1. Introduction

Online shopping has now become a familiar form of shopping for consumers. Large e-commerce platforms, such as JD.com, have integrated manufacturer resources to create a category-rich online marketplace that has become a popular shopping channel for consumers [

1]. The overall revenue for JD.com in 2021 was RMB 951,592 million, an increase of 27.6% from the previous year. While e-commerce platforms keep expanding in the context of the Internet, manufacturers are establishing new sales channels. The establishment of direct sales channels by manufacturers, such as official websites, applets, and apps, is known as channel encroachment by manufacturers [

2].

Channel encroachment by manufacturers is cannibalization for e-commerce platforms and may have some impact on demand. For manufacturers, establishing a new channel means incurring new costs and there will also be issues with channel competition. Thus, the manufacturer’s channel decision is a key operational decision. The issue of channel competition has also generated sufficient discussion among scholars.

The e-commerce supply chain is a complex system and the manufacturer’s channel decisions have an impact on various aspects of the system as a whole, as well as being influenced by different factors. For the problem of channel encroachment in e-commerce, previous research has mainly used game theory methods to build mathematical models for analysis, but lacks a multi-period dynamic discussion from the perspective of multiple subjects. How will manufacturers make price adjustments in a dynamic decision-making environment? How will the manufacturer’s encroachment strategy change in the face of consumer comparison and choice? What factors will have an impact on manufacturers’ channel strategies? What equilibrium will be reached in the e-commerce supply chain after multiple periods?

An agent-based model of the e-commerce supply chain is created to solve these problems in this study, and multi-period simulations are conducted. We conduct different scenarios by varying parameters, recording, and analysing the data for each scenario. Our main findings are as follows: (1) The most profitable circumstances for manufacturers are meantime the least profitable ones for the e-commerce platform, which means that manufacturer encroachment leads to a loss of profit for the platform. (2) Consumer preferences, such as channel preferences and quality preferences, benefit e-commerce platforms and are bad for manufacturers. (3) Manufacturers are more likely to engage in channel encroachment when consumers are less sensitive to product quality and have no channel preference. Higher commission rates and maintenance costs for direct sales channels will both reduce manufacturers’ propensity for channel encroachment.

The rest of this paper is organized as follows. The previous study is summarized in

Section 2.

Section 3 explains the model’s setup and provides five alternative scenarios. The analysis is presented in

Section 4 together with the results from the simulation.

Section 5 discusses the implications of the model results for practice and the extension direction of the model. The findings of the research and the managerial insights are summarized in

Section 6.

2. Literature Review

The literature relevant to this study focuses on three areas: agent-based modelling channel encroachment, and supply chain evolution.

2.1. Agent-Based Modelling

Wooldridge and Jennings earlier proposed the theory and application of intelligent agents, noting that they are more often used at a concrete level for human concepts or conceptualizations of realizations, in addition to representing the meaning of software or hardware in computer systems [

3].

Agent-based modelling has been well used in the study of supply chains. He et al. developed a multi-product, multi-retailer model to analyse the evolution of supply chains under demand uncertainty and channel competition [

4]. For a multi-product supplier selection setting, Yu et al. created an intelligent agent model to automate the supplier selection process with synergistic benefits [

5]. In order to examine the issue of project-driven supply chains under conditions of information asymmetry and decentralized decision-making, Fu and Xing combine an agent-based method with evolutionary algorithms [

6]. Yuan et al. created a three-way agent model to examine how government laws and individual green-product purchase behaviour impact producers’ greenness decisions and market evolution features [

7]. To solve the optimization problem of make-to-order scenarios in supply chains, an agent-based heuristic algorithm was further proposed by Bagheri et al. to improve the efficiency of problem-solving [

8].

Problems related to e-commerce can also be solved using intelligent agent modelling. Using agent modelling and simulation to analyse the user behaviour on B2C e-commerce websites, Čavoški et al. improved the assessment of online sales systems [

9]. Jiang et al. developed an agent-based model that combines similarity to ideal solution (TOPSIS) and network structure to study the sales strategies of e-retailers [

10]. Haleema and Iyengar built a mathematical model of adaptable negotiating methods based on intelligence and show how effective the strategies are [

11]. Tian et al. examined horizontal and vertical differentiation while studying the problem of manufacturer channel strategy in e-commerce supply chains using an intelligent agent-based model [

12]. Terán et al. present an agent-based model of cross-border e-commerce in China, simulating real markets and exploring possible future configurations [

13]. Agent modelling is also applicable to the study of collective diffusion. Jiang et al. employed smart agent modelling to investigate the evolution of market share in a multi-brand online marketplace [

14]. Wang and Yang discussed the competition under the platform product encroachment in the e-platform and the product innovation strategies of third-party sellers [

15]. Wautelet and Kolp proposed a structured model-driven approach to develop agent-oriented software through elemental transformations, providing Tropos with a business and model-driven perspective, allowing full traceability of elements from strategic to operational levels [

16]. Multi-agent modelling methods have also been applied to medical management. In order to reduce the waste of medical resources in the hospital, Wautelet et al. constructed a software solution based on a multi-agent system, which optimizes the hospital’s bed management and coordination, and is beneficial to the hospital’s long-term strategy [

17].

