Energy-Based Economic Sustainability Protocols

Abstract

:1. Introduction

2. Background

2.1. Limitations on Impact Assessments

2.2. Opportunities for Blockchain-Based Impact Assessment

3. Materials and Methods

3.1. Circular Economy Reformulation: About Energy-Based Protocols on Resources and Impacts

3.2. Framework Boundaries

3.3. LCA Tree: Allocation, Aggregation, and Cut-Off

3.4. Impact Standardisation

4. Theory

4.1. Energy Theory of Value

4.1.1. Capital (Energy) and Debt

4.1.2. Use Value and Exchange Value

4.1.3. Measuring the Exchange Value

4.2. Evaluation of Societal Wealth

4.2.1. Quality of the Common

4.2.2. The Value of the Common

4.2.3. Evaluating the Costs of Impacts

4.3. Time-Discrete Activities, Overcoming a Lack of Raw-Material Tokenization

5. Results

5.1. A Tool for Industrial Policies: Stakeholder’s Responsibility Paradigm

5.2. Grouped Interests

5.2.1. Wealth of Territories

5.2.2. Land Use Issuance Cap

5.3. Sustainable Minting Function: Keen Universal Basic Energy

5.4. Node Consensus for Pollution Sampling Schemes

5.5. The Role of a Payment Tracking System in the Depletion of the Commons

5.6. About Extractors, Recyclers, and Optimizers

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Nomenclature and Abbreviations

| CExC | Cumulative Exergy Consumption is an indicator introduced by Szargut [32] in 1987. It integrates exergy accounting as an ecological and thermodynamic indicator for the assessment of production processes and supply chains. |

| CF | Community (-based) Forestry is the concept of local communities that, when granted sufficient property rights over local forest commons, can organize autonomously [44]. |

| cradle-to-gate | Cradle-to-gate is a boundary condition of LCA analysis. It refers to an assessment of the life cycle of events related to the production of a good from the extraction of raw materials required for its fabrication until the product’s sale [45]. |

| cradle-to-grave | Cradle-to-grave is a boundary condition of LCA analysis. It refers to an assessment of the life cycle of a product from the extraction of raw materials required for its fabrication, until its use and disposal. |

| EIB | European Investment Bank. The EIB has as shareholders the EU member states. |

| EPD | Environmental Product Declaration is a report standard that states what a product is made of and how it impacts the environment across its entire life cycle. It is defined by International Organization for Standardization (ISO 14025) as a Type III declaration [46]. It enables comparisons between products fulfilling the same function. For more information, see: www.environdec.com, accessed on 23 May 2023). |

| ETS | Emission Trading System is a market mechanism that limits by a ’cap’ the number of emission allowances. In this paper, ETS is particularly referred to as European emission trading system (EU ETS). https://ec.europa.eu/clima/policies/ets/cap_en, accessed on 23 May 2023. |

| exchange value | The objective value given as the cost of production sustained by the seller to create a particular activity [47]. |

| externalities | External costs that are not computed in the production cost by the producer given the divergent interest among the decisional criteria of the producer (e.g., minimization of cost) and the internalisation of its social cost [48]. |

| FDI | Foreign Direct Investment is an investment made by a firm or individual resident in one specific country into business interests located abroad. |

| gate-to-gate | Gate-to-gate is a boundary condition of LCA analysis. In this paper, gate-to-gate refers to the boundary condition from the procurement of the resources until sales of goods. Therefore, it is only referenced in the production stage of the considered activity. |

| GHG | Greenhouse Gases are those gaseous constituents of the atmosphere, both natural and anthropogenic, that absorb and emit radiation at specific wavelengths within the spectrum of thermal infrared radiation emitted by the Earth’s surface, the atmosphere itself, and by clouds. This property causes the greenhouse effect. |

| GRI | Global Reporting Initiative is an international standards organization that helps businesses, governments, and other organizations to understand and communicate their impacts. https://www.globalreporting.org/, accessed on 23 May 2023. |

