Leveraging Blockchain Usage to Enhance Slag Exchange

Abstract

1. Introduction

2. Background

2.1. Slag Circularity

2.2. Blockchain Applications

3. Materials and Methods

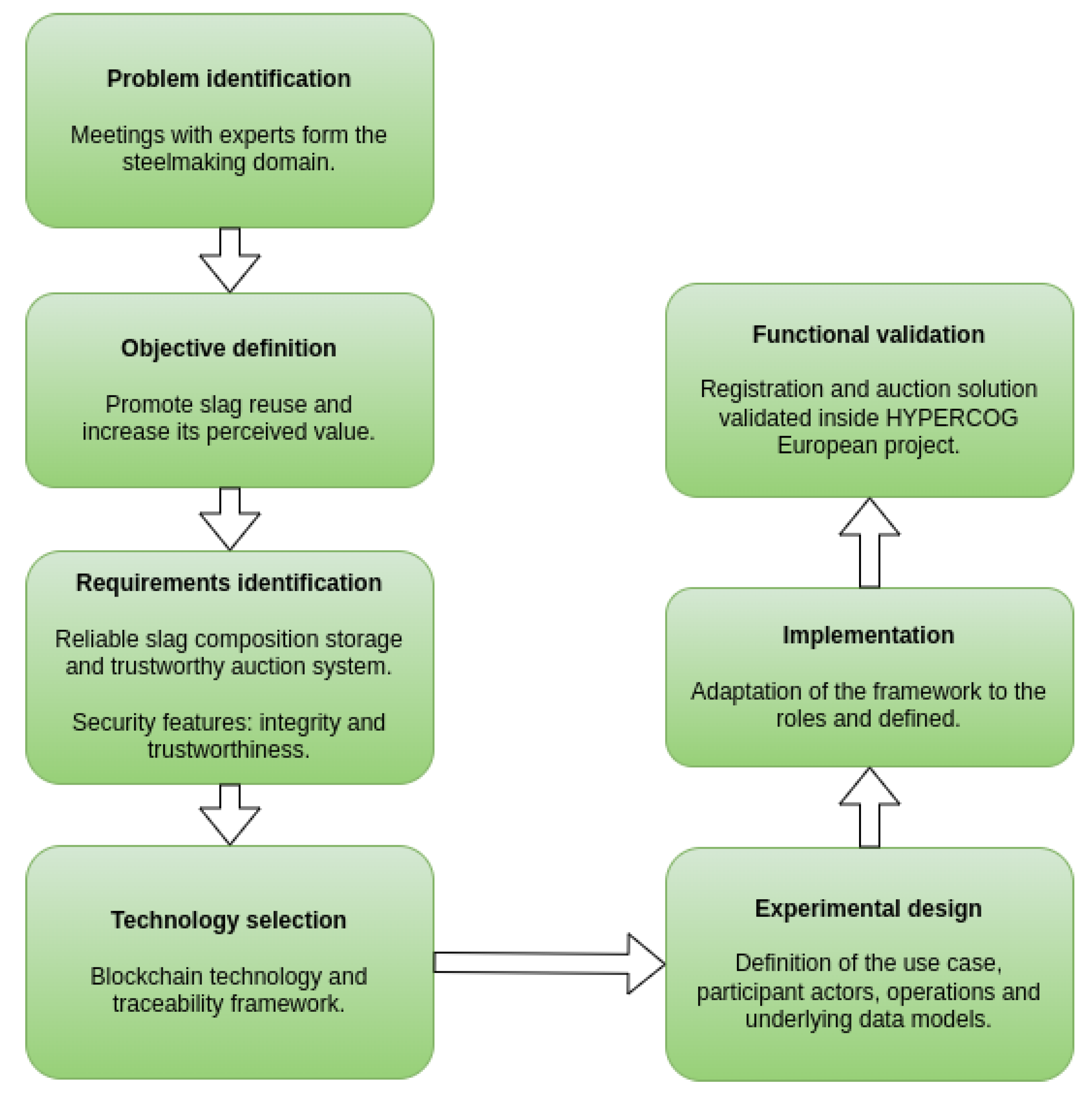

3.1. Research Methodology

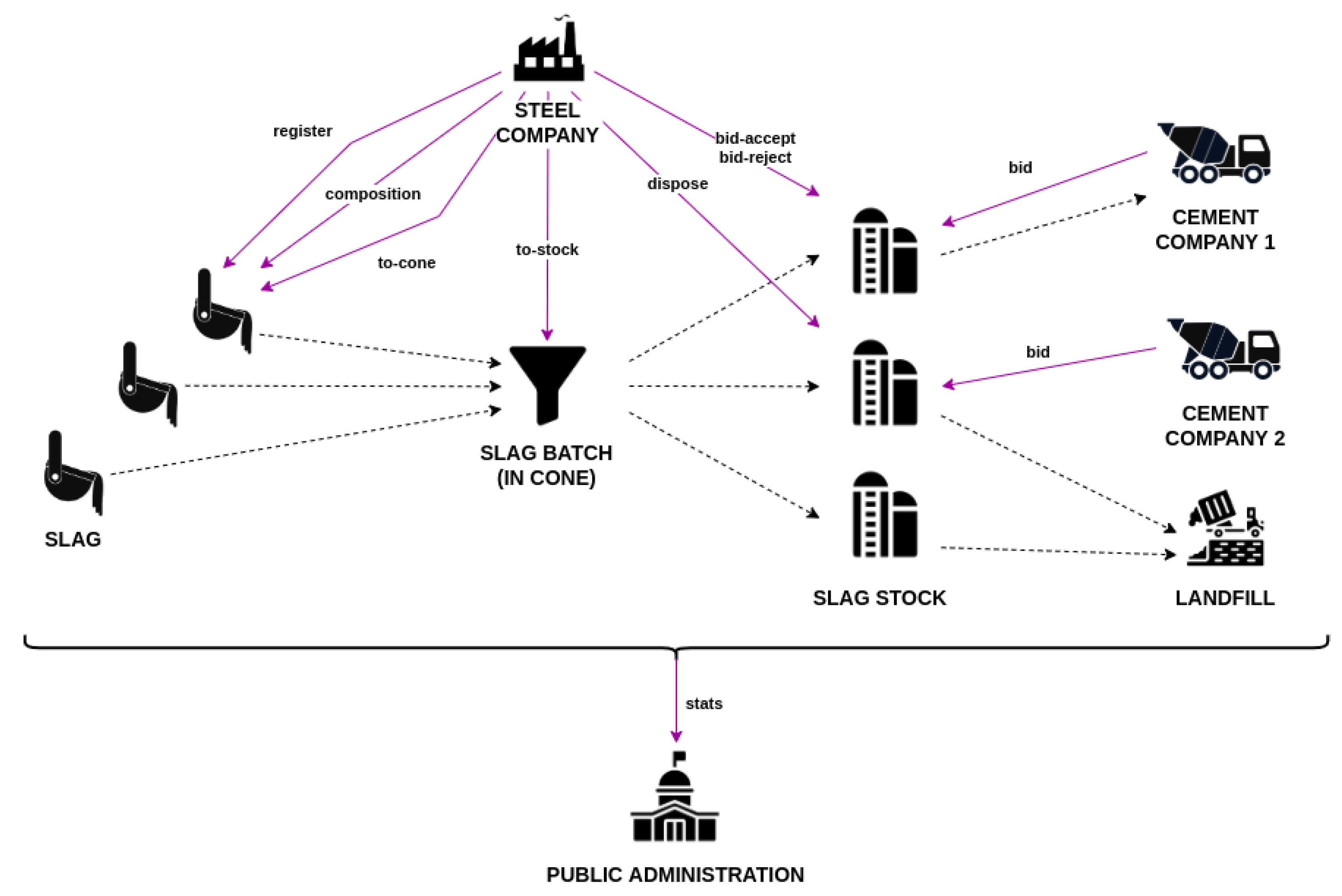

