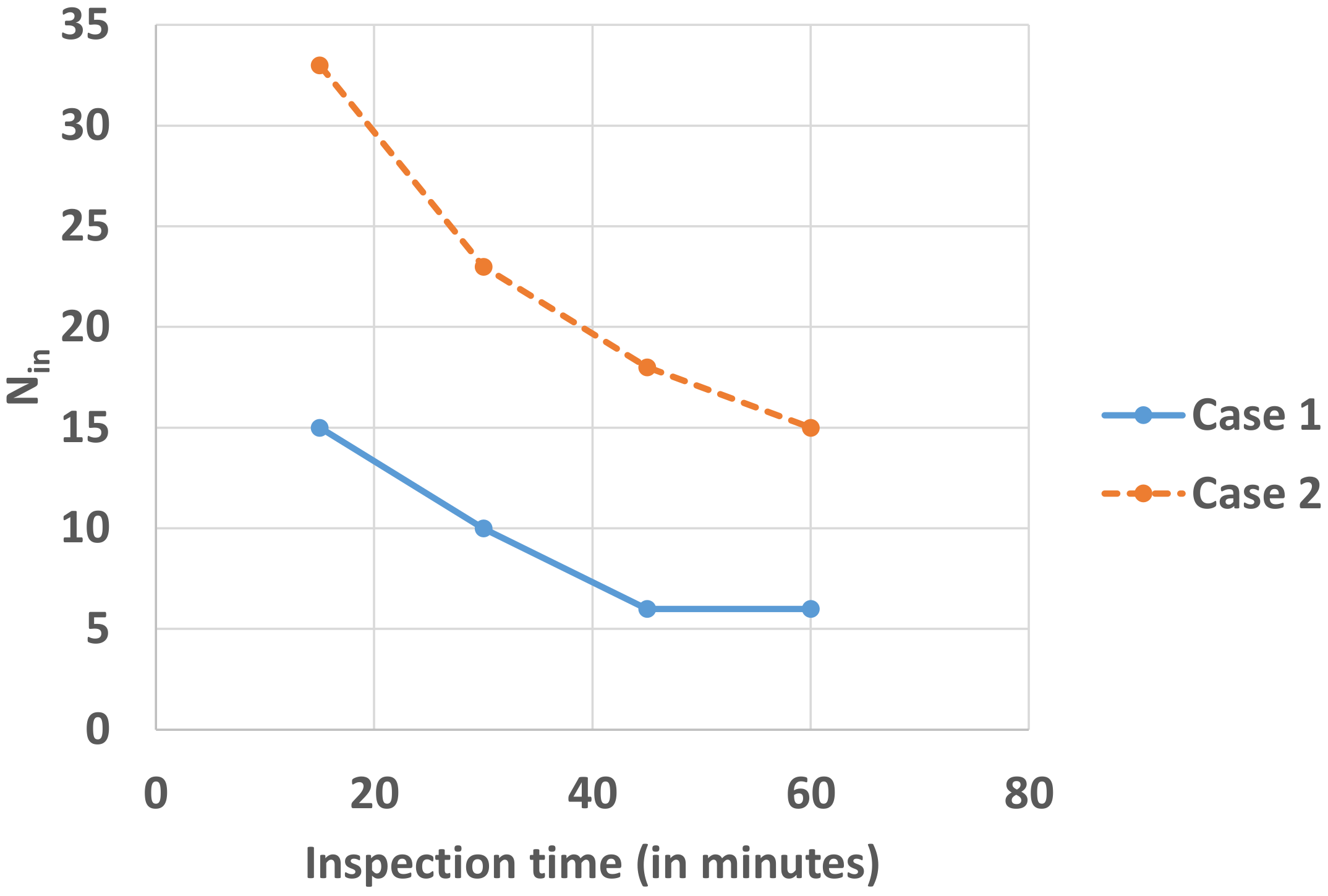

5.2. Variation of Inspection Time

5.3. Variation of Operational Losses

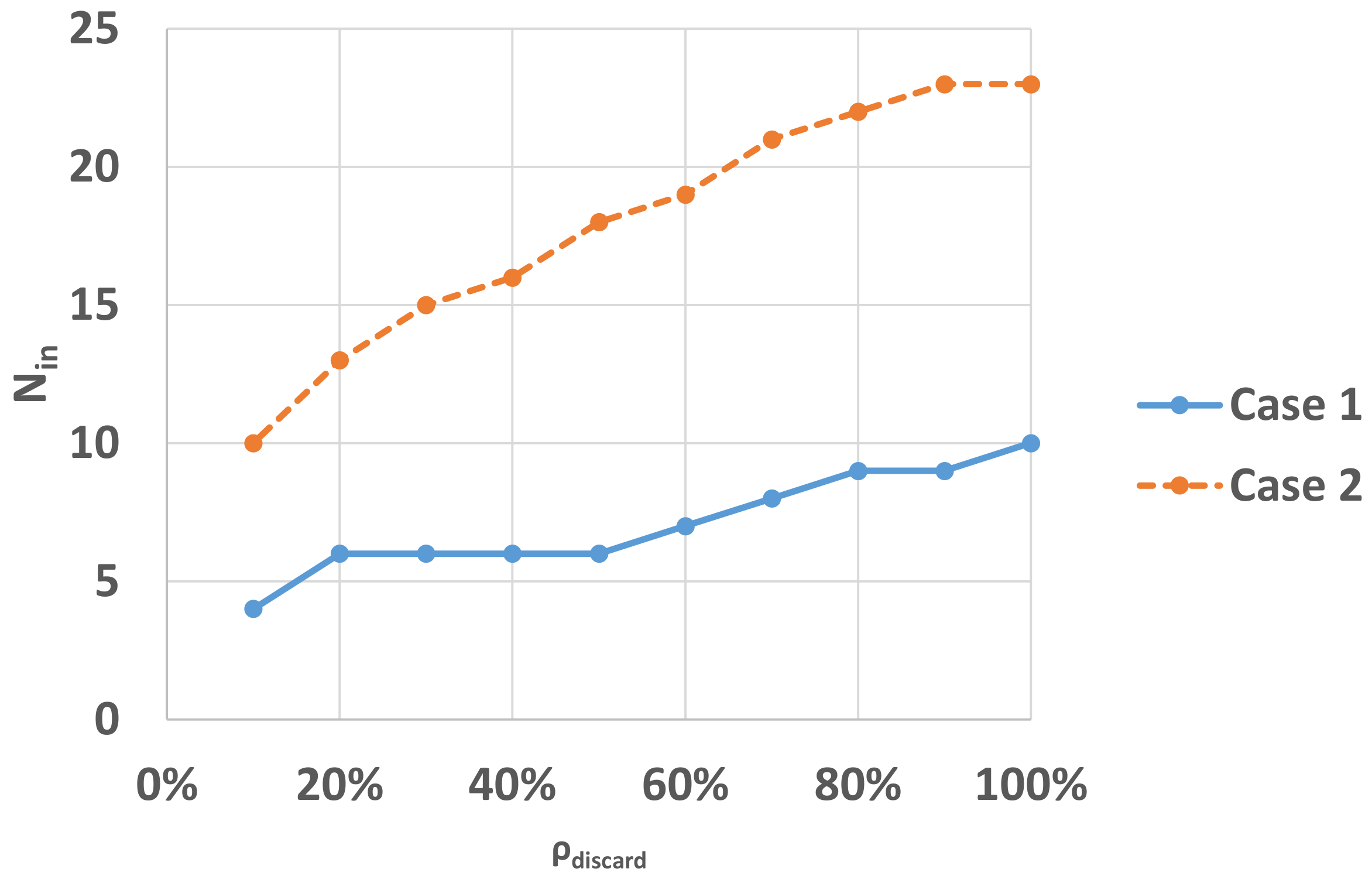

5.4. Variation of the Discard Rate

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| CAFE | Clean Air For Europe program |

| CAFE-CBA | Methodology for Cost-Benefit Analysis used by the Clean Air For Europe program |

