Abstract

The integration of Distributed Energy Resources utilizing Renewable Energy Sources, Energy Storage Systems, and Information and Communication Technologies is transforming traditional energy systems into adaptable, flexible, and sustainable systems, with the Smart Grid concept playing a pivotal role. This paper surveys intelligent techniques and methods applied in various markets and applications, particularly focusing on their potential adaptation for negotiation processes in Smart Grid contexts. The negotiation mechanisms, crucial for prosumers who engage in real-time transactions, are analyzed with a focus on fuzzy logic tools, specifically q-Rung Orthopair Fuzzy Sets. These tools are evaluated for their capability to handle negotiation tasks and Multi-Criteria Decision-Making problems. The paper proposes a negotiation schema for healthcare buildings, especially hospitals, given their significant environmental impact, providing insight for future research.

1. Introduction

1.1. General Context

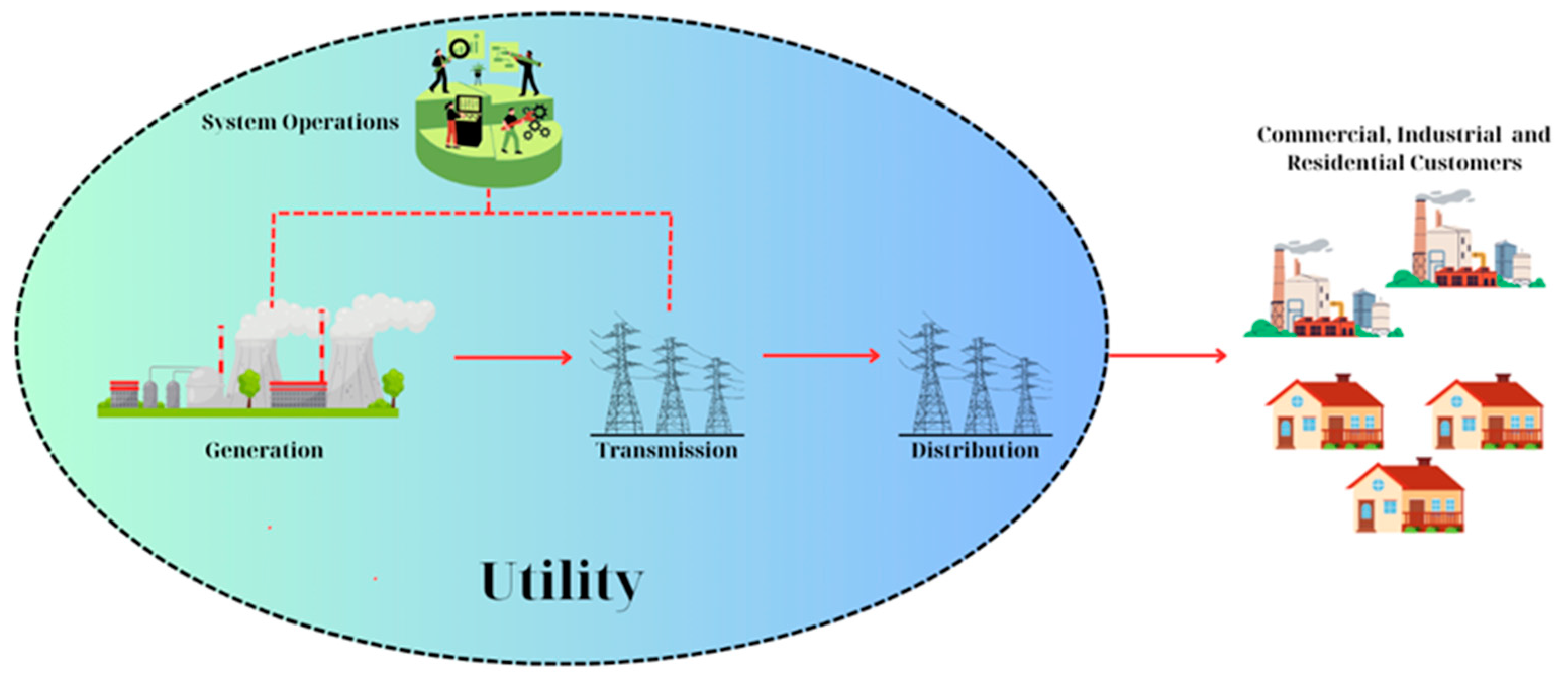

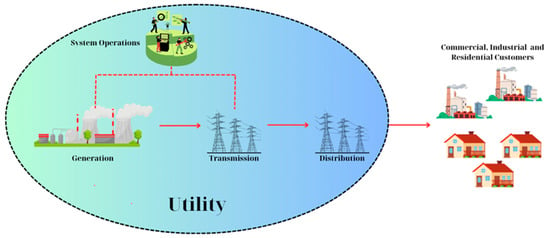

Electricity is a fundamental element of modern civilization, significantly improving human working and living conditions [1]. Historically, the electricity industry, encompassing generation, transmission, distribution and retailing, was integrated vertically operating as a monopoly, often under government ownership. In the United States and some other countries, local electricity providers were privately owned but regulated. Throughout most of the 20th century this model prevailed until the 1980s, when market reforms were initiated to introduce competition [2], particularly in the generation and retail sectors, aiming to improve efficiency and adaptability to new generation technologies [3]. The structure of a traditional electric grid is presented in Figure 1.

Figure 1.

Traditional Electric Grid.

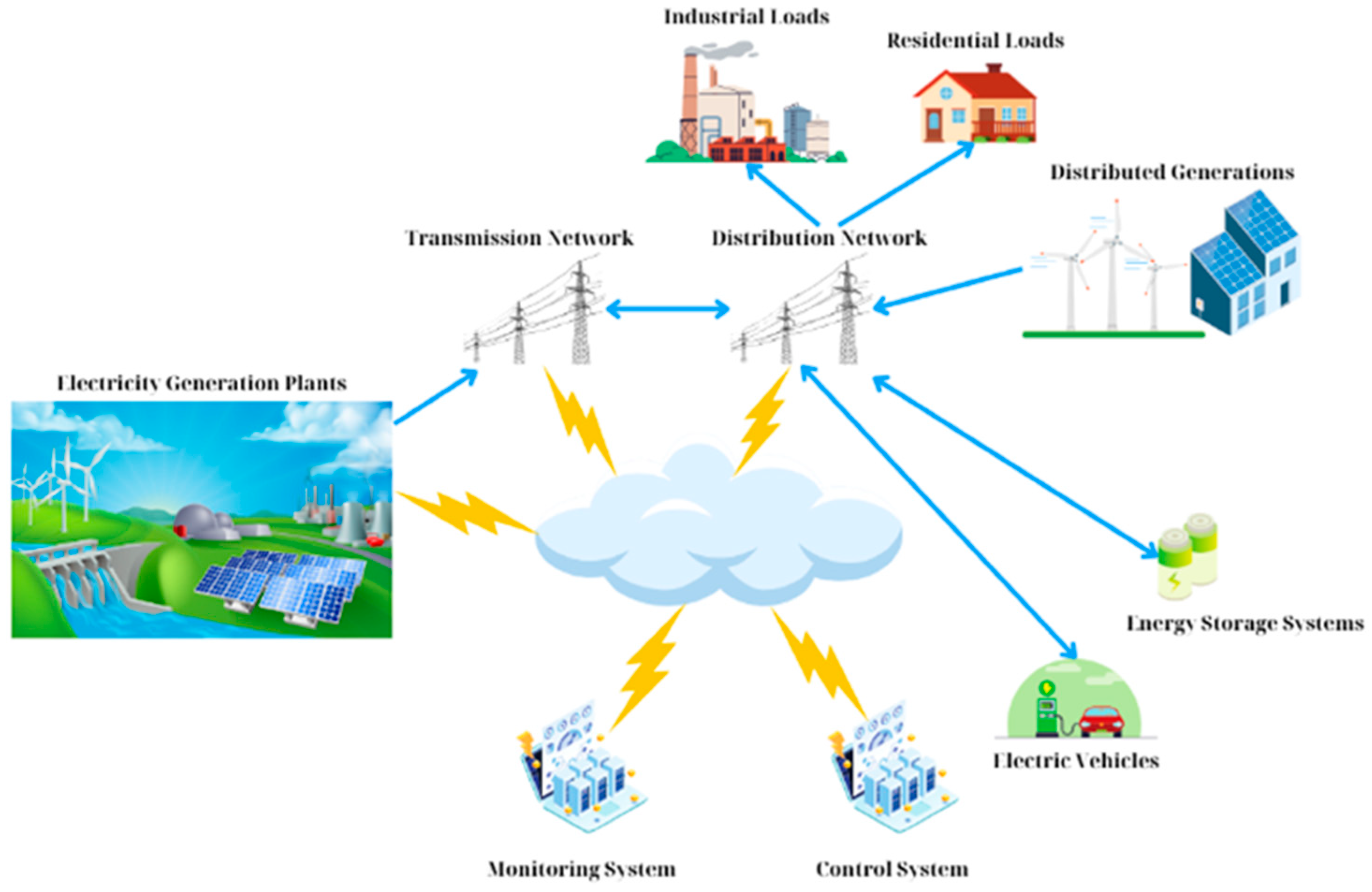

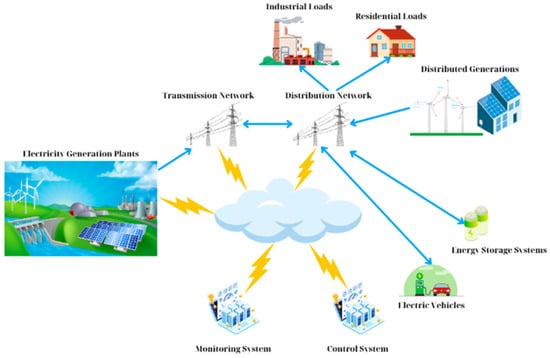

Recent decades have witnessed radical transformations in the electric power industry driven by environmental imperatives and technological advancements. The need for the urgent reduction of CO2 emissions has accelerated the restructuring of the electricity sector [4], leading to the integration of Distributed Energy Resources (DER), Renewable Energy Sources (RES), Energy Storage Systems (ESS) and Information and Communication Technologies (ICT) into Smart Grids (SG). This shift moved the industry away from the traditional vertical models towards more flexible and sustainable energy systems, resulting to an incremental transition of the traditional consumers to prosumers, who actively participate in both the consumption and production of electricity [5,6]. The Smart Grid concept is presented in Figure 2.