It can be seen that the agent-based model simulation can effectively solve complex problems in supply chains and can better restore the problem context by building a multi-subject environment. This method has not been applied to the channel encroachment problem in e-commerce in previous studies. In this paper, agent-based modelling combined with genetic algorithms is used to simulate the decision-making and evolutionary process of subjects in the e-commerce supply chain.

2.2. Channel Encroachment

Many wholesale suppliers have set up direct channels to compete with retailers as e-commerce has grown. The term “supplier encroachment” is frequently used to describe this competition [

18]. While intuition generally assumes that channel encroachment by manufacturers will impact retailers, studies by Arya et al. and Tsay et al. suggest that retailers can also benefit from channel encroachment [

19,

20].

A manufacturer’s choice to expand into new channels might be impacted by a number of commercial considerations. Product quality is one of the factors that is often taken into account in channel encroachment issues. Ha et al. found that quality differentiation in channel encroachment does not always benefit manufacturers or retailers [

21]. The manufacturer encroachment decision for differentiating product quality was considered in Zhang and Li’s study while also taking the manufacturer’s equity sensitivity into account [

22]. Along with discussing the effects of product quality on vertical product differentiation, channel competition, and product competition, Zhang et al. also discuss the effects of these factors on the supply chain, concluding that dual-product manufacturers are always more disposed to channel encroachment [

23]. The signalling game and manufacturers’ quality choices in the face of channel incursion are discussed by Zhang et al. [

24]. The influence of information structure on manufacturer appropriation and quality choices is covered by Zhang et al. in their discussion of the relationship between product quality and information structure [

25]. Li et al. explore the connection between information management and channel appropriation by moving the research of channel appropriation from an information symmetric to an information asymmetric environment [

26].

Researchers have discovered that the invaded party (usually the retailers) has a variety of strategies for fending off manufacturers’ encroachment. Li et al. noted that the marketing advantage of the retailer influences the supplier’s encroachment decision when fairness concerns are considered [

18]. According to Zhang et al., retailers were able to successfully defend against encroachment by investing in their services [

27]. Three advertising structures were examined, along with their effects on manufacturer encroachment, by Zhang et al. in their study of the behaviour of manufacturers and/or retailers investing in informative advertising [

28]. According to Zhang et al., the establishment of retailer store brands was successful in preventing manufacturer encroachment and was related to product quality [

29]. The study by Cao et al. examined the effects of product substitutability and customer green consciousness on manufacturer encroachment strategies [

30]. The effect of quality effort and platform e-word-of-mouth on the encroachment of private label manufacturers was also examined by Li et al. [

31]. Yue et al. describe how retailers might prevent manufacturer encroachment by disseminating risk-averse information [

32]. According to He et al., retail platform parties can protect themselves against manufacturer encroachment by integrating their logistics [

33]. Yao et al. investigated how retailers’ strategic pricing affected supplier encroachment incentives and found that these techniques may be employed as an innovative, affordable anti-intrusion weapon [

34].

While previous studies have generally focused on one or two factors for analysis, this study takes advantage of agent-based modelling to build multiple scenarios to compare and analyse the impact of different factors, including consumer quality preferences and channel competition, and others. Meanwhile, most of the previous studies on channel encroachment are based on a static perspective and do not consider multi-period and multi-subject situations. This study complements this part of the research by analysing the decision and evolution of manufacturer encroachment in e-commerce supply chains from a dynamic perspective.

2.3. Supply Chain Evolution

Many scholars have discussed and studied the evolution of supply chains from a dynamic perspective. In the context of disruption risk, Wang et al. measured the complexity and evolution of various network architectures of supply chains [

35]. Sun et al. proposed a dumbbell-type multilevel supply chain complex network description rule and evolutionary algorithm to establish an evolutionary model of the integrated supply chain network and its subnetworks, revealing the evolution of statistical features [

36]. Wang et al. also looked at disruption risk as well as the evolution of supply chain decisions in terms of temporal dynamics and geographical characteristics using evolutionary game theory (EGT) and meta-cellular automata (CA) methods [

37].

Much attention had been paid to the evolution of competitive-cooperative relationships among supply chain members. Liu examined the competitive and cooperative behaviour in the supply chain of e-commerce platforms using the evolutionary game and ABM theory [

38]. To analyse the key variables impacting the evolution, Fang et al. offered a new model of manufacturer-centred supply chain evolution based on external market demand and internal competition cooperation [

39]. Park et al. studied the evolution of supply chain alliance networks from an empirical perspective, using a combination of econometric analysis and simulation experiments [

40]. In their discussion of the tourism supply chain, Fong et al. looked at the evolutionary dynamics that lead to collaborations between horizontal suppliers [

41]. Bressanelli et al. explore the evolution of supply chain structures and interactions in industrial sectors transitioning to a circular economy using an empirical method [

42].