| CM | Corrective maintenance |

| DALYs | Disability-Adjusted Life Years |

| DDDS | Driver Drowsiness Detection System |

| DOAJ | Directory of open access journals |

| EBD | Environmental Burden of Disease |

| LD | Linear dichroism |

| MAIS | Maximum Abbreviated Injury Scale |

| MDPI | Multidisciplinary Digital Publishing Institute |

| PdM | Predictive Maintenance |

| PM | Preventive Maintenance |

| RM | Reactive Maintenance |

| RUL | Reminaing Useful Life |

| TLA | Three letter acronym |

| VSL | Value of Statistical Life |

| Acronyms | |

| c | Cost of loss of one client for the business |

| Expected cost of CM | |

| Cost of a corrective replacement | |

| Cost of system down time per unit of time | |

| Expected cost of system down time | |

| Expected cost of inspections | |

| Cost of an inspection | |

| Expected cost of PdM | |

| Cost of a predictive replacement | |

| Consequences of injuries of level | |

| Expected total cost of maintenance | |

| Duration of corrective replacement | |

| Duration of predictive replacement | |

| Duration of global system exploitation | |

| Function that gives the expected value of a random variable | |

| Probability density function of failure distribution (at inspection i) | |

| Level of injury: from death (j = 1) to minor (j = 6) | |

| Form parameter of Weibull distribution (at inspection i) | |

| l | Number of chemicals that may be emitted during system failure |

| m | Number of potential clients at the beginning of |

| n | Number of persons possibly impacted by system failure |

| Binary variable for predictive maintenance between inspection i and i+1 | |

| Number of inspections | |

| Probability distribution corresponding to | |

| Probability distribution after classification of consequences in ascending order | |

| Emission probabilities of pollutants | |

| Expected cost of financial risks | |

| Expected cost of human risks | |

| Threshold of RUL for predictive maintenance | |

| Interval of approximation of | |

| Survival function | |

| Set of possible n events following a decision | |

| T | Random variable describing the lifetime of the system |

| Valuation function | |

| Valuation function of an outcome | |

| Emission volumes of pollutants | |

| Function from the unit interval to itself used to transform (positive/negative) probabilities | |

| Set of consequences after classification in ascending order | |

| Percentage of business loss in the case of CM | |

| Parameters of the valuation function and their corresponding mean values | |

| Parameters of the probability transformation function and their corresponding mean values | |

| Scale parameter of Weibull distribution | |

| Probability transformation function of (positive/negative) consequences | |

| Density vector of pollutants | |

| Discard rate between probabilities of occurrence of a drowsiness situation with and without the drowsiness driver detection system | |

| Inspection step |

References

- UNE EN 13306:2018 AFNOR; Maintenance Terminology. European Standard: Pilsen, Czech Republic, 2018.

- Ran, Y.; Zhou, X.; Lin, P.; Wen, Y.; Deng, R. A survey of predictive maintenance: Systems, purposes and approaches. arXiv 2019, arXiv:1912.07383. [Google Scholar]

- Ly, C.; Tom, K.; Byington, C.S.; Patrick, R.; Vachtsevanos, G.J. Fault diagnosis and failure prognosis for engineering systems: A global perspective. In Proceedings of the 2009 IEEE International Conference on Automation Science and Engineering, Bangalore, India, 22–25 August 2009; pp. 108–115. [Google Scholar]

- Banjevic, D. Remaining useful life in theory and practice. Metrika 2009, 69, 337–349. [Google Scholar] [CrossRef]

- Si, X.S.; Wang, W.; Hu, C.H.; Zhou, D.H. Remaining useful life estimation—A review on the statistical data driven approaches. Eur. J. Oper. Res. 2011, 213, 1–14. [Google Scholar] [CrossRef]

- Okoh, C.; Roy, R.; Mehnen, J.; Redding, L. Overview of remaining useful life prediction techniques in through-life engineering services. Procedia Cirp. 2014, 16, 158–163. [Google Scholar] [CrossRef] [Green Version]

- Khan, F.I.; Haddara, M.M. Risk-based maintenance (RBM): A quantitative approach for maintenance/inspection scheduling and planning. J. Loss Prev. Process. Ind. 2003, 16, 561–573. [Google Scholar] [CrossRef]

- Louhichi, R.; Sallak, M.; Pelletan, J. A cost model for predictive maintenance based on risk-assessment. In Proceedings of the 13th Conférence Internationale CIGI QUALITA, Montreal, QC, Canada, 25 June 2019. [Google Scholar]

- Kahneman, D. Prospect theory: An analysis of decisions under risk. Econometrica 1979, 47, 278. [Google Scholar] [CrossRef] [Green Version]

- Allais, M. Le comportement de l’homme rationnel devant le risque: Critique des postulats et axiomes de l’école américaine. Econom. J. Econom. Soc. 1953, 21, 503–546. [Google Scholar] [CrossRef] [Green Version]

- Pelletan, J. Fondements Économiques d’une Politique de Sécurité: L’Exemple du Risque de Criminalité. Economics Thesis, University Paris Dauphine, Paris, France, 2008. [Google Scholar]