Figure 2.

Smart grid concept [7].

In this new energy landscape, Demand Side Management (DSM) techniques [8], particularly Demand Response (DR) and Real-Time Pricing (RTP—also known as Dynamic Pricing, DP), play a critical role. The aforementioned techniques enhance the operational efficiency, market dynamics, and reliability of power systems by encouraging customer interaction and responsiveness. DR incentivizes consumers to shift their electricity usage to periods of surplus supply, typically through price signals or monetary incentives.

When integrated with SG and ESS, DR helps manage the impact of renewable energy variability and increases the stability of the grid [9]. RTP impacts the consumers’ behavior through variable price signals that reflect real-time market conditions, contributing further to the grid’s efficient operation [10].

DR and RTP techniques have operational and economic benefits. Operational benefits include load shifting as mentioned before, which optimizes the system’s operation, peak load reduction, which can alleviate stress on the grid and reduce the need for expensive peaking power plants, and the integration of RES, by aligning electricity consumption with renewable generation patterns, maximizing the utilization of RES. Economic benefits include cost savings for consumers and utilities when the consumers adjust their electricity usage according to price fluctuations, revenue generation by offering incentives to the consumers to earn by curtailing their electricity usage during peak hours or shifting it to times with lower prices, and efficient resource allocation by optimizing the electricity consumption patterns based on price signals, benefitting both consumers and utilities [11].

Furthermore, the integration of DER and ESS within the SG framework improves the grid’s flexibility and sustainability. As for flexibility, DER allows to generate power closer to the point of consumption, reducing the need for extensive transmission infrastructure and minimizing transmission losses. They also can be deployed strategically to meet peak demand periods, reducing the need for peaking power plants. ESS, on the other hand, can store excess energy generated in low-demand periods and release it during high-demand periods, balancing dynamically the supply and demand. They can also provide rapid response to deviations of frequency, helping to maintain the grid’s stability and maintain voltage levels within the desired range, which is important for the grid’s stability and efficiency. In sustainability terms, the RES integration reduces the reliance on fossil fuels, lowering greenhouse gas emissions. ESS mitigates the intermittency of RES by storing the excess energy and providing it when RES are not generating. The result is the reduction of carbon footprint and lower emissions of pollutants and greenhouse gases.

The evolution of electricity markets, especially in liberalized retail environments, fosters competition between suppliers, leading to innovative tariff structures. Consumers benefit from a wider selection of tariffs tailored to their consumption patterns and risk preferences, thereby facilitating the adoption of RTP strategies. This competitive landscape transforms the electricity market from a static, vertical structure with fixed-rate tariffs to a dynamic and resilient market where consumers are potential producers and energy transactions occur in real time, exploiting the advantages given by ICT, like smart meters and systems of energy management [12].

Prosumers in an SG contribute actively to its stability and performance. They produce and store electricity for self-consumption and engage in energy transactions when production exceeds or falls short of their needs. This requires efficient negotiation processes to determine the terms of energy transactions. This context’s negotiation involves complex Decision Making (DM) where multiple parties seek to resolve conflicting interests. This process includes pre-negotiation, intention (offers and counter-offers), and post-optimization phases to achieve mutually satisfying agreements.

Artificial Intelligence (AI) technologies offer significant potential for optimizing these negotiation processes. AI techniques such as Machine Learning, Metaheuristic Algorithms (MA), and Fuzzy Logic (FL) systems can improve DM efficiency and adaptability in environments characterized as dynamic and uncertain. Especially, integrating FL systems like q-Rung Orthopair Fuzzy Sets (q-ROFS) with MA can enhance the handling of uncertainty and provide robust solutions in negotiation scenarios.

1.2. Contribution of the Review

The transition to a green energy model necessitates the integration of RES and Electric Vehicles (EVs) into the system. However, the inherent variability and unpredictability of these resources make the flexibility of the system essential for maintaining stability and security while ensuring efficient energy supply to all users. To address these challenges, the present review focuses on intelligent methods to manage variability and enhance system flexibility through demand-shifting policies.

Lower energy costs can be achieved when consumers act as prosumers forming energy communities of microgrids. These prosumers can participate collaboratively in energy exchange or trade energy directly among themselves, reducing electricity costs through local trading at mutually beneficial prices [5]. There are three primary scenarios where negotiation occurs in the SG context:

- Energy Market Transactions: The case where prosumers sell surplus energy to the grid.

- Peer-to-Peer (P2P) and Local Transactions: In this case, the energy transactions occur directly between prosumers.

- Retail Market Tariff Selection: Consumers choose tariffs that best suit their needs among various options offered by retailers, as part of RTP strategy.

The first two scenarios involve direct negotiation of energy amounts and prices, while the third scenario, though not purely a negotiation, involves continuous DM as consumers evaluate and select the most suitable tariffs [13].

This review highlights the significant potential of AI techniques in optimizing these negotiation processes. By reviewing the existing literature on negotiation cases and DM scenarios using AI, including applications of q-ROFS combined with MA, the present study provides insights into effective strategies for managing complex DM processes in SG. This integration of AI enhances the robustness and reliability of negotiation processes, helping to cope with the inherent variability and uncertainty of SG where RES plays a significant role.

In summary, this review contributes to the understanding of intelligent negotiation methods in SG, emphasizing the integration of advanced AI techniques to improve DM and transaction outcomes in the evolving energy market landscape.

2. Methodology

In this survey, a total of 24 studies were examined, published from 1994 to 2023. The selected studies were chosen because of their potential applicability to the Energy Transaction context in SG. Seven of them focus on e-commerce and cloud services applications where negotiations take place, seven focus on energy transactions and allocation of sources in electricity networks and buildings, three refer to general applications without specific examples, six present examples covering a wide range of applications from negotiation in politics to car market negotiation, and one reviews the application of PSO variants in DSM applications. The majority of them introduce FS while some refer to MA, such as GA, PSO, and Bat Algorithm (BA). A summary is presented in Table 1.

Table 1.

List of reviewed publications.

3. Discussion

Comprehensive Review of the Selected Studies

In [14], the author introduces soft constraints that adequately address problems where not all of the constraints need to be satisfied. More specifically, constraints or sets of constraints are compared on the basis of certain criteria, such as, for example, weights, which indicate their importance which is tied to given crisp importance. These “soft” constraints generalize conceptually the idea of crisp constraints. Since crisp constraints are characterized by their according set of tuples for which the constraints apply, it is entailed that Fuzzy sets characterize the according Fuzzy constraints, where different tuples satisfy on a different degree a given constraint. A generalization of classical solving heuristics which are used in classical CSP can be used to control the solution construction process of the Fuzzy CSP solving. Branch and bound search can replace the abovementioned heuristic search.

This study provides novelties such as a good and general framework of mathematics defining Fuzzy constraints, Fuzzy Constrained Satisfaction Problems (FCSP), and the degree of satisfaction of solutions. It also shows that the classical solution method can also be applied to FCSP cases. An example of a robot facing the problem of choosing matching pieces of clothing when trying to get dressed can be illustrated as a FCSP. The level of compatibility among potential combinations is represented by the satisfaction level of corresponding binary Fuzzy constraints. This collective satisfaction adheres to the principle of “production combination”.

The suggested heuristics can be implemented with any definition of solution degree that meets the criteria of independent computation and monotonicity. Additionally, further enhancement of the branch and bound search is possible by integrating heuristics for prioritizing constraint verification.

In [15], a GA-agent ANS with application on e-commerce is proposed, in order to minimize the required user input. The negotiation model studied involves a bilateral, multi-issue negotiation. Multi-issue negotiation involves reaching an agreement encompassing multiple terms. The system acquires knowledge of the opponent’s preferences through observing counteroffers and adjusts to the environment by dynamically modifying its mutation rate. The proposed structure proactively anticipates user needs, initiating a purchase process. The agent proposes a set of default parameters and seeks confirmation from the owner, considering the user’s profile and schedule. Negotiation can then adopt a suitable strategy based on the deadline and user preferences.

The novelty of the suggested structure is that, unlike other GA-based negotiation agents, the proposed agent attempts to learn the opponent’s preference using dynamic mutation rate modification following a rule wherein the mutation rate is directly linked to the logarithm of the population size but inversely related to the goodness value. Therefore, as the goodness value increases, a lower mutation rate should be employed. The proposed structure can be used as an online ANS.

In [16], a linear algorithm is presented to tackle the complexities of multi-issue negotiation, including the challenging task of balancing decision variables. This algorithm empowers agents to navigate trade-offs involving both discrete and continuous decision variables, particularly in scenarios involving information uncertainty and resource constraints for multi-dimensional commodities. Employing Fuzzy similarity, the algorithm approximates the opponent’s structure of preferences in the negotiation and employs a hill-climbing technique to investigate the possible range of trade-offs, aiming to identify the most probable acceptable solution. Despite the algorithm’s applicability being limited to linear problem domains, the abstract structure of the underlying similarity model serves as a component of the overall negotiation algorithm, making it adaptable for use by any negotiating agent. The algorithm has undergone not only theoretical analysis to assess its complexity but also empirical evaluation to gauge its operational performance. Theoretical analysis has revealed that the algorithm’s average complexity is linearly correlated with the number of negotiation decision variables under consideration.

The empirical findings, using a car dealing negotiation as an illustration, showcased the algorithm’s efficacy in generating trade-offs across various negotiation scenarios. Notably, it highlighted the correlation between the algorithm’s exploration of potential outcomes and its capacity to yield agreements with enhanced joint gains. This amplified search for higher joint outcomes in each iteration of the algorithm, whether in a singular or multiple environment, also led to increased communication costs due to the necessity for more proposals before reaching an agreement. The crafted computational model using heuristics to represent trade-off strategies holds the potential to augment the social welfare of the system.

