Thermodynamic and Economic Analysis of a Liquid Air Energy Storage System with Carbon Capture and Storage for Gas Power Plants

Abstract

:1. Introduction

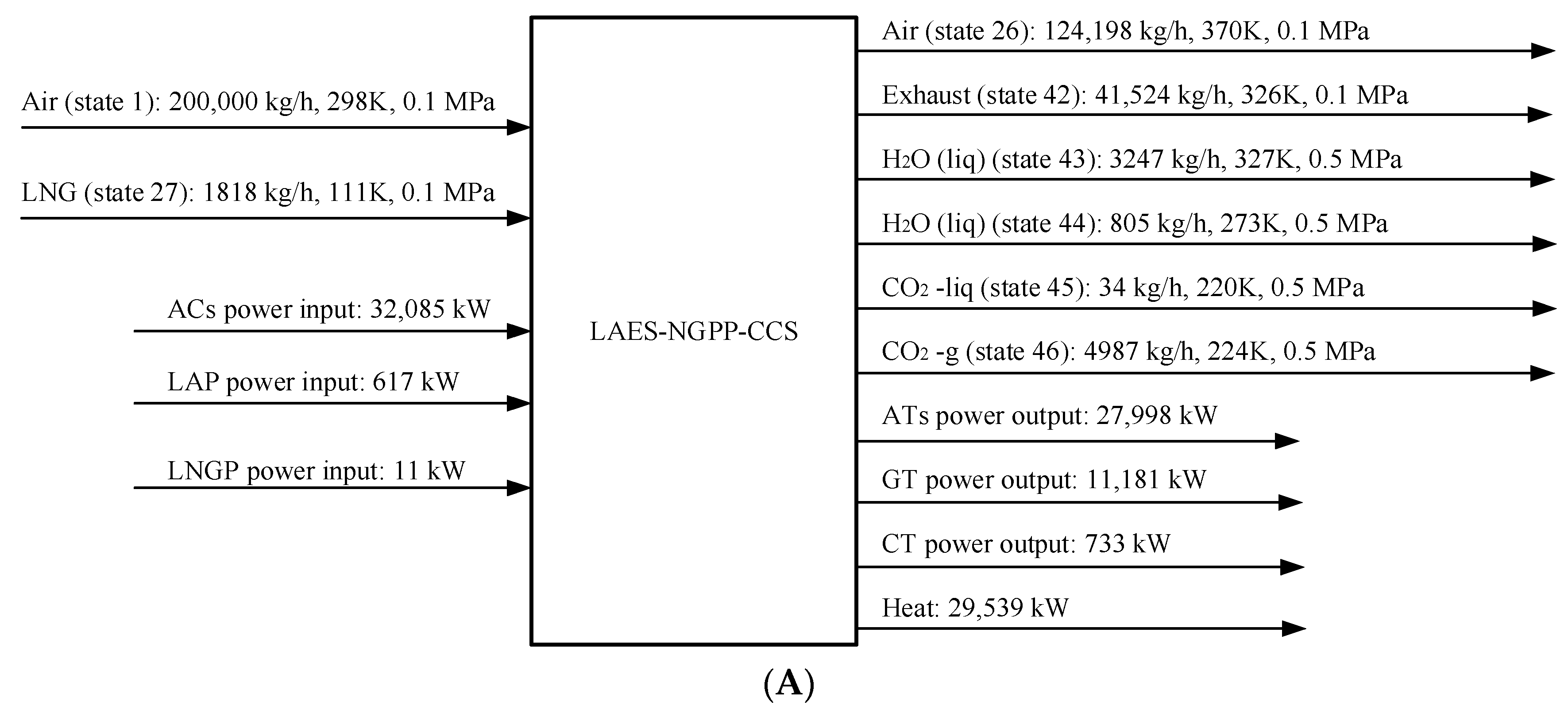

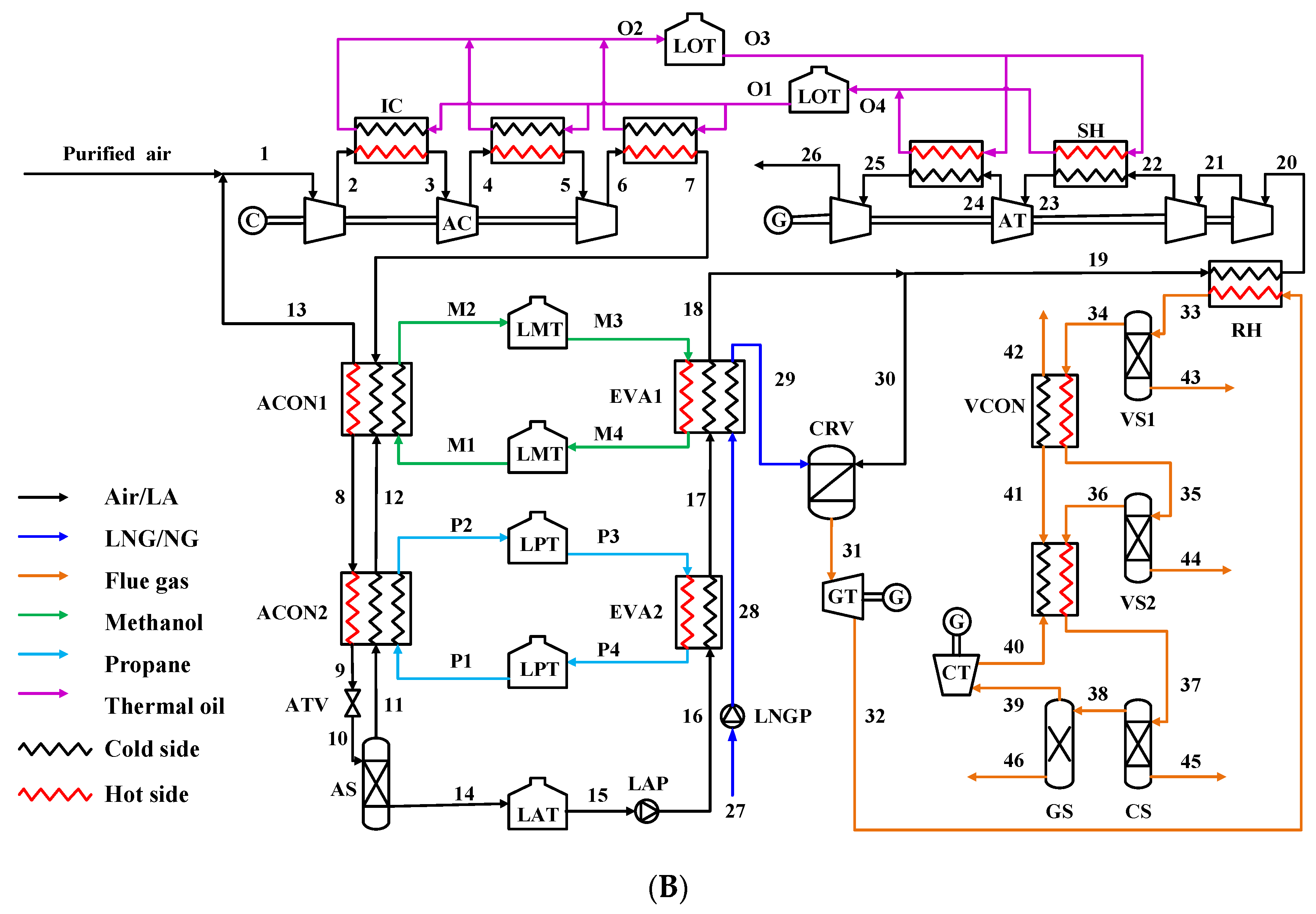

2. System Description

3. Methods

3.1. Initial Condition and Assumptions

- The atmospheric temperature and pressure are set to 298.1 K and 101.3 kPa [26];

- The energy storage and recovery processes operate at steady states [27];

- Ignore the kinetic and potential energy variations [28];

- The pressure drops through the heat exchangers are considered to be 1% of the inlet pressure [29];

- The minimum temperature difference (MTD) in the heat exchangers is set at 3K [27];

- NG is completely combusted in the CRV;

- The LNG is composed of methane [31]. The purified air stream is simplified to a ternary mixture consisting of 77% nitrogen, 22% oxygen, and 1% argon.

