1. Introduction

Climate change is widely acknowledged to be one of the biggest threats facing humanity. It is already leading to loss of life, livelihood and property and to food and drinking water shortages, as a result of increasingly frequent extreme weather events, such as heatwaves, storms and floods. Fossil fuels, including coal, oil and gas, have been the world’s primary energy source for over a century [

1]. Much effort is put into energy transformation worldwide in order to mitigate various climate change impacts. The green transition of electricity generation is gaining speed in most of developed countries, as there is a shift from the fossil-fuel dominance of previous decades to zero greenhouse gas (GHG) emissions by 2050, which means the reduction of 53.8 gigatonnes (Gt) of annual CO

2 emissions, limiting global long-term average temperature rise to 1.5 °C [

2].

Hydrogen is emerging as a promising renewable energy carrier that can help to solve the variability issues typical to renewable energy sources by its ability of storing large amounts of energy for long periods of time [

1]. Therefore, hydrogen, as the most abundant element in the universe, has become a central point in the search for sustainable energy solutions. Increasing population and global economic growth are projected to drive future demand for hydrogen-derived products. Developing industrial hydrogen technologies have a potential to curb the greenhouse emissions up to 2030. Industry has ramped up the effort in decarbonisation of their manufacturing processes [

3,

4,

5]. Deep transformations of energy systems are also influenced by geopolitical forces leading to the choice of alternative technological trajectories [

6]. As evidence of this, the ongoing military conflict in Ukraine has destabilized energy supplies from Russia, one of the largest fossil fuel producers in the world; this will lead to an increase in energy costs and thus an intensive search for acquisition of alternative renewable fuels, such as hydrogen [

7,

8].

Baltic states stand out with a rapid development speed of renewable energy in the region due to abundant unexploited wind and solar resources and are perceived as potential renewable energy hubs in Europe. Lithuania is part of The Baltic Net Hydrogen Network Development Initiative, which aims to establish interconnections of net hydrogen gas systems between countries that are projected to have a large supply of net hydrogen resources (Finland, Lithuania) due to their huge renewable energy potential, developable capacities and availability, with countries in Europe (Germany, Poland), which will be able to import hydrogen from other European countries or from their neighbours in order to meet the hydrogen demand.

This paper is structured as follows:

Section 2 outlines hydrogen-related policies and supply–demand strategies in the EU. Meanwhile, hydrogen value chain components are outlined in

Section 3. Technological aspects of hydrogen use in various industrial applications are addressed in

Section 4. Some insights into hydrogen pricing are provided in

Section 5 while

Section 6 gives a scope of current situation and prospects of hydrogen use in Lithuania. Finally,

Section 7 summarises the paper and proposes a discussion of perspectives in terms of future hydrogen applications.

2. Hydrogen Energy Regulation Tendencies in EU

As the world strives to implement the energy transition, hydrogen is emerging as one of the most important corner stone together with renewable energy-based electricity on the way of achieving this goal. An increasing number of countries are updating their regulatory base to include the rising role of hydrogen in future energy balances [

9]. The EU has been among the leaders in regards to the ambitious targets for the share of renewable energy, and hydrogen is becoming an inevitable part of this dramatic transition. Key targets for hydrogen energy development are set in the Communication from EU Commission regarding a Hydrogen Strategy [

10], which is a part of a larger ambition of a European Green Deal [

11] that was introduced as an urgent plan in tackling climate change. The most important aim is to become the first “climate neutral and circular economy” continent by 2050, which is in line with Paris Agreement—a legally binding treaty signed by 196 countries at the climate change conference in Paris in 2015 where there was an agreement reached—to cut global greenhouse gases in order to limit global temperature increases as close as possible to 1.5 degrees Celsius.

To achieve this, the EU Commission has set out an ambitious “The 2030 Climate target plan” in their Communication [

12] in 2020. A new EU economy-wide greenhouse gas emissions reduction target was set for 2030: at least 55% reduction compared to 1990 level including emissions and removals. Additionally, following the New Industrial Strategy for Europe [

13], the European Clean Hydrogen Alliance was formed. Moreover, in 2023 EU released two delegated acts defining green hydrogen and its derivatives [

14]. One of the acts describes the methodology of greenhouse gas emissions calculation from renewable and recycled carbon fuels to ensure a 70% reduction in CO

2 equivalents. The other act defines the rules for defining “renewable” hydrogen.

After conducting the search of hydrogen-related policies in force worldwide that include hydrogen production and supply, transportation and storage, a few main points can be concluded [

15]:

There are 113 policies in force with Australia leading the way (17 policies) followed by United States (USA) (8) and Portugal with Japan (6);

The earliest policy was released in 2004 “Hydrogen and Fuel Cells Program” (United States);

In 2023 six countries introduced hydrogen-related policies (Italy, Argentina, India, Denmark, Oman and Estonia);

Overall, Europe is leading the way with 50 policies (EU accounts for 31) followed by Asia Pacific region (28) and North America (12);

The majority of policies (109) are related to hydrogen production and supply including 49 dedicated solely to hydrogen electrolysis technologies.

The future hydrogen demand until 2050 has been projected by PwC and shows moderate growth until 2030 after which demand will increase more substantially beyond 2035 [

16]. The rise of the hydrogen fuel demand across sectors in the USA is projected to increase from 1% to 14% of the total final energy balance in 2030–2050 [

17].

It is widely accepted that by 2050 globally consumed hydrogen in various forms needs to be low carbon from the beginning and ultimately green. The International Renewable Energy Agency (IRENA) World Energy Transition Outlook 2022 [

18] foresees that green and blue hydrogen production will grow from negligible levels to 19 EJ (154 million tonnes) by 2030 and over 74 EJ (614 million tonnes) by 2050. The International Energy Agency’s (IEA) report Net Zero by 2050 [

19] gives the prediction that global hydrogen and hydrogen-based fuel use will reach 530 million tonnes. Around 75% of this amount is planned to be merchant hydrogen (hydrogen produced by one company to sell to others) and the remainder (about 25%) will be produced within industrial facilities (including refineries), making the industry an important sector player in the future.