Scholars have analysed the evolution of different decisions in supply chain operations. In order to understand the evolutionary process of capturing the retailer population through evolutionary analysis, Kogan examined the effects of a supplier offering regular wholesale prices and regular single-price breakpoint quantity discounts to multiple retailers participating in the Cournot-Nash competition [

43]. Under the setting of unconstrained government incentives and punishments, Liu and Zhao simulated the evolution of strategic decisions for each link in the supply chain to establish information nodes individually or collectively [

44]. The motive behind information sharing between remanufacturers and recyclers in a closed-loop supply chain, as well as the variables influencing it, are investigated by Li et al. using evolutionary game theory and system dynamics [

45].

The evolution of supply chains has been discussed from a variety of perspectives and approaches including, but not limited to, evolutionary games, system dynamics, and empirical studies. It is clear from these studies that the supply chain is a complex and dynamic system, and that analysis from a dynamic perspective is more likely to reveal its development patterns. In the many studies of supply chain evolution, there is a lack of analysis of manufacturers’ channel encroachment strategies, and this study completes this part of the gap.

3. Model

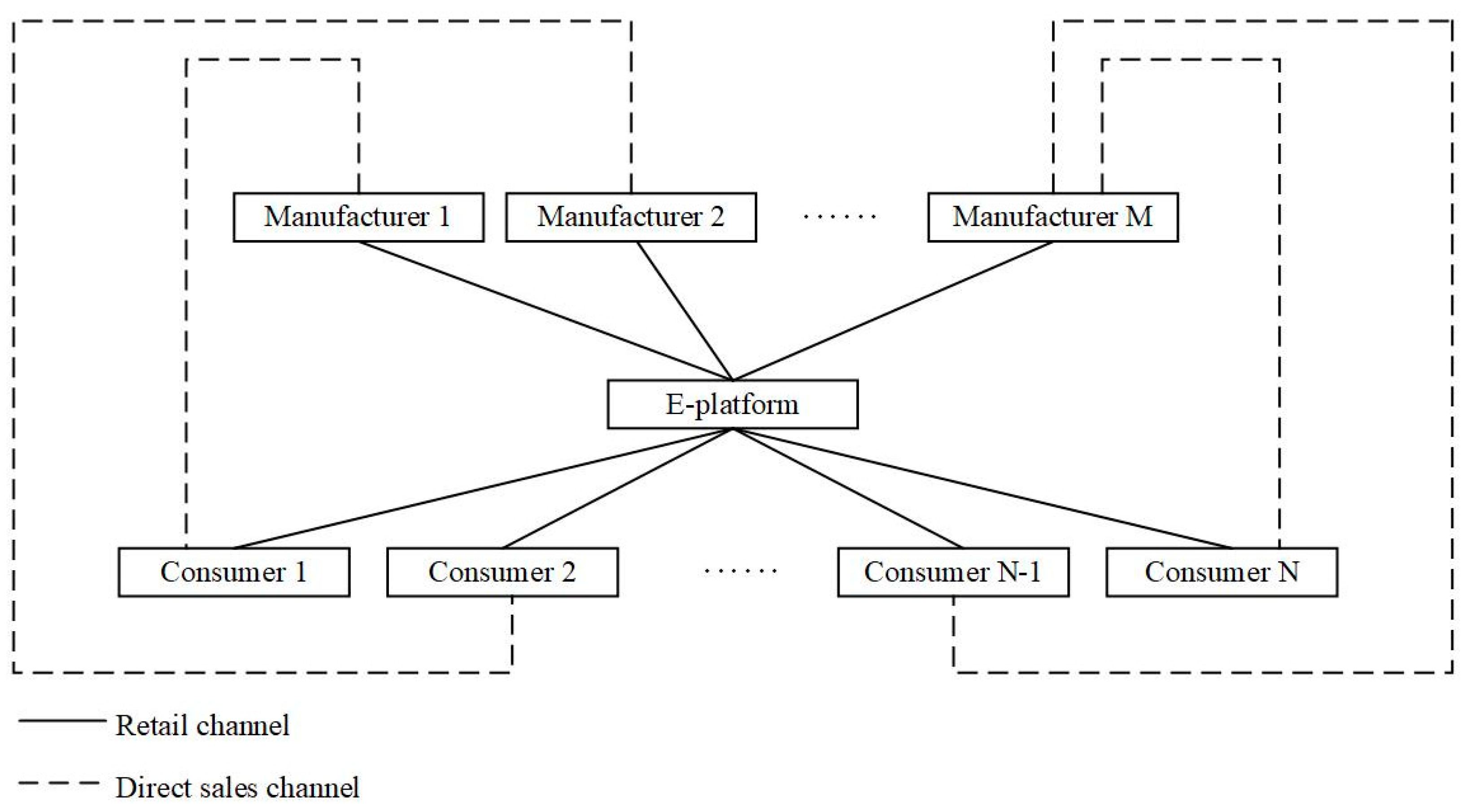

This research looks at an e-commerce supply chain that includes an e-commerce platform, M manufacturers, and N consumers. The manufacturers’ basic sales channel is to retail on an e-commerce platform and pay a commission to the e-commerce platform, which is commonly known as the agency model in e-commerce [

33,

46]. On this basis, manufacturers can opt for channel encroachment, i.e., developing a direct-to-consumer channel, such as an official website, in addition to the existing agency channel. Each manufacturer sells two substitutable products of the same type, a high-quality product, and a low-quality product. Consumers have quality preferences for the products and end up choosing one manufacturer for both products by comparing the utility they get from different manufacturers and channels. The sales model is shown in

Figure 1, with the solid and dashed lines indicating sales by manufacturers through e-commerce platforms and sales through direct channels, respectively.