| Parameters | Values |

|---|---|

| /kg·h−1 | 200,000 |

| /K | 298.1 |

| /MPa | 0.1013 |

| /MPa | 0.1 |

| /MPa | 0.1 |

| /MPa | 8 |

| /K | 111.4 |

| /MPa | 0.1 |

| /MPa | 7 |

| /h | 8 |

| /h | 8 |

3.2. Thermodynamic Analysis

3.3. Economic Analysis

3.3.1. Investment Cost Function

3.3.2. Economic Performance Indicators

4. Results and Discussion

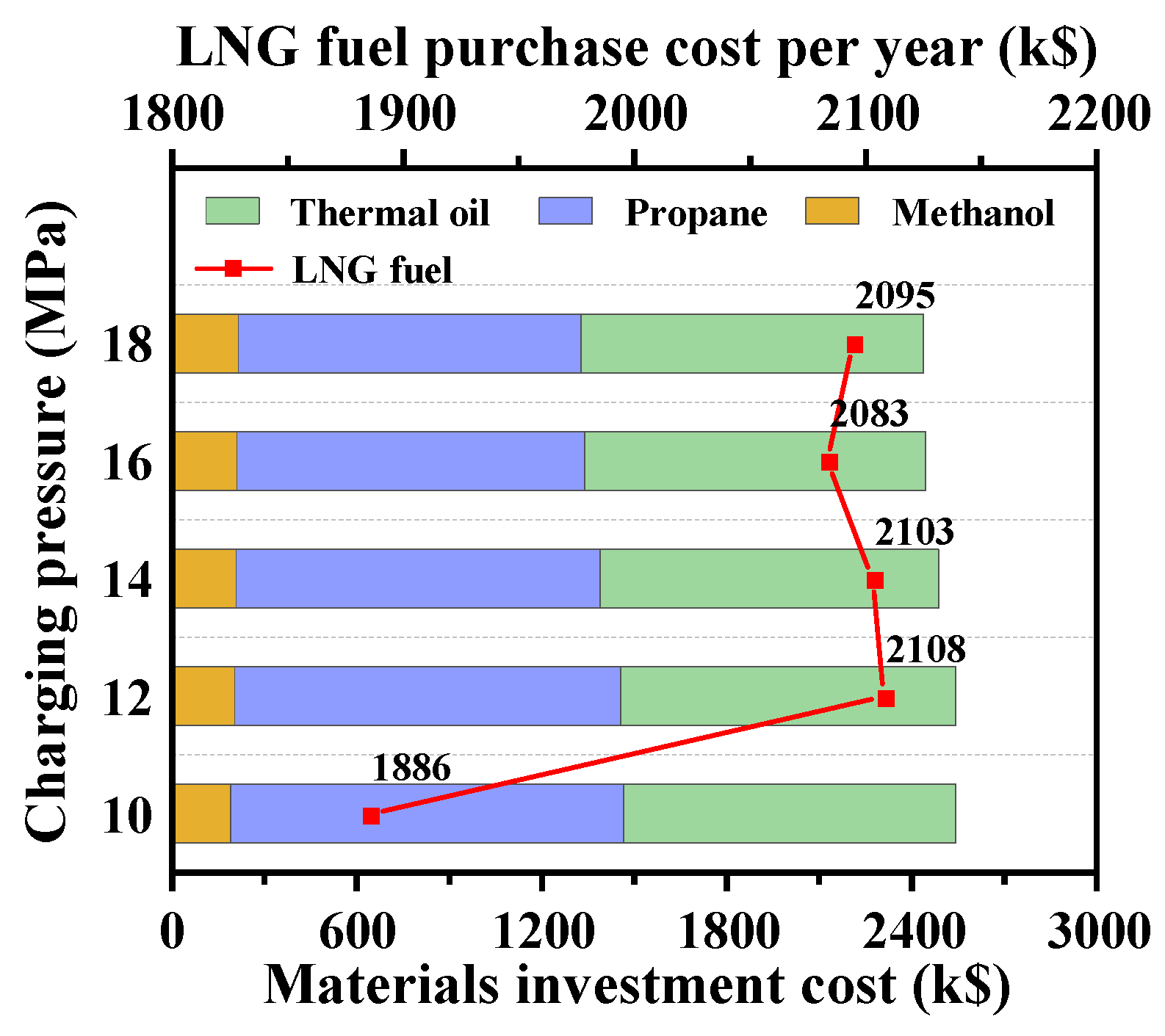

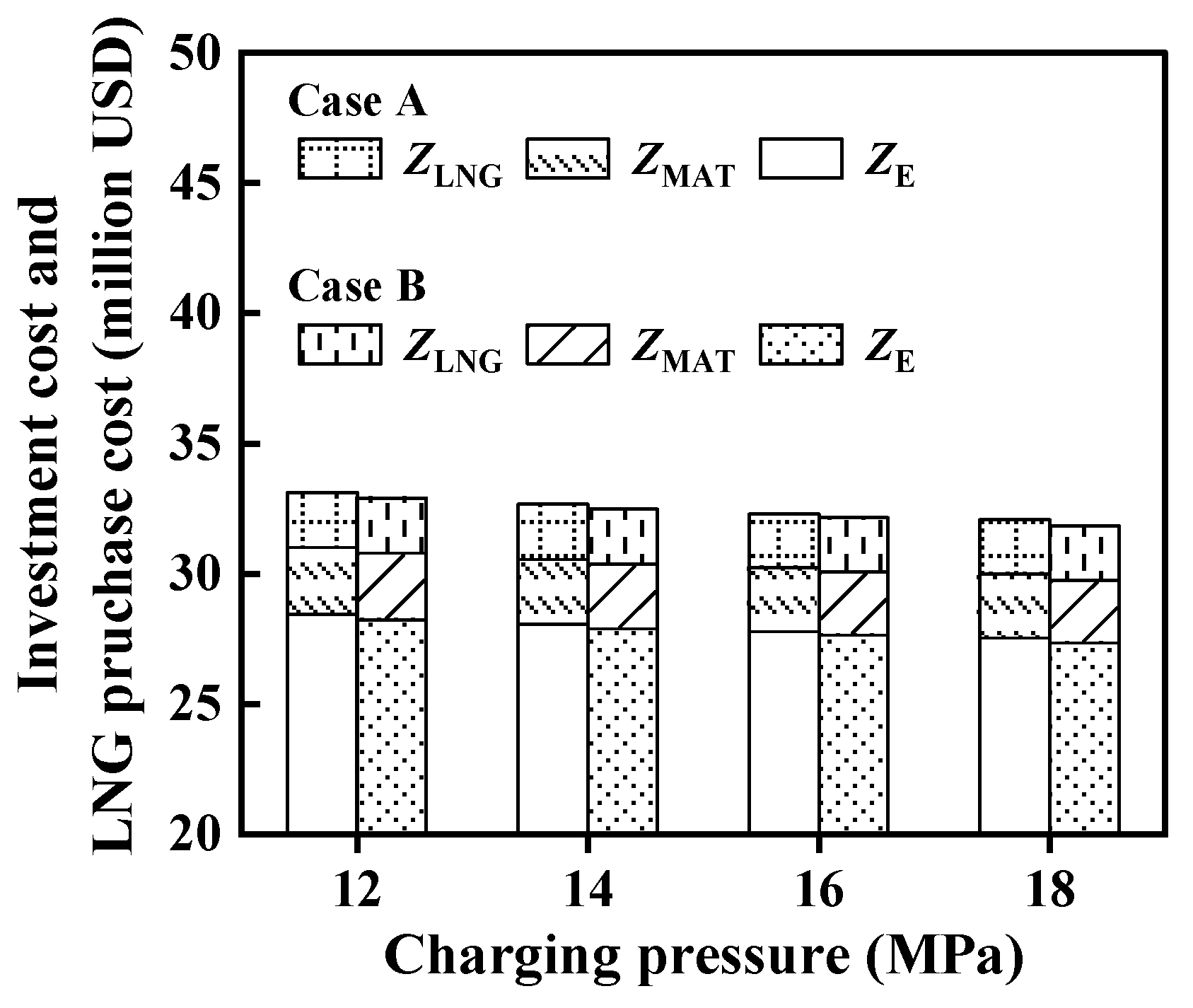

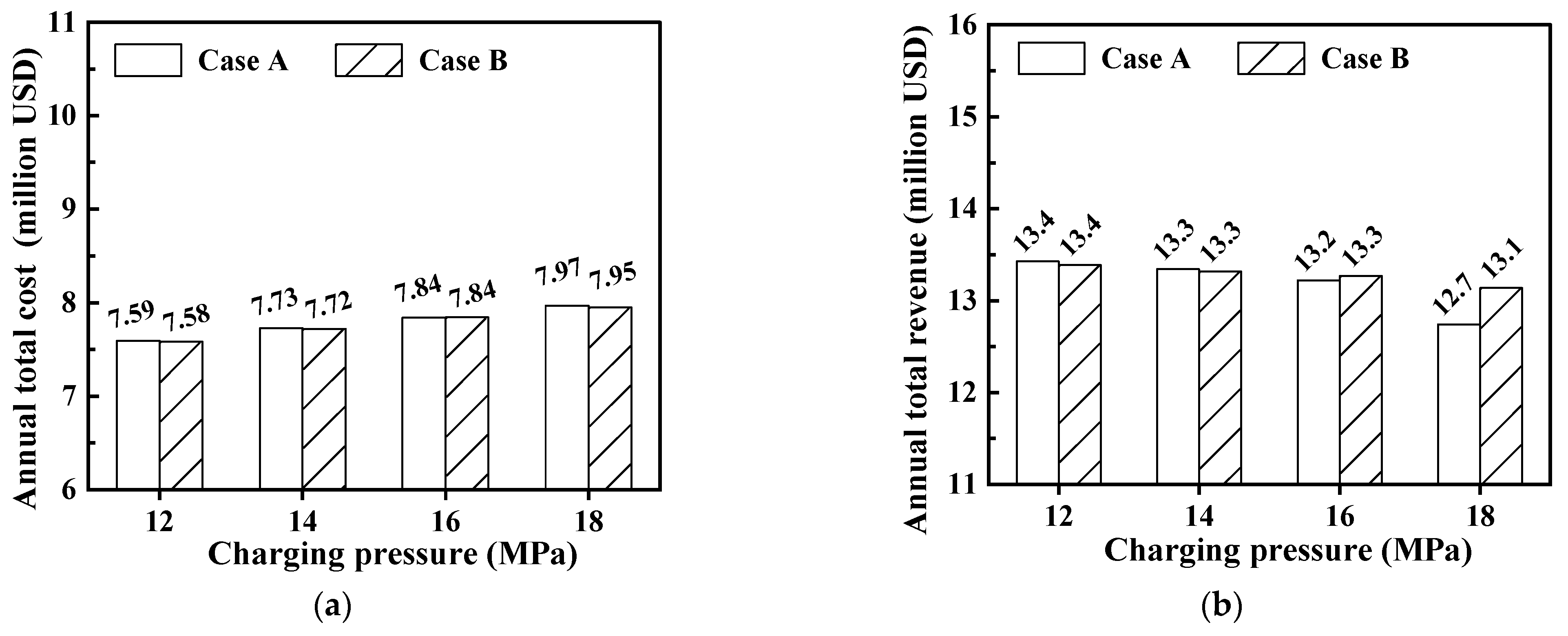

4.1. Compressor Outlet Pressure

4.2. Air Expansion Stages and Superheating Stages

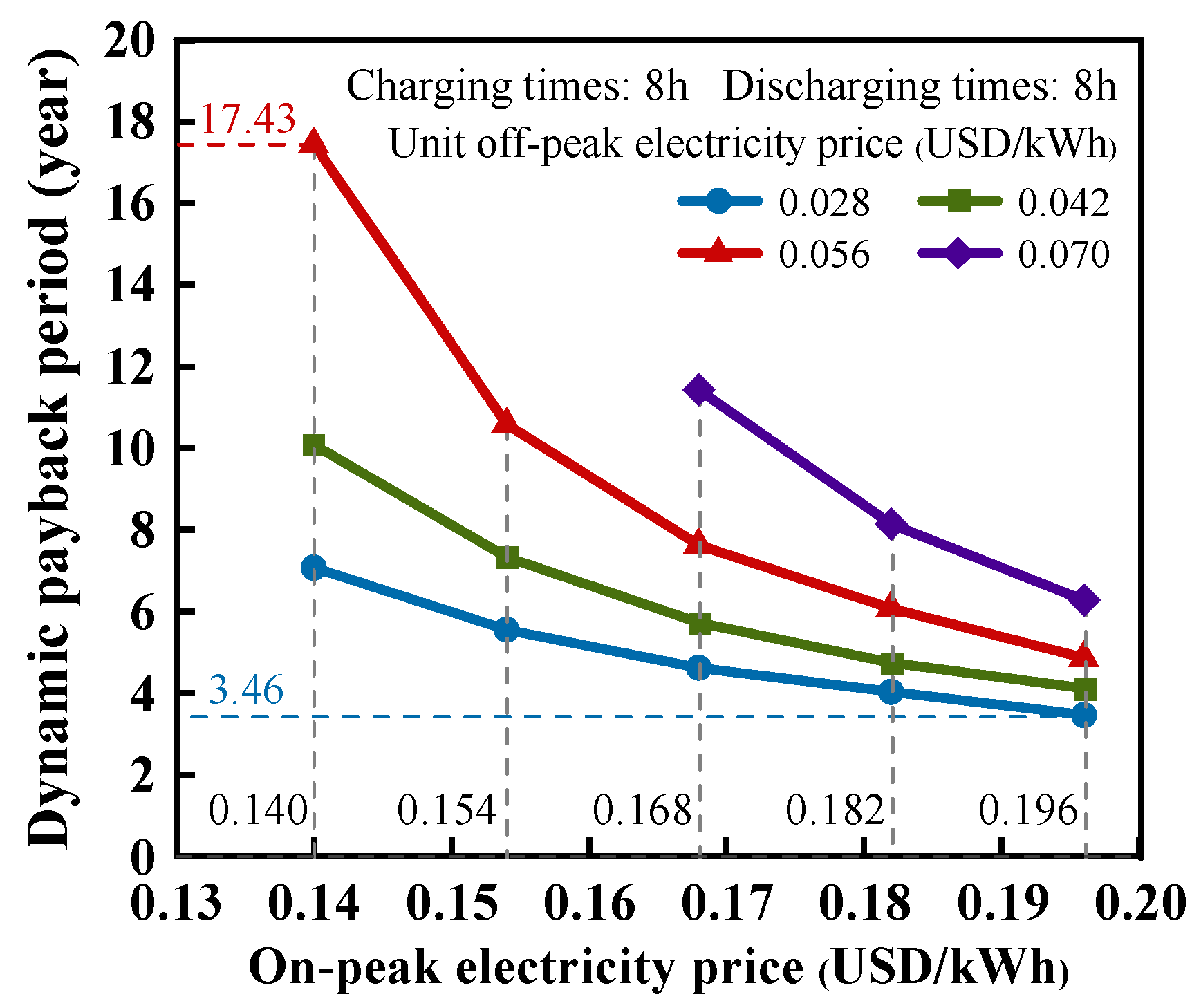

4.3. On-Peak and Off-Peak Electricity Prices

5. Conclusions

- A charging pressure of 12 MPa was preferred for both thermodynamic and economic advantages. In this scenario, Case A had its highest net generation of 27,369 kW with an RTE of 47.72% and an ERTE of 69.74%. The equipment and material investment costs were calculated to be USD 28.44 and 2.55 million, respectively. The best outcome for Case A resulted in an SPC of 0.1855 kWhe·kgLA−1 and an LCOE of 0.0965 USD·kWh−1;

