Analyzing Regulatory Impacts on Household Natural Gas Consumption: The Case of the Western Region of Ukraine

Abstract

:1. Introduction

2. Literature Review

3. Aim of the Research

4. Research Methodology

- Billing data—actual data of household consumers with a monthly breakdown and metadata (category of consumers, location, presence and type of gas meter, volume of consumption, etc.)

- Meteorological data—average monthly air temperature per month in Volyn region ([30], “Temperature.csv”)

- Actual prices of natural gas and tariffs for the distribution per cubic meter in relevant periods ([30], “Cost.csv”).

- The volume of gas consumption per month (Consumption) in cubic meters (m3).

- The average monthly temperature (Temperature) in degrees Celsius (°C).

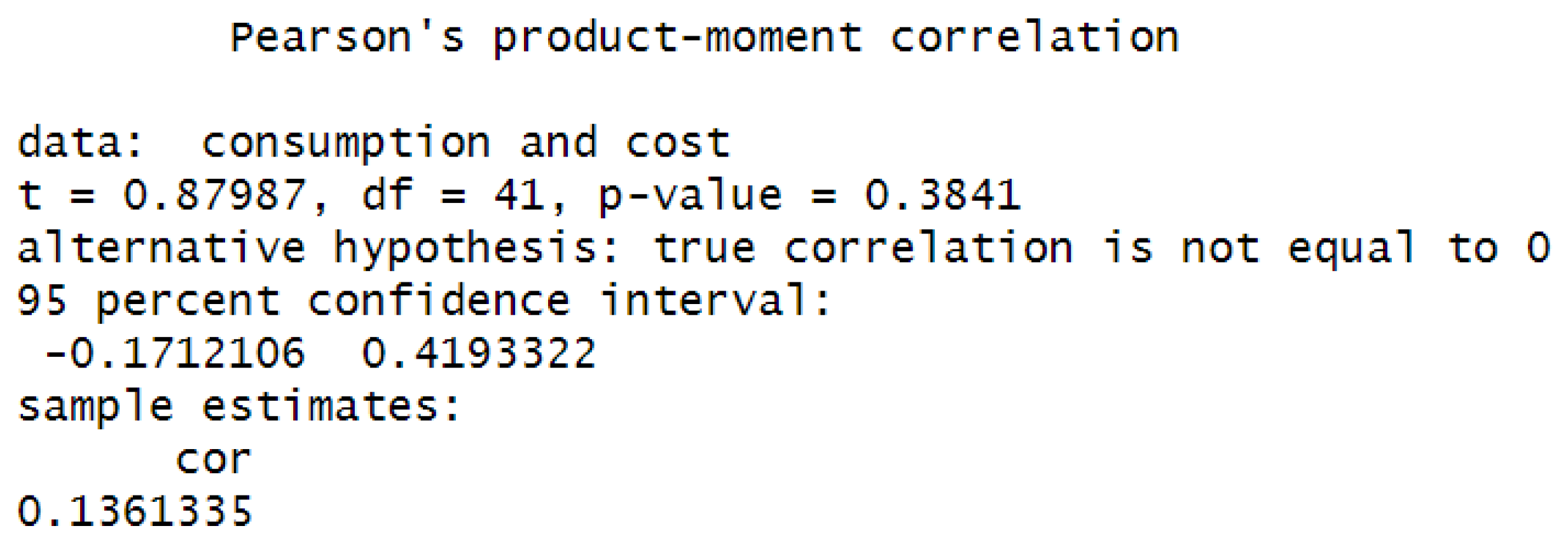

- The natural gas cost of 1 m3 (Cost) in UAH.