3.2. Actors

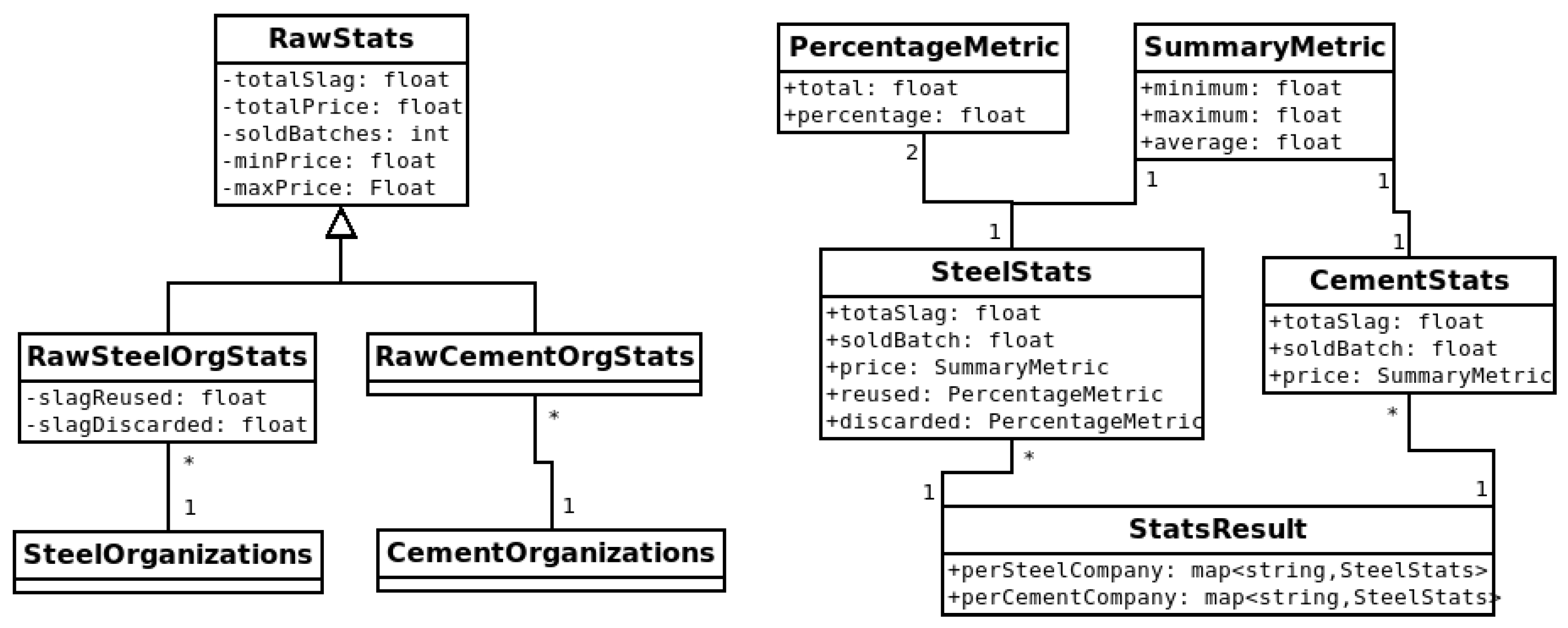

3.3. Data Model

3.4. Use Case

4. Results

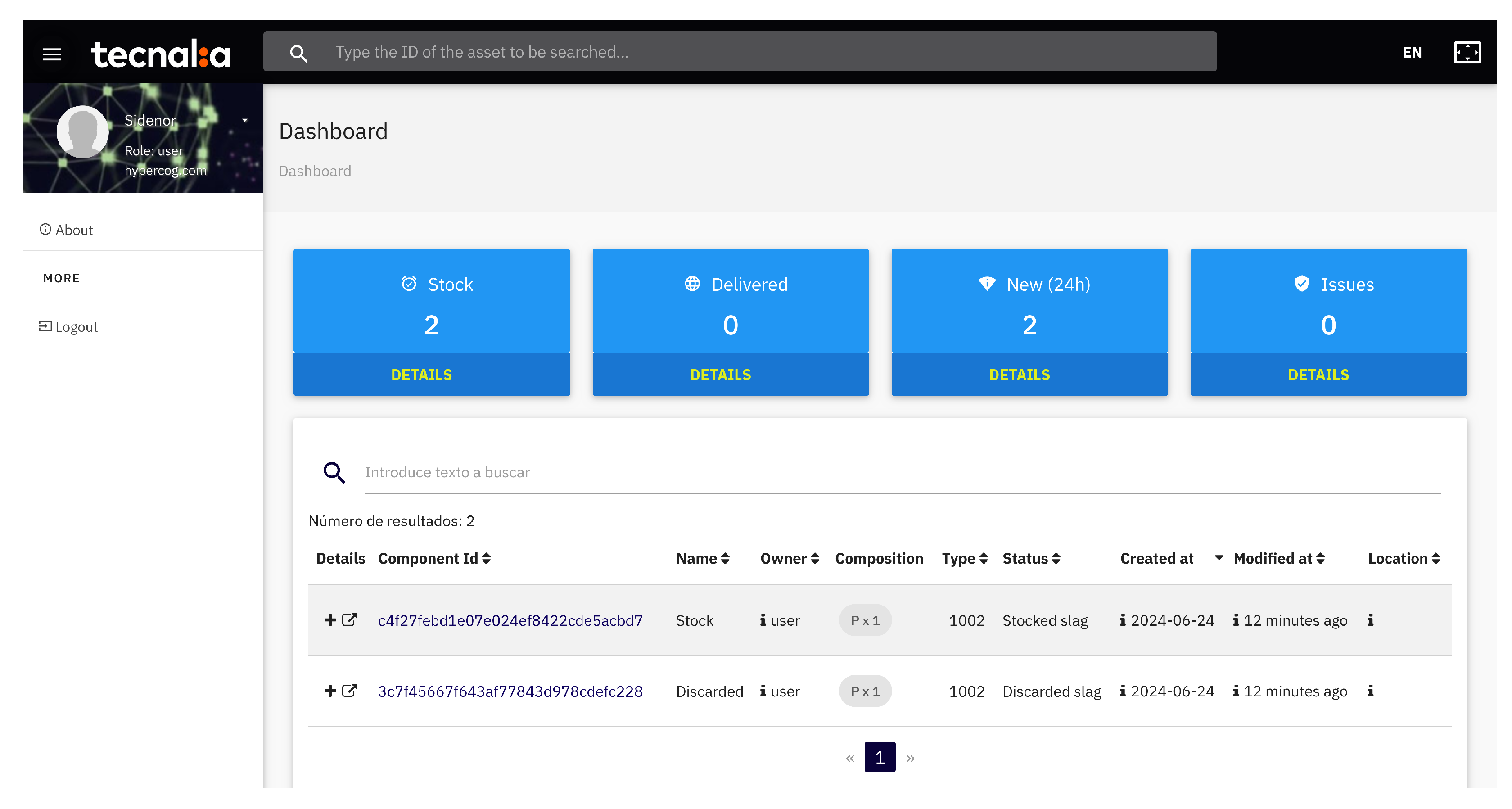

4.1. Implementation

| Algorithm 1: Function bid-accept. |

|

4.2. Deployment

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Wu, L.; Li, H.; Mei, H.; Rao, L.; Wang, H.; Lv, N. Generation, utilization, and environmental impact of ladle furnace slag: A minor review. Sci. Total Environ. 2023, 895, 165070. [Google Scholar] [CrossRef] [PubMed]

- Shi, C. Characteristics and cementitious properties of ladle slag fines from steel production. Cem. Concr. Res. 2002, 32, 459–462. [Google Scholar] [CrossRef]

- The European Green Deal-European Commission. Available online: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal_en (accessed on 8 April 2024).