- A net power output of 27,291 kW was observed in Case B when the charging pressure was 12 MPa, giving an RTE of 47.58% and an ERTE of 69.91%. Benefiting from the cost reductions from the ATs and SHs, the equipment investment in Case B was USD 28.23 million, which was USD 209.98 thousand less than that in Case A. The SPC and LCOE for Case B were USD 0.1855 kWhe·kgLA−1 and 0.0967 USD·kWh−1, respectively, which were almost equal to those of Case A;

- The proposed system allowed for better access to price arbitrage. By operating the system with 8 h charging and 8 h discharging per day, while considering off-peak and on-peak electricity prices of 0.042 USD/kWh and 0.196 USD/kWh, respectively, the NPV was expected to be USD 88.8 million. An off-peak electricity price of 0.028 USD·kWh−1 and an on-peak electricity price of 0.196 USD·kWh−1 led to an attractive DPP of 3.46 years and an LCOE of 0.0802 USD·kWh−1;

- The viability of price arbitrage was constrained by the electricity price. The on-peak electricity price fell below 0.168 USD·kWh−1 and the off-peak price exceeded 0.070 USD·kWh−1, which meant that it did not reach good profitability for the allowed electricity market conditions. The DPP may exceed the specified time limit (20 years) and even fail to achieve a positive annual profit.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| Symbols | |

| heat exchange area, kW·K−1 | |

| mass entropy, kJ·kg−1·K−1 | |

| electricity, kWh | |

| exergy, kW | |

| exergy destruction, kW | |

| inflation rate | |

| mass enthalpy, kJ·kg−1 | |

| discount rate | |

| mass flow rate, kg·h−1 | |

| pressure, MPa | |

| power, kW | |

| compression heat, kW | |

| capital recovery factor | |

| annual interest rate | |

| charging time per day, h | |

| discharging time per day, h | |

| temperature, K | |

| volume, m3 | |

| Y | liquefaction ratio |

| total materials investment cost, USD | |

| total equipment investment cost, USD | |

| unit price of on-peak electricity, USD·kWh−1 | |

| unit price of off-peak electricity, USD·kWh−1 | |

| initial investment cost, USD | |

| purchase cost of LNG fuel per year, USD | |

| purchase cost of thermal oil, USD | |

| purchase cost of propane, USD | |

| purchase cost of methanol, USD | |

| annual operation and maintenance factor | |

| Abbreviations | |

| NG | natural gas |

| AC | air compressor |

| annual total cost, USD | |

| ACON | air condenser |

| annual total profit, USD | |

| annual total revenue, USD | |

| AS | air separator |

| AT | air turbine |

| ATV | air throttle valve |

| CCON | carbon dioxide condenser |

| CON | condenser |

| CRV | combustion chamber |

| CS | carbon dioxide separator |

| CT | cryo-turbine |

| DPP | dynamic payback period, years |

| EES | electrical energy storage |

| ERTE | exergy round-trip efficiency |

| EVA | evaporator |

| GT | flue gas turbine |

| GS | gas separator |

| HTES | hot thermal energy storage |

| IC | inter-cooler |

| LA | liquid air |

| LAES | liquid air energy storage |

| LAP | liquid air pump |

| LAT | liquid air tank |

| LCOE | levelized cost of electricity, USD·kWh−1 |

| LHV | low heat value, kJ·kg−1 |

| LMT | liquid methanol tank |

| LNG | liquefied natural gas |

| LNGP | liquefied natural gas pump |

| LOT | liquid thermal oil tank |

| LPT | liquid propane tank |

| MTD | minimum temperature difference, K |

| NPV | net present value, USD |

| ORC | organic Rankine cycle |

| RH | re-heater |

| RTE | round-trip efficiency |

| SEP | separator |

| SH | superheater |

| SPC | specific power consumption, kWhe·kgLA−1 |

| VCON | vapor condenser |

| VS | vapor separator |

| Subscripts and superscripts | |

| in | input |

| year of the first positive net present value harvest | |

| n | counters |

| out | output |

| service life | |

| t | total |

Appendix A

| Equipment | Energy Balance Equations | Exergy Balance Equations |

|---|---|---|

| ACs | ||

| ICs | ||

| ACONs | ||

| ATV | ||

| AS | ||

| LAP | ||

| LNGP | ||

| EVAs | ||

| CRV | ||

| GT | ||

| RH | ||

| VS1 | ||

| VCON | ||

| VS2 | ||

| CCON | ||

| CS | ||

| GS | ||

| CT | ||

| AT | ||

| SH |

| Stream Point | Mass Flow (kg/h) | Temperature (K) | Pressure (MPa) | Composition |