- −

- −

- −

5. Discussion

5.1. t-Test Statistical Significance of the Coefficients of Regression

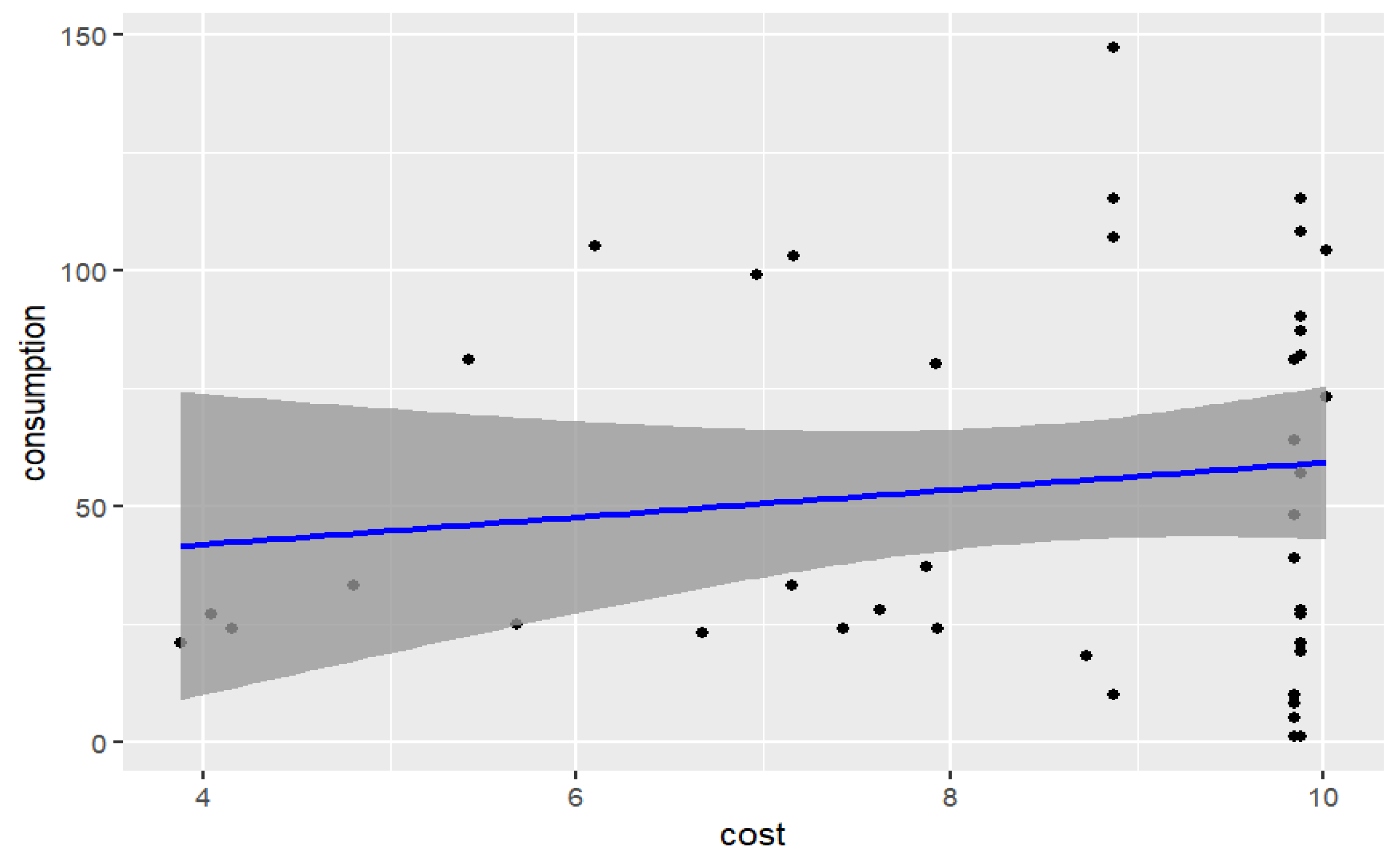

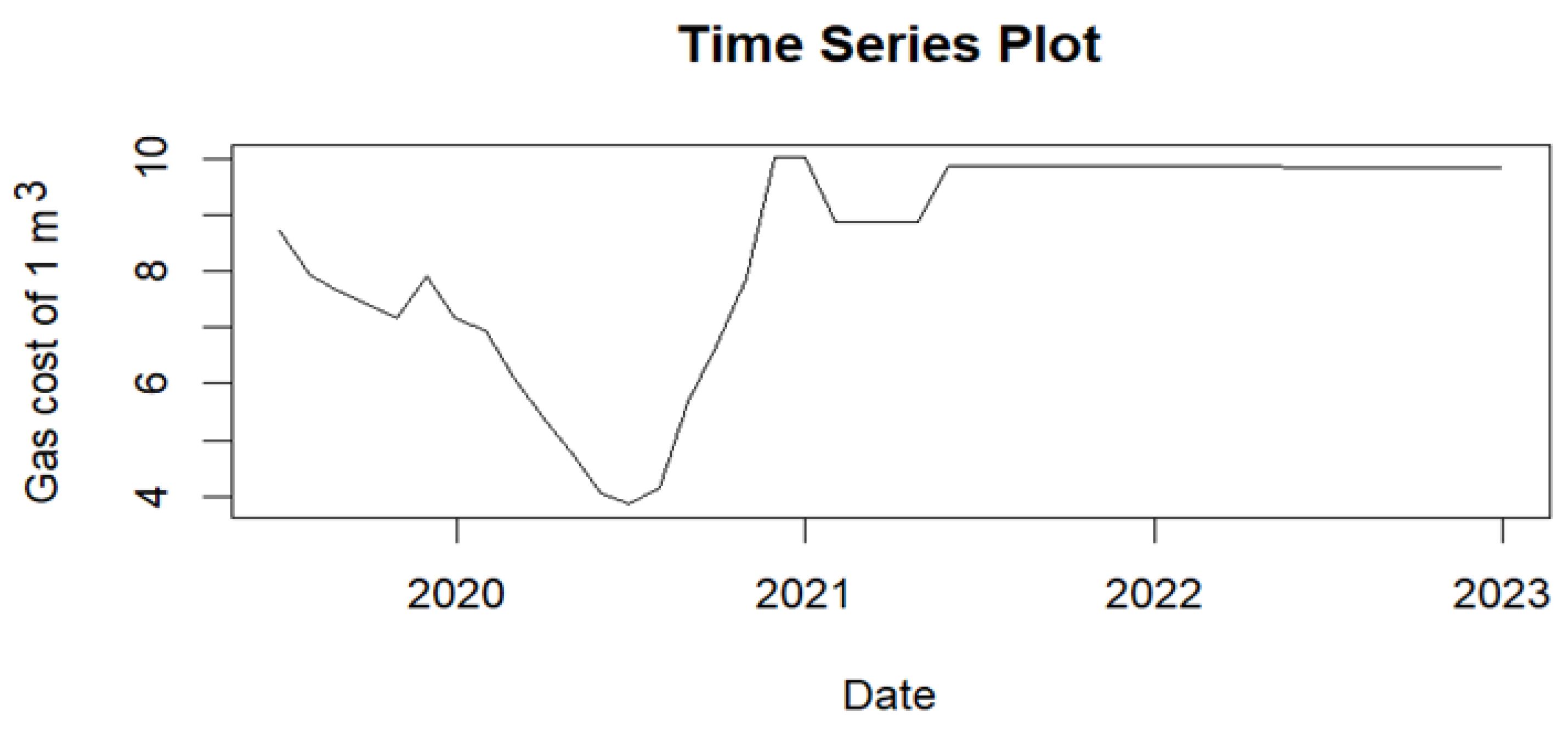

5.2. Test for the Significance of the Correlation Coefficient

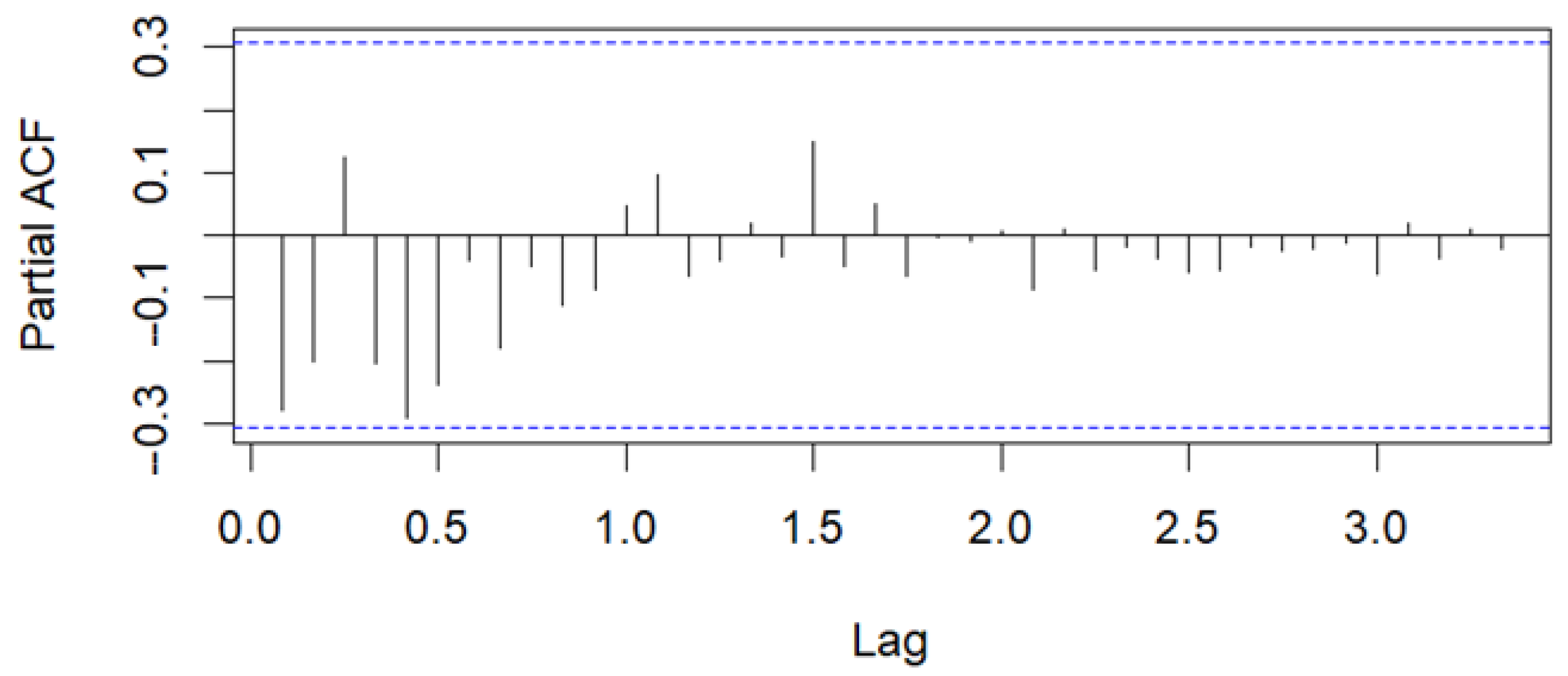

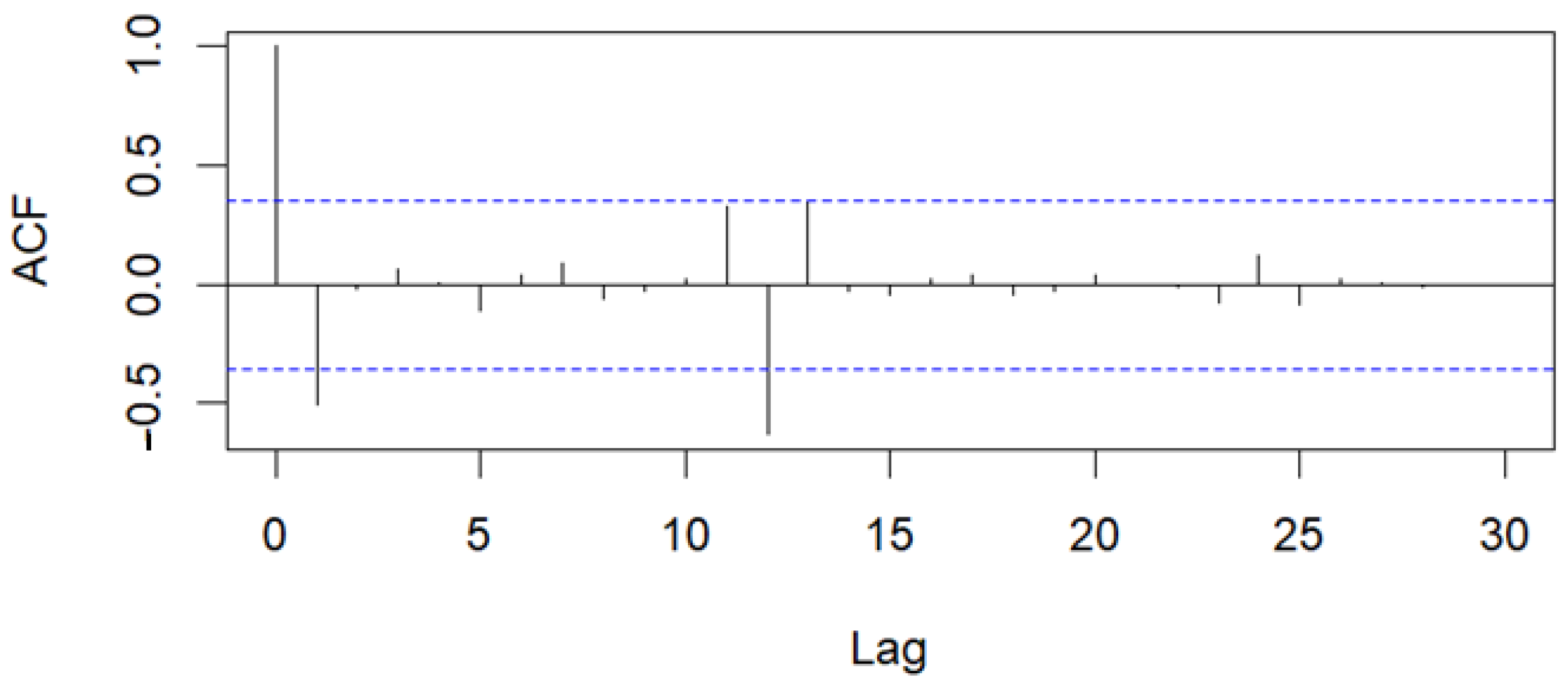

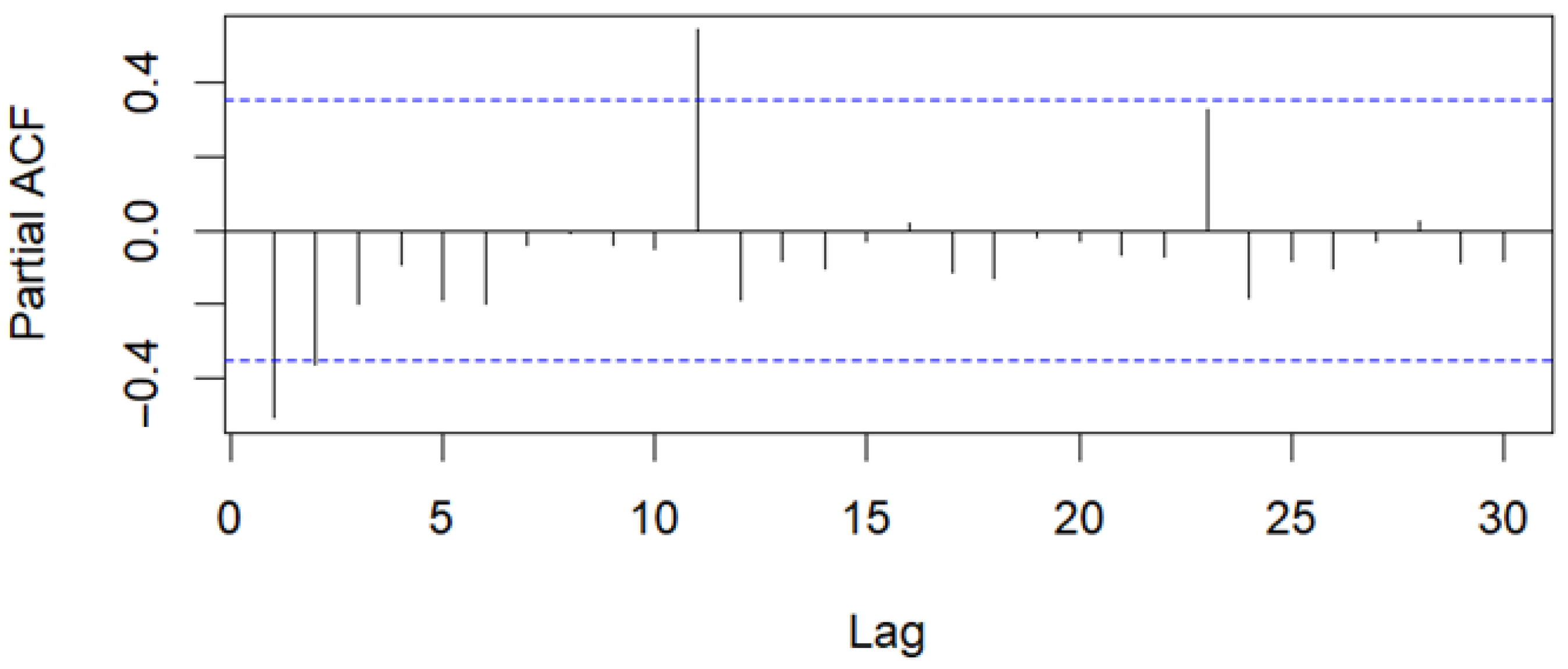