- Louhichi, R. Élaboration d’un Modèle Économique Optimisant la Stratégie de Maintenance. Ph.D. Thesis, Université de Technologie de Compiègne, Compiègne, France, 2021. [Google Scholar]

- Hewes, D.E.; Kahneman, D.; Slovic, P.; Tversky, A. Judgement under uncertainty: Heuristics and biases. J. Commun. 1983, 33, 21–22. [Google Scholar]

- Tversky, A.; Koehler, D. Support theory: A nonextensional representation of subjective probability. Psychol. Rev. 1994, 101, 547–567. [Google Scholar] [CrossRef]

- Cheng, M.; Frangopol, D.M. Life-cycle optimization of structural systems based on cumulative prospect theory: Effects of the reference point and risk attitudes. Reliab. Eng. Syst. Saf. 2022, 218, 108100. [Google Scholar] [CrossRef]

- Gong, C.; Frangopol, D.M.; Cheng, M. Application of Cumulative Prospect Theory to Optimal Inspection Decision-Making for Ship Structures. In Model Validation and Uncertainty Quantification, Volume 3. Conference Proceedings of the Society for Experimental Mechanics Series; Barthorpe, R., Ed.; Springer: Cham, Switzerland, 2020. [Google Scholar]

- Louhichi, R.; Sallak, M.; Pelletan, J. A maintenance cost optimization approach: Application on a mechanical bearing system. Int. J. Mech. Eng. Robot. Res. 2020, 9, 658–664. [Google Scholar] [CrossRef]

- Zeller, O. L’historien et Les Risques Industriels: Récente Émergence d’une Curiosité. Fondation Pour une Culture de Sécurité Industrielle; FONCSI: Toulouse, France, 2015. [Google Scholar]

- Louhichi, R.; Sallak, M.; Pelletan, J. Avenues for future research on predictive maintenance purposes in terms of risk minimization. In Proceedings of the European Safety and Reliability Conference (ESREL), Venice, Italy, 21–26 June 2020. [Google Scholar]

- Zio, E. The future of risk assessment. Reliab. Eng. Syst. Saf. 2018, 177, 176–190. [Google Scholar] [CrossRef]

- Aven, T. Risk Analysis; John Wiley & Sons: Hoboken, NJ, USA, 2015. [Google Scholar]

- Krishnasamy, L.; Khan, F.; Haddara, M. Development of a risk-based maintenance (RBM) strategy for a power-generating plant. J. Loss Prev. Process. 2005, 18, 69–81. [Google Scholar] [CrossRef]

- Bertolini, M.; Bevilacqua, M.; Ciarapica, F.E.; Giacchetta, G. Development of risk-based inspection and maintenance procedures for an oil refinery. J. Loss Prev. Process. Ind. 2009, 22, 244–253. [Google Scholar] [CrossRef]

- Leoni, L.; BahooToroody, A.; De Carlo, F.; Paltrinieri, N. Developing a risk-based maintenance model for a Natural Gas Regulating and Metering Station using Bayesian Network. J. Loss Prev. Process. Ind. 2019, 57, 17–24. [Google Scholar] [CrossRef]

- Kao, C.S.; Hu, K.H. Acrylic reactor runaway and explosion accident analysis. J. Loss Prev. Process. 2002, 15, 213–222. [Google Scholar] [CrossRef]

- Yazdi, M.; Korhan, O.; Daneshvar, S. Application of fuzzy fault tree analysis based on modified fuzzy AHP and fuzzy TOPSIS for fire and explosion in the process industry. Int. J. Occup. Ergon. 2020, 26, 319–335. [Google Scholar] [CrossRef]

- Dionne, G.; Lebeau, M. Le calcul de la valeur statistique d’une vie humaine. Actual. Écon. 2010, 86, 487–530. [Google Scholar] [CrossRef] [Green Version]

- Dionne, G.; Lanoie, P. Public choice about the value of a statistical life for cost-benefit analyses: The case of road safety. J. Transp. Econ. Policy (JTEP) 2004, 38, 247–274. [Google Scholar]

- Lanoie, P.; Pedro, C.; Latour, R. The value of a statistical life: A comparison of two approaches. J. Risk Uncertain. 1995, 10, 235–257. [Google Scholar] [CrossRef]

- Handbook of the Economics of Risk and Uncertainty; Machina, M.; Viscusi, W.K. (Eds.) Elsevier: Amsterdam, The Netherlands, 2013. [Google Scholar]