European gas transmission system operators have set out a vision to achieve the goals of RePowerEU plan in order to develop the European hydrogen network by 2030. To deliver the 2030 targets local supply is not going to meet national demand; therefore, five large-scale hydrogen supply pipeline corridors are foreseen in different parts of Europe. These supply corridors have been introduced by the European Hydrogen Backbone (EHB) initiative [

20] that initially is devoted for connecting local supply and demand in Europe, and later for expanding low-cost hydrogen export potential between European regions and neighbouring countries. Five hydrogen supply corridors are foreseen:

A: North Africa and southern Europe;

B: Southwest Europe and North Africa;

C: North Sea;

D: Nordic and Baltic regions;

E: East and south-east Europe.

An ambitious hydrogen target of 20 MT (665 TWh) by 2030 has been defined that will help to completely phase out the fossil fuel imports from Russia. This projected amount includes 6 MT of “renewable” hydrogen and 4 MT of imported ammonia or derivatives.

Notably, there are significant differences in supply–demand balance of hydrogen across Europe. The countries that benefit from vast renewable energy resources, substantial land availability can become net suppliers of low-cost hydrogen. Meanwhile, other countries with high hydrogen demand will have to import from other European or neighbouring countries thus becoming net importers. Purposely built or adapted hydrogen pipeline infrastructure will provide European regions with cost-effective supply and demand of hydrogen.

3. Hydrogen Value Chain

In most of energy forecasts up to 2050 hydrogen is predicted to become a major energy carrier, in addition to electricity, to meet energy demand of end users in different economic sectors. Hydrogen is valued for its energy efficiency, application versatility, abundant resources and minor environmental emissions [

21]. A hydrogen-based economy would introduce new technological and economic opportunities and would be capable of changing the oil refining industry drastically, contributing to changes in the supply and demand mix.

Green hydrogen stands out with a long and complex value chain consisting of green electricity production, hydrogen production, hydrogen distribution, storage and transportation, as well as the various hydrogen applications in mobility, industry, heat supply or base chemistry. Looking from a high level, hydrogen value chain is typically split into the three main fields: production, storage and distribution and consumption/application. Each of these fields is described further.

Hydrogen can be made using different methods and is classified to a range of “colours” depending on the source of energy and the production method used. Most common is grey hydrogen which is produced from natural gas or coal by steam-methane reforming (SMR). This means high-pressure steam (H

2O) reacts with natural gas (CH

4) resulting in hydrogen (H

2) and greenhouse gas CO

2. This type of hydrogen is a dominant technology, accounting for 95% of the production market [

22]. Another report shows that the share of high-emission (natural gas without carbon capture, coal and oil refineries) hydrogen production reaches 99.3% [

23]. Meanwhile, a blue hydrogen results from the same production processes as grey hydrogen, but most of CO

2 is captured, used, and stored. Currently, this technology is at the experimental stage with only a few pilot projects launched around the world [

22], accounting for only 0.6% of global hydrogen production [

23]. The use of other hydrogen types, including green hydrogen, is marginal, reaching only 0.1% [

23].

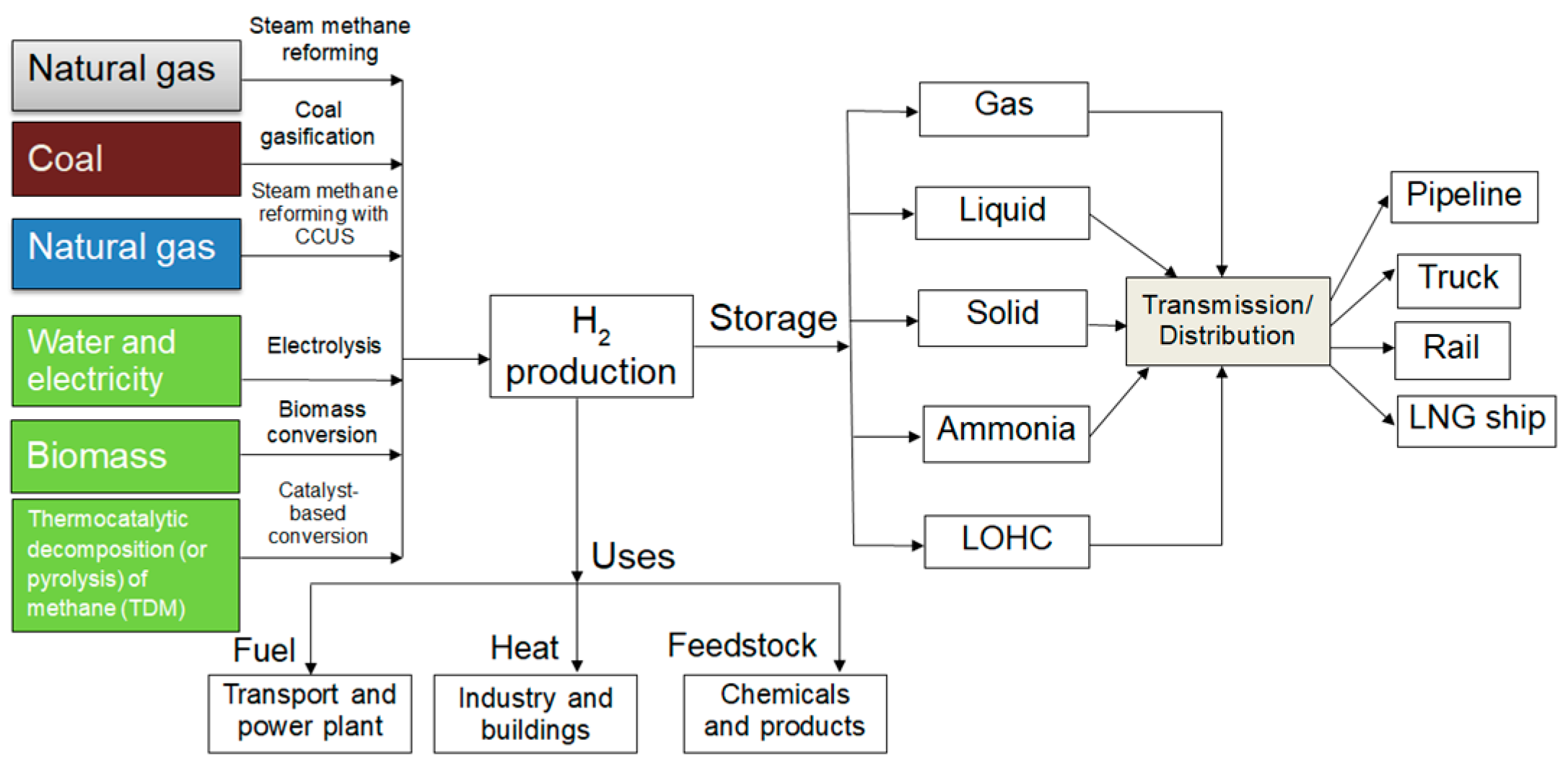

Figure 1 below shows graphically a typical hydrogen value chain where the process starts on a left-hand side with hydrogen production.

When grey or brown hydrogen is formed using brown coal or natural gas through either SMR or gasification techniques, in both cases the CO2 emissions are released into the atmosphere. However, if a starting material is biomass (different conversion processes), water and renewable electricity (electrolysis) or thermocatalytic decomposition (or pyrolysis) of methane (TDM) are used, then the green hydrogen is produced. Once produced, hydrogen can be used as a fuel in a transport or power sectors as well as a heat source for industry and buildings and finally as a feedstock in chemical production. Additionally, hydrogen can be stored as a compressed or liquefied gas, as ammonia and in a form of LOHC (liquid organic hydrogen carriers, like toluene). Eventually, hydrogen is distributed by pipelines, truck, rail and LNG (liquefied natural gas) ships.

According to the latest Global Hydrogen Review 2023 [

23], the industry is now particularly focused on extracting hydrogen from fossil fuels using water electrolysis or carbon capture and storage (CCUS) techniques. As green hydrogen is at the centre of research, much effort is being given to the search for the best water electrolysis technologies which are being continuously developed to increase process efficiency and are used in industrial applications. Each water electrolysis technology has its own challenges, significance and technological breakthroughs briefly described below.

According to [

24], there are four types of water electrolysis technologies based on operating conditions, electrolyte used and their ionic agents (OH

−, H

+, O

2−):

- -

Alkaline water electrolysis;

- -

Anion exchange membrane (AEM) water electrolysis;

- -

Proton exchange membrane (PEM) water electrolysis;

- -

Solid oxide water electrolysis.

Alkaline water electrolysis is the most popular and widely-used process. It is an electrochemical water splitting technique in the presence of electricity. This process consists of two individual half-cell reactions: hydrogen evolution reaction (HER) at the cathode and oxygen evolution reaction (OER) at the anode. According to [

24], the main advantages of such technique would be well established technology; electrocatalysts are made from non-noble metals, etc. However, the disadvantage would be a highly-concentrated alkaline solution (5M potassium hydroxide (KOH)) used as a liquid electrolyte, which causes the corrosion. The efficiency of this type of water electrolysis in 2020 was 50–78% [

22].

AEM water electrolysis is a process that utilises a semipermeable membrane (anion exchange membrane) that conducts hydroxide ions with help of electricity. This electrochemical reaction consists of the same two half-cell reactions (HER and OER) as in alkaline water electrolysis; it has the advantage of lower concentration alkaline solution needed (1M KOH), but it has limited stability and it is not yet commercialised [

24]. According to [

22], in 2020 the efficiency of AEM water electrolysis was 57–69%.

PEM water electrolysis is a process where water is electrochemically split into hydrogen and oxygen. During this electrolysis initially water molecule is decomposed to generate oxygen (O

2) and protons (H

+), and electrons (e

−) at the anode side. The main advantages are the high purity of hydrogen gases being produced and compact system design; however, the major issues are its dependence on iridium, one of the rarest and most expensive elements, and the acidity of the electrolyte [

24,

25]. The efficiency for this type of electrolysis was between 50% and 83% in 2020 [

22].

Solid oxide water electrolysis typically operates at higher temperatures, consumes water in the form of steam and splits it to green hydrogen and oxygen. As well as AEM water electrolysers, they are still under development, but their overall efficiency is the highest compared to the other types of water electrolysers and could reach around 89% at a lab scale [

24].

Intensive research is performed at laboratories in an attempt to increase the efficiency of hydrogen production process, some of these have demonstrated promising results. A team of researchers implementing a GrInHy2.0 hydrogen project have achieved a technological breakthrough by demonstrating the high production efficiency of green hydrogen: the solid oxide electrolyser produced 200 Nm

3 of green hydrogen per hour and proven electrical efficiency is 84% [

26]. Even more promising results come from Hodges et al. [

27], they have published the results of their team’s experiments with an alkaline capillary-fed electrolysis (CFE) cell demonstrating water electrolysis performance exceeding commercial electrolysis cells, with a cell voltage at 0.5 A cm

−2 and 85 °C of only 1.51 V, equating to 98% energy efficiency. These examples clearly show that higher electrolysis efficiency is possible to achieve and combined with the potential of balance-of-plant simplification, brings cost-competitive green hydrogen closer to reality.

Attention should also be given to green hydrogen production through biomass fermentation such as dark or photo-fermentation, pyrolysis, direct or indirect biophotolysis and gasification, during which a small amount of CO

2 is produced [

28,

29]. This CO

2 is part of the natural carbon cycle as a form of biomass; these processes are therefore environmentally friendly ways of producing hydrogen. Dark fermentation is considered as most productive and technically available and it is also one of the technologies with the lowest production cost [

30]. According to Hamelinck and Faaij [

31], hydrogen production from biomass has shown a net HHV (higher heating value) energy efficiency of 56–64%.

Additionally, catalyst-based technology TDM (methane pyrolysis) is gaining the momentum as one of the cleaner and more economical options to produce COx-free H

2 as it does not require an additional step to separate H

2, which significantly reduces the cost and complexity and creates only structured solid carbon nanomaterial as a byproduct. The methane conversion efficiency can reach 60–90%, while H

2 yield is between 71–77% [

32]. Researches show that TDM has proven to be one of the most reliable and beneficial method for the production of pure green hydrogen for various applications, particularly for fuel cells [

33,

34].

Although great laboratory-scale achievements have been accomplished so far, TDM and biomass fermentation technologies for green hydrogen production are still in a very early stage of commercial development.

Hydrogen storage has become the key component of the whole value chain due to its flammable and explosive properties. Green hydrogen can be stored in three different states (gas, liquid or solid) depending on the various conditions (storage duration, pressure and volumes):

Gaseous. The most widely-used hydrogen storage method currently. It must be compressed up to 700 bars and kept as a pressurized gas in suitable cylinders, tanks or underground caverns [

22]. As hydrogen energy density by volume is low, it has to be compressed at high pressure and stored ideally in underground salt caverns (so far, the best storage option as much larger volumes can be stored);

Liquid. This method requires a vacuum insulated storage tank and a considerable amount of energy for the cooling process of hydrogen due to its boiling temperature −253 °C [

22]. Due to the boil-off effect, heat absorption and vaporization, it is not economical to store hydrogen for long periods due to gradual decrease in the volume [

35];

Solid. It is considered as the safest mode of storing hydrogen in either a form of metal hydrides (magnesium metal has been proven to be a good choice) or as a LOHC (ammonia, methanol or toluene). Hydrogen can be extracted from solid form by applying heat at atmospheric pressure, thus reducing the costs [

22].

The most economically-viable hydrogen applications are considered those where hydrogen is consumed at the point of production avoiding hydrogen transportation. However, due to geographical differences between large-scale renewable energy generation and energy consumers’ concentration areas hydrogen transportation component is inevitable. This sector is categorized as transmission (hydrogen transportation from its production sites to the suppliers) and distribution (hydrogen transportation to the fuelling stations or the end users) [

36]. If distances are less than 1500 km, then the pipeline transportation is the most advantageous option; however, trucks are used to transport small volumes [

22]. The most promising and economically-viable way is using natural gas pipelines for moving hydrogen [

37]. Technical possibility has already been proven with tests that keep a mix of 20–25% hydrogen blended into natural gas [

38]. It is vital to notice that the injection of hydrogen into gas networks is related to several technical risks, which require additional consideration and upgrade of gas network infrastructure. According to [

39], due to the density and concentration differences between hydrogen and methane or natural gas, poor gas mixing may occur following the hydrogen injection into the pipeline; this may lead to increased risk of steel embrittlement and consequently pipeline rupture. Moreover, in order to maintain the same calorific value of the mixed gas flow (hydrogen density is nine times lower than that of natural gas), the blend flow rates or pressure must be increased. Possible solutions to this issue could be introduction of steel pipes with thicker walls, using fiberglass pipe system design or adding passive inline mixers, e.g., porous plates in the hydrogen inlet points.

Gas pipelines are also much cheaper than transporting hydrogen as the end products of methanol or ammonia in highly-pressurized containers or via transport (trucks) designed to move chemical substances. For larger distances (e.g., overseas), ships are considered to be the best option. Rail is one current transportation modes evaluated as a possible option. According to [

22], the hydrogen delivery method depends on geographical and market characteristics, such as distribution network of refuelling stations, market availability of fuel cell vehicles and population density. In the medium term, a new market for green hydrogen transport is developing; other applications might emerge in the long term, such as the specifically designed hydrogen gas grid [

40,

41].

The green hydrogen value chain ends with end use/application. Use of green hydrogen depending on an end user can be grouped into a few different categories:

Power to mobility (green hydrogen-powered vehicles with integrated fuel cells and hydrogen storage tanks that eventually can substitute unabated fossil fuel vehicles);

Power to power (green hydrogen can help to avoid electric grid imbalance. Hydrogen could be produced during the nighttime through water electrolysis using cheap electricity from offshore wind farms, stored and used later during the peak moments in winter months);

Power to gas (green hydrogen, proportionally up to 25% due to technological and safety constraints [

42], can be mixed and injected into existing natural gas networks. That would help reduce CO

2 emissions while heating various buildings);

Power to industry (green hydrogen can be used as a feedstock in heavily polluting refineries, fertilisers, and the cement and steel production industries, to replace the currently used grey hydrogen).

An overview of the current global hydrogen market shows that currently about 99.9% of all hydrogen produced each year is fossil fuel-based hydrogen used in industry. The whole market totals to ~77 million tons a year, using this hydrogen primarily for the refining and ammonia industries. Following the global energy transition, hydrogen demand is foreseen to increase dramatically by 2050 and due to its versatility green hydrogen will inevitably play a significant role in implementing carbon-free energy scenarios by transforming existing energy value chains from production to consumption.

4. Technological Aspects of Hydrogen Use in Industry

Most attention and efforts are given to decarbonization of electricity generation by increasing the share of renewables. However, one of the world’s biggest climate challenges on the way to zero GHG emissions is decarbonizing fossil energy uses that cannot be directly electrified using renewable power. These are the so-called “hard-to-abate” (HTA) sectors, such as major industries relying on fossil fuels for the supply of high temperatures for specific technological processes (iron, steel, cement and building materials) or for chemical feedstocks. It has been estimated that together they are responsible for approximately 30% of the world’s annual CO

2 emissions [

36]. Heavy-duty transport is another sector where GHG emission reduction is difficult to achieve. Hydrogen has a strong potential to become a solution for development of carbon-neutral energy systems and link electricity and gas grids due to its wide range of use as storage medium for renewable excess energy and as fuel [

43].

Currently grey hydrogen is widely used in industrial processes. According to the estimated data from 2021, 34 Mt of hydrogen demand was used for ammonia, 15 Mt for the production of methanol and 5 Mt for direct reduced iron (DRI) in the steel industry [

23] worldwide. Small industrial applications would be in such areas as chemical industry, electronics and glass making. Moreover, hydrogen can also be produced as a byproduct during chlor-alkali processes in steam crackers, coke ovens or incinerated or used for hydrogenation or power generation. Hydrogen plays an important role in the production of a wide range of chemical compounds, the purification of petroleum products and the processing of metals. Additionally, it is used as a raw material in the production of ammonia, methanol, hydrogen peroxide, solvents, plastics, polyester and nylon. Hydrogen gas is used in furnaces to harden metals and hydrogen and oxygen flames are used to cut ferrous metals. It is also often mixed with argon and used in welding metals.

During the pandemic, back in 2020, the main industrial applications for hydrogen demand remained almost unchanged. However, according to IEA, the hydrogen-derived products in 2021 were all on a rise: ammonia by 3%, followed by methanol and DRI production—both at 12%. Due to the fact that nearly all hydrogen used in industry is produced using coal and natural gas as a primary source, it accounted for 7% of industrial CO2 net emissions released into the atmosphere (630 Mt) in 2021. Few of those industrial applications are electrolytic and CCUS-equipped ammonia, steel and methanol production, as well as hydrogen use for industrial heat demand. These new low-emission production processes account for 13 Mt of total industrial hydrogen production by 2030.

Oil refineries are another industrial sector that requires hydrogen in its processing operations in order to remove sulphur and other impurities, and to upgrade heavy oil residues into lighter products. According to [

23], the historic maximum stood at 40 Mt in 2018–2019 of hydrogen demand in refining. During 2020 it dropped sharply to 38 Mt and recovered to pre-pandemic levels in 2021 to reach the all-time high of 41 Mt in 2022. However, it is important to mention that most of the hydrogen used in refineries was produced from fossil fuels that resulted in CO

2 emissions of more than 200 Mt back in 2021. According to Stated Policies Scenario of IEA (STEPS), the outlook for 2030 suggests a promising scenario, with the global hydrogen demand in refining to reach around 47 Mt. In 2021, nearly 50% of all hydrogen demand in refining was based in two regions: North America at around 10 Mt and China over 9 Mt. Meanwhile, Europe has observed a significant decrease in refining capacity in recent years. Not to mention, the refineries based in Russia that, due to the international sanctions imposed, face an uncertain future. According to the IEA Oil Market Report (OMR), China accounted for nearly 70% of global net refinery additions in the 2019–2023.

There are only 11 refining plants that produce low-emission (made from renewables or nuclear, biomass or fossil fuels with CCUS) hydrogen: 7 of those are retrofitted with CO2 capture and 4 use electrolysers, producing 260 kt (~0.7% of hydrogen demand in refining) of low-emission hydrogen, a slight increase (~30 kt) compared to previous years. Replacing fossil fuel-based hydrogen with low-emission hydrogen in oil refining poses relatively minor technical challenges, compared to a fuel switch operation. Up to 2030 there are a substantial number of projects under development with the aim of producing low-emission hydrogen using either electrolysis or fossil fuel-based CCUS technique. Notably, most projects are based in Europe, accounting for around two thirds of the total production capacity of such projects. The current energy crisis might present a very much needed acceleration in the uptake of producing low-emission renewables-based hydrogen in Europe’s refineries.

There are other opportunities for hydrogen demand in refineries in near future. Those include the production of synfuels (low-emission synthetic hydrocarbon fuels), the biofuels upgrade or high-temperature heating for industrial processes. The production of synfuels is making the very first steps towards the decarbonisation of the aviation industry. However, by 2030 there should be more than 2 billion litres of synthetic kerosene produced annually, which could help to replace oil-based kerosene consumption in aviation and reduce the equivalent of nearly 1% of 2021 global demand for oil-based products in aviation.

As has been described previously, the diverse end uses of hydrogen depend on whether it is used directly in the form of pure hydrogen, as an energy carrier, or in a chemical compound using hydrogen as a raw material. Despite the technical challenges, green hydrogen is forecasted to be increasingly widely used in industrial sector, making the industry one of the largest hydrogen consumers in coming decades.

5. Hydrogen Costs

Green hydrogen is considered to be one of the most promising solutions to the problem of decarbonising industry, transport, energy management and the residential sector; it holds significant promise in meeting the world’s future energy demands. Its ability to compete with fossil fuels and alternatively sourced (blue and grey) hydrogen and the establishment of the whole green hydrogen economy in the next decade will only be achieved if green hydrogen production costs become cheaper. The green hydrogen economy is understood as a variety of hydrogen production through end-use application technologies employed to decarbonize specific economic sectors and activities which may be technically, cost-effectively and energy-efficiently difficult to decarbonize in other ways [

44]. However, because of the underlying costs, conversion efficiency and geographical scarcity and variation in the renewable energy sources, the economics of green hydrogen have been challenging so far [

45].

It is widely believed that green hydrogen costs will decrease over the years, mainly due to the gradual decline in renewable energy production costs, advances in technology, projects already finished, ongoing research and economies of scale [

45]. The cost of produced green hydrogen depends mainly on two factors: the cost of electricity supplied and the cost of technology used. The hydrogen cost for the end user will be a function of production and distribution costs. According to [

46], technology cost depends on the following factors:

Capital expenditure (CAPEX);

Variable and fixed operating expenditure (OPEX);

Hydrogen compression costs;

Efficiency;

Build and lifetime.

All those factors differ depending on hydrogen production technology used. For example, CAPEX and OPEX are calculated for CCUS-enabled methane reformation, electrolysis and gasification. Meanwhile, hydrogen compression costs are excluded due to uncertain timings of transmission, distribution and storage networks emerging. Efficiency is based on turning electricity MWh input into MWh (HHV) hydrogen output. Build times and technologies vary depending on project.

The cost of electricity from renewable energy sources varies across the globe; therefore, the cost of hydrogen has a geographical component. For example, solar photovoltaics (PV) are the cheapest option in southern European countries. Meanwhile, in northern European countries, hydrogen production costs are lowest when onshore wind electricity is used. Offshore wind tends to be the cheapest in Belgium and Germany [

47].

There were numerous models created by various researchers to calculate the price of hydrogen [

48,

49]. In 2023 the analysis provided by Hydrogen Insight discusses the issues calculating the actual cost of production of green hydrogen [

50]. The main message of this analysis is that green hydrogen barely exists today; it is made in small quantities, mainly on experimental basis, and therefore the companies producing it typically refuse to reveal their costs, as current pricing does not represent the future costs of large-scale manufacturing. However, various calculations have been carried out showing a clearer picture of possible cost range. Vu Dinh et al. created a geospatial model for estimating the levelized cost of hydrogen (LCOH) produced from offshore wind in Irish waters and found out that LCOH values can vary by over 50% depending on location [

51]. Messaoudi et al. [

52] investigated the possibilities of hydrogen production from wind generated electricity across Algeria, their results show that LCOH can vary from 1.51 to 15.37 USD/kg depending on location and wind turbine used.

Green hydrogen is already close to being competitive today in regions with favourable conditions for renewable energy deployment as hydrogen‘s cost is directly related to the amount of renewable energy installed capacities, generating cheap electricity. Sgaramella et al. analysed the impact of PV installations on LCOH in Italy and found that the cost of 3.6 EUR/kg would be reached if 35 GW of PV installed capacity were added on top of national targets [

53]. Walter et al. [

54] applied a cost-minimising electricity system investment model eNODE to different hydrogen demand levels and came to a conclusion that the majority of the future European hydrogen demand can be cost effectively covered with variable renewable energy at a cost of 60–70 EUR/MWhH

2 (2.0–2.3 EUR/kgH

2) if hydrogen consumption is positioned strategically in locations with good wind and solar potential and low electricity demand, creating a cheap energy surplus. Another example is given by IRENA report [

55]; here, Patagonia is mentioned as a region where electricity from wind power plants is generated with capacity factor of almost 50%, leading to electricity cost of USD 25–30/MWh. This is estimated to be enough to the lower green hydrogen production cost to about USD 2.5/kg. However, despite numerous technological achievements and increasing renewable energy capacities, in most locations, green hydrogen is still two to three times more expensive than blue hydrogen. This difference is determined by the cost of electricity, investment cost, fixed operating costs and the number of operating hours of the electrolyser facilities. The cost of equipment becomes decisive when the electrolyser utilisation factor drops down, e.g., the electrolyser is used for only a few hours per day.

As technology innovation research progresses and hydrogen production projects are likely to further scale up in size and number in this decade, together with other forms of renewable energy green hydrogen will follow the same cost-down efficiency-up trajectory and will become a cost-efficient fuel alternative bridging the gap between the cheap renewable energy supply and the increasing energy demand side [

35].

6. Current Situation and Prospects of Hydrogen Use in Lithuania

Lithuania pursues a rapid transition to renewable energy and aims to reach 100% energy production from renewable sources by 2050. This ambitious target has spurred energy sector transformation, which is related to the substitution of fossil fuels by hydrogen-based fuels produced locally from renewable energy sources. Lithuania’s dependence on oil and natural gas imports can be reduced by successful application of hydrogen in the market. This goal would be implemented as part of the National Energy Independence Strategy (NEIS), approved in 2018 [

56]. This strategy is part of National Energy and Climate Action Plan 2021–2030, prepared in line with the requirements set out in the Energy Union Governance Regulation [

57].

Gradual transition from fossil fuels to renewable energy and replacement of hydrogen from fossil fuels with hydrogen from renewable sources in the Lithuanian energy industry would contribute to the overall EU and Lithuanian energy and climate change objectives: reduction in fossil fuel dependence, reduction in GHG emissions and increasing the share of renewable energy in the energy mix.

Recent global and national developments challenges faced by the Lithuanian industry makes the transition towards climate neutrality more urgent. In recent years, Lithuania has been facing significant energy and climate challenges: high dependence on energy imports and the challenge of ensuring energy security, reducing GHG emissions to meet long-term climate change mitigation targets and the still dominant fossil fuel use compared to all energy sources. Between 2015 and 2021, the production and use of hydrogen from fossil fuels in Lithuania amounted to 260–320 tonnes per year (100% grey hydrogen); a total of 75–80% of the hydrogen produced in Lithuania was used for ammonia, 20–25% for the production of refined petroleum products and approximately 1% for other purposes [

58]. Therefore, the potential for the production and use of hydrogen from renewable energy in the industrial sector in Lithuania is linked to economic activities that already use hydrogen (production of refined petroleum products and production of ammonia) and economic activities whose industrial processes require very high and stable temperatures (glass production, cement production, etc.). In addition, ammonia produced from hydrogen from renewable sources could be used for energy storage when balancing Lithuanian energy system.

According to Lithuania‘s national inventory report 2020 [

59], the largest contributors to fossil fuel and biomass GHG emissions in Lithuanian industry using grey hydrogen came from ammonia production (AB “Achema”), petroleum products production (AB “ORLEN Lietuva”) and cement production (AB “Akmenės cementas”). The industrial processes carried out by these companies use hydrogen for different purposes: in oil refining, hydrogen is used as a process material, and in ammonia production, hydrogen is used as a process raw material. Moreover, they are foreseen to remain the largest green hydrogen users in coming decades.

The first nation-wide study ordered by the Ministry of Energy of the Republic of Lithuania shows that Lithuania has the potential to become a significant stakeholder in the development and transportation of hydrogen resources in Europe [

58]. To foster partnerships in the hydrogen sector, the Lithuanian Hydrogen Platform was established in 2020 after signing a cooperation agreement between the Ministry of Energy of the Republic of Lithuania and a number of business associations and companies [

60]. This platform encompasses various businesses, national research and public sector institutions in achieving national and European energy and climate targets, by means of creating and developing hydrogen technologies. The agreement also includes the development of a National Hydrogen Strategy that promotes the use of hydrogen in energy, industry and transport. The results of this initiative will be implemented in Lithuania’s National Energy and Climate Action Plan (NECP) [

61].

The NEIS (National Energy Independence Strategy) has led to cooperation on the development of the first pilot green hydrogen project in Lithuania and announcement of plans to integrate large-scale renewable energy capacity, including onshore and offshore wind and solar energy, into Lithuania’s energy system. The structure of this project is capable of covering the complete value chain of H2 from production in electrolysers to distribution using gaseous hydrogen delivery using trucks, storage and end use in order to decarbonize a geographical area (Lithuania), provide energy flexibility and improve Lithuanian system resilience through the use of green hydrogen by blending it into country’s national natural gas grid.

An example of green hydrogen application in the transport sector in Lithuania is a planned project by one of Lithuania’s public transport companies. It plans to acquire 16 hydrogen-fuelled buses and build 3 MW electrolysers with a hydrogen filling station by 2026. Moreover, various scientists from the Lithuanian Energy Institute have initiated a few hydrogen-related projects in Lithuania as part of the Clean Hydrogen Partnership initiative [

62].

One of the key tools for exploiting the potential of green hydrogen in local economies and export markets is the creation of green hydrogen valleys, aimed at the development of production capacities, integration of projects in the industrial, transport and energy sectors, the production of components of the green hydrogen value chain (e.g., electrolysers), creation of a favourable investment climate and exploitation of the country’s geographical situation and interconnections. It has been estimated that two green hydrogen valleys could be established in Lithuania. The first of these could be close to the Baltic Sea (or offshore), which would exploit the enormous potential of offshore wind power generation, as well as the offshore wind development potential of neighbouring countries. At the same time, it would aim to integrate the potential of the region’s industry and the Klaipėda State Seaport, creating a favourable investment environment for the production and export of new green hydrogen products. Another valley could be established in one of the energy infrastructure facilities. It would be designed to exploit the potential of green hydrogen and its products for flexible electricity generation. Strong electricity interconnections would allow the use of the country’s surplus electricity and renewable energy peaks for hydrogen production, while existing natural gas networks could be adapted to transport surplus hydrogen.

According to [

63], the peak consumption of electricity in Lithuania is predicted to reach 13.7 TWh by 2030 (1.9% annual rise on average). Local electricity production is set to increase to 7 TWh in 2030, of which 45% will be produced from renewable sources like wind energy (53% or 3.71 TWh) and solar energy (22% or 1.54 TWh) [

56,

57,

58]. This would fully cover the expected amount of renewable electricity needed for water electrolysis to produce green hydrogen: 20,000 tonnes of hydrogen or 1 TWh of electricity prediction is given in [

49] and 1.74 TWh is stated in the guidelines for the development of the hydrogen sector [

23]. Moreover, Lithuania’s electricity production in 2050 is set to increase to 18 TWh, which will consist of 100% renewable energy. A feasibility study [

49] predicts that 6.3–16 TWh of electricity will be required for green hydrogen production alone (225,000 t of hydrogen in various forms). The guidelines [

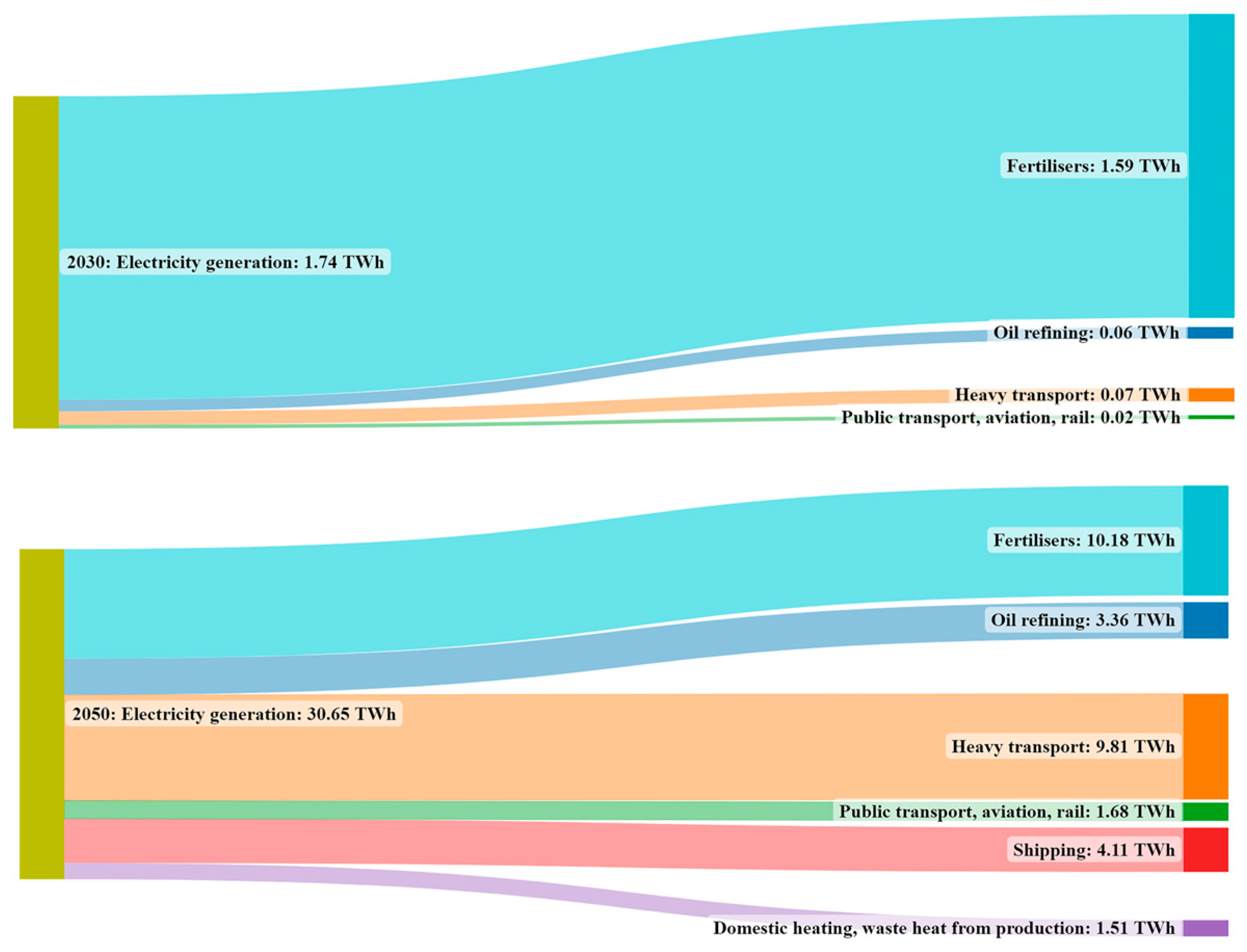

64] foresee that the required amount of electricity for green hydrogen may be even bigger and may reach up to 30.65 TWh, with the largest demand coming from fertilisers and the heavy transport sector (

Figure 2).