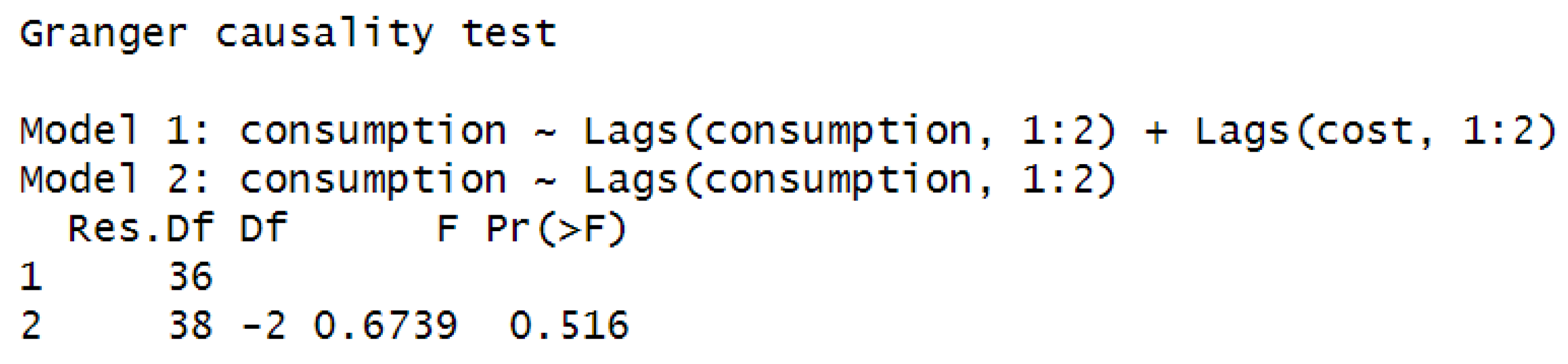

5.3. Granger Causality Test

- Unrestricted model (URM):

- 2.

- Restricted model (RM):

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Colombo, S.; El Harrak, M.; Sartori, N. (Eds.) The Future of Natural Gas: Markets and Geopolitics; Lenthe Publishers/European Energy Review: Diepenheim, The Netherlands, 2016; Available online: https://www.iai.it/sites/default/files/iai-ocp_gas.pdf (accessed on 10 May 2024).

- On Approval of the Regulation on the Imposition of Special Obligations on Natural Gas Market Participants to Ensure Public Interest in the Operation of the Natural Gas Market; Parliament of Ukraine: Kyiv, Ukraine, 2022. Available online: https://zakon.rada.gov.ua/laws/show/222-2022-%D0%BF#Text (accessed on 10 May 2024).

- State Statistics Service of Ukraine; National Bank of Ukraine. Inflation Index (2000–2024). 2024. Available online: https://index.minfin.com.ua/ua/economy/index/inflation/ (accessed on 10 May 2024).

- Ukraine Energy Market Observatory. Energy-Community.org. 2024. Available online: https://www.energy-community.org/Ukraine/observatory.html (accessed on 10 May 2024).