The opponent’s preference structure is also used in [17], as the historical data from which the system learns. This study outlines the negotiation tactics of agents within e-marketplaces, presented as Fuzzy rules, wherein agents learn from past proposals aiming at estimating the opponent’s preference framework This approach aims to improve subsequent negotiation rounds by enabling the formulation of more promising offers. Specifically, FIS are employed to conduct heuristic searches, facilitating the learning of opponent issue weights. Furthermore, agents’ trade-off strategies are explicitly articulated as FIS, allowing for the generation of new offers in each negotiation round based on issue importance levels and the opponent’s previous offer.

The experimental results indicate that the performance of the proposed approach meets satisfactory criteria regarding negotiation duration, the attained joint utility, and the Pareto efficiency of the negotiated agreements. Nevertheless, the authors propose the necessity for a more refined learning scheme to improve the accuracy of the agent’s predictions regarding the opponent’s preference structure.

In [18], the agents were categorized into two groups: matching agents and negotiation agents. Matching agents pair buyers and suppliers by identifying the M most analogous proposals to each participant in an e-marketplace, sorting the number of the opponents who a negotiation agent has to negotiate with, to a few who are considered the most promising. This method operates on the premise that dyads with a high matching degree are more likely to efficiently reach agreements in subsequent negotiations. This reduces the occurrence of fruitless negotiations, thereby enhancing the success rate of contracts. When matched agents inform a participant about a set of potential opponents and their offers, the participant activates its negotiation agent to engage with each of them. The agent can either decline an opponent’s offer or present a counteroffer. The strategies employed by agents during trade-offs are structured as FIS, enabling the generation of new offers in each negotiation round.

The experimental findings illustrate the effectiveness of the proposed ANS regarding the number of exchanged offers, the achieved joint utility, and the Pareto efficiency of negotiated contracts. However, this study’s automated negotiations did not account for the quantities demanded by buyers or provided by suppliers. In practice, sellers supply products to multiple buyers, while buyers may distribute their demand across various sellers. The quantity aspect complicates the negotiation decision-making process as it interacts with factors like price. Although the proposed approach enables agents to negotiate with multiple opponents simultaneously, each negotiation is treated independently. It could be more advantageous if agents could leverage information from one negotiation into another. The utility function employed in this approach was relatively simplistic and rigid, influencing the outcomes of automated negotiations. To prevent unfavorable contracts, a minimum acceptable value for each issue is established. In a real Business-to-Business environment, a more sophisticated utility function should be adopted to enhance the utility of the proposed approach.

A study on a topic relevant to SG and energy market concepts is presented in [19]. An AABS is devised and assessed concerning the energy exchanges between an integrated smart building and a utility grid system. The building adopts RES and ESS technologies and acts as a seller when the renewable energy has a surplus after supplying all demands. The agent bridges the smart building and the utility power grid. A Fuzzy controller is employed to estimate the necessary power under dynamic circumstances. The proposed model is not based on AI but on mathematical models expressed by equations. The strategy is adopted by a negotiation agent which explores various attitudes in bid determination. An important factor of the negotiation model is the “eagerness” of the involved sides to reach an agreement, behaving as human traders. For example, if the eagerness factor has a large value, the agent aims to accomplish the transaction within the set deadline at any cost, provided it aligns with the reservation price. Conversely, a low eagerness value suggests that the agent is willing to risk not making the sale by the deadline, opting instead to wait for a higher selling price.

Comfort level and the battery’s State Of Charge (SOC) are dynamic factors affecting the outcome of the negotiation. The agents adapt their behavior according to real-time situations and should be efficient computationally, relying on the hypothesis of bounded instead of perfect rationality.

The proposed method offers customers more logical trade-off solutions by taking into account various dynamic factors across the entire system and emulating human behavior. The efficiency of the model proposed in making sound negotiation decisions is evident in its ability to lower customers’ energy costs or enhance their economic profit. An enhancement of [19] is discussed in [21], where an AABS has been formulated and assessed for potential deployment within a cohesive system combining smart building technology and utility grid integration; the negotiation agent utilizes an adaptive strategy to explore various approaches in determining bids. However, a significant drawback of the AABS-based negotiation agent is its heavy reliance on assumptions regarding the negotiation environment, thus complicating generalization. A PSO-AABS negotiation agent is developed to eliminate the aforementioned limitation. The proposed agent approaches the tendency of the traders to maximize their own payoffs while ensuring the achievement of the agreement.

The models demonstrate efficacy in generating rational negotiation choices while simultaneously diminishing customers’ energy expenses or enhancing their economic gains.

Intelligent technologies such as GA and NN can be utilized in the advancement of the negotiation agent.

By comparing options, the most appropriate intelligent technology for negotiation can be identified. The AABS-based negotiation model simulates traders’ eagerness and behavior, employing a mathematical function for the representation and computation of eagerness. Dynamic factors like comfort level and battery SOC significantly influence the negotiation’s outcome.

In [20], a desire-based negotiation model is proposed based on mathematical models. Again, the agents’ behavior is influenced by their desire to complete the negotiation, similar to the eagerness concept in [19]. The model facilitates agents in exhibiting adaptive negotiation behaviors within e-markets, considering both the e-market’s context and the agent’s preferences. Additionally, a negotiation protocol is introduced to outline the negotiation process within e-markets.

The experimental results convincingly showed that the proposed model adeptly adapts to changes in the e-market’s conditions, thereby modifying agents’ negotiation behaviors accordingly.

Furthermore, drawing from the experimental results, the concept of a “trading surface” is introduced, highlighting the enhanced applicability of the proposed negotiation model compared to traditional models in e-markets. Two significant aspects of the study stand out: Firstly, the investigation into expanding the current model from single-issue negotiation to multi-issue negotiation, integrating both numerical and categorical factors. Secondly, the investigation into leveraging Fuzzy and NN approaches to bolster agents’ adaptive negotiation behaviors.

A resource management of shared computing resources protocol is presented in [22], where negotiation between Grid Resource Owner (GRO) and Grid Resource Consumer (GRC) takes place to successfully reconcile the differences between GRO and GRC.

The proposed protocol emphasizes enhancing the alternating offers protocol by introducing two new Fuzzy decision controllers. One controller models the criteria of GRO, while the other models those of GRC.

Again, the concept of eagerness is underlying the concept of Grid Market Pressure (GMP). The study’s distinguished features are the presentation of the GMP value determination approach, in which sets of Fuzzy rules are employed to furnish negotiation agents with a more precise GMP value, specifically in terms of the degree of relaxation. Moreover, the mentioned work introduces the EAlternating offer protocol, an improvement upon Rubinstein’s sequential alternating offer protocol proposed in [39,40]. This protocol is designed to handle multiple trading opportunities and market competition, ensuring control over invalid behavior and relaxation of bargaining criteria for negotiation agents based on the GMP value. Finally, this study proposes a new design of negotiation agents, namely EMBDNA augmenting Market and Behavior Driven Negotiation Agents (MBDNA) proposed in an older work of the authors [41], which were not adopting the proposed Fuzzy negotiation model and were not relaxing their bargaining term in intense GMP conditions with the proposed negotiation protocol.

The experiments conducted for the evaluation of the performance of GRC under various market types, densities, grid loads and deadlines, demonstrated that GRC EMBDNA took shorter negotiation time on average while having higher success rates, and achieved higher expected utilities than MBDNA and GRC Enhanced Market Driven Agent (EMDA), a negotiation agent design which adapts its bargaining terms when faced with significant GMP, considering two relaxation factors. Furthermore, GRO EMBDNA typically exhibited shorter average negotiation times, higher success rates, and superior resource utilization levels compared to both MBDNA and EMDA counterparts.

A decision-making model is proposed in [23], which embraces an FL-based negotiation protocol tailored for electronic marketplaces. In a bilateral single-issue scenario, a buyer and a seller engage in exchanging offers with the aim of reaching an agreement on the price of a product. The emphasis is on the seller’s behavior, and an FL-based decision-making scheme is adopted. Entities have the discretion to determine when offers should be accepted within a predefined framework. FL demonstrates capabilities which utilized without any prior knowledge of the opponent’s characteristics. “Zero knowledge” entails that players are unaware of crucial parameters defining the opponent’s behavior, such as the deadline, utility function, and negotiation strategy. The focus of the study is on the seller’s decision-making process. The seller leverages the FL system to ascertain the deadline for each interaction and determine the appropriate course of action in every negotiation round.

The evaluation of the efficiency of the proposed system is performed in terms of the overall number of agreements across multiple negotiations, the duration needed to conclude each negotiation, and the seller’s utility, the experiments indicate that the proposed system delivers notable efficiency for the seller.

A many-to-many supplier selection negotiation strategy is presented in [24] with respect to supply chain application. In this form of negotiation, each participant competes with others within the same tier of the supply chain to secure a cooperative partner. Much of the negotiation environment information remains undisclosed, except for public data like bid prices from opponents in each round and the current lineup of participating suppliers and demanders. The interactive bidding strategy design is a variation inspired by earlier research conducted by Lee and Ou-Yang [25]. Furthermore, alongside established negotiation concepts such as negotiator’s power, concession, target price, reservation price, time pressure, and the principle of equal concessions, this paper extends its analysis to include the competitive factor in the formulation of bidding strategies. Specifically, the research leverages the quantities of suppliers and demanders to assess the competitive dynamics within the negotiation process, and integrates these quantitative measures into the design of the interactive bidding strategy.

The examination of experimental findings elucidates the distinct impact of individual decision variables on each parameter of negotiation performance, offering guidance to demanders in the pursuit of their supplier selection objectives across diverse negotiation scenarios. Due to the constrained information available during the negotiation process, this study highlights the competitive conditions by considering the current numbers of participants on both sides. These guidelines prove effective in providing decision support to demanders facing intricate and practical many-to-many supplier negotiation situations. The authors found it judicious to utilize Fuzzy Set Theory to introduce Fuzziness into the intricate and ambiguous negotiation conditions prevalent in many-to-many supplier scenarios. This approach facilitated the development of a Fuzzy ES tailored for enhanced practical applicability.

