Energy Cost Minimization with Hybrid Energy Storage System Using Optimization Algorithm

Abstract

:Featured Application

Abstract

1. Introduction

- Design and implementation of a techno-economical model of a HESS operating in a microgrid;

- The creation of a model that includes two battery types with their respective round trip efficiencies and costs of depreciation related to battery degradation during cycling;

- The design of an optimization method that calculates a schedule for each battery in a 24 h window;

- The validation and comparative analysis of a proposed method with a benchmark approach based on real life energy usage and production data of a research centre in Poland;

- The novelty of the proposed method is the considering of the multi-battery setup and the inclusion of battery depreciation cost related to its degradation, so that total operating costs are minimized.

2. Materials and Methods

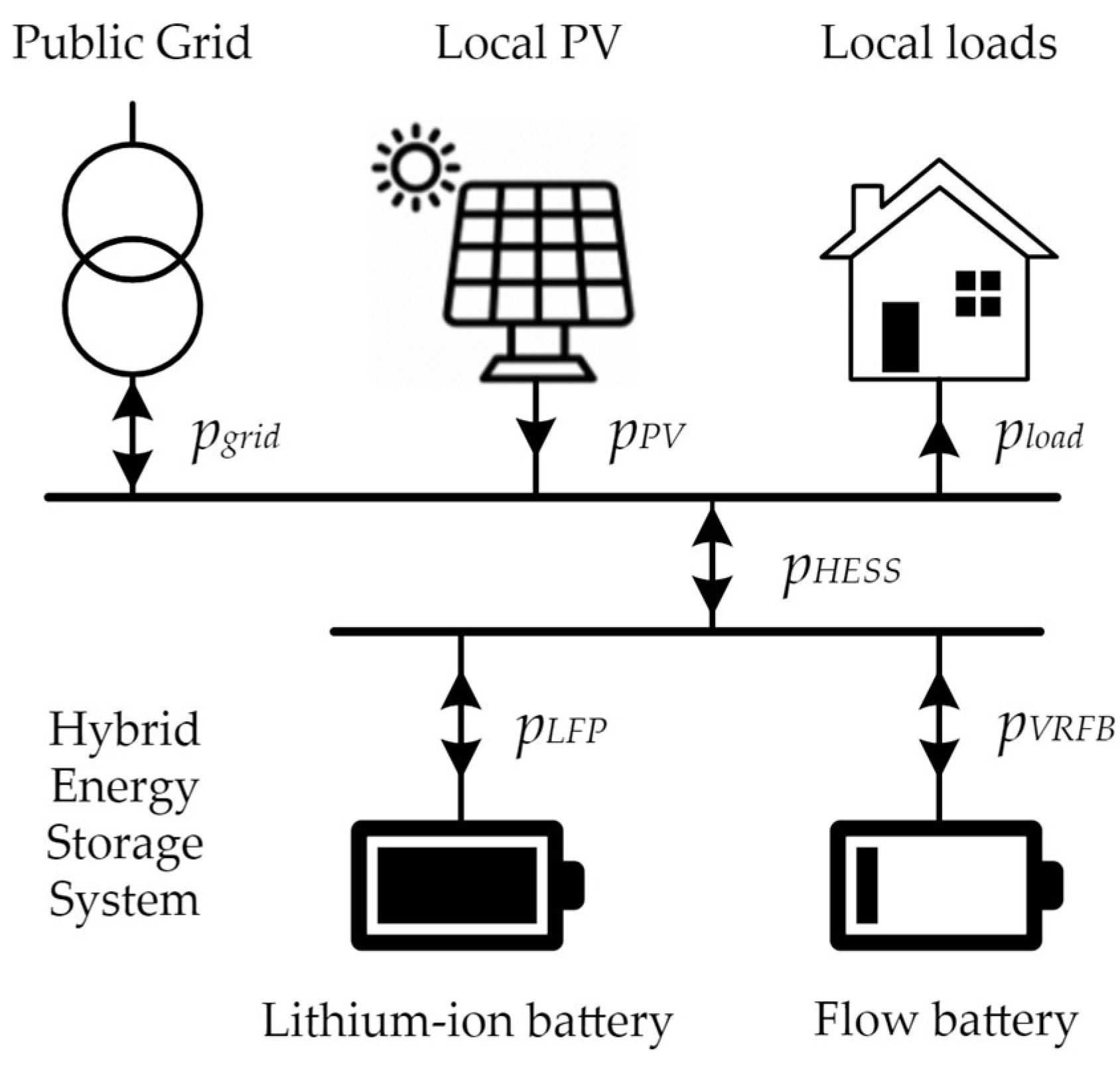

2.1. HESS Model

2.2. Energy Balancing

2.3. Economic Optimization

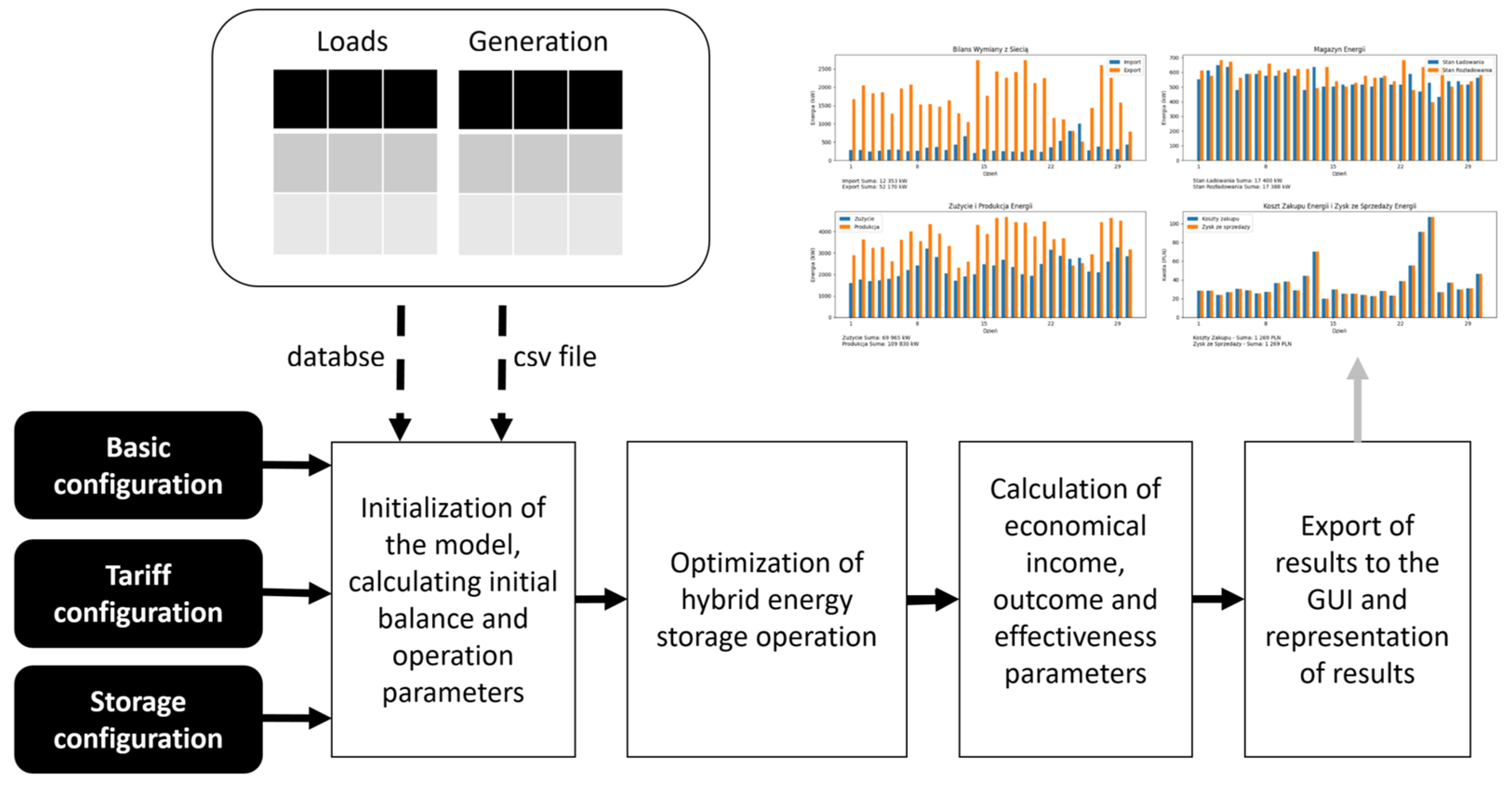

2.4. Implementation

- The initial setup parameters, which included the general description of the microgrid parameters and date range for the simulation—the program allowed us to calculate the optimization for any data from a database or csv files.

- The information regarding energy prices—for the calculation of costs and revenues, it was necessary to have the full information regarding the zones, which can change monthly, and the prices of tariffs. The program has the ability to read the prices from a csv file in case there are dynamic tariffs; for the purpose of the project, the most typical Polish tariffs were implemented.

- The setup of the HESS—the parameters relevant for cost calculation and optimization of each battery that constitutes HESS had to be defined. The parameters were: the capacity, the maximum power of charging and of discharging, depth-of-discharge (DoD), number of cycles limit (NoC), round-trip efficiency (RTE), the capex cost and the cost ReC of replacing the battery unit when it reaches the end of its life.

- Time series of load and generation values for the installation—the required format consisted of separate files with a timestamp and average power in a row of csv files.

- The tariff profile file that consisted of a timestamp, the price for purchasing energy from the grid (or other entity in future, e.g., an aggregator) in PLN per kWh, the price for selling energy to the grid (or other) in PLN per kWh. It can represent dynamic tariffs [31] related to market or fixed peak hours tariffs. We assumed that changes can occur after a 15 min interval.

3. Results

3.1. Energy Balancing

3.2. Economic Optimization

3.3. Modified Economic Optimization

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Armstrong, R.; Chiang, Y.-M.; Gruenspecht, H.; Brushett, F.; Deutch, J.; Engelkemier, S.; Gençer, E.; Jaffe, R.; Joskow, P.; Mallapragada, D.; et al. The Future of Energy Storage—An Interdisciplinary MIT Study. Report. 2022. Available online: https://energy.mit.edu/research/future-of-energy-storage/ (accessed on 30 August 2022).

- European Association of Storage for Energy. Energy Storage Targets 2030 and 2050 Ensuring Europe’s Energy Security in a Renewable Energy System. 2022. Available online: https://ease-storage.eu/publication/energy-storage-targets-2030-and-2050/ (accessed on 30 August 2022).

- IEA. Grid-Scale Storage; IEA: Paris, France, 2022; Available online: https://www.iea.org/reports/grid-scale-storage (accessed on 30 August 2022).

- Hannan, M.A.; Wali, S.B.; Ker, P.J.; Rahman, M.S.A.; Mansor, M.; Ramachandaramurthy, V.K.; Muttaqi, K.M.; Mahlia, T.M.I.; Dong, Z.Y. Battery energy-storage system: A review of technologies, optimization objectives, constraints, approaches, and outstanding issues. J. Energy Storage 2021, 42, 103023. [Google Scholar] [CrossRef]

- Miao, Y.; Chen, T.; Bu, S.; Liang, H.; Han, Z. Co-Optimizing Battery Storage for Energy Arbitrage and Frequency Regulation in Real-Time Markets Using Deep Reinforcement Learning. Energies 2021, 14, 8365. [Google Scholar] [CrossRef]

- Yang, Y.; Lian, C.; Ma, C.; Zhang, Y. Research on Energy Storage Optimization for Large-Scale PV Power Stations under Given Long-Distance Delivery Mode. Energies 2020, 13, 27. [Google Scholar] [CrossRef] [Green Version]

- Chen, Y.-T.; Kuo, C.-C.; Jhan, J.-Z. Research on Energy Storage Optimization Operation Schedule in an Island System. Appl. Sci. 2021, 11, 3690. [Google Scholar] [CrossRef]

- Luo, L.; Abdulkareem, S.S.; Rezvani, A.; Miveh, M.R.; Samad, S.; Aljojo, N.; Pazhoohesh, M. Optimal scheduling of a renewable based microgrid considering photovoltaic system and battery energy storage under uncertainty. J. Energy Storage 2020, 28, 101306. [Google Scholar] [CrossRef]

- Wang, Y.; Tian, J.; Sun, Z.; Wang, L.; Xu, R.; Li, M.; Chen, Z. A comprehensive review of battery modeling and state estimation approaches for advanced battery management systems. Renew. Sustain. Energy Rev. 2020, 131, 110015. [Google Scholar] [CrossRef]

- Wang, L.; Li, M.; Chen, Z. An Energy Management Strategy for Hybrid Energy Storage Systems coordinate with state of thermal and power. Control Eng. Pract. 2022, 122, 105122. [Google Scholar] [CrossRef]

- Lai, C.S.; Locatelli, G.; Pimm, A.; Wu, X.; Lai, L.L. A review on long-term electrical power system modeling with energy storage. J. Clean. Prod. 2021, 280, 124298. [Google Scholar] [CrossRef]

- Katiraei, F.; Iravani, R.; Hatziargyriou, N.; Dimeas, A. Microgrids management. IEEE Power Energy Mag. 2008, 6, 54–65. [Google Scholar] [CrossRef]

- Zia, M.F.; Elbouchikhi, E.; Benbouzid, M. Microgrids energy management systems: A critical review on methods, solutions, and prospects. Appl. Energy 2018, 222, 1033–1055. [Google Scholar] [CrossRef]

- Meng, L.; Sanseverino, E.R.; Luna, A.; Dragicevic, T.; Vasquez, J.C.; Guerrero, J.M. Microgrid supervisory controllers and energy management systems: A literature review. Renew. Sustain. Energy Rev. 2016, 60, 1263–1273. [Google Scholar] [CrossRef]

- Menniti, D.; Pinnarelli, A.; Sorrentino, N.; Vizza, P.; Burgio, A.; Brusco, G.; Motta, M. A Real-Life Application of an Efficient Energy Management Method for a Local Energy System in Presence of Energy Storage Systems. In Proceedings of the IEEE International Conference on Environment and Electrical Engineering and 2018 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I&CPS Europe), Palermo, Italy, 12–15 June 2018. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, K.; Tang, X.; Dong, G. Editorial: Hybrid energy storage systems: Materials, devices, modeling, and applications. Front. Energy Res. 2022, 10, 1–3. [Google Scholar] [CrossRef]

- Hajiaghasi, S.; Salemnia, A.; Hamzeh, M. Hybrid energy storage system for microgrids applications: A review. J. Energy Storage 2019, 21, 543–570. [Google Scholar] [CrossRef]

- Tahir, Y.; Nadeem, M.F.; Ahmed, A.; Khan, I.A.; Qamar, F. A Review on Hybrid Energy Storage Systems in Microgrids. In Proceedings of the 3rd International Conference on Computing, Mathematics and Engineering Technologies (iCoMET), Sukkur, Pakistan, 29–30 January 2020. [Google Scholar] [CrossRef]

- Tabart, Q.; Vechiu, I.; Etxeberria, A.; Bacha, S. Hybrid Energy Storage System Microgrids Integration for Power Quality Improvement Using Four-Leg Three-Level NPC Inverter and Second-Order Sliding Mode Control. IEEE Trans. Ind. Electron. 2018, 65, 424–435. [Google Scholar] [CrossRef]

- Li, F.; Xie, K.; Yang, J. Optimization and Analysis of a Hybrid Energy Storage System in a Small-Scale Standalone Microgrid for Remote Area Power Supply (RAPS). Energies 2015, 8, 4802–4826. [Google Scholar] [CrossRef]

- Bharatee, A.; Ray, P.K.; Subudhi, B.; Ghosh, A. Power Management Strategies in a Hybrid Energy Storage System Integrated AC/DC Microgrid: A Review. Energies 2022, 15, 7176. [Google Scholar] [CrossRef]

- Gan, L.K.; Reniers, J.; Howey, D. A hybrid vanadium redox/lithium-ion energy storage system for off-grid renewable power. In Proceedings of the IEEE Energy Conversion Congress and Exposition (ECCE), Cincinnati, OH, USA, 1–5 October 2017. [Google Scholar] [CrossRef]

- Qiu, X.; Nguyen, T.A.; Crow, M.L. Heterogeneous Energy Storage Optimization for Microgrids. IEEE Trans. Smart Grid 2016, 7, 1453–1461. [Google Scholar] [CrossRef]

- Viswanathan, V.; Mongird, K.; Franks, R.; Li, X.; Sprenkle, V.T. 2022 Grid Energy Storage Technology Cost and Performance Assessment. Available online: https://www.pnnl.gov/sites/default/files/media/file/ESGC%20Cost%20Performance%20Report%202022%20PNNL-33283.pdf (accessed on 30 August 2022).

- Energa Obrót. Standard Energy Prices for Commercial Customers Valid from 17.08.2022. Available online: https://www.energa.pl/dam/jcr:ae1072bf-f32f-4a83-8a89-dda88aa03ffd/Cennik%20standardowy%20dla%20przedsi%C4%99biorstw%20obowi%C4%85zuj%C4%85cy%20od%2017%20sierpnia%202022.pdf (accessed on 30 August 2022).

- Urząd Regulacji Energetyki. Energy Market: The Average Energy Price on the Competitive Market in the Second Quarter of 2022 Was almost PLN 472/MWh. Available online: https://www.ure.gov.pl/pl/urzad/informacje-ogolne/aktualnosci/10551,Rynek-energii-srednia-cena-energii-na-rynku-konkurencyjnym-w-drugim-kwartale-202.html (accessed on 30 September 2022).

- Yang, Y.; Li, H.; Aichhorn, A.; Zheng, J.; Greenleaf, M. Sizing Strategy of Distributed Battery Storage System With High Penetration of Photovoltaic for Voltage Regulation and Peak Load Shaving. IEEE Trans. Smart Grid 2014, 5, 982–991. [Google Scholar] [CrossRef]

- Available online: https://www.python.org/ (accessed on 30 August 2022).

- Available online: https://numpy.org/ (accessed on 30 August 2022).

- Available online: https://scipy.org/ (accessed on 30 August 2022).

- Eid, C.; Koliou, E.; Valles, M.; Reneses, J.; Hakvoort, R. Time-based pricing and electricity demand response: Existing barriers and next steps. Util. Policy 2016, 40, 15–25. [Google Scholar] [CrossRef] [Green Version]

- Powell, M.J. A Direct Search Optimization Method That Models the Objective and Constraint Functions by Linear Interpolation. In Advances in Optimization and Numerical Analysis: Mathematics and Its Applications; Springer: Dordrecht, The Netherlands, 1994; pp. 51–67. [Google Scholar] [CrossRef]

- SLSQP Documentation of Python Scipy Package. Available online: https://docs.scipy.org/doc/scipy/reference/optimize.minimize-slsqp.html#optimize-minimize-slsqp (accessed on 30 August 2022).

- Dieter Kraft: A Software Package for Sequential Quadratic Programming; DFVLR-FB 88-28; DLR German Aerospace Center: Cologne, Germany, 1988.

- Fracas, P.; Camarda, K.V.; Zondervan, E. Shaping the future energy markets with hybrid multimicrogrids by sequential least squares programming. Phys. Sci. Rev. 2021, 6, 20200050. [Google Scholar] [CrossRef]

- Fracas, P.; Zondervan, E.; Franke, M.; Camarda, K.; Valtchev, S.; Valtchev, S. Techno-Economic Optimization Study of Interconnected Heat and Power Multi-Microgrids with a Novel Nature-Inspired Evolutionary Method. Electronics 2022, 11, 3147. [Google Scholar] [CrossRef]