- Savic, D.; Walters, G. Genetic Algorithms for Least-Cost Design of Water Distribution Networks. J. Water Resour. Plan. Manag. 1997, 123, 67–77. [Google Scholar] [CrossRef]

- PapersGeeks. Essential Competencies in Social Work. 2023. Available online: https://papersgeeks.com/essential-competencies-in-social-work/ (accessed on 16 May 2024).

- Yemelyanov, O.; Symak, A.; Petrushka, T.; Vovk, O.; Ivanytska, O.; Symak, D.; Havryliak, A.; Danylovych, T.; Lesyk, L. Criteria, Indicators, and Factors of the Sustainable Energy-Saving Economic Development: The Case of Natural Gas Consumption. Energies 2021, 14, 5999. [Google Scholar] [CrossRef]

- Mrówczyńska, M.; Skiba, M.; Bazan-Krzywoszańska, A.; Sztubecka, M. Household standards and socio-economic aspects as a factor determining energy consumption in the city. Appl. Energy 2020, 264, 114680. [Google Scholar] [CrossRef]

- Hou, Y.; Wang, X.; Chang, H.; Dong, Y.; Zhang, D.; Wei, C.; Lee, I.; Yang, Y.; Liu, Y.; Zhang, J. Natural Gas Consumption Monitoring Based on k-NN Algorithm and Consumption Prediction Framework Based on Backpropagation Neural Network. Buildings 2024, 14, 627. [Google Scholar] [CrossRef]

- Sala, D.; Bashynska, I.; Pavlova, O.; Pavlov, K.; Chorna, N.; Chornyi, R. Investment and Innovation Activity of Renewable Energy Sources in the Electric Power Industry in the South-Eastern Region of Ukraine. Energies 2023, 16, 2363. [Google Scholar] [CrossRef]

- Pavlova, O.; Pavlov, K.; Horal, L.; Novosad, O.; Korol, S.; Perevozova, I.; Obelnytska, K.; Daliak, N.; Protsyshyn, O.; Popadynet, N. Integral estimation of the competitiveness level of the western Ukrainian gas distribution companies. Accounting 2021, 7, 1073–1084. [Google Scholar] [CrossRef]

- Pavlov, K.; Pavlova, O.; Haliant, S.; Perevozova, I.; Shostak, L.; Begun, S.; Bortnik, S. Determination of the Level of Innovative Activity of Gas Distribution Enterprises of the Western Region of Ukraine. AD ALTA J. Interdiscip. Res. 2022, 12, 130–134. [Google Scholar] [CrossRef]

- Kurbatova, T.; Sotnyk, I.; Prokopenko, O.; Bashynska, I.; Pysmenna, U. Improving the Feed-in Tariff Policy for Renewable Energy Promotion in Ukraine’s Households. Energies 2023, 16, 6773. [Google Scholar] [CrossRef]

- Prokopenko, O.; Prokopenko, M.; Chechel, A.; Marhasova, V.; Omelyanenko, V.; Orozonova, A. Ecological and Economic Assessment of the Possibilities of Public-private Partnerships at the National and Local Levels to Reduce Greenhouse Gas Emissions. Econ. Aff. 2023, 68, 133–142. [Google Scholar] [CrossRef]

- Zou, C.; Lin, M.; Ma, F.; Liu, H.; Yang, Z.; Zhang, G.; Yang, Y.; Guan, C.; Liang, Y.; Wang, Y.; et al. Development, challenges and strategies of natural gas industry under carbon neutral target in China. Pet. Explor. Dev. 2024, 51, 418–435. [Google Scholar] [CrossRef]

- Li, L.; Ming, H.; Fu, W.; Shi, Q.; Yu, S. Exploring household natural gas consumption patterns and their influencing factors: An integrated clustering and econometric method. Energy 2021, 224, 120194. [Google Scholar] [CrossRef]

- Novosad, O. Methodical and practical approaches of determining the level of competitiveness of gas distribution companies of the western region of Ukraine. Ukr. J. Appl. Econ. Technol. 2019, 4, 376–385. [Google Scholar] [CrossRef]

- Rybitskyi, I.; Trofimchuk, V.; Kogut, G. Enhancing the efficiency of gas distribution stations operation by selecting the optimal gas pressure and temperature parameters at the station outlet. Nauk. Visnyk Natsionalnoho Hirnychoho Universytetu 2020, 3, 47–52. [Google Scholar] [CrossRef]

- Bashynska, I.; Lewicka, D.; Filyppova, S.; Prokopenko, O. Green Innovation in Central and Eastern Europe; Routledge: Abingdon-on-Thames, UK, 2024; ISBN 9781003492771. [Google Scholar]

- Perrons, R. Who Are the Innovators in the Upstream Oil and Gas Industry? Highlights from the Second SPE Global Innovation Survey. J. Pet. Technol. 2023, 75, 49–56. [Google Scholar] [CrossRef]

- Yusuf, Y.Y.; Gunasekaran, A.; Musa, A.; Dauda, M.; El-Berishy, N.M.; Cang, S. A relational study of supply chain agility, competitiveness and business performance in the oil and gas industry. Int. J. Prod. Econ. 2014, 147 Pt B, 531–543. [Google Scholar] [CrossRef]

- Varadarajan, R. Customer information resources advantage, marketing strategy and business performance: A market resources based view. Ind. Mark. Manag. 2020, 89, 89–97. [Google Scholar] [CrossRef]

- Kröger, M.; Longmuir, M.; Neuhoff, K.; Schütze, F. The Costs of Natural Gas Dependency: Price Shocks, Inequality, and Public Policy; DIW Discussion Papers, No. 2010; Deutsches Institut für Wirtschaftsforschung (DIW): Berlin, Germany, 2022; Available online: https://hdl.handle.net/10419/263154 (accessed on 10 May 2024).