- Holappa, L.; Kekkonen, M.; Jokilaakso, A.; Koskinen, J. A Review of Circular Economy Prospects for Stainless Steelmaking Slags. J. Sustain. Metall. 2021, 7, 806–817. [Google Scholar] [CrossRef]

- Branca, T.A.; Colla, V.; Algermissen, D.; Granbom, H.; Martini, U.; Morillon, A.; Pietruck, R.; Rosendahl, S. Reuse and Recycling of By-Products in the Steel Sector: Recent Achievements Paving the Way to Circular Economy and Industrial Symbiosis in Europe. Metals 2020, 10, 345. [Google Scholar] [CrossRef]

- Yi, H.; Xu, G.; Cheng, H.; Wang, J.; Wan, Y.; Chen, H. An Overview of Utilization of Steel Slag. Procedia Environ. Sci. 2012, 16, 791–801. [Google Scholar] [CrossRef]

- Dong, Q.; Wang, G.; Chen, X.; Tan, J.; Gu, X. Recycling of steel slag aggregate in portland cement concrete: An overview. J. Clean. Prod. 2021, 282, 124447. [Google Scholar] [CrossRef]

- Gencel, O.; Karadag, O.; Oren, O.H.; Bilir, T. Steel slag and its applications in cement and concrete technology: A review. Constr. Build. Mater. 2021, 283, 122783. [Google Scholar] [CrossRef]

- Fisher, L.; Barron, A. The recycling and reuse of steelmaking slags — A review. Resour. Conserv. Recycl. 2019, 146, 244–255. [Google Scholar] [CrossRef]

- Ichinose, D. Landfill Scarcity and the Cost of Waste Disposal. Environ. Resour. Econ. 2024, 87, 629–653. [Google Scholar] [CrossRef]

- Murphy, T.; Howard, I. Balancing Availability, Quality, Economics, and the Environment When Using Steel Slag within Pavements. In Geo-Congress 2023; ASCE: Reston, VA, USA, 2023; Volume 2023, pp. 408–418. ISSN 0895-0563. [Google Scholar] [CrossRef]

- Murphy, T.R. Integrating Steel Slag Aggregates Into Asphalt Paving by Harmonizing Availability, Quality, Economics, and the Environment. Ph.D Thesis, Mississippi State University, Starkville, MS, USA, 2023. [Google Scholar]

- Nakamoto, S. Bitcoin: A Peer-To-Peer Electronic Cash System. Decentralized Business Review 2008. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 10 July 2024).

- Pavloff, U.; Amoussou-Guenou, Y.; Tucci-Piergiovanni, S. Ethereum Proof-of-Stake under Scrutiny. In Proceedings of the 38th ACM/SIGAPP Symposium on Applied Computing, Tallinn, Estonia, 27–31 March 2023; pp. 212–221. [Google Scholar] [CrossRef]

- Pournader, M.; Shi, Y.; Seuring, S.; Koh, S.L. Blockchain applications in supply chains, transport and logistics: A systematic review of the literature. Int. J. Prod. Res. 2020, 58, 2063–2081. [Google Scholar] [CrossRef]

- Chang, S.E.; Chen, Y. When Blockchain Meets Supply Chain: A Systematic Literature Review on Current Development and Potential Applications. IEEE Access 2020, 8, 62478–62494. [Google Scholar] [CrossRef]

- Kummer, S.; Herold, D.M.; Dobrovnik, M.; Mikl, J.; Schäfer, N. A Systematic Review of Blockchain Literature in Logistics and Supply Chain Management: Identifying Research Questions and Future Directions. Future Internet 2020, 12, 60. [Google Scholar] [CrossRef]

- Voorter, J.; Koolen, C. The Traceability of Construction and Demolition Waste in Flanders via Blockchain Technology: A Match Made in Heaven? J. Eur. Environ. Plan. Law 2021, 18, 347–369. [Google Scholar] [CrossRef]

- Rejeb, A.; Appolloni, A.; Rejeb, K.; Treiblmaier, H.; Iranmanesh, M.; Keogh, J.G. The role of blockchain technology in the transition toward the circular economy: Findings from a systematic literature review. Resour. Conserv. Recycl. Adv. 2023, 17, 200126. [Google Scholar] [CrossRef]

- Belt, A.; Kok, S. A Reality Check for Blockchain in Commodity Trading; Technical Report; Boston Consulting Group: Auckland, New Zealand, 2018. [Google Scholar]