|---|---|---|---|---|

| 1 | 200,000 | 298 | 0.1 | N2, O2, Ar |

| 2 | 200,000 | 485 | 0.5 | N2, O2, Ar |

| 3 | 200,000 | 298 | 0.5 | N2, O2, Ar |

| 4 | 200,000 | 485 | 2.4 | N2, O2, Ar |

| 5 | 200,000 | 298 | 2.4 | N2, O2, Ar |

| 6 | 200,000 | 487 | 12.0 | N2, O2, Ar |

| 7 | 200,000 | 298 | 11.9 | N2, O2, Ar |

| 8 | 200,000 | 184 | 11.8 | N2, O2, Ar |

| 9 | 200,000 | 90 | 11.8 | N2, O2, Ar |

| 10 | 200,000 | 80 | 0.1 | N2, O2, Ar |

| 11 | 27,024 | 79 | 0.1 | N2, O2, Ar |

| 12 | 27,024 | 181 | 0.1 | N2, O2, Ar |

| 13 | 27,024 | 293 | 0.1 | N2, O2, Ar |

| 14 | 172,976 | 79 | 0.1 | N2, O2, Ar |

| 15 | 172,976 | 79 | 0.1 | N2, O2, Ar |

| 16 | 172,976 | 84 | 8.0 | N2, O2, Ar |

| 17 | 172,976 | 173 | 7.9 | N2, O2, Ar |

| 18 | 172,976 | 292 | 7.8 | N2, O2, Ar |

| 19 | 124,198 | 292 | 7.8 | N2, O2, Ar |

| 20 | 124,198 | 700 | 7.8 | N2, O2, Ar |

| 21 | 124,198 | 539 | 2.6 | N2, O2, Ar |

| 22 | 124,198 | 433 | 0.9 | N2, O2, Ar |

| 23 | 124,198 | 457 | 0.9 | N2, O2, Ar |

| 24 | 124,198 | 367 | 0.3 | N2, O2, Ar |

| 25 | 124,198 | 457 | 0.3 | N2, O2, Ar |

| 26 | 124,198 | 370 | 0.1 | N2, O2, Ar |

| 27 | 1818 | 111 | 0.1 | LNG |

| 28 | 1818 | 115 | 7.0 | LNG |

| 29 | 1818 | 292 | 7.0 | NG |

| 30 | 48,778 | 292 | 7.8 | N2, O2, Ar |

| 31 | 50,596 | 1723 | 7.0 | CO2, H2O, N2, Ar |

| 32 | 50,596 | 1124 | 0.5 | CO2, H2O, N2, Ar |

| 33 | 50,596 | 327 | 0.5 | CO2, H2O, N2, Ar |

| 34 | 47,349 | 327 | 0.5 | CO2, H2O, N2, Ar |

| 35 | 47,349 | 273 | 0.5 | CO2, H2O, N2, Ar |

| 36 | 46,544 | 273 | 0.5 | CO2, N2, Ar |

| 37 | 46,544 | 220 | 0.5 | CO2, N2, Ar |

| 38 | 46,510 | 220 | 0.5 | CO2, N2, Ar |

| 39 | 41,524 | 220 | 0.5 | N2, Ar |

| 40 | 41,524 | 155 | 0.1 | N2, Ar |

| 41 | 41,524 | 216 | 0.1 | N2, Ar |

| 42 | 41,524 | 326 | 0.1 | N2, Ar |

| 43 | 3247 | 327 | 0.5 | H2O |

| 44 | 805 | 273 | 0.5 | H2O |

| 45 | 34 | 220 | 0.5 | H2O, CO2 |

| 46 | 4987 | 224 | 0.5 | CO2 |

| O1 | 417,405 | 293 | 0.1 | Thermal oil |

| O2 | 417,405 | 460 | 0.1 | Thermal oil |

| O3 | 417,405 | 460 | 0.1 | Thermal oil |

| O4 | 417,405 | 443 | 0.1 | Thermal oil |

| M1 | 71,961 | 172 | 1.0 | Methanol |

| M2 | 71,961 | 293 | 1.0 | Methanol |

| M3 | 71,961 | 293 | 1.0 | Methanol |

| M4 | 71,961 | 172 | 1.0 | Methanol |

| P1 | 241,071 | 89 | 1.0 | Propane |

| P2 | 241,071 | 181 | 1.0 | Propane |

| P3 | 241,071 | 181 | 1.0 | Propane |

| P4 | 241,071 | 89 | 1.0 | Propane |

References

- Osman, A.I.; Hefny, M.; Abdel Maksoud, M.I.A.; Elgarahy, A.M.; Rooney, D.W. Recent advances in carbon capture storage and utilisation technologies: A review. Environ. Chem. Lett. 2020, 19, 797–849. [Google Scholar] [CrossRef]

- Gandhi, A.; Zantye, M.S.; Faruque Hasan, M.M. Integration of cryogenic energy storage with renewables and power plants: Optimal strategies and cost analysis. Energy Convers. Manag. 2022, 269, 116165. [Google Scholar] [CrossRef]

- Borri, E.; Tafone, A.; Romagnoli, A.; Comodi, G. A review on liquid air energy storage: History, state of the art and recent developments. Renew. Sustain. Energy Rev. 2021, 137, 110572. [Google Scholar] [CrossRef]

- Wang, C.; Akkurt, N.; Zhang, X.; Luo, Y.; She, X. Techno-economic analyses of multi-functional liquid air energy storage for power generation, oxygen production and heating. Appl. Energy 2020, 275, 115392. [Google Scholar] [CrossRef]

- Tafone, A.; Romagnoli, A.; Borri, E.; Comodi, G. New parametric performance maps for a novel sizing and selection methodology of a Liquid Air Energy Storage system. Appl. Energy 2019, 250, 1641–1656. [Google Scholar] [CrossRef]

- Saleh Kandezi, M.; Mousavi Naeenian, S.M. Investigation of an efficient and green system based on liquid air energy storage (LAES) for district cooling and peak shaving: Energy and exergy analyses. Sustain. Energy Technol. Assess. 2021, 47, 101396. [Google Scholar] [CrossRef]

- She, X.; Peng, X.; Nie, B.; Leng, G.; Zhang, X.; Weng, L.; Tong, L.; Zheng, L.; Wang, L.; Ding, Y. Enhancement of round trip efficiency of liquid air energy storage through effective utilization of heat of compression. Appl. Energy 2017, 206, 1632–1642. [Google Scholar] [CrossRef]

- Zhang, T.; She, X.; Ding, Y. A power plant for integrated waste energy recovery from liquid air energy storage and liquefied natural gas. Chin. J. Chem. Eng. 2021, 34, 242–257. [Google Scholar] [CrossRef]

- Lee, I.; Park, J.; Moon, I. Conceptual design and exergy analysis of combined cryogenic energy storage and LNG regasification processes: Cold and power integration. Energy 2017, 140, 106–115. [Google Scholar] [CrossRef]

- Park, J.; You, F.; Mun, H.; Lee, I. Liquefied natural gas supply chain using liquid air as a cold carrier: Novel method for energy recovery. Energy Convers. Manag. 2021, 227, 113611. [Google Scholar] [CrossRef]

- Park, J.; Mun, H.; Kim, J.; Lee, I. Advanced natural gas liquefaction process on LNG supply chain with liquid air: From design to thermodynamic and techno-economic analyses. Energy Convers. Manag. 2022, 252, 115107. [Google Scholar] [CrossRef]