- Smajla, I.; Vulin, D.; Karasalihović Sedlar, D. Short-term forecasting of natural gas consumption by determining the statistical distribution of consumption data. Energy Rep. 2023, 10, 2352–2360. [Google Scholar] [CrossRef]

- Hooijmans, M. Modelling the non-linear relation between natural gas consumption and temperature. Environ. Sci. 2016, 1–41. Available online: https://www.semanticscholar.org/paper/Modelling-the-non-linear-relation-between-natural-Hooijmans/b8ec576f35af27e98ac1f0732df447a124edd315 (accessed on 10 May 2024).

- Wang, H.; Gu, C.; Zhang, X.; Li, F.; Gu, L. Identifying the correlation between ambient temperature and gas consumption in a local energy system. CSEE J. Power Energy Syst. 2018, 4, 479–486. [Google Scholar] [CrossRef]

- Bianco, V.; Scarpa, F.; Tagliafico, L.A. Analysis and future outlook of natural gas consumption in the Italian residential sector. Energy Convers. Manag. 2014, 87, 754–764. [Google Scholar] [CrossRef]

- Gong, C.; Yu, S.; Zhu, K.; Hailu, A. Evaluating the influence of increasing block tariffs in residential gas sector using agent-based computational economics. Energy Policy 2016, 92, 334–347. [Google Scholar] [CrossRef]

- Liu, G.; Dong, X.; Jiang, Q.; Dong, C.; Li, J. Natural gas consumption of urban households in China and corresponding influencing factors. Energy Policy 2018, 122, 17–26. [Google Scholar] [CrossRef]

- Tymchyshak, A. GitHub—Atymchyshak/Impact-of-Regulatory-Factors: Research on the Impact of Regulatory Factors on the Volumes of Household Natural Gas Consumption of the Volyn Region in 2019–2022; GitHub: San Francisco, CA, USA, 2019; Available online: https://github.com/atymchyshak/Impact-of-regulatory-factors (accessed on 10 May 2024).

- Gas Distribution System Code of Ukraine. Available online: https://zakon.rada.gov.ua/laws/show/z1379-15 (accessed on 10 May 2024).

- Gujarati, D.N.; Porter, D.C. Basic Econometrics, 5th ed.; Tata McGraw Hill: New York, NY, USA, 2004; ISBN 978-0-07-337577-9. Available online: https://cbpbu.ac.in/userfiles/file/2020/STUDY_MAT/ECO/1.pdf (accessed on 10 May 2024).

- Hill, R.C.; Griffiths, W.E.; Lim, G.C. Principles of Econometrics, 5th ed.; Wiley: Hoboken, NJ, USA, 2018; p. 912. ISBN 978-1-118-45227-1. [Google Scholar]

- Nieminen, P. Application of Standardized Regression Coefficient in Meta-Analysis. BioMedInformatics 2022, 2, 434–458. [Google Scholar] [CrossRef]

- Ye, T.; Liu, B. Uncertain significance test for regression coefficients with application to regional economic analysis. Commun. Stat.-Theory Methods 2023, 52, 7271–7288. [Google Scholar] [CrossRef]

- Granger, C.W.J. Economic processes involving feedback. Inf. Control. 1963, 6, 28–48. [Google Scholar] [CrossRef]

- Shojaie, A.; Fox, E.B. Granger Causality: A Review and Recent Advances. Annu. Rev. Stat. Its Appl. 2022, 9, 289–319. [Google Scholar] [CrossRef]

- The R Stats Package. Ethz.ch. 2024. Available online: https://stat.ethz.ch/R-manual/R-devel/library/stats/html/00Index.html (accessed on 10 May 2024).