- Commissariat Général à la Stratégie et à La Prospective Département Dévelopement Durable. Éléments Pour Une Révision de La Valeur de La vie Humaine; République Française: Paris, France, 2013. [Google Scholar]

- Commissariat Général à la Stratégie et à la Prospective. Eléments Pour une Révision de la Valeur Statistique de la vie Humaine; Public Report; France Stratégie: Paris, France, 2013. [Google Scholar]

- Quinet, E. Commissariat Général à la Stratégie et à la Prospective. L’évaluation Socioéconomique des Investissements Publics; Public Report; France Stratégie: Paris, France, 2013; p. 105. [Google Scholar]

- Ngobo, P.V.; Ramaroson, A. Facteurs déterminants de la relation entre la satisfaction des clients et la performance de l’entreprise. Décis. Mark. 2005, 40, 75–84. [Google Scholar] [CrossRef]

- Crie, D. Rétention de clientèle et fidélité des clients. Décis. Mark. 1996, 7, 25–30. [Google Scholar] [CrossRef]

- Gao, T.; Wang, X.C.; Chen, R.; Ngo, H.H.; Guo, W. Disability adjusted life year (DALY): A useful tool for quantitative assessment of environmental pollution. Sci. Total Environ. 2015, 511, 268–287. [Google Scholar] [CrossRef] [PubMed]

- Salomon, J.A. Techniques for valuing health states. Encycl. Health Econ. 2014, 2, 454–458. [Google Scholar]

- Prüss-Üstün, A.; Mathers, C.; Corvalán, C.; Woodward, A. Introduction and Methods: Assessing the Environmental Burden of Disease at National and Local Levels; World Health Organization: Geneva, Switzerland, 2003. [Google Scholar]

- Holland, M.; Pye, S. Damages per Tonne Emission of EU25 Member State (Excluding Cyprus) and Surrounding Sea Service Contract for Carrying Out Cost-Benefit Analysis of Air Quality Related Issues, in Particular in the Clean Air for Europe (CAFE) Programme Customer; AEA Technology Environment: Oxfordshire, UK, 2005. [Google Scholar]

- Dehghani, N.L.; Darestani, Y.M.; Shafieezadeh, A. Optimal life-cycle resilience enhancement of aging power distribution systems: A MINLP-based preventive maintenance planning. IEEE Access 2020, 8, 22324–22334. [Google Scholar] [CrossRef]

- Yazdi, M.; Nedjati, A.; Abbassi, R. Fuzzy dynamic risk-based maintenance investment optimization for offshore process facilities. J. Loss Prev. Process. Ind. 2019, 57, 194–207. [Google Scholar] [CrossRef]

- Von Neumann, J.; Morgenstern, O. Theory of Games and Economic Behavior. In Theory of Games and Economic Behavior; Princeton University Press: Princeton, NJ, USA, 2007. [Google Scholar]

- Morgenstern, O. The collaboration between Oskar Morgenstern and John von Neumann on the theory of games. J. Econ. Lit. 1976, 14, 805–816. [Google Scholar]

- Camerer, C.F.; Ho, T.H. Nonlinear weighting of probabilities and violations of the betweenness axiom. J. Risk Uncertain. 1994, 8, 167–196. [Google Scholar] [CrossRef]

- Kachelmeier, S.J.; Shehata, M. Examining Risk Preferences under High Monetary Incentives Experimental Evidence from the People’s Republic of China. Am. Econ. Rev. 1992, 82, 1120–1141. [Google Scholar]

- Abdellaoui, M. Parameter-Free Elicitation of Utility and Probability Weighting Functions. Manag. Sci. 2000, 46, 1497–1512. [Google Scholar] [CrossRef]

- Abdellaoui, M.; Vossmann, F.; Weber, M. Choice-based Elicitation and Decomposition of Decision Weights for Gains and Losses under Uncertainty. Manag. Sci. 2005, 51, 1384–1399. [Google Scholar] [CrossRef] [Green Version]

- Wu, G.; Gonzalez, R. Curvature of the Probability Weighting Function. Manag. Sci. 1996, 42, 1676–1690. [Google Scholar] [CrossRef] [Green Version]

- Bleichrodt, H.; Pinto, J.L. A Parameter-Free Elicitation of the Probability Weighting Function in Medical Decision Analysis. Manag. Sci. 2000, 46, 1485–1496. [Google Scholar] [CrossRef]