As Bagheri et al. said, the mathematical programming approach is no longer used for some problems where combinations and larger scales are considered. However, agent-based models can solve such problems very well [

8]. We build an agent-based simulation model and use a genetic algorithm optimisation approach to study the manufacturer’s decision-making and evolutionary process from a dynamic perspective.

Figure 2 shows the actions of the agents in one period. The evolutionary process is analysed by observing the manufacturer’s channel existence and various parameters such as price and sales volume after

t periods of model running.

3.1. Manufacturers’ Behaviour

The manufacturers’ state chart is shown in

Figure 3. In the

Initialize state, the manufacturer establishes two sales channels and randomly sets the price of the product for the first period, and informs the consumer. The consumers evaluate the utility of the product and return the purchase decision to the manufacturers, who then enter the

Sell state and record sales and profits. In the

Check state, the manufacturers calculate the accumulated wealth and determine whether to give up channel encroachment, i.e., whether to quit the direct sales channel. In the

GAsc/GAdc state, the manufacturer uses the genetic algorithm to obtain the optimal price decision of single-channel or dual-channel for the next period. In the

Reset Price state, the manufacturers update the optimal price obtained by the GA algorithm and enter a new period.

The manufacturer’s objective function is as follows:

Table 1 shows the expressions of the profits, and

Table 2 shows the notations and explanations.

The logic of the manufacturer’s channel decision is as follows. At the t period, the manufacturer in the Check state calculates the cumulative profit for the previous t − 1 periods. A manufacturer chooses to exit the direct sales channel when its cumulative profit in the channel is less than the cost of maintaining the channel for one cycle (). This means that manufacturers will abandon channel encroachment when their accumulated profits are not sufficient to cover the cost of maintaining the channel in the next period. Thus, in period t + 1, the manufacturer will only operate the retail channel based on the e-commerce platform.

3.2. Consumers’ Behaviour

There are N consumers in the supply chain network. They obtain information on the selling price of products from different channels and choose a manufacturer to maximise utility. The consumers’ state chart is shown in

Figure 4. In the

Initial state, the consumer does not act and waits for the manufacturers to set the price. After manufacturers release their prices, consumers enter the

Getinfo state by randomly selecting x + y manufacturers on the e-commerce platform and the direct sales channel to obtain information on the goods’ prices and subsequently calculate the utility. Here x and y denote the consumer’s channel preference. In the baseline model, x = y. In the scenario where channel preferences are considered, x > y. This will be explained in a later section. In the

Buy period, the consumers choose the manufacturer that will yield the highest utility and give the purchase information back to the manufacturers. In the

Waiting period, the consumers wait for the manufacturers to update the price using the genetic algorithm, after which they move on to the next period.

The following objective function is obtained by modelling the consumers’ behaviour using the Cobb–Douglas utility function, with reference to He et al. [

32].

The consumers’ demand function is obtained using the Lagrange multiplier method as follows.

is the utility of consumer

j in period

t.

and

denote the number of high-quality and low-quality products purchased from the manufacturer

i, respectively.

and

denote consumer

j’s quality preferences for high- and low-quality products, respectively,

.

and

denote the sales price of the manufacturer

i’s high- and low-quality products in period t, respectively.

is the consumer

j’s purchasing budget.

In summary, the consumers use the demand function to calculate the utility gained from buying goods from different manufacturers and then choose the best manufacturer that offers the greatest utility and buys the goods from him.

3.3. GA Progress

The problem discussed in this study is a multi-stage and multi-subject problem. In a single stage, manufacturers have to make pricing decisions under different channels. In multi-period, manufacturers have to make channel choices according to previous operating conditions. In this model, consumers each choose a certain number of products for comparison, and finally generate demand. Thus, there is randomness in the generation of demand, which leads to the fact that the manufacturer’s profit function cannot be calculated easily. Therefore, the manufacturer’s price decision cannot be solved by traditional mathematical methods in operations research. A genetic algorithm is a probabilistic search and optimization technique based on the principle of evolution, which can simulate natural evolution to find the optimal solution [

47]. The manufacturer’s abandonment of dual-channel operations in this model can be seen as a process of elimination over time, and the combination of genetic algorithms and multi-agent simulation can restore the evolution of this e-commerce supply chain model. Similar to our study, He et al. also used a genetic algorithm to find the optimal solution when discussing similar problems [

4]. Saghaeeian and Ramezanian used a genetic algorithm when discussing the supply chain network design problem under multi-product competition [

48]. Ding et al. also adopted a genetic algorithm in the optimization design of enterprise network [

49]. It can be seen that the use of genetic algorithms can help solve complex optimization problems in supply chains.

In this study, the genes of each individual in the genetic population are the four prices at which decisions need to be made, i.e., gene = {

}. The individual’s fitness is profit defined in

Section 3.1, and the goal is to find the genetic values that maximise the profit.

The main solution steps are as follows.

Initializing the population. A random function is used to randomly generate individuals to form the initial population.

Individual evaluation. Fitness, i.e., profit value, is calculated for each individual.

Selection. A roulette wheel algorithm is used to select the parents of the population, first by deriving the probability of each individual being selected based on fitness, and then using a random number to determine the position and to select the individuals.

Crossover. The crossover operator is applied to the selected parent to produce two offspring.

Mutation. The mutation operator is applied to the resulting offspring, which mutates with a certain probability to give a new offspring.

Sorting. The population is sorted after each new generation is produced, the less adapted individuals are eliminated and the selection-crossover-mutation cycle begins again.

Termination. When enough generations have been iterated, the computation stops, and the best individuals and genes are output.

At the end of each period, the manufacturers use the genetic algorithm to calculate the optimal prices and apply it in the next period, enabling a continuous cycle of optimisation. When a manufacturer exits the direct sales channel, only the retail prices remain for the individual genes and the fitness is adjusted so that no more decisions are made about the direct sales prices. These are the

GAsc and

GAdc states in

Figure 2.

4. Simulation and Results

Simulations are run in five distinct scenarios to examine how different factors impact the evolution of the supply chain, and analyse manufacturers’ actions regarding channel encroachment. In addition to the benchmark scenario, the other four scenarios differed in terms of the parameter settings for consumer quality preference, consumer channel preference, direct sales channel maintenance cost, and e-commerce platform commission rate, as shown in

Table 3. According to the control variable principle, only one parameter is changed at a time. The numbers marked in red differ from the benchmark. Each scenario is run for 100 experiments over 100 periods.

We collect data on the number of dual-channel manufacturers, product prices, product sales, customer utility, manufacturer profits, and platform profits in different situations. Additionally, we analyse these data using graphical and statistical tests. The following are the key findings.

4.1. The Effect of Consumer Quality Preference

This study discusses consumers who have a preference for quality. In the benchmark model, consumers’ preferences for high and low-quality products are 0.6 and 0.4 respectively, a relatively small difference. Under scenario B, consumer preference for high-quality products increases from 0.6 to 0.8, i.e., consumers have a higher expectation of product quality.

Observation 1. Consumer quality preference has an impact on the number of dual-channel manufacturers (NDM), retail channel prices, product sales, and consumer utility.

As shown in

Figure 5, an increase in quality preference reduces the number of dual-channel manufacturers. Under scenario A, 5 out of 100 experiments have 6 dual-channel manufacturers remaining after 100 periods of running and 1 experiment has 7 dual-channel manufacturers remaining. However, under scenario B there are only 3 and 0 experiments respectively. With a stronger preference for quality, the survival of 7 dual-channel manufacturers no longer occurs, with a maximum of 6.

At

t = 100, the retail price of high-quality products increases, and that of low-quality products decreases in scenario B. There is no significant difference in the prices of the direct sales channel. The midpoints of the inverted U-shaped curve in

Figure 6a,b shift significantly to the right/left, while

Figure 6c,d show no significant changes. We conduct two-sample

t-tests to further validate these findings, as shown in

Table 4. The results of the hypothesis test indicate that there is a significant difference in retail prices and no significant difference in direct sales prices between the two scenarios.

Besides the prices, scenarios A and B differ significantly in terms of product sales and consumer utility. We plot the sales and utility values for the two scenarios in ascending order at

t = 100 of the 100 experiments. It is clear that as consumer quality preferences increase, product sales decrease and consumer utility increases, as shown in

Figure 7.

The above findings are consistent with the actual situation. E-commerce platforms have large volumes, a solid consumer base, and a word-of-mouth base. When consumers have higher quality aspirations, platform endorsement makes buying from e-commerce platforms more reliable. For manufacturers, the cost of operating an independent direct sales channel is borne on top of the high cost of high-quality products. As a result, manufacturers are more likely to forgo channel encroachment and sell higher prices of high-quality products in the resale channel to make more profit. Because consumer preference for lower quality products becomes less, manufacturers will lower the price of lower quality products to attract purchases. We further analyse the quantity of high- and low-quality products purchased by consumers and find that when consumer quality preference rises, fewer low-quality products are purchased and more high-quality products are purchased, so that the total utility of consumers with quality preference is increased.

4.2. The Effect of Consumer Channel Preference

In the benchmark (Scenario A), consumers select two manufacturers in each of the e-commerce platform and direct sales channels, obtain the price information and evaluate utility. Under scenario C, we consider the existence of the channel preference, i.e., consumers will be willing to access more information about products from e-commerce channels in the GetInfo state. This is also common in reality. Large e-commerce platforms have well-developed customer service and after-sales service, and some have integrated logistics, which can give consumers a better experience. When consumers have a channel preference, they will choose three (x = 3) manufacturers from the e-commerce platform and one (y = 1) manufacturer from the direct sales channel to evaluate and make a purchase decision.

Observation 2. Consumer channel preference has an impact on the number of dual-channel manufacturers (NDM) and product prices.

From

Figure 8, it is clear that the distribution of the NDM differs significantly between scenarios A and C. Out of one hundred experiments under scenario C, there are eight times where only the single channel exists, which is not the case in the benchmark scenario. When there is a channel preference among consumers, it means that channel competition becomes more aggressive. E-commerce retail platforms have a channel advantage and can gain more exposure relative to direct sales channels. The viability of the direct sales channel is squeezed, so there is an abandonment of channel encroachment by all manufacturers.

In terms of price, as shown in

Figure 9, all prices have decreased under scenario C. Manufacturers will cut retail prices to convert more views into purchases to earn larger profits when the retail channel has more exposure than the direct channel. In the case of the direct channel, the manufacturer needs to use a low-price strategy to attract more consumers to overcome the channel’s disadvantage in the face of aggressive competition. Again we further validate these findings through two-sample

t-tests, as shown in

Table 5. According to the results of the statistical tests, all four prices in the two scenarios are significantly different and are lower in Scenario C. The effect of channel preference on product sales and consumer utility is not very significant, as can be seen in

Figure 10. However, through further analysis we find a significant reduction in sales in the direct sales channel. It is reasonable that consumer channel preferences influence demand for direct marketing channels. For consumers, the presence of channel preference means that the retail channels on e-commerce platforms have more exposure and are more likely to be selected. However, for the supply chain, demand is shifting from the direct sales channel to the retail channel. There will be no significant change in overall sales volume or consumer utility.

4.3. The Effect of Channel Maintenance Cost

The channel maintenance price is the cost that the manufacturer has to bear each cycle to keep the direct sales channel running properly, i.e., the channel encroachment cost. In Scenario D, we experiment with increasing the channel maintenance cost from 200 to 300. This means increased costs for dual-channel manufacturers.

Observation 3. Channel maintenance prices have an impact on the number of dual channel manufacturers (NDM), product sales, and consumer utility.

Looking at

Figure 11, we find that the maximum number of dual channel manufacturers after 100 periods is 5 in the 100 experiments of scenario D, while the benchmark scenario has 6 and 1 dual channel manufacturer in 5 and 1 of the 100 experiments, respectively. This suggests that rising costs have inhibited channel encroachment by manufacturers. It is not difficult to explain that the cost of channel maintenance, as a cost of channel encroachment, is one of the most important factors influencing manufacturers’ channel decisions. When direct channel maintenance costs increase, manufacturing encroachment costs more, and over time the manufacturer’s propensity for channel encroachment becomes lower in the face of the intense channel competition that evolves.

By analysing the price data for Scenarios A and D, we find that channel maintenance costs do not have a significant impact on product prices, as shown in

Figure 12. According to

Table 6, the results of the statistical test showed no significant difference in the four prices between the two scenes. The manufacturers do not raise prices in the direct channel to offset the encroachment costs, nor do they raise prices in the retail channel to compensate for the loss in the direct channel. This suggests that manufacturers should maintain normal operational decisions when the cost of encroachment is unavoidable, and that they will directly choose to abandon encroachment when it is no longer profitable.

The reduced willingness of manufacturers to channel encroach mitigates the intensity of channel competition, resulting in consumers not being able to derive higher utility and consumption experience from channel competition. Therefore, as shown in

Figure 13, product sales and consumer utility are reduced slightly under Scenario D.

4.4. The Effect of Commission Rate

Commissions are a draw on the e-commerce platform for manufacturers who retail on the platform. Manufacturers pay commissions in return for using the online marketplace offered by the e-commerce platform. In Scenario E, we reduce the commission rate from 0.1 to 0.05 [

46].

Observation 4. The commission rate has an impact on the number of dual-channel manufacturers (NDM), product sales, and consumer utility.

Looking at

Figure 14, it can be seen that in the benchmark scenario the number of dual-channel manufacturers is clustered in the lower range (3, 4, and 5). However, when the commission rate is reduced, there are many experimental results clustered around five and six dual-channel manufacturers. This indicates a slight increase in manufacturer channel encroachment tendency under scenario E. In terms of price, it is not evident by comparison that the reduction in commission rate has had a significant impact on price as shown in

Figure 15. Two-sample

t-tests show the same results in

Table 7. There is no significant difference in the four prices between the two scenes according to the statistical results. This is not quite the same as the common perception that when platforms raise commissions, platform retailers generally raise prices [

50]. This study, however, finds no significant difference in prices between the two scenarios with different commissions. This result can be explained as follows: this study is not discussing a single-channel model; the manufacturer operates and decides on the prices of both channels. In the scenario where the commission rate is reduced (E), the manufacturer’s propensity to encroach becomes higher, meaning that competition between the two channels becomes stronger. For the manufacturer’s retail channel, there is no significant change, given the squeeze from the other channel and the impact of lower prices on margins.

As

Figure 16 shows, product sales and consumer utility also increase slightly under scenario E. For manufacturers, the commission is part of the cost, and when commission rates are reduced, manufacturers pay less for the retail channel. The manufacturer’s ability to cover the costs of the direct sales channel is then increased from the side and the tendency to encroach on the channel becomes stronger. For consumers, contrary to scenario D, the increase in dual-channel manufacturers means that channel competition has become stronger and consumers can get a better consumer experience from channel competition. As a result, consumers’ purchases and utilities increase slightly.

4.5. Overall Analysis

To have an overall assessment of the five scenarios, we compare manufacturers’ and the platform’s profit.

Figure 17a shows the manufacturer’s average cumulative revenue after 100 periods in the different scenarios, consisting of revenue from the retail channel and the direct sales channel. In terms of overall revenue, manufacturers gain the most under scenario E and the least under scenario B. Manufacturers receive the highest retail revenue when consumers have channel preferences (Scenario C). The highest direct sales revenue is achieved when commission rates are reduced. In a scenario where the platform reduces commissions, the manufacturer’s profits are increased to the relative maximum. Under Scenario E, there is no significant change in the manufacturer’s selling price, but there is an increase in overall sales volume, so higher profits can be made. Manufacturers suffer a relatively maximum loss of profit in the face of consumers with a high degree of quality preference. Under scenario B, there is a significant reduction in product sales. The retail prices of high and low-quality products increase and decrease respectively. The prices in the direct sales channel do not change significantly, so the overall profit became less.

The e-commerce platform receives the highest revenue when consumers have channel preferences, followed by the second highest revenue when consumers have quality preferences, and the lowest revenue when commission rates are reduced, as shown in

Figure 17b. Faced with channel-preferring consumers, e-commerce platforms can exploit their channel advantage, gaining more demand and thus higher profits through commission extraction. As a major source of revenue, it is not difficult to understand that lower commissions on e-commerce platforms can directly lead to lower profits. On the indirect side, lower commissions also increase the trend of channel encroachment by manufacturers, increasing the intensity of channel competition and thus affecting profits.

The results of the above analysis show that manufacturers are more likely to engage in channel encroachment when consumers are less sensitive to product quality and have no channel preference. Both lower commission rates and higher direct channel maintenance costs reduce manufacturers’ tendency to encroach. Of the five scenarios, manufacturers under Scenario E are most likely to engage in channel encroachment. This is also the most profitable scenario for manufacturers and the least profitable for e-commerce platforms. The two scenarios with higher platform revenues are both scenarios with lower levels of manufacturer encroachment, and both scenarios face consumers with preferences. On the one hand, there is a preference for high-quality products, and on the other hand, there is a preference for retail channels on e-commerce platforms. Both preferences are in favour of the e-commerce platform. However, the profit situation for manufacturers in such a preference is not very positive compared to other scenarios.

5. Discussion

In the discussion section, the results of the model simulation are discussed first, and the relevant results are presented for the deployment and operation of the e-commerce supply chain. Secondly, the research direction of the extended model is prospected.

5.1. Results Discussion

In this part, based on the simulation results of the above five scenarios, the specific influence and enlightenment of different factors on the e-commerce supply chain are discussed.

First, an increase in quality preference reduces the number of dual-channel manufacturers. Since e-commerce platforms have complete pre-sales and after-sales services and a good user base, consumers are more willing to trust mature e-commerce platforms when they have high quality preferences. Therefore, when a manufacturer establishes a direct sales channel, taking into account the quality needs of consumers, channel maintenance can be strengthened, and advertising can be increased to increase consumers’ trust in direct sales channels. In addition, consumers’ high-quality preference can bring higher utility for themselves, so it can be used as an incentive to the supply side of the market, and through high quality requirements, product providers can improve products with high quality and low price.

Consumers’ channel preference for e-commerce platforms is a big blow to dual-channel manufacturers. As consumers prefer to shop on e-commerce platforms, manufacturers’ strategy of establishing direct sales channels may not bring them benefits. In order to satisfy customer expectations, manufacturers should, on the one hand, pay attention to the maintenance of sales channels on the platform where channel preference is high. On the other hand, by marketing and other strategies to generate demand for direct sales channels, manufacturers may also build consumers’ trust in their own channels. E-commerce platforms need to continue to provide consumers with a good shopping experience in order to maintain consumers’ trust and preference for platform channels.

As an important component of operating costs, the manufacturer’s direct sales channel maintenance costs have an important impact on channel selection. It is not difficult to understand that higher maintenance costs will force manufacturers to abandon dual-channel operations. At the same time, the increase in cost makes the price of products rise accordingly, reducing the utility of consumers. Therefore, in order to achieve omnichannel operations and improve supply chain efficiency, manufacturers should pay attention to cost control and improve the efficiency of developing direct sales channels.

Finally, the reduction in e-commerce platform commissions can reduce the cost burden of manufacturers and make them more capable of developing direct sales channels. In consideration of improving the performance of the entire supply chain, e-commerce platforms should assume their own corporate social responsibilities, and can establish a coordination mechanism to reduce manufacturer commissions, thereby increasing the richness of the market, realizing an omnichannel, and improving consumer utility and supply chain efficiency.

5.2. Extended Model

In the basic model, we assume that there are two kinds of similar products of different quality in the supply chain. However, in real life, there is diversity in products, both vertical differences, such as quality differences, and horizontal differences, such as style and colour differences. This part discusses the extended model construction and analysis ideas under product diversity, and looks forward to the direction of future research.

In the extended model, a manufacturer simultaneously sells the same type of product but of different quality, and there is a difference in style from the products sold by other manufacturers. Heterogeneous consumers choose one manufacturer in one channel to purchase products. In the study of multi-product problems, scholars usually use Salop circle model, which uses a circle to represent the virtual distance between consumers and sellers and to describe the horizontal differences between products [

51,

52,

53]. Since consumers purchase two kinds of products, it is assumed that there are two circles, representing high-quality product collections and low-quality product collections, respectively. In a circle, the different products sold by manufacturers are evenly distributed on the circumference. Consumers are randomly distributed on the circumference.

The manufacturer’s behaviour is consistent with the basic model, and also makes price decisions and optimizations for products in different channels and formulates channel strategies. For consumers, their position on the circumference has an impact on their utility. When a consumer chooses to purchase products from manufacturers with a distance

from him, he needs to bear the cost

[

54]. Since different products are distributed in different locations, the cost to consumers is also different. Thus, the utility of the consumer can be expressed as:

.

are the consumer’s valuations of high-quality products and low-quality products, respectively.

are the prices. Consumers choose to buy products from one manufacturer by comparing different manufacturers in different channels to maximize utility.

Similarly, the multi-period simulation and data recording of the model can extend the conclusions in the basic model to the multi-product scenario, so as to analyse how the e-commerce supply chain will evolve under the influence of different factors at this time. The number of product categories in the market can be changed by changing the number of manufacturers, to analyse the impact of the number of categories on the evolution of the supply chain. In the extended model, the random distribution of consumers can be either concentrated or dispersed—how will this affect the implementation of the manufacturer’s dual-channel strategy? How will the distance cost of consumers affect the model? These problems are waiting to be solved in the multi-product model.

6. Conclusions

This study discusses the channel encroachment behaviour and evolution of manufacturers through an agent-based simulation model of an e-commerce supply chain. Through multi-period, adaptive, and elimination simulations, we find that the channel structure in the supply chain is influenced by a variety of factors, and some conclusions are drawn. We conclude with the following management insights.

For manufacturers, channel encroachment can be profitable, so steps should be taken to improve it. On the one hand, manufacturers wishing to expand their channels should focus on channel reputation and influence, and can increase consumer preference for direct sales channels through promotional marketing. For example, Apple regularly sends advertising emails to users recommending that consumers go to Apple’s official website to make a purchase. Such official promotion will increase consumers’ trust in the direct sales channel and bring the manufacturer closer to the consumer. On the other hand, from the perspective of cutting costs, manufacturers should also improve the operational efficiency of their direct sales channels. Specifically, manufacturers should reduce the cost of operating and maintaining their direct sales channels and improve their channel operating techniques. This will reduce the cost pressure on manufacturers’ channel encroachment. On the other hand, from the perspective of cutting costs, manufacturers should also improve the operational efficiency of their direct sales channels. Specifically, manufacturers should reduce the cost of operating and maintaining their direct sales channels and improve their channel operating techniques. This will reduce the cost pressure on manufacturers’ channel encroachment.

There are some defensive actions that e-commerce platforms should take since they may be harmed by manufacturer’s channels encroaching. Improving platform promotion and upholding its reputation are two important approaches. The e-commerce platform has a relatively large user base and user stickiness, and consumers are more trusting of the e-commerce platform. Based on this, the platform must consider both the loyalty of current users and the attraction of new ones. For example, Taobao regularly runs sales, and discounts and bonuses encourage consumers to choose the platform channel for their purchases. In addition to publicity and promotions, to maintain reputation, e-commerce platforms should also strengthen the regulation and management of resident sellers. Taobao has a protocol for sellers and has an exclusive platform monitoring mechanism for sellers to address after-sales issues for consumers. On the other hand, e-commerce platforms can also defend themselves against channel encroachment by increasing commissions. However, if the commission rate is too high it may cause manufacturers to withdraw from the platform for single-channel operations in the direct sales channel.

In addition to business management advice for operators, our study can also give consumers some insight. From our analysis, we can see that consumers can obtain higher utility when they have a higher preference for the quality of the product. Manufacturers may decide to change their price and channel strategies as a result of the consumer’s desire for high-quality products, which will ultimately benefit the consumer. This can improve the market’s quality-first buying environment and support the growth of high-quality products.

There are some limitations in this study. Firstly, this paper discusses manufacturers as the decision-makers but does not analyse platform decisions. In addition, the simulation model does not consider the entry of new manufacturers. Finally, future discussions could also be based on reselling models in e-commerce for channel encroachment.