By 2045, all electricity is expected to be generated from renewable energy in Lithuania. This creates incentives and opportunities to prioritise the production of green hydrogen. Judging from the tendencies and strategic documents it is most likely that the largest industrial companies and heavy transport will dominate the hydrogen production and consumption market in Lithuania absorbing the largest share of power from renewable sources including offshore wind farms in the Baltic Sea.

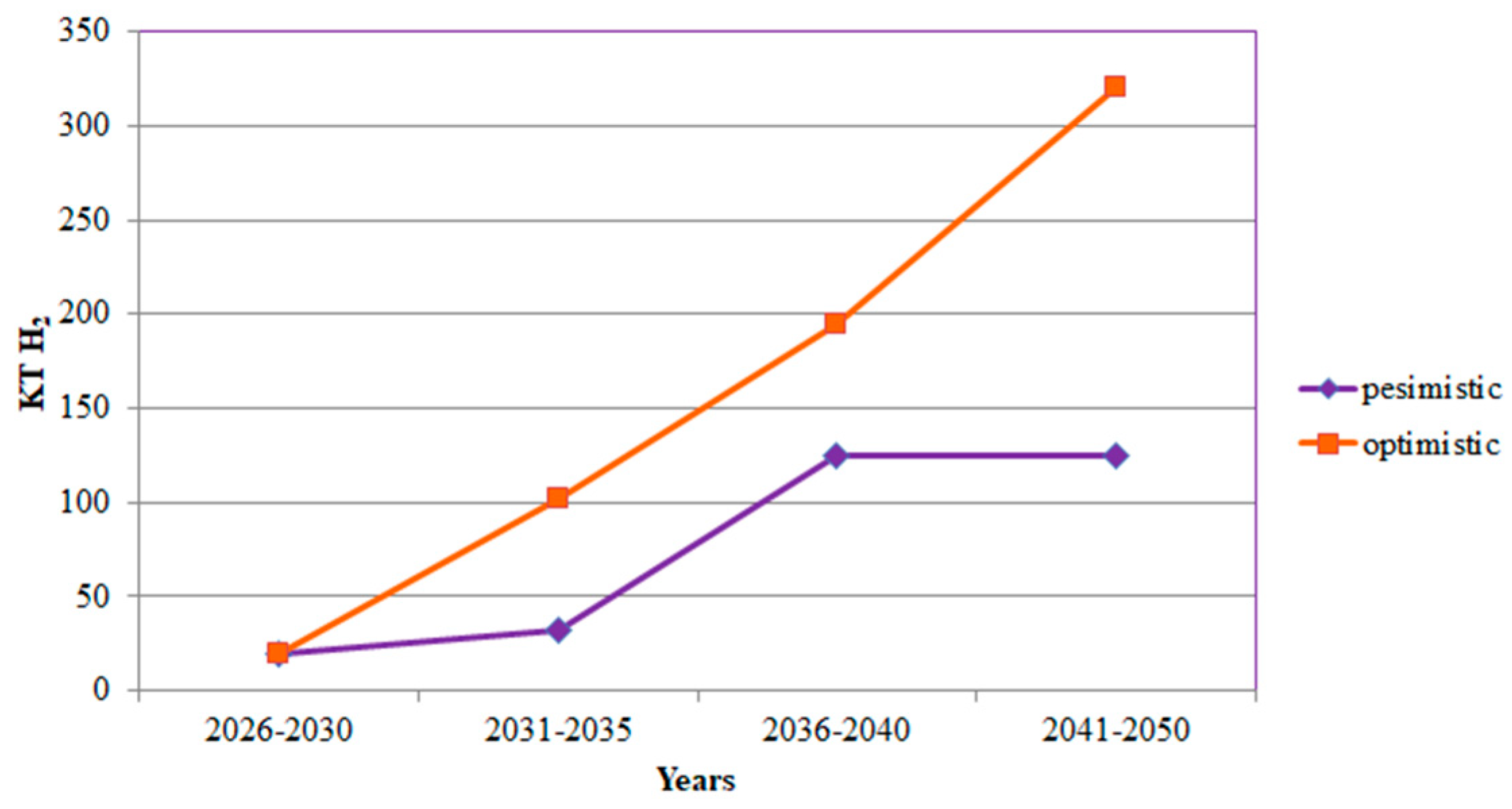

The first commercial power-to-gas project is being implemented in Lithuania; it began in 2021 and is expected to start producing green hydrogen in 2024. The innovation agency predicts [

58] that Lithuania’s industry could produce around 20 KT of green hydrogen in the period of 2026–2030 and could gradually increase this amount to 125–320 KT H

2 between 2041–2050 (

Figure 3).

As mentioned in previous chapters, while green hydrogen’s cost cannot compete with grey hydrogen yet, it could become competitive by 2030 under two main conditions: electricity price in the range of 10–40 EUR/MWh and 3000–6000 electrolyser’s full-load hours per year (capacity factor 34–68%) [

58]. Lithuania has high chances of meeting these conditions, due to the rapid increase in renewable energy (wind and solar PV) deployment which will lead to gradual reduction in electricity prices locally. Moreover, renewable energy generation has exceeded the total national power demand for one hour (>1 GW) recently; this will become more frequent with growing installed capacities periods with surplus electricity, which will pave the path to competitive power-to-gas project implementations.

Hydrogen demand in Lithuania is going to exceed the limits of industrial sector as a well-developed natural gas network is planned to be adapted to hydrogen infrastructure. Synergies between the energy sectors will allow the development of joint projects (e.g., the creation of hydrogen valleys), where cooperation between industry, transport, energy and other sectors is possible. Moreover, clear signs of serious determination to be in front of technological development and readiness to sectoral changes are shown by state gas transmission operator Amber Grid. Similarly to other gas transmission system operators across Europe, they are ready and are already taking actions to upgrade their infrastructure to allow hydrogen or a mixture of hydrogen and natural gas to flow through existing natural gas pipelines to the end users.