- Perera, S.; Nanayakkara, S.; Rodrigo, M.N.N.; Senaratne, S.; Weinand, R. Blockchain technology: Is it hype or real in the construction industry? J. Ind. Inf. Integr. 2020, 17, 100125. [Google Scholar] [CrossRef]

- Queiroz, M.M.; Telles, R.; Bonilla, S.H. Blockchain and supply chain management integration: A systematic review of the literature. Supply Chain Manag. Int. J. 2019, 25, 241–254. [Google Scholar] [CrossRef]

- Shi, Z.; de Laat, C.; Grosso, P.; Zhao, Z. Integration of Blockchain and Auction Models: A Survey, Some Applications, and Challenges. IEEE Commun. Surv. Tutor. 2023, 25, 497–537. [Google Scholar] [CrossRef]

- Salian, A.; Shah, S.; Shah, J.; Samdani, K. Review of blockchain enabled decentralized energy trading mechanisms. In Proceedings of the 2019 IEEE International Conference on System, Computation, Automation and Networking (ICSCAN), Pondicherry, India, 29–30 March 2019; IEEE: New York, NY, USA, 2019; pp. 1–7. [Google Scholar]

- Küster, K.K.; Aoki, A.R.; Lambert-Torres, G. Transaction-based operation of electric distribution systems: A review. Int. Trans. Electr. Energy Syst. 2020, 30, e12194. [Google Scholar] [CrossRef]

- Sreekumar, A.; Sakthivelu, A.; Kiesling, L. Auction Theory and Device Bidding Functions for Transactive Energy Systems: A Review. Curr. Sustain./Renew. Energy Rep. 2023, 10, 102–111. [Google Scholar] [CrossRef]

- Corsini, F.; Gusmerotti, N.M.; Frey, M. Fostering the Circular Economy with Blockchain Technology: Insights from a Bibliometric Approach. Circ. Econ. Sustain. 2023, 3, 1819–1839. [Google Scholar] [CrossRef]

- Regueiro, C.; Gómez-Goiri, A.; Pedrosa, N.; Semertzidis, C.; Iturbe, E.; Mansell, J. Blockchain-based refurbishment certification system for enhancing the circular economy. Blockchain Res. Appl. 2023, 5, 100172. [Google Scholar] [CrossRef]

- The Go Programming Language. Available online: https://go.dev (accessed on 10 July 2024).

- Shalaby, S.; Abdellatif, A.A.; Al-Ali, A.; Mohamed, A.; Erbad, A.; Guizani, M. Performance Evaluation of Hyperledger Fabric. In Proceedings of the 2020 IEEE International Conference on Informatics, IoT, and Enabling Technologies (ICIoT), Doha, Qatar, 2–5 February 2020; pp. 608–613. [Google Scholar] [CrossRef]

- Git Repository with the Code. Available online: https://git.code.tecnalia.com/hypercog-public/leveraging-blockchain-usage-to-enhance-slag-exchange (accessed on 10 July 2024).

- Sonarqube. Available online: https://www.sonarsource.com/products/sonarqube/ (accessed on 10 July 2024).

- Node.js. Available online: https://nodejs.org (accessed on 10 July 2024).

- Express Framework. Available online: https://expressjs.com (accessed on 10 July 2024).

- Vue.js. Available online: https://vuejs.org (accessed on 10 July 2024).

- Bodin, U.; Dhanrajani, S.; Abdalla, A.H.; Diani, M.; Klenk, F.; Colledani, M.; Palm, E.; Schelén, O. Demand-supply matching through auctioning for the circular economy. Procedia Manuf. 2021, 54, 82–87. [Google Scholar] [CrossRef]

- Raja Santhi, A.; Muthuswamy, P. Influence of Blockchain Technology in Manufacturing Supply Chain and Logistics. Logistics 2022, 6, 15. [Google Scholar] [CrossRef]

- Arulprakash, M.; Jebakumar, R. Commit-reveal strategy to increase the transaction confidentiality in order to counter the issue of front running in blockchain. AIP Conf. Proc. 2022, 2460, 020016. [Google Scholar] [CrossRef]