- Rajasekar, R.; Pattni, V.B.; Vanangamudi, S. Drowsy Driver Sleeping Device and Driver Alert System. Int. J. Sci. Res. 2014, 3, 2319–7064. [Google Scholar]

- Subbarao, A.; Sahithya, K. Driver drowsiness detection system for vehicle safety. Int. J. Innov. Technol. Explor. Eng. (IJITEE) 2010, 8, 815–819. [Google Scholar]

- Danisman, T.; Bilasco, I.M.; Djeraba, C.; Ihaddadene, N. Drowsy driver detection system using eye blink patterns. In Proceedings of the 2010 IEEE International Conference on Machine and Web Intelligence, Algiers, Algeria, 3–5 October 2010; pp. 230–233. [Google Scholar]

- Erto, P. New practical Bayes estimators for the 2-parameter Weibull distribution. IEEE Trans. Reliab. 1982, 31, 194–197. [Google Scholar] [CrossRef]

- Erto, P.; Giorgio, M. A note on using Bayes priors for Weibull distribution. arXiv 2013, arXiv:1310.7056. [Google Scholar]

- Nuyttens, N.; Stipdonk, H.; Van Schagen, I. Dossier Thématique Sécurité Routière no. 15. Les Blessés de la Route et Leurs Lésions; Vias Insitute—Centre de Connaissance Sécurité Routière: Brussels, Belgium, 2018. [Google Scholar]

- European Commission. Mobility and Transport, Road Safety; Road Safety Facts and Figures; Public Report from European Commission; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- Association Hello Victimes. Barèmes d’Indemnisation et Référentiels Indicatifs Actualisés des Courts d’Appel. Association Hello Victimes. 2018. Available online: https://www.hello-victimes.fr/ (accessed on 8 October 2020).

- Ministère de la Transition Écologique. Le Transport Collectif Routier de Voyageurs en 2015: Circulation et Parc en Progression, Parcours Moyen Stable; Public Report; Ministère de la Transition Écologique: Paris, France, 2016. [Google Scholar]

| Drowsiness Level | Description |

|---|---|

| Awake | Blink durations |

| Drowsy | Blink durations |

| Sleeping | Blink durations |

| Parameter | Value | Unit |

|---|---|---|

| 20 | € | |

| 60 | € | |

| 60 | €/hour | |

| 75 | €/hour | |

| 13,000 (5) | hours (years) | |

| 0.25 | hours | |

| 2 | hours |

| Real Values of | |

|---|---|

| 2 | , |

| 3 | , , |

| 4 | , , , |

| 5 | , ,, , |

| 6 | , , , , , |

| 7 | , , , , , , |

| 8 | , , , , , , , |

| 9 | , , , , , , , |

| 10 | , , , , , , , |

| , |

| Score (M)AIS | Compensation Cost (€) | Probability of Occurrence (per km per Billion Passengers) |

|---|---|---|

| 1 (Minor) | from 2000 to 4000 | 0.9375 |

| 2 (Moderate) | from 4000 to 20,000 | 0.9375 |

| 3 (Serious) | from 20,000 to 50,000 | 0.15 |

| 4 (Severe) | from 50,000 to 80,000 | 0.15 |

| 5 (Critical) | ≥80,000 | 0.15 |

| 6 (Fatal) | 0.0375 |

| Case 1: No Prospect Theory | Case 2: Prospect Theory | |

|---|---|---|

| Optimal | 10 | 23 |

| (hours) | [2024.3, 3133.3] | [1356.7, 1878.7] |

| Optimal (€) | 595.43 | 1332.42 |

| (€) | 110.66 | 436.60 |

| (€) | 71.68 | 143,97 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Louhichi, R.; Pelletan, J.; Sallak, M. Application of Prospect Theory in the Context of Predictive Maintenance Optimization Based on Risk Assessment. Appl. Sci. 2022, 12, 11748. https://doi.org/10.3390/app122211748

Louhichi R, Pelletan J, Sallak M. Application of Prospect Theory in the Context of Predictive Maintenance Optimization Based on Risk Assessment. Applied Sciences. 2022; 12(22):11748. https://doi.org/10.3390/app122211748

Chicago/Turabian StyleLouhichi, Rim, Jacques Pelletan, and Mohamed Sallak. 2022. "Application of Prospect Theory in the Context of Predictive Maintenance Optimization Based on Risk Assessment" Applied Sciences 12, no. 22: 11748. https://doi.org/10.3390/app122211748