The AHP and FTOPSIS combination for the analysis of the negotiator’s preferences, as well as the application of this approach to managing ill-structured negotiation challenges is the major contribution of the study in [26], which proposed a negotiation decision-making model designed to support negotiation problems which are ill-structured, based on the AHP and FTOPSIS techniques. The AHP technique is employed to scrutinize the structure of the negotiation conundrum and ascertain the significance weights of the negotiation issues while FTOPSIS allows the analysis of the negotiation problem representing the different kinds of data as Triangular Fuzzy Numbers (TFN) that can be aggregated further, giving the scores of any feasible package. This can be accomplished due to the mathematical characterization of offers, which entails the conversion of ambiguous expressions into Fuzzy numbers. These Fuzzy numbers facilitate straightforward arithmetic operations on offer evaluations. Furthermore, the evaluation of any package at any time during the intention negotiation phase by the negotiator in terms of overall performance is an extremely useful tool for the support of the negotiation. The proposed scoring system formation is resistant to new packages leading to a stable scoring system. FTOPSIS is computationally efficient and straightforward, while the AHP method elicits the importance of the issues rather than assigning them directly as usual. The iterative exchange of offers and counter-offers allows to reach an agreement which may be improved further during the post-agreement phase using the Nash and Kalai-Smorodinsky concepts on bargaining solutions. FTOPSIS in ill-structured negotiation problems is also analyzed in [28], as an applicable procedure to support certain tasks in negotiation, considering subjective and imprecise judgments of the negotiators. Again, FTOPSIS is used to evaluate the negotiation offers, to build the ranks of the compromise solutions, to construct the counteroffers, and to evaluate and compare the size of potential concessions. Also, it can support the improvisation of the achieved compromise by the negotiators by searching for the Pareto optimal and dominant solutions. The ability of FTOPSIS to deal with different types of values such as crisp, interval, Fuzzy, or linguistic. The FTOPSIS algorithm allows the transformation of data to a common domain of TFN and uses Fuzzy arithmetic to perform all required calculations. Again, the negotiation space for FTOPSIS calculations should be defined differently than the traditional approach, in order to avoid instabilities of the negotiation problems resulting in rank reversal. The initial negotiation space is broadened using TOPSIS-based maximum and minimum solutions, which include utopian packages that are unlikely to occur during the negotiation process, chosen on purpose by the negotiator. Nevertheless, this approach has drawbacks since the ideal and non-ideal solutions represented by max and min do not eliminate the instability problem entirely; extreme offers might still lie beyond the bounds of the feasible negotiation domain. Three approaches are suggested to deal with this problem, with the two using the TOPSIS-specific notion of distance measuring while the third one introduces the notion of deviation, shifting the viewpoint from which offers are assessed. These methodologies are not interchangeable nor universally applicable to any negotiation scenario. Their suitability hinges on the negotiator’s philosophy regarding offer evaluation and the robustness of their reference points, which sets the authors’ future research goals as the building of a negotiation support software and undertaking a series of experiments to determine the contextual circumstances under which each of the proposed approaches is chosen by negotiators and the underlying reasons behind these choices. In [36], a method named IFIRP multi-criteria method which belongs to the class of algorithms based on reference points such as TOPSIS is proposed; negotiation offers are assessed and ordered using an intuitionistic Fuzzy framework. Under the assumption that package selection operates within a bipolar framework, taking into account both their advantages and disadvantages across specific issues. Options’ evaluation can be represented by membership and non-membership grades, respectively. Moreover, an intuitionistic Fuzzy method is proposed to apply to the Multi-Criteria Decision Making (MCDM) problem, based on Hellwig’s concept of reference point to alternatives’ ranking. This method is also applied to evaluate negotiation offers. The IFIRP method offers the advantage of accommodating natural language, subjective considerations, and the handling of imprecision or uncertainties in the evaluation of negotiation offers. It presents a potential alternative multi-criteria approach for supporting negotiators, assisting them in mitigating biases and heuristics during the evaluation of negotiation offers. The proposed method—according to the author—needs to be empirically verified about the usefulness of intuitionistic framework for negotiation support. DM should also testify about the behavioral decision-making aspect of the proposed approach. Important issues are also the development of techniques for the assessment of satisfaction and dissatisfaction levels for the negotiation options, and finally, the recognition of the reference point’s impact or the distance measure for the obtained ranking’s stability.

An AFLS that participates in electronic marketplaces is presented in [27]. The AFLS is responsible for determining suitable actions in each round of negotiation. It relies on five input parameters and allows for the incorporation of new Fuzzy rules as needed, as well as the adjustment of membership functions. The simplex method plays a key role in the addition of new rules to the knowledge base, while an FL controller is responsible for the adaptation of the membership functions. Since this method lacks a reconstruction phase, the buyer can collect knowledge during successive negotiations, even if they refer to different items, in the same manner as humans do in real scenarios. The proposed model does not require complex modeling of the behavior of the buyer. It is not necessary to define a path to equilibrium or to perform complex calculations covering all the aspects of a negotiation. It generates, in addition, actions that fully adapt to the negotiation information. Furthermore, it does not require a training process.

The negotiation model necessitated an effective decision-making mechanism capable of managing uncertainty. FL stands out as a promising solution for this task due to its ability to handle uncertainty. FL systems utilize a Fuzzy rule base that addresses various aspects of an entity’s behavior, with this rule base typically defined with input from experts. Nevertheless, it remains challenging for experts to anticipate and cover all potential cases that an entity may face during automated negotiations.

In [29], a multi-demand negotiation model based on Fuzzy rules elicited via psychological experiments with an example in politics, where two parties negotiate over policies is presented. The model engages in multi-demand negotiations within discrete domains, effectively capturing human psychological traits such as risk aversion, patience, and regret. This is achieved through the utilization of Fuzzy rules to determine the extent to which a negotiating agent should adjust their preference structure, as elicited from psychological experiments.

The study elucidates how human psychological traits pertaining to risk, patience, and regret influence alterations in preference structures throughout the negotiation process, and also identifies the conditions conducive to reaching an agreement in bilateral negotiations. Fuzzy rules were deployed to represent degrees of “risk”, “patience”, and “regret” factors, and a standard Mamdani method of FL inference was utilized to dynamically calculate the extent to which an agent’s preferences should be adjusted based on factors such as risk, patience, and regret during the negotiation process. Empirical analysis was conducted to determine the influence of attitudes towards risk on negotiation outcomes and to demonstrate the superior performance of the FL-based model in terms of negotiation success rate, efficiency, and quality compared to a well-known model. Furthermore, the model’s efficacy in resolving a negotiation problem within the political domain is illustrated.

In [30], Atanassov intuitionistic Fuzzy constraints-based approach for offer evaluation during the course of a negotiation is proposed. According to the study, an offer is evaluated through three steps: First, prioritized Atanassov intuitionistic Fuzzy constraints are used to characterize the agent’s goals. Next, the overall satisfaction and dissatisfaction degrees of an offer according to the beforementioned constraints reflect the hesitation degrees of the users when estimating the satisfaction degrees of all relevant constraints. Lastly, the agents’ acceptability of an offer is calculated with aggregation of both overall satisfaction and dissatisfaction as well. Calculating the acceptability of the offer leads to the determination of the agents’ decision to accept an offer or deny and make a counteroffer instead. Atanassov intuitionistic Fuzzy constraints can represent human-like behavior during a negotiation process, like the goals they have during the process, the human cognitive limitations, and the knowledge that leads to the hesitation to accept an offer. The contribution of this tradeoff method lies in its consideration of not only the similarity to the previous offer when crafting a counteroffer but also the satisfaction and dissatisfaction levels pertaining to its most prioritized goal. Moreover, in this method, the weights are set to embody the disparities in opinions on the importance of these three factors between different users.

Furthermore, it is necessary to develop diverse forms of satisfaction and dissatisfaction functions to represent the individual characteristics of users and to analyze how these variances impact the results of a negotiation. In this study, the functions representing satisfaction and dissatisfaction degrees concerning various negotiation objectives are presumed to be defined by users of negotiating agents or chosen from a predetermined function set within a negotiation system. Establishing the functional expression of Fuzzy constraints, or acquiring Fuzzy constraints, poses a critical challenge that must be addressed when implementing the proposed model into practical negotiation systems.

Two examples from the business sector where buyer agents in an accommodation renting scenario illustrated how the model works, showing that this method can also be applied in both cases of independent and interdependent multi-issues. As a result, integrating various concession strategies and the proposed trade-off approach into a single negotiation system may be beneficial. When integrated with the suggested trade-off decision-making method, a negotiating agent may identify a suitable compromise before conceding utility, thereby enhancing the likelihood of reaching an agreement. Consequently, in scenarios with numerous alternative trade-off proposals, it becomes necessary to devise an algorithm capable of swiftly identifying the most suitable trade-off within a multi-issue negotiation environment.

A mixed-strategy ANS for a CCSN is recommended as a strategy in [31]. In this study, a new negotiation strategy was designed and simulated aiming to maximize utility for both trading parties while the speed in reaching an agreement is increased. Moreover, a process for the aggregation of the results of the negotiations on simple task requirements to ensure end-to-end composite service requirements is proposed. Proposals are generated based on factors such as remaining time, market competition, and opponent’s behavior which are environment-related factors, and preferences and utilities which are negotiator-related factors. These factors also can be divided into two categories considering their effect on the proposal generation, namely concession and tradeoff factors. A simple FIS was devised to gauge the appropriate level of concession, considering the preferences and utilities of negotiating parties, thereby striking a balance between preferences and achieved utilities to ascertain the extent of concession. Sugeno-type FIS is preferable because avoids time-consuming defuzzification in FIS which has Fuzzy consequences in its rules. The opponent’s behavior is estimated using a tradeoff algorithm based on Fuzzy similarity, where a proposal that has more similarity with the opponent’s proposal has a better chance of being accepted by the opponent. As a mixed strategy, the proposed framework maximizes the utilities of the negotiating parties in the shortest possible time. Simulation results show that negotiator-related factors, market competition, and opponent’s behavior affect the performance’s enhancement.