| IMF | International Monetary Fund. https://www.imf.org/en/About, accessed on 23 May 2023. |

| IP | Intellectual property refers broadly to the intangible creations of the human intellect. |

| IPCC | Intergovernmental Panel on Climate Change is a paragovernmental organization based in Switzerland. Website: www.ipcc.ch, accessed on 23 May 2023. |

| irradiance | Irradiance is the net amount of electromagnetic energy per unit of area that hits the Earth’s surface. It depends on the spectrum of the incoming source, on the absorbance characteristics of the atmosphere, and on the incident angle with respect to the planet surface. |

| ISO | The International Organization for Standardisation is an organization that brings together experts to share knowledge and develop voluntary, consensus-based, market-relevant International Standards. https://www.iso.org/home.html, accessed on 23 May 2023. |

| LCA | Life-Cycle Assessment methodology, the conjunction of impact assessment to life-cycle inventory analysis. |

| ReCiPe | ReCiPe is a method of Life-Cycle Impact Assessment (LCIA). It was first developed in 2008 through cooperation between Rijksinstituut voor Volksgezondheid en Milieu, Radboud University Nijmegen, Leiden University, and PRé Sustainability |

| REDD+ | Reducing Emissions from Deforestation and forest Degradation is a monetary incentive framework idealised by United Nations in Midtown Manhattan, New York City, United States. and having its claimed purpose as the conservation and sustainable management of forests and enhancement of forest carbon stocks in developing countries. |

| resources | A resource is a source or supply from which a benefit is produced and that has some utility. Throughout this paper, the term resource is used to identify both the raw material (e.g., air, water, minerals, etc.) and output of production activities, if not otherwise specified. |

| Scope 1 | Scope 1 emissions are direct emissions from sources that are either owned or controlled by stakeholders. |

| Scope 2 | Scope 2 emissions are indirectly produced by the generation of purchased energy. |

| Scope 3 | Scope 3 emissions are all indirect emissions (not included in Scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions. |

| Type III declaration | Environmental label or declaration that provides quantitative environmental data using predetermined parameters (based on the ISO 14040 series of standards) and, where relevant, additional environmental information in the form of quantitative or qualitative information. |

| use value | The subjective value, or usefulness, that a transaction has for the buyer [47]. Such value is defined only if higher than the exchange value of a transaction or higher than the value of the transaction plus the social cost (if not previously internalised at the production stage by the seller). |

| user groups | Groups of stakeholders in charge of managing CF practices. These groups are committees having the same interest with respect to the CF policies defined by the governmental authority that provides the ownership of the land. |