- Sahai, S.; Singh, N.; Dayama, P. Enabling Privacy and Traceability in Supply Chains using Blockchain and Zero Knowledge Proofs. In Proceedings of the 2020 IEEE International Conference on Blockchain (Blockchain), Rhodes, Greece, 2–6 November 2020; pp. 134–143. [Google Scholar] [CrossRef]

- Gopalakrishnan, P.K.; Hall, J.; Behdad, S. Cost analysis and optimization of Blockchain-based solid waste management traceability system. Waste Manag. 2021, 120, 594–607. [Google Scholar] [CrossRef] [PubMed]

- Zafar, S.; Hassan, S.F.U.; Mohammad, A.; Al-Ahmadi, A.A.; Ullah, N. Implementation of a Distributed Framework for Permissioned Blockchain-Based Secure Automotive Supply Chain Management. Sensors 2022, 22, 7367. [Google Scholar] [CrossRef] [PubMed]

- Li, N.; Song, B.; Li, L.; Jin, D. Fire product traceability system based on blockchain and IPFS. In Proceedings of the Second International Conference on Electronic Information Engineering, Big Data and Computer Technology (EIBDCT 2023); SPIE: Bellingham, WA, USA, 2023; Volume 2023, p. 12642. [Google Scholar] [CrossRef]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Pongnumkul, S.; Siripanpornchana, C.; Thajchayapong, S. Performance Analysis of Private Blockchain Platforms in Varying Workloads. In Proceedings of the 2017 26th International Conference on Computer Communication and Networks (ICCCN), Vancouver, BC, Canada, 31 July–3 August 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Kuzlu, M.; Pipattanasomporn, M.; Gurses, L.; Rahman, S. Performance Analysis of a Hyperledger Fabric Blockchain Framework: Throughput, Latency and Scalability. In Proceedings of the 2019 IEEE International Conference on Blockchain (Blockchain), Atlanta, GA, USA, 14–17 July 2019; pp. 536–540. [Google Scholar] [CrossRef]

- Melo, C.; Gonçalves, G.; Silva, F.A.; Soares, A. A comprehensive hyperledger fabric performance evaluation based on resources capacity planning. Clust. Comput. 2024, 1–16. [Google Scholar] [CrossRef]

- Mineral Commodity Summaries 2024; Technical Report; USGS: Reston, VA, USA, 2024. Available online: https://pubs.usgs.gov/publication/mcs2024 (accessed on 10 July 2024).

- Statistics 2021; Technical Report; Euroslag. Available online: https://www.euroslag.com/products/statistics/statistics-2021/ (accessed on 10 July 2024).

- Taherdoost, H. A Critical Review of Blockchain Acceptance Models—Blockchain TechnologyAdoption Frameworks and Applications. Computers 2022, 11, 24. [Google Scholar] [CrossRef]

- AlShamsi, M.; Al-Emran, M.; Shaalan, K. A Systematic Review on Blockchain Adoption. Appl. Sci. 2022, 12, 4245. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gómez-Goiri, A.; Gutierrez-Aguero, I.; Garcia-Estevez, D. Leveraging Blockchain Usage to Enhance Slag Exchange. Appl. Sci. 2024, 14, 6243. https://doi.org/10.3390/app14146243

Gómez-Goiri A, Gutierrez-Aguero I, Garcia-Estevez D. Leveraging Blockchain Usage to Enhance Slag Exchange. Applied Sciences. 2024; 14(14):6243. https://doi.org/10.3390/app14146243

Chicago/Turabian StyleGómez-Goiri, Aitor, Ivan Gutierrez-Aguero, and David Garcia-Estevez. 2024. "Leveraging Blockchain Usage to Enhance Slag Exchange" Applied Sciences 14, no. 14: 6243. https://doi.org/10.3390/app14146243

APA StyleGómez-Goiri, A., Gutierrez-Aguero, I., & Garcia-Estevez, D. (2024). Leveraging Blockchain Usage to Enhance Slag Exchange. Applied Sciences, 14(14), 6243. https://doi.org/10.3390/app14146243