- Testing Linear Regression Models [R Package Lmtest Version 0.9-40]. R-Project.org. 2022. Available online: https://cran.r-project.org/package=lmtest (accessed on 10 May 2024).

| Time Period | Consumption, m3 | Temperature, °C | Gas Cost of 1 m3, UAH |

|---|---|---|---|

| 2019-06 | 18 | 21.7 | 8.732320 |

| 2019-07 | 24 | 18.9 | 7.935010 |

| 2019-08 | 28 | 19.8 | 7.624890 |

| 2019-09 | 24 | 14.7 | 7.428200 |

| 2019-10 | 33 | 10.9 | 7.156520 |

| 2019-11 | 80 | 6.3 | 7.926800 |

| 2019-12 | 103 | 2.6 | 7.161360 |

| 2020-01 | 99 | 1.3 | 6.960492 |

| 2020-02 | 105 | 2.9 | 6.097030 |

| 2020-03 | 81 | 4.7 | 5.418070 |

| 2020-04 | 33 | 8.5 | 4.804300 |

| 2020-05 | 27 | 11.7 | 4.040130 |

| 2020-06 | 21 | 19.6 | 3.876000 |

| 2020-07 | 24 | 19.2 | 4.150950 |

| 2020-08 | 25 | 19.7 | 5.675990 |

| 2020-09 | 23 | 15.3 | 6.675998 |

| 2020-10 | 37 | 11.1 | 7.876260 |

| 2020-11 | 73 | 5.0 | 10.012050 |

| 2020-12 | 104 | 1.4 | 10.012050 |

| 2021-01 | 115 | −2.1 | 8.874000 |

| 2021-02 | 107 | −3.6 | 8.874000 |

| 2021-03 | 10 | 2.5 | 8.874000 |

| 2021-04 | 147 | 6.8 | 8.874000 |

| 2021-05 | 21 | 13.1 | 9.874000 |

| 2021-06 | 19 | 19.8 | 9.874000 |

| 2021-07 | 28 | 22.7 | 9.874000 |

| 2021-08 | 27 | 17.5 | 9.874000 |

| 2021-09 | 1 | 12.3 | 9.874000 |

| 2021-10 | 87 | 8.2 | 9.874000 |

| 2021-11 | 90 | 4.6 | 9.874000 |

| 2021-12 | 115 | −1.7 | 9.874000 |

| 2022-01 | 115 | −0.8 | 9.874000 |

| 2022-02 | 108 | 1.4 | 9.874000 |

| 2022-03 | 82 | 2.4 | 9.874000 |

| 2022-04 | 57 | 5.7 | 9.874000 |

| 2022-05 | 39 | 12.1 | 9.844000 |

| 2022-06 | 10 | 18.0 | 9.840900 |

| 2022-07 | 1 | 18.3 | 9.840900 |

| 2022-08 | 8 | 19.9 | 9.840900 |

| 2022-09 | 5 | 11.1 | 9.840900 |

| 2022-10 | 48 | 10.0 | 9.840900 |

| 2022-11 | 81 | 3.5 | 9.840900 |

| 2022-12 | 64 | −0.8 | 9.840900 |

| Group * | t-Test Statistical Significance of the Coefficients of Regression | Test for the Significance of the Correlation Coefficient | Granger Causality Test | |||

|---|---|---|---|---|---|---|

| Is Rejected | Is Not Rejected | Is Rejected | Is Not Rejected | Is Rejected | Is Not Rejected | |

| n/a | 100 | 0 | 100 | 0 | 80 | 20 |

| 1 | 85.55 | 14.45 | 86.58 | 13.42 | 94.51 | 5.49 |

| 2 | 87.64 | 12.36 | 87.59 | 12.41 | 94.34 | 5.66 |

| 3 | 87.48 | 12.52 | 88.57 | 11.43 | 95.69 | 4.31 |

| 6 | 93.8 | 6.2 | 96.73 | 3.27 | 99.44 | 0.56 |

| 7 | 93.34 | 6.66 | 96.2 | 3.8 | 99.73 | 0.27 |

| 8 | 88.8 | 11.2 | 91.06 | 8.94 | 97.14 | 2.86 |

| 9 | 87.5 | 12.5 | 87.5 | 12.5 | 97.5 | 2.5 |

| 14 | 94.31 | 5.69 | 98.42 | 1.58 | 99.57 | 0.43 |

| 15 | 94.33 | 5.67 | 97.95 | 2.05 | 99.54 | 0.46 |

| 16 | 94.65 | 5.35 | 97.45 | 2.55 | 99.4 | 0.6 |

| 17 | 92.21 | 7.79 | 96.1 | 3.9 | 100 | 0 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sala, D.; Pavlov, K.; Bashynska, I.; Pavlova, O.; Tymchyshak, A.; Slobodian, S. Analyzing Regulatory Impacts on Household Natural Gas Consumption: The Case of the Western Region of Ukraine. Appl. Sci. 2024, 14, 6728. https://doi.org/10.3390/app14156728

Sala D, Pavlov K, Bashynska I, Pavlova O, Tymchyshak A, Slobodian S. Analyzing Regulatory Impacts on Household Natural Gas Consumption: The Case of the Western Region of Ukraine. Applied Sciences. 2024; 14(15):6728. https://doi.org/10.3390/app14156728

Chicago/Turabian StyleSala, Dariusz, Kostiantyn Pavlov, Iryna Bashynska, Olena Pavlova, Andriy Tymchyshak, and Svitlana Slobodian. 2024. "Analyzing Regulatory Impacts on Household Natural Gas Consumption: The Case of the Western Region of Ukraine" Applied Sciences 14, no. 15: 6728. https://doi.org/10.3390/app14156728