Appendix A. Featuring the LCA Framework

Appendix A.1. Lack of Sampling Penalty

Appendix A.2. LCA Boundaries and Impact Thresholds

Appendix A.3. Asset-Specific Activities

Appendix A.4. Double-Allocation Criterion: Avoiding Double Counting

Appendix A.5. Economy-Embedded LCA, with or without Inventory

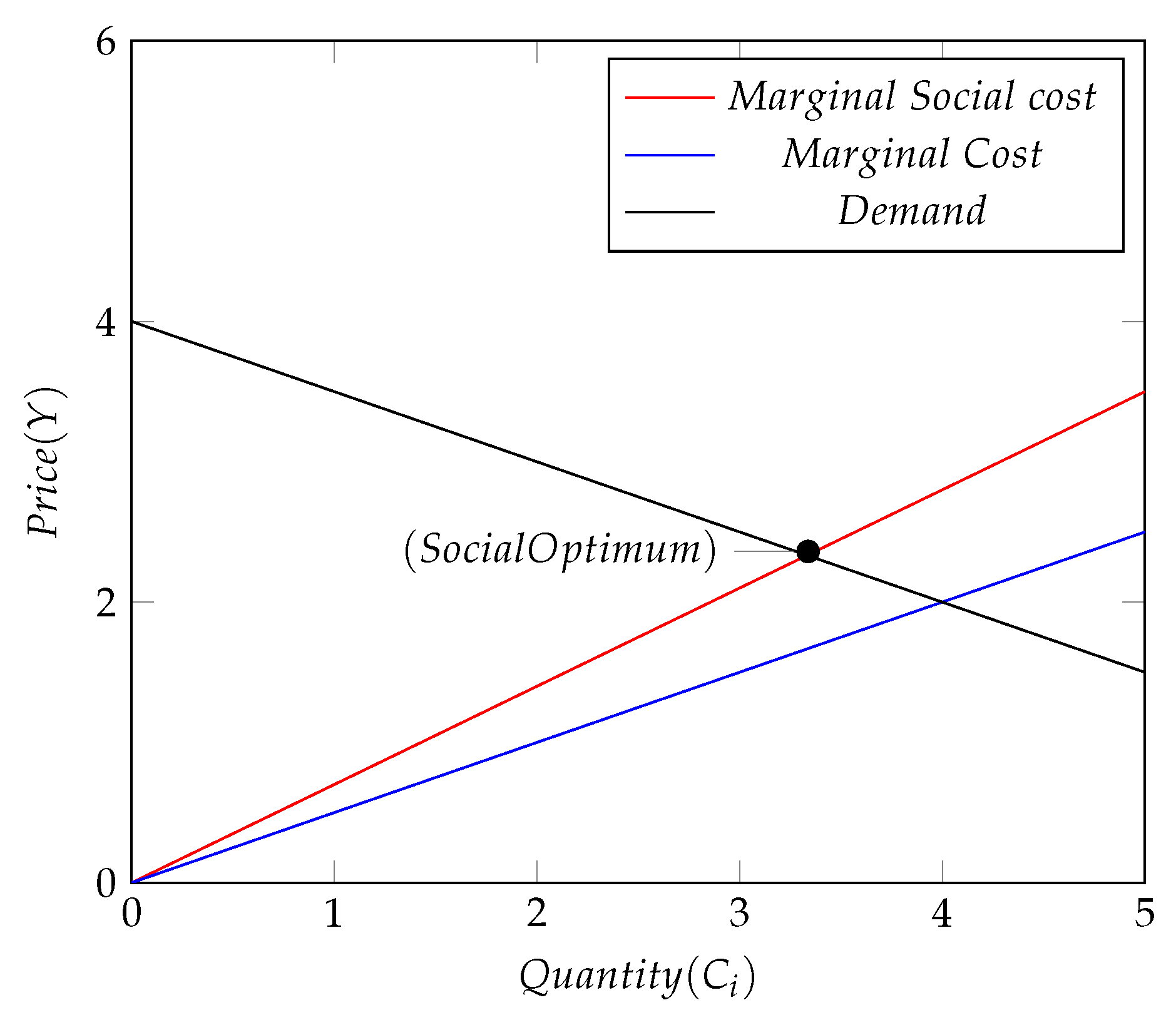

Appendix B. Pigouvian Relativism

Appendix B.1. One Transaction

Appendix B.2. Pigouvian Optimum in Real Case Scenario

- A

- Total marginal cost: 0.8Ct

- Marginal prod. cost: 0.5Ct

- Marginal benefit (Price): 4 − 0.5Ct

- B

- Total marginal cost: 0.8Ct

- Marginal prod. cost: 0.3Ct

- Marginal benefit (Price): 4 − 0.1C3t

- C

- Total marginal cost 2 − 0.3Ct

- Marginal prod. cost: 2

- Marginal benefit (Price): 4 − 0.8Ct

- D

- Total marginal cost 1.2Ct

- Marginal prod. cost: 0.6Ct

- Marginal benefit (Price): 1 − 0.2C3t + C2t

- A:

- 1.54137210620019

- B:

- 0.924823263720113

- C:

- 2

- D:

- 4.00756747612049

- A:

- 0.917255787599622

- B:

- 0.14554876689045

- C:

- −0.466195369920302

- D:

- 0.636488464188661

Appendix B.3. Pigouvian Fixed Tax and Known Abatement Costs

- MCAAB:

- 0.1Ct

- MCBAB:

- 0.3Ct

- MCCAB:

- 0 (does not emit the pollutant considered)

- MCDAB:

- 0.4 C2t

- A

- 3.08274420502072

- B

- 1.02758137221261

- C

- 0

- D

- 0.877887281291458

Appendix B.4. Cap and Trade Market

- A

- 3.08274420502072

- B

- 1.02758137221261

- C

- 0

- D

- 0.877887281291458

- A

- 0

- B

- 1.05592356733896

- C

- −2.85099355007665

- D

- 1.45841821623506

- A

- 0 − 0.950331183358883 = −0.950331183358883

- B

- 1.05592356733896 − 0.950331183358883 = 0.10559238398008

- C

- −2.85099355007665 − 0.950331183358883 = −3.80132473343553

- D

- 1.45841821623506 − 0.950331183358883 = 0.508087032876176

- A

- EUR −0.950331183358883/28 = −0.033940399405674 Ton CO2eq

- B

- 0.003771156570717 Ton CO2eq

- C

- −0.135761597622698 Ton CO2eq

- D

- 0.018145965459864 Ton CO2eq

Appendix B.5. Scenario Comparison: The Decisional Problem

| Listing A1. Problem initialization. |

|

Appendix B.5.1. Fixed Tax vs. Custom Tax

- tax = [0.91725579497928, 0.145548790143704,

- 0.466195364016576, 0.636488470361734]

| Listing A2. Cost function. |

|

Appendix B.5.2. Influence of Information on Abatement Costs in the Decisional Process

- tax = [1.07984316017484, 1.07984316017484,

- 1.07984316017484, 1.07984316017484]

- ctot = 2.43488451004777

Appendix C. Transparency in Neofeudalism

Appendix C.1. Land-Use Allocation in Wealth Generation

| Symbol | Unit | Value | 50 km2, 1 yr |

|---|---|---|---|

| Tree Density | No. of Plants/ha · yr | 10,000 | |

| RA* − YieldA | kgofficinalis/plant | 10 | Kg |

| RB* − YieldB | kgfruit/plant | 15 | Kg |

| RC* − YieldC | kgbiomass/plant | 20 | Kg |

| EUR/tonCO2 | 28 | - | |

| tonCO2/ Kg | −0.2 | - | |

| tonCO2/ Kg | - | ||

| tonCO2/ Kg | −0.2 | - | |

| CA | tonCO2/myr | −1 | tonCO2 |

| CB | tonCO2/myr | −0.5 | 107 tonCO2 |

| CC | tonCO2/mmyr | −2 | 108 tonCO2 |

| % | 1 | - | |

| kWh/kg | 0.34 (24 h · 365 d)/10 | - | |

| kWh/kg | 0.34 (24 h · 365 d)/15 | - | |

| kWh/kg | 0.34 (24 h · 365 d)/20 | - | |

| EUR/kWh | 0.2 | - | |

| /plant | 30 | m3 | |

| /plant | 40 | m3 | |

| /plant | 50 | m3 | |

| kWh/kg | - |

Appendix C.1.1. Evaluating Objective Wealth

| Stakeholders | f(UA) | f(UB) | f(UC) |

|---|---|---|---|

| user groups | EUR 10 | EUR 1 | EUR 2 |

| Aborigens | EUR 4 | EUR 2 | EUR 1 |

Appendix C.1.2. Evaluating Subjective Wealth

Appendix C.1.3. Including Impacts

References

- Quesnay, F. Tableau Oeconomique; Macmillan: New York, NY, USA, 1894. [Google Scholar]

- Cobb, C.W.; Douglas, P.H. A theory of production. Am. Econ. Rev. 1928, 18, 139–165. [Google Scholar]

- Coase, R.H. The problem of social cost. In Classic Papers in Natural Resource Economics; Springer: Berlin/Heidelberg, Germany, 1960; pp. 87–137. [Google Scholar]

- Pigou, A.C. The Economics of Welfare; Palgrave Macmillan: London, UK, 2013. [Google Scholar]