Opponent learning in real-time automated negotiation is the concept of the methodology presented in [32]. In the context of multi-participant and multi-issue negotiation, an estimation technique based on Fuzzy functions models the opponents’ preference profiles, since Fuzzy functions are very close to the human’s way of evaluating alternatives. During the negotiation, the agents learn the parameters of these models in real time recursively, using a Bayesian approach based on Unscented Particle Filtering (UPF). In UPF, the posterior distribution of the state is recursively estimated by a set of particles (samples) that evolve over time, conforming to the system’s transition and observation models. In each round, the proposer agent offers a proposal to stakeholders. Stakeholders respond to the proposer by sending feedback which includes a Fuzzy score assigned to the proposal and some arguments about the proposal. Using the feedback, the preference model is recursively estimated with the UPF approach. The estimated preference model is used by the proposer to find the next proposal that is closer to opponents’ preferences while at the same time meeting his criteria as well, enabling a Belief Propagation Proposal Preparation (BPPP) module. Therefore, the proposals in each round have a higher probability of being accepted by the stakeholders. This technique facilitates the process of negotiation and accelerates reaching an agreement. The proposed methodology was compared to a frequency-based approach using two different case studies: The planning of an energy system in Alberta and in real estate sales in King County, where the UPF methodology accelerated the process to 85% when realistic knowledge of the users was available and up to 95% when no prior knowledge about the users was available.

The uncertainty of the estimation is considered by the proposed approach which makes it capable of having a logical pattern in offering proposals. For example, when stakeholders show strong concerns about an attribute, the BPPP module opts for a new proposal significantly divergent from the preceding one. Moreover, the effectiveness of the proposed estimation technique relies on the initial approximations of the opponents’ preferences. Enhanced initial estimations result in faster convergence of the UPF towards the actual preference profile of the user.

The authors’ future work aims to provide more accurate initial approximations using natural language processing techniques. Also, another future goal is to use the auxiliary data to generate pseudo-observations for the UPF module, improving the estimations even more.

A one-to-one automated negotiation framework applied in local energy markets is proposed in [33] for P2P local trading of electricity. This framework utilizes an autonomous agent model to encompass the preferences of both sellers and buyers regarding the price and quantities of electricity to be traded across various periods within a day. A bilateral negotiation framework is established, drawing from Rubinstein’s alternating offers protocol. This framework aggregates the electricity quantity and price for different time periods into daily packages, which are then negotiated between the agents representing the buyer and seller.

Buyer and seller agent models are defined by utility functions. The study examines three negotiation strategies: Zero Intelligence, Boulware, and linear heuristic. The heuristic strategies select an offer from a narrowed set of viable packages. The proposed agents, employing these strategies and the negotiation protocol, were deployed in a case study involving a prosumer equipped with a solar home system and a battery, as well as various consumers with diverse energy and price preferences. Negotiations occur sequentially between the seller and individual buyers. Simulations within this framework, coupled with agent modeling, enable prosumers to enhance their revenues while facilitating affordable electricity access for the community.

Linear heuristic strategy proved to provide similar results with Boulware but in a shorter time.

The penetration of DER and deferrable loads such as EV introduces new challenges in the operation and control of modern power systems. In [34], an event-driven autonomous distributed architecture with real-time communication between a Transactive Agent (TA) communicating with multiple HEMS agents in real time where the residential customers possess generation and storage assets as well as diverse loads is introduced. For this reason, a Transactive Demand Response (TDR) algorithm is deployed. HEMS agents negotiate with the TA to determine their best response to the DR request, using a Fuzzy inference engine to satisfy the users’ comfort levels and preferences in responding to rewards offered by the TA. The DR scheme is meticulously designed to adhere fully to the IEEE2030.5 interoperability standard, enabling customers to choose their DR compliance level and offering incentives to optimize their engagement. Real-world smart meter data from Hydro Ottawa’s service area was utilized to model customer behavior. Employing k-means clustering, customers were categorized, and this information was leveraged by the TA to initiate the transactive negotiation process with each HEMS agent. The TDR algorithm integrates a flexible reward function to accommodate diversity in both power consumption and TDR compliance, facilitating a more precise quantification of customer behavior.

TA engaged in negotiations with customers’ HEMS agents utilizing event-based optimization techniques and a reward mechanism. The agents’ response to DR requests led to a reduction in consumption, aligned with compliance levels linked to their comfort preferences, as articulated through Fuzzy rule bases. The findings indicate the effectiveness of the proposed scheme, suggesting that full capability is a viable approach for vendors and solution providers to realize the SG concept.

A negotiation algorithm is proposed in [35], where users and end-users are modeled as prosumers. A multi-agent scheme enables the modeling of each user as a generator, consumer, or both and manages energy trading within the local market. The multi-agents scheme consists of a Multi-Objective Optimization algorithm, a Pareto front, and an FDM algorithm. The Multi-Objective Optimization algorithm evaluates several scenarios of buying or selling energy to or from the main grid and other agents. Each electrical load profile and electrical producer profile is treated as a decision variable and assessed within an objective function, aimed at maximizing earnings from electrical energy sales while minimizing high-cost electrical energy purchases. The evaluation outcomes are represented in the Pareto front to determine the optimal participation strategy in a free market, facilitated by the FDM algorithm. Here, Fuzzy sets are incorporated through partial values of elements defined via membership functions. A Pareto front solution is conceptualized as a continuous, monotonically decreasing function, akin to a membership function, aiming to identify the optimal solution in the optimization process. Each membership function is characterized on a scale ranging from 0 to 1, denoting compatibility and incompatibility, respectively. Hence, the solutions identified through the Pareto front graph can be characterized as a membership function. The FDM determines the decisions regarding buying or selling electrical energy.

The proposed algorithm, employing the Multi-Objective Bat Algorithm (MOBA), was compared with a Multi-Objective Particle Swarm Optimization (MOPSO) algorithm across six instances of buying and selling electrical energy.

The findings indicate that, in three out of six cases, the proposed algorithm achieves the lowest costs for purchasing electrical energy and maximizes agent profits from electrical energy sales in the market. In one case, both algorithms act similarly.

The suggested methodology holds the potential to facilitate autonomous energy transactions and foster the development of an intelligent energy market. Subsequent endeavors should focus on analyzing and substantiating the optimality and convergence of the proposed algorithm.

In [37], q-ROF set information is used on the prioritization of AO which is based on the AATN and AATCN. q-ROF sets cover wide information, therefore they are more flexible and suitable. The study proposes two new AOs based on q-ROF, AATN, and AATCN. q-Rung Orthopair Fuzzy Aczel-Alsina Averaging (q-ROFPAAA) and q-Rung Orthopair Fuzzy Aczel-Alsina Geometric (q-ROFPAAG) operators are proposed to involve the information’s priority weights. An MCGDM algorithm was developed based on the proposed operators since the prioritization of attributes and experts is of crucial importance in decision-making problems. MCGDM algorithm was applied to a real-life problem concerning the selection of energy resources and the proposed concepts compared with various q-ROF-based AO. The rival AO solved the example but failed to utilize prioritization, showcasing the contribution of the proposed approach. Additionally, AO relying on Pythagorean and Intuitionistic Fuzzy Sets, failed to solve the given problem highlighting the diverse nature of q-ROF sets and the proposed operators.

In conclusion, q-ROFPAA operators exhibit superior performance compared to existing AOs due to their consideration of prioritization relationships during information aggregation. Additionally, they have the capability to encompass a broader spectrum of information, unlike other operators that neglect certain data. Moreover, the proposed operators represent a generalization of the previous AO.

Lastly, in [38], a review of the application of PSO-based algorithms in DSM fields discusses the challenges of previous work. The variants of PSO are used to address the high complexity and uncertainties of the DSM modeling within the acceptable timeframe while considering user comfort. New prospects are discerned, paving the way for the advancement of PSO methods in forthcoming research initiatives.

In a systematic classification according to the application of PSO variants in DR programs, the Binary Particle Swarm Optimization (BPSO), MOPSO, and Enhanced Leader Particle Swarm Optimization (ELPSO) variants of PSO algorithm are proposed as suitable in RTP strategies. Specifically, BPSO qualifies in P2P trading between prosumers and consumers. Although the study is limited in DSM, the study establishes the significance of MA as a prominent component of AI in addressing optimization challenges. These methodologies demonstrate a level of precision suitable for addressing a wide array of optimization problems, yielding near-optimal solutions with minimal computational burden.

Their efficiency surpasses that of classical approaches due to their capacity to traverse the search space, approximating a globally optimal solution. MA are applicable to problems featuring numerous decision variables and can be seamlessly adapted to scenarios with multiple constraints, including real-world engineering design problems.

4. Conclusions and Remarks

The present work attempts to focus on an important aspect of the SG concept and provide a critical review of selected works which, in the authors’ opinion, may give scholars and researchers the spark to adapt the presented methodologies and concepts to their work, or to enhance the reviewed methods with new features and approaches.

Some interesting points were:

- –

- The concept of imitating eagerness and other human-like attributes like hesitation, the willingness to risk, etc. with Fuzzy sets.

- –

- The dominance of FL in tools able to learn tactics, and make trade-offs.

- –

- The Intuitionistic Fuzzy sets stability and applicability in ill-structured problems like negotiations.

- –

- The Bayesian UPF approach which offers flexibility to the negotiation offers in [32].

- –

- K-means clustering customer’s classification and Fuzzy inference engine to satisfy customer’s preferences in response to rewards offered by the TA in an SG context as described in [34].

- –

- The general description of a system applied in energy trades and the use of novel metaheuristic algorithms such as BA in [35].

- –

- The q-ROFPAA OA dominance in comparison to other q-ROF-based OA in [37].

- –

- The potential of integrating FL, Bayesian approaches, UPF, and NLP techniques into negotiation frameworks, where agents can enhance the robustness and reliability of negotiation methods in coping with the variability and uncertainty of renewable energy sources.

In most cases, AI approaches were implemented, while in others, AI was partially employed or had the potential to integrate with the presented methodology. Some may apply to one or two of the cases referred to in Section 2, while some may, with the proper arrangements, apply in all three cases. In Table 2, a summary is given.

Table 2.

A summary of the presented works and their potential use.

Conclusively, the present study conducted a cross-disciplinary survey and the selected studies covered a wide range of cases where negotiation takes place. The majority of them employ FL theory as a tool to adapt to the opponent’s behavior or to reach a decision-making inference. A small number of them employ or suggest metaheuristics such as PSO, GA, or BA mostly as a tool to refine Fuzzy rules allowing the agent to dynamically adapt to the opponent’s strategy. A few numbers of the surveyed studies propose models where AI tools like ANFIS, NN, and metaheuristic algorithms can apply to future work. Despite the temptation to follow an already tested methodology applied in SG applications, authors recommend using these methodologies as benchmarks against novel implementations that may occur following and adapting one or more methodologies that haven’t been applied yet in SG. Consulting the summary in Table 2, a scholar may step into a deeper search and propose new, more efficient models for SG and EM applications, or for markets with similar structures.