- Park, J.; Qi, M.; Kim, J.; Noh, W.; Lee, I.; Moon, I. Exergoeconomic optimization of liquid air production by use of liquefied natural gas cold energy. Energy 2020, 207, 118193. [Google Scholar] [CrossRef]

- Qi, M.; Park, J.; Kim, J.; Lee, I.; Moon, I. Advanced integration of LNG regasification power plant with liquid air energy storage: Enhancements in flexibility, safety, and power generation. Appl. Energy 2020, 269, 115049. [Google Scholar] [CrossRef]

- Gao, Z.; Ji, W.; Guo, L.; Fan, X.; Wang, J. Thermo-economic analysis of the integrated bidirectional peak shaving system consisted by liquid air energy storage and combined cycle power plant. Energy Convers. Manag. 2021, 234, 113945. [Google Scholar] [CrossRef]

- Zhang, T.; Chen, L.; Zhang, X.; Mei, S.; Xue, X.; Zhou, Y. Thermodynamic analysis of a novel hybrid liquid air energy storage system based on the utilization of LNG cold energy. Energy 2018, 155, 641–650. [Google Scholar] [CrossRef]

- Park, J.H.; Heo, J.Y.; Lee, J.I. Techno-economic study of nuclear integrated liquid air energy storage system. Energy Convers. Manag. 2022, 251, 114937. [Google Scholar] [CrossRef]

- Legrand, M.; Labajo-Hurtado, R.; Rodríguez-Antón, L.M.; Doce, Y. Price arbitrage optimization of a photovoltaic power plant with liquid air energy storage. Implementation to the Spanish case. Energy 2022, 239, 121957. [Google Scholar] [CrossRef]

- Rehman, A.; Qyyum, M.A.; Qadeer, K.; Zakir, F.; Ding, Y.; Lee, M.; Wang, L. Integrated biomethane liquefaction using exergy from the discharging end of a liquid air energy storage system. Appl. Energy 2020, 260, 114260. [Google Scholar] [CrossRef]

- Xie, C.; Hong, Y.; Ding, Y.; Li, Y.; Radcliffe, J. An economic feasibility assessment of decoupled energy storage in the UK: With liquid air energy storage as a case study. Appl. Energy 2018, 225, 244–257. [Google Scholar] [CrossRef]

- Liu, Q.; He, Z.; Liu, Y.; He, Y. Thermodynamic and parametric analyses of a thermoelectric generator in a liquid air energy storage system. Energy Convers. Manag. 2021, 237, 114117. [Google Scholar] [CrossRef]

- Cui, S.; He, Q.; Liu, Y.; Wang, T.; Shi, X.; Du, D. Techno-economic analysis of multi-generation liquid air energy storage system. Appl. Therm. Eng. 2021, 198, 117511. [Google Scholar] [CrossRef]

- Khani, H.; Dadash Zadeh, M.R. Real-Time Optimal Dispatch and Economic Viability of Cryogenic Energy Storage Exploiting Arbitrage Opportunities in an Electricity Market. IEEE Trans. Smart Grid 2015, 6, 391–401. [Google Scholar] [CrossRef]

- Gao, Z.; Guo, L.; Ji, W.; Xu, H.; An, B.; Wang, J. Thermodynamic and economic analysis of a trigeneration system based on liquid air energy storage under different operating modes. Energy Convers. Manag. 2020, 221, 113184. [Google Scholar] [CrossRef]

- Hamdy, S.; Morosuk, T.; Tsatsaronis, G. Exergetic and economic assessment of integrated cryogenic energy storage systems. Cryogenics 2019, 99, 39–50. [Google Scholar] [CrossRef]

- Guizzi, G.L.; Manno, M.; Tolomei, L.M.; Vitali, R.M. Thermodynamic analysis of a liquid air energy storage system. Energy 2015, 93, 1639–1647. [Google Scholar] [CrossRef]

- Adedeji, M.; Abid, M.; Dagbasi, M.; Adun, H.; Adebayo, V. Improvement of a liquid air energy storage system: Investigation of performance analysis for novel ambient air conditioning. J. Energy Storage 2022, 50, 104294. [Google Scholar] [CrossRef]

- Lee, I.; You, F. Systems design and analysis of liquid air energy storage from liquefied natural gas cold energy. Appl. Energy 2019, 242, 168–180. [Google Scholar] [CrossRef]

- Bao, J.; He, X.; Deng, Y.; Zhang, N.; Zhang, X.; An, B.; He, G. Parametric analysis and multi-objective optimization of a new combined system of liquid carbon dioxide energy storage and liquid natural gas cold energy power generation. J. Clean. Prod. 2022, 363, 132591. [Google Scholar] [CrossRef]

- Wen, N.; Tan, H. Modelling and optimization of liquid air energy storage systems with different liquefaction cycles. Energy Convers. Manag. 2022, 271, 116321. [Google Scholar] [CrossRef]

- Li, D.; Duan, L. Techno-economic analysis of solar aided liquid air energy storage system with a new air compression heat utilization method. Energy Convers. Manag. 2023, 278, 116729. [Google Scholar] [CrossRef]

- Huang, Z.F.; Soh, K.Y.; Wan, Y.D.; Islam, M.R.; Chua, K.J. Assessment of an intermediate working medium and cold energy storage (IWM-CES) system for LNG cold energy utilization under real regasification case. Energy 2022, 253, 124080. [Google Scholar] [CrossRef]

- Kim, J.; Noh, Y.; Chang, D. Storage system for distributed-energy generation using liquid air combined with liquefied natural gas. Appl. Energy 2018, 212, 1417–1432. [Google Scholar] [CrossRef]

- Wu, S.; Zhou, C.; Doroodchi, E.; Moghtaderi, B. Techno-economic analysis of an integrated liquid air and thermochemical energy storage system. Energy Convers. Manag. 2020, 205, 112341. [Google Scholar] [CrossRef]

- Su, R.; Yu, Z.; Xia, L.; Sun, J. Performance analysis and multi-objective optimization of an integrated gas turbine/supercritical CO2 recompression/transcritial CO2 cogeneration system using liquefied natural gas cold energy. Energy Convers. Manag. 2020, 220, 113136. [Google Scholar] [CrossRef]

- Wang, C.; Cui, Q.; Dai, Z.; Zhang, X.; Xue, L.; You, Z.; She, X. Performance analysis of liquid air energy storage with enhanced cold storage density for combined heating and power generation. J. Energy Storage 2022, 46, 103836. [Google Scholar] [CrossRef]

- Zhao, P.; Xu, W.; Zhang, S.; Gou, F.; Wang, J.; Dai, Y. Components design and performance analysis of a novel compressed carbon dioxide energy storage system: A pathway towards realizability. Energy Convers. Manag. 2021, 229, 113679. [Google Scholar] [CrossRef]

- Zhang, T.; She, X.; You, Z.; Zhao, Y.; Fan, H.; Ding, Y. Cryogenic thermoelectric generation using cold energy from a decoupled liquid air energy storage system for decentralised energy networks. Appl. Energy 2022, 305, 117749. [Google Scholar] [CrossRef]

- Liu, Q.; Arabkoohsar, A.; Liu, Y.; He, Z. Techno-economic analysis of a liquid air energy storage system combined with calcium carbide production and waste heat recovery. J. Energy Storage 2023, 60, 106689. [Google Scholar] [CrossRef]

- Nabat, M.H.; Zeynalian, M.; Razmi, A.R.; Arabkoohsar, A.; Soltani, M. Energy, exergy, and economic analyses of an innovative energy storage system; liquid air energy storage (LAES) combined with high-temperature thermal energy storage (HTES). Energy Convers. Manag. 2020, 226, 113486. [Google Scholar] [CrossRef]

- Trading Economics. 2023. Available online: https://zh.tradingeconomics.com/china/indicators (accessed on 12 June 2023).

- Inflation.eu, Table–2023 Inflation China (CPI). 2023. Available online: https://www.inflation.eu/en/inflation-rates/china/historic-inflation/cpi-inflation-china-2023.aspx#:~:text=Chart%20-%20CPI%20inflation%20China%202023%20%28yearly%20basis%29,of%20information%20that%20we%20believe%20to%20be%20reliable (accessed on 12 June 2023).

- FRED, Interest Rates, Discount Rate for China (INTDSRCNM193N). 2023. Available online: https://fred.stlouisfed.org/series/INTDSRCNM193N# (accessed on 12 June 2023).

- Yang, Y.; Tong, L.; Liu, Y.; Guo, W.; Wang, L.; Qiu, Y.; Ding, Y. A novel integrated system of hydrogen liquefaction process and liquid air energy storage (LAES): Energy, exergy, and economic analysis. Energy Convers. Manag. 2023, 280, 116799. [Google Scholar] [CrossRef]

| Equipment | Model (USD) |

|---|---|

| Air compressor (AC) [26,33] | |

| Air turbine (AT) [26,33] | |

| Cryo-turbine (CT) [26,33] | |

| Inter-cooler (IC) [6] | |

| Condenser (CON) [6] | |

| Evaporator (EVA) [6] | |

| Re-heater (RH) [6] | |

| Superheater (SH) [6] | |

| Liquid air tank (LAT) [6] | |

| Liquid methanol tank (LMT) [33] | |

| Liquid propane tank (LPT) [33] | |

| Liquid thermal oil tank (LOT) [33] | |

| Liquid air pump (LAP) [33] | |

| LNG pump (LNGP) [28] | |

| Combustion chamber (CRV) [34] | |

| Flue gas turbine (GT) [34] | |

| Air throttle valve (ATV) [6] | |

| Separator (SEP) [6] |

| Materials | Mathematical Model (USD) |

|---|---|

| Thermal oil [35] | |

| Methanol [35] | |

| Propane [35] |

| Charging Pressure (MPa) | 10 | 12 | 14 | 16 | 18 |

|---|---|---|---|---|---|

| Liquefaction ratio (%) | 83.44 | 86.49 | 85.94 | 85.38 | 84.97 |

| Total input power of the system (kW) | 30,546 | 32,085 | 33,412 | 34,588 | 35,649 |

| Total net output power of the system (kW) | 24,250 | 27,369 | 27,204 | 26,946 | 25,961 |

| Charging Pressure (MPa) | RTE (%) | ERTE (%) | SPC (kWhe·kgLA−1) | DPP (Year) | LCOE (USD·kWh−1) | |

|---|---|---|---|---|---|---|

| 12 | Case A | 47.72 | 69.74 | 0.1855 | 5.73 | 0.0965 |

| Case B | 47.58 | 69.91 | 0.1855 | 5.72 | 0.0967 | |

| 14 | Case A | 46.40 | 69.51 | 0.1944 | 6.02 | 0.0989 |

| Case B | 46.31 | 69.73 | 0.1944 | 6.00 | 0.0989 | |

| 16 | Case A | 45.24 | 69.33 | 0.2026 | 6.20 | 0.1011 |

| Case B | 45.28 | 69.68 | 0.2026 | 6.12 | 0.1008 | |

| 18 | Case A | 42.73 | 69.17 | 0.2098 | 7.06 | 0.1067 |

| Case B | 44.10 | 69.37 | 0.2102 | 6.32 | 0.1032 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qin, X.; Tan, H.; Wen, N.; Liu, W. Thermodynamic and Economic Analysis of a Liquid Air Energy Storage System with Carbon Capture and Storage for Gas Power Plants. Appl. Sci. 2023, 13, 9559. https://doi.org/10.3390/app13179559

Qin X, Tan H, Wen N, Liu W. Thermodynamic and Economic Analysis of a Liquid Air Energy Storage System with Carbon Capture and Storage for Gas Power Plants. Applied Sciences. 2023; 13(17):9559. https://doi.org/10.3390/app13179559

Chicago/Turabian StyleQin, Xiaoqiao, Hongbo Tan, Na Wen, and Weiming Liu. 2023. "Thermodynamic and Economic Analysis of a Liquid Air Energy Storage System with Carbon Capture and Storage for Gas Power Plants" Applied Sciences 13, no. 17: 9559. https://doi.org/10.3390/app13179559