- Baumol, W.J. Leontief’s great leap forward: Beyond Quesnay, Marx and von Bortkiewicz. Econ. Syst. Res. 2000, 12, 141–152. [Google Scholar] [CrossRef]

- Frischknecht, R. Transparency in LCA-a heretical request? Int. J. Life Cycle Assess. 2004, 9, 211–213. [Google Scholar] [CrossRef]

- Fritter, M.; Lawrence, R.; Marcolin, B.; Pelletier, N. A survey of Life Cycle Inventory database implementations and architectures, and recommendations for new database initiatives. Int. J. Life Cycle Assess. 2020, 25, 1522–1531. [Google Scholar] [CrossRef]

- Wittmaier, M.; Langer, S.; Sawilla, B. Possibilities and limitations of life cycle assessment (LCA) in the development of waste utilization systems-Applied examples for a region in Northern Germany. Waste Manag. 2009, 29, 1732–1738. [Google Scholar] [CrossRef] [PubMed]

- Howard, N. Environmental assessment and rating-have we lost the plot? Procedia Eng. 2017, 180, 640–650. [Google Scholar] [CrossRef]

- Leontief, W. Environmental repercussions and the economic structure: An input-output approach. Rev. Econ. Stat. 1970, 52, 262–271. [Google Scholar] [CrossRef]

- Hendrickson, C.; Horvath, A.; Joshi, S.; Juarez, O.; Lave, L.; Matthews, H.S.; McMichael, F.C.; Cobas-Flores, E. Economic Input-Output-Based Life Cycle Assessment (EIO-LCA). Mental 1998. Available online: https://www.researchgate.net/profile/H-Matthews-2/publication/242142910_Economic_Input-Output-Based_Life-Cycle_Assessment_EIO-LCA/links/0c96053b2c2bd76615000000/Economic-Input-Output-Based-Life-Cycle-Assessment-EIO-LCA.pdf (accessed on 23 May 2023).

- Troszak, T. Why do we burn coal and trees to make solar panels? Res. Gate 2019. [Google Scholar] [CrossRef]

- Remme, R.P.; Edens, B.; Schroter, M.; Hein, L. Monetary accounting of ecosystem services: A test case for Limburg province, the Netherlands. Ecol. Econ. 2015, 112, 121. [Google Scholar] [CrossRef]

- Ruet, J.; Gambiez, M.; Lacour, E. Private appropriation of resource: Impact of peri-urban farmers selling water to Chennai Metropolitan Water Board. Cities 2007, 24, 110–121. [Google Scholar] [CrossRef]

- Neir, A.M. The history of the Federal government’s involvement in water resources: An attempt to correct externalities? Water Resour. Prof. Proj. Rep. 2010, 12–13. Available online: https://digitalrepository.unm.edu/cgi/viewcontent.cgi?article=1140&context=wr_sp (accessed on 23 May 2023).

- Chiolerio, A. Liquid Cybernetic Systems: The Fourth-Order Cybernetics. Adv. Intell. Syst. 2020, 2, 2000120. [Google Scholar] [CrossRef]

- Solid Biomass Conformity Assessment Scheme for Energy Applications. Available online: https://wetten.overheid.nl/BWBR0040431/2018-01-01/ (accessed on 23 May 2023).

- Murray, D.; Stankovic, L.; Stankovic, V.; Espinoza-Orias, N. Appliance electrical consumption modelling at scale using smart meter data. J. Clean. Prod. 2018, 187, 237–249. [Google Scholar] [CrossRef]

- Pratt, R.G.; Balducci, P.J.; Gerkensmeyer, C.; Katipamula, S.; Kintner-Meyer, M.C.; Sanquist, T.F.; Schneider, K.P.; Secrest, T.J. The Smart Grid: An Estimation of the Energy and CO2 Benefits; Technical Report; Pacific Northwest National Lab. (PNNL): Richland, WA, USA, 2010. [Google Scholar] [CrossRef]

- Toma, A.R.; Gheorghe, C.M.; Neacsu, F.L.; Dumitrescu, A.M. Conversion of smart meter data in user-intuitive carbon footprint information. In Proceedings of the 2017 5th International Symposium on Electrical and Electronics Engineering (ISEEE), Galati, Romania, 20–22 October 2017; IEEE: Piscataway, NJ, USA, 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Taranto, F. Exergy Indicators for Resource Impact Assesment: An Application of Erosion Remediation Techniques on Highway Slope. POLITesi 2013. Available online: https://www.politesi.polimi.it/handle/10589/75062 (accessed on 23 May 2023).

- Cochrane, D.; Hammarfelt, B.; Rushforth, A.D.; de Rijcke, S.; Chong, P.K.; Bourgoin, A.; Meyer, M.; Wilbanks, R.; Bidet, A. Disobedient Things: The Deepwater Horizon Oil Spill and Accounting for Disaster. Valuat. Stud. 2020, 7, 3–32. Available online: https://valuationstudies.liu.se/article/download/357/1023 (accessed on 23 May 2023). [CrossRef]

- Hennings, K.H. Capital as a Factor of Production. In Capital Theory; Springer: Berlin/Heidelberg, Germany, 1990; pp. 108–122. [Google Scholar]

- Serrano, F.; Mazat, N. Quesnay and the Analysis of Surplus in the Capitalist Agriculture. Contrib. Political Econ. 2017, 36, 81–102. [Google Scholar] [CrossRef]

- Nitzan, J.; Bichler, S. Capital as Power: A Study of Order and Creorder; Routledge: London, UK, 2009. [Google Scholar]

- Alessio, F.J. Energy analysis and the energy theory of value. Energy J. 1981, 2. [Google Scholar] [CrossRef]

- Chen, J. An entropy theory of value. Struct. Chang. Econ. Dyn. 2018, 47, 73–81. [Google Scholar] [CrossRef]

- Costanza, R. Value theory and energy. Encycl. Energy 2004, 6, 337–346. [Google Scholar]

- Sciubba, E. From Engineering Economics to Extended Exergy Accounting: A Possible Path from Monetary to Resource-Based Costing. J. Ind. Ecol. 2004, 8, 19–40. [Google Scholar] [CrossRef]

- Stallinga, P. On the Energy Theory of Value: Economy and Policies. Mod. Econ. 2020, 11, 1083–1120. [Google Scholar] [CrossRef]

- Hyman, E. Net Energy Analysis and the Theory of Value: Is It a New Paradigm for a Planned Economic System? East-West Center: Honolulu, HI, USA, 1980. [Google Scholar]

- Szargut, J. Analysis of cumulative exergy consumption. Int. J. Energy Res. 1987, 11, 541–547. [Google Scholar] [CrossRef]

- Ayres, R.U.; Van den Bergh, J.C. A theory of economic growth with material/energy resources and dematerialization: Interaction of three growth mechanisms. Ecol. Econ. 2005, 55, 96–118. [Google Scholar] [CrossRef]

- Lindsey, R. Climate and Earth’s Energy Budget. NASA-Earth Obs. 2019. Available online: https://earthobservatory.nasa.gov/features/EnergyBalance (accessed on 23 May 2023).

- Brown, N. Contradictions of value: Between use and exchange in cord blood bioeconomy. Sociol. Health Illn. 2013, 35, 97–112. [Google Scholar] [CrossRef]

- Delgado-Galvan, X.; Perez-Garcia, R.; Izquierdo, J.; Mora-Rodriguez, J. An analytic hierarchy process for assessing externalities in water leakage management. Math. Comput. Model. 2010, 52, 1194–1202. [Google Scholar] [CrossRef]

- Szargut, J.; Morris, D.R. Cumulative exergy consumption and cumulative degree of perfection of chemical processes. Int. J. Energy Res. 1987, 11, 245–261. [Google Scholar] [CrossRef]

- Garofalo, E.; Bevione, M.; Cecchini, L.; Mattiussi, F.; Chiolerio, A. Waste Heat to Power: Technologies, Current Applications, and Future Potential. Energy Technol. 2020, 8, 2000413. [Google Scholar] [CrossRef]

- He, W.; Kong, X.; Qin, N.; He, Q.; Liu, W.; Bai, Z.; Wang, Y.; Xu, F. Combining species sensitivity distribution (SSD) model and thermodynamic index (exergy) for system-level ecological risk assessment of contaminates in aquatic ecosystems. Environ. Int. 2019, 133, 105275. [Google Scholar] [CrossRef]

- Chanel, O.; Douenne, T.; Lefèvre, M. Valuing the Economic Consequences of Air Pollution-Related Health Risks: A Review of Recent Studies. Int. J. Environ. Res. Public Health 2019, 16, 2373. [Google Scholar] [CrossRef]

- De Meester, B.; Dewulf, J.; Janssens, A.; Van Langenhove, H. An improved calculation of the exergy of natural resources for exergetic life cycle assessment (ELCA). Environ. Sci. Technol. 2006, 40, 6844–6851. [Google Scholar] [CrossRef]

- Bosch, M.E.; Hellweg, S.; Huijbregts, M.A.; Frischknecht, R. Applying cumulative exergy demand (CExD) indicators to the ecoinvent database. Int. J. Life Cycle Assess. 2007, 12, 181. [Google Scholar] [CrossRef]

- Castano, S.; Sanz, D.; Gomez-Alday, J.J. Methodology for quantifying groundwater abstractions for agriculture via remote sensing and GIS. Water Resour. Manag. 2010, 24, 795–814. [Google Scholar] [CrossRef]

- Burrows, P. Pigovian Taxes, Polluter Subsidies, Regulation, and the Size of a Polluting Industry. Can. J. Econ. 1979, 12, 497–499. [Google Scholar] [CrossRef]

- Parry, I.W.; Heine, M.D.; Lis, E.; Li, S. Getting Energy Prices Right: From Principle to Practice; International Monetary Fund: Washington, DC, USA, 2014. [Google Scholar]

- Hudson, M. The Road to Debt Deflation, Debt Peonage, and Neofeudalism; Number 708, Working Paper; Levy Economics Institute of Bard College: Annandale-On-Hudson, NY, USA, 2012. [Google Scholar]

- Kotkin, J. The Coming of Neo-Feudalism: A Warning to the Global Middle Class; Encounter Books: New York, NY, USA, 2020. [Google Scholar]

- Poudel, M. Examining Outcomes of REDD+ through Community Forestry in Rural Nepal. Ph.D. Thesis, Institute of Forestry, Tribhuvan University, Kirtipur, Nepal, 2014. [Google Scholar]

| Criterion | Unit |

|---|---|

| Acidification | Kg SO2eq |

| Eutrophication | Kg PO4-eq |

| Global warming | Kg CO2eq |

| Depletion of stratospheric ozone layer | Kg CFCeq |

| Formation of tropospheric ozone | Kg Ethyleneeq |

| Symbol | Unit |

|---|---|

| t | Stakeholder |

| N | Threshold |

| j | Supplier |

| Oi,j | € |

| Ei,j | € |

| Ci,j | Kg or m3 s.c. |

| Pi,j | € |

| pi,j | Standardised impact |

| unit (S.I.U.)/Kg | |

| Table 1; Section 3.4 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Taranto, F.; Assom, L.; Chiolerio, A. Energy-Based Economic Sustainability Protocols. Appl. Sci. 2023, 13, 6554. https://doi.org/10.3390/app13116554

Taranto F, Assom L, Chiolerio A. Energy-Based Economic Sustainability Protocols. Applied Sciences. 2023; 13(11):6554. https://doi.org/10.3390/app13116554

Chicago/Turabian StyleTaranto, Federico, Luigi Assom, and Alessandro Chiolerio. 2023. "Energy-Based Economic Sustainability Protocols" Applied Sciences 13, no. 11: 6554. https://doi.org/10.3390/app13116554