In Section 3, the detailed Discussion of the surveyed studies reveals the limitations of these methods which are:

- The uncertainty handling, which is a primary challenge during negotiations. FL stands as a promising solution for handling uncertainty. However, it remains challenging to anticipate and cover all potential cases that may arise during a negotiation. More robust FL systems should be developed.

- The incorporation of human psychological traits. Negotiation models often overlook the incorporation of human psychological traits such as risk aversion, patience, and regret. The authors propose the utilization of Fuzzy rules to determine the extent to which negotiating agents should adjust their preference structures based on these psychological traits. This involves eliciting psychological experiments to inform the Fuzzy rules accurately. Future research could delve deeper into understanding how these psychological traits influence negotiation outcomes and develop more sophisticated Fuzzy rule bases to capture human behavior effectively.

- The evaluation of negotiation offers. Evaluating offers during negotiations is a complex task, especially considering the diverse preferences and constraints of negotiating parties. The authors propose an Atanassov intuitionistic Fuzzy constraints-based approach for offer evaluation, considering satisfaction and dissatisfaction levels. This method aims to represent human-like behavior during the negotiation process and allows for the consideration of various negotiation objectives. Future research could focus on developing diverse forms of satisfaction and dissatisfaction functions to better represent individual characteristics and preferences, thereby enhancing the accuracy of offer evaluations.

- The adaptation and learning in real time. Negotiation agents often struggle to adapt to the changing preferences and behaviors of their counterparts in real time. The authors propose a methodology based on Bayesian approaches and Unscented Particle Filtering (UPF) for opponent learning in real-time automated negotiation. This approach enables negotiation agents to dynamically estimate their counterparts’ preference profiles and adjust their negotiation strategies accordingly. Future research could explore further enhancements to this methodology, such as leveraging natural language processing techniques for more accurate initial approximations of opponents’ preferences.

- The optimization in Energy Markets. Negotiation frameworks applied in energy markets face challenges such as maximizing utility for both trading parties while ensuring speed in reaching agreements. The authors propose various optimization algorithms, such as Multi-Objective Optimization and Particle Swarm Optimization (PSO) variants, to address these challenges. Future research could focus on analyzing the optimality and convergence of these algorithms further, as well as exploring new prospects for their application in energy markets.

Overall, the authors advocate for the integration of advanced AI techniques, such as FL, Bayesian approaches, and optimization algorithms, into negotiation frameworks to overcome existing limitations and improve negotiation outcomes in various domains.

Generally, by integrating flexible DR, RTP mechanisms, bi-level optimization approaches, and intelligent negotiation methods, prosumers, and the grid can optimize energy transaction negotiations, maximize economic benefits, and enhance the efficiency and reliability of the energy system.

5. Future Directions

5.1. Multi-Criteria Decision Making (MCDM)

MCDM is a vital aspect of decision theory, offering ranking outcomes for alternatives by combining diverse criteria [42]. Uncertainty affects decision-making and appears in a number of different forms. As pointed out by Zadeh, uncertainty is an attribute of information [43]. In real-world MCDM problems, decision-making information often involves imprecision and ambiguity. Therefore, the criteria are not consistently expressed as real numbers and they are better suited for representation through Fuzzy sets [44], Intuitionistic Fuzzy sets [45], Pythagorean Fuzzy sets [46], and q-ROFS [47].

Hospitals and healthcare buildings in general consist of an interesting case of study where energy consumption management and decision-making processes can reduce energy consumption. In [48], Smart Energy software achieved a reduction of 3.46% in energy consumption of a medium-sized University hospital in Brazil which equals to 100,000 kWh over a year.

Hospitals’ energy consumption has a significant environmental impact, since they are responsible for the 10.3% of the total consumed energy of the commercial buildings sector while they only cover 4.8% of the total area of the commercial buildings [49].

Since the decision-making issue in electricity purchasing has multiple aspects, the authors’ future work may focus on the decision-making process between different suppliers in competitive market. For example, let , , be three competitor retailers and C1, C2, C3 and C4 the user defined criteria concerning costs, source of energy, CO2 emissions and value-added services such as reliability of the supply respectively. Using q-ROFN of the form , with μ representing membership and ν non-membership degrees of the , the preference matrix may have the form of the Table 3:

Table 3.

q-ROFN preference matrix.

The preference information can then be aggregated using AO of q-Rung Orthopair Fuzzy Numbers (q-ROFN) and score values for each retailer can be calculated as presented in Table 4:

Table 4.

Score values of the aggregated preferences.

The authors’ future work will implement, among other intelligent techniques, a decision support system based on q-ROFNs for a healthcare facility. Healthcare facilities (Hospitals, district health centers, etc.) are a special category of commercial buildings due to their social importance and their environmental impact.

5.2. Fuzzy Negotiation

Considering the aforementioned notes, the authors will furtherly enquire Fuzzy negotiation methodologies based on similarity operators and Fuzzy sets described in [17,18]. Assuming that seller and buyer act uniformly, the generalized methodology described below is common for both unless stated otherwise:

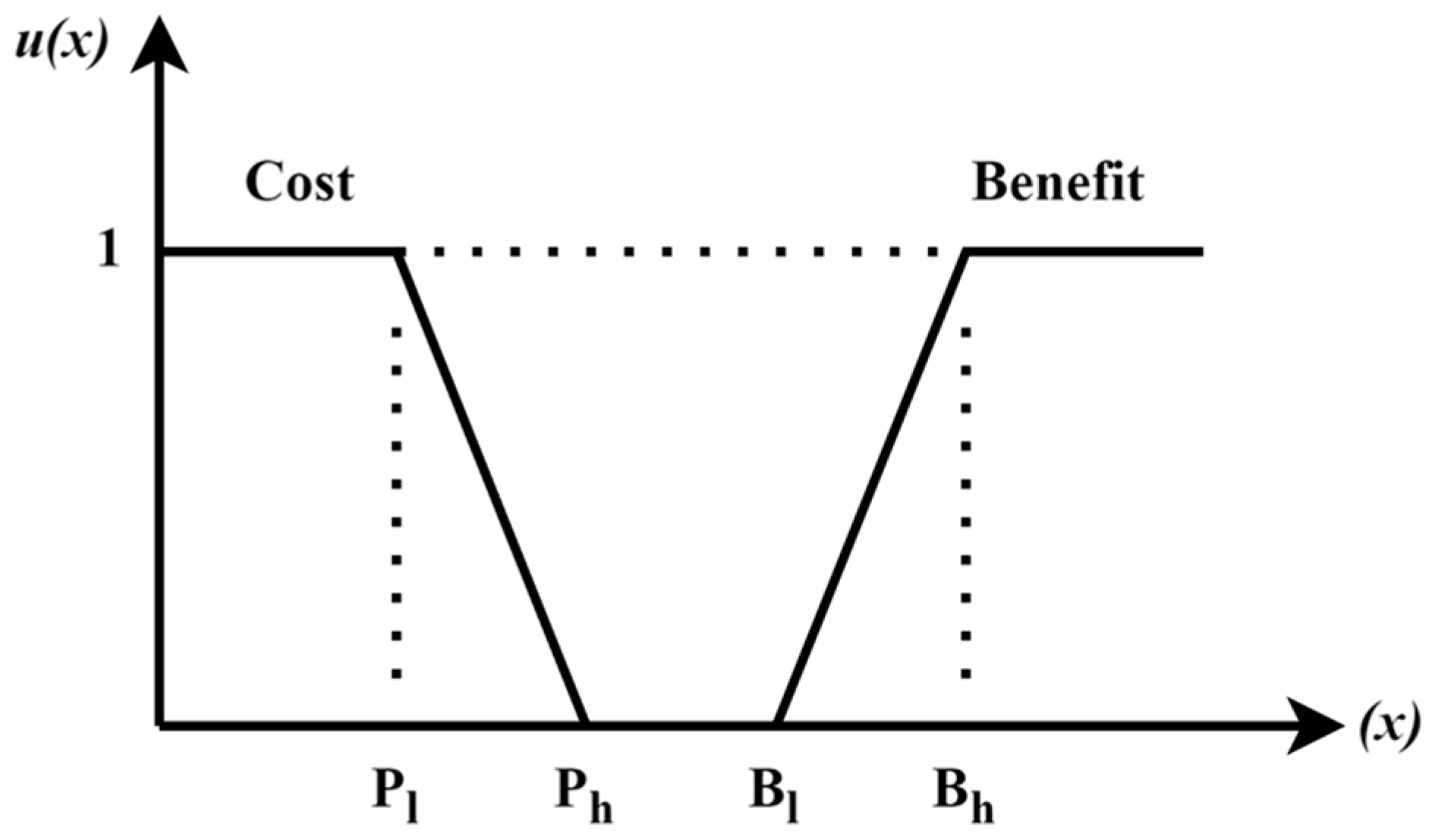

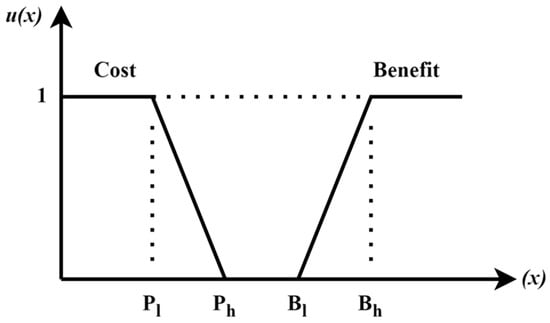

- Firstly, an initial offer is made from the first negotiator which can be a buyer or a seller. The other participant can accept the offer ending the process or submit a counteroffer. The counteroffer creation is described as follows: The opponent negotiator evaluates the offer employing a utility function which allocates values to the available options (Equation (1)).In Equation (1), is the overall utility value for the offer and is the utility value assigned to issue . Each utility value is assigned to its corresponding weight, .Some options—the qualitative ones—may be predefined, and can be assigned to certain values in the [0,1] interval-valued q-ROFS, while the quantitative options may have more vague definitions and can be expressed by fuzzy sets and q-ROFS. For example, the option “price” which is common option for both seller and buyer has a diverse significance for them. From the seller’s point of view, the price is expected to lead to a benefit and from the buyer’s perspective the cost is the issue which the price option incorporates. Naturally, the option “benefit” for the seller should be the larger while for the buyer the option “cost” should be the smaller. Moreover, the participants are setting the higher and the lower bounds they are willing to accept. Thus, these bounds are forming the constraints of the problem. The weights of the options as they are set by every participant along with the respective values form the submitted offer. The negotiating agent of the participant is now set. In Figure 3, the utility function of the price issue is shown. Pl and Ph stand for the lower and the higher bounds of the price the buyer is expecting to pay while the Bl and Bh the lower and the higher benefit bounds the seller is expecting to achieve.