- Carrier, G.; Destarac, D.; Dumont, A.; Méheut, M.; El Din, I.S.; Jacques, P.; Saloua, K.; Brezillon, J.; Pestana, M. Gradient-Based Aerodynamic Optimization with the elsA Software. In Proceedings of the 52nd AIAA Aerospace Sciences Meeting—AIAA Science and Technology Forum and Exposition, SciTech 2014, National Harbor, MD, USA, 13–17 January 2014. [Google Scholar] [CrossRef] [Green Version]

- Zahery, M.; Maes, H.; Neale, M. CSOLNP: Numerical Optimization Engine for Solving Non-linearly Constrained Problems. Twin Res. Hum. Genet. 2017, 20, 290–297. [Google Scholar] [CrossRef] [PubMed]

- Cormen, T.H.; Leiserson, C.E.; Rivest, R.L.; Stein, C. Introduction to Algorithms; The MIT Press: Cambridge, MA, USA, 2001; ISBN 0262032937. [Google Scholar]

| Parameter | Symbol | Unit | VRFB | LFP |

|---|---|---|---|---|

| Installed capacity | Ebol | kWh | 100 | 54 |

| Max. continuous power | Pmax | kW | 15 | 32 |

| Allowed depth of discharge | DoD | % | 100 | 80 |

| Nominal number of cycles | NoC | - | 5200 | 2000 |

| Round trip efficiency | RTE | % | 68 | 86 |

| Battery block replacement cost | ReC | PLN/system | 166,000 | 60,750 |

| Unit | Without HESS | Energy Balancing | Economic Optimization | Modified Economic Optimization | |

|---|---|---|---|---|---|

| Import of energy | [MWh] | 138.4 | 115.86 | 123.59 | 122.38 |

| Export of energy | [MWh] | −61.5 | −30.68 | −32.84 | −31.08 |

| Self-consumption rate | [%] | 57.3 | 78.7 | 77.8 | 79.3 |

| Energy balance | [MWh] | 76.8 | 85.19 | 90.75 | 91.3 |

| Cost of import | [PLN] | 324,091 | 270,695 | 261,351 | 258,820 |

| Profit from export | [PLN] | 29,060 | 14,478 | 15,502 | 14,671 |

| VRFB Charge energy | [MWh] | 23.11 | 35.88 | 37.71 | |

| VRFB Discharge energy | [MWh] | − | 15.78 | 24.45 | 25.71 |

| VRFB Equivalent cycles | - | − | 158 | 244 | 257 |

| VRFB Expected Lifetime | [years] | − | 33 | 21 | 20 |

| VRFB Depreciation cost | [PLN] | 5038 | 7804 | 8207 | |

| LFP Charge energy | [MWh] | 7.78 | 17.78 | 18.21 | |

| LFP Discharge energy | [MWh] | − | 6.79 | 15.33 | 15.78 |

| LFP Equivalent cycles | - | − | 126 | 284 | 292 |

| LFP Expected Lifetime | [years] | − | 16 | 7 | 7 |

| LFP Depreciation cost | [PLN] | 4773 | 10,778 | 11,096 | |

| Energy cost | [PLN] | 295,031 | 256,217 | 245,850 | 244,150 |

| Financial outcome (including battery depreciation) | [PLN] | 295,031 | 266,028 | 264,432 | 263,453 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rafał, K.; Radziszewska, W.; Grabowski, O.; Biedka, H.; Verstraete, J. Energy Cost Minimization with Hybrid Energy Storage System Using Optimization Algorithm. Appl. Sci. 2023, 13, 518. https://doi.org/10.3390/app13010518

Rafał K, Radziszewska W, Grabowski O, Biedka H, Verstraete J. Energy Cost Minimization with Hybrid Energy Storage System Using Optimization Algorithm. Applied Sciences. 2023; 13(1):518. https://doi.org/10.3390/app13010518

Chicago/Turabian StyleRafał, Krzysztof, Weronika Radziszewska, Oskar Grabowski, Hubert Biedka, and Jörg Verstraete. 2023. "Energy Cost Minimization with Hybrid Energy Storage System Using Optimization Algorithm" Applied Sciences 13, no. 1: 518. https://doi.org/10.3390/app13010518