Figure 3. Utility function of the issue “price”.

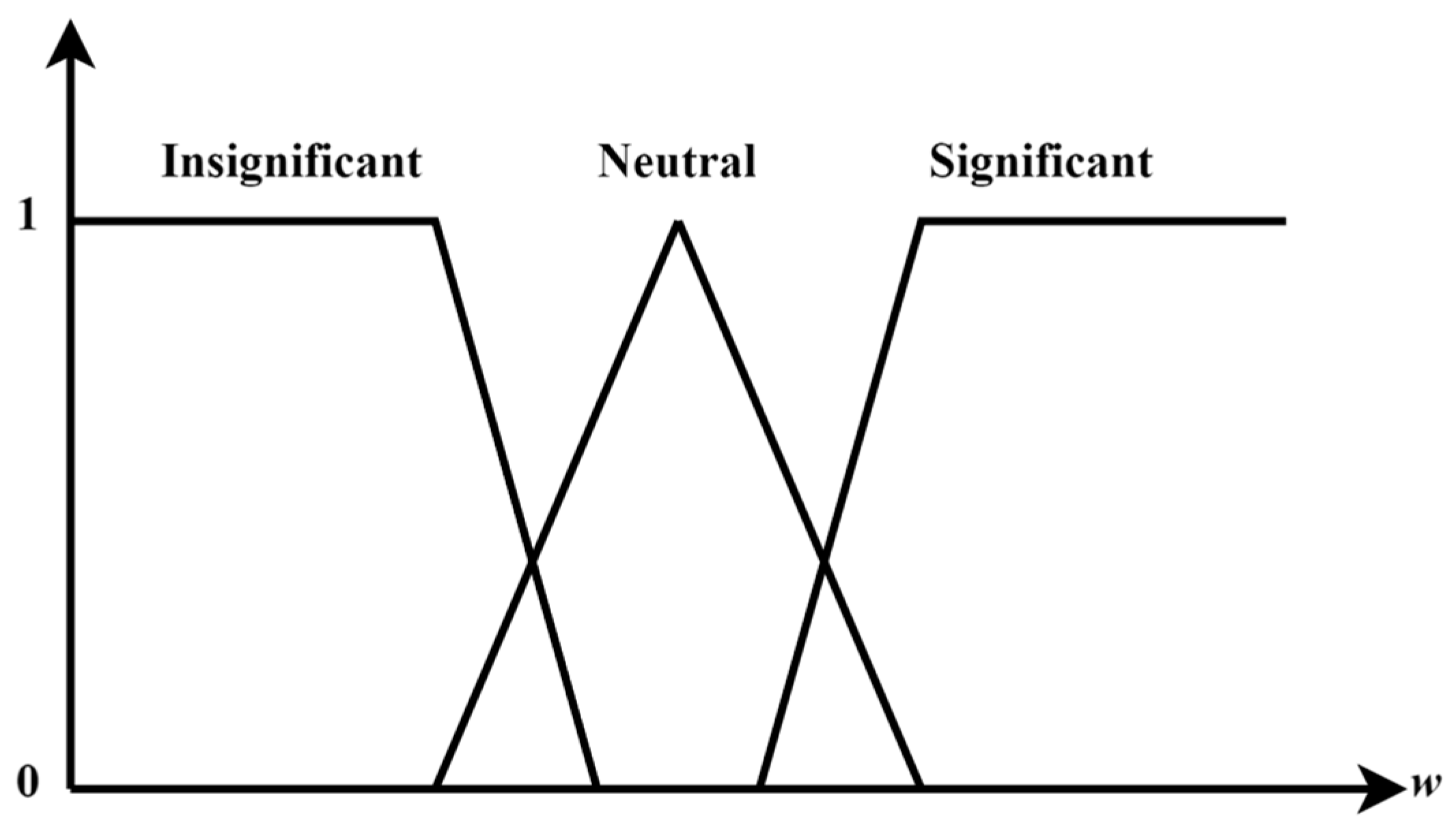

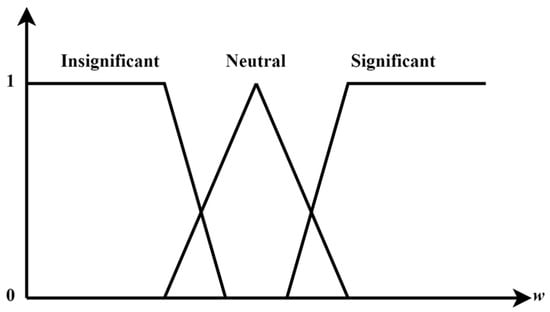

Figure 3. Utility function of the issue “price”. - As the utility function is now formulated, the participant can guess the opponent’s preferences employing a metaheuristic algorithm such as GA, PSO, or BA, assigning values to the utility functions’ weights. A counteroffer is now created based on Fuzzy inference. The weights are updated at every round of the negotiation, according to the opponent’s weights’ deviation from the estimated weights. The offer for each issue is compared to the participant’s expectation by means of similarity measure. In case of multiple opponents, a score is assigned to each of their offers, according to Section 5.1, and the selected offer is the base of the counteroffer. The issues’ values are also updated by using an inference system where the weights assigned to them by the participants ( and for the seller and the buyer respectively) are the inputs of the system and the output is , according to Equation (2):where is the number of rules of the FIS, the firing strength of rule as given in Equation (3):where the operator stands for the Fuzzy “and” and is the consequence of each rule.Every issue has its significance, , not necessarily the same, for every participant, and is expressed in linguistic terms as insignificant, neutral and significant. Therefore, the degree of significance could be represented as membership functions of Fuzzy sets, like the one in Figure 4:

Figure 4. Membership functions of the significance levels for an issue [28,29].

Figure 4. Membership functions of the significance levels for an issue [28,29]. - Depending on the type of the participant (utility grid or smart building), the negotiation strategy can be adapted by an eagerness factor representing the urge of the seller or the buyer to sell or buy [19,21]. Eagerness can be affected by multiple factors, as the time remaining, the history record of past transactions, the flexibility to curtail loads, etc. For short-time attitude, eagerness in a certain time, for both buyer and seller can be expressed as in Equation (4):where:is the average concession rate, is the length of time window, the opponent’s price offer and is a small positive value.This feature simulates the human behavior during a negotiation and has an impact on their offers. An implementation proposal of the abovementioned model considers it as an issue on the negotiation offer where its significance may dynamically vary from one round to another, differentiating the overall behavior of the participant in each round.

Furthermore, q-ROFS can be integrated with other advanced intelligent methods to optimize negotiation outcomes in complex MCDM scenarios following the abovementioned strategies:

- –

- Enhancement of uncertainty representation. Future research could focus on q-ROFS refining to better capture and represent uncertainty in negotiation scenarios.

- –

- Improvement of DM precision. Since q-ROFS offer improved DM precision compared to conventional FL systems, future research could focus to the fine-tuning of the membership functions and similarity measures.

- –

- Dynamic adaptation to changing conditions. With the ability of q-ROFS to adapt dynamically to changing conditions in real time, which is essential in negotiation scenarios, future research could focus on developing q-ROFS models that can dynamically adjust their parameters and decision-making strategies based on evolving negotiation conditions.

- –

- Improvement of robustness and reliability. The combination of q-ROFS with other advanced intelligent methods results in decision-making systems that are more robust against errors and data inconsistencies. Future research could investigate techniques for integrating q-ROFS with machine learning algorithms to improve robustness and reliability in negotiation scenarios.

- –

- Exploration of a Wider Range of Potential Solutions. q-ROFS enhance exploration capabilities in the decision-making process by considering a wider range of potential solutions. Future research could focus on developing optimization algorithms that leverage the exploration capabilities of q-ROFS to identify better solutions in complex negotiation scenarios.

Conclusively, integrating q-ROFS with MA offers significant advancements in DM capabilities for SG negotiation over conventional FL approaches. The key elements of this dominance are their enhanced representation of uncertainty, their improved DM precision, and the ability to search large solution spaces to find optimal or near-optimal solutions to complex, multi-objective problems representing negotiation scenarios. MA also offers dynamic adaptation to changing conditions in real time, which is essential in the SG context. Compared to conventional FL systems, q-ROFS provide higher discrimination power, differentiating closely related scenarios, and leading to more refined and accurate negotiation outcomes. Moreover, though conventional FL systems struggle with the level of ambiguity which is present in SG data, q-ROFS manage both uncertainty and vagueness offering a more robust framework for DM under ambiguous conditions. Furthermore, the combination of q-ROFS with MA result to a DM system more robust against errors and data inconsistencies. Finally, MA enhance exploration capabilities of DM process, considering a wider range of potential solutions, leading to better optimized solutions than the traditional FL systems.

Author Contributions

Conceptualization, A.I.D. and D.K.P.; methodology, A.I.D. and D.K.P.; formal analysis, A.I.D. and D.K.P.; investigation, A.I.D. and D.K.P.; resources, D.K.P.; writing—original draft preparation, D.K.P.; writing—review and editing, A.I.D. and D.K.P.; visualization, D.K.P.; supervision, A.I.D.; project administration, A.I.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Roux, E. Electricity, the decisive factor in modern civilization. Impact Sci. Soc. 1950, 1, 115–116. [Google Scholar]

- Georgilakis, P. Economic and Reliable Operation of Modern Electric Power Systems; Undergraduate Textbook; Kallipos Open Academic Publications: Athens, Greece, 2023. [Google Scholar]

- Biggar, D.R.; Hesamzadeh, M.R. The Economics of Electricity Markets; John Wiley & Sons Ltd.: Hoboken, NJ, USA, 2014. [Google Scholar]

- Fu, H.; Shi, Y.; Zeng, Y. Estimating Smart Grid’s Carbon Emission Reduction Potential in China’s Manufacturing Industry Based on Decomposition Analysis. Front. Energy Res. 2021, 9, 681244. [Google Scholar] [CrossRef]

- Gržanić, M.; Capuder, T.; Zhang, N.; Huang, W. Prosumers as active market participants: A systematic review of evolution of opportunities, models and challenges. Renew. Sustain. Energy Rev. 2021, 154, 111859. [Google Scholar] [CrossRef]

- Kotilainen, K.; Saari, U.A. Policy Influence on Consumers’ Evolution into Prosumers—Empirical Findings from an Exploratory Survey in Europe. Sustainability 2018, 10, 186. [Google Scholar] [CrossRef]

- Falvo, M.C.; Martirano, L.; Sbordone, D.; Bocci, E. Technologies for Smart Grids: A brief review. In Proceedings of the 12th International Conference on Environment and Electrical Engineering, Wroclaw, Poland, 5–8 May 2013. [Google Scholar]

- Strbac, G. Demand side management: Benefits and challenges. Energy Policy 2008, 36, 4419–4442. [Google Scholar] [CrossRef]

- Bertoli, E.; Rozite, V.; Reidenbach, B.; Vautrin, A.; Oh, S.; Suire, M. Demand Response-IEA. IEA-International Energy Agency. 11 July 2023. Available online: https://www.iea.org/energy-system/energy-efficiency-and-demand/demand-response (accessed on 6 February 2024).

- Panda, S.; Mohanty, S.; Rout, P.K.; Sahu, B.K.; Parida, S.M.; Samanta, I.S.; Bajaj, M.; Piecha, M.; Blazek, V.; Prokop, L. A comprehensive review on demand side management and market design for renewable energy support and integration. Energy Rep. 2023, 10, 2228–2250. [Google Scholar] [CrossRef]

- Li, Y.; Han, M.; Yang, Z.; Li, G. Coordinating Flexible Demand Response and Renewable Uncertainties for Scheduling of Community Integrated Energy Systems with an Electric Vehicle Charging Station: A Bi-level Approach. IEEE Trans. Sustain. Energy 2021, 12, 2321–2331. [Google Scholar] [CrossRef]

- Siano, P. Demand response and smart grids-A survey. Renew. Sustain. Energy Rev. 2013, 19, 461–478. [Google Scholar] [CrossRef]

- Reddy, P.P.; Veloso, M.M. Negotiated Learning for Smart Grid Agents: Entity Selection Based on Dynamic Partially Observable Features. In Proceedings of the Twenty-Seventh AAAI Conference on Artificial Intelligence 1313, Bellevue, WA, USA, 14–18 July 2013. [Google Scholar]

- Ruttkay, Z. Fuzzy Constraint Satisfaction. In Proceedings of the 1994 IEEE 3rd International Fuzzy Systems Conference, Orlando, FL, USA, 26–29 June 1994. [Google Scholar]

- Choi, S.P.; Liu, J.; Chan, S.-P. A genetic agent-based negotiation system. Comput. Netw. 2001, 37, 195–204. [Google Scholar] [CrossRef]

- Faratin, P.; Sierra, C.; Jennings, N. Using similarity criteria to make issue trade-offs in automated negotiations. Artif. Intell. 2002, 142, 205–237. [Google Scholar] [CrossRef]

- Cheng, C.-B.; Chan, C.-C.H.; Lin, C.-C. Buyer-Supplier Negotiation by Fuzzy Logic Based Agents. In Proceedings of the Third International Conference on Information Technology and Applications (ICITA’05), Sydney, Australia, 4–7 July 2005. [Google Scholar]

- Cheng, C.-B.; Chan, C.-C.H.; Lin, K.-C. Intelligent agents for e-marketplace: Negotiation with issue trade-offs by fuzzy inference systems. Decis. Support Syst. 2006, 42, 626–638. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, L. Negotiation agent with adaptive attitude bidding strategy for facilitating energy exchanges between smart building and utility grid. In Proceedings of the PES T&D 2012, Orlando, FL, USA, 7–10 May 2012. [Google Scholar]

- Ren, M.Z.F. A single issue negotiation model for agents bargaining in dynamic electronic markets. Decis. Support Syst. 2014, 60, 55–67. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, L. Adaptive Negotiation Agent for Facilitating Bi-Directional Energy Trading Between Smart Building and Utility Grid. IEEE Trans. Smart Grid 2013, 4, 702–710. [Google Scholar] [CrossRef]

- Adabi, S.; Movaghar, A.; Rahmani, A.M.; Beigy, H.; Dastmalchy-Tabrizi, H. A new fuzzy negotiation protocol for grid resource allocation. J. Netw. Comput. Appl. 2014, 37, 89–126. [Google Scholar] [CrossRef]

- Kolomvatsos, K.; Anagnostopoulos, C.; Hadjiefthymiades, S. Sellers in e-marketplaces: A Fuzzy Logic based decision support system. Inf. Sci. 2014, 278, 267–284. [Google Scholar] [CrossRef]

- Lee, C.-C. Development and evaluation of the many-to-many supplier negotiation strategy. Comput. Ind. Eng. 2014, 70, 90–97. [Google Scholar] [CrossRef]

- Lee, C.C.; Ou-Yang, C. Development and evaluation of the interactive bidding strategies for a demander and its suppliers in supplier selection auction market. Int. J. Prod. Res. 2008, 46, 4827–4848. [Google Scholar] [CrossRef]

- Roszkowska, E.; Brzostowski, J.; Wachowicz, T. Supporting Ill-Structured Negotiation Problems. In Human-Centric Decision-Making Models for Social Sciences; Guo, P., Pedrycz, W., Eds.; Springer: Berlin/Heidelberg, Germany, 2013; pp. 339–367. [Google Scholar]

- Kolomvatsos, K.; Trivizakis, D.; Hadjiefthymiades, S. An adaptive fuzzy logic system for automated negotiations. FUZZY Sets Syst. 2015, 269, 135–152. [Google Scholar] [CrossRef]

- Roszkowska, E.; Wachowicz, T. Application of fuzzy TOPSIS to scoring the negotiation offers in ill-structured negotiation problems. Eur. J. Oper. Res. 2014, 242, 920–932. [Google Scholar] [CrossRef]

- Zhan, J.; Luo, X.; Feng, C.; He, M. A multi-demand negotiation model based on fuzzy rules elicited via psychological experiments. Appl. Soft Comput. 2018, 67, 840–864. [Google Scholar] [CrossRef]

- Zhan, J.; Luo, X.; Jiang, Y. An Atanassov intuitionistic fuzzy constraint based method for offer evaluation and trade-off making in automated negotiation. Knowl.-Based Syst. 2018, 139, 170–188. [Google Scholar] [CrossRef]

- Shojaiemehr, B.; Rahmani, A.M.; Qader, N.N. Automated negotiation for ensuring composite service requirements in cloud computing. J. Syst. Archit. 2019, 99, 101632. [Google Scholar] [CrossRef]

- Eshragh, F.; Shahbazi, M.; Far, B. Real-time opponent learning in automated negotiation using recursive Bayesian filtering. Expert Syst. Appl. 2019, 128, 28–53. [Google Scholar] [CrossRef]

- Etukudor, C.; Couraud, B.; Robu, V.; Früh, W.-G.; Flynn, D.; Okereke, C. Automated Negotiation for Peer-to-Peer Electricity Trading in Local Energy Markets. Energies 2020, 13, 920. [Google Scholar] [CrossRef]

- Fattahi, J.; Samadi, M.; Erol-Kantarci, M.; Schriemer, H. Transactive Demand Response Operation at the Grid Edge using the IEEE 2030.5 Standard. Engineering 2020, 6, 801–811. [Google Scholar] [CrossRef]

- Soriano, L.A.; Avila, M.; Ponce, P.; Rubio, J.D.J.; Molina, A. Peer-to-peer energy trades based on multi-objective optimization. Int. J. Electr. Power Energy Syst. 2021, 131, 107017. [Google Scholar] [CrossRef]

- Roszkowska, E. The Intuitionistic Fuzzy Framework for Evaluation and Rank Ordering the Negotiation Offers. In Proceedings of the INFUS 2021 Conference, Istanbul, Turkey, 24–26 August 2021. [Google Scholar]

- Akram, M.; Ullah, K.; Ćirović, G.; Pamucar, D. Algorithm for Energy Resource Selection Using Priority Degree-Based Aggregation Operators with Generalized Orthopair Fuzzy Information and Aczel–Alsina Aggregation Operators. Energies 2023, 16, 2816. [Google Scholar] [CrossRef]

- Zaini, F.A.B.; Sulaima, M.F.; Razak, I.A.W.A.; Zulkafli, N.I.; Mokhlis, H. A review of PSO-based algorithm application in Demand Side Management: Challenges & Opportunities. IEEE Access 2023, 11, 53373–53400. [Google Scholar]

- Rubinstein, A. Perfect Equilibrium in a Bargaining Model. Econometrica 1982, 50, 97–109. [Google Scholar] [CrossRef]

- Sim, K.; Ng, K. Relaxed-criteria negotiation for grid resource allocation. Int. Trans. Syst. Sci. Appl. 2007, 3, 105–117. [Google Scholar] [CrossRef]

- Adabi, S.; Movaghar, A.; Rahmani, A.; Beigy, H. Market-based grid resource allocation using new negotiation model. J. Netw. Comput. Appl. 2013, 36, 543–565. [Google Scholar] [CrossRef]

- Liu, P.W.P. Some q-rung orthopair fuzzy aggregation operators and their applications to multiple-attribute decision making. Int. J. Intell. Syst. 2018, 33, 259–280. [Google Scholar] [CrossRef]

- Zadeh, L.A. Toward a generalized theory of uncertainty (GTU)––An outline. Inf. Sci. 2005, 172, 1–40. [Google Scholar] [CrossRef]

- Zadeh, L. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef]